1. Introduction

Integrity challenges along the food supply chain have received increasing attention by food safety authorities, industry and media in recent years. Adverse impacts of the adulteration of food products extend far beyond direct effects on the food industry itself. Indirect effects relate, amongst others, to the loss of public and consumer confidence in food production, the food industry, and food safety and quality [

1,

2]; international trade distortions and disputes [

3]; and effects on food policies and consumer politics [

4]. Following the BSE (Bovine Spongiform Encephalopathy) crisis at the end of the 1990s, Verbeke and Ward [

5] showed that negative media coverage largely outweighs similar amounts of positive coverage aimed at reassuring the market and consumers. Therefore, eliminating the grounds for negative press, such as by following food integrity issues, emerges as a key attention point for the food supply chain.

A variety of measures are being developed and applied to safeguard food safety and quality, and to detect and prevent food integrity issues by different actors, both technical and organizational. Ellis, Muhamadali, Haughey, Elliott, and Goodacre [

6] stressed that the ever-expanding portfolio of analytical methods, techniques and technologies in food control and future pervasive and predictive computation will together take on the role of a technology-based capable guardian for food systems. Simultaneously, more than ever before, experts recognize that food integrity is a challenge that requires a joint strategy and coordinated efforts involving all stakeholders, and that a strengthening of the collaboration between industry and governments is necessary [

7]. The development of an integrated private–public strategy requires clearly defined roles for each participating stakeholder and clarity and shared agreement on the specific purpose [

8].

The Elliott review following the 2013 horsemeat incident introduced eight pillars of food integrity: consumers first, zero tolerance, intelligence gathering, laboratory services, audits, government support, leadership, and crisis management [

9]. The recommendations that are formulated for these eight pillars refer multiple times to the need for data, information and intelligence sharing between stakeholders: “

There needs to be a shared focus by Government and industry on intelligence gathering and sharing. The Government should work with the Food Standards Agency (to lead for the Government) and regulators to collect, analyze and distribute information and intelligence; and work with the industry to help it establish its own ‘safe haven’ to collect, collate, analyze and disseminate information and intelligence.” [

9] (p. 7). Following the horsemeat incident, several actions were taken, and new initiatives were set up. For example, in the United Kingdom, the incident led to the establishment of the Food Industry Intelligence Network (FIIN), and on a European level it led to the Food Fraud Network (FFN), both aiming at the type of intelligence gathering that the Elliott review recommended [

7].

Information and data that could be relevant to identify potential issues of integrity in food supply chains are often initially only available to industry experts operating at a specific level of the agro-food supply chain. Ideally, this information and data would be shared, integrated and analyzed, in order to help reveal issues faster and more accurately, and to help prevent them. Although the integration of food integrity data and information covering the whole food supply chain in one digital system seems futuristic, the digital data revolution and developments in artificial intelligence are transforming many economic sectors already, and the food sector is often named as one that might benefit substantially from a similar transition too [

10,

11]. Several studies have explored ways to implement such a holistic approach to identify, detect or prevent food integrity issues. For example, Bayesian network models entail the potential for predicting increased likelihoods of the occurrence of incidents [

12,

13]. The potential adoption of the Internet of Things (IoT) in the agro-food supply chain seems promising but several challenges and constraints were identified by Brewster et al. [

14]. Decentralized traceability systems such as Blockchain structures are gaining interest and could provide solutions to these constraints [

15,

16].

While the development of analytical methods, technologies, systems, and infrastructures is gaining momentum, questions relating to stakeholder acceptance, intentions, and their willingness to adopt and participate remain largely unaddressed thus far. It is important to assess stakeholders’ attitudes towards data and information sharing and how information sharing systems will be received, with the goal of detecting and preventing food integrity issues. The aim of this study was to investigate food supply chain stakeholders’ attitudes and intentions towards a food integrity data and information sharing system (further referred to as an FI-ISS). The consultation of stakeholders focused on three objectives which were addressed in three consecutive rounds of data collection. Firstly, we aimed to analyze how food industry stakeholders receive the idea of an FI-ISS, which preconditions they consider important and what explains their intention to join an FI-ISS or not. The second objective of this study was to determine key success factors for the successful development and adoption of an FI-ISS. Lastly, the study explored in further detail the meaning of the defined key success factors, specific sensitivities facing the introduction of an FI-ISS and the origins of eventual contentious points.

2. Materials and Methods

This study combined exploratory and descriptive conclusive research methods and consisted of three consecutive rounds of data collection in which different stakeholders active in the European food supply chain were consulted. The first round (November 2017–February 2018) focused on food industry actors (

n = 143), while, during the second (March–April 2018) (

n = 61) and third rounds (May 2018) (

n = 37), the target group was broadened beyond food industry stakeholders alone. The type of stakeholders that participated and their distribution across stakeholder groups are presented in

Table 1.

