Economically Incentivising Smart Urban Regeneration. Case Study of Port Louis, Mauritius

Abstract

:1. Introduction

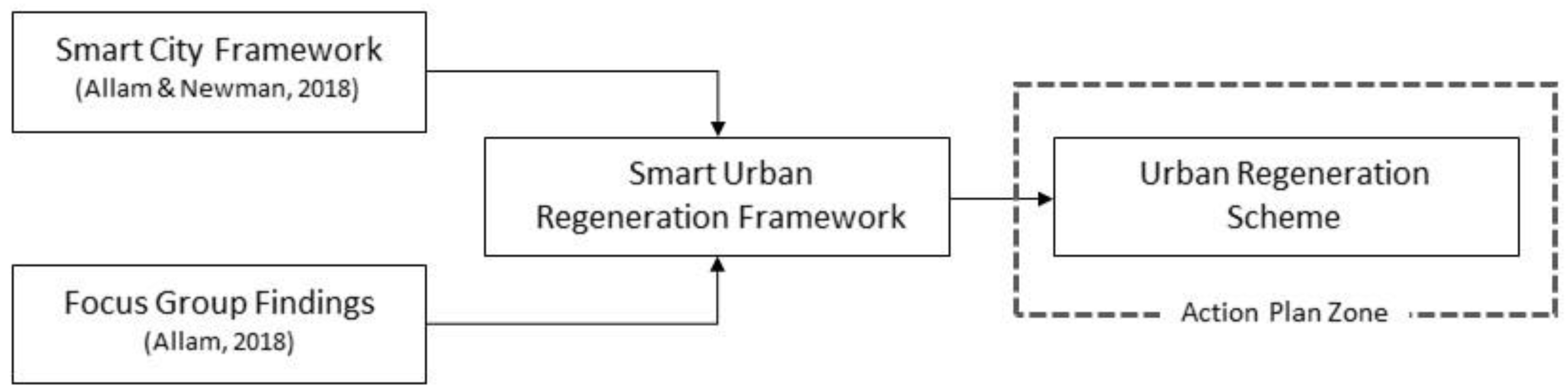

2. Methodology

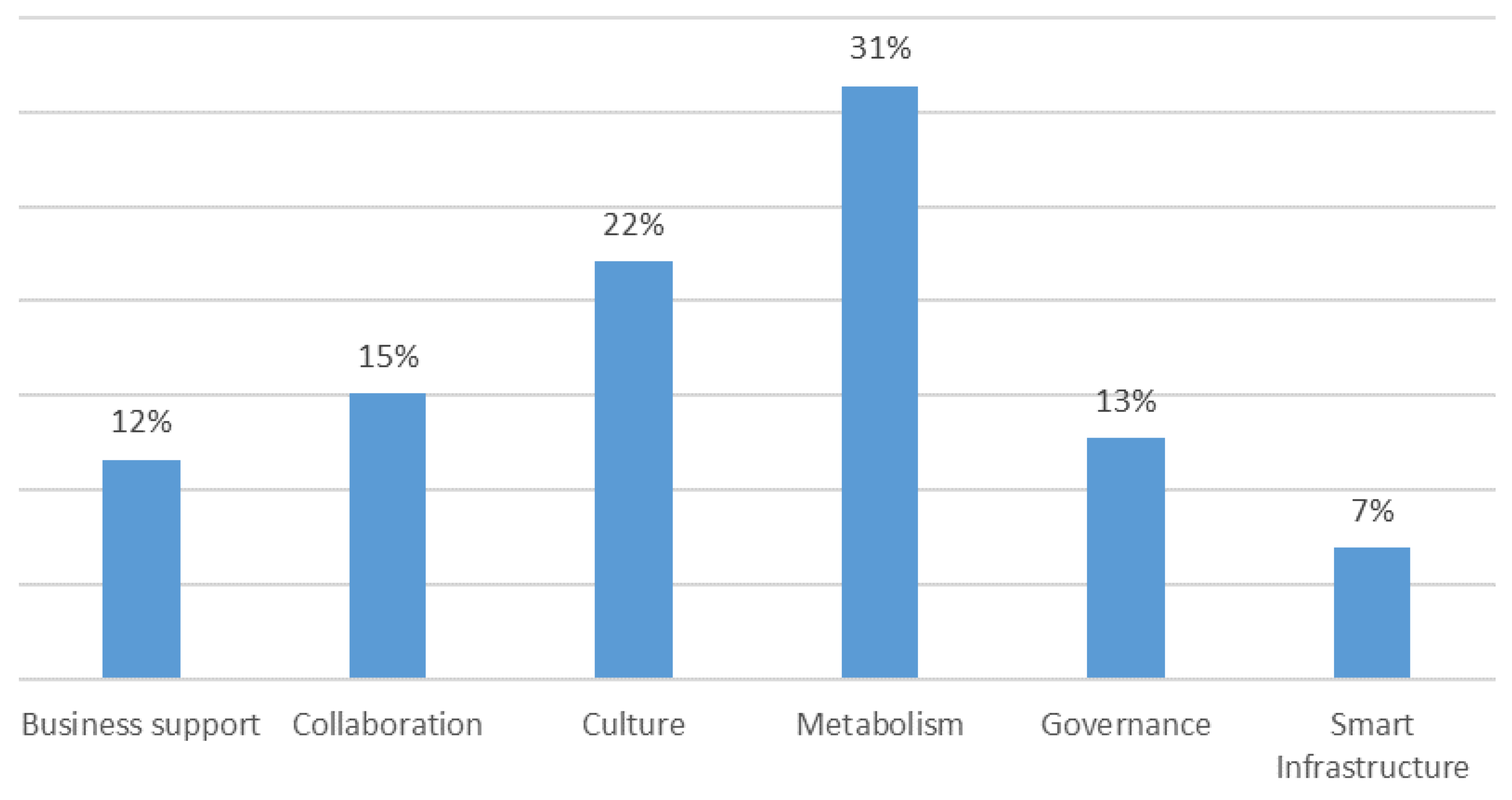

3. Focus Group Findings

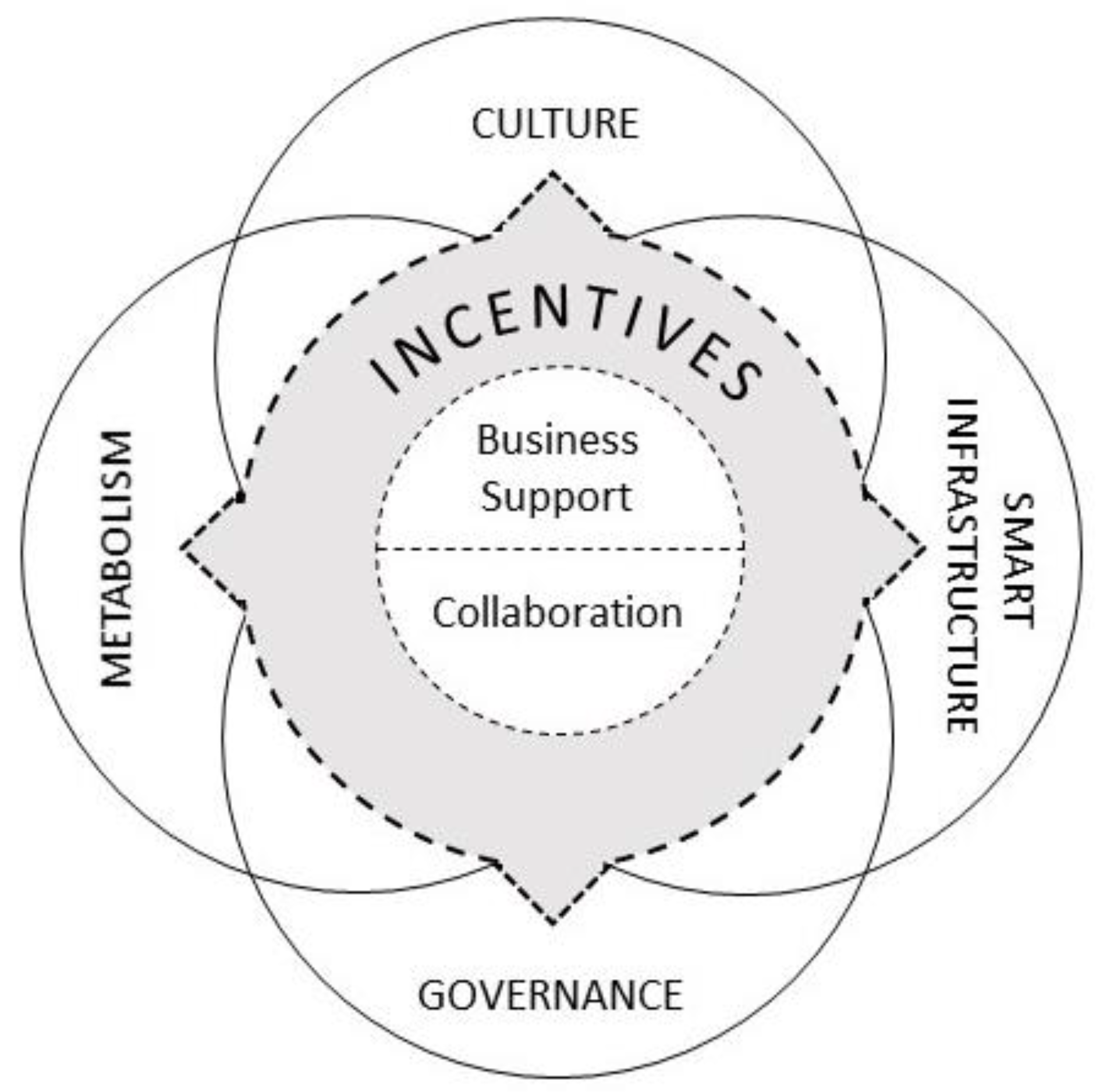

3.1. Six Dimensions for Smart Urban Regeneration

