A Forecasting Model for the Prediction of System Imbalance in the Greek Power System †

Abstract

:1. Introduction

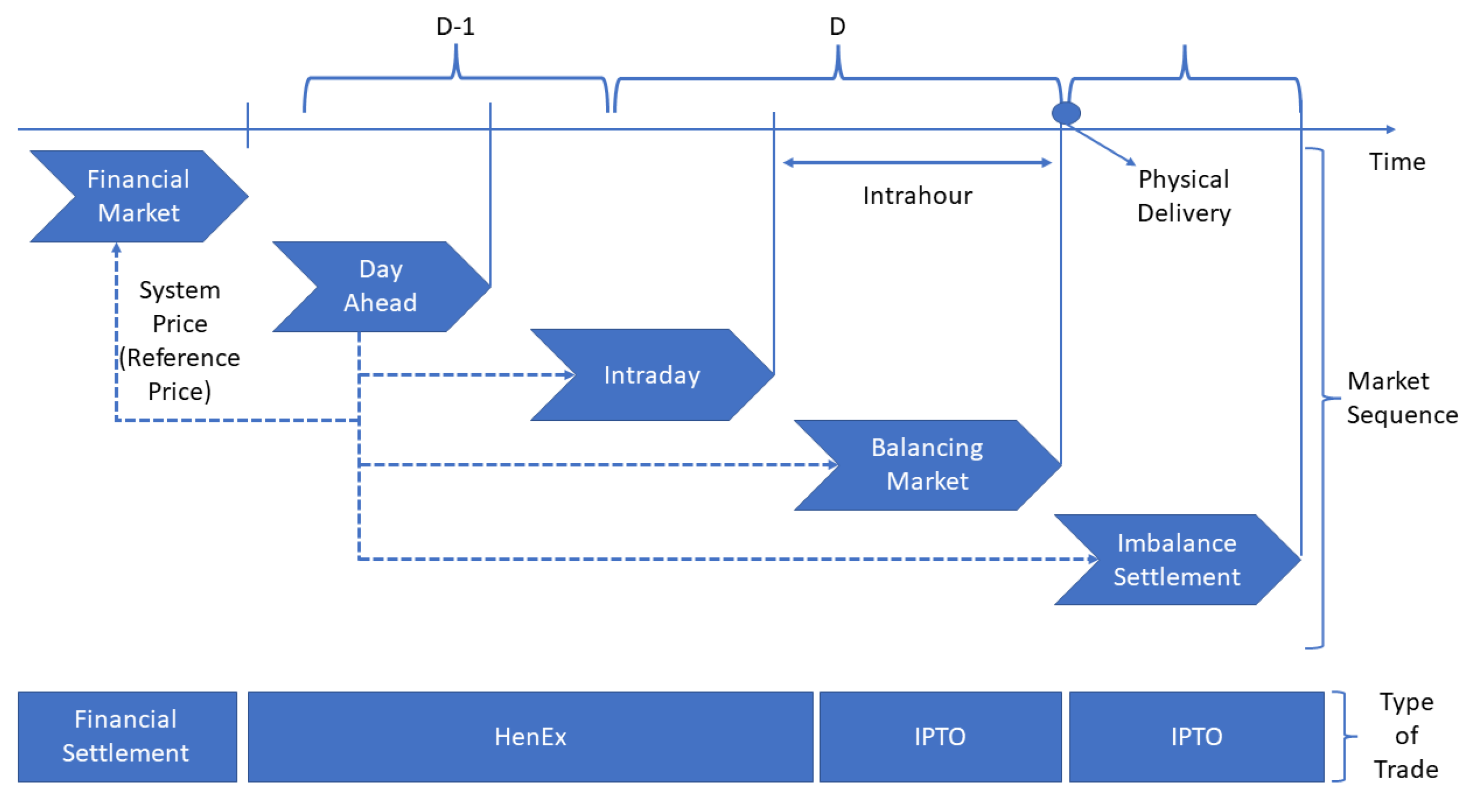

2. The Greek Electricity Market

3. The Proposed Forecasting Methodology

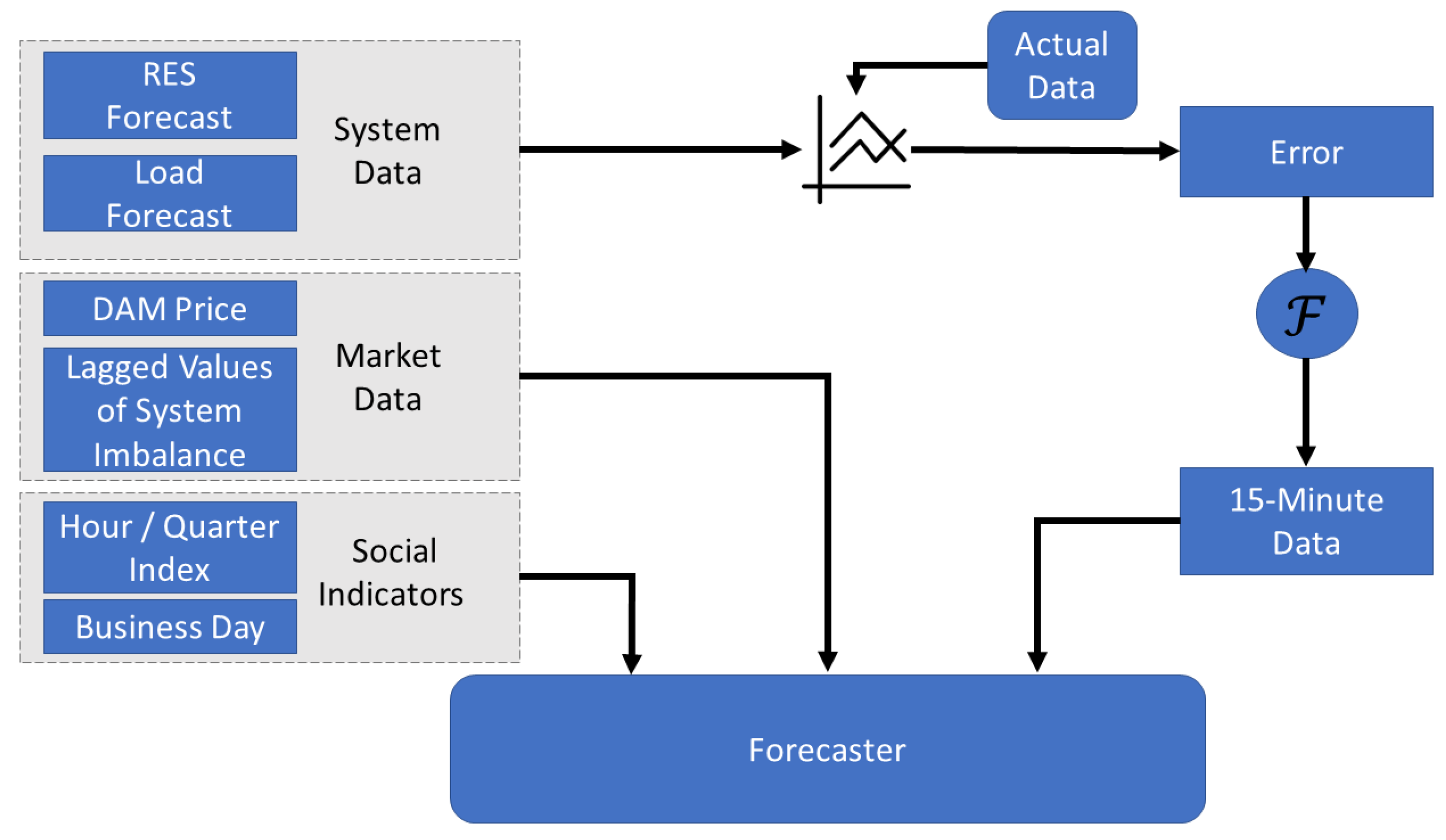

3.1. Architecture of the Forecasting Solution

- System data (system demand, RES forecast, RES actual production).

- Market data (DAM price, lagged DAM price, lagged values of system imbalance).

- Social indicators (hour index, quarter index, business day, etc.).

