Integrating Ecological and Economic Approaches for Ecosystem Services and Biodiversity Conservation: Challenges and Opportunities

Abstract

1. Introduction

2. Valuing Nature: An Economic Perspective on Ecosystem Services

2.1. Conceptualizing Ecosystem Services: Definitions, Classifications, and Significance

| Category | Definition | Examples |

|---|---|---|

| Provisioning | The material or energy outputs from ecosystems. These are the tangible products that can be directly consumed or used by people. | Food (crops, livestock, fisheries), fresh water, timber and fiber (cotton, wood), medicinal resources, biofuels. |

| Regulating | The benefits obtained from the regulation of ecosystem processes. These services often maintain environmental quality and stability. | Climate regulation (carbon sequestration), water purification, air quality regulation, flood and storm protection, erosion control, pollination, pest, and disease control. |

| Supporting | The underlying natural processes that are necessary to produce all other ecosystem services. Their impact on people is indirect and occurs over a long-time scale. | Nutrient cycling, soil formation, primary production (photosynthesis), water cycling, provision of habitat for species. |

| Cultural | The non-material benefits people obtain from ecosystems through spiritual enrichment, cognitive development, recreation, and esthetic experiences. | Recreational opportunities (hiking, fishing, ecotourism), esthetic values (scenic landscapes), spiritual and religious values, educational opportunities, cultural heritage, sense of place. |

