1. Introduction

Various alcoholic beverages are available worldwide, many based on different countries’ unique cultures and customs. For example, Japan is known for its

sake, a type of rice wine. This alcoholic beverage has been brewed from ancient times, at least from the seventh century (According to the Japanese

Sake and Shochu Makers Association, the description that Japanese people were brewing

sake in the seventh century was found in an old Japanese historical record called

Harima no kuni fudoki). In current days, most Japanese people have either consumed

sake or know the name of

sake even if they have never consumed it.

Sake is not only drunken on a daily basis, but is also frequently used for ceremonial occasions. For instance,

sake is used for wedding and funeral gifts, gifts for close friends and business partners, and so on. Thus,

sake is very familiar with Japanese culture. With the globalization of the modern age,

sake has gained recognition around the world.

Sake is often served in an auspicious wooden

sake cup called “masu”, and is associated with Japanese culture such as Shinto and Buddhist rituals (

Figure 1).

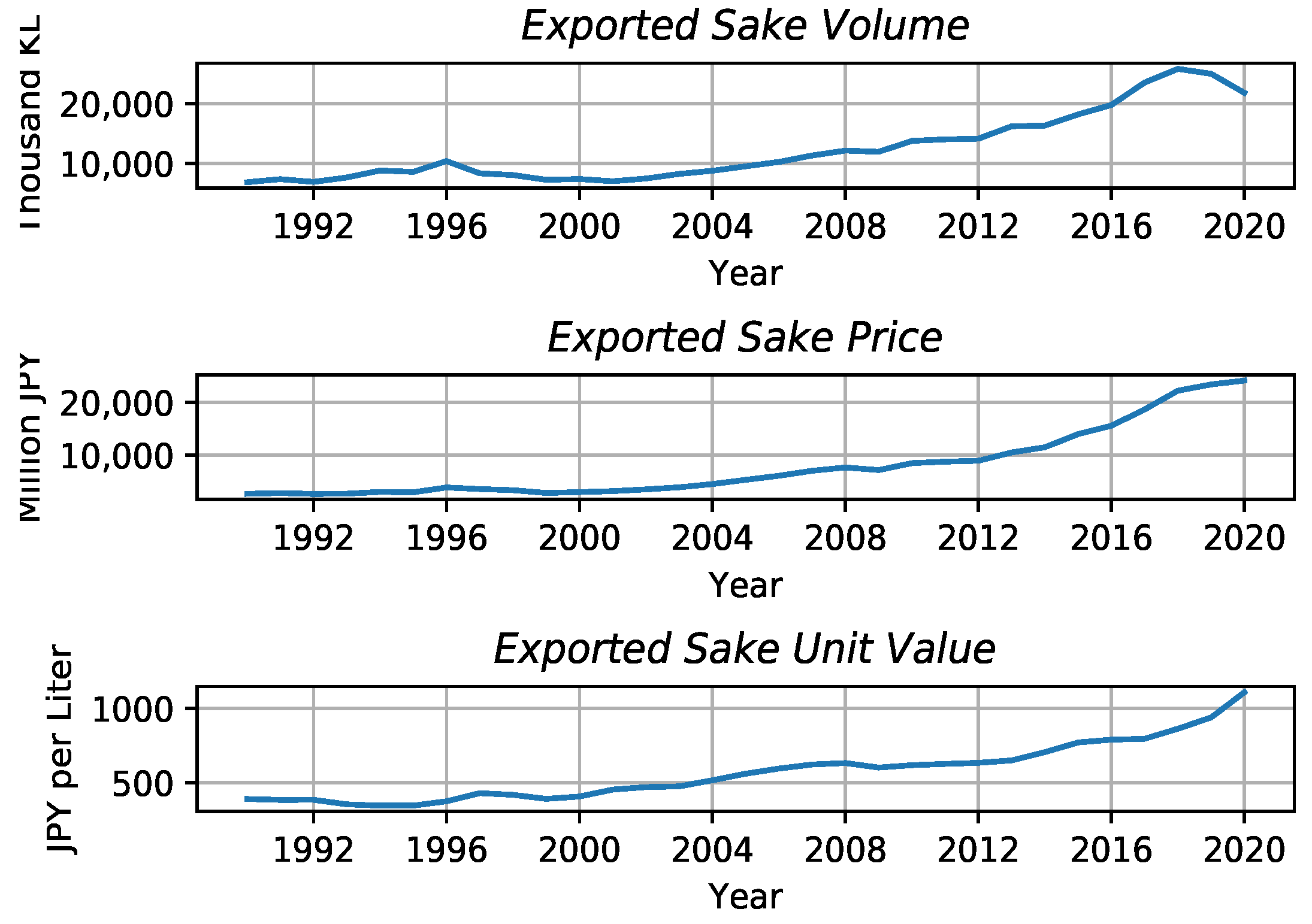

Sake exports have drastically increased over the last three decades (

Figure 2). Notably, the growth in the export volume was faster than the export value. To confirm this fact, the growth rate of the unit export price has been much more rapid than the growth rate of the export volume, indicating that

sake is becoming increasingly expensive in the overseas market. According to the Japanese National Tax Administration Agency [

1], the average export unit price was JPY 1323, almost double the average domestic price of JPY 736.

