1. Introduction

In the last decade, diverse stakeholders including industry leaders, policymakers, and advocacy groups [

1] have increasingly endeavored to replace fossil fuels with green hydrogen (from renewable resources) [

1]. The use of green hydrogen and its derivative products of green hydrogen will require a strong and resilient business model that ensures that long-term financing is provided, and that offtake agreements are in place alongside reliable technology, favorable policies and secure off-take agreements [

2]. This will accelerate an energy transition to a green economy characterized by zero or reduced greenhouse gas (GHG) emissions.

This study evaluates the different financing mechanisms for renewable energy and clean technologies like green hydrogen to enhance the green economy in sub-Saharan Africa (SSA), by leveraging clean energy sources like renewable resources (wind and solar), water, and abundant land [

3]. The significance of this study is that green financing mechanisms can promote green hydrogen development. Green hydrogen has the potential to provide fuel for all economic sectors that are currently dependent on fossil fuels. By utilizing their renewable resources and transforming grids, it can help achieve 100% zero-carbon energy [

4]. Further, this can contribute to decarbonizing the economies and achieving an energy transition in SSA by 2030. Given that climate change is caused by excessive GHG emissions, energy transformation unlocks new investment opportunities, and there is a need to finance green economies [

5].

According to the African Development Bank (AfDB), the uptake of the proposed green hydrogen project should be founded on well-articulated financial agreements between financial institutions, the industry, and policymakers. Further, the use of incentives like subsidies is encouraged [

2].

Green energy finance is essential to hydrogen energy development because it can contribute positively to closing the existing gap between the current Nationally Determined Contributions (NDCs), particularly, communicating the post-2020 climate efforts as NDCs help limit global temperature rises well below 2 °C, and the different initiatives needed to achieve the Paris temperature targets [

6]. Green hydrogen has garnered significant interest from various stakeholders worldwide.

Project finance is a way to attract capital flow that would help build a project. This can be achieved through debt acquisition or having an equity investment plan, which involves debt and/or financial resources from another stakeholder [

7]. Before financing any project, most financial institutions assess the credentials or technical abilities of the project developer to build or install high-quality infrastructure that will guarantee adequate equity returns or the project’s capability to repay the loan.

Although renewable energy resources are variable renewable energy systems (VRESs) in nature, they can leverage electrolyzers that can operate at lower temperatures (20–100 °C), like the Polymer Electrolyte Membrane (PEM) [

8]. However, this does not imply that other electrolyzers operating at higher temperature ranges cannot be utilized. Furthermore, financial institutions typically evaluate and negotiate project financing based on detailed projections of future returns. These assessments often include the anticipated revenue streams from offtake agreements, projected internal rate of return (IRR), payback period, and net present value (NPV) of the project. Additionally, several other factors contribute to a project’s financial attractiveness, including its geographic location, prevailing market conditions (such as electricity prices and hydrogen demand), regulatory stability, and perceived risks related to infrastructure, policy, and technology readiness [

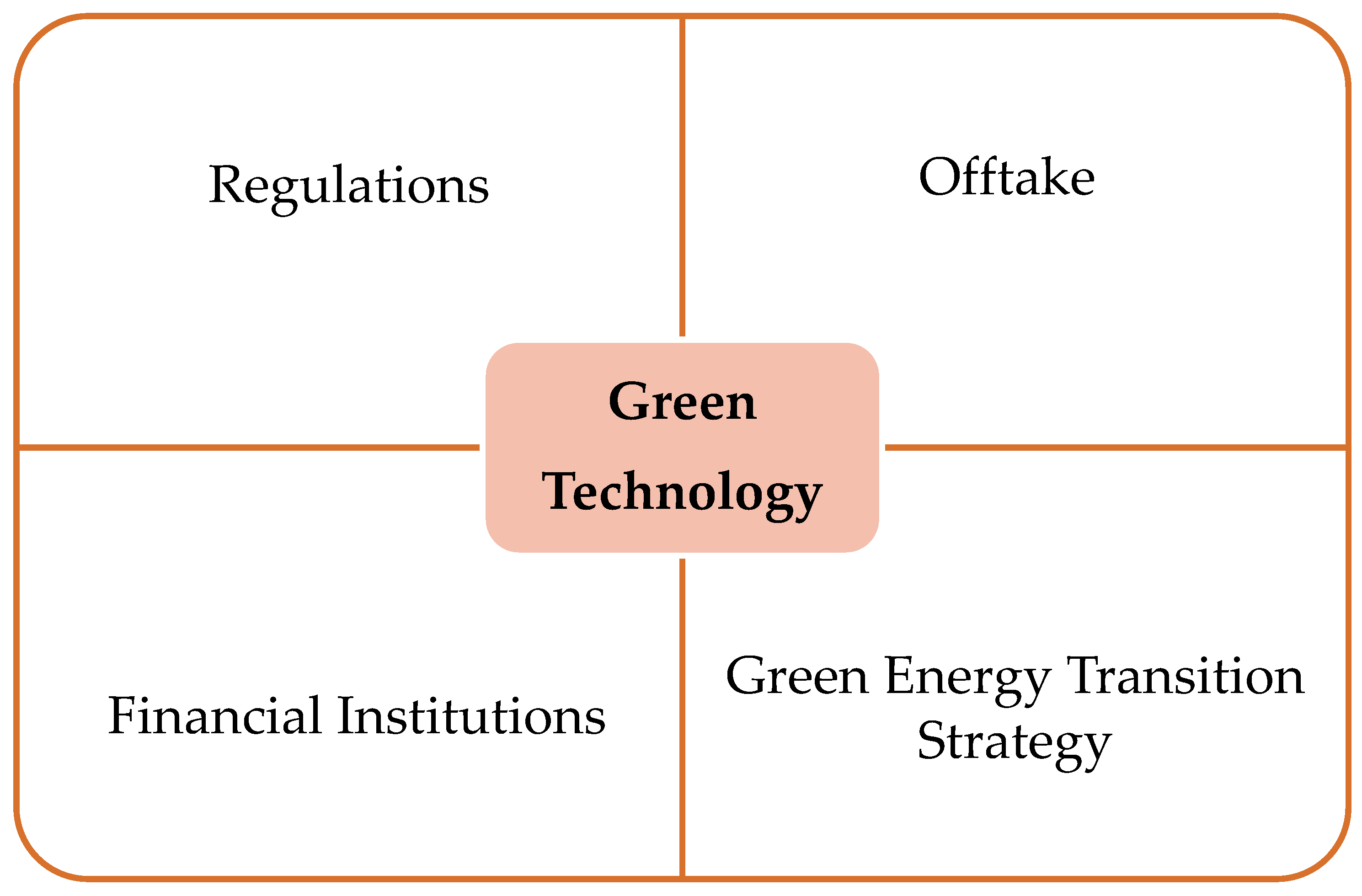

9]. The key factors supporting technology’s critical role in hydrogen development include favorable green hydrogen regulations, promising offtake, tested and reliable technology, green energy transition strategies, and financial institutions to achieve a resilient business model.

Figure 1 shows how these elements interact with each other.

Figure 1 shows that green hydrogen project finance is anchored on five interlocked key thematic areas for hydrogen energy development. Further to making a resilient business case that can attract investors, all the interlinking factors must be taken into consideration while noting that technology (electrolysis membrane) is the core of the green hydrogen energy financing model because it is the dominant process for energy production and its utilization and application. Technology has a great impact on the cost of hydrogen development [

10].

However, green hydrogen financing will not come without challenges and risks. Some of these risks may include poor energy project developers, poor funding/loan availability, poor electrical grid infrastructure, the road network, natural calamities and pandemics, political instability, and other security risks like war, to mention only a few.

While the main objective of this review is to analyze the potential financing mechanisms for green hydrogen development in sub-Saharan Africa, the key issues, like policies, strategies, financing institutions, and the risks associated with the financing mechanisms, are addressed. The key objectives that address the main objectives include the following:

- i.

Examine Policy and Regulatory Frameworks: Investigate the role of policy and regulatory frameworks in facilitating green hydrogen projects and attracting investments.

- ii.

Evaluate Financing Mechanisms: Assess the available and the most promising financing mechanisms for mobilizing funds to support renewable energy and green hydrogen development in SSA.

- iii.

Propose Strategies for Scale-Up: Develop strategies for scaling up green hydrogen production and infrastructure in SSA, considering technical, financial, and market challenges.

- iv.

Identify Opportunities and Risks: Analyze the opportunities and risks associated with transitioning to a Net-Zero emission economy driven by hydrogen energy in SSA.

The overarching reason for conducting this study was to complement and provide supporting data for the H2Atlas-Africa project [

11].

