Abstract

Sustainable finance is critical for solving global concerns such as climate change, social inequality, and fostering a circular economy, which seeks to decouple economic progress from resource extraction and waste production. This study explores how sustainable finance tools, such as green bonds, microfinance, and impact investing, can advance financial inclusion and sustainable development in developing countries. Employing a mixed-methods approach that encompasses financial analysis alongside case studies from Sub-Saharan Africa, Asia, and Latin America, the study discerns both successful initiatives and ongoing challenges in reconciling CE objectives with financial accessibility. The results indicate that the global green bond issuance exceeded $575 billion in 2023, while efforts toward financial inclusion have enabled mobile money access for over 70% of the adult population in Sub-Saharan Africa. Nevertheless, the uptake of CE remains constrained, with merely 7.2% of materials within the global economy being classified as circular. These findings emphasize the necessity for integrated policies and innovative financial instruments to dismantle systemic obstacles and amplify sustainable finance solutions in resource-limited contexts. The study contributes to the literature by building on the existing frameworks and offering an integrated approach that provides empirical insights and pragmatic strategies for policymakers and financial institutions to enhance sustainable development and foster equitable economic growth, addressing gaps in traditional finance and regulatory frameworks to support circular economy adoption in resource-constrained nations.

1. Introduction

Sustainable finance plays a vital role in linking circular economy (CE) aims with financial inclusion, especially in emerging nations. Integrating sustainable finance into the current financial institutions enables countries to expedite the attainment of the Sustainable Development Goals (SDGs) while fostering economic development and social fairness. The principal aim of sustainable finance is to allocate financial resources towards long-term, significant initiatives, guaranteeing that financial services are available to all demographics, especially marginalized communities. This strategy promotes economic growth while simultaneously enhancing inclusiveness and resilience, the essential components of sustainable development.

In 2023, the global issuance of green bonds exceeded $575 billion, and microfinance initiatives enabled mobile money penetration for over 70% of Sub-Saharan Africa’s adult population [1]. However, only 7.2% of materials in the global economy are circular, highlighting a significant gap in CE adoption [2]. This study explores how sustainable finance can bridge this gap by integrating financial inclusion with circular economy goals.

Financial institutions are pivotal in this process as they are responsible for providing the funds that are required to support sustainability projects. These organizations offer different financial instruments, including green bonds, impact investing, and microfinance, to support programs that promote resource efficiency, eliminate waste, and encourage environmentally responsible corporate practices. This is particularly crucial in poorer countries where financial institutions are weaker and access to credit and financial services is constrained. Facilitating equitable financial access enables more participation in sustainable economic endeavors, thus improving the overall efficacy of circular economy models in promoting social, environmental, and economic advancement.

The European Union’s policy framework exemplifies the alignment of sustainable finance with overarching development objectives. The EU has adopted legislation that encourages the inclusion of environmental, social, and governance (ESG) considerations in financial decision-making, thereby increasing sustainability across numerous industries. However, challenges remain in other regions, such as Botswana, where the absence of cohesive national policies hinders progress toward the SDGs. In such cases, industry-driven ESG practices alone are insufficient as they lack the regulatory backing needed to ensure widespread compliance and effectiveness [3]. To address these challenges, sustainable finance must evolve to include stronger social and environmental dimensions, which can help mitigate negative externalities and promote more inclusive and equitable growth [4,5].

The circular economy model offers a practical framework for implementing sustainable finance by focusing on resource efficiency, waste reduction, and sustainable corporate practices. This not only enhances sustainability outcomes, but also improves business performance [6]. However, adopting CE frameworks requires substantial financial investments, particularly in emerging markets. Innovative financing mechanisms such as blended finance, which combines public and private funding, are critical for overcoming financial constraints and supporting sustainability efforts in these regions [7].

At the center of this ecosystem is financial inclusion, which guarantees that underprivileged groups have access to the financial instruments essential for economic participation and progress. Inclusive financial systems are strongly linked to poverty reduction, productivity improvements, and overall economic development [8,9] Furthermore, digital financial services, such as mobile banking, have the potential to reduce the financial inclusion gap in locations with limited access to conventional banking infrastructure [10]. By addressing these challenges, sustainable finance can contribute to more equitable and resilient economies while supporting the transition toward a circular, sustainable future.

While sustainable finance and circular economy principles have been extensively explored independently, this study uniquely integrates these frameworks with financial inclusion to provide actionable strategies for resource-constrained developing economies. It addresses the following research questions:

- (1)

- What specific mechanisms within sustainable finance drive circular economy adoption in resource-constrained settings?

- (2)

- What role does financial inclusion play in enabling broader participation in sustainable development initiatives?

- (3)

- How do policy and infrastructural gaps impede sustainable finance and CE integration, and what strategies have been effective in overcoming them?

By exploring these questions and gaps, this paper contributes to the growing body of research on sustainable finance by integrating perspectives from CE and financial inclusion, emphasizing actionable recommendations for policymakers, institutions, and stakeholders in emerging markets. The remainder of the paper is organized as follows: Section 2 reviews the literature on sustainable finance and CE in developing economies. Section 3 describes the methodology, detailing the mixed-methods approach employed in this research, while the Section 4 discusses the key findings. Finally, Section 5 analyzes the findings and their implications for policymakers and financial institutions.

2. Literature Review

In recent years, sustainable finance has become an essential tool for promoting circular economy (CE) objectives, especially in low-income nations. Numerous studies [6,11] underscore the capacity of financial instruments such as green bonds and impact investments to finance extensive circular economy initiatives. Nonetheless, the research indicates substantial obstacles to the expansion of these instruments in resource-limited environments, such as policy fragmentation and restricted access to finance.

2.1. Sustainable Finance in Developing Economies

Sustainable finance refers to financial services and investment strategies that take environmental, social, and governance (ESG) factors into account when making decisions, with a focus on long-term societal and environmental benefits, as well as economic rewards. This approach is critical for developing nations, where financial institutions often struggle to support sustainable development and achieve the Sustainable Development Goals (SDGs) [12,13]. Unlike traditional finance, it prioritizes long-term value creation for societal and environmental well-being. The theoretical discourse highlights the transformative potential of sustainable finance in mitigating systemic risks [4], while case studies underscore the challenges in aligning fragmented policies with on-the-ground realities in developing economies [12].

A major challenge in sustainable finance is the absence of a globally standardized definition, hindering the development of coherent international policies. This is particularly problematic in the fragmented financial systems of developing economies, where integrating ESG principles remains difficult [14]. Such gaps in policy alignment exacerbate vulnerabilities to systemic risks such as climate change and environmental degradation, threatening progress toward SDGs [4].

Incorporating sustainability into financial systems enhances economic resilience by addressing long-term risks such as climate change and resource depletion. Financial systems embedding ESG principles are better equipped to mitigate global uncertainties and support stability [4]. Microfinance is pivotal in advancing sustainable finance within developing economies, offering marginalized communities access to financial resources. This fosters economic growth, reduces poverty, and promotes inclusivity by empowering disadvantaged groups to participate in the economy [15]. Such initiatives align with the broader goal of creating inclusive financial systems that support sustainable livelihoods.

Establishing frameworks for measuring social and environmental implications is critical to ensuring that investments provide significant societal benefits. Without these systems, it is impossible to guarantee that financial resources are properly distributed. Impact assessment methodologies are critical for prioritizing projects with significant social and environmental outcomes, as highlighted by [16,17]. As sustainable finance evolves, its integration with economic models prioritizing resource efficiency and waste reduction underscores its increasing alignment with circular economy principles.

