Generalisation Bounds of Zero-Shot Economic Forecasting Using Time Series Foundation Models

Abstract

1. Introduction

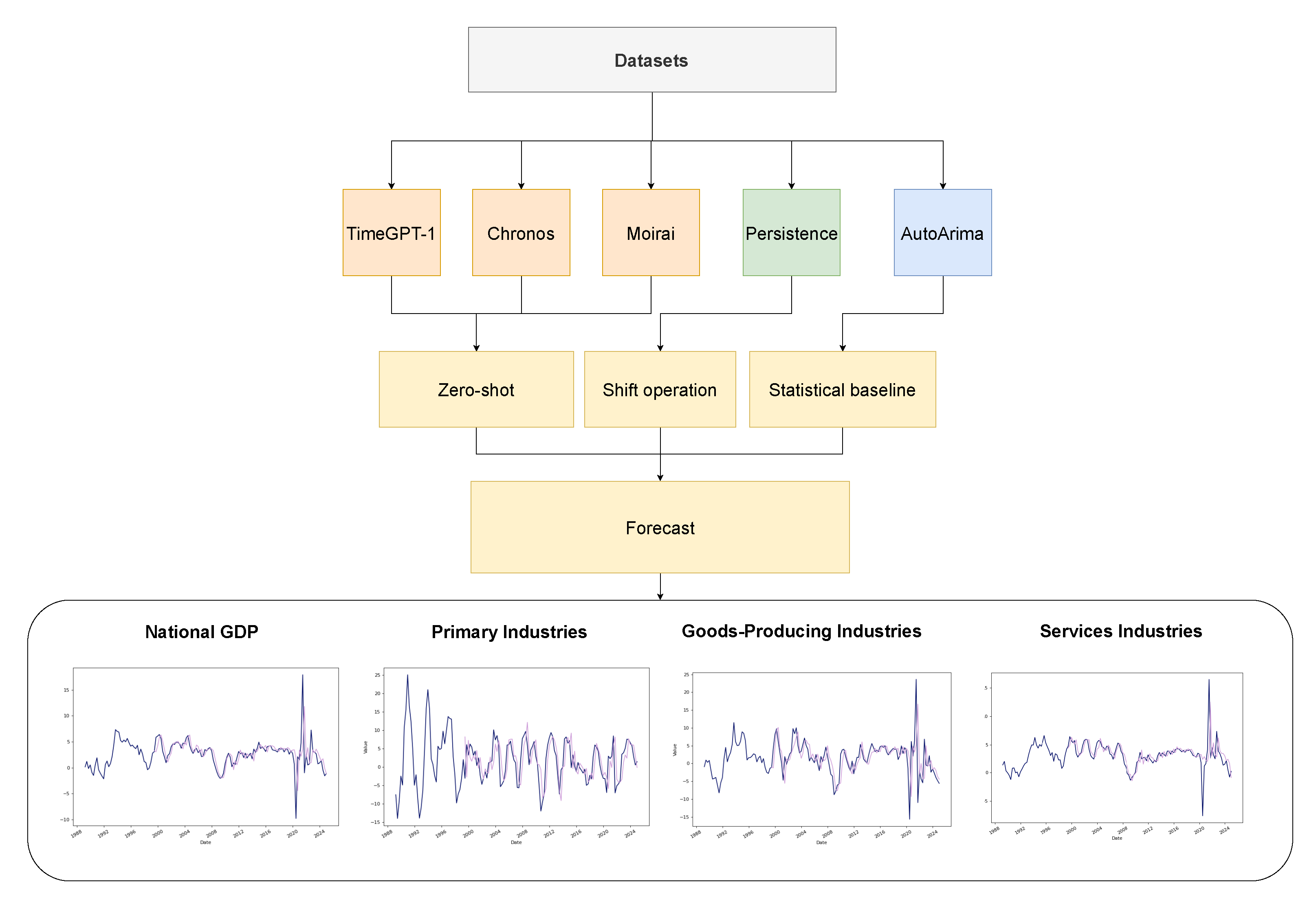

Contribution and Novelty

- Empirical benchmark: We provide the zero-shot evaluation of leading TSFMs (Chronos, Moirai, TimeGPT) against classical econometric baselines from the Reserve Bank of New Zealand (RBNZ) forecasts, covering New Zealand’s national GDP and sectoral industries.

- Performance measurement: We demonstrate that TSFMs outperform other classical methods across various horizons, including RBNZ’s benchmark models, and thus we establish their utility under certain conditions.

- Operational guidance: We offer actionable insights for policy analysts by mapping the boundary conditions under which zero-shot TSFMs serve as low-maintenance forecasting tools for practitioners or economists. We also identify scenarios where lightweight classical models remain preferable.

2. Related Works

2.1. Forecasting Difficulty for Macroeconomic Indicators

2.2. Modern and Emerging Forecasting Approaches

2.3. Zero-Shot Transfer Learning for Macroeconomic Forecasting

2.4. Zero-Shot TSFMs in Economic Forecasting

- Chronos repurposes the T5 language backbone for sequence-to-sequence forecasting, capturing fine-grained temporal dependencies [26].

- Moirai pushes universality further by introducing multi-patch projections that sidestep fixed-frequency constraints and perform well on both sub-hourly energy usage and daily retail sales [25].

- TimeGPT showed that a single globally trained network can forecast across hundreds of public datasets without per-task fine-tuning [24].

2.5. Summary and Research Questions

- RQ1 How effective are state-of-the-art TSFMs for zero-shot univariate forecasting with zero-shot transfer learning of macroeconomic and industry-level time series?

- RQ2 To what extent do zero-shot TSFM forecasts remain stable when confronted with periods of extreme volatility and significant economic disruption?

- RQ3 Can zero-shot TSFMs match or surpass the published forecast accuracy of expert judgement models produced by central banks and international agencies?

