Abstract

Energy is the foundation for human survival and socio-economic development, and electricity is a key form of energy. Electricity prices are a key factor affecting the interests of various stakeholders in the electricity market, playing a significant role in the sustainable development of energy and the environment. As the number of distributed energy resources (DERs) increases, today’s power systems no longer rely on a vertical market model and fixed electricity pricing scheme but instead depend on power dispatch and dynamic pricing to match supply and demand. This can help prevent significant fluctuations in supply–load imbalance and maintain system stability. Modern power grids have evolved by integrating information, communication, and intelligent control technologies with traditional power systems, giving rise to the concept of smart electric grids. Choosing an appropriate pricing scheme to manage large-scale DERs and controllable loads in today’s power grid become very important. However, the existing literature lacks a comprehensive review of electricity pricing in power systems and its transformative impact on shaping the energy landscape. To fill this void, this paper provides a survey on the developments, methods, and frameworks related to electricity pricing and energy trading. The review mainly considers the development of pricing in a centralized power grid, peer-to-peer (P2P) and microgrid-to-microgrid (M2M) energy trading and sharing, and various pricing methods. The review will cover the pricing schemes in modern power systems, particularly with respect to renewable energy sources (RESs) and batteries, as well as controllable load applications, and the impact of pricing schemes based on demand-side ancillary services (DSAS) for grid frequency support. Lastly, this review article describes the current frameworks and limitations of electricity pricing in the current energy market, as well as future research directions. This review should offer a great overview and deep insights into today’s electricity market and how pricing methods will drive and facilitate the future establishment of smart energy systems.

1. Introduction

Throughout most of the 20th century, traditional electricity markets were dominated by vertically integrated monopoly utilities, with consumers paying a fixed price based on usage. However, the escalating electricity demand has heightened the significance of optimizing power system management, minimizing costs, and mitigating environmental pollution. Researchers have developed new frameworks and algorithms to improve the planning and operation of electricity markets over the years. A single organization no longer manages the power market but involves various stakeholders, including producers, distributors, and consumers, who can exchange real-time information [1]. Consumers now have the capability to monitor their real-time electricity requirements and actively engage in the dispatch of power within the system.

In the past decade, DERs have increased significantly, changing the way energy is produced, transmitted, and consumed. It has increased the number of prosumers who can both buy and sell energy, resulting in a more decentralized and open power system [2]. With the integration of renewable energy sources (RESs) into the grid and the transition toward a low-carbon energy model, adopting new methodologies for pricing energy and enhancing the flexibility and efficiency of the energy market have become imperative [3]. Demand-side management is an important approach, with demand response (DR) being a change based on consumer behavior. As time and electricity prices change, users can alter their electricity consumption from normal patterns or are encouraged to reduce consumption and receive rewards when prices are high, or system reliability is threatened [4]. DR has the advantages of peak shaving, higher RESs utilization, rapid response, and cost reduction [5].

In recent years, the establishment of local energy markets has become essential to facilitate the direct trading of renewable energy generation among prosumers, eliminating the need for intermediaries [6]. As a result, P2P energy trading has become a way for prosumers to participate in electricity markets. P2P allows energy trading between prosumers and energy sharing, increasing their benefits. P2P energy trading provides users with greater flexibility, increases the utilization of RES, and improves the reliability and stability of the power system [7]. There are also some common dynamic pricing schemes in the power system, including time-of-use pricing, real-time pricing, critical peak pricing, demand-side bidding, interruptible load compensation pricing, and direct load control [8]. Dynamic pricing tracks future price fluctuations based on overall consumer demand, promoting more energy conservation as higher prices reflect lower consumer demand [9]. In general, the pricing of the electricity system can be summarized into two methods: One approach is to implement dynamic pricing, where the price of energy changes is based on factors such as demand, the availability of renewable energy, and time of day. This would incentivize consumers to shift their energy usage to times when renewable sources are abundant, reducing stress on the grid and lowering overall energy costs. Another method is to use blockchain technology to create a P2P energy trading system, where individuals and businesses can buy and sell excess energy directly to each other without intermediaries. This would make the market more decentralized and increase competition, leading to lower prices and more efficient use of renewable energy.

Existing literature reviews on power system electricity prices have predominantly focused on aspects such as electricity price prediction algorithms, strategies, and the development and status of specific countries. For example, in [10], the authors introduced the theory of electricity pricing based on economics and the development history of electricity prices in China. The main discussion is about price-based DR strategies for smart grids and the current state of research. In [11], the authors assessed the main driving factors of EU household electricity prices and developed a dynamic panel data model to promote the use of renewable energy under liberal policies. In [12], the historical demand and supply curves of the German day-ahead market were analyzed, demonstrating that the integration of renewable energy greatly reduces electricity prices. These review articles mainly focus on a country’s electricity price strategy and current situation. The review article in [13] examines state-of-the-art electricity price forecasting algorithms, compares two prediction models, and provides datasets for evaluating future electricity price prediction research. In [14], the authors used neural basis expansion analysis techniques to study electricity price predictions for a wide range of years in the electricity market and found that the prediction accuracy of this technique is higher than that of the original prediction model. In [15], the authors conducted a comparative analysis of MG energy management on different campuses of different universities, trying to address the uncertainties introduced by RESs while considering ESSs technologies. In [16], the authors reviewed probabilistic electricity price forecasting and further expanded on it, and they proposed related usage methods and measures. However, these articles focus more on reviewing algorithms for electricity price prediction in power systems. In [17], the authors provided a comprehensive review of P2P energy sharing and trading, including system configurations and pricing mechanisms. The author analyzes the benefits of P2P energy trading, which include the potential to reduce energy costs, increase the uptake of renewable energy sources, and enhance energy security. However, the success of these systems also relies on the development of effective pricing mechanisms that balance the interests of producers, consumers, and distribution network operators. In [18], the role of energy pricing policies in electricity markets is reviewed, mainly analyzing aspects such as power supply, possibilities, efficiency, and price structures. In [19], the authors evaluated pilot test results using a meta-analysis method, analyzing the impact of various incentive measures (including demographic changes and participants voluntarily joining) on household electricity consumption behavior. These articles mainly review pricing policies and mechanisms in the electricity market.

Considering the above, current review articles still lack a comprehensive review of pricing mechanisms within the context of smart power grids that integrate distributed energy resources (DERs), loads, and demand-side auxiliary services. Considering this research gap in the literature, this review article focuses on P2P and M2M energy trading (and energy sharing) pricing methods. This study will encompass pricing in renewable energy sources (RESs), energy storage systems (ESSs), applications for controllable loads, and the provision of demand-side ancillary services (DSAS), exploring their impact on the pricing scheme within the grid. The main contributions of this paper are as follows:

- Introduction of the development of power grid pricing in chronological order, from 1989 to the present, and changes in the framework of the electricity market so that readers can clearly understand the development of the electricity market;

- A comprehensive review of electricity pricing enables researchers to better identify current research gaps. These include pricing (and energy sharing)-enabled control for modern distributed power grids with P2P and M2M energy trading; pricing in RESs, ESSs, and controllable loads applications; and the impact of DSAS provision on power pricing schemes;

- A comprehensive summary of the current pricing framework and limitations of retail and wholesale markets, with suggestions for future electricity markets and research directions in this field.

The rest of this paper is organized as follows. Section 2 provides a brief overview of the development of electricity pricing and the main components of electricity pricing. Section 3 describes the pricing schemes of P2P and M2M energy trading. Section 4 reviews the pricing in power grids with RESs using batteries and controllable load applications. Section 5 presents DSAS provision and its impact on pricing schemes. Section 6 provides the current pricing framework for retail and wholesale markets and its limitations. Section 7 gives suggestions for future research directions. Finally, conclusions are drawn in Section 8.

2. Development of Pricing in the Power Grid

2.1. Brief History

The continuous changes in the power industry have driven reforms in energy pricing within the distribution system, improving efficiency while reducing wholesale electricity costs. Pricing is one of the essential factors in marketing strategies, benefiting stakeholders, maintaining the balance of the power system, and enabling the creation of new regional markets using more RESs. This provides more options for electricity access while reducing carbon emissions [20]. The electricity price reform will also be a great challenge for grid companies. The opening of the electricity sales market requires grid companies to have high market competitiveness [21]. In the evolving market environment, power grid companies have transitioned from a model focused solely on selling electricity to a profit model centered around electricity transmission and distribution.