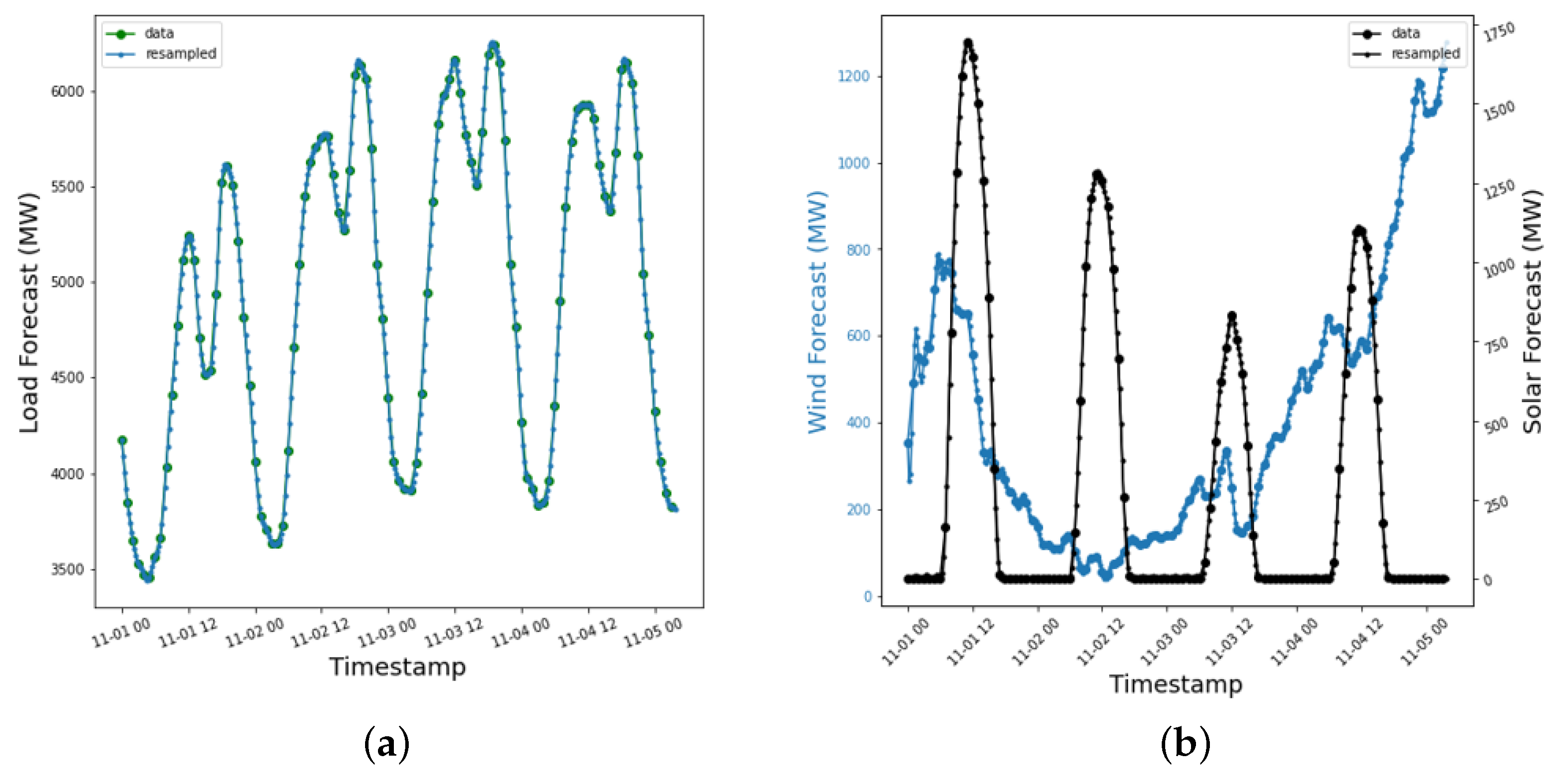

3.2. Fourier Transform Resampling

- Transform the original signal to the frequency domain using the FFT:where N is the number of samples in .