3. Methodology

3.1. Dataset

RBNZ Operational Dataset

3.2. Baseline Models

3.2.1. Persistence Model

3.2.2. ARIMA Model

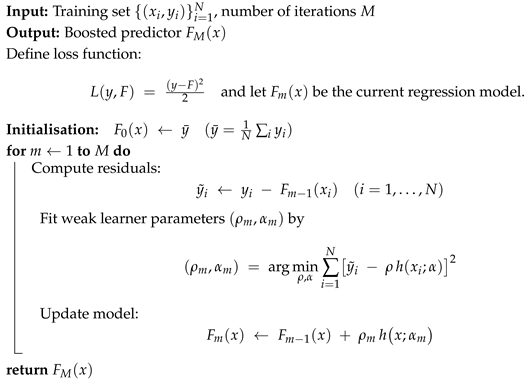

3.2.3. LSBoost (Least-Squares Boosting)

| Algorithm 1: LSBoost algorithm [76]. |

|

3.2.4. Factor Model

3.3. Time-Series Foundation Models

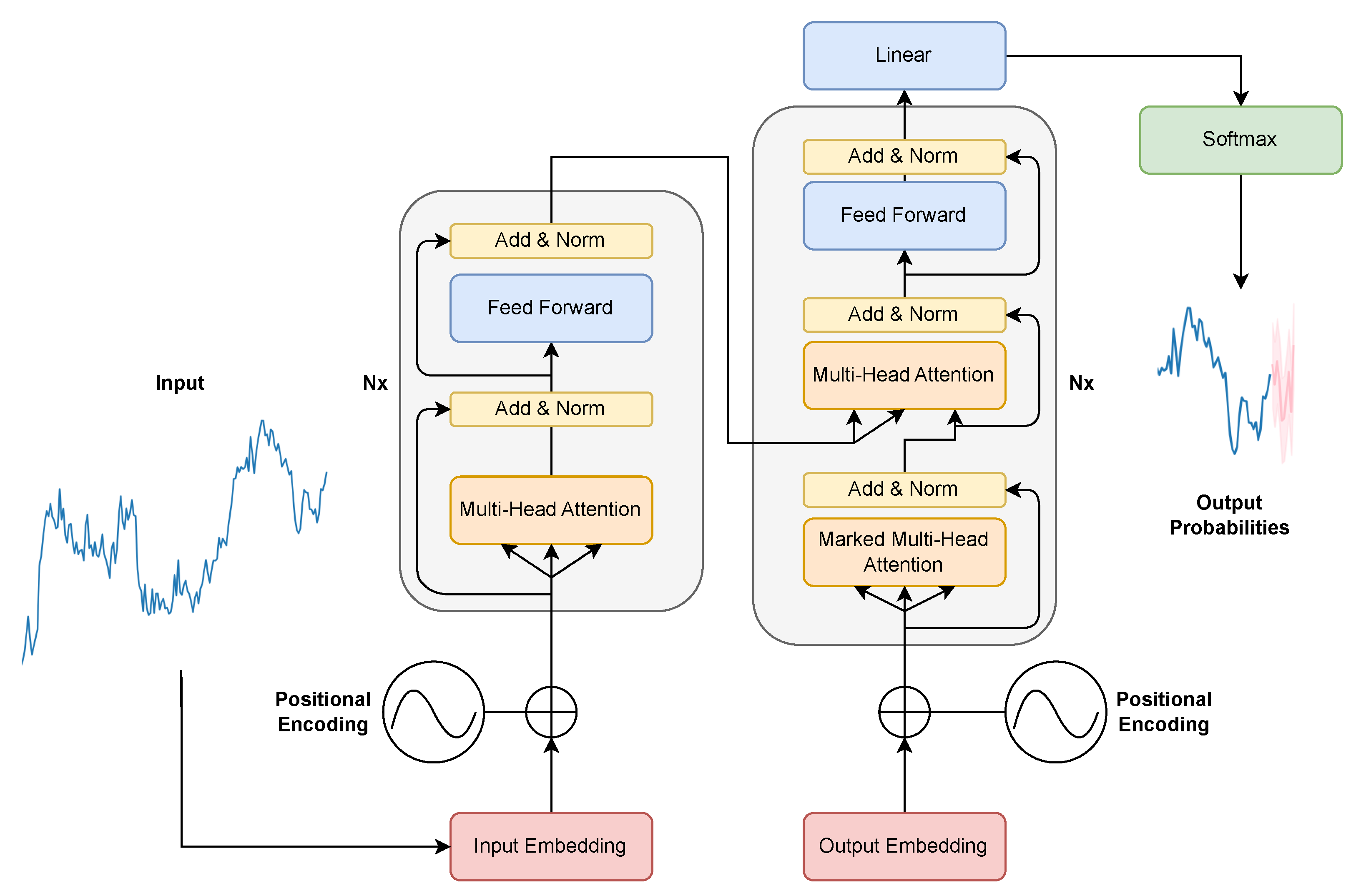

3.3.1. TimeGPT-1 Model

3.3.2. Chronos Model

3.3.3. Moirai Model

3.4. Model Evaluation

3.5. Probabilistic Policy Risk Evaluation

3.6. Zero-Shot Forecasts

3.7. Experiment Pipeline

4. Results

4.1. Analysis of Model Evaluation Results

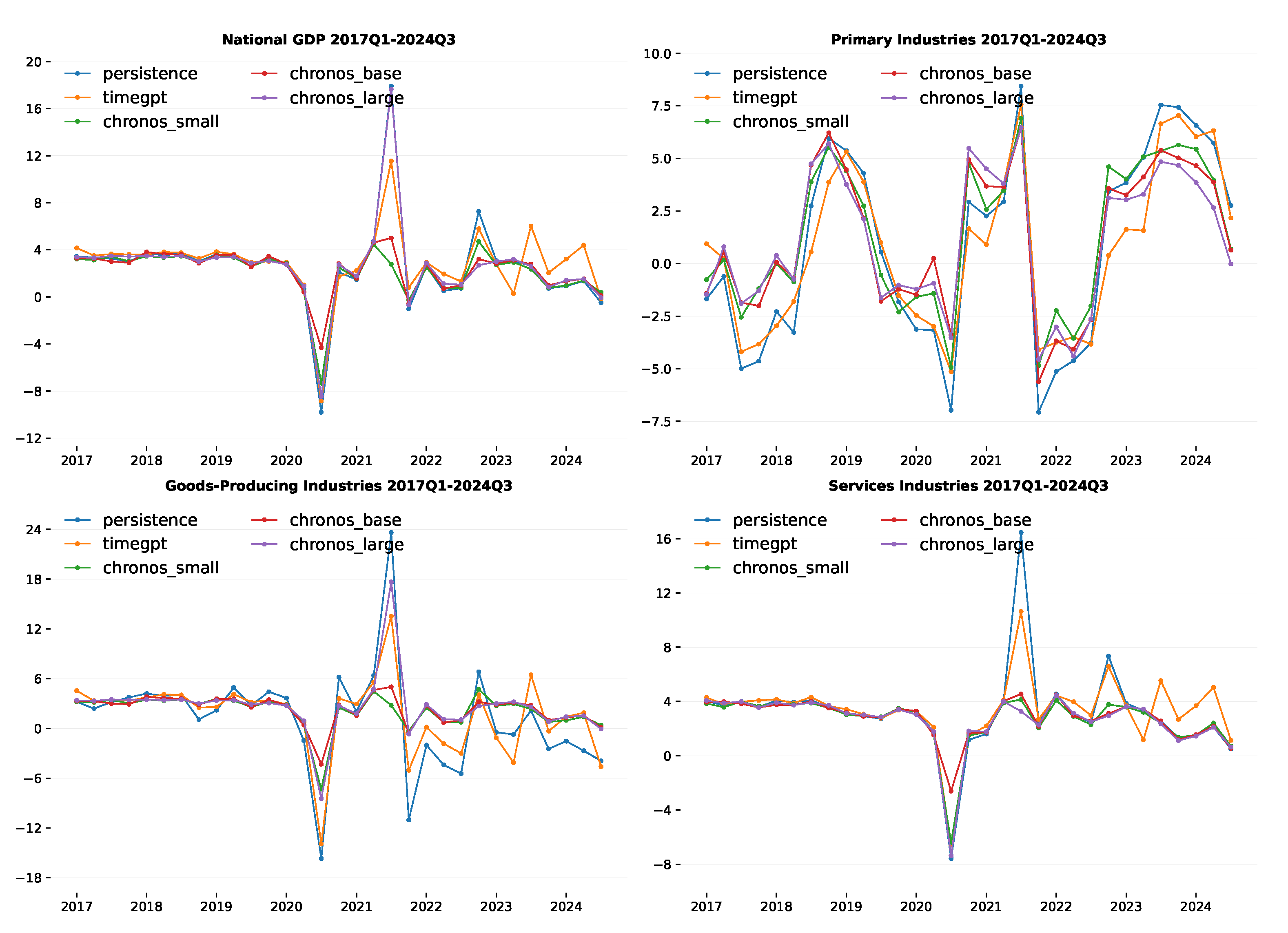

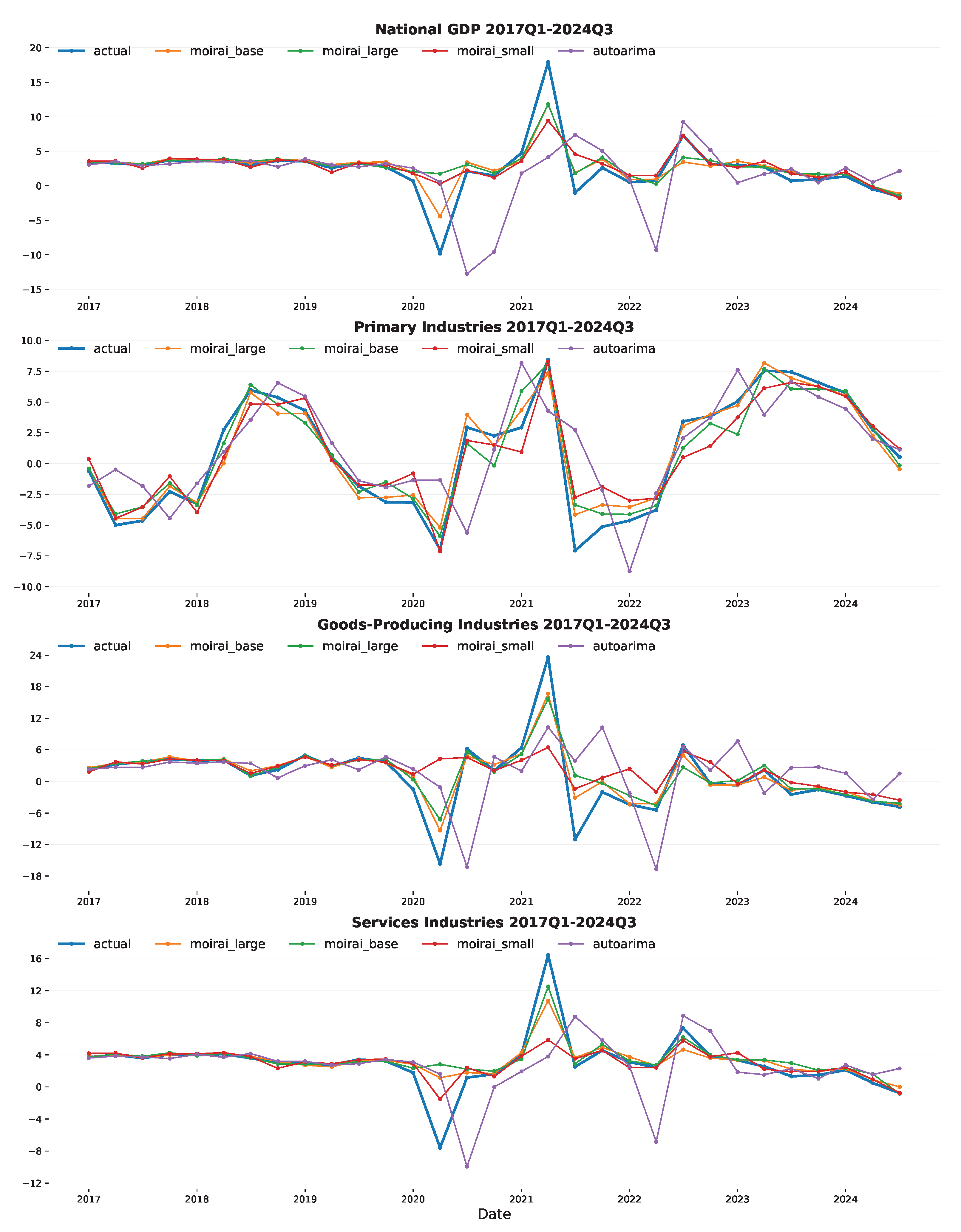

4.1.1. Forecast Analysis During Stable Phases

4.1.2. Forecast Analysis of During Shocks

4.1.3. Forecast Analysis Post Instability

4.1.4. Summary

4.2. Forecast Benchmarking Against State of the Art

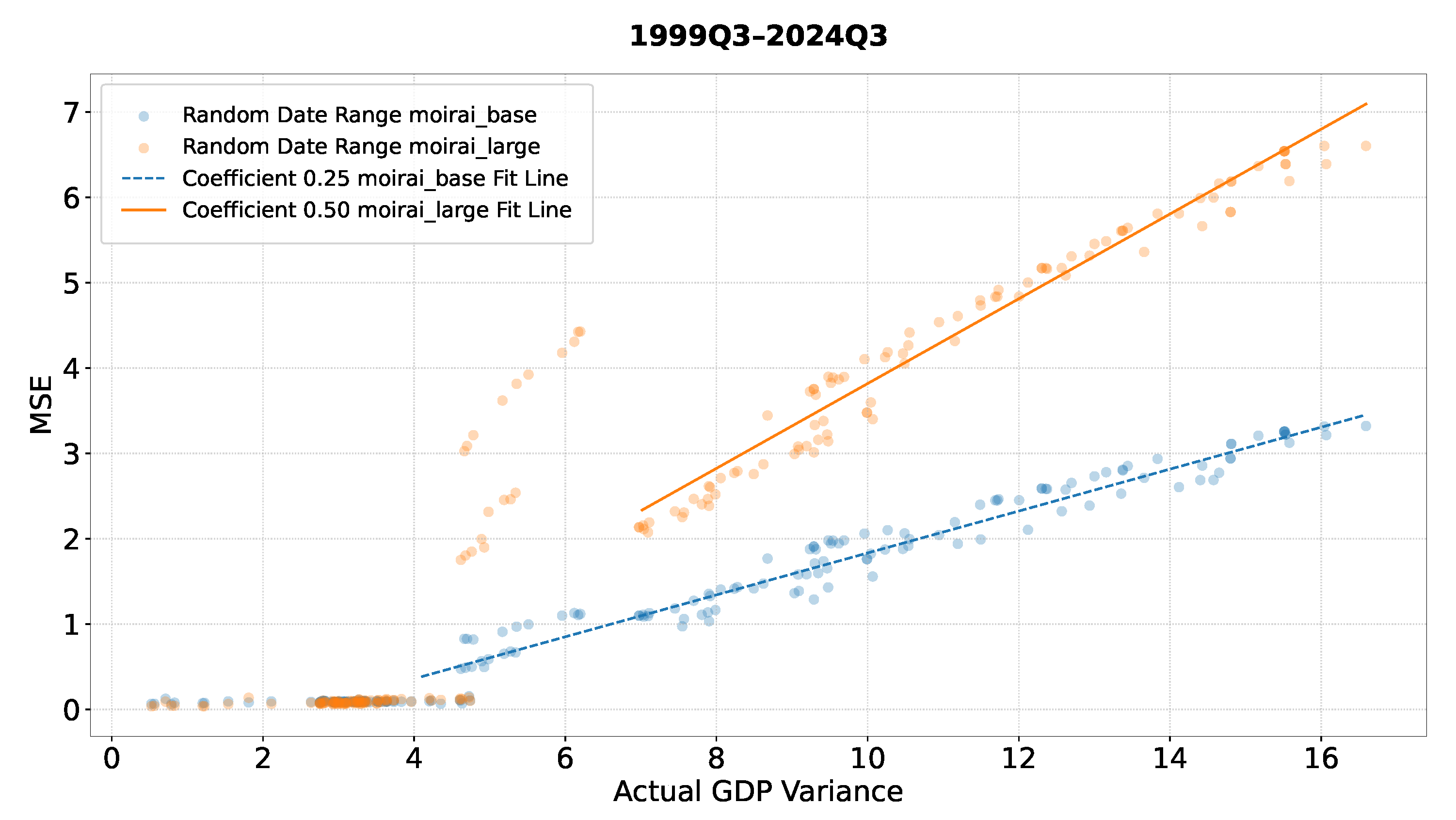

4.3. Probabilistic Evaluation

5. Discussion

5.1. TSFM Zero-Shot Effectiveness in Macroeconomic Forecasting

5.2. Effectiveness of TSFMs in Zero-Shot Forecasting During Shocks

5.3. Zero-Shot TSFMs vs. Domain-Specific Models for Macroeconomic Forecasting

5.4. Policy Interpretation and Trust

5.5. Limitations and Future Works

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

References

- International Monetary Fund. World Economic Outlook: Policy Pivot, Rising Threats; IMF: Washington, DC, USA, 2024. [Google Scholar]

- Borio, C.; Drehmann, M.; Tsatsaronis, K. Stress–Testing Macro Stress Testing: Does It Live Up to Expectations? J. Financ. Stab. 2014, 12, 3–15. [Google Scholar] [CrossRef]

- Bloom, N. Fluctuations in Uncertainty. J. Econ. Perspect. 2014, 28, 153–176. [Google Scholar] [CrossRef]

- OECD. OECD Economic Outlook, Volume 2023 Issue 2; OECD Publishing: Paris, France, 2023. [Google Scholar] [CrossRef]

- S&P Global Ratings. Sovereign Rating Methodology. Credit FAQ. 2017. Available online: https://enterprise.press/wp-content/uploads/2017/05/Sovereign-Rating-Methodology.pdf (accessed on 22 May 2025).

