Digitalisation and Big Data Mining in Banking

Abstract

1. Introduction

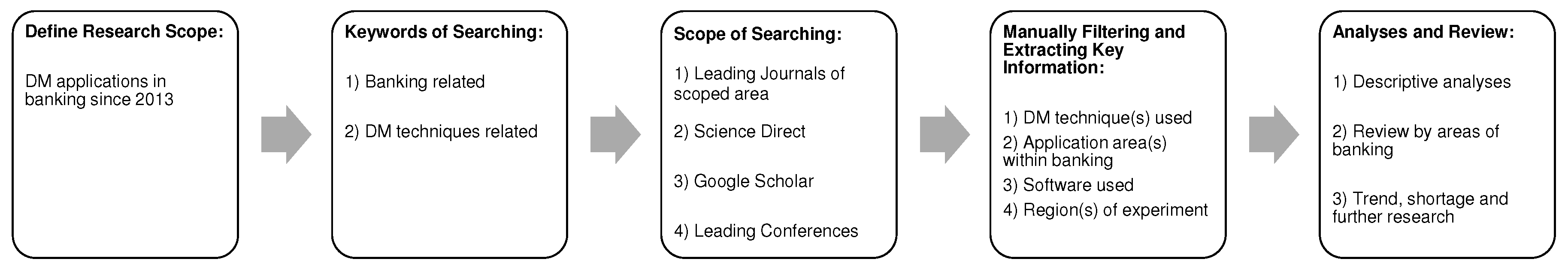

2. Methodology

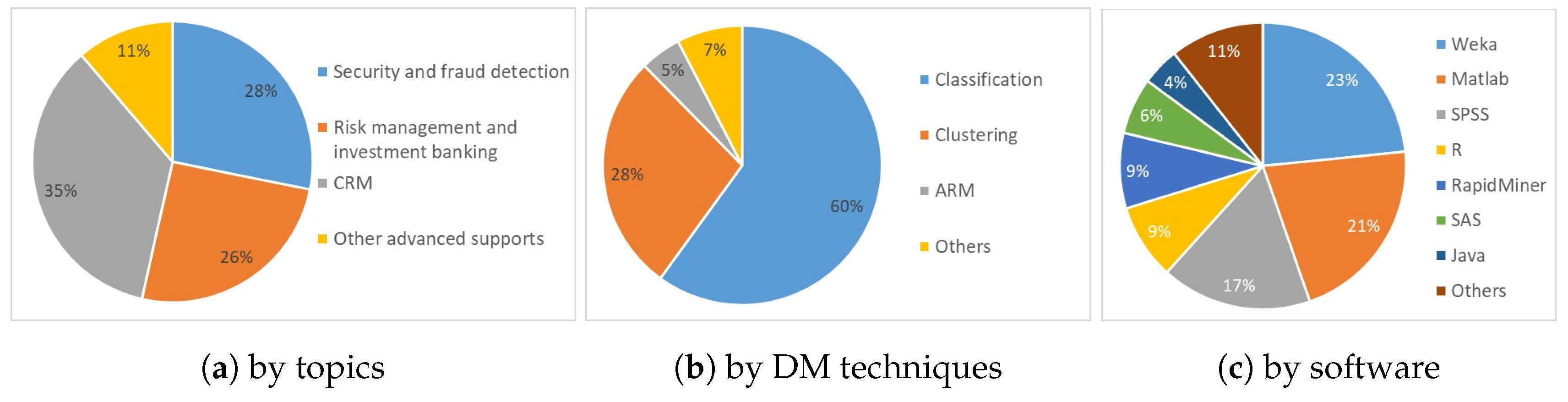

3. Value Creation of DM in Banking by Topics

3.1. Security and Fraud Detection

3.2. Risk Management and Investment Banking

3.3. Customer Relationship Management (CRM)

3.3.1. Customer Profiling and Knowledge

3.3.2. Customer Segmentation

3.3.3. Customer Satisfaction

3.3.4. Customer Development and Customization

3.3.5. Customer Retention and Acquisition

3.4. Other Advanced Supports

4. Key DM Techniques, Software for Banking and Trends

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Mayer-Schonberger, V.; Cukier, K. Big Data: A Revolution that Will Transform How We Live, Work, and Think; Houghton Mifflin Harcourt: New York, NY, USA, 2013. [Google Scholar]

