Supply Chain Relationships in Circular Business Models: Supplier Tactics at Royal Smit Transformers

Abstract

1. Introduction

2. Literature Review

2.1. Circular Economy and Business Models

2.2. Supply Chain Relationships and Circular Business Models

2.3. Supplier Tactics to Enhance Circular Business Models

2.3.1. Buyer–Supplier Relationship Management

2.3.2. Functional Integration of Stakeholders

2.3.3. Incentive Management

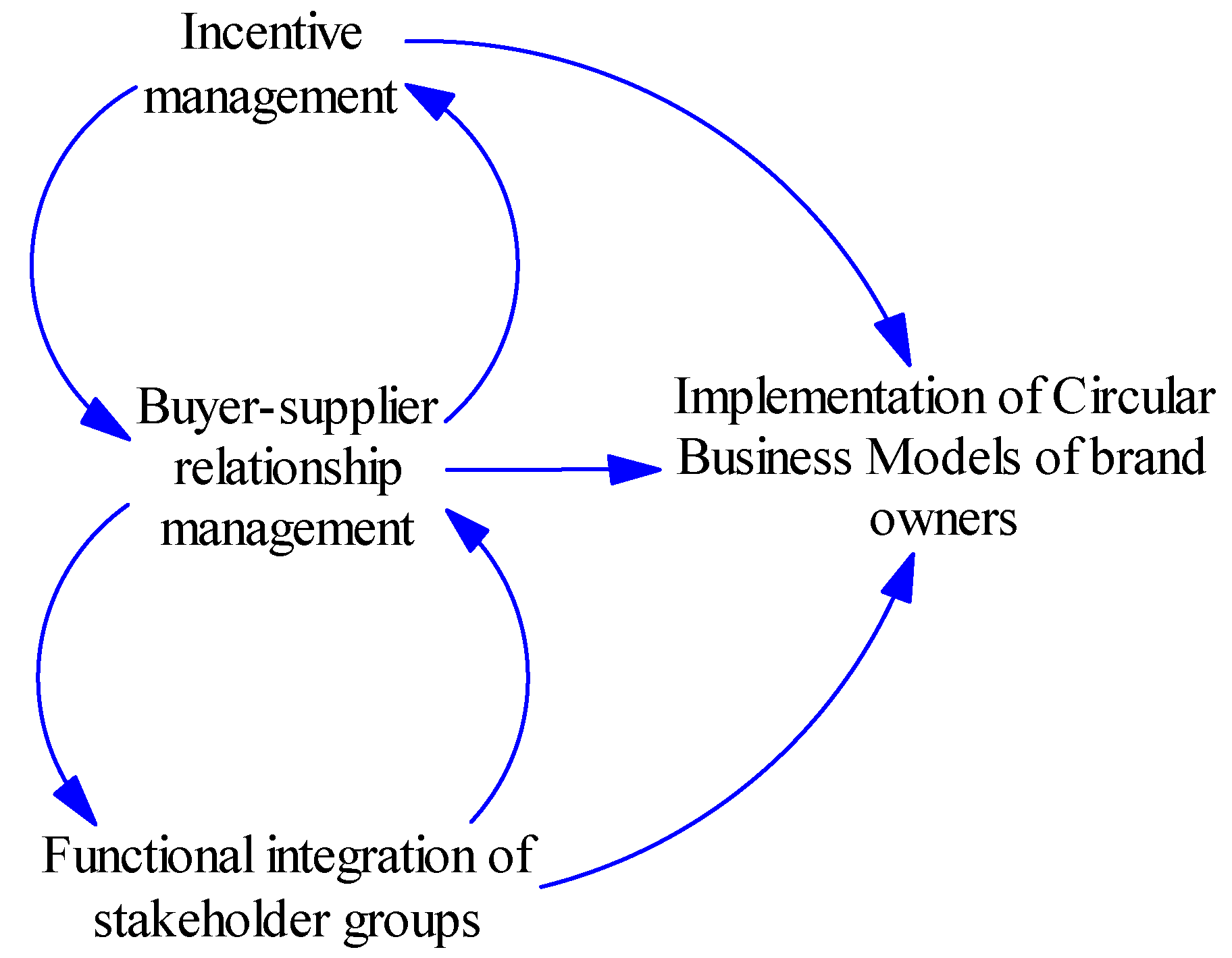

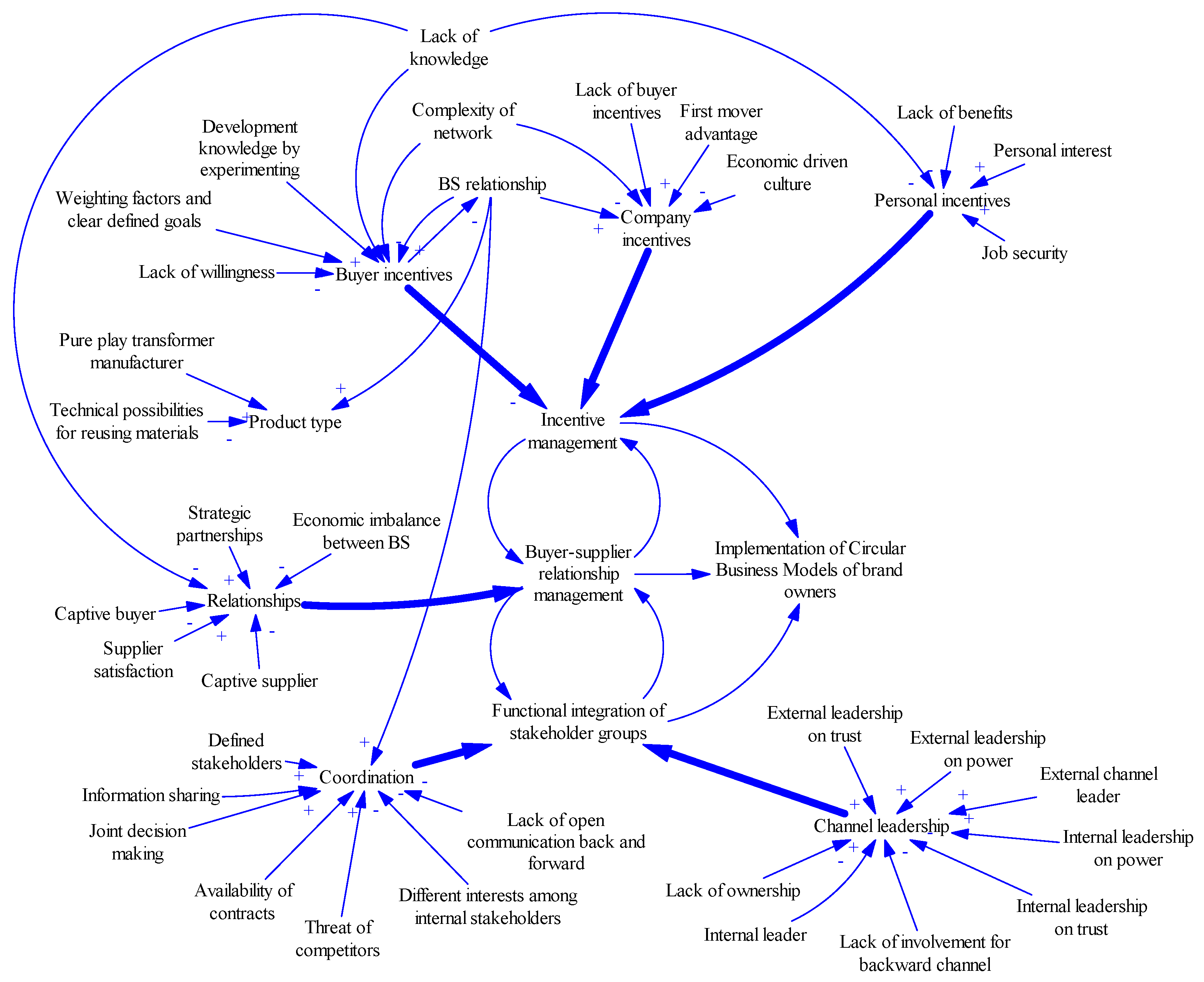

2.4. Causal Loop Diagram on Supplier Tactics

