What Institutional Dynamics Guide Waste Electrical and Electronic Equipment Refurbishment and Reuse in Urban China?

Abstract

:1. Introduction

2. Methods and Materials

2.1. Methodology

2.2. Data and Sources

3. Results

3.1. The Quantity of WEEE

3.1.1. Domestic Generation of WEEE in China

3.1.2. WEEE Flows: From Households to Collection to Refurbishment

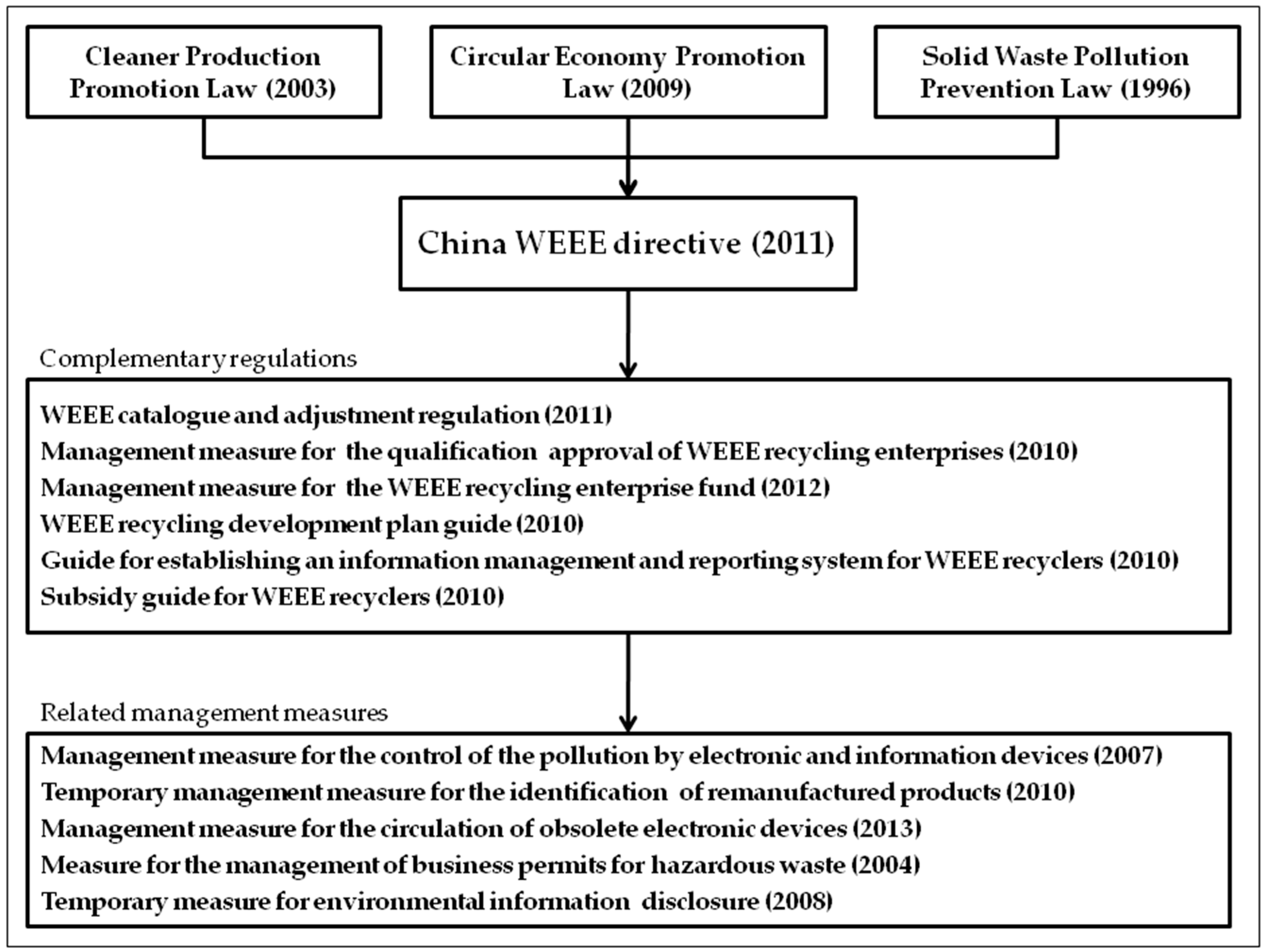

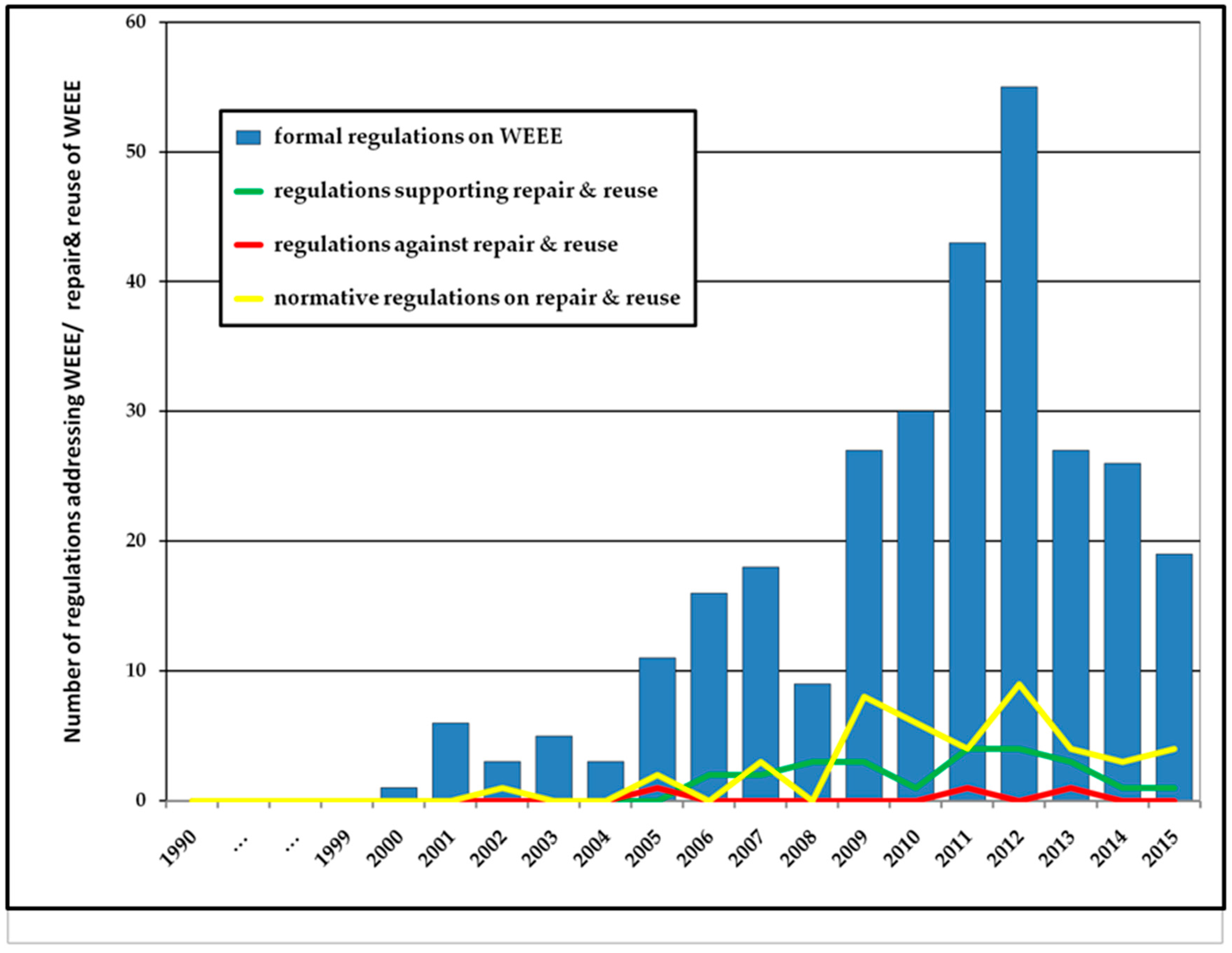

3.2. Formal Regulations on WEEE Refurbishment and Reuse

3.3. Informal Refurbishment and Reuse

3.3.1. The Development of Informal Refurbishment and Reuse Practices