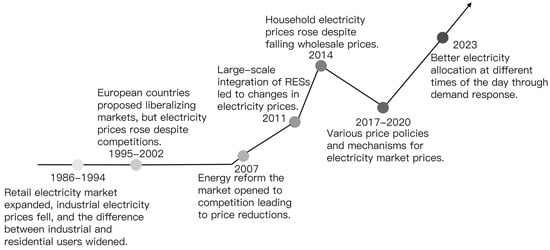

The earliest analysis of electricity prices and power market reforms can be found in [22], which reveals the impact of regulatory reforms on retail prices for industrial customers and the ratio of industrial to residential prices from 1986 to 1994. The retail electricity market expanded, industrial electricity prices fell, but the price difference between industrial and residential users widened, indicating that industrial users benefited from the reforms [23]. It was also observed that unbundling electric generation and introducing wholesale electricity markets did not necessarily lower electricity prices. From 1995 to 2002, European countries proposed liberalizing markets to provide reliable and secure electricity supplies, but electricity prices in each market model showed an upward trend despite increased competition [24]. This trend was partly due to the significant investments needed to upgrade infrastructure and meet environmental regulations. Additionally, market concentration remained high in some countries, limiting the benefits of competition. The liberalization process also faced opposition from trade unions and some political groups who feared job losses and the loss of national control over energy resources. It was not until 2007 that energy reforms impacted household energy prices [25]. Prior to this, the state-owned electricity company had a monopoly on the energy market and set prices according to governmental regulations. However, the market was opened for competition, and private companies were allowed to enter the market. This led to a decrease in electricity prices for industrial and commercial customers, as the new competition forced the state-owned electricity company to lower prices in order to remain competitive. However, it took several years for this to impact household energy prices as the reforms were implemented gradually. Although unbundling electric generation was not proven to have a significant effect on household electricity prices, the freedom to choose electricity suppliers was valued by consumers, leading to price reductions. By 2011, the large-scale integration of RESs into the grid can lead to changes in electricity prices, but it is not always the case that consumers profit from using RESs [26]. In some cases, electricity prices may decrease due to an oversupply of electricity from RESs during high production, but this may not necessarily translate into lower retail prices for consumers. Additionally, some utility companies may charge higher rates to customers who use RESs due to the cost of implementing and maintaining the necessary infrastructure to integrate them into the grid. Therefore, while integrating RESs can lead to changes in electricity prices, the impact on consumers may vary depending on the specific circumstances. In 2014, there was a notable discrepancy in the power system where household electricity prices generally increased despite a decline in wholesale electricity prices [27]. This divergence can be attributed to the lack of a simultaneous competitive marketing scheme in the industry and the government’s regulation of retail electricity prices, which prevented market forces from influencing them. Moreover, the lack of competition in the power system created a need for additional incentives for electricity retailers to lower prices and attract customers. This was exacerbated by the fact that many households could not switch electricity providers due to contractual obligations or a lack of awareness of alternative options. In recent years, researchers have proposed various new electricity price policies and mechanisms to adjust electricity market prices because there has been a push toward increased competition in the electricity market and the deregulation of retail prices. This led to more household pricing options and increased pressure on retailers to provide competitive prices in order to retain customers. In [28], the authors suggest a combined electricity price and capacity addition tariff as an analytical approach for evaluating the optimal pricing mechanism for wind and solar energy. The study concludes that the price of RESs will vary greatly depending on the location and type of RESs. A dynamic distributed solar energy pricing model is proposed in [29], considering unit cost, profit, and taxation. This incentive mechanism has resulted in a significant drop in electricity prices from 2017 to 2020. The authors in [30] conclude that different regional grids need to provide different price mechanisms. In today’s electricity system, we can find that wholesale electricity prices can vary widely from hour to hour, and peaks often occur during peak hours due to the high cost of generating electricity. Almost all end users are currently charged some fixed rate retail electricity price [31]. However, this will cause users to consume more electricity during peak hours, introduce high costs to retailers, and negatively impact the grid. Retailers will therefore want to better allocate electricity at different times of the day by implementing proper demand-side management. Figure 1 shows important events during the development of electricity pricing.

Figure 1.

Timeline of key historical events of electricity pricing.

2.2. Electricity Price Structure

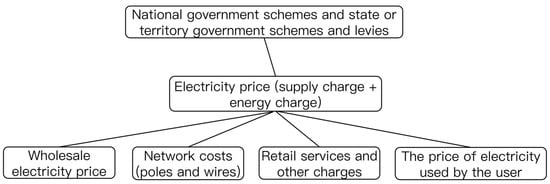

The electricity price paid by users encompasses not only the cost of energy consumption but also incorporates the power supply fee and service fees associated with energy usage. The components that contribute to the electricity price are shown in Figure 2.

Figure 2.

Components of electricity price.

A brief description of the main components of electricity price is as follows [32]:

- Wholesale electricity price: The wholesale electricity price is simply the cost incurred when preparing to transmit electricity to the user. It includes the cost of generating electricity, distributing it, and the cost of operating and maintaining transmission infrastructure. No matter what kind of energy is used (coal and RESs), it will enter the wholesale market once generated. Wholesale electricity prices are determined by supply and demand in the wholesale electricity market, which is where energy producers and retailers buy and sell electricity. Retailers buy electricity from the wholesale market, where prices are generally set every 30 min but fluctuate based on supply and demand. The factors that influence wholesale electricity prices include fuel prices, weather, electricity demand, transmission capacity, and renewable energy generation.

- Network costs (poles and wires): The network cost is the cost of the transmission and distribution network when transmitting energy required by the user to the user’s place of consumption. It includes the cost of building, operating, maintaining, and upgrading the infrastructure necessary to transmit and distribute electricity or gas. Energy suppliers typically charge network costs to cover using the energy grid in order to transport energy to customers. Network costs are regulated by regulatory bodies in each country to ensure that they are fair and transparent and that energy companies do not overcharge customers. These costs are usually calculated based on the amount of energy used by customers, as well as the distance between the energy source and the user’s location. Some factors that can affect network costs include the age and condition of the infrastructure, the level of demand and consumption, the cost of raw materials and labor, and the level of investment in new technologies and renewable energy sources. Reducing network costs is often a key priority for energy suppliers, as it can help them remain competitive and provide cost-effective energy solutions to their customers.

- National government schemes and state or territory government schemes and levies: Many national and state governments have environmental programs, such as Australia’s Large Scale Renewable Energy Target and Small Renewable Energy Plan. The cost of these government programs can also affect electricity prices for consumers. However, it is important to note that while these programs may increase electricity prices in the short term, they are ultimately expected to lead to greater energy efficiency and a transition toward RESs, which may ultimately reduce prices in the long term. Furthermore, the cost of environmental damage caused by non-renewable sources is often not factored into electricity prices, so these programs may lead to cost savings in the long run by reducing the impact of pollution on public health and other resources. Overall, government environmental programs can have a complex and nuanced impact on electricity prices, but they are ultimately a necessary step toward a more sustainable and equitable energy future.

- Retail services and other charges: Retail service is the bridge between energy retailers (such as ActewAGL) for consumers and the wholesale market. Energy retailers buy electricity for consumers from wholesale markets; arrange their meters, bills, and connections; and ensure that consumers can better manage their energy throughout the process. Retail services also offer customers a wide range of energy plans and options depending on their needs and preferences. They advise on energy efficiency, RESs, and the latest technologies that can help customers reduce their energy usage and bills. The retail services team manages customer accounts, billing, customer service, and support. They provide customers with information on their energy usage, tariffs, and billing and help them understand their consumption patterns and habits. Retail services also offer various payment options and plans to help customers manage their energy bills more effectively. In summary, retail services play a crucial role in ensuring the smooth and efficient operation of energy markets and in providing customers with high-quality services and support. Their expertise and knowledge help customers make informed decisions and take action to reduce their energy usage and bills while also contributing to a sustainable energy future.

