Chaos, Fractionality, Nonlinear Contagion, and Causality Dynamics of the Metaverse, Energy Consumption, and Environmental Pollution: Markov-Switching Generalized Autoregressive Conditional Heteroskedasticity Copula and Causality Methods

Abstract

1. Introduction

2. Methodology

3. Empirical Results

3.1. Data

3.2. Results

- Long-term dependence and fractionality. Fractionality and long-term dependence are examined for the dataset with Malderbrot and Wallis’ R/S and Lo’s modified R/S tests. Long-memory and fractional parameters are estimated, and further tests for statistical significance are conducted with the Geweke and Porter–Hudak [24] and Robinson–Henry methods [25].

- Determination of chaos, entropy, and complexity. To determine chaotic dynamics, the largest Lyapunov (λ) [21] exponents are calculated. The λ results provide insight into the average exponential rate of divergence or convergence of nearby orbits in the phase space. A positive Lyapunov exponent (λ > 0) indicates chaos, signifying the divergence of nearby trajectories. Conversely, when λ ≤ 0, the time series corresponds to regular motion. A λ value equal to zero indicates a bifurcation. A λ value greater than 1 signifies a deterministic chaotic process. If λ ≤ 0 and λ is greater than 1, we do not explore cointegration and Granger causality tests. However, when λ is less than 1 and falls between 0 and 1 (0 < λ < 1) and the Shannon entropy yields a positive value, it suggests uncertainty or a random process. Entropy is evaluated with Shannon entropy [22] and by Havrda–Charvât–Tsallis (HCT) entropy measures [32,33]. Kolmogorov–Sinai complexity (KS) is evaluated following the method of [34]. The measures above not only give information on the existence of chaos but also the degree of randomness and complexity. Following the steps above, we delve into the nonlinearities and the stochastic process of the variables.

- Unit root and stationarity testing. Following BDS tests, the unit root and stationary are tested with linear and nonlinear methods. To this end, traditional linear Augmented Dickey–Fuller (ADF) [54] is followed by a nonlinear Kapetanios et al. (KSS) [55] unit root, and the Kwiatowski et al. (KPSS) [56] test of stationarity is used. While the first assumes a linear unit root, the second tests the unit root against smooth transition autoregressive (STAR) type nonlinearity. Lastly, KPSS is a nonparametric test known to perform well under series with structural breaks and nonlinearity.

