2.1. Classic Market

To distinguish expressions related to a classic market from expressions related to our proposed system, we use the subscript

c, short for

classic, and

s, short for

smart contract. We consider a firm that proposes multiple units of a single product on a market. Producing a single unit of this product has a cost

, whereas the profit

generated by selling a single product is a function of the price

that is entirely decided by the firm:

To get its business started, the firm must invests a fixed cost

that includes the cost of machines, offices, research, and development. We consider for simplicity that the firm has no control over the two costs

and

. We can then express the quantity of sales

necessary for a firm to make a positive net profit as a function of the price

:

We model the market for this product as an interaction between a set of customers

where

,

, and the product’s price

. A customer is interested to buy the product at a specific day

, but will do so only if

at time

. The customer’s day of interest

is drawn from a random variable

I, whereas the maximum price that it is willing to pay

is drawn from a random variable

H. To model the time of interest random variable

I, we use the Bass Diffusion Model [

5], which describes how new products are adopted by a population through time. The Bass model is a continuous model in its original form, but a discrete approximation also exists [

6]. Originally, a number of sales for a specific day

t is obtained by an interaction between innovators and imitators, respectively parametrized by

p and

q, for a total number of customers

N. In our case, we rather consider this quantity as the number of customers that are willing to buy the product at a specific day

, but will do so only if

at time

. Parameters

p and

q won’t be mentionned further on: we will fix their values to the one used in

Figure 1, as those values give a Bass Model that fits most observed product adoption through time.

We either can consider the subset of customers interested to buy the product for any day

as being drawn from

M with or without replacement: wherever a customer buys the product or not the first time, will he be interested to buy it in the future again, or not ? For simplicity, we only consider customers to be drawn from the set

M without replacement. Then, inspired by the Bass Model formula, we express the estimated number of customers interested to buy the product between day

and

using the following expression:

Next, we model the probability density function

of the random variable

H, whose possible outcomes represent the maximum price a customer would be willing to pay for the product, as any smooth monotonically decreasing function.

is defined between

, the price for which all the market potential

N is captured, and

, the price for which no customers would buy the product. Interestingly, the demand function

for a product with price

, which describes the relationship between the price of a commodity and the quantity of that commodity that is demanded at that price, is simply equal to the market potential

N times the probability density function of

H:

Often simplified as a linear decreasing function, the demand-function

can also be modeled using a cumulative beta distribution function or a cumulative normal distribution function [

7]. Using Equation (

3), we can now express

the number of sales made from the introduction of the product to the market up to day

t, where

is the price considered by the customer, with the following expression:

We then get the net profit

as a function of the price

and the day

t, and the ROI function

For simplicity, we consider that there is no competition between firms. An increasing demand for the product of a firm won’t impact the demand for the product of another. We further assume that there is no constraints on the capability of a firm to satisfy the demand, and that a product is instantaneously produced whenever needed, without the need of an inventory. Special products like Veblen goods [

8], whose demand is known to increase with the price, are not taken into account.