This review article is limited to highlighting the financing mechanisms of the green hydrogen economy for hydrogen production and the associated enablers from a market perspective. The hydrogen opportunities are also indirectly presented by only highlighting the risks, supporting policies, strategies, funding institutions, and available modes without analyzing the success and failure rate of these mechanisms. One key limitation to this work is that although hydrogen energy technology is a core element for the green hydrogen financing model that we developed (

Figure 1), not enough information or deployment evidence of electrolysis technology and other clean energy technologies in SSA is provided in this study.

The importance of green financing is highlighted through value-added services that stem from three main business opportunity streams: manufacturing, hydrogen production, and hydrogen infrastructure for end-uses across the entire value chain network. The three main contributions of this study are as follows:

- i.

Green Economy Transition: This study emphasizes the importance of green financing mechanisms in promoting green hydrogen development, which can help transition economies to zero-carbon energy.

- ii.

Investment Opportunities: Green hydrogen projects offer new investment prospects, helping to decarbonize economies and support the energy transition by 2030 in SSA.

- iii.

Policy and Regulatory Support: This research highlights the importance of effective policies and regulatory frameworks to attract private investments and promote sustainable development and hydrogen project investment.

These factors provide investors, policymakers, and international organizations with insights into the ease or difficulty of doing business in SSA. This article proceeds as follows: starting with an introduction and then describing the methodology, which emphasizes the approach, financing for a green economy, financing mechanisms, scaling-up strategies (including policies), risk factors, and opportunity factors.

This manuscript’s novelty lies in its focused on green hydrogen financing in SSA, its comprehensive evaluation of financing mechanisms, and its practical risk assessment and mitigation strategies. By integrating policy recommendations and innovative financing approaches, this study provides valuable insights for stakeholders aiming to drive the green hydrogen economy in SSA.

2. Materials and Methods

This study serves as a complementary extension to the H2Atlas-Africa project by focusing specifically on the financial mechanisms required to operationalize green hydrogen development in sub-Saharan Africa. While the H2Atlas project provided a comprehensive technical assessment of hydrogen production potential, including renewable energy resource mapping, land and water eligibility, and techno-economic modeling, this review builds upon those findings by addressing the crucial financial dimension needed to mobilize investment and enable project implementation. This study leverages primary and secondary data generated during the H2Atlas process, including focus group discussions, regional datasets, and modeling results, to analyze and propose financing pathways tailored to SSA’s green hydrogen context. The methodology section of this manuscript outlines both the data collection approaches used in the H2Atlas project, and the independent analytical framework adopted in this review. The overarching objective is to fill a critical gap in the H2Atlas project initiative by systematically evaluating financial instruments, such as green bonds, public–private partnerships, and multilateral funding, that can support and supplement the project’s technical outputs, thereby enabling a bankable, scalable green hydrogen economy in the region.

2.1. Method for This Study

In this study, a mixed-methods approach was adopted to review the potential financing mechanisms for green hydrogen development in SSA. While the primary purpose or main objective was evaluating the financing mechanisms in SSA, four (4) key specific themes that were identified include: (1) green financing, (2) policy and regulatory frameworks, (3) financing mechanisms/modes, (4) scaling-up strategies, and (5) opportunities and risks associated with green financing in SSA.

This review study leveraged primary data on the H2Atlas project from key stakeholders like utility firms, government ministries (labor, environment, energy), research institutions, private firms, NGOs, universities, and other institutions in both the Southern African Development Community (SADC) and Economic Community of West African States (ECOWAS) countries, obtained through focus group discussions supporting the H2Atlas-Africa project findings, alongside credible secondary data from energy utility firms [

12]. Secondary data was also obtained from international organizations like the World Bank, IPCC, IMF, IEA, etc. and Peer-reviewed journals were collected.

2.1.1. H2Atlas Project Methods

The H2Atlas project utilized theoretical analysis with relevant analytical tools and data to measure the potential for green hydrogen production. The necessary data for this analysis includes location information related to renewable energy resources, local energy demands, current and future climate change scenarios and impacts, as well as land and water use preferences. The project begins by assessing the renewable energy potential and energy utilization in various countries, which is crucial since green hydrogen can only be produced if sufficient renewable energy is available. It also involves evaluating land eligibility and water resources required for hydrogen production. Using this information and other local preferences and conditions, the green hydrogen potential and associated costs are estimated through applied modeling and analytical tools [

12].

Technical teams from West and Southern Africa collaborate closely with the technical team at Forschungszentrum Jülich GmbH to ensure the acquisition of relevant data for each region. Validation workshops are conducted to ensure that all project partners and stakeholders contribute and agree on the results.

Different databases were collected using the guidelines outlined in the following H2Atlas work packages [

12].

Table 1 shows the work packages that guided the data collection during the H2Atlas project’s primary data collection process.

2.1.2. Primary Data Method from the H2Atlas Project

A rigorous method was adopted on the H2Atlas project to collect primary data from utilities such as the municipalities, energy utility firms, research centers, government departments, other public institutions, etc., 12 SADC countries involved are; Zambia, Zimbabwe, Botswana, Malawi, Mozambique, Namibia, South Africa, Eswatini, Lesotho, Mauritius, Angola, and DRC. In West Africa, the 14 countries that were involved in the H2Atlas project include; Benin, Burkina Faso, Cape Verde, Côte d’Ivoire, Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone, and Togo. In both SADC and West Africa, five (5) experts from the Water, Environment, Energy, Climate, and Lands departments were selected as project management team members for every country. Further, each expert brought at least 5 members to each focus group discussion. This implies that about seventy-two (72) experts were involved in SADC, and eighty-four (84) experts were involved in West Africa.

2.1.3. Secondary Data for This Study

Our search criteria in this review article relied on key search words that align with the four thematic areas identified in the first part of this methodology. Further, we also searched using the following article key phrases: hydrogen finance in SSA, hydrogen investment in SSA, hydrogen public–private partnerships in SSA, green hydrogen in SSA, and renewable energy investment risks in SSA. When data discrepancies existed, the reference was cross-checked with the actual source data. Some key databases used include EBSCO, Google Scholar, Web of Science, SAGE, Scopus, etc. Due to the nature of data resource scarcity, no data was excluded, but the very latest literature resources in the area of hydrogen and renewable energy were selected.

2.1.4. Identifying Project Opportunities and Challenges for This Study

The analysis of the data was performed alongside the thematic areas and the green financing model (

Figure 1) discussion and descriptions. The purpose of this review is to analyze the potential financing mechanisms for green hydrogen development in sub-Saharan Africa. The key issues, like policies, strategies, and financing institutions, were addressed, along with the risks associated with the financing mechanisms.

A risk matrix was developed, with the main risks and opportunities identified using the target datasets to be collected and stakeholder discussions, which were held during the H2Atlas project implementation. Furthermore, we also utilized secondary data, based on the target datasets to be collected. A detailed risk-weighting criterion is given in

Section 6.4. We also analyzed the opportunities and risks associated with green financing and green hydrogen production potential, with a focus on (1) project oversights during the implementation and commissioning phase (e.g., capital cost exceeded), (2) funding/loan availability, (3) electrical grid connection issues, (4) high pressure and large-quantity hydrogen storage, (5) hydrogen transport using pipelines or trucks, (6) pandemics or natural calamities and climate change, (7) political instability/change in governments, and (8) other security risks like war. These focus areas were given weights on a scale of 0–16 after a careful scientific and backed-up allocation method as follows:

A 0–3 score is a low risk that requires remedial action at the project/program manager’s discretion.

A 4–6 score is a medium risk that requires remedial action to be taken at the appropriate time.

A 7–8 score is high risk that requires remedial action to be given high priority.

A 10–16 score is a very high risk that may prevent operations from going on smoothly and therefore will need immediate action to operate.

2.1.5. Expert Selection Criteria for Primary Data Collection

To ensure the credibility and representativeness of the primary data collected during the H2Atlas-Africa project, a structured expert selection protocol was applied across the participating SADC and ECOWAS countries. Experts were selected based on specific criteria, including a minimum of five years of professional experience in energy systems, environmental policy, climate change, infrastructural planning, or renewable energy finance. Eligible experts were drawn from government ministries (e.g., energy, environment, finance), national research institutes, utility companies, and regional regulatory agencies, with priority given to individuals holding at least a master’s degree or an equivalent professional qualification in a related technical field. This approach ensured a multidisciplinary representation across technical, policy, and financial domains.

Furthermore, WASCAL and SASSCAL convened a Scientific Advisory Committee (SAC) composed of senior researchers and domain specialists. These committees played a critical role in validating the data collected by national H2Atlas teams, reviewing methodological soundness, and ensuring regional consistency in technical assumptions and data interpretation. The involvement of SACs significantly strengthened this study’s methodological robustness and enhanced the reliability of its findings across diverse sub-Saharan African contexts.

The conclusions of this review article are drawn from the entire analysis, but with a bias towards financing mechanisms/modes. All other analysis, including the risk matrix, was designed to address the financing mechanisms, which is essentially the purpose of this study.