2.3. The Evolution of the Electricity Market

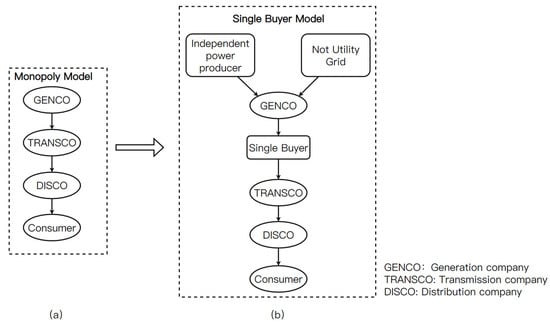

The framework of the electricity market has also changed with the development and progress of society. For most of the 20th century, the electricity market has operated within the framework of a monopoly model, as shown in Figure 3a. In this model, a single entity integrates generation, transmission, and distribution to form vertical marketing [33]. The monopoly model controls the timing and price strategy of electricity flow in the grid and has strict rules for transferring electricity. This model has been criticized for its lack of competition, which can lead to higher prices and lower-quality service. It also discourages innovation and investment in the sector, as the sole entity may have different incentives to invest in new technologies or improve existing infrastructure. Additionally, consumers may not be able to choose their electricity provider or negotiate prices, resulting in limited options for them. Many countries have moved toward a more competitive market model, such as a liberalized or deregulated one. In these models, multiple companies are allowed to participate in the market, which can lead to increased competition, innovation, and investment. Consumers may have more options and are able to negotiate prices, leading to improved overall service. Then, the electricity market framework of the single-buyer model emerges, as shown in Figure 3b. Independent power producers and existing traditional power generation companies have generated competition on the power generation side. Purchasing agencies can purchase electricity from power generation companies or independent power producers [34]. However, distribution companies do not have the right to choose power producers, and they can only follow the policy of the framework. The main purpose of the single-buyer model is to encourage private participation in the electricity market. However, its disadvantage is that consumers still need to sign long-term contracts and are subject to regulated prices. Table 1 compares the advantages and disadvantages of the monopoly and single-buyer models [33,34].

Figure 3.

(a) Monopoly model; (b) single-buyer model.

Table 1.

Advantages and disadvantages of the monopoly and single-buyer models.

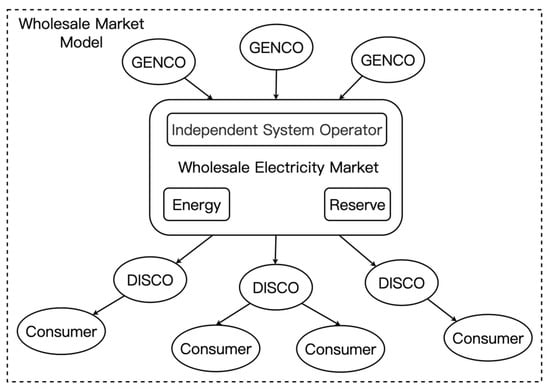

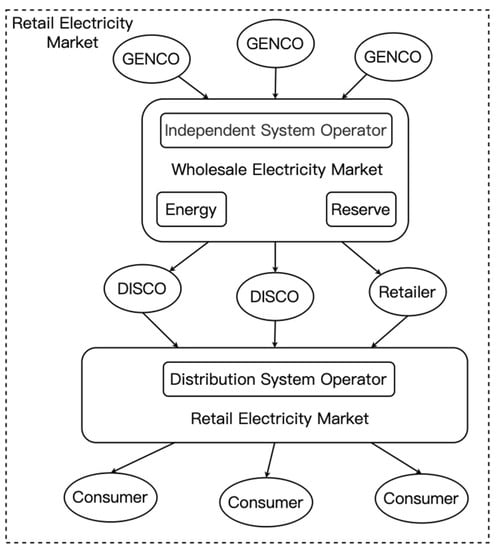

The current electricity system market consists of a wholesale market model and a retail market model, as shown in Figure 4 and Figure 5. In the wholesale market model, there is competition between generators and distributors [35]. Consumers can choose to buy electricity directly from retailers who buy electricity directly from the electricity generation company, or they can choose to buy electricity from distributors who buy electricity from multiple generators and then sell it to consumers. This model allows more competition, which can lead to lower prices for consumers. However, there are also concerns about the potential for market manipulation by large distributors and generators. In some cases, these companies may engage in anti-competitive behavior, such as price-fixing or limiting the electricity supply to drive up prices. Many countries have implemented regulations to ensure fair competition in the wholesale electricity market. These regulations may include measures that prevent market manipulation, increase transparency, and promote the development of renewable energy sources. In the retail market model, prosumers can obtain electricity from retailers or between prosumers and RESs (producers) [36]. Retailers purchase electricity from wholesale markets and sell it to end users, including prosumers. These retailers often offer fixed or variable rate plans for residential or commercial customers, considering factors such as demand, seasonality, and market prices. Prosumers can also choose to obtain electricity from RESs. They can enter into agreements with RESs to purchase a set amount of electricity directly, eliminating the need for an intermediary retailer. In some cases, prosumers may even generate and supply excess electricity back to the grid, receiving compensation from the retailer or network operator. This model gives customers the power to choose the seller, and its advantage is that it is more economical and efficient for consumers to purchase electricity. The downside is that transmission and distribution costs can increase during peak periods and in remote locations. Overall, the wholesale market model can effectively provide consumers with affordable electricity while promoting competition and innovation in the energy industry. However, it is important to balance the benefits of competition with the need for regulatory oversight to ensure fair and equitable market practices. The retail market model allows flexibility and provides choices for prosumers, who can select the most cost-effective and sustainable source of electricity for their needs.

Figure 4.

Wholesale market model.

Figure 5.

Retail electricity model.

3. P2P and M2M Energy Trading and Pricing in the Electricity Market

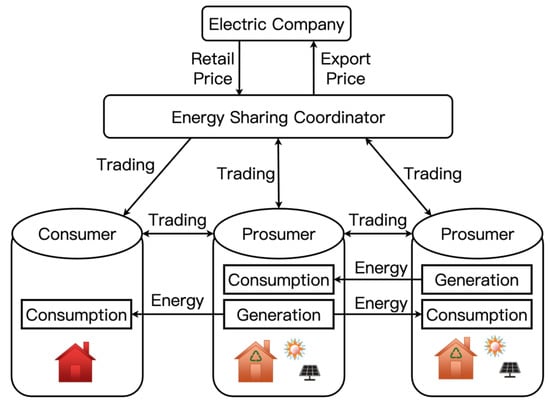

In recent years, the rapid expansion of distributed energy resources (DERs) has brought a significant transformation in energy systems, revolutionizing both the production and consumption of energy. Traditional consumers are gradually becoming prosumers who can store excess energy in storage devices, feed it back into the grid, or sell it to other prosumers. Direct energy trading between consumers and prosumers is called P2P energy trading, which can also be considered energy sharing (essentially free energy trading). With the advent of P2P energy trading, prosumers can exchange energy without intermediaries, increasing their benefits. A simplified P2P energy trading model diagram is shown in Figure 6 [37], featuring main participants such as power companies, energy sharing coordinators, consumers, and prosumers. Consumers can only purchase electricity, while prosumers can both buy electricity from or sell to other consumers or prosumers. Energy-sharing coordinators act as a platform for consumers and prosumers in negotiating energy transactions [38].

Figure 6.

P2P energy trading model.

3.1. Pricing Mechanism of P2P and M2M Electricity Trading

P2P and M2M energy trading and sharing pricing mechanisms include auction theory, bargaining, and game mechanisms based on dynamic pricing models. Auction theory involves a competitive bidding process where buyers and sellers compete to determine the market price. This approach is suitable for P2P and M2M energy trading, where participants bid for the price they are willing to pay for energy. Bargaining is another pricing mechanism that allows buyers and sellers to negotiate a mutually acceptable price [39]. This approach is suitable for situations where participants have specific energy requirements and can negotiate a price that fits their needs. Game mechanisms based on dynamic pricing models involve setting prices that are dynamically based on market demand and supply. This approach is suitable when the market is volatile and depends on weather conditions, time of day, and geographical location. Moreover, for P2P energy sharing in MGs, pricing mechanisms need to consider factors, such as battery aging, the depreciation of RESs, energy transmission losses, and the wear and tear of related facilities, to avoid inaccurate initial pricing [40]. Table 2 summarizes the methods related to pricing mechanisms for P2P and M2M energy trading and sharing within five years.

Table 2.

Pricing mechanisms for P2P and M2M energy trading and sharing.

