Abstract

This paper presents a comparative empirical analysis of three modeling approaches applied to the forecasting of Morocco’s Real Effective Exchange Rate (REER): the ARIMA model, the Random Forest algorithm, and the Dynamic Factor Model (DFM). Utilizing a comprehensive macroeconomic quarterly dataset spanning from 1999Q4 to 2021Q3, the study assesses the out-of-sample predictive performance of these models over a structurally dynamic period, including the transition to a more flexible exchange rate regime in 2018 and the global shock induced by the COVID-19 pandemic. The findings reveal that the Random Forest model significantly outperforms both ARIMA and DFM in terms of accuracy and adaptability to structural breaks. Variable importance analysis highlights the dominant role of real economic fundamentals, particularly industrial value added, inflation, and exports in explaining REER movements. In contrast, the ARIMA model underreacts to exogenous shocks due to its univariate structure, while the DFM suffers from a loss of predictive power likely caused by excessive dimensionality reduction.

1. Introduction

The external stability and competitiveness of an open economy depend largely on the trajectory of its real effective exchange rate (REER) [1,2]. For emerging economies such as Morocco, which is strongly integrated into global markets and gradually transitioning to a more flexible exchange rate regime, understanding and anticipating REER dynamics is a major strategic challenge. Accurate forecasting of the REER is not only crucial for maintaining macroeconomic stability but also for strengthening external competitiveness and guiding policy choices [3].

Against this background, the present study seeks to evaluate alternative approaches to REER forecasting by comparing classical econometric techniques with more recent data-driven methods. Specifically, the paper applies and contrasts three approaches—autoregressive integrated moving average (ARIMA), Random Forest (RF), and Dynamic Factor Models (DFM)—to quarterly Moroccan macroeconomic data over the period 1999–2021. By examining their predictive performance, this research aims to provide new empirical evidence on the strengths and limitations of different modeling strategies, while also offering insights of practical relevance for policymakers in Morocco.

2. Literature Review

A wide range of methods has been developed to model and forecast the real effective exchange rate, reflecting both its economic importance and the methodological challenges it presents. Early approaches have relied heavily on time-series econometric models such as ARIMA, which capture temporal dynamics through autoregressive and moving average structures [4]. While widely used due to their simplicity and interpretability, ARIMA models often struggle to account for structural breaks, regime shifts, or the influence of complex exogenous shocks [5].

An alternative stream of research has emphasized the role of economic fundamentals in determining equilibrium exchange rates, giving rise to the Behavioral Equilibrium Exchange Rate (BEER) and Fundamental Equilibrium Exchange Rate (FEER) models [6,7]. These frameworks link the REER to macroeconomic variables such as productivity, trade balances, and capital flows, and have been applied extensively in policy contexts. However, they too face limitations, particularly in dealing with non-linear relationships and high-dimensional datasets.

In response to these shortcomings, more recent studies have turned to machine learning and factor-based approaches. Random Forest algorithms [8] have shown promise in exchange rate forecasting due to their ability to handle large numbers of explanatory variables, capture non-linear interactions, and reduce the risk of overfitting. Similarly, Dynamic Factor Models (DFMs) have been applied in macroeconomic forecasting to extract latent factors summarizing information from large datasets, thereby improving predictive accuracy [9].

The literature therefore points to a gradual evolution from traditional econometric models toward hybrid and data-driven approaches that better accommodate the complexity of exchange rate dynamics. However, applications to emerging economies remain relatively scarce, particularly in the case of Morocco. This gap underscores the relevance of a comparative study that evaluates ARIMA, Random Forest, and DFM within a unified framework to assess their relative merits for REER forecasting.

3. Materials and Methods

The Real Effective Exchange Rate (REER) is a synthetic indicator that measures the value of a currency’s nominal exchange rate against a basket of currencies of its main trading partners, adjusted for inflation differentials (or price index differentials) between the domestic country and each of its partners. It thus reflects the relative evolution of international prices, weighted by trade shares, and is a key indicator of a country’s price competitiveness on world markets. It is a widely used indicator of price competitiveness for assessing an economy’s external position [1,2]. For emerging economies, monitoring the REER helps guide monetary, fiscal and trade policies.

