Abstract

Background: Pressure is growing in North America for heavy-duty, long-haul trucking to reduce greenhouse gas (GHG) emissions, ultimately to zero. With freight volumes rising, improvement depends on zero-emissions technologies, e.g., battery electric vehicles (BEVs) and fuel cell electric vehicles (FCEVs). However, emissions reductions are constrained by technological and commercial realities. BEVs and FCEVs are expensive. Further, BEVs depend on existing electricity grids and FCEVs rely on steam–methane reforming (SMR) or electrolysis using existing grids to produce hydrogen. Methods: This study assembles publicly available data from reputable sources to estimate breakeven vehicle purchase prices under various conditions to match conventional (diesel) truck prices. It also estimates GHG emissions reductions. Results: BEVs face numerous obstacles, including (1) limited range; (2) heavy batteries and reduced cargo capacity; (3) long recharging time; and (4) uncertain hours-of-service (HOS) implications. On the other hand, FCEVs face two primary obstacles: (1) cost and availability of hydrogen and (2) cost of fuel cells. Conclusions: In estimating emissions reductions and economic feasibility of BEVs and FCEVs versus diesel trucks, the primary contributions of this study involve its consideration of vehicle prices, carbon taxes, and electricity grid capacity constraints and demand fees. As electricity grids reduce their emissions intensity, grid congestion and capacity constraints, opportunities arise for BEVs. On the other hand, rising electricity demand fees benefit FCEVs, with SMR-produced hydrogen a logical starting point. Further, carbon taxation appears to be less important than other factors in the transition to zero-emission trucking.

1. Introduction

Moving trucking toward zero-emission vehicles (ZEVs) is a prominent approach to reducing emissions [1,2,3,4], helping to achieve commitments in the Paris Agreement. The agreement was adopted by over 190 nations plus the European Union at the UN Climate Change Conference (Conference of Parties 21 or COP21) on 12 December 2015 [5]. In North America, Canada ratified the agreement on 5 October 2016 [6], while the United States initially accepted, withdrew in November 2020, and then re-accepted on 20 January 2021 [7].

The focus for ZEVs, especially in popular media, is still on light-duty (LD) vehicles, which are used mostly for transporting people. A large majority of passenger cars on the road still run on gasoline. Largely out of the limelight, though almost as significant in terms of GHG emissions, are heavy-duty (HD) vehicles, especially trucks [8]. Trucks are used primarily for transporting goods, and almost all trucks still run on diesel fuel. Trucks are critical to North American supply chains and logistics, given the lingering “just-in-time” approach to delivery of goods. Indeed, modern economies cannot function without trucks and diesel fuel [9,10].

The United States and Canada are among the twenty-seven signatories to the Global Memorandum of Understanding on Zero-Emission Medium- and Heavy-Duty Vehicles, whereby countries commit to working together to enable 100% zero-emission new sales by 2040, with an interim goal of 30% zero-emission sales by 2030 [11]. Canada, as part of its plan to achieve emission targets by 2030 [12], places a strong emphasis on ZEV technologies of all types, as well as possible regulations. This includes an ambitious target for annual sales of zero-emission medium-duty (MD) vehicles, with gross vehicle weight ratings (GVWR) of 3000 kg to 12,000 kg, and HD vehicles to reach 35% by 2030. In the United States, a broad-based transitional blueprint has been developed to reduce transportation emissions, including MD and HD vehicles [13], with sales of zero-emission MD and HD vehicles expected to reach 42% of the market by 2030 [14].

These targets seem rather ambitious for HD trucks, given the time remaining to 2030. The issues involved can be studied using a “three-effects” (activity, structural and efficiency) model [15,16]. Activity effects refer to changes in demand for energy due to the volume of freight being shipped. Population and economic growth imply increasing volumes of freight. Structural effects relate to changes in the makeup of an industry, such as potential modal shifts from truck to rail or from airfreight to truck. North American freight volumes continue to increase, and motor carriers remain the dominant modal choice, within and between Canada and the United States [17]. Thus, progress relies on efficiency improvements from ZEV technologies, as well as operational improvements in conventional diesel vehicles. Moving forward on zero-emission HD vehicles is important in North America, given the obsession with economic growth combined with commitments to reduce emissions [18,19].

This paper presents an analysis of obstacles and opportunities for advancing zero-emission HD, long-haul trucking in North America, focusing on BEVs and FCEVs. High purchase prices of these vehicles hinder total cost of ownership (TCO) justification compared to their competition [20,21], including new and improved trucks powered by diesel. While there are calls in the literature for more research on alternative HD truck cost and emission factors [22,23], diesel-fueled trucks still account for about 97% of Class 8 trucks on the road in North America [24]. In evaluating the economic feasibility and emissions reductions of BEVs and FCEVs versus diesel trucks, the primary contributions of this study are its consideration of (1) breakeven vehicle prices; (2) electricity grid emission intensities, capacity constraints, and demand fees; (3) impact of carbon taxes; and (4) other jurisdictional issues.

The remainder of this paper is structured as follows. Section 2 presents a review of literature on zero-emission trucking, with a special focus on BEVs and FCEVs, including brief background on carbon taxes. Section 3 identifies sources of data used and describes methods developed to calculate breakeven vehicle prices and emission volumes under various scenarios. Next, Section 4 presents comparisons of BEVs and FCEVs to diesel vehicles, in terms of costs and emissions. Section 5 is a discussion of challenges and opportunities for BEVs and FCEVs, as the trucking sector shifts toward zero emissions. Finally, Section 6 offers conclusions, including limitations of the study and future research needs.

2. Zero-Emission Trucking Literature

The focus of this review is on HD BEVs and FCEVs in North America. This section offers definitions and positions various technologies in terms of readiness. It also briefly identifies other, currently less compelling alternatives. This is not intended to provide a comprehensive review, given the rapid pace of ZEV developments, as well as differences across global jurisdictions, e.g., Europe or China [25].

2.1. ZEV Technologies and Technology Readiness

The term ZEV follows from a progression of increasingly stringent definitions developed in California for air pollution management. ZEVs are defined as producing no emissions at the tailpipe, neither smog pollutants nor GHG. While there are subtleties in allowable ZEV characteristics between countries and situations [26], BEVs and FCEVs are considered ZEVs across North America [12,27].

Zero-emission technologies for HD trucks are less advanced toward commercial readiness compared to LD vehicles and other HD applications, e.g., transit buses. As outlined by the International Energy Agency (IEA) in 2022, the total stock of HD ZEV trucks was only about 66,000, less than 0.1% of the global fleet. This was also less than 10% of the number of ZEV buses in use by 2022 [28].

The Technology Readiness Level (TRL) scale, originally developed by NASA [29], is a useful tool for comparing the status of alternative technologies. A summary of adapted TRL scale levels employed in this work is provided in Table 1. For the main ZEV options, assessments by the California Air Resources Board (CARB) are widely used [30].

Table 1.

Explanation of technology readiness level (TRL).

2.2. Battery Electric Vehicle (BEV) Technologies

A 2021 technology assessment by CARB judged BEVs to be in the range of TRL 8 to TRL 9, implying early commercial entries from manufacturers [31]. This confirms that HD electric vehicles are behind LD electric vehicles, which reached TRL 9 status by the early 2010s [32].

A 2014 survey of BEVs for freight delivery [33] observed little action in the Class 8 market but predicted things were about to change. However, a 2016 Calstart study found that electric trucks and buses face unique challenges relative to LD electric vehicles, including limited charging stations and the structure of utility rates [34]. Another challenge, identified in 2018, was capacity to generate more electricity. Penetration of electric trucks above 50 percent market share was forecast to potentially overwhelm generation capabilities [35]. In contrast, a comparison of BEV potential in Finland and Switzerland estimated that electric trucks might only increase annual electricity energy needs by 1 to 3 percent [36]. The latter study called for more research comparing approaches to electrifying trucks, including battery swapping versus battery charging. A 2017 study of Class 6 (MD) trucks in Toronto found that BEVs generally had lower GHG emissions but higher total cost of ownership (TCO) vis-à-vis diesel trucks. In duty cycles involving frequent stops and starts, the TCO advantage shifted to BEVs [37].

Demonstration projects enhance understanding of costs and emissions characteristics of ZEVs. BEV projects up to 2021 primarily involved MD vehicles, with more than 900 units, including MD trucks, cargo vans and step vans, and short-range HD yard tractors. The number of HD trucks was much smaller, at less than 70 units [38], dominated by work in California, in particular demonstration of relatively short-distance HD drayage, involving 44 units [39]. While demonstration activities have continued to occur primarily in California, by 2022, significant efforts extended into five other U.S. states and two Canadian provinces, representing more than 13 fleets [38]. Still, BEV demonstrations continue to be focused on MD vehicles or HD vehicles moving short distances.