In low-income countries, the absence of standardized definitions and aligned financial policies further complicates the development of sustainable finance frameworks [12]. Although some case studies address the challenges of scaling sustainable finance in these regions, e.g., ref. [18], few studies integrate the financial inclusion aspect—a vital factor for enabling broader participation in CE projects. Our study addresses this gap by examining how financial inclusion mechanisms—particularly microfinance and impact investing—can foster circular economy adoption in regions with limited financial access. We propose a novel framework that integrates sustainable finance with financial inclusion, highlighting the dual impact of these financial tools in promoting both social equity and environmental sustainability.

2.2. Circular Economy Principles and Financial Investments

The circular economy (CE) is an economic model that enhances resource efficiency and minimizes waste through reuse, recycling, and recovery, contrasting with the traditional linear economy’s “take–make–dispose” approach [6,19]. CE principles are particularly relevant in developing nations, where resource scarcity and environmental degradation present critical challenges. By extending product lifecycles and promoting regenerative practices, the CE model fosters sustainable growth and reduces environmental impact [11,20].

Effective policies and financial support are essential to expanding CE initiatives. In emerging economies, adopting CE principles can enhance resource efficiency, promote sustainable production, and drive sustainable development [21]. Governments play a key role by establishing regulatory frameworks and offering incentives for industries to embrace CE practices [22].

Integrating CE principles into financial systems creates opportunities for sustainable investments. Financial institutions are increasingly recognizing the returns from CE investments, which reduce resource dependency, mitigate environmental risks, and strengthen economic resilience [23,24]. Aligning financial incentives with CE goals can attract private sector participation, enabling a shift toward sustainable economic models [25].

The success of CE initiatives also depends on equitable financial systems and widespread access to resources. Financial inclusion plays a critical role in developing economies, empowering individuals and small businesses to engage in CE activities. Inclusive financial systems can expand the reach of sustainable practices, supporting the transition to a more circular economy [18,26]. Thus, access to financial tools is fundamental to fostering sustainable and circular economic growth.

This study advances the discourse by integrating green bonds, microfinance, and impact investing as mechanisms that can bridge financial inclusion gaps and fund circular economy projects. By doing so, we offer actionable strategies for expanding CE adoption, particularly in rural and underserved regions.

2.3. Financial Inclusion as a Catalyst for Sustainability

Financial inclusion is an essential catalyst for sustainable development, especially in developing economies where a substantial segment of the population is either unbanked or underbanked. Access to financial services, including savings accounts, credit, and insurance, is crucial for involvement in vital sectors such as healthcare, education, and entrepreneurship, all of which are fundamental for economic growth. Improved financial literacy is fundamental in this context, providing individuals with the knowledge required to make informed financial decisions and enhancing access to financial services [27]. Despite notable progress in increasing account ownership, particularly between 2017 and 2021, when ownership in the emerging economies rose from 63% to 71%, driven largely by mobile money services in regions such as Sub-Saharan Africa [28], millions still lack access to formal financial systems.

The gender gap in account ownership has narrowed from 9 to 6 percentage points, reflecting some progress, yet barriers such as insufficient funds, distance to financial institutions, and lack of identification remain persistent challenges. Tackling these challenges necessitates a comprehensive strategy, encompassing enhanced access to identification systems and mobile phone services to more effectively assist marginalized groups. Digital financial services, especially mobile money platforms such as M-Pesa in Kenya, have shown considerable potential in mitigating financial exclusion by facilitating engagement in activities such as circular economy practices, including waste recycling and renewable energy initiatives [10]. These advances underscore the importance of integrating technology and financial services to reach marginalized communities.

Microfinance institutions (MFIs) are essential in promoting financial inclusion by offering small loans to low-income individuals, thus facilitating the growth of micro and small firms. Sustainable leadership within MFIs is crucial for their long-term success in promoting inclusive economic ecosystems, which directly contributes to reducing poverty and achieving the United Nations Sustainable Development Goals [29]. Even though financial inclusion has the potential to transform economies and address systemic injustices, it requires ongoing efforts in financial literacy initiatives, regulatory changes, and mobile infrastructure development to ensure that the most disadvantaged groups have access to financial services [9]. Thus, financial inclusion becomes a transformative tool for addressing structural inequities and promoting equitable development, aligning directly with the UN Sustainable Development Goals (SDGs).

2.4. Integration of Sustainable Finance, Circular Economy, and Financial Inclusion

Sustainable finance bridges the gap between circular economy (CE) aspirations and financial inclusion, particularly in resource-constrained developing countries. Green bonds, microfinance for circular startups, and impact investing are critical tools in this effort, enabling financial flows toward initiatives that deliver both financial returns and environmental or social benefits [30].

The CE offers a paradigm shift, decoupling economic growth from resource use and waste generation through practices such as reuse, recycling, and regeneration [6]. Green bonds, which exceeded $575 billion in 2023, fund renewable energy, waste reduction, and CE projects such as recycling infrastructure and sustainable product design [1]. Similarly, microfinance has expanded financial inclusion, serving over 1.4 billion clients globally. These small loans support circular startups focused on recycling, remanufacturing, and upcycling, advancing CE goals while promoting local economic development [31].

Despite these advancements, challenges persist. Only 7.2% of materials in the global economy were circular by 2023, down from 9.1% in 2018, indicating a regression in scaling CE practices 2. Simultaneously, 1.4 billion adults remain unbanked, limiting their ability to engage in both the financial system and circular economy initiatives [32,33].

This dual narrative—progress in sustainable financing and CE adoption versus persistent circularity and financial inclusion gaps—underscores the need for integrated solutions. Expanding access to green bonds and microfinance for small and medium-sized enterprises (SMEs) in developing regions is crucial [18]. Additionally, supportive regulatory frameworks and international collaboration can scale CE practices while ensuring equitable access to financial resources. Governments, international organizations, and the private sector must collectively enable sustainable finance and CE initiatives, driving progress toward equitable and environmentally responsible economic systems.

Takeaway

The literature on sustainable finance and circular economy (CE) has grown significantly, particularly in developed economies. Nonetheless, the incorporation of these frameworks in emerging economies has been inadequately examined. Although several studies [6,11] highlight the circular economy’s ability to separate economic growth from resource consumption, they mostly ignore the financial mechanisms that may promote CE adoption in low-income regions.

In this respect, ref. [6] emphasizes the theoretical advantages of CE in developed markets while providing little empirical data on how sustainable financing methods might help with its implementation in developing nations. Similarly, ref. [11] highlights challenges to CE adoption, such as regulatory fragmentation and poor infrastructure, but does not discuss how financial inclusion might help overcome these gaps. This study addresses these shortcomings by proposing a novel integration of financial inclusion with sustainable finance tools such as green bonds and microfinance, offering actionable solutions for policymakers in developing economies.

Moreover, the existing research on financial inclusion tends to emphasize access to credit and savings services [33], but rarely links these financial services to environmental sustainability. Our study expands this discourse by examining how financial inclusion can directly contribute to CE goals, particularly in rural and underserved communities, where traditional financing options are limited.

While sustainable finance and CE are well-researched independently, their intersection in developing economies remains underexplored. This study contributes by bridging this gap with region-specific financial mechanisms. It also contributes to the literature building on the existing frameworks by offering an integrated approach that combines financial inclusion, green bonds, microfinance, and impact investing to drive circular economy adoption in resource-constrained nations. By doing so, it responds to the call for more actionable solutions in regions where traditional finance mechanisms and regulatory structures are insufficient to support sustainable development.

3. Methodology

A mixed-methods strategy was used in this study, integrating quantitative and qualitative methods to assess the role of sustainable finance in advancing circular economy (CE) and financial inclusion in developing economies. The qualitative component involved an extensive literature review and case study analysis from Sub-Saharan Africa, Asia, and Latin America, regions selected for their diverse levels of financial inclusion and sustainable finance adoption. These case studies examined how sustainable financing tools, including green bonds, microfinance, and impact investing, support CE initiatives, following methodologies established by [7,12]. The case studies provided contextual insights into policy effectiveness and financial accessibility, especially in regions where quantitative data may not fully capture local nuances [34,35].

