The Energy Transition in Colombia: Government Projections and Realistic Scenarios

Abstract

1. Introduction

2. Energy Balance and Transition Context in Colombia

2.1. Energy Balance

2.2. Current State of Hydrogen Production in Colombia

2.3. Energy Transition Objectives

- The democratization of energy governance, to broaden public participation in the shift toward renewable sources.

- Fostering energy communities, characterized as diverse organizations including small and medium-sized enterprises, households, and other related entities that actively participate in one or more functions of the energy sector [43].

- The large-scale electrification of the transportation sector.

- Developing the national capacity for green hydrogen production.

2.4. Study Context

- Absence of an electric grid in non-interconnected zones.

- High investment and operating costs of renewable energy sources.

- Subsidies for fossil fuels.

- Lack of comprehensive long-term planning and poor public–private coordination.

- Insecurity related to armed conflict in different regions.

2.4.1. Renewable Electricity Technologies

- Wind;

- Solar;

- Bioenergy;

- Hydropower;

- Geothermal;

- Marine.

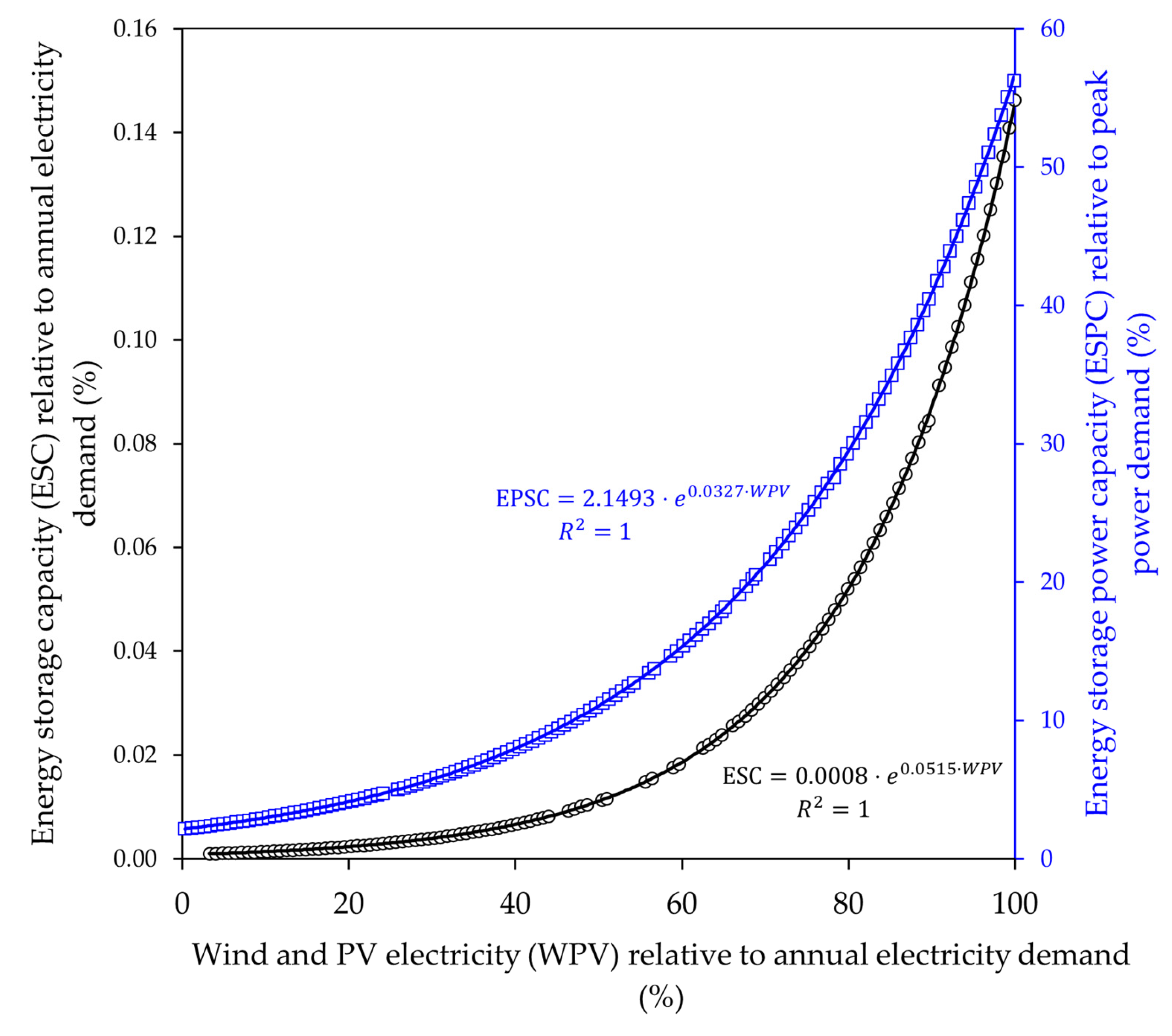

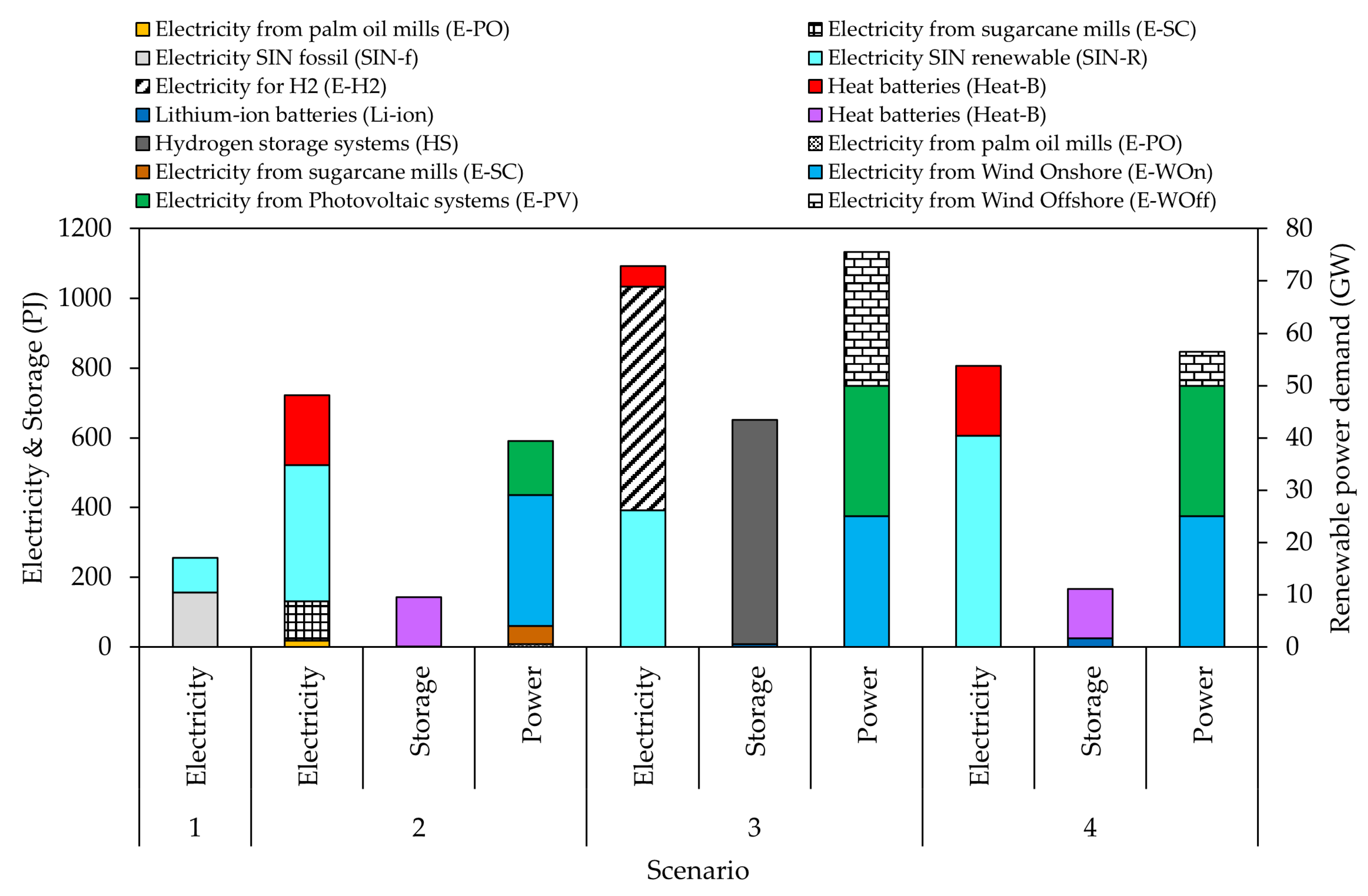

2.4.2. Energy Storage Systems

2.4.3. Industrial Heat Demand

2.4.4. Electric Transport

2.4.5. Biofuels

2.4.6. Wind and PV Potentials

- Wind onshore: Implementation of onshore wind turbines up to 25 GW.

- PV systems: Implementation of PV systems up to 25 GW.

- Wind offshore: Implementation of offshore wind turbines up to 50 GW.

3. Materials and Methods

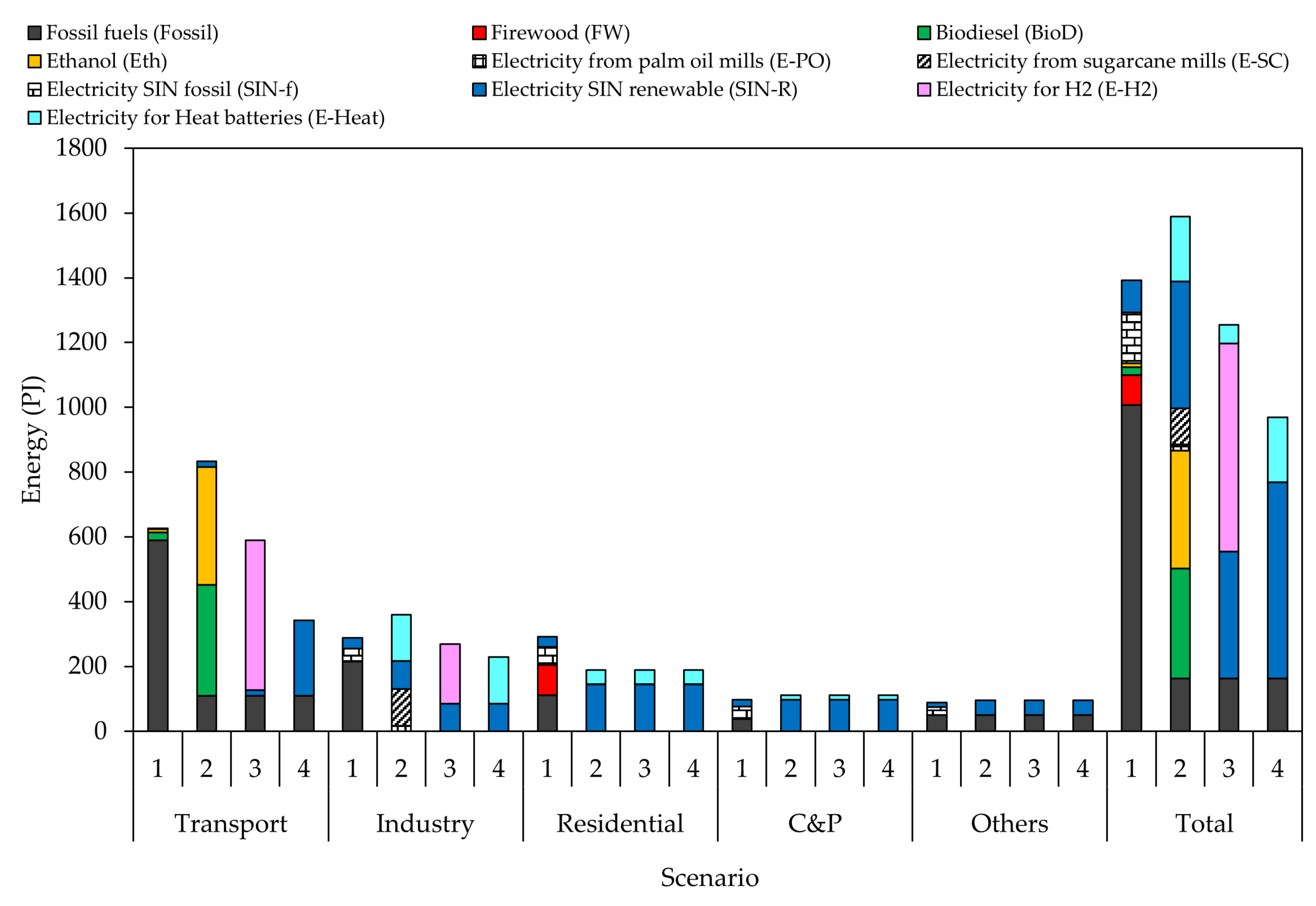

3.1. Scenarios

- Baseline scenario: 2021 national energy balance.