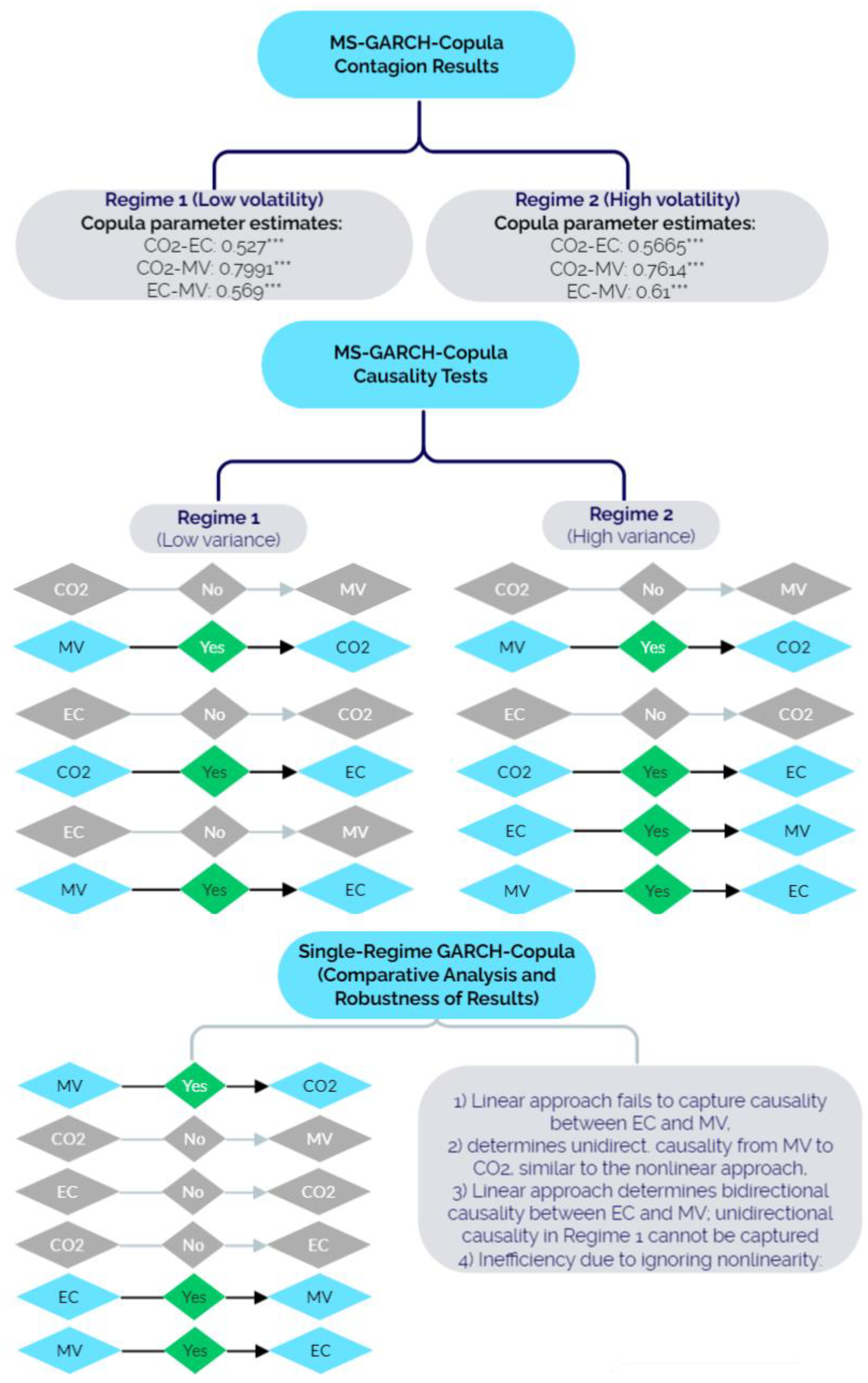

- Modeling series and their relationships are modeled for their marginal and joint distributions with Markov-Switching Generalized Autoregressive Conditional Heteroskedasticity Copula (MS-GARCH–Copula) modeling. The method allows for the modeling of nonlinear and heteroskedastic series for their tail dependence and contagion dynamics.

- Causality testing. The MS-GARCH–Copula Causality test is an extension of linear Granger causality testing to nonlinear and heteroskedastic series. The method benefits from GARCH–Copula and causality tests.

- Comparative analysis and robustness. After evaluating the models with diagnostics tests and following nonlinear causality testing in the previous stage, the directions of causality are determined under distinct regimes. At this stage, the results are compared to single-regime GARCH–Copula Causality test results. The findings are examined for possible deviations and differences from the nonlinear methods.

3.2.1. Long-Term Dependence and Fractionality

3.2.2. Chaos and Entropy Tests

3.2.3. Nonlinearity Test Results

3.2.4. MS-GARCH–Copula Estimation Results

3.2.5. Nonlinear Causality Test Results with Regime-Switching and Copulae

3.3. Discussion with Comparisons to the Existent Literature

4. Conclusions and Policy Recommendations

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Schaffer, W.M. Order and Chaos in Ecological Systems. Ecology 1985, 66, 93–106. [Google Scholar] [CrossRef]

- Lorenz, E.N. Deterministic Nonperiodic Flow. J. Atmos. Sci. 1963, 20, 130–141. [Google Scholar] [CrossRef]

- Li, I.-F.; Biswas, P.; Islam, S. Estimation of the Dominant Degrees of Freedom for Air Pollutant Concentration Data: Applications to Ozone Measurements. Atmos. Environ. 1994, 28, 1707–1714. [Google Scholar] [CrossRef]

- Raga, G.B.; Le Moyne, L. On the Nature of Air Pollution Dynamics in Mexico City—I. Nonlinear Analysis. Atmos. Environ. 1996, 30, 3987–3993. [Google Scholar] [CrossRef]

