Multi-Scale Explainable AI for RMB Exchange Rate Drivers

Highlights

- The CEEMDAN-PE-CatBoost-SHAP framework identifies scale-specific USD/CNY drivers.

- DXY/CCI, EFFR/M2, and gold/M2 are the primary driving indicators of high-, mid-, and low-frequency exchange-rate fluctuations, respectively.

- Market participants should tailor investment strategies to specific time horizons.

- This hybrid framework offers a transparent template adaptable to other complex financial systems.

Abstract

1. Introduction

2. Literature Review

3. Data Sources and Indicator Selection

4. Methodology

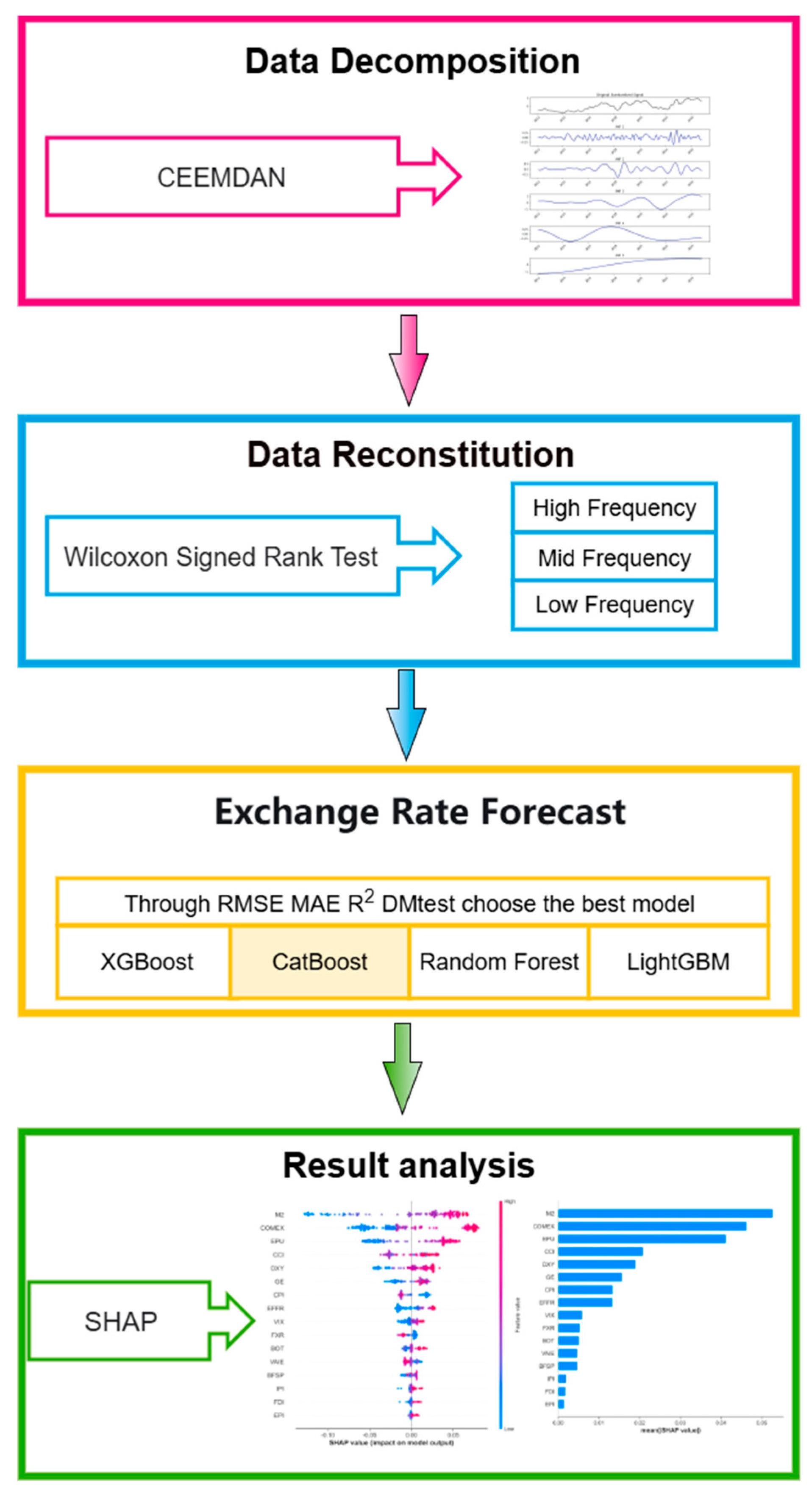

4.1. Research Framework

4.2. Multi-Scale Decomposition

4.2.1. CEEMDAN

4.2.2. Permutation Entropy (PE)

4.3. Interpretable AI Analysis

4.3.1. Random Forest

4.3.2. XGBoost

4.3.3. LIGHTGBM

4.3.4. CatBoost

4.3.5. Evaluation Metrics

4.3.6. SHAP

4.4. Model Training and Hyperparameter Selection

5. Empirical Study