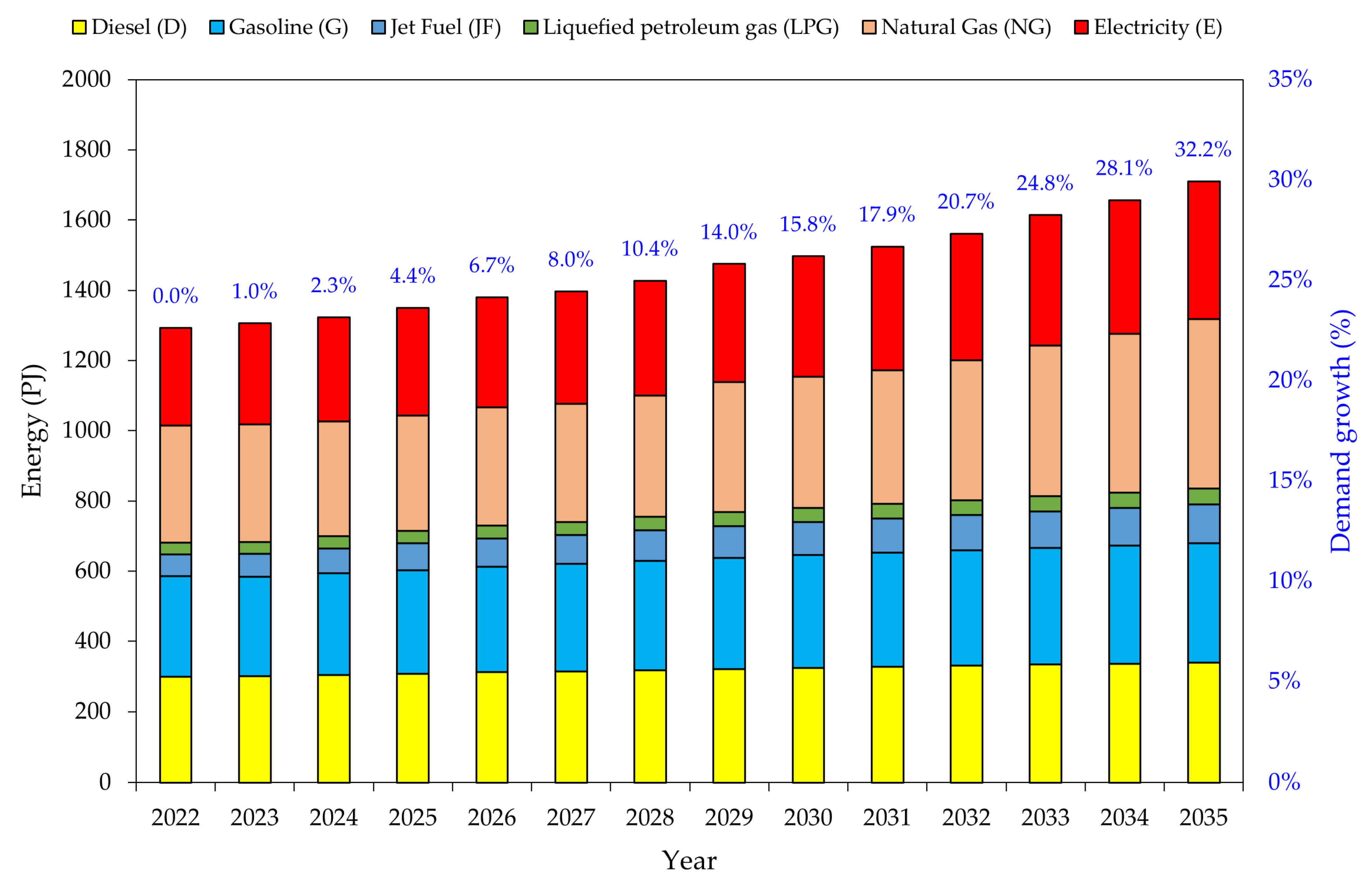

- 2035 projected energy balance: This scenario considers using biofuel to support transport and renewable electricity from biomass, PV, and wind systems to complement hydroelectricity in the electricity mix and support industrial heat.

- 2035 projected energy balance: This scenario considers using hydrogen to support transport, industrial heat, and renewable electricity from wind and PV systems to support the remaining energy demand.

- 2035 projected energy balance: Using renewable electricity to support the national energy demand.

3.2. Scenarios Methodology

3.3. Systems’ CAPEX Calculations

4. Results

5. Discussion

5.1. Principal Findings

5.2. Study Limitations

5.3. Directions for Future Research

5.4. Policy Implications and Recommendations

5.5. Challenges and Drawbacks of the Proposed Pragmatic Pathways

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| Al | Alcohol |

| BDPS | Bulk or distributed power services |

| Bg | Bagasse |

| BioD | Biodiesel |

| BPS | Bulk power services |

| C | Coal |

| C&P | Commercial and public |

| CAPEX | Capital expenditures |

| CC | Chalk coal |

| CCUS | Carbon capture, use, and storage |

| Co | Coque |

| CPO | Crude palm oil |

| D | Diesel |

| DPS | Distributed power services |

| E | Electricity |

| EG | Electricity from the grid |

| E-H2 | Electricity for H2 |

| E-Heat | Electricity for Heat batteries |

| EP | Exports primary energy |

| E-PO | Electricity from palm oil mills |

| E-PV | Electricity from Photovoltaic Systems |

| ES | Exports of secondary energy |

| ESC | Energy storage capacity |

| E-SC | Electricity from sugarcane mills |

| ESPC | Energy storage power capacity |

| Eth | Ethanol |

| EV | Electric vehicles |

| E-WOff | Electricity from Wind Offshore |

| E-WOn | Electricity from Wind Onshore |

| FC | Final energy consumption |

| FO | Fuel oil |

| Fossil | Fossil fuels |

| Fw | Firewood |

| G | Gasoline |

| Ga | Gasoline |

| H | Hydraulic |

| HE | Hydro energy |

| Heat-B | Heat batteries |

| HS | Hydrogen storage systems |

| IL | Inefficiencies and losses |

| In | Inefficiencies |

| InP | Inventories primary energy |

| IP | Imports primary energy |

| IS | Imports of secondary energy |

| JF | Jet fuel |

| Ke | Kerosene |

| LCOE | Levelized cost of electricity |

| Li-ion | Lithium-ion batteries |

| LP | Loss of primary energy |

| LPG | Liquefied petroleum gas |

| LS | Loss of secondary energy |

| LT | Loss in transformation processes |

| NG | Natural gas |

| O | Other renewables |

| OPEX | Operational expenditures |

| Pe | Petroleum |

| PHS | Pumped hydro energy storage |

| Pr | Primary energy |

| Pro | Primary energy sources |

| PV | Photovoltaic |

| RP | Reinjection of primary energy |

| S | Secondary energy |

| SCP | Self-consumption of primary energy |

| SCS | Self-consumption of secondary energy |

| SG | Electricity generated for self-consumption in industry |

| SIN | National Interconnected System |

| SIN-f | Electricity SIN fossil |

| SIN-R | Electricity SIN renewable |

| SMR | Steam methane reforming |

| TES | Thermal energy systems |

| ThP | Thermal power plants Natural gas, fueled with coal, bagasse, diesel, petroleum, liquified petroleum gas, or fuel oil |

| TP | Primary energy used in transformation processes |

| TRL | Technology readiness level |

| TrP | Transfer primary energy |

| TrS | Transfer of secondary energy |

| TS | Secondary energy used in transformation processes |

| UE | Useful energy |

| VRE | Variable renewable energy |

| W | Wind |

| Wa | Waste |

| WOff | Wind Offshore |

| WOn | Wind Onshore |

| WPV | Wind and PV electricity |

References

- Nerini, F.F. Shore up Support for Climate Action Using SDGs. Nature 2018, 557, 31. [Google Scholar] [CrossRef]

