Logistics Services Sector and Economic Recession in Greece: Challenges and Opportunities

Abstract

1. Introduction

- RQ#1: What are the scientifically reported repercussions of economic crisis eras on each functional area of logistics services?

- RQ#2: What is the prioritization of the main challenges confronted by the Greek logistics service providers within the recent economic recession period?

- RQ#3: What is the business outlook about the prospects of the Greek logistics landscape?

2. Materials and Methods

2.1. Basic Terminology

2.2. Theoretical Background

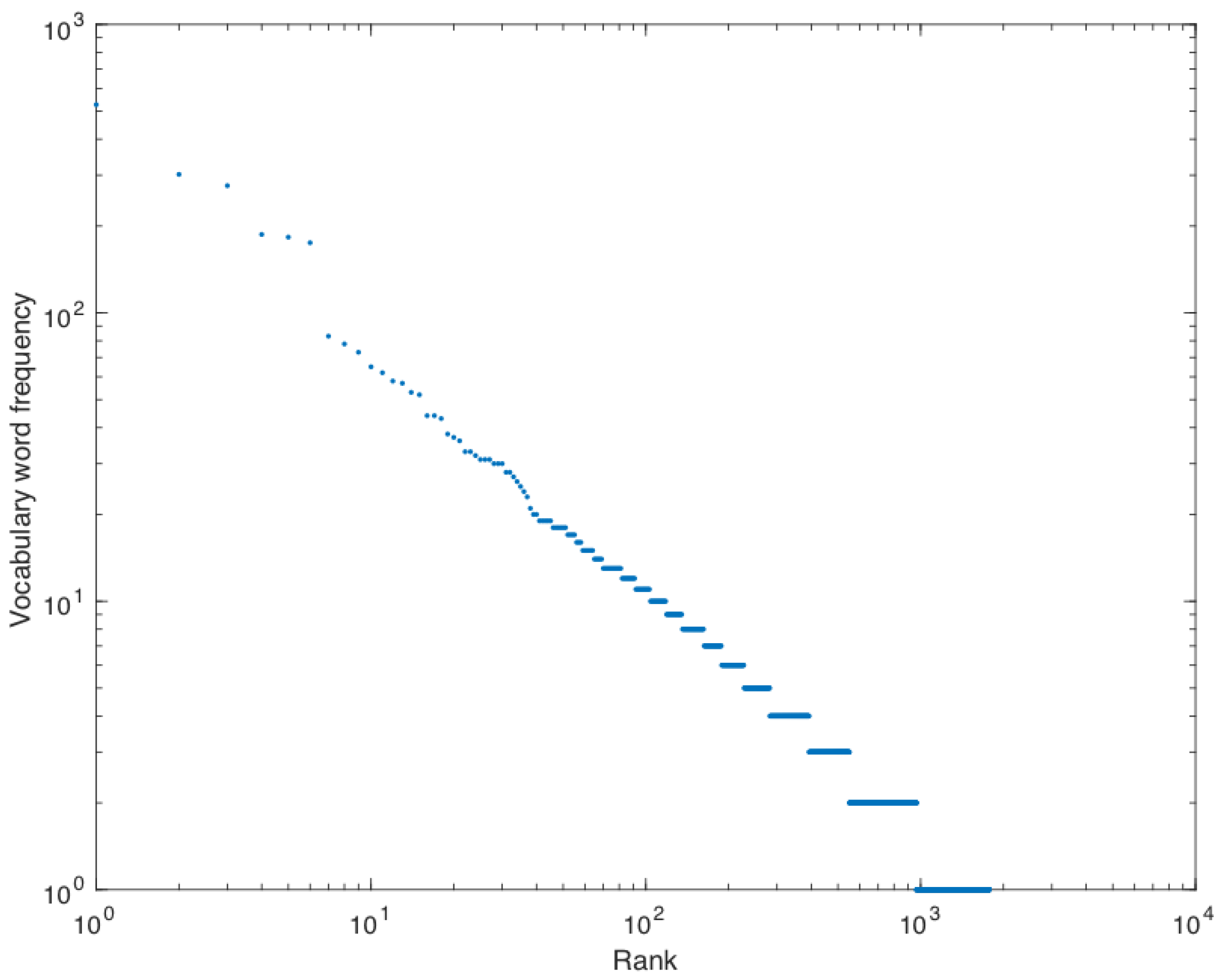

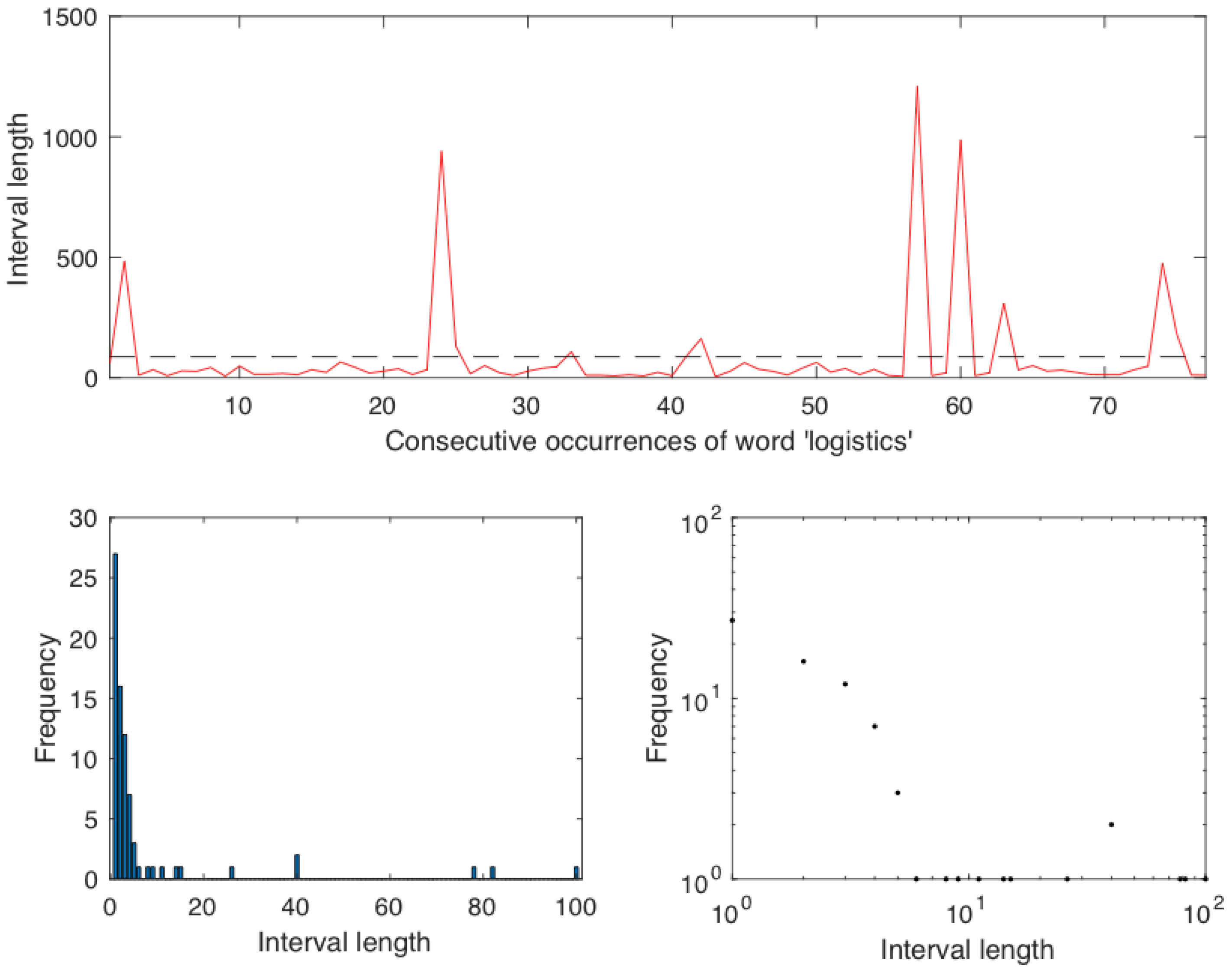

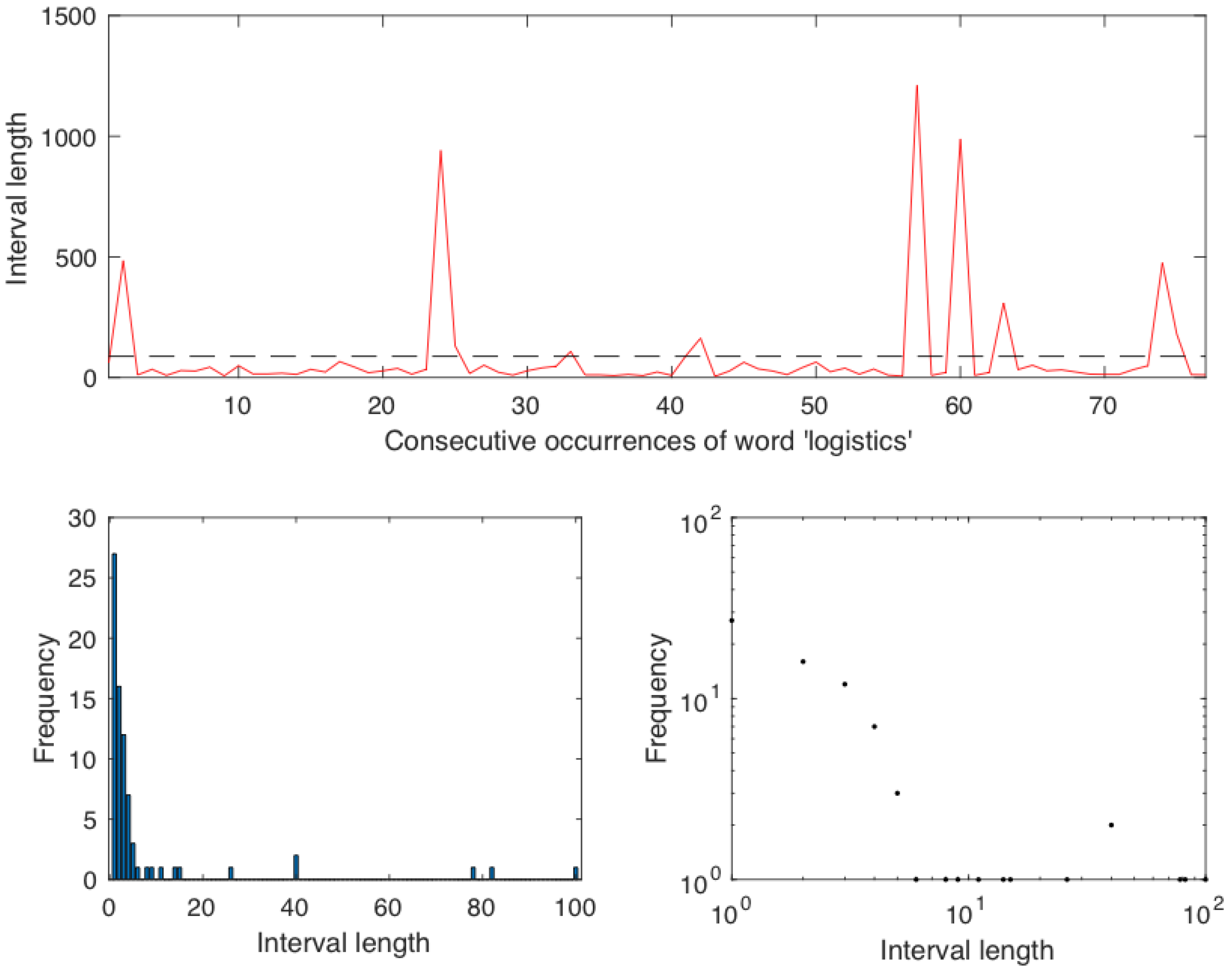

2.3. Critical Taxonomy and Semantic Analysis

2.4. Empirical Research

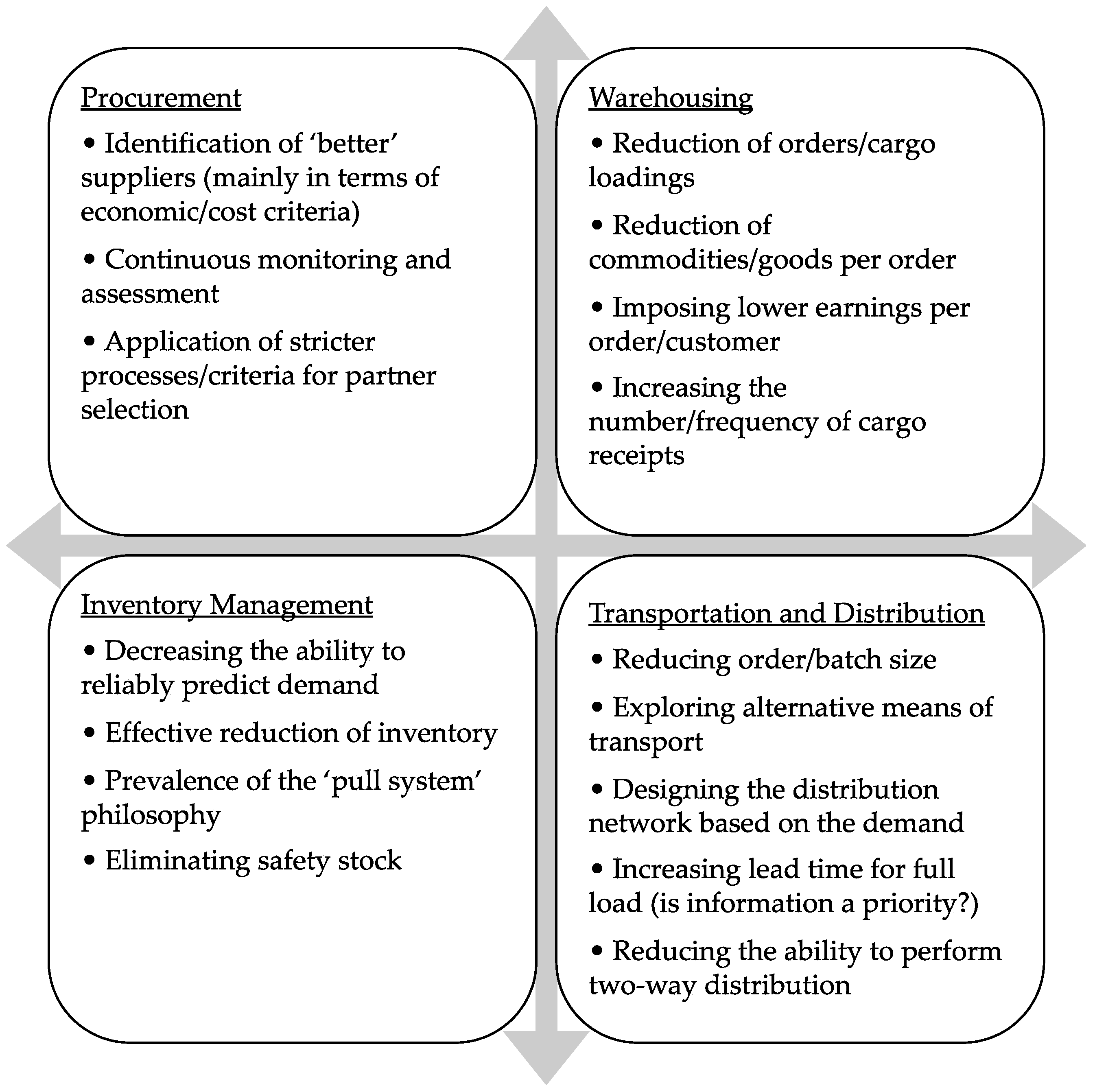

3. Economic Crisis and Logistics: Effects and Response Mechanisms

3.1. Warehousing

3.2. Transportation and Distribution

3.3. Procurement

