Cash Flow Bullwhip—Literature Review and Research Perspectives

Abstract

1. Introduction

2. Theoretical Basis

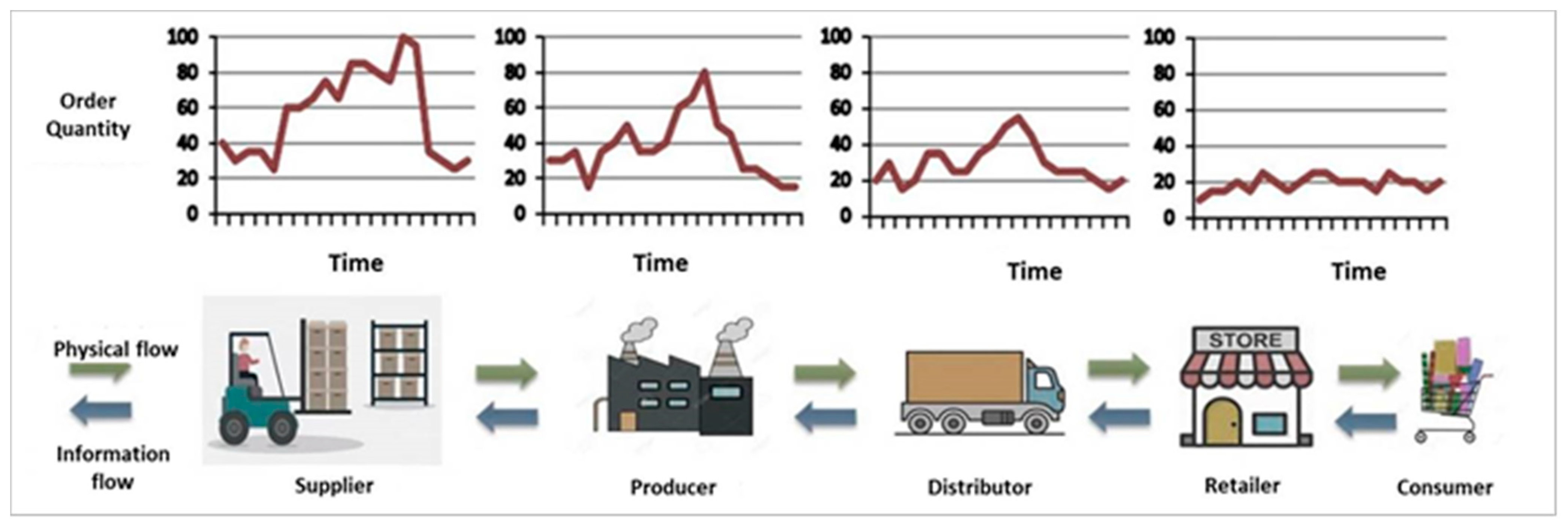

2.1. Supply Chains and Bullwhip Effect

- Frequency of updating the demand forecasts

- Additional lead times and safety stocks added to the forecasts by each actor in the chain

- Batch orders aiming to optimize the fixed launch costs at an individual level (economies of scale); indeed, instead of generating replenishment orders based on demand, planners wait until an economical order quantity, a lot size determined by MRP order policy, or periodic review to take place

- Price fluctuations and promotions pushing supply chain players to place orders that are disproportionate to the actual demand of the end customer, which increasingly amplifies the distortion of demand