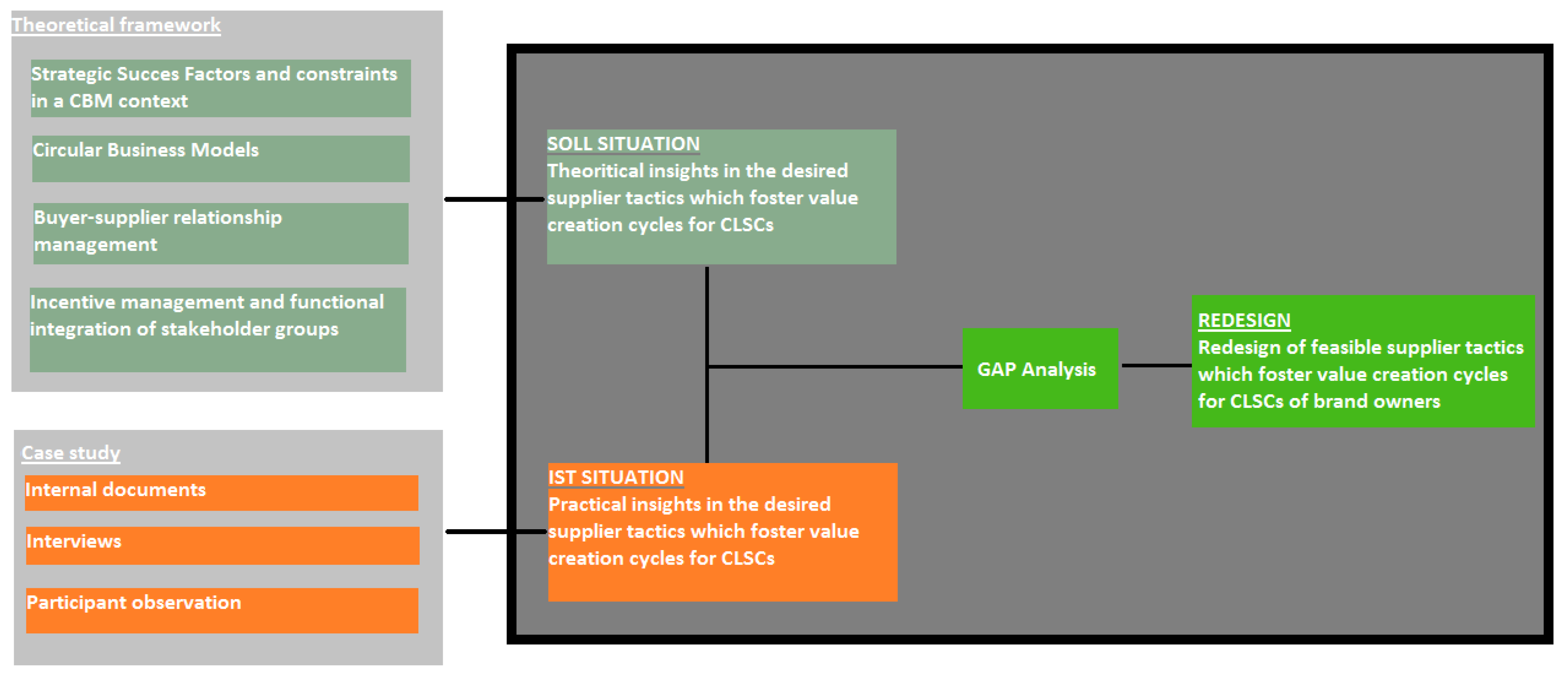

3. Methodology

3.1. Research Design

3.2. Data Collection

3.3. Operationalization and Data Analysis

3.4. Reliability and Validity

4. Results

4.1. Buyer–Supplier Relationship Management

4.1.1. Product Type

4.1.2. Relationship Type

4.2. Functional Integration of Stakeholders

4.2.1. Coordination

4.2.2. Channel Leadership

4.3. Incentive Management

4.3.1. Company Incentives

“the role of the buyer–supplier relationship management is key, it is very key”(interviewee 2)