3.4. Inventory Management

4. The Recession-Logistics Interplay in Greece

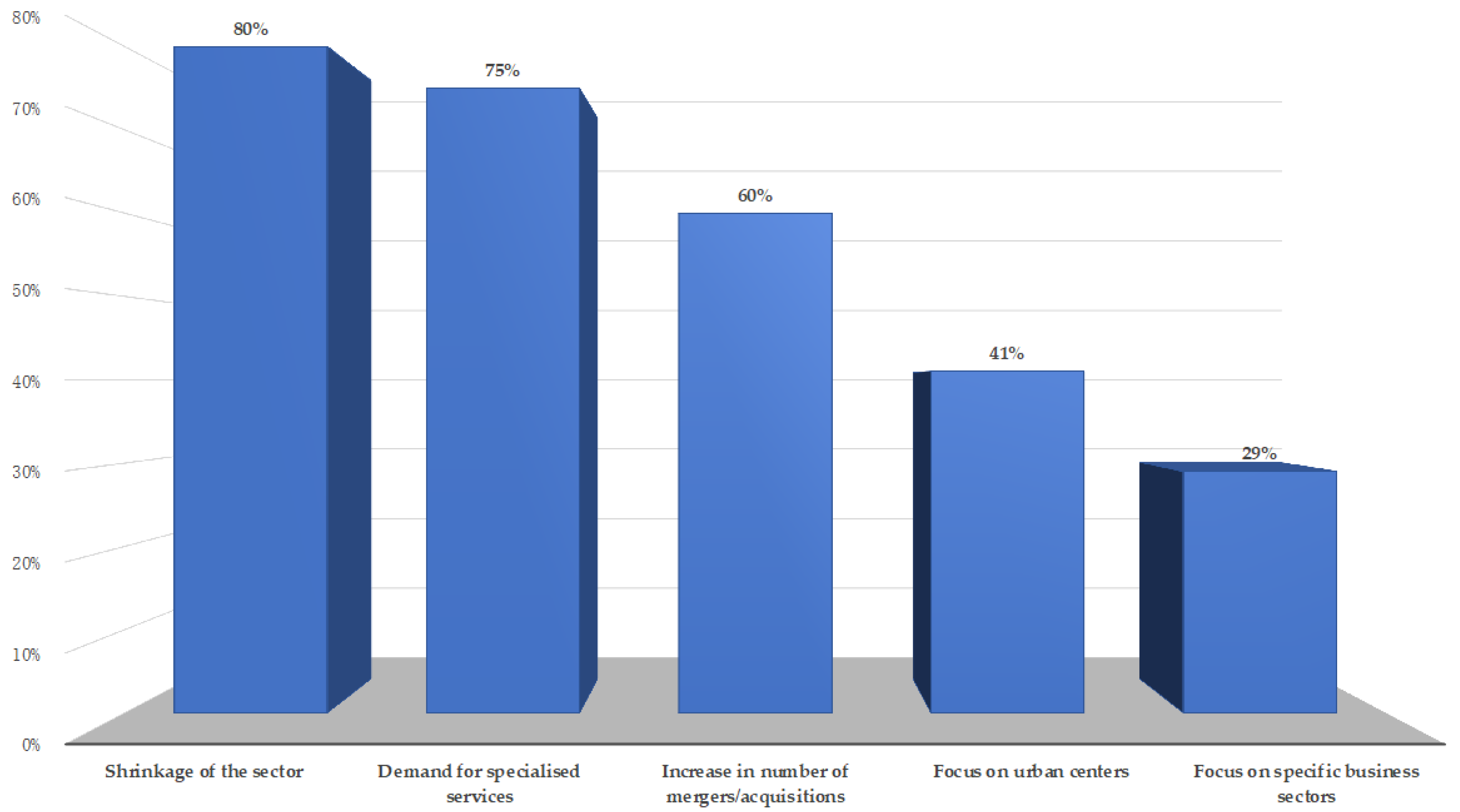

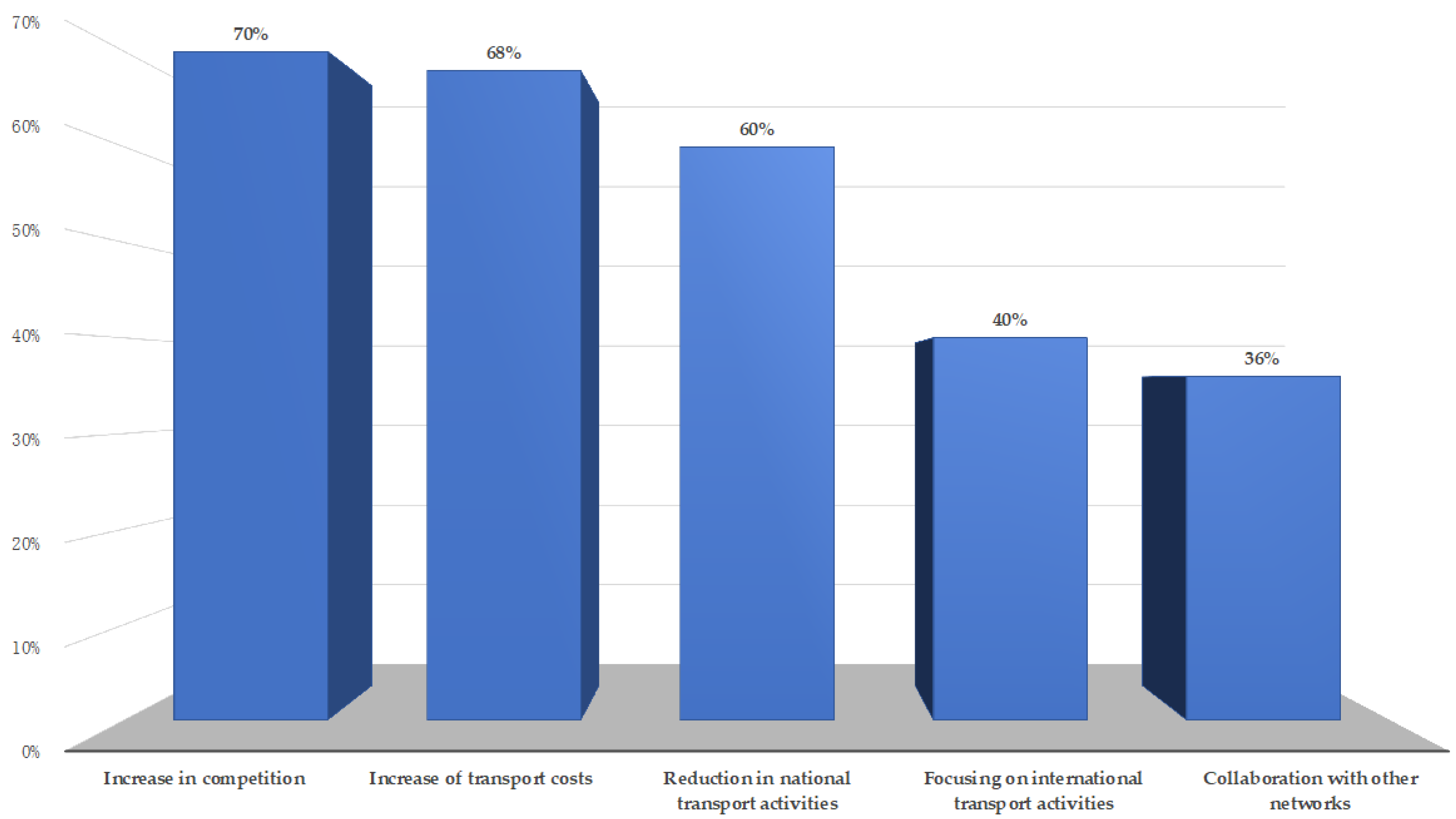

4.1. Challenges in the National Logistics Landscape

4.2. Prospects of the National Logistics Landscape

- Demand forecasting is a complex process—Demand prediction is difficult even for firms’ loyal customers. The main underlining challenges refer to the collection of reliable demand information and the lack of proper communication with the customers.

- Continuous partner evaluation is essential—Continuous monitoring and assessment of partners is required to redefine collaborative relations. In this sense, short-term and flexible contractual agreements are regarded as beneficial, considering demand volatility as well.

- Inventory management and control needs revision—Meticulous inventory management and control should be redefined from the basis of full service to cost efficiency.

