Quantum Computation of the Cobb–Douglas Utility Function via the 2D Clairaut Differential Equation

Abstract

1. Introduction

- Our method is grounded in the Clairaut differential equation, a general framework for describing function envelopes. This foundation is independent of specific functional forms or parameter values, providing a robust basis for analyzing tangency relationships between curves. The method for obtaining tangent points, intercepts, and the associated probabilities is derived from the general solution of the Clairaut equation, thus applying universally to any parameter set.

- Our mapping of economic concepts to the quantum realm relies on interpreting probabilities through the canonical budget equations and the geometric properties of envelopes. This translation is independent of specific Cobb–Douglas parameters. We demonstrate how key geometric features, such as intercepts and tangency points (which are parameter dependent), can be mapped to probabilities within this quantum framework. Consequently, our calculations are applicable to any parameterization of the Cobb–Douglas utility function.

- The homogeneity of the Cobb–Douglas function allows for rescaling the budget and parameters without affecting the core results. Our analysis utilizes normalized quantities that remain invariant under such rescaling, ensuring that our findings are representative beyond the specific values used for demonstration. Furthermore, our method emphasizes the structural properties of the utility function and budget constraint, particularly the tangency relationships captured by the Clairaut equation. The focus is on general characteristics, like the interplay between prices, income, and consumption choices, rather than specific numerical values.

- While the Cobb–Douglas function serves as a useful example, it is well established in econometrics and captures essential behaviors in consumer and production theory. Our methodology extends to a broader class of concave, well-behaved utility and production functions. The underlying economic concepts (e.g., tangency of indifference curves and budget constraints, elasticity, and marginal rates of substitution) can be represented within our quantum formalism, further supporting the general applicability of our approach.

- This paper presents an initial instantiation of our method. Future work will explore a wider range of parameters and functional forms through further simulations and empirical analysis, providing additional validation of its generality and robustness.