The quantitative component focused on financial trend analysis, assessing green bond issuance and microfinance expansion using secondary data from sources such as the World Bank, Statista, and Global Impact Investing Network reports. A comparative analysis framework was employed to evaluate financial inclusion levels, green bond growth, and CE adoption rates across different regions [30,32,36]. The study followed a triangulated research approach, combining case study evidence, secondary financial data, and policy assessments to enhance empirical depth. While econometric modeling, such as regression or correlation analysis, could provide additional statistical validation, prior studies in sustainable finance demonstrated the effectiveness of financial trend analysis and comparative data assessments in drawing meaningful conclusions [5,37].

A policy impact assessment framework was also integrated to evaluate the institutional factors shaping sustainable finance adoption, ensuring that the governance structures influencing CE practices were considered [5,28]. To mitigate limitations, such as reliance on secondary data and potential case study selection biases, the findings were triangulated using multiple sources to enhance reliability and validity. The study prioritized green bonds, microfinance, and impact investing as the primary financial mechanisms due to their scalability and demonstrated impact on fostering sustainable development. Green bonds have experienced exponential growth in the past decade, particularly in financing large-scale CE projects. Microfinance plays a crucial role in financial inclusion by providing capital to marginalized communities and supporting small circular enterprises. Impact investing bridges financial returns with social and environmental benefits, making it an essential tool for scaling CE initiatives in emerging markets. These tools were chosen based on their relevance and proven effectiveness in promoting sustainability in resource-constrained regions [38,39,40,41].

The selected case studies focused on Sub-Saharan Africa, Asia, and Latin America, regions chosen for their varying levels of financial inclusion and sustainable finance adoption. This selection enabled a comparative analysis of financial accessibility and its influence on circular economy integration [28]. Furthermore, these regions exhibit diverse policy frameworks, offering key insights into how different financial and regulatory environments impact sustainable finance outcomes [12]. Likewise, key international sustainability milestones, such as the 2015 Paris Agreement, which had a major impact on the global financial commitments to sustainability, and the adoption of the United Nations Sustainable Development Goals (SDGs) (2015–2030), which place an emphasis on financial inclusion and green finance, are in line with the selected timeframe (2014–2023).

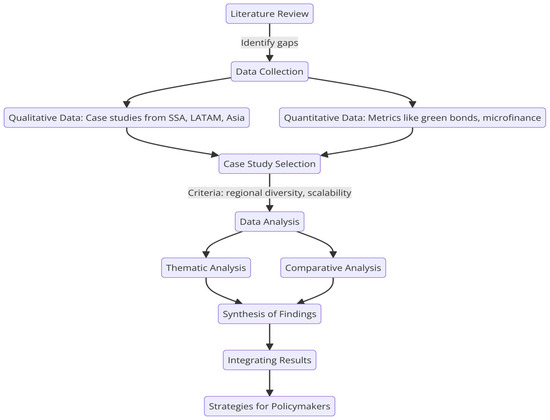

By adopting a multifaceted research design, this study ensured methodological feasibility and empirical rigor, offering a comprehensive evaluation of how sustainable finance mechanisms promote financial inclusion and circular economy integration in developing economies. Figure 1 below illustrates the overall research flow of the study.

Figure 1.

Research flowchart.

4. Results and Discussion

The intersection of sustainable finance, circular economy, and financial inclusion presents a critical opportunity to address global challenges such as climate change, environmental degradation, and social inequality. The following sections provide a detailed account of the study’s findings, with Section 4.1 presenting the results of the quantitative and qualitative analyses and Section 4.2 offering a discussion that contextualizes these findings within the broader academic literature and highlights their implications for policy and practice.

4.1. Results

The analysis highlights the role of sustainable financial instruments—green bonds, microfinance, and impact investing—in promoting circular economy adoption and enhancing financial inclusion in developing economies. By examining green bond issuance trends, socioenvironmental outcomes, and financial inclusion metrics across various regions, the findings offer valuable insights into how these financial tools contribute to reducing socioeconomic disparities and fostering sustainable development.

4.1.1. Regional Trends in Green Bond Issuance

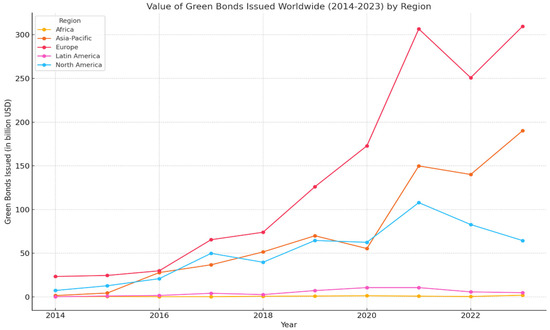

In line with the ideas of sustainable development and circular economy, green bonds have emerged as a crucial financial tool for assisting initiatives that improve the environment. These bonds provide governments, organizations, and businesses with an ability to raise money expressly for initiatives that focus on resource efficiency, adaptation, and mitigation of climate change—all of which are essential elements of a circular economy. Figure 2 illustrates the exponential increase in worldwide green bond issuance, with Europe leading owing to robust regulatory frameworks such as the EU Taxonomy for Sustainable Finance.

Figure 2.

Regional trends in green bond issuance (2014–2023). Source: compiled by authors using data from [42].

The growth of green bonds has significantly influenced sustainability performance in the countries and regions presented in Figure 2 by providing essential financial resources to support environmentally friendly projects. Green bonds, being dedicated to funding climate and sustainability initiatives, have enabled countries to invest in renewable energy, sustainable infrastructure, water management, and waste reduction—all key components of the circular economy and sustainable development goals (SDGs). Europe emerged as the largest issuer, peaking at $309.60 billion in 2023. This impressive growth is attributed to the EU’s Green Deal, its sustainable finance taxonomy, and initiatives such as NextGenerationEU, all of which have reinforced the region’s leadership in promoting green investments. The Asia–Pacific region also saw significant growth, particularly since 2016, with green bond issuance reaching $190.20 billion in 2023. The growth was spearheaded by China and Japan’s substantial commitments to renewable energy and sustainable infrastructure, aligned with international agreements such as the Paris Agreement.

In North America, green bond issuance peaked at $107.90 billion in 2021 but experienced slight declines afterward. This fluctuation can be attributed to varying levels of political support for green finance across the region. Latin America showed a modest peak in 2020, reaching $10.70 billion, largely driven by Brazil’s and Chile’s climate-focused initiatives. However, growth in this region remains constrained by a reliance on traditional sectors such as agriculture and mining, which hampers the shift towards green finance. Lastly, Africa displayed minimal green bond activity, with issuance peaking at $2.00 billion in 2023. This reflects the continent’s underdeveloped financial markets, limited policy frameworks, and low investor demand, which present significant barriers to green finance.

The data underscore the concentration of green bond issuance in industrialized regions such as Europe, Asia–Pacific, and North America, which benefit from advanced financial markets and strong policy frameworks. In contrast, Latin America and Africa face structural challenges that limit their capacity to grow green finance. These challenges include underdeveloped markets, higher investment risks, and a reliance on traditional industries. However, with international support and initiatives from multilateral development banks targeting sustainable projects, these regions have the potential for future growth in green finance.

In conclusion, the rise of green bonds highlights the growing integration of sustainable finance into global efforts to address environmental challenges. To tackle the existing disparities, more efforts must focus on expanding green bond markets in Latin America and Africa. This will allow these areas to play a more prominent role in climate change mitigation and contribute to sustainable development on a global scale.