- Customer selection should be more rigorous—Logistics service providers should evaluate and select their customers. In simple terms, logistics managers should explore cooperation with trusted customers who are able to fulfil their business obligations, as the financial liquidity problem in the Greek logistics sector is growing.

- Warehouse operational efficiency should increase—The increased workload of staff in warehouse/distribution centers results in decreased productivity, particularly at peak times. In this regard, logistics managers should explore solutions to increase productivity while minimizing the operating costs in warehouse/distribution centers.

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Pounder, P.; Bovell, G.; Pilgrim-Worrell, S. A review of supply chain management and its main external influential factors. Supply Chain Forum Int. J. 2013, 14, 42–50. [Google Scholar] [CrossRef]

- Christopher, M.; Holweg, M. “Supply chain 2.0”: Managing supply chains in the era of turbulence. Int. J. Phys. Distr. Logist. 2011, 41, 63–82. [Google Scholar] [CrossRef]

- Knack, S.; Keefer, P. Institutions and economic performance: Cross-country test using alternative institutional measures. Econ. Polit. 1995, 7, 207–227. [Google Scholar] [CrossRef]

- Lean, H.H.; Huang, W.; Hong, J. Logistics and economic development: Experience from China. Transp. Policy 2014, 32, 96–104. [Google Scholar] [CrossRef]

- Ghazzawi, I.A.; Palladini, M.; Martinelli-Lee, T. The Wal-Mart Stores, Inc.: An American dream that touched the world. J. Int. Acad. Case Stud. 2014, 20, 9–32. [Google Scholar]

- Solakivi, T.; Töyli, J.; Ojala, L. Logistics outsourcing, its motives, and the level of logistics costs in manufacturing and trading companies operating in Finland. Prod. Plan. Control 2013, 24, 388–398. [Google Scholar] [CrossRef]

- Hofmann, E.; Solakivi, T.; Töyli, J.; Zinn, M. Oil price shocks and the financial performance patterns of logistics service providers. Energy Econ. 2018, 72, 290–306. [Google Scholar] [CrossRef]

- Pallis, A.A.; de Langen, P.W. Seaports and the structural implications of the economic crisis. Res. Transp. Econ. 2010, 27, 10–18. [Google Scholar] [CrossRef]

- Folinas, D.; Aidonis, D. The effects of economic crisis to logistics outsourcing. Int. J. Bus. Sci. Appl. Man. 2012, 7, 56–68. [Google Scholar]

- Tsekeris, T. Interregional trade network analysis for road freight transport in Greece. Transport. Res. E-Logist. 2016, 85, 132–148. [Google Scholar] [CrossRef]

- Espinasse, B.; Ferrarini, A.; Lapeyre, R. A multi-agent system for modelisation and simulation-emulation of supply-chains. IFAC Proc. Vol. 2000, 33, 413–418. [Google Scholar] [CrossRef]

- Council of Logistics Management. What is Logistics?—Logistics means having the Right Thing, at the Right Place, at the Right Time. Available online: http://www.logisticsworld.com/logistics.htm (accessed on 10 April 2018).