The first round consisted of an online survey using a quantitative questionnaire, with the aim of identifying food industry actors’ attitudes towards, views on, intentions to join and preconditions for the uptake of an FI-ISS. The questionnaire was web-programmed in Qualtrics and covered industry stakeholders’ perceptions about food integrity issues, their attitudes towards the concept of sharing information to detect and prevent food integrity issues, and specific attitudes and intentions towards an FI-ISS. In order to inform participants and ensure consistent framing of the potential FI-ISS, participants were exposed to a 150 second explanation video that explained the main characteristics of an FI-ISS [

17].

After watching the video, 143 stakeholders started the survey, of which 111 continued until the end of the survey. All descriptive results are presented for each question using all valid answers, i.e., including all data for those participants that have answered that specific question. The participants are stakeholders with diverse relevant responsibilities in their organization, with 87% of them being employed in quality or R&D management. The rest of the participants (13%) had responsibilities such as purchase management, general management, sales management or consultancy. Their businesses or organizations are active on different levels of the food supply chain such as processing (68%), primary production (25%), retail (21%) and services to the food industry (10%) such as software or packaging. Two-thirds are active in international trade. The food commodities they are actively working with cover the food commodities most vulnerable to food integrity issues [

18]. All of the 111 participants that completed the survey from start to finish reported dealing with one or more of the most vulnerable commodities, namely, organic food (39%), milk (35%), grains (31%), spices (28%), fish (23%), olive oil (21%), honey and syrups (21%), fruit juices (19%), coffee and tea (17%), wine (10%) and meat (9%). This could be due to the fact that the topic of the survey, being food integrity issues, appeals more to those working in more vulnerable sectors, which might have increased their interest and motivation to participate in the study. Therefore, when interpreting these results, it is important to take the background of participants and possible self-selection bias into account.

First, participants were asked to report the frequency of occurrence of food integrity issues and their likelihood of detection within their own organization. Both items were measured on a 6-point categorical scale. Additionally, the perceived risk of food integrity issues was measured using three items on a 5-point Likert scale. Second, participants’ attitudes towards information sharing with the aim of tackling food integrity issues were assessed using three items (negative–positive, uninteresting–interesting, unimportant–important) on a 5-point bipolar interval scale. In a similar vein, perceived usefulness of information sharing was measured using three items (useless–useful; irrelevant–relevant; unnecessary–necessary). Three items on a 5-point Likert scale were used to measure how stakeholders perceive the risk of food integrity issues including “My company is very concerned about becoming a victim of food fraud”, “Food integrity issues are a growing problem in our sector” and “Food integrity issues are one of the main risks our company faces”. Third, participants were exposed to a series of potential advantages (n = 8) and disadvantages (n = 6) of information sharing; conditions for joining (n = 16) an FI-ISS; intention to join an FI-ISS (n = 7); third parties (n = 9) that could manage the FI-ISS; types of data (n = 9) that could be shared; and minimal output of the FI-ISS (n = 7), and were asked to indicate their degree of agreement using 5-point Likert scales. The selection of possible advantages, disadvantages, conditions for joining, third parties, the output of the system and types of data was based on literature review and expertise within the research team. For each set of items, participants were provided with the option to add additional items if they felt crucial items were missing. The construct scores for perceived advantages, perceived disadvantages, perceived risk and intention to join an FI-ISS were obtained by aggregating the items, leading to mean scores. Internal consistency was assessed with Cronbach’s α values. Finally, characteristics of the organization were recorded such as type of activity, food commodities or product groups covered, geographical scope (regional, national, pan-EU, global), and size (micro, small, medium-sized, large).

