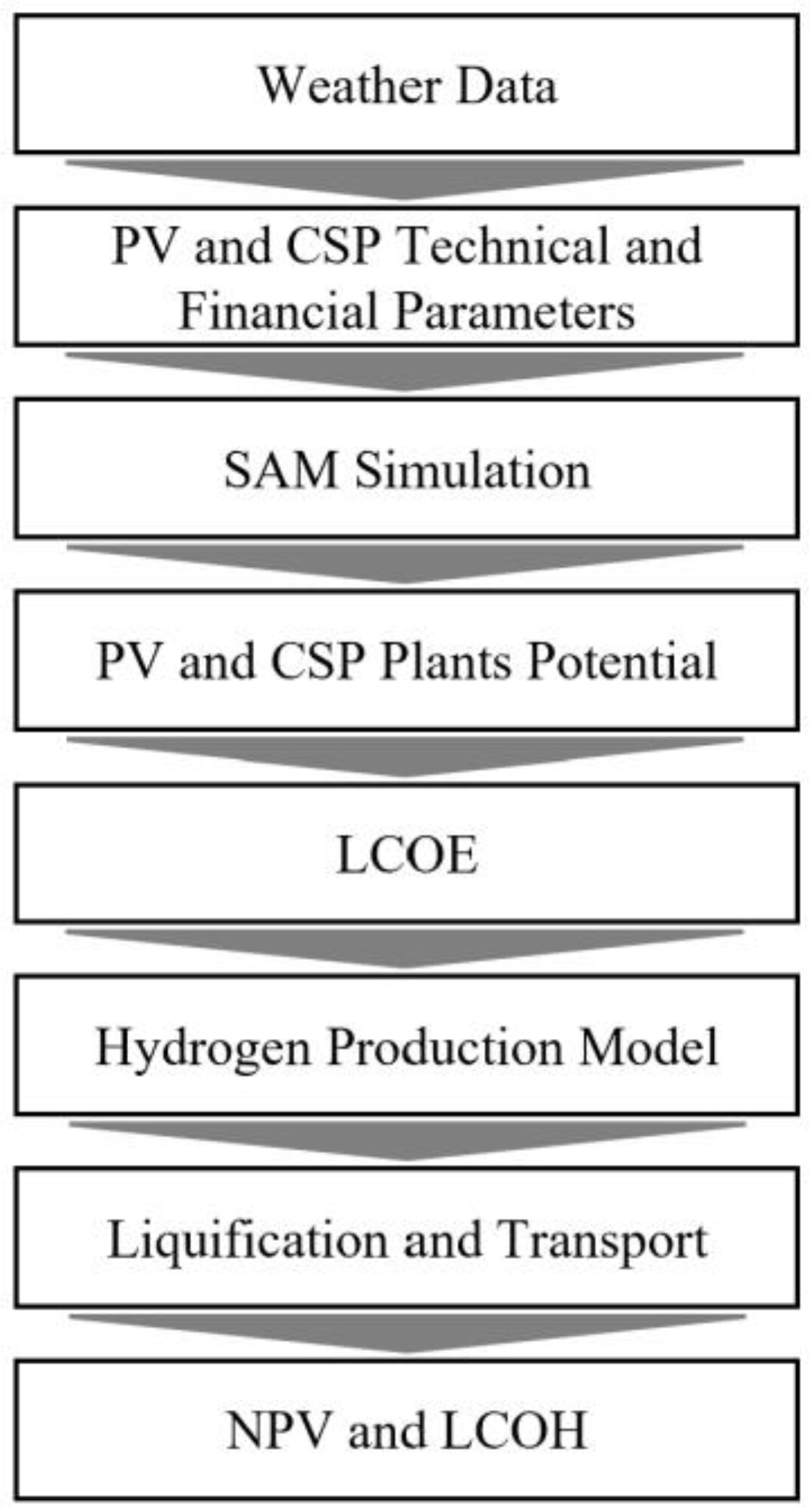

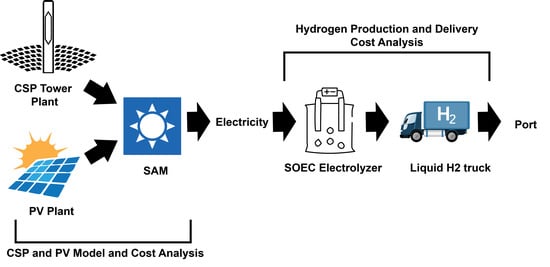

This study proposes a well-to-ship hydrogen from solar production model that aims to compare two different solar technologies from technical and financial aspects in the case of the United Arab Emirates in two different hydrogen delivery scenarios, to help provide an adequate discussion about which technology is more favorable in a zero-emission energy and hydrogen future of the Middle East region. PV and CSP solar plants are modeled at a chosen location in the UAE, following the results of our previous study shown in

