4.1. Exploration Phase: Train Operator as an Asset-Intensive Company

In this first phase, we explored the major constraints that arise from conventional requirements-driven procurement methods in companies with physical assets that have very long lifecycles [

45].

These constraints are evident in the CCTV case of NS trains.

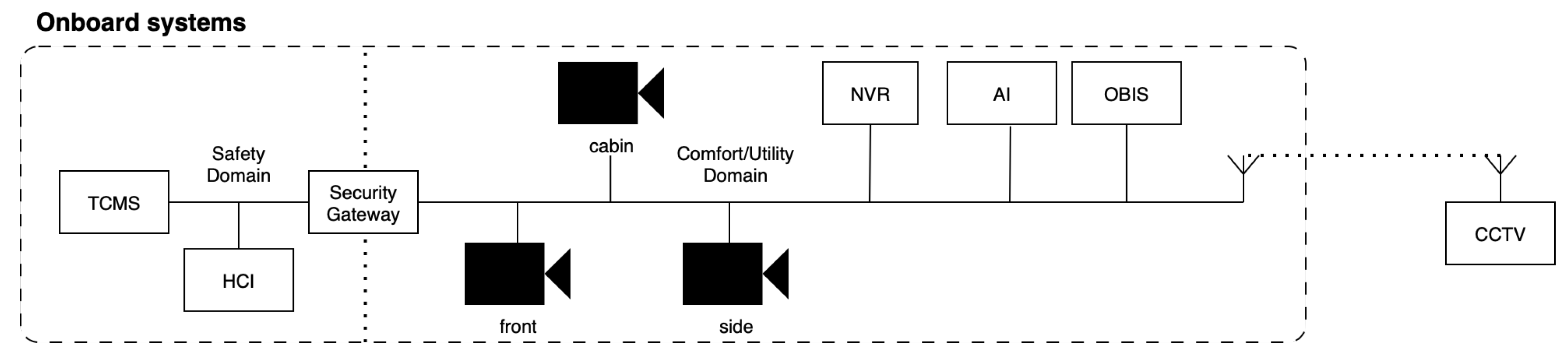

Figure 2 provides an abstract representation of a typical onboard CCTV. There are two separate networks on any train. First, the safety and security network, in which the Train Management Control System (TCMS) for the driver is located; this safety domain also includes a separate Human–Computer Interface (HCI) for the driver to access extra info, like camera images (see the left side of

Figure 2). The second network is for comfort and utility purposes, that is, managing front cameras, door cameras (to watch the safe entry of passengers), and cabin cameras. This network also contains the Onboard Information System (OBIS), Network Video Recorder (NVR) and modem connections to the shoreside CCTV management system.

The AI module is positioned next to OBIS and NVR in

Figure 2. In this respect, cabin cameras are used for various purposes like passenger counting and empty train detecting, which are part of regular train operations; but these cameras can also be used for advanced AI-driven applications regarding social safety (e.g., aggression detection), lost luggage, or even weapon detection. By default, all indications generated from these applications need to be shared directly with the driver, who has the primary responsibility for safety on the train; on a secondary basis, all indications are also shared with shore-side systems. The Train Digitalization department of NS is responsible for all systems on the train, including operations, partner management, interfaces, and standardization across all train series.