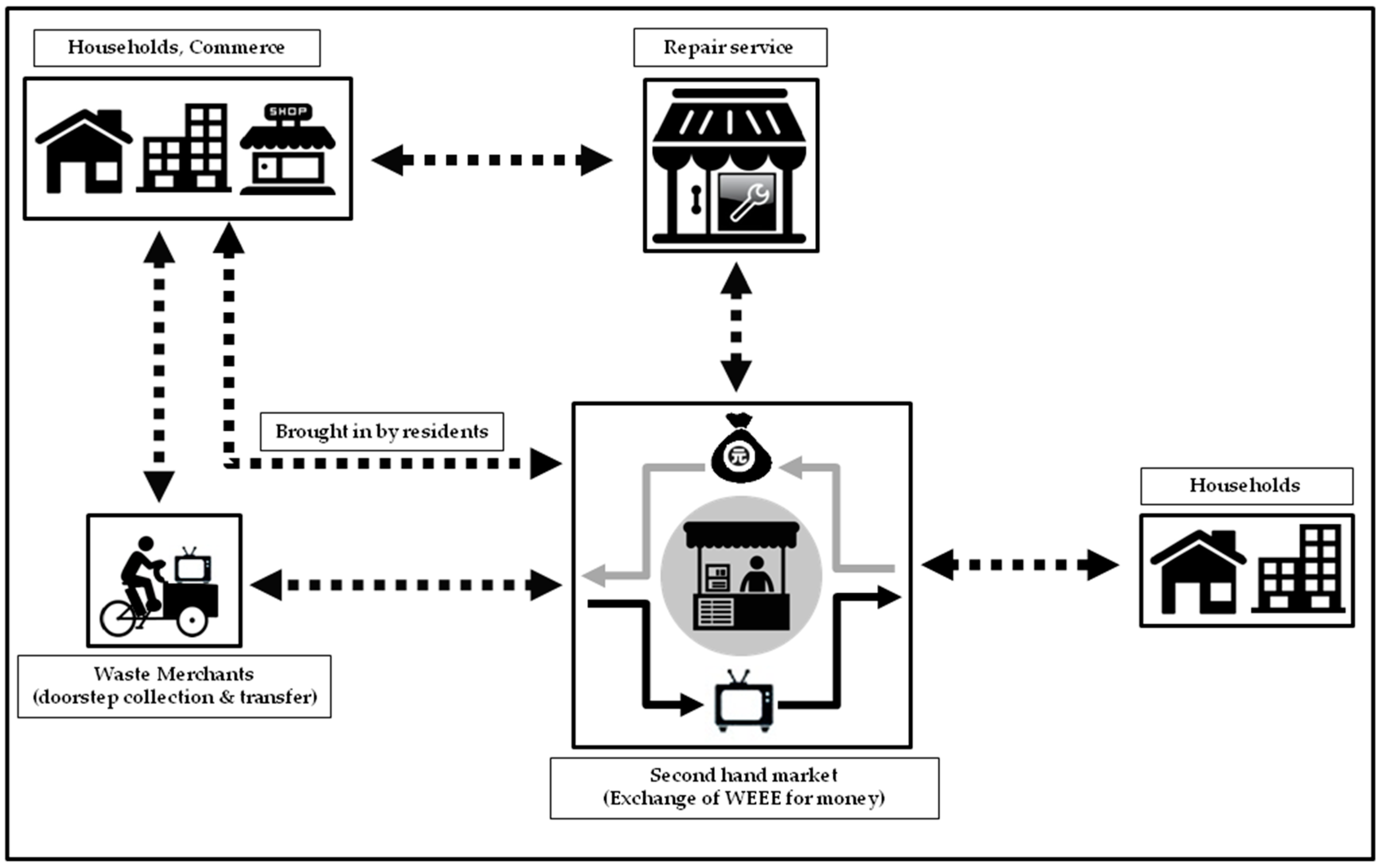

3.3.2. Systems of Informal Refurbishment and Reuse

3.4. Formal Refurbishment and Reuse

3.5. Pushing Formalisation against Persistent Informal Practices

4. Discussion

5. Conclusions

Acknowledgments

Conflicts of Interest

Abbreviations

| CHEARI | China Household Electronic Appliance Research Institute |

| CRRA | China Renewable Resource Association |

| EEE | Electrical and Electronic Equipment |

| EIP | Eco Industrial Park |

| EPR | Extended Producer Responsibility |

| MSW | Municipal solid waste |

| MOC | Ministry of Commerce |

| OfN | Old-for-New scheme for household electronics |

| PRC | People’s Republic of China |

| RoHS | Restriction of Hazardous Substances |

| VAT | Value-added tax |

| WEEE | Waste electrical electronic equipment; |

| WM | Waste management |

References

- Zhou, L.; Xu, Z. Response to waste electrical and electronic equipments in China: Legislation, recycling system, and advanced integrated process. Environ. Sci. Technol. 2012, 46, 4713–4724. [Google Scholar] [CrossRef] [PubMed]

- Tong, X.; Wang, J. Transnational flows of e-waste and spatial patterns of recycling in China. Eurasian Geogr. Econ. 2004, 45, 608–621. [Google Scholar] [CrossRef]