Impact Investing and Socioenvironmental Goals

Impact investing offers a strategic approach to aligning financial returns with social and environmental objectives, supporting circular economy (CE) goals. By funding initiatives that promote resource efficiency and waste reduction, impact investing drives the transition to a CE. Utilizing the GIIN data, this section provides a grounded and statistically informed examination of sustainable finance’s role in promoting CE goals while also addressing financial accessibility in emerging nations. The Global Impact Investing Network (GIIN) was used because it provides a comprehensive and authoritative dataset that captures both financial investment trends and measurable social and environmental impacts [43]. Unlike traditional financial databases that primarily track capital flows, the GIIN integrates impact assessment frameworks, offering deeper insights into how sustainable finance mechanisms contribute to CE adoption and financial inclusion [43]. With its global coverage and sector-specific data, the GIIN enables a robust evaluation of how green bonds, microfinance, and impact investing facilitate CE transition across different regions.

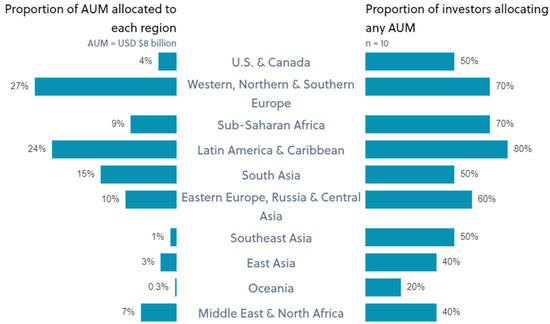

As illustrated in Figure 3 below, the allocation of assets under management (AUM) varies significantly across regions, reflecting differences in investment priorities and regional financial ecosystems.

Figure 3.

GIIN insight: impact investing allocations, activity, and performance. Source: Global Impact Investing Network (GIIN) [44].

- Europe (27%) leads in impact investing, driven by robust policies such as the EU Circular Economy Action Plan, which promotes waste reduction, recycling, and sustainable production.

- Latin America (24%) benefits from opportunities in sustainable agriculture, water management, and deforestation mitigation.

- Emerging markets: Sub-Saharan Africa (9%), South Asia (15%), and Southeast Asia (1%) receive lower AUM shares due to perceived risks, limited investment frameworks, and infrastructure challenges. However, these regions have untapped potential in waste management, resource-efficient agriculture, and technology-enabled circular practices.

- Oceania (0.3%) and MENA (7%) see minimal allocations despite opportunities in resource management and sustainable manufacturing.

The disparity between investor interest and actual AUM allocations is stark. For example, while Sub-Saharan Africa and Southeast Asia show high investor interest (70% and 50%, respectively), the actual funds remain low, highlighting the need for derisking mechanisms such as blended finance and capacity-building initiatives.

Overall, green bonds have emerged as a key instrument to channel capital into CE projects globally. Europe’s success in leveraging green bonds and supportive policies offers a blueprint for emerging markets. Policymakers in underfunded regions can replicate this by implementing clear roadmaps, fostering public–private partnerships, and offering investor incentives.

In a nutshell, Figure 3 highlights the potential for impact investing to align with circular economy objectives, but also underscores the need for better financial frameworks and regulatory support to scale these investments in underrepresented regions. Impact investing demonstrates the transformative potential to scale circular economy initiatives by addressing regional challenges in policy, risk, and infrastructure. By fostering collaboration among stakeholders and leveraging tools such as green bonds and microfinance, impact investing can drive the global shift toward sustainable, circular systems. This synergy between sustainable finance and the CE is critical for achieving the SDGs while promoting financial inclusion in emerging economies.

4.1.2. Financial Inclusion in Sustainable Development and CE Initiatives

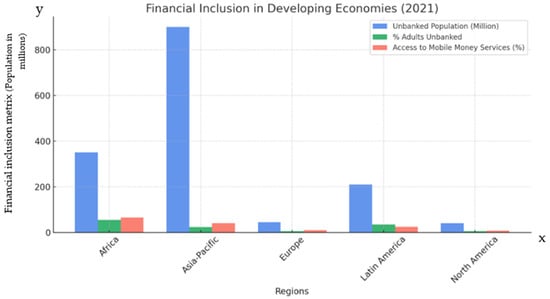

Financial inclusion is a crucial driver of sustainable development and circular economy (CE) initiatives, particularly in developing economies. It ensures equitable access to financial services, enabling broader participation in economic activities and fostering resource-efficient, socially inclusive growth. As evidenced by the World Bank [28,45], significant disparities persist in financial inclusion across regions, notably in Sub-Saharan Africa and the Asia–Pacific region, where a major share of the population remains unbanked. These disparities have a direct impact on both economic development and the adoption of circular economy practices, highlighting the interconnectedness of financial access and sustainability goals.

Figure 4 shows that in Sub-Saharan Africa, approximately 350 million people (57%) remain unbanked, largely due to rural populations, inadequate infrastructure, and socioeconomic barriers. Similarly, the Asia–Pacific region faces significant financial exclusion, with over 600 million unbanked individuals, representing 40% of the adult population. These regions rely heavily on cash-based economies, further widening economic inequality and hindering participation in sustainable development and CE initiatives. Latin America also struggles with financial exclusion, with 45% of its adult population (around 200 million) unbanked, primarily in rural areas. In contrast, Europe and North America have much lower unbanked rates—6% and 4%, respectively—thanks to advanced financial systems and robust regulatory frameworks.

Figure 4.

Financial inclusion in developing economies (2021). Source: compiled by authors using data from the World Bank [32].

Mobile money services have emerged as a transformative solution to financial exclusion, particularly in regions with poor banking infrastructure. In Africa, where conventional banking institutions are limited, mobile money platforms such as M-Pesa have gained significant acceptance, with 70% of adults in countries such as Kenya and Tanzania utilizing these services. This has significantly improved financial accessibility and created new opportunities for economic participation. The Asia–Pacific region follows closely, with 45% of adults using mobile money, particularly in India and China. Meanwhile, Latin America has seen slower adoption (30%), while Europe (10%) and North America (15%) continue to rely primarily on formal banking systems.

By improving financial access through mobile money services, microfinance, and fintech solutions, developing regions can overcome significant barriers to economic participation and facilitate the adoption of circular economy models. Financial inclusion helps people and companies in underserved regions to participate in circular economy activities such as recycling, resource sharing, and sustainable consumerism. For example, Africa’s strongly growing use of mobile money is helping to reduce financial exclusion in rural regions, while fintech innovations in the Asia–Pacific region are steadily decreasing the gap despite the region’s vast unbanked population. In Latin America, however, progress remains uneven, with rural areas and vulnerable groups still facing significant financial access challenges.

In conclusion, the integration of financial inclusion with circular economy concepts is vital for accomplishing global sustainability goals, particularly the Sustainable Development Goals (SDGs) and the Paris Agreement. A collaborative effort involving policymakers, financial institutions, and local communities is necessary to eliminate financial access barriers and promote an inclusive, sustainable, and transformative circular economy. This dual approach not only advances economic development, but also supports the creation of a fair, resilient, and ecologically sustainable global economy.

Despite progress in expanding access to financial services, Figure 4 demonstrates that nearly 57% of the population in the developing regions remains unbanked, limiting their ability to engage fully in the financial system and participate in CE projects. Expanding financial inclusion through fintech solutions, such as mobile banking and digital wallets, will be key to integrating more individuals and small businesses into the circular economy.

4.1.3. Comparative Insights of Finance, Green Bonds, and Circular Economy (CE)

Table 1 presents the comparative study of financial inclusion, green bond issuance, and circular economy (CE) practices, highlighting significant regional disparities shaped by policy environments, economic development, and societal focus on sustainability.

Table 1.

Comparative overview of finance, green bonds, and the circular economy across regions.

Financial inclusion. Regions with advanced economies, such as Europe and Central Asia (78%) and East Asia and the Pacific (76%), show the highest levels of financial inclusion, which is indicative of access to financial services. This success can be attributed to established digital financial infrastructures and supportive regulatory environments. In contrast, regions such as Sub-Saharan Africa (55%) and the Middle East and North Africa (44%) face significant challenges in promoting financial inclusion, largely due to infrastructural limitations and sociopolitical barriers.