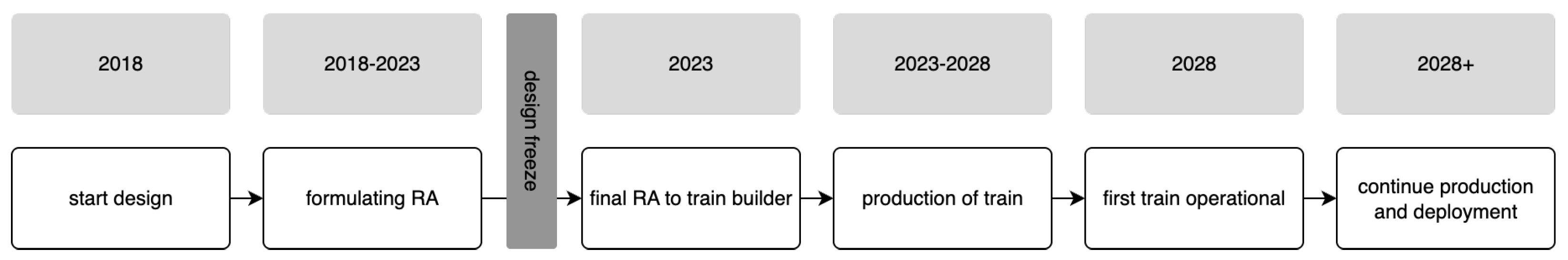

Our field notes as participant-observers also suggest that conventional tender processes, designed for mature technologies with established specifications, are inadequate for emerging digital technologies (e.g., applicable to the CCTV system in NS trains), characterized by rapid evolution and uncertain market readiness. That is, these digital technologies are temporally misaligned with train procurement cycles that take up to 10 years from the train’s initial conception to operational deployment. The case of the new DDNG train illustrates this timeline, as shown in

Figure 3. This process began with its initial design in 2018 and then involved the development of a Reference Architecture (RA) until 2023. A critical design freeze then locks the train’s specifications, when these are handed over to the train builder. Operational deployment of the DDNG train is planned as of 2028.

This extended timeline creates two significant challenges. First, technologies specified during the early design phases may become obsolete by the time they are actually implemented. Digital innovations typically evolve in much shorter cycles, creating a mismatch between the procurement timeline and the speed of digital technology development. Second, another consequence of the extended procurement timeline is that any new digital technologies (becoming available after the design freeze) cannot be integrated in the new train, once the final RA specifications are sent to the train builder.

This mismatch between procurement timelines and digital transformation cycles requires a novel process model that accommodates both traditional procurement requirements and dynamic innovation needs. Our data analysis in the first phase suggests that such a process model should integrate two pathways for technology development: in-house R&D capabilities for early-stage technologies and collaborative supplier development for market-ready solutions. This dual approach acknowledges that digital transformation requires flexible and iterative (in-house) processes that can adapt to technological uncertainty, while maintaining operational safety and regulatory compliance. It would also have to align the 10-year asset development cycle with rapid digital advancements. The design freeze phenomenon observed in the DDNG case, where specifications become immutable after five years, demonstrates the critical need for such a careful alignment.

4.2. Synthesis Phase: Design Propositions for Digital Transformation in Asset-Intensive Companies

The interview data and insights available in the literature were synthesized in six design propositions (DPs) that address the primary challenges of digital transformation in asset-intensive companies. These propositions arise from a systematic analysis of stakeholder perspectives but also reflect theoretically grounded mechanisms for managing the complex interplay between technological dynamics and operational stability. Each DP addresses specific aspects of the innovation process, while contributing to an integrated approach that enables sustainable digital transformation within the constraints of asset-intensive operations. As explained in

Section 3, the DPs are formulated in terms of the CAMO format.

Asset-intensive companies need to evaluate both technological maturity and market availability in preparing and making strategic sourcing decisions about digital technologies. This involves assessing market readiness against internal capabilities to determine whether to pursue an early adoption strategy or only adopt proven market solutions. Our data suggest a nuanced approach to technology adoption within railway operations, as a cluster lead expressed: “Travel information systems are now being developed in-house while standards are available in the open market.” This reflects the complexity of decision-making processes that need to balance and switch between between internal development and market procurement.

The technology integration strategy of the NS demonstrates a broad spectrum, spanning from internal development to “best-of-breed” market solutions, with collaboration as the central organizing principle. In moving across this spectrum, the NS oscillates between early adopter and smart follower roles, based on an evaluation process that considers both market maturity and the complexity of internal developments. An example of an internal development solution is the development of perception modules for recognizing (specifically Dutch) railway signage and signals, for which market solutions proved to be insufficient.