2.2. Methodological Toolkit for Economic Valuation

2.2.1. Cost-Based Methods

2.2.2. Revealed-Preference (RP) Methods

2.2.3. Stated-Preference (SP) Methods

2.2.4. Benefit Transfer and Non-Monetary Approaches

2.3. Global Applications: Quantifying the Economic Value of Key Services

2.3.1. Watershed Protection

2.3.2. Forest Carbon Sequestration

3. The Economics of Biodiversity: From Costs of Loss to Incentives for Conservation

3.1. The Dual Value of Biodiversity: Ecological Function and Economic Foundation

3.2. Quantifying the Economic Consequences of Biodiversity Decline in Key Sectors

3.2.1. Agriculture

3.2.2. Fisheries

3.2.3. Other Sectors

3.3. Economic Instruments for Conservation: Payments for Ecosystem Services (PES) and Innovative Finance

4. Bridging the Divide: Integrating Ecology and Economics in Policy and Governance

4.1. Designing Effective Eco-Economic Policy Instruments: Carbon Pricing and Green Taxation

4.2. Synergies in Governance: Combining Market-Based and Command-and-Control Mechanisms

4.3. Policy in Practice: Global Case Studies of Integrated Ecological–Economic Governance

4.3.1. Corporate Practice

4.3.2. Public Policy

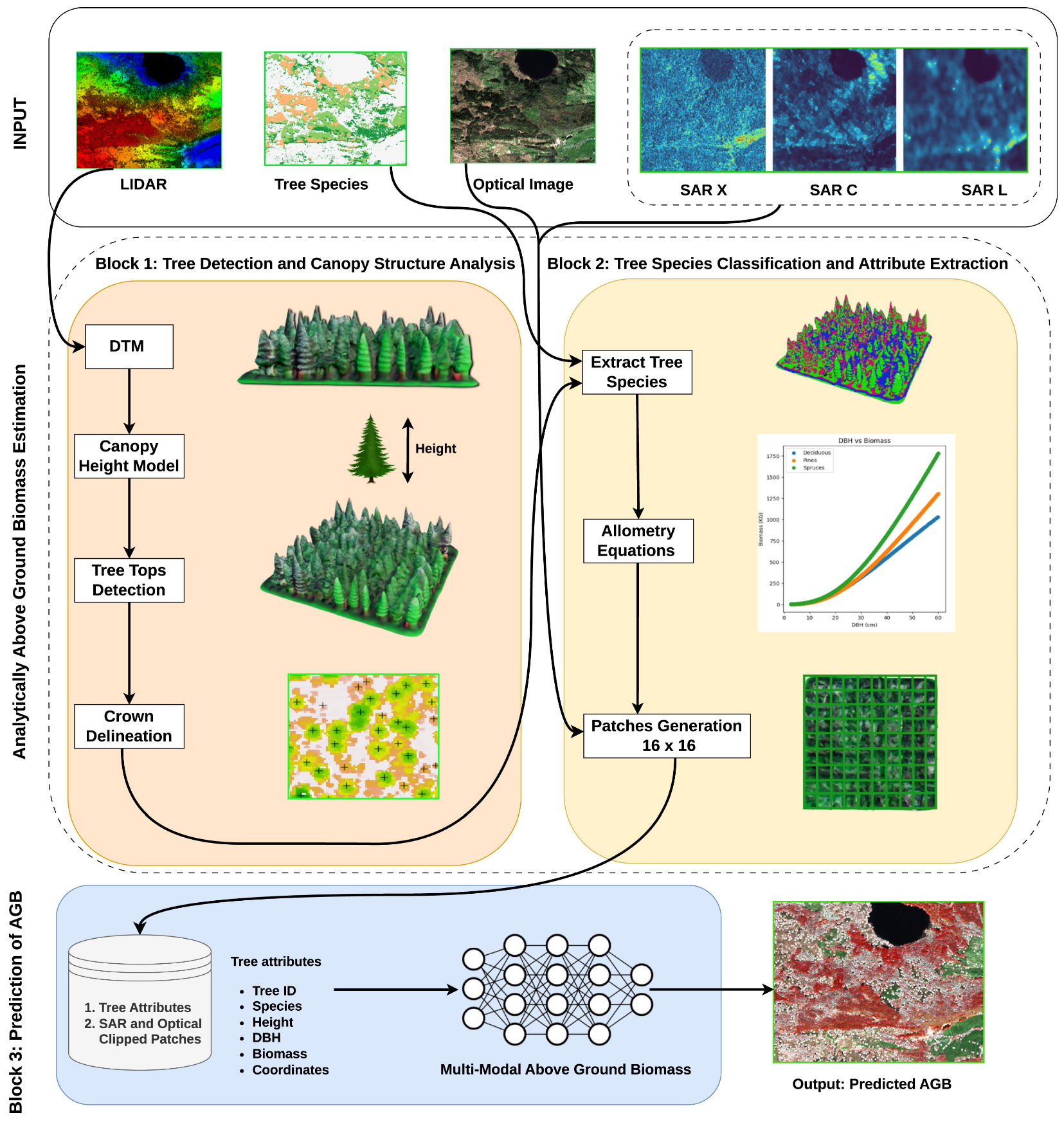

4.3.3. The Role of AI in Ecological–Economic Integration

5. Charting a Path to Sustainability: A Unified Ecological and Economic Vision

5.1. Aligning with Global Agendas: The Role of Natural Capital in the Sustainable Development Goals (SDGs)

5.2. Economic Paradigms for Sustainability: Green, Circular, and Low-Carbon Economies

5.3. The Ecological Foundation of Sustainability: Resilience, Restoration, and Planetary Boundaries

5.4. Long-Term Implications: Ecological–Economic Integration in the Face of Global Change

6. Frontiers and Headwinds: Challenges and Future Directions

6.1. Overcoming Interdisciplinary Barriers in Ecological Economics

6.2. The Next Generation of Ecological–Economic Modeling and Data Integration

6.3. The Role of Artificial Intelligence: Opportunities and Pitfalls

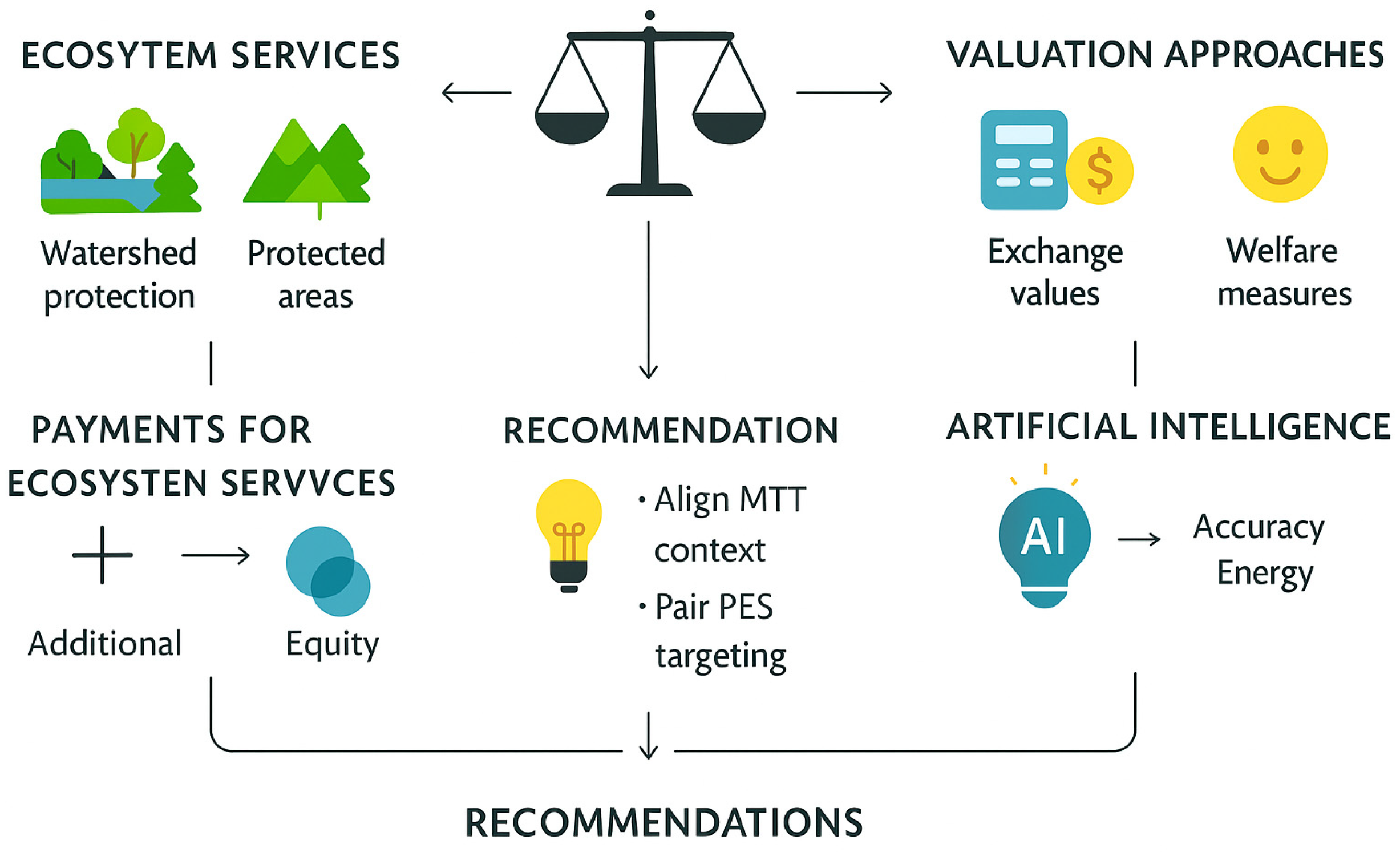

7. Conclusions: Synthesizing Insights and Charting the Path Forward

7.1. Recapitulation of Key Findings

7.2. Actionable Policy Recommendations for a Sustainable Future

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Chen, C.; Tabssum, N.; Nguyen, H.P. Study on Ancient Chu Town Urban Green Space Evolution and Ecological and Environmental Benefits. Nat. Environ. Pollut. Technol. 2019, 18, 1733–1738. [Google Scholar]

- Helm, D. Natural Capital: Valuing the Planet; Yale University Press: New Haven, CT, USA, 2015. [Google Scholar]

- Grunewald, K.; Zieschank, R.; Förster, J.; Hansjürgens, B.; Wildner, T.M. The future of economic reporting: Ecosystem services and biodiversity in government and corporate accounting. One Ecosyst. 2024, 9, e131326. [Google Scholar] [CrossRef]

- Giakoumi, S.; Richardson, A.J.; Doxa, A.; Moro, S.; Andrello, M.; Hanson, J.O.; Hermoso, V.; Mazor, T.; McGowan, J.; Kujala, H. Advances in systematic conservation planning to meet global biodiversity goals. Trends Ecol. Evol. 2025, 40, 395–410. [Google Scholar] [CrossRef]

