Cooperating to Compete in the Global Air Cargo Industry: The Case of the DHL Express and Lufthansa Cargo A.G. Joint Venture Airline ‘AeroLogic’

Abstract

:1. Introduction

2. Background

2.1. Joint Venture Partnerships

2.2. The Motivations for Forming Joint Venture Partnerships

2.3. Joint Venture Success Factors

2.4. Joint Ventures in the Global Air Cargo Industry

2.5. Past Failures of Air Cargo Alliances

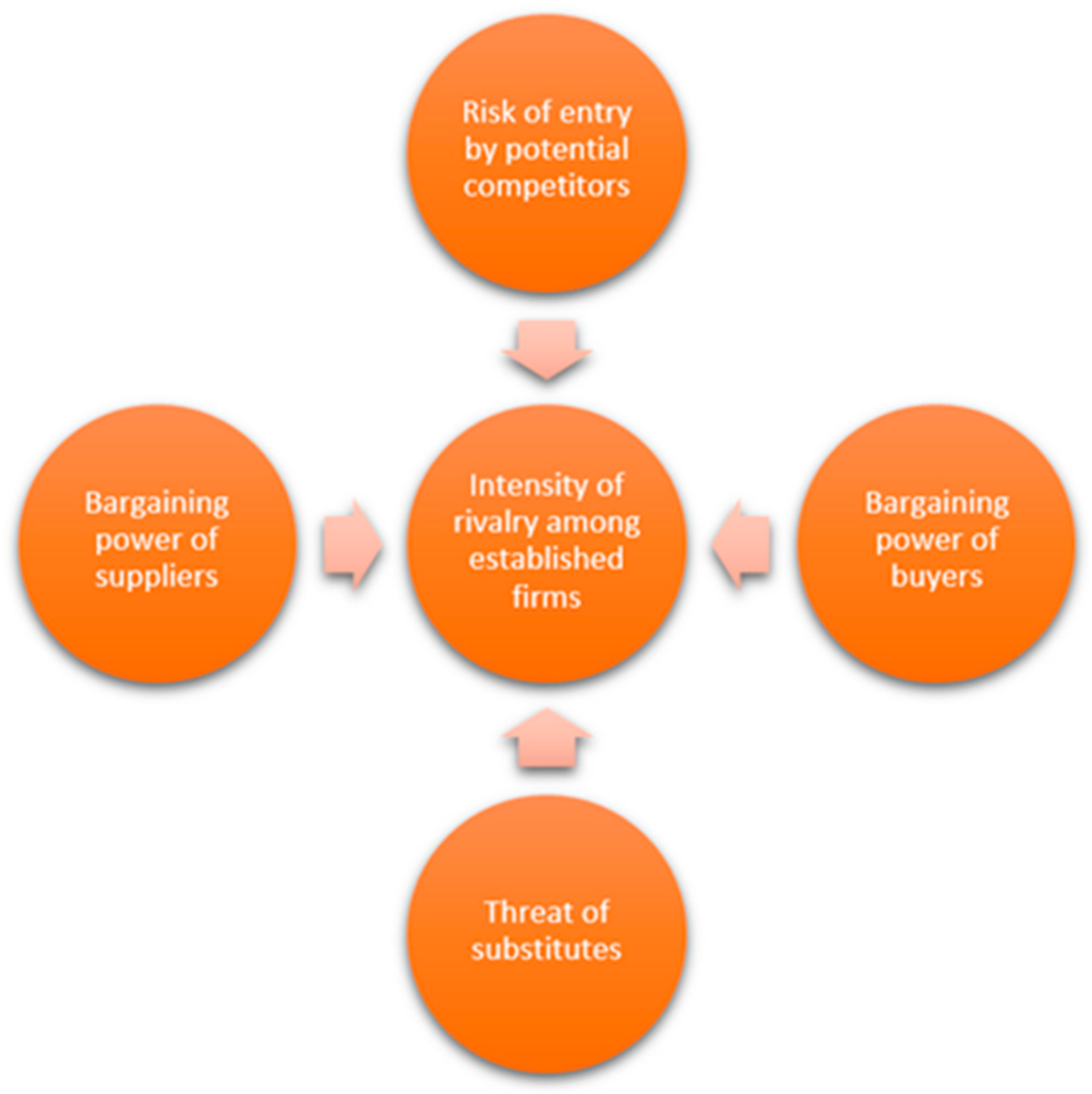

2.6. Porters Five Forces Model

2.6.1. Threat of New Market Entrants

- 1.

- Economies of scale: these economies deter entry by forcing the new entrant to enter the market on a large scale or to accept a cost disadvantage.

- 2.

- Product differentiation: brand identification creates a market entry barrier by forcing new entrants to invest heavily to overcome customer loyalty. Advertising, customer service, being first in the industry and differences in products and services are among the factors fostering brand identification.

- 3.

- Capital requirements: the requirement to invest large financial resources to compete in the market creates a barrier to market entry, especially if the capital is required for unrecoverable expenditures on advertising or research and development.

- 4.

- Cost disadvantages independent of firm size: entrenched incumbents may enjoy cost advantages that are not available to potential competitors, no matter what their size and attainable economies of scale.

- 5.

- Access to distribution channels: the new market entrant must secure distribution of their product or service. In some cases this barrier is so high that, to surmount it, a new entrant must create its own distribution channels.

- 6.

- Government policy: the government can restrict, or even foreclose, entry to industries through controls, such as, license requirements, controls on air and water pollution, and safety regulations [54] (pp. 13–15).

2.6.2. Bargaining Power of Suppliers

- It is dominated by a few firms and is more concentrated than the industry it sells to.

- Its product is unique or at least differentiated, or if switching costs have been built up. Switching costs are fixed costs that buyers confront in changing suppliers.

- It is not obliged to contend with other products for sale to the industry.

- It poses a credible threat of integrating forward into the industry’s business.

- The industry is not an important customer of the supplier group [54] (pp. 16–17).

2.6.3. Bargaining Power of Buyers

- It is concentrated or purchases in large volumes. Large-volume buyers are especially powerful forces if heavy fixed costs characterise the industry.

- The products that the buyer group acquires from the standard or undifferentiated.

- The products or services that the group purchases from the industry form a component of its product and represents a significant fraction of its cost. The buyers are most likely to look for favourable prices and purchase selectively.

- It earns low profits, which creates the incentive to lower its purchasing cost.

- The industry’s product is considered unimportant to the quality of the buyers’ product or services

- The industry’s product does not save the buyer money.

- The buyers pose a credible threat of integrating backward to produce the industry’s product [54] (p. 17).

2.6.4. Threat of Substitutes

2.6.5. Intensity of Rivalry among Established Firms

- There are numerous competitors or competitors are of approximately the same size and power.

- Industry growth is slow. This precipitates competition for market share amongst expansion-minded members.

- The product or service lacks differentiation or switching costs, which secure buyers and protect one incumbent from attacks its customer from another rival.

- There are high fixed costs and the product is perishable, creating a strong temptation to reduce prices.

- Capacity is typically introduced in large increments.

- Exit barriers are high. High exit barriers can keep firms competing even though they may be earning low or possibly even negative returns on their investment [54] (pp. 20–21).

