Recycling or Sustainability: The Road of Electric Vehicles Toward Sustainable Economy via Blockchain

Abstract

1. Introduction

- (i)

- What are the crucial issues in the ongoing debate on the development of the electric vehicle concept?

- (ii)

- Where are the major conflicting points and focuses between sustainable economy and electric vehicles?

- (iii)

- How does the mining of metals and minerals follow current zero-waste sustainability trends?

- (iv)

- How does the prediction of the magnitude of the future demand for EV batteries guide strategic decision-making in policies throughout the globe?

2. EVs in Today’s Context

2.1. Toward Industry 4.0 and Beyond

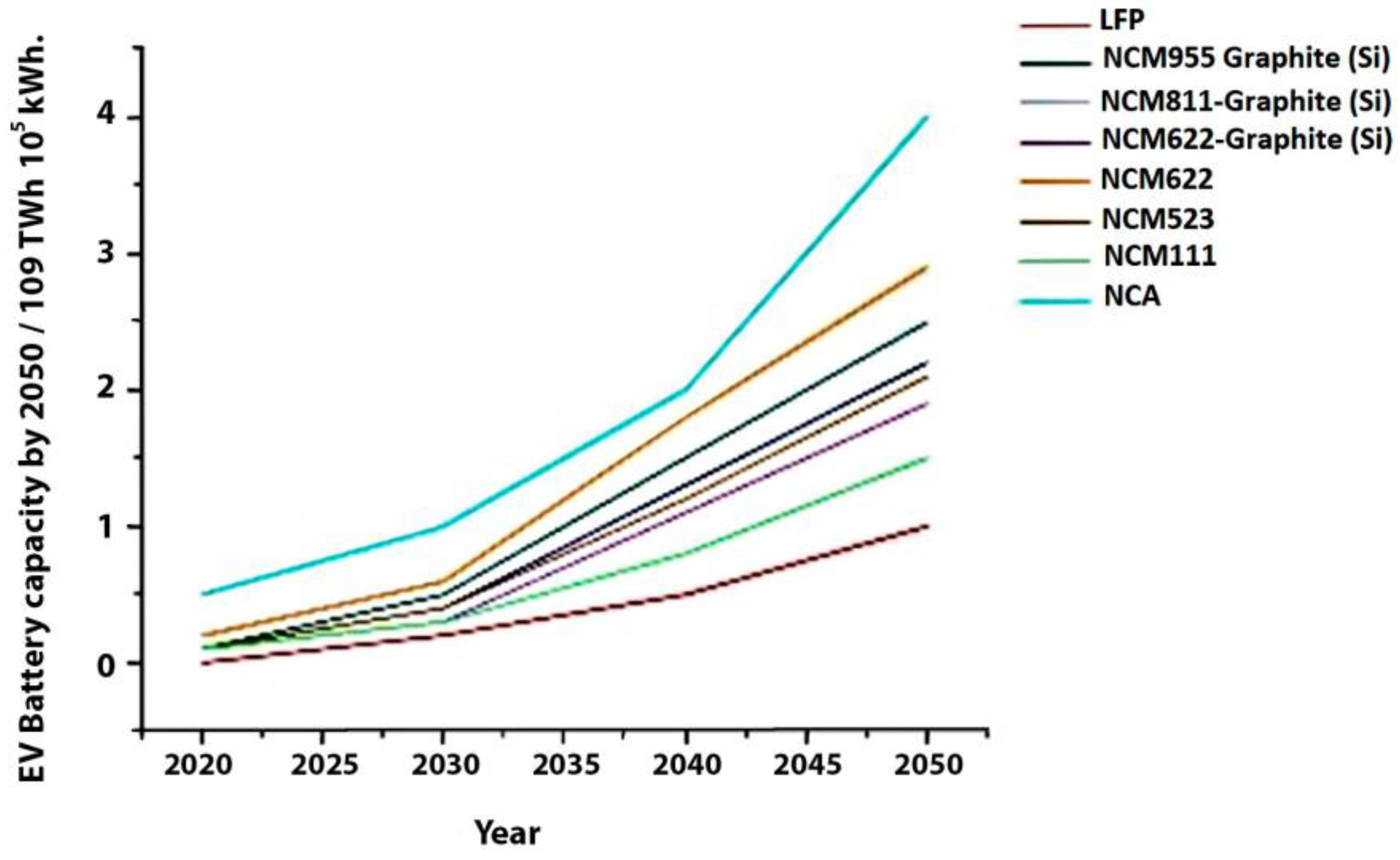

2.2. Quantifying the Future Demand for Battery Materials in the Shift to EV

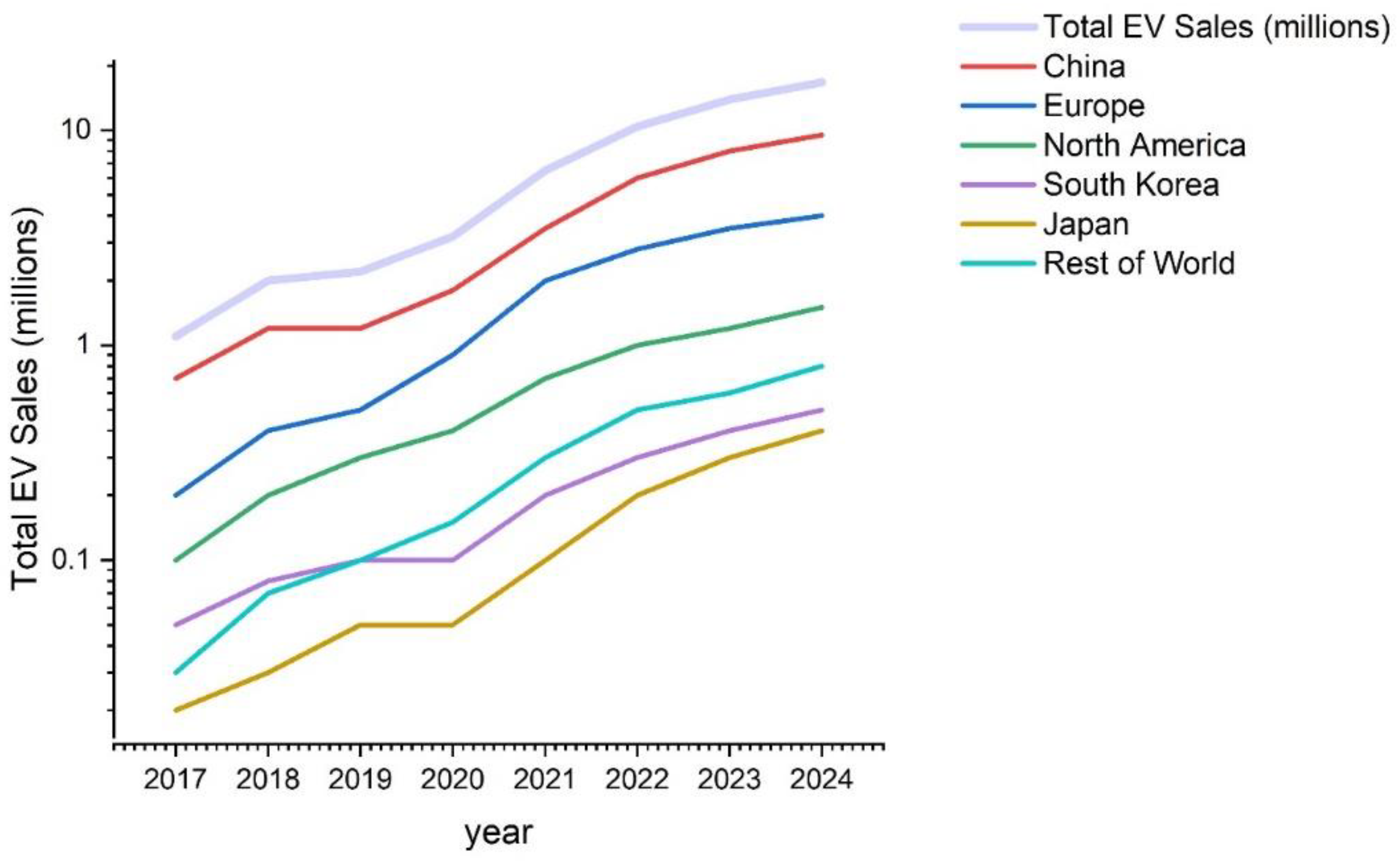