- Bravo, A.S.; Camps, S.P.; Pérez, M.Á.V.; Arvide, M.G.T. Soil ecosystem services valuation in a priority terrestrial region for biodiversity conservation in Mexico, from ecological economics and the local community perspective. Discov. Sustain. 2024, 5, 457. [Google Scholar] [CrossRef]

- Pisani, D.; Pazienza, P.; Perrino, E.V.; Caporale, D.; De Lucia, C. The economic valuation of ecosystem services of biodiversity components in protected areas: A review for a framework of analysis for the Gargano National Park. Sustainability 2021, 13, 11726. [Google Scholar] [CrossRef]

- Turnhout, E.; McElwee, P.; Chiroleu-Assouline, M.; Clapp, J.; Isenhour, C.; Kelemen, E.; Jackson, T.; Miller, D.C.; Rusch, G.M.; Spangenberg, J.H. Enabling transformative economic change in the post-2020 biodiversity agenda. Conserv. Lett. 2021, 14, e12805. [Google Scholar] [CrossRef]

- Wu, S.; Chen, Y.; Hao, C.; Liu, K.; Zhang, W.; Zhang, L. Promoting biodiversity conservation requires a better understanding of the relationships between ecosystem services and multiple biodiversity dimensions. Front. Ecol. Evol. 2022, 10, 891627. [Google Scholar] [CrossRef]

- Stanford, G.O.; Ferreira, S.; Landry, C.E.; Blachly, B. Economic valuation of ecosystem services and natural infrastructure: A quantitative review of the literature. Ecosyst. Serv. 2025, 75, 101754. [Google Scholar] [CrossRef]

- Greenhalgh, T.; Thorne, S.; Malterud, K. Time to challenge the spurious hierarchy of systematic over narrative reviews? Eur. J. Clin. Investig. 2018, 48, e12931. [Google Scholar] [CrossRef]

- Ferrari, R. Writing narrative style literature reviews. Med. Writ. 2015, 24, 230–235. [Google Scholar] [CrossRef]

- Thomasz, E.O.; Kasanzew, A.; García García, A. Economic valuation of ecosystem services in southwest Spain. Discov. Sustain. 2025, 6, 95. [Google Scholar] [CrossRef]

- Brander, L.; De Groot, R.; Schägner, J.; Guisado-Goñi, V.; Van’t Hoff, V.; Solomonides, S.; McVittie, A.; Eppink, F.; Sposato, M.; Do, L. Economic values for ecosystem services: A global synthesis and way forward. Ecosyst. Serv. 2024, 66, 101606. [Google Scholar] [CrossRef]

- Lawton, J. Earth system science. Science 2001, 292, 1965. [Google Scholar] [CrossRef]

- Amatucci, A.; Ventura, V.; Simonetto, A.; Gilioli, G. The Economic Value of Ecosystem Services: Meta-analysis and Potential Application of Value Transfer for Freshwater Ecosystems. Environ. Resour. Econ. 2024, 87, 3041–3061. [Google Scholar] [CrossRef]

- Pacifico, A.M.; Mulazzani, L.; Malorgio, G. Are the economic valuations of marine and coastal ecosystem services supporting policymakers? A systematic review and remaining gaps and challenges. Front. Mar. Sci. 2025, 11, 1501812. [Google Scholar] [CrossRef]

- Nilgen, M.; Rode, J.; Vorlaufer, T.; Vollan, B. Measuring non-use values to proxy conservation preferences and policy impacts. Ecosyst. Serv. 2024, 67, 101621. [Google Scholar] [CrossRef]

- Sandhu, H.; Zhang, W.; Meinzen-Dick, R.; ElDidi, H.; Perveen, S.; Sharma, J.; Kaur, J.; Priyadarshini, P. Valuing ecosystem services provided by land commons in India: Implications for research and policy. Environ. Res. Lett. 2023, 18, 013001. [Google Scholar] [CrossRef]

- Dingha, C.B.; Biber-Freudenberger, L.; Mbanga, L.A.; Kometa, S.S. Community-based valuation of wetland ecosystem services: Insights from Bamenda, Cameroon. Wetl. Ecol. Manag. 2025, 33, 14. [Google Scholar] [CrossRef]

- Atkinson, G.; Bateman, I.; Mourato, S. Recent advances in the valuation of ecosystem services and biodiversity. Oxf. Rev. Econ. Policy 2012, 28, 22–47. [Google Scholar] [CrossRef]

- Ruiz de Gauna, I.; Markandya, A.; Onofri, L.; Greño, F.; Warman, J.; Arce, N.; Navarrete, A.; Rivera, M.; Kobelkowsky, R.; Vargas, M. Economic Valuation of the Ecosystem Services of the Mesoamerican Reef, and the Allocation and Distribution of these Values; IDB Working Paper Series; IDB: Washington, DC, USA, 2021. [Google Scholar]

- Grabowski, J.H.; Brumbaugh, R.D.; Conrad, R.F.; Keeler, A.G.; Opaluch, J.J.; Peterson, C.H.; Piehler, M.F.; Powers, S.P.; Smyth, A.R. Economic valuation of ecosystem services provided by oyster reefs. Bioscience 2012, 62, 900–909. [Google Scholar] [CrossRef]

- Shang, L.; Chandra, Y. An Overview of Stated Preference Methods: What and Why. In Discrete Choice Experiments Using R: A How-To Guide for Social and Managerial Sciences; Springer: Berlin/Heidelberg, Germany, 2023; pp. 1–7. [Google Scholar]

- Triana, N.; Ota, T. Assessing preferences for forest carbon credit and co-benefits: A choice experiment case study in Japan. Environ. Chall. 2024, 15, 100936. [Google Scholar] [CrossRef]

- Xi, H.; Cui, W.; Cai, L.; Chen, M.; Xu, C. Evaluation and Prediction of Ecosystem Service Value in the Zhoushan Islands Based on LUCC. Sustainability 2021, 13, 2302. [Google Scholar] [CrossRef]

- Koko, I.A.; Misana, S.B.; Kessler, A.; Fleskens, L. Valuing ecosystem services: Stakeholders’ perceptions and monetary values of ecosystem services in the Kilombero wetland of Tanzania. Ecosyst. People 2020, 16, 411–426. [Google Scholar] [CrossRef]