- Yu, J.; Williams, E.; Ju, M.; Shao, C. Managing e-waste in China: Policies, pilot projects and alternative approaches. Resour. Conserv. Recycl. 2010, 54, 991–999. [Google Scholar] [CrossRef]

- Chi, X.; Streicher-Porte, M.; Wang, M.Y.L.; Reuter, M.A. Informal electronic waste recycling: A sector review with special focus on China. Waste Manag. 2011, 31, 731–742. [Google Scholar] [CrossRef] [PubMed]

- China Ministry of Commerce. Development Report on China’s Renewable Resource Recovery Industry (2015) (In Chinese). Available online: http://www.huanbao.bjx.com.cn/news/20150706/638381.shtml (accessed on 9 February 2016).

- Schulz, Y.; Steuer, B. Dealing with discarded e-devices. In Routledge Handbook—China’s Environmental Policy, 1st ed.; Sternfeld, E., Ed.; Routledge: London, UK, 2011. [Google Scholar]

- Chinalawinfo. Available online: http://www.chinalawinfo.com (accessed on 4 November 2015).

- Wang, Z.; Zhang, B.; Yin, J.; Zhang, X. Willingness and behavior towards e-waste recycling for residents in Beijing city, China. J. Clean. Prod. 2011, 19, 977–984. [Google Scholar] [CrossRef]

- Yang, J.; Lu, B.; Xu, C. WEEE flow and mitigating measures in China. Waste Manag. 2008, 28, 1589–1597. [Google Scholar] [CrossRef] [PubMed]

- The Establishment of Baidu’s Takeback Stations Green Service Alliance (In Chinese). Available online: http://www.tieba.baidu.com/p/4141655800 (accessed on 10 October 2015).

- Steuer, B.; Salhofer, S.; Linzner, R. The winner takes it all—Why is informal waste collection in urban China successful? In Proceedings of the Sardinia 2015, Fifteenth International Waste Management and Landfill Symposium, Sardinia, Italy, 5–9 October 2015.

- Schulz, Y. Towards a new waste regime? Critical reflections on China’s shifting market for high-tech discards. China Perspect. 2015, 3, 43–50. [Google Scholar]

- Steuer, B.; University of Vienna, Vienna, Austria. Personal observations within Guang’an Zhonghai Electronics Markets in Beijing, China. 2013. [Google Scholar]

- Steuer, B.; University of Vienna, Vienna, Austria. Personal observations within Guang’an Zhonghai Electronics Markets in Beijing, China. 2015. [Google Scholar]

- Schulz, Y.; Goldstein, J. Criminal Negligence? Discard Studies: Social Studies of Waste, Pollution and Externalities. 2015. Available online: http://www.discardstudies.com/2015/11/27/criminal-negligence-part-2/ (accessed on 20 November 2015).

- Qu, Y.; Zhu, Q.; Sarkis, J.; Geng, Y.; Zhong, Y. A review of developing an e-wastes collection system in Dalian, China. J. Clean. Prod. 2013, 52, 176–184. [Google Scholar] [CrossRef]

- Tong, X.; Tao, D. The rise and fall of a “waste city” in the construction of an “urban circular economic system”: The changing landscape of waste in Beijing. Resour. Conserv. Recycl. 2016, 107, 10–17. [Google Scholar] [CrossRef]

- Chi, X.; Streicher-Porte, M.; Reuter, M.A. E-waste collection channels and household recycling behaviors in Taizhou of China. J. Clean. Prod. 2014, 80, 87–95. [Google Scholar] [CrossRef]

- Steuer, B.; University of Vienna, Vienna, Austria. Personal observations and interviews with several informal recyclers within the Dongxiaokou “waste village” area in Beijing, China. 2013. [Google Scholar]

- Steuer, B.; University of Vienna, Vienna, Austria. Personal observations at informal waste trading points in Haidian district Beijing, China. 2015. [Google Scholar]

- Investigation on the Price of Obsolete Mobile Phones: Does It Pay off the Most to Sell Your Phone after Using It for Eleven Months? (In Chinese). Available online: http://www.news.enorth.com.cn/system/2014/07/07/011996864.shtml (accessed on 2 May 2015).