One possible factor contributing to this development is the inclusion of Japanese cuisine on UNESCO’s Intangible Cultural Heritage List in 2013. People outside Japan have become aware of traditional Japanese cuisine,

washoku, especially since it was included in the 2013 Intangible Cultural Heritage List of the United Nations Educational, Scientific and Cultural Organization (UNESCO). Shinato and Kato [

2] argue that the Japanese government began promoting

sake after the UNESCO registration. Kishi [

3] notes that the number of restaurants serving Japanese food worldwide doubled after the UNESCO registration. According to the Japan External Trade Organization (JETRO) [

4], in the past, only a few restaurants in China served Japanese cuisine; however, since the UNESCO registration and the economic boom due to the Beijing Olympics in 2008, the number of Japanese restaurants reached 900 in Shanghai and 500 in Beijing. Moreover, according to JETRO [

5], the consumption of cheap

sake in Taiwan, formerly from major affiliated companies, has risen since 2015 as more department stores and specialty shops offer high-end

sake. The UNESCO registration might also significantly impact the North American market, where Japanese cuisine rapidly spread in the 2010s. Fujishiro [

6] argues that the number of restaurants providing

washoku tripled after the UNESCO registration.

Another factor in export growth is the widening price gap between the domestic and overseas markets. Japan suffered from stagnation and deflation for the last three decades, while other countries experienced inflation during the same period. Furthermore, the depreciation of the JPY since the beginning of the Quantitative and Qualitative Easing (QQE) policy by the Bank of Japan in 2013 also contributed to this trend. As a result, the price gap in alcoholic beverages between Japan and other countries has been widening, which helps the sale of sake in overseas markets.

In any case, the future is not a simple continuation of the past. Therefore, it is essential to understand what factors determine the trend of

sake export (shown in

Figure 2) so that Japanese

sake breweries can sustain the current upward trend of

sake export. To our knowledge, no previous studies have examined

sake export. Our study conducts a panel data regression analysis of

sake exports to Japan’s major trade partners and investigates the influences of socio-economic variables upon

sake exports.

Although we could not find any previous studies on

sake exports, there are several studies on the export of other alcohol beverages in the literature. For example, Bouët et al. [

7] showed that income elasticity of demand had a significant impact on Cognac export. Furthermore, Bargain [

8] found that the income and price effects of French wine export to China differed according to the wine-growing regions in France. Cardebat and Figuet [

9] argued that the appreciation of the Euro increased the share of premium wines in French wine exports. Candau [

10] found that there were some differences in wine export by transportation. Capitello [

11] showed price elasticities differed by kinds of imported wine in the Chinese market. Fontagné [

12] implied that unit value had significant impact on the determinants of high-quality wines in European Market. Following the above studies on alcoholic beverages, we adopt a log–log model specification for the key variables in the panel data regression model. The number of countries in the panel data is relatively small (we have only five countries, as described in

Section 2); therefore, we apply hierarchical Bayesian modeling to the panel data regression model and estimate it with an efficient Markov chain Monte Carlo (MCMC) method called an ancillary-sufficiency interweaving strategy (ASIS) to improve the sampling efficiency of MCMC. In the next section, we will describe the data used in the analysis and elaborate on the estimation procedure. In sum, our modeling and estimation will be performed in the following process:

This paper is organized as follows.

Section 2 presents the datasets for our empirical research and explains the estimation procedure.

Section 3 shows the estimation results of panel data regression models for volume and unit value

sake exports; we also discuss their implications and how socio-economic variables influence

sake exports. However, it can be argued that these analyses are insufficient when the industrial structure of the

sake industry is taken into account because the industrial structure of the

sake industry differs significantly between certain region and others. The main region is called

Nada. The

Nada region is good for obtaining water suitable for

sake brewing, and its location near the port is advantageous for the distribution of

sake. So from the 18th century,

Nada has been the center of

sake brewing. As a result, in the

Nada region, an agglomeration of breweries occurred and large companies were set up to produce large volumes of

sake. In contrast, the other areas still have breweries which belong to small and medium enterprises. So in

Section 4, we explore possible export structure heterogeneity between

Nada, Japan’s central

sake brewing region, and the rest of the country. Finally,

Section 5 summarizes our research findings and draws a conclusion.

3. Hypotheses and Estimation Results

We consider the following hypotheses following the previous studies.

Hypothesis 1 (H1). The trend of sake export may exhibit heterogeneity among countries as demonstrated for other alcoholic beverages.

Hypothesis 2 (H2). , and may significantly impact sake exports. According to previous studies (Bargain [8] and Bouët [7]), Unit may negatively affect sake exports. Hypothesis 3 (H3). Seasonal effects may exist.

H1 and H2 seem legitimate in light of the previous studies but we may need to elaborate on H3. Traditional

sake brewing methods require sensitive temperature control (See more details on Saito and Nakatsuma [

23]). Without any modern temperature management equipment, it is impossible to brew

sake for all seasons, especially during a hot summer. For this reason, most

sake breweries start brewing in late autumn. This timing is also related to the harvest time of rice, the key material for

sake, which is harvested in autumn, too. Moreover, unlike wine,

sake is a fermented alcoholic beverage. So the longer it is brewed, the more its quality deteriorates, albeit gradually. This nature of

sake puts pressure on breweries to sell off

sake brewed during the winter by the next summer. Thus, we expect seasonal fluctuations in

sake exports due to supply-side constraints of

sake brewing.