- Clark, T.E.; West, K.D. Approximately Normal Tests for Equal Predictive Accuracy in Nested Models. J. Econom. 2007, 138, 291–311. [Google Scholar] [CrossRef]

- Croushore, D.; Stark, T. A Real-Time Data Set for Macroeconomists. J. Econom. 2001, 105, 111–130. [Google Scholar] [CrossRef]

- Perron, P. The Great Crash, the Oil Price Shock, and the Unit Root Hypothesis. Econometrica 1989, 57, 1361–1401. [Google Scholar] [CrossRef]

- Hamilton, J.D. Understanding Crude Oil Prices. Energy J. 2009, 30, 179–206. [Google Scholar] [CrossRef]

- Cavallo, E.; Noy, I. Natural Disasters and the Economy—A Survey. Int. Rev. Environ. Resour. Econ. 2011, 5, 63–102. [Google Scholar] [CrossRef]

- Jorda, O.; Singh, S.R.; Taylor, A.M. Longer-Run Economic Consequences of Pandemics. Rev. Econ. Stat. 2022, 104, 166–175. [Google Scholar] [CrossRef]

- Marcellino, M. Sectoral Aggregation in Multivariate Time-Series Models. Int. J. Forecast. 2005, 21, 277–291. [Google Scholar]

- Box, G.E.P.; Jenkins, G.M.; Reinsel, G.C. Time Series Analysis: Forecasting and Control, revised ed.; Holden-Day: San Francisco, CA, USA, 1976. [Google Scholar]

- Sims, C.A. Macroeconomics and Reality. Econometrica 1980, 48, 1–48. [Google Scholar] [CrossRef]

- Fildes, R.; Stekler, H. The State of Macroeconomic Forecasting. J. Macroecon. 2002, 24, 435–468. [Google Scholar] [CrossRef]

- D’Agostino, A.; Giannone, D.; Surico, P. (Un)Predictability and Macroeconomic Stability. SSRN Electron. J. 2006. [Google Scholar] [CrossRef]

- Jacobs, J.P.A.M.; van Norden, S. Why Do Revisions to GDP and Inflation Agree? J. Monet. Econ. 2011, 58, 450–465. [Google Scholar] [CrossRef]

- Carriero, A.; Clark, T.E.; Marcellino, M. Nowcasting Tail Risks to Economic Activity with Many Indicators; Working Paper 20-13R2, Revised 22 September 2020; Federal Reserve Bank of Cleveland: Cleveland, OH, USA, 2020. [Google Scholar] [CrossRef]

- Maccarrone, G.; Morelli, G.; Spadaccini, S. GDP Forecasting: Machine Learning, Linear or Autoregression? Front. Artif. Intell. 2021, 4, 757864. [Google Scholar] [CrossRef]

- Long, X.; Bui, Q.; Oktavian, G.; Schmidt, D.F.; Bergmeir, C.; Godahewa, R.; Lee, S.P.; Zhao, K.; Condylis, P. Scalable Probabilistic Forecasting in Retail with Gradient Boosted Trees: A Practitioner’s Approach. arxiv 2023, arXiv:2311.00993. [Google Scholar]

- Goel, A.; Pasricha, P.; Kanniainen, J. Time-Series Foundation AI Model for Value-at-Risk Forecasting. arXiv 2025, arXiv:2410.11773. [Google Scholar]

- Germán-Morales, M.; Rivera-Rivas, A.; del Jesus Díaz, M.; Carmona, C. Transfer Learning with Foundational Models for Time Series Forecasting using Low-Rank Adaptations. Inf. Fusion 2025, 123, 103247. [Google Scholar] [CrossRef]

- Bommasani, R.; Hudson, D.A.; Adeli, E.; Altman, R.; Arora, S.; von Arx, S.; Bernstein, M.S.; Bohg, J.; Bosselut, A.; Brunskill, E.; et al. On the Opportunities and Risks of Foundation Models. arXiv 2022, arXiv:2108.07258. [Google Scholar]

- Garza, A.; Challu, C.; Mergenthaler-Canseco, M. TimeGPT-1. arXiv 2024, arXiv:2310.03589. [Google Scholar]

- Woo, G.; Liu, C.; Kumar, A.; Xiong, C.; Savarese, S.; Sahoo, D. Unified Training of Universal Time Series Forecasting Transformers. arXiv 2024, arXiv:2402.02592. [Google Scholar]

- Ansari, A.F.; Stella, L.; Turkmen, C.; Zhang, X.; Mercado, P.; Shen, H.; Shchur, O.; Rangapuram, S.S.; Arango, S.P.; Kapoor, S.; et al. Chronos: Learning the Language of Time Series. arXiv 2024, arXiv:2403.07815. [Google Scholar]

- McKenzie, S. How Vulnerable Is New Zealand to Economic Shocks in Its Major Trading Partners? Analytical Note 24/04; New Zealand Treasury: Wellington, New Zealand, 2024. [Google Scholar]

- Gordon, M. First Impressions: Forthcoming Revisions to Lift NZ GDP Growth. Economics, 27 November 2024. Available online: https://www.westpaciq.com.au/economics/2024/11/nz-first-impressions-gdp-revisions-november-2024 (accessed on 1 August 2025).

- Hartigan, L.; Rosewall, T. Nowcasting Quarterly GDP Growth During the COVID-19 Crisis Using a Monthly Activity Indicator; Research Discussion Paper 2024/04; Reserve Bank of Australia: Sydney, Australia, 2024. [Google Scholar]

- Edge, R.M.; Rudd, J.B. Real-Time Properties of the Federal Reserve’s Output Gap. Rev. Econ. Stat. 2016, 98, 785–791. [Google Scholar] [CrossRef]

- Castle, J.L.; Fawcett, N.W.P.; Hendry, D.F. Forecasting Breaks and Forecasting during Breaks. In The Oxford Handbook of Economic Forecasting; Clements, M.P., Hendry, D.F., Eds.; Oxford University Press: Oxford, UK, 2011; pp. 315–349. [Google Scholar] [CrossRef]

- Lewis, D.J.; Mertens, K.; Stock, J.H.; Trivedi, M. Measuring Real Activity Using a Weekly Economic Index. J. Appl. Econom. 2022, 37, 667–687. [Google Scholar] [CrossRef]

- Rossi, T.; Guhathakurta, S. Machine Learning Methods for Capturing Nonlinear Relationships in Travel Behavior Research: A Review. Travel Behav. Soc. 2023, 32, 100–116. [Google Scholar]

- Oancea, B.; Simionescu, M. Improving Quarterly GDP Forecasts Using Long Short-Term Memory Networks: An Application for Romania. Electronics 2024, 13, 4918. [Google Scholar] [CrossRef]

- Oreshkin, B.N.; Carpov, D.; Chapados, N.; Bengio, Y. N-BEATS: Neural Basis Expansion Analysis for Interpretable Time Series Forecasting. arXiv 2020, arXiv:1905.10437. [Google Scholar]

- Susnjak, T.; Schumacher, C. Nowcasting: Towards Real-Time GDP Prediction. Technical Report, GDP Live Technical Report. 2018. Available online: https://gdp-live.s3-ap-southeast-2.amazonaws.com/GDP_Live_Working_Paper.pdf (accessed on 18 October 2025).

