Techno-Economic Assessment of Pink Hydrogen Produced from Small Modular Reactors for Maritime Applications

Abstract

1. Introduction

1.1. Motivation

1.2. Literature Review and Contribution

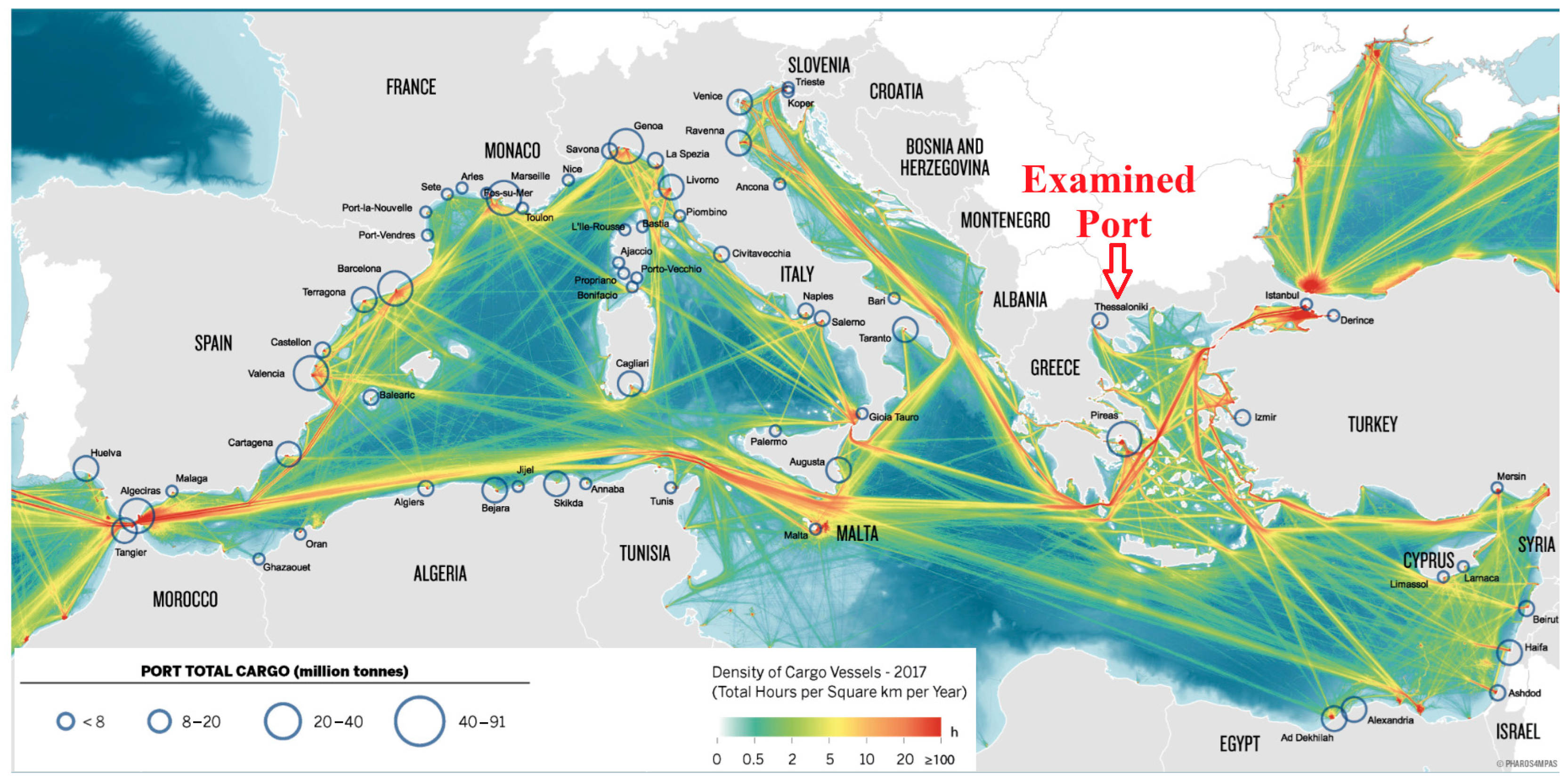

- It presents a comprehensive techno-economic assessment of hydrogen produced from SMRs for maritime use, using the port of Thessaloniki (the second-largest port in Greece) as a case study, as shown in Figure 2 [14]. The analysis includes both hydrogen production and transportation cost and evaluates the LCOH under a range of technical and economic scenarios.

