Key Drivers of Environmental, Social, and Governance Practices in Taiwan’s Manufacturing Industry: Digital Supply Chain by Hybrid Delphi Technique and Analytical Hierarchy Process †

Abstract

1. Introduction

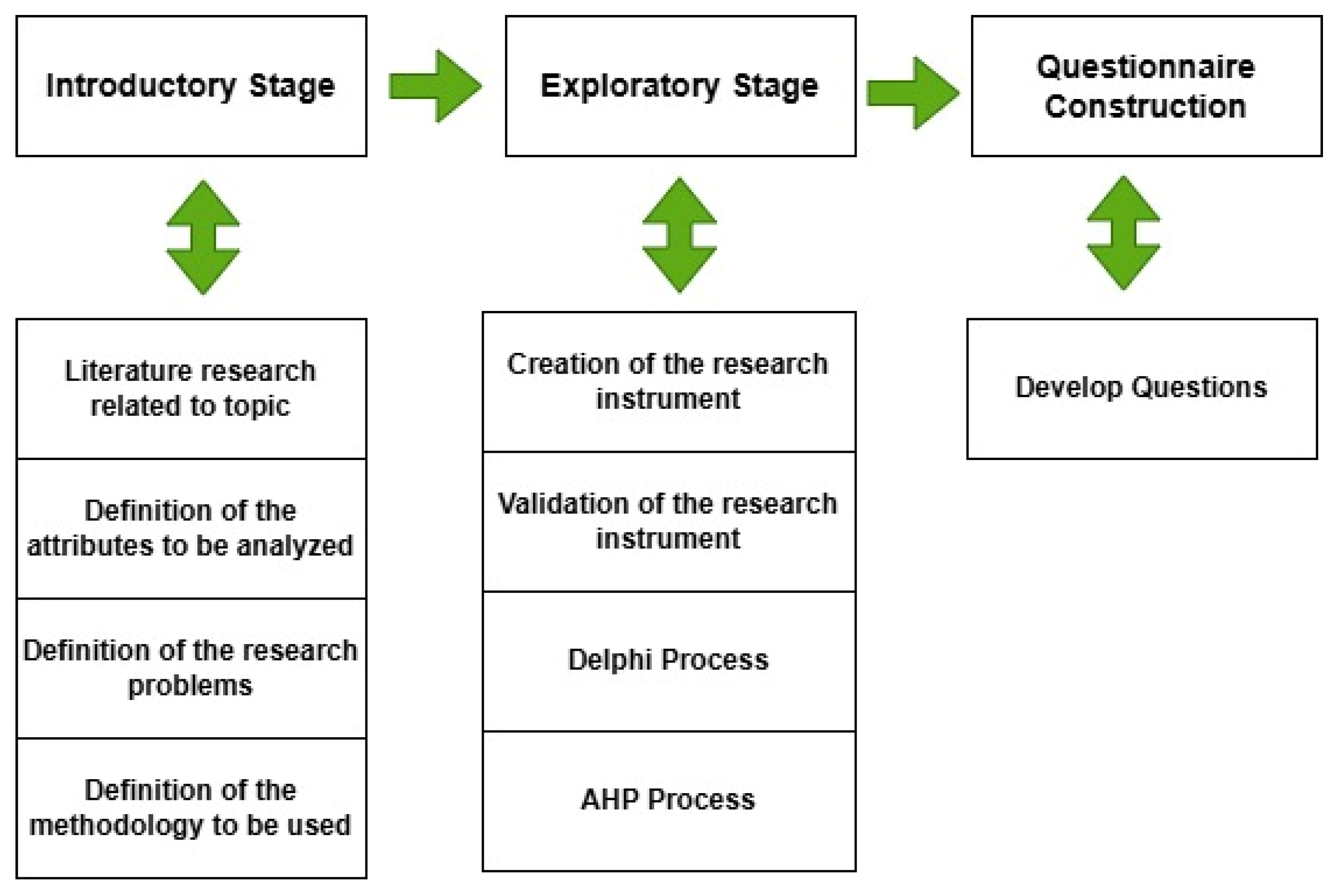

2. Methodology

3. Result and Discussion

3.1. Variable

3.2. AHP

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Goyal, S.; Esposito, M.; Kapoor, A. Circular economy business models in developing economies: Lessons from India on reduce, recycle, and reuse paradigms. Thunderbird Int. Bus. Rev. 2018, 60, 729–740. [Google Scholar] [CrossRef]

- Rajput, S.; Singh, S.P. Connecting circular economy and industry 4.0. Int. J. Inf. Manag. 2019, 49, 98–113. [Google Scholar] [CrossRef]