2. Simulation and Methods

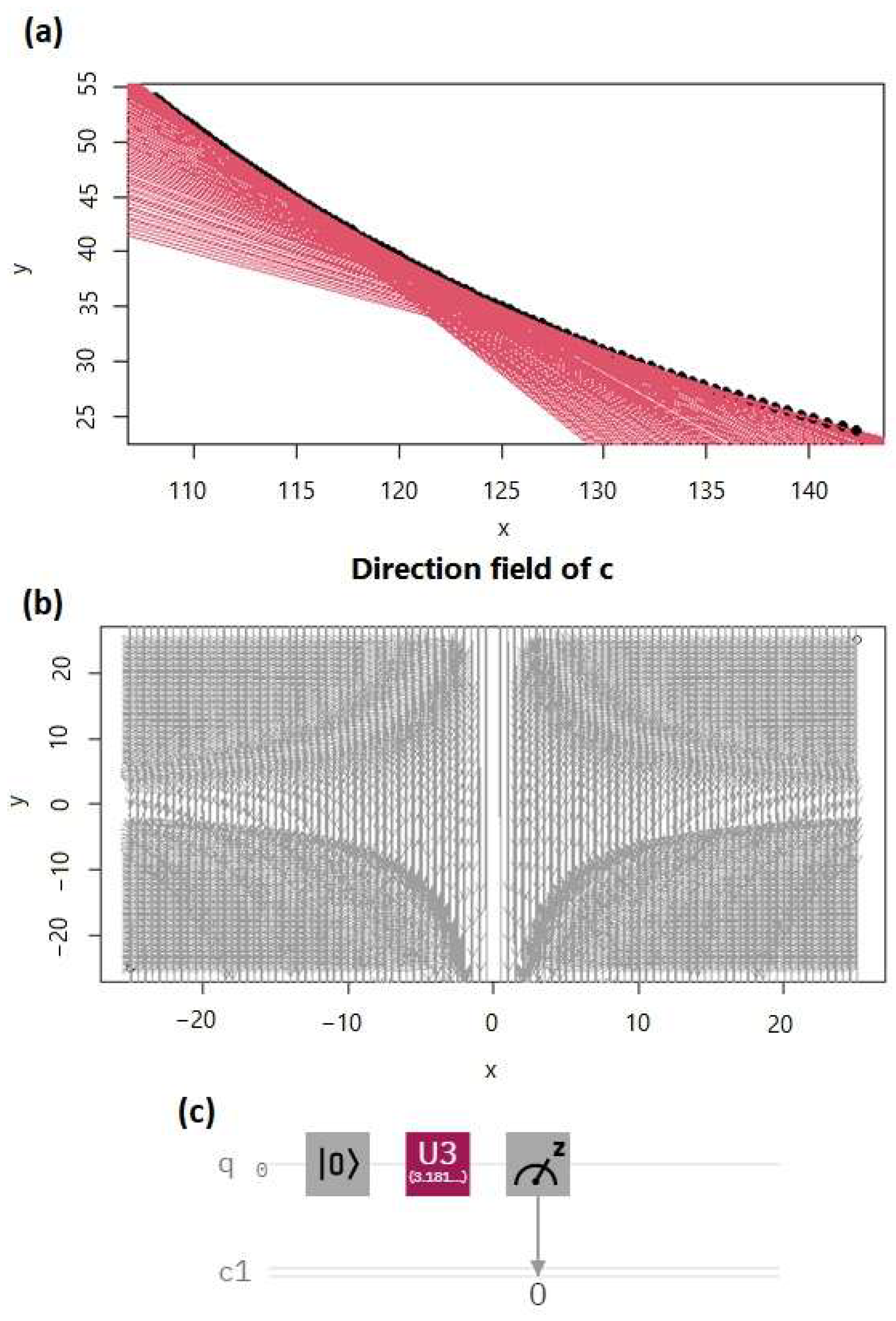

Envelopes of the Cobb–Douglas Function

3. Results and Discussion

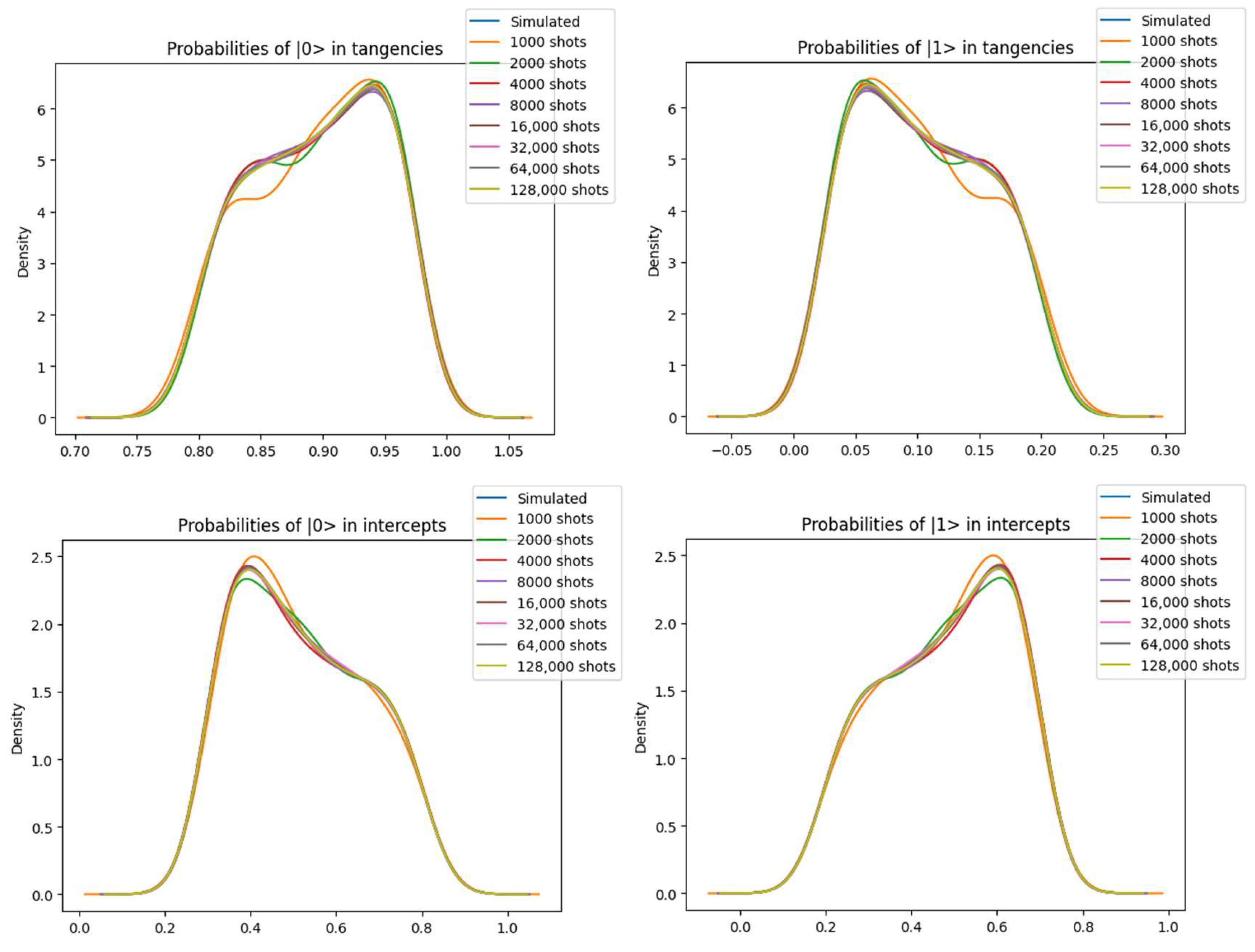

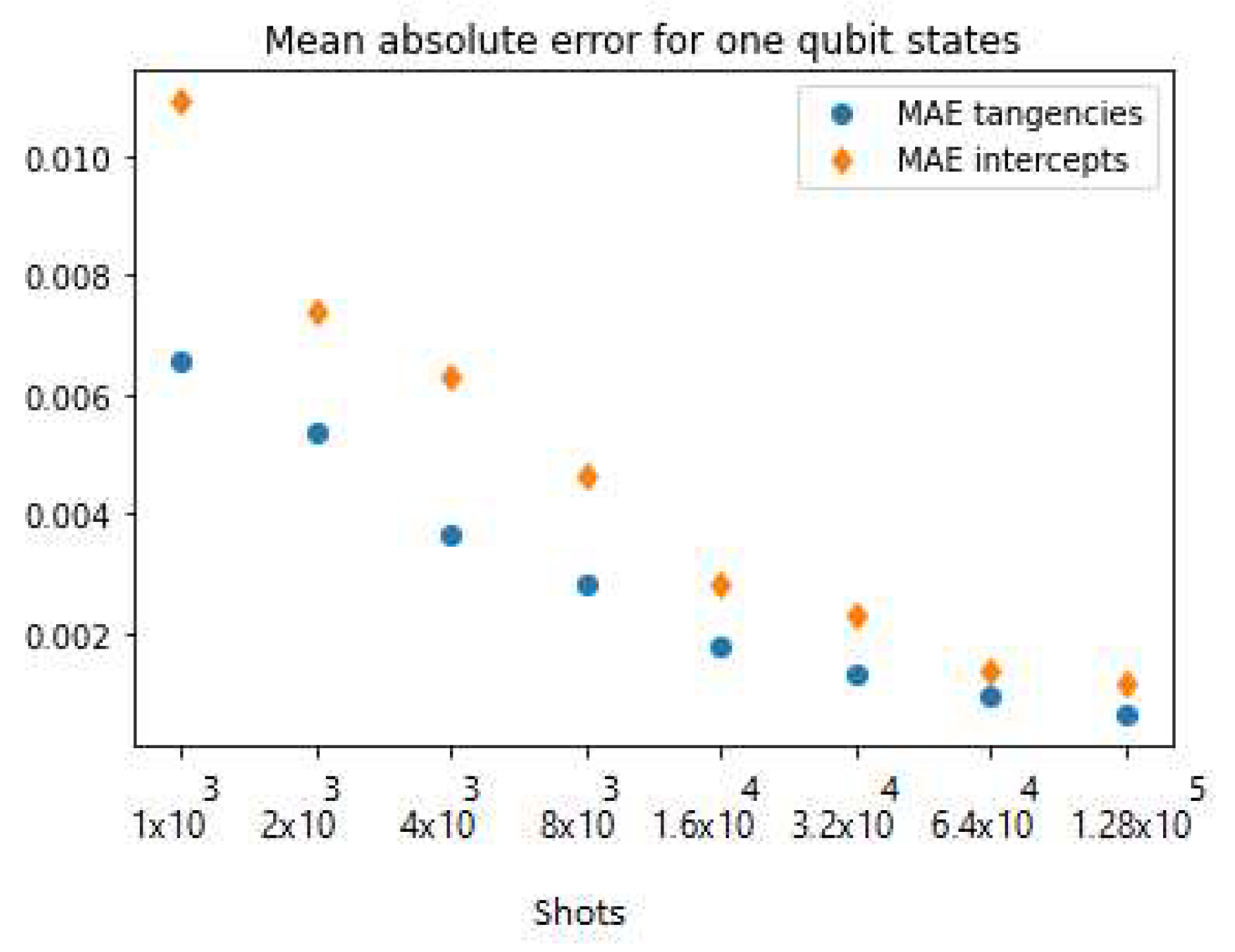

3.1. Calculation of the Probabilities of the Cobb–Douglas Function for a Qubit (q0)

3.2. Scaling Economic Parameters and Its Implications in the Quantum Circuit

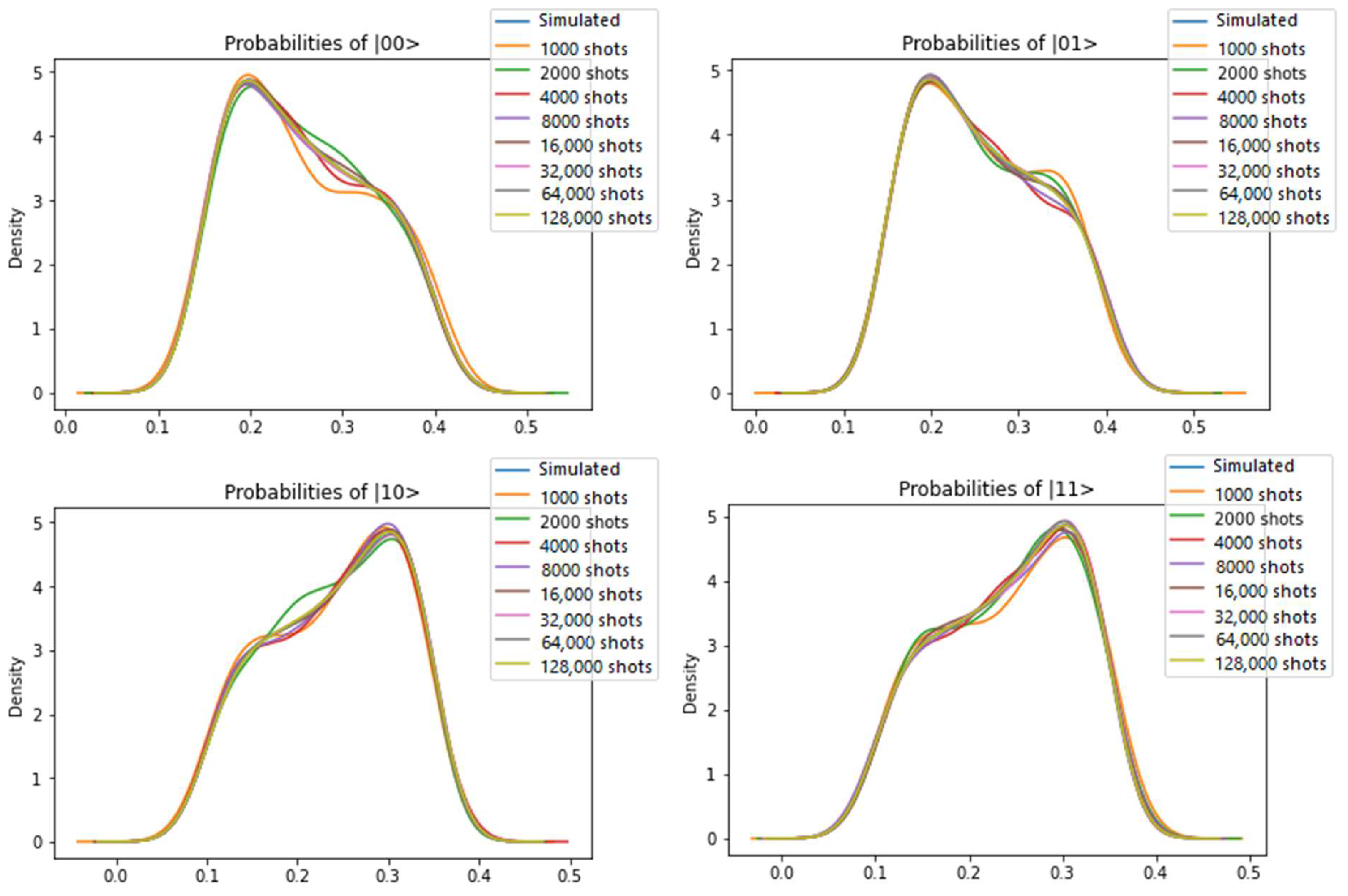

3.3. Calculation of the Probabilities of the Cobb–Douglas Function for Two Qubits (q0 and q1)

4. Comparative Analysis

- Entanglement as a novel tool: The ability to represent economic choices through quantum entanglement is not possible with conventional solutions. This could lead to new insights into complex economic behaviors.

- Simulation of trade-offs: Quantum mechanics allows for the direct simulation of trade-offs between goods as quantum probabilities within the budget constraint, which has a clear physical interpretation in our model. This provides a more explicit way of modeling the economic trade-offs.

