A Strategic Analysis of Cargolux Airlines International Position in the Global Air Cargo Supply Chain Using Porter’s Five Forces Model

Abstract

:1. Introduction

- What is Cargo Airlines International’s competitive position in the global air cargo supply chain?

- What strategic options has Cargolux Airlines International defined and implemented to capture and deliver a competitive advantage in the global air cargo industry?

- Are there any strategic differences between Cargolux Airlines International services/products offerings and those of their principal competitors?

2. Background

2.1. Porter’s Five Forces Model

2.1.1. The Intensity of Rivalry among Established Firms

2.1.2. The Bargaining Power of Buyers

2.1.3. The Bargaining Power of Suppliers

2.1.4. The Threat of Substitutes

- Brand loyalty of customers;

- close customer relationships;

- customer switching costs;

- the relative price of the substitute’s performance; and

- current industry trends [22].

2.1.5. The Risk of Entry by Potential Competitors

- The incumbents possess substantial resources to fight back, including excess cash, productive capacity, or a strong position with distribution channels and customers;

- the incumbents seem likely to reduce prices because of a desire to retain market shares or because of industrywide excess capacity; and

- industry growth is slow. This will influence its ability to absorb the new arrival and probably cause the financial performance of all the parties involved to decline [19] (p. 26).

2.2. Porter’s Generic Strategies

2.2.1. Overall Cost Leadership Strategy

2.2.2. Differentiation Strategy

2.2.3. Focus or Niche Strategy

2.3. Competitive Advantage: A Background Note

3. Research Approach

3.1. Research Method Used in the Study

3.2. Data Collection

3.3. Data Analysis Process

- Phase 1: This phase involved planning the types and required documentation and their availability;

- Phase 2: The data collection involved gathering the documents and developing and implementing a scheme for the document management;

- Phase 3: Documents were reviewed to assess their authenticity, credibility, and to identify any potential bias;

- Phase 4: The content of the collected documents was interrogated, and the key themes and issues were identified;

- Phase 5: This phase involved the reflection and refinement to identify and difficulties associated with the documents, reviewing sources, as well as exploring the documents’ content; and

- Phase 6: The analysis of the data was completed in this final phase of the study [47] (p. 179).

4. Results

4.1. A Brief Overview of Cargolux Airlines

4.2. The Application of Porter’s Five Forces Model to Cargolux Airlines’ International Position in the Global Air Cargo Industry Supply Chain

4.2.1. The Intensity of Rivalry among Established Airlines in the Global Air Cargo Supply Chain

- There are many competitors providing services in the global air cargo supply chain. These carriers typically operate the same aircraft types as Cargolux and their business models are virtually comparable at a global level [10]. Both the combination passenger airlines, who may also operate freighter aircraft in addition to their passenger services, and the dedicated all-cargo airlines, such as Cargolux, Cargo Logic Air, and Nippon Cargo Airlines (NCA), provide airport-to-airport services. These operators principally source their air cargo traffic from International Air Transport Association (IATA) accredited air freight forwarders and third-party logistics providers, for example, DB Schenker, DHL Global Forwarding, and Panalpina. In addition, the major integrated carriers, such as DHL Express, FedEx, and United Parcel Service, also compete strongly in both the global air cargo and air express market segments;

- air cargo capacity can only be introduced in quite large increments. As previously noted, the major global air cargo carrying airlines operate dedicated freighter aircraft, with airlines, such as Cargolux, AirBridge Cargo Logic Air, Cargo Airlines, and Nippon Cargo Airlines, operating fleets of Boeing B747-400 or Boeing 747-8 freighter aircraft. The Boeing B747-400 freighter has a cargo payload of 121.9 tonnes, whilst the Boeing 747-8 freighter has a cargo payload of 132.6 tonnes [71,72]. The Boeing B777-200LRF freighter aircraft is operated by Emirates SkyCargo, Ethiopian Airlines, Etihad Airways, EVA Air Cargo, Korean Air Cargo, Lufthansa Cargo, and Turkish Air Cargo. The Boeing B777-200LRF has a cargo payload of 103.7 tonnes [73]. Cargolux, like other air cargo-carrying airlines, offers large volumes of air cargo capacity when it enters a new market. Thus, detailed planning and market analysis is required prior to deciding whether to add new or additional air cargo capacities;

- the fixed assets that are required by the actors competing in the global air cargo industry, such as aircraft, aircraft unit load devices, and air cargo terminals, can typically only grow in larger and fixed steps [70]. The major assets that Cargolux requires are aircraft, and these are carefully planned for. Air cargo handling at the carrier’s primary hub at Luxemburg Airport is outsourced to LuxairCARGO [74]. In addition, Cargolux’s cargo handling is contracted to cargo handling agents at the various airports that it services on a scheduled and non-scheduled basis. This cargo handling outsourcing strategy eliminates the requirement for Cargolux to invest in costly air cargo terminals, whilst also avoiding the staffing and operating costs associated with the provision of cargo handling services; and

- the barriers for exiting the air cargo market are rated as high. This is due to the specialized means of production (air cargo transportation), fixed costs associated with the retirement of aircraft, and governmental barriers [70]. This factor did not apply to Cargolux Airlines International as the airline is an active competitor in the global air cargo supply chains.