Figure 1 [

26], where solar irradiance and slope conditions are satisfactory following NREL’s model [

27], with a distance of 25 km from main roads and electrical transmission lines, and does not intersect with populated, or preserved areas. Taking into consideration the properties of the UAE, technical and financial parameters are set to simulate the technical and financial performances of the PV and CSP plants using NREL’s simulation advisor model (SAM) after adding the weather data of the specified plant location. The electricity produced by each plant is then used to power the SOEC water electrolyzer for hydrogen production. Technical and financial parameters for the hydrogen plant are incorporated to fit SOEC’s technology characteristics and the UAE’s financial index to provide the net present value for each project (NPV) and the levelized cost of hydrogen (LCOH). The steps of this study are shown with a flowchart in

Figure 2.

Two different hydrogen supply chains are assumed in this study; in the first one the electrolyzer is located at the same site as the solar plant with the CSP plant being coupled to it, and for the PV plant, extra electric water heaters are used to heat the water feeding the high heat temperature electrolyzer. The produced hydrogen in the first scenario is then liquified before it is transported by liquid hydrogen trailers to port sites for export. In the second scenario, the SOEC electrolyzers are located at port sites to reduce transportation fees, assuming the electricity from the PV and CSP plants are transmitted to the hydrogen plant’s location using UAE’s current electricity grid. In this scenario, electric water heaters are used in both solar plants’ cases. Hydrogen supply chain scenarios are thoroughly explained in

Figure 3.

2.1. CSP and PV Plants Modelling

Version 2021.12.2 of the SAM optimization tool, developed by the U.S. Department of Energy’s National Renewable Energy Laboratory (NREL) [

28], is used to carry the simulation for the performance and financial metrics of CSP and PV plants.

A solar tower system is chosen for our CSP plant with molten salt as heat fluid and solar multiple of 2.4 coupled with a 10 h thermal storage, following NREL’s model [

29]. For the photovoltaic plant, NREL’s economic analysis case study with battery energy storage model is adapted [

30], SunPower SPR-210-BLK-U modules with SMA America: STP24000TL-US-10 480V inverters were selected as per the mentioned case study. Financial modeling for both plants is done under Power Purchase Agreement (PPA) models with Single Ownership. Furthermore, a 6% real discount rate is chosen for this study, befitting the UAE’s financial model [

31,

32] with an income tax rate of 9% [

33]. Detailed technical and financial parameters used for the simulation of CSP and PV plants using SAM software are mentioned in

Table 1 and

Table 2.