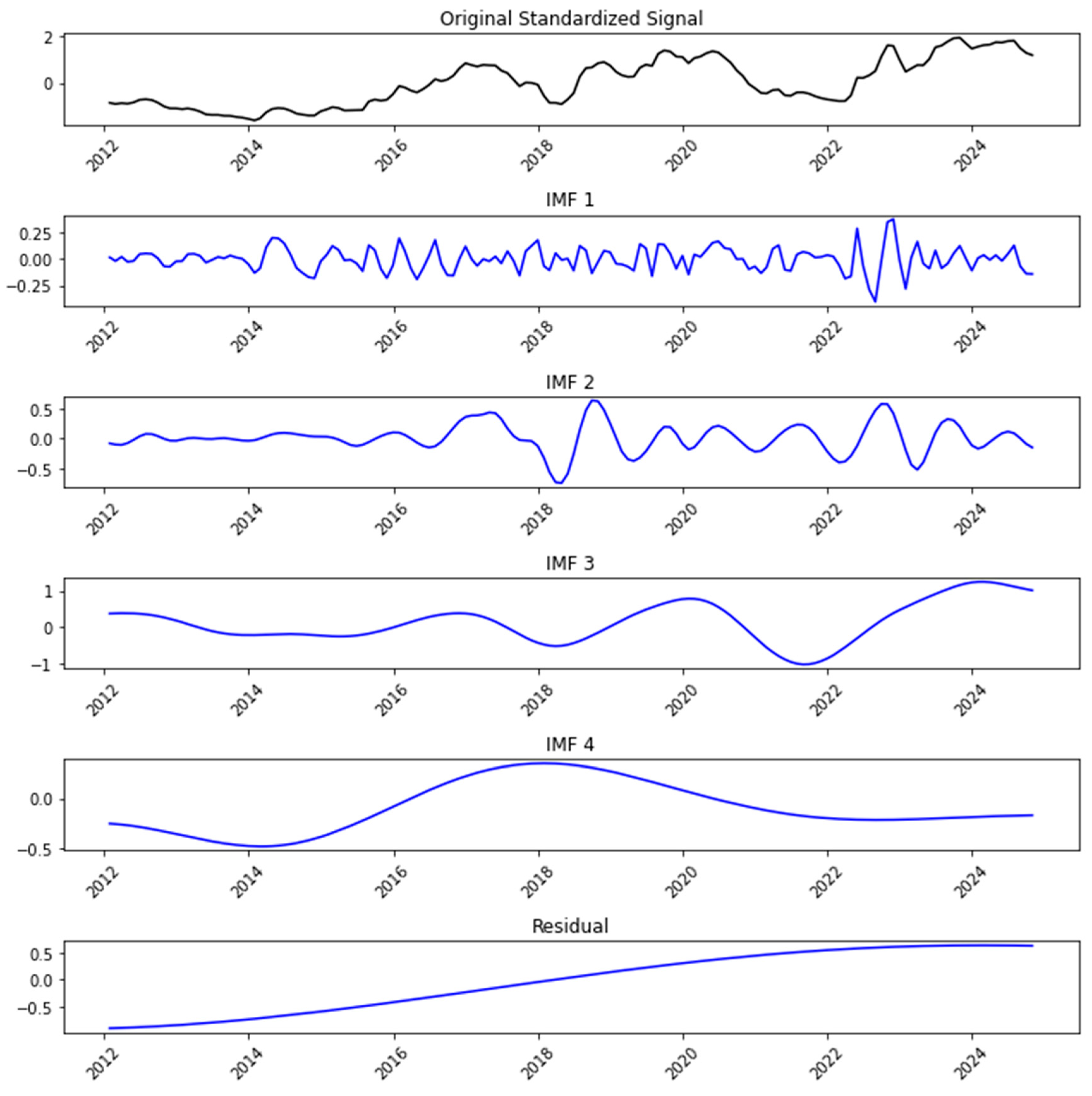

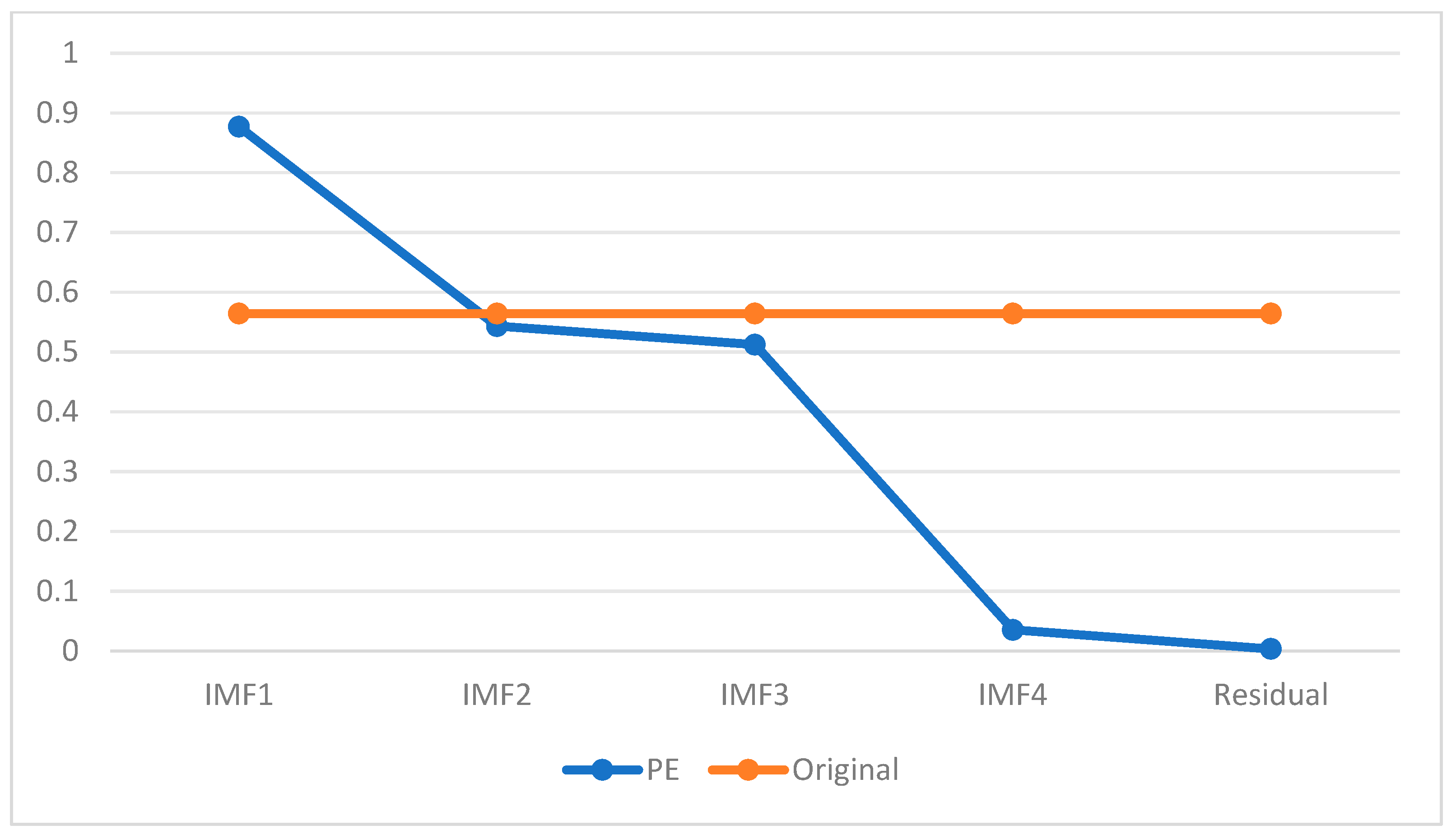

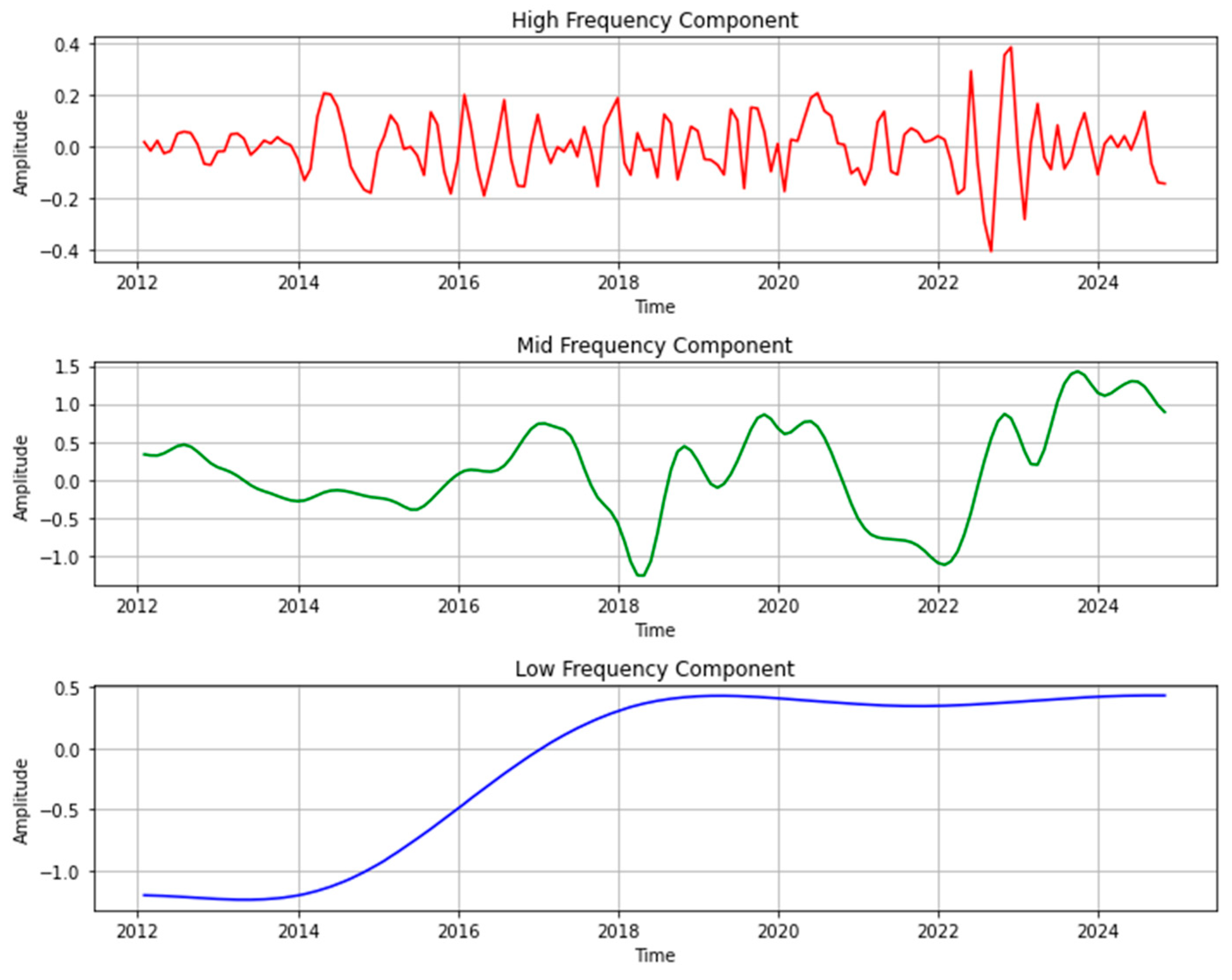

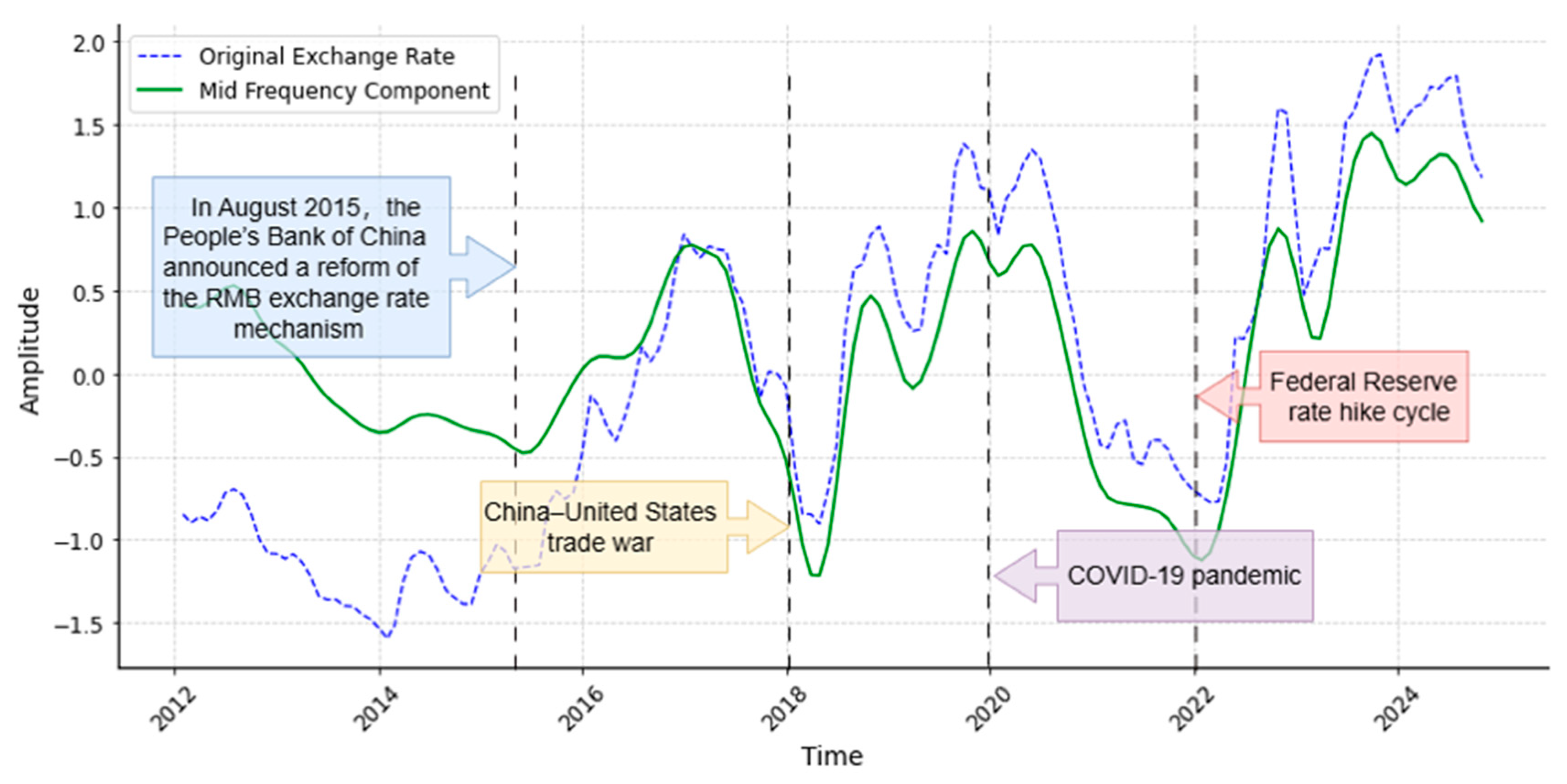

5.1. Multi-Scale Decomposition

5.2. Interpretable AI Analysis

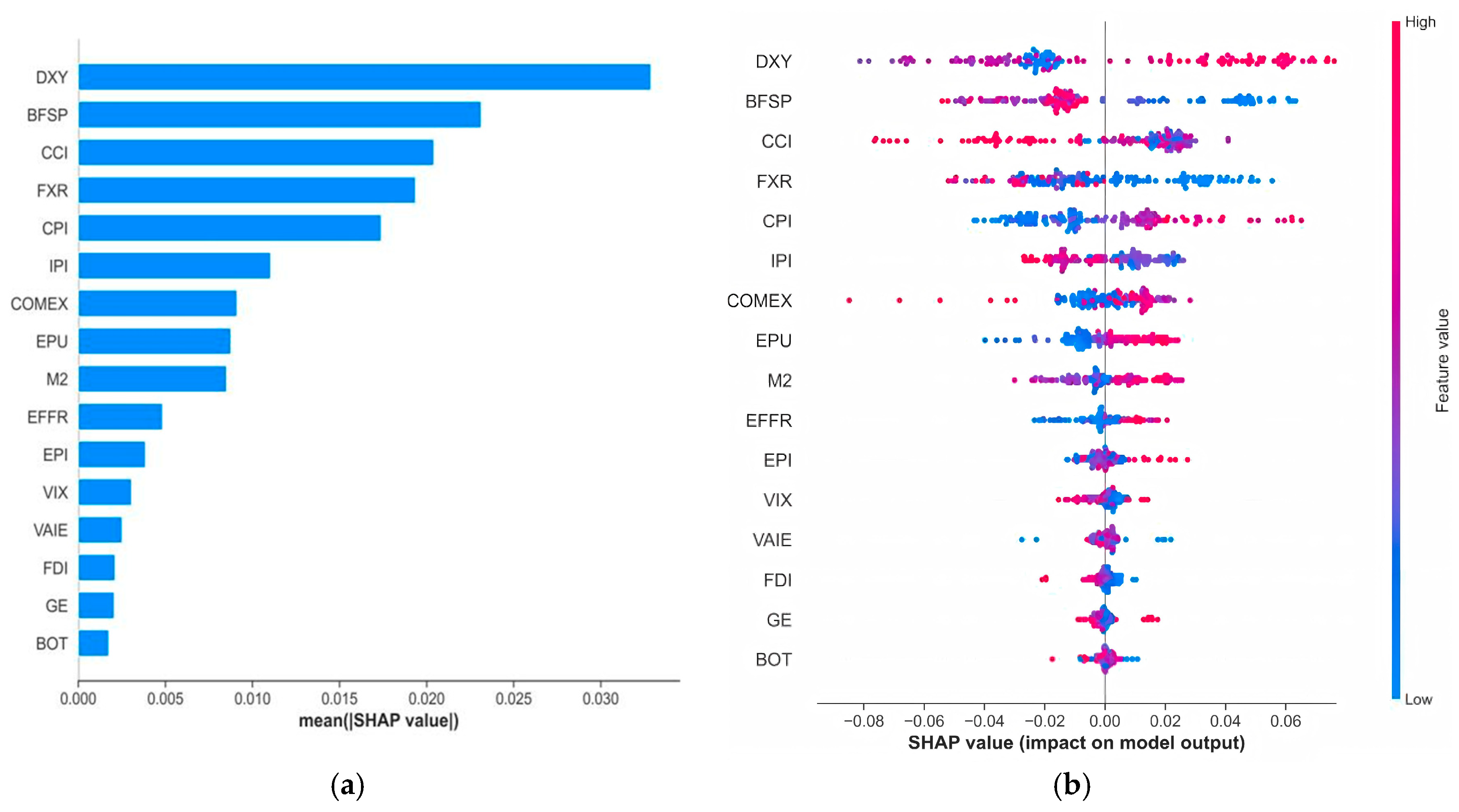

5.2.1. High-Frequency

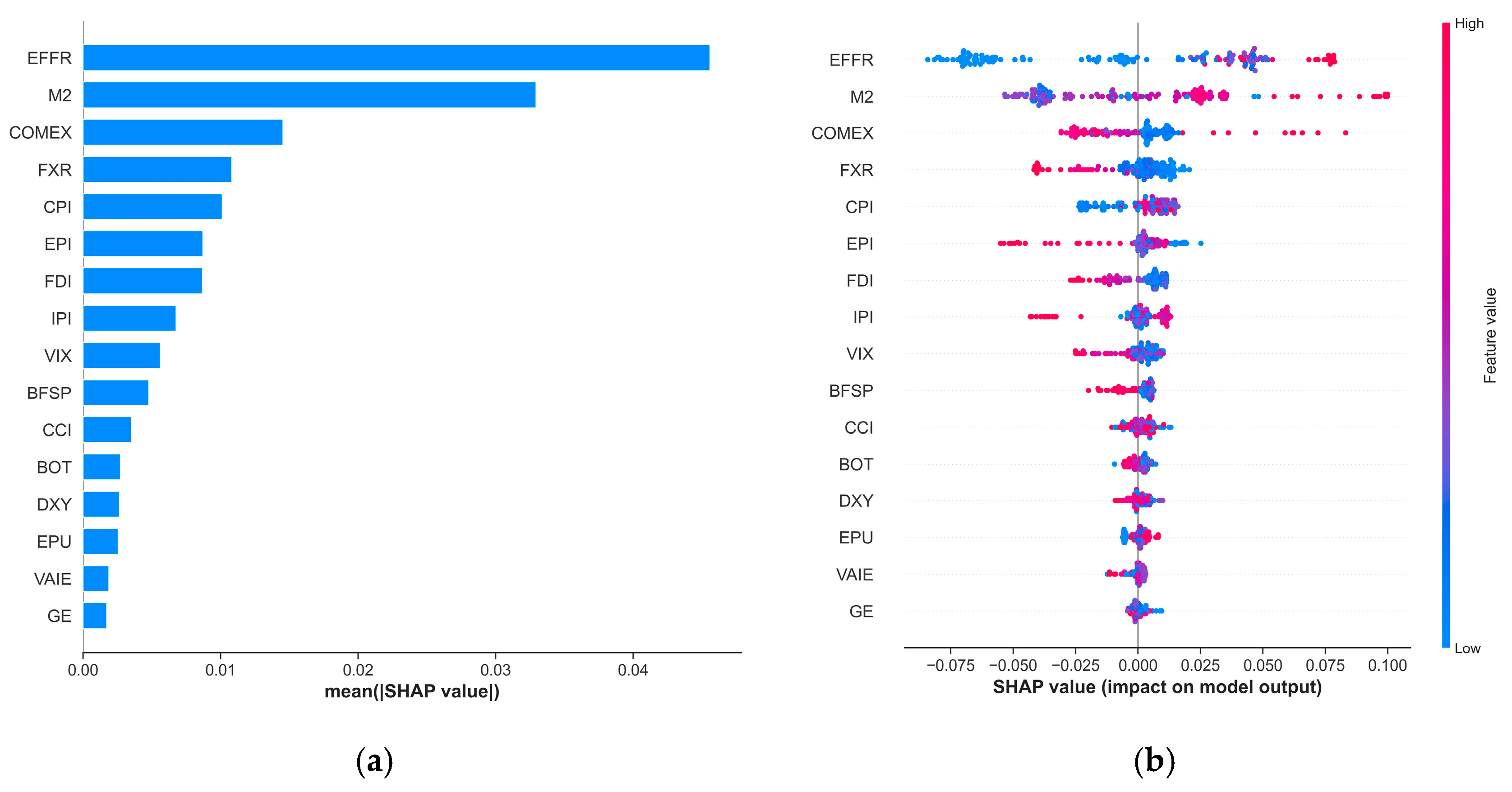

5.2.2. Mid-Frequency

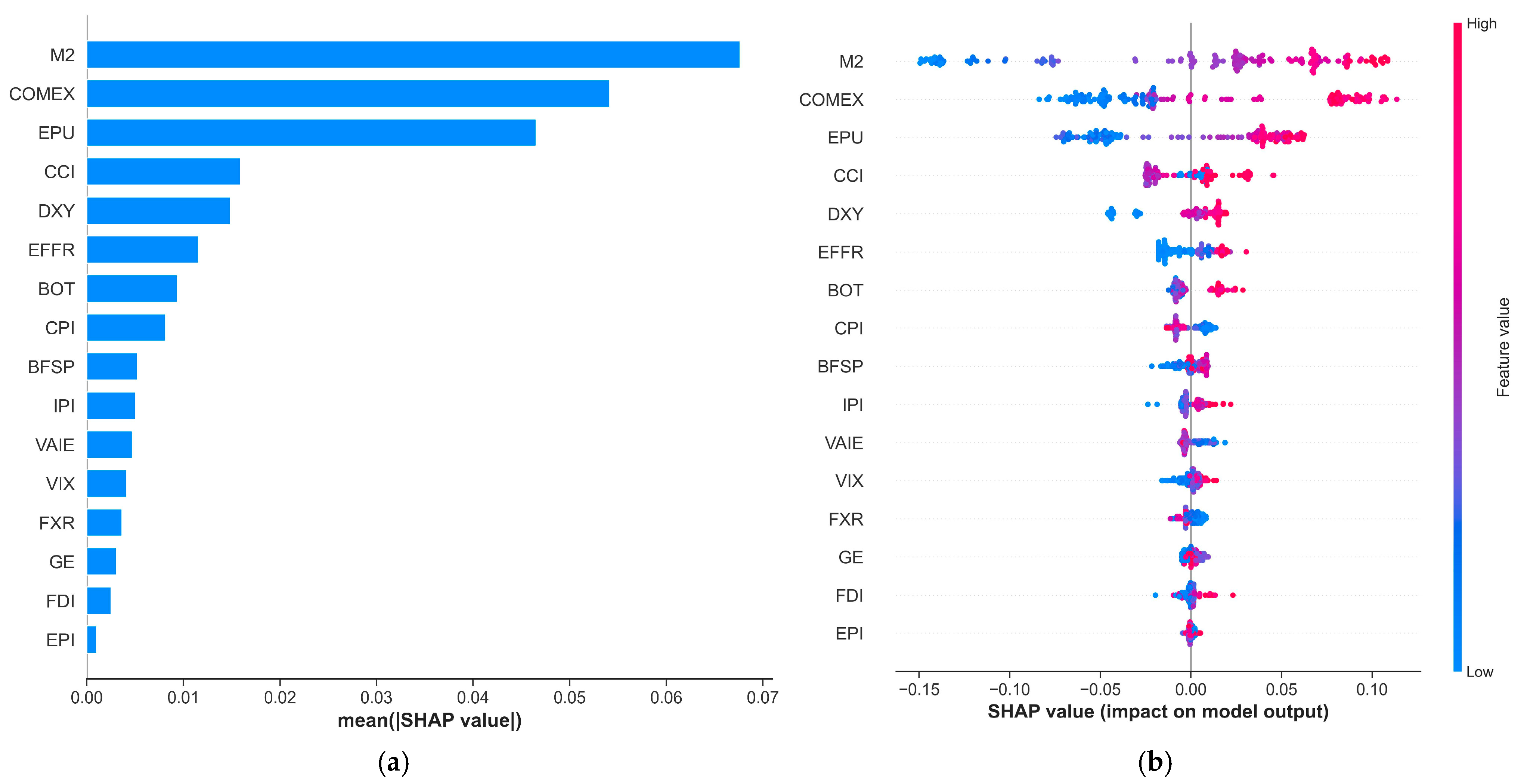

5.2.3. Low-Frequency

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Kumari, S.; Rajput, S.K.O.; Hussain, R.Y.; Marwat, J.; Hussain, H. Optimistic and pessimistic economic sentiments and US Dollar exchange rate. Int. J. Financ. Eng. 2022, 9, 2150043. [Google Scholar] [CrossRef]

- Ma, Z.; Wang, J.; Wang, N.; Xiao, Z. US monetary policy and real exchange rate dynamics: The role of exchange rate arrangements and capital controls. Econ. Lett. 2024, 242, 111891. [Google Scholar] [CrossRef]

