1. Introduction

The concept of “memory” holds significant importance across a wide range of situations, including those involving physical phenomena and the processes involved in making decisions. The choices made by managers concerning demand forecasting, price setting, and purchasing trends, along with customer emotions, are inevitably shaped by the accumulated experiences of those crafting the strategies. A mathematical model can be highly beneficial when examining physical events by utilizing a variety of mathematical techniques, allowing for a comprehensive understanding that closely approximates real-world situations and happenings. In this situation, the theoretical framework of fractional calculus (FC) emerged as a highly suitable and effective approach of said situation [

1,

2]. In ordinary derivatives, which measure how a function changes over time using integer orders, there is no mechanism to incorporate memory or retain information about past states. Consequently, ordinary calculus does not capture dynamic memory effects and is limited in its ability to reflect a system’s complete historical behavior. By contrast, the fractional derivative (FD) considers the rate of change as being shaped by all points across a given time span, with the fractional order serving as an indicator of the system’s memory retention [

3,

4,

5,

6]. It can take into account the past data leading up to the current moment or project forward from the present into future scenarios [

7]. Numerous scholars [

8,

9] have demonstrated profound investigations into memory processes by employing the mathematical relationships inherent in FC. To demonstrate the memory effect within the context of an inventory control, the researchers propose that the rate of inventory level is expressed as a fractional value [

10]. In this framework, the specific order of the FD serves as an indicator of the memory influence, and this type of derivative is called memory-dependent derivatives [

11]. As the fractional order drops, it indicates stronger memory effects on the system. The system becomes less memory dependent as the fractional order nears one. Various studies on memory effect criteria in fractional-order derivatives or integrals have emerged in inventory control theory.

Developing inventory models and making managerial decisions in real-world management and applied sciences inevitably involves uncertainty. Ambiguous data can reduce decision-making precision, leading to uncertain or unpredictable conclusions. Various approaches address uncertainty—probability theory considers likelihood, fuzzy sets [

12] handle belongingness, and intuitionistic fuzzy sets [

13] incorporate both belongingness and non-belongingness. However, indeterminacy is also crucial. To capture this, Smarandache [

14,

15] introduced neutrosophic logic, which includes indeterminacy along with belongingness and non-belongingness. The key distinction of neutrosophic sets lies in explicitly including indeterminacy as an independent component, enabling a more refined representation of incomplete or vague information. This enhances their utility in fields like decision making and control theory, where uncertainty is common. For example, in predicting a reasonable selling price, three cases may arise: ‘To what extent the price is reasonable (truth)’, ‘To what extent it is unreasonable (falsity)’, and ‘Uncertainty about its reasonableness (indeterminacy)’. This underscores the significance of neutrosophic numbers. The neutrosophic number can be represented by

, where

,

, and

are represented the degree of belongingness, indetermination, and non-belongingness, respectively, of

to the neutrosophic set. This idea can be valuable in the context of inventory management, especially the economic order quantity (EOQ) model, where forecasting demand and determining the best pricing strategies involve uncertainties stemming from unpredictable factors. Inspired by the above inferences, the authors explored an introductory study, guided by these research questions:

What might serve as an appropriate mathematical framework for addressing the inventory management problem when accounting for memory effects within a neutrosophic imprecise environment?

How does memory influence inventory control strategies, particularly when price and environmental sustainability are represented as uncertain neutrosophic numbers?

How might one articulate the mathematical structure of FC when it is situated within an environment characterized by neutrosophic uncertainty?

These research questions guided a review of the literature on fractional calculus, fuzzy logic, fuzzy-valued fractional calculus, and neutrosophic-valued calculus. A summary follows in subsequent subsections.

The paper is organized as follows: a detailed literature survey on the related topics, research gaps, and novelties of our study is presented in

Section 2.

Section 3 presents preliminaries on neutrosophic numbers and Riemann–Liouville and Caputo fractional differentiability.

Section 4 introduces the fractional calculus theory for neutrosophic-valued functions through the Riemann–Liouville fractional integral.

Section 5 covers the Riemann–Liouville fractional derivative, while

Section 6 discusses the Caputo fractional derivative from the perspective of the gH-Hukuhara derivative.

Section 7 applies the theory analytically to a green lot-sizing inventory model under memory and neutrosophic uncertainty.

Section 8 numerically illustrates the proposed model from a managerial perspective, and

Section 9 presents concluding remarks and future research directions.

3. Mathematical Preliminaries

Definition 1. A fuzzy set in a universe of discourse is characterized as , where is a membership function, which assigns to each element to a real number representing the degree of membership of in set .

Note: The value means that is not a member of , means that is a full member, and intermediate values represent partial membership. This concept generalizes the classical notion of a set, which can be seen as a special case where the membership function takes only binary values 0 and 1.

Definition 2. The -cut of a fuzzy set , denoted by , for a given , is the crisp subset of defined as Note: If is a convex fuzzy set, then its -cut can be represented as , where and . Here, is not a membership value of a particular element, but it represents a threshold or level of membership.

Definition 3 ([67]). Suppose that is the universal set. A neutrosophic set on is identified as , where , , and signify the truthiness, indetermination, and falseness membership functions, respectively, of the component in sustaining the relation .

Definition 4 ([67]). The -cut of a neutrosophic number on is defined as where are in .

Note: If is a neut-convex neutrosophic set, then its -cut can be obtained as , where , , , , and . Here, , , and , respectively, represent the truthiness, indetermination, and falseness membership threshold. Thus, in the parametric representation of a neutrosophic set, if the indeterminacy threshold is eliminated by setting , and the falsity threshold is defined as the complement of the truth parameter, i.e., , then the representation effectively reduces to that of a fuzzy representation.

Definition 5 ([67]). A neutrosophic set is said to be a neutrosophic number if it is defined on the universal set of real number and sustaining the following conditions:

is neut-normal, i.e., there exists points in , , and in for which , and .

is neut-convex, i.e., for any and of

and ;

,

,

and satisfy the following:

Note: There exist various types of neutrosophic numbers, including triangular neutrosophic numbers, trapezoidal neutrosophic numbers, etc., each designed to represent uncertainty and indeterminacy in different forms. The set of all such neutrosophic numbers is collectively denoted by , representing the complete class of neutrosophic numbers used in this study.

Definition 6 ([67]). A single valued trapezoidal neutrosophic number of type-1 is a special type of neutrosophic set defined on the set of real number with the following truthiness, indetermination, and falseness membership functions:with and it is denoted as .

Note: (i) The behavior of the membership functions associated with the above neutrosophic number is characterized by distinct trends over specific subintervals. The truthiness membership function exhibits a linear increase over the interval , remains constant throughout , and then decreases over . In contrast, the indeterminacy membership function decreases linearly over , remains constant in the interval , and increases linearly over . A similar trend is observed for the falsity membership function , which decreases linearly in , remains constant in [, and increases linearly over the interval .

(ii) The -cut of the single valued neutrosophic number of type-1 defined in definition 3.6 is obtained as , where , , , , , and .

Definition 7 ([67]). A single valued trapezoidal neutrosophic number is a special type of neutrosophic set defined on the set of real number . It is characterized by three membership functions: the truthiness-membership function , indetermination-membership function , and falseness-membership function , which are defined as follows:with ,

and it is denoted as .

Definition 8 ([60]). Let the -cut representation of a neutrosophic number be . The de-neutrosophication value of can be defined aswhere .

Definition 9 ([54]). Let be the neutrosophic-valued function defined on whose -cut representation is . Then, the generalized neutrosophic derivative of type-1 of is defined as

and the generalized neutrosophic derivative of type-2 of is defined as Definition 10 ([18]). The left-sided Riemann–Liouville Fractional Integral (RLFI) of order of a continuous function , which has a bounded derivative in , is defined as for all,

.

The left-sided Riemann–Liouville fractional derivative (RLFD) of order of a continuous function is for all,

and .

Note. The fundamental distinction between the RLFD and ordinary derivative is that the RLFD of a constant value does not result in zero.