3.2. Incentives

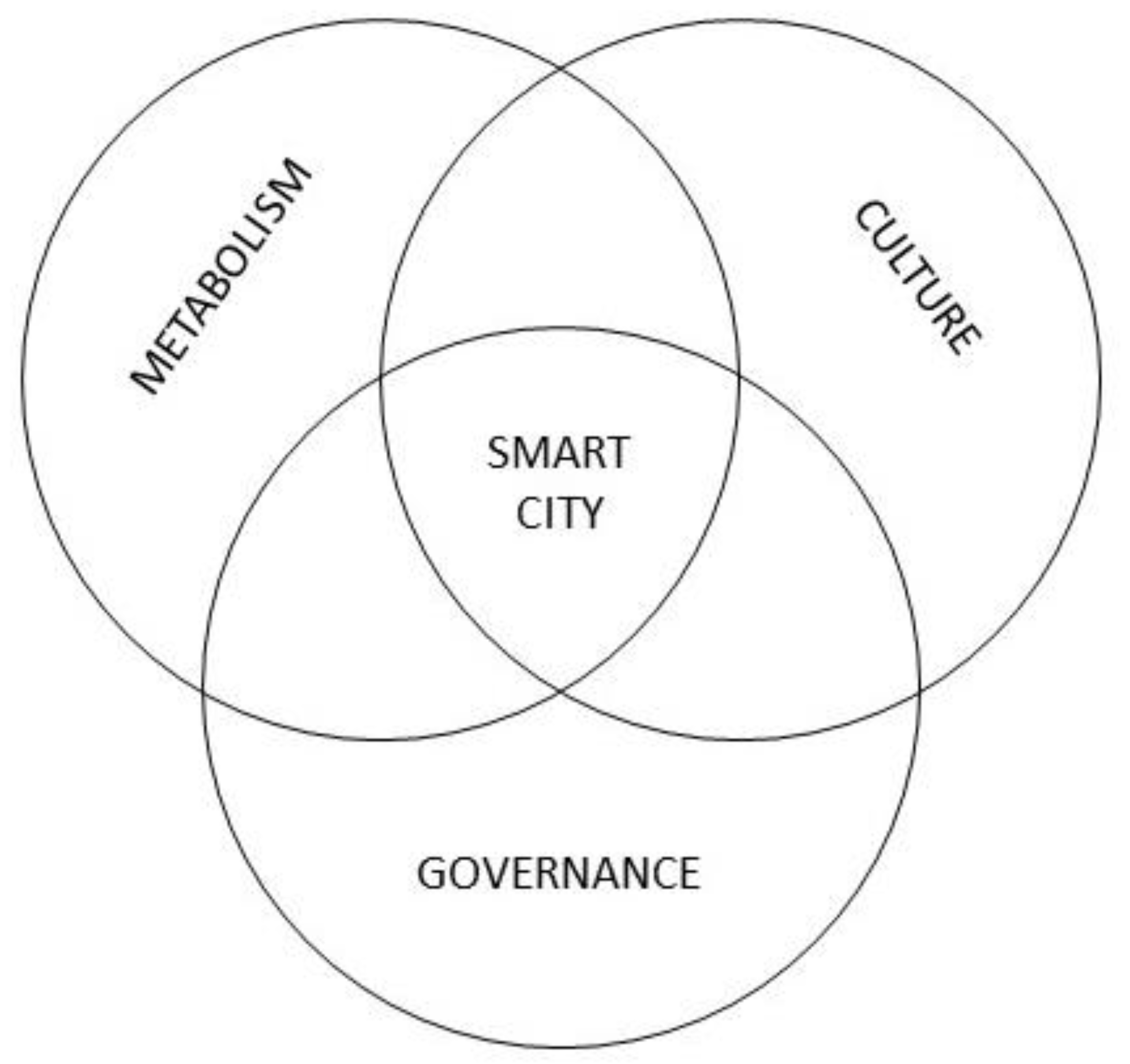

3.2.1. Smart Cities

3.2.2. Freeport

3.3. Opportunities for Urban Regeneration

3.3.1. Aapravasi Ghat Buffer Zone

3.3.2. Landlord and Tenant Act

4. The Smart Urban Regeneration Framework

5. The Urban Regeneration Scheme

Action Plan Zone

6. Application of the Smart Urban Regeneration Model to the Action Plan Zone

6.1. Smart Infrastructure

- (a)

- Digital inclusion: to not only increase access to ICT, but also to popularize and promote ICT knowledge. Such a theme is being proposed in the URS and APZ where knowledge transfer from foreigners to locals is being highly incentivised.

- (b)

