The Comparison of Evaluation on User Experience and Usability of Mobile Banking Applications Using User Experience Questionnaire and System Usability Scale †

Abstract

:1. Introduction

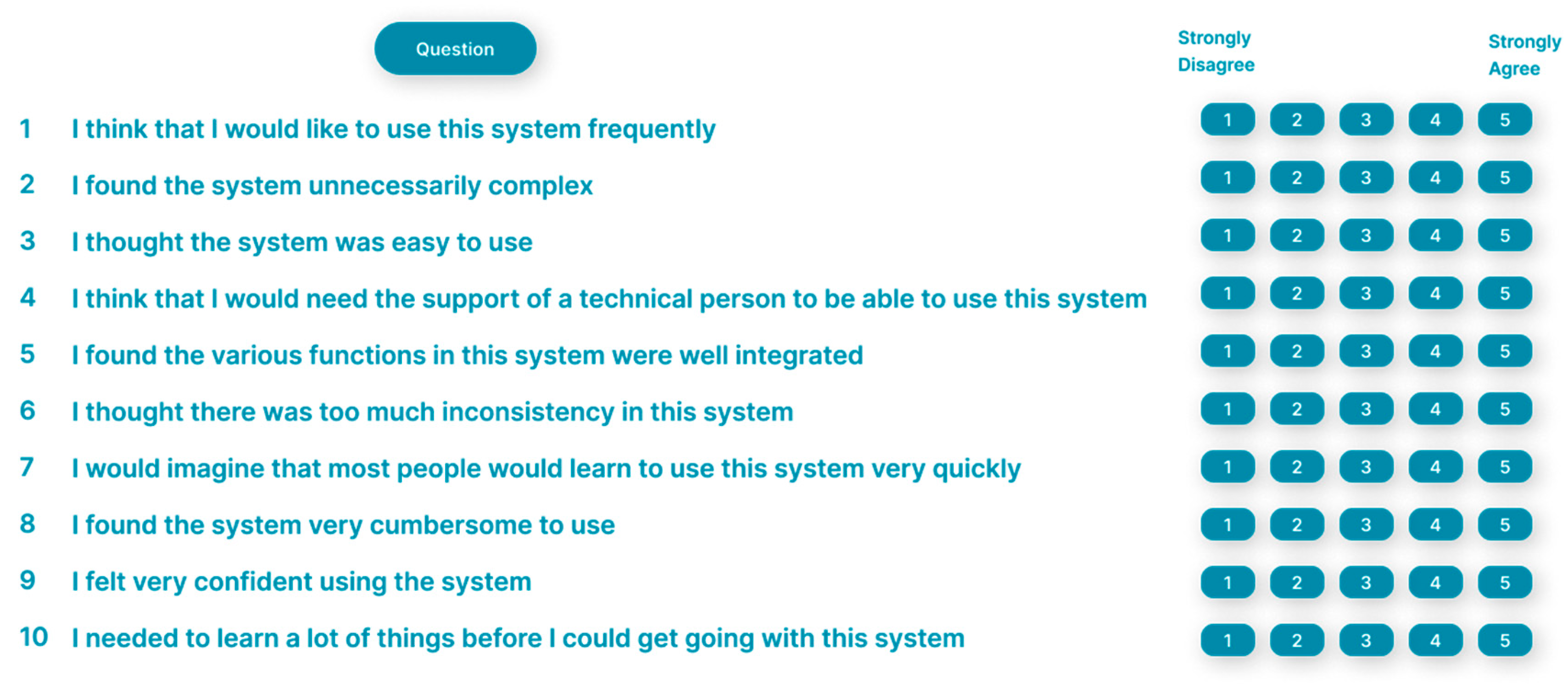