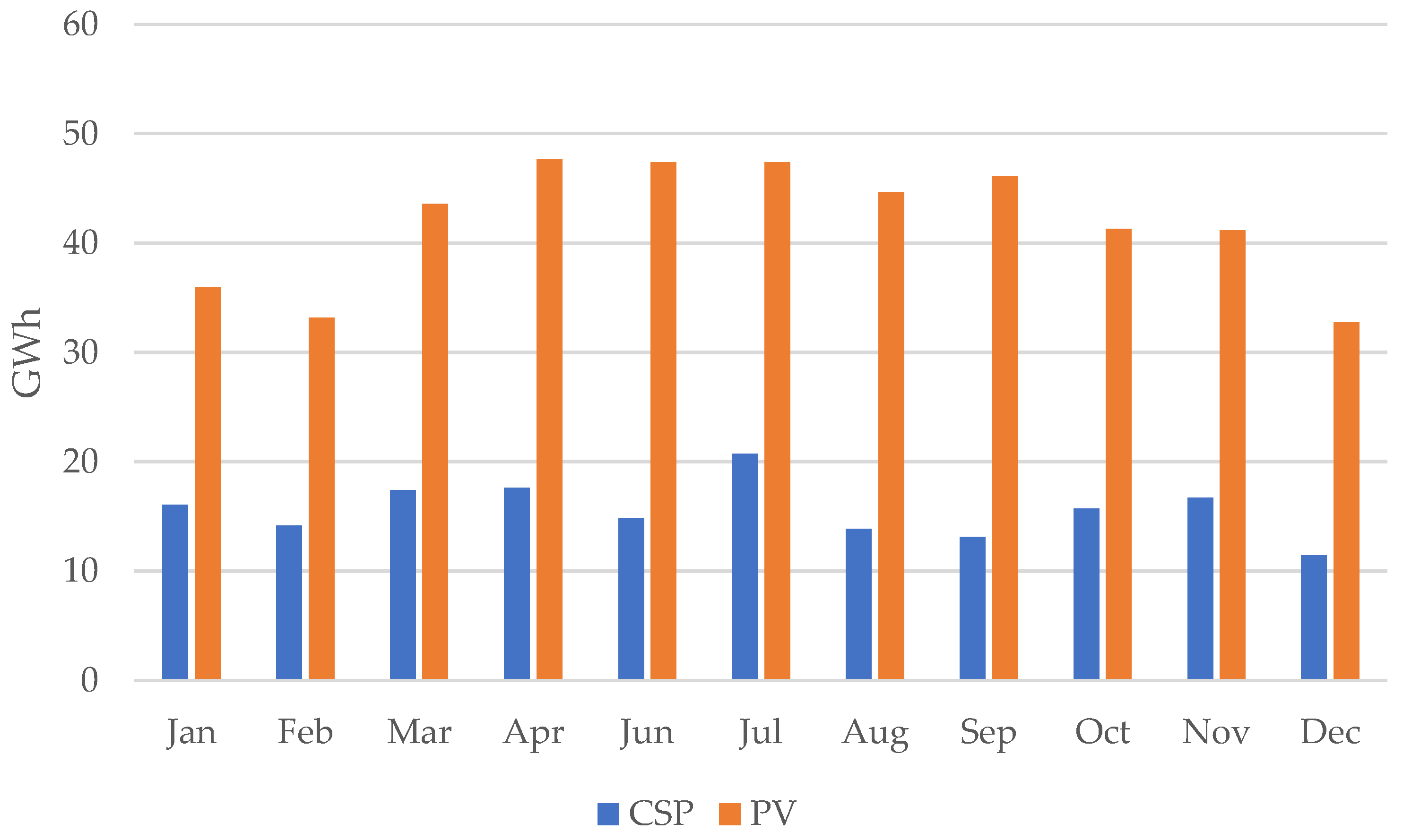

SAM uses Typical Metrological Year (TMY) data to access the hourly Direct Normal Irradiation (DNI) and Global Horizontal Irradiation (GHI) needed to estimate the technical performance of a specified site. TMY data adapted from the PV-GIS database [

34] is used for the chosen location of the plants that is shown in

Figure 1, and then added to SAM’s weather library to estimate the annual average DNI and GHI before incorporating the assumed technical and financial parameters and going through the simulation.