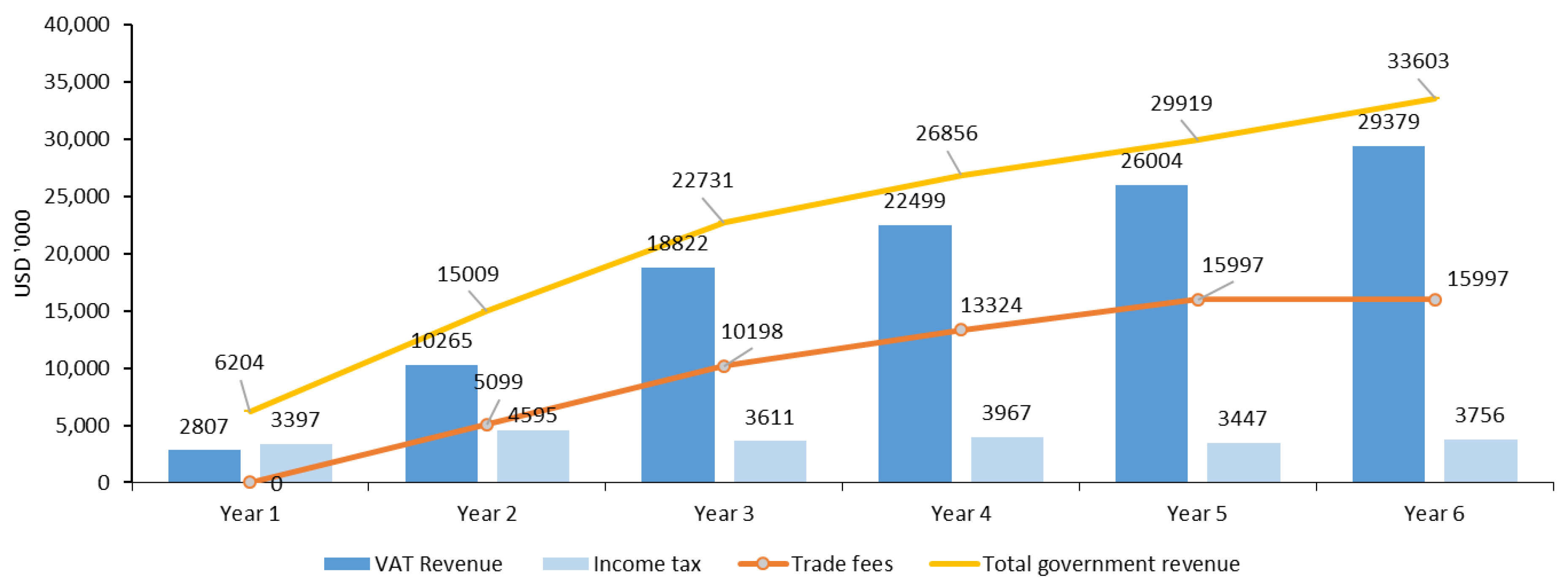

- Digital industries: to build upon the highly effective energy and communication grids of Port Louis to lead as a community of digital industries. This requires consequential financial input, which is predicted to be generated within the first few years of adopting the URS (Figure 13, Figure 14, Figure 15, Figure 16 and Figure 17).

- (c)

- Digital innovation: to promote a smart approach to all facets of city life including the governance and cultural aspects outlined below, as well as the metabolism aspects of transport, energy, water, waste management, as well as governance issues such as disaster monitoring and control within a safe, resilient and sustainable environment.