One of the enterprise architects highlighted the ongoing transition in the NS toward using commercial products. This transition marks the shift from a traditional build-centric to a purchase-centric approach. A systematic approach to evaluating market readiness would have to enable the NS (and other asset-intensive companies) to assess technology maturity before taking the decision about whether or not to implement the new technology, with the NS evaluating market readiness against internal capabilities to determine whether to pursue an early adoption strategy or implement a proven market solution. We synthesize these findings in the DP described in

Table 4, which extends the literature on Technology Readiness Level frameworks [

46,

47] by incorporating market dynamics and supplier maturity [

48,

49] to bridge the gap between purely technical assessments and complex market realities.

DP1 extends DCs theory [

9,

20] by operationalizing DC’s sensing process specifically for asset-intensive contexts, in which traditional market sensing must be extended toward the evaluation of both technological maturity and supplier ecosystem readiness.

A Reference Architecture (RA) can serve as an instrument for the modular integration of digital technologies, while maintaining system coherence across diverse asset portfolios. This integration would involve the creation of standardized interfaces that accommodate both current technologies and future innovations. Stakeholders interviewed consistently emphasized the strategic importance of modular approaches; for example, a cluster lead said: “It is essential that this application be modularly integrated.” And an enterprise architect explained the procurement strategy shift: “We adopt more of a ’buy before make’ strategy,” especially for passenger information systems for which the NS prefers to follow market standards rather than internally develop its own solutions.

The transition to this (preferred) "purchasing" model emphasizes the integration of off-the-shelf and Software as a Service solutions, requiring robust supplier and project management capabilities that are key in adapting third-party systems to specific operational needs. This represents a shift from development-centric to managerial and integrative organizational activities. But the enterprise architects as well as business consultants (interviewed) pointed at major challenges in implementing industry standards: that is, despite the suppliers’ adherence to these standards, product functionalities continue to vary between suppliers, which necessitates custom-made integration work for each module delivered by suppliers.

Moreover, several enterprise architects highlighted the importance of the RA, which

“ensures that an NS train can also run on German or Belgian tracks,” referring to interoperability requirements for cross-border European rail operations. The RA’s development over time also reflects the need for adaptability to future technological changes, as a cluster leader noted:

“We try to look ahead and anticipate what might happen in the future.” This forward-looking approach ensures the RA accommodates current as well as anticipated future functionalities, while providing flexibility for modifications based on advancements in IT and operational technologies. Here, layered modular architecture theory [

28,

50] has to be extended to asset-intensive contexts in which physical constraints severely limit modularity options. Digital transformation in an asset-intensive company therefore requires a new approach to system architecture, one that accommodates both asset legacy issues and emerging digital capabilities.

A cluster leader also acknowledged the practical limitations of achieving true homogeneity, which reflects the variability in component availability from start to end [

51,

52] in the train production process of the NS. As also observed in

Section 3, the NS currently operates approximately 800 trains across the Netherlands, comprising eight different series and a new type coming up; the oldest trains are from 1991 and the most recent one is from 2023. Each train type is equipped with distinct camera systems and IT layers, depending on the manufacturer and the period of construction. This diversity creates major challenges for replacing parts, as new components must fit into older spaces while meeting updated specifications to ensure correct configuration and compliance with international standards.

The design proposition in

Table 5 synthesizes these insights in the area of modular architecture and standardization.

DP2 advances digital innovation theory’s layered modular architecture framework [

21,

28] by dissecting how physical constraints in asset-intensive industries limit modularity options. This DP proposes a new approach to system architecture that accommodates both legacy asset integration and emerging digital capabilities, while maintaining operational coherence across diverse asset portfolios.