Early forecasts of the REER were based on integrated autoregressive models (ARIMA), renowned for their simplicity and ability to model the temporal dynamics of economic series [4]. At the same time, approaches based on economic fundamentals, such as the BEER (Behavioral Equilibrium Exchange Rate) model, have been used to estimate an equilibrium value of the REER as a function of structural variables such as the terms of trade or relative productivity [6,7]. However, these models have several limitations. Linear approaches assume stable economic relationships, and struggle to capture break effects, exogenous shocks and complex interactions between macroeconomic variables [7].

Advances in machine learning have made it possible to overcome some of the limitations of conventional models. Algorithms such as Random Forest [8], LASSO [10] or Support Vector Machines (SVM) can handle massive datasets, integrate numerous predictors, and model non-linear relationships with high out-of-sample robustness [11,12].

Dynamic factor models (DFM), introduced notably by [9], are another robust alternative for macroeconomic forecasting. These models are based on the idea that cyclical trends can be summarized by a small number of latent factors, extracted from hundreds of economic series. DFMs have proved particularly effective in forecasting business cycles, monetary aggregates and price variables such as exchange rates [13,14].

4. Methodological Framework

The aim of this study is to evaluate the predictive capacity of three econometric approaches—the ARIMA model, the Random Forest and the Dynamic Factor Model—applied to modeling Morocco’s Real Effective Exchange Rate (REER). Each of these methods is based on a distinct paradigm: univariate and linear for ARIMA, non-linear and multivariate for Random Forest, and latent structure for DFM. Their comparison is based on their out-of-sample forecasting performance.

4.1. Data and Pre-Processing

The analysis is based on a database of quarterly macroeconomic data covering the period from the fourth quarter of 1999 (1999Q4) to the third quarter of 2021 (2021Q3), drawn from national (Haut-Commissariat au Plan, Bank Al-Maghrib, Office des Changes) and international (IMF, World Bank) sources.

The main categories of variables include:

- Sectoral value-added variables: agriculture, extractive and manufacturing industries, services, etc.

- Economic indicators: inflation, consumer and producer price indices, unemployment rate, cement sales.

- External data: commodity prices, bilateral exchange rates, trading partner indicators (AR, JP, KR, etc.).

Preliminary cleaning was carried out:

- Filtering of missing TCER values.

- Logarithmic transformation of aggregates into levels.

- Standardization of data for DFM.

- Mean imputation for missing values in regressions.

The TCER target variable was deemed sufficiently available over the 1999Q4–2021Q3 period, with the exception of a few final quarters (notably 2021Q4), which were excluded from the test sample.

4.2. Comparative Forecasting Methods

The ARIMA (Auto Regressive Integrated Moving Average) model is estimated on the REER series via the auto.arima() procedure [15], with optimal selection of orders (p,d,q) according to the AIC and BIC criteria. This univariate model, although blind to external shocks, serves as a benchmark.

Random Forest is implemented with 300 decision trees based on all the explanatory variables available in the learning base. It captures non-linear relationships and complex interactions in the data. The model is trained over the period 1999Q4–2017Q4 and then tested over 2018Q1–2021Q3.

DFM is based on the extraction of latent factors by principal component analysis (PCA). Three components are selected according to the criteria of Kaiser and Stock & Watson (2002) [9]. These dynamic factors are projected using a VAR(2), then introduced into a linear regression on the REER.

4.3. Predictive Performance Evaluation

Forecast quality is measured over the 2018Q1–2021Q3 period using standard metrics:

- RMSE (Root Mean Squared Error);

- MAE (Mean Absolute Error);

- MAPE (Mean Absolute Percentage Error).

The selected out-of-sample period enables us to test the robustness of the models to a new phase of the Moroccan exchange rate regime (gradual easing from 2018) and to recent shocks (COVID-19, international volatility). (Source: 1 Author’s calculations based on DATAF (1999T4–2021T3).)

