European and American Options Valuation by Unsupervised Learning with Artificial Neural Networks †

Abstract

:1. Introduction

2. Artificial Neural Networks Solving PDEs

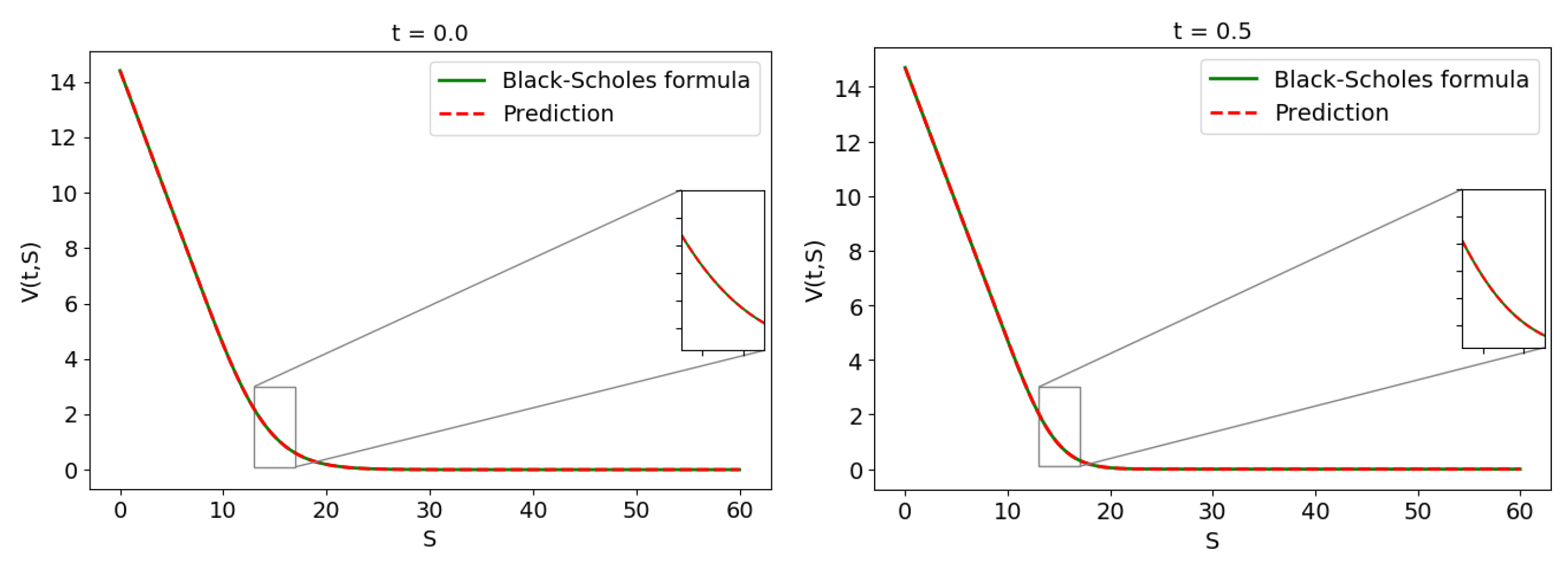

3. Financial Derivatives Pricing PDEs

4. ANN Option Pricing Results

Author Contributions

Funding

Conflicts of Interest

References

- van der Meer, R.; Oosterlee, C.; Borovykh, A.T. Optimally weighted loss function for solving PDEs with neural Networks. arXiv 2020, arXiv:2002.06269. [Google Scholar] [CrossRef]

- Raissi, M.; Karniadakis, G.E.; Perdikris, P. Physics informed deep learning (part I): Data-driven solutions of nonlinear partial differential equations. arXiv 2017, arXiv:1711.10561v1. [Google Scholar]

| Error | |

|---|---|

| Max-call | |

| Spread | |

| Arithmetic average put |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Salvador, B.; Oosterlee, C.W.; Meer, R.v.d. European and American Options Valuation by Unsupervised Learning with Artificial Neural Networks. Proceedings 2020, 54, 14. https://doi.org/10.3390/proceedings2020054014

Salvador B, Oosterlee CW, Meer Rvd. European and American Options Valuation by Unsupervised Learning with Artificial Neural Networks. Proceedings. 2020; 54(1):14. https://doi.org/10.3390/proceedings2020054014

Chicago/Turabian StyleSalvador, Beatriz, Cornelis W. Oosterlee, and Remco van der Meer. 2020. "European and American Options Valuation by Unsupervised Learning with Artificial Neural Networks" Proceedings 54, no. 1: 14. https://doi.org/10.3390/proceedings2020054014

APA StyleSalvador, B., Oosterlee, C. W., & Meer, R. v. d. (2020). European and American Options Valuation by Unsupervised Learning with Artificial Neural Networks. Proceedings, 54(1), 14. https://doi.org/10.3390/proceedings2020054014