3. Financing the Green Economy Transition

Financing to achieve a green economy is referred to as green financing. The United Nations Environmental Programme (UNEP) defines green financing as an increase in the level of financial flow (from the banks, micro-credit, insurance, and investment) from the public, private, and not-for-profit sectors to sustainable development priorities [

13]. It may incorporate grants, loans, investments, or debt mechanisms that decarbonize economies or limit the effect of climate change. To achieve green economies in SSA, and to attain self-sustainability, linking green finance with policy reforms is critical. Such innovative approaches would support governments in formulating sound green policies for a green economy and conjointly developing strategies that build responsive financial investment systems that are sustainable [

14,

15].

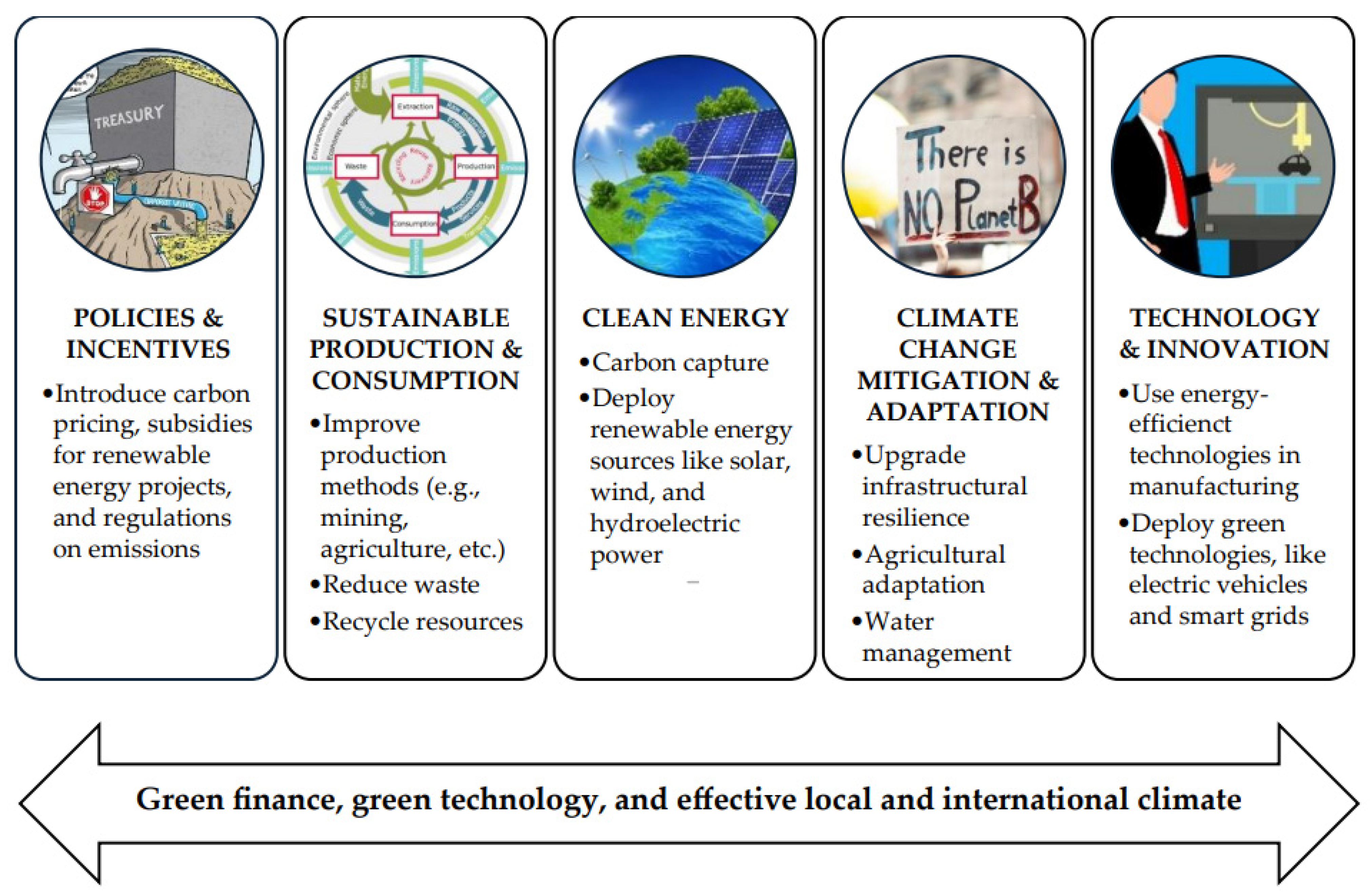

The five key sectors that can unlock financial investment, economic growth, and sustainability opportunities for financing a green economy transformation are shown in

Figure 2.

Figure 2 shows that policies and incentives play a crucial role in driving the green economy by encouraging businesses and individuals to adopt sustainable practices. They create a framework that supports the transition to clean energy, promotes sustainable production and consumption, and fosters innovation in green technologies. Sustainable production and consumption reduce environmental impact and resource depletion, ensuring a long-term ecological balance. Clean energy sources, such as solar and wind, are vital for reducing greenhouse gas emissions and combating climate change. Climate mitigation and adaptation strategies help manage and reduce the risks associated with climate change, protecting communities and ecosystems. Technology and innovation are essential for developing new solutions and improving efficiency in various sectors, making green practices more accessible and cost-effective. Financial investment is significant as it provides the necessary capital to develop and scale green technologies, infrastructure, and projects, ensuring the successful implementation of sustainable initiatives. Together, these elements create a synergistic effect that drives the transformation towards a sustainable and resilient green economy.

A green hydrogen economy is reflected in three main economic sectors: industries, transportation, and energy production [

16], including the entire supply chain network. Correspondingly, activity concentrates in three business streams [

17]:

- i.

Manufacturing upstream and downstream equipment Hydrogen production Infrastructures for hydrogen end-uses alongside the entire value chain network.

This development presents different challenges and risk profiles for each of these business streams. Before approving a green hydrogen loan, financing institutions focus on (i) assessing the investment risk for green hydrogen’s offtake and (ii) developing cost-effective financing mechanisms along the supply chain network. The purpose of this two-factor evaluation approach of green finance is to develop or unravel the private-sector finance and public-sector financing mechanisms for green hydrogen development in SSA. To effectively support the development of a green hydrogen economy, it is essential to explore the financial mechanisms that can facilitate this transition.

4. Green Financing Mechanisms

In Africa, green finance is seen as crucial for economic growth. It provides access to various sources of funding, offering low-cost and essential capital for infrastructure projects and green funding initiatives [

17]. While every African country has significant green resources, financing challenges have held most nations back from harnessing their potential [

18]. Nevertheless, many sources and forms of green finance are available to most African nations [

19]. Many African countries have also expressed their commitment through the Paris Agreement to promote and implement green issuance as part of their national strategies. Green finance mechanisms are well-suited for African countries that need to balance infrastructure development with raising capital to achieve their Sustainable Development Goals [

17]. Immediate action is needed from governments, the private sector, and donors to invest in green projects by working together and leveraging their unique strengths to promote a green economy and enhance living conditions. Across Africa, there are at least five main sources of green funding: (i) government sources, (ii) multilateral and bilateral development funds, (iii) carbon financing, (iv) private-sector investments, and (v) innovative new financing options [

20].

While sub-Saharan Africa holds substantial potential for green hydrogen production due to its abundant solar, wind, and hydropower resources, associated investment costs remain significant and often require external financing from private investors, governments, or multilateral institutions. Modeling results from the H

2Atlas-Africa initiative, using a multidisciplinary regional approach, indicate that the Levelized Cost of Hydrogen (LCOH) across sub-Saharan Africa varies significantly depending on the energy source, geographic region, and expansion level. In Southern Africa, where solar and wind resources are highly favorable, LCOH values range from approximately EUR 1.30/kg H

2 for hydropower-based production to about EUR 2.40/kg H

2 when onshore wind systems are fully deployed. In West Africa, initial costs are somewhat higher due to more limited infrastructure and a less favorable renewable resource density, with modeled values starting near EUR 1.60/kg H

2 and increasing with scale. Notably, even when desalination is required for water supply, its impact remains minimal, contributing less than 1.2% to the total hydrogen cost. These findings confirm that, with proper resource optimization and targeted infrastructure development, green hydrogen production in sub-Saharan Africa can achieve globally competitive cost levels [

18]. Government resources alone are inadequate to attract international investment requirements for scaling up green services. On the one hand, these resources are limited, and worse still, several other sectors of the economy compete for the same resources as the private sector, and this means most of the private investors in sub-Saharan African countries find it risky to invest in clean energy, including renewable energy [

