The Economic Contributions of the Virginia Seafood Industry and the Effects of Virginia Seafood Products in Retail Stores and Restaurants in 2023

Abstract

1. Introduction

2. Materials and Methods

2.1. Identification of Required Data and Gaps

2.2. Data on Direct Effects and Expenditure Data

2.3. Survey Design and Data Collection

2.4. Scope of Data Collection

2.5. List Frame, Recruitment of Participants, and Survey Activities

2.6. Accounting for Non-Responses

2.7. Economic Contributions Assessment—Theory of Input–Output Modeling

2.8. Industry Impact Analysis

2.9. Study Area Characteristics

3. Results

3.1. Response and Coverage Rates

3.2. Economic Contributions of the Virginia Seafood Industry, 2023

3.3. Tax Revenue Generated by the Virginia Seafood Industry in 2023

3.4. Economic Contributions of Virginia Seafood Products from Retail Stores and Restaurants in 2023

3.5. Tax Revenue Generated by Virginia Seafood Products from Retail Stores and Restaurants, 2023

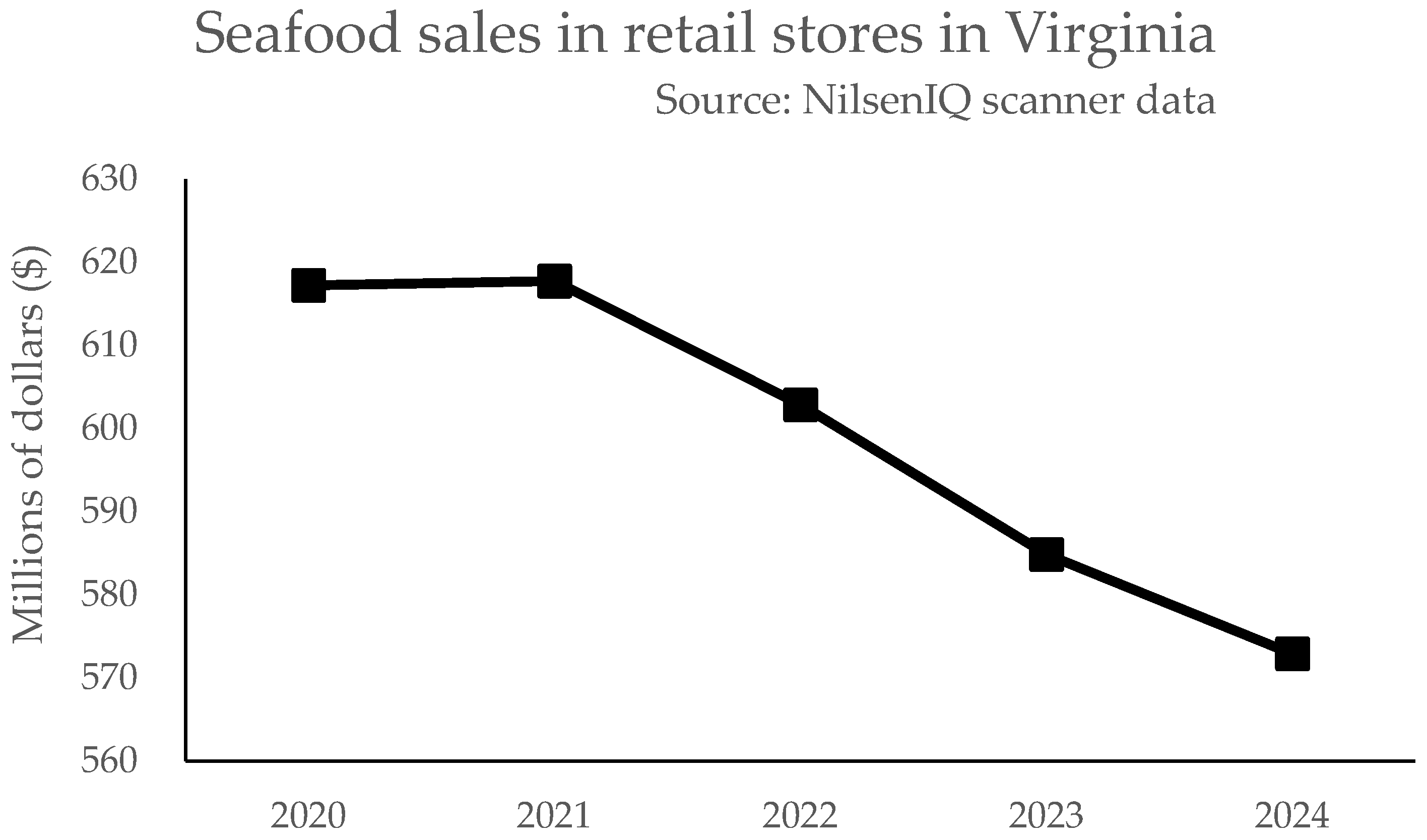

3.6. Seafood Sales Trend in Retail Stores

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Hegde, S.; Kumar, G.; Engle, C.; Hanson, T.; Roy, L.A.; van Senten, J.; Johnson, J.; Avery, J.; Aarattuthodi, S.; Dahl, S.; et al. Economic Contribution of the U.S. Catfish Industry. Aquac. Econ. Manag. 2022, 26, 384–413. [Google Scholar] [CrossRef]

- Kumar, G.; Hegde, S.; van Senten, J.; Engle, C.; Boldt, N.; Parker, M.; Quagrainie, K.; Posadas, B.; Asche, F.; Dey, M.; et al. Economic Contribution of U.S. Aquaculture Farms. J. World Aquac. Soc. 2024, 55, e13091. [Google Scholar] [CrossRef]

- Gonçalves, F.H.; van Senten, J.; Schwarz, M.H.; Hegde, S. Assessing Economic Contributions of the Virginia Seafood Industry: An Estimation Framework Utilizing Primary Data. Fishes 2024, 9, 200. [Google Scholar] [CrossRef]