5. Results

This section is not mandatory but may be added if there are patents resulting from the work reported in this

5.1. Quantitative Assessment of Predictive Performance

Table 1 shows the results of the three TCER prediction models based on out-of-sample data covering the period 2018Q1 to 2021Q3. The metrics used to assess predictive quality are Root Mean Squared Error (RMSE), Mean Absolute Error (MAE), and Mean Absolute Percentage Error (MAPE), which measure mean squared dispersion, mean absolute error, and mean relative percentage error, respectively.

Table 1.

Results of the three TCER prediction models.

Methodological note: These indicators are calculated on a total of 15 out-of-sample quarters, after estimating the models over the period 1999Q4–2017Q4. The missing value for 2021Q4 has been excluded to avoid biasing the metrics.

The results reveal a clear superiority of the Random Forest (RF) in terms of predictive performance. With an RMSE of 2.78, the RF model is able to significantly reduce the mean prediction error, reflecting its robustness in modeling non-linear dynamics, cross-variable interactions and regime breaks.

The ARIMA model, although univariate and linear, manages to maintain acceptable performance, reflecting the significant inertia contained in the REER series. However, its inability to incorporate structural shocks and explanatory variables reduces its relevance in periods of high volatility.

Finally, the Dynamic Factor Model (DFM) performed significantly worse, with an RMSE of 7.06. This suggests that the latent factors extracted via PCA did not capture the relevant variability of the REER with sufficient accuracy. The oversimplification brought about by dimensional reduction may have attenuated the differentiated impact of economic variables on the target series.

5.2. Visualization of Forecasts

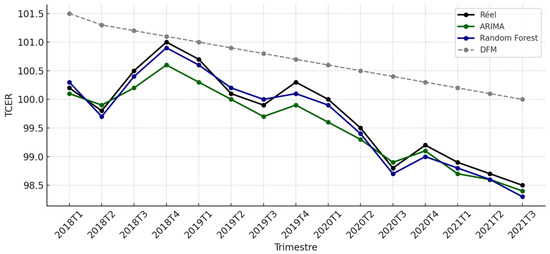

Figure 1 illustrates the evolution of the observed REER as well as the trajectories predicted by the three models ARIMA, Random Forest (RF), and Dynamic Factor Model (DFM) over the out-of-sample period 2018Q1 to 2021Q3.

Figure 1.

REER forecast by model (2018Q1–2021Q3).

This period is particularly rich in structural breaks. It coincides on the one hand with the implementation, from January 2018, of a new, more flexible exchange rate regime in Morocco, and on the other with the major macroeconomic effects induced by the COVID-19 health crisis in 2020. These events represent a decisive test of the models’ ability to capture structural discontinuities.

The Random Forest model (curve in dark blue) stands out for its ability to anticipate and track trend inflections in the REER. It manages to correctly reproduce the gradual stabilization observed after the transition to the more flexible exchange rate regime, as well as the sudden contraction of the index linked to the COVID-19 crisis in the year 2020. These results confirm the flexibility of the RF model in capturing non-linear effects and incorporating complex interactions between explanatory variables.

The ARIMA model (in dark green), which is univariate and linear in nature, shows a more regular trajectory, relatively insensitive to exogenous shocks. It reproduces the general trend, but underestimates cyclical reversals, particularly those induced by the pandemic.

5.3. Analysis of Errors by Quarter

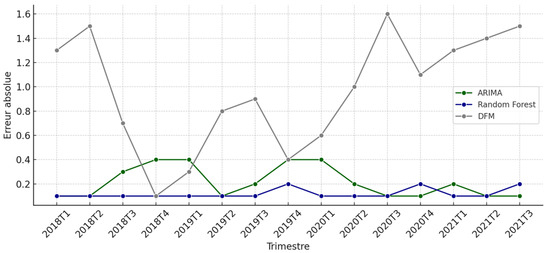

Figure 2 allows us to assess the temporal stability of model performance by observing their absolute errors quarter by quarter over the period 2018Q1 to 2021Q3. This analysis is particularly relevant in a context of regime breaks and exogenous shocks, where models are expected to maintain their accuracy without falling out of sync with observed dynamics.

Figure 2.

Absolute errors per quarter for each model.

The Random Forest model confirms its robustness here: its absolute errors are generally low and regular over the quarters. It manages to adapt to shocks while maintaining constant accuracy, making it a resilient model in the face of economic fluctuations.