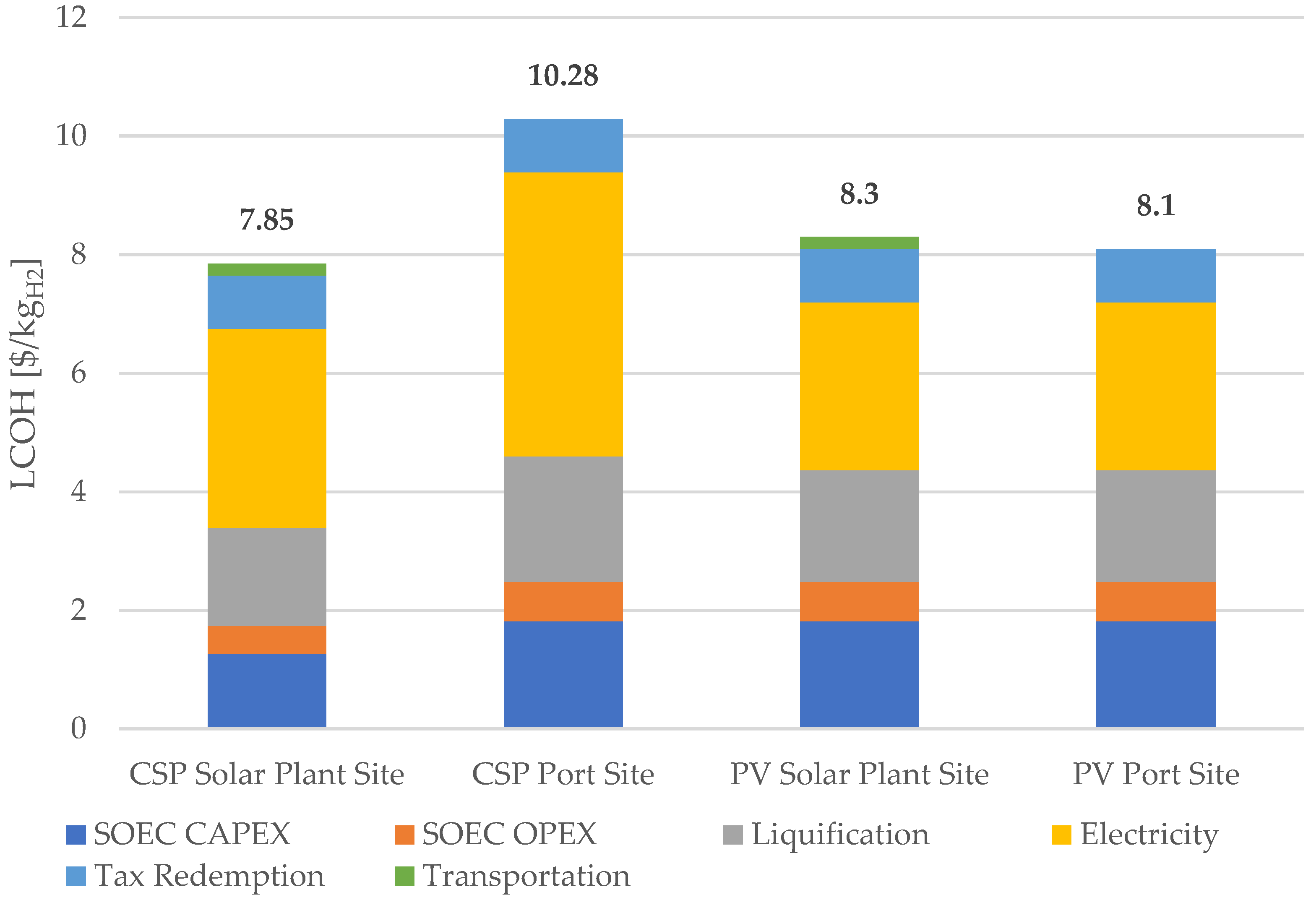

2.2. H2 Production and Cost Model

Four scenarios of hydrogen production are considered in this study, the first with CSP coupled to the SOEC electrolyzer at the same solar plant site (CSP Solar Plant Site), the second with electricity generated by the same CSP plant but with the SOEC electrolyzer with electric heaters placed at the port site (CSP Port Site), the third is with the H2 plant at the same place as the PV solar plant using electric heaters (PV Solar Plant Site), and finally placing the SOEC electrolyzer again at the port site and providing it with an electric heater and electricity from the PV plant (PV Port Site).

Hydrogen plants in all scenarios are assumed as a class of 1 MW

el.

Table 3 shows the SOEC electrolyzer efficiency and operation point derived from Jang et al. study [

36] which is used to calculate the hydrogen production potential in each scenario.

In this study we adopt the method and equations of Nicita et al. [

37] and Jang et al. [

36] to calculate the hydrogen production cost. This method uses cash flow of the project to calculate the net present value (NPV) and the levelized cost of hydrogen (LCOH). The NPV measures the feasibility of projects by estimating the project’s final value over plant life at the present point in time [

36]. The NPV is calculated by dividing the expected future cash flows from the plant operating by the discount rate and then summing them all, and it is presented as follows [

36]:

represents the term of the project in years,

is the net cash flow at year

,

is the discount rate which is needed to estimate the change in cash value, assumed at 6% for UAE’s case [

31,

32], and

is the capital expenditure (CAPEX).

Equation (1) can be described as follows to help calculate the cash flow [

36]:

where project revenues are

,

is the operating expenditure, from labor to maintenance and electricity fees, and

is the income tax rate. Equation (2) can be further explained as follows [

36]:

Again, the

terms of Equation (4) can be further specified as follows [

36]:

where

is the revenue from the hydrogen sales,

is oxygen sales revenues,

is the annual mass hydrogen production,

is the system’s rate of degradation which represents the deterioration in efficiency for hydrogen production over time,

and

are the selling price of hydrogen and oxygen, respectively, and

is a factor of 0 or 1 that indicates whether oxygen is sold or not. As hydrogen and oxygen gas are generated at a mole ratio of 1:0.5 by water electrolysis, it can be calculated that oxygen is coproduced eight times the mass of hydrogen [

36].