3. Research Method

3.1. Research Approach

3.2. Data Collection

3.3. Document Analysis Process

4. Case Study Results

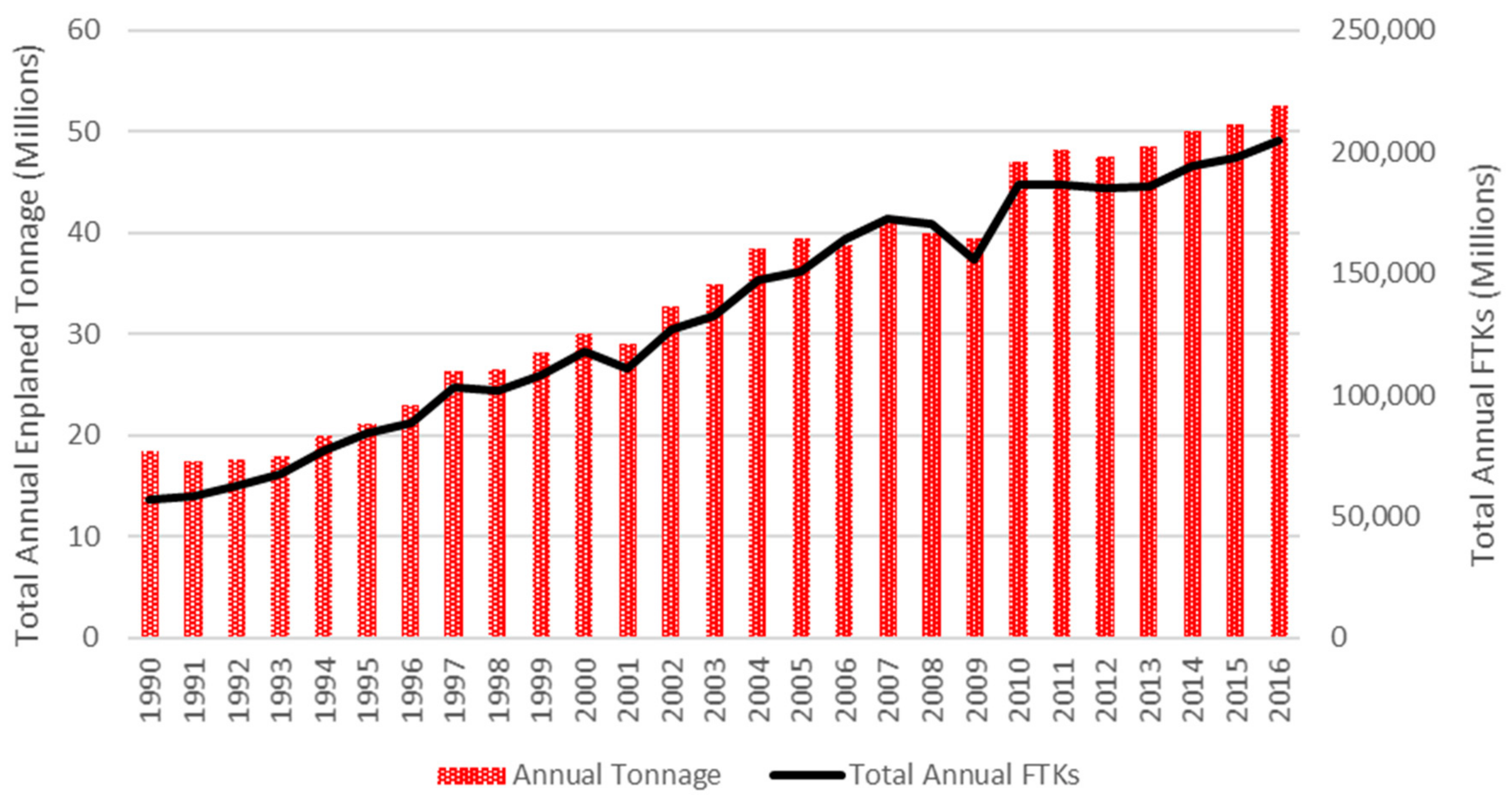

4.1. The Global Air Cargo and Express Industry: A Background Note

4.2. A Brief Background of the AeroLogic Joint Venture Partners

4.2.1. DHL Express

4.2.2. Lufthansa Cargo AG

- handling counts GmbH (100%)

- Jettainer GmbH (100%)

- time:matters GmbH (100%)

- AeroLogic GmbH (50%)

- Lufthansa Cargo Servicios Logísticos de Mexico, S.A. DE C.V. (100%)

- Shenzhen Airport Int’l Cargo Terminal (ICCS) (50%)

- Airmail Center Frankfurt GmbH (40%)

- Shanghai, China-based Shanghai Pudong International Airport Cargo Terminal Co. Ltd. (PACTL) (29%) [106]

4.3. The Origin and Evolution of the AeroLogic Joint Venture

4.4. The Core Elements of AeroLogic’s Business Model

4.4.1. AeroLogic’s Freighter Aircraft Type and Fleet Requirements

4.4.2. Location of the AeroLogic Operational Base

- Sufficient airside apron parking space to accommodate aircraft up to International Civil Aviation Organization (ICAO) Category F (Apron 2, Apron 3). Note: Apron 2 can accommodate up to six Category F aircraft;

- World Cargo Centre (20,000 square metres) with direct access to Apron 2 (located in the airport security area);

- Close proximity to motorway and main roads;

- Railway ramp and track;

- Veterinary/Plant Border Inspection Post; and

- Animal Export Centre [146].