- Giannone, D.; Reichlin, L.; Small, D. Nowcasting: The Real-Time Informational Content of Macroeconomic Data. J. Bus. Econ. Stat. 2008, 26, 464–480. [Google Scholar] [CrossRef]

- Herculano, M.C. A Monthly Financial Conditions Index for New Zealand; Discussion Paper DP2022-01; Reserve Bank of New Zealand: Wellington, New Zealand, 2022. [Google Scholar]

- Galt, D. New Zealand’s Economic Growth; Treasury Working Paper 00/09; New Zealand Treasury: Wellington, New Zealand, 2000. [Google Scholar]

- Wu, Y.; Zhou, X. VAR Models: Estimation, Inferences, and Applications. In Handbook of Financial Econometrics and Statistics; Lee, C., Lee, J.C., Eds.; Springer: New York, NY, USA, 2015; pp. 2077–2091. [Google Scholar] [CrossRef]

- Litterman, R.B. Forecasting with Bayesian Vector Autoregressions—Five Years of Experience. J. Bus. Econ. Stat. 1986, 4, 25–38. [Google Scholar] [CrossRef]

- Stock, J.H.; Watson, M.W. Macroeconomic Forecasting Using Diffusion Indexes. J. Bus. Econ. Stat. 2002, 20, 147–162. [Google Scholar] [CrossRef]

- Bernanke, B.S.; Boivin, J.; Eliasz, P. Measuring the Effects of Monetary Policy: A Factor-Augmented Vector Autoregressive (FAVAR) Approach. Q. J. Econ. 2005, 120, 387–422. [Google Scholar]

- Ghysels, E.; Sinko, A.; Valkanov, R. MIDAS Regressions: Further Results and New Directions. Econom. Rev. 2007, 26, 53–90. [Google Scholar] [CrossRef]

- Kant, D.; Pick, A.; de Winter, J. Nowcasting GDP Using Machine Learning Methods; DNB Working Paper 790; De Nederlandsche Bank: Amsterdam, The Netherlands, 2024. [Google Scholar]

- Del Negro, M.; Giannoni, M.P.; Schorfheide, F. The FRBNY DSGE Model: Description and Forecasting Performance; Staff Report 674; Federal Reserve Bank of New York: New York, NY, USA, 2014. [Google Scholar]

- Higgins, P. GDPNow: A Model for GDP “Nowcasting”; Working Paper 2014-07; Federal Reserve Bank of Atlanta: Atlanta, GA, USA, 2014. [Google Scholar]

- Oancea, B.; Simionescu, M. GDP Forecasting with Long Short-Term Memory Networks: Evidence from Romania. Econ. Comput. Econ. Cybern. Stud. Res. 2024, 58, 101–118. [Google Scholar]

- Longo, L.; Riccaboni, M.; Rungi, A. A Neural Network Ensemble Approach for GDP Forecasting. Econ. Model. 2021, 104, 105657. [Google Scholar] [CrossRef]

- Oreshkin, B.N.; Carpov, D.; Chapados, N.; Bengio, Y. Meta-Learning Framework with Applications to Zero-Shot Time-Series Forecasting. Proc. AAAI Conf. Artif. Intell. 2021, 35, 9242–9250. [Google Scholar] [CrossRef]

- Dooley, S.; Khurana, G.S.; Mohapatra, C.; Naidu, S.; White, C. ForecastPFN: Synthetically-Trained Zero-Shot Forecasting. arXiv 2023, arXiv:2311.01933. [Google Scholar]

- Zhou, T.; Niu, P.; Wang, X.; Sun, L.; Jin, R. One Fits All: Power General Time Series Analysis by Pretrained LM. In Proceedings of the Advances in Neural Information Processing Systems, New Orleans, LA, USA, 10–16 December 2023. [Google Scholar]

- Auer, A.; Parthipan, R.; Mercado, P.; Ansari, A.F.; Stella, L.; Wang, B.; Bohlke-Schneider, M.; Rangapuram, S.S. Zero-Shot Time Series Forecasting with Covariates via In-Context Learning. arXiv 2025, arXiv:2506.03128. [Google Scholar]

- Xiao, C.; Zhou, J.; Xiao, Y.; Lu, X.; Zhang, L.; Xiong, H. TimeFound: A Foundation Model for Time Series Forecasting. arXiv 2025, arXiv:2503.04118. [Google Scholar]

- Liang, Y.; Wen, H.; Nie, Y.; Jiang, Y.; Jin, M.; Song, D.; Pan, S.; Wen, Q. Foundation Models for Time Series Analysis: A Tutorial and Survey. In Proceedings of the 30th ACM SIGKDD Conference on Knowledge Discovery and Data Mining (KDD ’24), Barcelona, Spain, 25–29 August 2024; ACM: New York, NY, USA, 2024; pp. 6555–6565. [Google Scholar] [CrossRef]

- Zhou, H.; Zhang, S.; Peng, J.; Zhang, S.; Li, J.; Xiong, H.; Zhang, W. Informer: Beyond Efficient Transformer for Long Sequence Time-Series Forecasting. arXiv 2021, arXiv:2012.07436. [Google Scholar] [CrossRef]

- Beltagy, I.; Peters, M.E.; Cohan, A. Longformer: The Long-Document Transformer. arXiv 2020, arXiv:2004.05150. [Google Scholar]

- Wu, H.; Xu, J.; Wang, J.; Long, M. Autoformer: Decomposition Transformers with Auto-Correlation for Long-Term Series Forecasting. arXiv 2022, arXiv:2106.13008. [Google Scholar]

- Yoon, M.; Palowitch, J.; Zelle, D.; Hu, Z.; Salakhutdinov, R.; Perozzi, B. Zero-shot Transfer Learning within a Heterogeneous Graph via Knowledge Transfer Networks. arXiv 2022, arXiv:2203.02018. [Google Scholar]

- Ye, J.; Zhang, W.; Yi, K.; Yu, Y.; Li, Z.; Li, J.; Tsung, F. A Survey of Time Series Foundation Models: Generalizing Time Series Representation with Large Language Model. arXiv 2024, arXiv:2405.02358. [Google Scholar]

- Jin, M.; Wang, S.; Ma, L.; Chu, Z.; Zhang, J.; Shi, X.; Chen, P.; Liang, Y.; Li, Y.; Pan, S.; et al. Time-LLM: Time Series Forecasting by Reprogramming Large Language Models. arXiv 2024, arXiv:2310.01728. [Google Scholar]

- Brown, T.B.; Mann, B.; Ryder, N.; Subbiah, M.; Kaplan, J.; Dhariwal, P.; Neelakantan, A.; Shyam, P.; Sastry, G.; Askell, A.; et al. Language Models are Few-Shot Learners. arXiv 2020, arXiv:2005.14165. [Google Scholar]

- Vaswani, A.; Shazeer, N.; Parmar, N.; Uszkoreit, J.; Jones, L.; Gomez, A.N.; Kaiser, L.; Polosukhin, I. Attention Is All You Need. arXiv 2017, arXiv:1706.03762. [Google Scholar]

- Statistics New Zealand. Gross Domestic Product: December 2024 Quarter—Visualisation Data. 2025. Available online: https://www.stats.govt.nz/assets/Uploads/Gross-domestic-product/Gross-domestic-product-December-2024-quarter/Download-data/gross-domestic-product-december-2024-quarter-visualisation.csv (accessed on 18 October 2025).