4.2.2. Barriers to Market Entry in the Global Air Cargo Supply Chain

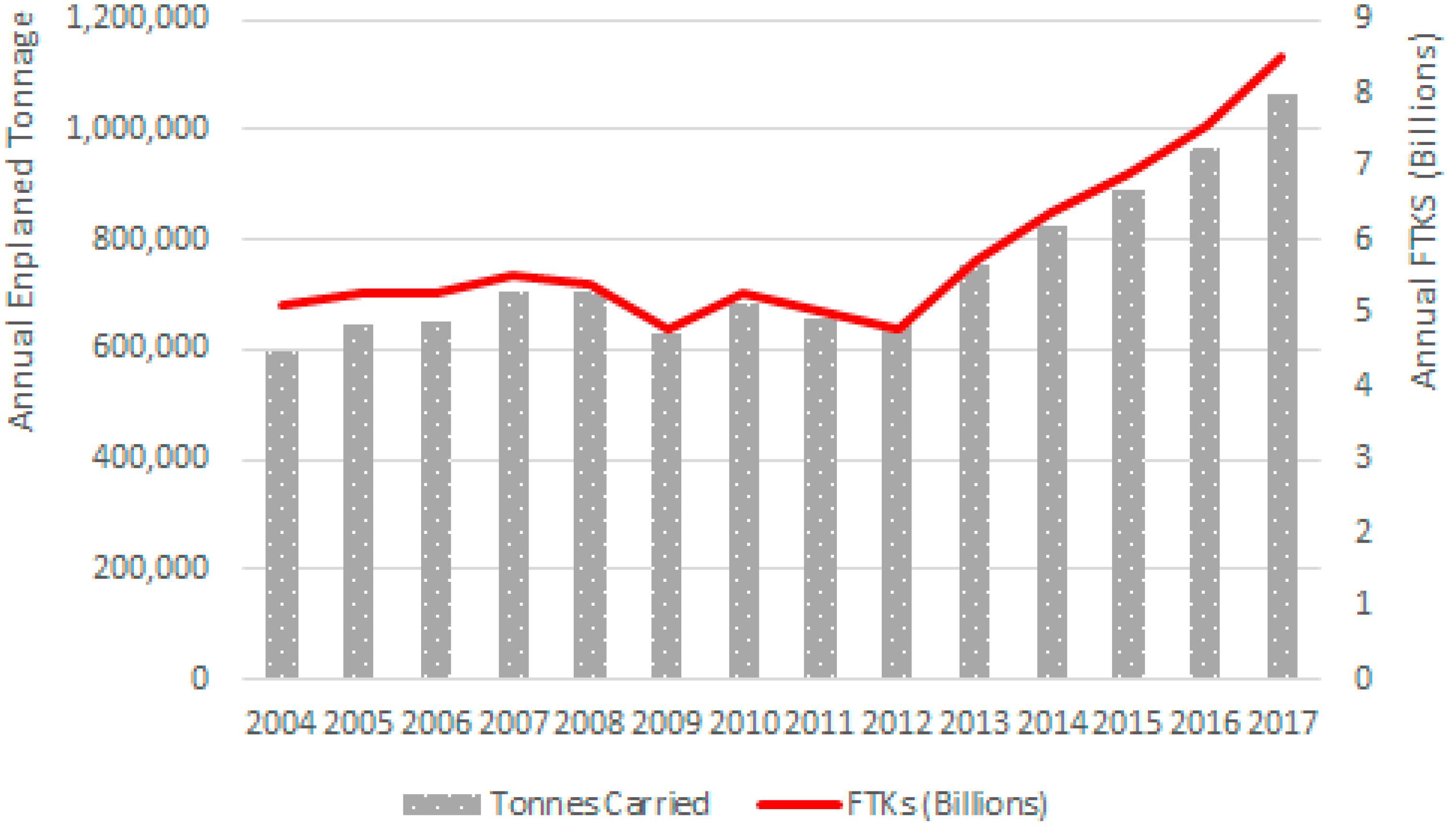

- Existing incumbent all cargo airlines realize economies of scale by over proportionally decreasing the total cost whilst, at the same time, increasing their production capacity, that is, freight tonne kilometres (FTKs) performed;

- the incumbent airlines may have already attained high brand recognition, intense customer loyalty, or similar marketing targets. For the new entrant to compete in the market, they must incur the costs associated with sales support, advertising, and other marketing initiatives. Cargolux has historically worked very closely with the freight forwarders, and hence, has a strong brand image and customer loyalty; and

- entry into the air cargo market requires substantial investment and capital. In terms of capital expenditure and costs incurred, the risk of a new cargo airline failing (sunk costs) presents a major hurdle for new market entrants [70] (p. 319).

4.2.3. Bargaining Power of Buyers

4.2.4. Bargaining Power of Suppliers

4.2.5. The Threat of Substitute Products in the Global Air Cargo Supply Chain

- Commodity mix effect: Higher growth of products that traditionally, and typically, were shipped by ocean freight versus those shipped by the air cargo mode;

- Value effect: There has been a higher growth of the lower end of a product, which has entailed the greater use of ocean freight; and

- Mode shift: This occurs when a product historically transported by the air cargo mode is shipped by ocean freight instead [89] (p. 5).

4.3. Cargolux Airlines’ Strategy

4.3.1. Cargolux Strengths in the Competitive Global Air Cargo Supply Chain

4.3.2. Cargolux Airlines’ International Differentiated Product and Service Range

4.3.3. Cargolux Italia

4.3.4. The Joint Sharing of Air Cargo Capacity with Alliance Partners

4.3.5. Cargolux International Airlines and Oman Air Strategic Cooperation Agreement

4.3.6. Cargolux International Airlines and Henan Civil Aviation and Investment Company (HNCA)

4.3.7. Cargolux 2025 Strategy

- Strategic Measures: The “Cargolux 2025 Strategy” emphasizes the airline having a flexible aircraft fleet that can take advantage of changing market conditions without incurring undue additional costs.

- Business Process Review: During 2017, Cargolux embarked on a company-wide transformation initiative to modernize work processes and to “future proof” the company, thereby ensuring its sustainability. This program contributes to job security and growth and includes training in more efficient work practices (lean). The Business Process Review is thus an important element within the Cargolux 2025 Strategy goals of digitalization and transformation. It highlights the workforce at every level of the organization as they identify small, incremental changes that can make a big difference to the organization. The Business Process Review ensures that Cargolux takes every available opportunity to strengthen the relationships with long-standing customers whilst also creating an unassailable value proposition for new ones.

- Digital Roadmap: An important tool of the Cargolux 2025 Strategy is a review program, which has mobilized staff and management to find better and even more productive methods for executing key business processes. The integrated digitalization of key business processes and the enhanced communication throughout the airline are welcomed by-products of this holistic and systematic review [69] (p. 60). Cargolux [69] (p. 60) have noted that “with each supply chain automation comes an even stronger connection with the customer”. The trend towards supply chain management (SCM) favours freighter aircraft over passenger airlines. This is because freighter aircraft can be more easily scheduled to satisfy the requirements of shippers, that is, for late night departures [170]. For air cargo shippers, services that are scheduled to depart in the late evening and at night tend to be more compatible with the firm’s daily production schedules [171].