6.2. Culture

6.3. Metabolism

6.4. Governance

7. Quantified Results from the Application of the URS

7.1. Financial Impact

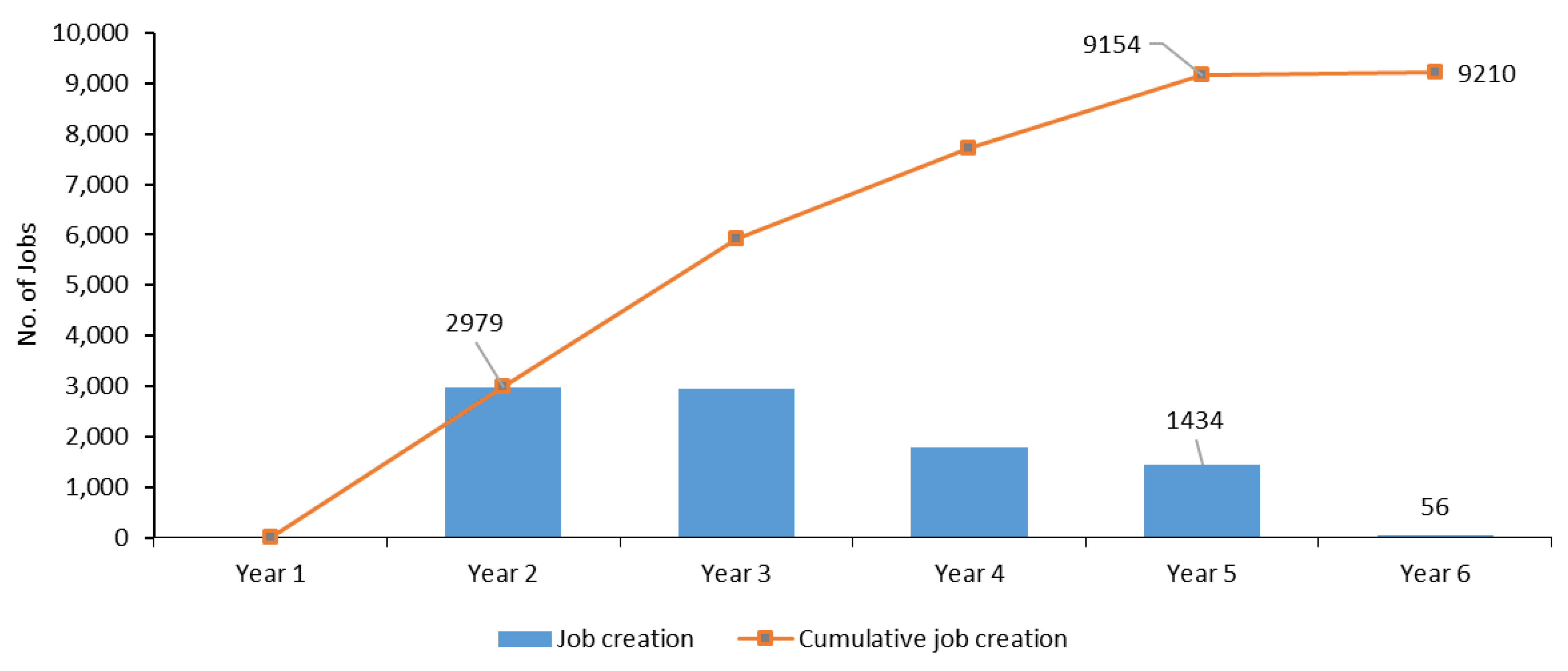

7.2. Business and Jobs’ Creation

8. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

A.1. The Econometric Model

A.2. Assumptions

A.2.1. General

A.2.2. Capital Expenditure for Construction

A.2.3. Start of New Constructions

A.2.4. Occupancy Rate

A.2.5. Rental Income

A.2.6. Turnover

A.2.7. Permanent Jobs’ Creation

A.2.8. Construction Jobs’ Creation

A.2.9. Governmental Revenue

A.3. Limitations

The Author Acknowledges Various Limitations Mainly Due to the Broadness of the Study

References

- Statistics Mauritius. Digest of Demographic Statistics; Statistics Mauritius: Port Louis, Mauritius, 2016.

- Bunwaree, S. The fading developmental state: Growing inequality in mauritius. Development 2014, 57, 578–590. [Google Scholar] [CrossRef]

- Redaction, L. Jean Claude de L’estrac: La Port Louis Development Initiative est un Bureau de Facilitation D’affaires; L’Express Maurice: Pamplemousses, Mauritius, 2017. [Google Scholar]

- Peck, J. Pushing austerity: State failure, municipal bankruptcy and the crises of fiscal federalism in the USA. Camb. J. Reg. Econ. Soc. 2014, 7, 17–44. [Google Scholar] [CrossRef]

- Groëme-Harmon, A. Gaëtan Siew: Ramener Jusqu’à 5000 Jeunes Vivre à Port-Louis; L’Express Maurice: Pamplemousses, Mauritius, 2018. [Google Scholar]

- Amini, M.H.; Boroojeni, K.G.; Iyengar, S.S.; Blaabjerg, F.; Pardalos, P.M.; Madni, A.M. A panorama of future interdependent networks: From intelligent infrastructures to smart cities. In Sustainable Interdependent Networks: From Theory to Application; Amini, M.H., Boroojeni, K.G., Iyengar, S.S., Pardalos, P.M., Blaabjerg, F., Madni, A.M., Eds.; Springer: Cham, Switzerland, 2018; pp. 1–10. [Google Scholar]

- Ramkissoon, H.; Nunkoo, R. City image and perceived tourism impact: Evidence from port louis, mauritius. Int. J. Hosp. Tour. Admin. 2011, 12, 123–143. [Google Scholar] [CrossRef]

- Bertacchini, E.E.; Re, A. Port Louis 2030: Investing in the City’s Cultural Assets; Centro Studi Silvia Santagata EBLA: Torino, Italy, 2017. [Google Scholar]

- Allam, Z. Focus group findings for smart urban regeneration. J. Urban Regen. Renew. 2018, in press. [Google Scholar]

- Allam, Z.; Newman, P. Redefining the smart city: Culture, metabolism & governance. Smart Cities 2018, 1, 4–25. [Google Scholar]

- Titus, D. Tax Incentives for Special Economic Zones; Asialaw, 2006. [Google Scholar]

- Adair, A.; Berry, J.; McGreal, S. Financing property’s contribution to regeneration. Urban Stud. 2003, 40, 1065–1080. [Google Scholar] [CrossRef]

- McGreal, S.; Berry, J.; Lloyd, G.; McCarthy, J. Tax-based mechanisms in urban regeneration: Dublin and chicago models. Urban Stud. 2002, 39, 1819–1831. [Google Scholar] [CrossRef]

- Laura Bottazzi, M.D.R.; Hellmann, T.F. The importance of trust for investment: Evidence from venture capital. Natl. Bur. Econ. Res. 2011. [Google Scholar] [CrossRef]

- Board of Investment (BOI). Smart Cities Guidelines; Board of Investment: Port Louis, Mauritius, 2015.

- Board of Investment (BOI). Smart Mauritius; Board of Investment: Port Louis, Mauritius, 2017.

- MPA. Mauritius Ports Authority. Available online: http://www.mauport.com/en/history-port (accessed on 29 April 2018).

- Board of Investment (BOI). Freeport Developer Handbook; Board of Investment: Port Louis, Mauritius, 2016.

- RoM. Bunkering Sector Can Become an Economic Pillar for Mauritius, Says Minister Gungah. Available online: http://www.govmu.org/English/News/Pages/Bunkering-sector-can-become-an-economic-pillar-for-Mauritius,-says-Minister-Gungah.aspx (accessed on 29 April 2018).

- Allam, Z. Rethinking Our Country’s Planning: A Need for a New Urban Form; Le Mauricien: Port Louis, Mauritius, 2013. [Google Scholar]

- Allam, Z.; Jones, D. Promoting resilience, liveability and sustainability through landscape architectural design: A conceptual framework for port louis, mauritius; a small island developing state. In International Federation of Landscape Architects World Congress; International Federation of Landscape Architects: Singapore, 2018. [Google Scholar]

- Ministry of Housing & Lands. Planning Policy Guidance–ppg6; Ministry of Housing & Lands: Quatre Bornes, Mauritius, 2011.

