On the Current and Future Outlook of Battery Chemistries for Electric Vehicles—Mini Review

Abstract

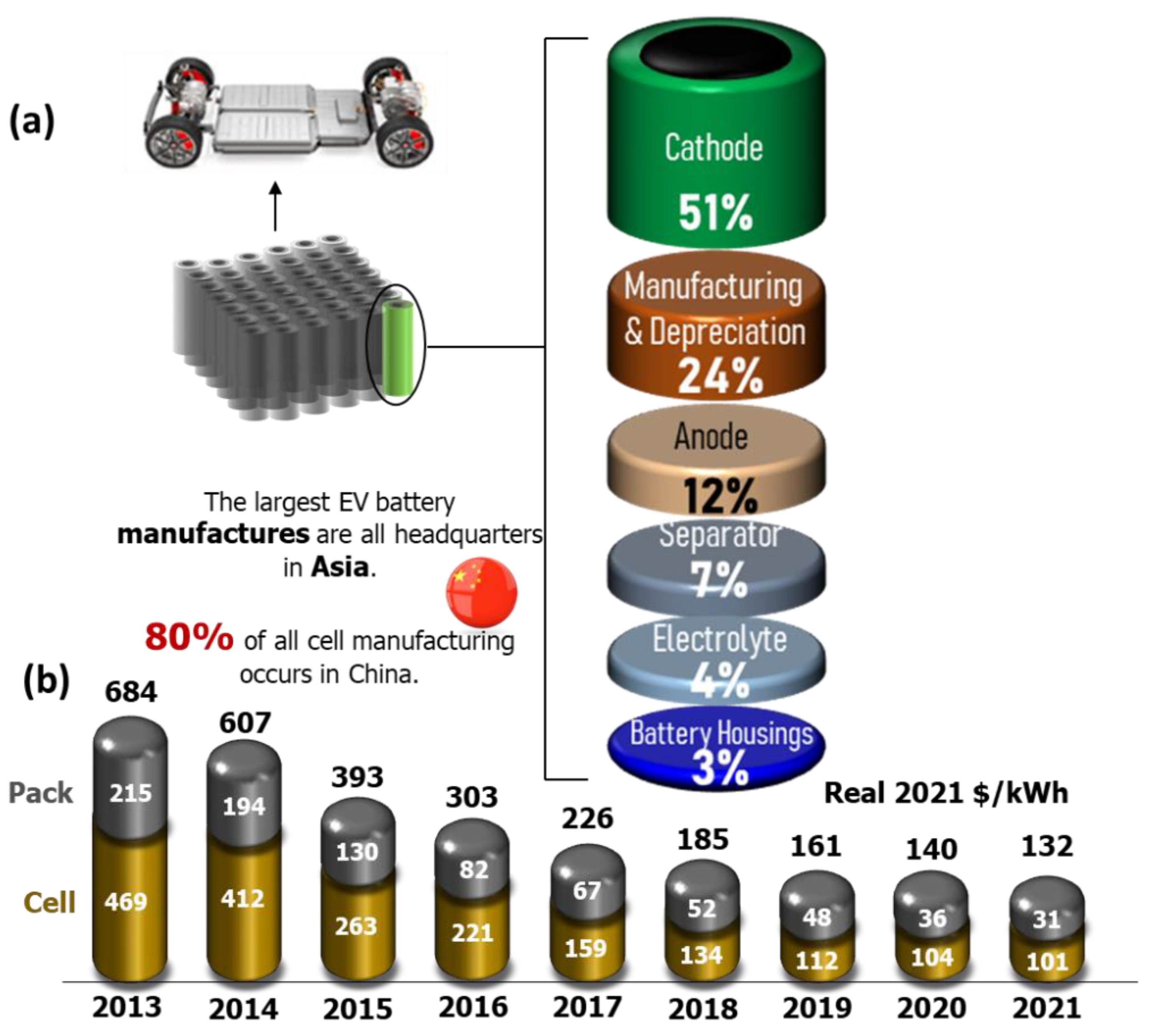

:1. Introduction

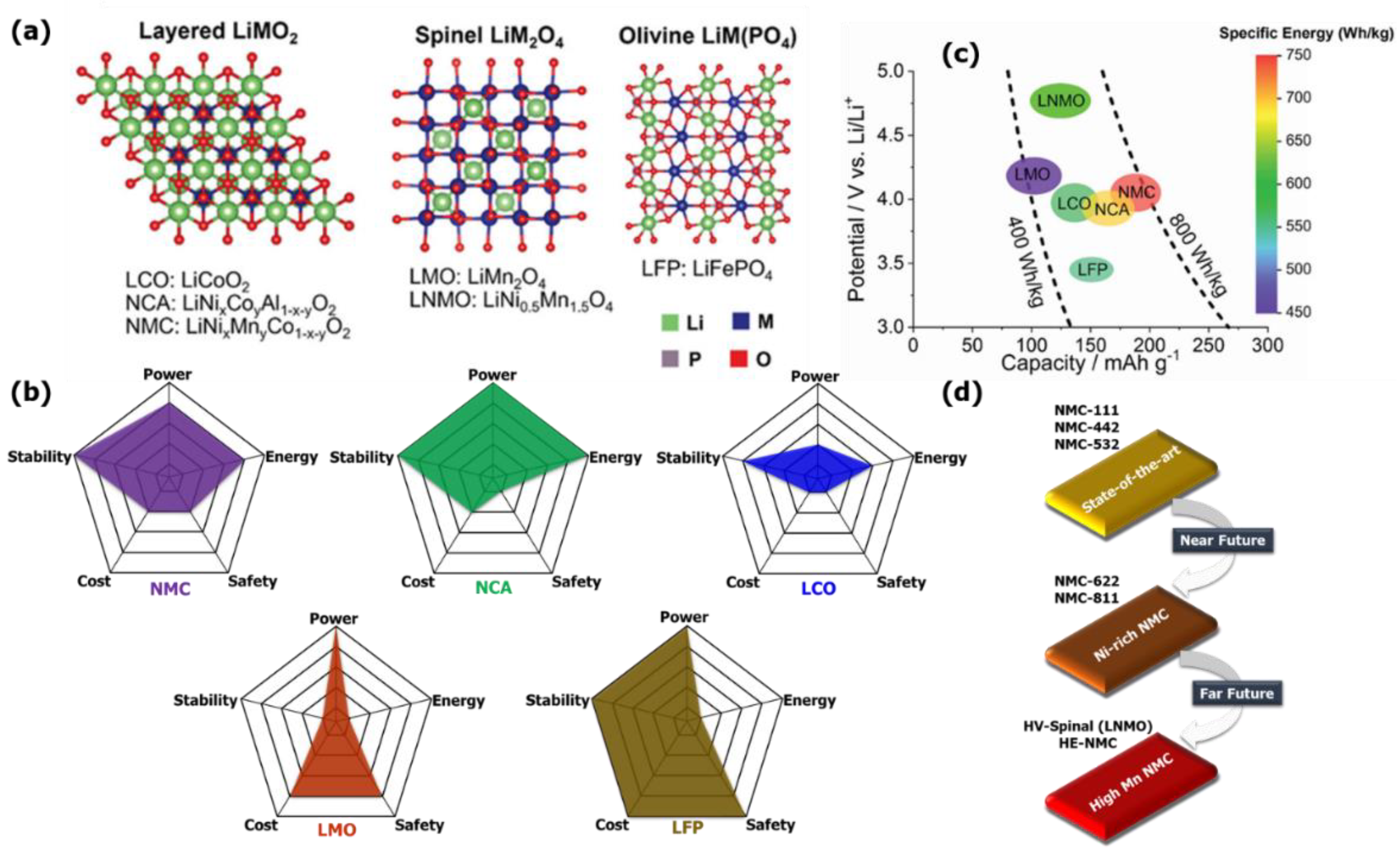

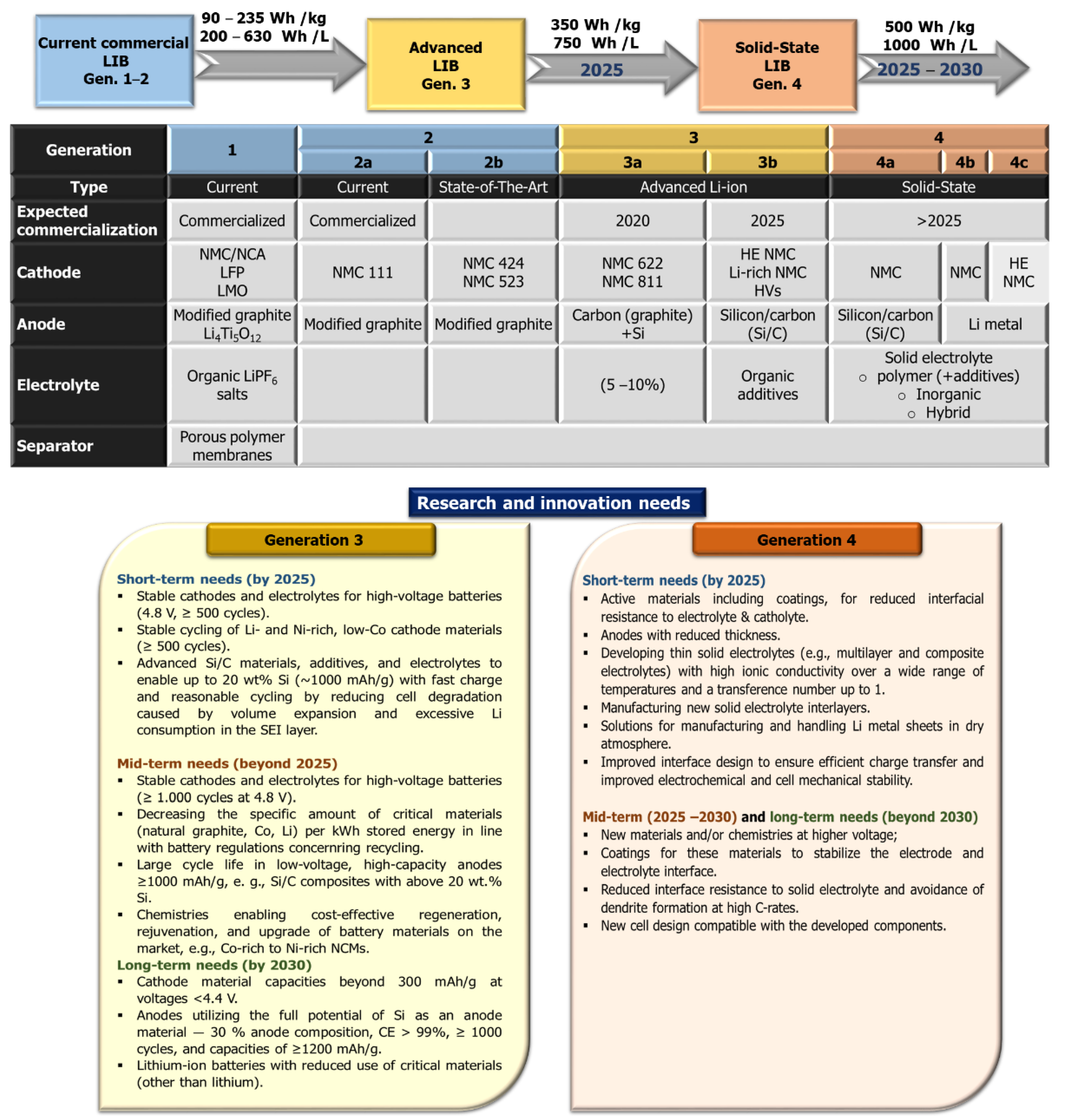

2. Automotive Batteries: State-of-the-Art Li-Ion Cathodes

2.1. Nonlayered Cathode Materials: LFP Technology

2.2. Nonlayered Cathode Materials: LMO Technology