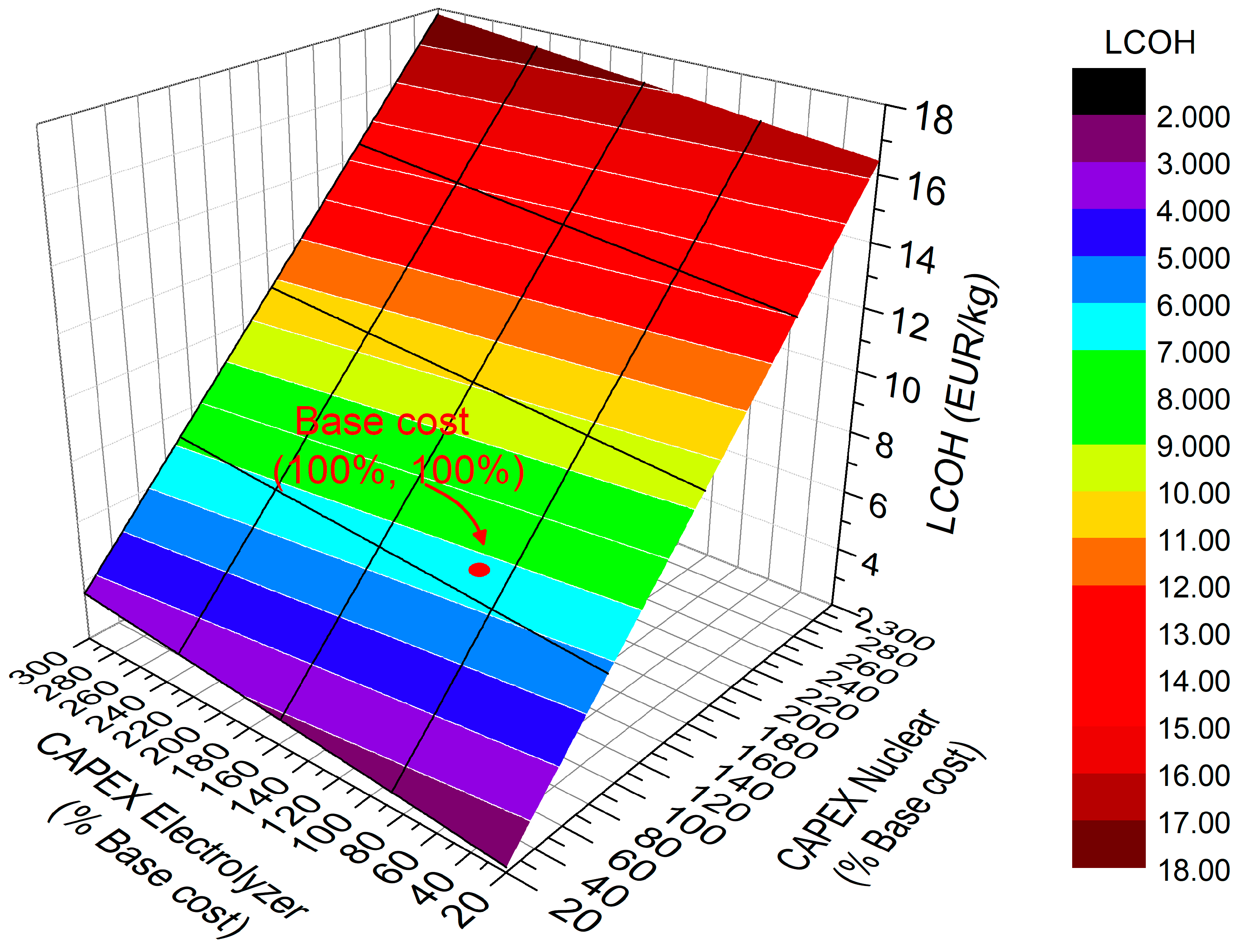

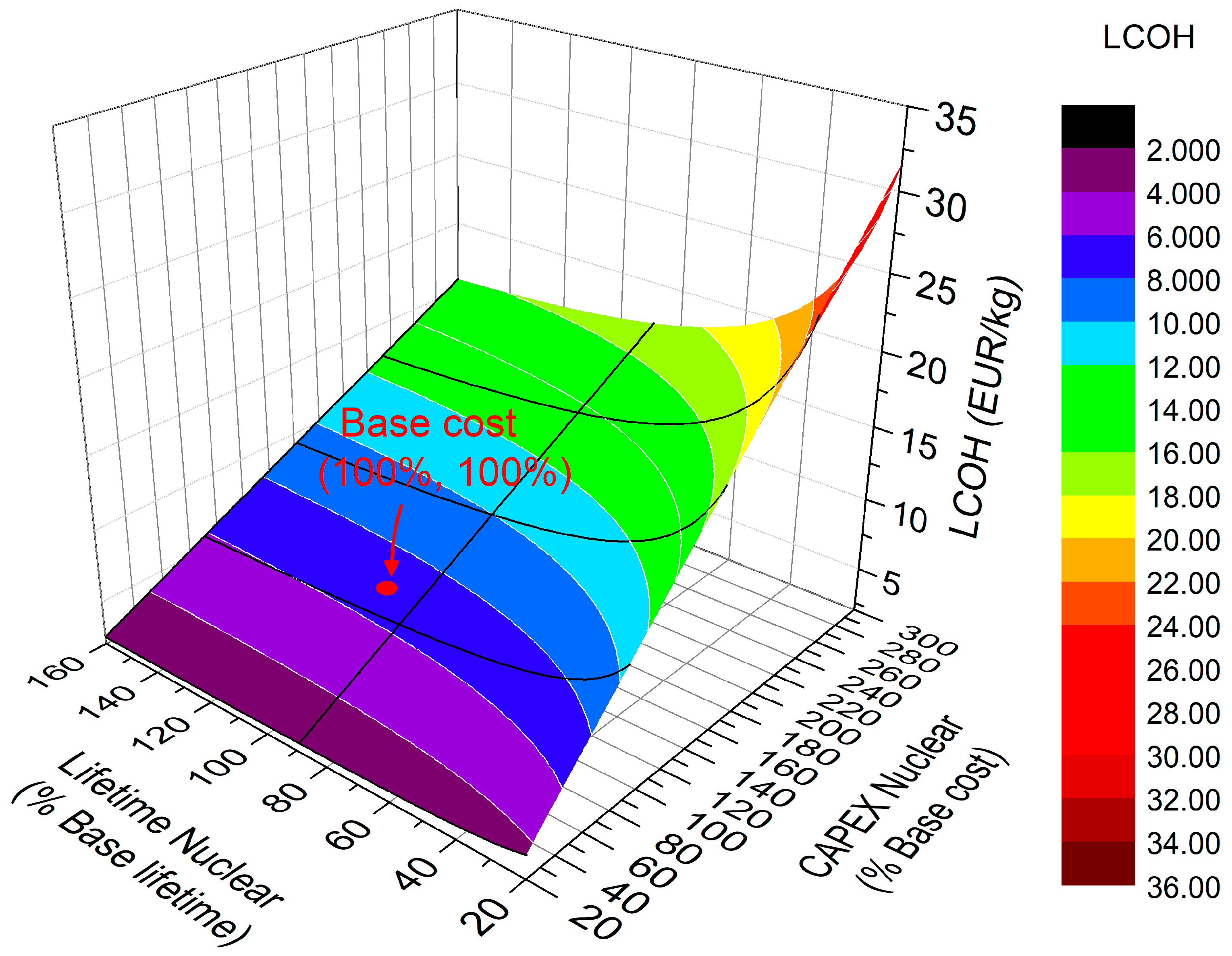

- It conducts a detailed sensitivity analysis on key LCOH drivers, including the capital costs of SMRs and electrolyzer, the cost of uranium fuel, and the operational lifetime of SMR units.