- AGS International Movers. Landlord and Tenant Act; Revised Laws of Mauritius; AGS International Movers: Port Louis, Mauritius, 1999. [Google Scholar]

- Aapravasi Ghat Trust Fund (AGTF). Aapravasi Ghat World Heritage Management Plan; Aapravasi Ghat Trust Fund: Port Louis, Mauritius, 2013. [Google Scholar]

- Attractions, M. Aapravasi Ghat. 2015. Available online: http://mauritiusattractions.com/aapravasi-ghat-visit-tour-p-1312.html (accessed on 1 July 2018).

- Chau, K.W.; Chin, T.L. Critical review of literature on the hedonic price model. Int. J. Hous. Sci. Appl. 2003, 27, 145–165. [Google Scholar]

- Mega. Développement Foncier à Port-Louis: Rs 200 Millions Réclamées à la Mairie. 2014. Available online: https://business.mega.mu/2014/03/17/developpement-foncier-port-louis-rs-200-millions-reclamees-la-mairie/ (accessed on 1 July 2018).

- Groëme-Harmon, A. Ile Maurice: Lloyd lai fak yu—j’ai Honte de Chinatown. Available online: http://fr.allafrica.com/stories/201605021457.html (accessed on 26 April 2018).

- Redaction, L. Les Cyclones les Plus Dévastateurs. 2015. Available online: https://www.lexpress.mu/article/257505/cyclones-plus-devastateurs (accessed on 26 April 2018).

- Paturau. Cyclone Carol in Port Louis. 1960. Available online: http://vintagemauritius.org/articles/chronology-key-events-mauritius/attachment/cyclone-carol-in-port-louis-feb-1960-paturau/?mode=list (accessed on 26 April 2018).

- Boutia, M. Raj Appadu: 10,000 Emplois Sauvés; Defi Media Group: Port Louis, Mauritius, 2017. [Google Scholar]

- Mauricien, L. Landlord and Tenants Act—Fin du Moratoire: Des Commerçants Craignent la Fermeture; Le Mauricien: Port Louis, Mauritius, 2017. [Google Scholar]

- Mauricien, L. Malgré le Moratoire, Quelle Aberration. Available online: https://www.lemauricien.com/article/malgre-le-moratoire-quelle-aberration/ (accessed on 26 April 2018).

- GPG. Landlord and Tenant Laws—Our Rating—Mauritius Compared to Continent. Available online: https://www.globalpropertyguide.com/Africa/Mauritius/landlord-tenant-law (accessed on 26 April 2018).

- Wavejourney. Day 39: Port Louis with Holland America. Available online: https://wavejourney.com/wj-reviews/day-39-port-louis-mauritius-with-holland-america/ (accessed on 19 July 2018).

- Carrotmadman. Carrotmadman’s Blog. Caudan Waterfront. Available online: http://carrotmadman6.blogspot.com/2010/06/caudan-waterfront.html (accessed on 8 August 2018).

- David. L’hopital militaire. Available online: https://www.patrimoineenperil.mu/inventaire/item.php?itemId=145 (accessed on 19 July 2018).

- Allam, Z. Sustainable architecture: Utopia or feasible reality? J. Biourban. 2012, 2, 47–61. [Google Scholar]

- Allam, Z. Building a conceptual framework for smarting an existing city in mauritius: The case of port louis. J. Biourban. 2017, 4, 103–121. [Google Scholar]

- Ministry of Housing and Lands (MoHL). Outline Scheme Port Louis; Ministry of Housing and Lands: Rue des Arts, Quatre Bornes, 2011.

- Carter, D. Urban regeneration, digital development strategies and the knowledge economy: Manchester case study. J. Knowl. Econ. 2013, 4, 169–189. [Google Scholar] [CrossRef]

- Geng, Y.; Cassandras, C.G. A new “smart parking” system infrastructure and implementation. Procedia Soc. Behav. Sci. 2012, 54, 1278–1287. [Google Scholar] [CrossRef]

- Newman, P.; Kosonen, L.; Kenworthy, J. Theory of urban fabrics: Planning the walking, transit/public transport and automobile/motor car cities for reduced car dependency. Town Plan. Rev. 2016, 87, 429–458. [Google Scholar] [CrossRef]

- Newman, P.; Kenworthy, J. The rise and fall of automobile dependence. In The End of Automobile Dependence; Island Press/Center for Resource Economics: Washington, DC, USA, 2015; pp. 1–31. [Google Scholar]

- Peter, W.N. Transport infrastructure and sustainability: A new planning and assessment framework. Smart Sustain. Built Environ. 2015, 4, 140–153. [Google Scholar]

- Abdoullaev, A. A smart world: A development model for intelligent cities. In Proceedings of the 11th IEEE International Conference on Computer and Information Technology (CIT-2011), Paphos, Cyprus, 31 August–2 September 2011. [Google Scholar]

- Morandi, C.R.A.; Di Vita, S. From Smart City to Smart Region: Digital Services for an Internet of Places; Springer: Berlin, Germany, 2016. [Google Scholar]

- UNESCO. Global Report on Culture for Sustainable Urban Development. Available online: http://unesdoc.unesco.org/images/0024/002459/245999e.pd (accessed on 2 April 2018).