Safety and regulatory considerations represent essential constraints that must be systematically integrated into the digital transformation process, rather than being addressed as external barriers. This requires structural collaboration between technical teams, legal experts, and safety committees. Our data consistently highlight the paramount importance of safety considerations. For example, one cluster leader emphasized: “There must always be attention to risk”; this implies operational risk and safety considerations are central in all innovation decisions. This conservative stance with regard to novel technologies reflects the railway operator’s commitment to maintaining operational integrity while pursuing technological transformation. The challenge of incorporating new hardware components is also evident from the observation of a project leader: “We’re only allowed to install RAIL-certified hardware.” The RAIL certification process, governed by specific standards and EU regulations, tends to significantly delay the integration of advanced technologies into train operations, creating a tension between innovation speed and safety requirements.

An enterprise architect emphasized the critical balance

“in which the CCTV chain can embrace many innovations, especially in the area of digital security,” while maintaining compliance with safety and operational protocols. Zhu [

53] and Kieslich et al. [

54] address the multifaceted challenges of integrating cyber-physical systems. Our data demonstrate how railway operators manage multiple constraints during technology adoption, by means of structural collaboration between developers, legal experts, and safety committees which implement risk mitigation and compliance mechanisms. DP3 thus integrates institutional theory (see

Section 2) with innovation processes to specify how asset-intensive companies can foster risk mitigation and regulatory compliance (see

Table 6).

DP3 integrates institutional theory [

33,

34] with digital innovation processes by demonstrating how regulatory constraints can be systematically embedded within innovation frameworks rather than treated as external barriers. It thereby addresses the institutional complexity that arises when cyber-physical systems challenge existing regulatory boundaries in safety-critical industries.

Asset-intensive companies must also develop capabilities to manage the misalignment between long development cycles and rapidly evolving technologies. This calls for adaptive governance structures and flexible implementation approaches, which balance long-term commitments with technological adaptability. For example, an NS project leader defined the following key challenge: “Rapid technological developments make uniformity between trains challenging.” In this respect, it is difficult to integrate the 10-year train development cycle (outlined earlier) with rapidly advancing digital technologies: once the final RA is submitted to train builders after five years, design modifications become problematic and the RA is potentially outdated by the time the new train is deployed.

The two interviewed cluster leaders both pointed at the financial implications of flexibility, noting that while adaptation to accommodate new technologies (sometimes) remains possible, it does incur huge costs due to investments in component redevelopment. In turn, this creates a financial risk that led the cluster leaders to argue that IT procurement should be decoupled from train tenders. This recommendation would imply that IT purchases are completely eliminated from train procurement tenders. One cluster leader also expected that there will be (a growing need for) more diversification of the train portfolio, with more train types but fewer units per type. This approach would promote innovation and accelerate the integration of new digital technologies, while reducing the risk of technological obsolescence.

More specifically, the transition to 5G networks and the increasing obsolescence of physical components (like network switches, modems and antennas) illustrate the difficulty of maintaining consistent technological standards across all train operations of the NS. The key challenge here is to reconcile the need for flexibility with the operational requirements of safety, reliability, and long-term asset management; in turn, this requires a novel approach to development processes that simultaneously accommodate stability and adaptability requirements (see

Table 7). DP4 addresses these fundamental tensions between control and flexibility, which have also been identified in the literature on organization design [

55,

56].

In sum, DP4 addresses the core tension outlined in ambidexterity theory [

38,

39] by providing guidelines for balancing the exploration of rapidly evolving digital technologies with the exploitation of decades-long physical asset investments.

Strategic sourcing decisions must account for the complex interplay between internal capabilities, external partnerships, and market dynamics. In other words, governance structures should be instrumental in effectively managing concurrent strategies of buying, making, and partnering. The complexity of partnerships with suppliers is evident, for example, when a cluster leader highlighted that “from our expertise, we can grow ourselves with the help of a supplier,” thereby emphasizing that the current ownership model of NS may evolve in the future. This cluster leader referred to the example of the “train as a service” model, exemplified by Alstom’s services to Danish railways (which procures trains as a complete service from Alstom, including their deployment), which strongly contrasts with the current ownership model of NS. The same cluster leader pointed at the difficulties of collaborative innovation within tender processes in which “you have to specify tenders in advance;” this shows how procurement processes constrain collaboration (e.g., with external suppliers).