- Bolumole, Y.A.; Closs, D.J.; Rodammer, F.A. The economic development role of regional logistics hubs: A cross-country study of interorganizational governance models. J. Bus. Logist. 2015, 36, 182–198. [Google Scholar] [CrossRef]

- Castán Broto, V.; Dewberry, E. Economic crisis and social learning for the provision of public services in two Spanish municipalities. J. Clean. Prod. 2016, 112, 3018–3027. [Google Scholar] [CrossRef]

- Pavlatos, O.; Kostakis, H. Management accounting practices before and during economic crisis: Evidence from Greece. Adv. Acc. 2015, 31, 150–164. [Google Scholar] [CrossRef]

- Geary, J. Economic crisis, austerity and trade union responses: The Irish case in comparative perspective. Eur. J. Ind. Relat. 2016, 22, 131–147. [Google Scholar] [CrossRef]

- Mosquera, M.S. Trade unionism and social pacts in Spain in comparative perspective. Eur. J. Ind. Relat. 2018, 24, 23–38. [Google Scholar] [CrossRef]

- World Trade Organization. WTO Sees 9% Global Trade Decline in 2009 as Recession Strikes. Available online: https://www.wto.org/english/news_e/pres09_e/pr554_e.htm (accessed on 24 August 2018).

- Lee, K.; Ni, S.; Ratti, R. Oil shocks and the macroeconomy: The role of price variability. Energy J. 1995, 16, 39–56. [Google Scholar] [CrossRef]

- Notteboom, T.; Rodrigue, J.-P. The future of containerization: Perspectives from maritime and inland freight distribution. GeoJournal 2009, 74, 7–22. [Google Scholar] [CrossRef]

- Kavussanos, M.G.; Marcoulis, S.N. Cross-industry comparisons of the behavior of stock returns in shipping, transportation and other industries. Res. Transp. Econ. 2004, 12, 107–142. [Google Scholar] [CrossRef]

- Vasiliauskas, A.V.; Barysiene, J. An economic evaluation model of the logistic system based on container transportation. Transport 2008, 23, 311–315. [Google Scholar] [CrossRef]

- Leuschner, R.; Carter, C.R.; Goldsby, T.J.; Rogers, Z.S. Third-party logistics: A meta-analytic review and investigation of its impact on performance. J. Supply Chain Manag. 2014, 50, 21–43. [Google Scholar] [CrossRef]

- Chikán, A. Integration of production and logistics—In principle, in practice and in education. Int. J. Prod. Econ. 2001, 69, 129–140. [Google Scholar] [CrossRef]

- Wacker, J.G.; Yang, C.; Sheu, C. A transaction cost economics model for estimating performance effectiveness of relational and contractual governance: Theory and statistical results. Int. J. Oper. Prod. Man. 2016, 36, 1551–1575. [Google Scholar] [CrossRef]

- Goulielmos, A.M.; Pardali, A.I. Container ports in Mediterranean Sea: A supply and demand analysis in the age of globalization. Int. J. Transp. Econ. 2001, 29, 91–117. [Google Scholar]

- Veselovsky, M.Y.; Izmailova, M.A.; Bogoviz, A.V.; Lobova, S.V.; Alekseev, A.N. Business environment in Russia and its stimulating influence on innovation activity of domestic companies. J. Appl. Econ. Sci. 2017, 12, 1967–1981. [Google Scholar]

- Mongeon, P.; Paul-Hus, A. The journal coverage of Web of Science and Scopus: A comparative analysis. Scientometrics 2016, 106, 213–228. [Google Scholar] [CrossRef]

- Allal-Chérif, O.; Maira, S. Collaboration as an anti-crisis solution: The role of the procurement function. Int. J. Phys. Distr. Log. 2011, 41, 860–877. [Google Scholar] [CrossRef]

- Bendavid, I.; Herer, Y.T.; Yücesan, E. Inventory management under working capital constraints. J. Simul. 2017, 11, 62–74. [Google Scholar] [CrossRef]

- Bendig, D.; Brettel, M.; Downar, B. Inventory component volatility and its relation to returns. Int. J. Prod. Econ. 2018, 200, 37–49. [Google Scholar] [CrossRef]

- Brandenburg, M. Supply chain efficiency, value creation and the economic crisis—An empirical assessment of the European automotive industry 2002-2010. Int. J. Prod. Econ. 2016, 171, 321–335. [Google Scholar] [CrossRef]

- de Leeuw, S.; Wiers, V.C.S. Warehouse manpower planning strategies in times of financial crisis: Evidence from logistics service providers and retailers in The Netherlands. Prod. Plan. Control 2015, 26, 328–337. [Google Scholar] [CrossRef]