By reviewing the literature related to the pricing mechanism of P2P and M2M energy trading, we can see that when the pricing mechanism for P2P energy trading and sharing appears in the power system, it is expected to revolutionize the way energy is bought and sold, enabling consumers to trade excess energy with each other via a decentralized platform. The pricing mechanism for P2P energy trading and sharing will be based on a market system, with consumers that are able to set prices for the energy they generate and consume. This will enable them to obtain the best value for their energy resources, and they are incentivized using RESs. The pricing mechanism will also consider factors such as the time of day and seasonal variations, as well as the level of demand in the market. This will ensure that consumers can sell their energy when prices are high and buy when prices are low. Ultimately, introducing P2P energy trading and sharing will create a more efficient and sustainable energy system, with consumers able to take control of their energy usage and make informed decisions about their energy needs. This will also enable the transition toward a more decentralized and decentralized energy system, with consumers becoming active participants in the energy market. In summary, P2P and M2M energy trading and sharing pricing mechanisms depend on various factors, including the market structure, participants’ requirements, and market volatility. Dynamic pricing models and auction theory can help optimize the trading process while ensuring fair prices for all participants.

3.2. Recent Development of P2P and M2M Energy Trading and Sharing

In recent years, researchers’ studies on P2P and M2M energy trading mechanisms in the power system have mainly focused on the following: energy trading platforms (allowing storage and trading), blockchain (equivalent to a distributed database), simulation experiments (to verify P2P energy trading mechanism), game theory (used to simulate the behavior of participants), optimization mechanism, algorithm, pricing mechanism, market design, and market regulation. These research areas aim to develop efficient, reliable, and scalable P2P and M2M energy trading mechanisms that can improve the overall performance of the electricity market and satisfy the needs of various stakeholders, including producers, consumers, and grid operators [53]. Some of the specific research topics that have emerged in recent years include peer-to-peer energy trading platforms based on blockchain technology; simulation experiments to evaluate the performance of different trading mechanisms; game-theoretic models to capture the strategic interactions among market participants; optimization algorithms to optimize the allocation and pricing of energy resources; pricing mechanisms that reflect the real-time value of electricity; market designs that balance the competing objectives of efficiency, fairness, and sustainability; and regulatory frameworks that ensure the security, privacy, and interoperability of energy markets. Table 3 summarizes the methods related to P2P and M2M energy trading mechanisms in the past five years.

Table 3.

Methods of P2P and M2M energy trading and sharing.

By reviewing the research on P2P and M2M energy trading mechanisms or methods in power systems, we can observe the following: There is great interest in developing novel approaches to enable P2P and M2M energy trading methods in power systems. Blockchain technology is a promising solution for implementing P2P energy trading mechanisms due to its decentralized nature, security, and transparency. Various market mechanisms, such as auctions, negotiations, and smart contracts, have been proposed to implement P2P and M2M energy trading in power systems. Machine learning and artificial intelligence techniques have been explored to facilitate efficient trading mechanisms and enhance the reliability of energy trading systems. Integrating RESs and ESSs into energy trading frameworks can help improve efficiency and reduce energy costs. Standards and protocols for data exchange and communication are crucial for developing reliable and secure P2P and M2M energy trading mechanisms in power systems. Overall, the research suggests that P2P and M2M energy trading mechanisms have the potential to revolutionize the energy market and provide significant benefits to consumers, producers, and the environment. However, further research and development are needed to overcome the technical, regulatory, and economic challenges associated with implementing these mechanisms.

4. Pricing in RESs, ESSs, and Controllable Loads Applications

4.1. Pricing Model in Today’s Smart Grid

The pricing mechanism mainly considers the following principles: the price should be between on-grid and public electricity prices. Based on the basic principles of economics, price is inversely proportional to the ratio of supply and demand and must always maintain an economic balance [63]. Supply and demand are basic concepts in economics and play a crucial role in determining the price of goods and services. The law of supply states that the quantity of an interest supplied will generally increase as the price of the good increases, while the law of demand states that the quantity of a suitable demand will generally decrease as the price increases [64]. The supply and demand relationship reflects the pricing basis that all producers and consumers can jointly determine in a market. When the demand for electricity increases, the price tends to increase as generators struggle to keep up with the increased demand. Conversely, when there is less demand for electricity, the price tends to fall as generators try to attract more buyers. The relationship between supply and demand can significantly impact the economy. A surplus of energy can lead to lower prices and profits for producers, while a shortage can lead to higher prices and potentially higher profits. Therefore, producers must monitor the energy demand closely and adjust their production and pricing strategies accordingly. Similarly, consumers also need to assess the energy price and determine whether it is reasonable based on their perceived value and willingness to pay. Ultimately, an equilibrium is reached when the price of energy satisfies both the producers and consumers in a market.

The ratio of total electricity sales to total electricity purchases can express the supply and demand relationship [65]. The supply and demand ratio varies over time and is inversely proportional to price. When the supply–demand ratio is zero, there is no producer or consumer that sells electricity, and individuals can only purchase the required energy from the public grid. When the supply–demand ratio is equal to or greater than 1, this indicates an excess of electricity in the system, which needs to be sold back to the utility grid. The selling price between the prosumer and the public grid will dynamically change when the supply–demand ratio falls within the range of zero and one. If there is no excess electricity trading, it can only be purchased from the public grid. From the perspective of prosumers, if supply and demand are relatively small, buyers hope to reduce electricity consumption at a lower purchase price, and sellers also hope to reduce electricity consumption to sell more energy. Conversely, if the supply–demand ratio is large, sellers will increase power consumption for higher selling prices, and buyers will increase power consumption for more energy. Pricing in this model logically appeals to prosumers via DR.

In the case of electricity pricing, supply and demand factors are influenced by various factors such as weather conditions, time of day, season, and overall economic conditions [66]. When there is excess demand for electricity, the price of electricity tends to increase, while when there is excess supply, the price tends to decrease. In the case of RESs, the pricing mechanism should also consider the energy source’s environmental benefits and long-term sustainability. Ultimately, the pricing mechanism must balance promoting efficient consumption and ensuring that electricity remains accessible and affordable for all.

4.2. Photovoltaic Prosumers

According to the feed-in tariffs of many countries, a typical photovoltaic prosumer metering configuration is two independent meters: one for photovoltaic power generation metering and one for a two-way measurement of the import and export of photovoltaic producers and consumers [67]. The photovoltaic power generation meter measures the amount of electricity generated by the photovoltaic system and is typically installed between photovoltaic panels and an inverter. This meter provides information on the amount of electricity generated from the photovoltaic system, which is used to calculate the feed-in tariff payment. The two-way meter measures the electricity consumed from the grid and the amount of electricity exported back to the grid by the photovoltaic prosumer. This meter is typically installed at the connection point between the prosumer’s electrical installation and the grid. This meter provides information on the amount of electricity consumed from the grid and the amount of electricity exported to the grid, which are used to calculate the net electricity consumption and the feed-in tariff payment [68]. The photovoltaic prosumer pays for the electricity consumed from the grid and receives payment for the electricity exported back to the grid at a feed-in tariff rate. The feed-in tariff rate is typically higher than the retail electricity rate, incentivizing prosumers to generate more electricity from their photovoltaic system than they consume from the grid [69]. The prices designed for photovoltaic producers and consumers are power generation and import and export prices. The price of power generation is set according to the total power generation (self-consumption and public use) of the photovoltaic system, and the export price is usually lower than the import price. For this feed-in tariff, the self-use of photovoltaic energy is greatly encouraged.

Each photovoltaic prosumer consists of photovoltaic systems, energy management systems, controllable loads, and smart meters [70]. The photovoltaic system is a technology that converts sunlight into electricity. It consists of photovoltaic modules, inverters, and other components that ensure proper functioning. The energy management system is responsible for optimizing the energy generated by the photovoltaic system. It can monitor energy consumption, adjust loads based on demand, and store surplus energy. Controllable loads are appliances or devices that can be turned on or off based on energy availability. Smart meters measure energy consumption and production and transmit real-time data to the energy management system. It helps prosumers optimize their energy usage and enables energy providers to manage the grid efficiently. Photovoltaic prosumers can share excess energy between prosumers instead of trading directly with the public grid. The difference between PV prosumers comes from their different load curves and PV capacity so that they can be shared in the MG. In the energy trading system, there will be an intermediate person in charge of maintaining the balance of electricity and payment in the energy trading system. The person in charge buys electricity from the utility grid or photovoltaic prosumers with surplus power and then sells the electricity to other prosumers or the utility grid. Although feed-in tariffs can provide the basic impetus for energy transactions, an appropriate pricing mechanism is still required. Because electricity price is the basic requirement of prosumer billing, DR based on dynamic pricing is conducive to improving the utilization rate of photovoltaic energy.