Definition 11 ([18]). The left-sided Caputo fractional derivative (CFD) of order of a continuous function , which has a bounded derivative in , is defined as for all,

and .

Note. , where is constant.

In the next three sections, the notion of the R-L fractional integral, R-L fractional derivative, and Caputo fractional derivative for the neutrosophic-valued function is introduced. The symbols that are used to define the notion of FC of the neutrosophic-valued function are presented in

Table 1.

4. R-L Fractional Integral of Neutrosophic-Valued Functions

Based on the Hukuhara difference and the original notion of RLFI in crisp case, we here presented the definition of Neutrosophic-valued Riemann–Liouville Fractional Integration (NRLFI).

Definition 12. Let be a Lebesgue integrable neutrosophic-valued function defined on . Suppose the parametric representation of is given as ; for all, . Then, each of the real valued functions of is the Lebesgue integrable function defined on . This indicated that, for all, , all the real valued functions , , , , , and are also Lebesgue integrable on . Accordingly, is also the Lebesgue integrable neutrosophic-valued function defined on . Thus, the integral ( is a parameter) exists for all , and it is denoted by , called the NRLFI of fractional order of the neutrosophic function .

Note: In this paper, the concept of integration of the neutrosophic-valued function is explored through the framework of neutrosophic Riemann integration (Biswas et al. [

68]).

Since

, the NRLFI of the neutrosophic-valued function

can be stated through the parametric representation as follows:

for all

, where

is the RLFI of order

of the crisp valued function

.

Remarks 1. (i) It is important to note that when is a crisp function, this definition corresponds to the classical RLFI of order . (ii) In the specific case where and is a neutrosophic-valued measurable function, this formulation encompasses the standard neutrosophic integral.

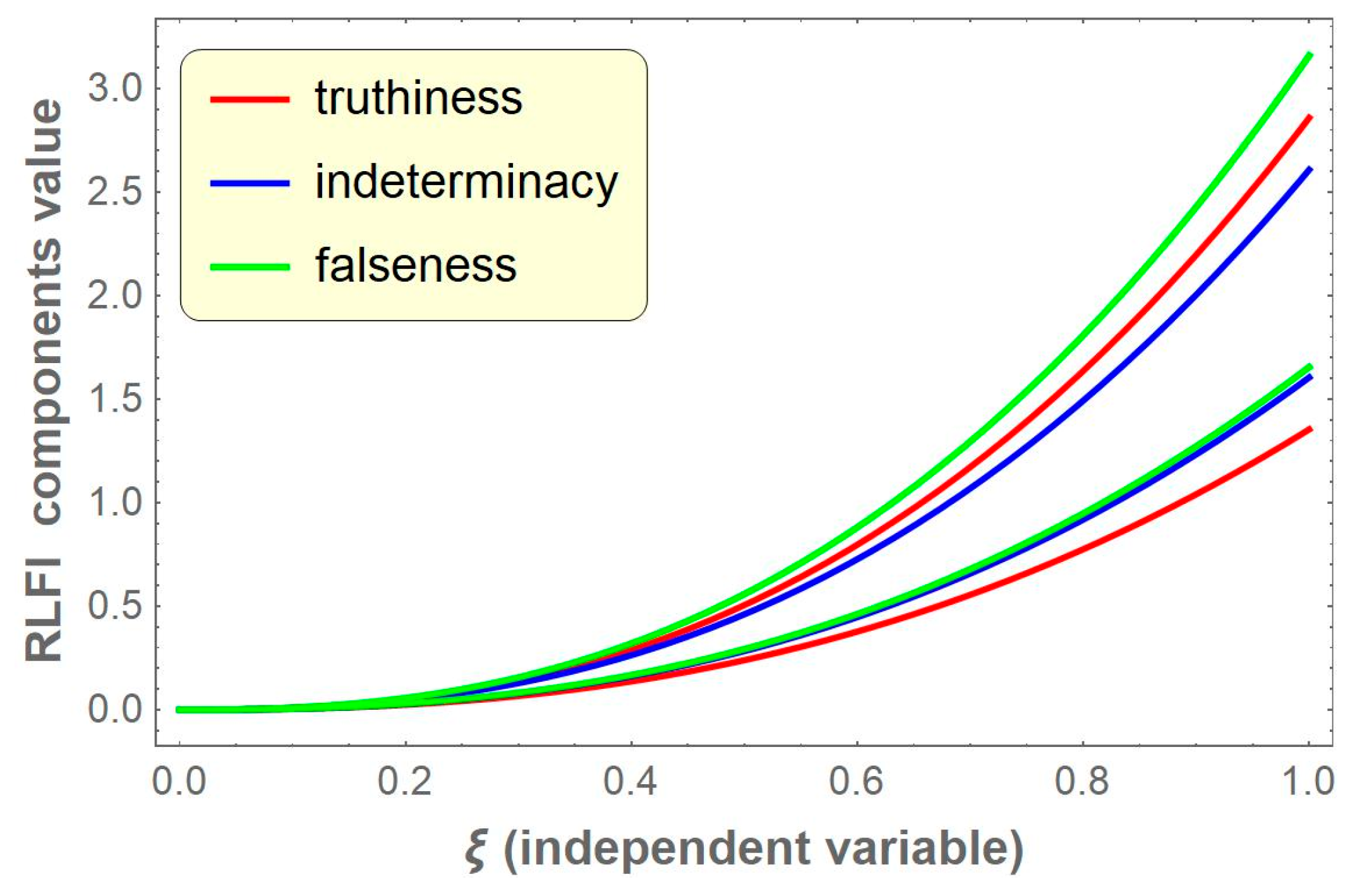

Example 1. Suppose a neutrosophic-valued function is given as , where is a single valued trapezoidal neutrosophic number. Then, the components of the -cut of areAlso, the components of the -cut of are obtained aswhere , , and

. Then, the RLFI of order of the neutrosophic function is The six components of RL fractional integrals of the neutrosophic function

are presented graphically in

Figure 1 for particular fractional order

and

,

, and

with respect to independent variable

. The region between red curves represents the truthiness area of the RLFI value, and, similarly, the region between the blue curves and green curves represents the indeterminacy and falseness area of RLFI value, respectively. For any given

, all six components are clearly visible in the figure.

Table 2 includes the different components of RLFI of the neutrosophic-valued function