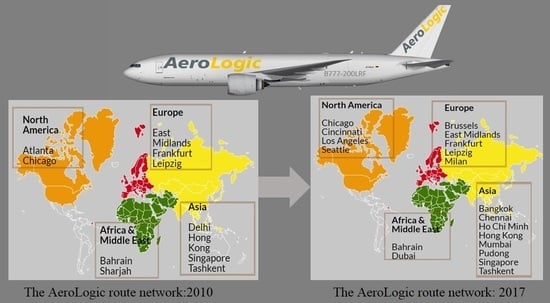

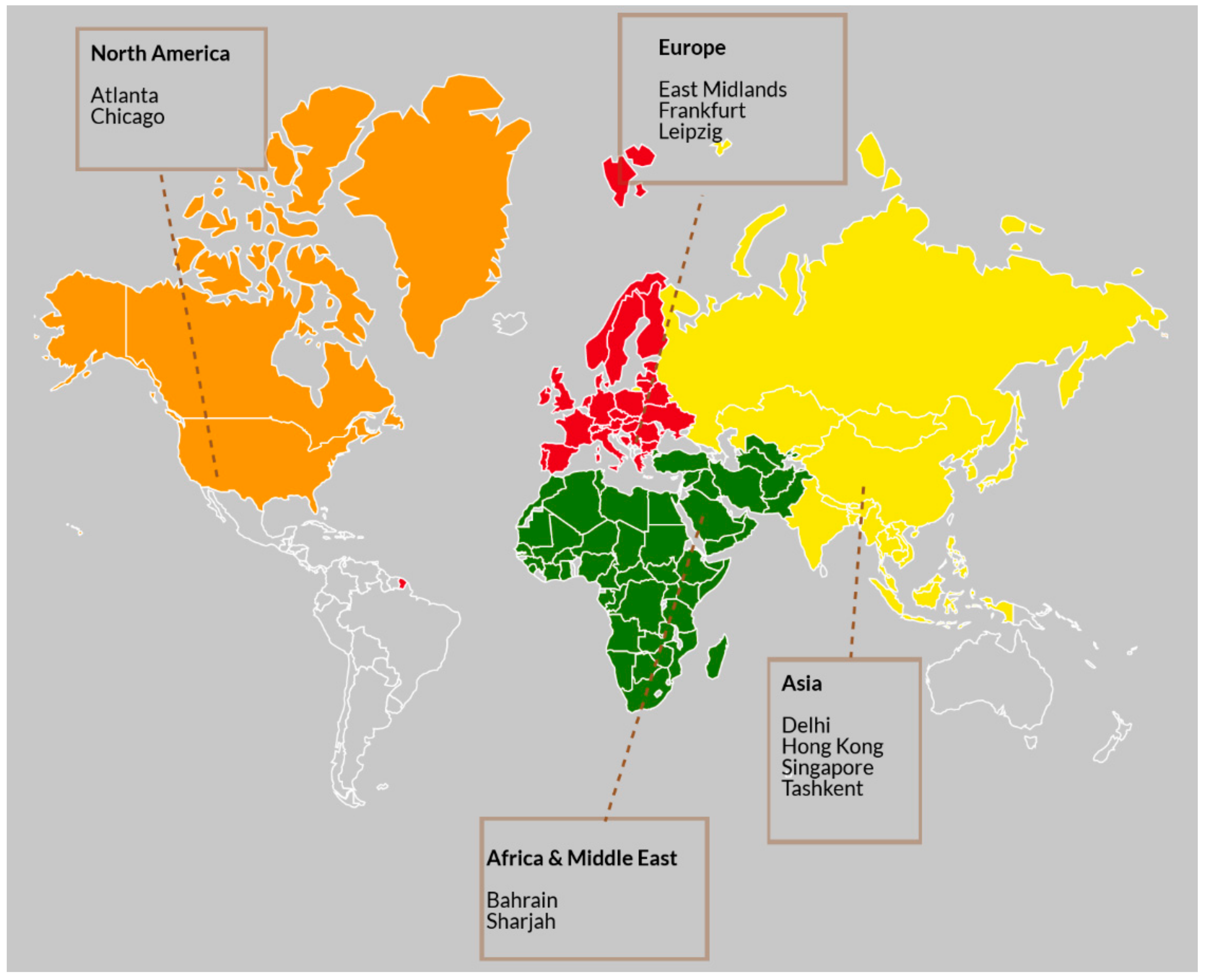

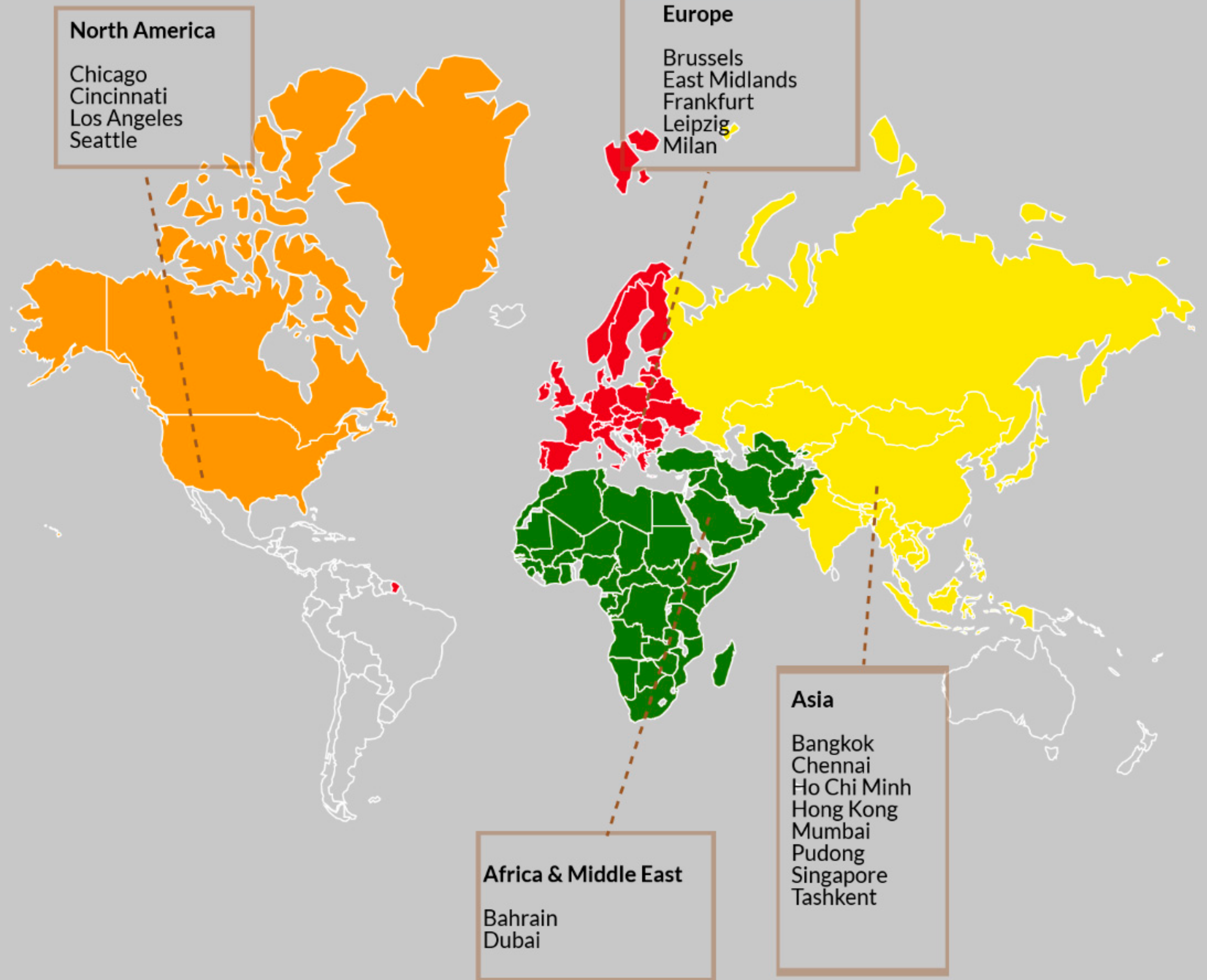

4.4.3. AeroLogic’s Route Network

4.4.4. AeroLogic’s Product

4.4.5. AeroLogic’s Distribution Strategy

4.4.6. AeroLogic’s Staff

4.4.7. AeroLogic’s Strategy

4.5. The Application of Porter’s Five Forces Model to the AeroLogic Joint Venture

4.5.1. Intensity of Rivalry among Established Firms in the Global Air Cargo Market

- There are many similar competitors active in the market. These carriers operate virtually the same aircraft type and their business models are comparable at a worldwide level [175]. Both the combination passenger airlines and the dedicated all-cargo airlines principally provide airport-to-airport services, and they source their traffic from air freight forwarders. In contrast, AeroLogic only acts as a linehaul carrier for its two JV partners, so its business model is quite different to the other incumbent airlines in the global air cargo industry.

- Air cargo capacity can only be introduced in quite large increments [175]. As previously noted, the major air cargo carrying airlines typically operate dedicated freighter aircraft, with airlines such as Cargolux, Nippon Cargo Airlines, and AirBridge Cargo Airlines operating fleets of Boeing B747-400 freighter or Boeing 747-8F freighters. These aircraft have a commercial payload of around 121.9 and 132.6 tonnes, respectively [179,180]. Other airlines, such as Etihad, Lufthansa Cargo, and Korean Air operate the Boeing B777-200LRF, which has a commercial payload of 103.7 tons [181]. Once again, AeroLogic has a competitive advantage in that its capacity is strategically deployed to satisfy the JV partners’ requirements. Additionally, it only transports cargo on their behalf, so the size of the fleet is tailored to meet the volumes of cargoes generated by the two JV partners.

- The fixed assets that are required by actors to compete in the global air cargo industry, such as aircraft, air cargo terminals, and office buildings, can usually only grow in larger and fixed steps [175]. Aerologic, once again, enjoys an advantage as its fleet size and aircraft type is tailored to satisfy the JV partner requirements. As the airline only transports the JV partners’ cargo on an airport-to-airport basis, it is not directly affected by the necessity for larger air cargo terminals as the JV partners take delivery of the cargoes directly from the aircraft. In contrast, both the combination and dedicated all-cargo airlines contract their cargo handling services to dedicated cargo handling companies [4] and, thus, adequate and efficient facilities are required to accommodate future growth and sustain the airline desired cargo service quality standards. The integrated carriers, such as FedEx and United Parcel Service (UPS) operate cargo terminals at their major and min-hubs, and contract cargo handling services at other airports.

- The barriers to market exit in the air cargo industry are high [175,182] due to the specialized means of production (aircraft), high fixed costs associated with the retirement of aircraft, and other government barriers [175]. Additionally, it can be quite difficult to sell large freighter aircraft [182].

4.5.2. Barriers to Market Entry in the Global Air Cargo Industry

- Existing incumbent all cargo airlines realize economies of scale by over proportionally decreasing the total cost whilst, at the same time, increasing their production capacity, that is, freight tonne kilometres (FTKs) performed;

- The incumbent carriers may have already attained high brand recognition, intense customer loyalty, or similar marketing targets. For the new entrant to compete in the market, then they must incur the costs for sales support, advertising, and other marketing initiatives; and

- Entry into the air cargo market requires substantial investment and capital. In terms of capital expenditure and costs incurred, the risk of a new cargo airline failing (sunk costs) presents a major hurdle for new market entrants [175] (p. 319).

4.5.3. Bargaining Power of Suppliers

4.5.4. Bargaining Power of Buyers

4.5.5. Threat of Substitute Products

4.6. The Strategic Benefits for the Two Partners from the AeroLogic Joint Venture

5. Conclusions

Author Contributions

Conflicts of Interest

References

- Royer, S.; Simons, R. Evolution of cooperation and dynamics of expectations—Implications of strategic alliances. Int. J. Strateg. Bus. Alliances 2009, 1, 73–88. [Google Scholar] [CrossRef]

- Conway, P. Forced marriages. Airl. Bus. 1999, 15, 54–58. [Google Scholar]

- Frampton, P. Where is air cargo heading? Insight 1997, 5, 22–27. [Google Scholar]

- Morrell, P.S. Moving Boxes by Air: The Economics of International Cargo; Routledge: Abingdon, UK, 2016. [Google Scholar]

- Zhang, A.; Hui, Y.V.; Leung, L.; Cheung, W.; Hui, Y.V. Air Cargo in Mainland China and Hong Kong; Ashgate Publishing: Aldershot, UK, 2004. [Google Scholar]

- Geloso Grosso, M.; Shepherd, B. Liberalising Air Cargo Services in APEC, Working Paper October 2009. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.493.9699&rep=rep1&type=pdf (accessed on 17 November 2017).