- Kumar, U.; Prakash, A.; Jain, V.K. Characterization of Chaos in Air Pollutants: A Volterra–Wiener–Korenberg Series and Numerical Titration Approach. Atmos. Environ. 2008, 42, 1537–1551. [Google Scholar] [CrossRef]

- Lee, C.-K.; Lin, S.-C. Chaos in Air Pollutant Concentration (APC) Time Series. Aerosol Air Qual. Res. 2008, 8, 381–391. [Google Scholar] [CrossRef]

- Yu, B.; Huang, C.; Liu, Z.; Wang, H.; Wang, L. A Chaotic Analysis on Air Pollution Index Change over Past 10 Years in Lanzhou, Northwest China. Stoch. Environ. Res. Risk Assess. 2011, 25, 643–653. [Google Scholar] [CrossRef]

- Bildirici, M. Chaotic Dynamics on Air Quality and Human Health: Evidence from China, India, and Turkey. Nonlinear Dyn. Psychol. Life Sci. 2021, 25, 207–236. [Google Scholar]

- Ucan, Y.; Bildirici, M. Air Temperature Measurement Based on Lie Group SO(3). Therm. Sci. 2022, 26, 3089–3095. [Google Scholar] [CrossRef]

- Rimol, M. Gartner Predicts 25% of People Will Spend at Least One Hour per Day in the Metaverse by 2026. Available online: https://www.gartner.com/en/newsroom/press-releases/2022-02-07-gartner-predicts-25-percent-of-people-will-spend-at-least-one-hour-per-day-in-the-metaverse-by-2026 (accessed on 13 June 2023).

- Wiggers, K. The Environmental Impact of the Metaverse. Available online: https://venturebeat.com/data-infrastructure/the-environmental-impact-of-the-metaverse/ (accessed on 13 June 2023).

- Morris, C. Citi Says Metaverse Could Be Worth $13 Trillion by 2030. Fortune, 1 April 2022. [Google Scholar]

- Stoll, C.; Gallersdörfer, U.; Klaaßen, L. Climate Impacts of the Metaverse. Joule 2022, 6, 2668–2673. [Google Scholar] [CrossRef]

- Kshetri, N.; Dwivedi, Y.K. Pollution-Reducing and Pollution-Generating Effects of the Metaverse. Int. J. Inf. Manag. 2023, 69, 102620. [Google Scholar] [CrossRef]

- Huang, J.; O’Neill, C.; Tabuchi, H. Bitcoin Uses More Electricity Than Many Countries: How Is That Possible? The New York Times, 3 September 2021. [Google Scholar]

- Iberdrola.com. What Are Green Cryptocurrencies and Why Are They Important? Available online: https://www.iberdrola.com/sustainability/green-cryptocurrencies (accessed on 13 March 2023).

- Malfuzi, A.; Mehr, A.S.; Rosen, M.A.; Alharthi, M.; Kurilova, A.A. Economic Viability of Bitcoin Mining Using a Renewable-Based SOFC Power System to Supply the Electrical Power Demand. Energy 2020, 203, 117843. [Google Scholar] [CrossRef]

- De Vries, A. Bitcoin’s Energy Consumption Is Underestimated: A Market Dynamics Approach. Energy Res. Soc. Sci. 2020, 70, 101721. [Google Scholar] [CrossRef]

- Digiconomist Bitcoin Energy Consumption Index—Digiconomist. Available online: https://digiconomist.net/bitcoin-energy-consumption (accessed on 14 March 2023).