2.3. Layered Cathode Materials: NCA Technology

2.4. Layered Cathode Materials: NMC Technology

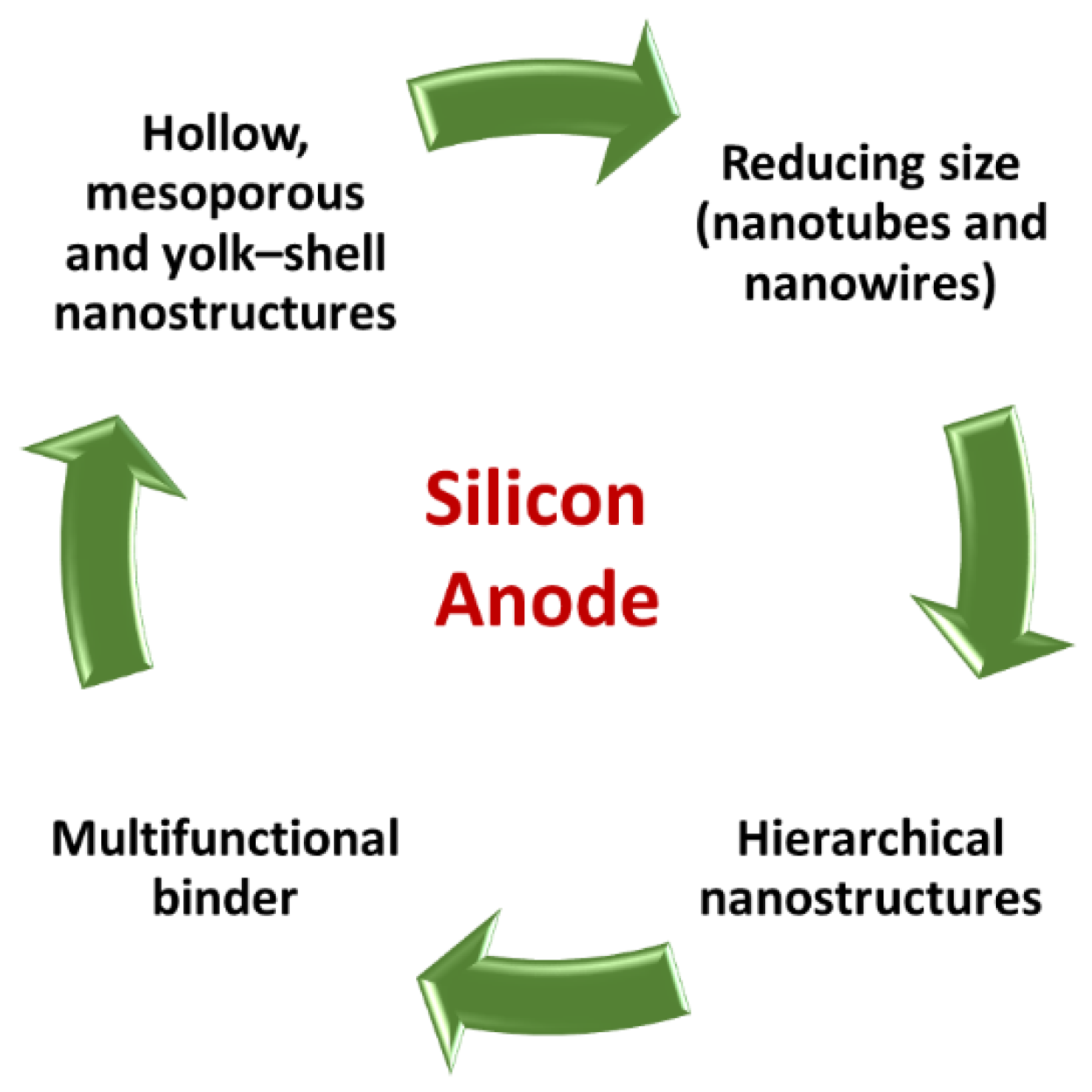

3. Promising Anode Materials for High Energy Density

3.1. Silicon Technology for Near-Term EVs

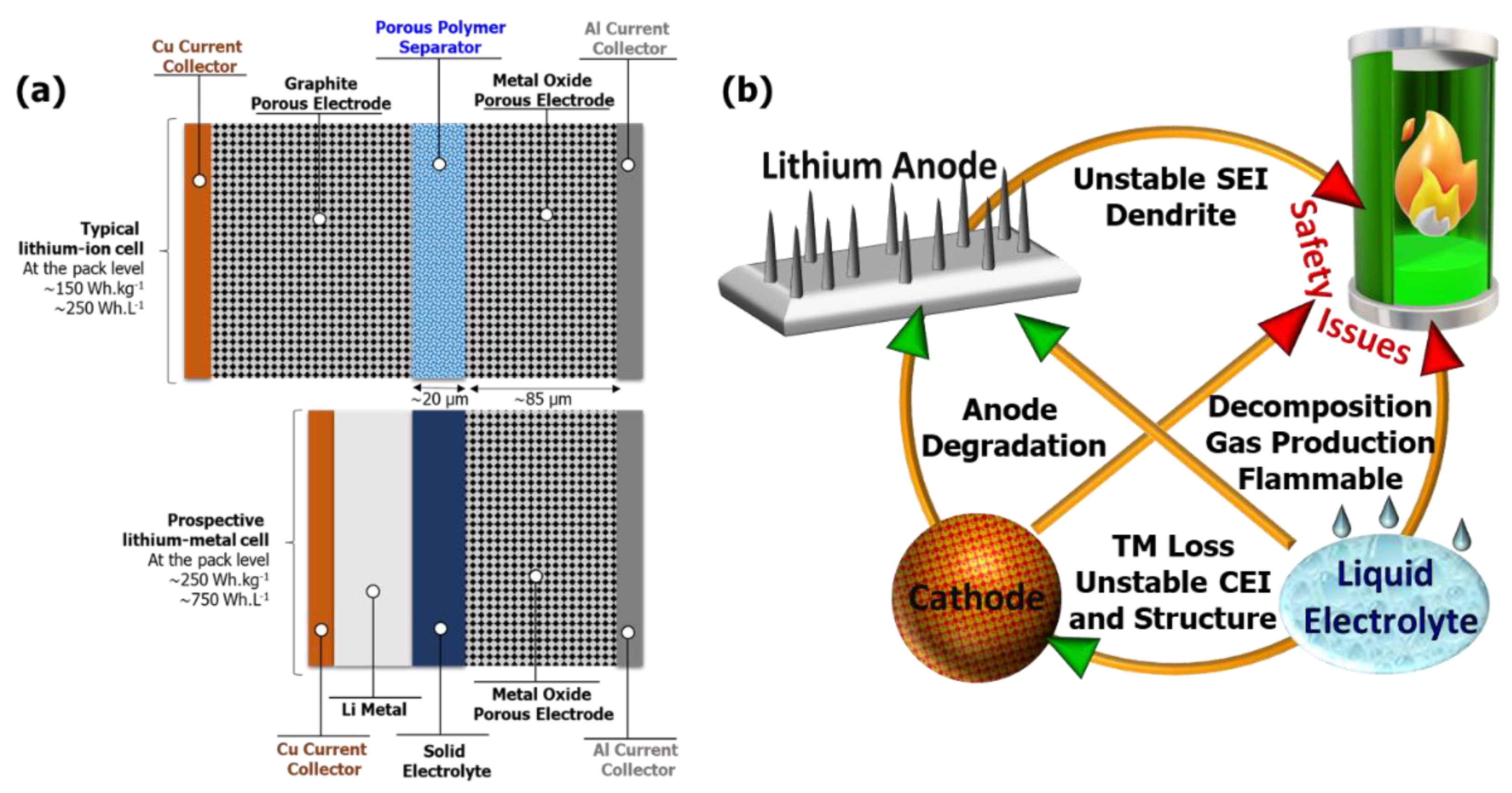

3.2. Li Metal Anode

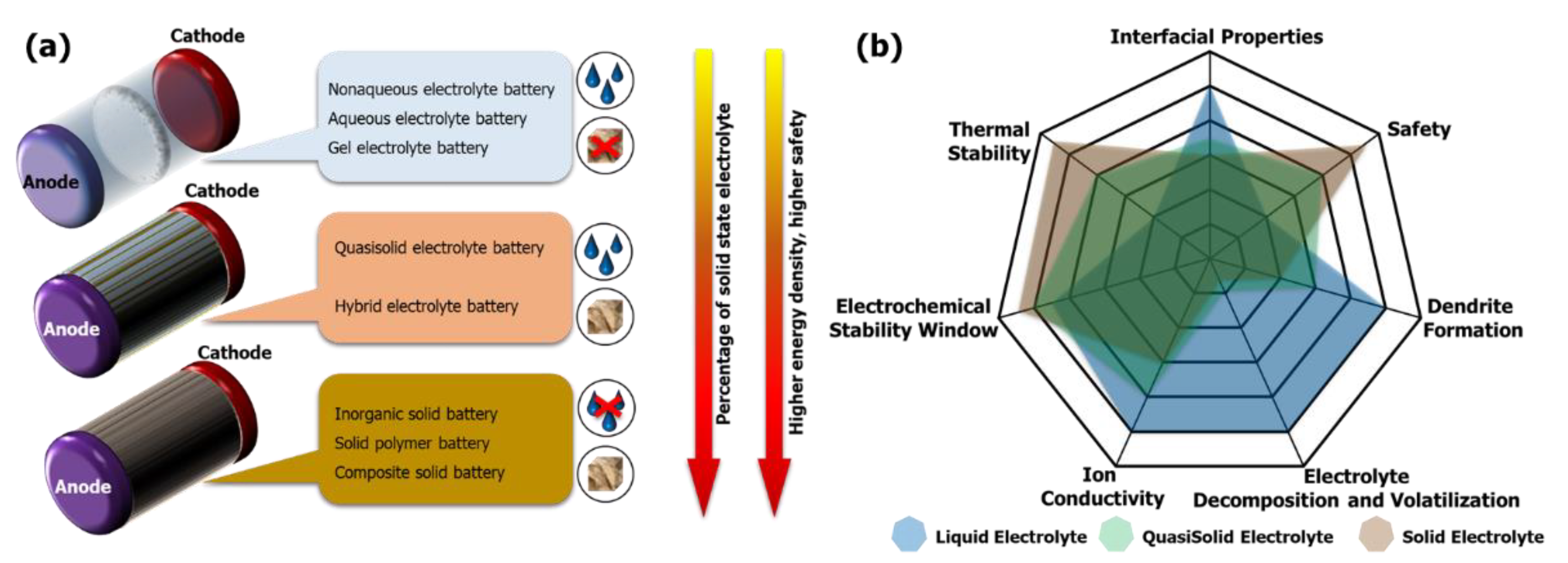

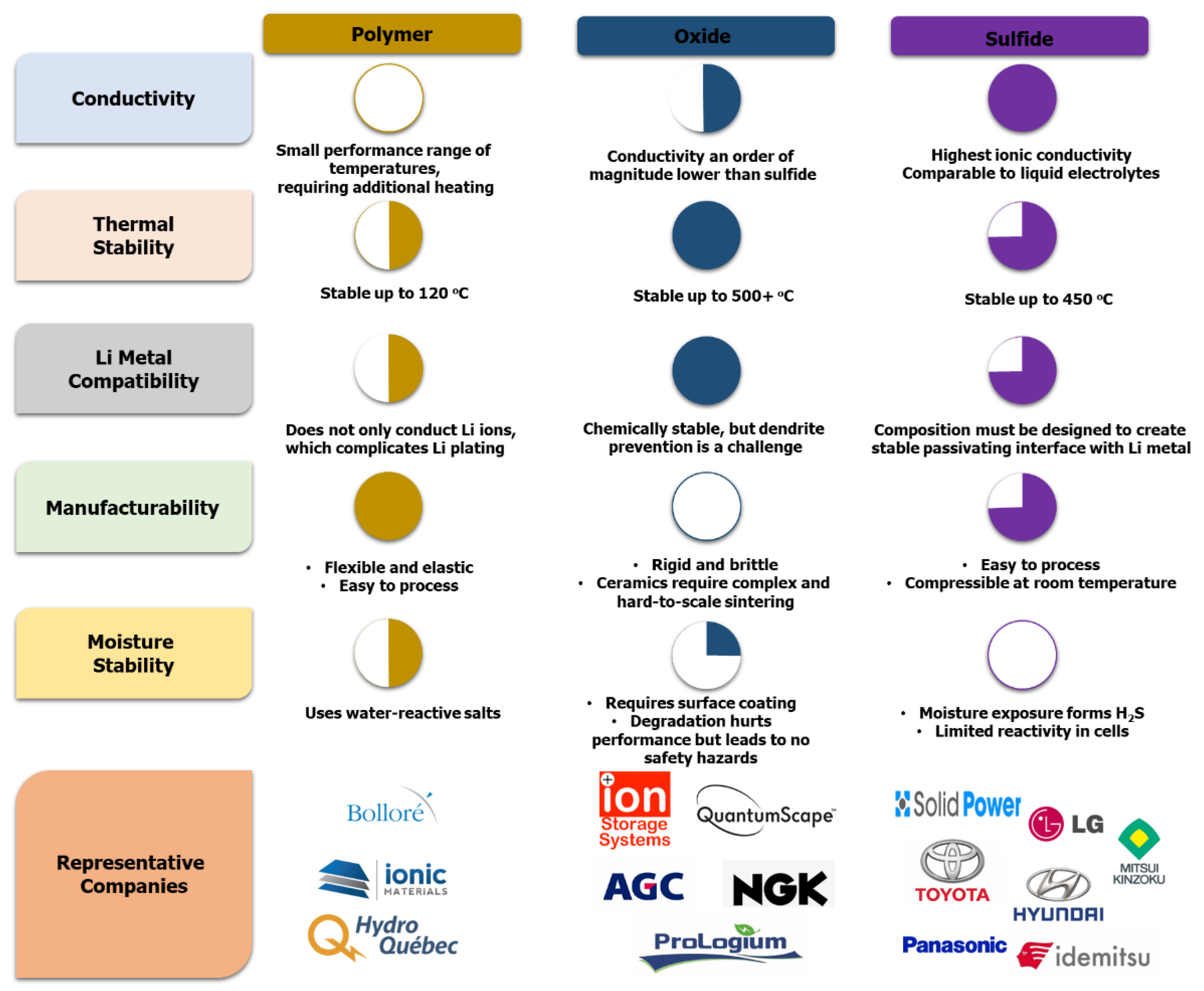

3.3. Solid-State Electrolytes

- (i)

- Organic polymer solid electrolytes: Polymers are the most mature solid electrolytes that have been adapted to large-format applications such as EVs and stationary storage. Polyethylene oxide (PEO) is the most common material that has seen commercial viability, and others being researched include polyacrylonitrile (PAN), polyvinylidene fluoride (PVDF), and polyphenylene sulfide (PPS) [57]. Most polymers can be adapted to conventional manufacturing techniques, and polymer extrusion is a well-understood industrial process. PEO polymers have low room-temperature ionic conductivity, which results in poor power output and slow charging. Low voltage stability also limits cathode choice and cutoff voltage.