- Richardson, A.; van Florenstein Mulder, T.; Vehbi, T. Nowcasting GDP Using Machine-Learning Algorithms: A Real-Time Assessment. Int. J. Forecast. 2021, 37, 941–948. [Google Scholar] [CrossRef]

- Bayarmagnai, G. Nowcasting New Zealand GDP Using a Dynamic Factor Model; Analytical Note AN2025/01; Reserve Bank of New Zealand: Wellington, New Zealand, 2025. [Google Scholar]

- Arro-Cannarsa, M.; Scheufele, R. Nowcasting GDP: What Are the Gains from Machine Learning Algorithms? SNB Working Papers 2024-06; Swiss National Bank: Zürich, Switzerland, 2024. [Google Scholar]

- Tenorio, J.; Perez, W. Monthly GDP nowcasting with Machine Learning and Unstructured Data. arXiv 2024, arXiv:2402.04165. [Google Scholar]

- Supriyatna, P.; Prastyo, D.; Akbar, M. Application of the dynamic factor model on nowcasting sectoral economic growth with high-frequency data. Media Stat. 2024, 17, 128–139. [Google Scholar] [CrossRef]

- Lim, B.; Zohren, S. Time-series forecasting with deep learning: A survey. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2021, 379, 20200209. [Google Scholar] [CrossRef] [PubMed]

- Taylor, S.J.; Letham, B. Forecasting at Scale. Am. Stat. 2018, 72, 37–45. [Google Scholar] [CrossRef]

- Cascaldi-Garcia, D.; Luciani, M.; Modugno, M. Lessons from Nowcasting GDP Across the World; Technical Report 1385; Board of Governors of the Federal Reserve System: Washington, DC, USA, 2023. [Google Scholar] [CrossRef]

- Barnes, J.; Barnes, M. The Role of Persistence Models in Forecast Evaluation. J. Forecast. 2020, 35, 123–135. [Google Scholar]

- Garza, A.; Mergenthaler Canseco, M.; Challú, C.; Olivares, K.G. StatsForecast: Lightning-Fast Forecasting with Statistical and Econometric Models; PyCon: Salt Lake City, UT, USA, 2022. [Google Scholar]

- Friedman, J.H. Greedy function approximation: A gradient boosting machine. Ann. Stat. 2001, 29, 1189–1232. [Google Scholar] [CrossRef]

- Alajmi, M.S.; Almeshal, A.M. Least Squares Boosting Ensemble and Quantum-Behaved Particle Swarm Optimization for Predicting the Surface Roughness in Face Milling Process of Aluminum Material. Appl. Sci. 2021, 11, 2126. [Google Scholar] [CrossRef]

- Forni, M.; Hallin, M.; Lippi, M.; Reichlin, L. The generalized dynamic factor model consistency and rates. J. Econom. 2004, 119, 231–255. [Google Scholar] [CrossRef]

- Chatfield, C. Time-Series Forecasting, revised ed.; Chapman & Hall/CRC: Boca Raton, FL, USA, 2000. [Google Scholar]

- Kim, S.; Kim, H. A New Metric of Absolute Percentage Error for Intermittent Demand Forecasts. Int. J. Forecast. 2016, 32, 669–679. [Google Scholar] [CrossRef]

- Hyndman, R.J.; Koehler, A.B. Another look at measures of forecast accuracy. Int. J. Forecast. 2006, 22, 679–688. [Google Scholar] [CrossRef]

- Diebold, F.X.; Mariano, R.S. Comparing Predictive Accuracy. J. Bus. Econ. Stat. 1995, 13, 253–263. [Google Scholar] [CrossRef]

- Waghmare, K.; Ziegel, J. Proper scoring rules for estimation and forecast evaluation. arXiv 2025, arXiv:2504.01781. [Google Scholar]

- van der Meer, D.; Pinson, P.; Camal, S.; Kariniotakis, G. CRPS-based online learning for nonlinear probabilistic forecast combination. Int. J. Forecast. 2024, 40, 1449–1466. [Google Scholar] [CrossRef]

- Wang, S.; Wang, Q.; Lu, H.; Zhang, D.; Xing, Q.; Wang, J. Learning about tail risk: Machine learning and combination with regularization in market risk management. Omega 2025, 133, 103249. [Google Scholar] [CrossRef]

- Taillardat, M.; Fougères, A.L.; Naveau, P.; de Fondeville, R. Evaluating probabilistic forecasts of extremes using continuous ranked probability score distributions. Int. J. Forecast. 2023, 39, 1448–1459. [Google Scholar] [CrossRef]

- Gneiting, T.; Raftery, A.E. Strictly Proper Scoring Rules, Prediction, and Estimation. J. Am. Stat. Assoc. 2007, 102, 359–378. [Google Scholar] [CrossRef]

- Das, A.; Faw, M.; Sen, R.; Zhou, Y. In-Context Fine-Tuning for Time-Series Foundation Models. arXiv 2024, arXiv:2410.24087. [Google Scholar]

| National GDP | Primary Ind. | Goods-Prod. Ind. | Services Ind. | Mean Rank | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Model | MAE | RMSE | SMAPE | MASE | MAE | RMSE | SMAPE | MASE | MAE | RMSE | SMAPE | MASE | MAE | RMSE | SMAPE | MASE | RMSE |

| 26-year Past to Present (1999Q3–2024Q3) | |||||||||||||||||

| Persistence | 1.44 | 3.08 | 0.49 | 1.01 | 3.02 | 4.12 | 0.88 | 1.02 | 3.06 | 5.54 | 0.90 | 1.01 | 1.18 | 2.48 | 0.38 | 1.00 | 8.75 |

| Arima | 1.49 | 3.03 | 0.50 | 1.05 | 2.39 | 3.23 | 0.76 | 0.81 | 2.97 | 4.63 | 0.93 | 0.98 | 1.15 | 2.39 | 0.39 | 0.98 | 6.75 |

| TimeGPT-1 | 1.49 | 2.80 | 0.52 | 1.05 | 3.32 | 4.33 | 0.99 | 1.12 | 2.93 | 4.95 | 0.91 | 0.97 | 1.20 | 2.27 | 0.38 | 1.02 | 7.50 |

| Chronos-t5-small | 1.22 | 2.31 | 0.49 | 0.86 | 2.70 | 3.67 | 0.90 | 0.91 | 2.71 | 4.24 | 0.94 | 0.89 | 1.01 | 2.00 | 0.36 | 0.86 | 5.25 |

| Chronos-t5-base | 1.23 | 2.26 | 0.50 | 0.87 | 2.76 | 3.66 | 0.89 | 0.93 | 2.70 | 4.26 | 0.92 | 0.89 | 0.98 | 1.88 | 0.36 | 0.83 | 4.75 |

| Chronos-t5-large | 1.38 | 2.98 | 0.49 | 0.97 | 2.78 | 3.62 | 0.88 | 0.94 | 2.79 | 4.57 | 0.94 | 0.92 | 1.02 | 2.03 | 0.37 | 0.86 | 6.00 |

| Moirai-1.1-R-small | 0.56 | 1.49 | 0.25 | 0.40 | 1.17 | 1.57 | 0.51 | 0.40 | 1.24 | 3.05 | 0.43 | 0.41 | 0.52 | 1.31 | 0.24 | 0.44 | 2.75 |

| Moirai-1.1-R-base | 0.48 | 1.04 | 0.20 | 0.34 | 1.19 | 1.60 | 0.48 | 0.40 | 0.91 | 1.57 | 0.44 | 0.30 | 0.42 | 1.18 | 0.17 | 0.36 | 1.75 |