2.3. The Rise of EVs: Trends in Electric Light-Duty Vehicles

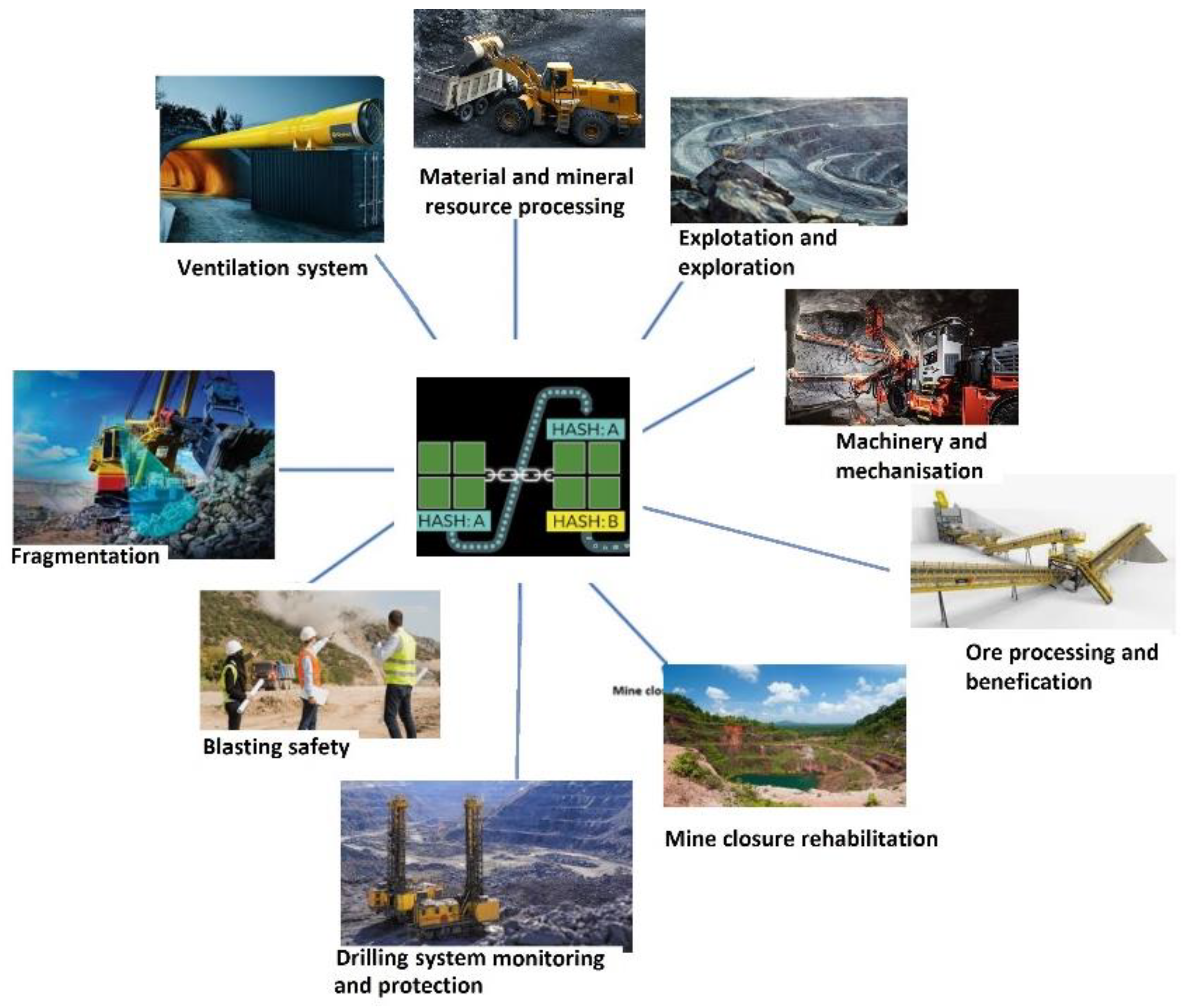

2.4. Trends in Modern Metal Mining Industry for Sustainable Transportation

2.5. Identifying the Regions with Abundant Metal Deposits Critical for EV Production

3. Blockchain Technology

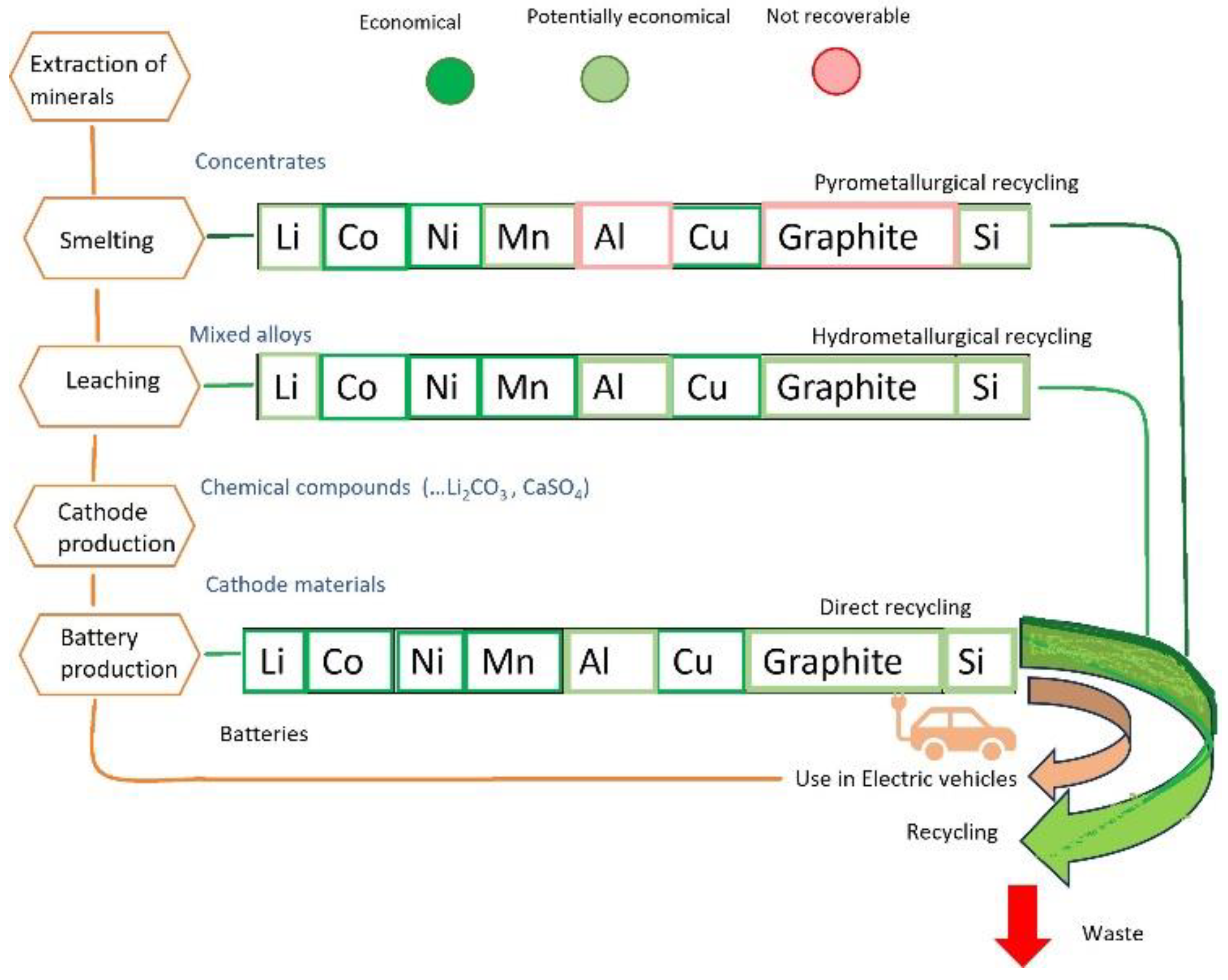

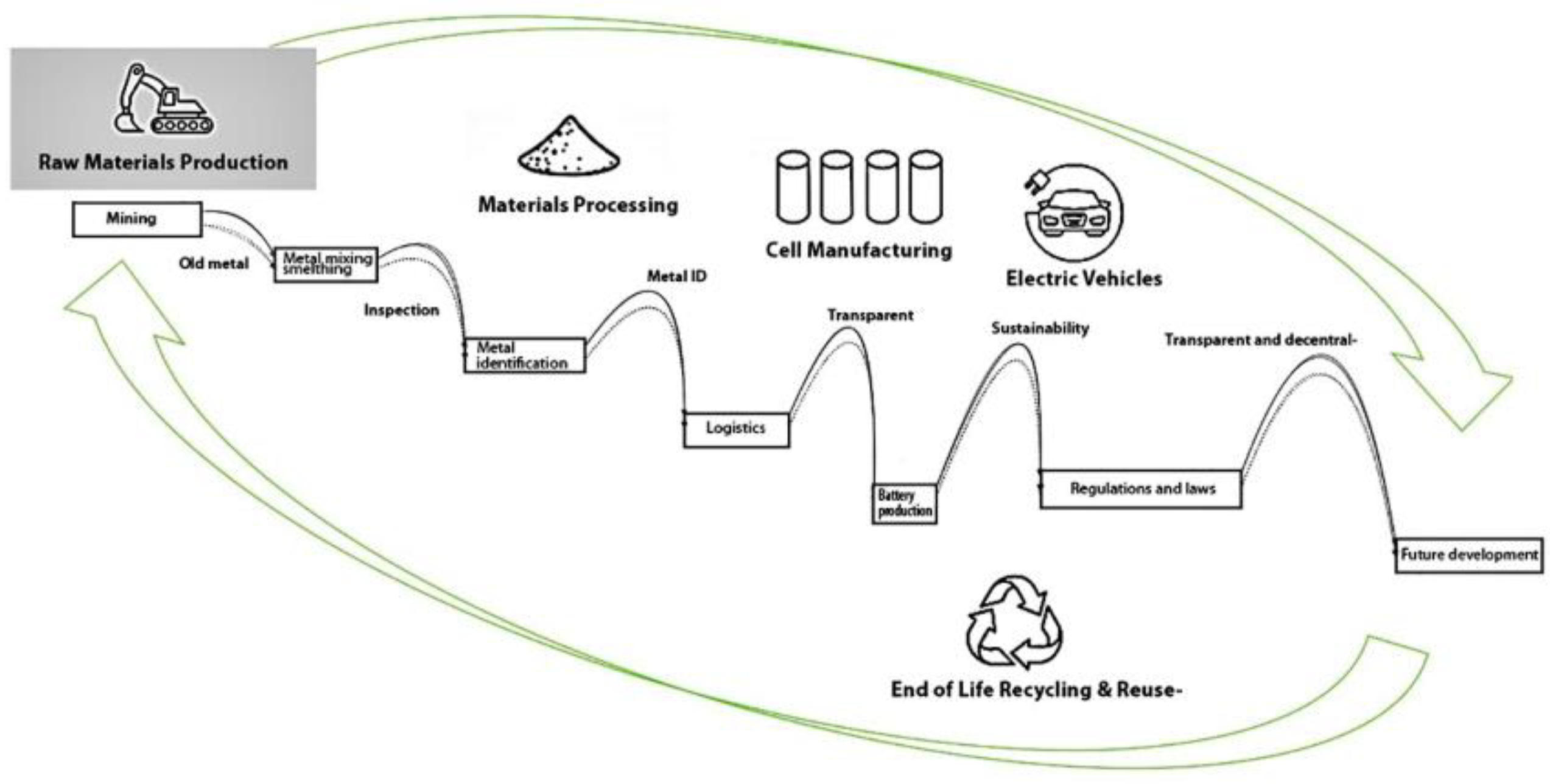

Blockchain in Metals Recycling

4. Electric Vehicles in the Road to the Sustainable Economy via Blockchain

4.1. Road to Sustainable Practices in EV Production via Resource-Balanced Economy

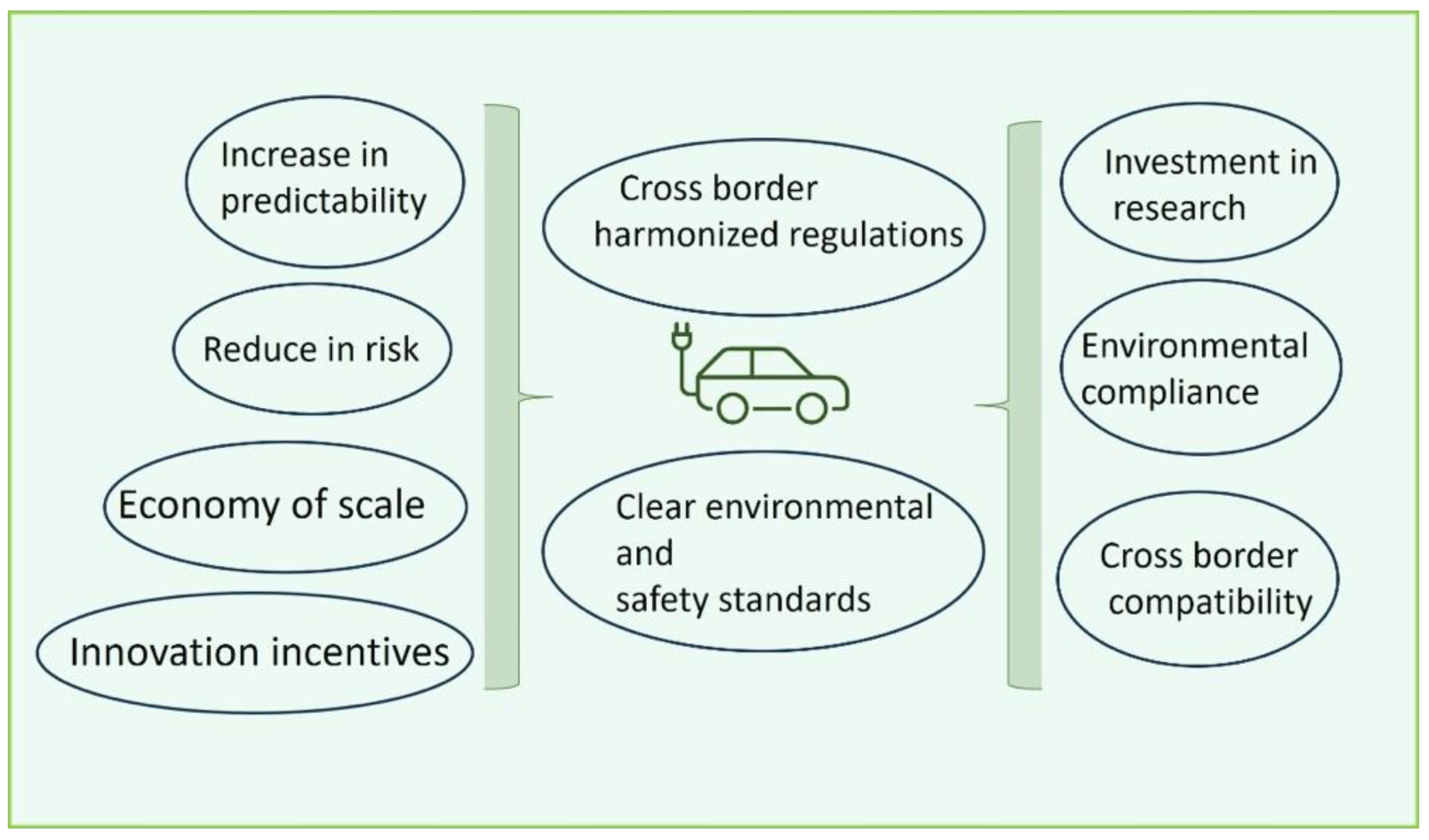

4.2. Standardization and Regulations for Sustainability of EVs

4.3. Key Challenges in International Standardization of EVs

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| BEVs | Battery electric vehicles |

| CL | Conductivity loss |

| DOD | Depth of discharge |

| EV | Electric vehicle |

| LAM | Loss of active material |

| LIBSC | Lithium-ion battery supply chain |

| LLI | The loss of lithium inventory |

| NCA | Lithium–nickel–cobalt–-aluminum batteries |

| NCM | Lithium–nickel–cobalt–manganese batteries |

| OEMs | Original equipment manufacturers |

| PHEVs | Plug-In Hybrid Electric Vehicles |

References

- Bibra, E.M.; Connelly, E.; Dhir, S.; Drtil, M.; Henriot, P.; Hwang, I.; Le Marois, J.B.; McBain, S.; Paoli, L.; Teter, J. Global EV Outlook 2022: Securing Supplies for an Electric Future. 2022, Volume 5, p. 221. Available online: https://iea.blob.core.windows.net/assets/ad8fb04c-4f75-42fc-973a-6e54c8a4449a/GlobalElectricVehicleOutlook2022.pdf (accessed on 15 March 2025).