The price of hydrogen can illustrate a better comparison between all energy technologies and delivery scenarios, the

LCOH can be estimated as follows [

36]:

The capital cost of expenditure indexes along with the annual operational costs and factors needed to calculate the equations above are explained in

Table 4 and

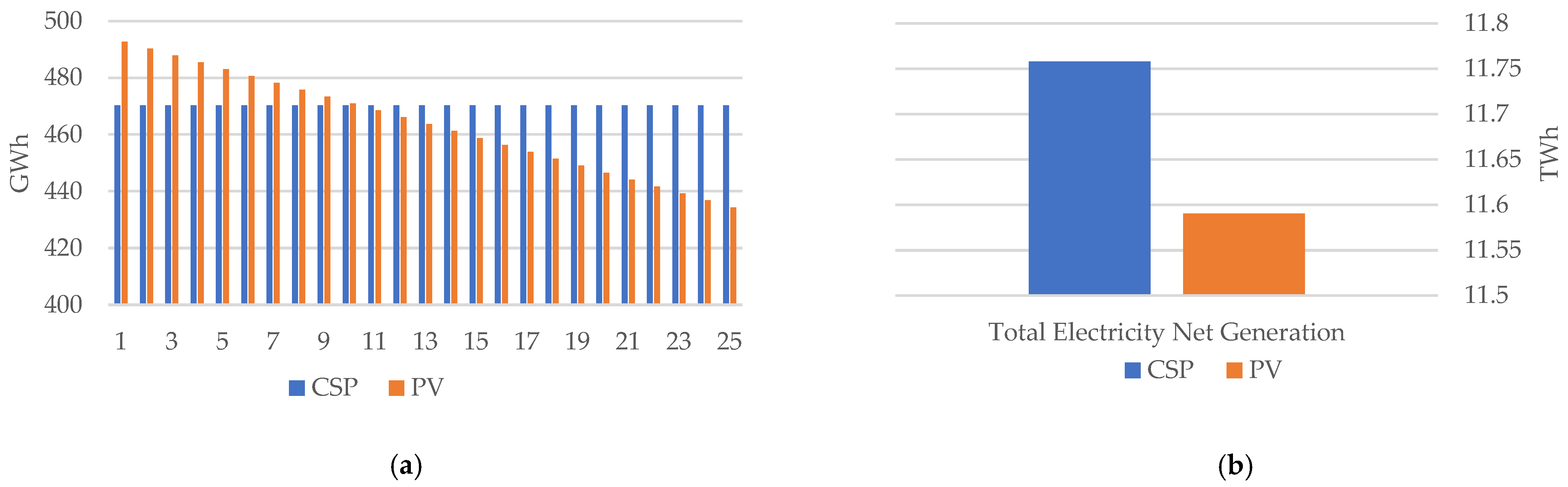

Table 5. The lifetime of hydrogen plants is set to 20 years, the SOEC stack unit is presumed to be replaced after 20,000 working hours [

36], which comes to once every 4.38 years in a 20-year plant lifetime, and the loss of efficiency is set to 10 %. The capacity of the hydrogen plants is set to 50% with 12 h a day, accumulating to 4380 h in each year [

36]. SAM’s results for the CSP and PV’s plants

LCOE accounts for the cost of electricity to operate the electrolyzers in each scenario. Additionally, 10 kg of water are assumed to provide 1 kg of hydrogen [

36]. UAE’s wage rates are considered for one full-time employee to manage each hydrogen plant. Hydrogen sales price is set to 10

$/kg

H2 [

38,

39], and 0.054

$/kg

O2 for oxygen [

40]. Loan payments and interest in debts were not considered for the hydrogen plants.

2.3. Liquification and Distribution

Liquification energy consumption assumptions are based on Gallardo et al. study with 6.4 kWh/kg

H2 [

39], and liquid hydrogen plant CAPEX of 50,000

$/(kg

H2/h) [

45], presuming operation and maintenance annual fees of 4% of the CAPEX according to Stolzenburg [

46].

For the first delivery scenario from solar plant sites to ports, trucks are considered to carry the liquified H

2. The IEA’s considerations of transportation cost as a function to distance with 0.12–0.13

$/kg

H2 for each 100 km traveled LH

2 are adapted in this study [

47]. The average distance between solar plants and the closest ports in the cases of the UAE are estimated at 154.34 km, as per our previous study [

26].