Nevertheless, our data underline that the NS is committed to creating and maintaining a balance between external collaborations and in-house R&D. The top managers of NS also acknowledges that the full ownership of its trains may limit its modification capabilities. They thus envision a new ownership model in which the NS gradually acquires ownership of newly acquired trains, aiming for full ownership 15 years after the initial procurement. The shared ownership with the train’s manufacturer would create stronger incentives for both the NS and the manufacturer to collaborate on upgrading the train with new (especially digital) innovations. This so-called vertical disintegration strategy [

11,

57] capitalizes on the train operator’s core competencies, while outsourcing activities related to non-core competencies. As such, railway operators would benefit from (partial) vertical disintegration via the novel train ownership model previously outlined. More generally speaking, DP 5 draws on the notion of concurrent sourcing in the industry architecture literature [

11,

23], as well as ecosystem governance theory [

58], to provide guidelines for managing the unique challenges of digital innovation partnerships within asset-intensive companies (see

Table 8).

DP5 therefore extends industry architecture theory [

11] and its concurrent sourcing framework [

23] by dissecting how strategic sourcing decisions must navigate the unique constraints of asset-intensive industries.

Finally, asset-intensive companies have to build dynamic capabilities for sensing opportunities, seizing resources, and reconfiguring operations to manage digital transformation effectively [

9,

15]. This requires a structured and sustained engagement with operational teams, external technology providers, academic institutions, and industry associations. In addition, it involves managing changes in organizational identity, while developing new competencies. Our data illustrate these challenges of digital transformation. Both cluster leaders noted major changes in the existing NS strategy for digital transformation (launched two years earlier), implying a move from a make-strategy to a buy-strategy. One of the interviewed consultants explained the new strategic focus as follows:

“This strategy is about purchasing more digital products and responding to market trends, rather than developing its own solutions.” This transformation requires role adjustments and potentially reduces the size of the R&D workforce, due to a decreased need for internal development. It also introduces ethical challenges among employees, particularly with respect to AI detection functions. The same consultant noted the personal impact of the digital transformation:

“A system engineer even dropped out because of personal concerns.”The transformation also causes an essential shift in the organizational identity of the NS, from a development-centric to an integrative railway operator. This shift implies NS managers need to carefully manage the technological, social and ethical dimensions of digital transformation. The study by Tripsas [

59] analyzed how organizational identity serves both as a lens to evaluate technological opportunities and as a filter for strategic action. The last design proposition therefore integrates DCs theory [

20] with organizational identity perspectives [

60,

61], to provide guidance in how an asset-intensive firm can build adaptive capabilities, while managing the challenges arising from digital transformation. This calls for a comprehensive approach to capability development, one that considers both technological and cultural dimensions (see

Table 9).

The six design propositions, developed in this section, collectively address the theoretical gaps identified in

Section 2. They integrate and adapt insights from the five theoretical perspectives outlined in

Table 1 to the digital transformation challenges of asset-intensive companies.

4.3. Creation Phase: The Iterative Development & Adoption Model (IDAM)

The six design propositions, developed previously, informed the creation of a process tool, the so-called

Iterative Development & Adoption Model. IDAM provides a systematic process for reducing the temporal misalignment between rapid cycles of digital innovation and the extended life-cycles of physical assets. It operationalizes the assessment of market maturity as the primary mechanism for managing make-to-buy transitions in digital transformation contexts. IDAM also integrates DCs theory [

20,

62] with the literature on industry architecture [

11] and digital innovation [

63].