3.1. Estimation Results of Export Volumes

Table 3 shows the estimation results of the panel data regression model in Equation (

1). In

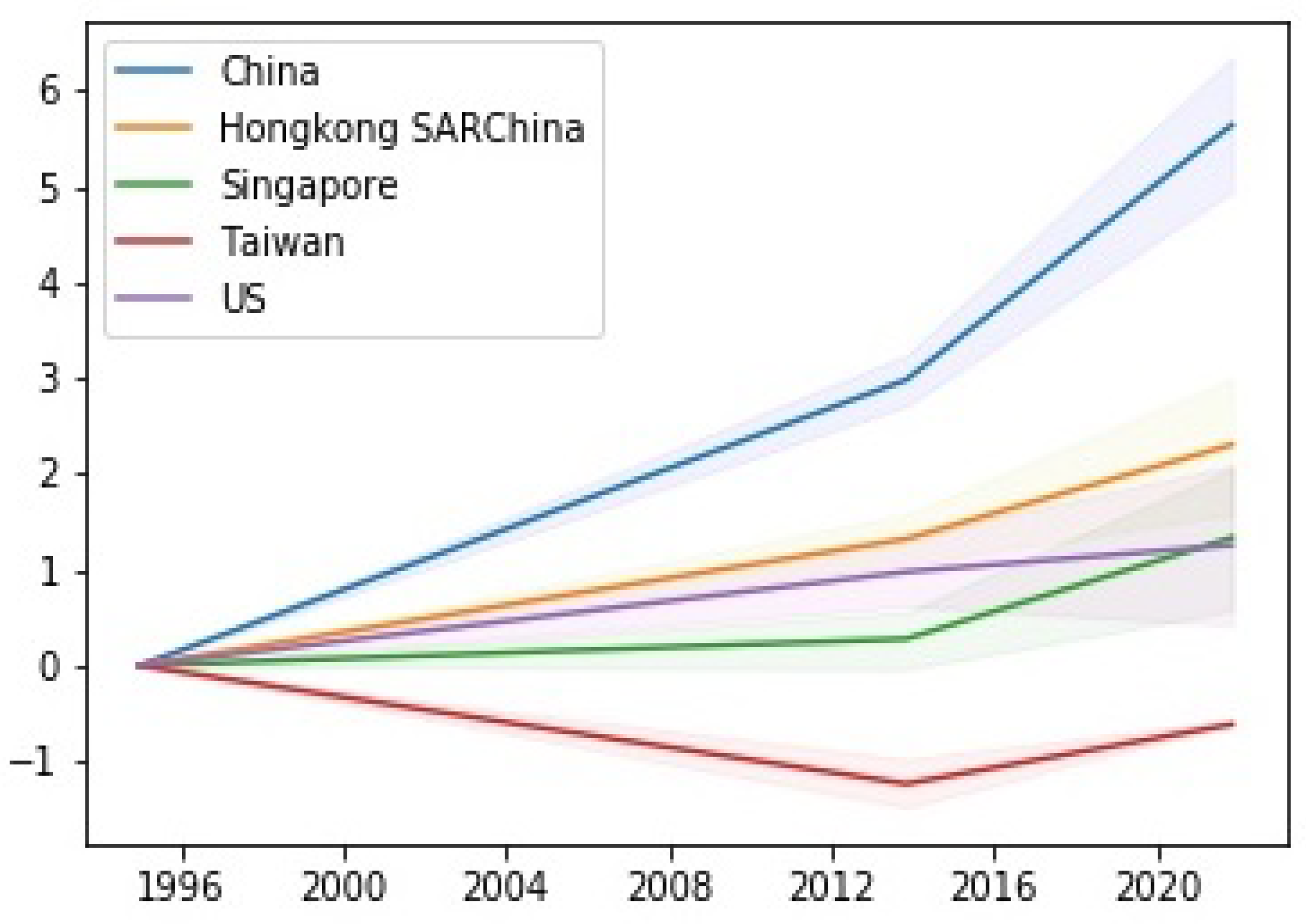

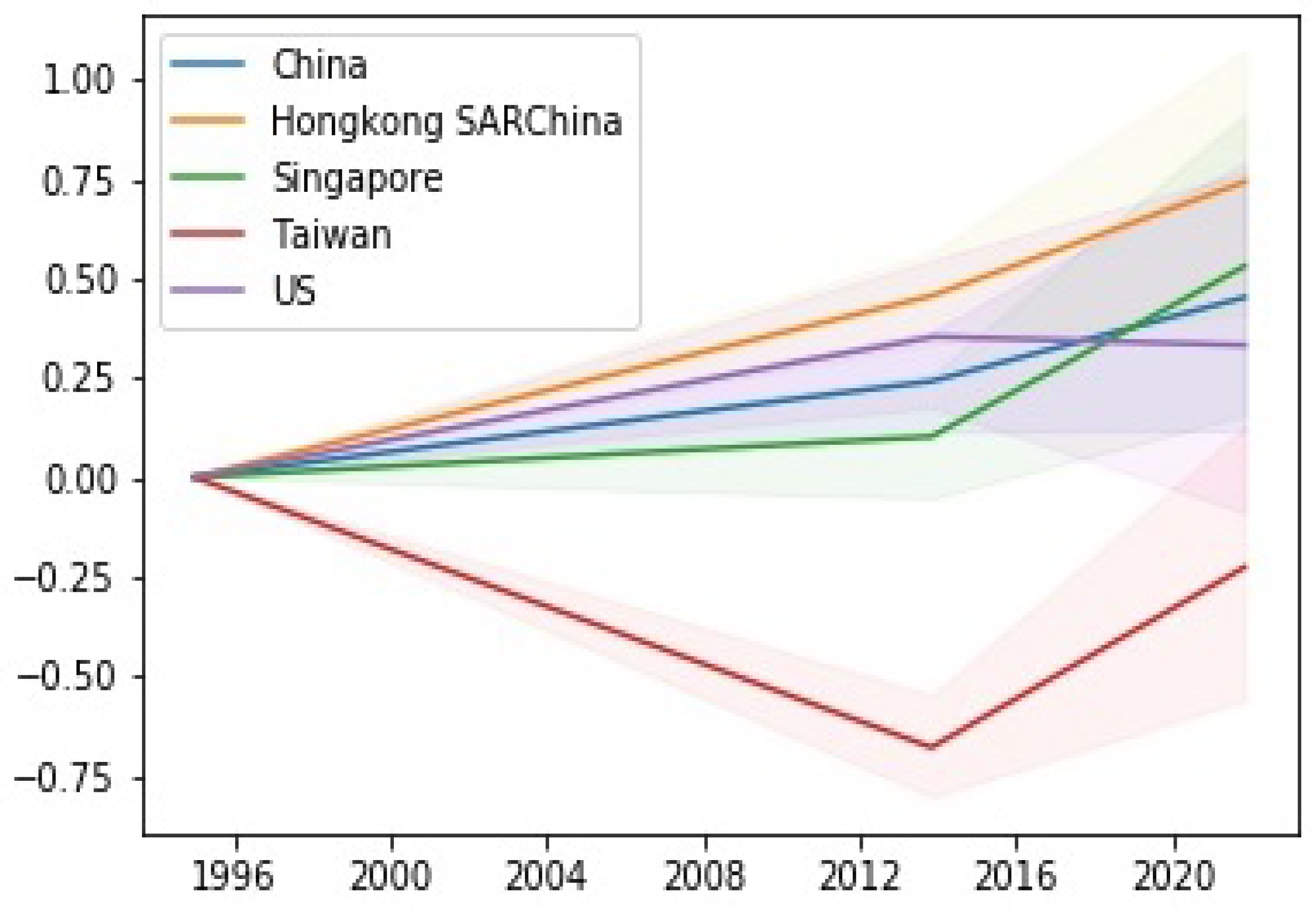

Table 3, Intercept (I) and Intercept (II) represent the country-specific intercepts (constant terms) in the panel data regression model, respectively. Slope (I) and Slope (II) represent the country-specific slope of the time trend, respectively. Then we illustrated Slope (II) in

Figure 3. Finally, Intercept (II, UNESCO) and Slope (II, UNESCO) represent the country-specific coefficient of the UNESCO registration dummy variable and the UNESCO registration time trend, respectively (In this section, “Hong Kong” is the abbreviation of “Hong Kong SAR China” in tables and sentences).

In

Table 3 and

Figure 3, the number without parentheses is the mean of the posterior distribution of each coefficient; the number within parentheses is the standard deviation of the corresponding posterior distribution. The double asterisk indicates that the 95% interval of the posterior distribution of the corresponding coefficient does not include zero. Following the convention, we conclude that the coefficient is “significant” if its 95% interval does not include zero. We follow the same rules for all tables and figures below. The notation

implies the coefficient is “significant” in 95% levels in the all following tables.

In

Table 3, Intercept (I) is significant for Hong Kong and Taiwan, while Intercept (II) is insignificant for any country. Intercept (II, UNESCO) is significantly negative for Hong Kong.

The export volume on the left-hand side of Equation (

1) is in the natural logarithm; therefore, the slope of the trend can be interpreted as the growth rate of

sake export to the corresponding country. In

Table 3, Slope (I) is significant for all five countries; it is significantly positive except for Taiwan, and it is highest for China. This result may reflect a steady growth of

sake exports to China during the sample period. Slope (II) shows a similar pattern, though it is insignificant for Singapore.

Note that Slope (II) is the growth rate of

sake export before the UNESCO registration of Japanese cuisine in 2013 while the sum of Slope (II) and Slope (II, UNESCO) is the growth rate after the UNESCO registration. Thus, Slope (II, UNESCO) indicates a change in the growth rate of

sake exports after the UNESCO registration. It is graphically illustrated in

Figure 3. It is significantly positive for four countries except for the US. This result indicates that the UNESCO registration might accelerate the growth of

sake exports to these four countries. Unsurprisingly, the UNESCO registration boosted

sake exports to countries like China and Hong Kong where

sake exports were already thriving. As we mentioned in