19]. This is largely connected to the different countries’ prevailing investment and business climate. Therefore, to attract private investors to the green program, the government must improve the policy and regulatory environment and create market-based mechanisms to incentivize businesses. Mobilizing multilateral and bilateral financing institutions is vital for ensuring the sustainable development of the green market in Africa. For instance, in 2020, the Multilateral Development Banks (MDBs) invested about USD 66 billion in low-carbon projects, of which 58% was committed in low- and middle-income countries. These included the Climate Investment Funds (CIF), Green Climate Fund (GCF), and climate-related funds under the Global Environment Facility (GEF), EU blending facilities, and others [

20]. The AfDB has doubled its climate finance to USD 25 billion for the period of 2020–2025, giving priority to adaptation finance and promotion of green growth [

21]. The bank supports its member countries in three ways: Firstly, by encouraging them to mainstream clean energy options into national development plans and energy planning. Secondly, by promoting investment in clean energy and energy efficiency ventures. Finally, by supporting the sustainable exploitation of the huge clean energy potential of the continent. Other financing mechanisms include the Sustainable Energy Fund for Africa (USD 400 million). The AfDB is projected to reach at least 70% by 2030 of its committed operations supporting green finance (about USD 80 billion). The African Development Bank (AfDB) supports a range of green projects, including renewable energy (solar, wind, hydro, geothermal), energy efficiency, sustainable agriculture, water management, climate resilience, and green infrastructure. These initiatives aim to promote sustainable development, reduce environmental impact, and improve the quality of life across Africa [

21].

Another financing mechanism for renewable energy is carbon finance. This innovative mechanism associates the economic value of carbon emissions offset as carbon credits earned for a sustainable project that has been implemented [

22]. According to the World Bank Group, a 5-year Climate Change Action Plan will support transformative investments in key sectors that contribute the most to global greenhouse gas emissions [

23]. Low-carbon transitions in energy, transport, cities, manufacturing, and food are expected to generate trillions of dollars of investment and millions of new jobs over the next decade [

24]. A further analysis of the financing climate in SSA, benchmarking with the global trends that take into consideration interest rates, inflation, exchange rate stability, infrastructure, and agreements (bilateral and multilateral), is explained in

Section 4.1. Given the importance of diverse financing mechanisms, it is crucial to understand the broader financing climate that supports these initiatives.

4.1. Financing Climate

According to the United Nations Framework Convention on Climate Change (UNFCCC), climate finance is “finance that aims at reducing emissions and enhancing sinks of greenhouse gases and aims at reducing the vulnerability of, and maintaining and increasing the resilience of, human and ecological systems to negative climate change impacts.” In sub-Saharan Africa, due to the threats posed by current climate impacts and the challenges of future climate vulnerability, the gap between resource needs and flows needed to build the continent’s resilience to an increasingly hostile climate is alarming. Support for sub-Saharan Africa is critical in addressing the fight against climate change; many people are already leaving the continent due to extreme conditions caused by rising temperatures. Without financial support, climate change is expected to push tens of millions more Africans into extreme poverty by 2030 [

25]. Therefore, the United Nations Framework Convention on Climate Change (UNFCCC) in 2010 set up the largest databases on multilateral climate finance initiatives and the Green Climate Fund for developing regions such as SSA [

25]. Current levels of funding for adaptation on the continent are estimated to be about USD 3 billion a year. According to the IMF, it is estimated that SSA needs at least USD 30 billion to USD 50 billion to cope with the impacts of climate change [

19]. According to the Climate Funds Update (CFU) report, between 2003 and 2020, a total of USD 5.9 billion has been approved for 827 projects and programs for SSA, of which just over a third or 37% of the approved funding from these multilateral climate funds has been provided for adaptation measures, as shown in

Table 1 [

26]. The level of financing currently reaching SSA countries is nowhere near enough to meet demonstrated needs, especially for immediate adaptation measures [

27]. In SSA, climate finance is unevenly distributed. From 2003 to 2020, 43 SSA countries received some climate finance, and about half (48%) of approved finance from the region went to the top ten recipient countries (South Africa, Ethiopia, DRC, Zambia, Burkina Faso, Tanzania, Mozambique, Niger, Nigeria, and Mali). For instance, between the years 2016 and 2019, the African continent received only 26% of the available climate finance. South Africa is the continent’s largest recipient of multilateral climate finance and ranks sixth globally. According to Savvidou and Trisos, this uneven distribution can be explained by no extensive mapping of climate finance to SSA [

28]. Further, Ngwenya and Simatele also explain this uneven climate finance distribution to the difficulties of many SSA countries in the design and coordination of projects due to a lack of effective institutions and expertise, which also creates uneven planning and coordination of projects [

29]. Savvidou and Trisos identified five ways in which finance for adaptation to climate change in Africa falls short. These are quantity, variation among countries, neglect of some sectors, difficulty spending funds, and debt [

30]. Therefore, policymakers in SSA need to revise their climate change ambitions (mitigation commitments) upwards and revise their commitments to use more renewable energy sources to maintain the low-emissions economic profile of the inhabitants of Africa, even with the advent of population growth and increased energy demand.

Table 2 presents the multilateral climate funds monitored by the Climate Fund in the region. The Green Climate Fund (GCF) has been the main source of climate finance for SSA since its first project approvals in late 2015, with USD 1.622 billion approved to date for 46 projects plus USD 77 million for 110 technology readiness programs.

Table 1 shows that between 2003 and 2020, the Least Developed Countries Fund (LDCF), which implements urgent adaptation activities prioritized by LDCs under National Adaptation Programs of Action (NAPAs), narrowly overtook the Clean Technology Fund (CTF) as the largest contributor. It has now approved USD 679 million in grants for 177 projects. Meanwhile, the Clean Technology Fund has approved USD 661 million for fourteen renewable energy and energy efficiency projects in Burkina Faso, Ethiopia, Kenya, Nigeria, South Africa, Tanzania, and Uganda, demonstrating a clear difference in fund allocations and investment strategies.

4.2. Funding Mechanisms in SSA

Green finance in the SSA has become vital in addressing climate change and sustainable development objectives. This has led to a huge mobilization and broadening of the scope and mandate of climate investment funds, which are vital financing mechanisms for the implementation of regional environmental finance action plans and green programs in the region [

31]. For instance, in the SADC region, the Departments of Financial Institutions (DFIs), governments, and Multilateral Development Banks (MDBs) are playing a crucial role in financing clean energy technologies within the SADC region. They are helping increase the uptake of clean energy technologies in the region by lowering tariffs, increasing funding tenors, and cutting funding costs [

32]. Multilateral Development Banks provide concessional debt and help in the capacity building of the national development banks and regional financial institutions. The Development Bank of Southern Africa (DBSA) is one of the largest financiers of renewable energy projects in Southern Africa. Other banks include China Exim Bank (CHEXIM), which offers loans to Zambia, the DRC, and Zimbabwe. The others are the Brazilian Development Bank (BNDES), International Finance Cooperation (IFC), etc. [

32]. In West Africa, the Green Fund gives access to funding through accredited national and sub-national implementing entities (including NGOs, government ministries, national development banks, and other domestic or regional organizations) that can meet the fund’s standards. Countries can also access funding through accredited international and regional entities (such as multilateral and regional development banks and UN agencies) under international access [

33]. Private-sector entities can also be accredited as implementing entities. Over the regions, allocation of the Green Climate Fund (GCF) is distributed through accredited institutions with Enhanced Direct Access (EDA), which allows countries to make their own decisions on how to use their resources. Nevertheless, the funds are only accessible through discrete projects and programs approved by the Climate Fund board. The AfDB, in partnership with the GCF, is actively engaged to ensure that West African countries have access to Climate Fund resources for financing climate actions [

34,

35]. In addition, in sub-Saharan Africa, local governments typically finance their capital investments through (1) borrowing (bonds, loans, and grants), (2) PPPs, (3) venture capital, and (4) foreign direct investment (FDI). Within these funding mechanisms, several innovations such as green bonds have evolved through which local governments in sub-Saharan Africa can benefit from additional investment and capital, especially from the private sector.

Some key financial mechanisms described in

Section 4.3 are loans, grants, green bonds, subsidies, foreign direct investment (FDI), venture capital, and public–private partnerships (PPPs). These mechanisms all serve the fundamental purpose of providing financial support to projects and initiatives. They are essential tools for fostering economic growth, innovation, and development. Each mechanism involves the allocation of financial resources to stimulate specific activities, whether it is business expansion, infrastructure development, or environmental sustainability. Additionally, these financing methods often aim to mitigate risks, attract further investment, and promote long-term benefits. Despite their structural differences, they share the common goal of enabling progress and addressing various economic, social, and environmental challenges.