- Hassani, H.; Saporta, G.; Silva, E.S. Data Mining and Official Statistics: The past, the present and the future. Big Data 2014, 2, 34–43. [Google Scholar] [CrossRef] [PubMed]

- Hassani, H.; Huang, X.; Silva, E.S.; Ghodsi, M. A review of data mining applications in crime. Stat. Anal. Data Min. ASA Data Sci. J. 2016, 9, 139–154. [Google Scholar] [CrossRef]

- Hassani, H.; Huang, X.; Ghodsi, M. Big Data and Causality. Ann. Data Sci. 2018, 5, 133–156. [Google Scholar] [CrossRef]

- Hassani, H.; Silva, E.S. Big Data: a big opportunity for the petroleum and petrochemical industry. OPEC Energy Rev. 2018, 42, 74–89. [Google Scholar] [CrossRef]

- Kharote, M.; Kshirsagar, V.P. Data mining model for money laundering detection in financial domain. Int. J. Comput. Appl. 2014, 85, 61–64. [Google Scholar] [CrossRef]

- Jayasree, V.; Balan, R.V.S. A review on data mining in banking sector. Am. J. Appl. Sci. 2013, 10, 1160. [Google Scholar] [CrossRef]

- Pulakkazhy, S.; Balan, R.V.S. Data mining in banking and its applications—A review. J. Comput. Sci. 2013, 9, 1252–1259. [Google Scholar] [CrossRef]

- Amani, F.A.; Fadlalla, A.M. Data mining applications in accounting: A review of the literature and organizing framework. Int. J. Account. Inf. Syst. 2017, 24, 32–58. [Google Scholar] [CrossRef]

- Wongchinsri, P.; Kuratach, W. A survey-data mining frameworks in credit card processing. In Proceedings of the 2016 13th International Conference on Electrical Engineering/Electronics, Computer, Telecommunications and Information Technology (ECTI-CON), Chiang Mai, Thailand, 28 June–1 July 2016; pp. 1–6. [Google Scholar]

- Bhasin, M.L. Menace of frauds in the Indian banking industry: An empirical study. Aust. J. Bus. Manag. Res. 2015, 4, 1–13. [Google Scholar] [CrossRef]

- Wei, W.; Li, J.; Cao, L.; Ou, Y.; Chen, J. Effective detection of sophisticated online banking fraud on extremely imbalanced data. World Wide Web 2013, 16, 449–475. [Google Scholar] [CrossRef]

- Akhilomen, J. Data mining application for cyber credit-card fraud detection system. In Proceedings of the Industrial Conference on Data Mining, New York, NY, USA, 16–21 July 2013; Springer: Berlin/Heidelberg, Germany, 2013; pp. 218–228. [Google Scholar]

- Carminati, M.; Caron, R.; Maggi, F.; Epifani, I.; Zanero, S. BankSealer: An online banking fraud analysis and decision support system. In Proceedings of the IFIP International Information Security Conference, Marrakech, Morocco, 2–4 June 2014; Springer: Berlin/Heidelberg, Germany, 2014; pp. 380–394. [Google Scholar]

- Malekpour, M.; Khademi, M.; Minae-Bidgoli, B. A Hybrid Data Mining Method for Intrusion and Fraud Detection in E-Banking Systems. J. Comput. Intell. Electron. Syst. 2014, 3, 1–6. [Google Scholar]

- Seeja, K.R.; Zareapoor, M. FraudMiner: A novel credit card fraud detection model based on frequent itemset mining. Sci. World J. 2014, 2014. [Google Scholar] [CrossRef] [PubMed]

- Zareapoor, M.; Shamsolmoali, P. Application of credit card fraud detection: Based on bagging ensemble classifier. Procedia Comput. Sci. 2015, 48, 679–685. [Google Scholar] [CrossRef]

- Hegazy, M.; Madian, A.; Ragaie, M. Enhanced Fraud Miner: Credit Card Fraud Detection using Clustering Data Mining Techniques. Egypt. Comput. Sci. J. 2016, 40, 72–81. [Google Scholar]