Section 1, the rapid increase in Japanese restaurants in China after the UNESCO registration had a significant impact on the increase in

sake export volume in the Chinese market. For Singapore and Taiwan, the impacts were more dramatic. Before the UNESCO registration, the growth rate of

sake export to Singapore was virtually zero and it was negative for Taiwan. From the estimation results in

Table 3, the growth trend of

sake exports to Singapore increased after the UNESCO registration. At the same time, the downward trend of the growth rate of export to Taiwan was clearly changed positive. This result is also consistent with the cases we have described in

Section 1. It is considered that after the UNESCO registration, more premium

sake has been exported to Taiwan. Conversely, the insignificant Slope (II, UNESCO) for the US may need some explanation. We conjecture that Japanese cuisine was already popular in the US before the UNESCO registration; therefore, it could not contribute so much to accelerating the growth of

sake exports. Overall, the results in

Table 4 show significant heterogeneity in

sake exports among the countries, which supports H1.

3.2. Estimation Results of Export Unit Values

Next, we examine the impacts of economic variables upon

sake exports with the estimation results in

Table 4. For both Model I and Model II,

Unit and

CPI are significant and their signs are consistent with the conventional wisdom in economics. As for

NER, it is insignificant in Model II; thus, we can support H2 completely in Model I, but only partially in Model II. Arguably, the trend shift due to the UNESCO registration confounded the effect of exchange rate fluctuations because the UNESCO registration and the QQE, which caused a sharp depreciation of the JPY, occurred in the same year.

The posterior statistics in

Table 5 indicate the monthly seasonal effects in

sake exports. Note that the base month is January. For both Models I and Model II, exports are significantly positive from October to April. The numbers from October to December may be related to the fact that

sake breweries start brewing in October, which means they start exporting freshly brewed

sake during this period. The period from February to April may be related to

sake contests. Many

sake breweries regularly participate in contests regarding the quality of premium

sake. If they are successful, it will be an excellent boon for marketing; hence, winning the contest is their top priority. However, brewing premium

sake is labor-intensive and hinders daily brewing operations. Since breweries start preparing for the contest in January, their daily operation will slow down. Only after they finish brewing premium

sake for the contest can breweries start exporting new

sake again. As a result, we observe seasonal fluctuations shown in

Table 5.