- Bassetti, T.; Blasi, S.; Sedita, S.R. The management of sustainable development: A longitudinal analysis of the effects of environmental performance on economic performance. Bus. Strategy Environ. 2021, 30, 21–37. [Google Scholar] [CrossRef]

- Dwyer, R.; Lamond, D.; Molina-Azorín, J.F.; Claver-Cortés, E.; Lopez-Gamero, M.D.; Tarí, J.J. Green management and financial performance. A literature review. Manag. Decis. 2009, 47, 1080–1100. [Google Scholar] [CrossRef]

- Linnenluecke, M.K.; Griffiths, A.; Winn, M. Extreme weather events and the critical importance of anticipatory adaptation and organizational resilience in responding to impacts. Bus. Strategy Environ. 2012, 21, 17–32. [Google Scholar] [CrossRef]

- Okorie, O.; Salonitis, K.; Charnley, F.; Moreno, M.; Turner, C.; Tiwari, A. Digitisation and the circular economy: A Review of Current Research and Future Trends. Energies 2018, 11, 3009. [Google Scholar] [CrossRef]

- Kouhizadeh, M.; Zhu, Q.; Sarki, J. Blockchain and the circular economy. Potential tensions and critical reflections from practice. Prod. Plan. Control 2020, 31, 950–966. [Google Scholar] [CrossRef]

- Butner, K. The more intelligent supply chain of the future. Strategy Leadersh. 2010, 38, 22–31. [Google Scholar] [CrossRef]

- Wu, L.; Yue, X.; Jin, A.; Yen, D.C. Smart supply chain management: A review and implications for future research. Int. J. Logist. Manag. 2016, 27, 395–417. [Google Scholar] [CrossRef]

- Zouari, D.; Ruel, S.; Viale, L. Does digitalizing the supply chain contribute to its resilience? Int. J. Phys. Distrib. Logist. Manag. 2021, 51, 149–180. [Google Scholar] [CrossRef]

- Yadav, G.; Luthra, S.; Jakhar, S.K.; Mangla, S.K.; Rai, D.P. A framework to overcome sustainable supply chain challenges through solution measures of industry 4.0 and circular economy. An automotive case. J. Clean. Prod. 2020, 254, 120112. [Google Scholar] [CrossRef]

- Krueger, P.; Sautner, Z.; Tang, D.Y.; Zhong, R. The Effects of Mandatory ESG Disclosure Around the World, European Corporate Governance Institute. Financ. Work. Pap. 2021, 754, 421–442. [Google Scholar]

- Li, Z.; Feng, L.; Pan, Z.; Sohail, H.M. ESG performance and stock prices: Evidence from the COVID-19 outbreak in China. Humanit. Soc. Sci. Commun. 2022, 9, 242. [Google Scholar] [CrossRef] [PubMed]

- Li, W.; Liu, Z. Social, Environmental, and Governance Factors on Supply-Chain Performance with Mediating Technology Adoption. Sustainability 2023, 14, 10865. [Google Scholar] [CrossRef]

- Zhou, Y.; Zhang, N.; Wu, C.; Wang, Y.; Zhang, X.; Zhang, D. The Impact of Supply Chain ESG Management on Supply Chain Resilience With Emerging IT Technologies. J. Organ. End User Comput. 2024, 36, 1–31. [Google Scholar] [CrossRef]

- Kim, S.; Li, Z. Understanding the Impact of ESG Practices in Corporate Finance. Sustainability 2021, 13, 3746. [Google Scholar] [CrossRef]

- Liu, J.; Xie, J. The Effect of ESG Performance on Bank Liquidity Risk. Sustainability 2024, 16, 4927. [Google Scholar] [CrossRef]

- Dong, B. A Systematic Review of the ESG Strategy Literature and Future Outlook. Front. Sustain. Dev. 2023, 3, 105–112. [Google Scholar] [CrossRef]

- Zaccone, M.C.; Pedrini, M. ESG Factor Integration into Private Equity. Sustainability 2020, 12, 5725. [Google Scholar] [CrossRef]

- Martiny, A.; Taglialatela, J.; Testa, F.; Iraldo, F. Determinants of environmental social and governance (ESG) performance. A systematic literature review. J. Clean. Prod. 2024, 456, 142213. [Google Scholar] [CrossRef]

- Khamisu, M.S.; Paluri, R.A.; Sonwaney, V. Stakeholders’ perspectives on critical success factors for environmental social and governance (ESG) implementation. J. Environ. Manag. 2024, 365, 121583. [Google Scholar] [CrossRef]