- Kroll, C.; Warchold, A.; Pradhan, P. Sustainable Development Goals (SDGs): Are We Successful in Turning Trade-Offs into Synergies? Palgrave Commun. 2019, 5, 140. [Google Scholar] [CrossRef]

- IPCC. Climate Change 2022—Mitigation of Climate Change; Intergovernmental Panel on Climate Change (IPCC), Ed.; Cambridge University Press: Cambridge, UK, 2023; ISBN 9781009157926. [Google Scholar]

- Alliance Manchester Business School Planning for a Green Economy: The Trade-Offs of Green Energy Measures. Available online: https://www.forbes.com/sites/alliancembs/2022/09/21/planning-for-a-green-economy-the-trade-offs-of-green-energy-measures/ (accessed on 25 August 2025).

- Dercon, S. Is Green Growth Good for the Poor? World Bank Res. Obs. 2014, 29, 163–185. [Google Scholar] [CrossRef]

- IPCC. Global Warming of 1.5 °C; Cambridge University Press: Cambridge, UK, 2022; ISBN 9781009157940. [Google Scholar]

- IEA. World Energy Investment 2023. Available online: https://www.iea.org/reports/world-energy-investment-2023 (accessed on 25 August 2025).

- DeSantis, D.; James, B.D.; Houchins, C.; Saur, G.; Lyubovsky, M. Cost of Long-Distance Energy Transmission by Different Carriers. iScience 2021, 24, 103495. [Google Scholar] [CrossRef]

- IEA. The Role of Critical Minerals in Clean Energy Transitions. Available online: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions (accessed on 25 August 2025).

- Ali, S.H. The US Should Get Serious about Mining Critical Minerals for Clean Energy. Nature 2023, 615, 563. [Google Scholar] [CrossRef]

- Briera, T.; Lefèvre, J. Reducing the Cost of Capital through International Climate Finance to Accelerate the Renewable Energy Transition in Developing Countries. Energy Policy 2024, 188, 114104. [Google Scholar] [CrossRef]

- Iqbal, A.; Tang, X.; Rasool, S.F. Investigating the Nexus between CO2 Emissions, Renewable Energy Consumption, FDI, Exports and Economic Growth: Evidence from BRICS Countries. Environ. Dev. Sustain. 2023, 25, 2234–2263. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Güngör, H.; Adebayo, T.S. Consumption-based Carbon Emissions, Renewable Energy Consumption, Financial Development and Economic Growth in Chile. Bus. Strategy Environ. 2022, 31, 1123–1137. [Google Scholar] [CrossRef]

- Ahmed, Z.; Ahmad, M.; Murshed, M.; Ibrahim Shah, M.; Mahmood, H.; Abbas, S. How Do Green Energy Technology Investments, Technological Innovation, and Trade Globalization Enhance Green Energy Supply and Stimulate Environmental Sustainability in the G7 Countries? Gondwana Res. 2022, 112, 105–115. [Google Scholar] [CrossRef]

- Samy, M.M.; Emam, A.; Tag-Eldin, E.; Barakat, S. Exploring Energy Storage Methods for Grid-Connected Clean Power Plants in Case of Repetitive Outages. J. Energy Storage 2022, 54, 105307. [Google Scholar] [CrossRef]

- Minenergía Ministra de Minas y Energía Socializó Retos y Apuestas Del Gobierno Para La Transición Energética Justa En Colombia. Available online: https://www.minenergia.gov.co/es/sala-de-prensa/noticias-index/ministra-de-minas-y-energ%C3%ADa-socializ%C3%B3-retos-y-apuestas-del-gobierno-para-la-transici%C3%B3n-energ%C3%A9tica-justa-en-colombia/ (accessed on 26 August 2025).

- Minenergía La Transición Energética Justa En Colombia Seguirá Avanzando de Manera Gradual. Available online: https://www.minenergia.gov.co/es/sala-de-prensa/noticias-index/la-transici%C3%B3n-energ%C3%A9tica-justa-en-colombia-seguir%C3%A1-avanzando-de-manera-gradual/ (accessed on 26 August 2025).

- Presidencia de la República Presidente Petro Propone una Alianza Sostenible Entre Europa y América Latina para Energía Limpia y Economía Descarbonizada. Available online: https://www.presidencia.gov.co/prensa/Paginas/Presidente-Petro-propone-una-alianza-sostenible-entre-Europa-y-America-Lati-230505.aspx (accessed on 19 August 2024).

- Presidencia de la República Invertir En La Transición Energética y Climática de Colombia, Propone Presidente Petro al Mundo. Available online: https://www.presidencia.gov.co/prensa/Paginas/Invertir-en-la-transicion-energetica-y-climatica-de-Colombia-propone-presidente-Petro-al-mundo-231202.aspx (accessed on 19 August 2024).

- The Editors of Nature. The World’s Plan to Make Humanity Sustainable Is Failing. Science Can Do More to Save It [Editorial]. Nature 2023, 618, 647. [Google Scholar] [CrossRef]

- Nerini, F.F.; Sovacool, B.; Hughes, N.; Cozzi, L.; Cosgrave, E.; Howells, M.; Tavoni, M.; Tomei, J.; Zerriffi, H.; Milligan, B. Connecting Climate Action with Other Sustainable Development Goals. Nat. Sustain. 2019, 2, 674–680. [Google Scholar] [CrossRef]

- Kaltenegger, O.; Löschel, A.; Baikowski, M.; Lingens, J. Energy Costs in Germany and Europe: An Assessment Based on a (Total Real Unit) Energy Cost Accounting Framework. Energy Policy 2017, 104, 419–430. [Google Scholar] [CrossRef]

- UPME. Balance Energético Colombiano. Available online: https://www1.upme.gov.co/DemandayEficiencia/Paginas/BECO.aspx (accessed on 22 January 2025).

- DANE. Exportaciones. Available online: https://www.dane.gov.co/index.php/estadisticas-por-tema/comercio-internacional/exportaciones (accessed on 9 January 2024).