- Modify the frequency components to achieve the desired sampling rate. In this case, hourly frequency data are transformed to 15 min data by zero-padding the frequency components:where the number of zeros is equal to the desired increase in the number of samples.

- Transform the modified frequency components back to the time domain using the inverse FFT:.

3.3. Models and Metrics for System Imbalance Forecasting

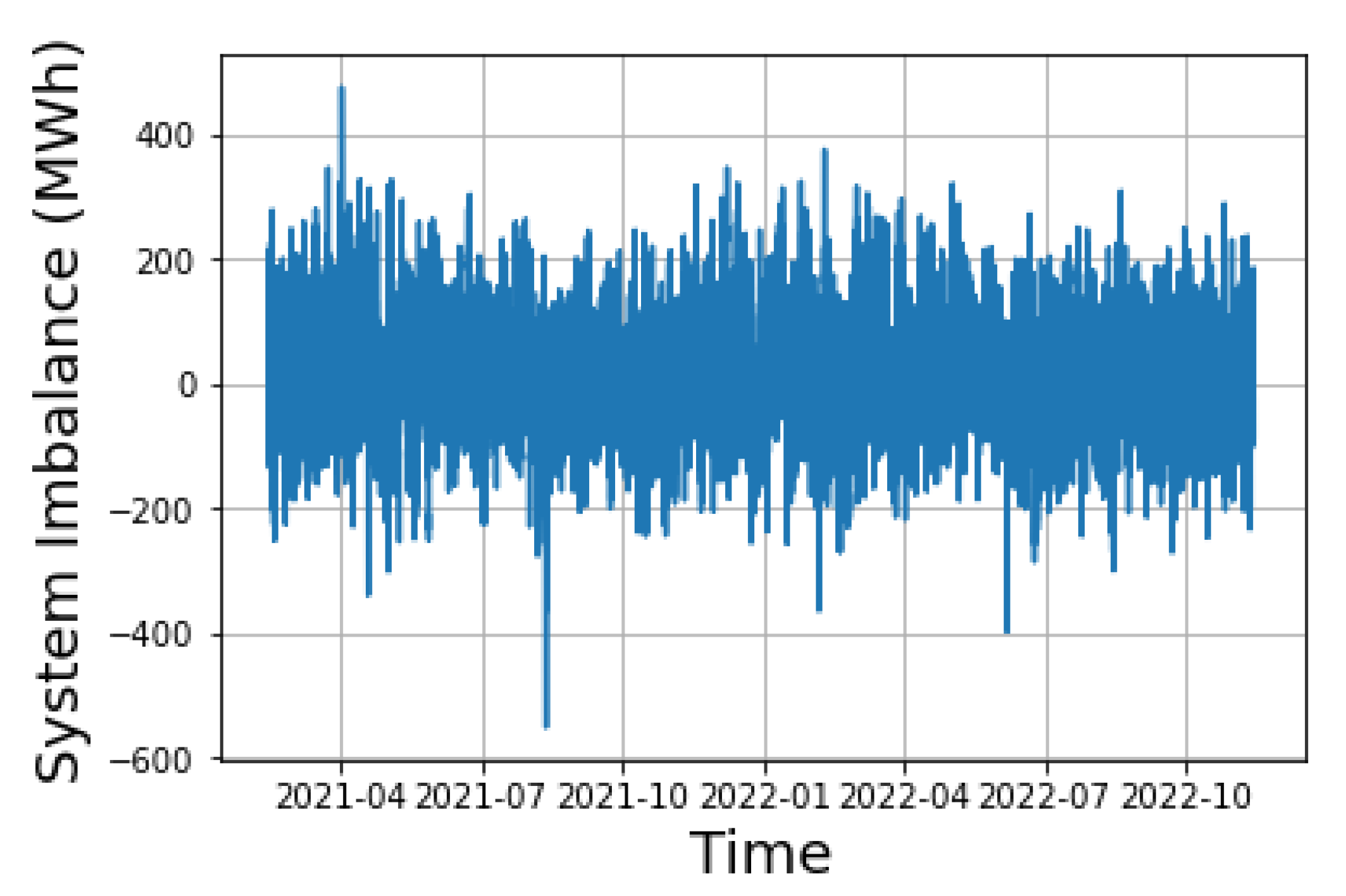

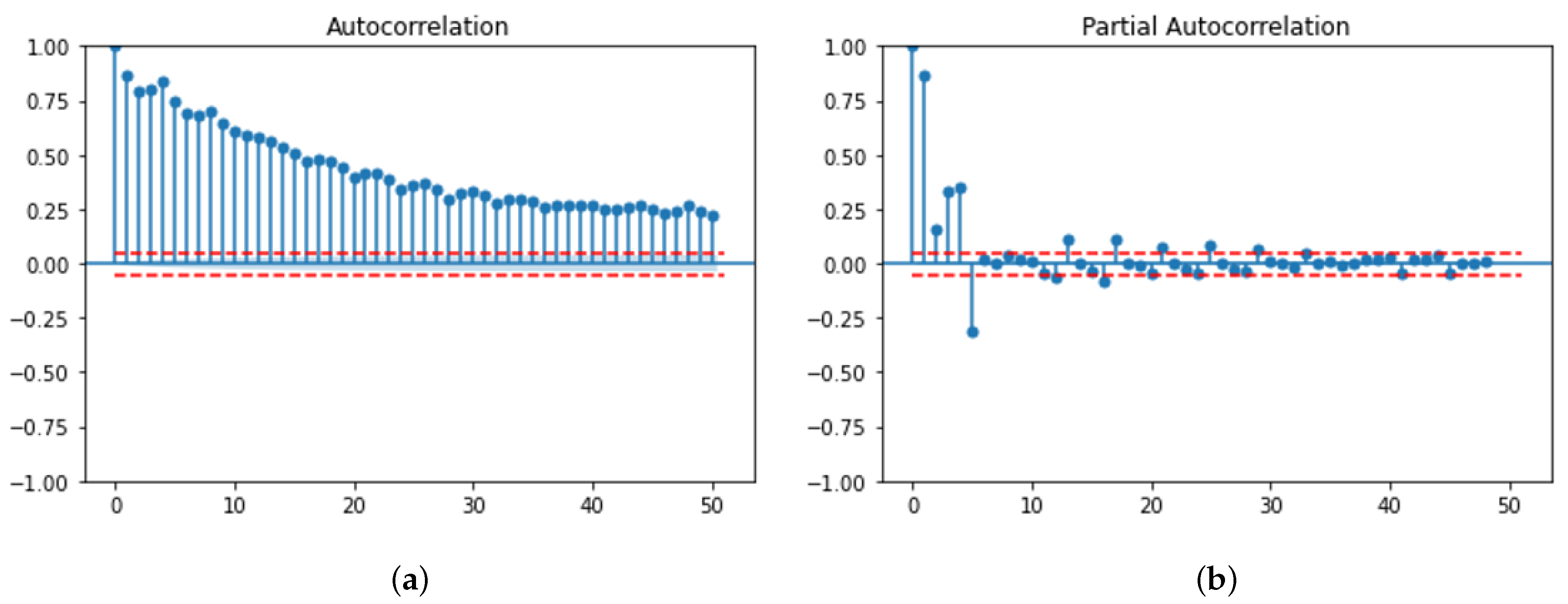

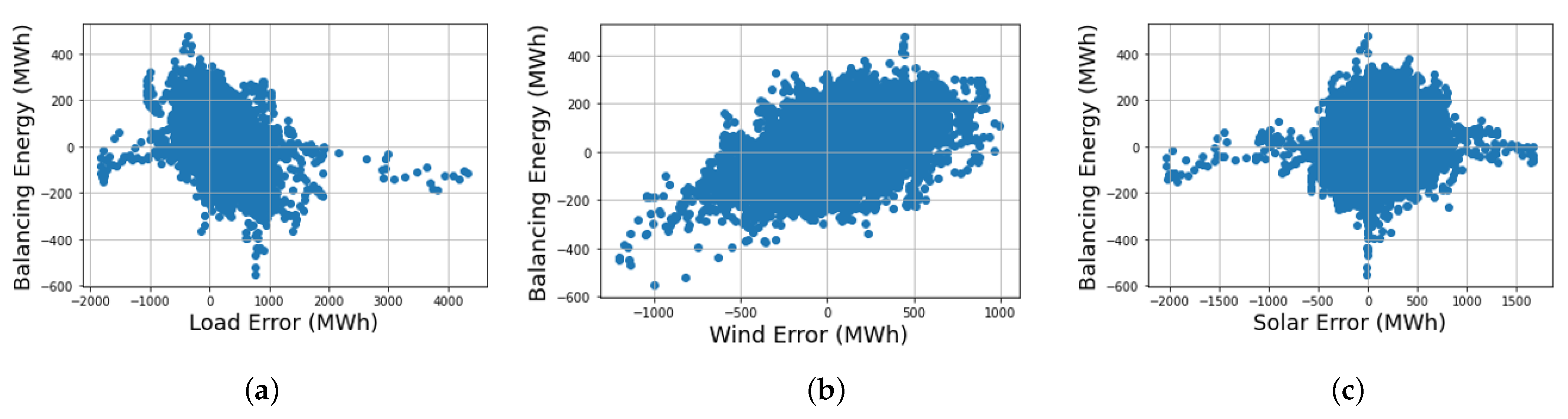

4. Statistical Analysis of the Greek Case Study

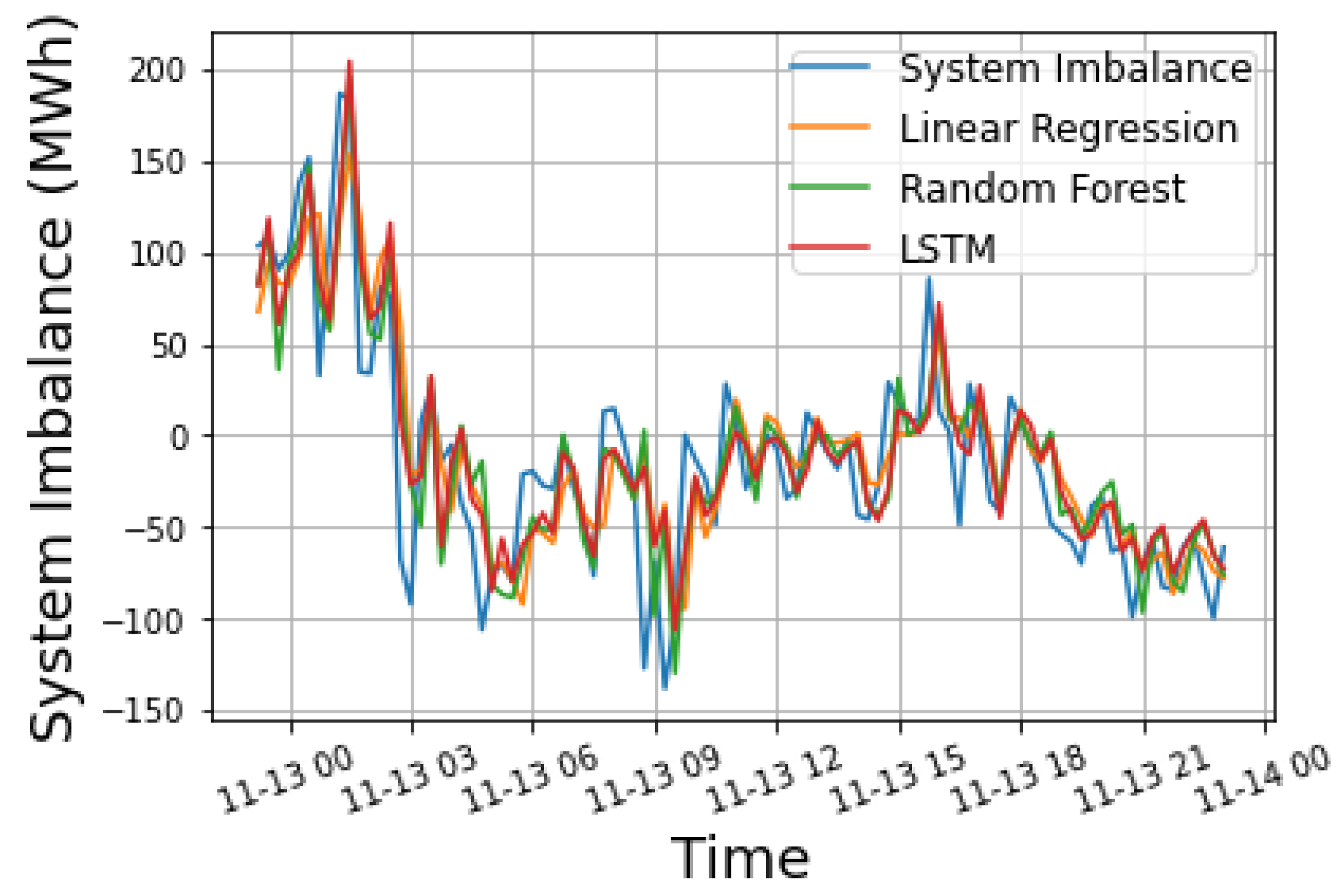

5. Forecasting Results

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| TSO | Transmission System Operator |

| RES | Renewable Energy Sources |

| DAM | Day-Ahead Market |