4.2.1. Environmental Justice Considerations in Hydrogen Development

As green hydrogen projects scale across Africa, it is essential to address environmental justice (EJ) concerns to avoid replicating past patterns of extractive development that marginalize vulnerable communities. Large-scale hydrogen infrastructure, particularly for export-oriented production, can lead to the displacement of rural populations, restricted access to land and water resources, and inequitable distribution of economic benefits. In regions already burdened by environmental degradation or energy poverty, introducing hydrogen projects without inclusive governance risks exacerbating social inequities. For example, desalination processes required for electrolysis in arid zones may divert water from local needs or generate saline effluents harmful to marine ecosystems, with disproportionate impacts on coastal fishing communities. To uphold EJ principles, project planning must incorporate free, prior, and informed consent (FPIC), local benefit-sharing agreements, and targeted job creation for historically underserved groups. Transparent environmental and social impact assessments (ESIAs), grounded in disaggregated data and local consultation, are crucial for aligning hydrogen development with equitable energy transitions [

35].

4.2.2. Justification of Interlinks Between Financing Mechanisms

Green bonds can also be used repetitively by other financing mechanisms to ensure continuous funding for environmentally sustainable projects. The following are examples:

Public–Private Partnerships (PPPs): Governments and private companies can issue green bonds multiple times during a PPP project. This helps finance different stages of development, like renewable energy installations, energy-efficient buildings, or sustainable transportation systems.

Foreign Direct Investment (FDI): Countries can attract foreign investors by issuing green bonds to fund large-scale environmental projects. These bonds can be issued repetitively to maintain ongoing investment in green infrastructure and technologies.

Venture Capital: Venture capital firms can invest in startups focused on green technologies and sustainability. They might use green bonds to raise additional capital for their portfolio companies, ensuring continuous support for innovative environmental solutions.

Loans and Grants: Organizations can use green bonds alongside loans and grants to diversify their funding sources. For example, a renewable energy project might secure initial grants and loans and then issue green bonds to cover further expansion and operational costs.

4.2.3. Financing Renewable Energy vs. Hydrogen Energy

While solar and wind energy technologies have matured with well-established business models, standardized technologies, and relatively low capital intensity, green hydrogen development in sub-Saharan Africa presents a distinctly different financing profile. Unlike solar or wind energy, which primarily generate electricity for immediate consumption or grid integration, green hydrogen involves a multi-stage value chain, spanning renewable electricity generation, electrolysis, compression, storage, transport, and end-use infrastructure. This extended chain introduces higher upfront capital costs, longer payback periods, and greater technological and operational risks, particularly due to the nascent nature of electrolyzer markets and the limited deployment experience in SSA [

36]. Moreover, hydrogen production is highly energy-intensive and sensitive to the cost of electricity, requiring dedicated pricing mechanisms such as investment tax credits, carbon finance, and feed-in tariffs tailored to hydrogen to ensure cost-competitiveness [

37]. Financing hydrogen as a sub-component of broader renewable energy programs risks underestimating these unique needs. Dedicated hydrogen financing mechanisms, such as hydrogen-specific green bonds, sovereign-backed guarantees, or targeted public–private partnership frameworks, are thus essential to de-risk investments, stimulate early-stage infrastructure, and bridge the financial viability gap that currently hinders green hydrogen deployment [

38].

4.3. Loans, Grants, Green Bonds, and Subsidies

Sub-Saharan Africa is expected to be hardest hit by the adverse effects of climate change if significant investments in mitigation and adaptation, as well as other relevant measures, remain insufficient [

39]. Therefore, climate finance offers hope in the form of green bonds. In recent years, the use of green bond issuance as a tool to unlock significant capital for sustainability-related investments has gained traction in many sub-Saharan African countries [

40]. However, the nascent green bond market on the continent is still underdeveloped. On the continent, the issuance of green bonds is considered one of the financial instruments that could help to mobilize capital for significant climate action and sustainable development. According to the World Bank, a green bond is defined as “a debt security that is issued to raise capital specifically to support climate-related environmental projects.” [

41]. Green bonds and green loans are basic financial instruments considered as sources of green project financing. Green bonds attract a wider range of investors, including a growing list of funds mandated to invest in green projects [

42]. As part of the Nationally Determined Contributions, many SSA countries have established various climate finance systems for climate adaptation and mitigation projects. These include climate finances from development agencies like the World Bank, the International Finance Corporation, and the African Development Bank.

4.4. Foreign Direct Investment

The literature holds that foreign direct investment (FDI) can be defined as “the process that allows investors of a source country to acquire substantial ownership of capital and controlling interest in an enterprise in a host country” [

43]. It plays a vital role in the expansion dynamics of host countries by filling “development gaps”, the “foreign exchange gap”, and the “tax revenue gap” [

44]. The FDI contributes to a country’s economic growth by generating domestic investment, facilitating the transfer of skills and technological knowledge, creating job opportunities, increasing local competition and global market access for locally produced export commodities, etc. [

43]. The United Nations Conference on Trade and Development (UNCTAD) identified ten relevant sectors first for the SDGs and estimated an annual investment gap in developing countries amounting for USD 2.5 trillion. However, due to pandemics like COVID-19, political and trade tensions, and an overall uncertain macroeconomic outlook, the expected level of global FDI flows in 2021 represents a 60% decline, from USD 2 trillion to less than USD 900 billion. In Africa, the decline was expected to be between 25% and 40% [

45]. Consequently, the investment in Greenfield announcements for Africa fell from USD 77 billion in 2019 to USD 29 billion in 2020, and international project finance for large infrastructure projects fell by 74% to USD 32 billion. FDI can support key sectors of the SSA economies and create opportunities for the continent’s growth in renewable energy capacity in Africa (to reach 310 GW by 2030), to allow the continent to build climate-resilient and attractive low-carbon investment opportunities that are anchored in renewable energy [

46].

4.5. Venture Capital

Venture capital is defined as independent and professionally managed pools of capital focused on equity or equity-linked investments in privately held, high-growth companies [

27]. Financial venture capital can be provided by venture capital firms, investment banks, other financial institutions, and high-net-worth individuals. Venture capital firms establish funds from pooled money collected from investors, companies, or other funds. They also invest their capital to demonstrate commitment to their clients. In Africa, venture capital is experiencing rapid and steady growth from both local and international investors. However, there is a scarcity of risk capital available for venture capital funds. To understand this growth, African startups raised USD 2 billion in 2019 through an Africa-focused fund [

28]. Compared to other funding options, venture capital funds are viewed as a unique mechanism to protect investors and secure investments. According to a study by Lin, venture capital funds are critically needed in sustainable investing by providing technical expertise, industry connections, or management skills, thereby offering equity financing alongside monetary contributions [

29]. Despite the financial crisis, the IFC has chosen to support early-stage ventures in developing countries by investing in top-tier entrepreneurs, fostering the creation of emerging markets that promote private-sector growth [

30].

4.6. Public–Private Partnership (PPP)

Public–private partnerships (PPPs) are significant financial instruments for accessing finance and reducing capital expenditure for energy infrastructure projects. According to Alloison and Carraro, PPPs become more relevant where the political, policy, and financial risks associated with infrastructure investment are higher. SSA represents 5% of the total cumulative volume of PPP investment from 1990 to 2020 and expects to grow in the future [

47]. Building back better and greener in Africa requires strong partnerships between public and private investors. For instance, the AfDB has partnered with the government of Morocco to finance the world’s largest concentrated solar power station, extending over 3000 hectares of desert in Morocco [

48]. The bank, through the Sustainable Energy Fund for Africa (SEFA), invested USD 965,000 to support its transition into the first Super Energy Service Company (ESCO) initiative in Africa. Governments and the private sector must adopt a whole systems approach to urgently deliver the climate-resilient and clean infrastructure that Africa needs. Scaled-up infrastructure, partnerships, de-risking, and mobilizing private-sector finance are all essential to long-term progress towards the Sustainable Development Goals [

49].

According to the Climate Funds (2009) update, the Scaling-up Renewable Energy Program in Low-Income Countries (SREP) under the Clean Investments Fund (CTF) aims to promote new pathways and opportunities in the energy sector using renewable energy. It provides grants, loans, guarantees, and equity [

34].

Donor funding and subsidies are financing tools and initiatives that support small-scale and pilot projects. IRENA (International Renewable Energy Agency) aims to help Southern African countries promote sustainable electricity generation from renewable sources [

50].

According to IRENA, the Renewable Energy Finance and Subsidy Office (REFSO) in South Africa has supported six projects with a total capacity of 23.9 MW. It provides advice to developers and stakeholders on renewable energy finance and subsidies. Eskom (the South African electrical utility firm) established the demand-side management subsidy solar water heater program to offer incentives to promote solar water heaters.