at fractional integration order

and

for different values of membership thresholds

,

, and

. When the value of truth membership threshold

increases, the value of

increases but

decreases. Again, when the value of indeterminacy threshold

increases, the value of

decreases but

increases, and the same occurs for the falseness membership threshold

. These components are presented graphically in

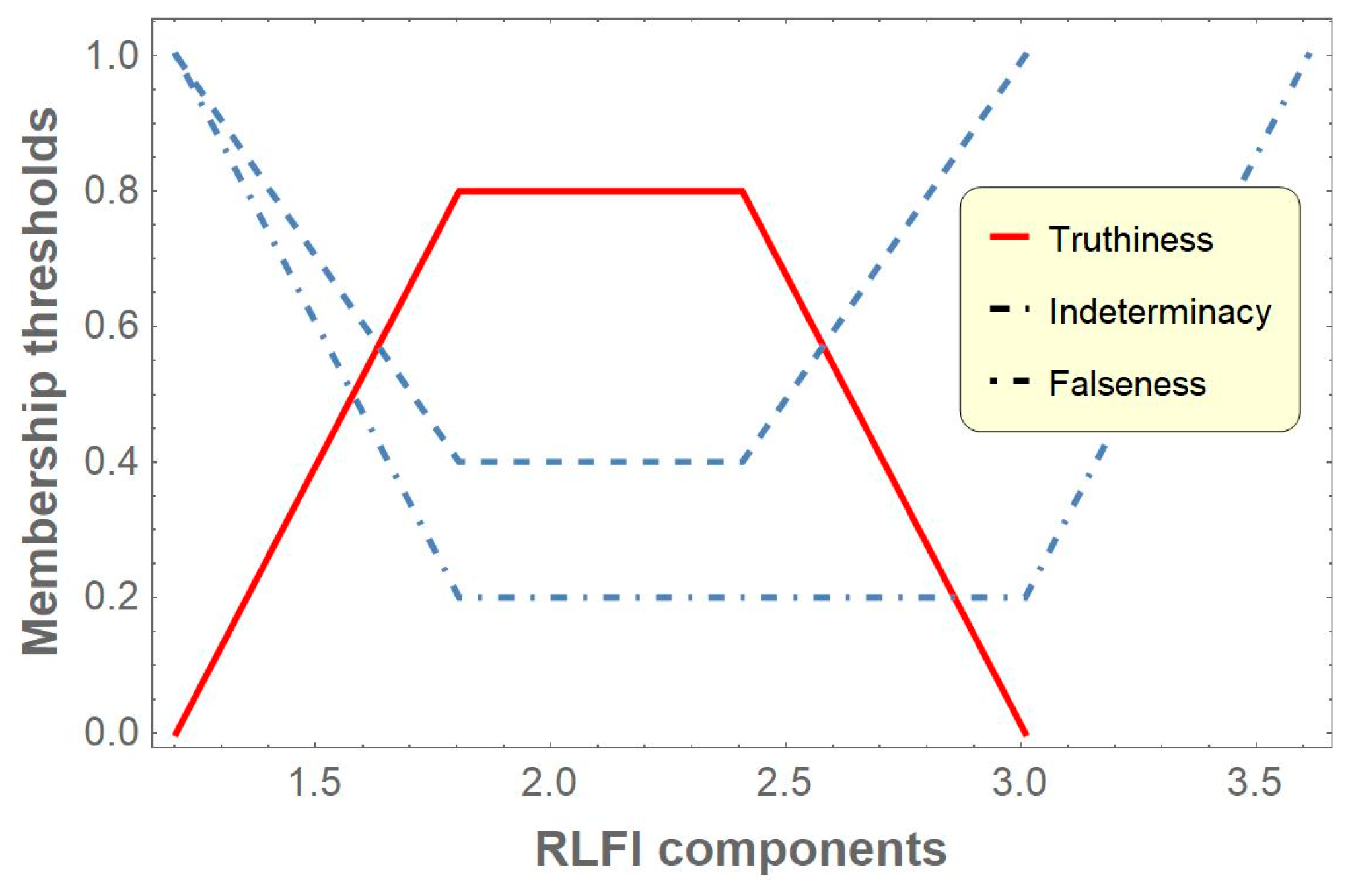

Figure 2.

Figure 2 illustrates that the RL fractional integration of

is also a trapezoidal neutrosophic number.

Lemma 1. Let and be two R-L fractionals integrals of the neutrosophic-valued function of order and respectively, where are real numbers. Then, the R-L fractional integration of of order isprovided .

Proof. From Definition 12, the R-L fractional integration of

of order

is

almost everywhere on

, if

.

□

Lemma 2. Let and be two NRLFIs of order for the neutrosophic-valued functions and , respectively. Then, Proof. The proof is simple and thus omitted. □

5. R-L Fractional Derivative of Neutrosophic-Valued Functions

Based on the Hukuhara difference and the original notion of the RLFD in the crisp case, we here presented the definition of the neutrosophic-valued Riemann–Liouville fractional derivative (NRLFD).

Definition 13. Suppose that is a neutrosophic-valued function that is absolutely continuous over and the parametric representation of is given asfor all,

.

Then, each of the real valued functions of is Lebesgue integrable defined on . This indicates that, for all, , and

all the real valued functions , , , , and

are also Lebesgue integrable on . Accordingly,is also a Lebesgue integrable neutrosophic function over . Thus, the NRLFI of order exists for all . Then, its generalized neutrosophic derivative is denoted as , called the neutrosophic-valued Riemann–Liouville fractional derivative (NRLFD) of order . Therefore, If the neutrosophic-valued function is type-1 generalized neutrosophic differentiable, then is called type-1 NRLFD of order , and if is type-2 generalized neutrosophic differentiable, then is called type-2 NRLFD of order .

Note: The NRLFD of order

of

is the derivative of NRLFI of order

of

, i.e.,

Theorem 1. Suppose is a neutrosophic-valued function and NRLFD of exists for all and its parametric form can be obtained as follows:

- (i)

If is a type-1 generalized neutrosophic differentiable function, then - (ii)

If is a type-2 generalized neutrosophic differentiable function, then

where is the RLFD of order of the crisp valued function and .

Proof. First, we assume that

is a type-1 generalized neutrosophic differentiable. Then, according to Moi et al. [

54], the six components of the derivative of

can be obtained as

By imposing

on both sides of the above expression, we get

By using the definition of RLFD, we get

For case (ii), when is a type-2 generalized neutrosophic differentiable, the proof can be conducted through the same approach and hence omitted. □

Lemma 3. Suppose is a neutrosophic-valued measurable function and . Then, the following expression holds almost everywhere on :

- (i)

for the case of type-1 generalized neutrosophic differentiability.

- (ii)

for the case of type-2 generalised neutrosophic differentiability.

Proof. From Definition 3 and Theorem 1 for case (i):

Consequently,

For case (ii), when

is type-2 generalised neutrosophic differentiability, the proof can be conducted through the same approach, and this completes the proof.

Lemma 4. Suppose is a neutrosophic-valued measurable and -integrable function, and is an absolutely continuous function on . Then, for

- (i)

for the case of type-1 generalized neutrosophic differentiability.

- (ii)

for the case of type-2 generalized neutrosophic differentiability.

Proof. From Definition 12 of R-L fractional integration, we obtain

For case (ii), when is type-2 generalised neutrosophic differentiability, the proof can be conducted through the same approach, and this completes the proof. □

7. Applying the Proposed Theory in an EOQ Model

Traditional integer-based calculus struggles to fully explain dynamics influenced by nature or emotions. So, the concept of the fractional differential equation has been used to explore how memory impacts inventory control challenges. Also, when tackling inventory control challenges, uncertainty often emerges. To handle this uncertainty, the concept of fuzzy logic is utilized. However, this method only accounts for the extent of belongingness, neglecting non-belongingness and indeterminacy factors. For this reason, neutrosophic set theory proves more appropriate, as it separately evaluates belongingness, non- belongingness, and indeterminacy. In this section, an economic order quantity model is discussed under memory and neutrosophic uncertainty.

7.1. Notations and Hypothesis

Table 3 outlines the symbols used to represent the objective functions, decision variables, and parameters for building and improving the model.

The suggested EOQ model is built using these novel assumptions:

In recent times, people are more conscious about selecting products that are kinder to the environment, while also showing a preference for buying items at lower costs. As a result, demand is shaped by both the eco-friendliness of a product and its selling price. Additionally, with changes in market strategies, demand rates can introduce uncertainty. To deal with the uncertainty, the unit selling price and the green level of the product are treated as neutrosophic numbers. Therefore, the demand pattern is expressed as , where , , and are constants influencing the relationship.

The lead time is assumed to be zero, meaning that restocking happens immediately once an order is placed.

The decision-making process concludes when the inventory drops to zero. The entire amount of goods produced matches the batch size, so no shortages occur.

The proposed EOQ model is influenced by memory, meaning that the level of demand is shaped by how customers remember their past interactions. These memories might relate to the shopkeeper’s attitude, the quality of the products, or other similar factors from previous experiences. This memory sensitivity is discussed through the neutrosophic FD.

7.2. Model Description

At time

, the inventory process starts with initial order size

. As time goes on, the inventory level

decreases because of the consumer demand rate

. The level of inventory reaches zero at time

and the whole process is terminated. The way a system retains and reflects its past can be understood through the use of FDE. In this discussion, we explore both neutrosophic uncertainty and the role of memory at the same time. Accordingly, the neutrosophic-valued Caputo FDE is adapted to model the uncertain retail processes influenced by memory in the following manner:

with the initial condition

and

.

To discuss the proposed model in a neutrosophic environment, the process of parametric representation is imposed. The parametric counterparts of the neutrosophic variables and parameters are taken as , , , and .

So, the six components of the consumer demand rate are obtained as , , , , , and .