In addition to the volume of

sake export, we estimated panel data regression models of the unit value of

sake export. Using the unit value of

sake export as the dependent variable in Models I and II, we computed the posterior statistics of the parameters in Equation (

1). They are shown in

Table 6 and

Table 7.

In

Table 6, Intercept (I) and Intercept (II) are significantly negative for all countries. As for Intercept (II, UNESCO), it is significant for Hong Kong (significantly negative) and Taiwan (significantly positive).

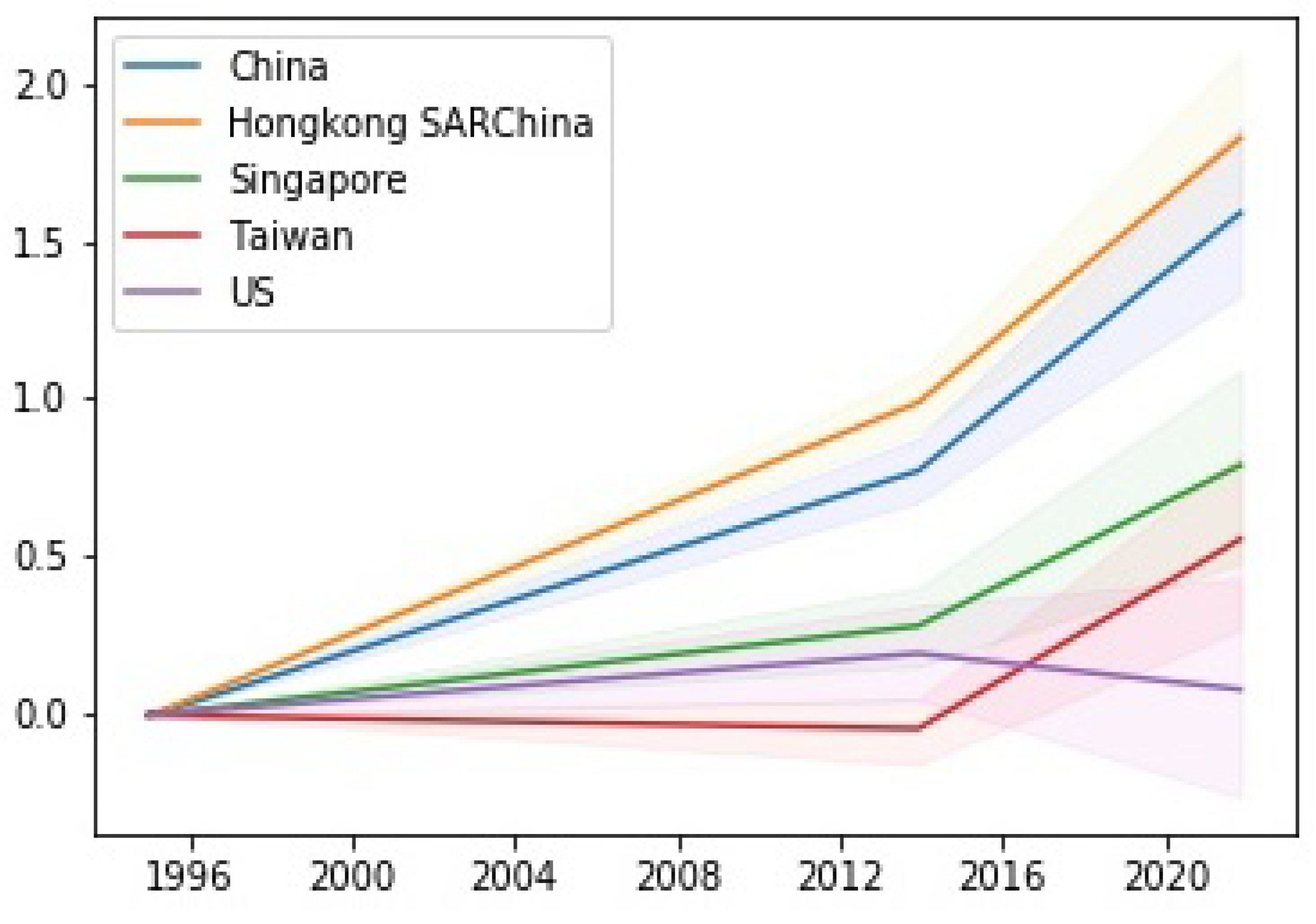

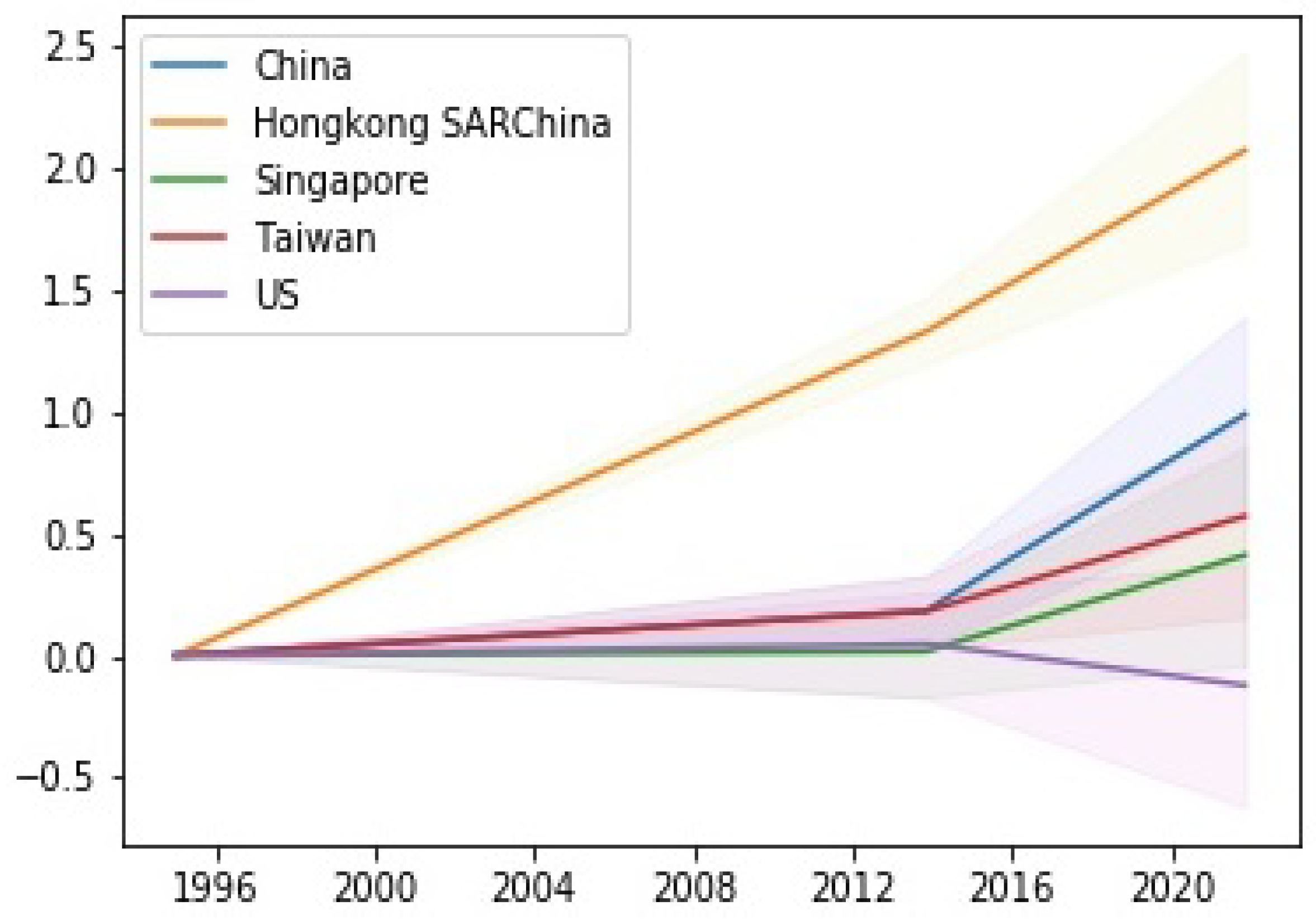

As shown, China and Hong Kong move in a similar direction. Slope (I), Slope (II) and Slope (II, UNESCO) in

Table 6 are all significantly positive for China and Hong Kong. This result indicates that the unit value of imported

sake has been rising for these countries, which is consistent with the rapid growth of the Chinese economy during the sample period. The economic growth made the people wealthier and higher-grade

sake became more affordable for them. Notably, the rise in the unit value was accelerated by the UNESCO registration for these countries as is shown in

Figure 4.

We may put Singapore and Taiwan into another category. In

Table 6, Slope (I) for Singapore and Taiwan is significantly positive, as is China and Hong Kong; thus, the same factor, economic growth, played the same role in making more expensive

sake affordable. Conversely, if we look into Slope (II) and Slope (II, UNESCO), we obtain a slightly different perspective on the unit value of imported

sake in these countries. Before the UNESCO registration, Slope (II) was insignificant for Singapore and it is even significantly negative for Taiwan; therefore, we may conclude that they preferred less expensive

sake during that period. After the UNESCO registration, on the other hand, Slope (II, UNESCO) was significantly positive for both Singapore and Taiwan and the absolute value of the coefficient was comparable to that of China and Hong Kong. This trend may imply that the people in Singapore and Taiwan started to accept higher-grade

