Abstract

Globally and locally, projects continue to miss their cost and schedule targets. It is largely because risks that occur in the construction industry are not addressed at the contract development stage. These risks may be divided into three basic categories, which are organizational risk, contractual risks, and allied risks. Although reviews of the literature show a large number of risks as already having been identified across the globe, organizations do not benefit from this worldwide experience and continue to derail their projects on multiple occasions. Two key reasons observed are the lack of a knowledge management process and key stakeholders working in isolation with no single point of ownership in the tendering process and contract development within many organizations. The solution lies in developing an AI-based framework that effectively addresses this lack of knowledge management and stakeholder integration within companies. The AI aspect brings speed and magnitude in reviewing contract development by pre-identifying risk factors and suggesting possible risk mitigation strategies.

1. Introduction

Oil and gas play a key role in a country’s energy mix. To maintain a constant supply of oil and gas, the companies operating in the oil and gas sector need to build and maintain the required infrastructure, which includes pipelines, installations, retail outlets, etc. Despite having decades of project execution experience, these oil and gas companies have very limited success in achieving the desired targets set for these projects in terms of cost and schedule. This lack of success in achieving project targets can be attributed to a lack of risk management in the pre-project execution stage. This lack of risk management can be attributed to knowledge management and a lack of ownership between the stakeholders involved in developing the contract. Both of these may be considered organizational issues.

The author has also observed that organization issues compound the development and execution of the tender process. Another observation is a fear factor amongst organizational stakeholders to document the risks that occurred on a project. This fear is bred often out of incompetence and a lack of confidence in project stakeholders who link a lack of success to a possible negative reaction from the organizational leader. Hence, materialized risks are not documented and shared as a lesson learned for future projects.

2. Literature Review

The literature review was conducted to assess what risks have already been identified in the infrastructure projects’ oil and gas sector. Previous research identified various risk factors which impact project performance. It includes the preparation of contracts [1]. Major areas of risk and their sub-factors have been identified by [2]. Multiple researchers have quoted additional factors [1,2,3,4,5,6,7]. An extensive search of scholarly papers in the oil and gas sector identified ninety-seven risks for infrastructure projects. The ninety-seven risks were identified in the works of [8,9,10,11,12,13]. These risks were analyzed and segregated into pre-contract, contractual, and allied risks. There were twenty-three risks in the precontact area, which can be subdivided further into three areas including: (i) organizational risks, which totaled eleven in number; (ii) finance-related risks, which totaled nine in number; and (iii) other pre-contract risks, which totaled three in number. Contractual risks were identified as those which can be addressed at the tender preparation and contract stage. Sixty-one risks out of the ninety-seven risks could be classified as contractual risks. These sixty-one risks can be subdivided based on commonality into the following subcategories: i. management of change; ii. timelines; iii. coordination and communication; iv. documentation; v. people; vi. HSE and security; vii. material; and viii. design.

There were thirteen risks in the third category, defined as allied risks.

3. Observations of Oil and Gas Company Practices

While working in oil and gas public and private sector companies operating in Pakistan, it was observed that project stakeholders are very protective of their areas of influence, and not only do they not openly engage with other stakeholders, but they also tend to keep their expertise within their respective areas of influence and departments. Hence, each stakeholder works on what is presumed to be their area of expertise and assumes that the other stakeholders will add their part to make a comprehensive tender and contract document. When the document is reviewed on completion, each stakeholder reviews only that part that they think pertains to them. There is no holistic ownership of the entire document or process. A lack of alignment within departments further compounds this as to what their role is. The main departments playing a role in the tendering and contract process are project/engineering, legal, and procurement. In multiple cases, engineering departments have been observed to limit their role in identifying the scope. They rely on procurement and legal departments to articulate the scope. Unfortunately, engineers are usually not technical writers, and departments that are relied on to articulate the scope lack the technical expertise and understanding. Hence, often, consultants are introduced to put together a tender package. In the instance being discussed, consultants were not engaged as the in-house team felt competent enough to design and articulate the scope of work. The legal department limits its review to legal aspects, checking to see if anything in the documents is in conflict with the law. The legal department also articulates the standard clauses which make up the general terms and conditions.

Interestingly, the existence of these organizational issues is not a new phenomenon in the industry, and references to the risk factors can be found in the literature on the subject. Table 1 provides an example of factors already elaborated in the literature.

Table 1.

Organizational factors available in the literature.