Beginning in 2021, there has been a surge of articles on BEV trucking applications, including assessing policy, workforce and infrastructure requirements [40,41]; modeling and evaluating TCO implications [42]; and assessing emissions, in particular on a life cycle basis [43]. A recent study by the Clean Air Task Force highlights the slow recharging speed for BEVs [44]. The International Council on Clean Transportation (ICCT) released a detailed analysis of BEV trucks for North America [45], compared to other options. While it was bullish on BEVs, the study used model-based vehicle costs rather than market values and assumed rather low power-delivery costs.

Nevertheless, the ICCT study provides insights adopted in this study, most importantly the significant mass of batteries required for long-haul vehicles and resulting payload limitation impacts. This concern is reflected in wry comments from trucking industry insiders, paraphrased here as “trucks need to carry freight, not batteries”. Selected data from ICCT showing payload capabilities across technology options are presented in Table 2, along with resulting replacement ratios compared to diesel. While 1 FCEV is sufficient to replace 1 diesel truck, roughly 1.25 BEVs may be needed to match conventional vehicle payload, due to battery weight.

Table 2.

Comparable payloads for vehicles and potential replacement ratios.

A similar situation has been observed for transit buses. As with trucks, a single fuel-cell bus can adequately replace a single diesel bus. However, as many as 1.25 electric buses may be required to replace 1 diesel bus, similar to the ratio for BEV trucks [46].

In summary, three key factors consistently appear in the literature as obstacles for BEVs: (1) limited trip range; (2) heavy weight of batteries, diminishing payload capacity; and (3) slow recharging times compared to diesel refueling.

2.3. Fuel Cell Electric Vehicle (FCEV) Technologies

A 2021 technology assessment by CARB judged FCEVs to be in the range of TRL 7 to TRL 8, implying activities still primarily involve technology demonstrations and pilots [31]. This confirmed FCEVs to be somewhat behind BEVs on technology readiness.

FCEVs as transit buses are further along in terms of technological readiness. Significant work on fuel-cell buses was conducted in California and British Columbia (BC), including a 20-unit FCEV bus deployment by BC Transit. The National Renewable Energy Laboratory (NREL) undertook analyses of the BC project, finding that hydrogen vehicles performed well technically—and outperformed diesel vehicles. However, operations beyond the initial demonstration period were ultimately suspended, due to high costs of delivered hydrogen fuel and high costs for further fuel-cell units [47,48].

Development and roll-out of FCEVs and associated hydrogen fuel are slowed by the classic “crossing the chasm” problem faced by many new technologies [49]. Reducing fuel cell costs and improving the cost and availability of hydrogen depend on achieving larger market penetration and better economies of scale, yet no one wants to buy until costs come down. This is exacerbated by negative reports about the utility of hydrogen in popular media and academic literature [50,51].

While lagging in terms of development status, FCEVs may be more applicable in the future for long-haul trucking [14], for being able to replace diesel units one-for-one. Researchers continue to argue that FCEVs can play an important role in reducing emissions over the next decade as a complement to BEVs [52,53,54]. However, this role will require development of the hydrogen supply chain, including production, storage, distribution, and optimizing hydrogen refueling site locations and capacities. Given the relative range characteristics, there could be fewer and less widespread hydrogen refueling stations compared to the number of BEV charging stations that would be needed.

One recent California initiative is the Zero and Near-Zero Emission Freight Facilities (ZANZEFF) shore-to-shore demonstration project for freight movement in conjunction with the Port of Los Angeles [55]. This project involves 10 Class 8 FCEV tractor units operated from 2019 through 2022 (with further possible operation), based on a collaboration between Toyota for fuel-cell systems and Kenworth for glider units, along with two hydrogen refueling stations by Shell. The success of the project, proving FCEVs can fully replace diesel units on a one-to-one basis, has been widely reported, and a factsheet with high-level summary results are available [56,57].

A recent demonstration project in Canada is the Alberta Zero-Emission Truck Electrification Collaboration (AZETEC) project, coordinated by the Alberta Motor Transport Association (ATMA). This project involves two Class 8 FCEV tractor units operated as long combination vehicles (LCVs), shuttling freight between Calgary and Edmonton, roughly 300 km apart. These FCEVs have an anticipated range of 700 km, with refueling located at existing Air Products and Praxair facilities, using hydrogen derived from natural gas, fuel-cell technology from Ballard Power, and gliders from Freightliner/Daimler [58]. Refueling time is estimated to be ten minutes, greatly outperforming BEVs of similar size. Operation of vehicles in this project was pushed back significantly due to COVID, with limited data currently available. It is expected that even without carbon capture, the project will achieve more than 25% reduction in emissions [59].

For many newer projects, performance information is limited, often for commercial reasons. A useful contrast is the high level of detail, including reports by NREL, on the BC Transit fuel-cell bus project noted earlier [47,48]. In summary, beyond a need for better information, two technical factors appear in the literature as consistent obstacles for FCEVs: (1) high cost and lack of availability of hydrogen fuel and (2) high cost of fuel-cell technology.

2.4. Developing Competition between BEVs versus FCEVs

An implication of having two ZEV technology options has been a suggestion in the literature of a competition between BEVs and FCEVs, and the question: which one will be the ultimate winner in trucking? [60]. Beyond a few dismissive reports regarding FCEVs [50,51], discussions have focused on comparing respective obstacles and opportunities. BEVs generally have lower costs and are compelling for shorter distances, i.e., intra-city and regional moves of less than 300 km up to 500 km [60,61,62,63,64,65,66,67]. However, for long-haul, inter-city trucking, FCEVs provide the advantages of adequate range, ability to replace diesel vehicles one-for-one, and comparable refueling speed [60,61,63,65,66,68]. Interestingly, in separate papers from 2019 and 2022, one research group adjusted their position from identifying BEVs as the most advantageous option across all trucking applications [64] to suggesting FCEVs are preferable for long-haul trucking [69]. Thus, it is reasonable to consider these options complementary—and to clarify the advantages of each.

2.5. Other Technologies and Approaches

Other fuels and emissions reduction approaches are available, which might be viable in certain situations. Though the North American Council for Freight Efficiency (NACFE) concurs that BEVs and FCEVs are most suitable for attaining zero emissions, they recently described the upcoming decade or so as the “messy middle”. This term implies that a broad range of options are likely to be available and used for HD freight vehicles [70], including hybrids and plug-in hybrid electric vehicles (PHEVs); catenary-based electric trucks; natural gas; biofuels; and ongoing efficiency improvements for conventional diesel vehicles. These options, along with rationales for their exclusion from detailed analysis, are outlined in the following subsections.

2.5.1. Hybrids and PHEVs

Hybrids, which gained traction in LD markets, were initially considered a possibility for HD vehicle power trains, as well. However, a practical fit for long-haul applications is questionable, given three trip characteristics: (1) relatively little stopping and starting, i.e., few opportunities for regenerative breaking; (2) relatively constant travel speeds; and (3) high-power requirements over long-periods, e.g., for grade climbing [71]. PHEVs can be considered ZEVs with limitations, including heavy batteries reducing load capacity. They appear to have been largely dismissed in North America for long-haul applications, but may be useful for local delivery, with shorter daily travel and frequent opportunities for charging. PHEV trucks for long-haul have been proposed, involving alcohol-powered spark-ignition engines [72]. However, these are still largely conceptual, i.e., at TRL Level 2 to TRL Level 4.

2.5.2. Catenary Systems

Catenary systems, where trucks mounted with pantographs contact overhead wires for electricity supply, have advanced in Europe. There is less interest in North America, due to much longer travel distances, greater infrastructure investment requirements and higher operating costs.

Such systems may be useful in parts of Europe [73], or in high-traffic jurisdictions in places like California [74]. Indeed, the only major demonstration in North America was completed in Los Angeles, associated with moves from the ports to distribution centers and rail yards [63,75,76]. Since then, there have been concept proposals put forward for other locations on the continent [77], but no tangible advancement.

Considering recent German experience, catenary systems can resolve some technical issues and may provide lower operating costs, but only if fully utilized [78]. However, these systems require enormous initial investment in infrastructure, whereas other options, such as fast-charging and battery-swapping, enable a more demand-driven roll-out of infrastructure.

Reluctance on catenary systems can be also explained from experience with tethered transit buses. Rubber-tire trolley buses were once common in North America, but shrunk dramatically and are seen now only in selected cities. Transit sources confirm inherent problems, e.g., inflexibility and inefficiency [79], with energy consumption about twice that of battery buses, due to lack of regenerative braking opportunities and large wiring networks with associated losses. In a 2020 report on FCEVs, catenary systems were rated at TRL Level 6 [80].