In contrast, the ARIMA model, although moderately accurate, shows an under-reaction to abrupt changes, particularly around the COVID-19 period (2020Q1–2020Q3), where the error tends to increase. This reflects the limitations of a purely autoregressive model in the face of unanticipated breaks.

The DFM has the highest and most volatile errors. Its performance is particularly degraded in the year 2020, suggesting that the latent factors extracted by PCA do not effectively integrate the punctual and asymmetric effects of a global shock such as the pandemic.

5.4. DFM Factorial Map (PCA)

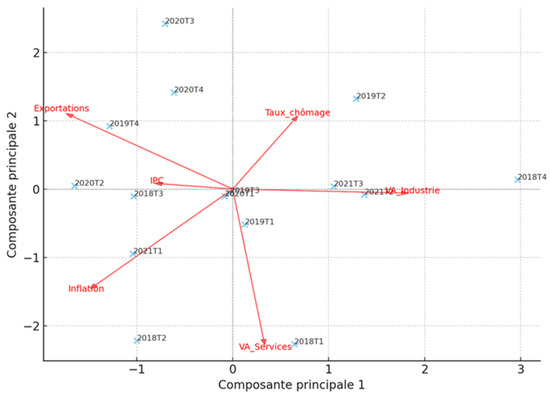

Figure 3 shows the factor map obtained by Principal Component Analysis (PCA) applied to the standardized explanatory variables used to estimate the Dynamic Factor Model (DFM). This projection provides a visual interpretation of the underlying structures of macroeconomic data across two main dimensions.

Figure 3.

Principal component factor map with variable contributions and projected quarters (2018Q1–2021Q3).

The factorial axes reveal distinct economic interpretations:

- Axis 1 (horizontal) appears to reflect an opposition between structural variables linked to productive activity (industrial value added, exports) and domestic consumption variables (CPI, services).

- Axis 2 (vertical) is more closely associated with macroeconomic imbalance variables such as inflation and unemployment.

The distribution of projected quarters (2018Q1 to 2021Q3) in the factorial plane shows a structured temporal evolution. The years 2018 and 2019 appear relatively clustered, reflecting relative stability. By contrast, the quarters of 2020 and 2021, affected by the COVID-19 crisis, are far from the barycentre, illustrating a marked cyclical break in aggregate economic dynamics.

Red arrows indicate variable contributions to the main axes. These include:

- Industrial value added and exports contribute strongly to axis 1,

- While inflation and the unemployment rate pull axis 2.

This suggests that factor space does capture the tensions between growth, domestic demand and imbalances, but that this simplification may obscure certain dynamic specificities, hence the observed limitations of DFM in terms of forecasting.

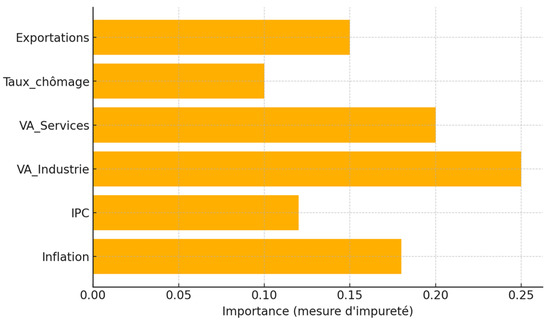

Figure 4 shows the results of the analysis of the importance of the explanatory variables in the prediction of the REER according to the Random Forest model. This importance is calculated from the average gains in node purity (Gini) during the construction of the decision trees, which makes it possible to identify the variables that contribute most to reducing the prediction error.

Figure 4.

Relative importance of explanatory variables in the Random Forest model.

The results highlight several fundamental determinants of the REER, consistent with the empirical literature on the equilibrium exchange rate (BEER model in particular). The most influential variables are:

- Industrial value added, which reflects the country’s productive capacity and its position in international trade.

- Inflation rate, which directly affects Morocco’s price competitiveness vis-à-vis its partners.

- Exports, a synthetic indicator of external performance.

- The consumer price index (CPI), which determines the relative level of domestic prices.

These results confirm the importance of real variables and cost competitiveness in determining the REER. The fact that the Random Forest gives relatively little weight to purely nominal or demographic variables suggests that REER fluctuations are explained more by economic fundamentals than by short-term monetary or institutional factors.