- Zhang, A.; Lang, C.; Hui, Y.V.; Leung, L. Intermodal alliance and rivalry of transport chains: The air cargo market. Transp. Res. E 2007, 43, 234–246. [Google Scholar] [CrossRef]

- Grönlund, P.; Skoog, R. Drivers of alliance formation in the air cargo business. In Strategic Management in the Aviation Industry; Delfmann, W., Baum, H., Auerbach, S., Albers, S., Eds.; Routledge: Abingdon, UK, 2016; pp. 473–487. [Google Scholar]

- Sowinski, L.L. Air cargo looks for ‘Open Skies’. World Trade 2007, 20, 24–26. [Google Scholar]

- Scott, W.R.; Davis, G.F. Organizations and Organizing: Rational, Natural and Open Systems Perspectives; Routledge: Abingdon, UK, 2016. [Google Scholar]

- Ekin, A.C.; King, T.R. A struggling international partnership: TNK-BP joint venture. Int. J. Strateg. Bus. Alliances 2009, 1, 89–106. [Google Scholar] [CrossRef]

- Ginter, P.M.; Duncan, W.J.; Swayne, L.E. The Strategic Management of Health Care Organizations, 7th ed.; Jossey-Bass: San Francisco, CA, USA, 2013. [Google Scholar]

- Johnson, S.A.; Houston, M.B. A reexamination of the motives and gains in joint ventures. J. Financ. Quant. Anal. 2000, 35, 67–85. [Google Scholar] [CrossRef]

- Shishido, Z.; Fukuda, M.; Umetani, M. Joint Venture Strategies: Design, Bargaining, and the Law; Edward Elgar Publishing: Cheltenham, UK, 2015. [Google Scholar]

- Morais, L. Joint Ventures and EU Competition Law; Hart Publishing: Oxford, UK, 2013. [Google Scholar]

- Hill, C.W.L.; Jones, G.R.; Schilling, M.A. Strategic Management: Theory: An Integrated Approach; Cengage Learning: Stamford, CT, USA, 2015. [Google Scholar]

- Kazmi, A. Strategic Management and Business Policy, 3rd ed.; Tata-McGraw Hill Publishing: New Delhi, India, 2008. [Google Scholar]

- Spulber, D.F. Economics and Management of Competitive Strategy; World Scientific Publishing: Singapore, 2009. [Google Scholar]

- Yan, Y. International Joint Ventures in China: Ownership, Control and Performance; Macmillan Press: London, UK, 2000. [Google Scholar]

- Hewitt, L. Joint Ventures, 3rd ed.; Sweet & Maxwell: London, UK, 2005. [Google Scholar]

- Harrison, J.S. Alternative to merger-Joint ventures and other strategies. Long Range Plan. 1987, 20, 78–83. [Google Scholar] [CrossRef]

- Kogut, B. Knowledge, Options, and Institutions; Oxford University Press: Oxford, UK, 2008. [Google Scholar]

- Yan, A.; Luo, Y. International Joint Ventures: Theory and Practice; Routledge: Abingdon, UK, 2015. [Google Scholar]

- Beamish, P.W.; Lupton, N.C. Managing joint ventures. Acad. Manag. Perspect. 2009, 23, 75–94. [Google Scholar] [CrossRef]

- Kukalis, S.; Jungemann, M. Strategic planning for a joint venture. Long Range Plan. 1995, 28, 4–57. [Google Scholar] [CrossRef]

- Hisrich, R.D.; Manimala, M.J.; Peters, M.P.; Shepherd, D.A. Entrepreneurship, 9th ed.; McGraw-Hill Education: New Delhi, India, 2012. [Google Scholar]

- Hisrich, R.D.; Peters, M.P.; Shepherd, D.A. Entrepreneurship, 6th ed.; McGraw-Hill Professional: New York, NY, USA, 2005. [Google Scholar]

- Harris, P.; McDonald, F. European Business and Marketing, 2nd ed.; SAGE Publications Ltd.: London, UK, 2004. [Google Scholar]

- Ott, U.F. International Joint Ventures: An Interplay of Cooperative and Noncooperative Games under Incomplete Information; Palgrave-Macmillan: Basingstoke, UK, 2006. [Google Scholar]

- Glaister, K.W.; Husan, R.; Buckley, P.J. Strategic Business Alliances: An Examination of the Core Dimensions; Edward Elgar Publishing: Cheltenham, UK, 2004. [Google Scholar]

- Altinay, L.; Paraskevas, A.; Jang, S.C. Planning Research in Hospitality and Tourism, 2nd ed.; Routledge: Abingdon, UK, 2016. [Google Scholar]

- Airlines International. Strategizing for Success. Available online: http://airlines.iata.org/analysis/joint-ventures-help-airlines-deliver-choice-to-consumers (accessed on 27 January 2018).

- Lufthansa Cargo. ANA and Lufthansa Cargo Successfully Launch Air Cargo Joint Venture. Available online: https://lufthansa-cargo.com/-/lhc-press-media-details-2014-page1-2 (accessed on 27 January 2018).

- Cargo Airports & Airline Services. United Airlines and Lufthansa Cargo Announce Cargo Joint Venture Agreement. Available online: http://www.caasint.com/single-post/2017/04/19/United-Airlines-and-Lufthansa-Cargo-Announce-Cargo-Joint-Venture-Agreement (accessed on 27 January 2018).

- Abeyratne, R. Convention on International Civil Aviation: A Commentary; Springer International Publishing: Cham, Switzerland, 2014. [Google Scholar]

- Oduntan, G. Sovereignty and Jurisdiction in Airspace and Outer Space: Legal Criteria for Spatial Delimitation; Routledge: Abingdon, UK, 2012. [Google Scholar]

- Oum, T.H.; Yu, C. Winning Airlines: Productivity and Cost Competitiveness of the World’s Major Airlines; Transportation, Research, Economics and Policy, Volume 6; Kluwer Academic Publishers: Norwell, MA, USA, 1998. [Google Scholar]

- Rochat, P. The challenges of the future for the International Civil Aviation Organization. In Handbook of Airline Economics; Jenkins, D., Ed.; McGraw-Hill: New York, NY, USA, 1995; pp. 55–61. [Google Scholar]

- Wang, Z. The impact of market liberalization on the formation of airline alliances. J. Air Transp. 2002, 7, 25–52. [Google Scholar]

- Doganis, R. The Airline Business, 2nd ed.; Routledge: Abingdon, UK, 2005. [Google Scholar]

- Ustaömer, T.C.; Durmaz, V.; Lei, Z. The effect of joint ventures on airline competition: The case of American airlines, British airways and Iberia joint business. Procedia Soc. Behav. Sci. 2015, 210, 430–439. [Google Scholar] [CrossRef]

- Wang, S.W. Do global airline alliances influence the passenger’s purchase decision? J. Air Transp. Manag. 2014, 37, 53–59. [Google Scholar] [CrossRef]

- Oum, T.H.; Park, J.H.; Kim, K.; Yu, C. The effect of horizontal alliances on firm productivity and profitability: Evidence from the global airline industry. J. Bus. Res. 2004, 57, 844–853. [Google Scholar] [CrossRef]

- Scholz, A.B. Network Structures of Cargo Airlines: An Empirical and Modelling Approach; KIT Scientific Publishing: Karlsruhe, Germany, 2012. [Google Scholar]

- Conway, P.; Kingsley-Jones, M. New era for Lufthansa-DHL. Airl. Bus. 2008, 24, 25. [Google Scholar]

- Holloway, S. Straight and Level: Practical Airline Economics, 3rd ed.; Routledge: Abingdon, UK, 2016. [Google Scholar]

- Air Cargo World. Cargo Alliances Await Technology. Available online: https://aircargoworld.com/allposts/cargo-alliances-await-technology-6721/ (accessed on 19 November 2017).