- Kumar, G.; Engle, C.; van Senten, J.; Sun, L.; Hegde, S.; Richardson, B.M. Resource Productivity and Costs of Aquaculture Practices: Economic-Sustainability Perspectives from U.S. Catfish Farming. Aquaculture 2023, 574, 739715. [Google Scholar] [CrossRef]

- Leontief, W.W. Quantitative Input and Output Relations in the Economic Systems of the United States. Rev. Econ. Stat. 1936, 18, 105. [Google Scholar] [CrossRef]

- Dumas, C. Economic Impact Analysis of North Carolina’s Commercial Fisheries—Commercial Harvesters Survey; Commercial Fishing Resource Fund Program: Morehead City, NC, USA, 2021. [Google Scholar]

- Botta, R.; Court, C.D.; Ropicki, A.; Camp, E.V. Evaluating the Regional Economic Contributions of US Aquaculture: Case Study of Florida’s Shellfish Aquaculture Industry. Aquac. Econ. Manag. 2021, 25, 223–244. [Google Scholar] [CrossRef]

- Deisenroth, D.B.; Bond, C.A.; Loomis, J.B. The Economic Contribution of the Private, Recreation-Based Aquaculture Industry in the Western United States. Aquac. Econ. Manag. 2012, 16, 1–21. [Google Scholar] [CrossRef]

- National Marine Fisheries Service. Fisheries of the United States, 2022; National Marine Fisheries Service: Silver Spring, MD, USA, 2024. [Google Scholar]

- National Restaurant Association Restaurant Economic Insights. 2025. Available online: https://restaurant.org/research-and-media/research/restaurant-economic-insights/economic-indicators/ (accessed on 25 April 2025).

- National Retail Federation. The Economic Contribution of the U.S. Retail Industry; National Retail Federation: Washington, DC, USA, 2024. [Google Scholar]

- National Restaurant Association. Economic Contributions of the Restaurant & Foodservice Industry—Virginia; National Restaurant Association: Washington, DC, USA, 2024. [Google Scholar]

- VMPB About Virginia Seafood. Virginia Marine Products Board. Available online: https://www.virginiaseafood.org/about-virginia-seafood/ (accessed on 5 June 2025).