- Perišić, M.; Barceló, E.; Dimic-Misic, K.; Imani, M.; Spasojević Brkić, V. The role of bioeconomy in the future energy scenario: A state-of-the-art review. Sustainability 2022, 14, 560. [Google Scholar] [CrossRef]

- Alvarenga, R.F.D.; Dewulf, J.; Guinée, J.B.; Schulze, R.; Weihed, P.; Bark, G.; Drielsma, J. Towards product-oriented sustainability in the (primary) metal supply sector. Resour. Conserv. Recycl. 2019, 145, 40–48. [Google Scholar] [CrossRef]

- Sato, F.E.K.; Furubayashi, T.; Nakata, T. Application of energy and CO2 reduction assessments for end-of-life vehicles recycling in Japan. Appl. Energy 2019, 237, 779–794. [Google Scholar] [CrossRef]

- Barceló, E.; Dimić-Mišić, K.; Imani, M.; Spasojević Brkić, V.; Hummel, M.; Gane, P. Regulatory paradigm and challenge for blockchain integration of decentralized systems: Example—Renewable energy grids. Sustainability 2023, 15, 2571. [Google Scholar] [CrossRef]

- Baars, J.; Domenech, T.; Bleischwitz, R.; Melin, H.E.; Heidrich, O. Circular economy strategies for electric vehicle batteries reduce reliance on raw materials. Nat. Sustain. 2021, 4, 71–79. [Google Scholar] [CrossRef]

- Church, C.; Crawford, A. Green Conflict Minerals: The Fuels of Conflict in the Transition to a Low-Carbon Economy; International Institute for Sustainable Development: Geneva, Switzerland, 2018; pp. 279–304. [Google Scholar]

- Pradip; Gautham, B.P.; Reddy, S.; Runkana, V. Future of mining, mineral processing and metal extraction industry. Trans. Indian Inst. Met. 2019, 72, 2159–2177. [Google Scholar] [CrossRef]

- Kurani, K.S. The state of electric vehicle markets, 2017: Growth faces an attention gap. Policy Brief 2019, 4, 1–3. [Google Scholar] [CrossRef]

- Mahrez, Z.; Sabir, E.; Badidi, E.; Saad, W.; Sadik, M. Smart urban mobility: When mobility systems meet smart data. IEEE Trans. Intell. Transp. Syst. 2021, 23, 6222–6239. [Google Scholar] [CrossRef]

- Pishdad-Bozorgi, P.; Yoon, J.H.; Dass, N. Blockchain-based Information Sharing: A New Opportunity for Construction Supply Chains. EPiC Ser. Built Environ. 2020, 1, 274–282. [Google Scholar] [CrossRef]

- Nguyen, D.; Abrantes, B.F. Blockchain Technology and the Future of Accounting and Auditing Services. In Essentials on Dynamic Capabilities for a Contemporary World: Recent Advances and Case Studies; Springer Nature: Cham, Switzerland, 2023; pp. 169–190. [Google Scholar]

- Ghobakhloo, M. Industry 4.0, digitization, and opportunities for sustainability. J. Clean. Prod. 2020, 252, 119869. [Google Scholar] [CrossRef]

- Lazarenko, Y.; Garafonova, O.; Marhasova, V.; Tkalenko, N. Digital Transformation in the Mining Sector: Exploring Global Technology Trends and Managerial Issues. EDP Sci. 2021, 315, 04006. [Google Scholar] [CrossRef]

- Wang, S. Multi-angle Analysis of Electric Vehicles Battery Recycling and Utilization. IOP Conf. Ser. Earth Environ. Sci. 2022, 1011, 012027. [Google Scholar] [CrossRef]

- Helmers, E.; Marx, P. Electric Cars: Technical Characteristics and Environmental Impacts; Springer Science+Business Media: Berlin/Heidelberg, Germany, 2012; Volume 24, pp. 1–15. [Google Scholar]

- Kiziroglou, M.E.; Boyle, D.E.; Yeatman, E.M.; Cilliers, J. Opportunities for Sensing Systems in Mining. IEEE Trans. Ind. Inform. 2017, 13, 278–286. [Google Scholar] [CrossRef]

- Ravishankar, B.; Kulkarni, P. When Block Chain and AI Integrates. In Proceedings of the 2020 International Conference on Mainstreaming Block Chain Implementation (ICOMBI), Bengaluru, India, 21–22 February 2020; pp. 1–4. [Google Scholar]

- Sánchez, F.; Hartlieb, P. Innovation in the Mining Industry: Technological Trends and a Case Study of the Challenges of Disruptive Innovation. Min. Metall. Explor. 2020, 37, 1385–1399. [Google Scholar] [CrossRef]

- Barnewold, L.; Lottermoser, B.G. Identification of digital technologies and digitalisation trends in the mining industry. Int. J. Min. Sci. Technol. 2020, 30, 747–757. [Google Scholar] [CrossRef]

- Zhang, Z.; Song, X.; Liu, L.; Yin, J.; Wang, Y.; Lan, D. Recent Advances in Blockchain and Artificial Intelligence Integration: Feasibility Analysis, Research Issues, Applications, Challenges, and Future Work. Secur. Commun. Netw. 2021, 1, 9991535. [Google Scholar] [CrossRef]

- Filipović, D.; Trolle, A.B. The term structure of interbank risk. J. Financ. Econ. 2013, 109, 707–733. [Google Scholar] [CrossRef]

- Vanmathi, C.; Farouk, A.; Alhammad, S.M.; Mangayarkarasi, R.; Bhattacharya, S.; Kasyapa, M.S. The Role of Blockchain in Transforming Industries Beyond Finance. IEEE Access 2024, 12, 148845–148867. [Google Scholar] [CrossRef]

- Su, X.; Xiao, Y.; Liu, S. Analysis on the Impact of Blockchain Technology on the Accounting Profession. In Proceedings of the 7th International Conference on Economy, Management, Law and Education (EMLE 2021), Moscow, Russia, 30–31 December 2021; pp. 10–14. [Google Scholar]

- Zhironkin, S.; Cehlár, M. Coal mining sustainable development: Economics and technological Outlook. Energies 2021, 14, 5029. [Google Scholar] [CrossRef]

- Segura-Salazar, J.; Tavares, L.M. Sustainability in the Minerals Industry: Seeking a Consensus on Its Meaning. Multidiscip. Digit. Publ. Inst. 2018, 10, 1429. [Google Scholar] [CrossRef]

- O’Fairchea llaigh, C. Social Equity and Large Mining Projects: Voluntary Industry Initiatives, Public Regulation and Community Development Agreements. J. Bus. Ethics 2014, 132, 91–103. [Google Scholar] [CrossRef]

- Batterham, R. The mine of the future—Even more sustainable. Miner. Eng. 2017, 107, 2–7. [Google Scholar] [CrossRef]

- Carvalho, F.P. Mining industry and sustainable development: Time for change. Food Energy Secur. 2017, 6, 61–77. [Google Scholar] [CrossRef]

- Jennings, C. An integrated “Mine to Mill” automation methodology applied to Sanbrado. Stud. Ex. Repos. 2022. Available online: https://sear.unisq.edu.au/id/eprint/51872 (accessed on 15 March 2025).

- Zhironkin, S.; Szurgacz, D. Mining technologies innovative development: Economic and sustainable outlook. Energies 2021, 14, 8590. [Google Scholar] [CrossRef]

- Fortier, S.M.; Nassar, N.T.; Lederer, G.W.; Brainard, J.; Gambogi, J.; McCullough, E.A. Draft Critical Mineral List—Summary of Methodology and Background Information—US Geological Survey Technical Input Document in Response to Secretarial Order No. 3359 (No. 2018–1021); US Geological Survey: Sunrise Valley Drive Reston, VA, USA, 2018.