A comparative analysis of the ARIMA, Random Forest (RF) and Dynamic Factor Model (DFM) models for forecasting the Real Effective Exchange Rate (REER) in Morocco has revealed a number of empirical and methodological lessons.

The Random Forest model stood out as the best-performing approach, both in terms of overall accuracy (RMSE, MAE, MAPE) and resilience to structural disruptions. Its ability to incorporate non-linear relationships, model complex interaction effects, and adapt to exogenous shocks (such as the COVID-19 crisis) makes it a robust alternative to traditional econometric models.

The ARIMA model, although univariate, has demonstrated a decent ability to track the historical trend in REER, particularly over periods of stability. However, its performance deteriorated in the face of shocks, due to its structural inability to incorporate exogenous explanatory variables.

The Dynamic Factor Model has shown significant limitations. Despite the theoretical sophistication of the approach based on the synthesis of multiple information via PCA, the DFM failed to reproduce the fine dynamics of the REER, particularly in times of crisis. This result highlights the risks associated with excessive reduction in the information dimension, which can lead to a loss of essential granularity in forecasts.

6. Conclusions

This study is an extension of our work on the estimation and forecasting of the Real Effective Exchange Rate (REER), proposing a rigorous comparison between three empirical approaches: the ARIMA model, the Random Forest, and the Dynamic Factor Model (DFM). By mobilizing a database of quarterly macroeconomic data covering the period 1999Q4–2021Q3 for Morocco, it meets a dual objective: to assess the predictive performance of these methods and to examine their ability to capture the structural dynamics of the REER in a context of exchange rate regime transition.

The empirical results reveal that the Random Forest model offers the most robust predictive performance, outperforming conventional approaches in terms of both accuracy (RMSE, MAE, MAPE) and responsiveness to shocks. This conclusion is in line with findings established in recent studies applied to other emerging economies (see, for example, [16,17], where machine learning methods have proved particularly effective in incorporating non-linearities, threshold effects and cross-variable interactions.

The ARIMA model, often used in the literature as a univariate benchmark [2,3], succeeds in reproducing historical trends, but fails to anticipate inflections associated with exogenous ruptures such as the COVID-19 crisis. The DFM, for its part, although underpinned by solid foundations in empirical macroeconomics [9], suffers in this context from an excessive reduction in information, which limits its ability to accurately reflect the cyclical tensions affecting the REER.

Our results confirm several theoretical intuitions from the literature on equilibrium exchange rates. On the one hand, the structural determinants of the REER identified (sectoral value added, inflation, exports) are in line with the components put forward in the BEER (Behavioural Equilibrium Exchange Rate) models proposed by Clark & MacDonald (1999) and Williamson (1994) [1,7]. On the other hand, the superiority of flexible, non-parametric methods in unstable contexts underlines the relevance of hybrid approaches combining statistical tools and learning algorithms.

In operational terms, these results have concrete implications for Morocco’s exchange rate policy. As the country continues its transition to a more flexible exchange rate regime, the need for accurate and reactive monitoring of the REER becomes central.

The use of models such as Random Forest, capable of anticipating potentially long-lasting misalignments, can help strengthen the credibility of monetary policy and preserve external competitiveness in a globalized and unstable environment.

Finally, several extensions can be envisaged. The integration of economic policy variables (fiscal balance, policy rate), financial dimensions (capital flows, risk premiums), or governance indicators could further refine the predictive quality of the models. Extending this analysis to a panel of emerging countries would also make it possible to test the robustness of the results from a comparative perspective. Finally, structural modeling of REER misalignment, within a computable general equilibrium framework, would offer a useful extension to assess the long-term macroeconomic effects of deviations from the equilibrium rate [18]. The use of models such as Random Forest, capable of anticipating potentially lasting misalignments, can help reinforce the credibility of monetary policy and preserve external competitiveness in a globalized and unstable environment.