- Li, Y. The effect of RMB exchange rate appreciation and aepreciation on export. In Proceedings of the 2023 International Conference on Economic Management, Financial Innovation and Public Service, Cangzhou, China, 29–30 December 2023; Atlantis Press: Dordrecht, The Netherlands, 2024; pp. 781–789. [Google Scholar]

- Lin, C.S.; Chiu, S.H.; Lin, T.Y. Empirical mode decomposition–based least squares support vector regression for foreign exchange rate forecasting. Econ. Model. 2012, 29, 2583–2590. [Google Scholar] [CrossRef]

- Wu, Z.; Huang, N.E. Ensemble empirical mode decomposition: A noise-assisted data analysis method. Adv. Adapt. Data Anal. 2009, 1, 1–41. [Google Scholar] [CrossRef]

- Yeh, J.R.; Shieh, J.S.; Huang, N.E. Complementary ensemble empirical mode decomposition: A novel noise enhanced data analysis method. Adv. Adapt. Data Anal. 2010, 2, 135–156. [Google Scholar] [CrossRef]

- Torres, M.E.; Colominas, M.A.; Schlotthauer, G.; Flandrin, P. A complete ensemble empirical mode decomposition with adaptive noise. In Proceedings of the 2011 IEEE International Conference on Acoustics, Speech and Signal Processing, Prague, Czech Republic, 22–27 May 2011; IEEE: New York City, NY, USA, 2011; pp. 4144–4147. [Google Scholar]

- Grebenkina, A.; Khandruev, A. Difference in intensity of exchange rate factors in countries with targeting inflation regime. J. New Econ. Assoc. 2021, 51, 125–143. [Google Scholar] [CrossRef]

- Korap, L. Impact of asymmetry on exchange rate determination: The role of fundamentals. Emerg. Mark. Rev. 2024, 63, 101206. [Google Scholar] [CrossRef]

- Panopoulou, E.; Souropanis, I. The role of technical indicators in exchange rate forecasting. J. Empir. Financ. 2019, 53, 197–221. [Google Scholar] [CrossRef]

- Draz, M.U.; Ahmad, F.; Gupta, B.; Amin, W. Macroeconomic fundamentals and exchange rates in South Asian economies: Evidence from pooled and panel estimations. J. Chin. Econ. Foreign Trade Stud. 2019, 12, 104–119. [Google Scholar] [CrossRef]