“we will have to develop some if I can expect if we are a serious, or if our partnership with a strategic customer takes us, this is actually something that is developed”(interviewee 6)

“At the moment you take this direction this will enhance the relationship”(interviewee 1)

4.3.2. Buyer Incentives

“There is a goal I think by 2030 20% less virgin material. Which means 20% of the copper in the transformer should be circular. They also want a reduced production waste. They want to see their suppliers reducing manufacturing waste. And it is now starting to form part of their strategic goals”(interviewee 2)

“The weighting factors of certain things that go towards circularity, for example, oil that has been refined will give you so many points for it, and if you do not include it, the chance of winning a tender will be considerably reduced”(interviewee 3)

“A lot of our clients are governmental or semi-governmental and that you see a trend that they are more and more incorporated in the tenders ideas about circularity”.(interviewee 8)

“At the customer side it is important that the contact persons have the drive and the knowledge and willingness as well, because they have an enormous influence on the successful implementation of CE in the supply chain”(interviewee 1)

“Our customers say they want to go to circular ways of more durable solutions, solar power, wind power, but in the end if it’s more expensive, or there are technical uncertainties involved they don’t make the steps”(interviewee 4)

4.3.3. Personal Incentives

5. Discussion

5.1. Buyer–Supplier Relationship Management

5.2. Functional Integration of Stakeholders

5.3. Incentive Management

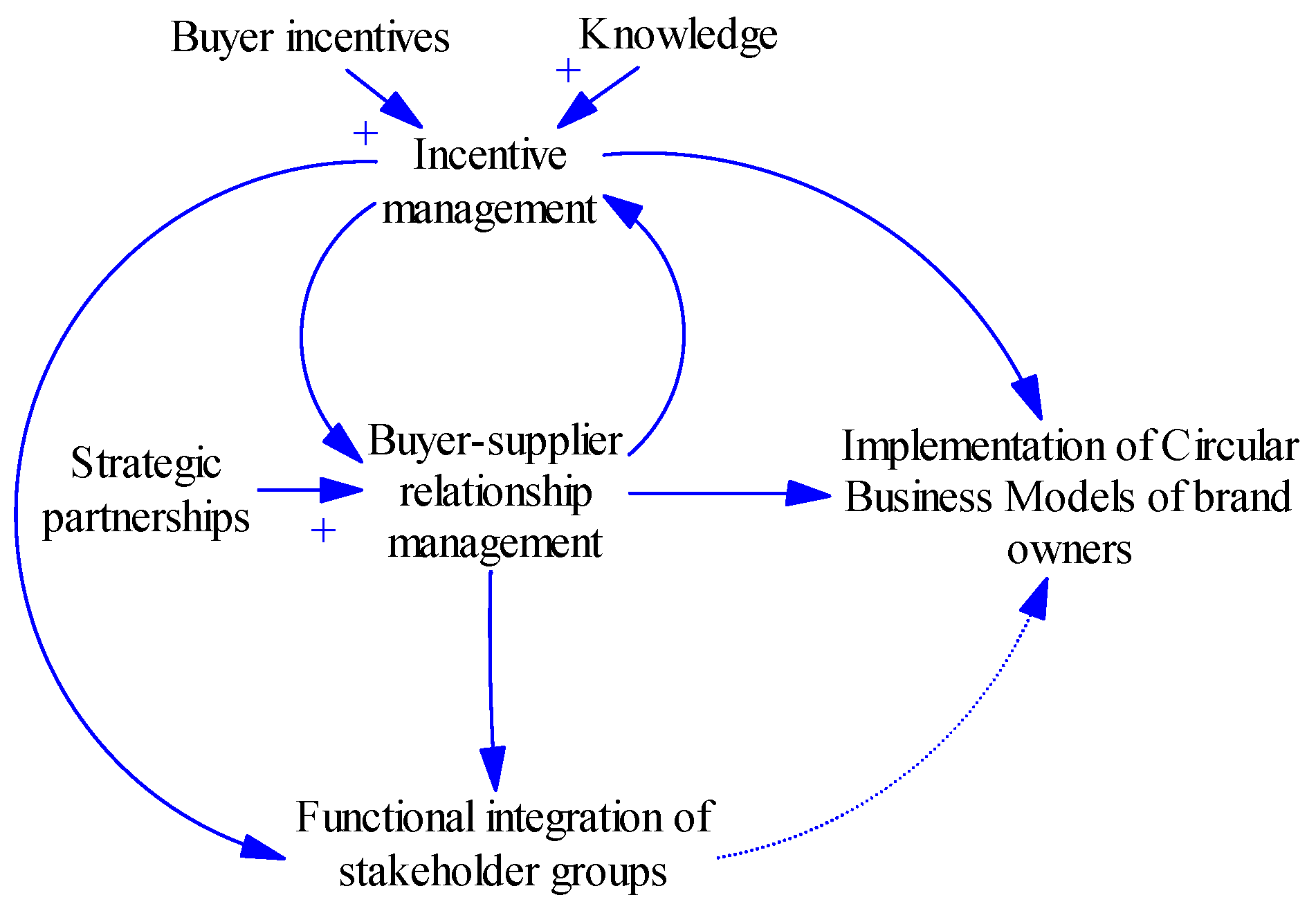

5.4. Redesign of the Supplier Tactics

6. Conclusions

- Closed-loop supply chains and circular economy involve more stakeholders, more objectives and specific investments from both buyer and supplier, which makes strategic, trust-based partnerships a must. Captive situations (dead-locks), modeled as vicious cycles, prove to be a serious obstacle in implanting CBMs.

- Supplier tactics in this study focus on BS relationships and operational enablers essential in implementation. In other words, next to supplier tactics we need enablers as well to successfully implement CBMs. The question here is which one of the two can provide leadership, i.e., who takes the initiative and supply chain directorship.