- Crundwell, F.K.; Du Preez, N.B.; Knights, B.D.H. Production of cobalt from copper-cobalt ores on the African Copperbelt—An overview. Miner. Eng. 2020, 156, 106450. [Google Scholar] [CrossRef]

- Jones, P.K.; Stimming, U.; Lee, A.A. Impedance-based forecasting of lithium-ion battery performance amid uneven usage. Nat. Commun. 2022, 13, 4806. [Google Scholar] [CrossRef]

- Scrosati, B.; Garche, J. Lithium batteries: Status, prospects and future. J. Power Sources 2010, 195, 2419–2430. [Google Scholar] [CrossRef]

- Zubi, G.; Dufo-López, R.; Carvalho, M.; Pasaoglu, G. The lithium-ion battery: State of the art and future perspectives. Renew. Sustain. Energy Rev. 2018, 89, 292–308. [Google Scholar] [CrossRef]

- Thatipamula, S.; Malaarachchi, C.; Alam, M.R.; Khan, M.W.; Babarao, R.; Mahmood, N. Non-aqueous rechargeable aluminum-ion batteries (RABs): Recent progress and future perspectives. Microstructures 2024, 4, N-A.2024057. [Google Scholar] [CrossRef]

- Wang, M.; Liu, K.; Dutta, S.; Alessi, D.S.; Rinklebe, J.; Ok, Y.S.; Tsang, D.C. Recycling of lithium iron phosphate batteries: Status, technologies, challenges, and prospects. Renew. Sustain. Energy Rev. 2022, 163, 112515. [Google Scholar] [CrossRef]

- Young, K.; Wang, C.; Wang, L.Y.; Strunz, K. Electric vehicle battery technologies. In Electric Vehicle Integration into Modern Power Networks; Springer: New York, NY, USA, 2012; pp. 15–56. [Google Scholar]

- Konarov, A.; Myung, S.T.; Sun, Y.K. Cathode materials for future electric vehicles and energy storage systems. ACS Energy Lett. 2017, 2, 703–708. [Google Scholar] [CrossRef]

- Koech, A.K.; Mwandila, G.; Mulolani, F.; Mwaanga, P. Lithium-ion battery fundamentals and exploration of cathode materials: A review. South Afr. J. Chem. Eng. 2024, 50, 321–334. [Google Scholar] [CrossRef]

- Bandhu, K.C.; Litoriya, R.; Lowanshi, P.; Jindal, M.; Chouhan, L.; Jain, S. Making drug supply chain secure traceable and efficient: A Blockchain and smart contract based implementation. Multimed. Tools Appl. 2022, 82, 23541–23568. [Google Scholar] [CrossRef] [PubMed]

- Song, J.M.; Sung, J.; Park, T. Applications of Blockchain to Improve Supply Chain Traceability. Procedia Comput. Sci. 2019, 162, 119–122. [Google Scholar] [CrossRef]

- Luyten, S.; Büscher, J.; Driesen, J.; Leemput, N.; Geth, F.; Roy, J.V. Standardization of conductive AC charging infrastructure for electric vehicles. In Proceedings of the 22nd International Conference and Exhibition on Electricity Distribution (CIRED 2013), Stockholm, Sweden, 10–13 June 2013; pp. 1–4. [Google Scholar]

- Kubota, K.; Dahbi, M.; Hosaka, T.; Kumakura, S.; Komaba, S. Towards K-ion and Na-ion batteries as “beyond Li-ion”. Chem. Rec. 2018, 18, 459–479. [Google Scholar] [CrossRef] [PubMed]

- Graham, J.D.; Belton, K.B.; Xia, S. How China beat the US in electric vehicle manufacturing. Issues Sci. Technol. 2021, 37, 72–79. [Google Scholar]

- Razmjoo, A.; Ghazanfari, A.; Jahangiri, M.; Franklin, E.; Denai, M.; Marzband, M.; Maheri, A. A comprehensive study on the expansion of electric vehicles in Europe. Appl. Sci. 2022, 12, 11656. [Google Scholar] [CrossRef]

- Alatawneh, A.; Torok, A. A predictive modeling framework for forecasting cumulative sales of euro-compliant, battery-electric and autonomous vehicles. Decis. Anal. J. 2024, 11, 100483. [Google Scholar] [CrossRef]

- Sawicki, M.; Shaw, L.L. Advances and challenges of sodium ion batteries as post lithium ion batteries. Rsc. Adv. 2015, 5, 53129–53154. [Google Scholar] [CrossRef]

- Yu, R.; Wang, X.; Xu, X.; Zhang, Z. Research on Forecasting Sales of Pure Electric Vehicles in China Based on the Seasonal Autoregressive Integrated Moving Average–Gray Relational Analysis–Support Vector Regression Model. Systems 2024, 12, 486. [Google Scholar] [CrossRef]

- Wang, H.; Feng, K.; Wang, P.; Yang, Y.; Sun, L.; Yang, F.; Chen, W.Q.; Li, J. China’s electric vehicle and climate ambitions jeopardized by surging critical material prices. Nat. Commun. 2023, 14, 1246. [Google Scholar] [CrossRef] [PubMed]

- Ou, S.; Hao, X.; Lin, Z.; Wang, H.; Bouchard, J.; He, X.; Wu, Z.; Zheng, J.; Lv, R.; LaClair, T.J. Light-duty plug-in electric vehicles in China: An overview on the market and its comparisons to the United States. Renew. Sustain. Energy Rev. 2019, 112, 747–761. [Google Scholar] [CrossRef]

- Beaudet, A.; Larouche, F.; Amouzegar, K.; Bouchard, P.; Zaghib, K. Key challenges and opportunities for recycling electric vehicle battery materials. Sustainability 2020, 12, 5837. [Google Scholar] [CrossRef]

- Niri, A.J.; Poelzer, G.A.; Zhang, S.E.; Rosenkranz, J.; Pettersson, M.; Ghorbani, Y. Sustainability challenges throughout the electric vehicle battery value chain. Renew. Sustain. Energy Rev. 2024, 191, 114176. [Google Scholar] [CrossRef]

- Holroyd, C. Corporate social responsibility, Indigenous Peoples and mining in Scandinavia. In Local Communities and the Mining Industry; Routledge: London, UK, 2023; pp. 103–122. [Google Scholar]

- Yang, A.; Liu, C.; Yang, D.; Lu, C. Electric vehicle adoption in a mature market: A case study of Norway. J. Transp. Geogr. 2023, 106, 103489. [Google Scholar] [CrossRef]

- Patil, G.; Pode, G.; Diouf, B.; Pode, R. Sustainable Decarbonization of Road Transport: Policies, Current Status, and Challenges of Electric Vehicles. Sustainability 2024, 16, 8058. [Google Scholar] [CrossRef]

- Cazzola, P.; Paoli, L.; Teter, J. Trends in the Global Vehicle Fleet: Managing the SUV Shift and the EV Transition. 2023. Available online: https://www.globalfueleconomy.org/data-and-research/publications/trends-in-the-global-vehicle-fleet-2023 (accessed on 15 March 2025).

- Khaleel, M.; Nassar, Y.; El-Khozondar, H.J.; Elmnifi, M.; Rajab, Z.; Yaghoubi, E.; Yaghoubi, E. Electric vehicles in China, Europe, and the United States: Current trend and market comparison. Int. J. Electr. Eng. Sustain. 2024, 2, 20. [Google Scholar]

- Mohammadi, F.; Saif, M. A comprehensive overview of electric vehicle batteries market. e-Prime-Adv. Electr. Eng. Electron. Energy 2023, 3, 100127. [Google Scholar] [CrossRef]

- Kok, I.; Hall, D. Battery electric and plug-in hybrid vehicle uptake in European cities. Work. Pap. 2023, 1. [Google Scholar]

- Antony Jose, S.; Dworkin, L.; Montano, S.; Noack, W.C.; Rusche, N.; Williams, D.; Menezes, P.L. Pathways to Circular Economy for Electric Vehicle Batteries. Recycling 2024, 9, 76. [Google Scholar] [CrossRef]

- Rostovski, J.K. How a Battery and Key Metals Shortage Could Halt the Growth of the Electric Vehicle Market. In Global Energy Transition and Sustainable Development Challenges; Scenarios, Materials, and Technology; Springer Nature: Cham, Switzerland, 2024; Volume 2, pp. 125–140. [Google Scholar]

- Mancini, L.; Sala, S. Social impact assessment in the mining sector: Review and comparison of indicators frameworks. Resour. Policy 2018, 57, 98–111. [Google Scholar] [CrossRef]

- Mudd, G.M. Sustainable/responsible mining and ethical issues related to the Sustainable Development Goals. Geol. Soc. Lond. 2020, 508, 187–199. [Google Scholar] [CrossRef]

- Leon, E.M.; Miller, S.E. An applied analysis of the recyclability of electric vehicle battery packs. Resour. Conserv. Recycl. 2020, 157, 104593. [Google Scholar] [CrossRef]