- Rios, C.J.; Velasco, A.M.; Zambrano, A. Efectos Macroeconómicos y Fiscales de Una Política de No Exploración y La Reforma Tributaria de 2022 En El Sector de Hidrocarburos (Macroeconomic and Fiscal Effects of a No Exploration Policy and the 2022 Tax Reform on the Hydrocarbons Sector. SSRN Electron. J. 2023. [Google Scholar] [CrossRef]

- PNUD. La Dependencia del país y de los Territorios de los Hidrocarburos y el Carbón en Colombia y la Necesidad de la Diversificación de las Exportaciones y de la Producción Ante la Transición Energética. Available online: https://indh2024.pnud.org.co/hd/papers/13-La-dependencia-del-pais-y-de-los-territorios-de-los-hidrocarburos-y-el-carbon-en-Colombia.pdf (accessed on 26 August 2025).

- DANE Producto Interno Bruto-PIB-Nacional Trimestral Históricos. Available online: https://www.dane.gov.co/index.php/estadisticas-por-tema/cuentas-nacionales/cuentas-nacionales-trimestrales/historicos-producto-interno-bruto-pib (accessed on 14 February 2024).

- UPME; IREES; TEP. Corpoema Primer Balance de Energía Útil Para Colombia y Cuantificación de Las Perdidas Energéticas Relacionadas y La Brecha de Eficiencia Energética: Resumen Ejecutivo BEU Sector Residencial y Rerciario. Available online: https://www1.upme.gov.co/DemandayEficiencia/Documents/Balance_energia_util/BEU-Residencial.pdf (accessed on 26 August 2025).

- UPME. Boletín Estadístico 2018–2022S1. Available online: https://www1.upme.gov.co/PromocionSector/SeccionesInteres/Documents/Boletines/Boletin_Estadistico_2018_2022.pdf (accessed on 12 May 2024).

- Gómez-Navarro, T.; Ribó-Pérez, D. Assessing the Obstacles to the Participation of Renewable Energy Sources in the Electricity Market of Colombia. Renew. Sustain. Energy Rev. 2018, 90, 131–141. [Google Scholar] [CrossRef]

- Trespalacios, A.; Cortés, L.M.; Perote, J. The Impact of the El Niño Phenomenon on Electricity Prices in Hydrologic-based Production Systems: A Switching Regime Semi-nonparametric Approach. Energy Sci. Eng. 2023, 11, 1564–1578. [Google Scholar] [CrossRef]

- Weng, W.; Becker, S.L.; Lüdeke, M.K.B.; Lakes, T. Landscape Matters: Insights from the Impact of Mega-Droughts on Colombia’s Energy Transition. Environ. Innov. Soc. Transit. 2020, 36, 1–16. [Google Scholar] [CrossRef]

- UPME. Plan de Expansión de Transmisión 2022–2037. Available online: https://docs.upme.gov.co/SIMEC/Energia%20Electrica/Documentos_Anexos/Plan_Transmision_2022-2034_V6_scc_31ago2022.pdf (accessed on 6 October 2024).

- UPME. Proyecciones de Demanda. Available online: https://www.upme.gov.co/simec/planeacion-energetica/proyeccion_de_demanda/ (accessed on 16 January 2025).

- Gasca Rojas, M.; Giraldo, J.D. Cuatro Años Después: Avances y Desafíos de La Hoja de Ruta Del Hidrógeno En Colombia; Asociación Hidrógeno Colombia (Hydrogen Colombia Association): Bogotá, Colombia, 2025. [Google Scholar]

- The Colombian Ministerio de Minas y Energía (Ministry of Mines and Energy). Minenergía Colombia’s Hydrogen Roadmap; Ministerio de Minas y Energía (Ministry of Mines and Energy): Bogotá, Colombia, 2022. [Google Scholar]

- World Bank Group; Minenergía; IDOM. Análisis de Las Cadenas de Valor de Derivados Del Hidrógeno y La Regulación Habilitante En Colombia; World Bank Group: Washington, DC, USA, 2025. [Google Scholar]

- Ruiz, L. Entre 2023 y 2024 La Capacidad de Producción de Hidrógeno Creció 12 Veces. Available online: https://naturgas.com.co/entre-2023-y-2024-la-capacidad-de-produccion-de-hidrogeno-crecio-12-veces/#:~:text=La%20Asociaci%C3%B3n%20de%20Hidr%C3%B3geno%20y%20WEC%20Colombia%20revelaron%20que%20durante,relaci%C3%B3n%20con%20la%20vigencia%20anterior. (accessed on 16 September 2025).

- Roa Barragán, R. World Economic Forum—Energy Transition; World Economic Forum: Geneva, Switzerland, 2024. [Google Scholar]

- Minenergía Gobierno Nacional Impulsa El Hidrógeno Como Motor de La Transición Energética En Colombia. Available online: https://minenergia.gov.co/es/sala-de-prensa/noticias-index/gobierno-nacional-impulsa-el-hidrogeno-como-motor-de-la-transicion-energetica-en-colombia/#:~:text=Hidr%C3%B3geno%2C%20eje%20central%20de%20la,ventajas%20competitivas%20a%20nivel%20internacional (accessed on 16 September 2025).

- Instituto Nacional de Metrología de Colombia. Hidrógeno: Realidad y Retos Desde La Metrología; INM: Bogotá, Colombia, 2025. [Google Scholar]

- Duque Márquez, I.; Mesa Puyo, D.; Lotero Robledo, M.; Sandoval Valderrama, S. Energy Transition: A Legacy for the Present and the Future of Colombia; Ministerio de Minas y Energía: Bogotá, Columbia, 2021; ISBN 978-958-59383-9-7. [Google Scholar]

- Löbbe, S.; Sioshansi, F.; Robinson, D. Energy Communities; Löbbe, S., Sioshansi, F., Robinson, D., Eds.; Elsevier: Amsterdam, The Netherlands, 2022; ISBN 9780323911351. [Google Scholar]

- Minenergía El Reino Unido Respalda La Transición Energética Justa En Colombia. Available online: https://www.minenergia.gov.co/es/sala-de-prensa/noticias-index/el-reino-unido-respalda-la-transici%C3%B3n-energ%C3%A9tica-justa-en-colombia/ (accessed on 26 August 2025).

- UPME. Primer Atlas Hidroenergético Revela Gran Potencial En Colombia. Available online: https://www1.upme.gov.co/Paginas/Primer-Atlas-hidroenergetico-revela-gran-potencial-en-Colombia.aspx (accessed on 26 August 2025).

- Filonchyk, M.; Peterson, M.P.; Zhang, L.; Hurynovich, V.; He, Y. Greenhouse Gases Emissions and Global Climate Change: Examining the Influence of CO2, CH4, and N2O. Sci. Total Environ. 2024, 935, 173359. [Google Scholar] [CrossRef]

- Eurostat Share of Renewables in Transport Rose in 2023. Available online: https://ec.europa.eu/eurostat/web/products-eurostat-news/w/ddn-20250207-1 (accessed on 25 August 2025).