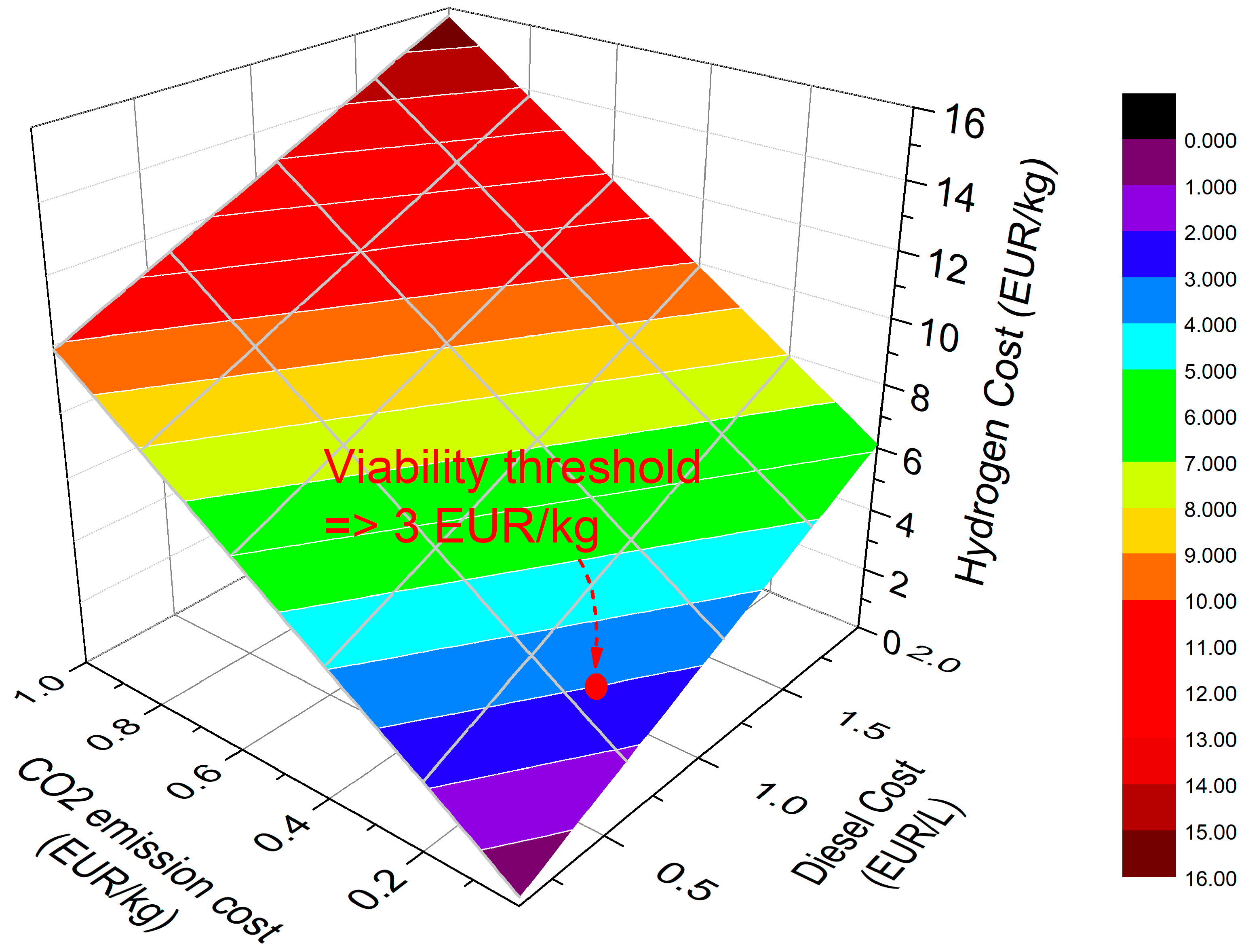

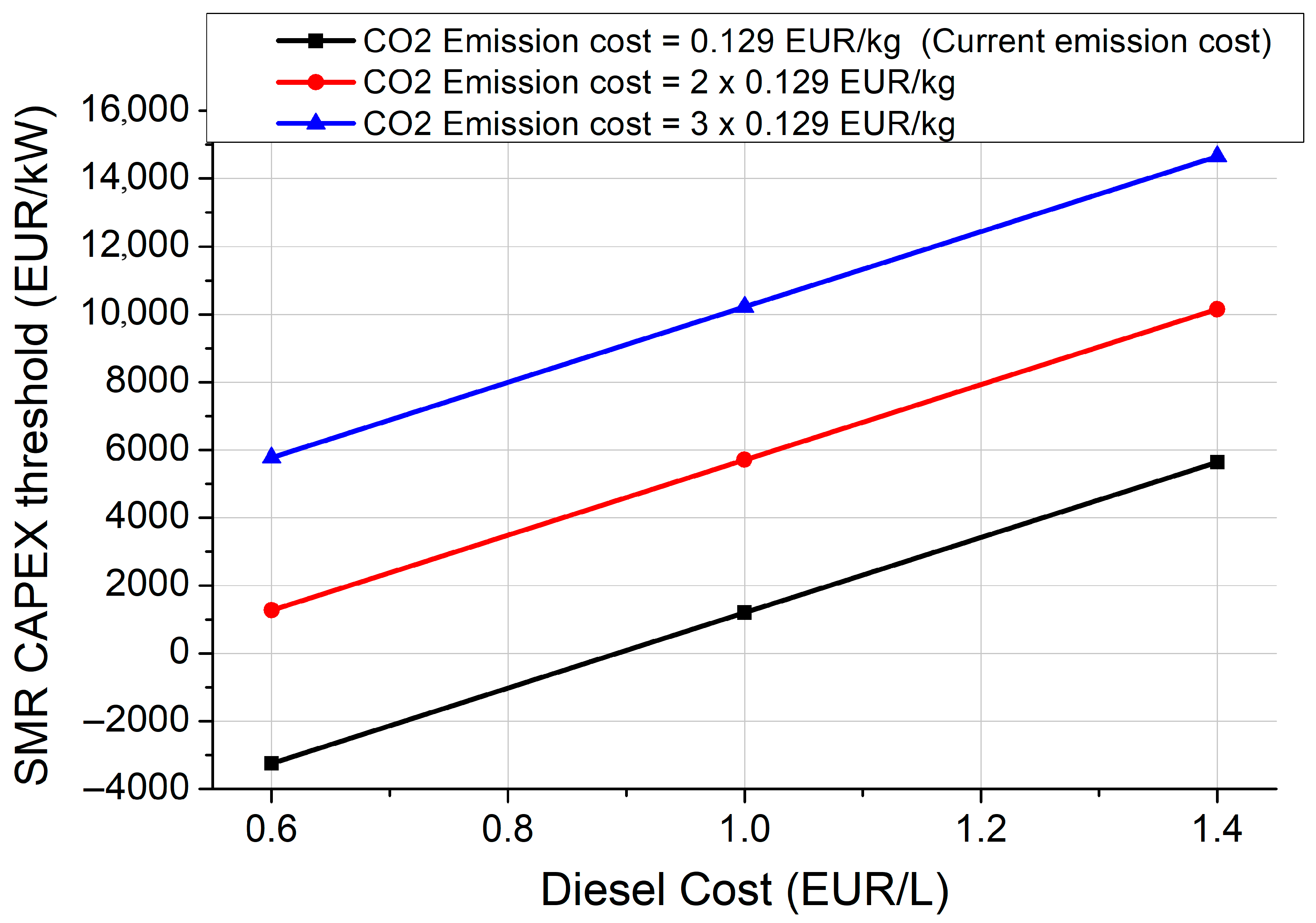

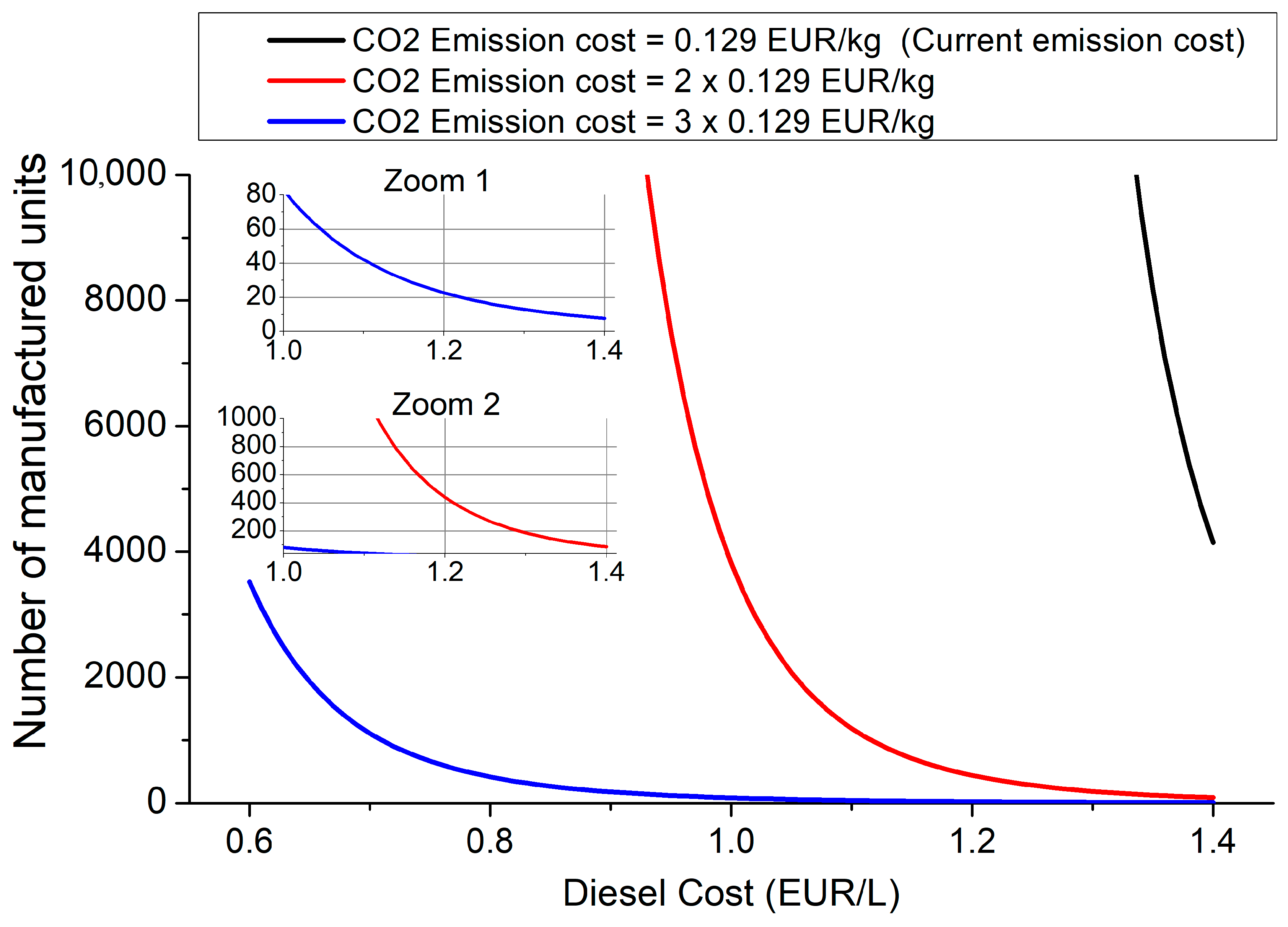

- It investigates the economic viability of SMR-produced pink hydrogen as a marine fuel by directly comparing it to diesel, the dominant conventional fuel in the shipping sector. The study identifies specific threshold values for LCOH and SMR CAPEX that must be achieved to make the transition to hydrogen-fueled shipping economically viable.

- It explores how the economics of mass SMR production can reduce unit capital costs and assesses whether these reductions are sufficient to make SMR-produced hydrogen competitive with diesel in maritime transport.

- Finally, it analyzes the extent to which policy mechanisms, particularly carbon pricing, can improve the economic viability of SMR-produced hydrogen in the maritime sector.