| Moirai-1.1-R-large | 0.52 | 1.43 | 0.22 | 0.37 | 0.93 | 1.27 | 0.36 | 0.32 | 0.85 | 1.86 | 0.36 | 0.28 | 0.45 | 1.13 | 0.20 | 0.38 | 1.50 |

| 3-year Pre-COVID-19 (2017Q1–2019Q4) | |||||||||||||||||

| Persistence | 0.41 | 0.50 | 0.13 | 0.94 | 2.29 | 2.84 | 0.90 | 0.95 | 1.19 | 1.51 | 0.39 | 0.97 | 0.33 | 0.38 | 0.10 | 0.99 | 7.25 |

| Arima | 0.39 | 0.45 | 0.12 | 0.90 | 1.80 | 2.08 | 0.71 | 0.75 | 1.13 | 1.34 | 0.41 | 0.92 | 0.27 | 0.33 | 0.08 | 0.80 | 4.25 |

| TimeGPT-1 | 0.41 | 0.51 | 0.12 | 0.95 | 2.44 | 2.99 | 1.09 | 1.02 | 1.02 | 1.39 | 0.31 | 0.83 | 0.38 | 0.44 | 0.11 | 1.13 | 7.75 |

| Chronos-t5-small | 0.40 | 0.47 | 0.13 | 0.92 | 1.84 | 2.37 | 0.88 | 0.76 | 1.22 | 1.52 | 0.44 | 0.99 | 0.31 | 0.34 | 0.09 | 0.91 | 6 |

| Chronos-t5-base | 0.41 | 0.55 | 0.13 | 0.94 | 1.84 | 2.43 | 0.86 | 0.76 | 1.22 | 1.53 | 0.48 | 1.00 | 0.31 | 0.35 | 0.09 | 0.92 | 7.5 |

| Chronos-t5-large | 0.33 | 0.40 | 0.10 | 0.75 | 1.96 | 2.54 | 0.91 | 0.82 | 1.17 | 1.45 | 0.40 | 0.95 | 0.34 | 0.38 | 0.10 | 1.00 | 6 |

| Moirai-1.1-R-small | 0.26 | 0.31 | 0.09 | 0.60 | 0.94 | 1.09 | 0.54 | 0.39 | 0.32 | 0.39 | 0.12 | 0.26 | 0.23 | 0.29 | 0.07 | 0.67 | 2.75 |

| Moirai-1.1-R-base | 0.23 | 0.29 | 0.07 | 0.52 | 0.70 | 0.83 | 0.28 | 0.29 | 0.30 | 0.40 | 0.12 | 0.25 | 0.11 | 0.14 | 0.03 | 0.33 | 1.75 |

| Moirai-1.1-R-large | 0.15 | 0.20 | 0.05 | 0.34 | 0.62 | 0.95 | 0.36 | 0.26 | 0.18 | 0.25 | 0.06 | 0.15 | 0.14 | 0.15 | 0.04 | 0.40 | 1.5 |

| 3-year During COVID-19 (2020Q1–2022Q4) | |||||||||||||||||

| Persistence | 6.42 | 8.54 | 1.32 | 0.94 | 3.92 | 6.06 | 0.75 | 0.92 | 11.13 | 14.52 | 1.43 | 0.95 | 5.11 | 6.85 | 0.94 | 0.94 | 9 |

| Arima | 6.68 | 8.35 | 1.27 | 0.98 | 3.86 | 4.83 | 0.90 | 0.90 | 8.73 | 10.98 | 1.34 | 0.75 | 5.00 | 6.56 | 1.07 | 0.92 | 6.5 |

| TimeGPT-1 | 5.57 | 7.30 | 1.22 | 0.82 | 3.96 | 5.69 | 0.94 | 0.93 | 9.50 | 12.22 | 1.53 | 0.81 | 4.44 | 5.86 | 0.87 | 0.82 | 7.25 |

| Chronos-t5-small | 4.70 | 6.21 | 1.28 | 0.69 | 3.83 | 5.46 | 0.89 | 0.90 | 8.36 | 10.28 | 1.49 | 0.72 | 3.66 | 5.34 | 0.79 | 0.67 | 5.25 |

| Chronos-t5-base | 4.53 | 5.98 | 1.25 | 0.67 | 3.76 | 5.38 | 0.91 | 0.88 | 8.60 | 10.46 | 1.55 | 0.74 | 3.42 | 4.95 | 0.81 | 0.63 | 4.75 |

| Chronos-t5-large | 6.00 | 8.26 | 1.28 | 0.88 | 3.92 | 5.32 | 0.94 | 0.92 | 9.24 | 11.45 | 1.60 | 0.79 | 3.75 | 5.44 | 0.79 | 0.69 | 6.25 |

| Moirai-1.1-R-small | 2.44 | 4.17 | 0.66 | 0.36 | 1.83 | 2.21 | 0.67 | 0.43 | 5.98 | 8.59 | 1.22 | 0.51 | 1.91 | 3.60 | 0.38 | 0.35 | 3 |

| Moirai-1.1-R-base | 2.06 | 2.83 | 0.60 | 0.30 | 1.40 | 1.78 | 0.48 | 0.33 | 2.73 | 3.78 | 0.64 | 0.23 | 1.65 | 3.26 | 0.35 | 0.30 | 1.5 |

| Moirai-1.1-R-large | 2.54 | 4.04 | 0.77 | 0.37 | 1.17 | 1.37 | 0.29 | 0.27 | 3.41 | 5.08 | 0.76 | 0.29 | 1.81 | 3.15 | 0.39 | 0.33 | 1.5 |

| 2-year Post-COVID-19 (2023Q1–2024Q3) | |||||||||||||||||

| Persistence | 0.85 | 1.12 | 0.71 | 0.87 | 1.53 | 1.81 | 0.43 | 0.97 | 1.71 | 2.21 | 0.86 | 0.88 | 0.89 | 1 | 0.68 | 0.94 | 4.25 |

| Arima | 1.66 | 1.96 | 1.18 | 1.71 | 1.53 | 1.84 | 0.38 | 0.97 | 4.71 | 5.2 | 1.73 | 2.41 | 1.24 | 1.48 | 0.75 | 1.31 | 7.75 |

| TimeGPT-1 | 2.46 | 3.03 | 1.21 | 2.52 | 2.31 | 3.01 | 0.65 | 1.46 | 3.85 | 4.95 | 1.4 | 1.97 | 2.16 | 2.62 | 0.98 | 2.28 | 8.75 |

| Chronos-t5-small | 0.94 | 1.21 | 0.82 | 0.96 | 1.17 | 1.41 | 0.26 | 0.74 | 2.13 | 2.54 | 1.28 | 1.09 | 0.87 | 1.06 | 0.66 | 0.92 | 6 |

| Chronos-t5-base | 0.92 | 1.27 | 0.78 | 0.95 | 1.59 | 1.85 | 0.33 | 1 | 2 | 2.53 | 1 | 1.02 | 0.89 | 1.02 | 0.68 | 0.94 | 6.5 |

| Chronos-t5-large | 0.87 | 1.2 | 0.76 | 0.89 | 1.9 | 2.27 | 0.64 | 1.2 | 2.03 | 2.46 | 1.12 | 1.04 | 0.89 | 1 | 0.69 | 0.94 | 5.5 |

| Moirai-1.1-R-small | 0.52 | 0.6 | 0.42 | 0.54 | 0.73 | 0.86 | 0.23 | 0.46 | 0.95 | 1.18 | 0.54 | 0.49 | 0.45 | 0.52 | 0.26 | 0.47 | 2 |

| Moirai-1.1-R-base | 0.52 | 0.62 | 0.47 | 0.53 | 0.81 | 1.18 | 0.44 | 0.51 | 0.57 | 0.69 | 0.31 | 0.29 | 0.65 | 0.85 | 0.38 | 0.69 | 2.75 |