| ARIMA | Autoregressive Integrated Moving Average |

| IDM | Intra-Day Market |

| BM | Balancing Market |

| HEnEx | Hellenic Energy Exchange |

| IPTO | Independent Power Transmission Operator |

| ISP | Integrated Scheduling Process |

| FCR | Frequency Conservation Reserve |

| FRR | Frequency Restoration Reserve |

| FFT | Fast Fourier Transformation |

| LR | Linear Regression |

| RF | Random Forest |

| LSTM | Long Short-Term Memory |

| RNN | Recurrent Neural Network |

| R-squared | |

| RMSE | Root Mean Squared Error |

| MAE | Mean Absolute Error |

References

- Zimmermann, F.; Keles, D. State or market: Investments in new nuclear power plants in France and their domestic and cross-border effects. Energy Policy 2023, 173, 113403. [Google Scholar] [CrossRef]

- IPTO. Preliminary Draft of the Ten Year Development Plan of HETS for the Period 2024–2033. Available online: https://www.admie.gr/en/nea/anakoinosi/preliminary-draft-ten-year-development-plan-hets-period-2024-2033 (accessed on 1 February 2023).

- Papalexopoulos, A.D.; Hesterberg, T.C. A regression-based approach to short-term system load forecasting. IEEE Trans. Power Syst. 1990, 5, 1535–1547. [Google Scholar] [CrossRef]

- Shahid, F.; Zameer, A.; Muneeb, M. A novel genetic LSTM model for wind power forecast. Energy 2021, 223, 120069. [Google Scholar] [CrossRef]

- Gao, F.; Guan, X.; Cao, X.R.; Papalexopoulos, A. Forecasting power market clearing price and quantity using a neural network method. In Proceedings of the Power Engineering Society Summer Meeting, Seattle, WA, USA, 16–20 July 2000; Volume 4, pp. 2183–2188. [Google Scholar]

- Lago, J.; Marcjasz, G.; De Schutter, B.; Weron, R. Forecasting day-ahead electricity prices: A review of state-of-the-art algorithms, best practices and an open-access benchmark. Appl. Energy 2021, 293, 116983. [Google Scholar] [CrossRef]

- Elia Group. Documentation of the Methodology Used for the System Imbalance Forecast Publications. Available online: https://www.elia.be/en/grid-data/balancing/system-imbalance-forecasts (accessed on 1 February 2023).

- Garcia, M.P.; Kirschen, D.S. Forecasting system imbalance volumes in competitive electricity markets. IEEE Trans. Power Syst. 2006, 21, 240–248. [Google Scholar] [CrossRef]

- Kratochvíl, Š. System Imbalance Forecast. Ph.D. Thesis, Czech Technical University, Prague, Czech Republic, 2016. Available online: https://dspace.cvut.cz/bitstream/handle/10467/67662/Disertace_ŠtěpanKratochvil2016.pdf?sequence=1 (accessed on 1 February 2023).