- Zhang, C.; Liu, S. Meta-Energy: When Integrated Energy Internet Meets Metaverse. IEEE/CAA J. Autom. Sin. 2023, 10, 580–583. [Google Scholar] [CrossRef]

- Bildirici, M. The Chaotic Behavior among the Oil Prices, Expectation of Investors and Stock Returns: TAR-TR-GARCH Copula and TAR-TR-TGARCH Copula. Pet. Sci. 2019, 16, 217–228. [Google Scholar] [CrossRef]

- Shannon, C.E. A Mathematical Theory of Communication. Bell Syst. Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Lo, A.W. Long-Term Memory in Stock Market Prices. Econometrica 1991, 59, 1279. [Google Scholar] [CrossRef]

- Geweke, J.; Porter-Hudak, S. The Estimation and Application of Long Memory Time Series Models. J. Time Ser. Anal. 1983, 4, 221–238. [Google Scholar] [CrossRef]

- Robinson, P.M.; Henry, M. Higher-Order Kernel Semiparametric M-Estimation of Long Memory. J. Econom. 2003, 114, 1–27. [Google Scholar] [CrossRef]

- Panas, E.; Ninni, V. Are Oil Markets Chaotic? A Non-Linear Dynamic Analysis. Energy Econ. 2000, 22, 549–568. [Google Scholar] [CrossRef]

- Gaspard, P.; Briggs, M.E.; Francis, M.K.; Sengers, J.V.; Gammon, R.W.; Dorfman, J.R.; Calabrese, R.V. Experimental Evidence for Microscopic Chaos. Nature 1998, 394, 865–868. [Google Scholar] [CrossRef]

- Pincus, S. Approximate Entropy (ApEn) as a Complexity Measure. Chaos Interdiscip. J. Nonlinear Sci. 1995, 5, 110–117. [Google Scholar] [CrossRef]

- Rosenstein, M.T.; Collins, J.J.; De Luca, C.J. A Practical Method for Calculating Largest Lyapunov Exponents from Small Data Sets. Phys. D Nonlinear Phenom. 1993, 65, 117–134. [Google Scholar] [CrossRef]

- Zhong, Z.-Q.; Wu, Z.-M.; Xia, G.-Q. Experimental Investigation on the Time-Delay Signature of Chaotic Output from a 1550 Nm VCSEL Subject to FBG Feedback. Photonics Res. 2017, 5, 6–10. [Google Scholar] [CrossRef]

- Savi, M.A. Chaos and Order in Biomedical Rhythms. J. Braz. Soc. Mech. Sci. Eng. 2005, 27, 157–169. [Google Scholar] [CrossRef]

- Havrda, J.; Charvât, F. Quantification Method of Classification Processes Concept of Structural α-Entropy. Kybernetica 1967, 3, 30–35. [Google Scholar]

- Tsallis, C. Possible Generalization of Boltzmann-Gibbs Statistics. J. Stat. Phys. 1988, 52, 479–487. [Google Scholar] [CrossRef]

- Kaspar, F.; Schuster, H.G. Easily Calculable Measure for the Complexity of Spatiotemporal Patterns. Phys. Rev. A 1987, 36, 842–848. [Google Scholar] [CrossRef] [PubMed]

- Mandelbrot, B.B.; Wallis, J.R. Robustness of the Rescaled Range R/S in the Measurement of Noncyclic Long Run Statistical Dependence. Water Resour. Res. 1969, 5, 967–988. [Google Scholar] [CrossRef]

- Brock, W.A.; Dechert, W.D.; Scheinkman, J.A. A Test for Independence Based on the Correlation Dimension; University of Wisconsin, Social Systems Research Unit: Madison, WI, USA, 1987. [Google Scholar]

- Broock, W.A.; Scheinkman, J.A.; Dechert, W.D.; LeBaron, B. A Test for Independence Based on the Correlation Dimension. Econom. Rev. 1996, 15, 197–235. [Google Scholar] [CrossRef]

- White, H. A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity. Econometrica 1980, 48, 817–838. [Google Scholar] [CrossRef]

- Engle, R.F. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Bildirici, M.E.; Salman, M.; Ersin, Ö.Ö. Nonlinear Contagion and Causality Nexus between Oil, Gold, VIX Investor Sentiment, Exchange Rate and Stock Market Returns: The MS-GARCH Copula Causality Method. Mathematics 2022, 10, 4035. [Google Scholar] [CrossRef]

- Bildirici, M.E. Chaos Structure and Contagion Behavior between COVID-19, and the Returns of Prices of Precious Metals and Oil: MS-GARCH-MLP Copula. Nonlinear Dyn. Psychol. Life Sci. 2022, 26, 209–230. [Google Scholar]