- Ottaviani, D. Economic Value of Ecosystem Services from the Deep Seas and the Areas Beyond National Jurisdiction; Food & Agriculture Organization: Rome, Italy, 2020. [Google Scholar]

- Scheufele, G.; Pascoe, S. Ecosystem accounting: Reconciling consumer surplus and exchange values for free-access recreation. Ecol. Econ. 2023, 212, 107905. [Google Scholar] [CrossRef]

- Mameno, K.; Tsuge, T.; Kubo, T.; Kuriyama, K.; Shoji, Y. High monetary valuation of regulating forest ecosystem services in Japan: Integrating the best-worst scaling and contingent valuation methods. Ecosyst. People 2024, 20, 2400544. [Google Scholar] [CrossRef]

- Selivanov, E.; Hlaváčková, P. Methods for monetary valuation of ecosystem services: A scoping review. J. For. Sci. 2021, 67, 499–511. [Google Scholar] [CrossRef]

- Nijnik, M.; Miller, D. Valuation of ecosystem services: Paradox or Pandora’s box for decision-makers? One Ecosyst. 2017, 2, e14808. [Google Scholar] [CrossRef]

- Costanza, R.; de Groot, R.; Sutton, P.; van der Ploeg, S.; Anderson, S.J.; Kubiszewski, I.; Farber, S.; Turner, R.K. Changes in the global value of ecosystem services. Glob. Environ. Change 2014, 26, 152–158. [Google Scholar] [CrossRef]

- Liang, X.; Wang, Y. Old CO2 released from rivers complicates evaluations of fossil-fuel emissions. Nature 2025, 643, 336. [Google Scholar] [CrossRef]

- Pagiola, S. Payments for environmental services in Costa Rica. Ecol. Econ. 2008, 65, 712–724. [Google Scholar] [CrossRef]

- Ouyang, Z.; Song, C.; Zheng, H.; Polasky, S.; Xiao, Y.; Bateman, I.J.; Liu, J.; Ruckelshaus, M.; Shi, F.; Xiao, Y.; et al. Using gross ecosystem product (GEP) to value nature in decision making. Proc. Natl. Acad. Sci. USA 2020, 117, 14593–14601. [Google Scholar] [CrossRef]

- Chan, K.M.A.; Satterfield, T. The maturation of ecosystem services: Social and policy research expands, but whither biophysically informed valuation? People Nat. 2020, 2, 1021–1060. [Google Scholar] [CrossRef]

- Costanza, R.; d’Arge, R.; de Groot, R.; Farber, S.; Grasso, M.; Hannon, B.; Limburg, K.; Naeem, S.; O’Neill, R.V.; Paruelo, J.; et al. The value of the world’s ecosystem services and natural capital. Nature 1997, 387, 253–260. [Google Scholar] [CrossRef]

- Borovics, A.; Király, É.; Kottek, P.; Illés, G.; Schiberna, E. From Climate Liability to Market Opportunity: Valuing Carbon Sequestration and Storage Services in the Forest-Based Sector. Forests 2025, 16, 1251. [Google Scholar] [CrossRef]

- Suarez-Fernandez, G.E.; Martinez-Sanchez, J.; Arias, P. Enhancing carbon stock estimation in forests: Integrating multi-data predictors with random forest method. Ecol. Inform. 2025, 86, 102997. [Google Scholar] [CrossRef]

- Cusack, J.J.; Bradfer-Lawrence, T.; Baynham-Herd, Z.; Castelló y Tickell, S.; Duporge, I.; Hegre, H.; Moreno Zárate, L.; Naude, V.; Nijhawan, S.; Wilson, J.; et al. Measuring the intensity of conflicts in conservation. Conserv. Lett. 2021, 14, e12783. [Google Scholar] [CrossRef] [PubMed]

- Bennett, E.M.; Cramer, W.; Begossi, A.; Cundill, G.; Díaz, S.; Egoh, B.N.; Geijzendorffer, I.R.; Krug, C.B.; Lavorel, S.; Lazos, E.; et al. Linking biodiversity, ecosystem services, and human well-being: Three challenges for designing research for sustainability. Curr. Opin. Environ. Sustain. 2015, 14, 76–85. [Google Scholar] [CrossRef]

- Sumaila, U.R.; Rodriguez, C.M.; Schultz, M.; Sharma, R.; Tyrrell, T.D.; Masundire, H.; Damodaran, A.; Bellot-Rojas, M.; Rosales, R.M.P.; Jung, T.Y.; et al. Investments to reverse biodiversity loss are economically beneficial. Curr. Opin. Environ. Sustain. 2017, 29, 82–88. [Google Scholar] [CrossRef]