- Behera, T.K.; Panigrahi, S. Credit Card Fraud Detection: A Hybrid Approach Using Fuzzy Clustering & Neural Network. In Proceedings of the 2015 Second International Conference on Advances in Computing and Communication Engineering (ICACCE), Dehradun, India, 1–2 May 2015; pp. 494–499. [Google Scholar]

- Behera, T.K.; Panigrahi, S. Credit Card Fraud Detection Using a Neuro-Fuzzy Expert System. In Computational Intelligence in Data Mining; Springer: Singapore, 2017; pp. 835–843. [Google Scholar]

- Van Vlasselaer, V.; Bravo, C.; Caelen, O.; Eliassi-Rad, T.; Akoglu, L.; Snoeck, M.; Baesens, B. APATE: A novel approach for automated credit card transaction fraud detection using network-based extensions. Decis. Support Syst. 2015, 75, 38–48. [Google Scholar] [CrossRef]

- Save, P.; Tiwarekar, P.; Jain, K.N.; Mahyavanshi, N. A Novel Idea for Credit Card Fraud Detection using Decision Tree. Int. J. Comput. Appl. 2017, 161, 6–9. [Google Scholar] [CrossRef]

- John, S.N.; Anele, C.; Kennedy, O.O.; Olajide, F.; Kennedy, C.G. Realtime fraud detection in the banking sector using data mining techniques/algorithm. In Proceedings of the 2016 International Conference on Computational Science and Computational Intelligence (CSCI), Las Vegas, NV, USA, 15–17 December 2016; pp. 1186–1191. [Google Scholar]

- Azimi, A.; Noor Hosseini, M. The hybrid approach based on genetic algorithm and neural network to predict financial fraud in banks. Int. J. Inf. Secur. Syst. Manag. 2017, 6, 657–667. [Google Scholar]

- Devadiga, N.; Kothari, H.; Jain, H.; Sankhe, S. E-Banking Security using Cryptography, Steganography and Data Mining. Int. J. Comput. Appl. 2017, 164, 26–30. [Google Scholar] [CrossRef]

- Osinski, S.; Stefanowski, J.; Weiss, D. Lingo: Search results clustering algorithm based on singular value decomposition. In Intelligent Information Processing and Web Mining; Springer: Berlin/Heidelberg, Germany, 2004; pp. 359–368. [Google Scholar]

- Panigrahi, S.; Kundu, A.; Sural, S.; Majumdar, A.K. Credit card fraud detection: A fusion approach using Dempster–Shafer theory and Bayesian learning. Inf. Fusion 2009, 10, 354–363. [Google Scholar] [CrossRef]

- Abdelhamid, N.; Ayesh, A.; Thabtah, F. Phishing detection based associative classification data mining. Expert Syst. Appl. 2014, 41, 5948–5959. [Google Scholar] [CrossRef]

- Sundarkumar, G.G.; Ravi, V. A novel hybrid undersampling method for mining unbalanced datasets in banking and insurance. Eng. Appl. Artif. Intell. 2015, 37, 368–377. [Google Scholar] [CrossRef]

- He, W.; Tian, X.; Shen, J. Examining Security Risks of Mobile Banking Applications through Blog Mining. In Proceedings of the 26th Modern Artificial Intelligence and Cognitive Science Conference (MAICS), Greensboro, CA, USA, 25–26 April 2015; pp. 103–108. [Google Scholar]

- Hasheminejad, S.M.; Salimi, Z. FDiBC: A Novel Fraud Detection Method in Bank Club based on Sliding Time and Scores Window. J. AI Data Min. 2018, 6, 219–231. [Google Scholar]

- Jayasree, V.; Balan, R.S. Money laundering regulatory risk evaluation using Bitmap Index-based Decision Tree. J. Assoc. Arab Univ. Basic Appl. Sci. 2017, 23, 96–102. [Google Scholar] [CrossRef]

- Siami, M.; Hajimohammadi, Z. Credit scoring in banks and financial institutions via data mining techniques: A literature review. J. AI Data Min. 2013, 1, 119–129. [Google Scholar]

- Madyatmadja, E.D.; Aryuni, M. Comparative study of data mining model for credit card application scoring in bank. J. Theor. Appl. Inf. Technol. 2014, 59, 269–274. [Google Scholar]