2.5.3. Natural Gas and Related

Compressed natural gas (CNG), liquefied natural gas (LNG), and propane, known as liquefied petroleum gas (LPG), are alternative fuels for heavy-duty vehicles. They are all commercially ready, at TRL Level 9. The primary advantage of these fuels comes from lower costs compared to diesel, rather than emissions reductions. While sometimes characterized as potentially “green”, in all cases GHG emissions reductions for conventional natural gas in heavy-duty applications are small [81,82].

An emerging innovation is the application of renewable natural gas (RNG). RNG is pipeline quality biogas generated through naturally occurring anaerobic methanogenesis processes, including from landfills, livestock operations, wastewater treatment plants, etc. Thus, RNG is not a fossil fuel [83]. The generated methane, once purified, is identical to conventional natural gas and completely fungible. The use of RNG has been spurred through tradeable credit systems, whereby emissions reductions from RNG input at one location in pipeline networks can be used by a designated user at a different location. RNG is growing in popularity and prominence in the United States [84,85] and Canada [86,87]. While database tracking shows increases in recovery of RNG, the application is constrained by limited biogas availability [88].

2.5.4. Biofuels and Other Options

Liquid biofuels, including biodiesel and renewable diesel, are already used in HD vehicles, which are commercially available at TRL Level 9. These “drop-in” fuels, blended with conventional diesel, increase renewable content and are covered by existing relevant fuel standards. There are situations where pure biofuels have been employed, but three limitations preclude them as full zero-emissions options: (1) low-temperature operating limits, especially biodiesel; (2) compatibility constraints, again primarily biodiesel; and (3) product availability limitations. The latter is the most significant, with realistic supply limits in the range of 10% to 20% of diesel. A related emerging option is co-blending of renewably derived hydrogen gas into diesel engines. These fuels are suitable options for emissions reductions over the near-term.

There are a variety of other alternative fuels, but all are either too early in technology readiness, or excessively costly, making them unrealistic. These include dimethyl ether (DME), Fischer–Tropsch diesel (also called “gas-to-liquids”), ammonia, and electro-fuels, also termed e-fuels. For feedstock, the latter combine captured carbon dioxide (CO2) plus hydrogen from renewable sources. They can be similar to Fischer–Tropsch fuels but use more exotic, direct electrochemical processes. Fischer–Tropsch-based fuels are the most technically well developed; at TRL Level 9. However, they cost roughly 3 to 4 times more than diesel fuel [89].

2.5.5. Efficiency Improvements (“Green” Trucking Programs)

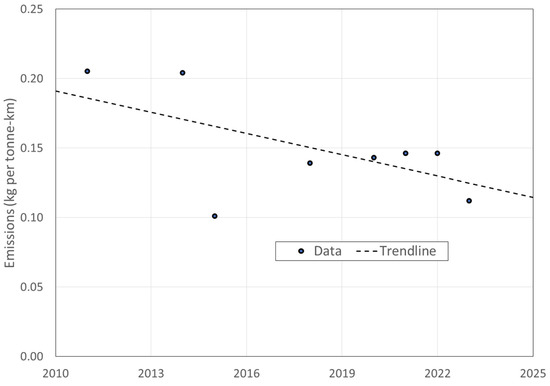

A final emissions reduction approach involves efficiency improvements for conventional long-haul diesel trucks. Efforts have been underway for decades to improve fuel efficiency, well before the advent of ZEVs [71,90]. By the later 2000s, efficiency improvements were identified across the continent as a significant opportunity to reduce fuel consumption [15,91]. While initially focused on conserving fuel and reducing costs, such efforts also reduce GHG emissions. The leading North American organization in this area is NACFE, which documented the benefits of “green trucking” [92]. The U.S. Environmental Protection Agency (EPA) has observed reductions in freight transport GHG emissions for trucking (in kg per tonne-km) since 2011, as shown in Figure 1 [93].

Figure 1.

Reduction in GHG emissions for trucking in the U.S. (Source: [93]).

A detailed review of green trucking programs identified three main categories of improvement initiatives: (1) company practices; (2) public policies; and (3) technologies [94]. Company practices include driver training, feedback, and incentives; speed limits; intermodal (truck–rail) shifts; and load/capacity matching to fill trucks and reduce empty backhauls. Public policies include harmonization of regulations across jurisdictions, such as vehicle weight and length limits, e.g., allowing LCVs; relaxation of cabotage rules; and rebates or tax incentives to trucking companies that invest in various green technologies. Technologies consist of a suite of installations, including auxiliary power units (APUs); low-rolling resistance tires; tire pressure monitoring and reinflation systems; wide-based tires; aerodynamic improvement equipment for tractors and trailers, including fairings, trailer side-skirts, and trailer boat-tails; light-weighting; telematics, such as for improved route planning; and other measures. Calculated fuel-savings from “non-electrification” technologies for Class 8 trucks are substantial, with efficiency gains potentially exceeding 20% based on a combination of technologies [95].

2.6. Carbon Taxation

Carbon taxation is a public policy tool, intended to motivate GHG emissions reduction. While carbon taxation has been a national policy in Canada since 2019, it has not yet been adopted in the United States. This section provides relevant background on carbon taxation but is not a comprehensive review or general evaluation of the tax.

Carbon taxation involves an emission-fee system, a levy on fossil fuels, designed to (1) reflect cost of externalities tied to fossil fuel consumption, and (2) use price differences to induce users to adopt “greener” options. In terms of emissions reduction, the impact of carbon taxation has been uncertain. While generally considered economically efficient in application, the policy is controversial, with concerns expressed about its fairness and effectiveness for inducing large reductions in emissions [96].

Sweden presents a positive example of carbon taxes, with appreciable reductions in emissions over time [97]. Canada and its province of British Columbia (BC), on the other hand, are uncertain in terms of results. BC enacted North America’s first broad-based carbon tax in 2008. While lauded by many analysts, its effectiveness has been questioned. BC has not experienced a long-term GHG emissions reduction trend [98]. Even advocates of carbon taxation admit emissions have increased [99]. Of course, population and activity have also increased. The Government of Canada justified its national carbon tax in part based on an evaluation of BC’s system [100]. Indeed, it was predicted that carbon taxation would reduce Canadian emissions by 80 to 90 million tonnes annually by 2022 [101]. Unfortunately, such reductions have not materialized.

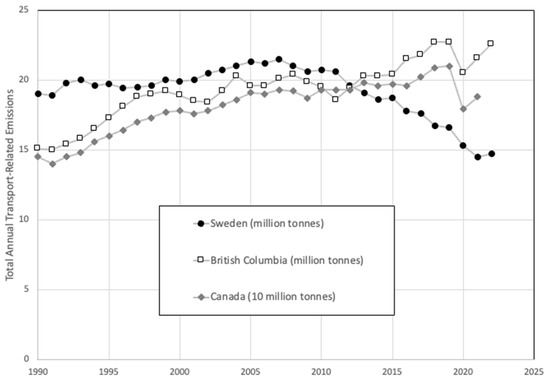

To provide an objective comparison of jurisdictions, and understand uncertainties of carbon tax impacts, Figure 2 presents time-series of annual transport-related emissions for Sweden, BC, and Canada. Note: To highlight the trends, the scale for Canada is 10x the scales for Sweden and BC. While official 2022 figures for Canada are pending release, emissions are known to have increased from 2021.

Figure 2.

Transport emissions in Sweden, BC, and Canada. Data sources: [102,103,104].

Sweden initially shows a moderate upward trend in transport emissions, followed by a steady decline beginning in 2008. On the other hand, BC and Canada show steady upward trends despite carbon taxes being imposed in 2008 and 2019, respectively. While all three jurisdictions enjoyed declines in emissions due to COVID-19, post-pandemic emissions have risen in BC and Canada, but not Sweden. The differences between BC and Sweden are particularly stark, with BC’s transport emissions surpassing Sweden’s after 2012, despite Sweden having more than twice the population.

Two additional aspects need to be considered in assessing North American carbon tax impacts: (1) extent to which taxes are passed down supply chains to consumers; and (2) implications of cross-border travel. It can be reasonably assumed that carbon tax costs will be passed down supply chains. In Canada, standard business practice involves such a pass-through [105], with concerns expressed for emissions-intensive and trade-exposed (EITE) industries, which cannot readily pass costs on to customers [106]. Transportation services, including trucking, are not considered EITE. Fuel surcharges, a well-established practice across North America, are added in response to sudden, unexpected spikes in diesel prices. The practice involves passing such costs onto customers, similar to what might be expected with carbon taxes [107].

Cross-border travel is relevant for emissions and carbon taxes, between nations and between provincial and state jurisdictions. This is especially relevant for BEVs given the differences in grid intensities by jurisdiction, and movement of freight vehicles between jurisdictions. Procedures have been established for diesel vehicles under the International Fuel Tax Agreement (IFTA), administered by the non-profit International Fuel Tax Association, Inc. [108]. A similar allocation procedure would be feasible to address emissions and carbon taxes, by tallying travel and fueling/charging across different jurisdictions to estimate emissions and associated taxes for a given trip.