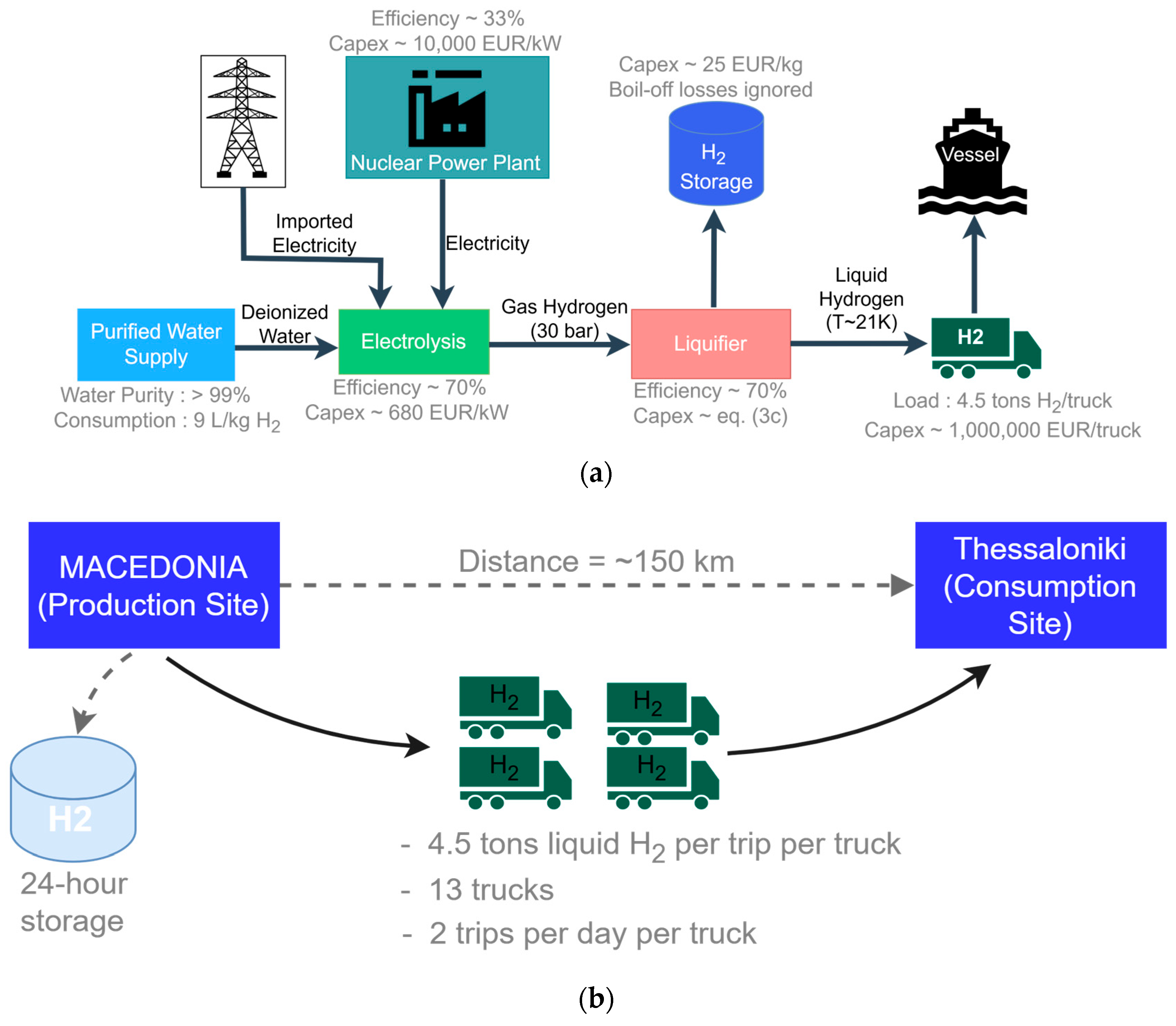

2. Description of the Installations

2.1. Nuclear Power Plant

2.2. Uranium Supply Chain

2.3. Hydrogen Supply Chain

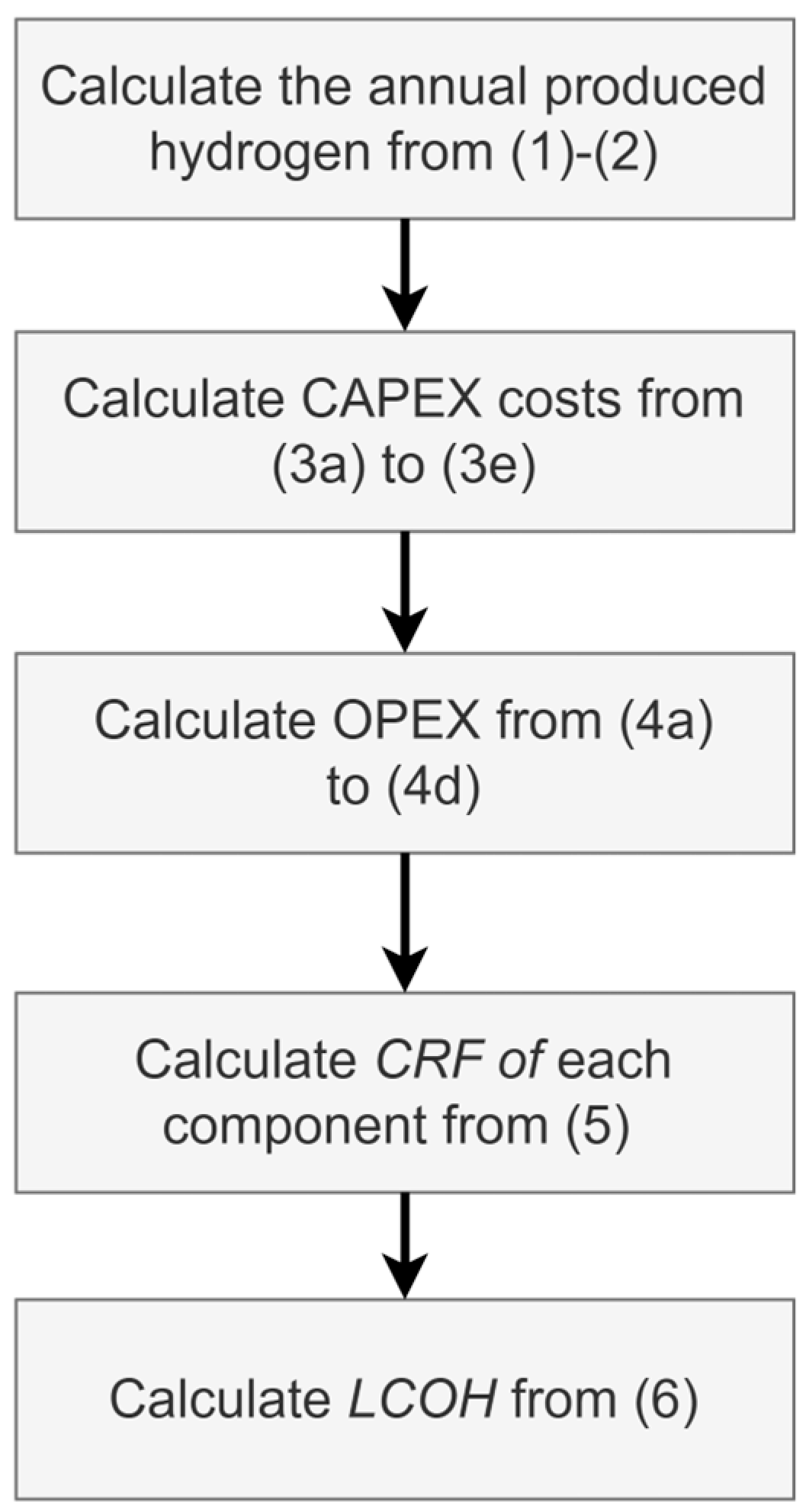

3. Methodology

3.1. Hydrogen Production Estimation

3.2. Cost Estimation

3.2.1. Capital Expenditures (CAPEX)

3.2.2. Operational Expenditures (OPEX)

3.3. Economic Evaluation and LCOH Calculation