4.4. Looking to the Future

5. Discussion

5.1. Findings

5.2. Study Limitations

5.3. Future Work

6. Conclusions

Funding

Conflicts of Interest

References

- International Air Transport Association. Air Cargo: Enabling Global Trade. Available online: https://www.iata.org/whatwedo/cargo/Pages/index.aspx (accessed on 22 November 2018).

- Baxter, G.S.; Bardell, N.S. Can the renewed interest in ultra-long-range passenger flights be satisfied by the current generation of civil aircraft? Aviation 2017, 21, 42–54. [Google Scholar] [CrossRef]

- Cook, G.N.; Billig, B. Airline Operations and Management: A Management Textbook; Routledge: Abingdon, UK, 2017. [Google Scholar]

- Dresner, M.; Zou, L. Air cargo and logistics. In Air Transport Management: An International Perspective; Budd, L., Ison, S., Eds.; Routledge: Abingdon, UK, 2017; pp. 247–264. [Google Scholar]

- Baxter, G.; Srisaeng, P.; Wild, G. The role of freighter aircraft in a full-service network airline air freight services: The case of Qantas Freight. Mag. Aviat. Dev. 2018, 6, 28–51. [Google Scholar] [CrossRef]

- Wensveen, J.G. Air Transportation A Management Perspective, 8th ed.; Routledge: Abingdon, UK, 2016. [Google Scholar]

- Boeing Commercial Airplanes. World Air Cargo Forecast 2016–2017. Available online: https://www.boeing.com/resources/boeingdotcom/commercial/about-our-market/cargo-market-detail-wacf/download-report/assets/pdfs/wacf.pdf (accessed on 22 November 2018).

- Air Cargo News. Top 25 Cargo Airlines: FedEx Leads the Pack while Qatar Edges Higher. Available online: https://www.aircargonews.net/news/single-view/news/top-25-cargo-airlines-fedex-leads-the-pack-while-qatar-edges-higher.html (accessed on 22 November 2018).

- Ahlstrom, D.; Bruton, G.D. International Management: Strategy and Culture in the Emerging World; South-Western Cengage Learning: Mason, OH, USA, 2010. [Google Scholar]

- Krassadaki, E.; Matsatsinis, N.F. Decision aiding process in the frame of the strategic farm management. In Operational Research in Business and Economics, Proceedings of the 4th International Symposium and 26th National Conference on Operational Research, Chania, Greece, 4–6 June 2015; Grigoroudis, E., Doumpos, M., Eds.; Springer International Publishing: Cham, Switzerland, 2017; pp. 113–144. [Google Scholar]

- Porter, M.E. Competitive Strategy: Techniques for Analyzing Industries and Competitors with a New Introduction; The Free Press: New York, NY, USA, 2008. [Google Scholar]

- Moon, H.C. Global Business Strategy: Asian Perspective; World Scientific Publishing: Singapore, 2010. [Google Scholar]

- Rice, J.F. Adaption of Porter’s Five Forces Model to Risk Management. Available online: http://www.dtic.mil/dtic/tr/fulltext/u2/a523879.pdf (accessed on 22 November 2018).

- Porter, M.E. How competitive forces shape strategy. In On Competition; Porter, M.E., Ed.; Harvard Business School Publishing: Boston, MA, USA, 1998; pp. 21–38. [Google Scholar]

- Hubbard, G.; Beamish, P. Strategic Management: Thinking, Analysis, Action; Pearson Education Australia: Sydney, Australia, 2011. [Google Scholar]

- Slater, S.F.; Olson, M.E. A fresh look at industry and market analysis. Bus. Horizons 2002, 45, 15–22. [Google Scholar] [CrossRef]

- Porter, M.E. The five competitive forces that shape strategy. Harv. Bus. Rev. 2008, 86, 78–93. [Google Scholar]

- Jones, S. A Summary of Michael Porter’s “The Five Competitive Forces That Shape Strategy. Available online: https://shannonjonesbranchingout.wordpress.com/2013/05/05/a-summary-of-the-five-competetive-forces-that-shape-strategy-michael-porter/ (accessed on 27 December 2018).

- Porter, M.E. How competitive forces shape strategy. In Strategy: Seeking and Securing Competitive Advantage; Harvard Business School Publishing: Boston, MA, USA, 1991; pp. 11–25. [Google Scholar]

- Farnham, D. Human Resource Management in Context: Insights, Strategy and Solutions; CIPD: London, UK, 2015. [Google Scholar]

- Chinhui, Y.; Dzever, S. Market development strategies of mobile communication operators in China: A comparative analysis of China Mobile and China Unicom. In The Economic Relations between Asia and Europe: Organisation, Trade and Investment; Andreosso-O’Callaghan, B., Bassino, J.P., Dzever, S., Jaussaud, J., Eds.; Chandos Publishing: Oxford, UK, 2007; pp. 207–224. [Google Scholar]

- Kotur, A.S. Developing a competitive wine tourism destination: A case study of vineyards in Maharashtra, India. In Evolving Paradigms in Tourism and Hospitality in Developing Countries: A case Study of India; Varghese, B., Ed.; Apple Academic Press: Oakville, ON, Canada, 2018; pp. 401–416. [Google Scholar]

- Porter, M.E. Competitive Strategy: Techniques for Analyzing Industries and Competitors; The Free Press: New York, NY, USA, 1980. [Google Scholar]

- Flouris, T.G.; Oswald, S.L. Designing and Executing Strategy in Aviation Management; Routledge: Abingdon, UK, 2016. [Google Scholar]

- Kling, J.A.; Smith, K.A. Identifying strategic groups in the U.S. airline industry: An application of the Porter model. Transp. J. 1995, 35, 26–34. [Google Scholar]

- Griffin, R.W. Fundamentals of Management, 5th ed.; Houghton Mifflin Company: Boston, MA, USA, 2008. [Google Scholar]

- Kenton, W. Competitive Advantage. Available online: https://www.investopedia.com/terms/c/competitive_advantage.asp (accessed on 28 December 2018).