Carbon taxation has potential as a public policy tool to reduce emissions; however, success is not guaranteed. Since such a policy exists in Canada, and may someday be enacted in the United States, it is important to include carbon taxes in the evaluation to understand their implications, in light of technological and jurisdictional characteristics.

2.7. Summary of Gaps in the Literature

While there is considerable literature examining the economics and GHG emissions of various ZEV options, there is little published research that analyzes carbon taxes and jurisdictional issues, such as demand fees and electricity grid capacity and intensity. In addition, most of the existing literature focuses on LD vehicles (e.g., cars) rather than HD trucks. According to Yan et al., “there remains a need for enhanced policy making and research to explore de-carbonization of freight transport” ([23], p. 11).

The intention of carbon taxes is to make ZEV options more attractive economically. On the other hand, electricity demand fees increase BEV operating costs, and grid intensity impacts life cycle GHG emissions. These factors vary widely across jurisdictions. As noted in the introduction, these gaps in the literature inspire the contributions of this study. In general, the academic literature is lagging, with many sources of relevant information coming from government agencies, non-governmental organizations (NGOs), and industry players.

3. Methods

To assess obstacles and opportunities for BEVs and FCEVs, it is necessary to understand performance characteristics, economics, and emissions compared to conventional diesel trucks. These items vary across jurisdictions, given differences in electrical grids on emissions and electricity fee structures. Methods and assumptions for calculating costs and emissions reductions are outlined in the following sections. Selected equations used in the calculations are provided in Appendix C.

3.1. Vehicle Performance Characteristics

In North America, HD long-haul trucks are Class 8 vehicles, with GVWR of more than 15,000 kg, as defined by the U.S. Federal Highway Administration (FHWA) [109]. These trucks typically involve tractor/trailer combinations. Relevant performance factors are discussed in the following subsections.

3.1.1. Travel Distances

“Long-haul” trips are generally considered to be origin-to-destination trips of more than 320 km (or 200 miles) [110]. Recent U.S. trip data show the following variability in trip length: 28% of trips were local (less than 100 miles); 37% were regional (100 to 500 miles); and 35% were inter-regional, national, or international (greater than 500 miles) [111]. In Canada, daily travel ranges from 600 to 1000 km for long-haul trucks [112].

In this paper, two annual travel distances are considered:

- 100,000 km, aligned with average 2019 U.S. Class 8 travel [113];

- 200,000 km.

Average travel speed and HOS regulations for drivers are related relevant factors. Average travel speed of 100 km (62 miles) per hour is assumed. HOS rules differ in the two countries. In the U.S., these rules are established by the Federal Motor Carrier Safety Administration (FMCSA) [114]; in Canada, they are set by individual provinces and coordinated through the Canadian Council of Motor Transport Administrators, generally following federal directions [115]. HOS rules are most important for BEVs, due to battery charging times. Respective national HOS rules are summarized as follows:

- Drivers in the U.S. can be on-duty for 14 consecutive hours per day but can drive a maximum of 11 h, and they must take breaks, e.g., 30-min minimum break after 8 h of driving;

- Drivers in Canada can be on-duty 16 h per day but can drive a maximum of 13 h.

3.1.2. Vehicle Lifespan and Cost-of-Money

For Class 8 long-haul trucks, vehicle lifespan of 12 years is assumed. For large fleet operators, new vehicles may be used for shorter periods, in the range of 4 to 5 years, with more intense operation, and then sold on the used-vehicle market. Lifespan refers to the vehicle, which could have multiple owners. Cost of money of 6% is assumed.

3.1.3. Vehicle Fuel (Energy) Consumption

Vehicle fuel consumption is needed to estimate operating costs and emissions. Fuel consumption estimates are given in Table 3 for typical tractor–trailer combinations, with sources for these estimates listed in Table 4, Table 5 and Table 6.

Table 3.

Heavy-duty truck fuel consumption estimates.

Fuel/energy consumption for different types of vehicles is known to be variable, based on powertrains, load volume, weather conditions, terrain, road conditions, traffic congestion, and other situational factors. More detailed evaluations would be required to understand specific situations. The diesel-consumption estimate of 38.5 L per 100 km in Table 3 is supported by multiple sources, as shown in Table 4.

Table 4.

Diesel fuel consumption estimates from the literature.

Table 4.

Diesel fuel consumption estimates from the literature.

| Source | Consumption Value | Comments |

|---|---|---|

| [116,117] | 39 L per 100 km | U.S. DOE 2020 fuel economy for Class 8 vehicles 1 |

| [118] | 37.5 L per 100 km | U.S. GREET Model estimates for HD vehicles 2 |

| [66] | 39 L per 100 km | 2021 NRCan estimate of Canadian average |

| [119] | 39.5 L per 100 km | 2000 NRCan Class 8 benchmarking study |

| [120] | 39 L per 100 km | 2021 article, comparing BEV with diesel in U.S. |

| [121] | 37.9 L per 100 km | 2021 NACFE Annual Fleet Fuel Study (AFFS) |

| [121] | 38.5 L per 100 km | 2018 NACFE Annual Fleet Fuel Study (AFFS) |

1 Average fuel economy = 5.29 miles/gasoline gallon equivalent (GGE) = 39 L/100 km. 2 Average fuel economy = 6.3 miles/gallon = 37.5 L/100 km.

Diesel fuel consumption for HD truck–trailer combinations varies widely across world regions. Typical consumption in Europe is estimated at 33 L per 100 km [122], while typical consumption in China is estimated at 45 L per 100 km [25]. These estimates reflect differences in trip distances, terrain, climate, traffic congestion, regulations and infrastructure, and installed diesel systems. In practical terms, diesel engines for Class 8 vehicles are all similar, with differences between systems largely associated with the nature and extent of emission controls, in particular controls for nitrogen oxides (NOx) and diesel particulate matter (PM).

Table 5.

Electricity consumption estimates from the literature.

Table 5.

Electricity consumption estimates from the literature.

| Source | Consumption Value | Comments |

|---|---|---|

| [36] | 118 kWh per 100 km | 2019 study of 8 BEV models > 15,000 kg GVWR |

| [123] | 134 kWh per 100 km | 2021 Environmental Defense Fund report |

| [80] | 126–132 kWh per 100 km | 2020 European Union report |

| [124] | 110 kWh per 100 km | 2022 Volvo news release 1 |

| [125] | 118–120 kWh per 100 km | 2022 Freightliner (Daimler) news release 2 |

| [126] | ≥88 kWh per 100 km | 2022 Kenworth (Paccar) news release 3 |

| [127] | 125 kWh per 100 km | 2022 Tesla announcement 4 |

1 Driving range = 345 km, implying battery capacity of about 380 kWh. 2 Driving range = 250 to 370 km; battery capacity of 300 to 400 kWh. 3 Driving range = 240 to 320 km; battery capacity of 200 to 300 kWh. 4 Driving range up to 800 km; battery capacity of about 1000 kWh.

The BEV electricity consumption estimate of 120 kWh per 100 km is also supported by multiple sources, as summarized in Table 5. The shift to BEVs would require 2.5 to 3.5 kWh of electricity to replace one litre of diesel fuel. The estimate of 120 kWh per 100 km in Table 3 implies 3.1 kWh per litre of diesel. This aligns with diesel energy content of about 11 kWh per litre, and the idea that HD electric vehicles are considered to be 3 to 4 times more efficient than conventional vehicles [128]. Further, electric vehicles are known to be relatively insensitive to electric rates (per kWh), for light-duty vehicles [129], as well as HD vehicles, such as transit buses [79].

Table 6.

Hydrogen consumption estimates from the literature.

Table 6.

Hydrogen consumption estimates from the literature.

| Source | Consumption Value | Comments |

|---|---|---|

| [45,130] | 9.0–9.2 kg H2 per 100 km | 2022–23 ICCT reports: Europe & N. America |

| [131] | 6.6–10.9 kg H2 per 100 km | 2020 NACFE report |

| [80] | 7.6–8.0 kg H2 per 100 km | 2020 European Union report |

| [68] | 6.8–11.3 kg H2 per 100 km | 2021 Canadian article in Clean Technologies |

| [66] | 10 kg H2 per 100 km | 2021 NRCan estimate of Canadian average |

The FCEV hydrogen consumption estimate of 8.5 kg H2 per 100 km is supported by multiple sources as well, as summarized in Table 6. Note that the estimates range from 6.6 to 11.3 kg H2 per 100 km.