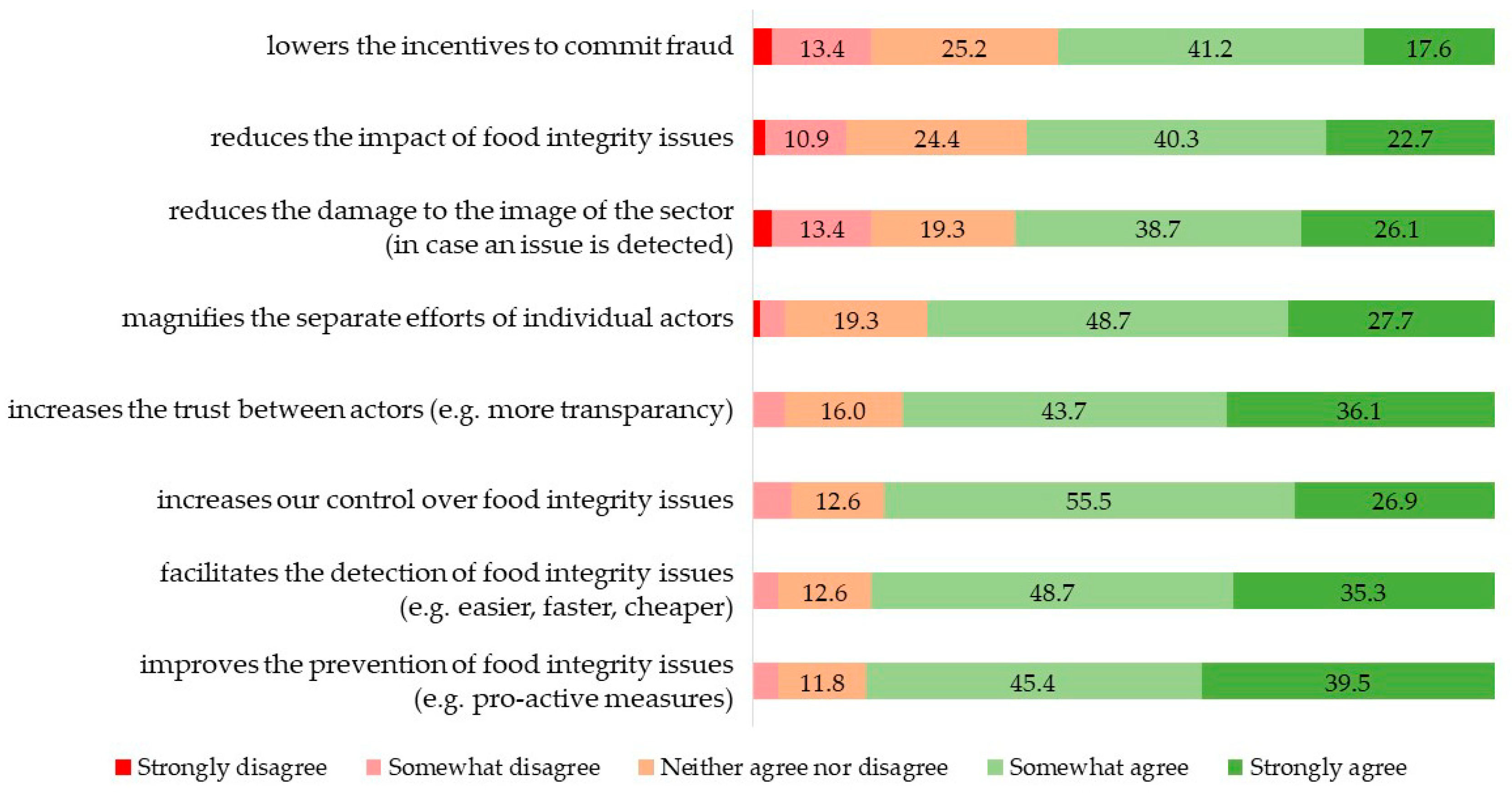

The results of the first round were summarized and presented to the participants of the second round with summarizing text and bar charts. The stakeholders involved in the second round were thus exposed to the insights obtained from round 1 and invited to provide feedback and additional comments with the aim of identifying key success factors for an FI-ISS. The survey in the second round consisted of five sections. It assessed perception of current food integrity issues; the potential of information sharing; suitable trusted third parties; types of data to share; and initiatives for setting up an FI-ISS. A combination of closed-ended and open-ended questions was used, allowing the collection of both quantitative data and qualitative insight. As a graphical aid, a selection of the bar charts (as shown in the results section of this paper) were presented to the participants of round 2 (

Figure 1 and

Figure 2).

The third round of data collection consisted of an interactive workshop with stakeholders and experts involved in the food supply chain. The results of the previous rounds were shared with the participants by means of a plenary presentation, after which these were discussed in four parallel working group sessions with a moderator and following a discussion guide. Each working group provided feedback and conclusions, which were discussed in plenary. This third-round interactive workshop envisaged providing a better understanding of the meaning of different views and perspectives on the future application of an FI-ISS.