- Our case shows that economic objectives are dominating the closed-loop supply chain and also how primary stakeholders (buyer–supplier) struggle together to implement CBM. Secondary stakeholders may influence primary stakeholders, however, not fundamentally. Despite the fact that (top-down) CSR policies are formally in place, social and environmental objectives are hardly mentioned by the interviewees. The only exception is compliance which is usually ‘economized’, by regulations and fines.

- Limitations and future research. Our study also has a number of limitations, that lead to recommendations for further research. In order to obtain extra insights into how to break through the vicious cycles by actually implementing supplier tactics, it is recommended to do additional case studies. Furthermore, the interviewees all come from the brand owner, therefore, it would also be interesting to involve buyers as well, in order to obtain more validated results. Moreover, the role of supplier tactics in relation to the other SSFs next to CBMs can be further explored.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| CLSC Process | Constraint | Reference |

| Return process and trade-in of used products and parts | Capacity and utilization, uncertainty of timing, quality and quantity, trade-in price, installed vase visibility, reverse logistics costs and uncontrolled disposal | [4] |

| Recovery of used products and parts | Ease of disassembly and recovery, compatibility and recovery costs | [4] |

| Sales and re-integration into forward supply chain | Market uncertainty, bonus systems, third-party influence, regulation and customer demand for new products | [4] |

| SSF for CE | Constraint | Reference |

| Product Design | Limited R&D budget, time to market pressure and lagging supplier integration in the design process. Resistance to change and communication which can influence implementing sustainability in designs | [4,70] |

| Business Models | Organizational inertia, limited time and resources, no explicitly developed guidelines, linear accounting system, focus on short-term profitability and selling new equipment, uncertainty about quality of recovery and lacking top-management commitment | [4,71] |

| Customer Service | Limited customer demand for leasing, customers wish to keep control over products, no reduced total cost of ownership or economic benefits of leasing, pre-investment and risk that customer might go bankrupt during leasing period and preference for traditional ownership | [4] |

| Information Management | Complex information systems, e.g., due to multiple databases | [4] |

Appendix B

| ID | Question | Source |

|---|---|---|

| Incentive management section | ||

| 1 | What are the company’s incentives in terms of economic, environmental and social value to implement a CBM? | [52,61] |

| 2 | How are these circularity incentives communicated and shared in the company? | [52] |

| 3 | What are the buyer’s visions on circularity and how are the company’s incentives in line with the buyer’s expectations of circularity goals? | [8] |

| 4 | What are your personal incentives (in terms of salary, benefits, job security) to implement a CBM? | [52] |

| 5 | What is the circular product design strategy? Is it based on slowing and/or closing the supply chain? Slowing; designing long-life products and for product-life extension. Closing; design for a technological, biological cycle, for dis-and reassembly. | [12] |

| 6 | What is the Circular Business Model strategy? Is it based on slowing and/or closing the supply chain? Slowing; access and performance model (PSS), extending product value, classic long life, encourage sufficiency. Closing; extending resource value, industrial symbiosis. | [12] |

| 7 | What is constraining the incentive management for CBMs? How are these constraints related to each other? | |

| 8 | How is the incentive management related to the buyer–supplier relationship management? | |

| Functional integration of stakeholder groups section | ||

| 9 | Who are the internal and external stakeholders for CBMs in terms of power, urgency and legal? | [49] |

| 10 | Which stakeholder is leading the forward and reverse channel? (buyer/supplier/third party) | [48] |

| 11 | How is this channel coordination organized? (supply chain contracts, IT structure, information sharing, joint decision-making) | [30,47] |

| 12 | What type of leadership (based on trust or power) is applied in this channel? | [50] |

| 13 | Which internal department is leading the forward and reverse channel? | [50] |

| 14 | What internal type of leadership (based on trust or power) is applied? | [50] |

| 15 | What are the constraints for external and internal stakeholder coordination and leadership? How are these constraints related to each other? | |

| 16 | How is the functional integration of stakeholder groups related to the buyer–supplier relationship management? | |

| BS relationship management section | ||

| 17 | How are customers selected and managed? (based on customer attractiveness and supplier satisfaction) | [44] |

| 18 | What type of buyer–supplier relationships are applied? (market exchange, captive buyer, captive supplier or partnerships) | [28,31] |

| 19 | Why is this type of relationship applied? (product type, level of investments) | [24,28,30,31] |

| 20 | What are the constraints caused by the buyer–supplier relationship management which have an effect on the implementation of the CBM? |

References

- Witjes, S.; Lozano, R. Towards a more Circular Economy: Proposing a framework linking sustainable public procurement and sustainable business models. Resour. Conserv. Recycl. 2016, 112, 37–44. [Google Scholar] [CrossRef]

- Ellen MacArthur Foundation. Towards the Circular Economy: Economic and business rationale for accelerated transition. J. Ind. Ecol. 2013, 2, 23–44. [Google Scholar]

- Lewandowski, M. Designing the business models for circular economy—Towards the conceptual framework. Sustainability 2016, 8, 43. [Google Scholar] [CrossRef]

- Schenkel, M.; Krikke, H.; Caniëls, M.C.J.; Lambrechts, W. Vicious cycles that hinder value creation in closed loop supply chains: Experiences from the field. J. Clean. Prod. 2019, 223, 278–288. [Google Scholar] [CrossRef]

- Kaur, H.; Singh, S.P. Flexible dynamic sustainable procurement model. Ann. Oper. Res. 2019, 273, 651–691. [Google Scholar] [CrossRef]

- Yang, M.; Smart, P.; Kumar, M.; Jolly, M.; Evans, S. Product-service systems business models for closed loop supply chains. Prod. Plan. Control 2018, 29, 498–508. [Google Scholar] [CrossRef]

- Linder, M.; Williander, M. Circular Business Model Innovation: Inherent Uncertainties. Bus. Strategy Environ. 2017, 26, 182–196. [Google Scholar] [CrossRef]

- Lieder, M.; Rashid, A. Towards circular economy implementation: A comprehensive review in context of manufacturing industry. J. Clean. Prod. 2016, 115, 36–51. [Google Scholar] [CrossRef]