- Chen, Y.; Shi, Y.; Lee, C.F.; Li, M.; Liu, Y. Measuring and Predicting Systemic Risk in the Chinese Banking System. In Proceedings of the 2014 IEEE International Conference on Data Mining Workshop (ICDMW), Shenzhen, China, 14 December 2014; pp. 55–59. [Google Scholar]

- Koh, H.C.; Tan, W.C.; Goh, C.P. A two-step method to construct credit scoring models with data mining techniques. Int. J. Bus. Inf. 2006, 1, 96–118. [Google Scholar]

- Koutanaei, F.N.; Sajedi, H.; Khanbabaei, M. A hybrid data mining model of feature selection algorithms and ensemble learning classifiers for credit scoring. J. Retail. Consum. Serv. 2015, 27, 11–23. [Google Scholar] [CrossRef]

- Harris, T. Credit scoring using the clustered support vector machine. Expert Syst. Appl. 2015, 42, 741–750. [Google Scholar] [CrossRef]

- Zhao, Z.; Xu, S.; Kang, B.H.; Kabir, M.M.J.; Liu, Y.; Wasinger, R. Investigation and improvement of multi-layer perceptron neural networks for credit scoring. Expert Syst. Appl. 2015, 42, 3508–3516. [Google Scholar] [CrossRef]

- Danenas, P.; Garsva, G. Selection of support vector machines based classifiers for credit risk domain. Expert Syst. Appl. 2015, 42, 3194–3204. [Google Scholar] [CrossRef]

- Alaraj, M.; Abbod, M.F. Classifiers consensus system approach for credit scoring. Knowl.-Based Syst. 2016, 104, 89–105. [Google Scholar] [CrossRef]

- Alaraj, M.; Abbod, M.F. A new hybrid ensemble credit scoring model based on classifiers consensus system approach. Expert Syst. Appl. 2016, 64, 36–55. [Google Scholar] [CrossRef]

- Lessmann, S.; Baesens, B.; Seow, H.V.; Thomas, L.C. Benchmarking state-of-the-art classification algorithms for credit scoring: An update of research. Eur. J. Oper. Res. 2015, 247, 124–136. [Google Scholar] [CrossRef]

- Louzada, F.; Ara, A.; Fernandes, G.B. Classification methods applied to credit scoring: Systematic review and overall comparison. Surv. Oper. Res. Manag. Sci. 2016, 21, 117–134. [Google Scholar] [CrossRef]

- Abellán, J.; Castellano, J.G. A comparative study on base classifiers in ensemble methods for credit scoring. Expert Syst. Appl. 2017, 73, 1–10. [Google Scholar]

- Xiong, T.; Wang, S.; Mayers, A.; Monga, E. Personal bankruptcy prediction by mining credit card data. Expert Syst. Appl. 2013, 40, 665–676. [Google Scholar] [CrossRef]

- Sousa, M.D.M.; Figueiredo, R.S. Credit analysis using data mining: Application in the case of a credit union. J. Inf. Syst. Technol. Manag. 2014, 11, 379–396. [Google Scholar] [CrossRef]

- Wu, D.D.; Olson, D.L.; Luo, C. A decision support approach for accounts receivable risk management. IEEE Trans. Syst. Man Cybern. Syst. 2014, 44, 1624–1632. [Google Scholar] [CrossRef]

- Serrano-Cinca, C.; Gutiérrez-Nieto, B. The use of profit scoring as an alternative to credit scoring systems in peer-to-peer (P2P) lending. Decis. Support Syst. 2016, 89, 113–122. [Google Scholar] [CrossRef]

- Li, H.; Zhang, Y.; Zhang, N.; Jia, H. Detecting the Abnormal Lenders from P2P Lending Data. Procedia Comput. Sci. 2016, 91, 357–361. [Google Scholar] [CrossRef]

- Xia, Y.; Liu, C.; Li, Y.; Liu, N. A boosted decision tree approach using Bayesian hyper-parameter optimization for credit scoring. Expert Syst. Appl. 2017, 78, 225–241. [Google Scholar] [CrossRef]