- IEA. Renewables 2024. Available online: https://www.iea.org/reports/renewables-2024 (accessed on 25 August 2025).

- Minenergía Potencial Energético Subnacional y Oportunidades de Descarbonización En Usos de Energía Final. Available online: https://www.minenergia.gov.co/documents/10443/4._Potencial_energ%C3%A9tico_subnacional_y_oportunidades_de_descarbonizaci%C3%B3n_en_uso_zIqm9dM.pdf (accessed on 25 August 2025).

- Barrera Hernandez, J.C.; Sagastume Gutierrez, A.; Ramírez-Contreras, N.E.; Cabello Eras, J.J.; García-Nunez, J.A.; Barrera Agudelo, O.R.; Silva Lora, E.E. Biomass-Based Energy Potential from the Oil Palm Agroindustry in Colombia: A Path to Low Carbon Energy Transition. J. Clean. Prod. 2024, 449, 141808. [Google Scholar] [CrossRef]

- UN. What Is Renewable Energy? Available online: https://www.un.org/en/climatechange/what-is-renewable-energy (accessed on 22 August 2024).

- IEA. Renewable Energy Market Update: Outlook for 2022 and 2023; OECD Publishing: Paris, France, 2022; ISBN 9789264412040. [Google Scholar]

- Gonzalez-Salazar, M.A.; Morini, M.; Pinelli, M.; Spina, P.R.; Venturini, M.; Finkenrath, M.; Poganietz, W.-R. Methodology for Biomass Energy Potential Estimation: Projections of Future Potential in Colombia. Renew. Energy 2014, 69, 488–505. [Google Scholar] [CrossRef]

- Sagastume, A.; Mendoza, J.M.; Cabello, J.J.; Rhenals, J.D. The Available Waste-to-Energy Potential from Agricultural Wastes in the Department of Córdoba, Colombia. Int. J. Energy Econ. Policy 2021, 11, 44–50. [Google Scholar] [CrossRef]

- Sagastume Gutiérrez, A.; Balbis Morejón, M.; Cabello Eras, J.J.; Cabello Ulloa, M.; Rey Martínez, F.J.; Rueda-Bayona, J.G. Data Supporting the Forecast of Electricity Generation Capacity from Non-Conventional Renewable Energy Sources in Colombia. Data Brief 2020, 28, 104949. [Google Scholar] [CrossRef]

- Cabello, J.J.; Balbis, M.; Sagastume, A.; Pardo, A.; Cabello, M.J.; Rey, F.J.; Rueda-Bayona, J.G. A Look to the Electricity Generation from Non-Conventional Renewable Energy Sources in Colombia. Int. J. Energy Econ. Policy 2019, 9, 15–25. [Google Scholar] [CrossRef]

- NREL. NREL Annual Technology Baseline. Available online: https://atb.nrel.gov/ (accessed on 1 September 2024).

- Cárdenas, B.; Swinfen-Styles, L.; Rouse, J.; Hoskin, A.; Xu, W.; Garvey, S.D. Energy Storage Capacity vs. Renewable Penetration: A Study for the UK. Renew. Energy 2021, 171, 849–867. [Google Scholar] [CrossRef]

- Hill, C.A.; Such, M.C.; Chen, D.; Gonzalez, J.; Grady, W.M. Battery Energy Storage for Enabling Integration of Distributed Solar Power Generation. IEEE Trans. Smart Grid 2012, 3, 850–857. [Google Scholar] [CrossRef]

- Liang, X. Emerging Power Quality Challenges Due to Integration of Renewable Energy Sources. IEEE Trans. Ind. Appl. 2017, 53, 855–866. [Google Scholar] [CrossRef]

- Bowen, T.; Chernyakhovskiy, I.; Xu, K.; Gadzanku, S.; Coney, K. USAID Grid-Scale Energy Storage Technologies Primer; NREL: Washington, DC, USA, 2021. [Google Scholar]

- Albertus, P.; Manser, J.S.; Litzelman, S. Long-Duration Electricity Storage Applications, Economics, and Technologies. Joule 2020, 4, 21–32. [Google Scholar] [CrossRef]

- Schmidt, O.; Staffell, I. Monetizing Energy Storage; Oxford University Press: Oxford, UK, 2023; ISBN 019288817X. [Google Scholar]

- Beaudin, M.; Zareipour, H.; Schellenberglabe, A.; Rosehart, W. Energy Storage for Mitigating the Variability of Renewable Electricity Sources: An Updated Review. Energy Sustain. Dev. 2010, 14, 302–314. [Google Scholar] [CrossRef]

- Mitali, J.; Dhinakaran, S.; Mohamad, A.A. Energy Storage Systems: A Review. Energy Storage Sav. 2022, 1, 166–216. [Google Scholar] [CrossRef]

- Olabi, A.G.; Onumaegbu, C.; Wilberforce, T.; Ramadan, M.; Abdelkareem, M.A.; Al-Alami, A.H. Critical Review of Energy Storage Systems. Energy 2021, 214, 118987. [Google Scholar] [CrossRef]

- Bielewski, M.; Pfrang, A.; Bobba, S.; Kronberga, A.; Georgakaki, A.; Letout, S.; Kuokkanen, A.; Mountraki, A.; Ince, E.; Shtjefni, D.; et al. Batteries for Energy Storage in the European Union: Status on Technology Development, Trends, Value Chains and Markets: 2022; Publications Office of the European Union: Luxembourg, 2022. [Google Scholar]

- Krishan, O.; Suhag, S. An Updated Review of Energy Storage Systems: Classification and Applications in Distributed Generation Power Systems Incorporating Renewable Energy Resources. Int. J. Energy Res. 2019, 43, 6171–6210. [Google Scholar] [CrossRef]

- Patel, P. Liquid-Metal Battery will Be on the Grid Next Year the Molten Calcium-Antimony Design Promises Low Cost and Long Life. Available online: https://spectrum.ieee.org/liquid-metal-battery (accessed on 3 November 2024).

- Zhou, X.; Zhou, H.; Yan, S.; He, Y.; Zhang, W.; Li, H.; Wang, K.; Jiang, K. Increasing the Actual Energy Density of Sb-Based Liquid Metal Battery. J. Power Sources 2022, 534, 231428. [Google Scholar] [CrossRef]

- Stocks, M.; Stocks, R.; Lu, B.; Cheng, C.; Blakers, A. Global Atlas of Closed-Loop Pumped Hydro Energy Storage. Joule 2021, 5, 270–284. [Google Scholar] [CrossRef]

- Friedmann, J.; Fan, Z.; Tang, K. Low-Carbon Heat Solutions for Heavy Industry: Sources, Options, and Costs Today. Available online: https://www.energypolicy.columbia.edu/publications/low-carbon-heat-solutions-heavy-industry-sources-options-and-costs-today/ (accessed on 25 August 2025).