- Schenkel, M.; Krikke, H.R.; Caniëls, M.C.J. Value Creation in Closed Loop Supply Chains. Ph.D. Thesis, Open University of the Netherlands, Heerlen, The Netherlands, 2016. [Google Scholar]

- Van Boerdonk, P.J.M.; Krikke, H.R.; Lambrechts, W.D.B.H.M. New business models in circular economy: A multiple case study into touch points creating customer values in health care. J. Clean. Prod. 2021, 282, 125375. [Google Scholar] [CrossRef]

- Reim, W.; Parida, V.; Örtqvist, D. Product-Service Systems (PSS) business models and tactics—A systematic literature review. J. Clean. Prod. 2015, 97, 61–75. [Google Scholar] [CrossRef]

- Bocken, N.M.P.; De Pauw, I.; Bakker, C.; Van Der Grinten, B. Product design and business model strategies for a circular economy. J. Ind. Prod. Eng. 2016, 1015, 308–320. [Google Scholar] [CrossRef]

- Boons, F.; Lüdeke-Freund, F. Business models for sustainable innovation: State-of-the-art and steps towards a research agenda. J. Clean. Prod. 2013, 45, 9–19. [Google Scholar] [CrossRef]

- Lahti, T.; Wincent, J.; Parida, V. A Definition and Theoretical Review of the Circular Economy, Value Creation, and Sustainable Business Models: Where Are We Now and Where Should Research Move in the Future? Sustainability 2018, 10, 2799. [Google Scholar] [CrossRef]

- Jain, S.; Jain, N.K.; Metri, B. Strategic framework towards measuring a circular supply chain management. Benchmarking 2018, 25, 3238–3252. [Google Scholar] [CrossRef]

- Brüning Larsen, S.; Masi, D.; Cordes Feibert, D.; Jacobsen, P. How the reverse supply chain impacts the firm’s financial performance. Int. J. Phys. Distrib. Logist. Manag. 2018, 48, 284–307. [Google Scholar] [CrossRef]

- Zink, T.; Geyer, R. Circular Economy Rebound. J. Ind. Ecol. 2017, 21, 593–602. [Google Scholar] [CrossRef]

- Antikainen, M.; Valkokari, K. A Framework for Sustainable Circular Business Model Innovation. Technol. Innov. Manag. Rev. 2016, 6, 5–12. [Google Scholar] [CrossRef]

- Tukker, A. Eight types of product-service system: Eight ways to sustainability? Experiences from suspronet. Bus. Strategy Environ. 2004, 13, 246–260. [Google Scholar] [CrossRef]

- Batista, L.; Bourlakis, M.; Smart, P.; Maull, R. In search of a circular supply chain archetype—A content-analysis-based literature review. Prod. Plan. Control 2018, 29, 438–451. [Google Scholar] [CrossRef]

- Guide, V.D.R.; Van Wassenhove, J.L.N.; Kleindorfer, P. Closed-Loop Supply Chains: An Introduction to the Feature Issue. Prod. Oper. Manag. 2006, 15, 345–350. [Google Scholar] [CrossRef]

- Schallehn, H.; Seuring, S.; Strähle, J.; Freise, M. Customer experience creation for after-use products: A product–service systems-based review. J. Clean. Prod. 2019, 210, 929–944. [Google Scholar] [CrossRef]

- Choi, T.Y.; Wu, Z. Triads in supply networks: Theorizing buyer–supplier–supplier relationships. J. Supply Chain Manag. 2009, 45, 8–25. [Google Scholar] [CrossRef]

- Kraljic, P. Purchasing must become Supply management. Harv. Bus. Rev. 1983, 83509, 109–117. [Google Scholar]

- Caniëls, M.C.; Gelderman, C.J. Power and interdependence in buyer supplier relationships: A purchasing portfolio approach. Ind. Mark. Manag. 2007, 36, 219–229. [Google Scholar] [CrossRef]

- Pagell, M.; Wu, Z.; Wasserman, M.E. Thinking differently about purchasing portfolios: An assessment of sustainable sourcing. J. Supply Chain Manag. 2010, 46, 57–73. [Google Scholar] [CrossRef]

- Dabhilkar, M.; Bengtsson, L.; Lakemond, N. Sustainable supply management as a purchasing capability: A power and dependence perspective. Int. J. Oper. Prod. Manag. 2016, 36, 2–22. [Google Scholar] [CrossRef]

- Bensaou, M. Portfolios of buyer-supplier relationships. Sloan Manag. Rev. 1999, 40, 35. [Google Scholar]

- Day, G.S. Managing Market Relationships. J. Acad. Mark. Sci. 2000, 28, 24–31. [Google Scholar] [CrossRef]

- Cox, A. Understanding buyer and supplier power. J. Supply Chain Manag. 2001, 37, 1–11. [Google Scholar] [CrossRef]

- Bensaou, M.; Anderson, E. Buyer-Supplier Relations in Industrial Markets: When Do Buyers Risk Making Idiosyncratic Investments? Organ. Sci. 2008, 10, 460–481. [Google Scholar] [CrossRef]

- Álvarez-Gil, M.J.; Berrone, P.; Husillos, F.J.; Lado, N. Reverse logistics, stakeholders’ influence, organizational slack, and managers’ posture. J. Bus. Res. 2007, 60, 463–473. [Google Scholar] [CrossRef]

- Narayanan, S.; Narasimhan, R.; Schoenherr, T. Assessing the contingent effects of collaboration on agility performance in buyer-supplier relationships. J. Oper. Manag. 2015, 33–34, 140–154. [Google Scholar] [CrossRef]

- De Blasio, N.; Fallon, P. The Plastic Waste Challenge in a Post-COVID-19 World: A Circular Approach to Sustainability. J. Self Gov. Manag. Econ. 2022, 10, 7–29. [Google Scholar]

- Krikke, H. Value creation in a circular economy: An interdisciplinary approach. In Decent Work and Economic Growth; Springer Nature: Cham, Switzerland, 2021; pp. 1–15. [Google Scholar]