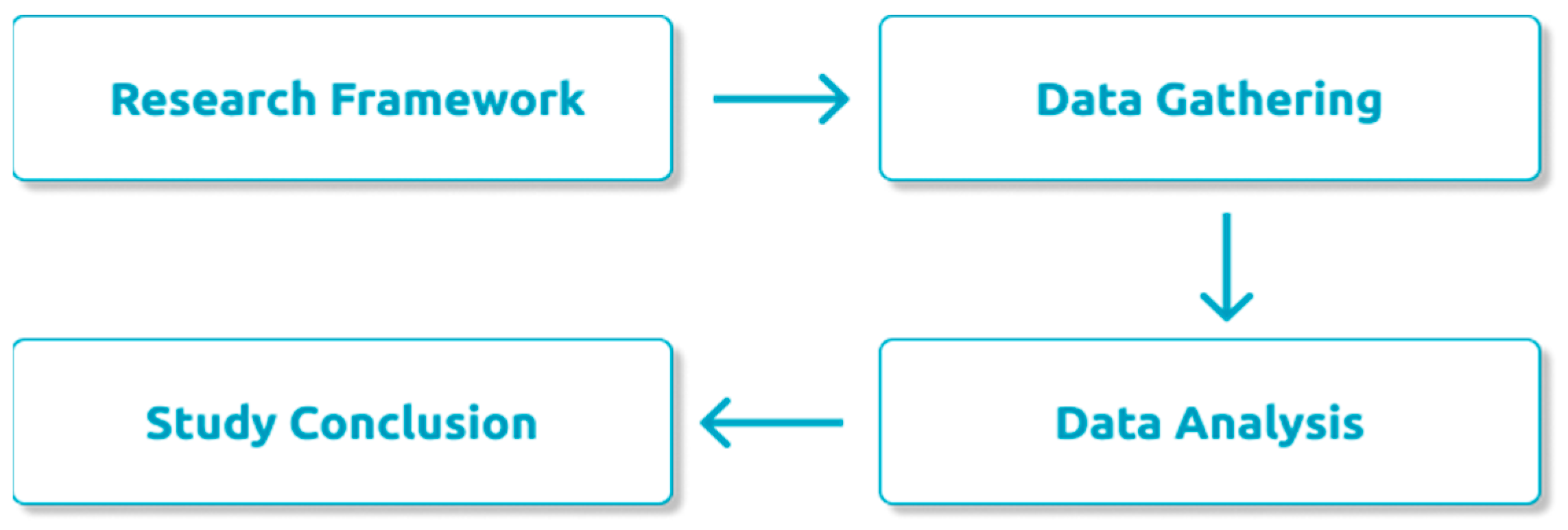

2. Method

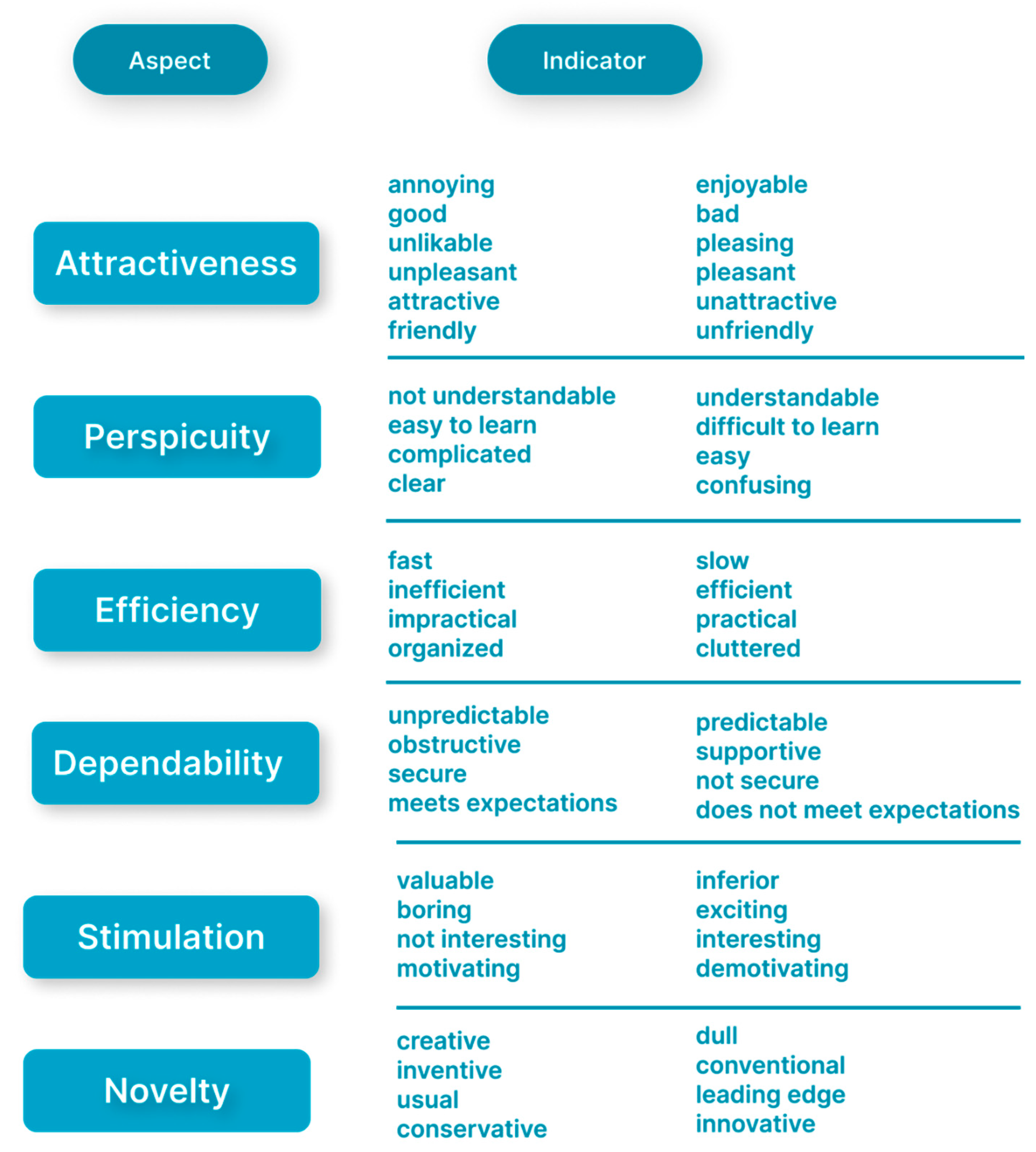

- Attractiveness (users’ general perception);

- Perspicuity which relates to how easy an application is to be used;

- Efficiency (the amount of time required in completing a task);

- Dependability (whether users have control over the application);

- Stimulation (the extent to which users are motivated to use the product;

- Novelty (innovation in a system, service and product).