- Virginia Marine Products Board (VMPB). Virginia Seafood Supplier’s Directory. Available online: https://virginiaseafood.org (accessed on 26 February 2024).

- NOAA Fisheries. Fisheries One Stop Shop (FOSS); NOAA Fisheries: Silver Spring, MD, USA, 2025. [Google Scholar]

- USDA-NASS. 2023 Census of Aquaculture; USDA-NASS: Washington, DC, USA, 2024. [Google Scholar]

- Virginia Marine Resources Commission (VMRC). Public Records from the Commercial Fishing License System (CFLS). Requested via VMRC Plans & Statistics Data Request Form 2024. Available online: https://mrc.virginia.gov/ (accessed on 26 February 2024).

- IMPLAN Economic Impact Analysis for Planning. Available online: https://implan.com (accessed on 26 February 2024).

- Kaliba, A.R.; Engle, C.R. The Economic Impact of the Catfish, Ictalurus Punctatus, Industry on Chicot County, Arkansas. J. Appl. Aquac. 2004, 15, 29–59. [Google Scholar] [CrossRef]

- U.S. Bureau of Labor Statistics CPI Inflation Calculator. Available online: https://www.bls.gov/data/inflation_calculator.htm (accessed on 27 May 2025).

- Taylor, J.E.; Charlton, D.; Yuńez-Naude, A. The End of Farm Labor Abundance. Appl. Econ. Perspect. Policy 2012, 34, 587–598. [Google Scholar] [CrossRef]

- Pascoe, S.; Paredes, S.; Coglan, L. The Indirect Economic Contribution of Fisheries to Coastal Communities through Tourism. Fishes 2023, 8, 138. [Google Scholar] [CrossRef]

- Nguyen, L.; Gao, Z.; Anderson, J.L. Regulating Menu Information: What Do Consumers Care and Not Care about at Casual and Fine Dining Restaurants for Seafood Consumption? Food Policy 2022, 110, 102272. [Google Scholar] [CrossRef]

- van Senten, J.; Engle, C.R.; Smith, M.A. Effects of COVID-19 on U.S. Aquaculture Farms. Appl. Econ. Perspect. Policy 2021, 43, 355–367. [Google Scholar] [CrossRef]

- Landais, E.; Miotto-Plessis, M.; Bene, C.; Maitre D’hotel, E.; Truong, M.T.; Erome, J.; Som, W.; Verger, E.O. Consumption of Food Away from Home in Low- and Middle-Income Countries: A Systematic Scoping Review. Nutr. Rev. 2023, 81, 727–754. [Google Scholar] [CrossRef]

- Davis, G.C.; You, W. The Time Cost of Food at Home: General and Food Stamp Participant Profiles. Appl. Econ. 2010, 42, 2537–2552. [Google Scholar] [CrossRef]

- Sun, L.; Engle, C.; Kumar, G.; van Senten, J. Retail Market Trends for Seafood in the United States. J. World Aquac. Soc. 2023, 54, 603–624. [Google Scholar] [CrossRef]

- Cerar, J.; Nell, P.C.; Reiche, B.S. The Declining Share of Primary Data and the Neglect of the Individual Level in International Business Research. J. Int. Bus. Stud. 2021, 52, 1365–1374. [Google Scholar] [CrossRef]

- Watson, P.; Cooke, S.; Kay, D.; Alward, G. A Method for Improving Economic Contribution Studies for Regional Analysis. J. Reg. Anal. Policy 2015, 45, 1–15. [Google Scholar] [CrossRef]

