ARIMA Time Series Models for Full Truckload Transportation Prices

Abstract

:1. Introduction

2. Materials and Methods

2.1. ARIMA Methodology and Trucking Pricing

2.2. Data Sources

3. Results

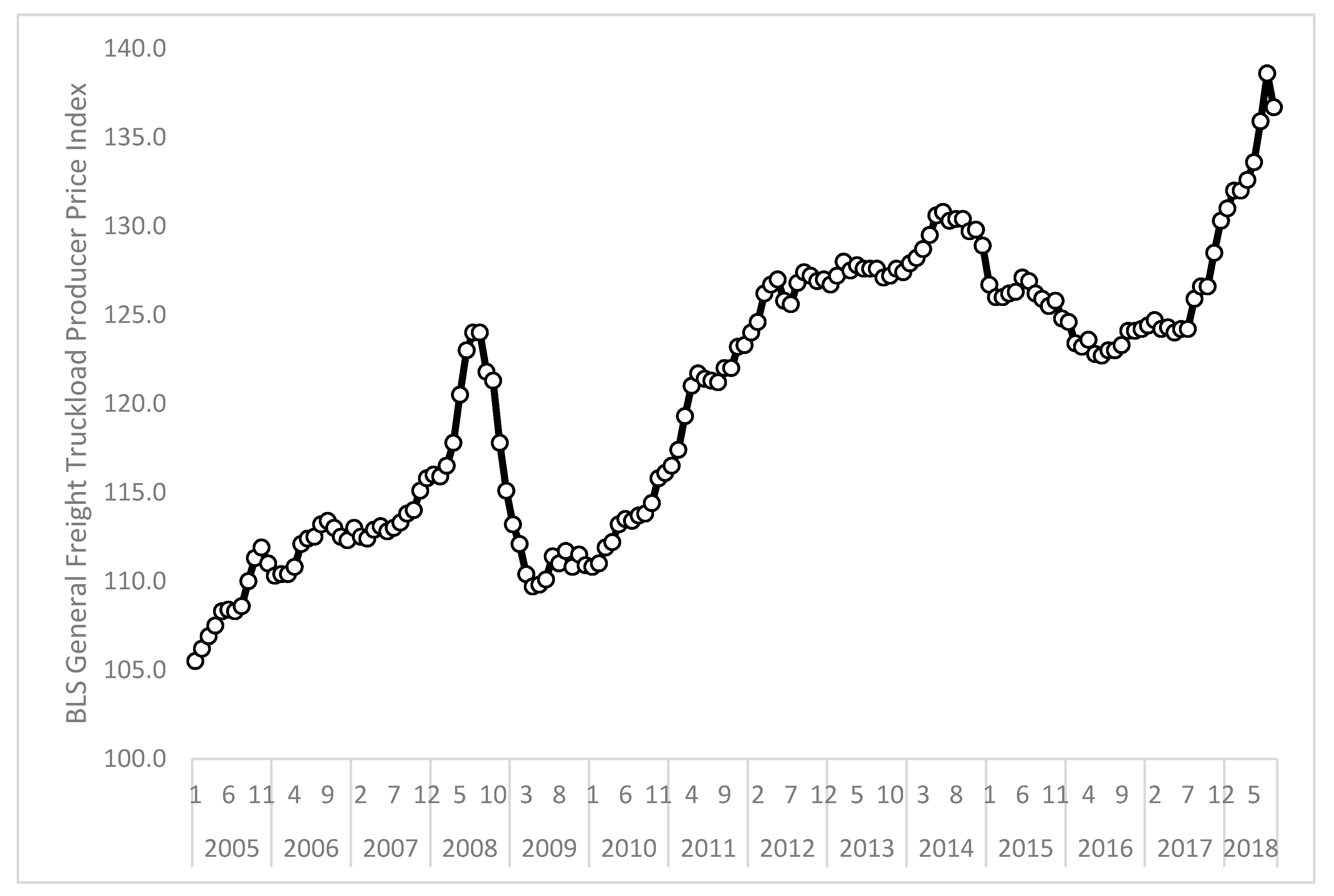

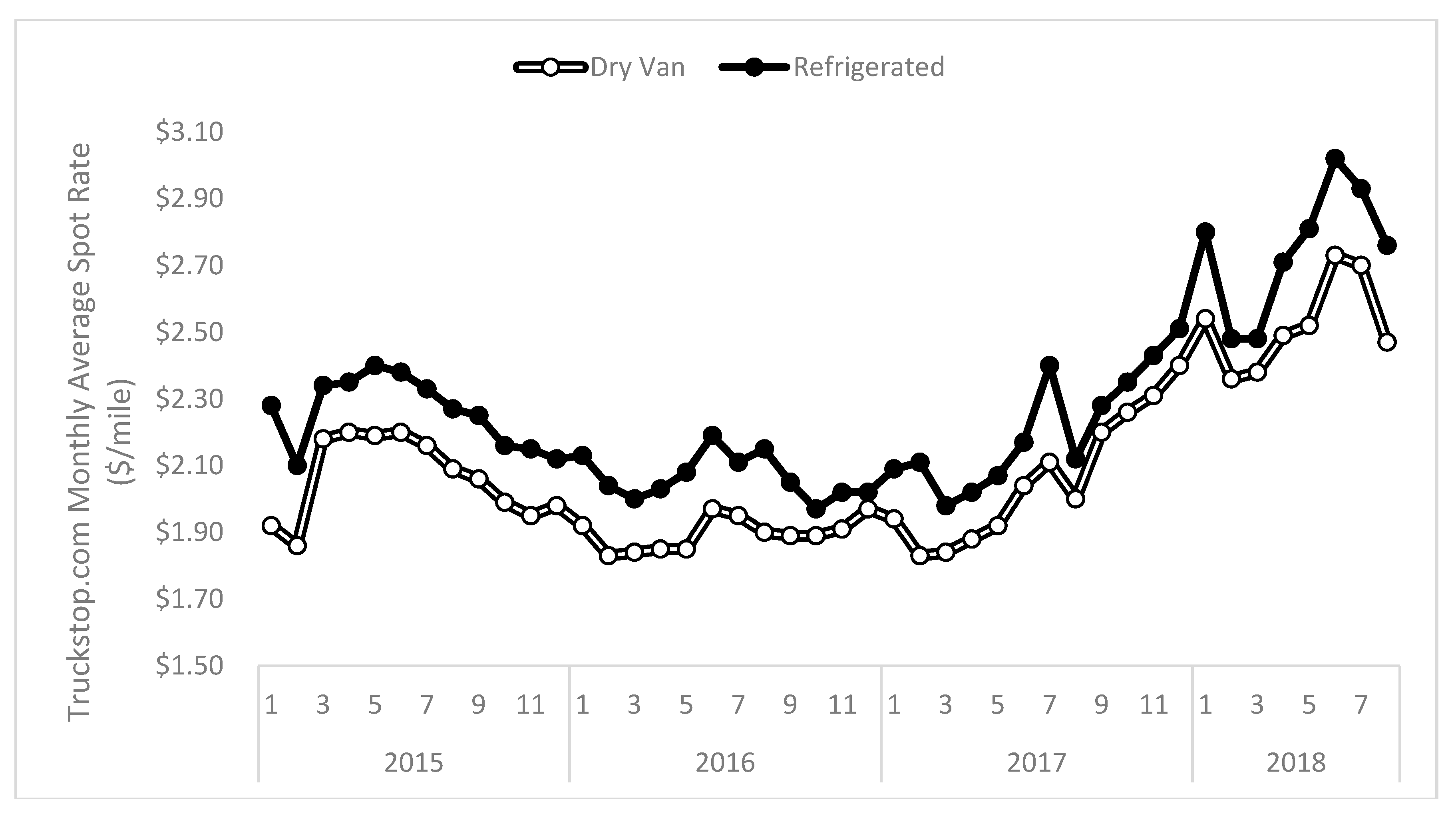

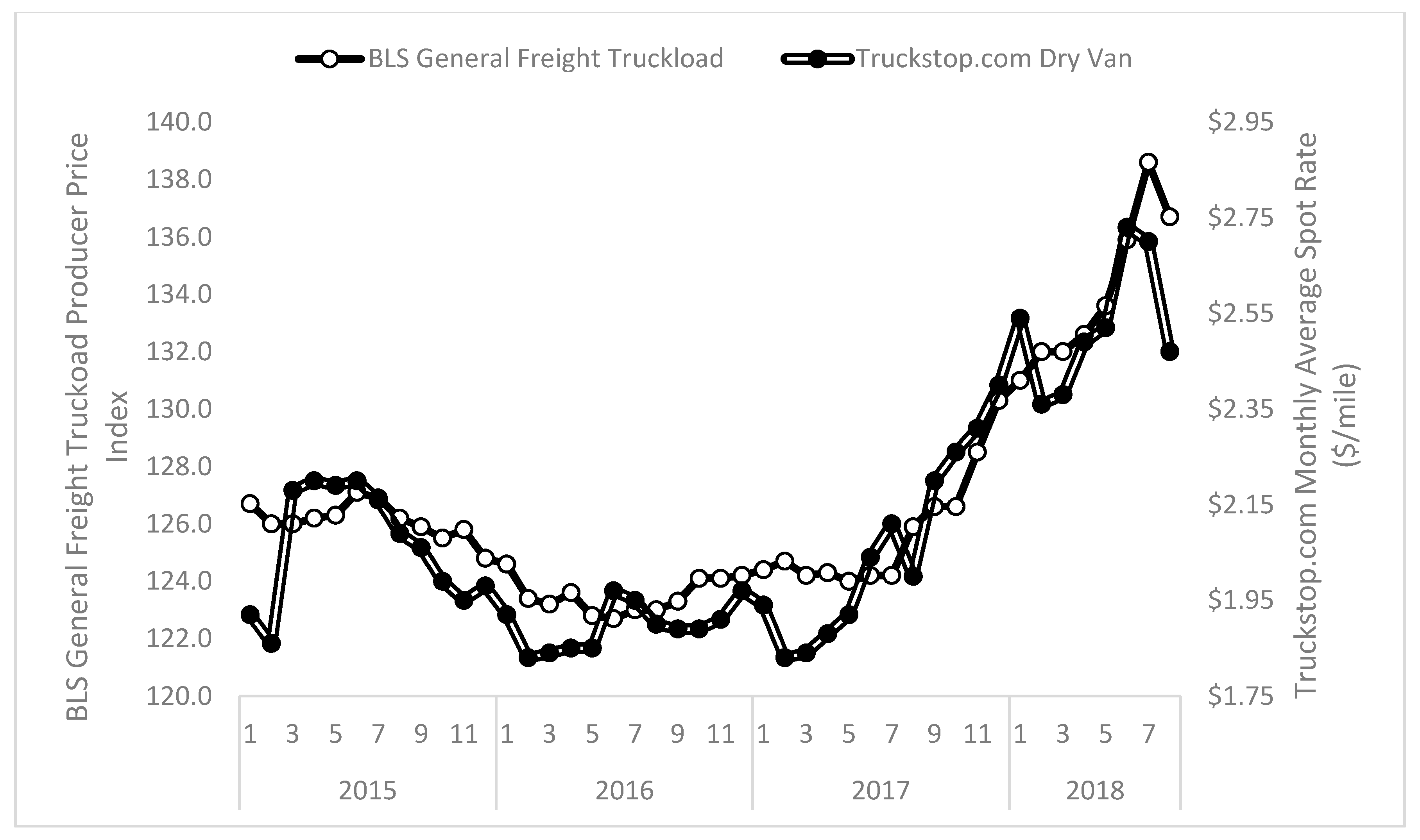

3.1. Descriptive Statistics and Data Transformations