- Luong, J.H.; Tran, C.; Ton-That, D. A paradox over electric vehicles, mining of lithium for car batteries. Energies 2022, 15, 7997. [Google Scholar] [CrossRef]

- Nordqvist, A.; Wimmer, M.; Grynienko, M. Gravity flow research at the Kiruna sublevel caving mine during the last decade and an outlook into the future. In MassMin 2020: Proceedings of the Eighth International Conference Exhibition on Mass Mining; University of Chile: Santiago, Chile, 2020; pp. 505–518. [Google Scholar]

- Yin, J.Z.; Shi, A.; Yin, H.; Li, K.; Chao, Y. Global lithium product applications, mineral resources, markets and related issues. Nat. Sci. 2024, 1, 197–217. [Google Scholar]

- Phelps-Barber, Z.; Trench, A.; Groves, D.I. Recent pegmatite-hosted spodumene discoveries in Western Australia: Insights for lithium exploration in Australia and globally. Appl. Earth Sci. 2022, 131, 100–113. [Google Scholar] [CrossRef]

- Schlosser, N. Externalized Costs of Electric Automobility: Social-Ecological Conflicts of Lithium Extraction in Chile (No. 144/2020). Work. Pap. Leibniz Information Center for Economics Working Paper. 2020. Available online: https://hdl.handle.net/10419/222406 (accessed on 15 March 2025).

- Winjobi, O.; Kelly, J.C.; Dai, Q. Life-cycle analysis, by global region, of automotive lithium-ion nickel manganese cobalt batteries of varying nickel content. Sustain. Mater. Technol. 2022, 32, e00415. [Google Scholar] [CrossRef]

- Li, Y.; Tan, Z.; Liu, Y.; Lei, C.; He, P.; Li, J.; He, Z.; Cheng, Y. Past, present and future of high-nickel materials. Nano Energy 2024, 119, 109070. [Google Scholar] [CrossRef]

- Cheng, A.L.; Fuchs, E.R.; Karplus, V.J.; Michalek, J.J. Electric vehicle battery chemistry affects supply chain disruption vulnerabilities. Nat. Commun. 2024, 15, 2143. [Google Scholar] [CrossRef]

- Chae, O.B.; Adiraju, V.A.; Lucht, B.L. Lithium cyano tris (2,2,2-trifluoroethyl) borate as a multifunctional electrolyte additive for high-performance lithium metal batteries. ACS Energy Lett. 2021, 6, 3851–3857. [Google Scholar] [CrossRef]

- Clausen, E.; Sörensen, A. Required and desired: Breakthroughs for future-proofing mineral and metal extraction. Miner. Econ. 2022, 35, 521–537. [Google Scholar] [CrossRef]

- Liu, L.; Wang, S.; Zhang, Z.; Fan, J.; Qi, W.; Chen, S. Fluoroethylene carbonate as an electrolyte additive for improving interfacial stability of high-voltage LiNi0.6Co0.2M0.2O2 cathode. Ionics 2019, 25, 1035–1043. [Google Scholar] [CrossRef]

- Chengjian, X.; Qiang, D.; Gaines, L.; Hu, M.; Arnold, T.; Bernhard, S. Reply to: Concerns about global phosphorus demand for lithium-iron-phosphate batteries in the light electric vehicle sector. Commun. Mater. 2022, 3, 14. [Google Scholar] [CrossRef]

- De Putter, T. “Cobalt means conflict”–Congolese cobalt, a critical element in lithium-ion batteries. Acad. Overzeese Wet. 2019, 65, 97–110. [Google Scholar]

- Bernards, N. Child labour, cobalt and the London Metal Exchange: Fetish, fixing and the limits of financialization. Econ. Soc. 2021, 50, 542–564. [Google Scholar] [CrossRef]

- Mitchell, C.; Deady, E. Graphite Resources, and Their Potential to Support Battery Supply Chains, in Africa; British Geological Survey Open Report OR/21/039; NERC: Atlanta, GA, USA, 2021; 30p. [Google Scholar]

- Ramji, A.; Dayemo, K. Releasing the Pressure: Understanding Upstream Graphite Value Chains and Implications for Supply Diversification; University of California: Oakland, CA, USA, 2024. [Google Scholar] [CrossRef]

- Guo, X.; Lu, Y.; Zhang, Q.; Ren, J.; Cai, W. The Geological Characteristics, Resource Potential, and Development Status of Manganese Deposits in Africa. Minerals 2024, 14, 1088. [Google Scholar] [CrossRef]

- Oruko, R.O.; Edokpayi, J.N.; Msagati, T.A.; Tavengwa, N.T.; Ogola, H.J.; Ijoma, G.; Odiyo, J.O. Investigating the chromium status, heavy metal contamination, and ecological risk assessment via tannery waste disposal in sub-Saharan Africa (Kenya and South Africa). Environ. Sci. Pollut. Res. 2021, 28, 42135–42149. [Google Scholar] [CrossRef]

- Mwitwa, J.; German, L.; Muimba-Kankolongo, A.; Puntodewo, A. Governance and sustainability challenges in landscapes shaped by mining: Mining-forestry linkages and impacts in the Copper Belt of Zambia and the DR Congo. For. Policy Econ. 2012, 25, 19–30. [Google Scholar] [CrossRef]

- Goodenough, K.; Deady, E.; Shaw, R. Lithium Resources, and Their Potential to Support Battery Supply Chains, in Africa; British Geological Survey, (OR/21/037); NERC: Atlanta, GA, USA, 2021. [Google Scholar]

- Umair, S.; Björklund, A.; Petersen, E.E. Social impact assessment of informal recycling of electronic ICT waste in Pakistan using UNEP SETAC guidelines. Resour. Conserv. Recycl. 2015, 95, 46–57. [Google Scholar] [CrossRef]

- Billy, R.G.; Müller, D.B. Aluminium use in passenger cars poses systemic challenges for recycling and GHG emissions. Resour. Conserv. Recycl. 2023, 190, 106827. [Google Scholar] [CrossRef]

- Jones, B.; Elliott, R.; Nguyen-Tien, V. The EV revolution: The road ahead for critical raw materials demand. Appl. Energy 2020, 280, 115072. [Google Scholar] [CrossRef] [PubMed]

- Zeng, A.; Wu, C.; Rasmussen, K.D.; Lee, S.; Lundhaug, M.; Müller, D.B.; Tan, J.; Keiding, J.K.; Liu, L.; Dai, T.; et al. Battery technology and recycling alone will not save the electric mobility transition from future cobalt shortages. Nat. Commun. 2022, 13, 1341. [Google Scholar] [CrossRef]

- Poole, C.J.M.; Basu, S. Systematic Review: Occupational illness in the waste and recycling sector. Occup. Med. 2017, 67, 626–636. [Google Scholar] [CrossRef]

- Ma, T.; Zhang, Q.; Tang, Y.; Liu, B.; Li, Y.; Wang, L. A review on the industrial chain of recycling critical metals from electric vehicle batteries: Current status, challenges, and policy recommendations. Renew. Sustain. Energy Rev. 2024, 204, 114806. [Google Scholar] [CrossRef]

- Neumann, J.; Petranikova, M.; Meeus, M.; Gamarra, J.D.; Younesi, R.; Winter, M.; Nowak, S. Recycling of lithium-ion batteries—Current state of the art, circular economy, and next generation recycling. Adv. Energy Mater. 2022, 12, 2102917. [Google Scholar] [CrossRef]

- Kang, Y.; Lu, Q. Design and Implementation of Data Sharing Traceability System Based on Blockchain Smart Contract. Sci. Program. 2021, 2021, 1455814. [Google Scholar] [CrossRef]

- Babaei, A.; Khedmati, M.; Jokar, M.R.A.; Tirkolaee, E.B. Designing an integrated blockchain-enabled supply chain network under uncertainty. Nat. Portf. 2023, 13, 3928. [Google Scholar] [CrossRef]

- Yang, R.; Wakefield, R.; Lyu, S.; Jayasuriya, S.; Han, F.; Yi, X.; Yang, X.; Amarasinghe, G.; Chen, J. Public and private blockchain in construction business process and information integration. Autom. Constr. 2020, 118, 103276. [Google Scholar] [CrossRef]

- Augustin, N.; Eckhardt, A.; Jong, A.W.D. Understanding decentralized autonomous organizations from the inside. Electron. Mark. 2023, 33, 38. [Google Scholar] [CrossRef]