sake after the UNESCO registration.

Consumer preference in the US seems different from that of Asian countries. Slope (I) is insignificant and the posterior mean is virtually zero for the US, meaning that the unit value of imported sake remains unchanged in the sample period. Furthermore, Slope (II) is significantly positive but Slope (II, UNESCO) is significantly negative, which implies that the upward trend in the unit value was reversed after the UNESCO registration. This seemingly confusing result may be explained by the fact that, in the US, the UNESCO registration increased the number of Japanese restaurants. This increase led to a surge in the volume of sake exports, possibly resulting in a decline in the unit value.

In

Table 7, both

CPI and

NER are significantly positive in Model I, but

is not significant in Model II. This result is the same as the volume regression in

Table 4.

In

Table 8, the unit value is higher after June. This is probably due to the fact that

sake breweries are unable to ship more expensive

sake until June when contests on premium

sake finish and breweries can start exporting.

From these analyses, we can argue three facts. Firstly, China and Hong Kong were originally on a growth trend in terms of both volumes and unit values, but the UNESCO registration has further accelerated their growth. Secondly, it can be said that Singapore originally had a near-constant growth rate, but the UNESCO registration accelerated the growth of the sake export at a rapid increase, both with regard to volume and unit value. And it was also confirmed that although Taiwan’s growth rate had been on a downward trend in terms of both volume and unit value, the growth rate has turned to an upward trend since the UNESCO registration. So the registration had great impact on export growth in Taiwan. Finally, the UNESCO registration did not have significant effects on sake exports to the US. So we confirmed some heterogeneity in the growth rates of sake exports.