For sub-Saharan Africa (SSA), a combination of financing mechanisms works best. Green bonds and subsidies mobilize significant capital for climate-related projects [

29], while foreign direct investment (FDI) is essential for large-scale infrastructure and renewable energy capacity expansion. Public–private partnerships (PPPs) are effective for large infrastructure projects, leveraging the strengths of both the public and private sectors [

30]. Multilateral and bilateral sources are crucial for sustainable development and capacity building [

26]. By leveraging these diverse financing mechanisms, SSA can effectively address its green hydrogen development needs and achieve a sustainable energy transition. A comparison analysis of these financing mechanisms reveals that while each has its unique advantages, their combined application provides a comprehensive approach to overcoming financial barriers and scaling up green hydrogen initiatives.

The African Development Bank (AfDB) has been instrumental in developing green finance taxonomies across various African countries, including Kenya, South Africa, and Rwanda. These taxonomies are designed to classify green projects and guide investments towards sustainable initiatives. By aligning with international standards, such as the EU taxonomy, these frameworks aim to attract both local and international green investments. The taxonomies help ensure that projects meet specific environmental criteria, promoting transparency and consistency in green finance. This alignment with global standards not only facilitates investment but also supports the broader goals of sustainable development and climate resilience in Africa [

51].

The African Development Bank (AfDB) funds various green projects, such as renewable energy (solar, wind, hydro, geothermal), energy efficiency, sustainable agriculture, water management, climate resilience, and green infrastructure. These efforts aim to promote sustainable development, lessen environmental impact, and enhance quality of life throughout Africa.

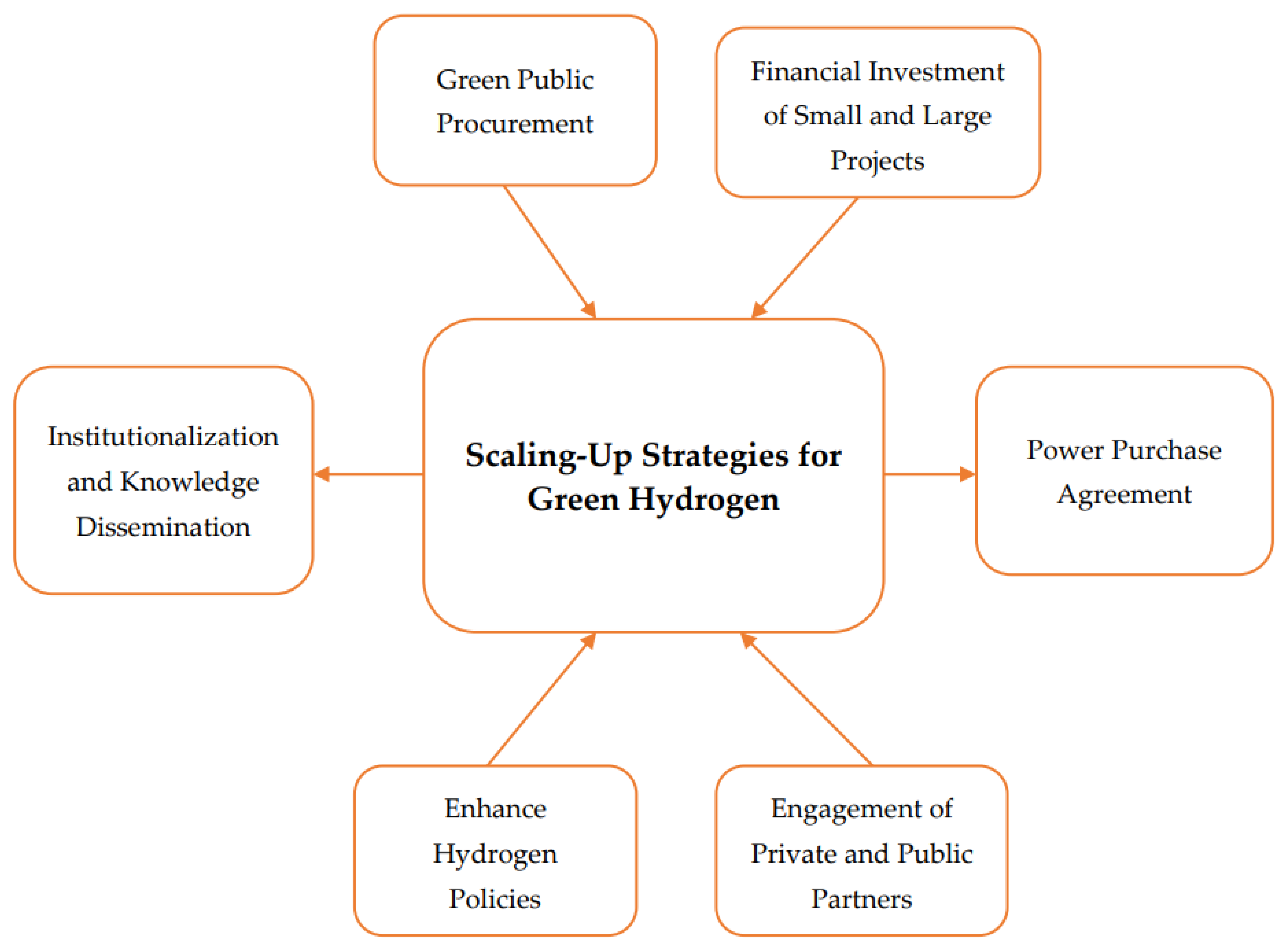

To effectively mobilize the necessary capital for green hydrogen development in sub-Saharan Africa, various financing mechanisms such as loans, grants, bonds, subsidies, foreign direct investment (FDI), venture capital, and public–private partnerships (PPsP) play a vital role. These mechanisms enable access to diverse funding sources, supporting the creation of green projects and infrastructure. However, to truly unlock the potential of green hydrogen and make a significant impact, expanding production and infrastructure is essential. This expansion demands substantial investments in technology, policy support, and market development. Strategies for scaling up include promoting green public procurement, increasing financial investments in both small and large-scale projects, establishing power purchase agreements (PPAs), engaging private and public partners, and developing strong hydrogen policies. These initiatives will foster the growth of the green hydrogen economy, ensuring sustainable development and energy transition in the region. To ensure the successful deployment and expansion of green hydrogen projects, it is crucial to develop effective strategies for scaling up production and infrastructure.

5. Green Hydrogen Energy Scale-Up Strategies

Transitioning to green hydrogen energy unlocks new development opportunities for regions rich in renewable resources. Green hydrogen production and export can significantly boost Africa due to its abundant renewable resources. By 2050, increasing hydrogen use could make up about one-fifth of total final energy consumption, potentially reducing annual CO2 emissions by around 6 gigatons (GT) and helping to curb global warming. The Hydrogen Council also highlights that hydrogen could power 10 to 15 million cars and 500,000 trucks by 2030. In the mining and industrial sectors, hydrogen technology offers opportunities for sustainable economic growth. Takeshi Uchiyamada emphasizes in his study that the world must shift away from fossil fuels, and hydrogen energy can facilitate this transition, especially in power generation, industry, and transportation. This indicates that governments and investors need to play a key role in energy planning and develop strategies to promote hydrogen projects [

52,

53].

While hydrogen technologies such as electrolysis, hydrogen storage, fuel cells, and transportation systems are increasingly mature in high-income countries, technology readiness in sub-Saharan Africa (SSA) remains limited. Most countries in the region are still in the early planning or pilot phases of hydrogen development, with few operational demonstration projects. Electrolyzer deployment is minimal, and local manufacturing capacity for hydrogen technologies is virtually nonexistent. In many SSA nations, institutional knowledge, technical training, and standards for hydrogen safety are still emerging, indicating a need for accelerated technology transfer, workforce development, and research partnerships to close the readiness gap [

54].

Scaling up green hydrogen production requires substantial investment. Hydrogen plays a crucial role in the energy transition, and there is a clear need to support and promote its large-scale use. However, increasing green hydrogen production presents challenges [

31]. It involves several steps, such as generating green electricity from sources like solar or wind power, followed by electrolysis, storage, and transportation. Additionally, hydrogen gas is very light due to its low density, which means it requires specialized facilities for transportation [

7].

The electrolysis of water to produce hydrogen and oxygen is a catalyzed reaction that requires improved kinetics for large-scale production. Catalyst degradation poses another challenge that needs further research and development. Additionally, there are only a few electrolyzer manufacturers worldwide. These are some of the technical challenges that must be addressed before expanding deployment.

Lowering production costs will enable large-scale manufacturing, including reducing expenses for solar power and electrolyzers. Increased funding will enhance investments and support infrastructure development. Advanced, affordable green hydrogen infrastructure combined with demand will drive the growth of the green hydrogen economy [

55]. Enacting policies such as green public procurement and promoting public–private partnerships will also bolster this growth. To further cultivate the green hydrogen economy, implementing strategic procurement practices is essential.