- Mansingh, G.; Rao, L.; Osei-Bryson, K.M.; Mills, A. Profiling internet banking users: A knowledge discovery in data mining process model based approach. Inf. Syst. Front. 2015, 17, 193–215. [Google Scholar] [CrossRef]

- Nishanth, K.J.; Ravi, V. A computational intelligence based online data imputation method: An application for banking. J. Inf. Process. Syst. 2013, 9, 633–650. [Google Scholar] [CrossRef]

- Noori, B. An Analysis of Mobile Banking User Behavior Using Customer Segmentation. Int. J. Glob. Bus. 2015, 8, 55. [Google Scholar]

- Patel, Y.S.; Agrawal, D.; Josyula, L.S. The RFM-based ubiquitous framework for secure and efficient banking. In Proceedings of the 2016 International Conference on Innovation and Challenges in Cyber Security (ICICCS-INBUSH), Noida, India, 3–5 February 2016; pp. 283–288. [Google Scholar]

- Liebana-Cabanillas, F.; Nogueras, R.; Herrera, L.J.; Guillén, A. Analysing user trust in electronic banking using data mining methods. Expert Syst. Appl. 2013, 40, 5439–5447. [Google Scholar] [CrossRef]

- Elsalamony, H.A. Bank direct marketing analysis of data mining techniques. Int. J. Comput. Appl. 2014, 85, 12–22. [Google Scholar] [CrossRef]

- Moro, S.; Cortez, P.; Rita, P. A data-driven approach to predict the success of bank telemarketing. Decis. Support Syst. 2014, 62, 22–31. [Google Scholar] [CrossRef]

- Bahari, T.F.; Elayidom, M.S. An efficient CRM-data mining framework for the prediction of customer behaviour. Procedia Comput. Sci. 2015, 46, 725–731. [Google Scholar] [CrossRef]

- Vajiramedhin, C.; Suebsing, A. Feature selection with data balancing for prediction of bank telemarketing. Appl. Math. Sci. 2014, 8, 5667–5672. [Google Scholar] [CrossRef]

- Amini, M.; Rezaeenour, J.; Hadavandi, E. A cluster-based data balancing ensemble classifier for response modeling in Bank Direct Marketing. Int. J. Comput. Intell. Appl. 2015, 14, 1550022. [Google Scholar] [CrossRef]

- Zakaryazad, A.; Duman, E. A profit-driven Artificial Neural Network (ANN) with applications to fraud detection and direct marketing. Neurocomputing 2016, 175, 121–131. [Google Scholar] [CrossRef]

- Barman, D.; Shaw, K.K.; Tudu, A.; Chowdhury, N. Classification of Bank Direct Marketing Data Using Subsets of Training Data. In Information Systems Design and Intelligent Applications; Springer: New Delhi, India, 2016; pp. 143–151. [Google Scholar]

- Lahmiri, S. A two-step system for direct bank telemarketing outcome classification. Intell. Syst. Account. Financ. Manag. 2017, 24, 49–55. [Google Scholar] [CrossRef]

- Shih, J.Y.; Chen, W.H.; Chang, Y.J. Developing target marketing models for personal loans. In Proceedings of the 2014 IEEE International Conference on Industrial Engineering and Engineering Management (IEEM), Bandar Sunway, Malaysia, 9–14 December 2014; pp. 1347–1351. [Google Scholar]

- Mitik, M.; Korkmaz, O.; Karagoz, P.; Toroslu, I.H.; Yucel, F. Data Mining Based Product Marketing Technique for Banking Products. In Proceedings of the 2016 IEEE 16th International Conference on Data Mining Workshops (ICDMW), Barcelona, Spain, 12–15 December 2016; pp. 552–559. [Google Scholar]

- Mitik, M.; Korkmaz, O.; Karagoz, P.; Toroslu, I.H.; Yucel, F. Data Mining Approach for Direct Marketing of Banking Products with Profit/Cost Analysis. Rev. Soc. Strateg. 2017, 11, 17–31. [Google Scholar] [CrossRef]

- Wang, S.; Petrounias, I. Big Data Analysis on Demographic Characteristics of Chinese Mobile Banking Users. In Proceedings of the 2017 IEEE 19th Conference on Business Informatics (CBI), Thessaloniki, Greece, 24–27 July 2017; Volume 2, pp. 47–54. [Google Scholar]