- Bildirici, M.E.; Sonustun, B. Chaotic Behavior in Gold, Silver, Copper and Bitcoin Prices. Resour. Policy 2021, 74, 102386. [Google Scholar] [CrossRef]

- Kim, J.M.; Lee, N.; Hwang, S.Y. A Copula Nonlinear Granger Causality. Econ. Model. 2020, 88, 420–430. [Google Scholar] [CrossRef]

- Bildirici, M.; Ersin, Ö. Modeling Markov Switching ARMA-GARCH Neural Networks Models and an Application to Forecasting Stock Returns. Sci. World J. 2014, 2014, 497941. [Google Scholar] [CrossRef]

- Bildirici, M.E. Economic Growth and Electricity Consumption: MS-VAR and MS-Granger Causality Analysis. OPEC Energy Rev. 2013, 37, 447–476. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized Autoregressive Conditional Heteroskedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Henneke, J.S.; Rachev, S.T.; Fabozzi, F.J.; Nikolov, M. MCMC-Based Estimation of Markov Switching ARMA–GARCH Models. Appl. Econ. 2011, 43, 259–271. [Google Scholar] [CrossRef]

- Francq, C.; Zakoïan, J.-M. Stationarity of Multivariate Markov–Switching ARMA Models. J. Econom. 2001, 102, 339–364. [Google Scholar] [CrossRef]

- Kim, C.J. Dynamic Linear Models with Markov-Switching. J. Econom. 1994, 60, 1–22. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating Causal Relations by Econometric Models and Cross-Spectral Methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Zhu, K.; Yamaka, W.; Sriboonchitta, S. Multi-Asset Portfolio Returns: A Markov Switching Copula-Based Approach. Thai J. Math. 2016, 183–200. [Google Scholar]

- Nalatore, H.; Sasikumar, N.; Rangarajan, G. Effect of Measurement Noise on Granger Causality. Phys. Rev. E Stat. Nonlinear Soft Matter Phys. 2014, 90, 062127. [Google Scholar] [CrossRef]

- Lee, T.-H.; Yang, W. Granger-Causality in Quantiles between Financial Markets: Using Copula Approach. Int. Rev. Financ. Anal. 2014, 33, 70–78. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the Estimators for Autoregressive Time Series With a Unit Root. J. Am. Stat. Assoc. 1979, 74, 427. [Google Scholar] [CrossRef]

- Kapetanios, G.; Shin, Y.; Snell, A. Testing for a Unit Root in the Nonlinear STAR Framework. J. Econom. 2003, 112, 359–379. [Google Scholar] [CrossRef]

- Kwiatkowski, D.; Phillips, P.C.B.; Schmidt, P.; Shin, Y. Testing the Null Hypothesis of Stationarity against the Alternative of a Unit Root: How Sure Are We That Economic Time Series Have a Unit Root? J. Econom. 1992, 54, 159–178. [Google Scholar] [CrossRef]

- Sivakumar, B. Chaos Theory in Hydrology: Important Issues and Interpretations. J. Hydrol. 2000, 227, 1–20. [Google Scholar] [CrossRef]

- Kaplan, D.T.; Furman, M.I.; Pincus, S.M.; Ryan, S.M.; Lipsitz, L.A.; Goldberger’, A.L. Aging and the Complexity of Cardiovascular Dynamics. Biophys. J. 1991, 59, 945–949. [Google Scholar] [CrossRef] [PubMed]

- Richman, J.S.; Randall Moorman, J.; Randall, J.; Physi, M. Physiological Time-Series Analysis Using Approximate Entropy and Sample Entropy. Am. J. Physiol. Heart Circ. Physiol. 2000, 278, 2039–2049. [Google Scholar] [CrossRef] [PubMed]

- Ferreira, P.; Dionísio, A.; Movahed, S.M.S. Assessment of 48 Stock Markets Using Adaptive Multifractal Approach. Phys. A Stat. Mech. Its Appl. 2017, 486, 730–750. [Google Scholar] [CrossRef]