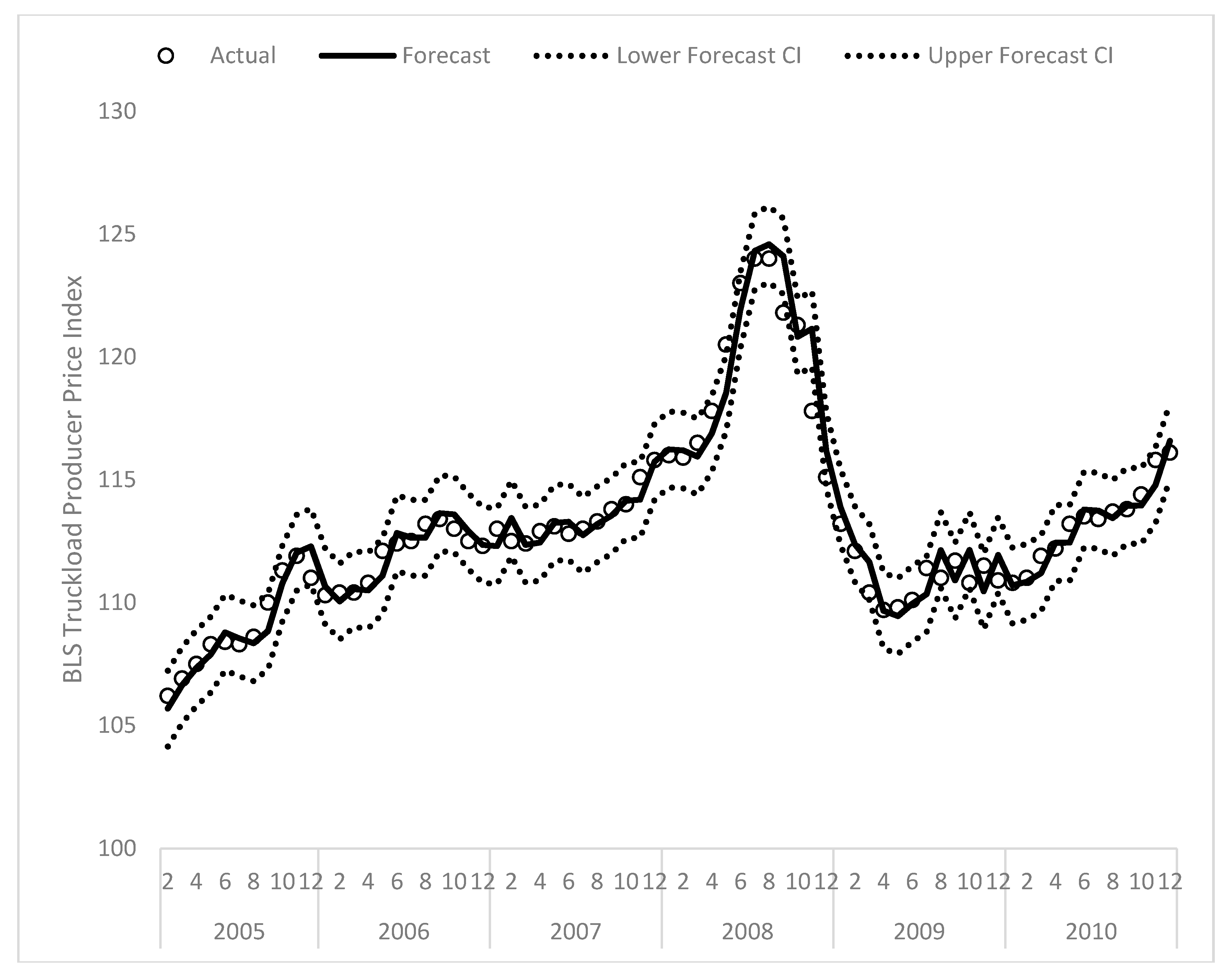

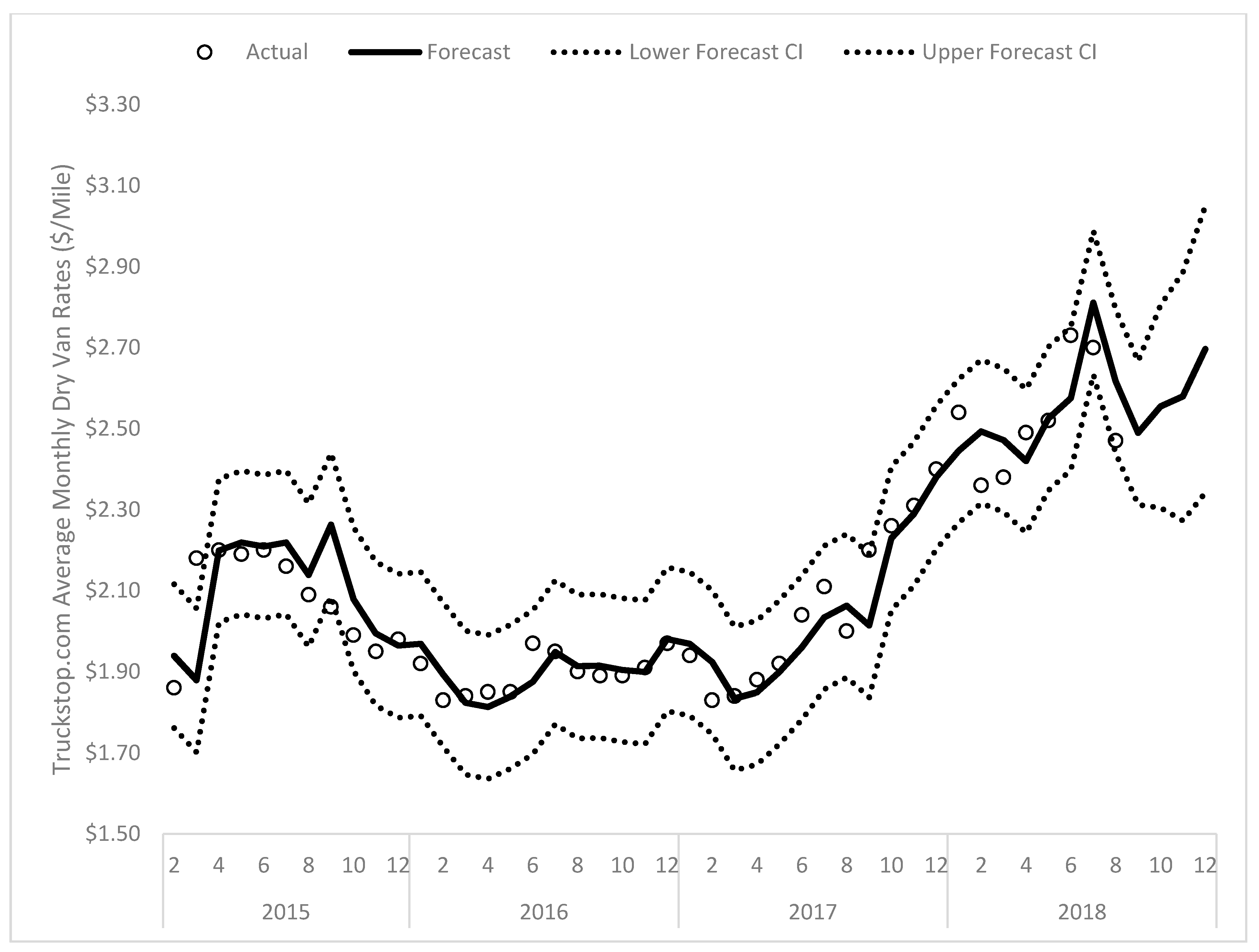

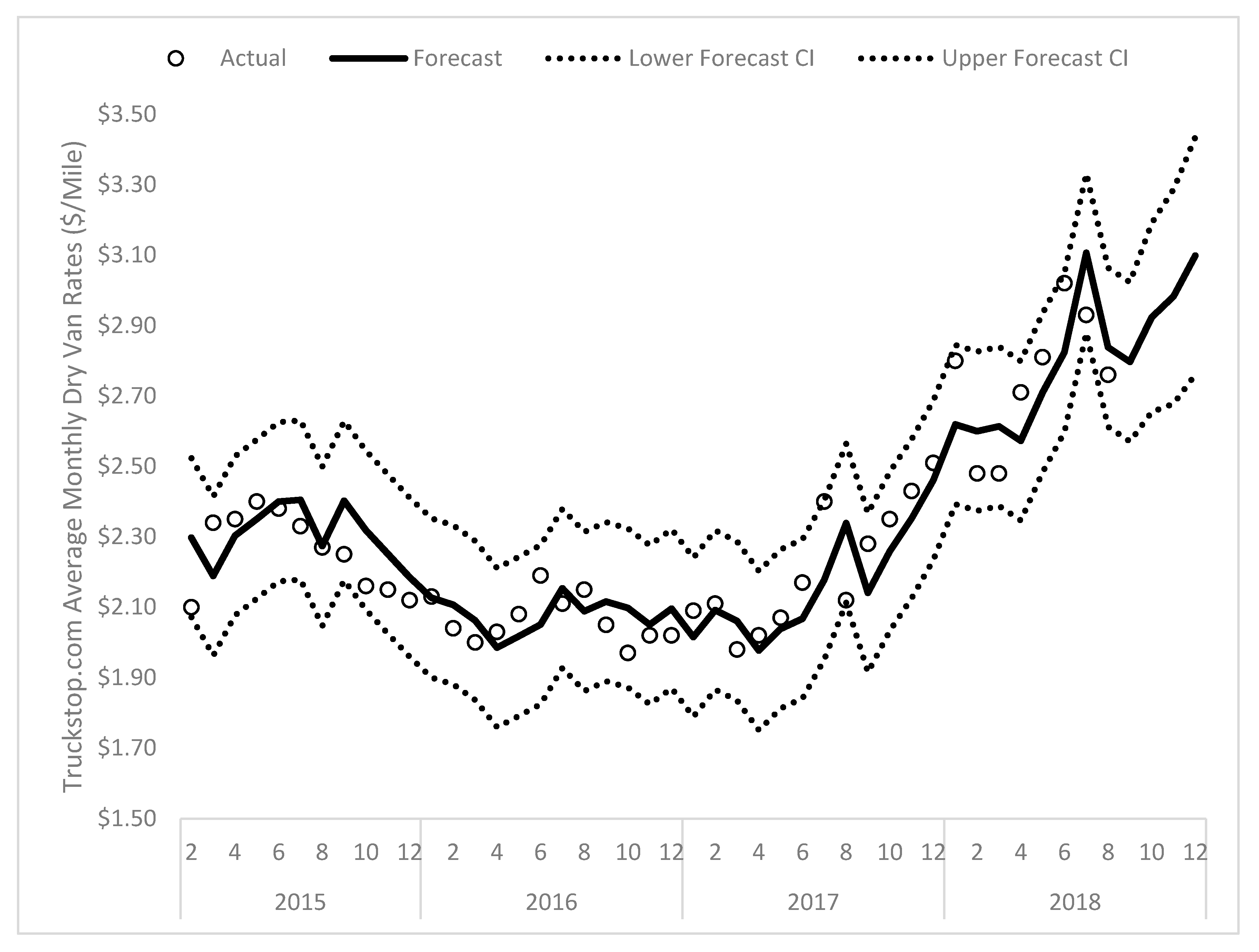

3.2. Results

4. Discussion

5. Conclusions

Supplementary Materials

Funding

Acknowledgments

Conflicts of Interest

References

- American Trucking Association. Reports, Trends & Statistics. 2018. Available online: https://www.trucking.org/News_and_Information_Reports_Industry_Data.aspx (accessed on 9 September 2018).

- Viscelli, S. Driverless? Autonomous Trucks and the Future of the American Trucker. Center for Labor Research and Education, University of California, Berkeley, and Working Partnerships USA. 2018. Available online: http://www.wpusa.org/files/reports/driverless.pdf (accessed on 10 September 2018).