In the interest of gathering unrestrained answers from food industry stakeholders, an anonymous approach was adopted for both data collection rounds involving online surveys. Before starting the survey, participants were informed about the context and purpose of the study, and researcher’s contact details were provided. After completing the surveys, participants were invited to subscribe in a separate form (not linked to their responses) to receive feedback and an invitation for the next rounds. As such, the survey responses were never linked to personal identifiers and not linked between two rounds. All information was stored and processed in a non-identifiable format and reported in aggregated form only. Both surveys were distributed through an online link to a Qualtrics webpage. To reach a wide range of potential participants, multiple channels were contacted, and several federations and organizations agreed to share the survey links and workshop invitations within their professional networks, including the national federations of the Belgian, French and Dutch food industries (Fevia, ANIA, FNLI), specialized press such as Food Quality News and through the Food Integrity Network.

A challenge in this study was avoiding the dropout of participants during the consecutive rounds of the study. The questionnaire was concise and clear to limit the number of participants dropping out during the survey and to avoid survey fatigue. After the first round, it was explained to participants that they would receive the aggregate findings of the first round when staying involved in the study, with the aim of motivating them to take part in the next rounds. However, the possible efforts to avoid dropout were limited as a result of the anonymization, which made it impossible to send personalized reminders to participants. Statistical analyses were performed with SPSS Statistics 23.0 (IBM SPSS, Armonk, NY, USA), and qualitative responses to open-ended questions were analyzed with QSR International’s NVivo 11 qualitative data analysis software (Melbourne, Australia). Cronbach’s α values were computed to assess the internal consistency of measurement scales. Quantitative data processing and analysis included descriptive (frequency distributions), bivariate (correlations, chi-square tests, t-tests, and ANOVA) and regression analyses. Stepwise linear regression was adopted to identify predictors of the intention to join an FI-ISS. The Breusch–Pagan test was conducted to verify whether the assumption of homoscedasticity was satisfied. Qualitative data from open-ended questions were coded into categories for interpretation purposes.

4. Conclusions

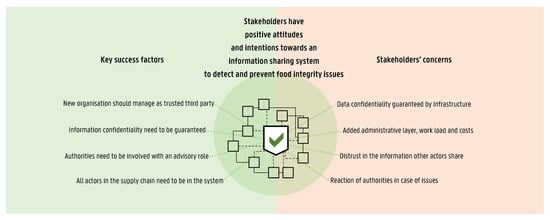

Dealing with complex food integrity issues requires a multi-dimensional approach. Besides the development of innovative analytical food process control methods, systems and practices, data and information sharing between actors in the food supply chain could help to facilitate the detection and prevention of food integrity issues. This study has demonstrated positive attitudes towards an FI-ISS among food industry stakeholders in the European food supply chain. Stakeholders are convinced of its benefits for detecting issues more rapidly and inexpensively, and for preventing the occurrence of issues. They believe that sharing information might magnify their own efforts, increase trust and improve the image of the food sector as a whole. Nonetheless, they are concerned about the increase in workload and the cost of such a system. An industry stakeholder’s perception of the advantages of an FI-ISS is a predictor of their intention to join an FI-ISS. Though perceived disadvantages are negatively correlated with perceived advantages, this does not emerge as a significant determinant of intention to join. The perception of the risk of food integrity issues for their organization is not a significant predictor of their intention to join an FI-ISS. Importantly, food industry actors remain somewhat reluctant to trust the information that other actors might share, and they are doubtful about the reaction when a food integrity issue is detected. Medium-sized companies perceive the difficulties regarding the detection of food integrity issues as worse compared to small or larger companies, but still have a lower intention to join an FI-ISS. This empirical finding deserves further attention in future research.