- Grandy, G. Instrumental case study. In Encyclopedia of Case Study Research; Mills, A.J., Durepos, G., Wiebe, E., Eds.; SAGE Publications: Thousand Oaks, CA, USA, 2010; Volume 1, pp. 473–475. [Google Scholar]

- Stake, R.E. The Art of Case Study Research; SAGE Publications: Thousand Oaks, CA, USA, 1995. [Google Scholar]

- Stake, R.E. Qualitative case studies. In The SAGE Handbook of Qualitative Research; Denzin, N.K., Lincoln, Y.S., Eds.; SAGE Publications: Thousand Oaks, CA, USA, 2005. [Google Scholar]

- Doorewaard, H. Conceptional model: Causal model study. In Encyclopedia of Case Study Research; Mills, A.J., Durepos, G., Wiebe, E., Eds.; SAGE Publications: Thousand Oaks, CA, USA, 2010; Volume 1, pp. 202–203. [Google Scholar]

- Bryman, A. Social Research Methods, 4th ed.; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Rahim, A.R.; Baksh, M.S. Case study method for product development in engineer-to-order organisations. Work Study 2003, 52, 25–36. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research and Applications, 6th ed.; SAGE Publications: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- Baxter, G.; Srisaeng, P. Cooperating to compete in the global air cargo industry: The case of the DHL Express and Lufthansa Cargo A.G. Joint Venture Airline ‘AeroLogic’. Infrastructures 2018, 3, 7. [Google Scholar] [CrossRef]

- Baxter, G.; Srisaeng, P. The strategic deployment of the Airbus A350-900XWB aircraft in a full-service network carrier route network: The case of Singapore Airlines. Infrastructures 2018, 3, 25. [Google Scholar] [CrossRef]

- Ramon Gil-Garcia, J. Enacting Electronic Government Success: An Integrative Study of Government-Wide Websites, Organizational Capabilities, and Institutions; Springer Science-Business Media: New York, NY, USA, 2012. [Google Scholar]

- Simons, H. Case Study Research in Practice; SAGE Publications: London, UK, 2009. [Google Scholar]

- Oates, B.J. Researching Information Systems and Computing; SAGE Publications: London, UK, 2006. [Google Scholar]

- Chester, L. A rėgulationist analysis of an industry sector using mixed research methods. In Handbook of Research Methods and Applications in Heterodox Economics; Lee, F.S., Cronin, B., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2016; pp. 569–590. [Google Scholar]

- Fitzgerald, T. Documents and documentary analysis. In Methods in Educational Leadership and Management, 3rd ed.; Briggs, A.N.R.J., Coleman, M., Morrison, M., Eds.; SAGE Publications: London, UK, 2012; pp. 296–308. [Google Scholar]

- Love, P. Document analysis. In Research in the College Context: Approaches and Methods; Stage, F.K., Manning, K., Eds.; Brunner-Routledge: New York, NY, USA, 2003; pp. 83–96. [Google Scholar]

- Scott, J.; Marshall, G. A Dictionary of Sociology, 3rd ed.; Oxford University Press: New York, NY, USA, 2009. [Google Scholar]

- Fulcher, J.; Scott, J. Sociology, 4th ed.; Oxford University Press: Oxford, UK, 2011. [Google Scholar]

- Shrader-Frechette, K.; McCoy, E.D. Community ecology, population biology, and the method of case studies. In The Philosophy of Ecology: From Science to Synthesis; Keller, D.R., Golley, F.B., Eds.; University of Georgia Press: Athens, Greece, 2000; pp. 153–169. [Google Scholar]

- Van Schoor, B. Fighting Corruption Collectively: How Successful Are Sector-Specific Coordinated Governance Initiatives in Curbing Corruption; Springer: Wiesbaden, Germany, 2017. [Google Scholar]

- O’Leary, Z. The Essential Guide to Doing Research; SAGE Publications: London, UK, 2004. [Google Scholar]

- Morris, P.L. Triangulation. In The SAGE Encyclopedia of Communication Research Methods; SAGE Publications: Thousand Oaks, CA, USA, 2017; pp. 1781–1783. [Google Scholar]

- Green, W.; Swanborough, G. The Observer’s World Airlines and Airliners Directory; Frederick Warne & Co. Ltd.: London, UK, 1975. [Google Scholar]

- Sydow, J.; Schüßler, E.; Müller-Seitz, G. Managing Inter-Organizational Relations: Debates and Cases; Palgrave McMillan: London, UK, 2016. [Google Scholar]

- Buyck, C. Built for cargo. Air Transp. World 2004, 41, 26–28. [Google Scholar]

- Belson, J. Cargolux Airlines International. Flight Int. 1977, 112, 311–312. [Google Scholar]

- Nelms, D.W. Small base, big carrier. Air Transp. World 1996, 33, 88–90. [Google Scholar]

- Air Transport World. Cargo development award: Cargolux. Air Transp. World 1998, 35, 42–43. [Google Scholar]

- Ostrower, J. 747-8 freighter on the ‘home stretch’. Flight Int. 2011, 180, 9. [Google Scholar]

- Conway, P. Volume switch. Flight Int. 2012, 181, 28–29. [Google Scholar]

- Ostrower, J. 747-8F delivers second life to Jumbo. Flight Int. 2011, 180, 13. [Google Scholar]

- Boeing Commercial Airplanes. Boeing Delivers First 747-8 Freighter to Cargolux. News Release 12 October. Available online: http://boeing.mediaroom.com/2011-10-12-Boeing-Delivers-First-747-8-Freighter-to-Cargolux (accessed on 24 November 2018).

- Kesmodel, D. Cargolux to Take First Boeing 747-8 Wednesday, The Wall Street Journal, 12 October. Available online: https://www.wsj.com/articles/SB10001424052970203914304576627094033488846 (accessed on 24 November 2018).

- Cargolux Airlines International. Cargolux Takes Corporate Social Responsibility to the Next Level. News Release 3 May. Available online: http://www.cargolux.com/media-room/media-releases/media-releases (accessed on 24 November 2018).

- Bloomberg. Company Overview of Cargolux Airlines International S.A. Available online: https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=2991292 (accessed on 24 November 2018).

- Siren, J.; Irmov, K.; Stigaad, H.C.; Backman, F. Air cargo market development and business actions. In Air Cargo Role for Regional Development and Accessibility in the Baltic Sea Region; Beifert, A., Gerlitz, L., Prause, G., Eds.; Berliner Wissenschafts-Verlag: Berlin, Germany, 2014; pp. 151–185. [Google Scholar]

- Daley, B. Air Transport and the Environment; Routledge: Abingdon, UK, 2016. [Google Scholar]

- Cargolux Airlines International. Cargolux Annual Report 2006. Available online: http://paperjam.lu/sites/default/files/old-files/fichiers_contenus/rapports_annuels/2006/Cargolux_2006_GB.pdf (accessed on 24 November 2018).