4. Techno-Economic Analysis

4.1. Techno-Economic Data

4.2. Techno-Economic Results

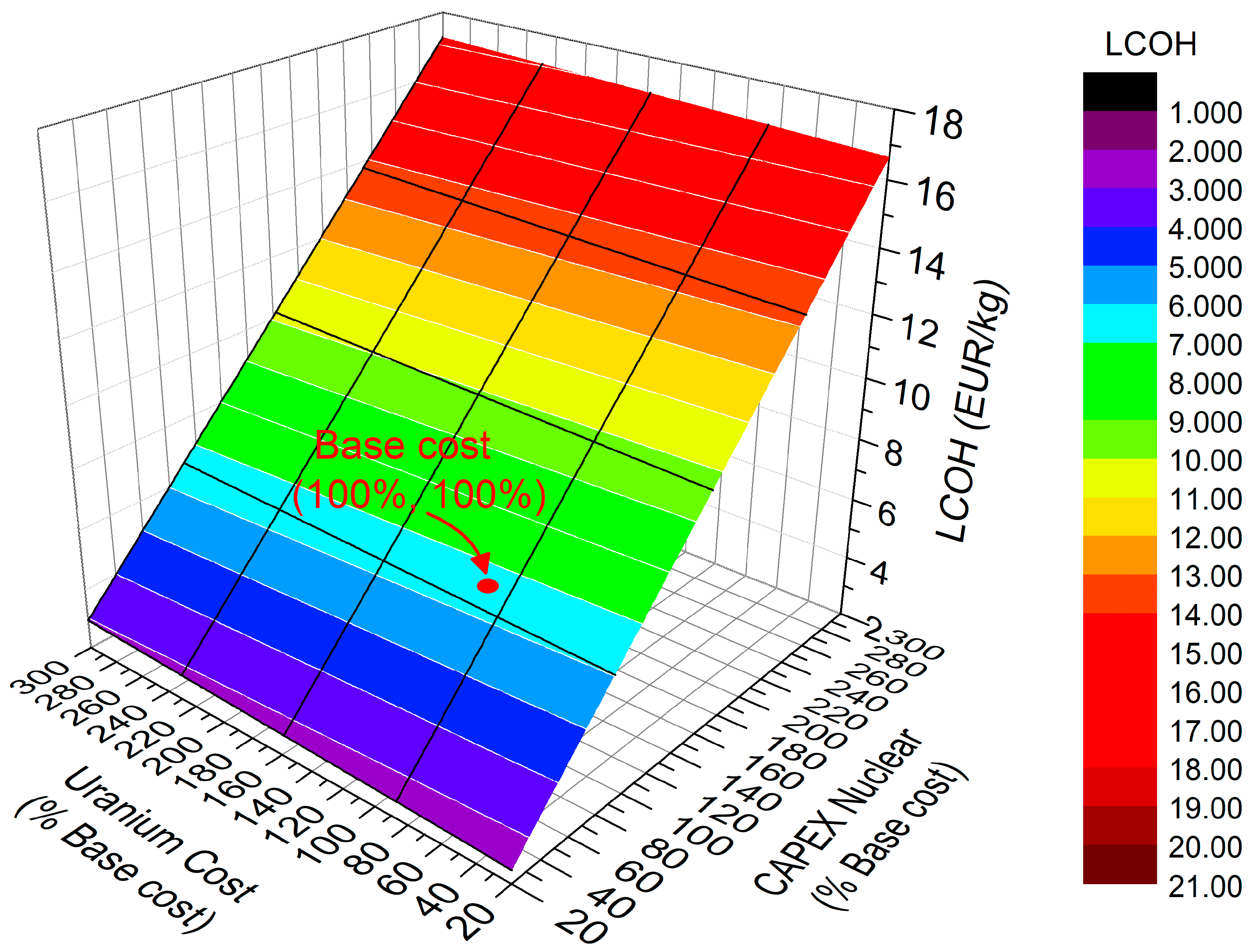

4.3. Sensitivity Analysis

5. Investigating Economic Viability of Hydrogen Ships

5.1. Specifying Viability Thresholds for LCOH and SMR’s CAPEX

| Specific Fuel Consumption * | Diesel Price | Emissions | CO2 Emissions Cost | Cost of Engine | Lifetime of Engine |