- Wilson, D.C.; Araba, A.O.; Chinwah, K.; Cheeseman, C.R. Building recycling rates through the informal sector. Waste Manag. 2009, 29, 629–635. [Google Scholar] [CrossRef] [PubMed]

- Gutberlet, J. Cooperative urban mining in Brazil: Collective practices in selective household waste collection and recycling. Waste Manag. 2015, 45, 22–31. [Google Scholar] [CrossRef] [PubMed]

- Ardi, R.; Leisten, R. Assessing the role of informal sector in WEEE management systems: A system dynamics approach. Waste Manag. 2015, in press. [Google Scholar] [CrossRef] [PubMed]

- Groenewegen, J.; Spithoven, A.; van den Berg, A. Institutional Economics an Introduction, 1st ed.; Palgrave Macmillan: London, UK, 2010; p. 369. [Google Scholar]

- Hodgson, G.M. The approach of institutional economics. J. Econ. Lit. 1998, 36, 166–192. [Google Scholar]

- Hodgson, G.M. What are institutions? J. Econ. Issues 2006, 40, 1–25. [Google Scholar] [CrossRef]

- Hodgson, G.M. Institutions and individuals: Interaction and evolution. Organ. Stud. 2007, 28, 95–116. [Google Scholar] [CrossRef]

- China Solid Waste News. Available online: http://www.news.solidwaste.com.cn (accessed on 16 April 2016).

- Steuer, B.; Ramusch, R.; Part, F.; Salhofer, S. Analysis of the value chain and network structure in informal waste recycling in Beijing, China. Resour. Conserv. Recycl. 2016. under review. [Google Scholar]

- Wilson, D.C.; Costas, V.; Cheeseman, R.C. Role of informal sector recycling in waste management in developing countries. Habitat Int. 2006, 30, 797–808. [Google Scholar] [CrossRef]

- Li, S. Junk-buyers as the linkage between waste sources and redemption depots in urban China: The case of Wuhan. Resour. Conserv. Recycl. 2002, 36, 319–335. [Google Scholar] [CrossRef]

- China Household Electronic Appliance Research Institute (CHEARI). White Paper on WEEE Recycling Industry in China. 2015. Available online: http://www.upload.cheaa.com/2015/0611/1434006482554.pdf (accessed on 27 August 2015).

- Salhofer, S.; Steuer, B.; Ramusch, R.; Beigl, P. WEEE management in Europe and China—A comparison. Waste Manag. 2015, in press. [Google Scholar]

- Wang, F.; Kuehr, R.; Ahlquist, D.; Li, J. E-Waste in China: A Country Report. StEP Green Paper Series 2013. pp. 1–60. Available online: http://www.ewasteguide.info/files/Wang_2013_StEP.pdf (accessed on 19 August 2015).

- Li, J.; Tian, B.; Liu, T.; Liu, H.; Wen, X.; Honda, S. Status quo of e-waste management in mainland China. J. Mater. Cycles Waste Manag. 2006, 8, 13–20. [Google Scholar] [CrossRef]

- China Ministry of Commerce. Development report on China’s renewable resource industry (2013). 2014, 7, 1–4. (In Chinese) [Google Scholar]

- China Ministry of Commerce. Report on the Analysis of the Renewable Resource and Recovery Industry (2014) (In Chinese). 2014; pp. 1–10. Available online: http://www.images.mofcom.gov.cn/ltfzs/201406/20140618113317258.pdf (accessed on 20 August 2015). [Google Scholar]

- Too Little of Obsolete Household Electronics Enter Formal Recovery Channels (In Chinese). Available online: http://www.crrainfo.org/content-14-21173-1.html (accessed on 14 February 2016).

- Streicher-Porte, M.; Geering, A.-C. Opportunities and threats of current e-waste collection system in China: A case study from Taizhou with a focus on refrigerators, washing machines, and televisions. Environ. Eng. Sci. 2009. [Google Scholar] [CrossRef]

- Zhong, W. The WEEE collection management process and legislative institutional build-up. Policy Innov. Stud. 2010, 3, 41–56. (In Chinese) [Google Scholar]

- Ma, J.; Wen, X.; Yin, F. The recycling of e-waste and challenges in China. Adv. Biomed. Eng. 2012, 7, 239–247. [Google Scholar]

- Yang, R.; Zhu, H.; Chen, Q. Project Report of Shanghai’s YHZC Waste Material Recovery Convenience Services Company. 2013, pp. 1–40. Available online: http://www.wenku.baidu.com/view/823ec6f589eb172ded63b743.html (accessed on 7 July 2015).