- Conway, P. Selective customers. Airl. Bus. 2003, 19, 62–64. [Google Scholar]

- Conway, P. Team work. Airl. Bus. 2004, 20, 58–59. [Google Scholar]

- Ahlstrom, D.; Bruton, G.D. International Management: Strategy and Culture in the Emerging World; South-Western Cengage Learning: Mason, OH, USA, 2010. [Google Scholar]

- Krassadaki, E.; Matsatsinis, N.F. Decision aiding process in the frame of the strategic farm management. In Operational Research in Business and Economics, Proceedings of the 4th International Symposium and 26th National Conference on Operational Research, Chania, Greece, 4–6 June 2015; Grigoroudis, E., Doumpos, M., Eds.; Springer International Publishing: Cham, Switzerland, 2017; pp. 113–144. [Google Scholar]

- Porter, M.E. Competitive Strategy: Techniques for Analyzing Industries and Competitors with a New Introduction; The Free Press: New York, NY, USA, 2008. [Google Scholar]

- Rice, J.F. Adaption of Porter’s Five Forces Model to Risk Management. Available online: http://www.dtic.mil/dtic/tr/fulltext/u2/a523879.pdf (accessed on 30 January 2018).

- Porter, M.E. How competitive forces shape strategy? In Strategy: Seeking and Securing Competitive Advantage; Montgomery, C.A., Porter, M.E., Eds.; Harvard Business School Publishing: Moston, MA, USA; pp. 11–25.

- Hill, C.W.L.; Jones, G.R. Essentials of Strategic Management, 2nd ed.; South-Western: Mason, OH, USA, 2009. [Google Scholar]

- Dawes Farquhar, J. Case Study Research for Business; SAGE Publications: London, UK, 2012. [Google Scholar]

- Yin, R.K. Case Study Research: Design and Methods, 6th ed.; SAGE Publications: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- Rahim, A.R.; Baksh, M.S. Case study method for new product development in engineer-to-order organisations. Work Study 2003, 52, 25–36. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods, 4th ed.; SAGE Publications: Thousand Oaks, CA, USA, 2009. [Google Scholar]

- Remenyi, D.; Williams, B.; Money, A.; Swartz, E. Doing Research in Business and Management: An Introduction to Process and Method; SAGE Publications: London, UK, 2010. [Google Scholar]

- Ang, S.H. Research Design for Business & Management; SAGE Publications: London, UK, 2014. [Google Scholar]

- Simons, H. Case Study Research in Practice; SAGE Publications: London, UK, 2009. [Google Scholar]

- Ramon Gil-Garcia, J. Enacting Electronic Government Success: An Integrative Study of Government-Wide Websites, Organizational Capabilities, and Institutions; Springer Science-Business Media: New York, NY, USA, 2012. [Google Scholar]

- Chester, L. A rėgulationist analysis of an industry sector using mixed research methods. In Handbook of Research Methods and Applications in Heterodox Economics; Lee, F.S., Cronin, B., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2016; pp. 569–590. [Google Scholar]

- Fitzgerald, T. Documents and documentary analysis. In Research Methods in Educational Leadership and Management, 3rd ed.; Briggs, A.N.R.J., Coleman, M., Morrison, M., Eds.; SAGE Publications: London, UK, 2012; pp. 296–308. [Google Scholar]

- Love, P. Document analysis. In Research in the College Context: Approaches and Methods; Stage, F.K., Manning, K., Eds.; Brunner-Routledge: New York, NY, USA, 2003; pp. 83–96. [Google Scholar]

- Scott, J.; Marshall, G. A Dictionary of Sociology, 3rd ed.; Oxford University Press: Oxford, UK, 2009. [Google Scholar]

- Kridel, C. An Introduction to Documentary Research. Available online: http://www.aera.net/SIG013/Research-Connections/Introduction-to-Documentary-Research (accessed on 30 January 2018).

- Scott, J. A Matter of Record: Documentary Sources in Social Research; Polity Press: Cambridge, UK, 1990. [Google Scholar]

- Scott, J. Documents, types of. In The SAGE Encyclopedia of Social Science Research Methods; Lewis-Beck, M.S., Bryman, A.E., Futing Liao, T., Eds.; SAGE Publications: Thousand Oaks, CA, USA, 2004; pp. 281–284. [Google Scholar]

- O’Leary, Z. The Essential Guide to doing Research; SAGE Publications: London, UK, 2004. [Google Scholar]

- Van Schoor, B. Fighting Corruption Collectively: How Successful Are Sector-Specific Coordinated Governance Initiatives in Curbing Corruption; Springer VS: Wiesbaden, Germany, 2017. [Google Scholar]

- Morris, P.L. Triangulation. In The SAGE Encyclopedia of Communication Research Methods; Allen, M., Ed.; SAGE Publications: Thousand Oaks, CA, USA, 2017; pp. 1781–1783. [Google Scholar]

- International Air Transport Association. Air Cargo: Enabling Global Trade. Available online: http://www.iata.org/whatwedo/cargo/Pages/index.aspx (accessed on 22 November 2017).

- Dahl, R.V. Freighter aircraft: Outlook uncertain. Aviat. Week Space Technol. 2001, 156, 55–58. [Google Scholar]

- Dahl, R.V. Outlook improving for freighter aircraft. Aviat. Week Space Technol. 2003, 13, 58–61. [Google Scholar]

- Dahl, R.V. Turbulence in the cargo arena. Aviat. Week Space Technol. 2010, 25, 82–86. [Google Scholar]

- Belobaba, PP. Introduction and overview. In The Global Airline Industry, 2nd ed.; Belobaba, P., Odoni, A., Barnhart, C., Eds.; John Wiley & Sons: Chichester, UK; pp. 1–18.

- Airlines for America®. World Airlines Traffic and Capacity. Available online: http://airlines.org/dataset/world-airlines-traffic-and-capacity/ (accessed on 20 November 2017).

- Kupfer, F.; Meersman, H.; Onghena, E.; Van de Voorde, E. World air cargo and merchandise trade. In Critical Issues in Air Transport Economics and Business; Macário, R., Van de Voorde, E., Eds.; Routledge: Abingdon, UK, 2011; pp. 98–111. [Google Scholar]

- Leinbach, T.R.; Bowen, J.T. Air cargo services and the electronics industry in Southeast Asia. J. Econ. Geogr. 2004, 4, 299–321. [Google Scholar] [CrossRef]

- Hui, G.W.L.; Hui, Y.V.; Zhang, A. Analyzing China’s air cargo flows and data. J. Air Transp. Manag. 2004, 10, 125–135. [Google Scholar] [CrossRef]

- Dahl, R.V. Expansion seen for air cargo industry. Aviat. Week Space Technol. 2001, 15, 59–64. [Google Scholar]

- Yuan, X.M.; Low, J.M.W.; Tang, L.C. Roles of the airport and logistics services on the outcomes of an air cargo supply chain. Int. J. Prod. Econ. 2010, 127, 215–225. [Google Scholar] [CrossRef]

- Boeing Commercial Airplanes. World Air Cargo Forecast 2016–2017. Available online: http://www.boeing.com/resources/boeingdotcom/commercial/about-our-market/cargo-market-detail-wacf/download-report/assets/pdfs/wacf.pdf (accessed on 20 November 2017).

- Kupfer, F.; Kessels, R.; Goos, P.; Van de Voorde, E.; Verhetsel, A. The origin–destination airport choice for all-cargo aircraft operations in Europe. Transp. Res. E 2016, 87, 53–74. [Google Scholar] [CrossRef]

- Doganis, R. Flying off Course: Airline Economics and Marketing, 4th ed.; Routledge: London, UK, 2010. [Google Scholar]

- Air Cargo News. Top 25 Cargo Airlines: FedEx Maintains Top Spot But ABC and Qatar on the Up. Available online: http://www.aircargonews.net/news/single-view/news/top-25-cargo-airlines-fedex-maintains-top-spot-but-abc-and-qatar-on-the-up.html (accessed on 22 November 2017).