Green bond issuance. Green bond issuance reflects a region’s capacity and commitment to green finance. Europe and Central Asia, a leading region in this regard, demonstrates strong activity, bolstered by initiatives such as the Circular Economy Action Plan. Similarly, East Asia and the Pacific show significant progress, with China emerging as a global leader in green bond issuance and CE policy integration. However, regions such as South Asia and Sub-Saharan Africa have minimal or nascent green bond markets, highlighting a critical need for institutional and market development in sustainable finance.

Prevalence of CE practices. The prevalence of CE practices varies significantly by region. Europe and Central Asia lead globally with comprehensive CE policies, such as the EU’s Circular Economy Action Plan. Similarly, East Asia and the Pacific, led by China, has integrated CE principles into its policies since the early 2000s. Conversely, CE practices in South Asia, Sub-Saharan Africa, and the Middle East and North Africa are still in the early stages, primarily focusing on waste reduction and recycling. These regions demonstrate growing interest in CE, but they require substantial policy and infrastructure investments to achieve significant progress.

Conclusion. This analysis highlights the interplay between financial inclusion, green finance, and CE adoption across regions. Regions with strong policy support and institutional frameworks exhibit higher rates of financial inclusion and CE integration. Conversely, developing regions require targeted interventions, including investments in infrastructure, capacity-building, and regulatory support, to advance financial inclusion and sustainable practices. These findings emphasize the urgent need for region-specific strategies to achieve global sustainability goals.

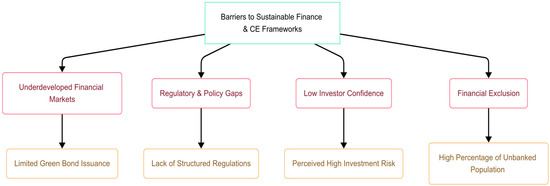

4.1.4. Challenges in Implementing Sustainable Finance and CE Frameworks in Developing Economies

The adoption of sustainable finance mechanisms and circular economy (CE) frameworks in developing economies faces several significant barriers, as identified through the analysis of green bond issuance, financial inclusion rates, and the effectiveness of impact investing. A primary obstacle is the underdeveloped financial markets in these regions, which limit the capacity to raise capital for sustainable projects. As demonstrated in Table 1, regions such as Sub-Saharan Africa and Latin America have seen minimal issuance of green bonds, with Africa raising only $2 billion in 2023, far behind Europe’s green bond issuance of $309.60 billion. This stark contrast highlights the lack of robust financial infrastructure capable of supporting the scale required to finance large-scale sustainability initiatives.

The second major barrier is the absence of comprehensive policy frameworks that promote sustainable finance and circular economy objectives. In regions such as Botswana, the lack of cohesive national policies to support green finance has significantly impeded progress toward Sustainable Development Goals (SDGs). While Europe benefits from structured guidelines, such as the EU’s Green Deal and Sustainable Finance Taxonomy, which provide regulatory certainty, most developing nations lack similar frameworks. This regulatory gap limits the ability of these countries to attract international investment in green bonds or impact investing for CE-related projects.

Low investor confidence also contributes to the slow uptake of sustainable finance in developing economies. As shown in Figure 3, impact-investing flows into regions such as Sub-Saharan Africa and Southeast Asia remain minimal, as investors perceive these markets as high-risk due to political instability, economic volatility, and insufficient governance structures. These concerns deter private sector investment, leaving many CE projects underfunded or unable to scale.

Moreover, financial exclusion presents a significant barrier to the successful implementation of CE frameworks. In spite of progress with mobile money platforms such as M-Pesa in Kenya, 57% of the population in the developing countries continues to be unbanked, as seen in Figure 4. Restricted access to financial services inhibits many people and enterprises from engaging in the formal economy, including participants in circular economy initiatives such as waste management, renewable energy implementation, and resource-efficient technology. Without inclusive financial systems that provide credit, insurance, and investment opportunities to underserved populations, the uptake of sustainable finance tools will remain constrained, especially in rural areas where financial infrastructure is weakest.

In summary, the barriers to implementing sustainable finance and CE frameworks in developing economies are multifaceted, encompassing underdeveloped financial markets, regulatory gaps, low investor confidence, and financial exclusion. Addressing these constraints requires a mix of legal reforms, market development strategies, and creative financing structures tailored to the unique difficulties of these regions (Figure 5).

Figure 5.

Challenges in implementing sustainable finance and circular economy in developing economies. Source: compiled by the authors (2024).

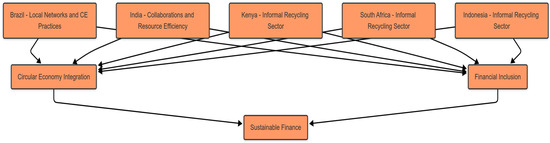

4.1.5. Integrated Solutions for Scaling CE Initiatives: Case Studies of Innovative Practices

The integration of sustainable finance, circular economy (CE) principles, and financial inclusion offers transformative solutions to the socioeconomic and environmental challenges faced by developing economies. This section presents case studies from Brazil, India, Kenya, South Africa, and Indonesia, showcasing diverse strategies for combining sustainable finance with CE practices and financial inclusion. These case studies were selected for their regional diversity, scalability, and financial innovation, highlighting how specific socioeconomic contexts shape the implementation of CE and financial inclusion efforts.

Brazil—Local Networks and Circular Economy Practices

As the largest economy in Latin America, Brazil faces significant challenges in the adoption of CE practices, particularly among small enterprises. However, rising awareness of sustainability issues has spurred the development of local business networks that are embracing CE principles. One example is a Brazilian network of small businesses that focus on product design, environmental management, and sustainable commercial relations. Research in [48] identifies three key categories of CE practices adopted by this network:

- Internal environmental management. Businesses prioritize waste reduction, energy efficiency, and water conservation, laying the groundwork for sustainable production.

- Ecological design. Enterprises in sectors such as furniture and textiles emphasize reusable and biodegradable materials, aligning with consumer demand for sustainable products. Local artisans play a critical role in driving this movement.

- Investment recovery. By recycling and repurposing waste, businesses find new revenue streams, reducing costs while improving resource efficiency.

Collaboration is central to the network’s success, creating a shared value chain where one business’s waste becomes another’s raw material. This integration also promotes financial inclusion, enabling marginalized enterprises to participate in CE initiatives. While challenges remain—such as inconsistent adoption and limited planning—public policies and financial incentives are crucial to addressing these gaps and fostering inclusive growth.

India—Collaborations and Resource Efficiency in SMEs

In India, collaborations between small and medium-sized enterprises (SMEs) and multinational corporations (MNCs) have played a key role in advancing CE practices. These partnerships have facilitated access to clean technologies, improved organizational learning, and enhanced resource efficiency. The research in [49] highlights how partnerships in textiles, agriculture, and manufacturing have enabled SMEs to adopt circular business models focused on waste reduction and recycling. Through technology transfer, production processes have been optimized, reducing waste and generating additional revenue from byproducts.

This model has also contributed to financial inclusion as the adoption of circular practices has made SMEs more competitive, attracted loans and subsidies, and fostered job creation in sectors such as green technology and recycling. By promoting multi-stakeholder collaborations, public–private partnerships in India have successfully enhanced competitiveness and sustainability, while contributing to global sustainability goals.

Kenya, South Africa, and Indonesia—Circular Economy and Informal Recycling

In Kenya, South Africa, and Indonesia, the informal recycling sector has played a critical role in advancing CE initiatives. Despite being a major contributor to recycling efforts, informal waste pickers are often excluded from formal policies, lacking financial resources and social protections. Recent efforts in these countries have aimed to integrate the informal recycling sector into formal frameworks, offering financial access, social protections, and legal recognition.