- Urom, C.; Ndubuisi, G.; Guesmi, K. Dynamic Dependence and Predictability between Volume and Return of Non-Fungible Tokens (NFTs): The Roles of Market Factors and Geopolitical Risks. Financ. Res. Lett. 2022, 50, 103188. [Google Scholar] [CrossRef]

- Zhao, N.; You, F. The Growing Metaverse Sector Can Reduce Greenhouse Gas Emissions by 10 Gt CO2e in the United States by 2050. Energy Environ. Sci. 2023, 16, 2382–2397. [Google Scholar] [CrossRef]

- Syuhada, K.; Tjahjono, V.; Hakim, A. Dependent Metaverse Risk Forecasts with Heteroskedastic Models and Ensemble Learning. Risks 2023, 11, 32. [Google Scholar] [CrossRef]

- Yu, P.; Hou, L.; Wang, C.; Chen, G. Insights into the Nonlinear Behaviors of Dual-Rotor Systems with Inter-Shaft Rub-Impact under Co-Rotation and Counter-Rotation Conditions. Int. J. Non-Linear Mech. 2022, 140, 103901. [Google Scholar] [CrossRef]

| CO2 | EC | MV | |

|---|---|---|---|

| Mean | 0.000016 | 0.000277 | 0.000222 |

| Med. | 0.000025 | 0.000436 | 0.000333 |

| Mx. | 0.010198 | 0.127332 | 0.021183 |

| Mn. | −0.01024 | −0.115797 | −0.028083 |

| Skw. | −0.613858 | 0.036475 | −0.526506 |

| Kr. | 6.750716 | 20.54980 | 8.171633 |

| JB | 2628.4308 [0.0000] | 33495.09 [0.0000] | 3029.190 [0.0000] |

| Data explanation and sources | Daily CO2 emission concentration, given in PPM, taken as a proxy of air pollution. Source: CO2 Earth Database, Publicly available at https://www.co2.earth/ (accessed on 1 January 2024) | Energy consumption of Bitcoin, in Twh. Source: Uni. of Cambridge, Center for Alternative Finance. Publicly available at https://ccaf.io/cbnsi/cbeci (accessed on 1 January 2024) | Extended version of Roundhill’s metaverse index/Source: Authors’ own calculations following Roundhill’s method. Source: Refinitiv Eikon Database. |

| Tests/Series | CO2 | EC | MV |

|---|---|---|---|

| Series in levels | |||

| Mandelbrot–Wallis R/S test statistic | 22.3131 *** | 21.4118 *** | 20.7831 *** |

| Lo’s modified R/S test statistic | 15.7823 *** | 15.1506 *** | 14.7048 *** |

| d-parameter (s.e.) [p-value] | 0.990215 *** (0.01870) [0.0000] | 0.99511 *** (0.01901) [0.0000] | 0.994037 *** (0.01869) [0.0000] |

| Series, first differenced | |||

| Mandelbrot–Wallis R/S test statistic | 3.06288 *** | 0.768264 | 1.52558 |

| Lo’s modified R/S test statistic | 2.17338 *** | 0.80196 | 1.56507 |

| d-parameter (s.e.) [p-value] | 0.0525454 (0.175986) [0.7653] | −0.0395671 ** (0.018712) [0.0345] | −0.0193269 (0.018706) [0.3015] |

| Volatility series | |||

| Mandelbrot–Wallis R/S test statistic | 3.80497 *** | 3.90547 *** | 4.31435 *** |

| Lo’s modified R/S test statistic | 5.35633 *** | 3.20997 *** | 3.77577 *** |

| d-parameter (s.e.) [p-value] | 0.84098 *** (0.01401) [0.0000] | 0.475363 *** (0.013012) [0.0000] | 0.263036 *** (0.013857) [0.0000] |