- Veenstra, A.; Wang, C.; Fan, W.; Ru, Y. An analysis of e-waste flows in China. Int. J. Adv. Manuf. Technol. 2010, 47, 449–459. [Google Scholar] [CrossRef]

- Li, J.; Liu, L.; Ren, J.; Duan, H.; Zheng, L. Behavior of urban residents toward the discarding of waste electrical and electronic equipment: A case study in Baoding, China. Waste Manag. Res. 2012. [Google Scholar] [CrossRef] [PubMed]

- The WEEE Situation of Hangzhou Does Not Allow for Optimism (In Chinese). Available online: http://www.crrainfo.org/content-14-1734-1.html (accessed on 15 November 2015).

- Steuer, B.; University of Vienna, Vienna, Austria. Personal communication with informal collectors in Haidian district (Beijing), 2013–2015; in Huangpu district (Shanghai), 2014; in Futian district (Shenzhen), 2015; in Yuexiu district (Guangzhou), 2015.

- China National People’s Congress. The Cleaner Production Promotion Law of the PRC (In Chinese). 2002. Available online: http://www.chinalaw.gov.cn/article/fgkd/xfg/fl/200207/20020700056258.shtml (accessed on 10 April 2016). [Google Scholar]

- China National People’s Congress. The Circular Economy Promotion Law of the PRC (In Chinese). 2008. Available online: http://www.gov.cn/flfg/2008-08/29/content_1084355.htm (accessed on 10 April 2016). [Google Scholar]

- China National People’s Congress. The Solid Waste Environmental Pollution Prevention Law (In Chinese). 1995. Available online: http://www.szciq.gov.cn/cn/doI/coid/pr/lr/20151124/48943.html (accessed on 10 April 2016). [Google Scholar]

- China National People’s Congress. Management Regulation for the Recovery and Treatment of Waste Electrical and Electronic Products (In Chinese). 2009. Available online: http://www.gov.cn/zwgk/2009-03/04/content_1250419.htm (accessed on 10 April 2016). [Google Scholar]

- China Ministry of Commerce. Management Measure for the Circulation of Obsolete Electronic Devices (In Chinese). 2013. Available online: http://www.mofcom.gov.cn/article/b/c/201303/20130300062999.shtml (accessed on 10 April 2016). [Google Scholar]

- China Ministry of Commerce; China State Bureau of t’Taxation. Notice on the Streamlining and Combination of Value Added Tax Levy Rates (In Chinese). 2012. Available online: http://www.chinatax.gov.cn/n810341/n810765/n812141/n812252/c1078631/content.html (accessed on 10 April 2016). [Google Scholar]

- Tao, D.; Tong, X.; Ferri, C. The production of grey space in rural-urban fringe: A case study of the “waste village” in Beijing. Urban Int. Plan. 2014, 29, 8–14. (In Chinese) [Google Scholar]

- Li, C. Waste Pickers and the Underclass: A Research on Concentrated Settlements of the New Migrants (In Chinese). Available online: http://www.xuewen.cnki.net/CJFD-GXZS200706011.html (accessed on 13 June 2015).

- Second Hand Computer Markets: Distribution Centres for Japanese Waste? (In Chinese). Available online: http://www.tech.sina.com.cn/c/2001-08-02/4855.html (accessed on 15 November 2015).

- Ecological Environmental Protection Centre for a Liveable Guangzhou. Survey Report on Guangzhou’s Waste Separation (2013–2014). Available online: http://www.scefund.org/tools/download.ashx?id=25 (accessed on 23 November 2015).

- Steuer, B.; University of Vienna, Vienna, Austria. Personal communication at formal recycling facilities in Beijing, Shanghai, Wuhan, Chengdu and Xi’an. 2013–2015. [Google Scholar]

- A New System for the Recovery of Waste Household Electronics Will Be Developed—Can the Sector’s Maladies Be Remedied? (In Chinese). Available online: http://www.crrainfo.org/content-14-29423-1.html (accessed on 15 November 2015).

- Orlins, S.; Guan, D. China’s toxic informal e-waste recycling: Local approaches to a global environmental problem. J. Clean. Prod. 2016, 114, 71–80. [Google Scholar] [CrossRef]

- Steuer, B.; University of Vienna, Vienna, Austria. Personal communication with Mr. Xu an informal refurbisher in Panyu district, Guangzhou. 2013. [Google Scholar]

- Secretly Lifting the Curtain of the Street Side Waste Recovery Business (In Chinese). Available online: http://www.360doc.com/content/15/0626/15/11542102_480837420.shtml (accessed on 15 November 2015).

- Cemetery of the Refrigerators (In German). Available online: http://www.sueddeutsche.de/wirtschaft/elektroschrott-in-china-friedhof-der-kuehlschraenke-1.2040129 (accessed on 28 May 2015).