- (ii)

- Inorganic sulfide-based solid electrolytes: Sulfide-based inorganic electrolytes are the closest to commercialization in large-format cells. LGPS systems (Li10GeP2S12) and LPS systems (Li7P3S11) are the most pursued materials [57]. Sulfide-based materials exhibit mechanical properties that allow for roll to-roll processing without unreasonably high pressures and are electrochemically stable at both high and low voltages. Exposed to air or water, sulfide materials generate toxic hydrogen sulfide gas. This is both a risk, potentially exposing customers to these gases, and an added cost, requiring additional dry-room requirements during manufacturing.

- (iii)

- Inorganic oxide-based solid electrolytes: Oxide-based electrolytes attract less attention than organic polymers or sulfide-based inorganics but show promising performance. Lithium lanthanum zirconium oxide (LLZO) is the most investigated material, while lithium phosphorous oxynitride (LiPON) has been investigated for thin-film batteries [57]. Very high ionic conductivity and wide electrochemical stability offer promising performance, while LiPON can be deposited in thin layers for thin-film and flexible batteries. These materials are very brittle and cannot typically be adopted for use in conventional roll-to-roll manufacturing, requiring time- and energy-intensive deposition processes or tape-casting. High interfacial resistance with lithium leads to lower power output and low efficiency. Perovskite has the general formula ABO3 (A = Ca, Sr or La; B = Al, Ti) [58]. The most studied perovskite electrolyte is Li3xLa2/3−xTiO3 (LLTO), with bulk Li+ ion conductivity of 10−3 S. cm−1 at 25 °C [59]. Ti-based perovskite electrolyte is thermally and chemically stable in air/humid conditions. However, LLTO can be deteriorated by the reduction of Ti4+ to Ti3+ when it touches the Li metal anode as LATP [60]. In addition, Na superionic conductor, or NASICON (Na1+xZr2SixP3−xO12, 0 < x < 3), has been found to exhibit high ionic conductivity [61]. The substitution in NASICON generates structural modification and allows improving the conductivity of compounds [62]. The maximum ionic conductivity is ∼1 × 10−3 S. cm−1 at 25 °C for Li1+xTi2−xAlx (PO4)3 (LATP), where x ≈0.3 [63]. However, at low potential (≤1.5 V vs. Li/Li+), the reduction reaction (Ti4+ to Ti3+) can occur when NASICON is in direct contact with lithium metal, which induces undesirable electronic conductivity and short circuit of the cell [64].

4. Conclusions and Outlook

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Baes, K.; Kolk, M.; Carlot, F.; Merhaba, A.; Ito, Y. Future of Batteries “Winner Takes All?”. Available online: https://www.adlittle.com/en/insights/viewpoints/future-batteries (accessed on 10 February 2022).

- Berdichevsky, G.; Yushin, G. The Future of Energy Storage Towards A Perfect Battery with Global Scale. Sila. Available online: https://www.silanano.com/uploads/Sila-_-The-Future-of-Energy-Storage-White-Paper.pdf (accessed on 10 February 2022).

- EV Battery Supply Chain “Trends, Risks and Opportunities in a Fast-Evolving Sector”. FitchSo-lutions. 2021. Available online: https://store.fitchsolutions.com/all-products/ev-battery-supply-chain-trends-risks-and-opportunities-in-a-fast-evolving-sector (accessed on 1 March 2022).

- North America Accelerates Its Commitment to the Development of the Gigafactory Industry|CIC energiGUNE. Available online: https://cicenergigune.com/en/blog/north-america-accelerates-commitment-development-gigafactory-industry (accessed on 15 February 2022).

- Breaking Down the Cost of an EV Battery Cell. Available online: https://elements.visualcapitalist.com/breaking-down-the-cost-of-an-ev-battery-cell/ (accessed on 10 February 2022).

- Battery Pack Prices Fall to an Average of $132/kWh, But Rising Commodity Prices Start to Bite|BloombergNEF. Available online: https://batteriesnews.com/battery-pack-prices-fall-132-kwh-commodity-prices-bloomberg/ (accessed on 10 February 2022).

- Mauler, L.; Lou, X.; Duffner, F.; Leker, J. Technological innovation vs. tightening raw material markets: Falling battery costs put at risk. Energy Adv. 2022, 1, 136–145. [Google Scholar] [CrossRef]

- Key Canadian Minerals for Electric Transportation—Fact Sheet—Research Interfaces. Available online: https://researchinterfaces.com/canadian-minerals-for-electric-transportation/ (accessed on 20 February 2022).

- Cho, J. Dependence of AlPO4 coating thickness on overcharge behaviour of LiCoO2 cathode material at 1 and 2 C rates. J. Power Sources 2004, 126, 186–189. [Google Scholar] [CrossRef]

- Muralidharan, N.; Self, E.C.; Dixit, M.; Du, Z.; Essehli, R.; Amin, R.; Belharouak, I. Next-Generation Co-balt-Free Cathodes–A Prospective Solution to the Battery Industry’s Cobalt Problem. Adv. Energy Mater. 2022, 9, 2103050. [Google Scholar] [CrossRef]

- Pillot, C. The Rechargeable Battery Market and Main Trends 2016–2025. Available online: http://www.avicenne.com/pdf/The%20Rechargeable%20Battery%20Market%20and%20Main%20Trends%202016-2025_C%20Pillot_M%20Sanders_September%202017.pdf (accessed on 2 March 2022).

- Global EV Outlook 2017, International Energy Agency. Available online: https://www.iea.org/publicati-ons/freepublications/publication/GlobalEVOutlook2017.pdf (accessed on 2 March 2022).

- Janek, J.; Zeier, W.G. A solid future for battery development. Nat. Energy 2016, 1, 16141. [Google Scholar] [CrossRef]

- Ma, Q.; Zeng, X.-X.; Yue, J.; Yin, Y.-X.; Zuo, T.-T.; Liang, J.-Y.; Deng, Q.; Wu, X.-W.; Guo, Y.-G. Viscoelastic and nonflammable interface design–enabled dendrite-free and safe solid lithium metal batteries. Adv. Energy Mater. 2019, 9, 1803854. [Google Scholar] [CrossRef]

- Wentker, M.; Greenwood, M.; Leker, J. A bottom-up approach to lithium-ion battery cost modeling with a focus on cathode active materials. Energy 2019, 3, 504. [Google Scholar] [CrossRef] [Green Version]

- Wagemaker, M.; Ellis, B.L.; Luetzenkirchen-Hecht, D.; Mulder, F.M.; Nazar, L.F. ChemInform Abstract: Proof of Supervalent Doping in Olivine LiFePO4. ChemInform 2008, 20, 6313–6315. [Google Scholar] [CrossRef]

- Andre, D.; Kim, S.-J.; Lamp, P.; Lux, S.F.; Maglia, F.; Paschos, O.; Stiaszny, B. Future generations of cathode materials: An automotive industry perspective. J. Mater. Chem. A 2015, 3, 6709–6732. [Google Scholar] [CrossRef]