- Probabilistic nature: The quantum approach allows the system to work with probabilities between combinations of goods, and this allows for a better approach to the system, where probabilities play a crucial role.

- Non-linearity: The model represents the non-linearity of economic phenomena through its mathematical construction.

- Resource intensive: Current quantum computing hardware still presents limits and requires the use of specific platforms (such as IBM-Q). This makes it still a non-conventional approach for modeling utility.

- Practicality on large scales: While our model presents a quantum computation of utility for two types of goods, real economics studies involve very large scales of goods, and it is not clear how to extend the model for this kind of analysis.

- Interpretation of quantum probability: While our probabilities have an economic meaning, further study in the subject is needed, since there is still no consensus on interpreting quantum probability.

- Conventional solution advantages: direct and computationally less intensive than quantum approaches for optimization and elasticity calculations;

- Conventional solution limitations: lacks the capability to explicitly model entanglement or probabilistic nature through quantum mechanisms and lacks an underlying physical approach.

5. Conclusions

- Verify the general nature of the system by showing explicit numerical calculations using an example;

- Conduct simulations on the IBM-Q quantum platform, which requires a well-defined initial setup; this concrete example served as a crucial validation point for our proposed approach and the associated interpretations.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Bertoldo, F.; Ali, S.; Manti, S.; Thygesen, K.S. Quantum point defects in 2D materials—The QPOD database. npj Comput. Mater. 2022, 8, 56. [Google Scholar] [CrossRef]

- Moussa, C.; Wang, H.; Bäck, T.; Dunjko, V. Unsupervised strategies for identifying optimal parameters in Quantum Approximate Optimization Algorithm. EPJ Quantum Technol. 2022, 9, 11. [Google Scholar] [CrossRef]