- Cargolux Airlines International. Cargolux Annual Report 2008. Available online: http://paperjam.lu/sites/default/files/old-files/fichiers_contenus/rapports_annuels/2008/Cargolux_2008_GB.pdf (accessed on 24 November 2018).

- Cargolux Airlines International. Cargolux Annual Report 2010. Available online: http://paperjam.lu/sites/default/files/old-files/fichiers_contenus/rapports_annuels/2011/ar_2010_-_cargolux.pdf (accessed on 24 November 2018).

- Cargolux Airlines International. Cargolux Annual Report 2011. Available online: http://paperjam.lu/sites/default/files/old-files/fichiers_contenus/rapports_annuels/2012/cargoluxfinal_version_web.pdf (accessed on 24 November 2018).

- Cargolux Airlines International. Cargolux Annual Report 2015. Available online: http://paperjam.lu/sites/default/files/nodes/rapports_annuels/rapports/2017/08/cargolux_2015_en_0.pdf (accessed on 24 November 2018).

- Cargolux Airlines International. Cargolux Corporate Social Responsibility Report 2017. Available online: http://csr.cargolux.com/wp-content/uploads/2018/04/Cargolux_Sustainability_report_2017.pdf (accessed on 24 November 2018).

- Oedekoven, M. Air cargo management. In Introduction to Aviation Management; Wald, A., Fay, C., Gleich, R., Eds.; LIT-Verlag: Münster, Germany, 2010; pp. 309–327. [Google Scholar]

- Boeing Commercial Airplanes. 747-400 Airplane Characteristics for Airport Planning, Document Number D6-58326-1. Available online: http://www.boeing.com/resources/boeingdotcom/commercial/airports/acaps/747_4.pdf (accessed on 24 November 2018).

- Boeing Commercial Airplanes. 747-8 Airplane Characteristics for Airport Planning, Document Number D6-58326-3. Available online: http://www.boeing.com/assets/pdf/commercial/airports/acaps/747_8.pdf (accessed on 24 November 2018).

- Boeing Commercial Airplanes. 777-200LR/-300ER/-Freighter Airplane Characteristics for Airport Planning, Document Number D6-58329-2. Available online: http://www.boeing.com/assets/pdf/commercial/airports/acaps/777_2lr3er.pdf (accessed on 24 November 2018).

- Air Cargo World. Cargolux, Luxair Expand Animal Care Facilities. Available online: https://aircargoworld.com/allposts/cargolux-luxair-expand-animal-care-facilities/ (accessed on 24 November 2018).

- Knorr, A.; Arndt, A. Most low-cost airlines fail(ed): Why did Southwest Airlines prosper. In Competition Versus Predation in Aviation Markets: A Survey of Experience in North America, Europe and Australia; Forsyth, P., Gillen, D.W., Mayer, O.G., Niemeier, H.M., Eds.; Routledge: Abingdon, UK, 2018; pp. 145–172. [Google Scholar]

- Shaw, S. Airline Marketing and Management, 7th ed.; Ashgate Publishing: Farnham, UK, 2011. [Google Scholar]

- Senguttuvan, P.S. Principles of Airport Economics; Excel Books: New Delhi, India, 2007. [Google Scholar]

- Tretheway, M.W.; Andriulaitis, R.J. Airport competition for freight. In Airport Competition: The European Experience; Forsyth, P., Gillen, D., Mϋller, J., Niemeier, H.M., Eds.; Routledge: Abingdon, UK, 2016; pp. 137–147. [Google Scholar]

- Air Cargo News. Flexport Adds Scheduled Freighter Offering. Available online: https://www.aircargonews.net/news/freight-forwarder/single-view/news/flexport-adds-scheduled-freighter-offering.html (accessed on 24 November 2018).

- Mecham, M. Freight forward. Aviat. Week Space Technol. 2010, 172, 42–45. [Google Scholar]

- Norris, G. Closing in. Aviat. Week Space Technol. 2011, 173, 39–40. [Google Scholar]

- Boeing Commercial Airplanes. Cargolux Orders Two More Boeing 747-400 Freighters. Available online: https://boeing.mediaroom.com/1998-12-08-Cargolux-Orders-Two-More-Boeing-747-400-Freighters (accessed on 25 November 2018).

- Cargolux Airlines International. Introducing Cargolux. Available online: http://www.cargolux.com/about-us/profile/introducing-cargolux (accessed on 25 November 2018).

- Cargolux Airlines International. Road Feeder. Available online: http://www.cargolux.com/Our-Expertise/Road-Feeder (accessed on 25 November 2018).

- Xia, Y. A brief analysis of competition environment of air freight market at Kunming Airport. Adv. Mater. Res. 2012, 573–574, 293–297. [Google Scholar] [CrossRef]

- The Economist. New Rail Routes between China and Europe will Change Trade Patterns. Available online: https://www.economist.com/news/business/21728981-new-silk-railroad-will-challenge-airlines-and-shipping-firms-new-rail-routes-between-china (accessed on 25 November 2018).

- Leach, P.T. Shift to Ocean Erodes Air Cargo Market Share. Available online: https://www.joc.com/air-cargo/international-air-freight/shift-ocean-erodes-air-cargo-market-share_20140319.html (accessed on 25 November 2018).

- Air Cargo News. The Cost of Modal Shift. Available online: https://www.aircargonews.net/news/single-view/news/the-cost-of-modal-shift.html (accessed on 25 November 2018).

- Seabury Consulting. Mode Shift: Impact and How to Respond? Available online: https://www.iata.org/whatwedo/Documents/economics/modal-shift-cargo-mar14.pdf (accessed on 25 November 2018).

- van de Weg, R. Presentation at the Logistics Business Forum Luxembourg, 13 May 2013. Available online: https://www.cc.lu/uploads/media/Presentation_6_Robert_vd_Weg_Cargolux.pdf (accessed on 25 November 2018).