- Breen, J.D.; Hu, L. The predictive content of oil price and volatility: New evidence on exchange rate forecasting. J. Int. Financ. Mark. Inst. Money 2021, 75, 101454. [Google Scholar] [CrossRef]

- Zhang, Z.; Qin, Y. Study on the nonlinear interactions among the international oil price, the RMB exchange rate and China’s gold price. Resour. Policy 2022, 77, 102683. [Google Scholar]

- Jammazi, R.; Lahiani, A.; Nguyen, D.K. A wavelet-based nonlinear ARDL model for assessing the exchange rate pass-through to crude oil prices. J. Int. Financ. Mark. Inst. Money 2015, 34, 173–187. [Google Scholar]

- Vancsura, L.; Tatay, T.; Bareith, T. Enhancing policy insights: Machine learning-based forecasting of euro area inflation HICP and subcomponents. Forecasting 2025, 7, 63. [Google Scholar] [CrossRef]

- Bhargava, V.; Konku, D. Impact of exchange rate fluctuations on US stock market returns. Manag. Financ. 2023, 49, 1535–1557. [Google Scholar]

- Wang, Y.; Wang, L.; Pan, C.; Hong, S. Economic policy uncertainty and price pass-through effect of exchange rate in China. Pac.-Basin Financ. J. 2022, 75, 101844. [Google Scholar] [CrossRef]

- Fantazzini, D. Detecting stablecoin failure with simple thresholds and panel binary models: The pivotal role of lagged market capitalization and volatility. Forecasting 2025, 7, 68. [Google Scholar] [CrossRef]

- Bosupeng, M.; Naranpanawa, A.; Su, J.J. Does exchange rate volatility affect the impact of appreciation and depreciation on the trade balance? A nonlinear bivariate approach. Econ. Model. 2024, 130, 106592. [Google Scholar]

- Lin, C.C.; Chen, K.M. Market competition, exchange rate uncertainty, and foreign direct investment. Rev. Dev. Econ. 2022, 26, 405–422. [Google Scholar]

- Msomi, S.; Muzindutsi, P.F. Exchange rates, supply chain activity/disruption effects, and exports. Forecasting 2025, 7, 10. [Google Scholar] [CrossRef]