For instance, in Kenya and South Africa, informal recyclers manage a significant portion of the countries’ waste but have historically faced marginalization. Recent initiatives have sought to provide these recyclers with access to microcredit and loans, enabling them to scale operations and improve livelihoods. Similarly, in Indonesia, informal waste collectors have been incorporated into formal systems through financial tools such as microfinance, allowing them to invest in small recycling businesses and improve their economic stability.

This integration has yielded significant economic and social benefits, including job formalization, better working conditions, and improved financial inclusion. Furthermore, these efforts have contributed to environmental gains by improving recycling rates, reducing landfill waste, and creating green jobs. The case of Kenya, South Africa, and Indonesia illustrates how integrating the informal sector into formal CE frameworks can drive inclusive economic growth while promoting environmental sustainability. Figure 6 below presents Integrated solutions for scaling CE initiatives showcasing case studies of innovative practices.

Figure 6.

Integrated solutions for scaling CE initiatives: case studies of innovative practices. Source: compiled by the authors (2024).

4.2. Discussion

This section contextualizes the study’s findings within the existing literature and highlights their implications for policy and practice. The findings of this study underscore the critical role of sustainable finance tools—particularly green bonds, microfinance, and impact investing—in advancing circular economy (CE) goals and promoting financial inclusion in developing economies. By examining the intersection of these elements, the study provides valuable insights into the regional trends and barriers to implementing CE frameworks, as well as potential solutions to overcome these challenges.

4.2.1. Green Bonds and Regional Disparities

As shown in Figure 2, green bond issuance has surged in the past decade, with Europe leading global issuance, driven by robust regulatory frameworks such as the EU’s Green Deal and Sustainable Finance Taxonomy. However, Sub-Saharan Africa and Latin America have experienced minimal green bond activity, reflecting underdeveloped financial markets and a lack of incentives for investors. This finding aligns with prior research, which highlights the importance of regulatory certainty and government-backed incentives in encouraging green finance adoption in regions such as Europe and the Asia–Pacific.

The low level of green bond issuance in Africa and Latin America can be attributed to a combination of financial market underdevelopment, limited policy frameworks, and low investor confidence, as noted in Table 1. These barriers prevent large-scale investment in CE projects such as renewable energy, waste management, and sustainable infrastructure. To address these challenges, blended finance models, which combine public and private funds to derisk investments, have emerged as a viable solution.

4.2.2. Microfinance and Financial Inclusion

Financial inclusion remains a critical enabler of CE adoption in developing economies. The findings show that microfinance institutions (MFIs) and mobile money platforms have played a pivotal role in expanding access to financial services in underbanked regions, as evidenced by the success of Kenya’s M-Pesa system (Figure 4). These platforms have enabled small businesses and informal entrepreneurs to access funding for CE-related activities such as waste recovery, recycling, and renewable energy projects.

The impact of microfinance on financial inclusion is especially significant in regions such as Sub-Saharan Africa, where over 70% of the adult population now has access to mobile money services, enabling broader participation in CE initiatives. This finding is consistent with the existing studies that emphasize the transformative potential of fintech innovations in promoting financial inclusion and supporting sustainability efforts.

However, challenges remain in other regions, particularly in Latin America and the Middle East, where financial exclusion is still prevalent. As shown in Table 1, financial inclusion rates in these regions remain below 50%, limiting access to credit for small enterprises and informal CE businesses. Expanding access to microfinance and improving the regulatory environment for digital financial services are essential steps toward bridging this gap and enabling sustainable development.

4.2.3. Barriers to Sustainable Finance and CE Integration

The results reveal several key barriers to the integration of sustainable finance and CE frameworks in developing economies, including:

- Underdeveloped financial markets. As shown in Table 1, green bond issuance in regions such as Sub-Saharan Africa and Latin America remains limited, restricting access to capital for sustainability projects.

- Regulatory gaps. Unlike Europe, where structured policies such as the EU’s Green Deal incentivize green finance, many developing regions lack the regulatory certainty needed to attract investors.

- Low investor confidence. Figure 3 highlights that despite high investor interest in Sub-Saharan Africa and Southeast Asia, actual investment flows remain low due to perceived risks and governance challenges.

- Financial exclusion. Limited access to formal banking systems continues to hinder the growth of small-scale CE enterprises, particularly in rural and underserved areas, as demonstrated in Figure 4.

4.2.4. Integrated Solutions and Policy Recommendations

Given these barriers, the study emphasizes the need for multi-stakeholder interventions to overcome financial, policy, and infrastructural challenges. Blended finance models, which pool public and private funds, offer a promising solution to derisk investments and encourage private sector participation in CE projects. Similarly, expanding microfinance services and strengthening digital financial infrastructure are essential strategies for enabling broader participation in the circular economy.

Moreover, public–private partnerships (PPPs) can help mobilize resources for large-scale investments in sustainable infrastructure, waste management, and renewable energy projects. These partnerships are especially critical in underdeveloped regions such as Sub-Saharan Africa, where access to capital for CE projects remains limited.

Finally, improving regulatory frameworks to support environmental, social, and governance (ESG) principles in financial markets will help attract sustainable finance and promote inclusive economic growth. By aligning financial systems with sustainability goals, policymakers can incentivize investments in circular economy initiatives and foster long-term, sustainable development.

5. Conclusions

This study examined how sustainable finance tools, such as green bonds, microfinance, and impact investing, can promote financial inclusion and support the adoption of circular economy (CE) principles in developing economies. The findings highlight significant progress in some regions, but also underscore the challenges that remain, particularly in Latin America, Sub-Saharan Africa, and South Asia.

The analysis of green bond issuance reveals that while regions such as Europe and the Asia–Pacific have successfully leveraged green finance to fund CE projects, many developing economies lag behind. Europe’s leadership, driven by strong regulatory frameworks such as the EU’s Green Deal and Sustainable Finance Taxonomy, has resulted in significant investments in renewable energy and sustainable infrastructure. However, Africa and Latin America face barriers such as underdeveloped financial markets and low investor confidence, with green bond issuance peaking at only $2 billion and $10.70 billion, respectively. These regional disparities illustrate the need for targeted policy interventions and the development of robust financial ecosystems to scale green finance and CE adoption in underrepresented regions.

The role of financial inclusion in promoting CE practices is also critical, particularly in regions where access to traditional financial services is limited. As demonstrated in Kenya through the widespread use of mobile money platforms such as M-Pesa, financial inclusion enables broader participation in CE initiatives by providing access to credit and investment for small businesses and individuals. Nevertheless, significant financial exclusion persists in many regions, with nearly 57% of the population in the developing economies remaining unbanked. Expanding access to fintech solutions, such as mobile banking and digital wallets, is essential for integrating marginalized communities into the formal economy and promoting the adoption of CE business models.

In addition to these barriers, the findings underscore the potential of integrated solutions to scale CE initiatives in resource-constrained settings. Case studies from Brazil, Kenya, and Bangladesh demonstrate how blended finance models and public–private partnerships can successfully align financial incentives with sustainability goals. In Brazil, for instance, the Amazon Fund has promoted sustainable agriculture and reforestation by combining public and private capital, while microfinance in Bangladesh has supported waste management and recycling businesses. These examples highlight the importance of financial innovation in overcoming challenges such as low investor confidence and limited regulatory support.

Despite these successes, the study identifies several ongoing challenges. Regulatory gaps, insufficient policy frameworks, and the lack of investment-ready projects in many developing economies continue to impede the growth of sustainable finance and the adoption of CE practices. Addressing these challenges will require coordinated efforts from governments, international financial institutions, and the private sector. Blended finance models, capacity-building efforts, and the development of investment-friendly environments will be critical to overcoming these barriers and ensuring that sustainable finance becomes a key driver of inclusive growth and environmental sustainability.