5.1. Green Public Procurement

Green public procurement (GPP) refers to buying goods and services with low environmental impact across life cycles [

56]. It accounts for human health and the environment to seek prime quality products and services at competitive prices. There is a high need for countries to encourage departments to include environmental considerations when procuring goods and services. Electrolyzers should be purchased at reduced costs for affordability and to ensure reduced production costs. The government should adopt green procurement practices and set it as a compulsory requirement in tender specifications for products on the market. That helps trigger actions in response to individual incentives, for example, resource savings and market-based stimuli. Green procurement is effective in stimulating the assembly of hydrogen products [

57]. Implementing these high public purchasing powers can potentially orient production and consumption trends and encourage the demand for environmentally friendly products and services. It may also stimulate the innovation capabilities of firms in hydrogen production. Indeed, the high impact of green public procurement on production activities positively influences the probability that industries invest in innovative solutions [

58]. This can present an opportunity to allow the market to search for the most cost-effective, feasible energy savings and conservation potential and compare the measures of various life cycle performance costs. Green public procurement processes consider socio-environmental factors and are increasingly referred to as sustainable public procurement (SPP).

Stoffel et al.’s study on the multidimensionality of sustainable public procurement in SSA found that SPPs have recently focused on environmental aspects, policy documents, and regulations of many countries, emphasizing social and economic aspects of public procurement for pilot projects. Further, SSA rarely implements environmental criteria. However, some governments, like South Africa and Kenya, have concentrated on having a more effective implementation of public tenders that is country-specific while conjointly fostering socio-economic development, through preferential treatment of certain societal groups to redress past discrimination [

59]. To achieve the Sustainable Development Goals and support the energy transition, targeted financial investments in both small and large-scale projects are essential.

Figure 3 shows a schematic outline of the H2 scaling-up strategies.

5.2. Financial Investments in Small and Large-Scale Projects

Sub-Saharan Africa needs reliable and adequate financing to achieve SDG 7, which emphasizes clean energy for all. To achieve this goal, small and large-scale investment projects will be needed to expand the renewable energy capacity and create strong economic structures to support an African energy transition and secure the desired energy transition pathway. According to the Hydrogen Council, there is a need for more investment to scale up green hydrogen generation and thus improve its cost-competitiveness. Large-scale hydrogen projects need additional financial policy support from the government or potential investors to attract private financing and investment. Establishing carbon financing and green loan financial incentives, for example, investment tax credits, can help reduce the cost of investment in hydrogen projects. Lowering feed-in tariffs can help lower the costs of the electrolyzer. Governments need to support small and large projects through grants and incentives to increase hydrogen energy scaling-up and uptake globally. There is a great need for a deliberate continental drive to leverage financial resources from existing and emerging global funds related to climate change. That will hinge on improved infrastructure and greater involvement of the private sector and banking institutions [

53]. To further enhance the financing landscape, leveraging power purchase agreements can play a pivotal role in driving the hydrogen market.

5.3. Power Purchase Agreement Strategies

A power purchase agreement (PPA) is a contract between the public- and private-sector parties to facilitate the sale and purchase of electricity [

60]. Introducing public–private Market Facilitating Organizations in SSA at the national and provincial levels will support the growth of the hydrogen market. These organizations improve networking, financing, policy advocacy, user education, technical assistance, and information dissemination, which will help the green hydrogen market grow. They facilitate awareness among potential investors and business communities concerning business opportunities available on the market. By fostering collaboration and providing essential resources, these organizations can significantly enhance market readiness and investment appeal. Business models, for example, pay-as-you-go and public–private partnerships (PPPs), can help sell hydrogen products in small installments and offer loans at interest rates. Power purchase agreements (PPAs) and PPPs offer independent power producers (IPPs) and private businesses the privilege to work on large projects, providing them with knowledge, skills, and financial support. All this can lead to upscaling hydrogen projects [

61]. To promote PPAs in SSA, for the development of the green hydrogen economy, there is a need to draw a new commercial structure, strengthen the regulatory environment, and set up a competitive procurement framework, alongside comprehensive planning. This will help to tackle financial risks related to political instability, legal uncertainty, and currency fluctuations that threaten the attractiveness of the PPAs [

62,

63]. Engaging private and public partners is crucial to overcoming these challenges and driving the hydrogen economy forward.

5.4. Engagement of Private and Public Partners—Businesses, Policymakers

To upscale hydrogen technology on the African continent, it is vital to support the capacities and skills of market enablers and gamers. Policymakers are required to create more effective and evidence-based regulations that favor a market environment for scaling up hydrogen technology. On the other hand, project developers, financiers, and equipment producers may need training to build capacity. Therefore, there is a preference for the potential to enhance skills at the country and regional levels for each renewable strength market enabler and gamer. Policymakers need to call upon global financing establishments to offer financing mechanisms that facilitate non-public sectors globally in hydrogen projects [

64]. Complementing these efforts with robust policies will further accelerate the adoption of hydrogen energy.

5.5. Enhance Policies That Support Green Hydrogen Production

To scale up hydrogen energy production, it is essential to establish policies and standards that encourage its adoption. To date, national and international policies have been put in place to support renewable energy technologies by many countries globally.

There is a need to have policies that encourage IPPs in place in SSA [

65]. For instance, in SADC, institutions like the Southern African Power Pool (SAPP) and the Regional Electricity Regulators Association of Southern Africa (RERA) must be given powers to introduce such policies [

66]. Policy successes can be combined and adapted to the local, national, and regional situation. At a national level, hydrogen energy development policies should include regulation measures, such as equipment standards, subsidies, and financial incentives, like feed-in tariffs that are specific to hydrogen production, with clear roll-out strategies and agreements between governments and the private sector. Policies must be evaluated by considering how they impact the environment and enhance cost-effectiveness, distributional aspects, institutional feasibility, and suitability. Policy measures that need to be implemented at regional and sub-regional levels include focused use of emission targets and trading systems, technology cooperation, and financial systems like FDI [

67]. To effectively implement these policies, it is crucial to focus on institutionalization and knowledge dissemination.

5.6. Institutionalization and Knowledge Dissemination

Skills development through training initiatives and workshops helps share knowledge and technical skills among experts, entrepreneurs, and SMEs. These training programs help with hydrogen energy integration and resource capacity assessment. There is a need for developing countries to learn skills and techniques from developed countries, to avoid making mistakes and failing. Exceptional levels of technical labor in business development, manufacturing, and overall management are required. The public sector needs enough skilled manpower to drive and sustain the technology within the region [

68]. The inclusion of hydrogen technologies in the school curriculum from early levels to tertiary levels helps in spreading awareness and market transformation, thereby achieving hydrogen energy institutionalization. Furthermore, providing a form of certification for organizations involved in hydrogen technologies can increase the uptake and offer incentives to certified companies [

69,

70].

Establishing sub-regional hydrogen hubs would provide remote communities with access to reliable hydrogen energy. Help centers would be an important feature to train people and communities on hydrogen energy and its importance through capacity building [

69,

71]. Digital platforms such as website images and video content, blog posts, eBook reviews, and customer testimonials can offer channels for knowledge dissemination and public sensitization. These platforms help provide a central place to share ideas, knowledge, and research projects, to mention a few, on hydrogen energy. Through these platforms, partnerships with other countries that are successful and experienced in hydrogen energy can be built [

72]. To ensure effective implementation and adherence to best practices, establishing Standard Operating Procedures (SOPs) is essential.

5.7. Standard Operating Procedure (SOP)

A Standard Operating Procedure (SOP) is a well-laid-out procedure, usually in the form of a document, video, etc., which is specific to any firm’s operations and describes in detail the critical activities needed to complete the tasks without neglecting the country-specific set of industry regulations [

73]. Using the best procedures for hydrogen projects helps in scaling up the technologies. Setting up Standard Operating Procedures and keeping to best practices can help in upscaling and hydrogen development acceptance in SSA. These standards help to describe how to perform tasks and activities. One can easily follow these rules and know what needs to be carried out correctly. That leaves room for no errors, producing the best outcomes, thereby increasing project implementation efficiency. Procedures also enhance safety, which can reduce incidents, leading to investor and consumer confidence [

74].

While hydrogen production processes require a lot of energy, there is a need to keep the carbon dioxide levels as low as possible or even capture or store it for carbon sequestration; if fossil fuels are used alongside renewable electricity in the supply chain and to compensate for it, fossil fuels are used alongside non-carbon electricity. This will comprise the entire hydrogen supply chain network, including production methods, transport methods, and downstream hydrogen distribution and applications. These parts of the supply chain network can be certified individually or entirely to help owners gain independent and international recognition concerning hydrogen energy’s climate neutrality [

75]. Further, Imasiku et al. explain that the existing gap in today’s climate governance system suggests that a more aggressive business approach of adopting the renewable energy/green energy certifications (REC certification) system should be adopted as a global criterion for awarding business opportunities [

76]. Despite all these standard procedures and other essential scaling-up strategies, the hydrogen economy’s opportunities come with risks. Understanding these risks and opportunities is crucial for the successful development of the hydrogen economy.