- Where Is Your Household’s E-Waste Going? (In Chinese). Available online: http://www.crrainfo.org/content-19-31182-1.html (accessed on 15 November 2015).

- The Development of the Recovery System for Discarded Household Electronics Is Gradually Embarking on a Formal Track (In Chinese). Available online: http://www.crrainfo.org/content-14-182-1.html (accessed on 15 November 2015).

- Report on the Statistical Analysis of the Household Electronics Services and Refurbishment Sector in 2012 (In Chinese). Available online: http://www.cheasa.org/c/cn/news/2014-06/05/news_888.html (accessed on 15 November 2015).

- E-Waste Recovery Merchants Are Advancing towards Electronics Business: C2B Are Bidding against Each Other, Waiting and Collecting the Goods (In Chinese). Available online: http://www.crra.org.cn/html/2014/hangye_1202/51.html (accessed on 15 November 2015).

- The Good Trade of Second-Hand Markets (In Chinese). Available online: http://www.finance.sina.com.cn/roll/20141229/171621189082.shtml (accessed on 15 November 2015).

- Steuer, B.; University of Vienna, Vienna, Austria. Personal communication with Manson Loo, CEO of Taolü Huanbao in Shenzhen. 2015. [Google Scholar]

- Park, J.; Sarkis, J.; Wu, Z. Creating integrated business and environmental value within the context of China’s circular economy and ecological modernization. J. Clean. Prod. 2010, 18, 1494–1501. [Google Scholar] [CrossRef]

- Steuer, B.; University of Vienna, Vienna, Austria. Personal communication with managers at Fuji Xerox Eco-Manufacturing (Suzhou) Co., Ltd., Suzhou. 2015. [Google Scholar]

- The Old for New [Scheme] for Household Electronics Conceals Illegal Deals—Old Household Electronics Re-Enter the Market (In Chinese). Available online: http://www.cheasa.org/c/cn/news/2012-05/21/news_284.html (accessed on 15 November 2015).

- The Formal Forces vs. the Scrap Kings, on Which Path Do Electronics Embark? (In Chinese). Available online: http://www.gz.ifeng.com/zaobanche/detail_2014_12/12/3278535_0.shtml (accessed on 15 November 2015).

- Guangzhou Intends to Spend 750,000 [RMB] on Establishing a Network to Register and Reorganise “the Collect-to-Buy Fellows” (In Chinese). Available online: http://www.gz.ifeng.com/zaobanche/detail_2014_12/12/3278535_0.shtml (accessed on 15 November 2015).

- The Doubts of Waste Pickers after “Turning Formal” (In Chinese). Available online: http://www.gufei-chuli.info/shihuangzhe-guanli/ (accessed on 15 November 2015).

- Waste Pickers “Turning Formal”: Is 660 Yuan in Management Costs Becoming the Government’s Way to Snatch Funds? (In Chinese). Available online: http://www.china.com.cn/city/txt/2007-08/30/content_8771560_2.htm (accessed on 15 November 2015).

- Beijing’s Gold Bridge Profit and Health Electronics Market (In Chinese). Available online: http://www.218.240.46.112/index.php/article/show?id=24 (accessed on 15 November 2015).

- Steuer, B.; University of Vienna, Vienna, Austria; Schulz, Y.; Université de Neuchâtel, Neuchâtel, Switzerland. Personal communication with traders at the second-hand electronic component market within the Guiyu Eco-industrial Park, Guiyu. 2015. [Google Scholar]

- Party Office of the Dongxiaokou Area. 2006–2013 Comprehensive Plan for the Land Use of Dongxiaokou Village in Beijing City’s Changping District. 2013. Available online: http://www.cp.bjgtj.gov.cn/attach/-1/150618171010003671.pdf (accessed on 9 September 2015). [Google Scholar]

- Beijing’s Second Hand Electronic Product Markets (In Chinese). Available online: http://www.diannao-huishou.com/news/html/9.html (accessed on 15 November 2015).

- Steuer, B.; University of Vienna, Vienna, Austria. Personal communication with several traders at Guang’an Zhonghai Electronics Markets, Beijing. 2013. [Google Scholar]

- Steuer, B.; University of Vienna, Vienna, Austria. Personal communication with several traders at Guang’an Zhonghai Electronics Markets, Beijing. 2015. [Google Scholar]

- A Basic Investigation of “Guiyu Dismantling” Where to Go from This Critical Point? (In Chinese). Available online: http://www.yicai.com/news/2015/06/4637340.html (accessed on 15 November 2015).