4. Extension: Differences between Traditional Sake Brewing Region Nada and the Others

So far we have used export data on the overall

sake brewing industry. The

sake brewing industry’s structure differs significantly in

Nada compared to the rest of Japan. The

Nada region has played a significant role in the Japanese

sake brewing industry. Akiyama [

24] stated that, in the Edo period (1603–1868),

Nada was a region blessed with good quality rice and water suitable for

sake brewing, as well as good maritime transportation. This led to an industrial agglomeration of

sake breweries in the

Nada region which has had a significant impact on the

sake brewing industry even today. The Japanese National Tax Agency reports that almost half of the

sake consumed in the domestic market is brewed by breweries in the

Nada region. So it is safe to say that large-scale

sake breweries, which are called major

sake companies, are almost exclusively concentrated in this region.

To examine any differences between

sake breweries in the

Nada region and the rest of Japan, we first estimated panel data regression models of the volume of

sake export from the

Nada region (We substituted

in Equation (

1) for the export volume or unit value of

Nada and

for the unit value of

Nada). Data on

sake exported from Kobe Customs is used as a proxy variable for

sake exported from the

Nada region because

sake from

Nada is mostly exported from Kobe (represented by Kobe Customs reports).

4.1. Estimation Results of Export Volumes in Nada

Compared to the results in

Table 3, we do not see any notable differences among the intercept estimates in

Table 9, except that Intercept (I) is insignificant and Intercept (II) is significantly negative for all countries. As for the slope of the trend, Slope (I) is no longer significant for Singapore and Taiwan and Slope (II, UNESCO) is not significant for Hong Kong. We can also identify these facts from

Figure 5. All in all, the

sake exported from

Nada follows a trend similar to the whole country.

Table 10 presents the posterior statistics of coefficients of economic variables. They are comparable to the results in

Table 4. Monthly seasonal effects in

Table 11 show a one-month lag to the whole country as shown in

Table 5. While the seasonal upward movement in export shipments begins in October for the whole country, it starts in November for the

Nada region because the

Nada region has older breweries that start brewing later. A milder climate in this region also causes the arrival of winter behind much cooler regions (The

Nada region is located in a warmer southern part of Japan, while most other

sake brewing regions are located in a much cooler northern part of Japan). As a result, breweries in the

Nada region must delay the starting date of

sake brewing until the temperature becomes sufficiently low.

4.2. Estimation Results of Export Unit Values in Nada

Next, we estimated panel data regression models of the unit value of

sake exports from the

Nada region. The posterior statistics on trends, coefficients of economic variables, and monthly seasonal effects are shown in

Table 12,

Table 13 and

Table 14,

Figure 6, respectively. As for the trend and the impacts of economic variables, we see no clear differences between the

Nada region and the whole country. As for the monthly seasonal effects, they almost disappear except for June (Model I and II) and August (Model I). This is because

sake breweries in the

Nada region tend to prioritize quantity over quality. They do not differentiate their products so much and tend to prioritize the stable supply of their products with fixed prices throughout the year. Unlike small and medium-sized enterprises (SMEs), large breweries do not emphasize entering their products into competition as do small and medium-sized companies, but rather focus on producing inexpensive products with a high degree of productivity.

4.3. Estimation Results of Export Volumes in the Other Area

For the last empirical analysis in this section, we estimated panel data regression models for

sake exports from the other regions in Japan. While we have just analyzed

sake exports by large firms in the

Nada region, it would be fair to say that it is an analysis of small and medium-sized enterprises (SMEs) in the

sake brewing industry since large firms are concentrated in the

Nada region. The posterior statistics of trends, coefficients of economic variables and monthly seasonal effects in the volume model are shown in

Table 15,

Table 16 and

Table 17 while the corresponding posterior statistics in the unit value model are shown in

Table 18,

Table 19 and

Table 20.

The results of the volume model in

Table 15 and

Figure 7 are comparable to those in

Table 3 and

Figure 3, though they show that SMEs are more successful in exporting

sake to Singapore and Taiwan because the trends of these countries in

Table 15 are steeper than

Table 3.

As for economic variables,

NER is insignificant for both models in

Table 16. This indicates that the impact of exchange rate fluctuations upon the

sake exports by SMEs were ambiguous in the sample period.

The seasonal effects are shown in

Table 17. This finding is consistent with our conjecture on why seasonal fluctuations appear in

sake exports. If the monthly seasonal effects in

sake exports are mainly caused by supply-side constraints, they must be more evident for SMEs that lack resources for production and less evident for large firms that have plenty of resources. Thus, the difference in seasonal fluctuations between the

Nada region and the other regions reinforces our conjecture.