6. Hydrogen Economy: Risks and Opportunities

Hydrogen energy development requires reliable offtake agreements in strategic sectors such as ammonia production, refining, energy production, and transportation. Financing low-carbon technologies like green hydrogen projects requires an inventory analysis of the different risks associated with that location of investment. This is one of the key indicators of desirability to finance such a project by financing institutions [

77,

78].

Since a readily available market already exists for ammonia, there is a need to propose many initiatives around ammonia. Ammonia has many desirable characteristics that indicate that it can be used as a medium to store hydrogen as liquid anhydrous ammonia (NH3), which can be easily transported in fuel tank vehicles [

79]. The transport or mobility sector also offers enormous potential, especially in providing fuel for specialty vehicles. Besides identifying the potential offtake products, there is a need to establish offtake structures to ensure that the market is secure and guarantees future revenue. Most financiers would be comfortable having these offtake agreements or structures negotiated well in advance between the producer and the buyers, so that firstly, shareholder value is established among all stakeholders, and secondly, to realize the value of the investment [

80,

81]. Financers will be evaluating the entire value chain network before building or concluding an investment plan [

10]. Emerging offtake structures are particularly relevant in regions where hydrogen energy is not yet widely adopted.

6.1. Emerging Offtake Structures

In sub-Saharan Africa, where hydrogen energy is not currently used at any scale, establishing offtake structures can be challenging to finance initially, but they are possible to pilot and then upscale at a later stage. For instance, it is easier for countries in developed nations to know how much hydrogen is needed at specific locations for refueling trains and buses in the transport sector [

8,

82].

Even if project financing is feasible, it will only become viable once infrastructure plans are supported by the government to ensure that appropriate fuel-cell trucks and hydrogen refueling infrastructure are put in place. Although these structures are highly applicable in the power sector, areas with high renewable resources make the hydrogen projects more appealing because conventional electricity is already in short supply [

81].

Although few projects are being implemented in sub-Saharan Africa, several projects have been proposed to use hydrogen in existing coal-fired power plants in South Africa and use green hydrogen as feedstock in projects like H2Atlas-Africa [

11], Green-LFG, green hydrogen, and the H2.SA project [

83,

84,

85]. Further, key industries like steel- and concrete-making are good examples of such reliable offtake arrangements. Understanding the financing risks associated with these projects is crucial for their successful implementation.

6.2. Financing Risks

The appropriate standard for project financing is a long-term, fixed-cost offtake contract with a public buyer. While the power sector and the transportation sector may increase the chances of having early hydrogen energy development opportunities signed up, many offtake structures will rely on corporate off-takers, with higher credit risks. Although hydrogen production is favored by factors like having electrolyzers near the client to be serviced, green hydrogen investment is still considered to be a risky investment by financiers, given a limited track record of electrolyzer deployment [

86,

87].

The financing agents will likewise be focused on the risk of the technology [

88]. Even though electrolysis technology has existed for quite a while, given the limited deployment evidence, financing agents will cautiously look at the manufacturing sector and engineering, procurement, and construction (EPC) guarantees [

81,

89].

While there is an enormous increase in the number of firms signing partnership agreements to leverage other firms’ good monetary records, lending institutions often also demand major maintenance reserves. Such security will be costly for first-mover projects. Addressing hydrogen marketing, regulatory, and technology risks is essential to ensure the viability and growth of the green hydrogen market.

6.3. Hydrogen Marketing: Regulatory and Technological Risks

Government backing will be fundamental to getting the green hydrogen market going. Backing for electrolyzer development will be vital but may be deficient if it is the only focus for hydrogen marketing [

90].

Because policy frameworks for hydrogen remain underdeveloped, the market’s future is more uncertain than it was for wind and solar during their maturation. Hydrogen has not yet penetrated industry for large-scale use like other energy sources. The provision of economic incentives by governments in sub-Saharan Africa in the transport sector would help provide appropriate hydrogen transportation standards using pipelines, ships, and trucks [

83,

88].

In summary, it is preferred that financial institutions adopt a multi-disciplinary approach while leveraging the firms’ technical capacity to finance oil and gas, power, infrastructure, transport, and mining projects, (1) to analyze hydrogen project risks and (2) to structure the financing mode. These institutions have increased the liquidity rate for sustainable projects by reallocating finance meant for fossil fuels to sustainable energy projects [

2]. This raises several financing risks. In sub-Saharan Africa, addressing these risks is crucial for the successful financing of hydrogen projects.

6.4. Hydrogen Financing Risks in Sub-Saharan Africa

The project risks associated with hydrogen energy finance can be identified, mitigated, and addressed to accommodate lenders and key project stakeholders. This points to the fact that projects use technologies that have been tested and proven to decrease both the project and operational costs, thereby making project financing more attractive to potential equity investors and financiers. The key issue in the offtake structure is that most lenders are attracted to projects whose projected revenue can offset the debt service and the operating expenses of the loans [

91,

92].

Table 3 shows this study’s risk assessment for green hydrogen deployment in sub-Saharan Africa. To streamline the relevant risks and opportunities, stakeholder engagement meetings with the utilities were also conducted alongside data validation workshops between the data source firms and the scientific advisory committees. Allocating weights to risks involves assessing the likelihood and impact of each risk to prioritize and manage them effectively. The risks highlighted in

Table 3 were allocated weights based on four key approaches. These are [

93]

Risk Scoring: Assign numerical scores based on the probability and impact of each risk. Multiply these scores to derive a weighted risk value

Risk Matrix: Use a matrix to categorize risks by their likelihood and impact, assigning weights accordingly

Expert Judgment: Gather insights from experts to evaluate and weigh risks based on their experience and knowledge

Historical Data Analysis: Analyze past data to understand the frequency and severity of risks, helping to allocate appropriate weights.

Table 3 shows the project risk, threats, and opportunity matrix for any potential green hydrogen project in SSA. It shows that the risk factor for the hydrogen economy’s development in SSA is less than 50% of the worst-case scenario. The table further shows a calculated risk factor of about 35% (5.6 score on the risk description). The following are the risk matrix implications for green hydrogen in SAA:

The implications of project oversights during the implementation and commissioning phase (e.g., capital cost exceeded) with a risk score of 6 are that potential budget overruns and delays in project completion exist, and this could affect the overall timeline and financial stability of the project.

The implications of the funding/loan availability having a low-risk score of 3 are that there are some funding issues that suggest that financial backing is stable and reliable. A high electrical grid connection issue risk score of 8 implies that a significant risk of problems connecting to the electrical grid exists, which could lead to operational delays and increased costs. According to World Bank estimates, inadequate investment in critical infrastructure, including roads, telecommunications, water, and electricity, reduces the continent’s productivity by approximately 40%. Respondents to the World Economic Forum’s recent survey identified this persistent infrastructure gap as one of the most significant risks to doing business in the region [

96].

The risk score of 5 for high-pressure and large-quantity hydrogen storage implies that a moderate risk associated with storing hydrogen exists but requires careful management to prevent accidents and ensure safety.

Hydrogen transportation using pipelines or trucks has a high-risk score of 7, implying a high risk in transporting hydrogen, which could involve logistical challenges and safety concerns.

Like any location globally, pandemics or natural calamities and climate change are mostly inevitable. The average risk score of 5 implies that moderate risk from external factors like pandemics or natural disasters, which could disrupt operations and supply chains, is expected.

Political instability/change in governments with a risk score of 7 implies that high risks prevail due to potential political changes, and this could affect regulations, policies, and overall project stability.

Other risks like security due to war have a low score of 3, which implies that there is a low risk and that a relatively stable geopolitical environment exists.

In summary, with a 5.6 risk score, the investment rating is medium, less risky, and implies that remedial action will only be taken at an appropriate time. The risk description shows that any score up to nine (9) is still tolerable while keeping all hydrogen energy developers and investors informed about the associated risks. The score points to either a high priority or indicates that the investment is not feasible or allowable. With none of the risk factors categorized as a very high factor in

Table 3, it shows that the opportunities for hydrogen energy investment outweigh the threats in SSA and are viable. The total risk score of 44 indicates a moderate to high overall risk level for hydrogen energy project development in SSA. The highest risks are associated with electrical grid connection issues, hydrogen transport, and political instability. To address the issues raised, the mitigation strategies should focus on these high-risk areas to ensure project success and stability [

98,

99,

100].

7. Conclusions and Recommendations

Green hydrogen, produced using renewable energy sources such as solar and wind, is often hailed as the fuel of the future because of its zero emissions when burned. Supporting green hydrogen projects in sub-Saharan Africa (SSA) requires strong partnerships among financial institutions, industry stakeholders, and policymakers. The availability of financial resources is essential for hydrogen energy development and can significantly drive the transition from fossil fuel-based economies to green economies.