Compounding the organizational issues is the genuine belief of stakeholders regarding the extent of their role in the project, which leads them to draw boundaries limiting their involvement in the project documentation.

3.1. Lack of Single-Point Accountability

Any infrastructure project being executed on a client’s requirement is ultimately beneficial to the client, and the client decides on the terms of the tender, which can be elaborated, clarified, or amended through pre-bid meetings, etc. However, when reviewing contractual risk factors associated with the infrastructure project, the client does not take accountability for all the risk factors, but instead, defers several risks to other stakeholders. It is also interesting to note that clients place a heavy reliance on consultants to ensure a comprehensive and effective contract. However, consultants assess that many risk factors are not in their key expertise area. The legal fraternity defers the majority of risk factors to other stakeholders. In contrast, many stakeholders assume that the contract in its entirety is the responsibility of the legal fraternity since it is a legal document.

3.2. Lack of Knowledge Management

Oil and gas companies in Pakistan do not have a formal knowledge management process. This is compounded by the individual being afraid to highlight lapses in projects. Hence, lessons learned from the lapses in executing a project get buried in the minds of stakeholders, and no learnings are captured in the form of a database for future projects. In large multinational oil and gas companies, dealing with lessons learned is a normal process. They have defined it as a value-improving process and executed the lessons-learned workshop twice. First, at the start of a project, the workshop is run as an “extract” process where lessons learned on similar projects are extracted from databases available to the company. These extracted risks are then addressed in preparation for the project at hand. The workshop is conducted a second time after the project on a “capture” basis, where lessons learned from the recently completed project can be captured in the database, which can then be extracted when a new project comes up.

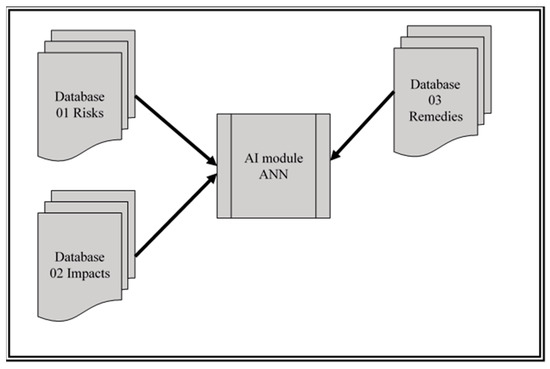

4. The Use of Artificial Intelligence

Tender and contract documents are fairly voluminous; hence, they are time-consuming and difficult to review. Artificial intelligence can overcome the magnitude of the task and substantially reduce the time consumed in setting up contract documents. As a first step, three databases are developed. The first database consists of risks. These risks are extracted from a literature review and substantiated by industry experts. The second database consists of the impact of materializing these risks on the projects. The impact is defined as the product of the magnitude of the consequence and its likelihood of occurrence. The third database consists of possible strategies to tackle the risk. Once these databases have been developed, they can be linked through an artificial intelligence system. The first two databases generate a pattern showing the impact of the absence of certain risks in a contract. Eighty percent of the data from these databases will be used to train the artificial neural network system, whereas the remaining twenty percent of the data will be used to validate the system. The third database of risk managing strategies is an add-on that will be used when the system is applied to contracts under development. The schematic for this is shown in Figure 1 below.

Figure 1.

Framework development and training of the ANN.

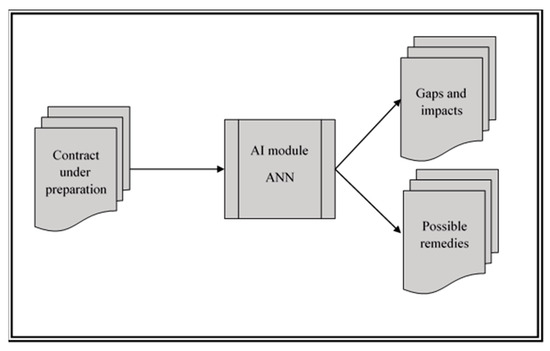

Once trained, the ANN module will take input from a contract being prepared and identify the gaps, the magnitude of the impact of these gaps, and possible remedial solutions. The contract under preparation will be checked to see how many pre-identified risks have been addressed, and these will be mapped as the input layer to the artificial neural network. The output layer will list the risks that have been left out, the magnitude of these omissions, and possible remedies. This is schematically shown below in Figure 2.

Figure 2.

Applying the ANN module.