- Baranes, G.; Ruimy, R.; Gorlach, A.; Kaminer, I. Free electrons can induce entanglement between photons. npj Quantum Inf. 2022, 8, 32. [Google Scholar] [CrossRef]

- Ji, X.; Liu, J.; He, J.; Wang, R.N.; Qiu, Z.; Riemensberger, J.; Kippenberg, T.J. Compact, spatial-mode-interaction-free, ultralow-loss, nonlinear photonic integrated circuits. Commun. Phys. 2022, 5, 84. [Google Scholar] [CrossRef]

- Robson, B.; St. Clair, J. Principles of Quantum Mechanics for Artificial Intelligence in medicine. Discussion with reference to the Quantum Universal Exchange Language (Q-UEL). Comput. Biol. Med. 2022, 143, 105323. [Google Scholar] [CrossRef] [PubMed]

- Chakraborti, A.; Toke, I.M.; Patriarca, M.; Abergel, F. Econophysics review: I. Empirical facts. Quant. Financ. 2011, 11, 991–1012. [Google Scholar] [CrossRef]

- Mimkes, J. Introduction to macro-econophysics and finance. Contin. Mech. Thermodyn. 2011, 24, 731–737. [Google Scholar] [CrossRef]

- Adekanye, T.; Oni, K.C. Comparative energy use in cassava production under different farming technologies in Kwara State of Nigeria. Environ. Sustain. Indic. 2022, 14, 100173. [Google Scholar] [CrossRef]