- Caplice, C. Electronic markets for truckload transportation. Prod. Oper. Manag. 2007, 16, 423–436. [Google Scholar] [CrossRef]

- Miller, J.W.; Schwieterman, M.A.; Bolumole, Y.A. Effects of motor carriers’ growth or contraction on safety: A multiyear panel analysis. J. Bus. Logist. 2018, 39, 138–156. [Google Scholar] [CrossRef]

- Phillips, E.E. Get in Line: Backlog for Big Rigs Stretches to 2019. Available online: https://www.wsj.com/articles/get-in-line-backlog-for-big-rigs-stretches-to-2019-1534500005 (accessed on 10 September 2018).

- Phillips, E.E.; Smith, J. As Shipping Costs Soar, Supply Chains Get a Makeover. Available online: https://www.wsj.com/articles/as-shipping-costs-soar-supply-chains-get-a-makeover-1529244003 (accessed on 10 September 2018).

- Baker, J.A. Emergent pricing structures in LTL transportation. J. Bus. Logist. 1991, 12, 191–202. [Google Scholar]

- Smith, L.D.; Campbell, J.F.; Mundy, R. Modeling net rates for expedited freight services. Transp. Res. E Logist. Transp. Rev. 2007, 43, 192–207. [Google Scholar] [CrossRef]

- Kay, M.G.; Warsing, D.P. Estimating LTL rates using publicly available empirical data. Int. J. Logist.-Res Appl. 2009, 12, 165–193. [Google Scholar] [CrossRef]

- Özkaya, E.; Keskinocak, P.; Joseph, V.R.; Weight, R. Estimating and benchmarking less-than-truckload market rates. Transp. Res. E Logist. Transp. Rev. 2010, 46, 667–682. [Google Scholar] [CrossRef]

- Scott, A. The value of information sharing for truckload shippers. Transp. Res. E Logist. Transp. Rev. 2015, 81, 203–214. [Google Scholar] [CrossRef]

- Lindsey, C.; Frei, A.; Alibabai, H.; Mahmassani, H.S.; Park, Y.W.; Klabjan, D.; Reed, M.; Langheim, G.; Keating, T. Modeling Carrier Truckload Freight Rates in Spot Markets. Working Paper. 2013. Available online: http://docs.trb.org/prp/13-4109.pdf (accessed on 10 September 2018).

- Budak, A.; Ustundag, A.; Guloglu, B. A forecasting approach for truckload spot market pricing. Transp. Res. A Pol. 2017, 97, 55–68. [Google Scholar] [CrossRef]

- Joo, S.J.; Min, H.; Smith, C. Benchmarking freight rates and procuring cost-attractive transportation services. Int. J. Logist. Manag. 2017, 28, 94–205. [Google Scholar] [CrossRef]

- Smith, J. Trucking’s Tight Capacity Squeezes U.S. Businesses. Available online: https://www.wsj.com/articles/truckings-tight-capacity-squeezes-u-s-businesses-1533816002 (accessed on 10 September 2018).

- Scott, A.; Parker, C.; Craighead, C.W. Service refusal in supply chains: Drivers and deterrents of freight rejection. Transp. Sci. 2017, 54, 1086–1101. [Google Scholar] [CrossRef]

- Box, G.E.P.; Jenkins, G.M. Time Series Analysis: Forecasting and Control; Holden-Day: San Francisco, CA, USA, 1970. [Google Scholar]

- Browne, M.W.; Nesselroade, J.R. Representing psychological processes with dynamic factor models. In Psychometrics: A festschrift to Roderick P. McDonald; Maydeu-Olivares, A., McArdle, J.J., Eds.; Lawrence Erlbaum Associates Publishers: Mahwah, NJ, USA, 2005; pp. 415–452. [Google Scholar]

- Enders, W. Applied Econometric Time Series, 4th ed.; John Wiley & Sons: Hoboken, NJ, USA, 2015. [Google Scholar]

- Tsai, M.T.; Regan, A.; Saphores, J.D. Freight transportation derivatives contracts: State of the art and future developments. Transp. J. 2009, 48, 7–19. [Google Scholar]

- FTR. Hurricane Harvey Disrupting Freight Transportation in Gulf Region—Nearly Ten Percent of U.S. Trucking Impacted. Available online: https://ftrintel.com/news/hurricane-harvey-disrupting-freight-transportation-in-gulf-region-nearly-ten-percent-of-us-trucking-impacted (accessed on 10 September 2018).