- Leavins, J.R.; Ramaswamy, V. Improving Internal Control Over Fixed Assets with BLOCKCHAIN. Int. J. Bus. Manag. Stud. 2023, 4. [Google Scholar] [CrossRef]

- Buchholz, P.; Ericsson, M.; Steinbach, V. Breakthrough technologies and innovations along the mineral raw materials supply chain—Towards a sustainable and secure supply. Miner. Econ. 2022, 35, 345–347. [Google Scholar] [CrossRef]

- Difrancesco, R.M.; Meena, P.; Kumar, G. How blockchain technology improves sustainable supply chain processes: A practical guide. Oper. Manag. Res. 2022, 16, 620–641. [Google Scholar] [CrossRef]

- Cerrillo-Gonzalez, M.D.M.; Villen-Guzman, M.; Vereda-Alonso, C.; Rodriguez-Maroto, J.M.; Paz-Garcia, J.M. Towards sustainable lithium-ion battery recycling: Advancements in circular hydrometallurgy. Processes 2024, 12, 1485. [Google Scholar] [CrossRef]

- Sermpinis, T.; Sermpinis, C. Traceability Decentralization in Supply Chain Management Using Blockchain Technologies. arXiv 2018, arXiv:1810.09203. [Google Scholar] [CrossRef]

- Sauer, P.C.; Seuring, S. Sustainable supply chain management for minerals. J. Clean. Prod. 2017, 151, 235–249. [Google Scholar] [CrossRef]

- Gaustad, G.; Krystofik, M.; Bustamante, M.L.; Badami, K. Circular economy strategies for mitigating critical material supply issues. Resour. Conserv. Recycl. 2018, 135, 24–33. [Google Scholar] [CrossRef]

- Upadhyay, A.; Mukhuty, S.; Kumar, V.; Kazançoğlu, Y. Blockchain technology and the circular economy: Implications for sustainability and social responsibility. J. Clean. Prod. 2021, 293, 126130. [Google Scholar] [CrossRef]

- Liu, Y.; Chen, S. Application of Blockchain Technology in Agricultural Water Rights Trade Management. Sustainability 2022, 14, 7017. [Google Scholar] [CrossRef]

- Noudeng, V.; Quan, N.V.; Xuan, T.D. A Future Perspective on Waste Management of Lithium-Ion Batteries for Electric Vehicles in Lao PDR: Current Status and Challenges. Int. J. Environ. Res. Public Health 2022, 19, 16169. [Google Scholar] [CrossRef]

- Nygaard, A. The Geopolitical Risk and Strategic Uncertainty of Green Growth after the Ukraine Invasion: How the Circular Economy Can Decrease the Market Power of and Resource Dependency on Critical Minerals. Circ. Econ. Sustain. 2022, 3, 1099–1126. [Google Scholar] [CrossRef]

- Cheng, M.; Sun, H.; Wei, G.; Zhou, G.; Zhang, X. A sustainable framework for the second-life battery ecosystem based on blockchain. eTransportation 2022, 14, 100206. [Google Scholar] [CrossRef]

- Xu, J.; Thomas, H.R.; Francis, R.W.; Lum, K.R.; Wang, J.; Liang, B. A review of processes and technologies for the recycling of lithium-ion secondary batteries. J. Power Sources 2008, 177, 512–527. [Google Scholar] [CrossRef]

- Harper, G.; Sommerville, R.; Kendrick, E.; Driscoll, L.; Slater, P.; Stolkin, R.; Walton, A.; Christensen, P.; Heidrich, O.; Lambert, S.; et al. Recycling lithium-ion batteries from electric vehicles. Nature 2019, 575, 75–86. [Google Scholar] [CrossRef] [PubMed]

- Börner, M.F.; Frieges, M.H.; Späth, B.; Spütz, K.; Heimes, H.H.; Sauer, D.U.; Li, W. Challenges of second-life concepts for retired electric vehicle batteries. Cell Rep. Phys. Sci. 2022, 3, 101095. [Google Scholar] [CrossRef]

- Tang, Y.-C.; Wang, J.; Chou, C.; Shen, Y.-H. Material and Waste Flow Analysis for Environmental and Economic Impact Assessment of Inorganic Acid Leaching Routes for Spent Lithium Batteries’ Cathode Scraps. Batteries 2023, 9, 207. [Google Scholar] [CrossRef]

- Patel, A.N.; Lander, L.; Ahuja, J.; Bulman, J.; Lum, J.K.H.; Pople, J.O.D.; Hales, A.; Patel, Y.; Edge, J. Lithium-ion battery second life: Pathways, challenges and outlook. Front. Chem. 2024, 11, 121358417. [Google Scholar]

- Arya, S.; Kumar, S. Bioleaching: Urban mining option to curb the menace of E-waste challenge. Bioengineered 2020, 11, 640. [Google Scholar] [CrossRef]

- Kar, K.; Hossain, M.A.; Roshni, A.; Hossain, M.S. Recovery and Recycling of Valuable Metals from Low-Grade Ores Using Microorganisms: A Brief Review. Am. J. Pure Appl. Sci. 2021, 3, 1–16. [Google Scholar]

- Wang, Q.; Geng, F.; Zhang, P.; Chen, Y.; He, L.; Cheng, S. A Social Governance Scheme Based on Blockchain. J. Phys. Conf. Ser. 2020, 1621, 012103. [Google Scholar] [CrossRef]

- Lutsey, N. Integrating electric vehicles within US and European efficiency regulations. Int. Counc. Clean Transp. 2017, 6, 1–16. [Google Scholar]

- Peng, R.; Tang, J.H.C.G.; Yang, X.; Meng, M.; Zhang, J.; Zhuge, C. Investigating the factors influencing the electric vehicle market share: A comparative study of the European Union and United States. Appl. Energy 2024, 355, 122327. [Google Scholar] [CrossRef]

- Sathiyan, S.P.; Pratap, C.B.; Stonier, A.A.; Peter, G.; Sherine, A.; Praghash, K.; Ganji, V. Comprehensive assessment of electric vehicle development, deployment, and policy initiatives to reduce GHG emissions: Opportunities and challenges. IEEE Access 2022, 10, 53614–53639. [Google Scholar] [CrossRef]

- Florini, A. The International Energy Agency in global energy governance. Glob. Policy 2011, 2, 40–50. [Google Scholar] [CrossRef]

- Das, H.S.; Rahman, M.M.; Li, S.; Tan, C.W. Electric vehicles standards, charging infrastructure, and impact on grid integration: A technological review. Renew. Sustain. Energy Rev. 2020, 120, 109618. [Google Scholar] [CrossRef]

- Sanguesa, J.A.; Torres-Sanz, V.; Garrido, P.; Martinez, F.J.; Marquez-Barja, J.M. A review on electric vehicles: Technologies and challenges. Smart Cities 2021, 4, 372–404. [Google Scholar] [CrossRef]

- Bacchetta, A.V.B.; Krümpel, V.; Cullen, E. Transparency with Blockchain and Physical Tracking Technologies: Enabling Traceability in Raw Material Supply Chains. Mater. Proc. 2021, 5, 1. [Google Scholar] [CrossRef]

- Green, J.M.; Hartman, B.; Glowacki, P.F. A system-based view of the standards and certification landscape for electric vehicles. World Electr. Veh. J. 2016, 8, 564–575. [Google Scholar] [CrossRef]

- Gillingham, K.T.; Ovaere, M.; Weber, S.M. Carbon policy and the emissions implications of electric vehicles. J. Assoc. Environ. Resour. Econ. 2025, 12, 313–352. [Google Scholar] [CrossRef]

- Coffin, D.; Croty, P.; Walling, J.; Yuan, W.J. The Impact of Changes in Trade Policies on the Electric Vehicle (EV) Sector: A CGE Analysis; US International Trade Commission: Washington, DC, USA, 2024.