- Contreras, C. System Imbalance Forecasting and Short-Term Bidding Strategy to Minimize Imbalance Costs of Transacting in the Spanish Electricity Market. 2016. Available online: https://repositorio.comillas.edu/xmlui/handle/11531/16621 (accessed on 1 February 2023).

- Salem, T.S.; Kathuria, K.; Ramampiaro, H.; Langseth, H. Forecasting intra-hour imbalances in electric power systems. In Proceedings of the AAAI Conference on Artificial Intelligence, Honolulu, HI, USA, 27–31 January 2019; Volume 33, pp. 9595–9600. [Google Scholar]

- Ioannidis, F.; Kosmidou, K.; Andriosopoulos, K.; Everkiadi, A. Assessment of the Target Model Implementation in the Wholesale Electricity Market of Greece. Energies 2021, 14, 6397. [Google Scholar] [CrossRef]

- Makrygiorgou, J.J.; Karavas, C.-S.; Dikaiakos, C.; Moraitis, I.P. The electricity market in Greece: Current status, identified challenges and arranged reforms. Sustainability 2023, 15, 3767. [Google Scholar] [CrossRef]

- Papavasiliou, A. An Overview of Probabilistic Dimensioning of Frequency Restoration Reserves with a Focus on the Greek Electricity Market. Energies 2021, 14, 5719. [Google Scholar] [CrossRef]

- Third Energy Package. Available online: https://energy.ec.europa.eu/topics/markets-and-consumers/market-legislation/third-energy-package_en (accessed on 1 February 2023).

- IPTO Balancing Market Data. Available online: https://www.admie.gr/en/market/market-statistics/detail-data (accessed on 1 February 2023).

- ENTSO-E Transparency Platform. Available online: https://transparency.entsoe.eu/dashboard/show (accessed on 1 February 2023).

- Tian, L.; Wilding, G.E. Confidence interval estimation of a common correlation coefficient. Comput. Stat. Data Anal. 2008, 52, 4872–4877. [Google Scholar] [CrossRef]

| 2021 | 2022 | |

|---|---|---|

| Average | 11.42 | 6.64 |

| Standard Deviation | 80.99 | 76.28 |

| 25th Quantile | −39.20 | −41.31 |

| 50th Quantile | 10.10 | 3.61 |

| 75th Quantile | 59.86 | 51.51 |

| (-) | RMSE (MWh) | MAE (MWh) | ||

|---|---|---|---|---|

| 15 min forecast | Linear Regression | 0.77 | 33.23 | 24.41 |

| Random Forest | 0.84 | 26.93 | 19.63 | |

| LSTM | 0.83 | 28.12 | 20.64 | |

| 1 h forecast | Linear Regression | 0.68 | 39.64 | 29.75 |

| Random Forest | 0.72 | 36.53 | 27.01 | |

| LSTM | 0.66 | 40.04 | 30.27 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Plakas, K.; Andriopoulos, N.; Birbas, A.; Moraitis, I.; Papalexopoulos, A. A Forecasting Model for the Prediction of System Imbalance in the Greek Power System. Eng. Proc. 2023, 39, 18. https://doi.org/10.3390/engproc2023039018

Plakas K, Andriopoulos N, Birbas A, Moraitis I, Papalexopoulos A. A Forecasting Model for the Prediction of System Imbalance in the Greek Power System. Engineering Proceedings. 2023; 39(1):18. https://doi.org/10.3390/engproc2023039018

Chicago/Turabian StylePlakas, Konstantinos, Nikos Andriopoulos, Alexios Birbas, Ioannis Moraitis, and Alex Papalexopoulos. 2023. "A Forecasting Model for the Prediction of System Imbalance in the Greek Power System" Engineering Proceedings 39, no. 1: 18. https://doi.org/10.3390/engproc2023039018

APA StylePlakas, K., Andriopoulos, N., Birbas, A., Moraitis, I., & Papalexopoulos, A. (2023). A Forecasting Model for the Prediction of System Imbalance in the Greek Power System. Engineering Proceedings, 39(1), 18. https://doi.org/10.3390/engproc2023039018