However, suppose there exists a set of three databases comprising a database of risks identified from the literature review and experience, along with a second database showing the impact the risks have had, and a third database that proposes generic strategies to address different risks. In that case, the process of contact development can be expedited by using artificial intelligence to map the three databases to each other. One possible application of artificial intelligence that can be used is the artificial neural network (ANN), which has significant pattern recognition capabilities. Hence, once trained, the ANN would be able to identify the gaps in the required pattern of risk addressed, would link them to the possible remedies, and would rank them by impact by using the three databases.

5. Conclusions and Recommendations

It can be seen that there is a need for substantial improvement in developing tender and contract documentation by improving or importing expertise. Given the current organizational structures and level of in-house competence, it would be prudent to: (a) develop a checklist of risk factors along with a database of risk management strategies based on past experiences of the stakeholders, as well as academic research; and (b) develop, maintain, and use lessons-learned databases. These should be managed through an artificial intelligence-based support system to be applied at the tender development stage and used for verification at the contract finalization stage.

Author Contributions

Conceptualization, S.A.A.T. and F.A.; methodology, S.A.A.T.; Literature Review, S.A.A.T., writing—original draft preparation, S.A.A.T.; writing—review and editing, F.A.; visualization, S.A.A.T.; supervision, F.A.; project administration, F.A.; funding acquisition, F.A. All authors have read and agreed to the published version of the manuscript.

Funding

Ph.D. Research Project Funding from Advanced Studies and Research Board (AS&RB), NED University of Engineering and Technology, Karachi, Pakistan Acad/50(48)/466).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All the data provided are collected by the authors and are available in the paper.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Chau, K. Application of a PSO-based neural network in analysis of outcomes of construction claims. Autom. Constr. 2007, 16, 642–646. [Google Scholar] [CrossRef]

- Shen, L.Y.; Wu, G.W.C.; Ng, C.S.K. Risk Assessment for Construction Joint Ventures in China. J. Constr. Eng. Manag. 2001, 127, 76–81. [Google Scholar] [CrossRef]

- Wang, S.Q.; Dulaimi, M.F.; Aguria, M.Y. Risk management framework for construction projects in developing countries. Constr. Manag. Econ. 2004, 22, 237–252. [Google Scholar] [CrossRef]

- Siraj, N.B.; Fayek, A.R. Risk Identification and Common Risks in Construction: Literature Review and Content Analysis. J. Constr. Eng. Manag. 2019, 145, 03119004. [Google Scholar] [CrossRef]

- Jayasudha, K.; Vidivelli, B. Analysis of major risks in construction projects. ARPN J. Eng. Appl. Sci. 2016, 11, 6943–6950. [Google Scholar]

- Iqbal, S.; Choudhry, R.M.; Holschemacher, K.; Ali, A.; Tamošaitienė, J. Risk management in construction projects. Technol. Econ. Dev. Econ. 2015, 21, 65–78. [Google Scholar] [CrossRef]

- Fang, C.; Marle, F.; Xie, M. Applying Importance Measures to Risk Analysis in Engineering Project Using a Risk Network Model. IEEE Syst. J. 2016, 11, 1548–1556. [Google Scholar] [CrossRef]

- Arain, F.M. Significant causes of changes in oil and gas construction projects in Alberta, Canada. Int. J. Constr. Proj. Manag. 2011, 3, 145. [Google Scholar]

- Elhenshiri, O.A. Exploring Organizational Risk Strategies Project Managers Need to Reduce Performance Errors in Oil and Gas Pipeline Construction Projects. Doctoral Dissertation, Colorado Technical University, Colorado Springs, CO, USA, December 2019. [Google Scholar]

- Kassem, M.A.; Khoiry, M.A.; Hamzah, N. Risk factors in oil and gas construction projects in developing countries: A case study. Int. J. Energy Sect. Manag. 2019, 13, 846–861. [Google Scholar] [CrossRef]

- Kassem, M.A.; Khoiry, M.A.; Hamzah, N. Assessment of the effect of external risk factors on the success of an oil and gas construction project. Eng. Constr. Arch. Manag. 2020, 27, 2767–2793. [Google Scholar] [CrossRef]

- Kassem, M.A.; Khoiry, M.A.; Hamzah, N. Theoretical review on critical risk factors in oil and gas construction projects in Yemen. Eng. Constr. Arch. Manag. 2020, 28, 934–968. [Google Scholar] [CrossRef]

- Van Thuyet, N.; Ogunlana, S.O.; Dey, P.K. Risk management in oil and gas construction projects in Vietnam. Int. J. Energy Sect. Manag. 2007, 1, 175–194. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).