In this study, we apply Laplace transformation to the neutrosophic-valued function that was introduced in the earlier section. By employing the generalized neutrosophic Laplace transformation on Equation (1), we obtain the following result:

7.2.1. Case I: When Is a Type-1 Generalized Neutrosophic Differentiable

When discussing the concept of generalized neutrosophic differentiability of type-1, Equation (2) outlines the system described below:

In Equation (3),

,

,

,

,

, and

represent the Laplace transform of

,

,

,

,

, and

, respectively. By applying the inverse Laplace transform to the equations provided in (3), we obtained

Uncertain lot-size

for case I is obtained by imposing the initial condition

in Equation (4).

Holding cost: The holding cost per unit time of the inventory is represented by

the overall holding cost can be calculated by multiplying

by the total amount of stock accumulated in the storage facility over the time period from 0 to

T. Consequently, the total holding cost

for case I, expressed as

, can be determined using the following approach:

where

.

Purchasing cost: The cost of purchasing each individual unit is represented by

; the overall expense for acquiring the items can be calculated by multiplying this per-unit cost,

, by the total number of units in the lot

. Therefore, the complete purchasing cost

for case I, expressed as

, can be determined through the following method:

Sales revenue: The revenue generated can be calculated by multiplying the product selling price

p by the total supply accumulated for consumption over the time period from

to

. Subsequently, the overall earned revenue

for case I, expressed as

, can be determined using the following approach:

Average profit: The term

denotes the average profit for Case I. It is understood that average profit equals the difference between sales revenue and total expenses, divided by the time period. Both the revenue generated and the total costs are obtained as parametric forms of the neutrosophic-valued function. The average profit for this scenario, represented as

, can be determined through the following method:

,

,

,

,

and

. Therefore,

The de-neutrosophication value of the neutrosophic profit function

and ordering quantity

for the case of type-1 generalised neutrosophic differentiability is obtained as follows:

Consequently, the optimization problem associated with the suggested model can be expressed mathematically using the following formulation:

7.2.2. Case II: When Is Type-2 Generalized Neutrosophic Differentiable

represents the lot size

for Case II. Proceeding in a similar manner as in Case I, the lot size

is obtained as

Average profit: The average profit for Case II, represented as

, can be determined through the following method:

The de-neutrosophication value of the neutrosophic profit function

and ordering quantity

for the case of type-2 generalized neutrosophic differentiability is obtained as

8. Numerical Explanation of the Proposed Model

Numerical experimentation on the formulated model is discussed in this segment. Suppose the inputs of empirical parameters are

unit/year,

,

,

/item,

/unit/year, and

/cycle with appropriate units. The unit selling price

and the greenness

of the item are taken as a single valued trapezoidal neutrosophic number of type-1 as

and

. Then, the

-cut of

and

are obtained as

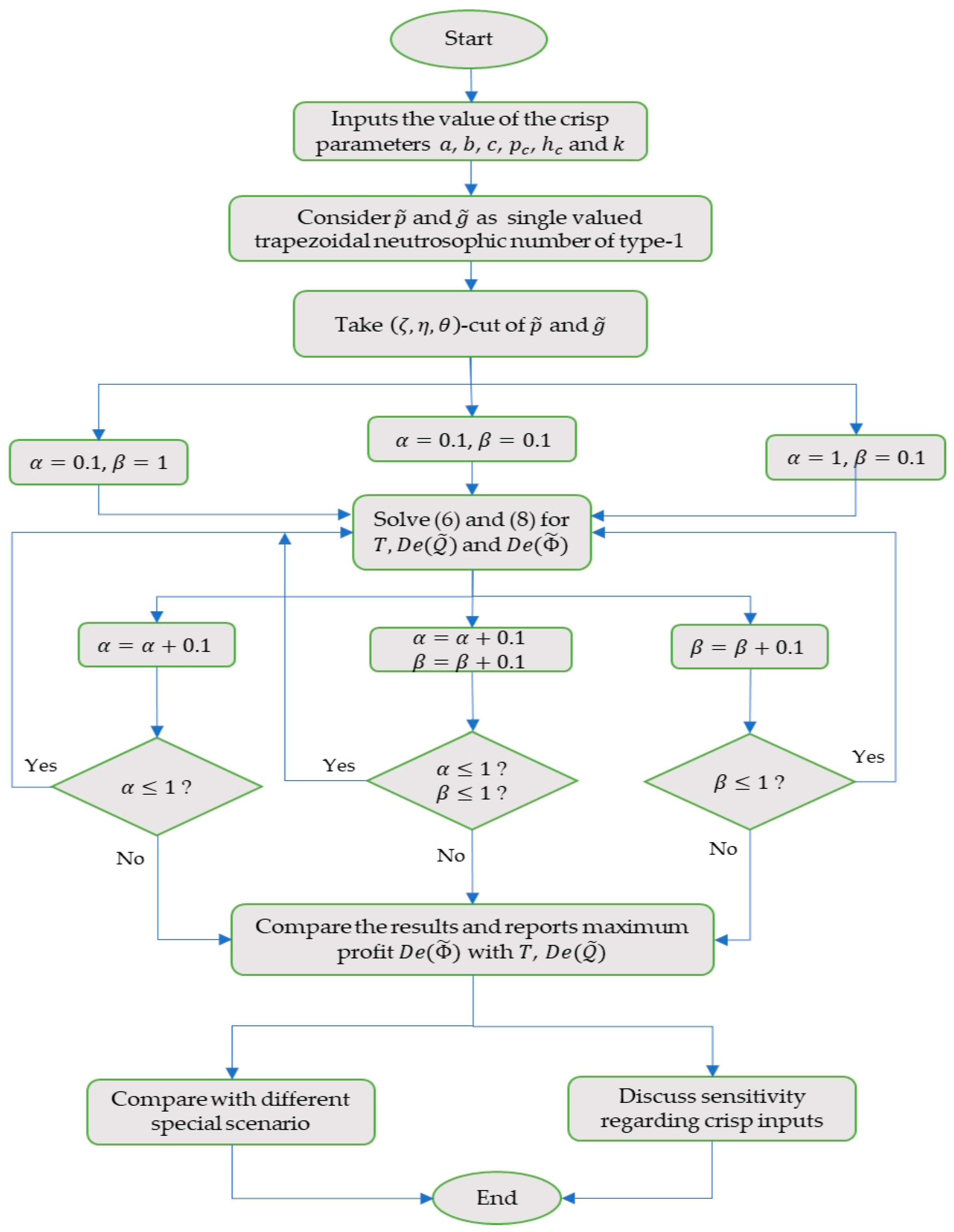

The optimal values of the decision variable and the objective functions for both cases are obtained using LINGO 20.0 software. The block diagram of solution methodology is depicted visually in

Figure 3. Here, the effects of memory on the suggested inventory framework are explored by allowing the order of integration and differentiation to be expressed in fractional terms. The impacts of memory on the optimal values of the inventory cycle time

, order quantity

, and average profit

concerning the integral and differential memory index and combined memory indexes are presented in

Table 4,

Table 5, and

Table 6, respectively. One memory index is consistently maintained at a value of 1 during the evaluation of how other memory indexes affect the overall outcome.