- Belobaba, P.P. Airline operating costs and measures of productivity. In The Global Industry; Belobaba, P., Odoni, A., Barnhart, C., Eds.; John Wiley & Sons: Chichester, UK, 2009; pp. 113–151. [Google Scholar]

- Goedeking, P. Networks in Aviation: Strategies and Structures; Springer-Verlag: Heidelberg, Germany, 2010. [Google Scholar]

- Hatum, A. Adaptation or Expiration in Family Firms: Organizational Flexibility in Emerging Economies; Edward Elgar Publishing: Cheltenham, UK, 2007. [Google Scholar]

- Volberda, H.W. Building the Flexible Firm: How to Remain Competitive; Oxford University Press: Oxford, UK, 1999. [Google Scholar]

- The Economist. Trends in the Air-Freight Business. Available online: https://www.economist.com/business/2017/04/14/trends-in-the-air-freight-business (accessed on 25 November 2018).

- International Air Transport Association. IATA Cargo Strategy. Available online: https://www.iata.org/whatwedo/cargo/Documents/cargo-strategy.pdf (accessed on 25 November 2018).

- Merkert, R.; Van de Voorde, E.; de Wit, J. Making or breaking—Key success factors in the air cargo market. J. Air Transp. Manag. 2017, 61, 1–5. [Google Scholar] [CrossRef]

- Scholz, A.B. Network Structures of Cargo Airlines: An Empirical and a Modelling Approach; KIT Scientific Publishing: Karlsruhe, Germany, 2012. [Google Scholar]

- Otto, A. Reflecting the prospects of an air cargo carrier. In Strategic Management in the Aviation Industry; Albers, S., Baum, H., Auerbach, S., Delfmann, W., Eds.; Routledge: Abingdon, UK, 2017; pp. 452–470. [Google Scholar]

- Kasilingam, R.G. Air cargo revenue management: Characteristics and perspectives. Eur. J. Oper. Res. 1997, 96, 36–44. [Google Scholar] [CrossRef]

- Baxter, G. AERO2426 Air Cargo Management and Operations Topic 2 Learning Guide: Air Cargo Market Characteristics; RMIT University: Melbourne, Australia, 2015. [Google Scholar]

- Cargolux Airlines International. Products Overview: CV Classic. Available online: http://www.cargolux.com/Our-Expertise/Product-Overview/CV-classic (accessed on 26 November 2018).

- Krause, K. All in good time. Traffic World 1998, 256, 51–52. [Google Scholar]

- Sudalaimuthu, S.; Raj, S.A. Logistics Management for International Businesses: Text and Cases; PHI Private Learning: New Delhi, India, 2009. [Google Scholar]

- Cargolux Airlines International. Products Overview: CV Select. Available online: http://www.cargolux.com/Our-Expertise/Product-Overview/CV-select (accessed on 26 November 2018).

- Cargolux Airlines International. Products Overview: CV Select+. Available online: http://www.cargolux.com/Our-Expertise/Product-Overview/CV-select2 (accessed on 26 November 2018).

- Thompson, J.F.; Bishop, C.F.H.; Brecht, P.E. Air Transport of Perishable Products; University of California: Oakland, CA, USA, 2004. [Google Scholar]

- Baxter, G.; Kourousis, K. Temperature controlled aircraft unit load devices: The technological response to growing global air cargo cool chain requirements. J. Technol. Manag. Innov. 2015, 10, 157–172. [Google Scholar] [CrossRef]

- Cargolux Airlines International. Products Overview: CV Fresh. Available online: http://www.cargolux.com/Our-Expertise/Product-Overview/CV-fresh (accessed on 26 November 2018).

- Air Cargo World. Pharma market: Poised for growth. Air Cargo World 2013, 16, 32–35. [Google Scholar]

- Ramanujam, V. Pharma transport by air: Delivering the modern world. ACAAI News 2013, 4, 9–11. [Google Scholar]

- Sales, M. The Air Logistics Handbook: Air Freight and the Global Supply Chain; Routledge: Abingdon, UK, 2013. [Google Scholar]

- Haan, G.H.; van Hillegersberg, J.; de Jong, E.; Sikkel, K. Adoption of wireless sensors in supply chains: A process view analysis of a pharmaceutical cold chain. J. Theor. Appl. Electron. Commer. Res. 2013, 8, 138–154. [Google Scholar]

- Cargolux Airlines International. Products Overview: CV Pharma. Available online: http://www.cargolux.com/Our-Expertise/Product-Overview/CV-pharma (accessed on 26 November 2018).

- Air Cargo World. Animal trade. Air Cargo World 2006, 96, 6. [Google Scholar]

- Ball, L. Animal kingdom. Air Cargo World 2015, 105, 28–32. [Google Scholar]

- Woods, R. When pigs (and horses) fly: Demand rises for customized live animal transport. Air Cargo World 2017, 107, 28–30. [Google Scholar]

- Solomon, A. Few pets experience trouble on airlines. Air Cargo World 2013, 103, 23. [Google Scholar]

- Cargolux Airlines International. Products Overview: CV Alive. Available online: http://www.cargolux.com/Our-Expertise/Product-Overview/CV-alive (accessed on 26 November 2018).

- Vyshehirsky, V. Heavy-lift air transportation. In The Air Logistics Handbook: Air Freight and the Global Supply Chain; Sales, M., Ed.; Routledge: Abingdon, UK, 2013; pp. 139–151. [Google Scholar]

- Cargolux Airlines International. Products Overview: CV Jumbo. Available online: http://www.cargolux.com/Our-Expertise/Product-Overview/CV-jumbo# (accessed on 26 November 2018).

- Cargolux Airlines International. Products Overview: CV Precious. Available online: http://www.cargolux.com/Our-Expertise/Product-Overview/CV-precious (accessed on 26 November 2018).

- Cargolux Airlines International. Products Overview: CV Power. Available online: http://www.cargolux.com/Our-Expertise/Product-Overview/CV-power (accessed on 26 November 2018).

- Cargolux Airlines International. Products Overview: CV Hazmat. Available online: http://www.cargolux.com/Our-Expertise/Product-Overview/CV-hazmat (accessed on 26 November 2018).

- AirBridge Cargo. abc XL Oversize. Available online: https://www.airbridgecargo.com/en/page/19/abc-xl (accessed on 28 December 2018).

- AirBridge Cargo. abc Pharma. Available online: https://www.airbridgecargo.com/en/page/20/abc-pharma (accessed on 28 December 2018).