| Moirai-1.1-R-large | 0.43 | 0.55 | 0.47 | 0.44 | 0.49 | 0.55 | 0.36 | 0.31 | 0.58 | 0.67 | 0.46 | 0.3 | 0.49 | 0.58 | 0.52 | 0.52 | 1.25 |

| Model | 1999Q3–2024Q3 | Pre-COVID-19 | COVID-19 | Post-COVID-19 | ||||

|---|---|---|---|---|---|---|---|---|

| National GDP | ||||||||

| TimeGPT-1 | 0.421 | 0.520 | 0.897 | 0.599 | 0.274 | 0.456 | 0.235 | 0.844 |

| Chronos_Small | 0.231 | 0.072 | 0.473 | 0.679 | 0.252 | 0.076 | 0.360 | 0.484 |

| Chronos_Base | 0.190 | 0.088 | 0.137 | 0.218 | 0.200 | 0.101 | 0.332 | 0.461 |

| Chronos_Large | 0.112 | 0.928 | 0.082 | 0.467 | 0.250 | 0.889 | 0.298 | 0.453 |

| Moirai_Small | 0.048 | 0.017 | 0.033 | 0.154 | 0.087 | 0.044 | 0.126 | 0.187 |

| Moirai_Base | 0.037 | 0.011 | 0.045 | 0.103 | 0.055 | 0.017 | 0.084 | 0.244 |

| Moirai_Large | 0.061 | 0.022 | 0.016 | 0.012 | 0.104 | 0.052 | 0.097 | 0.225 |

| Primary Industries | ||||||||

| TimeGPT-1 | 0.275 | 0.001 | 0.686 | 0.088 | 0.119 | 0.614 | 0.102 | 0.156 |

| Chronos_Small | 0.005 | 0.054 | 0.327 | 0.320 | 0.277 | 0.559 | 0.296 | 0.866 |

| Chronos_Base | 0.012 | 0.057 | 0.455 | 0.274 | 0.389 | 0.630 | 0.472 | 0.656 |

| Chronos_Large | 0.020 | 0.067 | 0.594 | 0.209 | 0.298 | 0.687 | 0.979 | 0.414 |

| Moirai_Small | 0.001 | 0.001 | 0.030 | 0.076 | 0.144 | 0.035 | 0.238 | 0.300 |

| Moirai_Base | 0.001 | 0.001 | 0.031 | 0.036 | 0.142 | 0.031 | 0.211 | 0.165 |

| Moirai_Large | 0.001 | 0.001 | 0.017 | 0.069 | 0.135 | 0.028 | 0.169 | 0.045 |

| Goods-Producing Industries | ||||||||

| TimeGPT-1 | 0.317 | 0.534 | 0.490 | 0.831 | 0.268 | 0.463 | 0.443 | 0.978 |

| Chronos_Small | 0.174 | 0.390 | 0.917 | 0.258 | 0.188 | 0.587 | 0.596 | 0.519 |

| Chronos_Base | 0.184 | 0.396 | 0.855 | 0.116 | 0.209 | 0.635 | 0.678 | 0.584 |

| Chronos_Large | 0.164 | 0.901 | 0.560 | 0.431 | 0.178 | 0.875 | 0.836 | 0.622 |

| Moirai_Small | 0.080 | 0.042 | 0.029 | 0.011 | 0.212 | 0.397 | 0.323 | 0.094 |

| Moirai_Base | 0.025 | 0.001 | 0.024 | 0.008 | 0.072 | 0.032 | 0.125 | 0.024 |

| Moirai_Large | 0.021 | 0.002 | 0.024 | 0.008 | 0.069 | 0.049 | 0.118 | 0.036 |

| Service Industries | ||||||||

| TimeGPT-1 | 0.443 | 0.614 | 0.237 | 0.100 | 0.273 | 0.615 | 0.194 | 0.701 |

| Chronos_Small | 0.257 | 0.136 | 0.233 | 0.790 | 0.279 | 0.167 | 0.362 | 0.382 |

| Chronos_Base | 0.183 | 0.126 | 0.278 | 0.496 | 0.197 | 0.188 | 0.268 | 0.368 |

| Chronos_Large | 0.287 | 0.137 | 0.971 | 0.369 | 0.315 | 0.150 | 0.279 | 0.371 |

| Moirai_Small | 0.039 | 0.015 | 0.233 | 0.695 | 0.069 | 0.047 | 0.090 | 0.207 |

| Moirai_Base | 0.054 | 0.039 | 0.005 | 0.020 | 0.097 | 0.121 | 0.121 | 0.214 |

| Moirai_Large | 0.040 | 0.025 | 0.013 | 0.029 | 0.068 | 0.074 | 0.076 | 0.231 |

| Comparison | ||

|---|---|---|

| Model Comparison | RMSE | p-Value |

| Moirai Base | 0.2692 | 0.0014 |

| LSBoost [65] | 0.4876 | 0.2389 |

| Factor [65] | 0.6328 | 0.4936 |

| CRPS | Tail | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Model | Mean | Median | p95 | p90 | p85 | p80 | Spread | (Upper) Steepness | Mean Rank |

| Moirai_Base | 0.48 | 0.24 | 1.32 | 0.95 | 0.59 | 0.47 | 1.08 | 0.85 | 1 |

| Moirai_Large | 0.52 | 0.21 | 1.36 | 0.93 | 0.59 | 0.47 | 1.14 | 0.88 | 2 |

| Moirai_Small | 0.56 | 0.27 | 1.13 | 0.76 | 0.61 | 0.52 | 0.86 | 0.61 | 3 |

| Chronos_Small | 1.22 | 0.71 | 3.18 | 2.17 | 1.63 | 1.51 | 2.46 | 1.68 | 4 |

| Chronos_Base | 1.23 | 0.76 | 3.17 | 2.05 | 1.69 | 1.46 | 2.41 | 1.71 | 5 |

| Chronos_Large | 1.37 | 0.75 | 3.28 | 2.01 | 1.80 | 1.39 | 2.53 | 1.88 | 6 |

| Persistence | 1.43 | 0.74 | 4.17 | 2.10 | 1.88 | 1.33 | 3.43 | 2.84 | 7 |

| Arima | 1.48 | 0.73 | 8.39 | 2.47 | 1.85 | 1.46 | 7.65 | 6.93 | 8 |

| TimeGPT-1 | 1.49 | 0.88 | 5.28 | 2.52 | 2.12 | 1.68 | 4.40 | 3.60 | 9 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jetwiriyanon, J.; Susnjak, T.; Ranathunga, S. Generalisation Bounds of Zero-Shot Economic Forecasting Using Time Series Foundation Models. Mach. Learn. Knowl. Extr. 2025, 7, 135. https://doi.org/10.3390/make7040135

Jetwiriyanon J, Susnjak T, Ranathunga S. Generalisation Bounds of Zero-Shot Economic Forecasting Using Time Series Foundation Models. Machine Learning and Knowledge Extraction. 2025; 7(4):135. https://doi.org/10.3390/make7040135

Chicago/Turabian StyleJetwiriyanon, Jittarin, Teo Susnjak, and Surangika Ranathunga. 2025. "Generalisation Bounds of Zero-Shot Economic Forecasting Using Time Series Foundation Models" Machine Learning and Knowledge Extraction 7, no. 4: 135. https://doi.org/10.3390/make7040135

APA StyleJetwiriyanon, J., Susnjak, T., & Ranathunga, S. (2025). Generalisation Bounds of Zero-Shot Economic Forecasting Using Time Series Foundation Models. Machine Learning and Knowledge Extraction, 7(4), 135. https://doi.org/10.3390/make7040135