Load forecasting technology is based on previous data, weather conditions, and RES availability in predicting the system’s future energy demand. Load forecasting directed at the primary user aims to better forecast the future load of a given system over a specific time in order to ensure a balance between energy supply and demand. Demand forecasting is a key parameter for power system operation and planning. Larger errors in the forecasting model will increase operating costs, so an accurate load forecasting model becomes very important. The most used forecasting methods are multiple linear regression, stochastic time series, exponential smoothing, state space and Kalman filters, and artificial neural networks [71]. The battery controller only receives the electronic speed controller’s control signal without considering the prosumer’s net load [72]. For example, a battery may be discharged when the prosumer has excess photovoltaic generation. For instance, the battery may be discharged when the prosumer has excess photovoltaic generation. It can lead to inefficient battery use and potential loss of energy. Therefore, it is important to integrate a load controller that considers the prosumer’s net load. This load controller can adjust the battery’s charging and discharging rate based on the net load, optimizing the use of the battery, and ensuring maximum energy efficiency. Additionally, incorporating an energy management system can help monitor and regulate the overall energy consumption of the prosumer’s home, helping them further reduce their energy expenses.

5. Pricing in Smart Grid with Demand-Side Ancillary Services Provision

Enabled by the growing installed capacities of DERs and energy storage systems, demand-side ancillary service provision from prosumers can help maintain the stability of the power system. This is achieved by actively controlling the energy assets at the demand side to follow the regulation curve sent by the grid operator. The regulation curve is essentially a frequency control signal, resulting from the area control error in a power system. Hence, following the regulation curve will help stabilize the grid frequency upon events such as sudden load changes and/or generator malfunctions. To motivate the prosumers to participate in the DSAS, the grid operator establishes incentive schemes that reward the entities that can provide DSAD. This involves an advanced pricing scheme for incentivization [73,74,75].

DR refers to the practice of managing electricity consumption in response to grid conditions, such as price, to balance demand and supply [76]. It is a flexible approach that allows consumers to reduce their energy consumption during peak hours voluntarily or when there is a supply shortage in the grid. It can help maintain grid stability, reduce the risk of blackouts, and avoid constructing additional power generators in order to meet peak demands. DR can also help reduce energy costs for consumers and improve energy efficiency by incentivizing them to use energy more wisely. Thus, it has become an important tool for grid operators and policymakers to manage the energy system.

D-FCAS, as a type of DR, comprises the active participation of electricity prosumers in providing ancillary services to help maintain the stability and reliability of the power grid. When there is a sudden increase or decrease in electricity demand or unexpected changes in the power output from DERs, D-FCAS can help mitigate the impact by rapidly adjusting electricity consumption to help balance supply and demand. This means that prosumers are actively involved in managing the power system. Demand-side management programs, including DR, time-of-use tariffs, and energy efficiency measures, incentivize prosumers to participate in providing ancillary services [77]. With the growing penetration of RESs, D-FCAS is becoming increasingly important with respect to maintaining the stability and reliability of the power grid and supporting the transition to a low-carbon energy system.

DSAS is important to both the supply and demand sides of the electricity market and is conducive to the interactions between the two parties. Therefore, it is necessary to formulate a pricing strategy for DSAS. This pricing strategy for DSAS should consider the cost of providing the service, the level of demand, the value of the service, competition, and regulatory requirements [78]. The cost of service provision includes equipment, maintenance, and labor. The price should be set to cover these costs and provide a reasonable profit margin for service providers. The level of demand for DSAS is an important factor in setting prices. If demand is high, the price may be higher, whereas if demand is low, the price may need to be lowered to encourage more participation. The value of DSAS to the electricity market should also be considered. For example, if the service helps to stabilize the grid and prevent blackouts, the price can be higher. Competition between service providers can also affect pricing. If many service providers offer the same service, prices may need to be lower to remain competitive. Regulatory requirements may also impact pricing. For example, if regulations require a certain level of participation in DSAS, prices may be lower to encourage more participation. By considering these factors, service providers can set fair and competitive prices while still covering costs and providing a reasonable profit margin.

5.1. Market Structure and Pricing

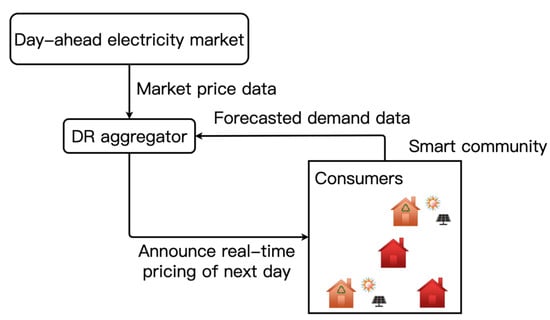

The market structure of DR is modelled based on the PJM electricity market [79] containing both day-ahead and hour-ahead decision-making processes. Prices are utilized to incentivize consumers to adjust their electrical loads and actively participate in the electricity market, facilitating DSAS and peak shaving. The PJM electricity market is an organized wholesale market that provides electricity to customers [80]. It operates as a competitive market where the price of electricity is determined by the supply and demand of electricity in real time. In this market structure, DR programs aim to manage peak demand by incentivizing customers to shift their electricity usage to times when electricity is cheaper, and demand is lower. By following this incentive, consumers can participate in the electricity market by reducing their demand during peak hours and increasing it during off-peak hours [81]. This creates a more efficient market by reducing the need for additional generation capacity during peak hours, and this reduces the likelihood of blackouts or power grid failures. DR programs enable consumers to benefit financially by reducing their electricity bills and participating in the electricity market. The programs also provide improved grid reliability, which helps utilities avoid investing in costly infrastructure upgrades. Encouraging participation in DR programs makes it possible to optimize the use of existing resources to meet the electricity demand and reduce the environmental impact of electricity use. The market structure of DR is based on the PJM electricity market, where prices are used to encourage consumers to participate in DR programs and manage peak demand. This enables DSAS and peak shaving, which creates a more efficient and less costly electricity market. By encouraging participation in DR programs, it is possible to optimize the use of existing resources, reduce the environmental impact of electricity use, and maintain grid reliability.

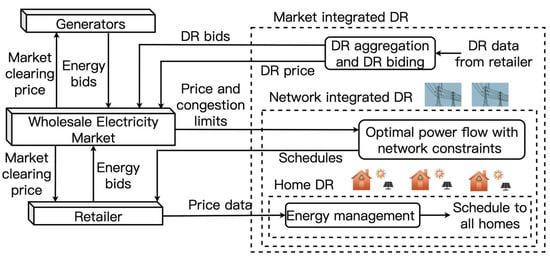

DR can be divided into economy-based and incentive-based DR. In the economy-based DR, the system operator will design different electricity price structures to motivate different types of users, such as residential and industrial [82]. Users can change their energy consumption patterns according to the pricing framework. End users are encouraged to participate in the DSAS scheme to reduce consumption when electricity prices increase and ensure safety and stability in the event of insufficient or faulty generation [83]. Figure 7 illustrates the implementation of DR among the main players in the power system. Generators and retail markets submit quotations to the wholesale market, which then provides market-clearing prices to both parties. These market-clearing prices reflect the prevailing supply and demand conditions of the wholesale market at a given time and are typically used as the basis for setting retail prices for electricity. In other words, generators and retailers submit their bids and offers to the wholesale market, and the market determines the price at which the energy will be sold. This price is based on some factors, including the cost of production, transmission and distribution, fuel prices, and market conditions. Retailers will then use this wholesale price as a starting point for setting their retail prices while considering their own costs and profit margins. Ultimately, the end user pays their energy bills based on this retail price, which is influenced by the wholesale market-clearing price. The user’s participation in DR is the need to receive the information of the predicted price. Then, the user coordinates with the aggregator to achieve the global goal of reducing energy consumption. The user’s participation is crucial to the success of DR programs, as it allows utilities to balance the supply and demand more effectively. This ultimately helps prevent power outages and reduces the cost of energy for everyone involved [67]. Additionally, users may be incentivized to participate in DR programs via other financial incentives. The DR of network integration is expected to minimize the cost of purchasing energy from the wholesale electricity market, network losses, and associated risk costs. It is achieved by optimizing the operation of assets and infrastructure, such as generators, storage systems, and transmission lines, and by leveraging advanced technology, data analytics, and modeling techniques to forecast demand and manage supply. Table 4 summarizes the research on pricing schemes related to DSAS within the past five years.