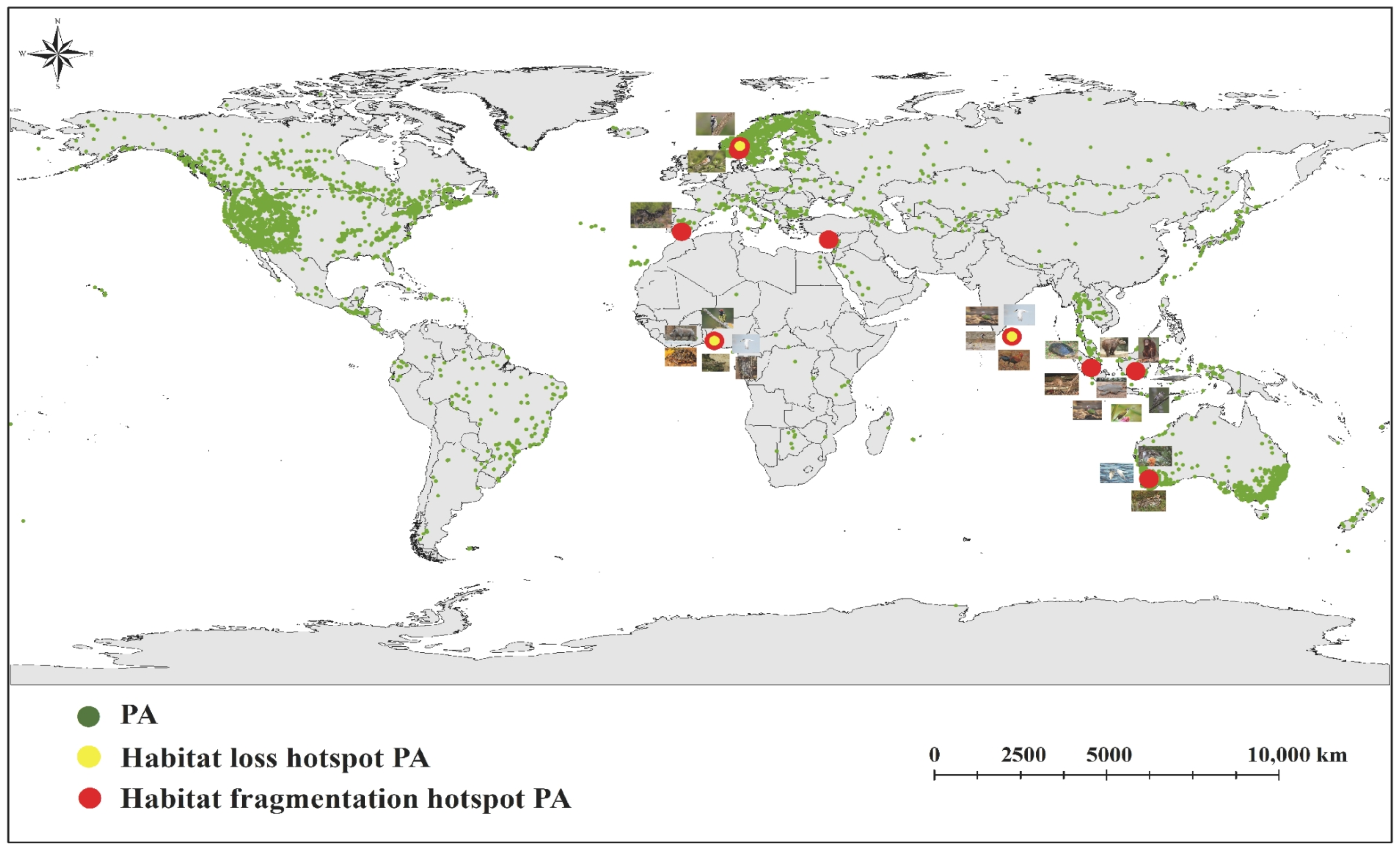

- Yuan, R.; Zhang, N.; Zhang, Q. The impact of habitat loss and fragmentation on biodiversity in global protected areas. Sci. Total Environ. 2024, 931, 173004. [Google Scholar] [CrossRef]

- Khalifa, S.; Elshafiey, E.; Shetaia, A.; Abd Elwahed, A.; Algethami, F.; Musharraf, S.; Alajmi, M.; Zhao, C.; Masry, S.; Abdel Daim, M.; et al. Overview of Bee Pollination and Its Economic Value for Crop Production. Insects 2021, 12, 688. [Google Scholar] [CrossRef]

- Dasgupta, P. The Economics of Biodiversity: The Dasgupta Review; Hm Treasury: Westminster, UK, 2021.

- Intergovernmental Science-Policy Platform on Biodiversity; Ecosystem Services. Global Assessment Report on Biodiversity and Ecosystem Services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services; IPBES: Bonn, Germany, 2019. [Google Scholar]

- Leclère, D.; Obersteiner, M.; Barrett, M.; Butchart, S.H.M.; Chaudhary, A.; De Palma, A.; DeClerck, F.A.J.; Di Marco, M.; Doelman, J.C.; Dürauer, M.; et al. Bending the curve of terrestrial biodiversity needs an integrated strategy. Nature 2020, 585, 551–556. [Google Scholar] [CrossRef]

- Smith, P. The Impact of Coral Degradation on Coastal Communities in Southeast Asia. Ballard Brief 2025, 2025, 3. [Google Scholar]

- Almond, R.E.; Grooten, M.; Peterson, T. Living Planet Report 2020—Bending the Curve of Biodiversity Loss; World Wildlife Fund: Gland, Switzerland, 2020. [Google Scholar]

- Mammone, M.; Ferrier-Pagés, C.; Lavorano, S.; Rizzo, L.; Piraino, S.; Rossi, S. High photosynthetic plasticity may reinforce invasiveness of upside-down zooxanthellate jellyfish in Mediterranean coastal waters. PLoS ONE 2021, 16, e0248814. [Google Scholar] [CrossRef]

- Roe, D.; Seddon, N.; Elliott, J. Biodiversity Loss Is a Development Issue: A Rapid Review of Evidence; International Institute for Environment and Development: London, UK, 2022. [Google Scholar]

- van Rees, C.B.; Waylen, K.A.; Schmidt-Kloiber, A.; Thackeray, S.J.; Kalinkat, G.; Martens, K.; Domisch, S.; Lillebø, A.I.; Hermoso, V.; Grossart, H.-P.; et al. Safeguarding freshwater life beyond 2020: Recommendations for the new global biodiversity framework from the European experience. Conserv. Lett. 2021, 14, e12771. [Google Scholar] [CrossRef]

- Lancker, K.; Iyer, L.; Usmani, F.; Allen IV, J.; Doruska, M.J.; Mbaye, S.; Sylla, A.; Sow, B.; Rohr, J.R.; Barrett, C.B. Do private incentives crowd out public good donations? Evidence from a lab-in-the-field experiment. In Proceedings of the Environmental Economic Conference 2025, Guilin, China, 19–21 April 2025. [Google Scholar]

- Murguia, J.M.; Ordoñez, P.; Corral, L.; Navarrete-Chacón, G. Payment for Ecosystem Services in Costa Rica: Evaluation of a Country-Wide Program; Inter-American Development Bank: Washington, DC, USA, 2022. [Google Scholar]

- Kumar, P. The Economics of Ecosystems and Biodiversity: Ecological and Economic Foundations; Routledge: Oxfordshire, UK, 2012. [Google Scholar]

- Wunder, S.; Schulz, D.; Montoya-Zumaeta, J.G.; Börner, J.; Ponzoni Frey, G.; Betancur-Corredor, B. Modest forest and welfare gains from initiatives for reduced emissions from deforestation and forest degradation. Commun. Earth Environ. 2024, 5, 394. [Google Scholar] [CrossRef]