4.4. Estimation Results of Export Unit Values in the Other Area

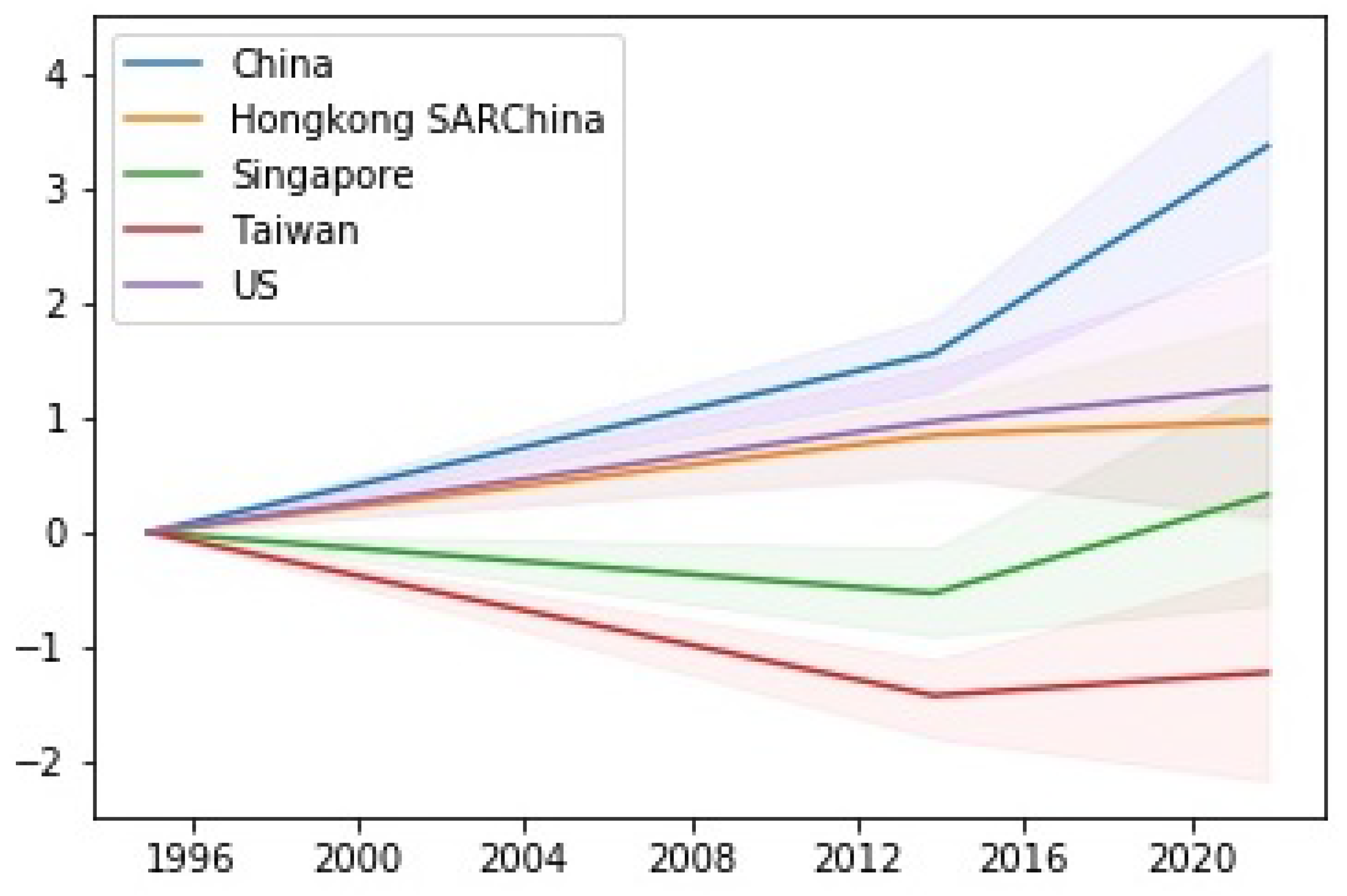

As for the unit value model, trends of

sake exports by SMEs are close to those of the whole country as shown in

Table 18 and

Figure 8. It can be seen that

sake has become more upscale since the UNESCO registration in all countries except the United States.

It should be noted that

sake brewed by SMEs is not affected by the exchange rate in terms of volume in

Table 16, but in terms of unit value in

Table 19. Exchange rates have a positive impact on both Model I and Model II. This may indicate that there is still room for price hikes and upscaling with regard to products exported by SMEs.

As for the monthly seasonal effects in the unit value model, compared to breweries in the Nada region, they tend to export high-end sake at different times of the year. March, April, and July have a higher impact than January. This is because, after finishing brewing sake for the competition in January, SMEs start entering their sake in the various competitions in February. The results of the competitions are often available between March and July, depending on the type of competition. If a product wins an award at this time, it sells at a higher price as an award-winning product, and this activity is likely to have an impact. Unit values will rise again from early fall onward for the same reasons as the whole country.

Based on findings in this study, it is now clear that there are significant differences in export activities between regions when it comes to sake. It can be said that this study showed the heterogeneity between two types of regions in Japan. For instance, there are some differences between volume trends. Large companies in Nada had a larger impact on the Chinese market than SMEs in the other areas while there is a reverse result in Hong Kong. In unit value trends, large companies made a great recovery in Taiwan market after the UNESCO registration. For the macroeconomic effect, the unit value of SMEs are supported by QQE because it has a significant impact. In the last section, from differences of monthly effects, we can argue that in regions like Nada with a high concentration of large companies and capital, priority is given to brewing stable quantities rather than raising prices, whereas in regions occupied largely by SMEs, brewing high value-added products is required because of the consideration for winning prizes such as Annual Japan Sake Awards.

5. Conclusions

In recent years, sake has been actively exported overseas; however, extant research has not investigated the factors involved. This study analyzed the unbalanced panel of each country using hierarchical Bayesian modeling. As a result, it was confirmed that the registration of Japanese cuisine as an intangible cultural heritage by UNESCO significantly impacted sake exports to some countries. We also confirmed that shipment volume and unit price were related to prices in each country. Furthermore, shipment volume and unit price may differ depending on the season. Additionally, when the data were analyzed separately by company size, it was confirmed that there was little reaction to the unit price in regions with a high concentration of large companies, while in regions with scattered small and medium-sized companies, the unit price was greatly affected by the exchange rate. Our studies can provide some implications for sake breweries and Japanese governments. Overall, the UNESCO registration has boosted exports, especially in China and Hong Kong, which are expected to develop more than ever before. Taiwan and Singapore are the second most attractive markets after China and Hong Kong, given that their growth trends, which were previously negative or close to zero, have improved since UNESCO registration. On the other hand, the export market in the USA is now showing a certain degree of maturity. For the Japanese government, it should be noted that their QQE had a positive impact on exports of SMEs. For large companies, the Japanese government should support them in Taiwan and Singapore, which have still negative trends after the UNESCO registration. Sake exports will continue to grow, and the Japanese government has also made it clear since preparing the 2020 budget that it will invest massive subsidies in sake exports. We hope our research will help businesses currently exporting or considering exporting in the future and the governments supporting them.