Interestingly, all fuel and energy consumption estimates in Table 3 for HD trucks are lower than those for standard 40-foot transit buses. In Canada, comparable transit bus consumption estimates are 60 L per 100 km for diesel fuel blend, 130 kWh per 100 km for BEVs, and 10 kg H2 per 100 km for FCEVs [46]. Unlike long-haul trucks, buses tend to have “stop-and-start” duty cycles, in urban areas with substantial traffic congestion.

3.2. Vehicle Costs

Vehicle selection for commercial freight operations is often based on estimation of vehicle TCO [22,132]. Relevant incremental costs are specified in this section including purchase price for diesel trucks, fuel costs, and infrastructure costs. Costs are presented for each type of vehicle to be compared (diesel, BEV, and FCEV). Other cost factors considered to be beyond the scope of this study are also briefly summarized. All costs in this section are in U.S. dollars (USD), with currency conversion of 1.0 USD = 1.3 Canadian dollars (CAD). To assess breakeven purchase prices, cost of money is assumed to be 6.0%.

3.2.1. Purchase Price

The purchase price for a conventional Class-8 long-haul truck tractor is assumed to be $160,000.00, exclusive of taxes or additions. This value was used by the U.S. Department of Energy in 2022 as a “representative vehicle cost” [133]. Reported costs and prices for BEVs and FCEVs are variable, though always much higher than for diesel trucks. Since they are only beginning to come onto the market, prices remain more speculative. In addition, government purchase incentives tend to skew reported prices. Initial units of BEVs and FCEVs are being sold to large customers in undisclosed private transactions. Thus, rather than attempting to analyze the economics based on assumed purchase prices for ZEVs, operating costs are presented on a per 100 km basis, with breakeven purchase prices estimated for alternative zero-emission units, enabling an assessment of relative attractiveness.

3.2.2. Fuel and Energy Costs, Excluding Carbon Taxes

Based on U.S. data, fuel costs continue to be the second largest cost component for trucking firms, behind driver compensation. Indeed, in some years fuel costs have been the largest cost item [111].

The 2023 U.S. Energy Information Administration (EIA) Annual Energy Outlook forecasts average price for diesel over the next 20 years at $1.30 per litre. Recently, prices have been higher, but they are expected to fall in the near-to-medium term before rising once again [134]. Added to this is a cost of $0.05 per litre to account for fuel price volatility effects, based on Black–Scholes model evaluation of risk-equivalency derived from longer-term past diesel price data [135]. An additional amount is added for DEF, at 2% utilization, also assumed to be priced at $1.30 per litre. These components combine for an effective diesel blend price of $1.35 per litre for future years, applied uniformly across jurisdictions. This price does not include a carbon tax. Of course, any dramatic increase in this price will favor BEVs and FCEVs over diesel trucks.

Regarding operating costs, a variety of analyses have shown significant advantage for BEVs compared to diesel trucks and FCEVs. Reports showing such results include media commentary based on suggestions from Tesla [136]. These estimates consider typical unit costs for electrical energy, supplemented by elements of demand fees and charging infrastructure costs. A recent evaluation of high-power charging approaches reveals that conventional analyses may not capture costs that will be seen in the field [137]. In the analysis to follow, a unit electrical energy cost of $0.10 per kWh is assumed for all jurisdictions, reflecting the average cost of delivered electrical energy in the U.S. [138,139].

Two additional costs are considered here: capital recovery for high-power charging stations and demand fees from local utilities. While lower-cost Level 1 and Level 2 AC stations can be adequate for light-duty vehicles, the magnitude of batteries and HOS time constraints necessitate use of direct current fast charge (DCFC or Level 3) stations, with high-power levels also needed. A typical BEV covering an average daily distance of 800 km requires electrical energy of at least 960 kWh, with even larger battery sizes advised for long-haul [133]. This necessitates charging stations not less than 150 kW for base-level charging, combined with 350 kW and 1 MW (1000 kW) on-route stations.

Demand fees from local utilities are charged per kVA of power required, rather than per kWh of energy. The application of demand fees by North American utilities is less well-documented and understood, being frequently variable and unexpected. For example, low energy-cost jurisdictions in some cases have high demand fees and vice versa. Some jurisdictions impose no demand fees, while complex rules are used in others. Thus, three demand fee levels, based on monthly demand, are considered:

- $15 per kVA;

- $7.5 per kVA;

- No demand fee.

Certain jurisdictions, notably California, employ time-of-use rates rather than demand fees, whereby peak-time prices per kWh are more than twice off-peak levels. Based on available price data, the case of California is reasonably consistent with high demand fees. Low utilization of high-power stations increases the impact of demand fees.

Assuming utilization of 10% for high-power stations, demand fees can be converted to costs per kWh for these stations, as follows:

- For $15 per kVA, cost = $0.208 per kWh;

- For $7.5 per kVA, cost = $0.104 per kWh;

- For no demand fee, cost = 0.

Hydrogen for HD FCEV applications is not yet available at commercial scale and remains expensive, whether production is based on steam–methane reforming (SMR) or electrolysis. Previous cost estimates include the following:

- A 2021 European study estimates “at-the-nozzle” costs ranging from $10 to $12 per kg for delivered hydrogen, and $14 to $16 per kg for on-site production [140].

- A 2022 analysis estimates dispensed costs, based on on-site production, in the range of $10 to $12 per kg [141].

- Data presented by the California Fuel Cell Partnership (CaFCP), primarily reflecting LD applications, calculated average hydrogen costs at refueling stations in 2019 at more than $20 per kg [142].

- AC Transit, with an advanced program in North America on zero-emission fuel cell transit buses, estimates average hydrogen cost of $10 per kg [143].

Hydrogen manufacturing involves substantial economies of scale and thus depends on building volume to reduce prices. An additional factor impacting hydrogen cost is the associated emissions, and whether the hydrogen comes from: “green sources”, e.g., electrolysis from wind or hydroelectric; “blue sources”, such as SMR with carbon capture; or “grey sources”, e.g., SMR without carbon capture. While much of the literature focuses on production costs only, costs to purify, compress or liquefy, deliver to refueling sites, and dispense should also be included.

Similar to zero-emission HD truck prices, the trajectory for hydrogen cost reductions is uncertain, but a range of costs can be estimated. For purposes of analysis, two “at-the-nozzle” hydrogen costs are used, whether production is based on SMR or electrolysis, as follows:

- $6 per kg;

- $12 per kg.

These costs include production, purification, compression, storage, transportation, and dispensing. The literature supports the low-cost value as reasonable. The Hydrogen Council suggests a breakeven price at the nozzle for heavy-duty truck applications of $6 per kg [144]. The 2020 Hydrogen Strategy for Canada estimates delivered cost of hydrogen at the nozzle in the range of $4 to $9 per kg [145]. None of the hydrogen costs noted above include carbon taxes.

3.2.3. Infrastructure Costs for High-Power Electrical Charging

High-power charging systems will be required for HD BEVs. A 2022 ICCT report includes a discussion of capital and operating/maintenance costs for high-power stations [146], which are summarized in Table 7. Costs from the ICCT report were converted at a rate of ~1.06 USD per EUR. Other sources estimate similar costs, such as Government of Canada incentive programs, estimating an installed cost of $115,000 for a 150 kW system [147].

Table 7.

Preliminary capital recovery costs for high-power charging stations.

Capital cost recovery is impacted by the expected low utilization of high-power stations. There is little experience with on-route HD BEV charging; however, utilization factors are implied for high-power stations for LD vehicles and appear to be about 10% [148]. An additional issue is that lifespans for high-power stations may only be about 5 years. This is due to the aggressive conditions imposed on power-electronics and obsolescence, i.e., improved technologies being progressively implemented [137]. In Table 7, a lifespan of 5 years and cost of money of 6% are assumed, along with charging station utilization of 10%.

Finally, the following initial power delivery profile is assumed: 30% at 1 MW; 30% at 350 kW; and 40% at 150 kW charging, with the latter mostly for end-of-day rather than on-route charging. This equates to an average capital recovery cost of $0.186 per kWh.

3.2.4. Excluded Operating Costs

Several additional operating cost categories in HD long-haul trucking are identified [111], but excluded from the analysis, as non-incremental and/or highly uncertain. These are listed below, in relative order of importance:

- Maintenance and repair: these costs are highly uncertain, with insufficient experience to make reasonable estimates. This is the most important excluded cost. BEVs could bring lower maintenance costs, avoiding regular oil changes and other overhauls. However, experience has revealed that complicated and difficult-to-diagnose issues can arise with BEV systems leading to unexpected higher costs, e.g., strings of cells suddenly not functioning. Thus, maintenance is considered non-incremental, with no discernable advantage for diesel trucks, BEVs or FCEVs;

- The following costs are also considered non-incremental: insurance premiums; tires; permits and licenses; tolls and related fees.