| Effect Type | Employment | Labor Income | Value-Added | Output |

|---|---|---|---|---|

| Direct Effect | 5224 | USD 147,679,352 | USD 811,637,573 | USD 986,703,783 |

| Indirect Effect | 580 | USD 49,215,728 | USD 82,653,390 | USD 157,223,744 |

| Induced Effect | 703 | USD 41,436,023 | USD 82,439,558 | USD 128,479,826 |

| Total Effect | 6507 | USD 238,331,103 | USD 976,730,521 | USD 1,272,407,353 |

| Effect Type | Employment | Labor Income | Value-Added | Output |

|---|---|---|---|---|

| Watermen | 1820 | USD 55,926,829 | USD 186,831,211 | USD 244,234,108 |

| Direct Effect | 1571 | USD 37,890,309 | USD 153,593,400 | USD 186,653,808 |

| Indirect Effect | 84 | USD 8,319,317 | USD 13,904,307 | USD 27,449,670 |

| Induced Effect | 165 | USD 9,717,202 | USD 19,333,504 | USD 30,130,630 |

| Aquaculture | 756 | USD 39,735,750 | USD 92,114,626 | USD 175,471,201 |

| Direct | 419 | USD 16,526,981 | USD 50,465,055 | USD 104,225,000 |

| Indirect | 219 | USD 16,240,540 | USD 27,790,798 | USD 49,646,603 |

| Induced | 118 | USD 6,968,229 | USD 13,858,773 | USD 21,599,599 |

| Processors | 2545 | USD 90,103,093 | USD 589,064,589 | USD 701,403,082 |

| Direct | 2089 | USD 56,681,019 | USD 528,362,990 | USD 593,261,318 |

| Indirect | 193 | USD 17,931,618 | USD 29,867,880 | USD 60,091,388 |

| Induced | 263 | USD 15,490,456 | USD 30,833,719 | USD 48,050,375 |

| Distributors | 1386 | USD 52,565,432 | USD 108,720,095 | USD 151,298,962 |

| Direct | 1145 | USD 36,581,043 | USD 79,216,128 | USD 102,563,657 |

| Indirect | 84 | USD 6,724,253 | USD 11,090,405 | USD 20,036,083 |

| Induced | 157 | USD 9,260,136 | USD 18,413,562 | USD 28,699,222 |

| Total Effect | 6507 | USD 238,331,104 | USD 976,730,521 | USD 1,272,407,353 |

| Industry Description | Employment | Labor Income | Value-Added | Output |

|---|---|---|---|---|

| Nondepository credit intermediation and related activities | 63 | USD 10,960,448 | USD 16,524,684 | USD 26,891,547 |

| Owner-occupied housing | 0 | USD 0 | USD 20,408,048 | USD 23,131,605 |

| Insurance agencies, brokerages, and related activities | 48 | USD 4,730,684 | USD 7,506,122 | USD 15,109,213 |

| Commercial and industrial machinery and equipment repair and maintenance | 60 | USD 4,742,691 | USD 5,268,634 | USD 8,349,706 |

| Polystyrene foam product manufacturing | 13 | USD 922,776 | USD 1,435,925 | USD 6,625,427 |

| Hospitals | 31 | USD 3,009,601 | USD 3,660,714 | USD 6,436,174 |

| Other real estate | 32 | USD 837,226 | USD 2,686,566 | USD 6,142,422 |

| Air conditioning, refrigeration, and warm air heating equipment manufacturing | 12 | USD 1,030,657 | USD 1,831,887 | USD 5,631,221 |

| Monetary authorities and depository credit intermediation | 11 | USD 1,144,335 | USD 3,238,249 | USD 4,770,293 |

| Electric power generation—nuclear | 4 | USD 775,067 | USD 2,687,925 | USD 4,514,392 |

| Water, sewage and other systems | 16 | USD 1,935,320 | USD 2,873,537 | USD 4,506,452 |

| Other animal food manufacturing | 3 | USD 204,154 | USD 735,925 | USD 4,330,616 |

| Electric power generation—fossil fuel | 2 | USD 395,652 | USD 2,376,040 | USD 4,275,647 |

| Data processing, hosting, and related services | 11 | USD 1,605,346 | USD 2,554,180 | USD 4,270,775 |

| Limited-service restaurants | 38 | USD 1,070,505 | USD 1,980,938 | USD 4,230,234 |

| All other industries * | 6164 | USD 216,534,169 | USD 920,282,285 | USD 1,143,191,628 |

| Indirect and induced impact | 1284 | USD 90,651,751 | USD 165,092,947 | USD 285,703,570 |

| Tax Category | Watermen | Aquaculture | Processors | Distributors | Total |

|---|---|---|---|---|---|

| Local tax * | USD 9,556,157 | USD 7,927,187 | USD 17,931,200 | USD 4,130,964 | USD 39,545,508 |