- Koengkan, M.; Fuinhas, J.A.; Kazemzadeh, E.; Osmani, F.; Alavijeh, N.K.; Auza, A.; Teixeira, M. Measuring the economic efficiency performance in Latin American and Caribbean countries: An empirical evidence from stochastic production frontier and data envelopment analysis. Int. Econ. 2022, 169, 43–54. [Google Scholar] [CrossRef]

- Sulvina, S.; Abidin, Z.; Supono, S. Production Analysis of Green Mussel (Perna viridis) in Lampung Province. e-J. Rekayasa Dan Teknol. Budid. Perair. 2020, 8, 975–983. [Google Scholar] [CrossRef]

- Mimkes, J. A thermodynamic formulation of economics. In Econophysics and Sociophysics: Trends and Perspectives; Wiley-VCH: Weinheim, Germany, 2006. [Google Scholar] [CrossRef]

- Piotrowski, E.W.; Sładkowski, J. Quantum bargaining games. Phys. A Stat. Mech. Its Appl. 2002, 308, 391–401. [Google Scholar] [CrossRef]

- Piotrowski, E.W.; Sładkowski, J. Quantum market games. Phys. A Stat. Mech. Its Appl. 2002, 312, 208–216. [Google Scholar] [CrossRef]

- Piotrowski, E.W.; Sładkowski, J. Quantum english auctions. Phys. A Stat. Mech. Its Appl. 2003, 318, 505–515. [Google Scholar] [CrossRef]

- Pawela, Ł.; Sładkowski, J. Quantum Prisoner’s Dilemma game on hypergraph networks. Phys. A Stat. Mech. Its Appl. 2013, 392, 910–917. [Google Scholar] [CrossRef]

- Guo, H.; Zhang, J.; Koehler, G.J. A survey of quantum games. Decis. Support Syst. 2008, 46, 318–332. [Google Scholar] [CrossRef]

- Betancur-Hinestroza, I.C.; Velásquez, E.A.; Caro-Lopera, F.J.; Bedoya-Calle, A. Quantum computation of the Cobb-Douglas utility function via the 2D-Clairaut differential equation. Mendeley Data 2024, V3. [Google Scholar] [CrossRef]

- Bedoya-Calle, A.H.; Betancur-Hinestroza, I.C. Software Quantum Cobb-Douglas Utility: Computo Cuántico de Cobb-Douglas vía Ecuación Diferencial 2d-Clairut; Universidad de Medellín Ciencia y Libertad: Medellín, Colombia, 2024. [Google Scholar]

- Python Software Foundation. Python [Computer Software], version 3.9.1; Python Software Foundation: Wilmington, DE, USA, 2020. Available online: https://www.python.org/ (accessed on 27 November 2024).