- Li, W.; Erickson, E.M.; Manthiram, A. High-nickel layered oxide cathodes for lithium-based automotive batteries. Nat. Energy 2019, 5, 26–34. [Google Scholar] [CrossRef]

- Zheng, G.; Zhang, W.; Huang, X. Lithium-Ion Battery Electrochemical-Thermal Model Using Various Materials as Cathode Material: A Simulation Study. ChemistrySelect 2018, 3, 11573–11578. [Google Scholar] [CrossRef]

- Lu, J.; Lee, Y.J.; Luo, X.; Lau, K.C.; Asadi, M.; Wang, H.-H.; Brombosz, S.; Wen, J.; Zhai, D.; Chen, Z.; et al. A lithium–oxygen battery based on lithium superoxide. Nature 2016, 529, 377–382. [Google Scholar] [CrossRef] [PubMed]

- Ding, Y.-L.; Xie, J.; Cao, G.-S.; Zhu, T.-J.; Yu, H.-M.; Zhao, X.-B. Single-Crystalline LiMn2O4 Nanotubes Synthesized Via Template-Engaged Reaction as Cathodes for High-Power Lithium Ion Batteries. Adv. Funct. Mater. 2010, 21, 348–355. [Google Scholar] [CrossRef]

- Ding, Y.; Cano, Z.P.; Yu, A.; Lu, J.; Chen, Z. Automotive Li-ion batteries: Current status and future per-spectives. Electrochem. Energy Rev. 2019, 2, 1–28. [Google Scholar] [CrossRef]

- Lu, D.; Xu, M.; Zhou, L.; Garsuch, A.; Lucht, B.L. Failure mechanism of graphite/ LiNi0.5Mn1.5O4 cells at high voltage and elevated temperature. J. Electrochem. Soc. 2013, 160, A3138–A3143. [Google Scholar] [CrossRef]

- Murdock, B.E.; Toghill, K.E.; Tapia-Ruiz, N. A Perspective on the Sustainability of Cathode Materials used in Lithium-Ion Batteries. Adv. Energy Mater. 2021, 11, 2102028. [Google Scholar] [CrossRef]

- Zhang, R.; Xia, B.; Li, B.; Lai, Y.; Zheng, W.; Wang, H.; Wang, W.; Wang, M. Study on the characteristics of a high capacity nickel manganese cobalt oxide (NMC) lithium-ion battery—An experimental investigation. Energies 2018, 11, 2275. [Google Scholar] [CrossRef] [Green Version]

- Kwak, W.-J.; Park, N.-Y.; Sun, Y.-K. ICAC 2018: The First International Conference Focused on NCM & NCA Cathode Materials for Lithium Ion Batteries. ACS Energy Lett. 2018, 3, 2757–2760. [Google Scholar] [CrossRef]

- Mukherjee, P.; Faenza, N.V.; Pereira, N.; Ciston, J.; Piper, L.F.; Amatucci, G.G.; Cosandey, F. Surface structural and chemical evolution of layered LiNi0. 8Co0. 15Al0. 05O2 (NCA) under high voltage and elevated temperature conditions. Chem. Mater. 2018, 30, 8431–8445. [Google Scholar] [CrossRef] [Green Version]

- Myung, S.-T.; Maglia, F.; Park, K.-J.; Yoon, C.S.; Lamp, P.; Kim, S.-J.; Sun, Y.-K. Nickel-Rich Layered Cathode Materials for Automotive Lithium-Ion Batteries: Achievements and Perspectives. ACS Energy Lett. 2016, 2, 196–223. [Google Scholar] [CrossRef]

- BASF. Available online: https://catalysts.basf.com/products-and-industries/battery-materials/cathode-activematerials/nca (accessed on 25 February 2022).

- Kim, J.; Lee, H.; Cha, H.; Yoon, M.; Park, M.; Cho, J. Prospect and reality of Ni-rich cathode for commer-cialization. Adv. Energy Mater. 2018, 8, 1702028. [Google Scholar] [CrossRef]

- Schmuch, R.; Wagner, R.; Hörpel, G.; Placke, T.; Winter, M. Performance and cost of materials for lithium-based rechargeable automotive batteries. Nat. Energy 2018, 3, 267. [Google Scholar] [CrossRef]

- Xia, Y.; Zheng, J.; Wang, C.; Gu, M. Designing principle for Ni-rich cathode materials with high energy density for practical applications. Nano Energy 2018, 49, 434–452. [Google Scholar] [CrossRef]

- Zeng, X.; Zhan, C.; Lu, J.; Amine, K. Stabilization of a high-capacity and high-power nickel-based cath-ode for Li-ion batteries. Chem 2018, 4, 690–704. [Google Scholar] [CrossRef] [Green Version]

- Jiang, M.; Danilov, D.L.; Eichel, R.A.; Notten, P.H. A Review of Degradation Mechanisms and Recent Achievements for Ni-Rich Cathode-Based Li-Ion Batteries. Adv. Energy Mater. 2021, 48, 2103005. [Google Scholar] [CrossRef]

- Liu, Q.; Su, X.; Lei, D.; Qin, Y.; Wen, J.; Guo, F.; Wu, Y.A.; Rong, Y.; Kou, R.; Xiao, X.; et al. Approaching the capacity limit of lithium cobalt oxide in lithium ion batteries via lanthanum and aluminium doping. Nat. Energy 2018, 3, 936–943. [Google Scholar] [CrossRef]

- Hou, P.; Zhang, H.; Zi, Z.; Zhang, L.; Xu, X. Core–shell and concentration-gradient cathodes prepared via co-precipitation reaction for advanced lithium-ion batteries. J. Mater. Chem. A 2017, 5, 4254–4279. [Google Scholar] [CrossRef]

- Zeng, X.; Li, M.; Abd El-Hady, D.; Alshitari, W.; Al-Bogami, A.S.; Lu, J.; Amine, K. Commercialization of lithium battery technologies for electric vehicles. Adv. Energy Mater. 2019, 9, 1900161. [Google Scholar] [CrossRef]

- Clément, R.J.; Lun, Z.; Ceder, G. Cation-disordered rocksalt transition metal oxides and oxyfluorides for high energy lithium-ion cathodes. Energy Environ. Sci. 2020, 13, 345–373. [Google Scholar] [CrossRef] [Green Version]

- Blomgren, G.E. The Development and Future of Lithium Ion Batteries. J. Electrochem. Soc. 2016, 164, A5019–A5025. [Google Scholar] [CrossRef] [Green Version]

- A. N. Laboratory. Available online: https://access.anl.gov/projects/nmc (accessed on 25 February 2022).

- F. D. P. Natalia Lebedeva, Lois Boon-Brett European Commission. Available online: https://core.ac.uk/download/pdf/81685675.pdf (accessed on 2 March 2022).