3.3. Vehicle Emission Characteristics Employed

GHG emissions associated with trucks are often characterized as either:

- Combustion only, or “tank-to-wheels” (TTW) emissions, excluding supply chain and off-vehicle aspects;

- Full-cycle, or “well-to-wheels” (WTW) emissions, including upstream energy emissions and vehicle construction inputs over vehicle lifespan, as is commonly used in life cycle analysis (LCA).

For this analysis, a slightly different approach is used, based on National Inventory Report (NIR) methodology. This involves calculating relevant emissions that may occur within the jurisdiction under consideration. As such, this approach is based neither on TTW nor WTW but is a bit of a hybrid. This approach reflects the basis on which jurisdictions are ultimately judged in terms of emissions [149]. It also reflects the manner in which carbon taxes have been applied in Canada, and involves comparing the following:

- Emissions for conventional vehicles based on diesel combustion, including DEF, as the baseline, since diesel fuel refining across the continent tends to be concentrated in a relatively small number of locations;

- Emissions for BEVs based on local electrical grid intensity per kWh, on a generation-basis in each jurisdiction (i.e., state or province), since emissions from BEVs are highly dependent on local grids;

- Emissions for FCEVs based on the hydrogen production technology used, assuming hydrogen for vehicles will be produced locally, using either SMR or electrolysis from the local grid.

This analysis uses vehicle-specific emission factors, outlined below; along with fuel consumption estimates (see Table 3). Emissions for each of the technologies are outlined in the following subsections, as well as consideration of carbon taxes.

3.3.1. Conventional Diesel Vehicle Emissions

For conventional diesel fuel, a combustion-based emission factor of 2.7 kg CO2e per litre of diesel is used. This estimate is endorsed by both the EPA [150] and Environment and Climate Change Canada (ECCC), and has been used by Natural Resources Canada researchers [66]. An emissions factor of 0.5 kg CO2e per litre of DEF is also included [46]. While DEF use is relatively small, it reflects emissions trade-offs to achieve Tier 4 requirements. Tier 4 diesel engine standards are the strictest EPA emissions requirements.

3.3.2. Electric Vehicle Emissions

For BEVs, emissions are determined by electrical grid intensity, in g CO2e per kWh, which varies substantially across the continent. In Canada, grid divisions largely coincide with political divisions. Emission levels are thus readily estimated by province in the most recent National Inventory Report reflecting data for 2021 [151]. For the U.S., grid boundaries do not necessarily coincide with state borders. The U.S. has 7 major regions under the North American Electric Reliability Corporation (NERC), subdivided into 27 Emissions and Generation Resource Integrated Database (eGRID) subregions [150]. The EIA provides 2021 emission intensity estimates for each U.S. state, as part of the state electricity profiles [138]. Similar data, showing consistent results, are presented by the EPA on a per state-basis, based on eGRID data [139]. This results in sixty-one jurisdictions—ten provinces, fifty states, and the District of Columbia. While categories of jurisdictions are created for further analysis, data on individual states and provinces from the EIA are presented in Appendix A.

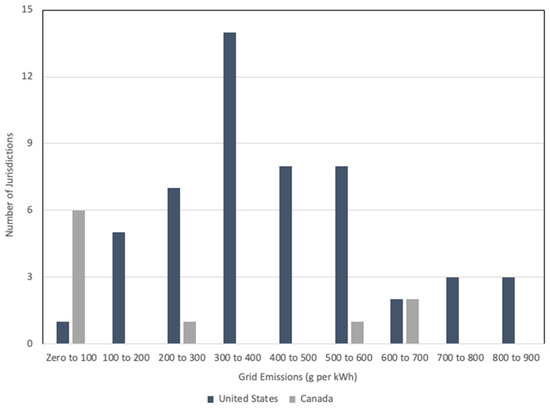

In North America, grid-intensity levels vary from near-zero to close to 900 g CO2e per kWh. Figure 3 shows numbers of jurisdictions, based on equal increments of 100 g CO2e per kWh, with American and Canadian jurisdictions categorized separately. Data for the U.S. conform reasonably to a normal distribution, clustering around an emission intensity level of 300 to 400 g CO2e per kWh. Indeed, aggregate mean emissions for electricity across the U.S. are approximately 400 g CO2e per kWh. Canada, on the other hand, is bimodal. Canada is often characterized as having “clean” electricity, illustrated by the large number of jurisdictions at the lowest incremental level and confirmed by Canada’s overall aggregate emissions of 110 g CO2e per kWh. However, there are also several provinces with much higher grid intensities, in the range of 500 to 700 g CO2e per kWh.

Figure 3.

Grid-intensity levels (g CO2e per kWh) in North America, 2021 [138,151].

The jurisdictions are clustered into six categories, based on grid-intensity ranges (see Appendix B). These six categories are characterized in Table 8, including grid-intensity range; number of jurisdictions; and median grid intensity for each category. Note that larger numbers of jurisdictions tend to fall into the higher grid-intensity categories.

Table 8.

Representative grid-intensity categories across North America for 2021.

3.3.3. Fuel-Cell Vehicle Emissions

For FCEVs, hydrogen must be manufactured. While by-product hydrogen sources exist, they tend to be site-specific and cannot be relied on. Other gasification technologies are theoretically possible but neither readily available nor practical. Two sourcing options are considered, with distinct emission profiles:

- Steam–methane reforming (SMR) of natural gas, with or without carbon capture. While carbon capture techniques are being developed, such hydrogen is not readily available. In this analysis, no carbon capture is assumed.

- Electrolysis to split water into hydrogen and oxygen gases. It is possible to isolate stipulated low-emission sources of electricity to be used for this purpose, but this is uncommon. More realistically, electrolysis can be done using grid-based electricity, which is assumed here.

Recent aggregate data suggest emissions for SMR-based hydrogen, without carbon capture, average about 9.0 kg CO2e per kg H2 [152]. This estimate is used here, although under ideal operating conditions, emissions can be as low as 7.9 kg CO2e per kg H2.

When using electrolysis, emissions result from electricity consumption. Formation of hydrogen gas from water is broadly identified as using 50 to 55 kWh of electricity per kg H2. For analysis, the more conservative value of 55 kWh per kg H2 is used, assuming inclusion of compression, purification, and dispensing requirements.

3.3.4. Consideration of Carbon Taxes

As described in Section 2.6, carbon taxes are emission fees designed to shift vehicle operators away from fossil fuels by increasing the price of those fuels. Carbon taxes have attracted controversy; they are contrary to the principle of progressive taxation, since everyone is taxed the same. There is also a lack of demonstrated emissions reductions in some jurisdictions [96].

For this analysis, carbon tax of $127.50 per tonne CO2e is assumed. This corresponds to the planned level to be implemented in Canada by 2030 [153]. Consistent with current practice in Canada, carbon taxes are applied on commodity fossil fuels, including the following: (1) diesel; (2) natural gas, relevant to SMR hydrogen production; and (3) electricity combustion emissions, relevant to BEVs and grid-electrolysis hydrogen production. A further assumption is that this carbon tax level is maintained over the life of the vehicle. The purpose is to calculate relative impacts on breakeven purchase prices.

4. Results

ZEV technologies for HD long-haul trucking are compared on three main aspects:

- Emissions reduction potential of BEVs and FCEVs compared to diesel, including implications of different fuel production technologies;

- Fuel-based operating cost savings per 100 km, based on annual travel distance and vehicle lifespan, plus breakeven vehicle purchase prices;

- Implications of carbon taxes, linking emissions to economics.

4.1. Emissions Reduction Potential

Theoretically, transitioning to BEVs using low-emission electricity or FCEVs using low-emission “green” hydrogen would dramatically reduce long-haul freight-related emissions. However, this transition seems to be impractical in the near- to medium-term. In estimating reduction potentials, the following aspects need to be considered:

- Electricity grid-intensity levels across the continent;

- Hydrogen produced via SMR without carbon capture;

- Hydrogen produced via electrolysis based on available grid electricity.

This analysis starts with estimation of breakeven points, where emissions from two technologies are equivalent. Using fuel consumption estimates from Table 3, conventional diesel emissions, including DEF, are estimated at 104.35 kg CO2e per 100 km. For SMR-based hydrogen FCEVs, without carbon capture, estimated emissions are 76.5 kg CO2e per 100 km (see Appendix C). Emissions associated with electricity vary across the continent, based on grid intensity. Breakeven calculations are shown in the next several paragraphs and summarized in Table 9.

Table 9.

Grid-intensity (emissions) equivalencies.

For one BEV, grid equivalency to diesel is 104.35 kg CO2e per 100 km/120 kWh per 100 km (energy consumption for 1 BEV) = 0.87 kg per kWh or 870 g CO2e per kWh. Thus, if the grid intensity is 870 g CO2e per kWh, emissions from one BEV will be the same as for one diesel truck. If the number of BEVs is increased to 1.25, then energy consumption = (1.25 × 120 kWh = 150 kWh per 100 km); more electricity is required and the grid equivalency value is lower at 696 g CO2e per kWh.