Figure 7.

DR at all levels of the power system.

Table 4.

Pricing strategies related to DSAS.

5.2. Impact on Pricing Schemes

Table 5 shows the main positive impacts and limitations of DSAS on the electricity price scheme of the power system [10,94,95].

Table 5.

DSAS impact on the pricing scheme in the power system.

While DASA may introduce certain restrictions on power system pricing schemes, it is essential for the sustainability of the electricity market as they promote grid stability, energy efficiency, and RESs while reducing electricity price volatility and achieving environmental sustainability. DSAS allows for managing and controlling electricity supply and demand by integrating technologies such as energy storage, smart meters, and advanced control systems. With the growing adoption of renewable energy sources, DSAS is becoming increasingly important in ensuring the effective integration, management, and optimization of variable, intermittent sources into the grid.

6. Pricing Framework in Retail and Wholesale Markets in the Modern Smart Grid

The modern power trading market mainly comprises two types of markets: the wholesale market and the retail market. Wholesale market participants buy electricity from utility providers and sell it to retailers at wholesale prices that are generally not predictable due to fluctuations in supply and demand [96]. These participants include power generators, wholesale energy traders, and energy brokers. The wholesale electricity market plays a critical role in ensuring a reliable and affordable electricity supply for consumers. Providing a platform for energy trading, it allows for efficient price discovery and the allocation of resources. Participants in the wholesale market must navigate complex regulations and manage risk associated with market volatility. They also play a key role in facilitating RESs integration and DR programs. Wholesalers need to maintain relationships with their suppliers and retailers to ensure consistent supply and demand for their products. Whereas retailers profit by buying from wholesalers at variable prices and selling to end users at a fixed price in the retail market, wholesalers’ profit by buying products in bulk at a lower price and selling them to retailers at a slightly higher price [97]. It allows retailers to purchase products at a price that allows them to profit while offering competitive prices to end users. It is necessary to establish various electricity price frameworks and evaluate the market to ensure good and potential energy transactions.

6.1. Pricing Framework in the Retail and Wholesale Markets

The setting of the pricing framework depends on the network’s characteristics and the pricing strategy. Some current pricing models include unified pricing, block pricing, seasonal pricing, time-of-use pricing, peak hour pricing, key peak pricing, and real-time pricing. The setting of the pricing framework for power distribution is typically influenced by factors such as the type of customers being served (e.g., residential, commercial, or industrial), the level of demand for electricity in the area, the cost of delivering power to different areas, and regulatory requirements [98]. In general, the goal of setting a pricing framework for power distribution is to ensure that prices are set at a level that covers the cost of delivering electricity while encouraging the efficient use of the network and minimizing the impact on consumers.

Flat pricing means that even if demand changes, the price remains the same, and consumers will not pay high electricity bills for using electricity that was not planned or used during peak demand times [99]. Utility companies typically use this type of pricing for residential and small commercial customers. Flat pricing can give customers a sense of stability and predictability in their monthly bills, as they will always know what their electricity costs will be regardless of the time of day or year. However, it may not incentivize customers to reduce their energy usage during peak demand times, which can lead to increased strain on the electric grid during these times. This pricing strategy has a negative impact on utilities because their consumers pay the same rate for electricity no matter how much energy is consumed [100]. Block pricing helps segment consumers based on their electricity usage, and sloped rates increase prices as consumption increases while declining schemes have the opposite effects [101]. Utility companies can use this pricing strategy to encourage energy conservation among high-usage customers. For example, a utility company might have a block pricing system where the first 500 kilowatt hours (kWh) of electricity used monthly is charged at a lower rate: for example, USD 0.10 per kWh. Any usage above that amount is charged at a higher rate: for example, USD 0.20 per kWh. This encourages customers to use less electricity to stay within the lower-priced block. A declining scheme could also be used where the price per kWh decreases as usage increases. For instance, the first 200 kWh may be charged at USD 0.15 per kWh, the next 300 kWh may be charged at USD 0.12 per kWh, and anything above 500 kWh may be charged at USD 0.10 per kWh. This may encourage customers to use more electricity since the cost per kWh decreases as usage increases. Overall, block pricing helps segment consumers based on their electricity usage, encouraging those who use more energy to conserve and those who use less energy to consume more without incurring higher costs.

Seasonal pricing means that electricity prices are priced according to different seasons to meet different needs in different seasons [46]. This is usually carried out to reflect changes in demand for electricity caused by changes in weather patterns, economic activities, and other factors that affect consumers’ energy consumption [85]. During peak seasons, especially in summer and winter, electricity demand is usually high due to the increased use of air conditioners, electric heaters, and other appliances. To balance the demand and supply of electricity, power companies usually charge higher prices during these periods to discourage excessive energy usage and help maintain a consistent electricity supply. On the other hand, during off-peak seasons such as spring and fall, when electricity demand is usually lower, power companies may offer lower prices to encourage energy consumption and utilization and avoid having an oversupply of electricity. Overall, seasonal pricing helps balance electricity demand, reduce energy wastage, and ensure that the electricity supply remains reliable and sustainable over time. Time-of-use pricing is a pre-declared price that varies depending on the time of day [102]. Electricity prices increase during peak load hours and decrease during off-peak load hours, encouraging customers to use electricity during non-peak hours when the demand for electricity is lower. This pricing strategy is designed to help utilities manage electricity demand and avoid overloading the power grid during peak demand periods [103]. This also helps create a fair pricing structure for customers who use electricity during off-peak hours. Time-of-use pricing can benefit customers who are able to shift their electricity usage to off-peak hours, reducing their overall electricity costs. However, it can be a challenge for customers who cannot easily shift their usage. Peak hour pricing electricity costs are much higher than at other times of the day. The difference from segment pricing is that the duration of peak hour pricing is shorter [104]. It typically applies only during certain times of the day when electricity demand is highest. This type of pricing is designed to encourage consumers to reduce their electricity usage during peak times, which helps reduce strain on the grid and prevent blackouts. Consumers can avoid high peak-hour prices by shifting their electricity usage to off-peak times. Many utilities also offer programs that allow customers to enroll in special rate plans that offer lower prices during off-peak hours [105]. Critical peak pricing is a dynamic pricing strategy in which utilities increase electricity prices in response to wholesale market price increases or emergencies, such as high demand or transmission constraints [84]. Critical peak pricing aims to reduce peak demand, avoid blackouts or brownouts, and minimize the need for expensive upgrades to the electricity grid. Utilities can reduce the strain on the grid by incentivizing consumers to lower their electricity usage during peak hours and maintain a more stable and efficient system. To participate in critical peak pricing programs, consumers typically need to enroll and agree to reduce their electricity usage during peak hours. Utilities may incentivize participants, such as bill credits or reduced rates during non-peak hours.

Real-time pricing is a pricing model that adjusts prices based on real-time market conditions [106]. In the case of energy usage, real-time pricing means that the cost of electricity changes regularly throughout the day as demand and supply change. For consumers, electricity may be cheaper during off-peak hours when demand is low and more expensive during peak hours when demand is high. Real-time pricing has been observed to encourage consumers to be more mindful of their energy use and to shift their consumption to times when it is less expensive, ultimately reducing energy demand during peak times. It also encourages energy providers to invest in RESs in order to reduce reliance on fossil fuels during peak hours, as prices for non-renewable energy sources can become prohibitively expensive. A brief scheme of real-time pricing is shown in Figure 8. The current research on real-time pricing mainly focuses on the following three aspects. The first is to focus on how users respond to real-time prices and realize demand with lower electricity prices. The second is to focus on real-time retail prices, regardless of users. The last aspect is to set the real-time retail electricity price based on users and retailers, matching supply and demand [106].

Figure 8.

Graphical illustration of a real-time pricing strategy.

6.2. Limitation in Electricity Retail and Wholesale Markets

The limitations of the pricing framework for retail and wholesale markets in modern smart grids are as follows [107,108]:

- Lack of flexibility: The traditional pricing framework is rigid and lacks the flexibility to accommodate changes in customers’ behavior and preferences. It cannot adapt to the dynamic energy demand and supply patterns in modern smart grids.

- Complexity: Pricing frameworks for smart grids are often complex and difficult to understand for the average consumer. This creates confusion and may discourage them from adopting energy-efficient practices.