In conclusion, the integration of sustainable finance, financial inclusion, and circular economy principles presents a powerful approach to addressing both the socioeconomic and environmental challenges faced by developing economies. By implementing targeted policies, expanding financial access, and fostering public–private partnerships, policymakers and financial institutions can scale sustainable development initiatives and promote equitable economic growth in regions most vulnerable to climate change and resource constraints.

5.1. Contribution of the Paper

This study contributes to the literature on sustainable finance and the circular economy (CE) by presenting a novel framework that integrates financial inclusion with CE objectives, offering a comprehensive approach to sustainability in resource-constrained regions. It provides actionable recommendations for policymakers, emphasizing the need for stronger regulations, international cooperation, and tailored financial solutions to address regional disparities. Additionally, it highlights the dual impact of microfinance on social equity and environmental sustainability, demonstrating its role in promoting local CE adoption and economic resilience in low-income communities. By addressing these key issues, the study enhances the understanding of how sustainable finance can drive inclusive and resilient economies. Future studies should investigate the impact of digital financial services on enhancing financial inclusion and promoting the adoption of the circular economy, especially in underserved rural regions with restricted access to conventional banking systems. Furthermore, investigating blockchain technology’s role in sustainable finance could enhance transparency and accountability in CE-related investments. To provide empirical validation of these financial tools, we recommend employing econometric methods, longitudinal analyses, and experimental approaches to assess their direct quantitative impact on CE adoption and financial inclusion.

5.2. Recommendations

To advance circular economy (CE) principles and promote financial inclusion, a comprehensive policy framework is essential. This framework should embed environmental, social, and governance (ESG) principles into financial systems to encourage banks, financial institutions, and investors to fund sustainable initiatives. Aligning financial institutions with ESG goals can incentivize private sector investments that address both CE objectives and social equity.

Public–private partnerships (PPPs) are critical for mobilizing resources and scaling sustainable finance. These partnerships distribute risk and enhance capacity, enabling large-scale investments in CE projects, including infrastructure, waste management, and renewable energy. Governments can combine public and private resources to promote long-term, sustainable development initiatives that might otherwise face funding challenges. A specific recommendation is given below.

- 1.

- Promoting Green Bonds. Governments should incentivize the issuance of green bonds to finance CE projects by offering tax breaks, subsidies, and favorable regulations. Green bonds provide direct funding for sustainable infrastructure, renewable energy, and resource-efficient technologies. Fiscal incentives reduce capital costs, encouraging public and private investments in CE initiatives, particularly in underdeveloped regions where funding barriers persist.

- 2.

- Supporting Microfinance for Circular Enterprises. Enhanced regulatory frameworks can expand microfinance to support small-scale CE enterprises. Microfinance plays a key role in financial inclusion, enabling marginalized groups to access funding for ventures such as recycling, waste management, and upcycling. Tailoring microfinance programs to incorporate sustainability criteria can help small businesses adopt environmentally responsible practices, driving economic growth and environmental protection.

- 3.

- Developing Impact Investing Ecosystems. Governments and financial institutions should foster impact-investing ecosystems to channel capital into CE initiatives. Impact investing, which combines financial returns with social and environmental benefits, is well-suited to CE projects. Creating supportive regulatory frameworks, incentives, and platforms connecting investors with CE businesses can scale investments in renewable energy, sustainable agriculture, and eco-friendly manufacturing.

Focusing on green bonds, microfinance, and impact investing can accelerate sustainable finance adoption and CE transitions. These efforts must be supported by clear and consistent policies to ease financial access, foster market growth for circular goods, and ensure regulatory stability. With the right policy mix, sustainable finance can drive economic transformation, helping emerging economies achieve environmental sustainability, financial inclusion, and resilience.

Author Contributions

Conceptualization, E.G.T. and Z.L.; methodology, E.G.T.; formal analysis, E.G.T.; investigation, Z.L.; resources, E.G.T. and Z.L.; writing—original draft preparation, E.G.T.; supervision, Z.L.; project administration, Z.L.; funding acquisition, E.G.T. and Z.L. All authors have read and agreed to the published version of the manuscript.

Funding

This manuscript received no external funding; however, the Hungarian University of Agriculture and Life Sciences covers the article processing fee.

Data Availability Statement

This study is based on publicly available online data, with sources cited in the references.

Acknowledgments

The authors would like to acknowledge the support of the Hungarian University of Agriculture and Life Sciences (MATE) for providing the necessary resources to conduct this study.

Conflicts of Interest

The authors have no conflict of interest.

References

- World Economic Forum. What Are Green Bonds, and How Do They Help Fight Climate Change? Available online: https://www.weforum.org/stories/2024/11/what-are-green-bonds-climate-change/ (accessed on 18 November 2024).

- Circle Economy. Circularity Gap Report 2024: Global. European Circular Economy Stakeholder Platform. Available online: https://circulareconomy.europa.eu/platform/en/knowledge/circularity-gap-report-2024 (accessed on 18 November 2024).

- Liyanage, S.I.H.; Netswera, F.G.; Motsumi, A. Insights from EU policy framework in aligning sustainable finance for sustainable development in Africa and Asia. Int. J. Energy Econ. Policy 2021, 11, 459–470. [Google Scholar]

- Ziolo, M.; Filipiak, B.Z.; Bąk, I.; Cheba, K.; Tîrca, D.M.; Novo-Corti, I. Finance, sustainability and negative externalities. An overview of the European context. Sustainability 2019, 11, 4249. [Google Scholar] [CrossRef]

- Ziolo, M.; Bak, I.; Cheba, K. The role of sustainable finance in achieving sustainable development goals: Does it work? Technol. Econ. Dev. Econ. 2021, 27, 45–70. [Google Scholar]

- Geissdoerfer, M.; Savaget, P.; Bocken, N.M.; Hultink, E.J. The Circular Economy—A new sustainability paradigm? J. Clean. Prod. 2017, 143, 757–768. [Google Scholar] [CrossRef]

- Andersen, O.W.; Basile, I.; De Kemp, A.; Gotz, G.; Lundsgaarde, E.; Orth, M. Blended Finance Evaluation: Governance and Methodological Challenges; OECD Development Co-operation Working Papers No. 51; OECD: Paris, France, 2019. [Google Scholar]

- Timer, S.; Raza, S.A. Nonlinear relationship between financial inclusion and inclusive economic development in developed economies: Evidence from panel smooth transition regression model. Int. J. Soc. Econ. 2023, 50, 1022–1037. [Google Scholar] [CrossRef]

- Affandi, H.; Malik, Q.A. Financial Inclusion between Financial Innovation and Economic Growth: A Study of Lower Middle-Income Economies. J. Account. Financ. Emerg. Econ. 2021, 7, 913–920. [Google Scholar]

- Khera, P.; Ng, S.; Ogawa, S.; Sahay, R. Measuring digital financial inclusion in emerging market and developing economies: A new index. Asian Econ. Policy Rev. 2022, 17, 213–230. [Google Scholar]

- Korhonen, J.; Honkasalo, A.; Seppälä, J. Circular economy: The concept and its limitations. Ecol. Econ. 2018, 143, 37–46. [Google Scholar] [CrossRef]

- Migliorelli, M. What do we mean by sustainable finance? Assessing existing frameworks and policy risks. Sustainability 2021, 13, 975. [Google Scholar] [CrossRef]

- Aleknevičienė, V.; Bendoraitytė, A. Role Of Green Finance in Greening the Economy: Conceptual Approach. Cent. Eur. Bus. Rev. 2023, 12, 105–130. [Google Scholar] [CrossRef]

- Yakovlev, I.A.; Nikulina, S.I. Indonesia’s Strategy for Sustainable Finance. Master’s Thesis, Finansovyy Zhurnal, Moscow, Russia, 2019. [Google Scholar]

- Machingambi, J. The Impact of Microfinance on The Sustainability of ‘Poor’ Clients: A Conceptual Review. J. Entrep. Innov. 2020, 1, 50. [Google Scholar] [CrossRef]

- Rawhouser, H.; Cummings, M.; Newbert, S.L. Social impact measurement: Current approaches and future directions for social entrepreneurship research. Entrep. Theory Pract. 2019, 43, 82–115. [Google Scholar] [CrossRef]

- Bengo, I.; Boni, L.; Sancino, A. EU financial regulations and social impact measurement practices: A comprehensive framework on finance for sustainable development. Corp. Soc. Responsib. Environ. Manag. 2022, 29, 809–819. [Google Scholar] [CrossRef]

- Schröder, P.; Anantharaman, M.; Anggraeni, K.; Foxon, T.J. The circular economy and the Global South. In The Circular Economy and the Global South; Routledge: London, UK, 2019. [Google Scholar] [CrossRef]

- Ellen MacArthur Foundation. Which Country Is Leading the Circular Economy Shift? Available online: https://www.ellenmacarthurfoundation.org/articles/which-country-is-leading-the-circular-economy-shift (accessed on 27 November 2024).