- AirBridge Cargo. abc DG. Available online: https://www.airbridgecargo.com/en/page/21/abc-dg (accessed on 28 December 2018).

- AirBridge Cargo. abc extraSAFE. Available online: https://www.airbridgecargo.com/en/page/101/abc-extrasafe (accessed on 28 December 2018).

- AirBridge Cargo. abc Care. Available online: https://www.airbridgecargo.com/en/page/22/abc-care (accessed on 28 December 2018).

- AirBridge Cargo. abc Fresh. Available online: https://www.airbridgecargo.com/en/page/24/abc-fresh (accessed on 28 December 2018).

- AirBridge Cargo. abc Valuable. Available online: https://www.airbridgecargo.com/en/page/81/abc-valuable (accessed on 28 December 2018).

- CargoLogic Air. We Offer a Range of Solutions for Specific Types of Air Cargo Which Require the Highest Levels of Service Quality. Available online: https://www.cargologicair.com/our-services/ (accessed on 28 December 2018).

- Nippon Cargo Airlines. Products & Service: NCA Express. Available online: https://www.nca.aero/e/service/transport/nca_express.html (accessed on 28 December 2018).

- Nippon Cargo Airlines. Products & Service: NCA Freight. Available online: https://www.nca.aero/e/service/transport/nca_freight.html (accessed on 28 December 2018).

- Nippon Cargo Airlines. Products & Service: NCA Super Sensitive. Available online: https://www.nca.aero/e/service/transport/nca_super.html (accessed on 28 December 2018).

- Nippon Cargo Airlines. Products & Service: NCA Sensitive. Available online: https://www.nca.aero/e/service/transport/nca_sensitive.html (accessed on 28 December 2018).

- Nippon Cargo Airlines. Products & Service: NCA Space. Available online: https://www.nca.aero/e/service/transport/nca_space.html: (accessed on 28 December 2018).

- Nippon Cargo Airlines. Products & Service: NCA Cool. Available online: https://www.nca.aero/e/service/transport/nca_cool.html (accessed on 28 December 2018).

- Nippon Cargo Airlines. Products & Service: NCA Art. Available online: https://www.nca.aero/e/service/transport/nca_art.html (accessed on 28 December 2018).

- Nippon Cargo Airlines. Products & Service: NCA Vehicle. Available online: https://www.nca.aero/e/service/transport/nca_vehicle.html (accessed on 28 December 2018).

- Nippon Cargo Airlines. Products & Service: NCA Thermo+. Available online: https://www.nca.aero/e/service/transport/nca_thermo.html (accessed on 28 December 2018).

- Polar Air Cargo Worldwide. Products and Services: Polar Priority Plus. Available online: http://www.polaraircargo.com/polar-priority-express.html (accessed on 28 December 2018).

- Polar Air Cargo Worldwide. Products and Services: Polar X. Available online: http://www.polaraircargo.com/polar-priority-services.html (accessed on 28 December 2018).

- Polar Air Cargo Worldwide. Products and Services: General Cargo. Available online: http://www.polaraircargo.com/general-cargo.html (accessed on 28 December 2018).

- Polar Air Cargo Worldwide. Products and Services: Special Cargo. Available online: http://www.polaraircargo.com/special-requirements.html (accessed on 28 December 2018).

- Air Cargo World. Cargolux adds an Italian wing for more lift. Air Cargo World 2009, 99, 8–9. [Google Scholar]

- Payload Asia. EUROPE & CIS: Cargolux Italia Begins HK Services. Available online: http://www.payloadasia.com/europe-cis-cargolux-italia-begins-hk-services/ (accessed on 26 November 2018).

- Payload Asia. Cargolux, Cargolux Italia Receive AEO Status. Available online: http://www.payloadasia.com/cargolux-cargolux-italia-receive-aeo-status/ (accessed on 26 November 2018).

- Urquhart, D. Cargolux Italia in Partnership with Japan’s NCA. Available online: http://www.payloadasia.com/cargolux-italia-in-partnership-with-japans-nca/ (accessed on 26 November 2018).

- Cargolux Italia. Profile: Introducing Cargolux. Available online: http://www.cargolux-italia.com/about-us/profile/introducing-cargolux (accessed on 26 November 2018).

- Nelson, C. Emirates SkyCargo to Expand Operations with Cargolux Airlines Tie-Up. Available online: https://www.thenational.ae/business/emirates-skycargo-to-expand-operations-with-cargolux-airlines-tie-up-1.34591 (accessed on 26 November 2018).

- King, L. Cargolux, Emirates SkyCargo ink novel-and puzzling airfreight deal. Air Cargo World 2017, 107, 15. [Google Scholar]

- Kaminiski-Morrow, D. Cargolux shares load with Emirates. Flight Int. 2017, 191, 13. [Google Scholar]

- Cheng-Jui Lu, A. International Airline Alliances: EC Competition Law/US Antitrust Law and International Air Transport; Kluwer Law International: The Hague, The Netherlands, 2003. [Google Scholar]

- Air Cargo News. Emirates Signs Codeshare with Cargolux. Available online: https://www.aircargonews.net/news/airline/single-view/news/emirates-signs-codeshare-with-cargolux.html (accessed on 26 November 2018).

- Livingston, C. Emirates, Cargolux Sign Air Cargo Codeshare Agreement. Available online: https://aircargoworld.com/allposts/emirates-cargolux-sign-air-cargo-codeshare-agreement/ (accessed on 26 November 2018).

- Cargolux Airlines International. Cargolux & Nippon Cargo Airlines Sign Cooperation Agreement. Available online: http://www.cargolux.com/media-room/Articles/cargolux-nippon-cargo-airlines-sign-cooperation-agreement (accessed on 26 November 2018).

- Cargolux Airlines International. Cargolux Completes Cooperation Agreement with Oman Air: Agreement Includes New Services to India, Media Release 10 March 2015. Available online: http://www.cargolux.com/media-room/media-releases/media-releases/archives-2015/cargolux-completes-cooperation-agreement-with-oman-air (accessed on 26 November 2018).