| State tax | USD 9,893,745 | USD 6,958,179 | USD 23,149,663 | USD 5,024,333 | USD 45,025,921 |

| Federal tax | USD 16,832,195 | USD 9,884,516 | USD 40,780,367 | USD 12,374,080 | USD 79,871,159 |

| Total tax | USD 36,282,098 | USD 24,769,882 | USD 81,861,230 | USD 21,529,378 | USD 164,442,588 |

| Effect Type | Employment | Labor Income | Value-Added | Output |

|---|---|---|---|---|

| Retail stores | 2111 | USD 76,422,996 | USD 168,835,178 | USD 225,826,595 |

| Direct | 1509 | USD 56,579,779 | USD 112,994,846 | USD 154,926,269 |

| Indirect | 378 | USD 6,684,900 | USD 29,650,432 | USD 30,086,372 |

| Induced | 224 | USD 13,158,317 | USD 26,189,900 | USD 40,813,954 |

| Full-service restaurants | 839 | USD 32,847,343 | USD 59,387,211 | USD 117,233,380 |

| Direct | 638 | USD 20,683,835 | USD 34,448,612 | USD 61,889,727 |

| Indirect | 105 | USD 6,511,627 | USD 13,688,960 | USD 37,812,450 |

| Induced | 96 | USD 5,651,881 | USD 11,249,639 | USD 17,531,203 |

| Limited-service restaurants | 686 | USD 25,156,361 | USD 48,908,633 | USD 108,605,469 |

| Direct | 500 | USD 13,899,236 | USD 25,720,127 | USD 54,924,579 |

| Indirect | 112 | USD 6,925,137 | USD 14,566,300 | USD 40,244,162 |

| Induced | 74 | USD 4,331,989 | USD 8,622,206 | USD 13,436,728 |

| All other food and drink places | 53 | USD 2,277,731 | USD 3,741,194 | USD 6,377,802 |

| Direct | 42 | USD 1,606,615 | USD 2,376,150 | USD 3,547,371 |

| Indirect | 5 | USD 279,538 | USD 585,611 | USD 1,615,783 |

| Induced | 7 | USD 391,578 | USD 779,434 | USD 1,214,648 |

| Total Effect | 3689 | USD 136,704,431 | USD 280,872,216 | USD 458,043,246 |

| Industry Description | Employment | Labor Income | Value-Added | Output |

|---|---|---|---|---|

| Commercial fishing | 375 | USD 6,491,199 | USD 29,314,842 | USD 29,486,185 |

| Owner-occupied housing | 0 | USD 0 | USD 4,916,955 | USD 5,573,148 |

| Hospitals | 10 | USD 956,558 | USD 1,163,505 | USD 2,045,645 |

| Other real estate | 7 | USD 188,862 | USD 606,038 | USD 1,385,613 |

| Offices of physicians | 8 | USD 927,039 | USD 893,940 | USD 1,340,134 |

| Limited-service restaurants | 12 | USD 334,060 | USD 618,169 | USD 1,320,081 |

| Full-service restaurants | 12 | USD 385,149 | USD 641,461 | USD 1,152,436 |

| Retail—motor vehicle and parts dealers | 4 | USD 307,255 | USD 661,985 | USD 892,832 |

| Monetary authorities and depository credit intermediation | 2 | USD 213,865 | USD 605,197 | USD 891,521 |

| Tenant-occupied housing | 2 | USD 55,907 | USD 818,076 | USD 873,720 |

| Insurance carriers, except direct life | 2 | USD 146,757 | USD 331,959 | USD 752,491 |

| Other financial investment activities | 4 | USD 169,204 | USD 189,593 | USD 721,819 |

| Management of companies and enterprises | 2 | USD 405,793 | USD 490,405 | USD 712,562 |

| Data processing, hosting, and related services | 2 | USD 248,784 | USD 395,827 | USD 661,851 |

| Retail—general merchandise stores | 7 | USD 252,091 | USD 451,309 | USD 643,582 |

| All other industries * | 1,662 | USD 65,340,471 | USD 126,735,919 | USD 177,372,975 |