|---|---|---|---|---|---|

| 185 kg fuel/MWh [48,51] | X-axis (Figure 7) | 3.15 kg CO2/kg fuel [48] | Y-axis (Figure 7) | 0.25 million EUR/MW [48] | 20 years |

| Specific Fuel Consumption | Hydrogen Price | Cost of Fuel Cell, Inverter, Electric Motor | Lifetime |

|---|---|---|---|

| 60 kg H2/MWh | Z-axis (Figure 7) | 1 million EUR/MW [52] | 20 years |

5.2. Defining the Minimum SMR Fleet for Economies of Mass Production

6. Conclusions and Discussion

- ✓

- Assuming an average SMR’s CAPEX of 10,000 EUR/MW, the end-user LCOH is as high as 6.64 EUR/kg, which is too high to compete with diesel engines under the current diesel and carbon emission prices.

- ✓

- For a carbon emission cost of 0.129 EUR/kg (the current cost), the number of units required to achieve sufficient economies of mass production grows to infinite, clearly indicating an economically unfeasible scenario for SMRs.

- ✓

- The economic feasibility of SMRs is attainable only if the carbon cost rises to 0.387 EUR/kg and diesel prices exceed 0.70 EUR/L, conditions under which a manageable deployment of fewer than 1000 units (equivalent to 77 GW) is sufficient to achieve economies of mass production.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Melideo, D.; Desideri, U. The use of hydrogen as alternative fuel for ship propulsion: A case study of full and partial retrofitting of roll-on/roll-off vessels for short distance routes. Int. J. Hydrogen Energy 2024, 50 Pt B, 1045–1055. [Google Scholar] [CrossRef]

- Pompodakis, E.E.; Ahmed, A.; Condaxakis, C.; Orfanoudakis, G.I.; Karapidakis, E.S. Paving the way toward hydrogen mobility: An effective policy to reduce the green hydrogen cost. Int. J. Hydrogen Energy 2025, 100, 417–427. [Google Scholar] [CrossRef]

- Vinoya, C.L.; Ubando, A.T.; Culaba, A.B.; Chen, W.H. State-of-the-Art Review of Small Modular Reactors. Energies 2023, 16, 3224. [Google Scholar] [CrossRef]

- Maio, F.D.; Bani, L.; Zio, E. The Contribution of Small Modular Reactors to the Resilience of Power Supply. J. Nucl. Eng. 2022, 3, 152–162. [Google Scholar] [CrossRef]

- Zhang, Z.; Jiang, J. On load-following operations of small modular reactors. Prog. Nucl. Energy 2024, 173, 105274. [Google Scholar] [CrossRef]

- Poudel, B.; Gokaraju, R. Small Modular Reactor (SMR) Based Hybrid Energy System for Electricity & District Heating. IEEE Trans. Energy Convers. 2021, 36, 2794–2802. [Google Scholar]

- Kim, J.Y.; Seo, J.H.; Bang, I.C. Carbon neutrality strategy with small modular reactor-based hybrid energy system: A case study for a small Island and isolated power grid. Energy Convers. Manag. 2024, 301, 118041. [Google Scholar] [CrossRef]

- Zhang, T. Techno-economic analysis of a nuclear-wind hybrid system with hydrogen storage. J. Energy Storage 2022, 46, 103807. [Google Scholar] [CrossRef]

- Arcos, J.M.M.; Santos, D.M.F. The Hydrogen Color Spectrum: Techno-Economic Analysis of the Available Technologies for Hydrogen Production. Gases 2023, 3, 25–46. [Google Scholar] [CrossRef]

- Ayon, A.S.; Alif, A.R.; Nasim, A.S.M. A Review and Analysis of Nuclear Hydrogen Production in Generation IV Reactors. Int. J. Nucl. Secur. 2024, 9, 1. [Google Scholar] [CrossRef]

- Alabbadi, A.A.; Obaid, O.A.; AlZahrani, A.A. A comparative economic study of nuclear hydrogen production, storage, and transportation. Int. J. Hydrogen Energy 2024, 54, 849–863. [Google Scholar] [CrossRef]

- Ramana, M.V. Available online: https://www.utilitydive.com/news/nuscale-uamps-project-small-modular-reactor-ramanasmr-/705717/ (accessed on 7 June 2025).

- Mignacca, B.; Locatelli, G. Economics and finance of Small Modular Reactors: A systematic review and research agenda. Renew. Sustain. Energy Rev. 2020, 118, 109519. [Google Scholar] [CrossRef]

- WWF. Available online: https://www.wwfmmi.org/medtrends/shifting_blue_economies/maritime_traffic/ (accessed on 14 June 2025).

- Jin, I.J.; Bang, I.C. The time for revolutionizing small modular reactors: Cost reduction strategies from innovations in operation and maintenance. Prog. Nucl. Energy 2024, 174, 105288. [Google Scholar] [CrossRef]

- Baumhof, M.T.; Raheli, E.; Johnsen, A.G.; Kazempour, J. Optimization of Hybrid Power Plants: When Is a Detailed Electrolyzer Model Necessary? In Proceedings of 2023 IEEE PowerTech Conference, Belgrade, Serbia, 25–29 June 2023.

- International Atomic Energy Agency. Nuclear Power Reactors in the World, Reference Data Series No.2; IAEA: Vienna, Austria, 2020. [Google Scholar]

- NuScale Power. NuScale 2023 Analyst Day Presentation; U.S. Securities and Exchange Commission: Washington, DC, USA, 2023. [Google Scholar]

- Simoglou, C.K.; Kaissas, I.M.; Biskas, P.N. Assessing the Implications of Integrating Small Modular Reactors in Modern Power Systems. Energies 2025, 18, 2578. [Google Scholar] [CrossRef]

- Reuß, M.; Grube, T.; Robinius, M.; Preuster, P.; Wasserscheid, P.; Stolten, D. Seasonal storage and alternative carriers: A flexible hydrogen supply chain model. Appl. Energy 2017, 200, 290–302. [Google Scholar] [CrossRef]

- Papoutsa, A.; Vasilatos, C. The REE-Zr-U-Th Minerals of the Maronia Monzodiorite, N. Greece: Implications on the Saturation and Segregation Mechanisms of Critical Metals in Intermidiate-Mafic Compositions. Minerals 2023, 13, 1256. [Google Scholar]

- Tsikos, H.; Tzifas, I.T.; Papadopoulos, A. The Potential of REE and Associated Critical Metals in Coastal Sand (Placer) Deposits of Greece: A Review. Minerals 2019, 9, 469. [Google Scholar] [CrossRef]

- Yao, J.; Li, G. A Review of In Situ Leaching (ISL) for Uranium Mining. Mining 2024, 4, 120–148. [Google Scholar] [CrossRef]

- International Atomic Energy Agency. Ensuring Safe and Secure Passage for the Nuclear Industry’s Vital Natural Resource. Available online: https://www.iaea.org/newscenter/news/ensuring-safe-and-secure-passage-for-the-nuclear-industrys-vital-natural-resource (accessed on 19 June 2025).