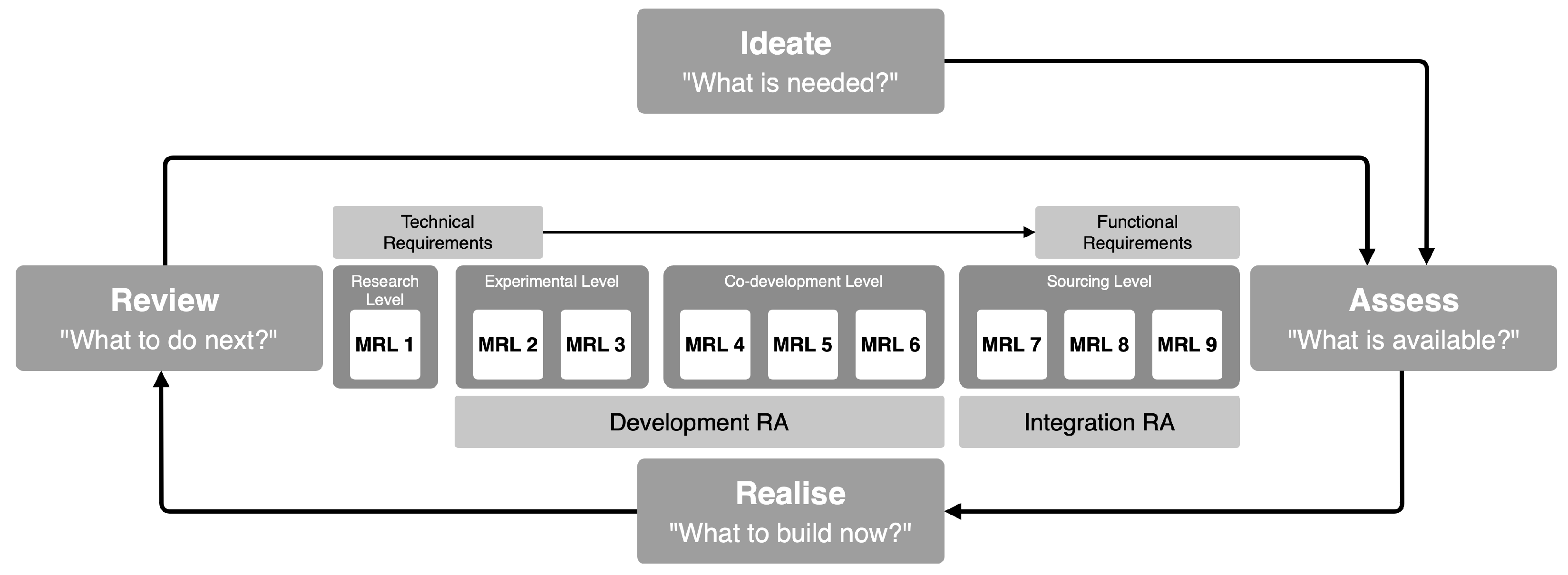

Figure 4 provides a visual overview of IDAM.

Accordingly, IDAM provides structured guidance via four iterative phases for building organizational capabilities, while managing the temporal coordination challenges. It allows for early introductions of new (e.g., digital) technologies, also in areas where the market of suppliers has not fully evolved yet. As such, it differs from stage-gate processes that focus on whether or not to continue to invest in specific new products being developed [

64]. The remainder of this section describes each key step (i.e., ideate, assess, realize, and review) in IDAM.

Ideate: Collaborative Sensing and Opportunity Recognition—The ideation phase operationalizes DCs theory’s sensing dimension [

20], by identifying digital innovation opportunities that are aligned with operational needs and strategic objectives. The key question

“What is needed?” extends the company’s sensing capabilities beyond its organizational boundaries. DP6 on organizational capability development drives this phase by establishing systematic sensing routines that help the company identify innovation opportunities, through structured engagement with internal operations teams, external technology providers, academic institutions, and industry associations. DP4 implies that these opportunities need to be assessed from both the immediate operational requirements and the long-term implications for the asset lifecycle, to prevent any unsustainable misalignment. Here, collaborative innovation allows the company to draw on external expertise to identify promising opportunities at the intersection of digital technology and physical assets in heavily regulated environments.