| Indirect and induced impact | 602 | USD 19,843,217 | USD 55,840,332 | USD 70,900,326 |

| Industry Description | Employment | Labor Income | Value-Added | Output |

|---|---|---|---|---|

| Seafood product preparation and packaging | 96 | USD 6,381,887 | USD 15,444,137 | USD 58,632,059 |

| Owner-occupied housing | 0 | USD 0 | USD 3,876,547 | USD 4,393,892 |

| Truck transportation | 15 | USD 1,059,540 | USD 1,471,975 | USD 3,189,140 |

| Commercial fishing | 38 | USD 660,334 | USD 2,982,128 | USD 2,999,558 |

| Management of companies and enterprises | 10 | USD 1,653,477 | USD 1,998,244 | USD 2,903,461 |

| Wholesale—Grocery and related product wholesalers | 10 | USD 806,651 | USD 1,583,546 | USD 2,789,933 |

| Other real estate | 9 | USD 230,064 | USD 738,250 | USD 1,687,896 |

| Hospitals | 8 | USD 754,279 | USD 917,464 | USD 1,613,061 |

| Offices of physicians | 6 | USD 731,015 | USD 704,915 | USD 1,056,760 |

| Monetary authorities and depository credit intermediation | 2 | USD 238,711 | USD 675,507 | USD 995,095 |

| Insurance agencies, brokerages, and related activities | 3 | USD 290,027 | USD 460,183 | USD 926,311 |

| Electric power transmission and distribution | 1 | USD 95,115 | USD 414,456 | USD 855,397 |

| Data processing, hosting, and related services | 2 | USD 297,625 | USD 473,536 | USD 791,786 |

| Insurance carriers, except direct life | 2 | USD 151,231 | USD 342,078 | USD 775,428 |

| Retail—Motor vehicle and parts dealers | 3 | USD 247,375 | USD 532,973 | USD 718,832 |

| All other industries * | 1524 | USD 46,684,106 | USD 79,421,099 | USD 147,888,041 |

| Indirect and induced impact | 398 | USD 24,091,749 | USD 49,492,149 | USD 111,854,973 |

| Tax Category | Retail Stores | Full-Service Restaurants | Limited-Service Restaurants | All Other Food and Drink Places | Total |

|---|---|---|---|---|---|

| Local tax * | USD 14,418,608 | USD 3,391,512 | USD 3,395,179 | USD 187,739 | USD 21,393,038 |

| State tax | USD 12,592,431 | USD 3,410,165 | USD 3,175,719 | USD 199,436 | USD 19,377,751 |

| Federal tax | USD 19,458,058 | USD 7,792,721 | USD 6,107,644 | USD 524,640 | USD 33,883,063 |

| Total tax | USD 46,469,097 | USD 14,594,398 | USD 12,678,542 | USD 911,816 | USD 74,653,853 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gonçalves, F.H.; van Senten, J.; Schwarz, M.H. The Economic Contributions of the Virginia Seafood Industry and the Effects of Virginia Seafood Products in Retail Stores and Restaurants in 2023. Fishes 2025, 10, 373. https://doi.org/10.3390/fishes10080373

Gonçalves FH, van Senten J, Schwarz MH. The Economic Contributions of the Virginia Seafood Industry and the Effects of Virginia Seafood Products in Retail Stores and Restaurants in 2023. Fishes. 2025; 10(8):373. https://doi.org/10.3390/fishes10080373

Chicago/Turabian StyleGonçalves, Fernando H., Jonathan van Senten, and Michael H. Schwarz. 2025. "The Economic Contributions of the Virginia Seafood Industry and the Effects of Virginia Seafood Products in Retail Stores and Restaurants in 2023" Fishes 10, no. 8: 373. https://doi.org/10.3390/fishes10080373

APA StyleGonçalves, F. H., van Senten, J., & Schwarz, M. H. (2025). The Economic Contributions of the Virginia Seafood Industry and the Effects of Virginia Seafood Products in Retail Stores and Restaurants in 2023. Fishes, 10(8), 373. https://doi.org/10.3390/fishes10080373