- Ali, O.G.; Ariturk, U. Dynamic churn prediction framework with more effective use of rare event data: The case of private banking. Expert Syst. Appl. 2014, 41, 7889–7903. [Google Scholar]

- He, B.; Shi, Y.; Wan, Q.; Zhao, X. Prediction of customer attrition of commercial banks based on SVM model. Procedia Comput. Sci. 2014, 31, 423–430. [Google Scholar] [CrossRef]

- Oyeniyi, A.O.; Adeyemo, A.B.; Oyeniyi, A.O.; Adeyemo, A.B. Customer churn analysis in banking sector using data mining techniques. Afr. J. Comput. ICTs 2015, 8, 165–174. [Google Scholar]

- Ogwueleka, F.N.; Misra, S.; Colomo-Palacios, R.; Fernandez, L. Neural network and classification approach in identifying customer behavior in the banking sector: A case study of an international bank. Hum. Factors Ergonom. Manuf. Serv. Ind. 2015, 25, 28–42. [Google Scholar] [CrossRef]

- Bilal Zoric, A. Predicting customer churn in banking industry using neural networks. Interdiscip. Descr. Complex Syst. 2016, 14, 116–124. [Google Scholar] [CrossRef]

- Keramati, A.; Ghaneei, H.; Mirmohammadi, S.M. Developing a prediction model for customer churn from electronic banking services using data mining. Financ. Innov. 2016, 2, 10. [Google Scholar] [CrossRef]

- Azad, M.A.K. Predicting mobile banking adoption in Bangladesh: A neural network approach. Transnatl. Corp. Rev. 2016, 8, 207–214. [Google Scholar] [CrossRef]

- Suvarna, V.K.; Banerjee, B. Social Banking: Leveraging Social Media to Enhance Customer Engagement; Capgemini White Paper; Capgemini: Paris, France, 2014. [Google Scholar]

- Afolabi, I.T.; Ezenwoke, A.A.; Ayo, C.K. Competitive analysis of social media data in the banking industry. Int. J. Internet Market. Advert. 2017, 11, 183–201. [Google Scholar] [CrossRef]

- Batmaz, I.; Danisoglu, S.; Yazici, C.; Kartal-Koc, E. A data mining application to deposit pricing: Main determinants and prediction models. Appl. Soft Comput. 2017, 60, 808–819. [Google Scholar] [CrossRef]

- Negnevitsky, M. Identification of failing banks using Clustering with self-organising neural networks. Procedia Comput. Sci. 2017, 108, 1327–1333. [Google Scholar] [CrossRef]

- Herrera-Restrepo, O.; Triantis, K.; Seaver, W.L.; Paradi, J.C.; Zhu, H. Bank branch operational performance: A robust multivariate and clustering approach. Expert Syst. Appl. 2016, 50, 107–119. [Google Scholar] [CrossRef]

- Met, I.; Tunali, G.; Erkoc, A.; Tanrikulu, S.; Dolgun, M.O. Branch Efficiency and Location Forecasting: Application of Ziraat Bank. J. Appl. Financ. Bank. 2017, 7, 1–13. [Google Scholar]

- Wanke, P.; Kalam Azad, M.; Barros, C.P.; Hadi-Vencheh, A. Predicting performance in ASEAN banks: An integrated fuzzy MCDM–neural network approach. Expert Syst. 2016, 33, 213–229. [Google Scholar] [CrossRef]

- Wanke, P.; Azad, M.A.K.; Barros, C.P.; Hassan, M.K. Predicting efficiency in Islamic banks: An integrated multicriteria decision making (MCDM) approach. J. Int. Financ. Market. Inst. Money 2016, 45, 126–141. [Google Scholar] [CrossRef]

- Wanke, P.; Azad, A.K.; Emrouznejad, A. Efficiency in BRICS banking under data vagueness: A two-stage fuzzy approach. Glob. Financ. J. 2017, 35, 58–71. [Google Scholar] [CrossRef]

- Parvatiyar, A.; Sheth, J.N. Customer relationship management: Emerging practice, process, and discipline. J. Econ. Soc. Res. 2001, 3, 1–34. [Google Scholar]