- Ferrara, L.; Metelli, L.; Natoli, F.; Siena, D. Questioning the puzzle: Fiscal policy, real exchange rate and inflation. J. Int. Econ. 2021, 133, 103524. [Google Scholar] [CrossRef]

- Harrison, A.; Liu, X.; Stewart, S.L. Are exchange rates absorbers of global oil shocks? A generalized structural analysis. J. Int. Money Financ. 2024, 146, 103126. [Google Scholar] [CrossRef]

- Huynh, T.L.D.; Nasir, M.A.; Nguyen, D.K. Spillovers and connectedness in foreign exchange markets: The role of trade policy uncertainty. Q. Rev. Econ. Financ. 2023, 87, 191–199. [Google Scholar] [CrossRef]

- Aslam, F.; Aziz, S.; Nguyen, D.K.; Mughal, K.S.; Khan, M. On the efficiency of foreign exchange markets in times of the COVID-19 pandemic. Technol. Forecast. Soc. Change 2020, 161, 120261. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Kyei, C.K.; Gupta, R.; Olson, E. Investor sentiment and dollar-pound exchange rate returns: Evidence from over a century of data using a cross-quantilogram approach. Financ. Res. Lett. 2021, 38, 101504. [Google Scholar] [CrossRef]

- Cui, Z.; Li, T.; Ding, Z.; Li, X.A.; Wu, J. Probabilistic oil price forecasting with a variational mode decomposition-gated recurrent unit model incorporating pinball loss. Data Sci. Manag. 2025, 8, 237–247. [Google Scholar] [CrossRef]

- Zhu, Q.; Du, J.; Li, Y. Exploration of salience theory to deep learning: Evidence from Chinese new energy market high-frequency trading. Data Sci. Manag. 2025, 8, 296–309. [Google Scholar] [CrossRef]

- Zhu, Q.; Han, C.; Li, Y. Dual-market quantitative trading: The dynamics of liquidity and turnover in financial markets. Data Sci. Manag. 2025, 8, 48–58. [Google Scholar] [CrossRef]

- Charfi, S.; Mselmi, F. Modeling exchange rate volatility: Application of GARCH models with a normal tempered stable distribution. Quant. Financ. Econ. 2022, 6, 206–222. [Google Scholar] [CrossRef]

- Zhou, Z.; Fu, Z.; Jiang, Y.; Zeng, X.; Lin, L. Can economic policy uncertainty predict exchange rate volatility? New evidence from the GARCH-MIDAS model. Financ. Res. Lett. 2020, 34, 101258. [Google Scholar]

- Escudero, P.; Alcocer, W.; Paredes, J. Recurrent neural networks and ARIMA models for euro/dollar exchange rate forecasting. Appl. Sci. 2021, 11, 5658. [Google Scholar] [CrossRef]

- Liang, F.; Zhang, H.; Fang, Y. The analysis of global RMB exchange rate forecasting and risk early warning using ARIMA and CNN model. J. Organ. End User Comput. 2022, 34, 1–25. [Google Scholar] [CrossRef]

- Gu, S.; Kelly, B.; Xiu, D. Empirical asset pricing via machine learning. Rev. Financ. Stud. 2020, 33, 2223–2273. [Google Scholar] [CrossRef]

- Raza, H.; Akhtar, Z. Predicting stock prices in the Pakistan market using machine learning and technical indicators. Mod. Financ. 2024, 2, 46–63. [Google Scholar] [CrossRef]

- Naeem, S.; Mashwani, W.K.; Ali, A.; Uddin, M.I.; Mahmoud, M.; Jamal, F.; Chesneau, C. Machine learning-based USD/PKR exchange rate forecasting using sentiment analysis of Twitter data. Comput. Mater. Contin. 2021, 67, 3451–3461. [Google Scholar] [CrossRef]

- Colombo, E.; Pelagatti, M. Statistical learning and exchange rate forecasting. Int. J. Forecast. 2020, 36, 1260–1289. [Google Scholar] [CrossRef]

- Su, Z.; Cai, X.; Wu, Y. Exchange rates forecasting and trend analysis after the COVID-19 outbreak: New evidence from interpretable machine learning. Appl. Econ. Lett. 2023, 30, 2052–2059. [Google Scholar] [CrossRef]

- Yu, X.; Li, Y.; Wang, X. RMB exchange rate forecasting using machine learning methods: Can multimodel select powerful predictors? J. Forecast. 2024, 43, 644–660. [Google Scholar] [CrossRef]

- Neghab, D.P.; Cevik, M.; Wahab, M.I.M.; Basar, A. Explaining exchange rate forecasts with macroeconomic fundamentals using interpretive machine learning. Comput. Econ. 2024, 65, 1857–1899. [Google Scholar] [CrossRef]

- Bilis, E.; Papadimitriou, T.; Diamantaras, K.; Goulianas, K. EXPERT: Exchange rate prediction using encoder representation from transformers. Forecasting 2025, 7, 65. [Google Scholar] [CrossRef]

- Lundberg, S.M.; Lee, S.-I. A unified approach to interpreting model predictions. In Proceedings of the NIPS’17: Proceedings of the 31st International Conference on Neural Information Processing Systems, Long Beach, CA, USA, 4–9 December 2017; Curran Associates, Inc.: New York City, NY, USA, 2017; Volume 30, pp. 4765–4774. [Google Scholar]

- Bandt, C.; Pompe, B. Permutation entropy: A natural complexity measure for time series. Phys. Rev. Lett. 2002, 88, 174102. [Google Scholar] [CrossRef]

- Breiman, L. Random forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef]

- Chen, T.; Guestrin, C. XGBoost: A scalable tree boosting system. In Proceedings of the 22nd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining, San Francisco, CA, USA, 13–17 August 2016; ACM: New York City, NY, USA, 2016; pp. 785–794. [Google Scholar]

- Ke, G.; Meng, Q.; Finley, T.; Wang, T.; Chen, W.; Ma, W.; Ye, Q.; Liu, T.-Y. LightGBM: A highly efficient gradient boosting decision tree. In Proceedings of the 31st Conference on Neural Information Processing Systems (NIPS 2017), Long Beach, CA, USA, 4–9 December 2017; Curran Associates, Inc.: New York City, NY, USA, 2017; Volume 30, pp. 3146–3154. [Google Scholar]