Author Contributions

Conceptualization, S.B. and H.E.B.; methodology, S.B.; software, K.B.; validation, A.F., H.E.B. and M.E.; formal analysis, S.B.; investigation, K.B.; data curation, S.B.; writing—original draft preparation, S.B. and H.E.B.; writing—review and editing, H.E.B.; visualization, S.B.; supervision, A.F.; project administration, A.F. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Williamson, J. Estimating Equilibrium Exchange Rates; Institute for International Economics: Washington, DC, USA, 1994. [Google Scholar]

- Egert, B.; Halpern, L.; MacDonald, R. Equilibrium exchange rates in transition economies: Taking stock of the issues. J. Econ. Surv. 2006, 20, 257–324. [Google Scholar] [CrossRef]

- Coudert, V.; Couharde, C. Currency misalignments and exchange rate regimes in emerging and developing countries. Rev. Int. Econ. 2008, 16, 121–136. [Google Scholar] [CrossRef]

- Box, G.E.P.; Jenkins, G.M. Time Series Analysis: Forecasting and Control; Holden-Day: San Francisco, CA, USA, 1976. [Google Scholar]

- Obstfeld, M.; Rogoff, K. The six major puzzles in international macroeconomics: Is there a common cause? NBER Macroecon. Annu. 2000, 15, 339–390. [Google Scholar] [CrossRef]

- Edwards, S. Real Exchange Rates, Devaluation and Adjustment: Exchange Rate Policy in Developing Countries; MIT Press: Cambridge, MA, USA, 1989. [Google Scholar]

- Clark, P.B.; MacDonald, R. Exchange rates and economic fundamentals: A methodological comparison of BEERs and FEERs. In Equilibrium Exchange Rates; IMF Working Paper, 99/67; Springer: Dordrecht, The Netherlands, 1999; Volume 69, pp. 285–322. [Google Scholar]

- Breiman, L. Random Forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef]

- Stock, J.H.; Watson, M.W. Forecasting using principal components from a large number of predictors. J. Am. Stat. Assoc. 2002, 97, 1167–1179. [Google Scholar] [CrossRef]

- Tibshirani, R. Regression shrinkage and selection via the lasso. J. R. Stat. Soc. Ser. B (Methodol.) 1996, 58, 267–288. [Google Scholar] [CrossRef]

- Athey, S.; Imbens, G.W. Machine learning methods that economists should know about. Annu. Rev. Econ. 2019, 11, 685–725. [Google Scholar] [CrossRef]

- Ghosh, M.; Thirugnanam, A. Introduction to Artificial Intelligence. In Artificial Intelligence for Information Management: A Healthcare Perspective; Srinivasa, K.G., Siddesh, G.M., Mani Sekhar, S.R., Eds.; Springer: Singapore, 2021; Volume 88, pp. 23–44. [Google Scholar]

- Forni, M.; Hallin, M.; Lippi, M.; Reichlin, L. The generalized dynamic factor model: One-sided estimation and forecasting. J. Am. Stat. Assoc. 2005, 100, 830–840. [Google Scholar] [CrossRef]

- Bańbura, M.; Modugno, M. Maximum likelihood estimation of factor models on datasets with arbitrary pattern of missing data. J. Appl. Econom. 2014, 29, 133–160. [Google Scholar] [CrossRef]

- Hyndman, R.J.; Khandakar, Y. Automatic time series forecasting: The forecast package for R. J. Stat. Softw. 2008, 27, 1–22. [Google Scholar] [CrossRef]

- Bussière, M.; Delle Chiaie, S.; Peltonen, T.A. Exchange rate misalignments and external imbalances: A global perspective. J. Int. Money Financ. 2020, 101, 102098. [Google Scholar]

- Medeiros, M.C.; Vasconcelos, G.F.; Veiga, Á.; Zilberman, E. Forecasting inflation in a data-rich environment: The benefits of machine learning methods. J. Bus. Econ. Stat. 2021, 39, 98–119. [Google Scholar] [CrossRef]

- Baya, S.; Fadlallah, A.; Baraka, H.E.; Mouhil, I. Empirical Investigation of Real Exchange Rate Misalignments in Morocco: A Machine Learning Approach. In Proceedings of the International Conference on Digital Technologies and Applications, Benguerir, Morocco, 10–11 May 2024; Volume 1100, pp. 543–552. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).