- Berry, M.; Linoff, G. Mastering Data Mining: The Art and Science of Customer Relationship Management; John Wiley & Sons: New York, NY, USA, 1999. [Google Scholar]

- Ngai, E.W.; Xiu, L.; Chau, D.C. Application of data mining techniques in customer relationship management: A literature review and classification. Expert Syst. Appl. 2009, 36, 2592–2602. [Google Scholar] [CrossRef]

- Soltani, Z.; Navimipour, N.J. Customer relationship management mechanisms: A systematic review of the state of the art literature and recommendations for future research. Comput. Hum. Behav. 2016, 61, 667–688. [Google Scholar] [CrossRef]

- Desai, D.B.; Kulkarni, R.V. A Review: Application of data mining tools in CRM for selected banks. Int. J. Comput. Sci. Inf. Technol. 2013, 4, 199–201. [Google Scholar]

- Sun, N.; Morris, J.G.; Xu, J.; Zhu, X.; Xie, M. iCARE: A framework for big data-based banking customer analytics. IBM J. Res. Dev. 2014, 58, 4:1–4:9. [Google Scholar] [CrossRef]

- Gautam, P.; Singh, Y.P.; Shaikh, P. Significance and Importance of Data Mining for Marketing Analysis in Finance, Banking Sectors. Int. J. Appl. Res. Sci. Eng. 2017, 26–29. Available online: http://ijarse.org/images/scripts/201706.pdf (accessed on 9 September 2017).

- Xu, D.; Tian, Y. A comprehensive survey of clustering algorithms. Ann. Data Sci. 2015, 2, 165–193. [Google Scholar] [CrossRef]

- Agrawal, R.; Imieliński, T.; Swami, A. Mining Association Rules between sets of items in large databases. In Proceedings of the ACM SIGMOD International Conference on Management of Data and ACM SIGMOD, Washington, DC, USA, 25–28 May 1993; pp. 207–216. [Google Scholar]

- Pang-Ning, T.; Steinbach, M.; Kumar, V. Introduction to Data Mining (2ed edition); Pearson: Boston, MA, USA, 2006. [Google Scholar]

- Breiman, L.; Friedman, J.; Olshen, R.; Stone, C. Classification and Regression Trees; Belmont: Wadsworth, OH, USA, 1984. [Google Scholar]

- Quinlan, J.R. C4.5: Program for Machine Learning; Morgan Kaufmann: Burlington, MA, USA, 1992. [Google Scholar]

- Widrow, B.; Rumelhart, D.E.; Lehr, M.A. Neural networks: Applications in industry, business and science. Commun. ACM 1994, 37, 93–105. [Google Scholar] [CrossRef]

- Suykens, J.A.; Vandewalle, J. Least squares support vector machine classifiers. Neural Process. Lett. 1999, 9, 293–300. [Google Scholar] [CrossRef]

- Langley, P.; Iba, W.; Thompson, K. An analysis of Bayesian classifiers. In Proceedings of the Tenth National Conference on Artificial Intelligence, San Jose, CA, USA, 12–16 July 1992; Volume 90, pp. 223–228. [Google Scholar]

- Dreiseitl, S.; Ohno-Machado, L. Logistic regression and artificial neural network classification models: A methodology review. J. Biomed. Inform. 2002, 35, 352–359. [Google Scholar] [CrossRef]

- Marous, J. Improving the Customer Experience in Banking. Digital Banking Report. 2017. Available online: https://www.digitalbankingreport.com/dbr/dbr246/ (accessed on 8 September 2017).

- Lagazio, M.; Sherif, N.; Cushman, M. A multi-level approach to understanding the impact of cyber crime on the financial sector. Comput. Secur. 2014, 45, 58–74. [Google Scholar] [CrossRef]

- Kirkos, E.; Spathis, C.; Manolopoulos, Y. Data mining techniques for the detection of fraudulent financial statements. Expert Syst. Appl. 2007, 32, 995–1003. [Google Scholar] [CrossRef]

- Ngai, E.W.T.; Hu, Y.; Wong, Y.H.; Chen, Y.; Sun, X. The application of data mining techniques in financial fraud detection: A classification framework and an academic review of literature. Decis. Support Syst. 2011, 50, 559–569. [Google Scholar] [CrossRef]