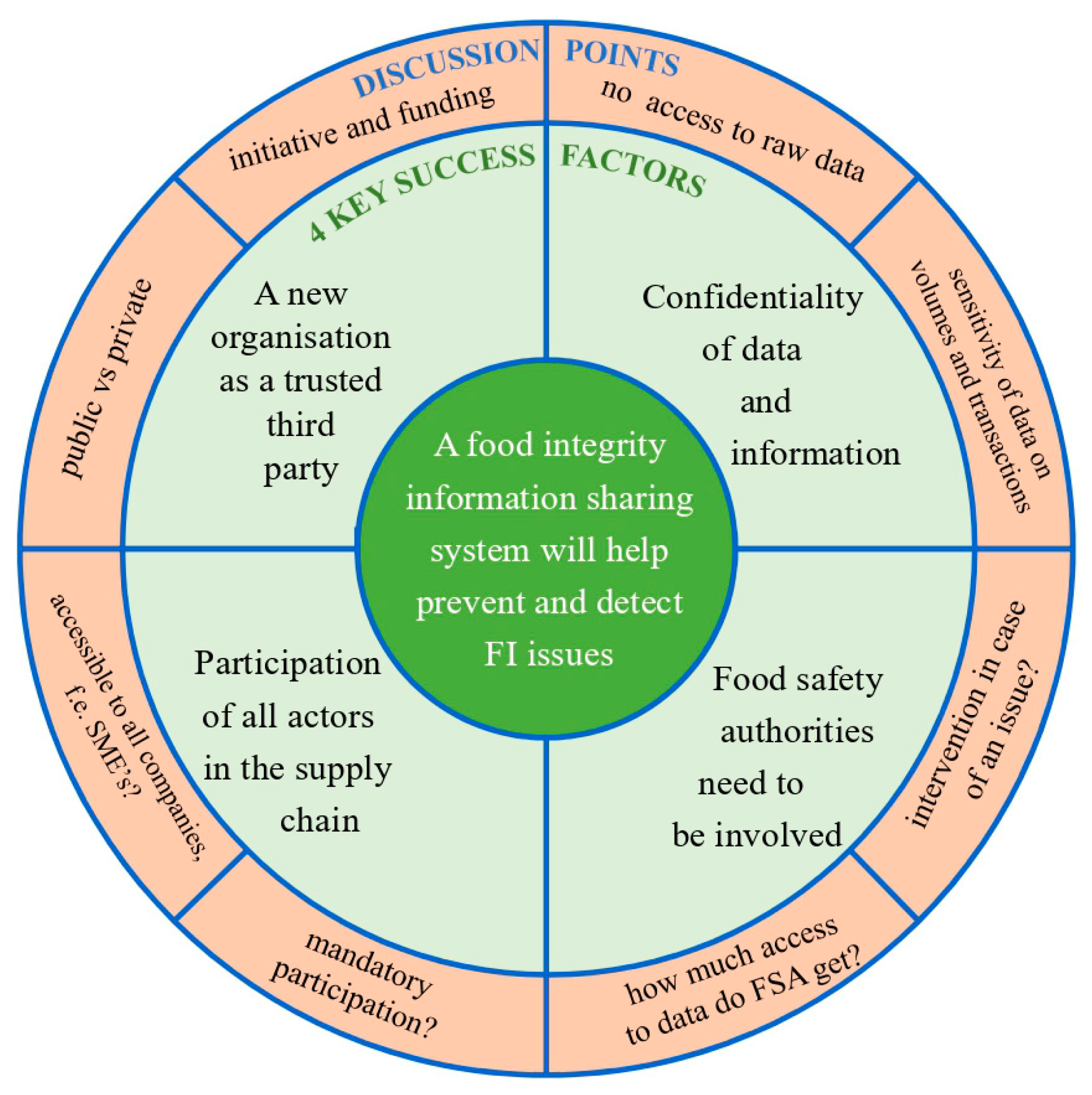

Exposing a broader group of stakeholders to the results of the first round provided additional practical insights and led to the identification of four key success factors for an FI-ISS. Our study shows that the trusted third party that will manage an FI-ISS is preferably a new organization. However, a successful FI-ISS should also involve food safety authorities, albeit in an advisory role rather than a management one. As a third success factor, the study shows that the majority of stakeholders consider an FI-ISS to only be promising if data confidentiality is guaranteed by the data infrastructure. Our study showed that, in spite of their enthusiasm, most stakeholders are skeptical about the ways in which their information could be protected. The fourth key factor for the success of an FI-ISS is the participation of all actors in the food supply chain, including consumer organizations and retailers.

This stakeholder study faces limitations owing to its relatively small and self-selected sample of stakeholders. There may be selection bias as a result of higher involvement with food integrity issues among the study participants. Stakeholders’ positive attitudes may, therefore, represent a best-case scenario, but are nevertheless encouraging for the development of an FI-ISS. The findings apply within the boundaries of the sample and generalization to the broader population of companies may be speculative. Insights on the barriers that might be encountered can be helpful for the food industry, food safety authorities and the science community in their efforts to ensure future food integrity, and eventually develop an effective FI-ISS.

Relatively high dropout levels of participants were encountered during the first round and between the consecutive rounds of the present study. Future studies might limit dropouts through stimulating the motivation and involvement of participants, e.g., by providing them with more detailed feedback and concrete benefits from the study findings. Another recommendation is to reduce the time lag between consecutive waves of data collection to maintain momentum and interest in the study topic.

As the development of an FI-ISS evolves, future socio-economic research could focus on monitoring the adoption process and collecting feedback about the experiences of food supply chain stakeholders. Eventually, cost-benefit analysis might be relevant to perform, and thus insight would be provided into what can be gained from the establishment and use of an FI-ISS. Additionally, the integration or linking of an FI-ISS to existing, private or public, traceability or alert systems requires further research.