- Prokhorenkova, L.; Gusev, G.; Vorobev, A.; Dorogush, A.V.; Gulin, A. CatBoost: Unbiased boosting with categorical features. In Proceedings of the NIPS’18: Proceedings of the 32nd International Conference on Neural Information Processing Systems, Montréal, QC, Canada, 3–8 December 2018; Curran Associates, Inc.: New York City, NY, USA, 2018; Volume 31, pp. 6638–6648. [Google Scholar]

- Zhang, G.; Wu, Y.; Wong, K.P.; Xu, Z.; Dong, Z.Y.; Iu, H.H.C. An advanced approach for construction of optimal wind power prediction intervals. IEEE Trans. Power Syst. 2014, 30, 2706–2715. [Google Scholar] [CrossRef]

- Liu, B.Y.; Ji, Q.; Nguyen, D.K.; Fan, Y. Dynamic dependence and extreme risk comovement: The case of oil prices and exchange rates. Int. J. Financ. Econ. 2021, 26, 2612–2636. [Google Scholar] [CrossRef]

| Factor | Indicator | Variable | Abbreviation |

|---|---|---|---|

| Economic Fundamentals | Economic Development Level | Value Added of Industry Enterprises | VAIE |

| Inflation Rate | Consumer Price Index | CPI | |

| Fiscal Policy | Government Fiscal Expenditure | GE | |

| Monetary Policy | Money Supply | M2 | |

| Foreign Exchange Reserves | Foreign Exchange Reserves | FXR | |

| International Financial Market | International Currency Exchange Rates | US Dollar Index | DXY |

| International Market Interest Rates | Effective Federal Funds Rate | EFFR | |

| International Crude Oil Prices | Brent Crude oil Futures Settlement Price | BFSP | |

| International Gold Prices | Gold Futures Closing Price | COMEX | |

| International Trade | Terms of Trade | Import Price Index | IPI |

| Export Price Index | EPI | ||

| Trade Balance | Balance of Trade | BOT | |

| Foreign Direct Investment | Foreign Direct Investment | FDI | |

| Public Sentiment | Sentiment Index | Consumer Confidence Index | CCI |

| Economic Policy Uncertainty Index | EPU | ||

| Panic Index | S&P 500 Volatility Index | VIX |

| N | Max | Min | Mean | Std. Dev. | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|---|

| EX | 153 | 7.307 | 6.051 | 6.618 | 0.358 | 0.239 | −1.199 |

| CPI | 153 | 24.000 | 13.758 | 1.208 | 3.049 | 2.613 | 25.823 |

| M2 | 153 | 14.554 | 8.768 | 11.664 | 1.410 | 0.010 | −0.504 |

| FXR | 153 | 39,932.130 | 29,982.040 | 32,870.752 | 2609.926 | 1.421 | 0.822 |

| VAIE | 153 | 52.339 | −25.867 | 6.700 | 6.362 | 1.706 | 21.577 |

| GE | 153 | 37,742 | 6897.340 | 17,260.864 | 6370.799 | 0.798 | 0.353 |

| EFFR | 153 | 5.330 | 0.050 | 1.333 | 1.744 | 1.361 | 0.488 |

| DXY | 153 | 111.937 | 78.922 | 94.029 | 8.183 | −0.396 | −0.714 |

| BFSP | 153 | 124.545 | 26.637 | 75.736 | 24.205 | 0.170 | −1.041 |

| COMEX | 153 | 2571.741 | 1069.282 | 1545.950 | 331.621 | 0.698 | −0.199 |

| IPI | 153 | 118.000 | 85.000 | 101.164 | 7.925 | 0.305 | −0.499 |

| EPI | 153 | 115.700 | 90.300 | 101.520 | 5.229 | 0.474 | 0.185 |

| FDI | 153 | 245.800 | 65.000 | 115.758 | 31.788 | 1.261 | 2.110 |

| BOT | 153 | 988.050 | −619.920 | 438.706 | 257.485 | −0.445 | 1.387 |

| VIX | 153 | 57.737 | 10.125 | 17.601 | 6.131 | 2.576 | 11.826 |

| CCI | 153 | 127.000 | 85.500 | 107.557 | 12.606 | −0.222 | −1.081 |

| EPU | 153 | 970.830 | 40.403 | 436.748 | 255.736 | 0.298 | −1.048 |

| N | Max | Min | Mean | Var | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|---|

| High_Frequency | 153 | 0.298 | −0.343 | 0.001 | 0.019 | −0.131 | −0.078 |

| Mid_Frequency | 153 | 0.346 | −0.248 | −0.002 | 0.022 | 0.248 | −0.698 |

| Low_Frequency | 153 | 6.923 | 6.283 | 6.618 | 0.049 | −0.154 | −1.439 |

| MAE | RMSE | R2 | ||

|---|---|---|---|---|

| Random Forest | 0.1427 | 0.1783 | 0.7339 | |

| XGboost | 0.1206 | 0.1621 | 0.7801 | |

| CatBoost | 0.0999 | 0.1296 | 0.8539 | |

| LightGBM | 0.1182 | 0.1629 | 0.7776 | |

| DM_stat | p_value | |||

| CatBoost vs. XGBoost | −2.3437 | 0.0118 * | ||

| CatBoost vs. LightGBM | −2.3331 | 0.0121 ** | ||

| CatBoost vs. RandomForest | −3.9108 | 0.0001 *** | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.

Share and Cite

Ji, J.; Wang, S.; Wei, Y. Multi-Scale Explainable AI for RMB Exchange Rate Drivers. Forecasting 2026, 8, 7. https://doi.org/10.3390/forecast8010007

Ji J, Wang S, Wei Y. Multi-Scale Explainable AI for RMB Exchange Rate Drivers. Forecasting. 2026; 8(1):7. https://doi.org/10.3390/forecast8010007

Chicago/Turabian StyleJi, Jie, Shouyang Wang, and Yunjie Wei. 2026. "Multi-Scale Explainable AI for RMB Exchange Rate Drivers" Forecasting 8, no. 1: 7. https://doi.org/10.3390/forecast8010007

APA StyleJi, J., Wang, S., & Wei, Y. (2026). Multi-Scale Explainable AI for RMB Exchange Rate Drivers. Forecasting, 8(1), 7. https://doi.org/10.3390/forecast8010007