- Kempf, K.G.; Erhun, F.; Hertzler, E.F.; Rosenberg, T.R.; Peng, C. Optimizing capital investment decisions at Intel Corporation. Interfaces 2013, 43, 62–78. [Google Scholar] [CrossRef]

- Kiesel, F.; Ries, J.M.; Tielmann, A. Reprint of “The impact of mergers and acquisitions on shareholders’ wealth in the logistics service industry”. Int. J. Prod. Econ. 2017, 194, 261–277. [Google Scholar] [CrossRef]

- Lan, S.L.; Zhong, R.Y. Coordinated development between metropolitan economy and logistics for sustainability. Resour. Conserv. Recy. 2018, 128, 345–354. [Google Scholar] [CrossRef]

- Mazzarino, M. Strategic scenarios of global logistics: What lies ahead for Europe? Eur. Transp. Res. Rev. 2012, 4, 1–18. [Google Scholar] [CrossRef]

- Moschovou, T.P. Freight transport impacts from the economic crisis in Greece. Transp. Policy 2017, 57, 51–58. [Google Scholar] [CrossRef]

- Rothengatter, W. Economic Crisis and Consequences for the Transport Sector. In Transport Moving to Climate Intelligence, 1st ed.; Rothengatter, W., Hayashi, Y., Schade, W., Eds.; Part of the Transportation Research, Economics and Policy Book Series; Springer Science + Business Media: New York, NY, USA, 2011. [Google Scholar]

- Tongzon, J.; Nguyen, H.-O. China’s economic rise and its implications for logistics: The Australian case. Transp. Policy 2009, 16, 224–231. [Google Scholar] [CrossRef]

- Yu, M.-C.; Wang, C.-N.; Ho, N.-N.-Y. A grey forecasting approach for the sustainability performance of logistics companies. Sustainability 2016, 8, 866. [Google Scholar] [CrossRef]

- Min, H. Examining logistics outsourcing practices in the United States: From the perspectives of third-party logistics service users. Logist. Res. 2013, 6, 133–144. [Google Scholar] [CrossRef]

- Popa, V. The financial supply chain management: A new solution for supply chain resilience. Amfiteatru Econ. 2013, 15, 140–153. [Google Scholar]

- Bentley, Y. Managers’ perspectives of logistics and supply chain changes during the recent economic downturn. Int. J. Logist. Res. Appl. 2011, 14, 427–441. [Google Scholar] [CrossRef]

- Piranfar, H. Innovative management of logistics and supply chains: The hard times. Int. J. Bus. Perform. Supp. Chain Model. 2009, 1, 240–255. [Google Scholar] [CrossRef]

- Laxe, F.G.; Seoane, M.J.F.; Montes, C.P. Maritime degree, centrality and vulnerability: Port hierarchies and emerging areas in containerized transport (2008-2010). J. Transp. Geogr. 2012, 24, 33–44. [Google Scholar] [CrossRef]

- Banchs, R.E. Text Mining with MATLAB®; Springer Science + Business Media: New York, NY, USA, 2013; pp. 113–144. ISBN 978-1-4614-4150-2. [Google Scholar]

- Flynn, B.B.; Sakakibara, S.; Schroeder, R.G.; Bates, K.A.; Flynn, E.J. Empirical research methods in operations management. J. Oper. Manag. 1990, 9, 250–284. [Google Scholar] [CrossRef]

- Miyashita, K. Structural change in the international advanced logistics. Asian J. Ship. Logist. 2009, 25, 121–138. [Google Scholar] [CrossRef]

- Cerda, R.; Silva, Á.; Valente, J.T. Impact of economic uncertainty in a small open economy: The case of Chile. Appl. Econ. 2018, 50, 2894–2908. [Google Scholar] [CrossRef]

- ICAP. Third Party Logistics Providers; ICAP Group: Athens, Greece, 2017. [Google Scholar]

- Milonas, P.; Tzakou-Lampropoulou, N. Small and Medium Enterprises: Conjunction Research—Special Topic: Logistics—Wholesale Services. Available online: https://www.nbg.gr/greek/the-group/press-office/e-spot/reports/Documents/SMEs_logistics_el.pdf (accessed on 17 June 2018).

- Zaman, K.; Shamsuddin, S. Green logistics and national scale economic indicators: Evidence from a panel of selected European countries. J. Clean. Prod. 2017, 143, 51–63. [Google Scholar] [CrossRef]

- Tsolakis, N.; Anthopoulos, L. Eco-cities: An integrated system dynamics framework and a concise research taxonomy. Sustain. Cities Soc. 2015, 17, 1–14. [Google Scholar] [CrossRef]

- Pagano, A.M.; Light, M.K.; Sánchez, O.V.; Ungo, R.; Tapiero, E. Impact of the Panama Canal expansion on the Panamanian economy. Marit. Policy Manag. 2012, 39, 705–722. [Google Scholar] [CrossRef]

| Study | Functional Area | Methodology | Research Sample | Key Repercussions of Economic Crisis |

|---|---|---|---|---|

| [29] | ● Procurement | Constructivist | 12 Buying experts | ● Promotes collaborative procurement practices |

| [30] | ● Inventory Management | Simulation | Experimentation | ● Promotes flexible inventory management practices |

| [31] | ● Warehousing ● Inventory Management | Statistical Analysis | 1219 U.S. manufacturing firms | ● Increases volatility |

| [32] | ● Logistics | Statistical Analysis | 40 Firms from the European automotive industry | ● Supports reductions in working capital and cost of goods sold |