- Martin, C. Driving change in the battery industry. Nat. Nanotechnol. 2014, 9, 327–328. [Google Scholar] [CrossRef]

- Grejtak, T.; Holzinger, C. Li-ion Battery Innovation Roadmap. Lux Research. 2019. Available online: https://members.luxresearchinc.com/research/report/31307 (accessed on 25 February 2022).

- Manthiram, A. An Outlook on Lithium Ion Battery Technology. ACS Cent. Sci. 2017, 3, 1063–1069. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Albertus, P.; Babinec, S.; Litzelman, S.; Newman, A. Status and challenges in enabling the lithium metal electrode for high-energy and low-cost rechargeable batteries. Nat. Energy 2017, 3, 16–21. [Google Scholar] [CrossRef]

- Xu, R.; Zhang, X.Q.; Cheng, X.B.; Peng, H.J.; Zhao, C.Z.; Yan, C.; Huang, J.Q. Artificial soft–rigid pro-tective layer for dendrite-free lithium metal anode. Adv. Funct. Mater. 2018, 28, 1705838. [Google Scholar] [CrossRef]

- Chang, Z.; Yang, H.; Zhu, X.; He, P.; Zhou, H. A stable quasi-solid electrolyte improves the safe opera-tion of highly efficient lithium-metal pouch cells in harsh environments. Nat. Commun. 2022, 13, 1–12. [Google Scholar]

- Patil, A.; Patil, V.; Shin, D.W.; Choi, J.W.; Paik, D.S.; Yoon, S.J. Issue and challenges facing rechargea-ble thin film lithium batteries. Mater. Res. Bull. 2008, 43, 1913–1942. [Google Scholar] [CrossRef]

- Liang, Z.; Lin, D.; Zhao, J.; Lu, Z.; Liu, Y.; Liu, C.; Yu, Y.; Wang, H.; Yan, K.; Tao, X.; et al. Composite lithium metal anode by melt infu-sion of lithium into a 3D conducting scaffold with lithiophilic coating. Proc. Natl. Acad. Sci. USA 2016, 113, 2862–2867. [Google Scholar] [CrossRef] [Green Version]

- Schnell, J.; Günther, T.; Knoche, T.; Vieider, C.; Köhler, L.; Just, A.; Keller, M.; Passerini, S.; Reinhart, G. All-solid-state lithium-ion and lithium metal batteries—Paving the way to large-scale production. J. Power Sources 2018, 382, 160–175. [Google Scholar] [CrossRef]

- Lee, Y.-G.; Fujiki, S.; Jung, C.; Suzuki, N.; Yashiro, N.; Omoda, R.; Ko, D.-S.; Shiratsuchi, T.; Sugimoto, T.; Ryu, S.; et al. High-energy long-cycling all-solid-state lithium metal batteries enabled by silver–carbon composite anodes. Nat. Energy 2020, 5, 299–308. [Google Scholar] [CrossRef]

- Liu, Y.; Zhang, R.; Wang, J.; Wang, Y. Current and future lithium-ion battery manufacturing. iScience 2021, 24, 102332. [Google Scholar] [CrossRef]

- Kerman, K.; Luntz, A.; Viswanathan, V.; Chiang, Y.M.; Chen, Z. Practical challenges hindering the development of solid state Li ion batteries. J. Electrochem. Soc. 2017, 164, A1731. [Google Scholar] [CrossRef]

- Zhang, W.; Leichtweiß, T.; Culver, S.P.; Koerver, R.; Das, D.; Weber, D.A.; Janek, J. The detrimental effects of carbon additives in Li10GeP2S12-based solid-state batteries. ACS Appl. Mater. Interfaces 2017, 41, 35888. [Google Scholar] [CrossRef] [PubMed]

- Strauss, F.; Stepien, D.; Maibach, J.; Pfaffmann, L.; Indris, S.; Hartmann, P.; Brezesinski, T. Influence of electronically conductive additives on the cycling performance of argyrodite-based all-solid-state batteries. RSC Adv. 2020, 2, 1114. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Jairam, S. Solid-State Batteries. Lux Research. 2021. Available online: https://members.luxresearchinc.com/research/technology/36430 (accessed on 25 February 2022).

- Chen, R.; Li, Q.; Yu, X.; Chen, L.; Li, H. Approaching Practically Accessible Solid-State Batteries: Stability Issues Related to Solid Electrolytes and Interfaces. Chem. Rev. 2019, 120, 6820–6877. [Google Scholar] [CrossRef] [PubMed]

- Li, B.; Su, Q.; Zhang, J.; Yu, L.; Du, G.; Ding, S.; Zhang, M.; Zhao, W.; Xu, B. Multifunctional Protection Layers via a Self-Driven Chemical Reaction To Stabilize Lithium Metal Anodes. ACS Appl. Mater. Interfaces 2021, 13, 56682–56691. [Google Scholar] [CrossRef] [PubMed]

- Li, Y.; Han, J.T.; Wang, C.A.; Xie, H.; Goodenough, J.B. Optimizing Li+ conductivity in a garnet framework. J. Mater. Chem. 2012, 22, 15357–15361. [Google Scholar] [CrossRef]

- Zheng, Z.; Fang, H.-Z.; Liu, Z.-K.; Wang, Y. A Fundamental Stability Study for Amorphous LiLaTiO3Solid Electrolyte. J. Electrochem. Soc. 2014, 162, A244–A248. [Google Scholar] [CrossRef]

- Goodenough, J.B.; Hong, H.Y.-P.; Kafalas, J.A. Fast Na+-ion transport in skeleton structures. Mater. Res. Bull. 1976, 11, 203–220. [Google Scholar] [CrossRef]

- Liu, Y.; Liu, L.; Peng, J.; Zhou, X.; Liang, D.; Zhao, L.; Su, J.; Zhang, B.; Li, S.; Zhang, N. A niobium-substituted sodium superi-onic conductor with conductivity higher than 5.5 mS cm−1 prepared by solution-assisted solid-state reaction method. J. Power Sources 2022, 518, 230765. [Google Scholar] [CrossRef]

- Huang, C.; Yang, G.; Yu, W.; Xue, C.; Zhai, Y.; Tang, W.; Hu, N.; Wen, Z.; Lu, L.; Song, S. Gallium-substituted Nasicon Na3Zr2Si2PO12 solid electrolytes. J. Alloy. Compd. 2020, 855, 157501. [Google Scholar] [CrossRef]

- Senguttuvan, P.; Rousse, G.; Arroyo YDe Dompablo, M.E.; Vezin, H.; Tarascon, J.M.; Palacín, M.R. Low-potential sodium insertion in a NASICON-type structure through the Ti (III)/Ti (II) redox couple. J. Am. Chem. Soc. 2013, 135, 3897–3903. [Google Scholar] [CrossRef]

- Schnell, J.; Tietz, F.; Singer, C.; Hofer, A.; Billot, N.; Reinhart, G. Prospects of production technologies and manufacturing costs of oxide-based all-solid-state lithium batteries. Energy Environ. Sci. 2019, 12, 1818–1833. [Google Scholar] [CrossRef]