- Inequity: Pricing frameworks may lead to inequity in terms of cost-sharing among customers, especially those who cannot afford to invest in energy-efficient appliances or heating systems.

- Data privacy concerns: Smart meters used to measure energy consumption and feed data into the pricing framework may raise privacy concerns among customers.

- Operational challenges: Implementing and maintaining pricing frameworks can be costly and time-consuming, especially for small utility companies.

- Resistance to change: Customers may resist changes in pricing structures due to familiarity and a lack of trust in new pricing mechanisms.

- Potential for market manipulation: Pricing frameworks have the potential to be manipulated by energy companies, leading to unfair pricing practices.

7. Future Research Directions

Researchers are actively studying pricing frameworks, methods, and strategies for power systems. However, despite ongoing efforts, this field still faces unresolved issues and challenges that require further investigation and exploration.

One of the main challenges is the pricing strategy after integrating variable RESs into the power system. RESs have intermittent generation patterns, making it difficult to forecast and plan for their output accurately.

Another challenge is determining the optimal pricing mechanism that promotes the efficient and cost-effective use of the power system while ensuring affordability for consumers. Some argue for a cost-based pricing approach, where prices reflect the true cost of providing electricity, while others advocate for market-based pricing approaches, where prices are determined by supply and demand.

Furthermore, there are concerns regarding power system pricing strategies’ equity and distributional impacts. Certain pricing mechanisms, such as time-of-use pricing and peak/off-peak pricing, may disproportionately affect low-income households or those with limited ability to shift their energy usage during peak periods.

Moreover, the dynamic energy trading price models combined with grid pricing schemes incentivize end-user participation in community-based peer-to-peer energy trading and sharing.

In addition, new pricing frameworks need to be proposed for consumer-centric energy trading in order to provide win–win economic benefits via cooperation and stimulate multi-stakeholder activities and market dynamism. Such pricing frameworks should have higher flexibility, lower complexity, better equality, and higher data security.

It also includes improved energy efficiency, power dispatch, voltage support, and congestion management services for local grids; cross-regional energy sharing and trading; equipment depreciation costs; and transmission losses. The above problems and challenges can be used as directions for future research.

8. Conclusions

Over the past few decades, with the increase in RESs, the electricity market has transformed, and the production and consumption of energy have also undergone dramatic changes. Electricity price is a key factor that affects the interests of various stakeholders in the electricity market and has also attracted research attention. As the number of prosumers increases, providing a more decentralized and distributed grid becomes more important. The power system has also changed from a single vertical market and fixed electricity pricing model to a diversified market mainly composed of retail markets and wholesale markets. Current power systems have dynamic pricing schemes, and many pricing frameworks and strategies related to P2P and M2M energy trading and the provision of demand-side ancillary services have also been proposed. The framework and strategies for formulating electricity prices in various ways have brought advantages to the power system.

First, formulating electricity prices in different ways can encourage consumers to use electricity efficiently. Second, having new market components such as feed-in tariffs can increase the utilization of RESs. Third, dynamic pricing can help balance supply and demand and reduce the chance of blackouts and brownouts during peak demand periods. Fourth, innovative dynamic pricing models can incentivize utilities and prosumers to adopt new technologies and energy management systems. Fifth, appropriate pricing can reduce system costs and make the electricity market more competitive and cost-effective.

This paper reviews a large body of literature on pricing methods, strategies, and frameworks in the electricity market. The electricity market’s reform and electricity price mechanism’s development have been investigated from the 20th century to the present. The main components of electricity prices and the electricity market framework from the monopoly model to the single-buyer model, and to today’s electricity market, were presented. Next, P2P and M2M energy trading and pricing strategies for DERs and load support were described. The pricing mechanisms of P2P and M2M energy trading and sharing and the current related research literature were reviewed. Recent technologies on energy trading platforms, blockchain, simulation experiments, game theory, optimization mechanisms, and algorithms were revisited. Then, pricing methodologies for RESs, batteries, and controllable load applications were elaborated. The market structure associated with DSAS and its advantages and disadvantages with respect to electricity system price schemes were detailed. We then presented the current pricing framework for retail and wholesale markets and the limitations that this framework imposes on the electricity system. Finally, future research directions for power system pricing methods, strategies, and frameworks were suggested.

From this review article, we know that government policies, regulations, technology, and market competition impact the power market framework and pricing strategies. Understanding the power market framework and pricing strategies can benefit policymakers, industries, and prosumers. Policymakers can use this knowledge to design effective policies and regulations that promote competition and innovation in the power market. Industry players can make informed decisions about investments, production, and pricing, while consumers can better manage their electricity consumption and expenses.

Author Contributions

Conceptualization, J.L. and S.S.Y.; methodology, J.L. and H.H.; formal analysis, J.L., H.H., S.S.Y. and H.T.; resources, S.S.Y. and H.T.; writing—original draft preparation, J.L.; writing—review and editing, H.H. and S.S.Y.; supervision, S.S.Y. and H.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

This is a review paper. There was no original data generated.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Mahmood, A.; Javaid, N.; Razzaq, S. A review of wireless communications for smart grid. Renew. Sustain. Energy Rev. 2015, 41, 248–260. [Google Scholar] [CrossRef]

- Li, Z.; Bahramirad, S.; Paaso, A.; Yan, M.; Shahidehpour, M. Blockchain for decentralized transactive energy management system in networked microgrids. Electr. J. 2019, 32, 58–72. [Google Scholar] [CrossRef]

- Rasheed, M.B.; Qureshi, M.A.; Javaid, N.; Alquthami, T. Dynamic pricing mechanism with the integration of renewable energy source in smart grid. IEEE Access 2020, 8, 16876–16892. [Google Scholar] [CrossRef]

- Rahimi, F.; Ipakchi, A. Demand response as a market resource under the smart grid paradigm. IEEE Trans. Smart Grid 2010, 1, 82–88. [Google Scholar] [CrossRef]

- Lu, T.; Chen, X.; McElroy, M.B.; Nielsen, C.P.; Wu, Q.; Ai, Q. A reinforcement learning-based decision system for electricity pricing plan selection by smart grid end users. IEEE Trans. Smart Grid 2021, 12, 2176–2187. [Google Scholar] [CrossRef]

- Wang, D.; Liu, B.; Jia, H.; Zhang, Z.; Chen, J.; Huang, D. Peer-to-peer Electricity Transaction Decisions of the User-side Smart Energy System Based on the SARSA Reinforcement Learning. CSEE J. Power Energy Syst. 2020, 8, 826–837. [Google Scholar]

- Zhang, C.; Wu, J.; Zhou, Y.; Cheng, M.; Long, C. Peer-to-Peer energy trading in a Microgrid. Appl. Energy 2018, 220, 1–12. [Google Scholar] [CrossRef]

- Bui, V.H.; Hussain, A.; Su, W. A Dynamic Internal Trading Price Strategy for Networked Microgrids: A Deep Reinforcement Learning-Based Game-Theoretic Approach. IEEE Trans. Smart Grid 2022, 13, 3408–3421. [Google Scholar] [CrossRef]

- Al-Rubaye, S.; Choi, B.J. Energy load management for residential consumers in smart grid networks. In Proceedings of the 2016 IEEE International Conference on Consumer Electronics (ICCE), Las Vegas, NV, USA, 7–11 January 2016. [Google Scholar]

- Yang, C.; Meng, C.; Zhou, K. Residential electricity pricing in China: The context of price-based demand response. Renew. Sustain. Energy Rev. 2018, 81, 2870–2878. [Google Scholar] [CrossRef]

- Da Silva, P.P.; Cerqueira, P.A. Assessing the determinants of household electricity prices in the EU: A system-GMM panel data approach. Renew. Sustain. Energy Rev. 2017, 73, 1131–1137. [Google Scholar] [CrossRef]

- Kolb, S.; Dillig, M.; Plankenbühler, T.; Karl, J. The impact of renewables on electricity prices in Germany-An update for the years 2014–2018. Renew. Sustain. Energy Rev. 2020, 134, 110307. [Google Scholar] [CrossRef]

- Lago, J.; Marcjasz, G.; De Schutter, B.; Weron, R. Forecasting day-ahead electricity prices: A review of state-of-the-art algorithms, best practices and an open-access benchmark. Appl. Energy 2021, 293, 116983. [Google Scholar] [CrossRef]