Grid-intensity equivalency to diesel for electrolysis FCEVs is 104.35 kg CO2e per 100 km/(8.5 kg H2 per 100 km × 55 kWh per kg H2) = 0.223 kg per kWh or 223 g CO2e per kWh.

For one BEV, grid-intensity equivalent to FCEV (SMR) is 76.5 kg CO2e per 100 km/120 kWh per 100 km = 0.638 kg, or 638 g CO2e per kWh. For 1.25 BEV, the previous result is divided by 1.25 to obtain 0.51 kg, or 510 g CO2e per kWh.

Grid equivalency for electrolysis versus SMR-based hydrogen is 76.5 kg CO2e per 100 km/(8.5 kg H2 × 55 kWh per kg H2) = 0.164 kg CO2e per kWh or 164 g CO2e per kWh. Finally, for SMR hydrogen compared to diesel, emission equivalence is: 104.35 kg CO2e per 100 km/8.5 kg H2 per 100 km = 12.28 kg CO2e per kg H2 or 12,280 g CO2e per kg H2.

The grid-intensity equivalent for one BEV to match a diesel truck (870) is very high. Indeed, there is only one jurisdiction (West Virginia at 879) where diesel trucks are slightly preferred to BEVs, in terms of emissions. If 1.25 BEVs are required to replace 1 diesel truck (696), there are seven (all American) jurisdictions where diesel is preferred (see Appendix A).

If hydrogen is produced via electrolysis, the breakeven grid intensity (223) is much lower than for BEVs, given the larger amount of electricity needed to produce hydrogen. Thus, grid-based electrolysis appears to be beneficial only for the very low and low grid-intensity jurisdictions (i.e., six provinces and six states). For SMR-produced hydrogen, the breakeven intensity (12,280) suggests considerable emissions reductions vis-à-vis diesel across all jurisdictions, even without carbon capture.

When compared to SMR-derived hydrogen, the breakeven grid intensity for 1.25 BEVs compared to 1 FCEV (510) implies that BEVs are an important emissions reduction option for many jurisdictions. For the ten very high grid-intensity jurisdictions (eight states and two provinces), FCEVs based on SMR are a better alternative for emissions reductions compared to BEVs (see Appendix A).

Considering the four ZEV options—one BEV per diesel truck; 1.25 BEVs per diesel truck; FCEVs, using electrolysis; and FCEVs, using SMR-derived hydrogen—emissions reductions achievable across all six grid-intensity categories are summarized in Table 10, using median emission estimates from Table 8. Note: Emissions from FCEVs using SMR hydrogen are independent of grid intensity, and the emissions reduction can be calculated as 1 − (SMR hydrogen emissions/diesel emissions) = 1 − (76.5/104.35) = 26.72%.

Table 10.

Emissions reductions per 100 km vs. diesel across grid intensities.

BEVs achieve greater emissions reductions compared to FCEVs using electrolysis, across all grid-intensity categories. In the case of FCEVs fueled by SMR hydrogen, BEVs are preferred, except in the very high grid-intensity category, where the reduction for SMR-fueled FCEVs (26.72%) is higher. FCEVs using SMR hydrogen are as good as or better than 1.25 BEVs in the high and very high categories, i.e., for up to 27 jurisdictions (see Appendix B). As expected, the emission impact of BEVs declines as grid intensity increases. Similarly, FCEVs via SMR outperform grid electrolysis as the grid intensity increases.

4.2. Economic Impact

Economic impact is an assessment of each option’s ability to achieve required travel distances, considering necessary refueling or recharging, along with ability to meet HOS requirements. Ultimately, the purpose of freight transport is to deliver the goods.

Daily travel of 800 km is assumed. For a conventional diesel unit, this requires 310 L of fuel, as well as 6 L of DEF, which is within existing fuel tank capacity of 450 to 550 L. Hence, HOS requirements are the more limiting factor. For FCEVs, this distance requires 68 kg of hydrogen. Based on available technology, this could be accomplished directly or might require one refueling stop on-route. Hydrogen refueling is almost as fast as diesel; again, HOS requirements are the more limiting factor.

BEVs are more challenging, requiring 960 kWh to travel the distance. While battery capacity is improving, multiple on-route charging stops would be required. Assuming average travel speed of 100 km per hour, covering the distance requires 8 h. This leaves less than 6 to 8 h, depending on jurisdiction, of on-duty time for recharging, which the driver would monitor. Under this trip scenario, 150 kW high-power charging systems leave little margin for error. Higher power levels of 1 MW or 350 kW are likely needed for on-route charging, implying one 1 hour stop using 1 MW or three 1 hour stops using 350 kW, with supplemental 150 kW charging at the destination to start the next day fully charged. Thus, a blend of charging types is assumed. Meeting travel distance needs and HOS requirements is possible for BEVs, but the margins of time, especially for HOS, are tight, leaving little room for error or unforeseen delays.

Based on annual fuel consumption and costs, present value fuel costs for the various vehicle options over their lifespan can be estimated. Present value fuel costs are summarized in Table 11 for annual travel of 100,000 km and 200,000 km.

Table 11.

Lifespan present value fuel cost *.

FCEVs at the lower fuel cost and BEVs (1.25) with no demand fees come in at lower present value of fuel cost compared to diesel. Using these present value costs, combined with the reference purchase price for conventional diesel trucks, maximum purchase prices for the alternatives to achieve breakeven with diesel can be estimated. These are shown in Table 12 for annual travel distance of 100,000 km and 200,000 km.

Table 12.

Breakeven purchase price, for 100,000 km and 200,000 km per year.

In Table 12, higher breakeven purchase price is interpreted as more advantageous, i.e., a more expensive ZEV can still achieve breakeven with the comparable diesel unit. Conversely, lower breakeven purchase price is disadvantageous, since the unit must be less costly than a diesel truck to break even.

The 1.25 BEV option for both travel distances, when medium or higher demand fees are in play, is either not feasible or requires a lower purchase price than diesel to break even. On the other hand, when there are no demand fees, the BEV option shows a much higher breakeven purchase price than diesel irrespective of annual travel distance. There is a strong economic rationale for BEVs, but only in jurisdictions with no demand fees.

At the lower price for hydrogen fuel, FCEVs have a higher breakeven purchase price than diesel. Further, when travel distance increases, breakeven purchase price also rises, improving the economics. Since this advantage is independent of jurisdiction, FCEVs seem more universally advantageous compared to BEVs. When the higher hydrogen fuel price is employed, irrespective of travel distance, FCEVs appear infeasible, since costs are much higher. Thus, for FCEVs, low-cost hydrogen fuel is essential.

4.3. Implications of Carbon Taxation

A carbon tax of $127.50 per tonne CO2e is applied to all the options. (As before, all $ amounts are in U.S. dollars). For the following two options, the impact is uniform across all jurisdictions:

- For diesel fuel blend, including DEF, the estimate is 104.4 kg CO2e per 100 km, which implies $13.30 per 100 km in carbon tax.

- For SMR-derived hydrogen, without carbon capture, the estimate is 76.5 kg CO2e per 100 km, which implies $9.75 per 100 km in carbon tax (see Appendix C).

A carbon tax can also apply to electricity used for BEVs and FCEVs using electrolysis-derived hydrogen produced from grid-based electricity. Due to jurisdictional variations, representative costs per 100 km are provided in Table 13, for the six grid-intensity categories (see Appendix B).

Table 13.

Carbon tax levels across grid-intensity categories for options using electricity.

To consider the carbon tax, present value fuel costs (Table 11) and breakeven purchase prices (Table 12) are modified. Due to the numerous variations, e.g., electricity grid differences combined with inter-jurisdictional travel, the following presentation of results focuses on selected important findings.

Regarding breakeven purchase price, at the higher hydrogen price level, whether supplied via SMR or electrolysis, FCEVs are still infeasible, despite the carbon tax. At the lower price level, if emissions are considered for SMR hydrogen and compared to diesel, breakeven purchase prices, modified from Table 12, become:

- $206,000 for 100,000 km per year, up from $177,220.90 with no tax

- $252,000 for 200,000 km per year, up from $194,441.80 with no tax.

While these changes are in a positive direction, 15% to 30% higher depending on distance, the most critical factor for hydrogen remains its basic price level. The results support an argument for focusing on reducing hydrogen price, along with or rather than relying on carbon taxation.

In the case of no demand fees, BEVs have an even stronger economic advantage, in terms of breakeven purchase price. With the application of a carbon tax, the advantage is enhanced, with breakeven purchase price levels increasing by 20% to 40%. While BEVs are the economically preferred technology, the no demand fee scenario only applies to certain jurisdictions. An important finding is the change in breakeven purchase price levels with high demand fees. The results are summarized in Table 14 and Table 15, for annual travel distances of 100,000 km and 200,000 km, respectively.