- Assessment, M.E. Ecosystems and Human Well-Being: Biodiversity Synthesis; World Resources Institute: Washington, DC, USA, 2005; p. 86. [Google Scholar]

- Folke, C.; Carpenter, S.R.; Walker, B.; Scheffer, M.; Chapin, T.; Rockström, J. Resilience thinking: Integrating resilience, adaptability and transformability. Ecol. Soc. 2010, 15, 20. [Google Scholar] [CrossRef]

- Samuel, S.A. Carbon pricing mechanisms for reducing greenhouse gas emissions and encouraging sustainable industrial practices. World J. Adv. Res. Rev. 2025, 25, 1–24. [Google Scholar] [CrossRef]

- Daily, G.C.; Polasky, S.; Goldstein, J.; Kareiva, P.M.; Mooney, H.A.; Pejchar, L.; Ricketts, T.H.; Salzman, J.; Shallenberger, R. Ecosystem services in decision making: Time to deliver. Front. Ecol. Environ. 2009, 7, 21–28. [Google Scholar] [CrossRef]

- Guerry, A.D.; Polasky, S.; Lubchenco, J.; Chaplin-Kramer, R.; Daily, G.C.; Griffin, R.; Ruckelshaus, M.; Bateman, I.J.; Duraiappah, A.; Elmqvist, T.; et al. Natural capital and ecosystem services informing decisions: From promise to practice. Proc. Natl. Acad. Sci. USA 2015, 112, 7348–7355. [Google Scholar] [CrossRef]

- Pascual, U.; Balvanera, P.; Díaz, S.; Pataki, G.; Roth, E.; Stenseke, M.; Watson, R.T.; Başak Dessane, E.; Islar, M.; Kelemen, E.; et al. Valuing nature’s contributions to people: The IPBES approach. Curr. Opin. Environ. Sustain. 2017, 26–27, 7–16. [Google Scholar] [CrossRef]

- COSTANZA, R.; DALY, H.E. Natural Capital and Sustainable Development. Conserv. Biol. 1992, 6, 37–46. [Google Scholar] [CrossRef]

- Bennett, E.M.; Peterson, G.D.; Gordon, L.J. Understanding relationships among multiple ecosystem services. Ecol. Lett. 2009, 12, 1394–1404. [Google Scholar] [CrossRef]

- Carpenter, S.R.; Mooney, H.A.; Agard, J.; Capistrano, D.; DeFries, R.S.; Díaz, S.; Dietz, T.; Duraiappah, A.K.; Oteng-Yeboah, A.; Pereira, H.M.; et al. Science for managing ecosystem services: Beyond the Millennium Ecosystem Assessment. Proc. Natl. Acad. Sci. USA 2009, 106, 1305–1312. [Google Scholar] [CrossRef] [PubMed]

- Fisher, B.; Turner, R.K.; Morling, P. Defining and classifying ecosystem services for decision making. Ecol. Econ. 2009, 68, 643–653. [Google Scholar] [CrossRef]

- Nelson, E.; Mendoza, G.; Regetz, J.; Polasky, S.; Tallis, H.; Cameron, D.; Chan, K.M.; Daily, G.C.; Goldstein, J.; Kareiva, P.M.; et al. Modeling multiple ecosystem services, biodiversity conservation, commodity production, and tradeoffs at landscape scales. Front. Ecol. Environ. 2009, 7, 4–11. [Google Scholar] [CrossRef]

- Potschin, M.B.; Haines-Young, R.H. Ecosystem services: Exploring a geographical perspective. Prog. Phys. Geogr. 2011, 35, 575–594. [Google Scholar] [CrossRef]

- Seppelt, R.; Dormann, C.F.; Eppink, F.V.; Lautenbach, S.; Schmidt, S. A quantitative review of ecosystem service studies: Approaches, shortcomings and the road ahead. J. Appl. Ecol. 2011, 48, 630–636. [Google Scholar] [CrossRef]

- Li, Y. Investigate the Impact of Supply Chain Sustainability Transformation on Enterprises: Case Study of IKEA. Adv. Econ. Manag. Political Sci. 2023, 65, 195–200. [Google Scholar] [CrossRef]

- de Groot, R.S.; Alkemade, R.; Braat, L.; Hein, L.; Willemen, L. Challenges in integrating the concept of ecosystem services and values in landscape planning, management and decision making. Ecol. Complex. 2010, 7, 260–272. [Google Scholar] [CrossRef]

- Radtke, J.; Löw Beer, D. Legitimizing sustainability transitions through stakeholder participation: Evaluating the Coal Commission in Germany. Energy Res. Soc. Sci. 2024, 116, 103667. [Google Scholar] [CrossRef]

- Rudin, C. Stop explaining black box machine learning models for high stakes decisions and use interpretable models instead. Nat. Mach. Intell. 2019, 1, 206–215. [Google Scholar] [CrossRef]

- Lundberg, S.M.; Lee, S.-I. A unified approach to interpreting model predictions. In Advances in Neural Information Processing Systems; Curran Associates: Red Hook, NY, USA, 2017; p. 30. [Google Scholar]

- Pezzey, J.C.; Toman, M.A. The Economics of Sustainability; Routledge: Oxfordshire, UK, 2017. [Google Scholar]

- Haines-Young, R.; Potschin, M. The links between biodiversity, ecosystem services and human well-being. In Ecosystem Ecology: A New Synthesis; Raffaelli, D.G., Frid, C.L.J., Eds.; Ecological Reviews; Cambridge University Press: Cambridge, UK, 2010; pp. 110–139. [Google Scholar]

- Kremen, C. Managing ecosystem services: What do we need to know about their ecology? Ecol. Lett. 2005, 8, 468–479. [Google Scholar] [CrossRef]

- Luck, G.W.; Chan, K.M.A.; Fay, J.P. Protecting ecosystem services and biodiversity in the world’s watersheds. Conserv. Lett. 2009, 2, 179–188. [Google Scholar] [CrossRef]

- Norgaard, R.B. Ecosystem services: From eye-opening metaphor to complexity blinder. Ecol. Econ. 2010, 69, 1219–1227. [Google Scholar] [CrossRef]