- Fox, M.C. Disintegrative Power Structures in Australian Export Airfreight Chains. Ph.D. Thesis, Griffith University, Brisbane, Australia, 2011. [Google Scholar]

- Forster, P.; Regan, A. Electronic Integration in the air cargo industry: An information processing model of on-time performance. Transp. J. 2001, 40, 46–61. [Google Scholar]

- Hallsworth, A.G.; Taylor, M.J. The transport sector and protected postal services: Regulating the activities of Purolator Courier Services in Canada. Transp. Policy 1999, 6, 159–168. [Google Scholar] [CrossRef]

- Taylor, M.; Hallsworth, A. Power relations and market transformation in the transport sector: The example of the courier services industry. J. Transp. Geogr. 2000, 8, 237–247. [Google Scholar] [CrossRef]

- Nelms, D.W. Holding its own. Air Transp. World 1996, 33, 151–154. [Google Scholar]

- Lefer, H. Getting there first. Air Transp. World 1991, 28, 81–82. [Google Scholar]

- Lobo, I.; Zairi, M. Competitive benchmarking in the air cargo industry: Part I. Benchmarking 1999, 6, 164–190. [Google Scholar] [CrossRef]

- Eaton, J. The crazy economics of air freight. Intereconomics 1994, 29, 33–37. [Google Scholar] [CrossRef] [Green Version]

- Mecham, M. DHL International extends worldwide network. Aviat. Week Space Technol. 1992, 137, 32. [Google Scholar]

- Hill, L. Pushing the envelope. Air Transp. World 2003, 40, 57–60. [Google Scholar]

- DHL Express. About Us: DHL. Logistics for the Connected Age. Available online: https://www.logistics.dhl/au-en/home/about-us.html (accessed on 22 November 2017).

- Deutsche Post DHL Group. Constantly Re-Inventing the Future of Logistics 2016 Annual Report. Available online: http://www.dpdhl.com/content/dam/dpdhl/Investors/Events/Reporting/2017/FY2016/DPDHL_2016_Annual_Report.pdf (accessed on 22 November 2017).

- Hill, L. Lufthansa chairman and CEO Jürgen Weber. Air Transp. World 2003, 40, 47–48. [Google Scholar]

- Spinler, S.; Huchzermeier, A.; Kleindorfer, P.R. An options approach to enhance economic efficiency in a dyadic supply chain. In Cost Management in Supply Chains; Seuring, S., Goldbach, M., Eds.; Springer: Berlin/Heidelberg, Germany, 2002; pp. 350–360. [Google Scholar]

- Bruch, H.; Sattelberger, T. The turnaround at Lufthansa: Learning from the change process. J. Chang. Manag. 2000, 1, 344–363. [Google Scholar] [CrossRef]

- Nelms, D.W. Lufthansa cargo on its own. Air Transp. World 1996, 33, 68. [Google Scholar]

- Lufthansa Cargo AG. About Us. Available online: https://lufthansa-cargo.com/meta/meta/company/about-us (accessed on 22 November 2017).

- Lufthansa Cargo AG. Facts & Figures. Available online: https://lufthansa-cargo.com/documents/20184/29414/Facts-Figures_30Mrz17_e.pdf/4975b3dc-0c90-8bbc-3e93-bfee8dbb582e (accessed on 22 November 2017).

- Lufthansa Cargo AG. Hubs & Service Center. Available online: https://lufthansa-cargo.com/network/hubs-service-center (accessed on 22 November 2017).

- Gallagher, T.L. Lufthansa, Austrian Airlines Create Joint Cargo Unit. Journal of Commerce Online, 27 May 2010. Available online: http://www.joc.com/air-cargo/lufthansa-austrian-airlines-create-joint-cargo-unit_20100527.html (accessed on 22 November 2017).

- Lufthansa Group. Annual Report 2016. Available online: https://irpages2.equitystory.com/download/companies/Lufthansa/Annual%20Reports/DE0008232125-JA-2016-EQ-E-00.pdf (accessed on 22 November 2017).

- Parker, J.; Krause, K.S. Towards the world crown. Traffic World 2000, 262, 11–12. [Google Scholar]

- Turney, R. Maybe mega. Air Cargo World 2004, 94, 14–16. [Google Scholar]

- Putzger, I. Gateway in the making. J. Commer. 2007, 8, 32–33. [Google Scholar]

- Flottau, J.; Taverna, M.A. Air Logic. Aviat. Week Space Technol. 2004, 160, 47. [Google Scholar]

- Siegmund, H. AeroLogic High Wide & Handsome, Air Cargo News, Volume 8, No. 65. Available online: http://www.aircargonews.com/090619/FT090619.html (accessed on 21 November 2017).

- AeroLogic GMBH. Profile: AeroLogic has Established Itself as a Powerful Cargo Airline. Available online: https://www.aerologic.aero/profile (accessed on 22 November 2017).

- Karp, A. Lufthansa, DHL to Launch AeroLogic Joint Venture Next Year, Air Transport World Online, 29 January 2008. Available online: http://atwonline.com/aircraft-amp-engines/lufthansa-dhl-launch-aerologic-cargo-jv-next-year (accessed on 22 November 2017).

- Whyte, R.; Lohmann, G. Airline business models. In Air Transport Management: An International Perspective; Budd, L., Ison, S., Eds.; Routledge: Abingdon, UK, 2017; pp. 107–121. [Google Scholar]

- Cook, G.N.; Billig, B. Airline Operations and Management: A Management Textbook; Routledge: Abingdon, UK, 2017. [Google Scholar]

- Moorman, R.W. Choosing the fleet. Air Cargo World 2007, 97, 32–37. [Google Scholar]

- Shaw, S. Airline Marketing and Management, 7th ed.; Ashgate Publishing: Farnham, UK, 2011. [Google Scholar]

- Shaw, S. Effective Air Freight Marketing; Hyperion Books: London, UK, 1993. [Google Scholar]

- Hatton, R. Complexities of air cargo vis-à-vis air finance: The economics of wide-body freighter aircraft. In Handbook of Airline, Finance; Butler, G.F., Keller, M.R., Eds.; McGraw-Hill: New York, NY, USA, 1999; pp. 535–542. [Google Scholar]

- AeroLogic GMBH. Profile: The Most Modern Air Freighter Fleet in Europe. Available online: https://www.aerologic.aero/fleet (accessed on 22 November 2017).

- Norris, G. Kings of cargo. Flight Int. 2006, 169, 36–38. [Google Scholar]

- Clark, J.S.; Kirwan, K.D. 777 Freighter: Efficiency for long-haul operators. AERO Mag. 2009, 2, 5–9. [Google Scholar]

- Conway, P. Decline of the jumbo? Airl. Bus. 2005, 21, 62–63. [Google Scholar]

- Flottau, J. Team spirit. Aviat. Week Space Technol. 2008, 168, 43. [Google Scholar]

- AeroLogic GmbH. AeroLogic Ready for Take-off with Low Emission Aircraft. Available online: http://parcelindustry.com/article-1213-Aerologic-Ready-for-Take-Off-with-Low-Emission-Aircraft.html (accessed on 22 November 2017).

- Barnard, B. Lufhansa, DHL Launch Joint Cargo Airline. Journal of Commerce Online, 19 June 2009. Available online: http://www.joc.com/air-cargo/lufthansa-dhl-launch-joint-cargo-airline_20090619.html (accessed on 20 November 2017).

- Barnard, B. AeroLogic Takes Delivery of First Freighter. Journal of Commerce Online, 14 May 2009. Available online: https://www.joc.com/air-cargo/aerologic-takes-delivery-first-freighter_20090514.html (accessed on 20 November 2017).

- Baxter, G.; Kourousis, K. Temperature controlled aircraft unit load devices: The technological response to growing global air cargo cool chain requirements. J. Technol. Manag. Innov. 2015, 10, 157–172. [Google Scholar] [CrossRef]

- Clark, P. Buying the Big Jets: Fleet Planning for Airlines, 3rd ed.; Routledge: Abingdon, UK, 2017. [Google Scholar]

- Lennane, A. Cargo calling. Airfinance J. 2008, 309, 23. [Google Scholar]

- Turney, R. Virtual air. Air Cargo World 2008, 98, 13–15. [Google Scholar]

- Aero News Network. Lufthansa Cargo/DHL Express JV AeroLogic to Operate Boeing 777 Freighters. Available online: http://www.aero-news.net/getmorefromann.cfm?do=main.textpost&id=6e3b2981-80ea-411b-aead-4ea87445d98d (accessed on 22 November 2017).

- Segal, S. Boeing delivers first 777F to AeroLogic. Airfinance Journal, 10 May 2009. [Google Scholar]

- Barnard, B. Eastern flow. J. Commer. 2008, 9, 22–26. [Google Scholar]

- Turney, R. Choosing Leipzig. Air Cargo World 2004, 94, 2–14. [Google Scholar]

- Field, A.M. Jump-starting the Trabant. J. Commer. 2008, 9, 32–36. [Google Scholar]

- Shippers Today. DHL Opens New European Hub in Leipzig. Available online: http://info.hktdc.com/shippers/vol31_4/vol31_4_air04.htm (accessed on 22 November 2017).