Table 14.

Impact of carbon tax on breakeven BEV price; high demand fees, 100,000 km per year.

Table 15.

Impact of carbon tax on breakeven BEV price; high demand fees, 200,000 km per year.

In all these grid-based cases involving carbon taxes and high demand fees, break even purchase prices for BEVs are higher than those identified without carbon taxes in Table 12. The extent of improvement, however, is not uniform, with lower-emission grids being most advantaged. Again, grid emissions are highly relevant. For BEVs, carbon taxes are less important than demand fees. Further, even with carbon taxes, breakeven purchase price for FCEVs at the lower hydrogen price level is better in all cases, except for very low emissions grids, even for hydrogen produced via SMR without carbon capture. This is especially true if 1.25 BEVs are required to match cargo payload. Finally, the 1.25 BEV configuration (with high demand fees) never reaches breakeven with the diesel unit.

5. Discussion

There is pressure on the freight transport sector to reduce GHG emissions, ultimately to zero. In North America, freight volumes are rising and trucking remains the dominant mode. Thus, to achieve zero-emission goals, long-haul trucking must become more efficient by adopting ZEV technologies, e.g., BEVs and FCEVs. The ability to reduce emissions, however, is limited by market realities and economics. While GHG emissions associated with electricity grids have been declining, only 7/61 jurisdictions in North America are categorized as “very low” in terms of grid intensity. BEVs rely on existing electrical grids, which generally have high emissions intensity. Moreover, low-emission hydrogen is not readily available, and FCEVs rely on available technologies, including SMR without carbon capture and electrolysis based on existing grids.

The ability of the sector to reduce emissions will depend on the state of technological and commercial development of BEVs and FCEVs, along with their costs and availability. The extent of reductions will depend on the emissions associated with respective energy inputs. If low-emission electricity and/or low-emission hydrogen, with carbon capture, were readily available, dramatic emissions reductions could be achieved. The analysis shows that there are a variety of constraints applicable in different jurisdictions, which will be important to consider for developing implementation strategies.

Given the uncertainties and potentially rapid changes in alternative zero-emission technologies, the approach used to assess relative economic feasibility involved calculating present-value breakeven purchase price levels compared to a conventional diesel reference price of $160,000. Higher prices compared to the diesel reference price are advantageous, since a vehicle price can be higher and still break even, in terms of TCO. Future research is needed to assess the impact of jurisdictional incentive programs for the purchase of HD zero-emission vehicles in North America [154,155]. Various government subsidies and incentives could dramatically alter breakeven purchase price scenarios.

BEV technology has been promoted, based on an assumption of replacing expensive diesel fuel with comparatively inexpensive electrical energy. However, three concerns with BEVs noted in the literature are: (1) limited travel range; (2) heavy battery weight; and (3) slow recharging compared to diesel refueling. This paper identified and studied the following additional concerns: (4) the high cost of high-power-level charging stations; (5) demand fees for electricity; (6) reductions in cargo capacity due to battery mass, requiring 1.25 BEVs to replace a single diesel vehicle; and (7) lack of certainty about vehicles being able to meet driver HOS rules.

The need for high-power level systems for on-route BEV charging implies a need for expensive charging stations and high demand fees. These costs can dwarf electric rates, on which many previous (and often positive) evaluations had been based. As long as no or low demand fees are applied, results reveal an economic advantage for BEVs. However, in selected jurisdictions, cost advantages decline, or even disappear, as demand fees rise and breakeven purchase prices drop. In addition, cargo carrying capacity limitations, when combined with higher demand fees, can render BEVs infeasible. Current market prices for BEV models are still in the range of $200,000 to $300,000, or more. Even with incentives, such units may be considerably more expensive than diesel trucks.

While demand fees are an economic problem for BEVs, they are not well understood. Thus, a comprehensive review and tabulation of demand fee levels across the continent is needed. In North America, electricity rates per unit of energy ($/kWh) have been the focus of analysis and reporting. Demand fees have been neglected. These fees tend to be unique by jurisdiction, including in some cases via time-of-use rates. Selected jurisdictions may have low electricity rates but high demand fees [137]. This implies a need for further investigation.

Beyond problems of high purchase prices and demand fees, the high power levels required for BEVs create an emerging electrification issue, as grids shift toward lower emissions intensity [156]. This is the need to address grid-congestion and power/demand capacity constraints. Intermittent renewable sources, such as solar and wind power, are being promoted across the continent as sources of electrical energy (i.e., kWh). They contribute little, however, in terms of electrical power support (i.e., kW), which is more urgently needed for charging long-haul BEVs. This is emphasized in recent representations by the American Trucking Associations (ATA) to U.S. government officials, noting that trucking firms cannot adopt BEVs, since local utilities are unable to provide adequate power levels [157].

FCEVs for HD long-haul freight transport offer various positive features compared to BEVs. FCEVs can readily adapt to freight vehicle operating strategies, matching travel distances without constraining the ability to meet driver HOS requirements. As shown in this analysis, there is a strong economic case for FCEVs under some circumstances. Moreover, even without carbon capture, SMR-based hydrogen can achieve emissions reductions of 27% compared to diesel.

Two concerns for FCEVs have been identified in the literature and are supported by results of this work: (1) high cost and lack of availability of hydrogen fuel; and (2) high cost of fuel-cell technology, i.e., high vehicle prices. Hydrogen-based technologies appear to suffer from the “crossing the chasm” problem faced by many new technologies [49]. Reducing fuel cell and hydrogen costs and increasing availability of hydrogen depend on achieving economies of scale, yet firms are hesitant to buy until the costs come down.

In the analysis undertaken, anticipated hydrogen costs range from $6 to $12 per kg H2 at the nozzle. At the higher price, FCEVs are generally infeasible. On the other hand, if hydrogen were available at or near the lower price, the technology could offer economic advantages. The lower price tends to be associated with by-product hydrogen, SMR, and large-scale electrolysis, while the higher price implies smaller scale electrolysis, especially for “green” hydrogen.

This suggests there is potential for much broader application of SMR hydrogen across the continent, based on relatively lower prices and emissions reductions compared to diesel. Emissions associated with hydrogen from SMR without carbon capture equate to an equivalent BEV grid intensity of 638 g CO2e per kWh, using one-to-one replacement. This covers the very high grid-intensity category, i.e., 10 out of 61 North American jurisdictions. At a 1.25-to-1 cargo capacity replacement basis, the equivalent BEV grid intensity drops to 510 g CO2e per kWh, covering 19 jurisdictions in the high and very high categories.

The relatively universal applicability of SMR technology yields a potential pathway for hydrogen. This begins with SMR-based hydrogen but allows lower-emission hydrogen to be progressively developed, implemented, and integrated over time. This only involves changes in upstream production technologies, not dispensing or vehicle technologies. Emissions reductions using hydrogen fuel can be undertaken separately and incrementally, without adversely impacting vehicle or refueling operations.

The ultimate movement toward greener hydrogen, likely using electrolysis, suggests an additional, longer-term advantage for FCEVs versus BEVs. This relates to constraints for BEVs associated with high-power charging stations. Expensive high-power systems, upwards of 1 MW, involve significant load spikes, with expected utilization of no more than 10%. Both aspects increase the cost of electricity delivered. Electrolysis systems used to produce hydrogen, on the other hand, can operate as steady loads, with utilization factors of around 90%. This gives electrolysis hydrogen an important characteristic as a “load-leveling” technique.

Electrolysis is often criticized as inefficient compared to direct use of electricity for BEVs, but an example clearly illustrates the advantage for hydrogen, as follows:

- A high-power charger at 1000 kW is expected to have annual utilization of about 10%, translating to about 876,000 kWh annually, on which all costs must be applied, fueling travel of about 730,000 km;

- The same power level used for an electrolysis system, with utilization of 90%, translates to about 7,884,000 kWh annually, which can be used as input energy for hydrogen production;

- Consumption of 55 kWh per kg H2 yields annual production of about 143,000 kg H2, enabling travel of about 1,680,000 km, a travel distance more than twice the same power level when used for BEVs;

- The same travel distance achieved with hydrogen creates electricity requirements for BEVs of about 2,016,000 kWh, implying required high-power station utilization of more than 23%, which is unlikely today.

The use of hydrogen is promising but not the only way to address grid constraints for charging BEVs. Two alternative electricity-only approaches are: (1) use of microgrids and (2) use of battery-based charging stations, i.e., charging slowly to limit grid-demand, then more rapidly delivering energy to a recipient vehicle, similar to the approach used with hydrogen. Further research into hydrogen, microgrids, and battery-based charging systems is needed, to better understand advantages, disadvantages, and future opportunities.