- Olivares, K.G.; Challu, C.; Marcjasz, G.; Weron, R.; Dubrawski, A. Neural basis expansion analysis with exogenous variables: Forecasting electricity prices with NBEATSx. Int. J. Forecast. 2022, 39, 884–900. [Google Scholar] [CrossRef]

- Muqeet, H.A.; Munir, H.M.; Javed, H.; Shahzad, M.; Jamil, M.; Guerrero, J.M. An energy management system of campus microgrids: State-of-the-art and future challenges. Energies 2021, 14, 6525. [Google Scholar] [CrossRef]

- Nowotarski, J.; Weron, R. Recent advances in electricity price forecasting: A review of probabilistic forecasting. Renew. Sustain. Energy Rev. 2018, 81, 1548–1568. [Google Scholar] [CrossRef]

- Zhou, Y.; Lund, P.D. Peer-to-peer energy sharing and trading of renewable energy in smart communities—Trading pricing models, decision-making and agent-based collaboration. Renew. Energy 2023, 207, 177–193. [Google Scholar] [CrossRef]

- Sampson, E.M.; Longe, O.M. Review of the Role of Energy Pricing Policies in Electricity Retail Market. In Proceedings of the 2021 IEEE PES/IAS PowerAfrica, Nairobi, Kenya, 23–27 August 2021. [Google Scholar]

- Buckley, P. Prices, information and nudges for residential electricity conservation: A meta-analysis. Ecol. Econ. 2020, 172, 106635. [Google Scholar] [CrossRef]

- Wang, Y.; He, Y.; Duan, Q.; Wang, H.; Bie, P. Distribution Locational Marginal Pricing for Active Network Management Considering High Penetration of Distributed Energy Resources. In Proceedings of the 2019 IEEE 3rd Conference on Energy Internet and Energy System Integration (EI2), Changsha, China, 8–10 November 2019. [Google Scholar]

- Wang, D. Research on the fixed assets of the power grid company under the power transmission and distribution price reform. Enterp. Reform Manag. 2017, 19, 130–131. [Google Scholar]

- Steiner, F. Regulation, industry structure, and performance in the electricity supply industry. Ph.D. Thesis, Stanford University, Stanford, CA, USA, August 2001. [Google Scholar]

- Erdogdu, E. The impact of power market reforms on electricity price-cost margins and cross-subsidy levels: A cross country panel data analysis. Energy Policy 2011, 39, 1080–1092. [Google Scholar] [CrossRef]

- Hattori, T.; Tsutsui, M. Economic impact of regulatory reforms in the electricity supply industry: A panel data analysis for OECD countries. Energy Policy 2004, 32, 823–832. [Google Scholar] [CrossRef]

- Florio, M. Energy Reforms and Consumer Prices in the EU over twenty Years. Econ. Energy Environ. Policy 2014, 3, 37–51. [Google Scholar] [CrossRef]

- Dillig, M.; Jung, M.; Karl, J. The impact of renewables on electricity prices in Germany—An estimation based on historic spot prices in the years 2011–2013. Renew. Sustain. Energy Rev. 2016, 57, 7–15. [Google Scholar] [CrossRef]

- Winkler, J.; Gaio, A.; Pfluger, B.; Ragwitz, M. Impact of renewables on electricity markets—Do support schemes matter? Energy Policy 2016, 93, 157–167. [Google Scholar] [CrossRef]

- Antweiler, W. A two-part feed-in-tariff for intermittent electricity generation. Energy Econ. 2017, 65, 458–470. [Google Scholar] [CrossRef]

- Yang, C.; Ge, Z. Dynamic feed-in tariff pricing model of distributed photovoltaic generation in China. Energy Procedia 2018, 152, 27–32. [Google Scholar] [CrossRef]

- Zhang, R.; Ni, M.; Shen, G.Q.; Wong, J.K. An analysis on the effectiveness and determinants of the wind power Feed-in-Tariff policy at China’s national-level and regional-grid-level. Sustain. Energy Technol. Assess. 2019, 34, 87–96. [Google Scholar] [CrossRef]

- Mohsenian-Rad, A.H.; Leon-Garcia, A. Optimal residential load control with price prediction in real-time electricity pricing environments. IEEE Trans. Smart Grid 2010, 1, 120–133. [Google Scholar] [CrossRef]

- ActewAGL-What Makes Up Your Electricity Price? Available online: https://www.actewagl.com.au/beyond-energy/blog/what-makes-up-your-electricity-price (accessed on 8 May 2023).

- Maiorano, A.; Song, Y.H.; Trovato, M. Imperfect competition: Modeling and analysis of oligopoly electricity markets. IEEE Power Eng. Rev. 1999, 19, 56–58. [Google Scholar] [CrossRef]

- Sakya, I.M.R.; Simanjutak, U.R.; Schavemaker, P.H.; van der Sluts, L. Experience with internal competition using the single buyer model in Jawa Bali-Indonesia. In Proceedings of the 2006 Eleventh International Middle East Power Systems Conference, Minia, Egypt, 19–21 December 2006. [Google Scholar]

- Bublitz, A.; Keles, D.; Zimmermann, F.; Fraunholz, C.; Fichtner, W. A survey on electricity market design: Insights from theory and real-world implementations of capacity remuneration mechanisms. Energy Econ. 2019, 80, 1059–1078. [Google Scholar] [CrossRef]

- Hesamzadeh, M.R.; Hosseinzadeh, N.; Wolfs, P.J. A multi-criteria decision framework for optimal augmentation of transmission grid-Addressing a tool for sensitive zone detection in electricity market. Int. J. Emerg. Electr. Power Syst. 2008, 9, 1–16. [Google Scholar] [CrossRef]

- Soto, E.A.; Bosman, L.B.; Wollega, E.; Leon-Salas, W.D. Peer-to-peer energy trading: A review of the literature. Appl. Energy 2021, 283, 116268. [Google Scholar] [CrossRef]

- Zhou, Y.; Wu, J.; Long, C. Evaluation of peer-to-peer energy sharing mechanisms based on a multiagent simulation framework. Appl. Energy 2018, 222, 993–1022. [Google Scholar] [CrossRef]

- Dehghanpour, K.; Nehrir, H. An agent-based hierarchical bargaining framework for power management of multiple cooperative microgrids. IEEE Trans. Smart Grid 2017, 10, 514–522. [Google Scholar] [CrossRef]

- Ali, L.; Azim, M.I.; Peters, J.; Bhandari, V.; Menon, A.; Tiwari, V.; Green, J.; Muyeen, S.M. Application of a Community Battery-Integrated Microgrid in a Blockchain-Based Local Energy Market Accommodating P2P Trading. IEEE Access 2023, 11, 29635–29649. [Google Scholar] [CrossRef]

- Lu, Z.; Bai, L.; Wang, J.; Wei, J.; Xiao, Y.; Chen, Y. Peer-to-Peer Joint Electricity and Carbon Trading Based on Carbon-Aware Distribution Locational Marginal Pricing. IEEE Trans. Power Syst. 2023, 38, 835–852. [Google Scholar] [CrossRef]

- Xia, Y.; Xu, Q.; Huang, Y.; Du, P. Peer-to-peer energy trading market considering renewable energy uncertainty and participants’ individual preferences. Int. J. Electr. Power Energy Syst. 2023, 148, 108931. [Google Scholar] [CrossRef]

- May, R.; Huang, P. A multi-agent reinforcement learning approach for investigating and optimising peer-to-peer prosumer energy markets. Appl. Energy 2023, 334, 120705. [Google Scholar] [CrossRef]

- Aznavi, S.; Fajri, P.; Shadmand, M.B.; Khoshkbar-Sadigh, A. Peer-to-peer operation strategy of PV equipped office buildings and charging stations considering electric vehicle energy pricing. IEEE Trans. Ind. Appl. 2020, 56, 5848–5857. [Google Scholar] [CrossRef]

- Zhang, B.; Du, Y.; Lim, E.G.; Jiang, L.; Yan, K. Design and Simulation of Peer-to-Peer Energy Trading Framework with Dynamic Electricity Price. In Proceedings of the 2019 29th Australasian Universities Power Engineering Conference (AUPEC), Nadi, Fiji, 26–29 November 2019. [Google Scholar]

- Tsao, Y.C.; Linh, V.T. A new three-part tariff pricing scheme for the electricity microgrid considering consumer regret. Energy 2022, 254, 124387. [Google Scholar] [CrossRef]