- Power, A. Cities for a Small Continent: International Handbook of City Recovery; Policy Press: Bristol, UK, 2016. [Google Scholar]

- Urquhart, D. Leipzig-Halle leapfrogs into the big time. Payload Asia 2009, 25, 32–33. [Google Scholar]

- Leipzig/Halle Airport. Cargo: Infrastructure. Available online: https://www.leipzig-halle-airport.de/en/business-and-partners/cargo/infrastructure-182.html (accessed on 22 November 2017).

- Leipzig/Halle Airport. Leipzig/Halle Airport: Driving Force in a Region in the Centre of Europe. Available online: https://www.leipzig-halle-airport.de/mediapool/company_profile_leipzig_halle_airport_july_2013.pdf (accessed on 22 November 2017).

- Putzger, I. Lufthansa’s zero-risk growth for 2009. Air Cargo World 2008, 98, 24–27. [Google Scholar]

- Leipzig/Halle Airport. Leipzig/Halle Airport: Europe’s Dynamic Cargo Hub. Available online: https://www.leipzig-halle-airport.de/mediapool/cargo-praesentation.pdf (accessed on 22 November 2017).

- Otto, A. Reflecting the prospects of an air cargo carrier. In Strategic Management in the Aviation Industry; Delfmann, W., Baum, H., Auerbach, S., Albers, S., Eds.; Routledge: Abingdon, UK, 2017; pp. 451–472. [Google Scholar]

- Cento, A. The Airline Industry: Challenges in the 21st Century; Springer: Berlin/Heidelberg, Germany, 2009. [Google Scholar]

- Holloway, S. Changing Planes: A Strategic Management Perspective on an Industry in Transition, Volume Two: Strategic Choice, Implementation, and Outcome; Ashgate Publishing: Aldershot, UK, 1998. [Google Scholar]

- AeroLogic GMBH. The Customised AeroLogic Network; AeroLogic: Leipzig, Germany, 2009. [Google Scholar]

- Yun, J. AeroLogic Ups Flights to Changi, Procurement Asia, 30 July 2009. Available online: http://www.procurement-online.com/news/14284 (accessed on 5 January 2014).

- Barnard, B. AeroLogic Adds Flights to U.S., Hong Kong. Journal of Commerce Online, 18 January 2010. Available online: http://www.joc.com/air-cargo/aerologic-adds-flights-us-hong-kong_20100118.html (accessed on 22 November 2017).

- Gallagher, T.L. Aerologic Expands into Middle East. Journal of Commerce Online, 18 May 2010. Available online: http://www.joc.com/air-cargo/aerologic-expands-middle-east_20100518.html (accessed on 22 November 2017).

- Hastings, P. DHL Expanding Its Mainland Footprint. Cargonews Asia, 12 July 2010. Available online: http://www.cargonewsasia.com/(F(mDf0Jo-2BTLE--sWIc-zqgEbsK1luJi-i3oC-NM64lgtBfzQdyJxJQsnaWnWCrxOCu-lvCfJygE158bMa0b8TBTA5f49Ld22a7p0Xamx5-w1))/secured/article.aspx?id=15&article=23181 (accessed on 9 October 2013).

- AeroLogic GmbH. AeroLogic Expands Network with Two New Routes to Asia and the U.S., AeroLogic Press Release 14 January 2010. Available online: http://www.aerologic.aero/pressdetail?pressID=21 (accessed on 7 July 2013).

- DHL Express. DHL Expands Express Air Route System Between Europe, Asia Pacific and Middle East, Press Release 19 October 2010. Available online: http://www.dhl.com/en/press/releases/releases_2010/express/191010.html (accessed on 20 November 2017).

- AeroLogic GmbH. AeroLogic Expands Network and Increases Connectivity Between Europe, the Middle East and Asia Pacific, AeroLogic Press Release 19 October 2010. Available online: http://www.aerologic.aero/pressdetail?pressID=24 (accessed on 7 July 2013).

- AeroLogic GmbH. AeroLogic Operates in Full Swing, AeroLogic Press Release 9 December 2010. Available online: http://www.aerologic.aero/pressdetail?pressID=25 (accessed on 7 July 2013).

- Lufthansa Cargo A.G. Lufthansa Cargo Serving New Destinations in Summer Timetable, Press Release March 2011. Available online: https://lufthansa-cargo.com/-/lhc-press-media-details-2011-page3-8 (accessed on 23 November 2017).

- Peri, K. Menzies Wins DHL as New Customer at Bangalore Airport. Available online: http://www.menziesaviation.com/item/detail/p/3/id/263/ref/Menzies-wins-DHL-as-new-customer-at-Banglaore-Airport (accessed on 19 November 2013).

- Finelli, M. Aerologic Fly Bergamo-Hong Kong for DHL, 22 March, 2012. Available online: http://www.flightglobal.com/airspace/blogs/flybolognairport/archive/2012/03/22/aerologic-fly-bergamo-hong-kong-for-dhl.aspx (accessed on 30 October 2013).

- Siegmund, H. AeroLogic Turns Five. Available online: https://www.cargoforwarder.eu/2014/06/23/aerologic-turns-five/ (accessed on 24 November 2017).

- Lufthansa Cargo AG. New Services to Ashgabat Successfully Started. Available online: https://lufthansa-cargo.com/-/new-services-to-ashgabat-successfully-started?redirect=https%3A%2F%2Flufthansa-cargo.com%2Fsearchresult%3Fp_p_id%3D3%26p_p_lifecycle%3D0%26p_p_state%3Dnormal%26p_p_mode%3Dview%26p_p_col_id%3Dcolumn-1%26p_p_col_pos%3D1%26p_p_col_count%3D2%26_3_keywords%3DAeroLogic%26_3_struts_action%3D%252Fsearch%252Fsearch&inheritRedirect=true (accessed on 23 November 2017).

- Lufthansa Cargo AG. Lufthansa Cargo Route Network Grows. Available online: https://lufthansa-cargo.com/-/lufthansa-cargo-route-network-grows (accessed on 23 November 2017).

- Wu, C.L. Airline Operations and Delay Management: Insights from Airline Economics, Networks, and Strategic Schedule Planning; Routledge: Abingdon, UK, 2016. [Google Scholar]

- AeroLogic GmbH. The Customised AeroLogic Network; AeroLogic: Leipzig, Germany, 2017. Available online: https://www.aerologic.aero/network (accessed on 23 November 2017).

- Button, K.J.; Stough, R. Air Transport Networks: Theory and Policy Implications; Edward Elgar Publishing: Cheltenham, UK, 2000. [Google Scholar]

- Zhang, A.; Zhang, Y. Issues on liberalization of air cargo services in aviation. J. Air Transp. Manag. 2002, 8, 275–287. [Google Scholar] [CrossRef]

- Baxter, G. AERO2426 Air Cargo Management and Operations Topic 4 Learning Guide: Airline Air Cargo Hubs and Route Networks; RMIT University: Melbourne, Australia, 2015. [Google Scholar]

- Cargolux Airlines S.A. Product Overview. Available online: http://www.cargolux.com/our-expertise/product-overview (accessed on 26 January 2018).

- Nippon Cargo Airlines. Products and Services. Available online: http://www.nca.aero/e/service/transport/index.html (accessed on 26 January 2018).

- Porter, M.E. What is strategy? In On Competition; Porter, M.E., Ed.; Harvard Business School Publishing: Boston, MA, USA, 1998; pp. 39–73. [Google Scholar]

- Porter, M.E. Competitive Strategy: Techniques for Analyzing Industries and Competitors; The Free Press: New York, NY, USA, 1980. [Google Scholar]

- Daft, R.L.; Murphy, J.; Willmott, H. Organization Theory and Design; Cengage Learning EMEA: Andover, UK, 2010. [Google Scholar]

- Oedekoven, M. Air cargo management. In Introduction to Aviation Management; Wald, A., Fay, C., Gleich, R., Eds.; LIT Verlag: Münster, Germany, 2010; pp. 310–327. [Google Scholar]

- Israeli, A. Generic strategies. In International Encyclopedia of Hospitality Management, 2nd ed.; Pizam, A., Ed.; Butterworth-Heinemann: Kidlington, UK, 2010; pp. 281–282. [Google Scholar]

- Baxter, G.S.; Bardell, N.S. Can the renewed interest in ultra-long-range passenger flights be satisfied by the current generation of civil aircraft? Aviation 2017, 21, 42–54. [Google Scholar] [CrossRef]

- Coyle, J.J.; Novack, R.A.; Gibson, B.; Bardi, E.J. Transportation: A Supply Chain Perspective, 7th ed.; South-Western Cengage Learning: Mason, OH, USA, 2011. [Google Scholar]

- Boeing Commercial Airplanes. 747-400 Airplane Characteristics for Airport Planning, Document Number D6-58326-1. Available online: http://www.boeing.com/resources/boeingdotcom/commercial/airports/acaps/747_4.pdf (accessed on 31 January 2018).