- Gao, R.X.; Youn, S.R.; Ko, W.I.; Kim, S.K. Nuclear fuel cycle cost estimation and sensitivity analysis of unit costs on the basis of an equilibrium model. Nucl. Eng. Technol. 2015, 47, 306–314. [Google Scholar]

- World Nuclear Association. Available online: https://world-nuclear.org/information-library/nuclear-fuel-cycle/introduction/nuclear-fuel-cycle-overview (accessed on 2 June 2025).

- Palacios, J.C.; Alonso, G.; Ramirez, R.; Gomez, A.; Ortiz, J.; Longoria, L.C. Levelized Costs for Nuclear, Gas and Coal for Electricity, Under the Mexican Scenario. In Proceedings of the Americas Nuclear Energy Symposium (ANES 2004), Miami, FL, USA, 3–6 October 2004. [Google Scholar]

- Huang, G.; Huang, Y.; Ali, A.; Chen, Z.; Shen, P.K.; Ni, B.J.; Zhu, J. Phase-controllable cobalt phosphide heterostructure for efficient electrocatalytic hydrogen evolution in water and seawater. Electron 2024, 2, e58. [Google Scholar] [CrossRef]

- International Atomic Energy Agency. Maintenance, Testing, Surveillance and Inspection in Nuclear Power Plants; IAEA Safety Standards Series No. SSG-74; IAEA: Vienna, Austria, 2022. [Google Scholar]

- Pashchenko, D. Green hydrogen as a power plant fuel: What is energy efficiency from production to utilization? Renew. Energy 2024, 223, 120033. [Google Scholar] [CrossRef]

- Sofranko, M.; Khouri, S.; Vegsoova, O.; Kacmary, P.; Mudarri, T.; Koncek, M.; Tyulenev, M.; Simkova, Z. Possibilities of Uranium Deposit Kuriskova Mining and Its Influence on the Energy Potential of Slovakia from Own Resources. Energies 2020, 13, 4209. [Google Scholar] [CrossRef]

- IEA. The Future of Hydrogen; IEA: Paris, France, 2019; Available online: https://www.iea.org/reports/the-future-of-hydrogen#overview (accessed on 14 June 2025).

- Jannelli, E.; Di Micco, S.; Forcina, A.; Perna, A.; Minutillo, M. Analyzing the levelized cost of hydrogen in refueling stations with on-site hydrogen production via water electrolysis in the Italian scenario. Int. J. Hydrogen Energy 2021, 46, 13667–13677. [Google Scholar]

- Ahmed, A.; Pompodakis, E.E.; Katsigiannis, Y.; Karapidakis, E.S. Optimizing the installation of a Centralized Green Hydrogen Production Facility in the Island of Crete, Greece. Energies 2024, 17, 1924. [Google Scholar] [CrossRef]

- Pompodakis, E.E.; Kryonidis, G.C.; Karapidakis, E.S. Optimizing the installation of hybrid power plants in non-interconnected islands. J. Energy Storage 2023, 74 Pt B, 109511. [Google Scholar] [CrossRef]

- Arif, A.F.M.; Brandl, P. Assessing the viability of non-light water reactor concepts for electricity and heat generation in decarbonized energy systems. arXiv 2024, arXiv:2412.15083. [Google Scholar]

- Asuega, A.; Limb, B.J.; Quinn, J.C. Techno-economic analysis of advanced small modular nuclear reactors. Appl. Energy 2023, 334, 120669. [Google Scholar] [CrossRef]

- Feinstein, D. Eye-Popping New Cost Estimates Released for NuScale Small Modular Reactor; Institute for Energy Economics and Financial Analysis (IEEFA): Victoria, Australia, 2023. [Google Scholar]

- Pompodakis, E.E.; Karapidakis, E.s.; Katsigiannis, G.; Orfanoudakis, G.I. Hydrogen Production from Wave Power Farms to Refuel Hydrogen-Powered Ships in the Mediterranean Sea. Hydrogen 2024, 5, 494–518. [Google Scholar] [CrossRef]

- Holst, M.; Aschbrenner, S.; Smolinka, T.; Voglstatter, C.; Grimm, G. Cost Forecast for Low Temperature Electrolysis—Technology Driven Bottom-Up Prognosis for Pem and Alkaline Water Electrolysis Systems, a Cost Analysis Study on Behalf of Clean Air Task Force; Fraunhofer Institute for Solar Energy Systems ISE: Freiburg, Germany, 2021; p. 79. [Google Scholar]

- Mäkelä, M.; Niemi, S.; Nuortila, C.; Nyystilä, L. Applicability of Hydrogen Fuel for a Cruise Ship. Clean Technol. 2025, 7, 6. [Google Scholar] [CrossRef]

- Barckholtz, T.; Burgunder, A.; Casey, D.; Dillich, S.; Elgowainy, A.; Merritt, J.; Parks, G.; Pawel, S.; Simnick, J.; Soto, H. Hydrogen Delivery Technical Team Roadmap, U.S.D. Partnership, Editor. 2013. Available online: https://www.energy.gov/eere/fuelcells/articles/hydrogen-delivery-roadmap, (accessed on 28 June 2025).

- Morales-Ospino, R.; Celzard, A.; Fierro, V. Strategies to recover and minimize boil-off losses during liquid hydrogen storage. Renew. Sustain. Energy Rev. 2023, 182, 113360. [Google Scholar] [CrossRef]

- Nøland, J.K.; Hjelmeland, M.N.; Hartmann, C.; Tjernberg, L.B.; Korpås, M. Overview of Small Modular and Advanced Nuclear Reactors and Their Role in the Energy Transition. IEEE Trans. Energy Convers. 2025, 1–12. [Google Scholar] [CrossRef]

- Institute for Energy Economics and Financial Analysis, Eye-Popping New Cost Estimates Released for NuScale Small Modular Reactor. Available online: https://ieefa.org/resources/eye-popping-new-cost-estimates-released-nuscale-small-modular-reactor (accessed on 14 June 2025).

- European Commission (EC). Document 52021PC0551, Proposal for a DIRECTIVE OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL Amending Directive 2003/87/EC Establishing a System for Greenhouse Gas Emission Allowance Trading Within the Union, Decision (EU) 2015/1814 Concerning the Establishment and Operation of a Market Stability Reserve for the Union Greenhouse Gas Emission Trading Scheme and Regulation (EU) 2015/757; European Commission (EC): Brussels, Belgium, 2021. [Google Scholar]

- VLSO Price. Available online: https://www.statista.com/statistics/1109263/monthly-vlsfo-bunker-price-worldwide/ (accessed on 16 July 2024).

- Bui, K.Q.; Perera, L.P.; Emblemsvåg, J. Life-cycle cost analysis of an innovative marine dual-fuel engine under uncertainties. J. Clean. Prod. 2022, 380 Pt 2, 134847. [Google Scholar] [CrossRef]

- Perna, A.; Jannelli, E.; Di Micco, S.; Romano, F.; Minutillo, M. Designing, sizing and economic feasibility of a green hydrogen supply chain for maritime transportation. Energy Convers. Manag. 2023, 278, 116702. [Google Scholar] [CrossRef]

- Bloomberg NEF, Europe’s New Emissions Trading System Expected to Have World’s Highest Carbon Price in 2030 at €149. Available online: https://shorturl.at/YG559 (accessed on 10 June 2025).