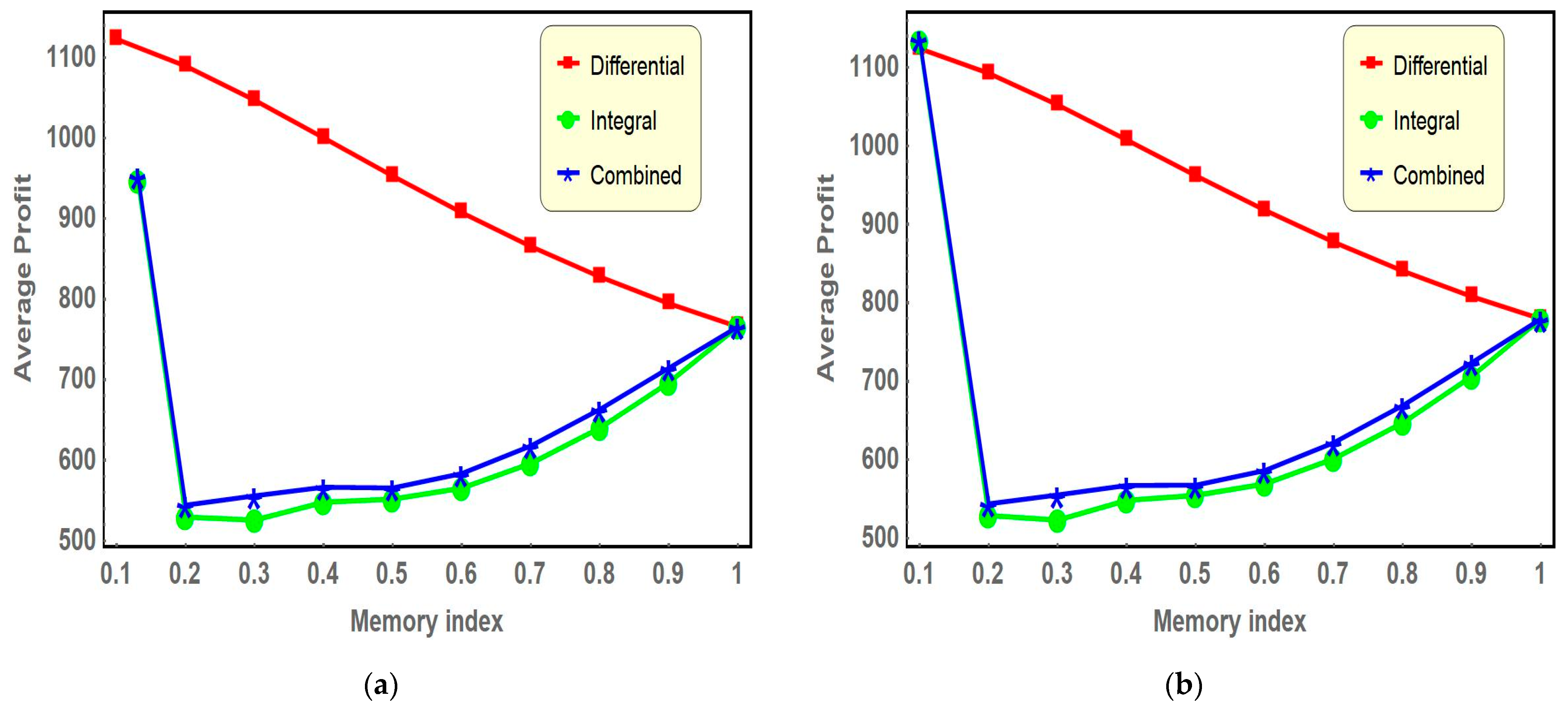

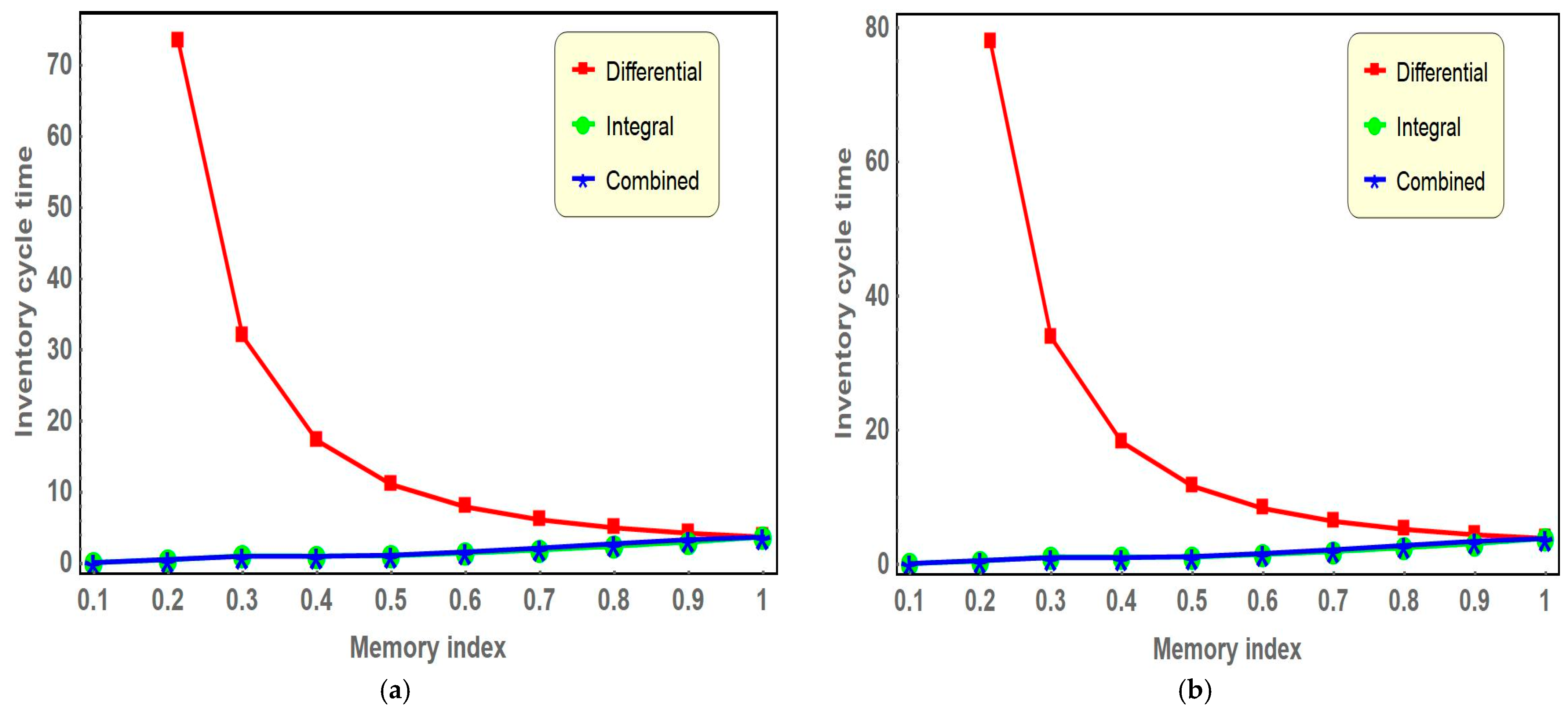

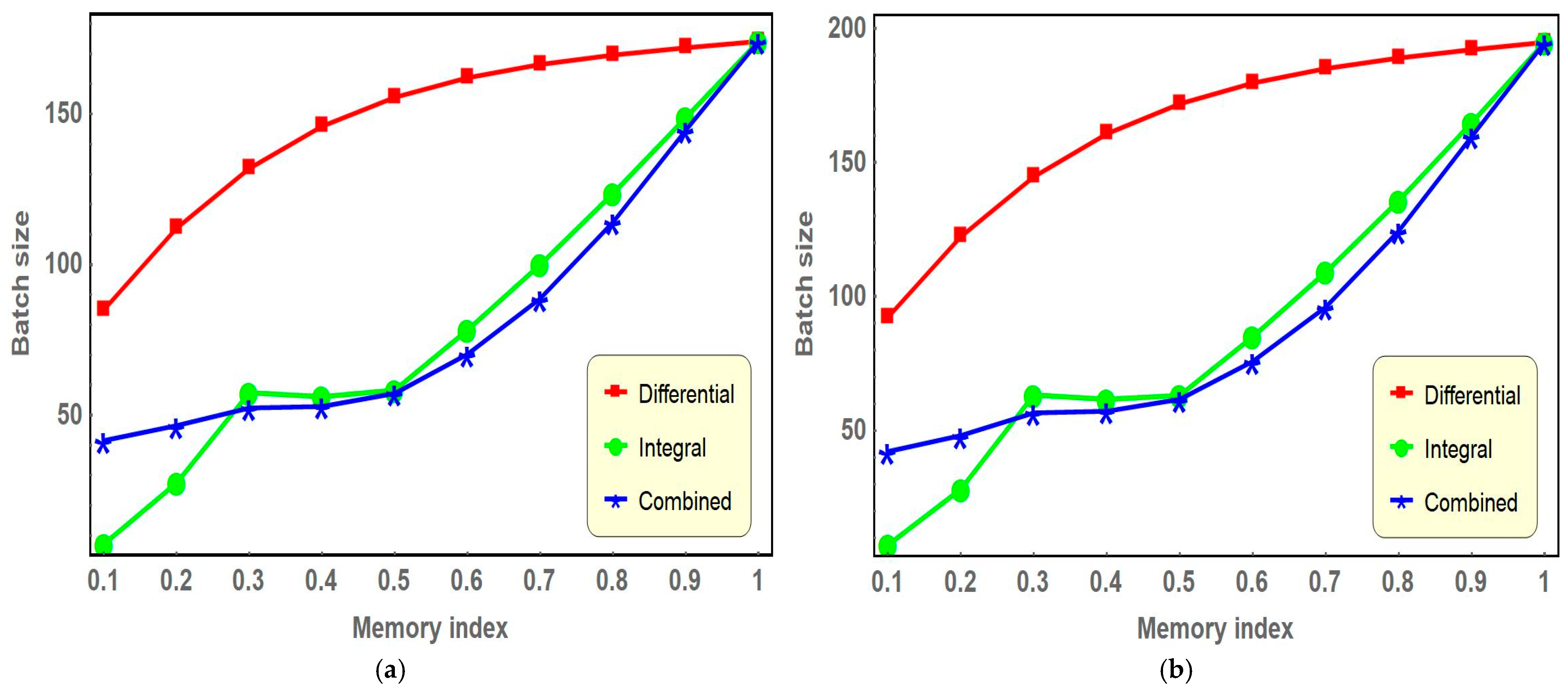

Figure 4,

Figure 5 and

Figure 6 visually illustrate the differences in the overall profit, the size of the lots, and the complete cycle time, respectively, showing how these elements change in relation to the memory indexes for both scenarios under consideration.

Based on the observations from

Figure 4 for both scenarios, it is evident that as the differential memory indexes rise (that is, the memory effect in the inventory system decreases), the graphical representation of the average profit function consistently exhibits a downward trend. In contrast, when examining the situation involving the integral memory index and the scenario that incorporates combined effects, the average profit initially experiences a decline but subsequently rises, forming a distinctive L-shaped curve. The analysis reveals that under strong memory effects, incorporating both differential and integral memory indexes, the average profit can be enhanced by approximately 44–49% compared to scenarios without memory effects.

Figure 5 illustrates that a decrease in the differential memory index (implying a stronger memory effect within the inventory system) results in an extreme increase in the inventory cycle time. In contrast, a reduction in the integral memory index leads to a gradual decrease in the inventory cycle time. In the case of the combined memory effect, when both memory indexes decrease simultaneously, the inventory cycle time also shows a gradual declining trend, closely resembling the behavior observed under the influence of the integral memory index alone.

Based on the observations from