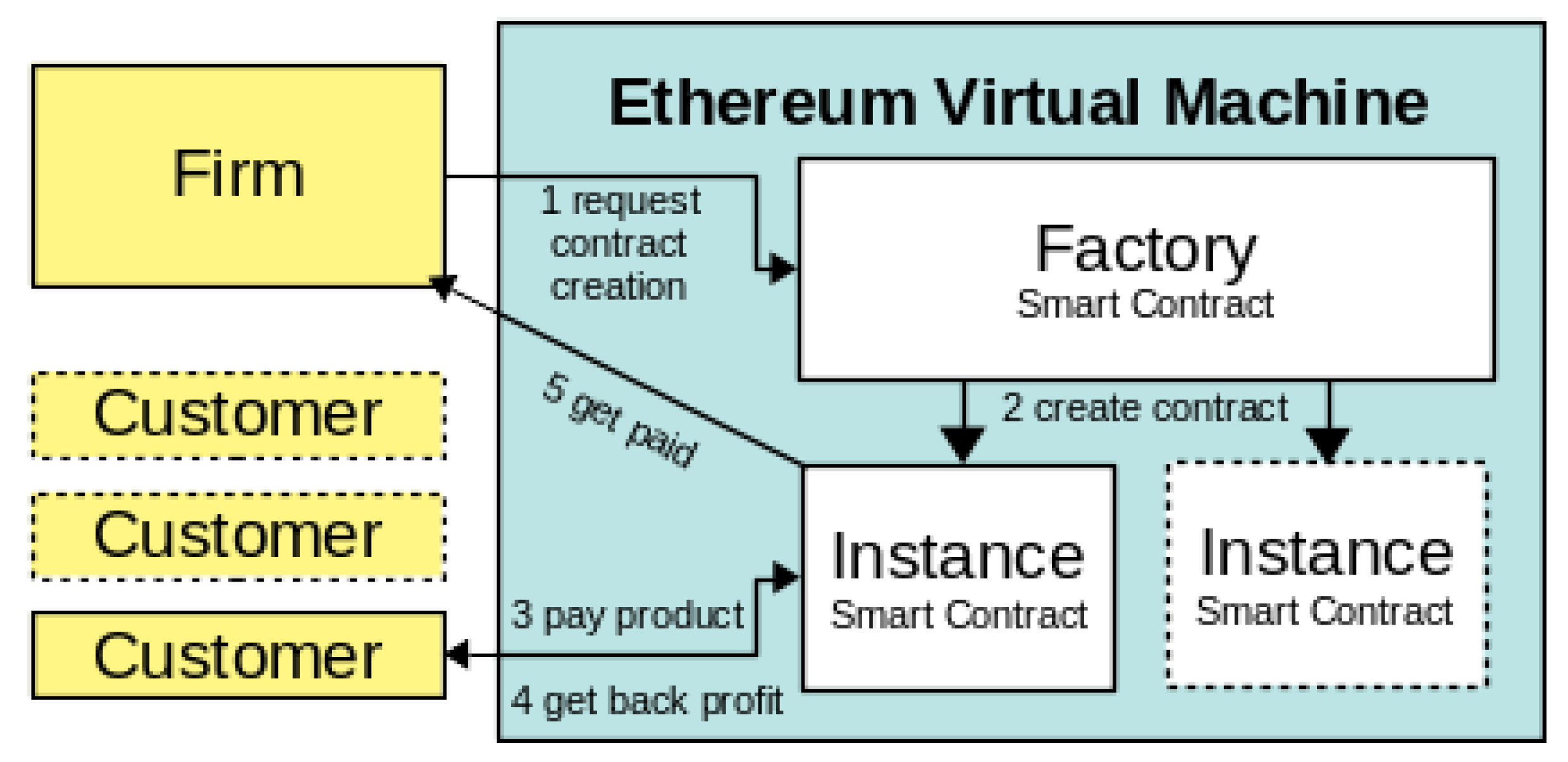

2.2. Market with Partial Profit Redistribution

We propose to equally redistribute part of the firm’s profit to each previous customer, after day

, if and only if the number of sales is greater than the quantity of sales

. We first define a new profit function

, where

is the percentage of the profit that is redistributed:

The redistribution will happen at time step

. Each additional sale made after

is reached will increase the final redistributed amount to each previous customer. Given the current number of sales

made by a firm since the product’s introduction to the market, it becomes possible for a customer to deterministically know how much he will receive at the end of the

period. We define

as the redistributed profit to each customer for the current number of sales

at time step

t:

By taking into account the redistributed amount

at a specific time

t and the current state of the smart contract, any customer can get the price he would

end up paying for the product after the redistribution of the profit at day

: we define this price as the

instantaneous price

. It is obtained from

, and is equal to the maximum amount a customer will end up paying for the firm’s product after receiving the redistributed part of the profit:

It should be emphasized that

is in fact a higher bound on the final price a customer will end up paying after the redistribution, because if additional sales occur between the current day

t and

,

will further decrease as the redistributed part of the profit

increases. Now, if we consider all customers to evaluate

and not the fixed price

, then their behaviors will clearly change. Each additional sale will increase the probability of subsequent sales because

will decrease as well, and because the price threshold density function

is a monotonically decreasing function. If we consider the number of sales made up to time step

t, defined in Equation (

5) with the new instantaneous price

, we get:

We can see that

is now a recursive function that calls itself backward from time step

t up to

. The new net profit function

is defined as:

And the ROI function

becomes:

Because the number of potential customers

N is a random variable, so is the profit function

and the ROI function

. A firm used to only have freedom over the price

of their product. With our proposed system, a firm can now influence its risk and return by choosing the price

, the percentage of profit that is redistributed

and the maximum duration of the contract

. It is reasonable to consider that, in the proposed system, customers are evaluating the instantaneous price

instead of the initial price

, and that in consequence their behaviors will change. Consequently, the ROI distribution

of our proposed system will be different from the one of the classic market

. We wish to evaluate the differences between those two probabilistic distributions, and see how the parameters chosen by a firm will influence them. First, we wish to see if a the market that is using our system can reduce the percentage of firms that are losing money after

, compare to a classic market. Namely:

where the ROI random variables

and

are respectively defined as

Second, we wish to quantify the reduction of the percentage of firm that made a profit higher that a specific threshold

: