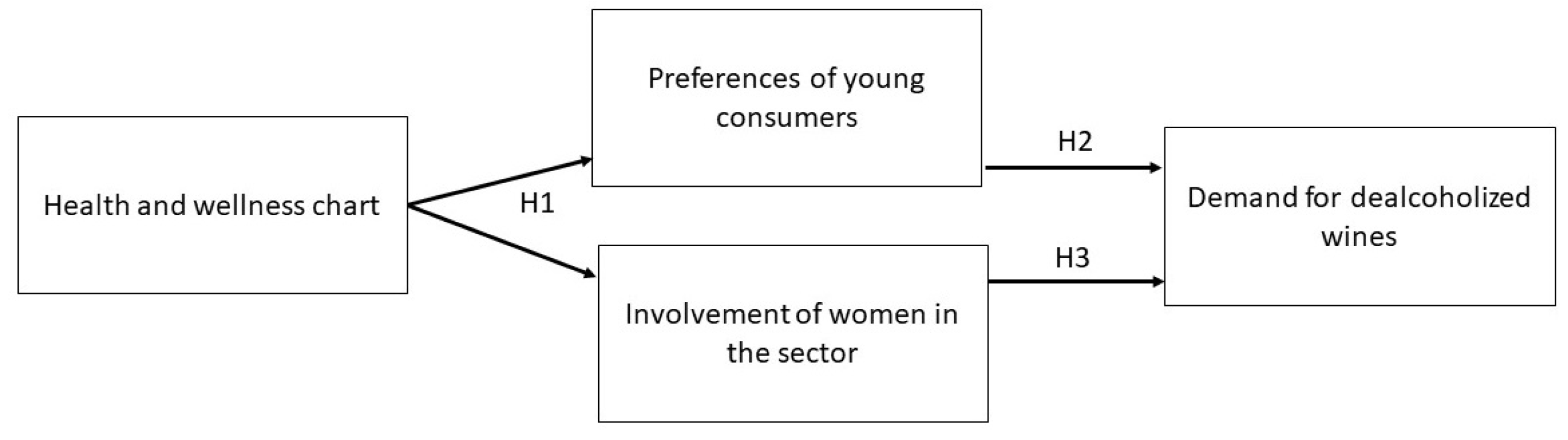

1. Introduction

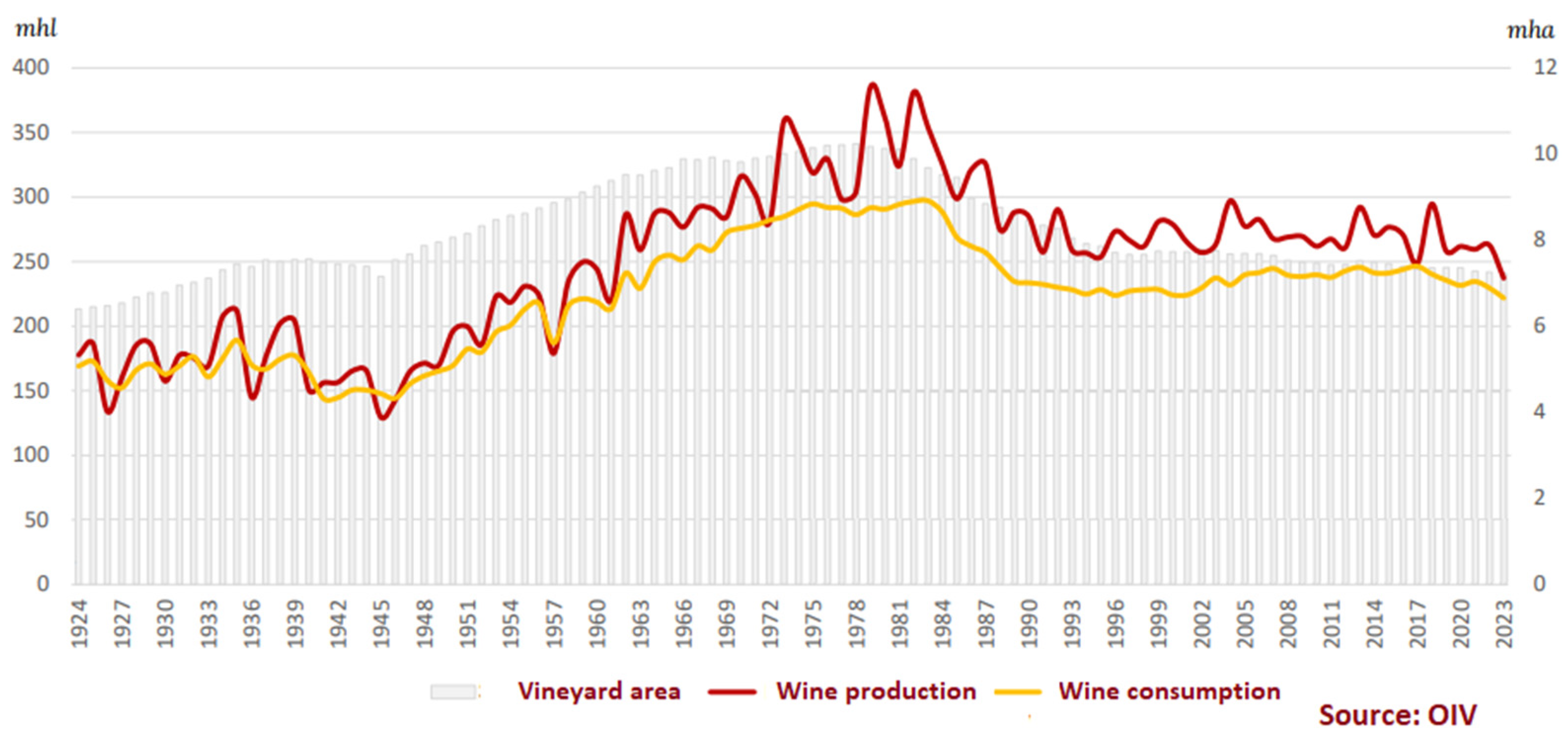

Spain’s wine sector has experienced significant transformations since the late 20th century. Following the devastating phylloxera epidemic in the late 19th century, which eradicated vineyards throughout Europe, the wine sector entered a phase of rehabilitation and prosperity. This revival was suddenly interrupted by World War II. However, in the post-war period, the global wine industry thrived, witnessing expansion in vineyard acreage, the number of wine-producing nations, per capita wine consumption, and the formation of new wineries (

Figure 1). By the 1970s, these favourable trends began to decline due to the economic crisis of 1973, leading to diminished household purchasing power. This downturn signified the commencement of a new phase, characterized by a gradual decrease in vineyard area, wine output, and per capita consumption across the majority of wine-producing countries (

Figure 1).

The period of decline in the wine sector [

1] was later followed by emerging trends and consumption habits [

2] influenced by health and sustainability concerns (

Figure 2). Since the final decade of the 20th century, concerns over climate change have brought sustainability to the forefront [

3]. Rising global temperatures have led to the production of wines with a higher alcohol content, prompting the emergence of companies such as ConTech (now BevZero), which specialize in R&D and innovation for technologies that reduce alcohol levels in wine. Today, this is a leading industry globally, with continuous advancements in wine dealcoholization technologies (

Figure 3) [

4,

5,

6].

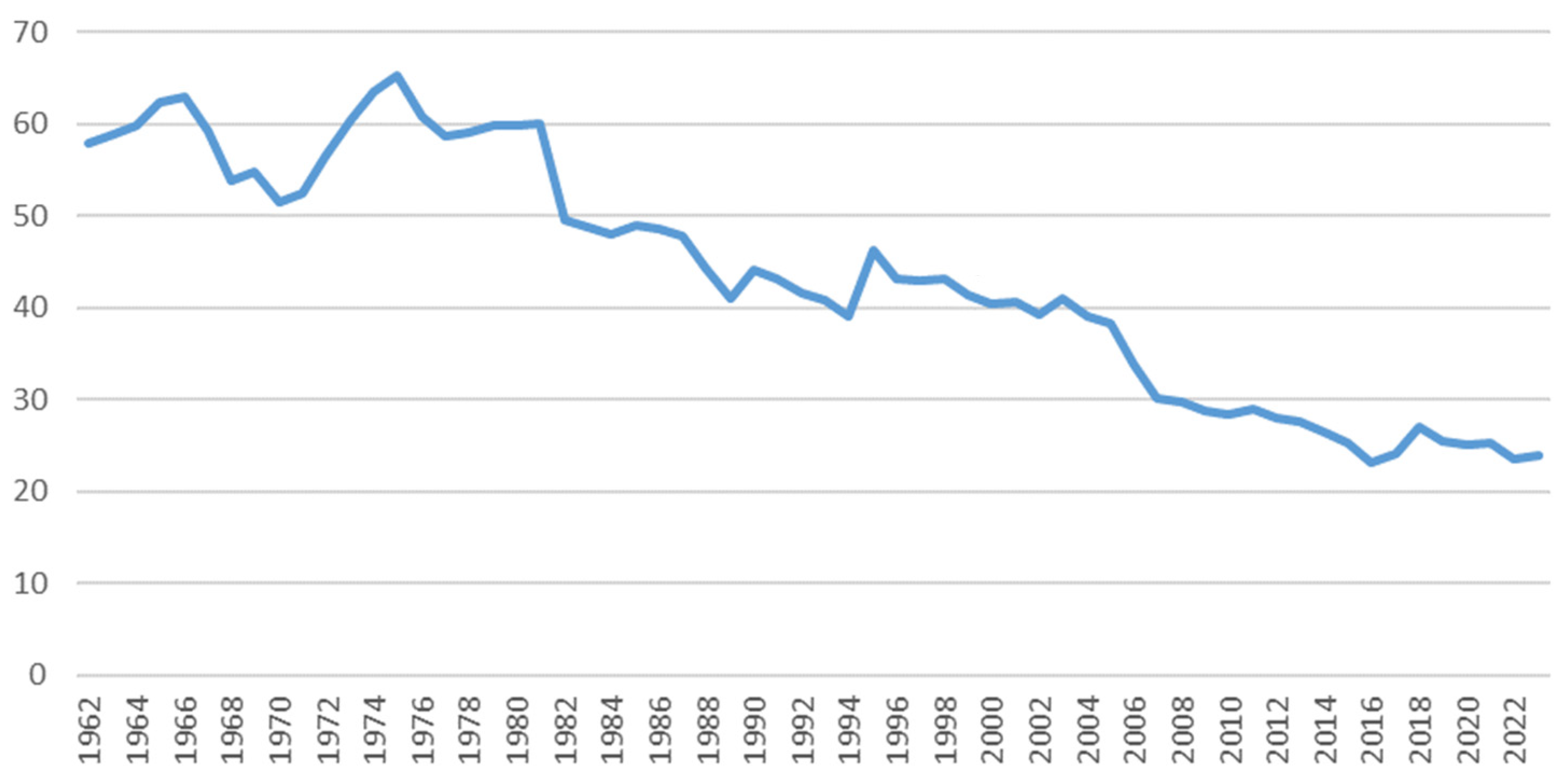

In Spain, as in many regions, per capita wine consumption has been decreasing since the mid-1970s. The peak was noted in 1975 (

Figure 4) [

7]. However, the decline in Spain was more pronounced than in neighbouring nations (

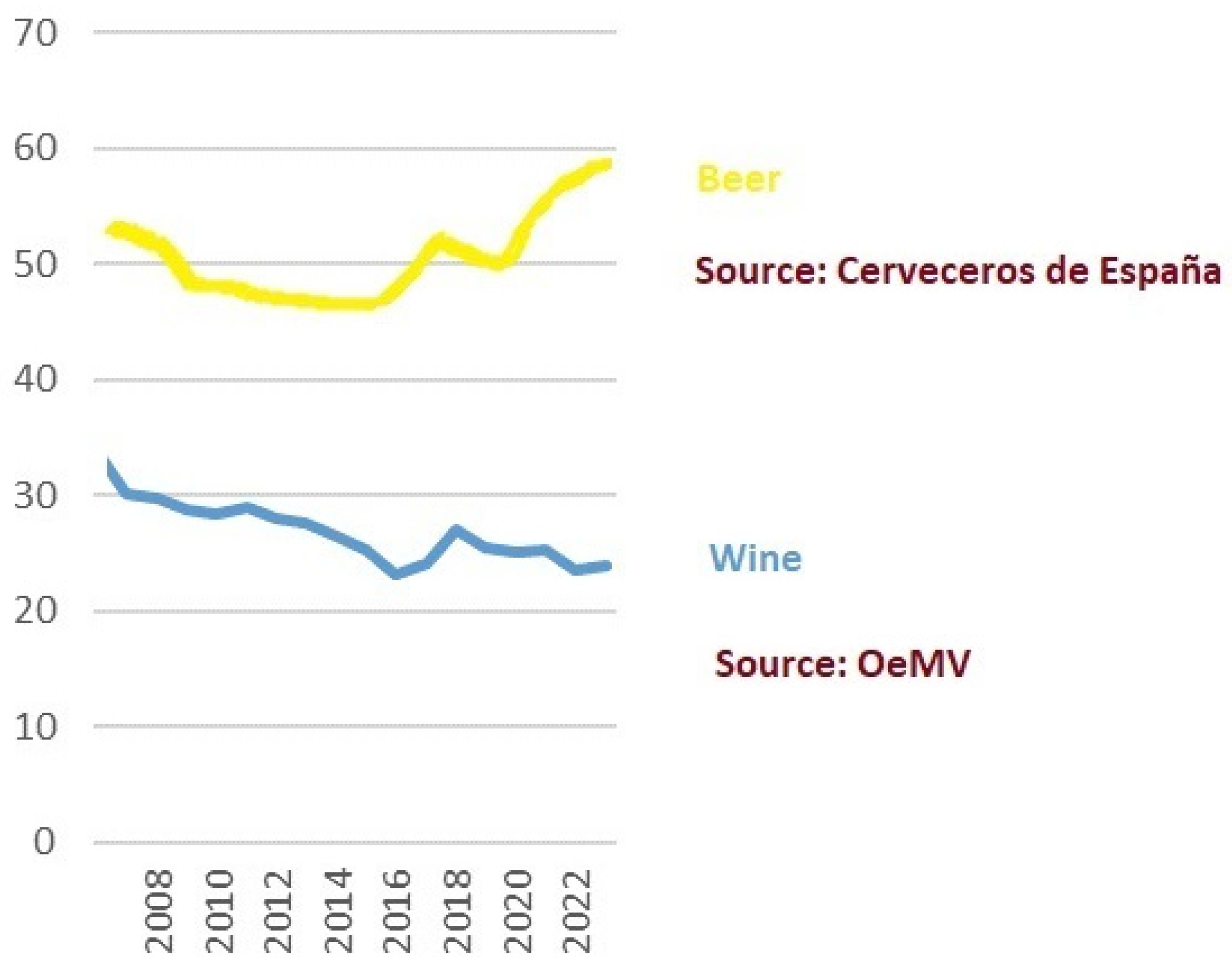

Figure 2), without taking into account the wine sustainability boom [

8] For example, in 1990, wine remained the preferred alcoholic beverage in Spain, similarly to other Mediterranean countries (e.g., France, Portugal, and Italy, where wine was the predominant drink, and Greece, where it was favoured). By 2015, Spain had shifted to beer as the leading alcoholic beverage, unlike its Mediterranean peers (

Figure 3), highlighting the severity of Spain’s domestic wine market decline [

9].

This transition compelled the Spanish wine sector to explore alternatives to align with global trends in wine production and consumption. According to the 2023 Socioeconomic Report on the Beer Sector in Spain, beer consumption decreased by 3.5% in 2023. Despite this decline, Spain remains the second-largest beer producer in Europe, with an output of 41.5 million hectoliters. Notably, Spain has the highest percentage of non-alcoholic beer consumption in the Western world, accounting for 14% of total beer consumption. Furthermore, beer plays a crucial role in rural Spain, contributing to both social and economic stability (

Figure 3). Spain, possessing the largest vineyard area globally [

9], could not depend on its internal market to absorb its production. Consequently, export markets became the logical avenue for surplus production.

Analyzing the sector’s evolution reveals that this transformation profoundly impacted Spanish viticulture [

10]. By 2005, Spain had experienced its largest annual decline in per capita consumption in 50 years. That year marked the first time that wine export volumes surpassed domestic consumption (

Figure 4). From that point onward, Spain positioned itself as a leading wine exporter [

11]. While exports increased steadily, domestic consumption continued to diminish, establishing Spain as the world’s second-largest wine exporter by volume (following Italy) and third by value (after France and Italy). Spain now exports 69% of its annual production volume, highlighting the crucial role of international markets for the Spanish wine sector.

Reaching this prominent position in the global wine sector would not have been possible without a strategic decision to concentrate on bulk wine exports instead of bottled wine. In a mature market such as wine, where innovations in new products are infrequent and tradition significantly influences consumer preferences [

12], price often becomes the primary entry point into new markets [

13]. Therefore, exporting bulk wine emerged as the least detrimental strategy for Spain concerning the quality–price ratio. The increasing volume of wine produced in Spain but remaining unsold domestically expedited international trade. Spanish producers prioritized the sale of their excess wine, even at the risk of accepting lower prices [

14].

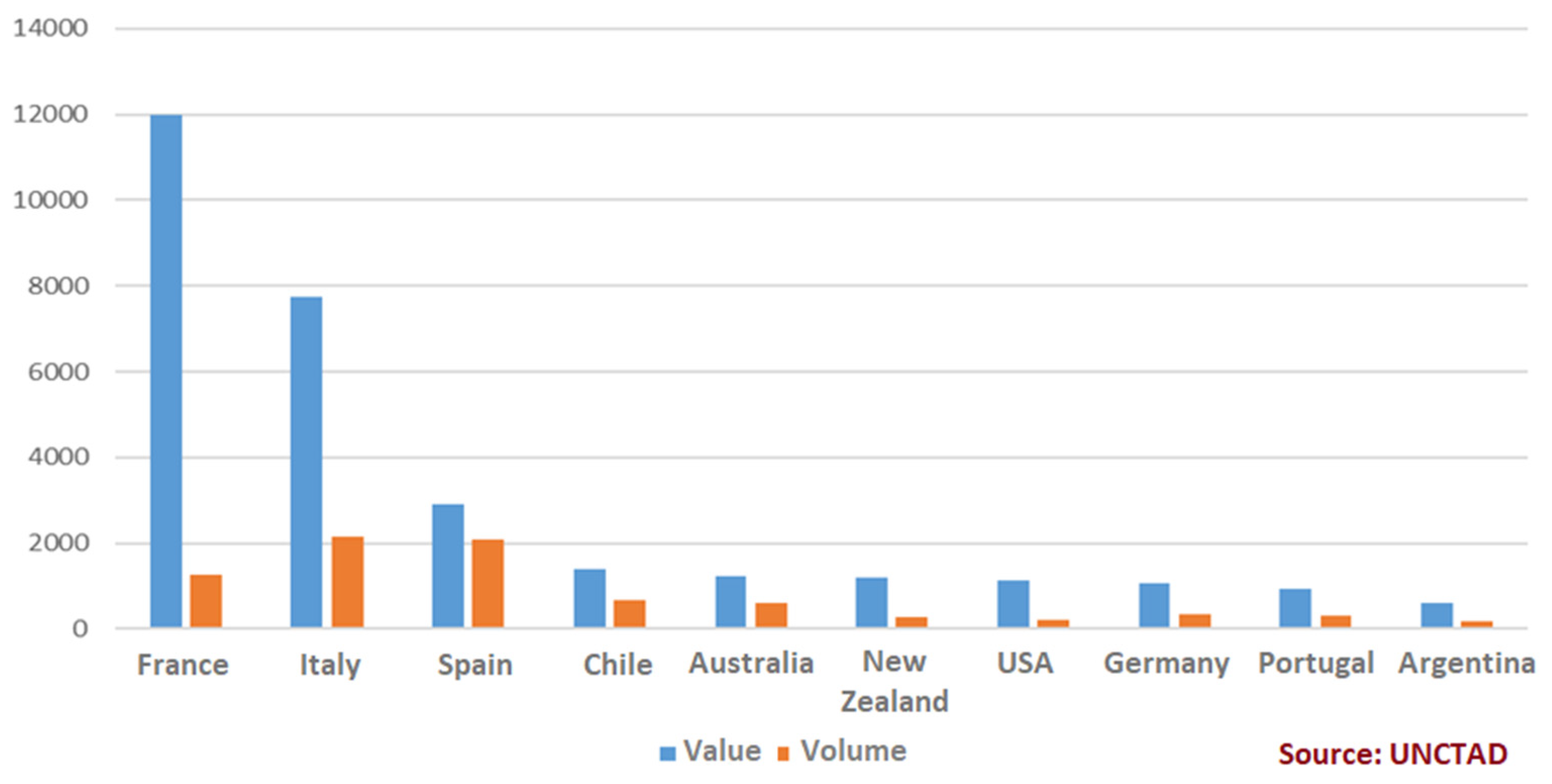

This approach has demonstrated efficacy, at least regarding export quantities, albeit not in monetary worth (

Figure 5). Spain has emerged as the foremost global exporter of bulk wine, with an impressive annual output exceeding 1.4 billion hectoliters, threefold the volume of the second-largest exporter, Italy [

15]. Nevertheless, Spain’s bulk wine is marketed at considerably lower prices compared to other nations, averaging EUR 0.49 per litre. In contrast, the price per litre of bulk wine from other exporters is higher: Australia (EUR 0.77/L), Italy (EUR 0.79/L), France (EUR 1.67/L), and New Zealand (EUR 2.87/L) [

16].

The statistics (

Figure 2 and

Figure 4) highlight the economic importance of bulk wine for Spain’s wine industry and, by extension, the Spanish economy. The Spanish Interprofessional Wine Organization states that the wine industry contributes 1.9% to Spain’s GDP in 2023 [

17]. Despite the abundance of data regarding Spain’s wine industry, there is a scarcity of academic research examining the interaction between diminishing domestic consumption, bulk wine exports, and sustainability issues.

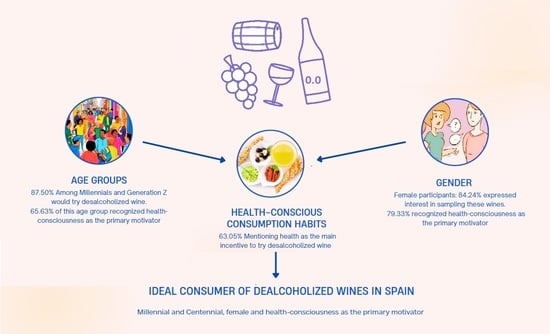

All consultancy studies focus on age studies, targeting Millennials and Centennials as a niche market for these drinks. In addition, in the study of Spain, we added the weight of the gender variable, concluding that, while Generation Y and Z will pull the market, women will do it more.

None of the studies we have found include the gender variable; they only consider age. Therefore, we cannot compare them directly with our study. However, we can contrast our study with existing studies that focus on age and healthy habits. Regardless of the consultant or the country, all these studies include age and health variables. We added in one more variable, which is gender, and it can be clearly seen that the female weight in Spain is of equal relevance to the other two variables, which is why they all account for almost a third of the correlation. If it were not included, the correlation would include two variables: healthy habits and age. We added gender.

This deficiency in the literature emphasizes the necessity for studies that explore how Spain can modify its strategies to accommodate emerging trends and societal expectations [

18]. Through this examination, we aimed to address that gap, offering a thorough analysis of the challenges and opportunities facing the Spanish wine sector [

19]. This study aimed to analyze how Spain’s wine sector could respond to emerging trends, concluding with recommendations on how the sector should act to secure its future in an evolving and competitive global market [

20,

21,

22].

1.1. Emerging Consumption Habits in Younger Generations

A thorough exploration of emerging consumer trends indicates a significant transformation in behaviour, particularly among younger demographics. Millennials (Generation Y) and Centennials (Generation Z) are leading this change, with a noticeable decline in alcohol consumption [

23]. This trend is propelled by an increasing focus on health and sustainability, which resonates with their overarching values of wellness and ecological accountability [

24].

These generations are increasingly prioritizing healthier lifestyles, which has led to a reduction in both the frequency and volume of alcohol consumption [

25]. The allure of wellness and conscious living is redefining how younger consumers select beverages, favouring choices that align with their principles. Consequently, the demand for alcohol-free options, such as dealcoholized wines, has surged.

This shift is not just about minimizing alcohol consumption but also about embracing innovation in the beverage industry. Dealcoholized wines, which provide the sensory experience of wine without the inebriating effects, are becoming a compelling option for health-orientated consumers. The rising popularity of these wines among younger generations is directly linked to their inclination towards sustainable and healthier products.

Market research studies further validate this trend, highlighting a strong correlation between generational preferences and the rise in alcohol-free alternatives. According to recent reports, Generation Z in the United States is significantly reducing its alcohol intake, a pattern also observed in Europe and Latin America.

The first proposed hypothesis is as follows:

Hypothesis 1 (H1). The health-consciousness of consumers is positively correlated with the acceptance of alcohol-free wine, especially among women and young people.

This trend reflects the alignment of the values of Millennials and Centennials—health, sustainability, and innovation—with the core attributes of dealcoholized wines [

26].

1.2. Legislative Adaptations and Their Implications for Spain

In light of altering consumption trends, both the industry and governmental bodies have enacted regulatory modifications. A notable advancement is the European Union’s Regulation 2021/2117 [

27,

28], which allows the production of dealcoholized wines to be labelled as “wine”, thereby circumventing earlier limitations [

29,

30,

31].

Spain, in accordance with global trends, has experienced a continuous decline in per capita wine consumption since the mid-1970s, with consumption peaking in 1975 [

7]. However, recent regulatory changes present an opportunity for innovation and market diversification, aligning with global consumption trends [

32]. We hypothesized the following:

Hypothesis 2 (H2). Millennials and Centennials show a high willingness to try dealcoholized wine.

This demographic shift, combined with regulatory changes, positions Spain well to cater to the growing demand for healthier and sustainable beverage options [

33].

1.3. The Role of Women in the Wine Sector

Another crucial factor shaping the evolution of the dealcoholized wine market is the increasing involvement of women in the wine sector [

34]. Women are taking on pivotal roles as both producers and consumers, significantly influencing market trends and demonstrating a clear preference for healthier and more innovative alternatives [

35].

Hypothesis 3 (H3). The increasing participation of women in the wine industry is positively correlated with the acceptance and relevance of dealcoholized wines.

Their increasing involvement is catalyzing a transformation in both the supply and demand dynamics within the market, highlighting health-orientated innovations and sustainable practices. This amalgamation of evolving consumer behaviours, regulatory shifts, and changing market demographics underscores the necessity for the Spanish wine industry to proactively adopt these trends and take advantage of the burgeoning dealcoholized wine segment.

2. Materials and Methods

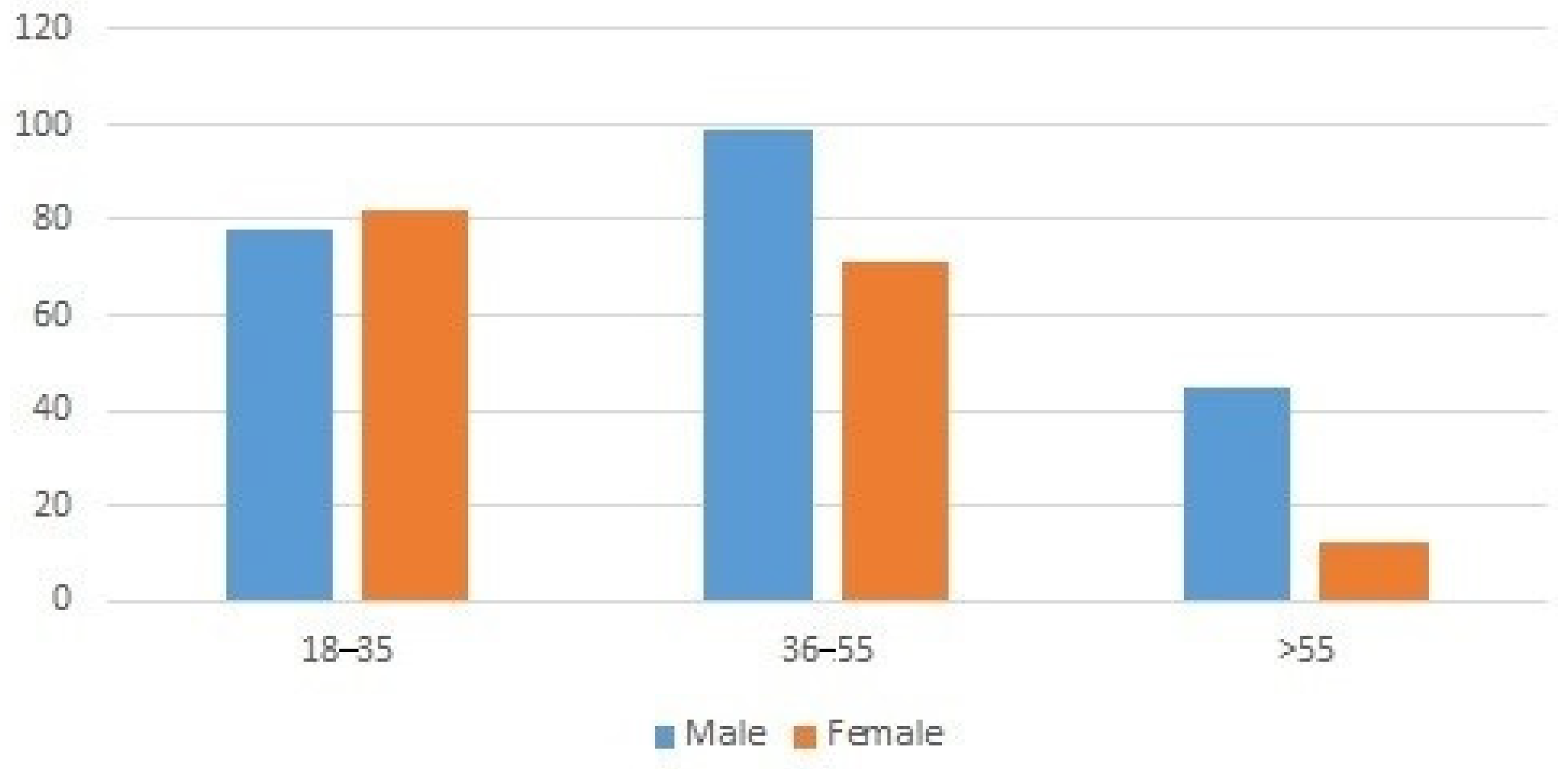

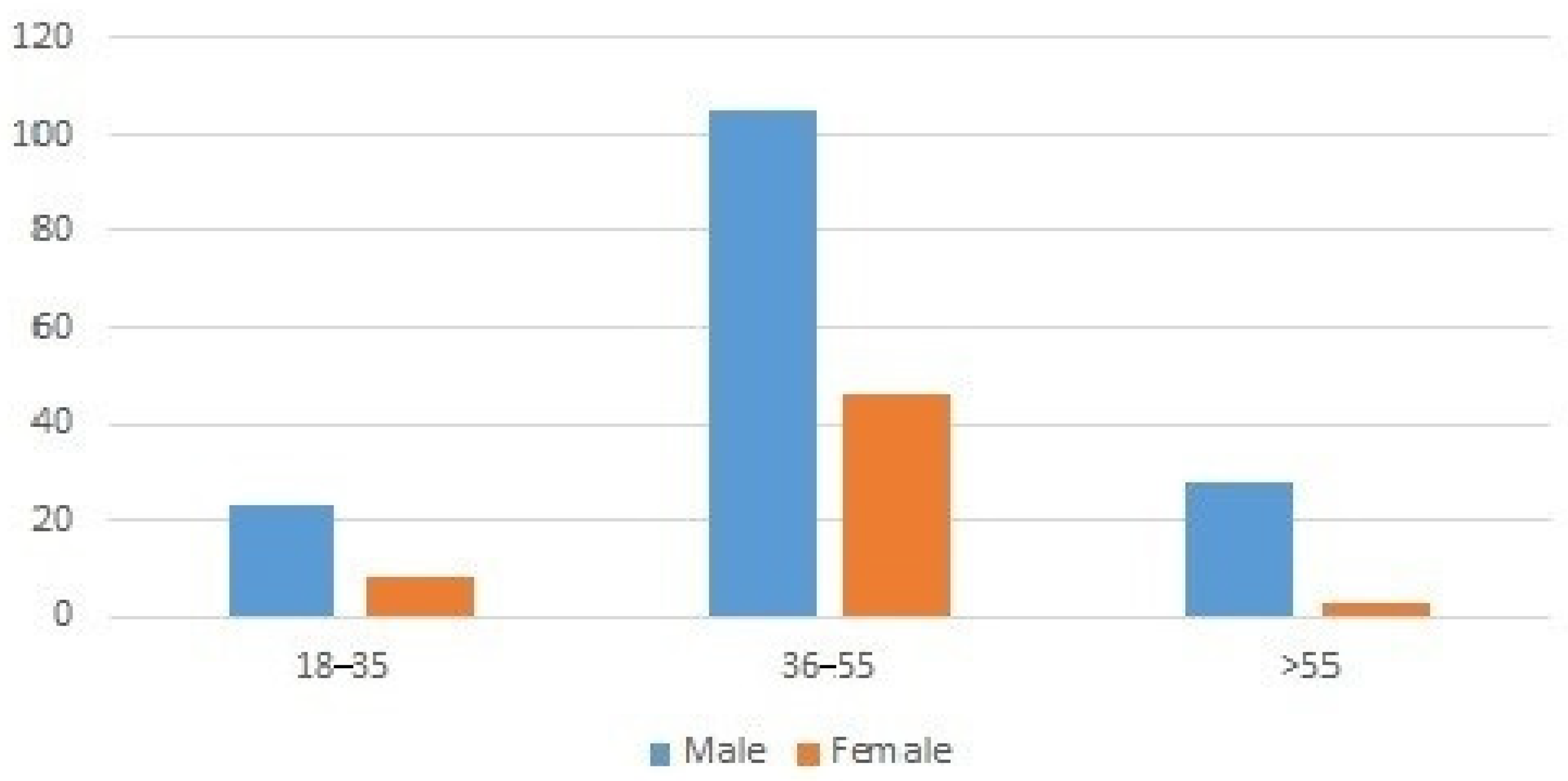

Data collection was conducted through dual surveys targeting both consumers and producers, administered in December 2024 via the Sobrelias.com platform. A total of 602 responses were collected, comprising 387 from consumers and 215 from producers. The surveys included ten questions and three control questions addressing age, gender, and origin.

Both surveys featured two identical questions, while the remaining eight were tailored separately for consumers and producers. The questionnaires were designed using Quiz and Survey Master software, version 10.0.2, ensuring a structured approach to assessing perceptions, preferences, and market potential regarding dealcoholized wines in Spain [

36].

The consumer survey examined whether pricing influenced purchase decisions, current non-alcoholic beverage consumption habits, and the willingness to modify drinking preferences in favour of dealcoholized wines. The producer survey, on the other hand, examined awareness of R&D advancements in dealcoholization technology, the role of outsourcing in production, and the potential for international market expansion facilitated by a globally recognized non-alcoholic wine category.

Survey responses were collected anonymously to maintain confidentiality, and participants were required to complete all questions before submission to ensure data integrity. The survey remained open for four weeks, allowing ample time for participation.

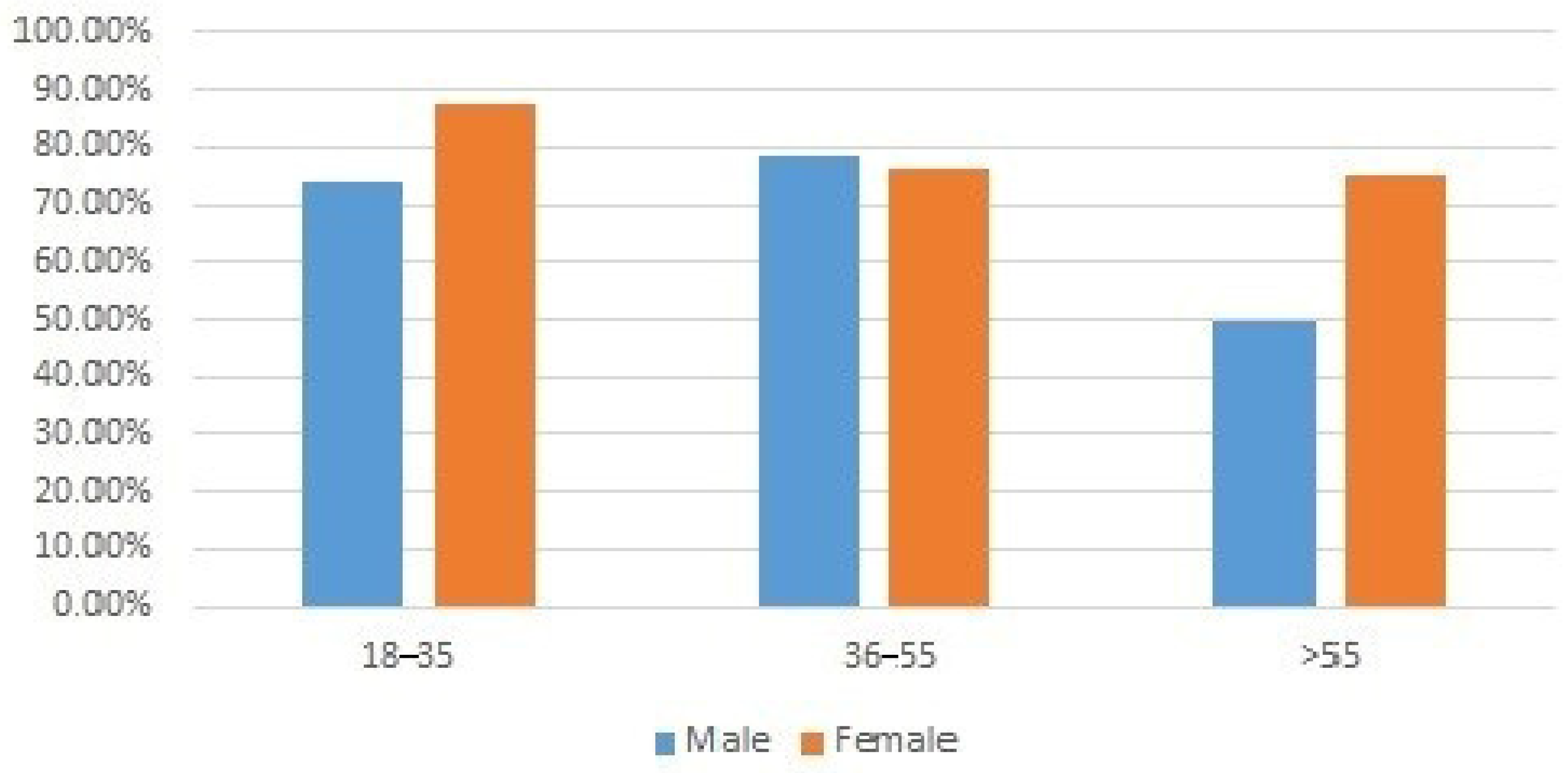

The study focused on three primary variables: health-conscious consumption habits, demographic segmentation (age groups), and gender. Statistical analyses were performed using ANOVA and PERMANOVA to determine the significance of these variables in shaping market dynamics. Additionally, a multiple linear regression model was utilized to quantify the growth potential of the market based on these elements.

Introducing the gender factor has a positive correlation with health and age, as women show a greater tendency to consume non-alcoholic beverages in all age groups, especially in the 18–35 segment. Additionally, this age and gender segment currently represents the highest consumption of non-alcoholic beverages. This demand has been underscored in various studies across different global markets [

37,

38].

The analysis first explored whether emerging health-conscious lifestyles would drive both demand and production in dealcoholized wines. Increasing trends toward healthier living and moderation in alcohol consumption are gaining prominence, positioning dealcoholized wine as a viable alternative for consumers seeking the enjoyment of wine without its alcoholic content.

Furthermore, the study identified the age demographics that are most amenable to this new category of wines. Millennials and Centennials emerged as the primary catalysts of the dealcoholized wine market in Spain. These generations emphasize sustainability, health-orientated options, and innovation in their consumption decisions, characteristics that align closely with the value proposition of dealcoholized wines. A pictorial overview of the research is presented in

Figure 6.

Women aged 18–35 are the most likely to consume non-alcoholic beverages for health reasons and represent the highest percentage of consumers willing to permanently shift their drinking habits toward these new options.

3. Results

3.1. Health-Conscious Consumption

A substantial segment of participants (78.04%) indicated a readiness to sample dealcoholized wines, with 63.05% mentioning health as the main incentive. Among producers, 58.60% recognized health trends as a significant factor influencing demand. This corresponds with wider societal initiatives aimed at decreasing alcohol intake due to its related health hazards. Remarkably, 57.63% of consumers suggested they would permanently embrace dealcoholized wines if these fulfilled their expectations.

The survey also examined the current consumption of non-alcoholic beverages in Spain, which may impact the acceptance of dealcoholized wines. While 40.05% of respondents already consume non-alcoholic beverages, 59.95% do not, indicating substantial potential for attracting new consumers (

Figure 7) and producers (

Figure 8).

When questioned about the reasons motivating their consumption, 41.34% of participants selected “Health” as the exclusive reason. When aggregating this with other factors such as “Trendiness”, “Price”, and “Sustainability”, the proportion of respondents citing “Health” increased to 72.21% (

Figure 9).

The survey further investigated the influence of legal frameworks on the expansion of the dealcoholized wine market. Recent regulations from the European Union have established a clear classification for these wines, outlining production methods and labelling requirements. Notably, 57.21% of producers viewed this categorization as a positive step, while 55.81% of consumers and 54.88% of producers believed that regulatory support would enhance market growth.

3.2. Demographics: The Role of Younger Generations

Millennials and Generation Z (ages 18–35) emerged as the most receptive demographic for dealcoholized wines, with 87.50% expressing a willingness to experiment with them. This cohort also exhibited a greater tendency (64.38%) to integrate these wines into their habitual consumption compared to older groups [

39] (

Figure 8).

The survey aimed to corroborate findings from earlier research that identified younger generations as key drivers of the dealcoholized wine market due to their preference for healthier consumption habits [

40]. Among participants, 78.04% expressed a willingness to try dealcoholized wines, a figure that rose to 87.50% among Millennials and Generation Z. Moreover, 65.63% of this age group recognized health-consciousness as the primary motivator, compared to 63.05% of the overall sample.

In terms of the permanent adoption of these wines, 57.63% of all respondents indicated a willingness to alter their habits, increasing to 64.38% among younger generations. This demonstrates both a heightened openness to innovation and a stronger dedication to aligning consumption habits with health-orientated values (

Table 1).

The survey also revealed that 47.50% of Millennials and Centennials are regular consumers of non-alcoholic beverages [

41]. However, this does not imply that the remainder exclusively consume alcohol. This highlights the position of Millennials and Centennials as early adopters and underscores their potential to drive market expansion.

3.3. Gender Influence: The Role of Women

Women emerged as a key demographic in the dealcoholized wine market. Among female participants, 84.24% expressed interest in sampling these wines, and 74.55% indicated a willingness to incorporate them into their regular consumption patterns. Health was the main motivator for 44.78% of women, which increased to 79.33% when additional factors such as price, sustainability, and social trends were considered [

42] (

Figure 10).

Women also constituted the largest segment of current non-alcoholic beverage consumers, with 45.46% reporting regular consumption. This highlights their crucial role in the market’s expansion [

43] (

Table 2).

3.4. Quantitative Analysis: Multiple Linear Regression

This segment delineates the modelling of data derived from the survey outcomes, with an emphasis on the hypotheses previously addressed. The latent variable in this examination is the likelihood of the inception and expansion of the dealcoholized wine market in Spain. The observed and weighted variables encompass the probability of embracing health-orientated consumption practices, the likelihood that Millennials and Centennials will propel market growth, and the potential contribution of women as significant stakeholders in this market.

The regression equation is expressed as follows:

where

Ŷ: Probability of market emergence and growth for dealcoholized wines;

K: Constant;

a, b, c: Parameters;

X1: Probability of adopting health-conscious consumption habits;

X2: Probability of younger generations (18–35 years) contributing to market growth;

X3: Probability of women playing a pivotal role in the dealcoholized wine market.

The data matrix is summarized below:

The multiple linear regression analysis yielded the following results:

Multiple correlation coefficient (R): 0.999999987

Coefficient of determination (R2): 0.999999974

Adjusted R2: 0.999999896

Standard error: 3.68808 × 10−5

The multiple correlation coefficient (R) represents the square root of the coefficient of determination (R2), which is derived from the ratio of the regression sum of squares to the total sum of squares. The near-perfect value of R (close to 1) indicates minimal error in the regression equation.

The adjusted R2 value confirms that 99.9999896% of the variance in the dependent variable (Ŷ) is explained by the regression model, accounting for sample size and variable inclusion. The small standard error further underscores the robustness of the regression.

Since the critical F-value (0.00020518) is significantly lower than the alpha level (0.05), the model demonstrates high statistical significance.

Regression Equation

The resulting regression equation is as follows:

Statistical Significance

The t-statistics and corresponding probabilities confirm the significance of all included variables:

Intercept: t = −1.348498

Health-conscious habits: t = 498.50916, p = 0.001277

Younger generations: t = 358.30742t, p = 0.0017767

Women: t = 483.57563, p = 0.0013165

All p-values are below the alpha threshold (0.05), indicating that each variable significantly contributes to the model.

4. Discussion

4.1. Health-Consciousness and Dealcoholized Wine Acceptance

The findings reveal a distinct trend toward the adoption of healthier consumption patterns, spurred by heightened awareness of the health hazards linked to alcohol intake. With 78.04% of consumers expressing a willingness to explore dealcoholized wines and 63.05% identifying health as their primary motivator, it is apparent that the inclination to decrease alcohol consumption is evident in Spain, akin to trends in other nations.

The readiness of 78.04% of consumers to sample these wines, with 63.05% indicating health as the foremost motivation, illustrates a broader societal transition toward healthier lifestyles. Producers also acknowledge this trend, with 58.60% recognizing health as a significant demand driver (

Figure 11). These findings resonate with global movements advocating for alcohol reduction and healthier consumption habits, which are bolstered by changing regulatory frameworks.

Hypothesis 1 (H1). The health-consciousness of consumers is positively correlated with the acceptance of alcohol-free wine, especially among women and young people.

The results substantiate this hypothesis, as 57.63% of consumers indicate that they would permanently modify their consumption habits if dealcoholized wines aligned with their expectations, suggesting that, while there is initial interest, the permanence of the shift will hinge on the product’s quality and attributes.

The identification of health as the principal motivator for 63.05% of consumers lends further credence to the notion that dealcoholized wines may serve as a feasible alternative for those pursuing healthier choices over conventional wine. Furthermore, the European legislation that distinctly categorizes this type of wine could be a pivotal element in promoting market acceptance [

44].

4.2. Millennials and Centennials’ Willingness to Try Dealcoholized Wine

Millennials and Centennials are, undoubtedly, the most receptive demographic for dealcoholized wines, with 87. 50% expressing a willingness to sample them. This cohort also demonstrated a greater readiness to permanently adopt these wines, with 64. 38% indicating they would integrate them into their standard consumption practices. This reflects a broader trend among younger generations who prioritize health and wellness over alcohol consumption.

Hypothesis 2 (H2). Millennials and Centennials show a high willingness to try dealcoholized wine.

This hypothesis is also reinforced by the findings, as the higher percentage of regular non-alcoholic beverage consumers within this group (47.50%) suggests that they are more accustomed to selecting alcohol-free options, facilitating the transition to dealcoholized wines.

4.3. Women’s Role in the Wine Industry and Dealcoholized Wine Acceptance

Women play a crucial role in the advancement of the dealcoholized wine market. With 84.24% expressing interest and 74.55% willing to incorporate these wines into their regular consumption habits, women represent an important segment. Additionally, motivation centred on health is more prominent within this group, with 44.78% of women citing health as their primary incentive [

45].

Hypothesis 3 (H3). The increasing participation of women in the wine industry is positively correlated with the acceptance and relevance of dealcoholized wines.

The results support this hypothesis, as women also represent the largest segment of regular non-alcoholic beverage consumers (45.46%), further reinforcing the idea that they represent a crucial demographic for the success of dealcoholized wines in the market.

4.4. Implications for Market Expansion

The quantitative analysis performed through multiple linear regression confirms that health-conscious habits, the influence of younger generations, and the role of women are key factors for the growth of the dealcoholized wine market. The high correlation (R = 0.999999987) and statistical significance of the variables suggest that these trends have a direct and significant impact on the adoption of these products.

To capitalize on this opportunity, the Spanish wine industry should concentrate on innovating products that correspond with health and sustainability principles, initiate marketing initiatives aimed at Millennials, Centennials, and women, and cooperate with regulatory authorities to ensure adherence to standards and utilize emerging legislative frameworks.

5. Conclusions

In summary, this research has delivered a comprehensive analysis of the capacity for the Spanish wine industry to adjust to emerging consumer patterns by capitalizing on dealcoholized wines. The outcomes underscore the importance of health-orientated consumption, demographic transformations, and gender dynamics as pivotal drivers for the expansion of this market segment.

The results emphasize that health-orientated consumption behaviours are a fundamental aspect influencing both consumer and producer perceptions regarding dealcoholized wines [

46].

The survey results also revealed critical determinants for the success of dealcoholized wines in the Spanish domestic market, as well as potential limitations. The working hypothesis aligns with findings from specialized consultancy reports, indicating that the future of dealcoholized wine in Spain will hinge on the acceptance and evolving preferences of both consumers and producers. These changes are anticipated to be shaped by health trends, demographic transitions, and the emergence of new key players in the sector.

Demographic evaluations reveal Millennials and Centennials as the most open to experimentation, with 87.50% showing a willingness to try dealcoholized wines and 64.38% expressing a likelihood of integrating these products into their regular consumption routines. These generations emphasize sustainability, innovation, and health-orientated options, positioning them as vital to the sector’s growth. Their receptiveness to novel consumption trends and alignment with the essential characteristics of dealcoholized wines categorize them as the principal catalysts of this emerging segment.

Women have surfaced as a significant demographic in the dealcoholized wine market, both as consumers and trendsetters. Among female participants, 84.24% indicated an interest in sampling dealcoholized wines, and 74.55% were inclined to incorporate them into their consumption patterns. Health was recognized as the predominant motivator, mentioned by 44.78% of women. Their increasing involvement in the wine industry emphasizes their role as early adopters and proponents of healthier, innovative alternatives.

The intersection of health-orientated consumption behaviours, demographic transitions, and gender dynamics provides a substantial opportunity for the Spanish wine industry to broaden its offerings and align with global market trends. The regulatory adjustments at the European level further substantiate the rationale for incorporating dealcoholized wines into Spain’s bulk wine strategy.

In conclusion, the insights from this study illuminate the transformative potential of dealcoholized wines within the Spanish wine industry. By addressing consumer preferences and aligning with global trends in health and sustainability, the sector can establish a competitive advantage in the evolving market landscape. The strategic incorporation of dealcoholized wines signifies not only a response to changing consumption behaviours but also an opportunity to redefine the future trajectory of Spanish viticulture.