- Wu, P.; Wu, P.; Bucknall, R. Marine propulsion using battery power. In Proceedings of the Shipping in Changing Climates Conference 2016, Newcastle, UK, 10–11 November 2016. [Google Scholar]

- Temiz, M.; Dincer, I. Techno-economic analysis of green hydrogen ferries with a floating photovoltaic based marine fueling station. Energy Convers. Manag. 2021, 247, 114760. [Google Scholar] [CrossRef]

- Tsapanos, T. Seismicity and Seismic Hazard Assessment in Greece. In Earthquake Monitoring and Seismic Hazard Mitigation in Balkan Countries; Springer: Dordrecht, The Netherlands, 2008. [Google Scholar] [CrossRef]

- Krall, L.M.; Macfarlane, A.M.; Ewing, R.C. Nuclear waste from small modular reactors. Proc. Natl. Acad. Sci. USA 2022, 119, e2111833119. [Google Scholar] [CrossRef] [PubMed]

- World Nuclear Association. Economics of Nuclear Power. Available online: https://shorturl.at/EA2EW (accessed on 6 July 2025).

- Hall, M.; Corradini, M.; Pawel, R. Technoeconomic Analysis of Small Modular Reactors for Hydrogen Production; U.S. Department of Energy Office of Scientific and Technical Information (OSTI): Oak Ridge, TN, USA, 2022; Report No. 2338209. [Google Scholar]

- Ganda, F.; Dixon, B.; Wigeland, R.; Taiwo, T.; Todosow, M. Economic Analysis of Complex Nuclear Fuel Cycles with NE-COST. Nucl. Technol. 2016, 193, 219–233. [Google Scholar] [CrossRef]

- Ramana, M.V. Small Modular and Advanced Nuclear Reactors: A Reality Check. IEEE Access 2021, 9, 42090–42099. [Google Scholar] [CrossRef]

- Abdulla, A.; Azevedo, I.L.; Morgan, M.G. Expert assessments of the cost of light water small modular reactors. Proc. Natl. Acad. Sci. USA 2013, 110, 9686–9691. [Google Scholar] [CrossRef]

- Anadón, L.D.; Bosetti, V.; Bunn, M.; Catenacci, M.; Lee, A. Expert judgments about RD&D and the future of nuclear energy. Environ. Sci. Technol. 2012, 46, 11497–11504. [Google Scholar]

- Hansen, J.K.; Jenson, W.D.; Wrobel, A.M.; Stauff, N.; Biegel, K.; Kim, T.K.; Belles, R.; Omitaomu, F. Investigating Benefits and Challenges of Converting Retiring Coal Plants into Nuclear Plants; Idaho National Laboratory (INL): Idaho Falls, ID, USA, 2022. [Google Scholar] [CrossRef]

- Cothron, E. Resources for Coal Repowering with Nuclear Energy; Nuclear Innovation Alliance: Washington, DC, USA, 2023; Available online: https://nuclearinnovationalliance.org/resources-coal-repowering-nuclear-energy (accessed on 7 June 2025).

- Zhou, Z.; Tao, J. Hydrogen-powered vessels in green maritime decarbonization: Policy drivers, technological frontiers and challenges. Front. Mar. Sci. 2025, 12, 1601617. [Google Scholar] [CrossRef]

- Ventayol, A.A.; Lam, J.S.L.; Bai, X.; Chen, Z.S. Comparative life cycle assessment of hydrogen internal combustion engine and fuel cells in shipping. Int. J. Hydrogen Energy 2025, 109, 774–788. [Google Scholar] [CrossRef]

| Reactor Type | Pressurized Water Reactor |

| Thermal Power | 250 MWth |

| Electrical Power | 77 MWe per module |

| Coolant | Light Water (primary and secondary loop) |

| Fuel | Uranium Dioxide |

| Fuel Cycle | 24 month refueling interval |

| Efficiency | ~33% thermal-to-electric |

| Maintenance Downtime | Estimated 15–20 days per 2-year fuel cycle [18,19] |

| Hydrogen Suitability | Demonstrated compatibility with PEM and alkaline [20] (AEL) electrolyzers (per vendor disclosures) |

| 10,000 EUR/kW [19] | |

| 930 EUR/kg LEU [19,27] | |

| 60 years [19] | |

| 4 × 77 MW [19] | |

| 3456 GJ/kg LEU (=960 MWh/kg) [19,26,27] | |

| 0.15 EUR/kWh | |

| 33% [19] |

| 680 EUR/kW [40] | |

| 1,000,000 EUR [20] | |

| 25 EUR/kg H2 [20] | |

| ~13 | |

| 110,000 EUR [20] | |

| 20 years [20] | |

| 20 years [20] | |

| 20 years [20] | |

| 20 years [20] | |

| 4 × 77 MW | |

| 70% [20,39] | |

| 70% [20,39] |

| Annual Hydrogen Production | 40,062.40 tons/year |

| Daily Hydrogen Production | 109.76 ton/day |

| LCOH (end-user cost) | 6.64 EUR/kg |

| Levelized production cost (nuclear and electrolyzer) | 5.93 EUR/kg |

| Levelized liquefication cost | 0.6483 EUR/kg |

| Levelized storage cost | 0.0066 EUR/kg |

| Levelized transport cost | 0.0575 EUR/kg |

| LCOH (end-user cost) | 6.64 EUR/kg |

| CAPEX nuclear station | 3080.00 million EUR |

| CAPEX electrolyzer | 209.44 million EUR |

| CAPEX liquefication unit | 176.43 million EUR |

| CAPEX storage system | 2.74 million EUR |

| CAPEX transport (trucks) | 13.00 million EUR |

| Total CAPEX | 3481.60 million EUR |

| OPEX nuclear station | 105.76 million EUR |

| OPEX electrolyzer | 6.28 million EUR |

| OPEX liquefication unit | 14.11 million EUR |

| OPEX storage system | 0.08 million EUR |

| OPEX transport (trucks) | 1.43 million EUR |

| Total OPEX | 127.67 million EUR |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pompodakis, E.E.; Papadimitriou, T. Techno-Economic Assessment of Pink Hydrogen Produced from Small Modular Reactors for Maritime Applications. Hydrogen 2025, 6, 47. https://doi.org/10.3390/hydrogen6030047

Pompodakis EE, Papadimitriou T. Techno-Economic Assessment of Pink Hydrogen Produced from Small Modular Reactors for Maritime Applications. Hydrogen. 2025; 6(3):47. https://doi.org/10.3390/hydrogen6030047

Chicago/Turabian StylePompodakis, E. E., and T. Papadimitriou. 2025. "Techno-Economic Assessment of Pink Hydrogen Produced from Small Modular Reactors for Maritime Applications" Hydrogen 6, no. 3: 47. https://doi.org/10.3390/hydrogen6030047

APA StylePompodakis, E. E., & Papadimitriou, T. (2025). Techno-Economic Assessment of Pink Hydrogen Produced from Small Modular Reactors for Maritime Applications. Hydrogen, 6(3), 47. https://doi.org/10.3390/hydrogen6030047