- Boeing Commercial Airplanes. 747-8 Airplane Characteristics for Airport Planning, Document Number D6-58326-3. Available online: http://www.boeing.com/assets/pdf/commercial/airports/acaps/747_8.pdf (accessed on 31 January 2018).

- Boeing Commercial Airplanes. 777-200LR/-300ER/-Freighter Airplane Characteristics for Airport Planning, Document Number D6-58329-2. Available online: http://www.boeing.com/assets/pdf/commercial/airports/acaps/777_2lr3er.pdf (accessed on 31 January 2018).

- Panibratov, A. Russian Multinationals: From Regional Supremacy to Global Lead; Routledge: Abingdon, UK, 2012. [Google Scholar]

- Knorr, A.; Arndt, A. Most low-cost airlines fail(ed): Why did Southwest Airlines prosper? In Competition Versus Predation in Aviation Markets: A Survey of Experience in North America, Europe and Australia; Forsyth, P., Gillen, D.W., Mayer, O.G., Niemeier, H.M., Eds.; Routledge: Abingdon, UK, 2018; pp. 145–172. [Google Scholar]

- Flouris, T.G.; Oswald, S.L. Designing and Executing Strategy in Aviation Management; Ashgate Publishing: Aldershot, UK, 2006. [Google Scholar]

- Boeing Commercial Airplanes. Lufthansa Group. Available online: http://www.boeing.com/commercial/customers/lufthansa/lufthansa-will-be-launch-customer-for-new-boeing-777x.page (accessed on 31 January 2018).

- Conway, P. Dominant force. Airl. Bus. 2005, 21, 52–54. [Google Scholar]

- Tretheway, M.W.; Andriulaitis, R.J. Airport competition for freight. In Airport Competition: The European Experience; Forsyth, P., Gillen, D., Mϋller, J., Niemeier, H.M., Eds.; Routledge: Abingdon, UK, 2016; pp. 137–150. [Google Scholar]

- Cottrill, K. High hopes. Traffic World 1998, 256, 28–33. [Google Scholar]

- The Economist. New Rail Routes between China and Europe will Change Trade Patterns. Available online: https://www.economist.com/news/business/21728981-new-silk-railroad-will-challenge-airlines-and-shipping-firms-new-rail-routes-between-china (accessed on 31 January 2018).

| Publication | Time Period | Database |

|---|---|---|

| Air Cargo World | 2001–2017 | EBSCO Host |

| Air Transport World | 1991–2017 | Proquest ABI/INFORM |

| Airline Business | 2002–2017 | Proquest ABI/INFORM |

| Flight International | 2004–2017 | Proquest ABI/INFORM |

| Journal of Commerce | 1996–2017 | Proquest ABI/INFORM |

| Phase of the Study | Activity/Task Undertaken |

|---|---|

| Phase 1 | This phase involved planning the types and required documentation and their availability. |

| Phase 2 | The data collection involved gathering the documents and developing and implementing a scheme for the document management; |

| Phase 3 | Documents were reviewed to assess their authenticity, credibility and to identify any potential bias |

| Phase 4 | The content of the collected documents was interrogated, and the key themes and issues were identified |

| Phase 5 | This phase involved the reflection and refinement to identify any difficulties associated with the documents, reviewing sources, as well as exploring the documents content |

| Phase 6 | The analysis of the data was completed in this final phase of the study |

| Wingspan | 64.8 m |

| Length | 63.7 m |

| Maximum Payload | 106 tons |

| Maximum Landing Weight | 261 tons |

| Maximum Take-Off Weight | 347 tons |

| Engines | GE90-110B1L |

| Main Deck ULD Configuration 1 | 27 AMX Containers |

| Lower Deck ULD Configuration | 32 LD3 Containers |

| Joint Venture Benefit | AeroLogic Joint Venture |

|---|---|

| Sharing of risk | Both DHL Express and Lufthansa Cargo AG are sharing the risk of operating dedicated freighter aircraft. These aircraft are achieving a high utilisation by operating weekday flights for DHL and weekend flights for Lufthansa Cargo |

| Synergistic benefits | Strategic and operational synergies are evident in the joint venture, for example, the optimization of aircraft utilization through the joint operations (DHL Express on weekdays and Lufthansa Cargo on weekends) |

| Joint sharing of costs | The AeroLogic joint venture is delivering cost-savings to the partners. As a result of the business model that has been implemented, the administrative burden has been significantly reduced providing AeroLogic with a lower cost base as compared to other dedicated all-cargo carriersFrom the Lufthansa Cargo perspective, the AeroLogic operation has enabled the airline to lower its operating costs, with the associated benefits being passed on to their customers |

| Accessing new markets | The lean company has enabled the partners to access new markets and also to serve existing markets |

| Participate in the industry’s evolution | Both DHL Express and Lufthansa Cargo have been able to participate in the fast growing express cargo market segment |

| Enhancing the competitive position in a market | Prior to the JV, DHL Express was at a competitive disadvantage to its main competitors FedEx and United Parcel Service (UPS) in that it did not have its own long-haul intercontinental freighter network. Cooperation with Lufthansa Cargo has repaired that deficiency, and has also provided DHL with the opportunity to utilize unused capacity on long-haul flights for the carriage of conventional air cargo, a practice that the major express operators rely on to some degree |

| Capturing competitive advantage | AeroLogic enjoys competitive advantages in that it only carries cargo on behalf of its partners, has a low cost base, operates a modern and efficient fleet of Boeing B777-200LRF aircraft |

| Access new markets | For Lufthansa Cargo the JV provides a more direct means to participate in the high-yielding air express market sector, while also being able to grow its long-haul intercontinental network for the carriage of conventional air cargoes |

| Overcome ownership restrictions | This was not applicable as both JV partners are based in Germany |

| Increase efficiency | The airline is extremely lean and provides a highly-efficient production platform for the two partners |

| Coordination of flight schedules to reduce fleet size and take advantage of offered capacity | The flight schedules and aircraft fleet size has been optimised for both DHL Express and Lufthansa Cargo. The aircraft operate for DHL during the week and for Lufthansa Cargo on the weekend |

| Shared use of knowledge, competencies and resources | Both partners offer complementary technical skills, in-depth market knowledge and resources and there is a very high level of cooperation between the partners |

| Joint procurement of fuel and amenities | No details of this were available at the time of the present study |

| Cooperative advertising and promotional campaigns | The costs of advertising and marketing are not applicable as AeroLogic only carries cargoes on behalf of the JV partners |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Baxter, G.; Srisaeng, P. Cooperating to Compete in the Global Air Cargo Industry: The Case of the DHL Express and Lufthansa Cargo A.G. Joint Venture Airline ‘AeroLogic’. Infrastructures 2018, 3, 7. https://doi.org/10.3390/infrastructures3010007

Baxter G, Srisaeng P. Cooperating to Compete in the Global Air Cargo Industry: The Case of the DHL Express and Lufthansa Cargo A.G. Joint Venture Airline ‘AeroLogic’. Infrastructures. 2018; 3(1):7. https://doi.org/10.3390/infrastructures3010007

Chicago/Turabian StyleBaxter, Glenn, and Panarat Srisaeng. 2018. "Cooperating to Compete in the Global Air Cargo Industry: The Case of the DHL Express and Lufthansa Cargo A.G. Joint Venture Airline ‘AeroLogic’" Infrastructures 3, no. 1: 7. https://doi.org/10.3390/infrastructures3010007

APA StyleBaxter, G., & Srisaeng, P. (2018). Cooperating to Compete in the Global Air Cargo Industry: The Case of the DHL Express and Lufthansa Cargo A.G. Joint Venture Airline ‘AeroLogic’. Infrastructures, 3(1), 7. https://doi.org/10.3390/infrastructures3010007