| Dimension | CO2 | MV | EC |

|---|---|---|---|

| 2 | 0.113 | 0.568 | 0.767 |

| 3 | 0.135 | 0.675 | 0.814 |

| 4 | 0.129 | 0.632 | 0.855 |

| 5 | 0.111 | 0.599 | 0.876 |

| 6 | 0.112 | 0.610 | 0.887 |

| CO2 | EC | MV | |

|---|---|---|---|

| Shannon entropy | 7.392 | 10.589 | 11.238 |

| Shannon, transformed to the [0, 1] range 1 | 0.513 | 0.464 | 0.472 |

| Havrda–Charvât–Tsallis (HCT) measure | 55.612 | 54.409 | 52.501 |

| Kolmogorov–Sinai (KS) complexity measure | 8.145 | 10.589 | 11.238 |

| Dimension | BDS Statistic | Std. Error | z-Statistic | Prob. |

|---|---|---|---|---|

| MV | ||||

| 2 | 0.016624 | 0.001766 | 9.414265 | 0.0000 |

| 3 | 0.035795 | 0.002800 | 12.78438 | 0.0000 |

| 4 | 0.050123 | 0.003327 | 15.06666 | 0.0000 |

| 5 | 0.059543 | 0.003460 | 17.20966 | 0.0000 |

| 6 | 0.063227 | 0.003329 | 18.99010 | 0.0000 |

| CO2 | ||||

| 2 | 0.030968 | 0.002296 | 13.48518 | 0.0000 |

| 3 | 0.052432 | 0.003657 | 14.33557 | 0.0000 |

| 4 | 0.064923 | 0.004367 | 14.86660 | 0.0000 |

| 5 | 0.076177 | 0.004565 | 16.68686 | 0.0000 |

| 6 | 0.082396 | 0.004416 | 18.65772 | 0.0000 |

| EC | ||||

| 2 | 0.186349 | 0.001552 | 120.0759 | 0.0000 |

| 3 | 0.322729 | 0.002453 | 131.5776 | 0.0000 |

| 4 | 0.418268 | 0.002904 | 144.0096 | 0.0000 |

| 5 | 0.483784 | 0.003010 | 160.7141 | 0.0000 |

| 6 | 0.528045 | 0.002887 | 182.9322 | 0.0000 |

| MV | CO2 | EC | |

|---|---|---|---|

| ARCH-LM(1–5) | 2287.181 | 223.3280 | 625.9534 |

| Result: | ARCH effects | ARCH effects | ARCH effects |

| White LM test | 1102.55 | 550.64 | 1112.81 |

| Result: | Heteroskedasticity | Heteroskedasticity | Heteroskedasticity |

| ADF | −51.45 | −4.306 | −9.739 |

| KSS | −8.37 | −85.95 | −23.29 |

| KPSS | 0.091 | 0.019 | 0.332 |

| Results: | I(1) | I(1) | I(1) |

| ARCH | GARCH | Cons. | P(1|1) | P(2|2) | Model Fit and Diagnostic Tests | |

|---|---|---|---|---|---|---|

| Dependent Variable: Metaverse | ||||||

| Regime 1 | 0.177220 *** (2.69) 1 | 0.699015 *** (4.74) | 0.1231 ** (3.44) | 0.768402 *** | 0.88031 *** | LogL: 2480.11 RMSE:1.002347, MAE: 1.002345, ARCH-LM: 0.0395 |

| Regime 2 | 0.1134 *** (3.47) | 0.8142 * (2.59) | 0.0727 ** (2.23) | |||

| Dependent Variable: Energy Consumption of Bitcoin | ||||||

| Regime 1 | 0.2417 ** (2.83) | 0.682 *** (2.76) | 0.077 ** (2.44) | 0.715692 *** | 0.83704 *** | LogL: 18117, RMSE:0.0118, MAE:0.0078, ARCH-LM: 0.026 |

| Regime 2 | 0.189579 (2.91) | 0.731939 (3.07) | 0.0796 ** (2.66) | |||

| Dependent Variable: CO2 Emission Concentration | ||||||

| Regime 1 | 0.40027 ** (2.09) | 0.58881 *** (3.06) | −0.000156 * (1.77) | 0.71011 *** | 0.86001 *** | LogL: 2287.44, RMSE: 0.132, MAE: 0.118, ARCH-LM: 0.15 |