- Kalay, Y.; Kvan, T.; Affleck, J. New Heritage: New Media and Cultural Heritage; Routledge: Abington, UK, 2007. [Google Scholar]

- Cohen, B. Urbanization in developing countries: Current trends, future projections, and key challenges for sustainability. Technol. Soc. 2006, 28, 63–80. [Google Scholar] [CrossRef]

- Siew, G.; Allam, Z. Culture as a driver for sustainable urban development. In UIA 2017 Seoul World Architecs Congress; International Union of Architects: Seoul, Korea, 2017. [Google Scholar]

- Bertacchini, E.E.; Re, A. Culture at Work-Port Louis 2030; Centro Studi Silvia Santagata-Ebla: Venice, Italy, 2017. [Google Scholar]

- EY. Cultural Times: The First Global Map of Cultural and Creative Industries; EY: London, UK, 2015. [Google Scholar]

- Porlwi. Festival Porlwi. Available online: www.porlwi.com (accessed on 29 April 2018).

- Glazebrook, G.; Newman, P. The city of the future. Urban Plan. 2018, 3, 20. [Google Scholar] [CrossRef]

- Wiktorowicz, J.; Babaeff, T.; Breadsell, J.; Byrne, J.; Eggleston, J.; Newman, P. Wgv: An australian urban precinct case study to demonstrate the 1.5 °C agenda including multiple sdgs. Urban Plan. 2018, 3, 64–81. [Google Scholar] [CrossRef]

- Priemus, H.; Nijkamp, P.; Banister, D. Mobility and spatial dynamics: An uneasy relationship. J. Transp. Geogr. 2001, 9, 167–171. [Google Scholar] [CrossRef]

- Leach, J.M.; Braithwaite, P.A.; Lee, S.E.; Bouch, C.J.; Hunt, D.V.L.; Rogers, C.D.F. Measuring urban sustainability and liveability performance: The city analysis methodology. Int. J. Complex. Appl. Sci. Technol. 2016, 1, 86–106. [Google Scholar] [CrossRef]

- Newman, P.W.G. Sustainability and cities: Extending the metabolism model. Landsc. Urban Plan. 1999, 44, 219–226. [Google Scholar] [CrossRef]

- Kennedy, C.; Pincetl, S.; Bunje, P. The study of urban metabolism and its applications to urban planning and design. Environ. Pollut. 2011, 159, 1965–1973. [Google Scholar] [CrossRef] [PubMed]

- Huang, S.-L.; Hsu, W.-L. Materials flow analysis and emergy evaluation of taipei’s urban construction. Landsc. Urban Plan. 2003, 63, 61–74. [Google Scholar] [CrossRef]

- Newman, P.W.G. Sustainability and Cities: Overcoming Automobile Dependence/Peter Newman, Jeffrey Kenworthy; Island Press: Washington, DC, USA, 1999. [Google Scholar]

- Shahrokni, H.; Lazarevic, D.; Brandt, N. Smart urban metabolism: Towards a real-time understanding of the energy and material flows of a city and its citizens. J. Urban Technol. 2015, 22, 65–86. [Google Scholar] [CrossRef]

- Cento Bull, A.; Jones, B. Governance and social capital in urban regeneration: A comparison between bristol and naples. Urban Stud. 2006, 43, 767–786. [Google Scholar] [CrossRef]

- Davies Jonathan, S. The governance of urban regeneration: A critique of the ‘governing without government’ thesis. Public Adm. 2002, 80, 301–322. [Google Scholar] [CrossRef]

- Degen, M.; GarcÍA, M. The transformation of the ‘barcelona model’: An analysis of culture, urban regeneration and governance. Int. J. Urban Reg. Res. 2012, 36, 1022–1038. [Google Scholar] [CrossRef]

- Jones, P.; Evans, J. Urban regeneration, governance and the state: Exploring notions of distance and proximity. Urban Stud. 2006, 43, 1491–1509. [Google Scholar] [CrossRef]

- Niedzielski, M.A.; Horner, M.W.; Xiao, N. Analyzing scale independence in jobs-housing and commute efficiency metrics. Transp. Res. Part A 2013, 58, 129–143. [Google Scholar] [CrossRef]

- Loo, B.P.Y.; Chow, A.S.Y. Jobs-housing balance in an era of population decentralization: An analytical framework and a case study. J. Transp. Geogr. 2011, 19, 552–562. [Google Scholar] [CrossRef]

- Wong, P.B.E.; Bressi, R.B.E.; Jerogin, P.B.; Kardash, V.B.E.M. From wasteland to world-class centre: Barangaroo south, sydney, australia. Proc. Inst. Civ. Eng. 2013, 166, 3–9. [Google Scholar] [CrossRef]

- Stickells, L. Barangaroo: Instant urbanism—Just add water. Archit. Aust. 2010, 99, 47–51. [Google Scholar]

- Thomson, G.; Newman, P. Urban fabrics and urban metabolism—From sustainable to regenerative cities. Res. Conserv. Recycl. 2018, 132, 218–229. [Google Scholar] [CrossRef]

- Stoker, G. Governance as theory: Five propositions. Int. Soc. Sci. J. 2008, 50, 17–28. [Google Scholar] [CrossRef]