- Lambrechts, W. Ethical and sustainable sourcing: Toward strategic and holistic sustainable supply chain management. In Encyclopedia of the UN Sustainable Development Goals. Decent Work and Economic Growth; Springer Nature: Cham, Switzerland, 2021; pp. 402–414. [Google Scholar]

- Gelderman, C.J.; Schijns, J.; Lambrechts, W.; Vijgen, S. Green marketing as an environmental practice: The impact on green satisfaction and green loyalty in a business-to-business context. Bus. Strategy Environ. 2021, 30, 2061–2076. [Google Scholar] [CrossRef]

- Musova, Z.; Musa, H.; Drugdova, J.; Lazaroiu, G.; Alayasa, J. Consumer attitudes towards new circular models in the fashion industry. J. Compet. 2021, 13, 111. [Google Scholar] [CrossRef]

- Veit, C.; Lambrechts, W.; Quintens, L.; Semeijn, J. The impact of sustainable sourcing on customer perceptions: Association by guilt from scandals in local vs. offshore sourcing countries. Sustainability 2018, 10, 2519. [Google Scholar] [CrossRef]

- Lăzăroiu, G.; Ionescu, L.; Uță, C.; Hurloiu, I.; Andronie, M.; Dijmărescu, I. Environmentally responsible behavior and sustainability policy adoption in green public procurement. Sustainability 2020, 12, 2110. [Google Scholar] [CrossRef]

- De Angelis, R.; Howard, M.; Miemczyk, J. Supply chain management and the circular economy: Towards the circular supply chain. Prod. Plan. Control 2018, 29, 425–437. [Google Scholar] [CrossRef]

- Blome, C.; Paulraj, A.; Schuetz, K. Supply chain collaboration and sustainability: A profile deviation analysis. Int. J. Oper. Prod. Manag. 2014, 34, 639–663. [Google Scholar] [CrossRef]

- Kohtamäki, M.; Partanen, J. Co-creating value from knowledge-intensive business services in manufacturing firms: The moderating role of relationship learning in supplier-customer interactions. J. Bus. Res. 2016, 69, 2498–2506. [Google Scholar] [CrossRef]

- Pulles, N.J.; Schiele, H.; Veldman, J.; Hüttinger, L. The impact of customer attractiveness and supplier satisfaction on becoming a preferred customer. Ind. Mark. Manag. 2016, 54, 129–140. [Google Scholar] [CrossRef]

- Schiele, H.; Calvi, R.; Gibbert, M. Customer attractiveness, supplier satisfaction and preferred customer status: Introduction, definitions and an overarching framework. Ind. Mark. Manag. 2012, 41, 1178–1185. [Google Scholar] [CrossRef]

- Guide, V.D.R.; Harrison, T.P.; Van Wassenhove, J.L.N. The Challenge of Closed-Loop Supply Chains. Interfaces 2003, 33, 3–6. [Google Scholar] [CrossRef]

- Arshinder; Kanda, A.; Deshmukh, S.G. Supply chain coordination: Perspectives, empirical studies and research directions. Int. J. Prod. Econ. 2008, 115, 316–335. [Google Scholar] [CrossRef]

- Choi, T.M.; Li, Y.; Xu, L. Channel leadership, performance and coordination in closed loop supply chains. Int. J. Prod. Econ. 2013, 146, 371–380. [Google Scholar] [CrossRef]

- Mitchell, R.K.; Agle, B.R.; Wood, D.J. Toward a Theory of Stakeholder Identification and Salience: Defining the Principle of Who and What Really Counts. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar] [CrossRef]

- Mokhtar, A.R.M.; Genovese, A.; Brint, A.; Kumar, N. Improving reverse supply chain performance: The role of supply chain leadership and governance mechanisms. J. Clean. Prod. 2019, 216, 42–55. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management; Pitman Series in Business and Public Policy: Marshfield, WI, USA, 1984. [Google Scholar]

- Čiarnienė, R.; Vienažindienė, M. Critical issues for compensation and incentives management: Theoretical approach. Manag. Theory Stud. Rural Bus. Infrastruct. Dev. 2010, 5, 15–23. [Google Scholar]

- Krikke, H.; Hofenk, D.; Wang, Y. Revealing an invisible giant: A comprehensive survey into return practices within original (closed-loop) supply chains. Resour. Conserv. Recycl. 2013, 73, 239–250. [Google Scholar] [CrossRef]

- Saunders, M.N.K.; Lewis, P.; Thornhill, A. Research Methods for Business Students; Pearson: Harlow, UK, 2012; pp. 170–181. [Google Scholar]

- Yin, R.K. The Case Study as a Serious Research Strategy. Knowledge 1981, 3, 97–114. [Google Scholar] [CrossRef]

- Royal Smit Transformers. R&D and Innovation Plan 2019–2023; Royal Smit Transformers: Nijmegen, The Netherlands, 2019. [Google Scholar]

- Malone, T.W.; Crowston, K. The interdisciplinary study of coordination. ACM Comput. Surv. 1994, 26, 87–119. [Google Scholar] [CrossRef]

- De Jong, J.P.J.; Den Hartog, D.N. How leaders influence employees’ innovative behaviour. Eur. J. Innov. Manag. 2007, 10, 41–64. [Google Scholar] [CrossRef]

- Yukl, G. An evaluation of conceptual weaknesses in transformational and charismatic leadership theories. Leadersh. Q. 1999, 10, 285–305. [Google Scholar] [CrossRef]

- Genovese, A.; Lenny Koh, S.C.; Kumar, N.; Tripathi, P.K. Exploring the challenges in implementing supplier environmental performance measurement models: A case study. Prod. Plan. Control 2014, 25, 1198–1211. [Google Scholar] [CrossRef]

- Nikolaou, I.E.; Evangelinos, K.I.; Allan, S. A reverse logistics social responsibility evaluation framework based on the triple bottom line approach. J. Clean. Prod. 2013, 56, 173–184. [Google Scholar] [CrossRef]