| Regime 2 | 0.4014 ** (2.45) | 0.590944 *** (3.15) | −0.0112 ** (2.465) | |||

| Copula Results | ||||||

| Regime 1 | Regime 2 | |||||

| CO2-EC | CO2-MV | EC-MV | CO2-EC | CO2-MV | EC-MV | |

| 0.527 *** | 0.7991 *** | 0.569 *** | 0.5665 *** | 0.7614 *** | 0.61 *** | |

| Direction of Causality under H1: | Regime 1 | Causality? | Result: | Regime 2 | Causality? | Result: |

|---|---|---|---|---|---|---|

| CO2→MV MV→CO2 | 1.00102 1 | No | MV→CO2 (Unidirect.) | 0.87728 | No | MV→CO2 (Unidirect.) |

| 3.31528 ** | Yes | 3.62045 ** | Yes | |||

| EC→CO2 CO2→EC | 0.17533 | No | CO2→EC (Unidirect.) | 1.22553 | No | CO2→EC (Unidirect.) |

| 2.74820 ** | Yes | 2.77701 ** | Yes | |||

| MV→EC EC→MV | 3.04436 ** | Yes | MV→EC (Unidirect.) | 2.94021 ** | Yes | MV⇄EC (Bidirect.) |

| 1.40628 | No | 2.98736 ** | Yes |

| Direction of Causality under H1: | Test Statistic 1 | Causality? | Result: |

|---|---|---|---|

| CO2→MV MV→CO2 | 0.51875 | No | MV→CO2 (Unidirectional) |

| 2.51875 * | Yes | ||

| CO2→EC EC→CO2 | 1.11234 | No | No causality |

| 0.74383 | No | ||

| EC→MV MV→EC | 8.63478 ** | Yes | MV⇄EC (Bidirectional) |

| 9.91133 ** | Yes |

| Direction of Causality: | MS-ARMA-GARCH Copula Causality | ARMA-GARCH-Copula Causality | Difference in Results? | |

|---|---|---|---|---|

| Regime 1 | Regime 2 | Single Regime | ||

| CO2→MV | MV→CO2 (Unidirectional) | MV→CO2 (Unidirectional) | MV→CO2 | No |

| MV→CO2 | ||||

| CO2→EC | CO2→EP (Unidirectional) | CO2→EP (Unidirectional) | No causality between CO2 and EP | Yes |

| EC→CO2 | ||||

| EC→MV | MV→EP (Unidirectional) | MV⇄EP (Bidirectional) | MV⇄EP (Bidirectional) | Yes, but similar to Regime 2 |

| MV→EC | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bildirici, M.; Ersin, Ö.Ö.; Ibrahim, B. Chaos, Fractionality, Nonlinear Contagion, and Causality Dynamics of the Metaverse, Energy Consumption, and Environmental Pollution: Markov-Switching Generalized Autoregressive Conditional Heteroskedasticity Copula and Causality Methods. Fractal Fract. 2024, 8, 114. https://doi.org/10.3390/fractalfract8020114

Bildirici M, Ersin ÖÖ, Ibrahim B. Chaos, Fractionality, Nonlinear Contagion, and Causality Dynamics of the Metaverse, Energy Consumption, and Environmental Pollution: Markov-Switching Generalized Autoregressive Conditional Heteroskedasticity Copula and Causality Methods. Fractal and Fractional. 2024; 8(2):114. https://doi.org/10.3390/fractalfract8020114

Chicago/Turabian StyleBildirici, Melike, Özgür Ömer Ersin, and Blend Ibrahim. 2024. "Chaos, Fractionality, Nonlinear Contagion, and Causality Dynamics of the Metaverse, Energy Consumption, and Environmental Pollution: Markov-Switching Generalized Autoregressive Conditional Heteroskedasticity Copula and Causality Methods" Fractal and Fractional 8, no. 2: 114. https://doi.org/10.3390/fractalfract8020114

APA StyleBildirici, M., Ersin, Ö. Ö., & Ibrahim, B. (2024). Chaos, Fractionality, Nonlinear Contagion, and Causality Dynamics of the Metaverse, Energy Consumption, and Environmental Pollution: Markov-Switching Generalized Autoregressive Conditional Heteroskedasticity Copula and Causality Methods. Fractal and Fractional, 8(2), 114. https://doi.org/10.3390/fractalfract8020114