- Rissman, J. Thermal Batteries Could Cut U.S Industrial Heating Power Costs in Half. Available online: https://www.forbes.com/sites/energyinnovation/2023/07/12/thermal-batteries-could-cut-us-industrial-heating-power-costs-in-half/ (accessed on 25 August 2025).

- Henry, A.; Prasher, R.; Majumdar, A. Five Thermal Energy Grand Challenges for Decarbonization. Nat. Energy 2020, 5, 635–637. [Google Scholar] [CrossRef]

- Crownhart, C. The Hottest New Climate Technology Is Bricks. Available online: https://www.technologyreview.com/2023/04/10/1071208/the-hottest-new-climate-technology-is-bricks/ (accessed on 25 August 2025).

- Shan, R.; Reagan, J.; Castellanos, S.; Kurtz, S.; Kittner, N. Evaluating Emerging Long-Duration Energy Storage Technologies. Renew. Sustain. Energy Rev. 2022, 159, 112240. [Google Scholar] [CrossRef]

- Thiel, G.P.; Stark, A.K. To Decarbonize Industry, We Must Decarbonize Heat. Joule 2021, 5, 531–550. [Google Scholar] [CrossRef]

- Ajanovic, A.; Sayer, M.; Haas, R. The Economics and the Environmental Benignity of Different Colors of Hydrogen. Int. J. Hydrogen Energy 2022, 47, 24136–24154. [Google Scholar] [CrossRef]

- Farzaneh, F.; Jung, S. Lifecycle Carbon Footprint Comparison between Internal Combustion Engine versus Electric Transit Vehicle: A Case Study in the U.S. J. Clean. Prod. 2023, 390, 136111. [Google Scholar] [CrossRef]

- Dominković, D.F.; Bačeković, I.; Pedersen, A.S.; Krajačić, G. The Future of Transportation in Sustainable Energy Systems: Opportunities and Barriers in a Clean Energy Transition. Renew. Sustain. Energy Rev. 2018, 82, 1823–1838. [Google Scholar] [CrossRef]

- Cerdas, F.; Titscher, P.; Bognar, N.; Schmuch, R.; Winter, M.; Kwade, A.; Herrmann, C. Exploring the Effect of Increased Energy Density on the Environmental Impacts of Traction Batteries: A Comparison of Energy Optimized Lithium-Ion and Lithium-Sulfur Batteries for Mobility Applications. Energies 2018, 11, 150. [Google Scholar] [CrossRef]

- Moriarty, P. Electric Vehicles Can Have Only a Minor Role in Reducing Transport’s Energy and Environmental Challenges. AIMS Energy 2022, 10, 131–148. [Google Scholar] [CrossRef]

- Zhang, R.; Fujimori, S. The Role of Transport Electrification in Global Climate Change Mitigation Scenarios. Environ. Res. Lett. 2020, 15, 034019. [Google Scholar] [CrossRef]

- Kapustin, N.O.; Grushevenko, D.A. Long-Term Electric Vehicles Outlook and Their Potential Impact on Electric Grid. Energy Policy 2020, 137, 111103. [Google Scholar] [CrossRef]

- Needell, Z.; Wei, W.; Trancik, J.E. Strategies for Beneficial Electric Vehicle Charging to Reduce Peak Electricity Demand and Store Solar Energy. Cell Rep. Phys. Sci. 2023, 4, 101287. [Google Scholar] [CrossRef]

- Canabarro, N.I.; Silva-Ortiz, P.; Nogueira, L.A.H.; Cantarella, H.; Maciel-Filho, R.; Souza, G.M. Sustainability Assessment of Ethanol and Biodiesel Production in Argentina, Brazil, Colombia, and Guatemala. Renew. Sustain. Energy Rev. 2023, 171, 113019. [Google Scholar] [CrossRef]

- Johnson, E. Goodbye to Carbon Neutral: Getting Biomass Footprints Right. Environ. Impact Assess. Rev. 2009, 29, 165–168. [Google Scholar] [CrossRef]

- ASTM D7467-20a; Specification for Diesel Fuel Oil, Biodiesel Blend (B6 to B20). ASTM: West Conshohocken, PA, USA, 2020.

- U.S. Department of Energy Diesel Vehicles Using Biodiesel. Available online: https://afdc.energy.gov/vehicles/diesel (accessed on 22 August 2024).

- Congreso de Colombia. Ley 693 de 2001; Diario Oficial No. 44.564; Congreso de Colombia: Bogotá, Colombia, 2001. [Google Scholar]

- Agronet Evaluaciones Agropecuarias-EVA y Anuario Estadístico Del Sector Agropecuario. Available online: https://www.agronet.gov.co/estadistica/paginas/home.aspx?cod=59 (accessed on 25 August 2025).

- Britton-Acevedo, E.L.; Vega-Jurado, J.M.; Lombana, J. Alternativas productivas para la industria de biodiésel en Colombia. Cuad. Latinoam. Adm. 2017, XIII, 135–148. [Google Scholar] [CrossRef]

- Delgado, J.E.; Salgado, J.J.; Perez, R. Perspectivas de Los Biocombustibles En Colombia. Rev. Ing. Univ. Medellín 2015, 14, 13–28. [Google Scholar] [CrossRef]

- Palacio-Ciro, S.; Vasco-Correa, C.A. Biofuels Policy in Colombia: A Reconfiguration to the Sugar and Palm Sectors? Renew. Sustain. Energy Rev. 2020, 134, 110316. [Google Scholar] [CrossRef]

- Fedebiocombustibles Estadísticas. Available online: https://fedebiocombustibles.com/statistics/ (accessed on 25 August 2025).

- IRENA. Sugarcane Bioenergy in Southern Africa: Economic Potential for Sustainable Scale-Up; IRENA: Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- Ramirez-Contreras, N.E.; Munar-Florez, D.A.; Garcia-Nuñez, J.A.; Mosquera-Montoya, M.; Faaij, A.P.C. The GHG Emissions and Economic Performance of the Colombian Palm Oil Sector; Current Status and Long-Term Perspectives. J. Clean. Prod. 2020, 258, 120757. [Google Scholar] [CrossRef]

- Carvajal-Romo, G.; Valderrama-Mendoza, M.; Rodríguez-Urrego, D.; Rodríguez-Urrego, L. Assessment of Solar and Wind Energy Potential in La Guajira, Colombia: Current Status, and Future Prospects. Sustain. Energy Technol. Assess. 2019, 36, 100531. [Google Scholar] [CrossRef]

- Gaona, E.E.; Trujillo, C.L.; Guacaneme, J.A. Rural Microgrids and Its Potential Application in Colombia. Renew. Sustain. Energy Rev. 2015, 51, 125–137. [Google Scholar] [CrossRef]

- World Bank Group; Minenergía Colombia’s Offshore Wind Roadmap. Executive Summary. Available online: https://www.minenergia.gov.co/static/ruta-eolica-offshore/src/document/Summary%20%20Off-Shore%20-%20english.pdf (accessed on 26 August 2025).