Assess: Market Maturity Evaluation and Strategic Sourcing—The assessment phase serves as a critical decision point, in which the evaluation of market maturity determines the most effective sourcing strategies for the innovation opportunities identified. It addresses the question

“What is available?” by means of structured evaluations of technological and market readiness. DP1 (Market-Technology Readiness Assessment) suggests that objective evaluation criteria need to be formulated for assessing both technological maturity and market availability, which, in turn, guide the digital transformation journey from “make” to “sourcing” decisions, as the market matures. The assessment in this phase employs four innovation levels, which are further detailed in a nine-level Market Readiness Level (MRL) scale;

Table 10 outlines the full scale. The four levels are:

Research Level (MRL 1): Early-stage technologies (e.g., arising from internal R&D or academic research) that are not yet transformed into solutions. Such a technology typically entails a proof-of-concept, but is not adequately prototyped yet; this technology is therefore characterized by high levels of risk and requires substantial investments in its further development. These proofs-of-concept often provide promising opportunities to be explored for future adoption.

Experimental Level (MRL 2-3): Prototypes of new technologies in their experimental stages, which are not (yet) fully transformed into viable market solutions; they therefore require (further) internal R&D investments and substantial efforts in capability building.

Co-development Level (MRL 4–6): Technologies available as emerging market solutions with reliable suppliers as partners. These partnerships enable risk-sharing and collaborative capability development.

Sourcing Level (MRL 7–9): Increasingly mature market solutions with multiple suppliers, which enables a focus on integration rather than development. Functional requirements can be specified in a relatively straightforward manner.

The design of the assessment phase is especially informed by DP5 on ecosystem governance and partnership strategy and DP3 about regulatory compliance and safety integration. This phase guides make-or-buy decisions by creating and applying evaluation criteria that help to prevent temporal misalignment. Market maturity here is the primary determinant of the decision about whether or not to source (i.e., "buy") a new technology from external suppliers, moderated by institutional constraints.

Realize: Architecture Integration and Development Pathways. The realization phase focuses on the question “What to build now?” by implementing different development pathways aligned with market readiness levels, while maintaining system coherence through modular architecture principles. DP2 regarding modular architecture and standardization strategy provides the structural foundation for integrating components from different sourcing strategies within a coherent system architecture.

The realization phase distinguishes between two types of Reference Architecture (RA), based on technology maturity. The first type, called Development RA, is designed for emerging technologies that require flexibility and experimentation. This developmental approach establishes experimental platforms and research capabilities to accommodate the high level of technological uncertainty of emerging technologies. The second type, called the Integration RA, is designed for mature market solutions that prioritize standardization and reliability. This integration approach provides standardized interfaces and integration protocols for proven technologies. The distinction between the two types enables the asset-intensive company to apply different architectural strategies, acknowledging the market maturity level for the technology being integrated.

In addition to DP2, two other DPs informed the creation of the realization phase. DP5 structures the implementation complexity when multiple sourcing approaches are simultaneously used by establishing governance structures for co-development partnerships, supplier relationships, and internal R&D coordination. In addition, DP3 ensures consistent safety-oriented models that accommodate both experimental developments and mature external solutions. This creates distinct pathways: that is, internal R&D labs for low-maturity technologies, co-development facilities for medium-maturity solutions, and integration platforms for high-maturity market offerings.

Review: Organizational Learning and Iterative Refinement—Finally, the review phase addresses “What to do next?” by capturing the insights and learnings that arise from the experiences obtained in the realization phase and translating these insights into (proposed) improvements of future innovation cycles. In this respect, DP4 suggests these insights have to be incorporated into long-term planning and capability roadmaps, to ensure that experiences in short-term implementation work inform long-term strategic decisions. Moreover, DP6 recommends that one learns from implementation experiences by rigorously documenting successes, failures, and causal factors; such an organizational memory improves future decision-making. The review phase is thus fueled by structured feedback loops that improve the company’s capability to navigate digital transformation while maintaining operational excellence.