- Federal Reserve Bank of St. Louis. Producer Price Index by Industry: General Freight Trucking, Long-Distance Truckload. Available online: https://fred.stlouisfed.org/series/PCU484121484121 (accessed on 9 September 2018).

- Gwin, C.R. Asymmetric price adjustment: Cross-industry evidence. South Econ. J. 2009, 76, 249–265. [Google Scholar] [CrossRef]

- Peltzman, S. Prices rise faster than they fall. J. Political Econ. 2000, 108, 466–502. [Google Scholar] [CrossRef]

- Truckstop.com. Available online: https://truckstop.com/ (accessed on 10 September 2018).

- CCJ Staff. Indicators: Spot Market Rates soften Some after Historic Run. Available online: https://www.ccjdigital.com/indicators-spot-market-rates-soften-some-after-historic-summer-run/ (accessed on 7 September 2018).

- Duel, D.; Christopher, C.G. Steady as She Goes. Supply Chain Quarterly. 2017, pp. 33–36. Available online: http://www.supplychainquarterly.com/topics/Inventory/20170825-steady-as-she-goes/ (accessed on 10 September 2018).

- Mitchell, J.U.S. Manufacturing Activity Loses Momentum. Available online: https://www.wsj.com/articles/u-s-manufacturing-activity-loses-momentum-1533138906 (accessed on 10 September 2018).

- Harding, M. The Epic Battle of the Bull and Bear—The Double-Edged Sword of Rapid Truckload Rate Increases. Available online: https://www.chainalytics.com/the-epic-battle-of-bull-and-bear-the-double-edged-sword-of-rapid-truckload-rate-increases/ (accessed on 10 September 2018).

- Elliott, G.; Rothenberg, T.J.; Stock, J.H. Efficient tests for an autoregressive unit root. Econometrica 1996, 64, 813–836. [Google Scholar] [CrossRef]

- Commercial Carrier Journal. Contract Rates Dart Upward to Catch Soaring Spot Market Rates. 2018. Available online: https://www.ccjdigital.com/contract-rates-dart-upward-to-catch-soaring-spot-market-rates/ (accessed on 10 September 2018).

- Sheffi, Y. Combinatorial auctions in the procurement of transportation services. Interfaces 2004, 34, 245–252. [Google Scholar] [CrossRef]

- Caplice, C.; Sheffi, Y. Optimization-based procurement for transportation services. J. Bus. Logist. 2003, 24, 109–128. [Google Scholar] [CrossRef]

- Box, G.E.P. Some problems of statistics and everyday life. J. Am. Stat. Assoc. 1979, 74, 1–4. [Google Scholar] [CrossRef]

- Cudeck, R.; Henly, S.J. Model selection in covariance structures analysis and the “problem” of sample size: A clarification. Psychol. Bull. 1991, 109, 512–519. [Google Scholar] [CrossRef] [PubMed]

- Bowman, R.J. Advice for Shippers Facing Rising Freight Rates in 2017. Available online: https://www.supplychainbrain.com/blogs/1-think-tank/post/24752-advice-for-shippers-facing-rising-freight-rates-in-2017 (accessed on 10 September 2018).

- Harding, M. Drinking from the Transportation Market Fire Hose—Part 2. Available online: https://www.chainalytics.com/drinking-transportation-market-fire-hose-part-2/ (accessed on 10 September 2018).

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Miller, J.W. ARIMA Time Series Models for Full Truckload Transportation Prices. Forecasting 2019, 1, 121-134. https://doi.org/10.3390/forecast1010009

Miller JW. ARIMA Time Series Models for Full Truckload Transportation Prices. Forecasting. 2019; 1(1):121-134. https://doi.org/10.3390/forecast1010009

Chicago/Turabian StyleMiller, Jason W. 2019. "ARIMA Time Series Models for Full Truckload Transportation Prices" Forecasting 1, no. 1: 121-134. https://doi.org/10.3390/forecast1010009