- Bhattacharyya, S.; Jha, S.; Tharakunnel, K.; Westland, J.C. Data mining for credit card fraud: A comparative study. Decis. Support Syst. 2011, 50, 602–613. [Google Scholar] [CrossRef]

- Coumaros, J.; Buvat, J.; Auliard, O.; Roys, S.; Kvj, S.; Chretien, L.; Clerk, V. Big Data Alchemy: How can banks maximize the value of their customer data. In Banks Have Not Fully Exploited the Potential of Customer Data; Digital Transformation Research Institute and Capgemini Consulting: Paris, France, 2014. [Google Scholar]

- Marous, J. Banking Industry Still Taking Small Steps with Big Data. The Financial Brand. 2017. Available online: https://thefinancialbrand.com/64166/banking-big-data-advanced-analytics-ai/ (accessed on 3 September 2017).

| Sector | References | Key Techniques | Regions | Purposes | |

|---|---|---|---|---|---|

| Security and fraud detection | [6,10,11,12,13,14,15,16,17,18,19,20,21,22,23,24,25,26,27,28,29,30,31,32] | classification (DT, NN, SVM, NB), k-mean clustering, ARM | Australia [12], Latin-America [29], Greece [24], Germany [32], Belgium [21], UCI Repository [15,16,17,18] | Identifying phishing, fraud, money laundering, credit card fraud, security trend of mobile/online/traditional banking. | |

| Risk management and investment banking | [33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51] | classification (DT, NN, SVM, NB, LR), k-mean clustering | UCI Repository International Dataset [41,42,45], Australia [51], Iran [37], Indonesia [34], China [35], German [36,38,39,51], Taiwan [51], US [49], Canada [46] | Credit scoring, credit granting, risk management for peer-to-peer lending. | |

| Customer profiling and knowledge | [52,53] | classification (DT, NN), k-mean clustering | Jamaica [52] | Efficiently build accurate customer profiles. | |

| Customer segmentation | [54,55] | k-mean clustering | Iran [54] | Provide sufficient customer segmentation, conduct customer-centric business strategies. | |

| CRM | Customer satisfaction | [56] | k-mean clustering, classification (NN) | Spain [56] | Make the most strategic investment on maintaining and enhancing customer satisfaction. |

| Customer development and customization | [57,58,59,60,61,62,63,64,65,66,67,68] | classification (DT, NN, NB, LR, SVM), k-mean clustering | Portugal [57,58,59,60,61,62], Turkey [66,67], China [68], Taiwan [65], UCI Repository [64] | Strategic banking via direct marketing, targeted marketing, product cross/up selling. | |

| Customer retention and acquisition | [69,70,71,72,73,74,75] | classification (DT, NN, LR, SVM), ARM, k-mean clustering | EU [69], China [70], Nigeria [71], Croatia [73], Bangladesh [75] | Customer churn prediction and prevention, attracting potential customers and strategic future service design. | |

| Other advanced supports | [76,77,78,79,80,81,82,83,84] | classification (NN, DT, SVM), k-mean clustering | Nigeria [77], Turkey [78,81], Canada [80], ASEAN [82], Islamic banks [83], BRICS [84], US [79] | Branch strategy, bank efficiency evaluation, deposit pricing, early warning of failing bank. | |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hassani, H.; Huang, X.; Silva, E. Digitalisation and Big Data Mining in Banking. Big Data Cogn. Comput. 2018, 2, 18. https://doi.org/10.3390/bdcc2030018

Hassani H, Huang X, Silva E. Digitalisation and Big Data Mining in Banking. Big Data and Cognitive Computing. 2018; 2(3):18. https://doi.org/10.3390/bdcc2030018

Chicago/Turabian StyleHassani, Hossein, Xu Huang, and Emmanuel Silva. 2018. "Digitalisation and Big Data Mining in Banking" Big Data and Cognitive Computing 2, no. 3: 18. https://doi.org/10.3390/bdcc2030018

APA StyleHassani, H., Huang, X., & Silva, E. (2018). Digitalisation and Big Data Mining in Banking. Big Data and Cognitive Computing, 2(3), 18. https://doi.org/10.3390/bdcc2030018