- Khan, R.Z.; Razak, L.A.; Premaratne, G. Green growth and sustainability: A systematic literature review on theories, measures and future directions. Clean. Responsible Consum. 2025, 17, 100274. [Google Scholar] [CrossRef]

- Velenturf, A.P.M.; Purnell, P. Principles for a sustainable circular economy. Sustain. Prod. Consum. 2021, 27, 1437–1457. [Google Scholar] [CrossRef]

- Ahmed, W.; Siva, V.; Bäckstrand, J.; Sarius, N.; Sundberg, H.-Å. Circular economy: Extending end-of-life strategies. Sustain. Prod. Consum. 2024, 51, 67–78. [Google Scholar] [CrossRef]

- D’Amato, D.; Korhonen, J. Integrating the green economy, circular economy and bioeconomy in a strategic sustainability framework. Ecol. Econ. 2021, 188, 107143. [Google Scholar] [CrossRef]

- Barros, M.V.; Salvador, R.; do Prado, G.F.; de Francisco, A.C.; Piekarski, C.M. Circular economy as a driver to sustainable businesses. Clean. Environ. Syst. 2021, 2, 100006. [Google Scholar] [CrossRef]

- Turner, R.K.; Van Den Bergh, J.C.; Söderqvist, T.; Barendregt, A.; Van Der Straaten, J.; Maltby, E.; Van Ierland, E.C. Ecological-economic analysis of wetlands: Scientific integration for management and policy. Ecol. Econ. 2000, 35, 7–23. [Google Scholar] [CrossRef]

- Wunder, S.; Engel, S.; Pagiola, S. Taking stock: A comparative analysis of payments for environmental services programs in developed and developing countries. Ecol. Econ. 2008, 65, 834–852. [Google Scholar] [CrossRef]

- Rockström, J.; Steffen, W.; Noone, K.; Persson, Å.; Chapin, F.S.; Lambin, E.F.; Lenton, T.M.; Scheffer, M.; Folke, C.; Schellnhuber, H.J.; et al. A safe operating space for humanity. Nature 2009, 461, 472–475. [Google Scholar] [CrossRef]

- Farley, J.; Costanza, R. Payments for ecosystem services: From local to global. Ecol. Econ. 2010, 69, 2060–2068. [Google Scholar] [CrossRef]

- Biggs, C.R.; Yeager, L.A.; Bolser, D.G.; Bonsell, C.; Dichiera, A.M.; Hou, Z.; Keyser, S.R.; Khursigara, A.J.; Lu, K.; Muth, A.F.; et al. Does functional redundancy affect ecological stability and resilience? A review and meta-analysis. Ecosphere 2020, 11, e03184. [Google Scholar] [CrossRef]

- Eisenhauer, N.; Hines, J.; Maestre, F.T.; Rillig, M.C. Reconsidering functional redundancy in biodiversity research. npj Biodivers. 2023, 2, 9. [Google Scholar] [CrossRef]

- Beller, E.E.; Spotswood, E.N.; Robinson, A.H.; Anderson, M.G.; Higgs, E.S.; Hobbs, R.J.; Suding, K.N.; Zavaleta, E.S.; Grenier, J.L.; Grossinger, R.M. Building Ecological Resilience in Highly Modified Landscapes. BioScience 2018, 69, 80–92. [Google Scholar] [CrossRef]

- Mosso, B.; Nino, A.; Salata, S. How to Plan Climate-Adaptive Cities: An Experimental Approach to Address Ecosystem Service Loss in Ordinary Planning Processes. Land 2025, 14, 532. [Google Scholar] [CrossRef]

- Blouin, D.; Bissonnette, J.-F.; Goyette, J.-O.; Cimon-Morin, J.; Mendes, P.; Torchio, G.M.; Gosselin-Tapp, J.; Poulin, M. Ecosystem services concept: Challenges to its integration in government organizations. Ecosyst. Serv. 2025, 71, 101691. [Google Scholar] [CrossRef]

- Bronsther, J.; Xu, Y. The social costs of solar radiation management. npj Clim. Action 2025, 4, 69. [Google Scholar] [CrossRef]

- Heyen, D.; Tavoni, A. Strategic dimensions of solar geoengineering: Economic theory and experiments. J. Behav. Exp. Econ. 2024, 112, 102271. [Google Scholar] [CrossRef]

- Muradian, R.; Corbera, E.; Pascual, U.; Kosoy, N.; May, P.H. Reconciling theory and practice: An alternative conceptual framework for understanding payments for environmental services. Ecol. Econ. 2010, 69, 1202–1208. [Google Scholar] [CrossRef]

- Vatn, A. An institutional analysis of payments for environmental services. Ecol. Econ. 2010, 69, 1245–1252. [Google Scholar] [CrossRef]

- Van Hecken, G.; Bastiaensen, J.; Windey, C. Towards a power-sensitive and socially-informed analysis of payments for ecosystem services (PES): Addressing the gaps in the current debate. Ecol. Econ. 2015, 120, 117–125. [Google Scholar] [CrossRef]

- Wunder, S. Revisiting the concept of payments for environmental services. Ecol. Econ. 2015, 117, 234–243. [Google Scholar] [CrossRef]

- Börner, J.; Baylis, K.; Corbera, E.; Ezzine-de-Blas, D.; Honey-Rosés, J.; Persson, U.M.; Wunder, S. The Effectiveness of Payments for Environmental Services. World Dev. 2017, 96, 359–374. [Google Scholar] [CrossRef]

- Engel, S.; Pagiola, S.; Wunder, S. Designing payments for environmental services in theory and practice: An overview of the issues. Ecol. Econ. 2008, 65, 663–674. [Google Scholar] [CrossRef]

- Jack, B.K.; Kousky, C.; Sims, K.R.E. Designing payments for ecosystem services: Lessons from previous experience with incentive-based mechanisms. Proc. Natl. Acad. Sci. USA 2008, 105, 9465–9470. [Google Scholar] [CrossRef] [PubMed]

- Kinzig, A.P.; Perrings, C.; Chapin, F.S.; Polasky, S.; Smith, V.K.; Tilman, D.; Turner, B.L. Paying for Ecosystem Services—Promise and Peril. Science 2011, 334, 603–604. [Google Scholar] [CrossRef] [PubMed]