- World Bank Group. Minenergía Hoja de Ruta Para El Despliegue de La Energía Eólica Costa Afuera En Colombia. Available online: https://www.minenergia.gov.co/documents/5858/Espa%C3%B1ol_Hoja_de_ruta_energ%C3%ADa_e%C3%B3lica_costa_afuera_en_Colombia_VE_compressed.pdf (accessed on 26 August 2025).

- Staffell, I.; Pfenninger, S. Using Bias-Corrected Reanalysis to Simulate Current and Future Wind Power Output. Energy 2016, 114, 1224–1239. [Google Scholar] [CrossRef]

- Pfenninger, S.; Staffell, I. Renewables Ninja. Available online: https://www.renewables.ninja/ (accessed on 19 September 2025).

- Pfenninger, S.; Staffell, I. Long-Term Patterns of European PV Output Using 30 Years of Validated Hourly Reanalysis and Satellite Data. Energy 2016, 114, 1251–1265. [Google Scholar] [CrossRef]

| System | CAPEX (USD/kW) | OPEX (USD/kW) | Lifespan (Years) |

|---|---|---|---|

| Wind Offshore (WOff) | 3285–5908 | 75–116 | 30 |

| Wind Onshore (WOn) | 1462 | 43 | 30 |

| PV | 1906 | 19 | 30 |

| Category | Storage System | Application a | CAPEX (USD/kW) | Levelized Cost of Electricity (LCOE) (USD/kWh) | Discharge Time | Energy Density (Wh/kg) | Power Density (W/kg) | Power Range (MW) | Roundtrip Efficiency (%) | Lifetime (Years) | TRL | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Electrochemical batteries | Lead–acid batteries | BDPS | 1520–1792 | 380–448 | s–h | 30–75 | 75–300 | 0–20 | 79–85 | 12 | 9 | |

| Lithium-ion batteries | BDPS | 2222 | 352–487 | min–h | 100–200 | 360 | 0–0.1 | 86–88 | 10 | 9 | ||

| Sodium Sulphur | BDPS | 2394–5170 | 599–1293 | min–h | 150–240 | 90–230 | 0.05–8 | 77–83 | 15 | 8 | ||

| Liquid Metal | BDPS | - | 180–250 | s–h | 135 | - | >1 | 80–90 | 20 | 6–7 | ||

| Flow batteries | Nickel-cadmium | BDPS | 1995–2438 | 499–609 | min–h | 40–90 | 150–240 | 0–40 | 65–70 | 15 | 9 | |

| Vanadium redox | BDPS | <10 h | 35–60 | 75–150 | <3 | 9 | ||||||

| Polysulfide bromide | BDPS | <20 h | 15–30 | - | <15 | 4–5 | ||||||

| Zinc bromine | BDPS | s–10 h | 75–85 | 90–110 | 90–100 | 6 | ||||||

| Mechanical | Compressed air energy storage system | BPS | 973–1259 | 97–126 | 1–24 h | 30–60 | 3.2–5.5 | 3–300 | 52 | 30 | 7–8 | |

| Low-speed flywheel | DPS | 1080–2880 | 4320–11,520 | s–min | 5–80 | 400–500 | 0.1–20 | 86–96 | 20 | 9 | ||

| Pumped hydro energy storage system | BPS | 2640 | 150–242 | 1 h–days | 0.5–1.5 | 100–400 | 10–5000 | 70–85 | 60 | 9 | ||

| Chemical | H2 storage | BPS | 2793–3488 | 279–349 | s–24 h | 600–1200 | 5–800 | 0.1–50 | 35 b | 30 | 5–6 | |

| Thermal | Thermal energy storage | BPS | 1700–1800 | 20–60 | h | 80–250 | 10–30 | 250 | 90 | 30 | 7–8 | |

| Electrical | Capacitors | DPS | 930–74,480 | - | ms–1 h | 0.05–5 | 105 | 0–0.05 | 60–90 | 10–15 | 6 | |

| Supercapacitors | DPS | 20,000 | 500–1000 | ms–1 h | 1.5–2.5 | 500–5000 | 0–0.3 | 75–95 | - | 8–9 | ||

| Superconducting magnetic | DPS | 200–300 | 1000–10,000 | ms–8 s | 0.5–5 | 500–2000 | 1–10 | >95 | 20 | 5–6 | ||

| Crop | Area (ha) | Biofuel | Units | CAPEX (USD/t) |

|---|---|---|---|---|

| Sugarcane | 2,078,591 | 40,000,000 | L | 165 |

| Palm oil | 576,799 | 685,694 | t | 49 |

| System | Category | Unit CAPEX |

|---|---|---|

| Biodiesel (BioD) | Power | 49 USD/tBioD |

| Ethanol (Eth) | Power | 158 USD/tc-capacity |

| Heat Batteries (HB) | Storage | 575 USD/kW |

| Hydrogen Storage (HS) | Storage | 2860 USD/kW |

| Photovoltaic (PV) | Power | 1909 USD/kW |

| Pumped hydro energy storage (PHS) | Storage | 2640 USD/kW |

| Wind Offshore (WOff) | Power | 3502 USD/kW |

| Wind Onshore (WOn) | Power | 1540 USD/kW |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sagastume Gutiérrez, A.; Cabello Eras, J.J.; Otero Meza, D.D. The Energy Transition in Colombia: Government Projections and Realistic Scenarios. Clean Technol. 2025, 7, 96. https://doi.org/10.3390/cleantechnol7040096

Sagastume Gutiérrez A, Cabello Eras JJ, Otero Meza DD. The Energy Transition in Colombia: Government Projections and Realistic Scenarios. Clean Technologies. 2025; 7(4):96. https://doi.org/10.3390/cleantechnol7040096

Chicago/Turabian StyleSagastume Gutiérrez, Alexis, Juan José Cabello Eras, and Daniel David Otero Meza. 2025. "The Energy Transition in Colombia: Government Projections and Realistic Scenarios" Clean Technologies 7, no. 4: 96. https://doi.org/10.3390/cleantechnol7040096

APA StyleSagastume Gutiérrez, A., Cabello Eras, J. J., & Otero Meza, D. D. (2025). The Energy Transition in Colombia: Government Projections and Realistic Scenarios. Clean Technologies, 7(4), 96. https://doi.org/10.3390/cleantechnol7040096