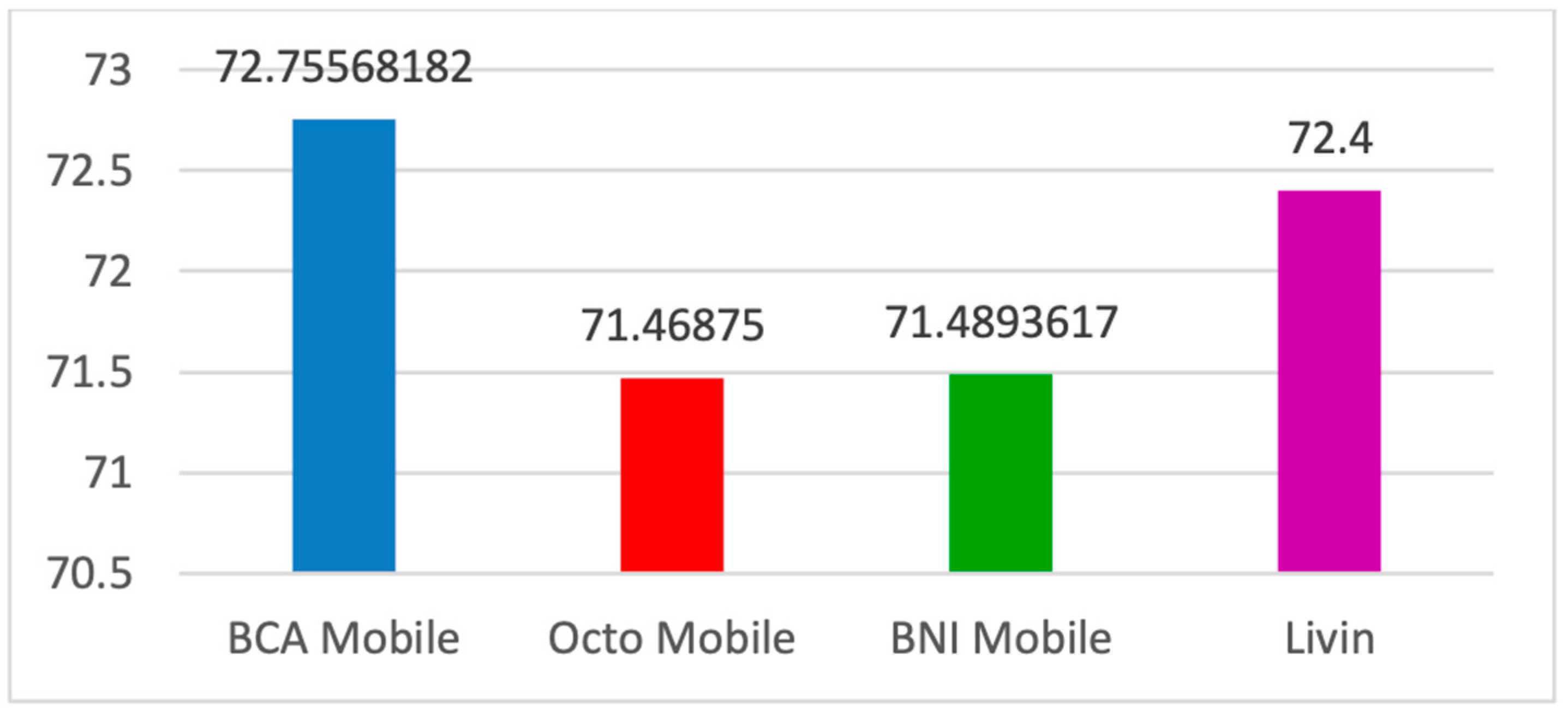

3. Results and Discussions

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- OJK. Digital Finance Innovation Road Map And Action Plan 2020–2024. Available online: http://www.digifin.org/digital-finance-innovation/ (accessed on 24 April 2022).

- Walfajri, M.; Handojo, B.I. Transaksi Digital Banking Meningkat 46,72% yoy Sampai September 2021. NewsSetup. Available online: https://newssetup.kontan.co.id/news/bi-transaksi-digital-banking-meningkat-4672-yoy-sampai-september-2021 (accessed on 24 April 2022).

- Ariesta, A. Transaksi Mobile dan Internet Banking Melonjak 300 Persen di 2021. IDX Channel. Available online: https://www.idxchannel.com/banking/transaksi-mobile-dan-internet-banking-melonjak-300-persen-di-2021 (accessed on 24 April 2022).

- Bayu, D.J.; Ridhoi, M.A. Layanan Perbankan Digital Makin Sering Digunakan Saat Pandemi. Available online: https://databoks.katadata.co.id/datapublish/2020/11/18/layanan-perbankan-digital-makin-sering-digunakan-saat-pandemi (accessed on 24 April 2022).

- Berni, A.; Borgianni, Y. From the Definition of User Experience to a Framework to Classify Its Applications. In Proceedings of the Design Society, Gothenburg, Sweden, 16–20 August 2021; Cambridge University Press: Cambridge, UK; Volume 1, pp. 1627–1636. [Google Scholar] [CrossRef]

- Yazid, M.A.; Jantan, A.H. User experience design (UXD) of mobile application: An implementation of a case study. J. Telecommun. Electron. Comput. Eng. 2017, 9, 197–200. [Google Scholar]

- Putra, D.O.; Setiawan, A. The Importance of User Experience Analysis in the Design of an Education Information System Application. In Proceedings of the 1st Borobudur International Symposium on Humanities, Economics and Social Sciences (BIS-HESS 2019), Magelang, Indonesia, 30 October 2019; Atlantis Press: Dordrecht, The Netherlands; 2020; Volume 436, pp. 1208–1211. [Google Scholar] [CrossRef]

- Weichbroth, P. Usability of Mobile Applications: A Systematic Literature Study. IEEE Access 2020, 8, 55563–55577. [Google Scholar] [CrossRef]

- Ergonomics of Human-System Interaction—Part 11: Usability: Definitions and Concepts. Available online: https://www.iso.org/obp/ui/#iso:std:iso:9241:-11:ed-2:v1:en (accessed on 22 April 2022).