- Bassett, K. Partnerships, business elites and urban politics: New forms of governance in an english city? Urban Stud. 1996, 33, 539–555. [Google Scholar] [CrossRef]

- Green, J.; Newman, P. Citizen utilities: The emerging power paradigm. Energy Policy 2017, 105, 283–293. [Google Scholar] [CrossRef]

- Costi, P.; Minciardi, R.; Robba, M.; Rovatti, M.; Sacile, R. An environmentally sustainable decision model for urban solid waste management. Waste Manag. 2004, 24, 277–295. [Google Scholar] [CrossRef]

- Tung, S.; Cho, S. Determinants of regional investment decisions in china: An econometric model of tax incentive. Rev. Quant. Financ. Account. 2001, 17, 167–185. [Google Scholar] [CrossRef]

- del Río, P.; Peñasco, C.; Romero-Jordán, D. What drives eco-innovators? A critical review of the empirical literature based on econometric methods. J. Clean. Prod. 2016, 112, 2158–2170. [Google Scholar] [CrossRef]

- Jadevicus, A. The use of combination forecasting approach and its application to regional market analysis. Region 2014, 1, Y1–Y7. [Google Scholar] [CrossRef]

- Combes, P.-P.; Duranton, G.; Gobillon, L. The identification of agglomeration economies. J. Econ. Geogr. 2011, 11, 253–266. [Google Scholar] [CrossRef]

- Thomas Ng, S.; Fan, R.Y.C.; Wong, J.M.W. An econometric model for forecasting private construction investment in hong kong. Constr. Manag. Econ. 2011, 29, 519–534. [Google Scholar] [CrossRef]

- Allen, P.G. Econometric forecasting. In Principles of Forecasting: A Handbook for Researchers and Practitioners; Springer: Berlin, Germany, 2001. [Google Scholar]

- Competition Commission Mauritius (CCM). Market Study of the Construction Industry in Mauritius; Competition Commission Mauritius: Port Louis, Mauritius, 2018. [Google Scholar]

- Seresinhe, C.I.; Preis, T.; Moat, H.S. Quantifying the Link between Art and Property Prices in Urban Neighbourhoods; Royal Society Open Science: London, UK, 2016. [Google Scholar]

- Seresinhe, C.I.; Preis, T.; Moat, H.S. Using Deep Learning to Quantify the Beauty of Outdoor Places; Royal Society Open Science: London, UK, 2017. [Google Scholar]

- Xiao, Y.; Li, Z.; Webster, C. Estimating the mediating effect of privately-supplied green space on the relationship between urban public green space and property value: Evidence from Shanghai, China. Land Use Policy 2016, 54, 439–447. [Google Scholar] [CrossRef]

- Brander, L.M.; Koetse, M.J. The value of urban open space: Meta-analyses of contingent valuation and hedonic pricing results. J. Environ. Manag. 2011, 92, 2763–2773. [Google Scholar] [CrossRef] [PubMed]

| 1 | A smart city company (holder of Smart City Scheme Certificate) is exempted from the payment of:

|

| 2 | A smart city company issued with a SCS Certificate is granted accelerated annual allowance at a rate of 50% of the costs with respect to capital expenditure incurred on:

|

| 3 | The smart city company may sell serviced land to another company to develop a component of the smart city project |

| 4 | Application for the permits and licenses submitted by the smart city company will be facilitated through the Board of Investment One Stop-Shop and fast tracked through the Investment Projects Fast-Track Committee |

| 5 | Sale of immovable property can be made by way of ‘Vente en Etat Futur d’Achevement’ (VEFA) or ‘Vente a Terme’ |

| 6 | Land transfer tax for immovable property sold on VEFA is payable in four 6-monthly instalments |

| 1 | A zero-rate tax on corporate profits |

| 2 | Exemption from customs duties and value-added tax on all goods and equipment imported into the freeport zones |

| 3 | Reduced port handling charges for all goods destined for re-export |

| 4 | Free repatriation of profits |

| 5 | 100% foreign ownership allowed |

| 6 | Possibility of selling a quota, 50% of the total value for customs purposes of the goods re-exported or exported in any period of 12 months, on the local market (Section 7 (5) of the Freeport Act 2004). However, profits generated from these transactions will be taxable at the normal corporate tax |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Allam, Z.; Newman, P. Economically Incentivising Smart Urban Regeneration. Case Study of Port Louis, Mauritius. Smart Cities 2018, 1, 53-74. https://doi.org/10.3390/smartcities1010004

Allam Z, Newman P. Economically Incentivising Smart Urban Regeneration. Case Study of Port Louis, Mauritius. Smart Cities. 2018; 1(1):53-74. https://doi.org/10.3390/smartcities1010004

Chicago/Turabian StyleAllam, Zaheer, and Peter Newman. 2018. "Economically Incentivising Smart Urban Regeneration. Case Study of Port Louis, Mauritius" Smart Cities 1, no. 1: 53-74. https://doi.org/10.3390/smartcities1010004

APA StyleAllam, Z., & Newman, P. (2018). Economically Incentivising Smart Urban Regeneration. Case Study of Port Louis, Mauritius. Smart Cities, 1(1), 53-74. https://doi.org/10.3390/smartcities1010004