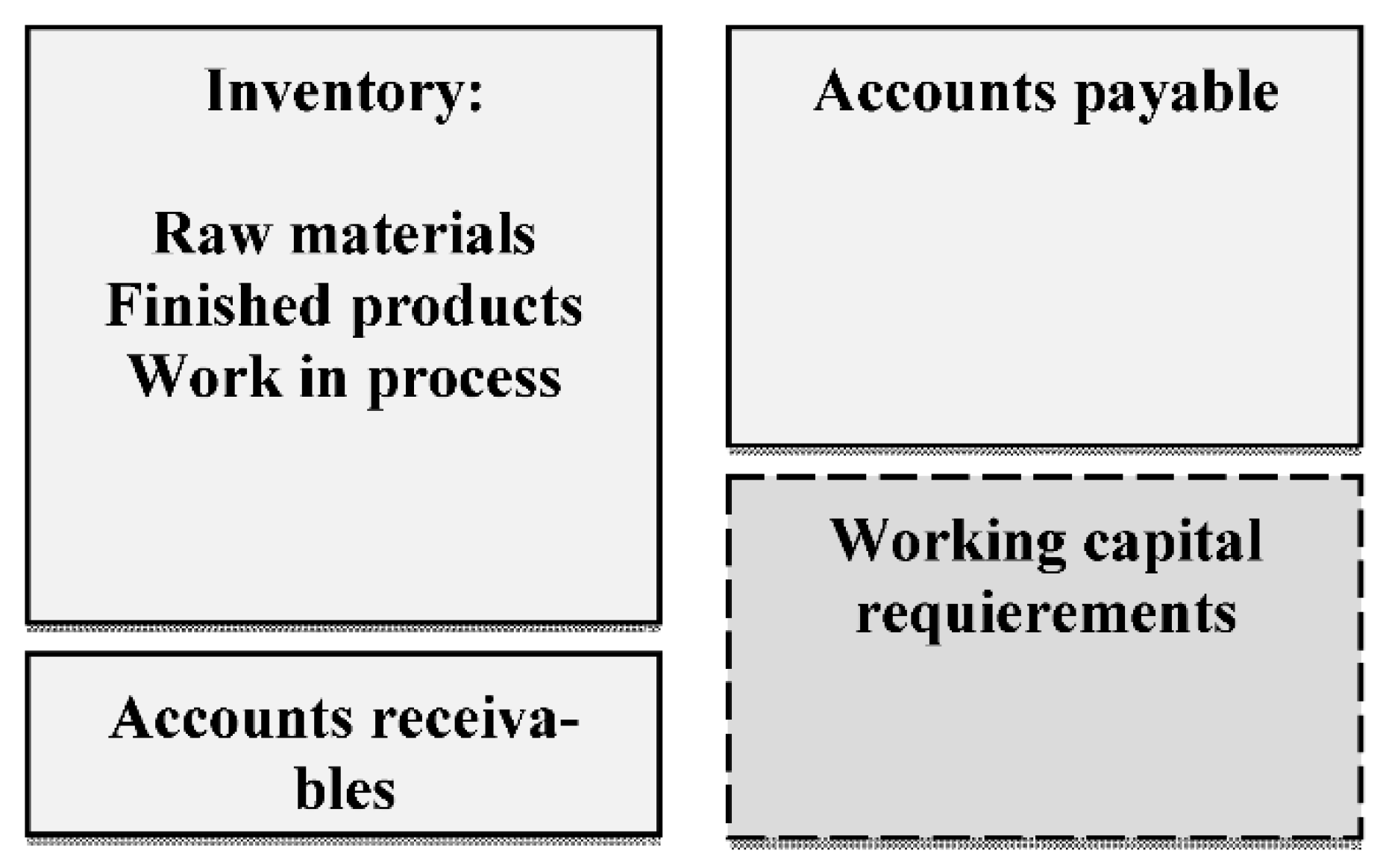

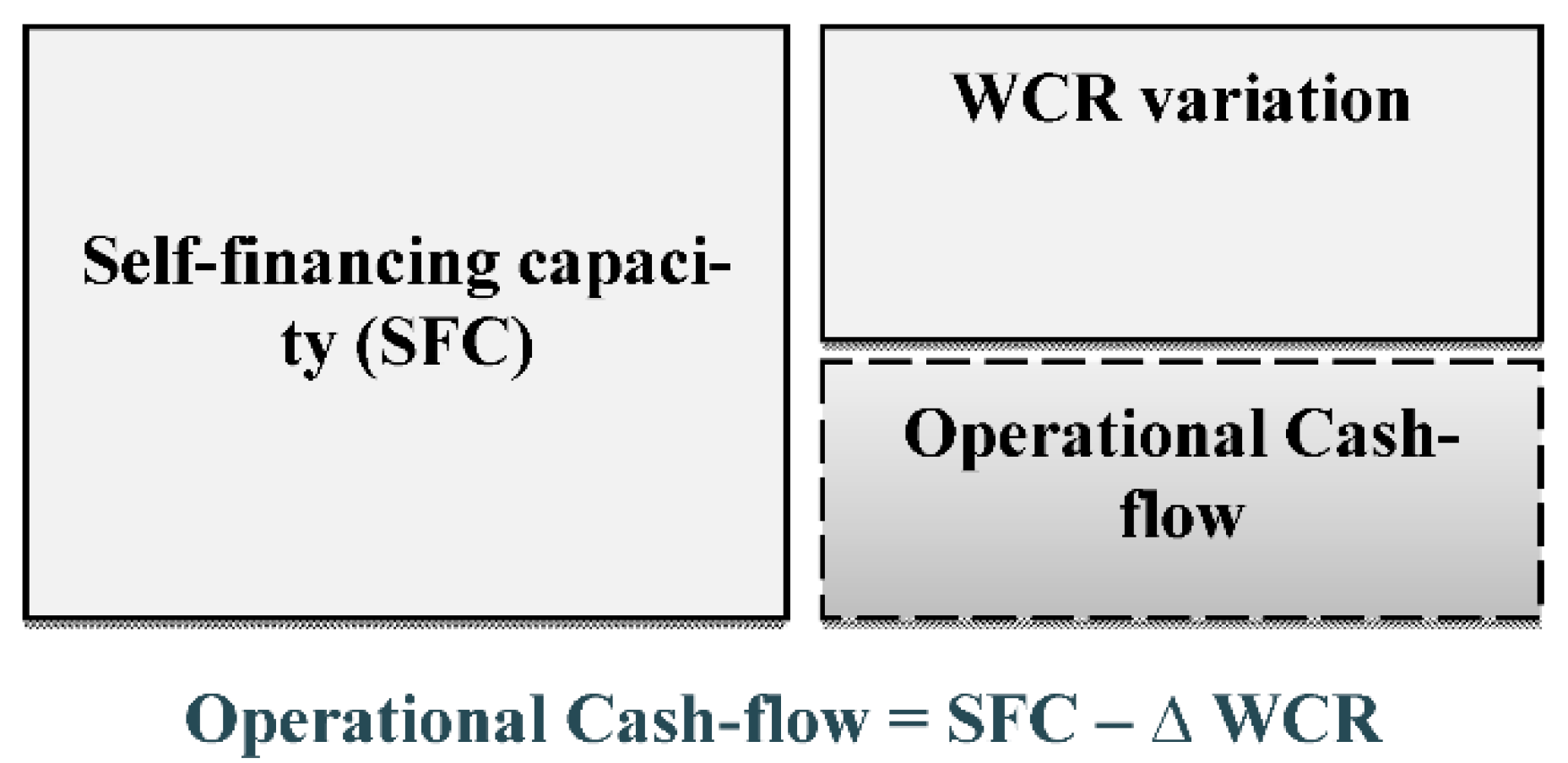

2.2. Bullwhip Effect and Financial Impacts: From Bullwhip Effect to Cash Flow Bullwhip

3. Cash Flow Bullwhip: State of the Art

3.1. Methodology

3.1.1. Definition of Keywords and Databases

3.1.2. Definition of Selection Criteria

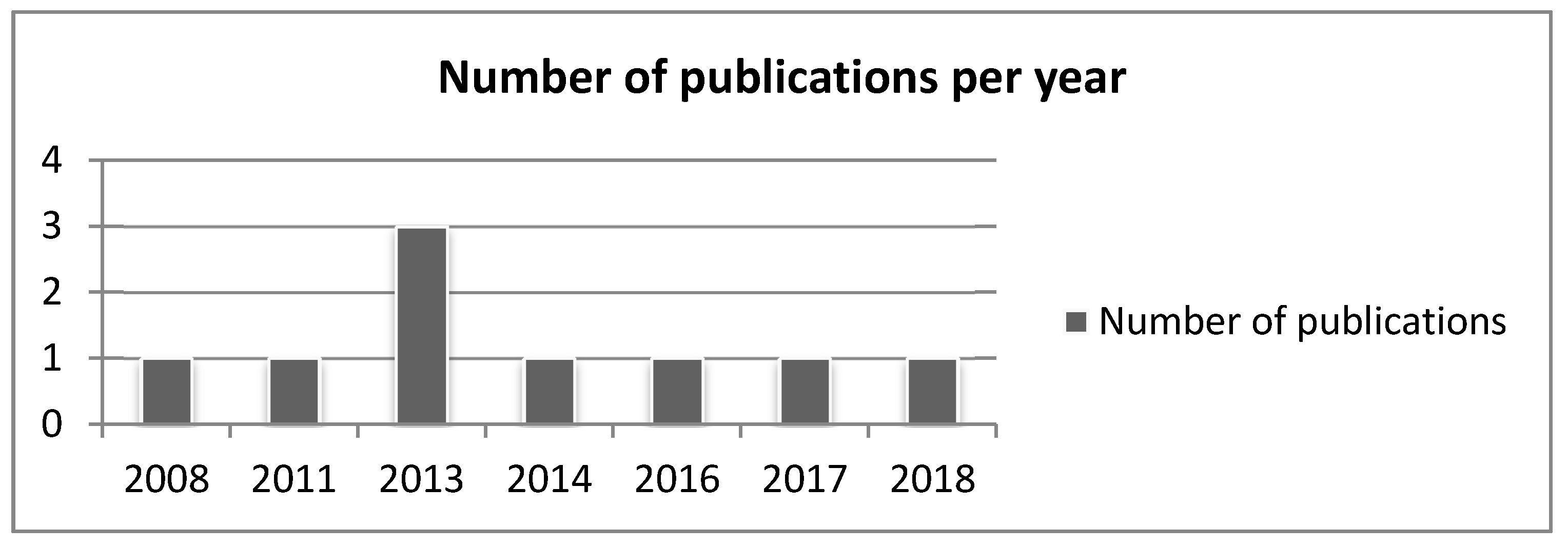

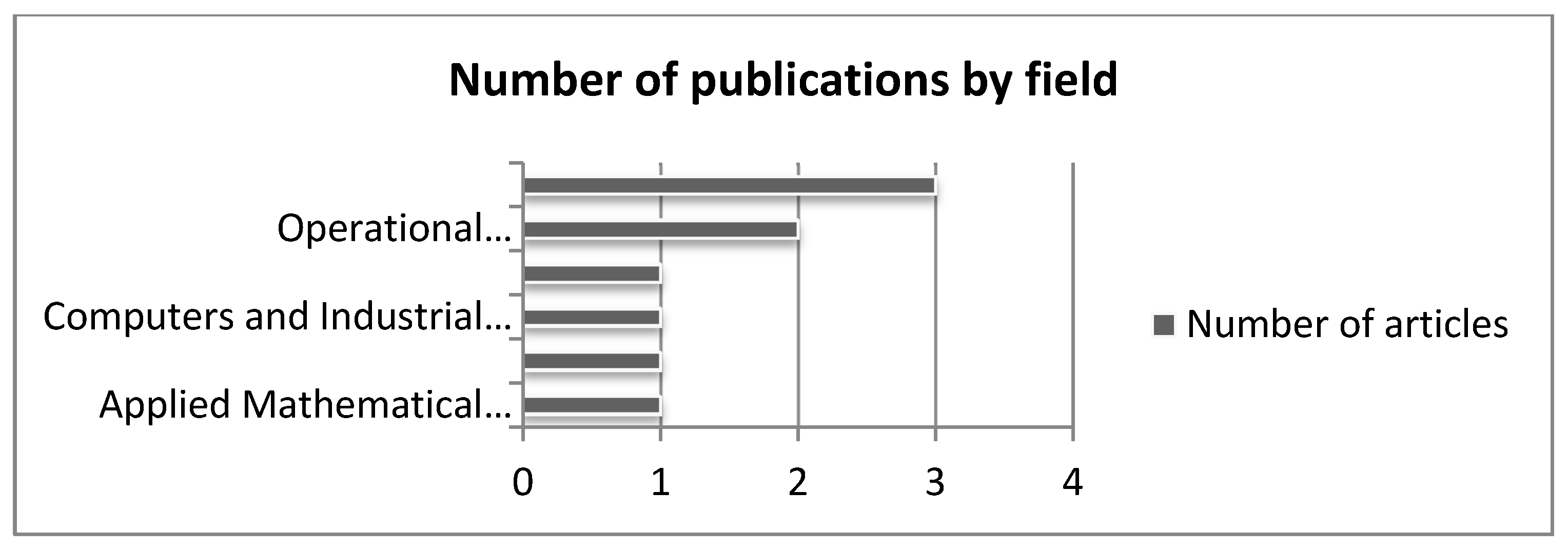

3.2. Descriptive Analysis of the Results

3.3. Content Analysis Results

4. Discussion

5. Conclusions

- The role of digital technologies in the control of CFB

- The impact of CFB on the profitability of the company and its investment capacity

- The study of the CFB phenomenon in light of the pandemic COVID-19 crisis

- The determination of CFB control’s mechanisms

- The study of the dynamics associated with CFB within the framework of the omnichannel commerce.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Burbidge, J.L. Production Flow Analysis; Oxford University Press: Oxford, UK, 1989. [Google Scholar]

- Drissi, H.; El Ghazali, M. Audit Intene et Management des Risques. 2018. Available online: https://www.ceeol.com/search/chapter-detail?id=685399 (accessed on 24 January 2021).