- Brown, S.P.A.; Pyke, D.F.; Steenhof, P.A. Electric vehicles: The role and importance of standards in an emerging market. Energy Policy 2010, 38, 3797–3806. [Google Scholar] [CrossRef]

- Franzò, S.; Nasca, A. The environmental impact of electric vehicles: A novel life cycle-based evaluation framework and its applications to multi-country scenarios. J. Clean. Prod. 2021, 315, 128005. [Google Scholar] [CrossRef]

- Saleem, U.; Joshi, B.; Bandyopadhyay, S. Hydrometallurgical Routes to Close the Loop of Electric Vehicle (EV) Lithium-Ion Batteries (LIBs) Value Chain: A Review. J. Sustain. Metall. 2023, 9, 950–971. [Google Scholar] [CrossRef]

- Kumar, S.; Lim, W.M.; Sivarajah, U.; Kaur, J. Artificial Intelligence and Blockchain Integration in Business: Trends from a Bibliometric-Content Analysis. Inf. Syst. Front. 2022, 25, 871–896. [Google Scholar] [CrossRef] [PubMed]

- Tian, H.; Qin, P.; Li, K.; Zhao, Z. A review of the state of health for lithium-ion batteries: Research status and suggestions. J. Clean. Prod. 2021, 261, 120813. [Google Scholar] [CrossRef]

- Kumar, G.; Mikkili, S. Advancements in EV international standards: Charging, safety and grid integration with challenges and impacts. Int. J. Green Energy 2024, 21, 2672–2698. [Google Scholar] [CrossRef]

- Chayambuka, K.; Mulder, G.; Danilov, D.L.; Notten, P.H.L. From Li-Ion Batteries toward Na-Ion Chemistries: Challenges and Opportunities. Adv. Energy Mater. 2020, 10, 2001310. [Google Scholar] [CrossRef]

- Haddad, A.Z.; Hackl, L.; Aküzüm, B.; Pohlman, G.; Magnan, J.F.; Kostecki, R. How to make lithium extraction cleaner, faster and cheaper—In six steps. Nature 2023, 616, 245. [Google Scholar] [CrossRef]

- Balcıoğlu, Y.S.; Çelik, A.A.; Altındağ, E. Integrating Blockchain Technology in Supply Chain Management: A Bibliometric Analysis of Theme Extraction via Text Mining. Sustainability 2024, 16, 10032. [Google Scholar] [CrossRef]

| Type | Label | Composition (%) | Explanation |

|---|---|---|---|

| NCM | NCM 622 | 60/20/20 (Ni/Co/Mn) | Cathode 60% Ni, 20% Co, 20% Mn. |

| NCM 523 | 50/20/30 (Ni/Co/Mn) | Cathode 50% Ni, 20% Co, 30% Mn. | |

| NCM 111 | 10/10/10 (Ni/Mn/Co) | Cathode Ni, Mn, Co (1:1:1 ratio). | |

| NCM 622-GL | 60/20/20 (Ni/Mn/Co) | Cathode NCM 622 with graphite layer. | |

| NCM 811-GL | 80/10/10 (Ni/Co/Mn) | Cathode 80% Ni, 10% Co, 10% Mn with graphite layer. | |

| NCM 955-GL | 90/5/5 (Ni/Mn/Co) | Cathode 90% Ni, 5% Co, 5% Mn with graphite layer. | |

| Other | NCA | Li, Ni, Co, Al | Specific weight ratios of lithium, nickel, cobalt, and aluminum as cathode. |

| LFP | Li-Fe phosphate battery | Lithium iron phosphate as cathode. | |

| Graphite (Si) | Graphite anode + Si | An anode is graphite with silicon to enhance performance. | |

| Li-S | Li-S battery | Cathode of Li and S. | |

| Li- | Air lithium–air battery | Lithium is used as the anode, and oxygen from the air as the cathode material. |

| Battery Metal | Peak Price (2022–2023) | Current Price (2024) | Trend | Projection for 2025 |

|---|---|---|---|---|

| Lithium (LiOH) | ~USD 85/kg | ~USD 23/kg | Down (75 percent due to oversupply) | Expected stabilization as mine closures reduce supply and EV demand increases |

| Cobalt (Co) | ~USD 80/kg | ~USD 24/kg | Down (Oversupply from the DRC, shift to cobalt-free batteries) | Slight recovery due to reduced mining activity |

| Nickel (Ni) | ~USD 30,000/ton | ~USD 18,000/ton | Down (High Indonesian production, slowing Chinese EV sales) | Continued downward pressure might stabilize if demand increases |

| Important Aspects | Essential Features | Characteristics and Explanation | |

|---|---|---|---|

| 1. | Ensuring safety and performance | Consistency in quality within whole production cycle | Standardized manufacturing ensures EV components meet performance and safety standards and safe handling of hazardous materials like lithium-ion batteries to protect workers and the environment. |

| 2. | Facilitating recycling | Materials recovery efficiency with reduction of waste | Battery design standards enable efficient disassembly and extraction of valuable metals like lithium, cobalt, and nickel. |

| 3. | Environmental sustainability | Reducing emissions and managing hazardous materials | Regulations promote environmentally responsible EV production and ensure safe disposal or reuse of toxic substances. |

| 4. | Global compatibility | Regional harmonization with universal production and charging infrastructure | Cross-border standardization ensures global compatibility, reducing trade barriers and infrastructure costs and simplifying recycling and repairs. |

| 5. | Promotion of innovation | Intensified research aids in establishing new manufacturing standards | Regulations set targets for battery efficiency, recycling, and emissions, while standardization ensures fair competition and sustainability. |

| 6. | Economic benefits | Decrease in production costs benefits market stability | Standardized components reduce manufacturing costs, while regulations boost market stability and long-term investment in EV production and recycling. |

| 7. | Consumer confidence | Transparency in transport and production establishes trust in the recycling process | Standardized labels and certifications inform consumers on environmental impact and safety, while regulations ensure responsible EV recycling. |

| 8. | Critical material availability | Efficient use of scarce resources with sustainable sourcing | Recycling regulations reduce reliance on mining, while ethical sourcing prevents child labor and environmental harm. |

| Category | Number | Description |

|---|---|---|

| Safety | ISO 26262 | Functional safety for automotive systems, focusing on risk management in electrical and electronic systems. |

| IEC 62133 | Safety requirements for portable sealed secondary cells and batteries, ensuring safe operation, handling, and protection from hazards. | |

| Euro NCAP/NHTSA | Vehicle crashworthiness and occupant safety standards, including specific guidelines for EVs. | |

| Charging | IEC 62196 | Specifies physical connectors and protocols for EV charging to ensure global interoperability. |

| CHAdeMO, CCS, Tesla Supercharger | Charging protocols define communication between vehicles and charging stations for fast charging and compatibility. | |

| Environmental and Emission | EU Battery Directive (2006/66/EC) | Ensures proper battery recycling and disposal to minimize environmental impact. |

| U.S. EPA Energy Efficiency Standards | Regulations ensuring EVs meet energy efficiency targets to reduce overall energy consumption. | |

| Management Standards | ISO 9001 | Quality management system standards ensure consistency and quality in manufacturing processes. |

| ISO 14001 | Environmental management standards to reduce ecological impact in manufacturing. | |

| ISO 15118 | Defines communication standards between EVs and charging stations to enable smart charging and grid integration. | |

| Performance Standards | Range and Charging Time Standards | Defines the acceptable range of vehicles on a single charge and the time required for charging. |

| Thermal Management Standards | Sets guidelines for battery cooling and heating systems to maintain optimal battery performance in varying temperatures. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dimic-Misic, K.; Chouhan, S.S.; Spasojević Brkić, V.; Marceta-Kaninski, M.; Gasik, M. Recycling or Sustainability: The Road of Electric Vehicles Toward Sustainable Economy via Blockchain. Recycling 2025, 10, 48. https://doi.org/10.3390/recycling10020048

Dimic-Misic K, Chouhan SS, Spasojević Brkić V, Marceta-Kaninski M, Gasik M. Recycling or Sustainability: The Road of Electric Vehicles Toward Sustainable Economy via Blockchain. Recycling. 2025; 10(2):48. https://doi.org/10.3390/recycling10020048

Chicago/Turabian StyleDimic-Misic, Katarina, Shailesh Singh Chouhan, Vesna Spasojević Brkić, Milica Marceta-Kaninski, and Michael Gasik. 2025. "Recycling or Sustainability: The Road of Electric Vehicles Toward Sustainable Economy via Blockchain" Recycling 10, no. 2: 48. https://doi.org/10.3390/recycling10020048

APA StyleDimic-Misic, K., Chouhan, S. S., Spasojević Brkić, V., Marceta-Kaninski, M., & Gasik, M. (2025). Recycling or Sustainability: The Road of Electric Vehicles Toward Sustainable Economy via Blockchain. Recycling, 10(2), 48. https://doi.org/10.3390/recycling10020048