Figure 6 in both scenarios, it can be noted that as the memory index rises, the graph depicting the optimal lot size values exhibits a modest upward trend initially, followed by a gentle decline. Nevertheless, the impact of the differential memory index on the lot size is significantly more pronounced when compared to the influence exerted by the integral memory index or the combined effect of both.

8.1. Comparison Among Different Special Scenario

Here, we have compared the optimal solutions of the proposed model with different special scenarios depending on the differential memory index

, integral memory index

, and membership threshold

,

, and

related to parametric representation of the neutrosophic number. In the case of the fractional-order model, the parameters

α and

β are theoretically allowed to take any value between 0 and 1; however, the numerical analysis is carried out specifically for

α = 0.1 and

β = 0.1. The optimal values of decision variable and objective functions of Case I and Case II are presented in

Table 7.

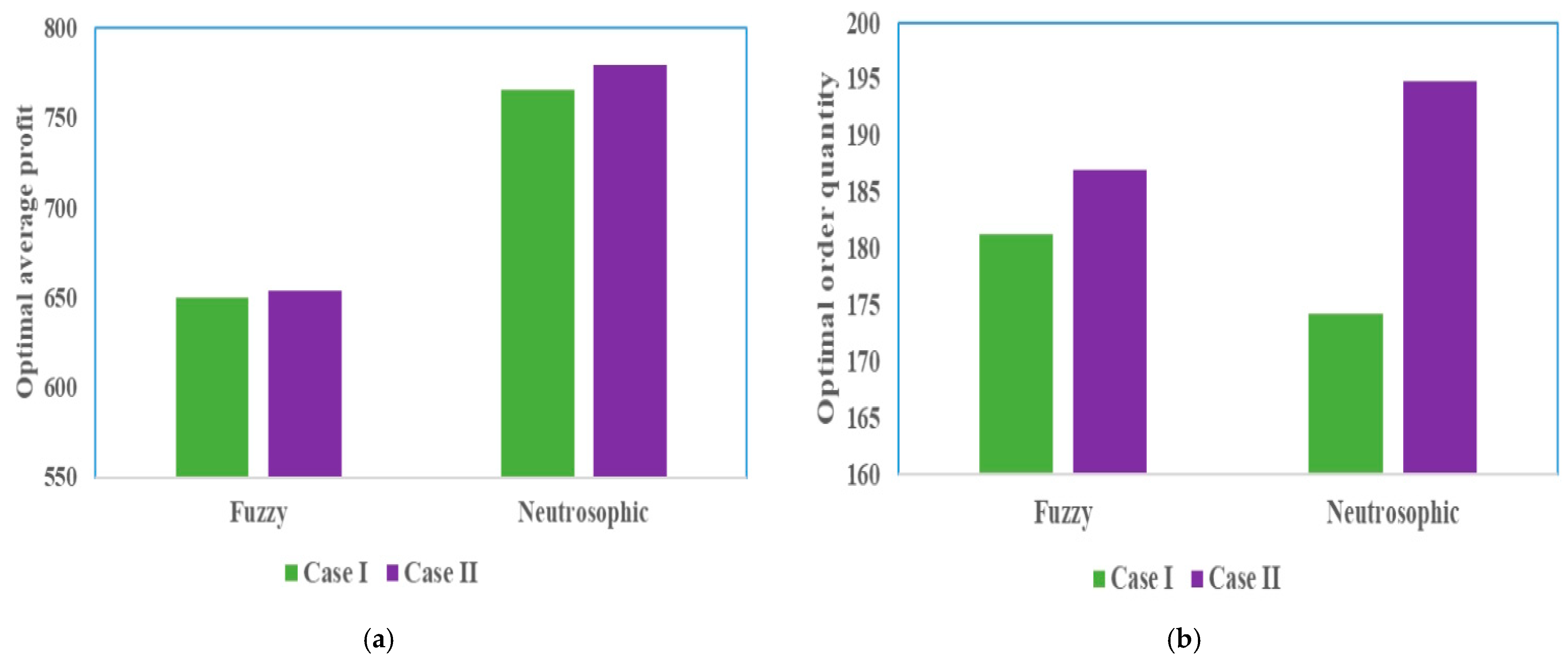

Table 7 clearly indicates that the fractional-order model within the neutrosophic environment generates the highest profit among all scenarios. Additionally, the average profit achieved under the neutrosophic setting surpasses those obtained in fuzzy environments. Moreover, the fractional-order model outperforms the integer-order model in terms of profit. For the integer-order model, a bar diagram of the optimal results under fuzzy and neutrosophic environments is illustrated in

Figure 7. As shown in

Figure 7a, the neutrosophic model yields a higher profit compared to the fuzzy model. Within the neutrosophic framework, Case II (associated with type-2 neutrosophic differentiability) outperforms Case I (based on type-1 neutrosophic differentiability) in terms of profitability.