| Shots | Adj. R-Squared | Shapiro Test p-Value |

|---|---|---|

| 1000 | 0.89733 | 0.617 |

| 2000 | 0.9421404 | 0.94509 |

| 4000 | 0.9733892 | 0.01685 |

| 8000 | 0.990534 | 0.4303 |

| 16,000 | 0.9907311 | 0.26655 |

| 32,000 | 0.9975929 | 0.97063 |

| 64,000 | 0.9980706 | 0.18466 |

| 128,000 | 0.9992747 | 0.46226 |

| Shots | Adj. R-Squared | Shapiro Test p-Value |

|---|---|---|

| 1000 | 0.9286 | 0.00426 |

| 2000 | 0.96443 | 0.9448 |

| 4000 | 0.97499 | 0.2305 |

| 8000 | 0.9893 | 0.97277 |

| 16,000 | 0.99371 | 0.39113 |

| 32,000 | 0.99732 | 0.56521 |

| 64,000 | 0.99849 | 0.993 |

| 128,000 | 0.99904 | 0.60723 |

| Shots | p-Value |

|---|---|

| 1000 | 0.30218 |

| 2000 | 0.76605312 |

| 4000 | 0.69022570 |

| 8000 | 0.09531355 |

| 16,000 | 0.04844261 |

| 32,000 | 0.16528009 |

| 64,000 | 0.46010394 |

| 128,000 | 0.89546159 |

| Economic Concept | Quantum Circuit Analogue | Explanation |

|---|---|---|

| Cobb–Douglas utility function | Quantum state vector | |Ψ> |

| Goods x and y | Probabilities associated with qubits (|0⟩ and |1⟩) | The goods x and y can be related to the probabilities of quantum states. For instance, they could be associated with the probability of being in state |0⟩ (|α|2) and the probability of being in the state |1⟩ (|β|2). For example, the state ∣0⟩ may represent the exclusive consumption of good x, the state ∣1⟩ may represent the exclusive consumption of good y, and the superposition states (α∣0⟩ + β∣1⟩) reflect a probabilistic distribution of consumption between x and y. In this sense, the probabilities indicate how many units of good x or units of good y can be obtained. The goods x and y, in their quantum representation, utilize the properties of qubits to model probabilities and combinations of consumption. |

| Optimal consumption | Measurement outcome After unitary transformation | Optimal consumption, the most preferred consumption bundle within budget constraints, corresponds to the measurement outcome of qubits following the application of a unitary operator. This operator, U(θ, ϕ, λ), transforms the initial state to achieve optimal consumption. This transformation can be decomposed into simpler quantum gates. For example, U3. |

| Tangent of the utility curve | Entanglement of quantum states | The tangent of the utility curve with the budget constraint represents the optimal consumption equilibrium. In this sense, the consumption of one good is influenced or related to the consumption of the other, as spending on one good (e.g., good x) leaves a portion of the budget available for spending on the other good (e.g., good y). Similarly, the entanglement of quantum states in a circuit reflects the probabilistic correlation between multiple states of a quantum system. In economics, the tangent illustrates the best way to allocate the budget between x and y to maximize utility. It acts as a rule that links the two goods. In quantum mechanics, entanglement links two qubits, making what happens to one depend on the other. This connection is analogous to the tangent in economics; both concepts demonstrate the optimal way to interact or allocate resources. |

| Intercepts of the budget constraint | Probabilities at the extremes of quantum states | The intercepts of the budget constraint indicate the consumption limits dictated by the budget and prices. In quantum terms, the probabilities at the extremes of the states (e.g., 0⟩ or 1⟩) define the likelihood of finding the system in specific states, analogous to the definition of the limits of consumption possibilities. |

| Budget constraint | Normalization of quantum states | The budget constraint limits total spending to the available income, in the same way that the normalization condition in quantum mechanics ensures that the total probability across all states equals one. Both frameworks impose systemic limits on behaviors or states. |

| Changes in price | Modifications to unitary operator parameters | Changes in the relative prices of goods are reflected by modifying the parameters of the unitary operator, such as θ, ϕ, and λ. These parameters are directly related to the probability amplitudes and, thus, to the shape of the unitary gate, which transforms the initial state, so the optimal choice in the quantum circuit is modified, reflecting new market conditions. |