- Lei, B.; Lee, J. Analysis on continuous usage intention of chinese mobile games from the perspective of experiential marketing and network externality. J. Inf. Technol. Appl. Manag. 2020, 27, 197–224. [Google Scholar] [CrossRef]

- Mantala, R.; Firdaus, M.R. Pengaruh customer experience terhadap customer satisfaction pada pengguna smartphone android (studi pada mahasiswa politeknik negeri banjarmasin). J. Wawasan Manaj. 2016, 4, 153–164. [Google Scholar]

- Febrian, D.; Simanjuntak, M.; Hasanah, N. The Effect of Benefits Offered and Customer Experience on Re-use Intention of Mobile Banking through Customer Satisfaction and Trust. J. Keuang. Perbank. 2021, 25, 551–569. [Google Scholar] [CrossRef]

- Badran, O.; Al-Haddad, S. The impact of software user experience on customer satisfaction. J. Manag. Inf. Decis. Sci. 2018, 21, 1–20. [Google Scholar]

- Mohamad Salleh, M.A.; Salman, A.; Ali, M.N.S.; Hashim, H. The Importance of Usability Features in Enhancing Online Communication Satisfaction. Malays. J. Commun. 2016, 32, 1–15. [Google Scholar] [CrossRef]

- Hartzani, A.G. Evaluasi User Experience Pada Dompet Digital Ovo Menggunakan User Experience Questionnaire (UEQ). Universitas Islam Negeri Syarif Hidayatullah. Available online: https://repository.uinjkt.ac.id/dspace/bitstream/123456789/57729/1/AL%20GHIFARI%20HARTZANI-FST.pdf (accessed on 11 April 2022).

- Izabal, S.V.; Aknuranda, I.; Az-zahra, H.M. Evaluasi dan Perbaikan User Experience Menggunakan User Experience Questionnaire (UEQ) dan Focus Group Discussion (FGD) pada Situs Web FILKOM Apps Mahasiswa Fakultas Ilmu Komputer Universitas Brawijaya. J. Pengemb. Teknol. Inf. Ilmu Komput. Univ. Brawijaya 2018, 2, 3224–3232. [Google Scholar]

- Schrepp, M.; Hinderks, A.; Thomaschewski, J. Applying the user experience questionnaire (UEQ) in different evaluation scenarios. In Proceedings of the International Conference of Design User Experience, and Usability, Crete, Greece, 22–27 June 2014; Springer: Berlin/Heidelberg, Germany, 2014; pp. 383–392. [Google Scholar] [CrossRef]

- digital.gov. System Usability Scale (SUS): Improving Products Since 1986. Available online: https://digital.gov/2014/08/29/system-usability-scale-improving-products-since-1986/ (accessed on 16 May 2022).

- Sidik, A. Penggunaan system usability scale (SUS) sebagai evaluasi website berita mobile. J. Ilm. Technol. 2018, 9, 83–88. [Google Scholar] [CrossRef]