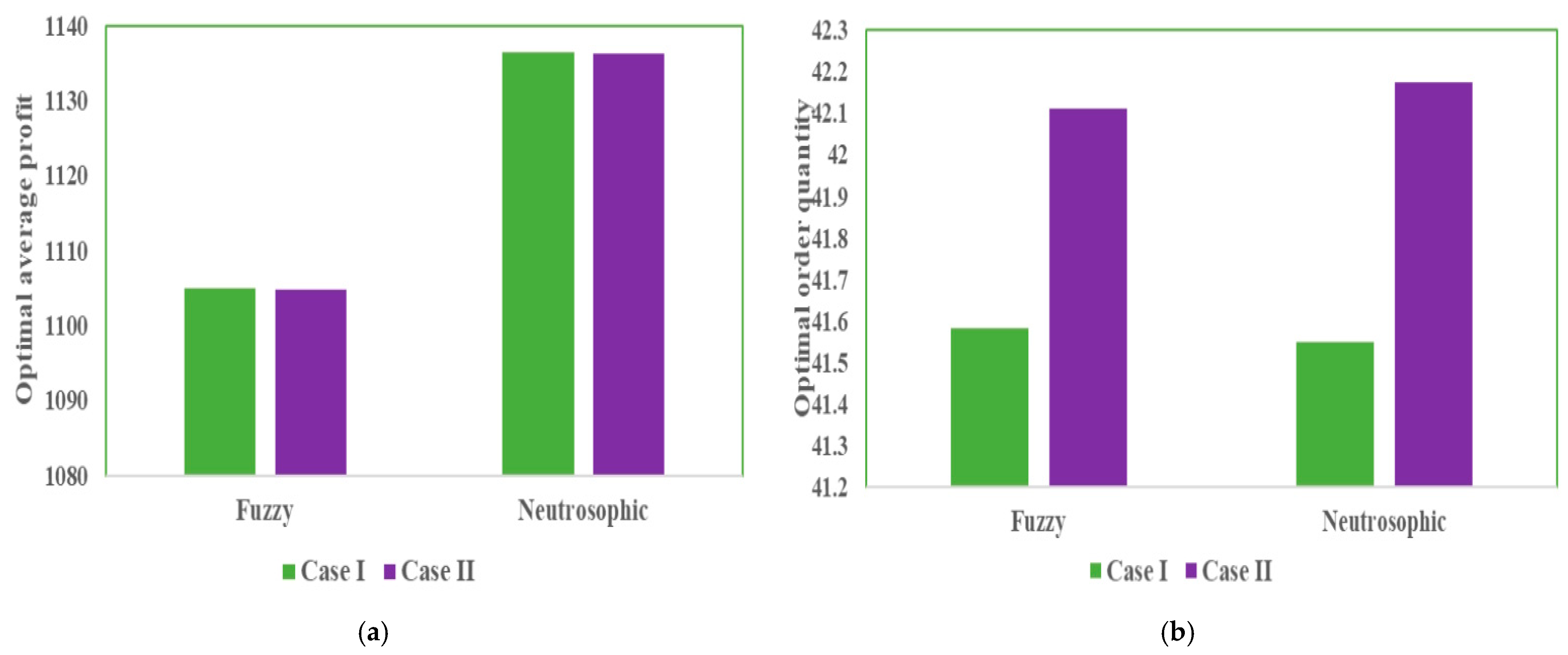

Figure 7b further reveals that the optimal order quantity is lowest in Case I of the neutrosophic model compared to all other scenarios. For the fractional-order model, a bar diagram of the optimal results under fuzzy and neutrosophic environments is presented in

Figure 8. From

Figure 8a, it is clear that the neutrosophic model yields higher profit than the fuzzy model, similar to the integer order model. However, in the neutrosophic model, both the cases give approximately the same results. The optimal order quantity is lowest in the neutrosophic model of Case I than all other scenarios.