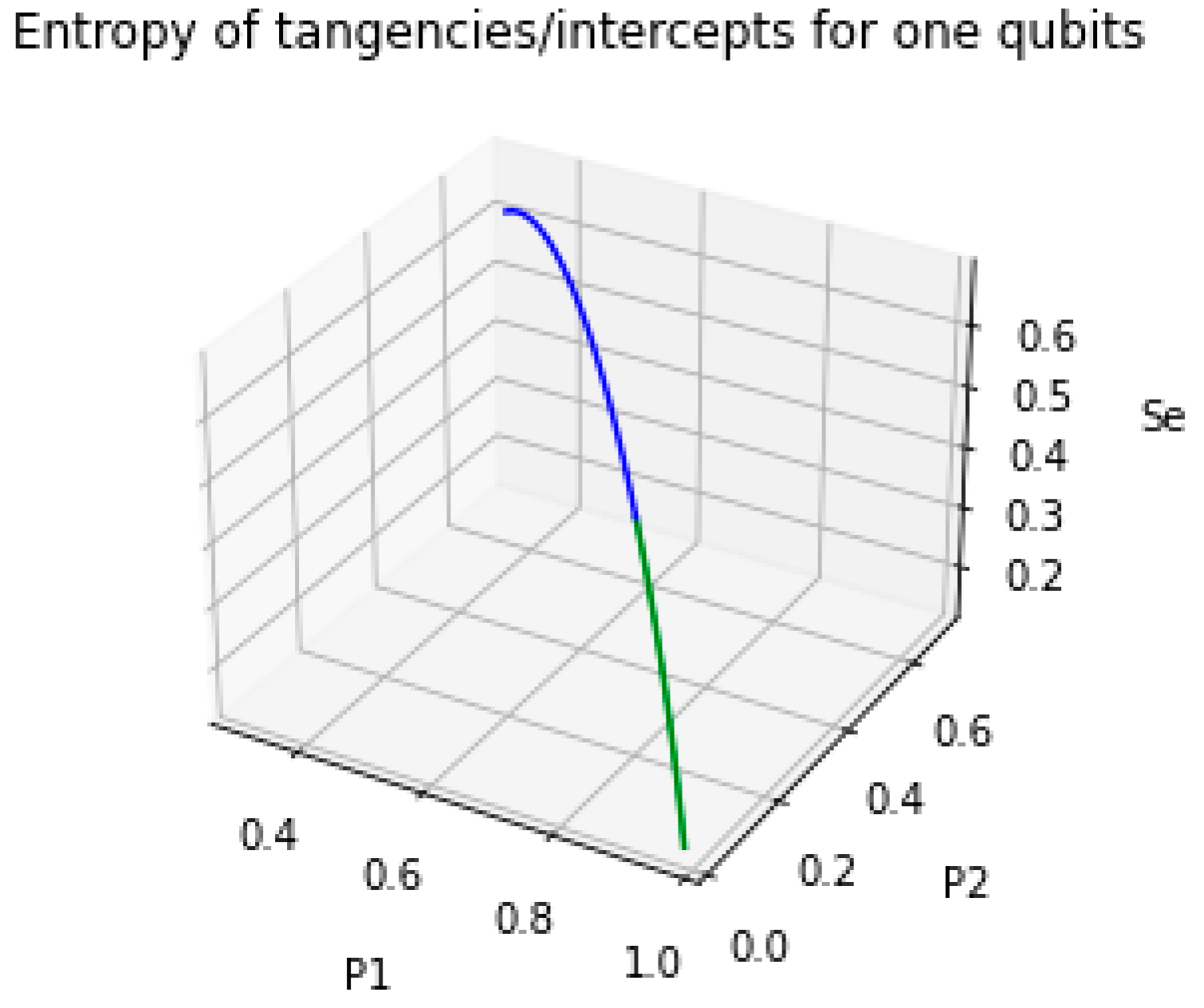

| Probabilities at tangency | Probabilities P1 and P2, associated with α and β | The probabilities on the tangency points, calculated using the budget constraint’s canonical equation, are directly associated with the probabilities of the quantum states in single qubit cases, denoted by the probabilities P1 and P2. This provides a direct correspondence to quantum probabilities. |

| Entropy in the utility framework | Entropy in quantum states | In economics, entropy measures the various ways x and y can be organized to generate a certain level of utility. In quantum mechanics, entropy quantifies the uncertainty in the superposition of states. Both concepts reveal the complexity and constraints of the system. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Betancur-Hinestroza, I.C.; Velásquez-Sierra, É.A.; Caro-Lopera, F.J.; Bedoya-Calle, Á.H. Quantum Computation of the Cobb–Douglas Utility Function via the 2D Clairaut Differential Equation. Quantum Rep. 2025, 7, 1. https://doi.org/10.3390/quantum7010001

Betancur-Hinestroza IC, Velásquez-Sierra ÉA, Caro-Lopera FJ, Bedoya-Calle ÁH. Quantum Computation of the Cobb–Douglas Utility Function via the 2D Clairaut Differential Equation. Quantum Reports. 2025; 7(1):1. https://doi.org/10.3390/quantum7010001

Chicago/Turabian StyleBetancur-Hinestroza, Isabel Cristina, Éver Alberto Velásquez-Sierra, Francisco J. Caro-Lopera, and Álvaro Hernán Bedoya-Calle. 2025. "Quantum Computation of the Cobb–Douglas Utility Function via the 2D Clairaut Differential Equation" Quantum Reports 7, no. 1: 1. https://doi.org/10.3390/quantum7010001

APA StyleBetancur-Hinestroza, I. C., Velásquez-Sierra, É. A., Caro-Lopera, F. J., & Bedoya-Calle, Á. H. (2025). Quantum Computation of the Cobb–Douglas Utility Function via the 2D Clairaut Differential Equation. Quantum Reports, 7(1), 1. https://doi.org/10.3390/quantum7010001