- Kosoy, N.; Corbera, E. Payments for ecosystem services as commodity fetishism. Ecol. Econ. 2010, 69, 1228–1236. [Google Scholar] [CrossRef]

- Leimona, B.; Van Noordwijk, M.; De Groot, R.; Leemans, R. Fairly efficient, efficiently fair: Lessons from designing and testing payment schemes for ecosystem services in Asia. Ecosyst. Serv. 2015, 12, 16–28. [Google Scholar] [CrossRef]

- Hanan, A.; Khan, M.; Fernandez-Anez, N.; Arghandeh, R. DeepBioFusion: Multi-modal deep learning based above ground biomass estimation using SAR and optical satellite images. Ecol. Inform. 2025, 90, 103277. [Google Scholar] [CrossRef]

- Pattanayak, S.K.; Wunder, S.; Ferraro, P.J. Show Me the Money: Do Payments Supply Environmental Services in Developing Countries? Rev. Environ. Econ. Policy 2010, 4, 254–274. [Google Scholar] [CrossRef]

- Sommerville, M.M.; Jones, J.P.; Milner-Gulland, E. A revised conceptual framework for payments for environmental services. Ecol. Soc. 2009, 14, 34. [Google Scholar] [CrossRef]

- Van Noordwijk, M.; Leimona, B. Principles for fairness and efficiency in enhancing environmental services in Asia: Payments, compensation, or co-investment? Ecol. Soc. 2010, 15, 17. [Google Scholar] [CrossRef]

- Wunder, S.; Albán, M. Decentralized payments for environmental services: The cases of Pimampiro and PROFAFOR in Ecuador. Ecol. Econ. 2008, 65, 685–698. [Google Scholar] [CrossRef]

- Alix-Garcia, J.M.; Sims, K.R.E.; Yañez-Pagans, P. Only One Tree from Each Seed? Environmental Effectiveness and Poverty Alleviation in Mexico’s Payments for Ecosystem Services Program. Am. Econ. J. Econ. Policy 2015, 7, 1–40. [Google Scholar] [CrossRef]

- Arriagada, R.A.; Ferraro, P.J.; Sills, E.O.; Pattanayak, S.K.; Cordero-Sancho, S. Do Payments for Environmental Services Affect Forest Cover? A Farm-Level Evaluation from Costa Rica. Land Econ. 2012, 88, 382–399. [Google Scholar] [CrossRef]

| Method Category | Specific Method | Underlying Principle | Primary Application (Service Types) | Key Strengths | Key Limitations |

|---|---|---|---|---|---|

| Cost-Based | Replacement Cost | Value is estimated as the cost of providing a human-made substitute for an ecosystem service. | Regulating (e.g., water filtration, flood control). | Intuitive and easily understood by policymakers; uses tangible cost data. | May over- or under-estimate value; assumes the substitute is equivalent and would be built. |

| Revealed Preference | Travel Cost Method (TCM) | Value is inferred from the time and money people spend to visit a natural site for recreation. | Cultural (Recreation). | Based on actual behavior, not hypothetical intentions; grounded in standard economic demand theory. | Cannot measure non-use values; requires complex data collection and statistical analysis. |

| Stated Preference | Contingent Valuation (CV) | A hypothetical market is created, and people are asked about their willingness-to-pay for a change in an ecosystem service. | All services, especially Cultural and Non-Use (Existence, Bequest). | Only method capable of estimating non-use values; highly flexible. | Subject to hypothetical bias; results can be sensitive to survey design and framing. |

| Choice Experiment (CE) | People make choices between alternative scenarios with varying levels of ecosystem services and costs, revealing implicit values. | All services, especially when valuing multiple attributes and trade-offs. | Can value individual attributes of an ecosystem; statistically robust. | Cognitively demanding for respondents; subject to hypothetical bias. | |

| Value Transfer | Benefit Transfer | Adapts value estimates from existing studies (“study sites”) to a new policy site. | All services. | Low cost and rapid assessment compared to primary studies. | Can be highly inaccurate if the study and policy sites are not sufficiently similar. |

| Feature | Carbon Tax | Cap-and-Trade (ETS) |

|---|---|---|

| Primary Control Variable | Price (tax rate per ton of CO2e) | Quantity (total emissions cap) |

| Price Certainty | High (price is set by the government) | Low (price is determined by the market and can be volatile) |

| Emissions Certainty | Low (emissions reduction depends on economic response to the price) | High (total emissions are fixed by the cap) |

| Administrative Complexity | Relatively low (can be integrated into existing tax systems) | High (requires setting up a market, allocating allowances, and monitoring trades) |

| Revenue Generation | Predictable revenue stream for the government | Revenue can be generated if allowances are auctioned, but can be volatile |

| Vulnerability to Volatility | Less vulnerable to economic shocks (tax rate is stable) | Price of allowances can crash during economic downturns, reducing the incentive to abate |

| Key Political Challenge | Politically difficult to set a tax rate high enough to be effective | Allocation of free allowances can create windfall profits and political opposition |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ma, L.; Hong, L.; Liang, X. Integrating Ecological and Economic Approaches for Ecosystem Services and Biodiversity Conservation: Challenges and Opportunities. Ecologies 2025, 6, 70. https://doi.org/10.3390/ecologies6040070

Ma L, Hong L, Liang X. Integrating Ecological and Economic Approaches for Ecosystem Services and Biodiversity Conservation: Challenges and Opportunities. Ecologies. 2025; 6(4):70. https://doi.org/10.3390/ecologies6040070

Chicago/Turabian StyleMa, Lexuan, Liang Hong, and Xiongwei Liang. 2025. "Integrating Ecological and Economic Approaches for Ecosystem Services and Biodiversity Conservation: Challenges and Opportunities" Ecologies 6, no. 4: 70. https://doi.org/10.3390/ecologies6040070

APA StyleMa, L., Hong, L., & Liang, X. (2025). Integrating Ecological and Economic Approaches for Ecosystem Services and Biodiversity Conservation: Challenges and Opportunities. Ecologies, 6(4), 70. https://doi.org/10.3390/ecologies6040070