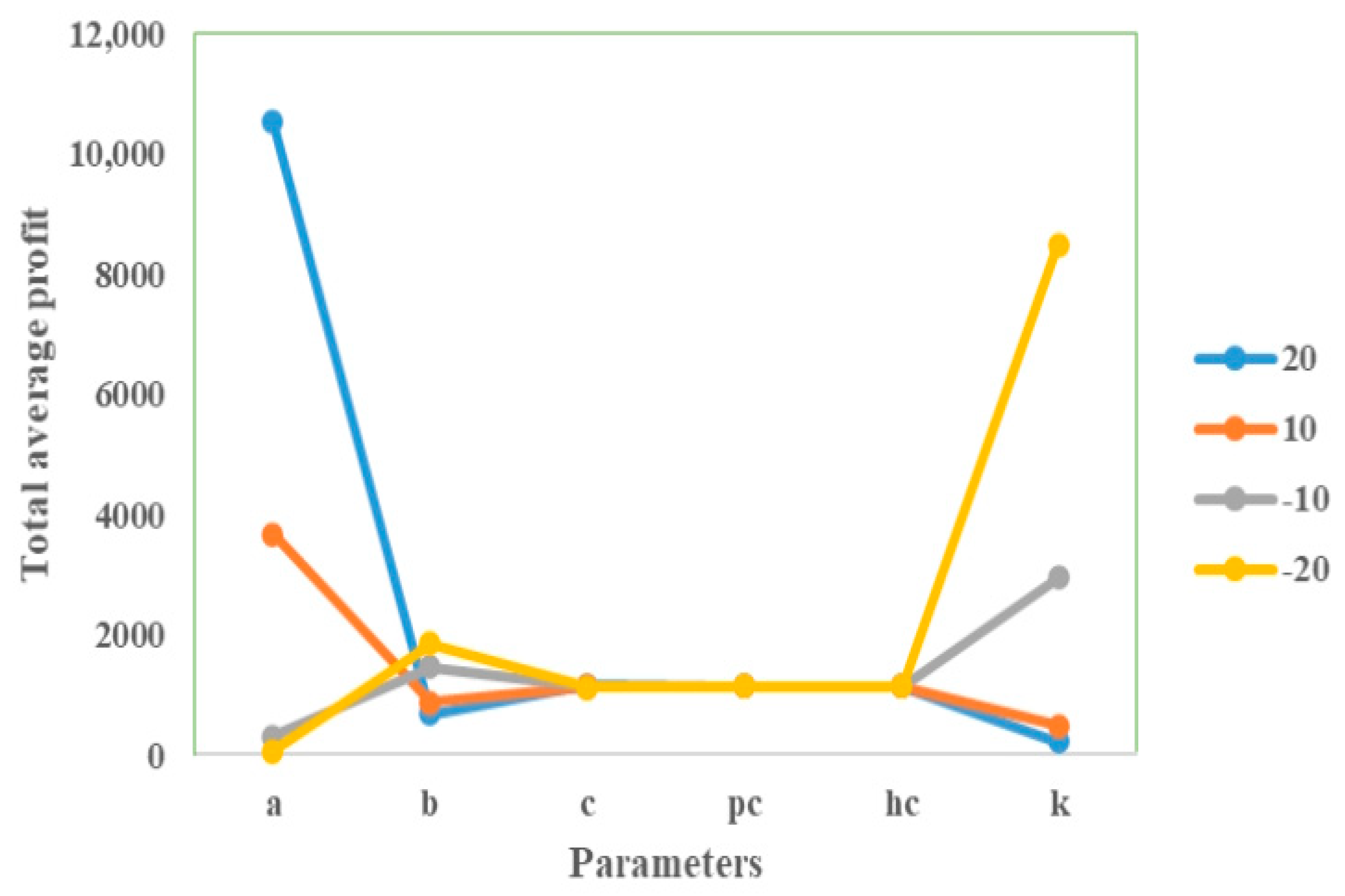

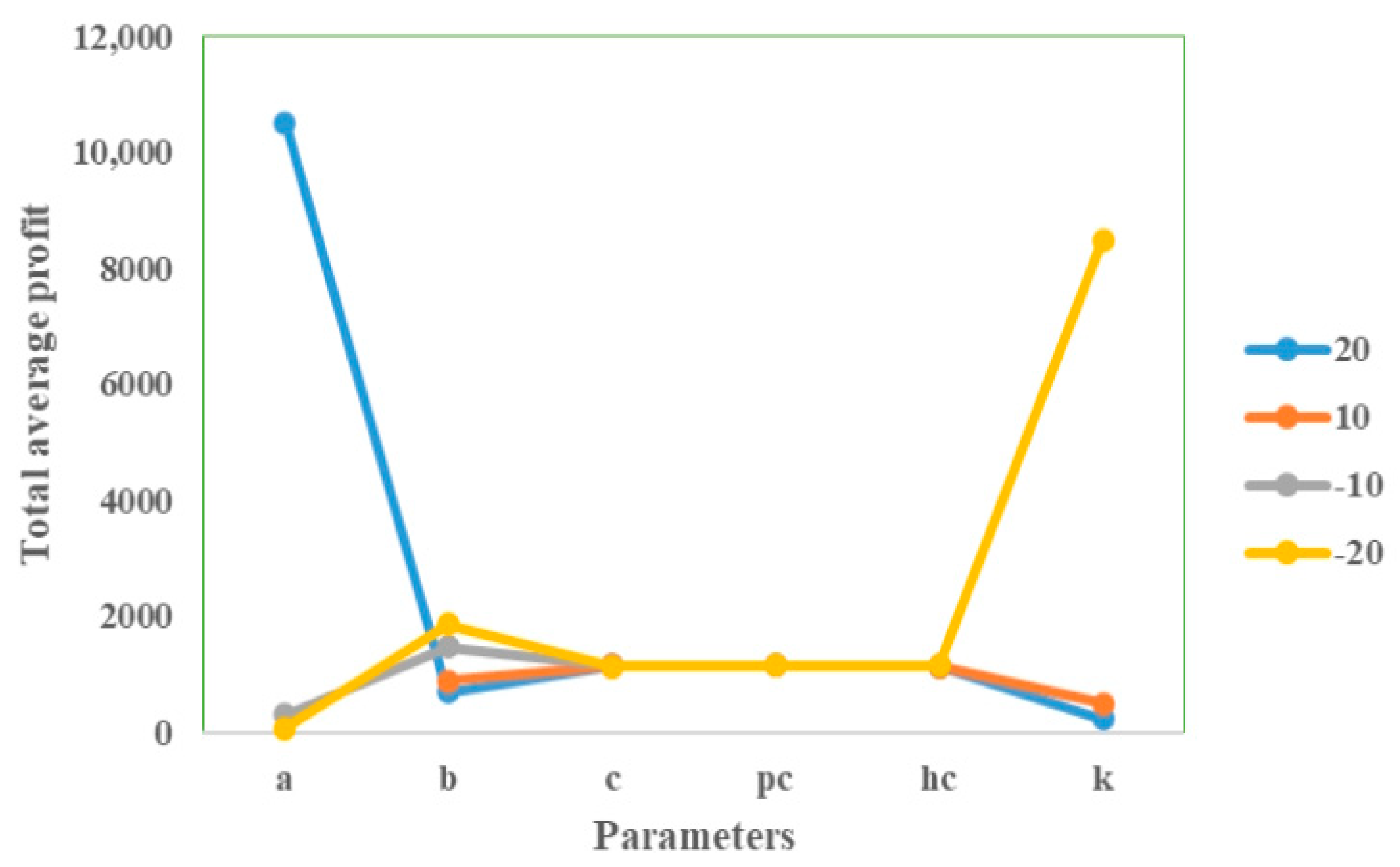

8.2. Sensitivity Analysis with Respect to Crisp Input Parameters

Based on the analysis presented in the preceding subsection, it can be concluded that the scenario involving the fractional-order model (with

and

) within the neutrosophic environment yields the best results for both the cases. So, in this subsection, an extensive sensitivity analysis is carried out for both considered cases to evaluate the influence of variations in the crisp input parameter on the optimal outcomes of the model. The chosen parameter is systematically varied within a range of −20% to +20%, while all other model parameters are maintained at their original values to isolate the effects of this single parameter change. The resulting sensitivity of the optimal solutions with respect to the crisp parameter is comprehensively presented in

Table 8. Furthermore, to enhance clarity and facilitate better understanding, a visual representation of the tabulated results is provided through

Figure 9 and

Figure 10. The key observations and insights derived from this analysis are summarized as follows:

The key observations and insights derived from this analysis are summarized as follows:

The fixed component of the demand rate is highly positively sensitive to profitability, meaning that even small increases in baseline demand can significantly enhance profits.

The selling price potential is negatively associated with average profit, as increasing the selling price tends to reduce demand. This underscores the importance of carefully balancing pricing strategies. The higher prices may improve per-unit margins, but they can lead to a decline in sales volume that outweighs the margin gains, ultimately reducing overall profitability.

Another important observation is that increasing the green level potential of the item positively influences profitability, as demand tends to rise for green products. Managers should consider enhancing the sustainability attributes of their inventory, as promoting greener products can drive higher sales and improve overall profit margins.

The unit holding cost and purchasing cost exhibit limited sensitivity to the overall profit function, while the ordering cost plays a much more critical role. This suggests that small variations in ordering cost can significantly impact profitability. Therefore, targeted interventions aimed at controlling and reducing ordering costs can serve as a more effective lever for enhancing overall inventory profitability.

8.3. Discussions and Managerial Insights

We analyze both scenarios of NCFD for the on-hand inventory level based on two types of generalized neutrosophic differentiability. Upon reviewing the tables and figures, we can outline the following observations:

The profit can be optimized by incorporating the stronger memory sense in the proposed EOQ model. The small value of the memory index implies the strong memory while unity regarding the memory index implies memory-free phenomena. From

Table 6 and

Figure 4, it is noted that the average profit in a memory-free environment is USD 765.8041 for a cycle time of 3.729939 years and order size of 174.1285 units in the first case of neutrosophic differentiability. In the alternative case, the optimal value of the objective function and decision variables are USD 779.5998, 3.872264 years, and 194.8317 units, respectively. Incorporation of soft or local memory exhibits inferior results compared to the memory-free environment. However, optimal results are given at a memory index of 0.1 with a strong memory sense where the optimal value of the objective function and decision variables are USD 1136.483, 0.147075 years, and 41.54867 units in the first case of neutrosophic differentiability and USD 1136.175, 0.1418115 years, and 42.17316 units in the second case of neutrosophic differentiability. Therefore, the managerial implication concerning profit is as follows:

The demand pattern was assumed to be imprecise due to its vague association with retail price and green level. Therefore, impacts of uncertain price and greenness are put into the model as conflicting or contradictory information, a common scenario in real-world socio-economic phenomena. We consider triangular neutrosophic numbers to present the incompleteness, inconsistency, and indeterminacy. Furthermore, there is a dedicated section, namely

Section 8.1, for comparing the numerical simulation of the same models in crisp and fuzzy environments with and without memory.

Table 7 shows that the highly expressive sense of uncertainty guaranteed by the neutrosophic environment provides the best results in terms of profit. The pattern regarding average profit, irrespective of the memory presence, is as follows:

Employment of memory and expert opinions under uncertainty, in a paradoxical sense, provides the best result. However, the manager has to reduce the length of the decision cycle and the lot size to reach the profit goal.

8.4. More Possible Applications of the Proposed Theory

In this subsection, we hint at some more applications of the FC for neutrosophic-valued functions.

8.4.1. Financial Modeling

Financial models include factors such as historical data regarding pricing, behavior of the consumers and investors, etc. The forecasting and optimization in decision making based on the past activities can be renamed as memory influenced. On the other hand, uncertainty and contradiction may come into the decision process as an integral part due to socio-political and psychological reasons. In this context, the proposed theory of FC for neutrosophic-valued functions can be used to analyze risks under conflicting opinions by various experts, to forecast the market pattern and optimal pricing.

8.4.2. Reliability Theory

The theory of reliability is about measuring system failure probabilities, component life expectancy, etc. Now, the degradation in efficiency may be memory influenced. Moreover, there may be incomplete failure data or conflicting maintenance records in the hand of the strategist. In such a case, the FC for neutrosophic-valued functions can fulfill the purposes regarding safety estimation and decision support.