- Morecroft, J.D.W. Strategic Modelling and Business Dynamics: A Feedback Systems Approach, 2nd ed.; John Wiley & Sons: Hoboken, NJ, USA, 2015. [Google Scholar] [CrossRef]

- Kim, D.H. Guidelines for Drawing Causal Loop Diagrams. Syst. Think. 1992, 3, 5–6. [Google Scholar]

- Mishra, J.L.; Chiwenga, K.D.; Ali, K. Collaboration as an enabler for circular economy: A case study of a developing country. Manag. Decis. 2019, 59, 1784–1800. [Google Scholar] [CrossRef]

- Jabbour, C.J.C.; Seuring, S.; de Sousa Jabbour, A.B.L.; Jugend, D.; Fiorini, P.D.C.; Latan, H.; Izeppi, W.C. Stakeholders, innovative business models for the circular economy and sustainable performance of firms in an emerging economy facing institutional voids. J. Environ. Manag. 2020, 264, 110416. [Google Scholar] [CrossRef]

- Hina, M.; Chauhan, C.; Kaur, P.; Kraus, S.; Dhir, A. Drivers and barriers of circular economy business models: Where we are now, and where we are heading. J. Clean. Prod. 2022, 333, 130049. [Google Scholar] [CrossRef]

- Moktadir, M.A.; Kumar, A.; Ali, S.M.; Paul, S.K.; Sultana, R.; Rezaei, J. Critical success factors for a circular economy: Implications for business strategy and the environment. Bus. Strategy Environ. 2020, 29, 3611–3635. [Google Scholar] [CrossRef]

- Oghazi, P.; Mostaghel, R. Circular business model challenges and lessons learned—An industrial perspective. Sustainability 2018, 10, 739. [Google Scholar] [CrossRef]

- Wrålsen, B.; Prieto-Sandoval, V.; Mejia-Villa, A.; O’Born, R.; Hellström, M.; Faessler, B. Circular business models for lithium-ion batteries-Stakeholders, barriers, and drivers. J. Clean. Prod. 2021, 317, 128393. [Google Scholar] [CrossRef]

- Verhulst, E.; Boks, C. The role of human factors in the adoption of sustainable design criteria in business: Evidence from Belgian and Dutch case studies. Int. J. Innov. Sustain. Dev. 2012, 6, 146–163. [Google Scholar] [CrossRef]

- Kirchherr, J.; Piscicelli, L.; Bour, R.; Kostense-Smit, E.; Muller, J.; Huibrechtse-Truijens, A.; Hekkert, M. Barriers to the Circular Economy: Evidence from the European Union (EU). Ecol. Econ. 2018, 150, 264–272. [Google Scholar] [CrossRef]

| Number | Company Document | Content | Year |

|---|---|---|---|

| 1 | Sustainability report of the SGB-SMIT Group. | Several content sources such as a statement of the CEO, countries, markets, customers, environmental, safety, health and quality management. The supply chain, stakeholders, employees, compliance management, resources and energy. | 2017 |

| 2 | Project Green and Circular Transformer | Goal DSO for purchasing transformers, | 2016 |

| 3 | Circularity meeting (conference call) | What is needed to obtain an overview of the complete supplier chain from mine to product? Recycle Nomex, wood, substite for paper, recycled oil. Percentage of materials in transformers | 2016 |

| 4 | MVO bij SGB-SMIT: Op weg naar circulariteit | Road to circularity at SGB-SMIT Group in line with CRS goals. | 2017 |

| 5 | R&D and Innovation Plan 2019–2023 | Strategic approach including the vision, the market and external developments, the current situation, SWOT analyses and the governance of projects. Moreover, the overview of R&D projects in the current situation and plan. | 2019 |

| 6 | Circular Economy: Contribution to material efficiency applied to transformers | Introduction, target of the mandate, transformers and eco-design directive, transformers’ durability, transformers and repair, maintenance, upgrade, retrofit, etc. | 2018 |

| 7 | Mission profile T&D Europe WG Circular Economy | Background information of the push for CE from the European Commission and identified issues including details and finally the mission of a T&D Europe Circular Economy. | 2019 |

| 8 | Circulaire economie in de elektrotechniek | Project information for the developments of circular economy in the electrical engineering sector. Circular properties of T&D equipment with a long life cycle are taken into account. | 2018 |

| 9 | Royal SMIT Transformers Proposal for TSOCircular replacement Transformers | A proposal to TSO including a circular E-platform and two case studies. | 2019 |

| 10 | SMIT Circularity Project | Presentation of the high-level process for preparing a proposal for a European customer, defining tasks for stakeholders, concept of business model and sales model for replacement and new asset orders. | 2019 |

| 11 | Market orientation replacement Power Transformers | Circularity targets, visions and request for proposal of replacement of 29 transformers. | 2019 |

| 12 | Verify Audit Declaration | Audit level verifies B2 of Royal Smit Transformers including health and safety, environment, quality and CSR. | 2018 |

| 13 | Project charter-Sustainability strategy for Royal Smit Transformers | Opportunity statement, goal statement, goals and the business case and stakeholders analyses. | 2019 |

| 14 | Sustainability-Strategic Framework 2020–2025 | Strategic decision on CSR strategy. Working on pillars of responsible business practices, sustainable employability and environmental footprint. | 2019 |

| 15 | 1749-Integrating Circular Economy in Asset Management | Material passport and sustainability in transformers. | 2019 |

| Professional Position | Role in Organization | Department | Interview Duration/Length of Transcript A4 | Interviewee Number |

|---|---|---|---|---|

| Commercial director | End responsible for sales and projects. | Sales and Projects | App. 40 min/5 pages | 6 |

| Business development, market intelligence and marketing manager | Responsible for marketing and the development of a business model by researching the market requirements. | Sales and Projects | App. 55 min/6 pages | 2 |

| Area sales manager USA | Responsible for sales in the USA. | Sales and Projects | App. 55 min/6 pages | 1 |

| Area sales manager SGB-Smit | Responsible for sales for the SGB-Smit group with most of the customers within Europe. | Sales and Projects | App. 50 min/6 pages | 3 |