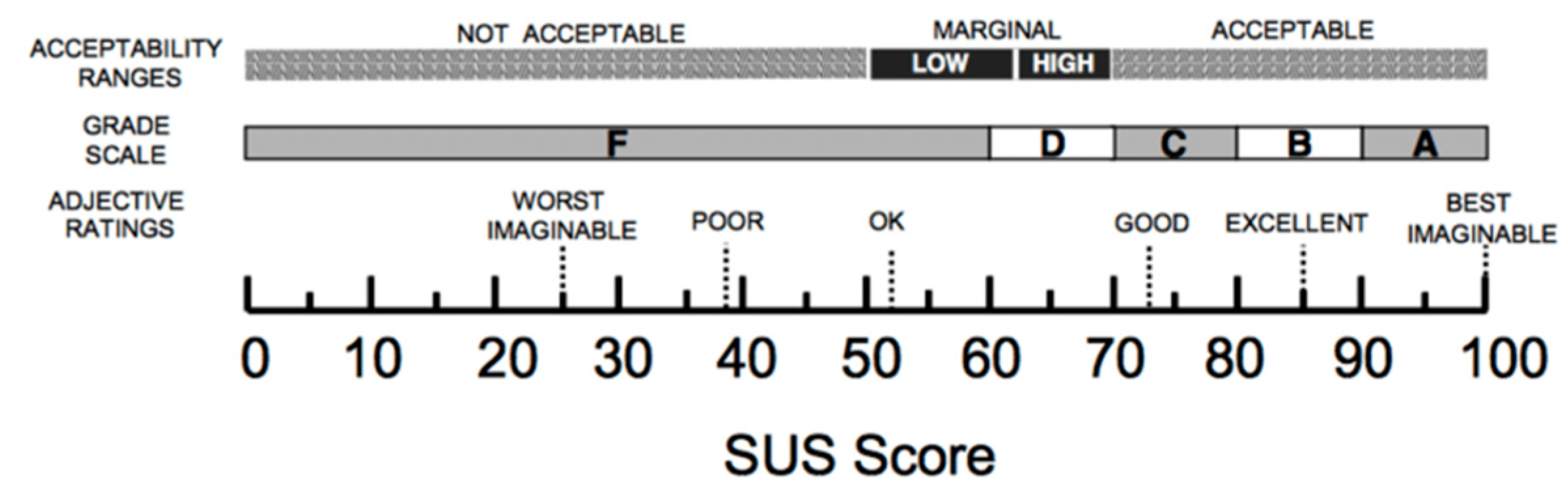

- Lewis, J.R.; Sauro, J. Item benchmarks for the system usability scale. J. User Exp. 2018, 13, 158–167. [Google Scholar]

- Rauschenberger, M.; Schrepp, M.; Perez-Cota, M.; Olschner, S.; Thomaschewski, J. Efficient Measurement of the User Experience of Interactive Products. How to use the User Experience Questionnaire (UEQ). Example: Spanish Language Version. Int. J. Interact. Multimed. Artif. Intell. 2013, 2, 39–45. [Google Scholar] [CrossRef]

- Hinderks, A.; Winter, D.; Schrepp, M.; Thomaschewski, J. Applicability of user experience and usability questionnaires. J. Univers. Comput. Sci. 2019, 25, 1717–1735. [Google Scholar]

- Bangor, A.; Kortum, P.; Miller, J. Determining what individual SUS scores mean: Adding an adjective rating scale. J. User Exp. 2009, 4, 114–123. [Google Scholar]

| Mobile Banking Application | Number |

|---|---|

| BCA Mobile | 88 |

| Octo Mobile | 80 |

| BNI Mobile | 94 |

| Livin | 100 |

| Scale | BCA Mobile | Octo Mobile | BNI Mobile | Livin |

|---|---|---|---|---|

| Attractiveness | Positive | Positive | Positive | Positive |

| Perspicuity | Positive | Positive | Positive | Positive |

| Efficiency | Positive | Positive | Neutral | Positive |

| Dependability | Positive | Positive | Positive | Positive |

| Stimulation | Positive | Positive | Positive | Positive |

| Novelty | Positive | Positive | Neutral | Neutral |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Setiyawati, N.; Bangkalang, D.H. The Comparison of Evaluation on User Experience and Usability of Mobile Banking Applications Using User Experience Questionnaire and System Usability Scale. Proceedings 2022, 82, 87. https://doi.org/10.3390/proceedings2022082087

Setiyawati N, Bangkalang DH. The Comparison of Evaluation on User Experience and Usability of Mobile Banking Applications Using User Experience Questionnaire and System Usability Scale. Proceedings. 2022; 82(1):87. https://doi.org/10.3390/proceedings2022082087

Chicago/Turabian StyleSetiyawati, Nina, and Dwi Hosanna Bangkalang. 2022. "The Comparison of Evaluation on User Experience and Usability of Mobile Banking Applications Using User Experience Questionnaire and System Usability Scale" Proceedings 82, no. 1: 87. https://doi.org/10.3390/proceedings2022082087

APA StyleSetiyawati, N., & Bangkalang, D. H. (2022). The Comparison of Evaluation on User Experience and Usability of Mobile Banking Applications Using User Experience Questionnaire and System Usability Scale. Proceedings, 82(1), 87. https://doi.org/10.3390/proceedings2022082087