- Murray, A.; Skene, K.; Haynes, K. The circular economy: An interdisciplinary exploration of the concept and application in a global context. J. Bus. Ethics 2017, 140, 369–380. [Google Scholar] [CrossRef]

- Preston, F.; Lehne, J. A wider circle? The circular economy in developing countries. In Proceedings of the Circular Economy Conference, London, UK, 5 December 2017. [Google Scholar]

- Ness, D. Sustainable urban infrastructure in China: Towards a Factor 10 improvement in resource productivity through integrated infrastructure systems. Int. J. Sustain. Dev. World Ecol. 2008, 15, 288–301. [Google Scholar]

- Dewick, P.; Bengtsson, M.; Cohen, M.J.; Sarkis, J.; Schröder, P. Circular economy finance: Clear winner or risky proposition? J. Ind. Ecol. 2020, 24, 1192–1200. [Google Scholar] [CrossRef]

- Stahel, W.R. The circular economy. Nature 2016, 531, 435–438. [Google Scholar] [CrossRef]

- Lieder, M.; Rashid, A. Towards circular economy implementation: A comprehensive review in the context of the manufacturing industry. J. Clean. Prod. 2016, 115, 36–51. [Google Scholar] [CrossRef]

- Ghisellini, P.; Cialani, C.; Ulgiati, S. A review on circular economy: The expected transition to a balanced interplay of environmental and economic systems. J. Clean. Prod. 2016, 114, 11–32. [Google Scholar] [CrossRef]

- Mabula, J.B.; Han, D.P. Financial literacy of SME managers on access to finance and performance: The mediating role of financial service utilization. Int. J. Adv. Comput. Sci. Appl. 2018, 9, 32–41. [Google Scholar] [CrossRef]

- World Bank. Global Findex Database 2021: Financial Inclusion, Digital Payments, and Resilience. Available online: https://www.worldbank.org/en/publication/globalfindex (accessed on 21 November 2024).

- Ranabahu, N.; Wickramasinghe, A. Sustainable Leadership in Microfinance: A Pathway for Sustainable Initiatives in Micro and Small Businesses? Sustainability 2022, 14, 5167. [Google Scholar] [CrossRef]

- United Nations Environment Programme Finance Initiative (UNEP FI). Financing Circularity: Demystifying Finance for the Circular Economy. Available online: https://www.unepfi.org/publications/financing-circularity/ (accessed on 29 November 2024).

- Ashraf, A.; Billah, M.; Ayoob, M.; Zulfiqar, N. Analyzing the impact of microfinance initiatives on poverty alleviation and economic development. Rev. Appl. Manag. Soc. Sci. 2024, 7, 431–448. [Google Scholar] [CrossRef]

- World Bank. Unveiling the Global Findex Database 2021: Five Charts. World Bank Blogs. Available online: https://blogs.worldbank.org/en/developmenttalk/unveiling-global-findex-database-2021-five-charts (accessed on 21 November 2024).

- Demirgüç-Kunt, A.; Klapper, L.; Singer, D.; Ansar, S. The Global Findex Database 2021: Financial Inclusion, Digital Payments, and Resilience in the Age of COVID-19; World Bank Publications: Washington, DC, USA, 2022. [Google Scholar]

- Yin, R.K. Case Study Research and Applications: Design and Methods, 6th ed.; SAGE Publications: Thousand Oaks, CA, USA, 2018. [Google Scholar]

- Preston, F.; Lehne, J.; Wellesley, L. An Inclusive Circular Economy: Priorities for Developing Countries; The Royal Institute of International Affairs, Chatham House: London, UK, 2019; Volume 6. [Google Scholar]

- European Environment Agency. Monitoring Report on Progress Towards the 8th EAP Objectives—2023 Edition. Available online: https://www.eea.europa.eu/en/analysis/publications/monitoring-progress-towards-8th-eap-objectives (accessed on 30 November 2024).

- Camilleri, M.A. Closing the loop for resource efficiency, sustainable consumption and production: A critical review of the circular economy. Int. J. Sustain. Dev. 2018, 21, 1–17. [Google Scholar]

- Adelaja, A.O.; Umeorah, S.C.; Abikoye, B.E.; Nezianya, M.C. Advancing financial inclusion through fintech: Solutions for unbanked and underbanked populations. World J. Adv. Res. Rev. 2024, 23, 427–438. [Google Scholar]

- Kumar, B.; Kumar, L.; Kumar, A.; Kumari, R.; Tagar, U.; Sassanelli, C. Green finance in circular economy: A literature review. Environ. Dev. Sustain. 2024, 26, 16419–16459. [Google Scholar]

- Sepetis, A. Sustainable finance and circular economy. In Circular Economy and Sustainability; Elsevier: Amsterdam, The Netherlands, 2022; pp. 207–226. [Google Scholar]

- Tang, C. Green finance and investment: Emerging trends in sustainable development. J. Appl. Econ. Policy Stud. 2024, 6, 36–39. [Google Scholar] [CrossRef]

- Statista. Value of Green Bonds Issued Worldwide from 2014 to 2023, by Region (In Billion U.S. Dollars). Available online: https://www.statista.com/statistics/1294449/value-of-green-bonds-issued-worldwide-by-region (accessed on 1 December 2024).

- Global Impact Investing Network, “About the GIIN.” (Online). Available online: https://thegiin.org/about/ (accessed on 1 December 2024).

- Global Impact Investing Network (GIIN). The 2023 GIINsight Series: A Comprehensive Overview of Impact Investing Activity and Impact Measurement & Management Practice. Available online: https://thegiin.org/publication/research/2023-giinsight-series (accessed on 1 December 2024).

- World Bank. COVID-19 Boosted the Adoption of Digital Financial Services. Available online: https://www.worldbank.org/en/news/feature/2022/07/21/covid-19-boosted-the-adoption-of-digital-financial-services (accessed on 29 November 2024).

- Mejía, D.; Saavedra, M. Financial Inclusion in Latin America: How Far We Have Come. CAF—Development Bank of Latin America. Available online: https://www.caf.com/en/blog/financial-inclusion-in-latin-america-how-far-we-have-come (accessed on 28 November 2024).

- FinDev Gateway. Financial Inclusion: Global Overview. Available online: https://www.findevgateway.org/region/financial-inclusion-global-overview (accessed on 29 November 2024).

- Silva, F.C.; Shibao, F.Y.; Kruglianskas, I.; Barbieri, J.C.; Sinisgalli, P.A.A. Circular economy: Analysis of the implementation of practices in the Brazilian network. Rev. Gestão 2019, 26, 39–60. [Google Scholar]

- Mishra, J.L.; Chiwenga, K.D.; Ali, K. Collaboration as an enabler for circular economy: A case study of a developing country. Manag. Decis. 2021, 59, 1784–1800. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).