Overall, the IDAM model integrates empirical findings and translates theoretical insights from multiple domains into practical guidelines for managing the digital transformation efforts in asset-intensive companies. By systematizing the assessment of market maturity as a key mechanism for managing temporal alignment, IDAM enables asset-intensive companies to pursue innovation across the full spectrum of technological maturity.

4.4. Evaluation Phase: Validating the Model

The evaluation of the IDAM model involved a two-step validation process, designed to ensure both theoretical rigor and practical applicability. The first evaluation step involved a formative assessment in the form of an alpha-test of the model [

17,

65]. In this alpha-test, we presented IDAM to the experts interviewed earlier, as well as to other NS stakeholders, including senior management representatives and members of the CCTV project team. These experts were especially invited to evaluate the completeness, logical consistency, and alignment of the IDAM with the requirements management process established within the NS. One general recommendation received as feedback in these meetings was to simplify the visual representation of the model, which initially was a bit more complex than the final version presented in

Figure 4. Other major points of feedback are discussed below, where we evaluate the IDAM in terms of the design propositions.

In the second step, we evaluated the IDAM in terms of the six design propositions (formulated in

Section 4.2), providing a more summative evaluation [

65]. This last evaluation step served to assess to what extent the DPs are incorporated into the final model. In the remainder of this section, we, therefore, explore how each DP is instantiated in the final IDAM.

DP1 (Market-Technology Readiness Assessment): This proposition provides a core decision mechanism in IDAM in the form of clear evaluation criteria and decision pathways through the nine levels of market readiness. All stakeholders in NS particularly valued this systematic approach to sourcing decisions, observing that it addresses the major challenges of NS in aligning decisions about the adoption of digital technologies with the long life-cycle of its physical assets.

DP2 (Modular Architecture and Standardization Strategy): The main thrust of this proposition is directly visible in the realization phase of IDAM in terms of the clear distinction between the Development and Integration reference architectures. Many experts praised this differentiation in two distinct RAs as it addresses the practical needs of managing experimental, as well as more mature technologies within the systems of an asset-intensive company. This modular approach also resonated strongly with technological experts within the NS, who recognized its value in managing the complexity of concurrent sourcing strategies.

DP3 (Regulatory Compliance and Safety Integration): This DP provides an essential constraint throughout all phases of the IDAM process, but several stakeholders noted that the requirements regarding regulatory compliance and safety integration are not explicitly visualized in

Figure 4, although these are clearly presented in the written IDAM guidelines. Despite the lack of visual presence in the figure outlining IDAM, interviewees from the Safety and Compliance department of NS emphasized how IDAM’s systematic approach improves their ability to evaluate and approve digital technologies by providing a structured process and clear criteria.

DP4 (Temporal Coordination and Flexibility Management): DP4 influenced IDAM’s overall iterative structure and informed the distinction between the Development RA and Integration RA. Many NS stakeholders recognized how this proposition addresses one of their most pressing challenges: managing digital transformation within long-term commitments to physical assets. They particularly praised the iterative nature of IDAM for its ability to accommodate the continually changing technological landscape while sustaining the strategic coherence of the NS.

DP5 (Ecosystem Governance and Partnership Strategy): This proposition shaped multiple aspects of IDAM, particularly in the assessment and realization phases in which partnership evaluation and partnership management become critical. NS stakeholders noted how the model’s explicit consideration of different sourcing strategies (i.e., make, buy, partner) aligns well with how the approach of the NS to collaborative innovation and supplier relationships has recently been evolving.

DP6 (Organizational Capability Development): The sixth DP informs the entire model through its emphasis on learning and capability building throughout all phases. Although not presented as a discrete component or step in IDAM, both experts and stakeholders recognized how the model’s design helps to build an asset-intensive company’s innovation capabilities through structured processes and iterative learning cycles.