| [33] | ● Warehousing | Survey | 50 Logistics services providers and 52 retailers | ● Motivates changes in manpower planning in warehouses |

| [34] | ● Procurement | Empirical Procurement Framework | Intel Corporation | ● Motivates new procurement frameworks that can drive cost reductions and revenues |

| [35] | ● Logistics | Event Study | 826 Mergers and Acquisitions (M&A) announcements from the global logistics industry between 1996 and 2015 | ● Fosters competition due to decline in international trade ● Benefits 3PL companies engaged in M&A announcements |

| [36] | ● Logistics | Bayesian Network | 87 Experts through questionnaires | ● Suggests the coordinated development of logistics with national economies through infrastructure investments, research and technological development, and growth of the logistics industry in terms of enhanced coordination and structural optimization |

| [37] | ● Logistics | Primary Research - Interviews | 15 Representatives from 10 firms | ● Decreases flows ● Fosters oligopoly in the logistics services market ● Promotes strategic alliances and mergers ● Promotes modal shifts towards less costly and more efficient modes of transport |

| [38] | ● Warehousing ● Transportation and Distribution | Descriptive Statistics (EU-28 data) | N/A | ● Reveals that road freight transport flows (in t-km) are corelated to GDP |

| [8] | ● Transportation and Distribution | Statistical Analysis | Major European ports | ● Supports reductions in container throughput ● Motivates structural changes in maritime logistics |

| [39] | ● Transportation and Distribution | System Dynamics | N/A | ● Fosters reductions in international trade and freight transport ● Promotes structural changes in the sector of freight transport and logistics |

| [40] | ● Warehousing ● Logistics | Statistical Analysis | GTAP 6 multi-regional trade database | ● Promotes reforms |

| [41] | ● Transportation and Distribution | Grey Model Forecasting; Data Envelopment Analysis | 19 Logistics companies from Europe, Japan, America and Korea | ● Fosters investments on sustainable technologies |

| [42] | ● Logistics | Survey | 64 U.S. firms | ● Limits the demand for 3PL services |

| [43] | ● Logistics | Critical Discussion | N/A | ● Promotes collaborations and alliances ● Motivates new financing strategies |

| [44] | ● Logistics | Survey | 316 Respondents from: UK Chartered Institute of Logistics and Transport, UK logistics events, MSc and Executive MBA students | ● Drives reductions in employment ● Fosters reduction in product lines ● Promotes leaner work-in-process inventories ● Supports decreased stock levels ● Promotes tightening of credit terms ● Motivates use of electronic documentation to save on costs ● Results in reduced company travels ● Promotes changes in the use of 3PL ● Promotes changes in warehousing ● Promotes re-organization in distribution networks ● Supports selection of local suppliers |

| [45] | ● Logistics | Survey | N/A | ● Motivates adaptive learning ● Promotes innovation in logistics activities ● Motivates inventory management changes ● Fosters the analysis of alternative routing options |

| [46] | ● Transportation and Distribution | Graph Theory | Sample of the movements of the world fleet of container ships that have docked at least once in a Chinese port in the years 2008 and 2010 | ● Affects containerized throughput ● Affects ports’ connectivity |

| Term | Occurrence Probability |

|---|---|

| ‘economic’ | 0.0068 |

| ‘crisis’ | 0.0039 |

| ‘logistics’ | 0.0102 |

| ‘transport’ | 0.0030 |

| ‘distribution’ | 0.0012 |

| ‘inventory’ | 0.0020 |

| ‘supply’ | 0.0048 |

| ‘development’ | 0.0042 |

| Challenge | Percentage | Prioritization/Ranking |

|---|---|---|

| ● Reduced production orders from headquarters/upper management | 52.17% | 3 |

| ● Reduced market orders from customers | 55.07% | 2 |

| ● Reduced prices requested by major customers | 62.31% | 1 |

| ● Prevailed inertia in major markets | 31.88% | 6 |

| ● Stagnation in new customers or markets development | 43.47% | 5 |

| ● Reduced sales prices due to global oversupply | 20.28% | 8 |

| ● Growing market shares of competitors | 14.49% | 10 |

| ● Increased inflow of cheap imported goods | 18.84% | 9 |

| ● Growing market shares of competitors (cost of competition) | 24.63% | 7 |

| ● Increased delays in accounts receivable | 47.82% | 4 |

| ● Other | 2.89% | 11 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Folinas, D.; Tsolakis, N.; Aidonis, D. Logistics Services Sector and Economic Recession in Greece: Challenges and Opportunities. Logistics 2018, 2, 16. https://doi.org/10.3390/logistics2030016

Folinas D, Tsolakis N, Aidonis D. Logistics Services Sector and Economic Recession in Greece: Challenges and Opportunities. Logistics. 2018; 2(3):16. https://doi.org/10.3390/logistics2030016

Chicago/Turabian StyleFolinas, Dimitrios, Naoum Tsolakis, and Dimitrios Aidonis. 2018. "Logistics Services Sector and Economic Recession in Greece: Challenges and Opportunities" Logistics 2, no. 3: 16. https://doi.org/10.3390/logistics2030016

APA StyleFolinas, D., Tsolakis, N., & Aidonis, D. (2018). Logistics Services Sector and Economic Recession in Greece: Challenges and Opportunities. Logistics, 2(3), 16. https://doi.org/10.3390/logistics2030016