| Manager R&D | Responsible for R&D and Innovation. | R&D | App. 50 min/8 pages | 4 |

| Technical director | Responsible for the engineering department. | Engineering | App. 50 min/5 pages | 7 |

| Manager installations and commissioning | Responsible after the Field Acceptance Test (FAT) up to and including the Site Acceptance Test (SAT). | Sales and Projects | App. 40 min/5 pages | 8 |

| Sales manager Smit Transformer Service (STS) | Responsible for sales for service projects. | Service | App. 55 min/5 pages | 5 |

| Observation | Nature of Group | Nature of Activity | Date |

|---|---|---|---|

| 1. | Project team | Attending workshop at European customer about optimized reuse of power transformers and/or materials in used power transformers | 10 April 2019 |

| 1. | Project team | Preparing proposal for European customer | 30 April 2019 |

| 2. | Project team | Providing internal documents for CSR strategy, circularity, supply chain relationships | 16 September 2019 |

| Tactic | Enabler | Examples | Reference |

|---|---|---|---|

| Buyer–supplier relationship management | 1. Product type | Product delivery risk Product value | [24] |

| 2. Relationships | Buyer investments Supplier investments Customer attractiveness Supplier satisfaction | [1,28,30,31,44] | |

| Functional integration of stakeholder groups | 3. Coordination | Availability of supply chain contracts Availability of supporting IT structure Availability of Information sharing/transparency Availability of joint decision making Availability of defined stakeholders | [47,49,57] |

| 4. Channel leadership | Availability of defined channel leader Level of trust Level of power | [50,58,59] | |

| Incentive management | 5. Company incentives | Clear statement and goals on circularity (Economic, Environmental, Social) Circular product design strategy (slowing/closing) Circular Business Model strategy (slowing/closing) | [12,50,60,61] |

| 6. Buyer incentives | Vision on circularity (Economic, Environmental, Social) | [8] | |

| 7. Personal incentives | Salary Benefits Job security | [52] |

| Tactics | Enablers | Source | Shortcomings (Gap) | Source |

|---|---|---|---|---|

| BS relationship-Product type | Pure play transformer manufacturer | Int. 6,7 | Technical possibilities for reusing materials | Int. 4,7 |

| BS relationship | Int. 1,5,8 | |||

| BS relationship-Relationship type | Partnerships | Int. 3,4,6,7,8 Obs. 1,2 | Lack of knowledge | Int. 1 Obs. 1,2,3 |

| Captive buyer | Int. 5 | Captive supplier | Int. 1,2,3,4,5,6,8 | |

| Supplier satisfaction | Int. 1,2,3,4,6,7,8 | Economic imbalance between BS | Int. 6 | |

| Captive buyer | Int. 5 | |||

| Stakeholder-Coordination | Joint decision making | Int.1,2,3,5 | Threat of competitors | Int. 1 |

| Information sharing | Int.1,2,3 Doc. 5,11 Obs. 1 | Different interests among internal stakeholders | Int. 3,4 Doc. 5 Obs. 1,2,3 | |

| Defined stakeholders | Int. 1,2,4,6 | Lack of open communication back and forward | Int. 4 | |

| Availability of contracts | Int. 6,7,8 | |||

| BS relationship | Int. 3,4,7 | |||

| Stakeholders-Channel leadership | Internal leader | Int. 1,2,3,4,6,7,8 | Lack of involvement for backward channel | Int. 1 |

| Internal leadership on power | Int. 2,7,8 | Lack of ownership | Int. 2,4 Obs. 2,3 | |

| Internal leadership on trust | Int. 1,3,5,6,7,8 | |||

| External channel leader | Int. 1,2,3,4,5,6,7,8 | |||

| External leadership on trust | Int. 1,2,3,4,5,6,7,8 | |||

| External leadership on power | Int. 2,4 | |||

| Company incentives | First mover advantage | Int. 5 | Lack of buyer incentives | Int. 1,2,3,4,5,6,8 Doc 1,4,5,6,12 |

| BS relationship | Int. 1,2,3,4,5,6,8 Doc 4 | Economic driven culture | Int. 2,7 | |

| Lack of knowledge | Int. 1,2,4,5,6,7,8 Obs. 1,2,3 Doc. 5,10,14 | |||

| Complexity of network | Int. 7 | |||

| Buyer incentives | Development knowledge by experimenting | Int. 1,2,3,4 Doc. 2,13,14,15 | Lack of knowledge | Int. 1,2,6,8 Doc. 8 |

| Weighting factors and clear defined goals | Int. 2,3,4,5,6,8 Doc. 7,15 | Lack of willingness | Int. 1,3,4,5,6,7 | |

| BS relationship | Int. 6,8 Doc. 2,3,9 | Complexity of network | Int. 7 | |

| BS relationship | Int. 5 | |||

| Personal incentives | Job security | Int. 2,6 | Lack of benefits | Int. 4,8 |

| Personal interest | Int. 1,2,3,4,5,6,7,8 | Lack of knowledge | Int. 1,5 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

van Tilburg, M.; Krikke, H.; Lambrechts, W. Supply Chain Relationships in Circular Business Models: Supplier Tactics at Royal Smit Transformers. Logistics 2022, 6, 77. https://doi.org/10.3390/logistics6040077

van Tilburg M, Krikke H, Lambrechts W. Supply Chain Relationships in Circular Business Models: Supplier Tactics at Royal Smit Transformers. Logistics. 2022; 6(4):77. https://doi.org/10.3390/logistics6040077

Chicago/Turabian Stylevan Tilburg, Marlies, Harold Krikke, and Wim Lambrechts. 2022. "Supply Chain Relationships in Circular Business Models: Supplier Tactics at Royal Smit Transformers" Logistics 6, no. 4: 77. https://doi.org/10.3390/logistics6040077

APA Stylevan Tilburg, M., Krikke, H., & Lambrechts, W. (2022). Supply Chain Relationships in Circular Business Models: Supplier Tactics at Royal Smit Transformers. Logistics, 6(4), 77. https://doi.org/10.3390/logistics6040077