- Shantou’s Guiyu: The Difficult Transformation of the “E-Waste Capital” (In Chinese). Available online: http://www.bbs.southcn.com/thread-8028636-1-1.html (accessed on 15 November 2015).

- The Huaqiangbei Scheme: A Triangular Alliance between Trade Makers, Bosses and Officials (In Chinese). Available online: http://www.infzm.com/content/112747 (accessed on 15 November 2015).

- The Second Hand Market for Household Electronics Is Cooling Down—New Regulations Targeting Post-Sale Product Services (In Chinese). Available online: http://www.cheasa.org/c/cn/news/2013-04/23/news_687.html (accessed on 15 November 2015).

| Source/Year | 2000 | 2006 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|---|

| Questionnaire survey [33] | 0.3 | 0.9 | 1.5 | 1.7 | 1.9 | 2.2 | 3.1 | 3.3 | - |

| Estimates and projections | 1.7 [4] | 4 [36] | 3.7 [37] | 1.9 [37] | 2.6 [38] 2.3 [16] | 3.1 [5] | 5.4 [9] | ||

| - | - | 3.3 [9] | |||||||

| 1.6 [8] |

| Informally Collected WEEE (% of Quantity Generated by Urban Households) | Area | Year of Measurement | Source |

|---|---|---|---|

| 60.0 | China | 2011 | [4] |

| 88.0 | China | 2011 | [16] |

| 57.0 | Peking | 2005 | [40] |

| 50.0 | Peking | 2005 | [40] |

| 30.0 | Peking | 2008 | [9] |

| 60.0 | Peking | 2010 | [41] |

| 60.0 | Peking | 2011 | [8] |

| 30.0 | Peking | 2012 | [42] |

| 76.0 | Shanghai | 2013 | [43] |

| 55.0 | Xi’an | 2010 | [44] |

| 51.0 | Baoding | 2012 | [45] |

| 50.0 | Hangzhou | 2013 | [46] |

| 37.0 | Taizhou | 2009 | [40] |

| 43.0 | Ningbo | 2003 | [40] |

| WEEE Received by | Proportion of WEEE (%) Generated | Area | Year of Measurement | Reference |

|---|---|---|---|---|

| Recovery and take back stations | 10 | Peking | 2010 | [41] |

| 10 | Peking | 2011 | [8] | |

| 24 | Shanghai | 2013 | [43] | |

| 13 | Baoding | 2012 | [45] | |

| 14 | Taizhou | 2009 | [40] | |

| Return to retailers before the OfN (2009–2011) | 16 | Ningbo | 2003 | [40] |

| 4 | Peking | 2005 | [40] | |

| 14 | Peking | 2005 | [40] | |

| Return to retailers during the OfN (2009–2011) | 7.8 | Xi’an | 2010 | [44] |

| 20 | Peking | 2009–2011 | [8] | |

| 20 | Peking | 2009–2010 | [41] | |

| 4 | Taizhou | 2009 | [40] |

| Area | Source of WEEE | Proportion by Source (%) | Reference |

|---|---|---|---|

| Peking | Informal collectors & traders | 80–85 | [8,40] |

| Residents | 5–6, 17 | ||

| Formal retailer or repair service | 10–15 | ||

| Baoding | Informal collectors & traders | 60–70 | [45] |

| Residents | 10 | ||

| Formal retail or repair service | 10–20 | ||

| Xi’an | Informal collectors & traders | 70 | [44] |

| Residents | 15 | ||

| other | 15 | ||

| Taizhou | Residents | 6 | [40] |

| Ningbo | Residents | 12 | [40] |

© 2016 by the author; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Steuer, B. What Institutional Dynamics Guide Waste Electrical and Electronic Equipment Refurbishment and Reuse in Urban China? Recycling 2016, 1, 286-310. https://doi.org/10.3390/recycling1020286

Steuer B. What Institutional Dynamics Guide Waste Electrical and Electronic Equipment Refurbishment and Reuse in Urban China? Recycling. 2016; 1(2):286-310. https://doi.org/10.3390/recycling1020286

Chicago/Turabian StyleSteuer, Benjamin. 2016. "What Institutional Dynamics Guide Waste Electrical and Electronic Equipment Refurbishment and Reuse in Urban China?" Recycling 1, no. 2: 286-310. https://doi.org/10.3390/recycling1020286

APA StyleSteuer, B. (2016). What Institutional Dynamics Guide Waste Electrical and Electronic Equipment Refurbishment and Reuse in Urban China? Recycling, 1(2), 286-310. https://doi.org/10.3390/recycling1020286