- Ball, L. Cargolux to India via Oman. Air Cargo World 2015, 105, 19. [Google Scholar]

- Cargolux Airlines International. Cargolux and Oman Air Extended Indian Freighter Network to Mumbai, Media Release 19 February 2016. Available online: http://www.cargolux.com/media-room/media-releases/media-releases/archives-2016/cargolux-and-oman-air-extended-indian-freighter-network-to-mumbai (accessed on 26 November 2018).

- Woods, R. Oman Air extends reach with Cargolux, SmartKargo. Air Cargo World 2016, 106, 15–16. [Google Scholar]

- Air Cargo Week. Joint Venture Agreed between Cargolux and Oman Air. Available online: https://www.aircargoweek.com/joint-venture-agreed-between-cargolux-and-oman-air/ (accessed on 26 November 2018).

- Pleasant, T. Chinese walls. Aviat. Week Space Technol. 2014, 176, 57–58. [Google Scholar]

- Wen, W. Henan Aviation Firm to Take Stake in Cargolux. Available online: http://usa.chinadaily.com.cn/business/2013-12/10/content_17164743.htm (accessed on 26 November 2018).

- Woods, R. Cargolux to expand service in China, Japan, Italy. Air Cargo World 2015, 105, 15. [Google Scholar]

- Air Cargo World. Cargolux starts off HNCA partnership with new route. Air Cargo World 2014, 104, 13. [Google Scholar]

- Harris, D. Cargolux’s dual-hub strategy pays off. Air Cargo World 2016, 19, 8. [Google Scholar]

- Air Cargo Week. Cargolux passes one million tonnes and has a record year. Air Cargo Week 2018, 21, 10. [Google Scholar]

- Cargolux Airlines International. Best year in history for the Cargolux Group, Media Release 25 April 2018. Available online: http://www.cargolux.com/media-room/media-releases/media-releases/best-year-in-history-for-cargolux-group (accessed on 27 November 2018).

- Bowen, J.T. The Economic Geography of Air Transportation: Space, Time, and the Freedom of the Sky; Routledge: Abingdon, UK, 2010. [Google Scholar]

- Bowen, J.T. The geography of freighter aircraft operations in the Pacific Basin. J. Transp. Geogr. 2004, 12, 1–11. [Google Scholar] [CrossRef]

- Boeing Commercial Airplanes. World Air Cargo Forecast 2018–2037. Available online: https://www.boeing.com/resources/boeingdotcom/commercial/about-our-market/cargo-market-detail-wacf/download-report/assets/pdfs/2018_WACF.pdf (accessed on 28 December 2018).

- Kapadia, S. Boeing: Air Cargo Growth Will Double Over 20 Years. Available online: https://www.supplychaindive.com/news/boeing-air-cargo-double-20-years/540240/ (accessed on 28 December 2018).

- Hui, G.W.L.; Hui, Y.V.; Zhang, A. Analyzing China’s air cargo flows and data. J. Air Transp. Manag. 2004, 10, 125–135. [Google Scholar] [CrossRef]

- Yuan, X.M.; Low, J.M.W.; Tang, L.C. Roles of the airport and logistics services on the outcomes of an air cargo supply chain. Int. J. Prod. Econ. 2010, 127, 215–225. [Google Scholar] [CrossRef]

- Kupfer, F.; Kessels, R.; Goos, P.; Van de Voorde, E.; Verhetsel, A. The origin–destination airport choice for all-cargo aircraft operations in Europe. Transp. Res. E. 2016, 87, 53–74. [Google Scholar] [CrossRef]

- Potter, A. Air cargo in the United Kingdom. In Global Logistics and Supply Chain Management; Mangan, J., Lalwani, C., Eds.; John Wiley & Sons: Chichester, UK, 2016; pp. 244–248. [Google Scholar]

| Publication | Publication Period | Source |

|---|---|---|

| Air Cargo World | 2001–2018 | EBSCO Host |

| Air Transport World | 1991–2017 | Proquest Central |

| Airline Business | 2002–2018 | Proquest Central |

| Aviation Week & Space Technology | 1991–2018 | Aviation Week & Space Technology |

| Cargo Airports & Services | 2011–2018 | Cargo Airports & Services |

| Flight International | 2004–2018 | Proquest Central |

| Journal of Air Transport Management | 1994–2018 | Elsevier Science Direct Journals |

| Payload Asia | 2015–2018 | Payload Asia |

| Market Segment | AirBridgeCargo Airlines | CargoLogic Air | Cargolux Airlines International | Nippon Cargo Airlines | Polar Air Cargo Worldwide |

|---|---|---|---|---|---|

| Aerospace & AOG 1 | x | ✓ | x | x | ✓ |

| Art Works | ✓ | x | x | ✓ | x |

| General | ✓ | ✓ | ✓ | ✓ | ✓ |

| Express | ✓ | ✓ | ✓ | ||

| Hazardous | ✓ | x | ✓ | x | ✓ |

| Humanitarian aid | x | ✓ | x | x | x |

| Live animals | ✓ | x | ✓ | x | ✓ |

| Oil & Gas | x | ✓ | x | x | x |

| Perishables | ✓ | ✓ | ✓ | ✓ | ✓ |

| Power 2, | x | x | ✓ | x | ✓ |

| Oversize | ✓ | x | ✓ | ✓ | ✓ |

| Pharmaceuticals | ✓ | ✓ | ✓ | ✓ | ✓ |

| Valuables | ✓ | x | ✓ | x | x |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Baxter, G. A Strategic Analysis of Cargolux Airlines International Position in the Global Air Cargo Supply Chain Using Porter’s Five Forces Model. Infrastructures 2019, 4, 6. https://doi.org/10.3390/infrastructures4010006

Baxter G. A Strategic Analysis of Cargolux Airlines International Position in the Global Air Cargo Supply Chain Using Porter’s Five Forces Model. Infrastructures. 2019; 4(1):6. https://doi.org/10.3390/infrastructures4010006

Chicago/Turabian StyleBaxter, Glenn. 2019. "A Strategic Analysis of Cargolux Airlines International Position in the Global Air Cargo Supply Chain Using Porter’s Five Forces Model" Infrastructures 4, no. 1: 6. https://doi.org/10.3390/infrastructures4010006

APA StyleBaxter, G. (2019). A Strategic Analysis of Cargolux Airlines International Position in the Global Air Cargo Supply Chain Using Porter’s Five Forces Model. Infrastructures, 4(1), 6. https://doi.org/10.3390/infrastructures4010006