- Faucher, P.; Bazet, J. Finance d’entreprise; Nathan: Paris, France, 2010. [Google Scholar]

- Fri, M.; Fedouaki, F.; Douaioui, K.; Mabrouki, C.; Semma, E. Supply chain performance evaluation models, state-of-the-art and future directions. Int. J. Eng. Adv. Technol. 2019, 9. [Google Scholar] [CrossRef]

- Goodarzi, M.; Makvandi, P.; Saen, R.F.; Sagheb, M.D. What are causes of cash flow bullwhip effect in centralized and decentralized supply chains? Appl. Math. Model. 2017, 44, 640–654. [Google Scholar] [CrossRef]

- Forrester, J.W. Industrial Dynamics; The MIT Press: Cambridge, MA, USA, 1961. [Google Scholar]

- Lee, H.L.; Padmanabhan, V.; Whang, S. The bullwhip effect in supply chains. Sloan Manag. Rev. 1997, 38, 93–102. [Google Scholar] [CrossRef]

- Serrano, A.; Oliva, R.; Kraiselburd, S. Risk propagation through payment distortion in supply chains. J. Oper. Manag. 2018, 58, 1–14. [Google Scholar] [CrossRef]

- Sterman, J.D. Modeling managerial behavior: Misperceptions of feedback in a dynamic decision making experiment. Manag. Sci. 1989, 35, 321–339. [Google Scholar] [CrossRef]

- Tangsucheeva, R.; Prabhu, V. Modeling and analysis of cash-flow bullwhip in supply chain. Int. J. Prod. Econ. 2013, 145, 431–447. [Google Scholar] [CrossRef]

- Tangsucheeva, R.; Prabhu, V. Stochastic financial analytics for cash flow forecasting. Int. J. Prod. Econ. 2014, 158, 65–76. [Google Scholar] [CrossRef]

- Tsai, C.Y. On supply chain cash flow risks. Decis. Support Syst. 2008, 44, 1031–1042. [Google Scholar] [CrossRef]

- Tsai, C.Y. On delineating supply chain cash flow under collection risk. Int. J. Prod. Econ. 2011, 129, 186–194. [Google Scholar] [CrossRef]

| - We consider the following elements at the end of the first month “M1” for a company: |

| |

| - Due to the phenomenon of bullwhip effect, we suppose that the average inventory of this company has grown to $1,100,000 in the following month “M1”. We assume that the rest of elements have not changed. |

|

| Authors | Analysis Angle | ||

|---|---|---|---|

| Simulation | Forecasting | Optimization | |

| Chih-Yang Tsai, 2008 | Optimization of the CCC and reduction of the risk of collection | ||

| Chih-Yang Tsai, 2011 | Reducing the risk of collection through a probabilistic optimization model | ||

| Rattachut Tangsucheeva, Vittaldas Prabhu, 2013 | Mathematical modeling of the CFB and simulation of the relationship between the stock and the CFB | ||

| Rattachut Tangsucheeva, Vittaldas Prabhu, 2014 | Stochastic cash flow forecasting model taking into account the CFB | ||

| Marziye Goodarzi, Payam Makvandi, Reza Farzipoor Saen, Mohammad Daniel Sagheb, 2017 | Mathematical modeling using response surface methodology (RSM) | ||

| Alejandro Serrano, Rogelio Oliva, Santiago Kraiselburd, 2018 | Mathematical modeling of the impact of CFB on the propagation of the risk of non-payment. | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lamzaouek, H.; Drissi, H.; El Haoud, N. Cash Flow Bullwhip—Literature Review and Research Perspectives. Logistics 2021, 5, 8. https://doi.org/10.3390/logistics5010008

Lamzaouek H, Drissi H, El Haoud N. Cash Flow Bullwhip—Literature Review and Research Perspectives. Logistics. 2021; 5(1):8. https://doi.org/10.3390/logistics5010008

Chicago/Turabian StyleLamzaouek, Hicham, Hicham Drissi, and Naima El Haoud. 2021. "Cash Flow Bullwhip—Literature Review and Research Perspectives" Logistics 5, no. 1: 8. https://doi.org/10.3390/logistics5010008

APA StyleLamzaouek, H., Drissi, H., & El Haoud, N. (2021). Cash Flow Bullwhip—Literature Review and Research Perspectives. Logistics, 5(1), 8. https://doi.org/10.3390/logistics5010008