- Saaty, T.L. The Analytic Hierarchy Process; McGraw-Hill: New York, NY, USA, 1980. [Google Scholar]

| Variables | Categories |

|---|---|

| Non-financial characteristics | Company characteristics |

| Managerial attributes | |

| Financial characteristics | |

| Financial Performance | Performance |

| Market Performance | |

| Environmental performance | |

| Third-party ratings | |

| Signaling future performance | |

| Strategic Orientation | Strategy |

| Diversity on the board of directors | Corporate governance |

| Board activity | |

| Sustainability governance of the company | |

| The company’s organizational visibility | |

| Investors | Investors relation |

| ESG reporting and disclosure | ESG adoption |

| ESG materiality | |

| ESG reporting guidelines | |

| Mandatory disclosure policies | |

| Audit and assurance | |

| Technology and competition | Technology |

| Variables | Questions |

|---|---|

| Name | |

| Company | |

| Category | Small Medium Large |

| Position | |

| Education | |

| Gender | |

| Age | |

| Organizational Characteristics | Are there specific budgets allocated for ESG-related projects? |

| How does the company balance financial performance with ESG investments? | |

| Does the company have a clear strategy to reduce its carbon footprint? How does the company manage its waste and recycling programs? Are there any certifications or benchmarks achieved related to sustainability (e.g., ISO 14001)? | |

| Performance | Does the leadership team demonstrate commitment to ESG initiatives? |

| How transparent is management regarding ESG-related performance? | |

| How does the company balance ESG initiatives with profitability goals? | |

| How have ESG announcements impacted the company’s stock price or market value? | |

| What metrics evaluate the company’s environmental performance (e.g., emissions, energy usage)? | |

| Strategy | What is the company’s current ESG rating from recognized third-party organizations (e.g., MSCI, Sustainalytics)? |

| Corporate Governance | What future ESG goals and targets has the company set, and are they publicly disclosed? |

| Does the company have a long-term strategic plan that integrates ESG priorities? | |

| How does board diversity contribute to the company’s strategic decision-making and ESG performance? | |

| Are there dedicated committees (e.g., sustainability or ESG committees) within the board structure? | |

| Investors Relation | How is sustainability performance tracked, reported, and communicated to stakeholders? |

| ESG Adoption | How does the company promote its ESG efforts and achievements to stakeholders (e.g., through reports, media, or campaigns)? |

| How does the company communicate its ESG strategy and performance to investors? | |

| Does the company have a formal ESG reporting framework in place? | |

| How does the company identify material ESG issues relevant to its industry and operations? | |

| Which ESG reporting frameworks or standards does the company follow (e.g., GRI, SASB, TCFD, CDP)? | |

| Technology | What ESG information is disclosed to comply with local, regional, or international regulations? |

| Are ESG reports independently audited or assured by third-party companies? | |

| What technologies has the company adopted to promote sustainability and reduce environmental impact? |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chang, H.-L.; Silitonga, R.M.; Jou, Y.-T.; Sukwadi, R.; Kristiana, S.P.D.; Silalahi, A. Key Drivers of Environmental, Social, and Governance Practices in Taiwan’s Manufacturing Industry: Digital Supply Chain by Hybrid Delphi Technique and Analytical Hierarchy Process. Eng. Proc. 2025, 108, 27. https://doi.org/10.3390/engproc2025108027

Chang H-L, Silitonga RM, Jou Y-T, Sukwadi R, Kristiana SPD, Silalahi A. Key Drivers of Environmental, Social, and Governance Practices in Taiwan’s Manufacturing Industry: Digital Supply Chain by Hybrid Delphi Technique and Analytical Hierarchy Process. Engineering Proceedings. 2025; 108(1):27. https://doi.org/10.3390/engproc2025108027

Chicago/Turabian StyleChang, Hsueh-Lin, Riana Magdalena Silitonga, Yung-Tsan Jou, Ronald Sukwadi, Stefani Prima Dias Kristiana, and Agustinus Silalahi. 2025. "Key Drivers of Environmental, Social, and Governance Practices in Taiwan’s Manufacturing Industry: Digital Supply Chain by Hybrid Delphi Technique and Analytical Hierarchy Process" Engineering Proceedings 108, no. 1: 27. https://doi.org/10.3390/engproc2025108027

APA StyleChang, H.-L., Silitonga, R. M., Jou, Y.-T., Sukwadi, R., Kristiana, S. P. D., & Silalahi, A. (2025). Key Drivers of Environmental, Social, and Governance Practices in Taiwan’s Manufacturing Industry: Digital Supply Chain by Hybrid Delphi Technique and Analytical Hierarchy Process. Engineering Proceedings, 108(1), 27. https://doi.org/10.3390/engproc2025108027