- Hanft, D.; Exner, J.; Moos, R. Thick-films of garnet-type lithium ion conductor prepared by the Aerosol Deposition Method: The role of morphology and annealing treatment on the ionic conductivity. J. Power Sources 2017, 361, 61–69. [Google Scholar] [CrossRef]

- Global Analysis of Electric Battery Market and Battery Thermal Management System for Electric and Hybrid Vehicles, Forecast to 2025. Available online: https://www.reportlinker.com/p05749218/Global-Analysis-of-Electric-Battery-Market-and-Battery-Thermal-Management-System-for-Electric-and-Hybrid-Vehicles-Forecast-to.html (accessed on 2 March 2022).

| Cell Chemistry | Type | Producer | Voltage (V) | Capacity (Ah) | Energy Density (Wh.L-1) | Specific Energy (Wh.kg-1) | Energy (kWh) | Driving Range (km) | EV Model |

|---|---|---|---|---|---|---|---|---|---|

| C/NMC721 | Pouch | LG Chem | 3.65 | 64.6 | 648 | 263 | 85 | 392 | Audi e-tron GT |

| C/NMC722 | Pouch | LG Chem | 3.65 | 129.2 | - | 148 | 93 | 472 | Audi e-tron GT |

| C/NMC721 | Pouch | LG Chem | 3.65 | 78 | - | 156 | 77 | 305 | Audi Q4 e-tron-SUV |

| C/NCM 622 | Prismatic | Samsung SDI | 3.68 | 94 | - | 148 | 38 | 178 | BMW i3 |

| C/NMC622 | Pouch | LG Chem | 3.75 | 55 | 228 | 151 | 65 | 417 | Chevrolet Bolt |

| LTO/NMC | Prismatic | Toshiba | 2.30 | 20 | 200 | 89 | 20 | 130 | Honda fit EV |

| C/NMC 622 | Pouch | LG Chem (Umicore) | - | 60 | 164 | 142 | 64 | 484 | Hyundai KONA Electric |

| Lithium-ion polymer C/NMC | Pouch | LG Chem | - | - | - | - | 77 | 488 | Hyundai ioniq 5-LR AWD |

| Lithium ion polymer-C/NMC811+NMC111 | Pouch | SK Innovation | 3.56 | 180 | - | 250 | 64 | 370 | Kia Niro |

| Lithium-ion polymer battery-C/NMC622 | Pouch | SK Innovation | 3.56 | 180 | - | 250 | 64 | 391 | Kia Soul EV |

| C/NMC811 | Pouch | LG Chem | - | 11.2 | 230 | 163 | 78 | 303 | Kia EV6-LR AWD |

| C/NMC622 | Laminated | LG Chem | - | 56.3 | - | 151 | 62 | 364 | Nissan LEAF E Plus |

| C/NMC532 | Pouch | AESC | 3.65 | 56.3 | 205 | 130 | 39 | 240 | Nissan LEAF |

| C/NMC721 | Pouch | LG Chem | 2.08 | 130 | 166 | 160 | 52 | 395 | Renault Zoe e-tech electrique |

| C/NMC | Pouch | LG chem | 3.65 | 52 | 316 | 152 | 18 | 145 | Smart fortwo Electric |

| C/NMC532 | Pouch | LG Chem | - | - | - | - | 78 | 292 | Volvo XC40 |

| C/NMC111 | Prismatic | Samsung SDI | 3.70 | 37 | 357 | 185 | 36 | 300 | VW e-Golf |

| C/NMC721 | Pouch | LG Chem | 1.85 | 145 | 267 | 164 | 58 | 350–544 | Volkswagen ID.3 |

| C/NCA | Cylindrical | Panasonic | 3.60 | 3.4 | 673 | 236 | 60–100 | 330–500 | Tesla Model S |

| C or SiOC/NCA | Cylindrical | Panasonic | 3.60 | 4.75 | 683 | 260 | 75–100 | 490–630 | Tesla model 3 |

| C or SiOC/NCA | Cylindrical | Panasonic | 3.60 | 3.4 | 673 | 236 | 60–100 | 330–500 | Tesla X |

| C/NCA | Cylindrical | Panasonic | - | - | - | - | 42 | 182 | Toyota rav4 EV |

| C/LFP | Prismatic | BYD | 3.20 | 216 | 279 | 166–140 | 86 | 505 | BYD Tang Electric |

| C/LFP | Pouch | LG Chem | 3.75 | 27 | 144 | 90 | 19 | 132 | Chevrolet Spark EV |

| C/NMC622-LMO | Prismatic | Samsung SDI | 4.08 | 105 | - | 126 | 42 | 320 | Fiat 500e |

| C/LMO-NMC | Pouch | LG Chem | 3.70 | 16 | - | - | 36 | 160 | Ford Focus Electric |

| C/LMO-NMC | Prismatic | Li Energy Japan | 3.70 | 50 | 218 | 109 | 16 | 132 | Mitsubishi iMiEV |

| Methodologies | Pros | Cons and Challenges |

|---|---|---|

| Graphite/Silicon | ||

| Wet processing |

|

|

| Solvent-free (or-reduced) approach (e.g., electrostatic spraying, extrusion) |

|

|

| Li metal | ||

| Melt processing (liquid phase) |

|

|

| Vapor-based processing (e.g., evaporation, sputtering) |

|

|

| Plating |

|

|

| Dry processing (extrusion) |

|

|

| Methodologies | Pros | Cons and Challenges |

|---|---|---|

| Aerosol deposition |

|

|

| Solvent-free (or minimized) processes (e.g., dry calendaring, extrusion) |

|

|

| Wet processing |

|

|

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Houache, M.S.E.; Yim, C.-H.; Karkar, Z.; Abu-Lebdeh, Y. On the Current and Future Outlook of Battery Chemistries for Electric Vehicles—Mini Review. Batteries 2022, 8, 70. https://doi.org/10.3390/batteries8070070

Houache MSE, Yim C-H, Karkar Z, Abu-Lebdeh Y. On the Current and Future Outlook of Battery Chemistries for Electric Vehicles—Mini Review. Batteries. 2022; 8(7):70. https://doi.org/10.3390/batteries8070070

Chicago/Turabian StyleHouache, Mohamed S. E., Chae-Ho Yim, Zouina Karkar, and Yaser Abu-Lebdeh. 2022. "On the Current and Future Outlook of Battery Chemistries for Electric Vehicles—Mini Review" Batteries 8, no. 7: 70. https://doi.org/10.3390/batteries8070070

APA StyleHouache, M. S. E., Yim, C.-H., Karkar, Z., & Abu-Lebdeh, Y. (2022). On the Current and Future Outlook of Battery Chemistries for Electric Vehicles—Mini Review. Batteries, 8(7), 70. https://doi.org/10.3390/batteries8070070