Seeking a Chaotic Order in the Cryptocurrency Market

Abstract

:1. Introduction

2. Literature Review

3. Methodology

3.1. BDS Test

3.2. Largest Lyapunov Exponent

3.3. Fractal Dimension: Box-Counting Method

3.4. Long-Memory (Long Range Dependence)

3.4.1. Rescaled Range

3.4.2. Modified DFA

3.4.3. Higuchi’s Method

3.4.4. Aggregated Variance Method

4. Empirical Analysis

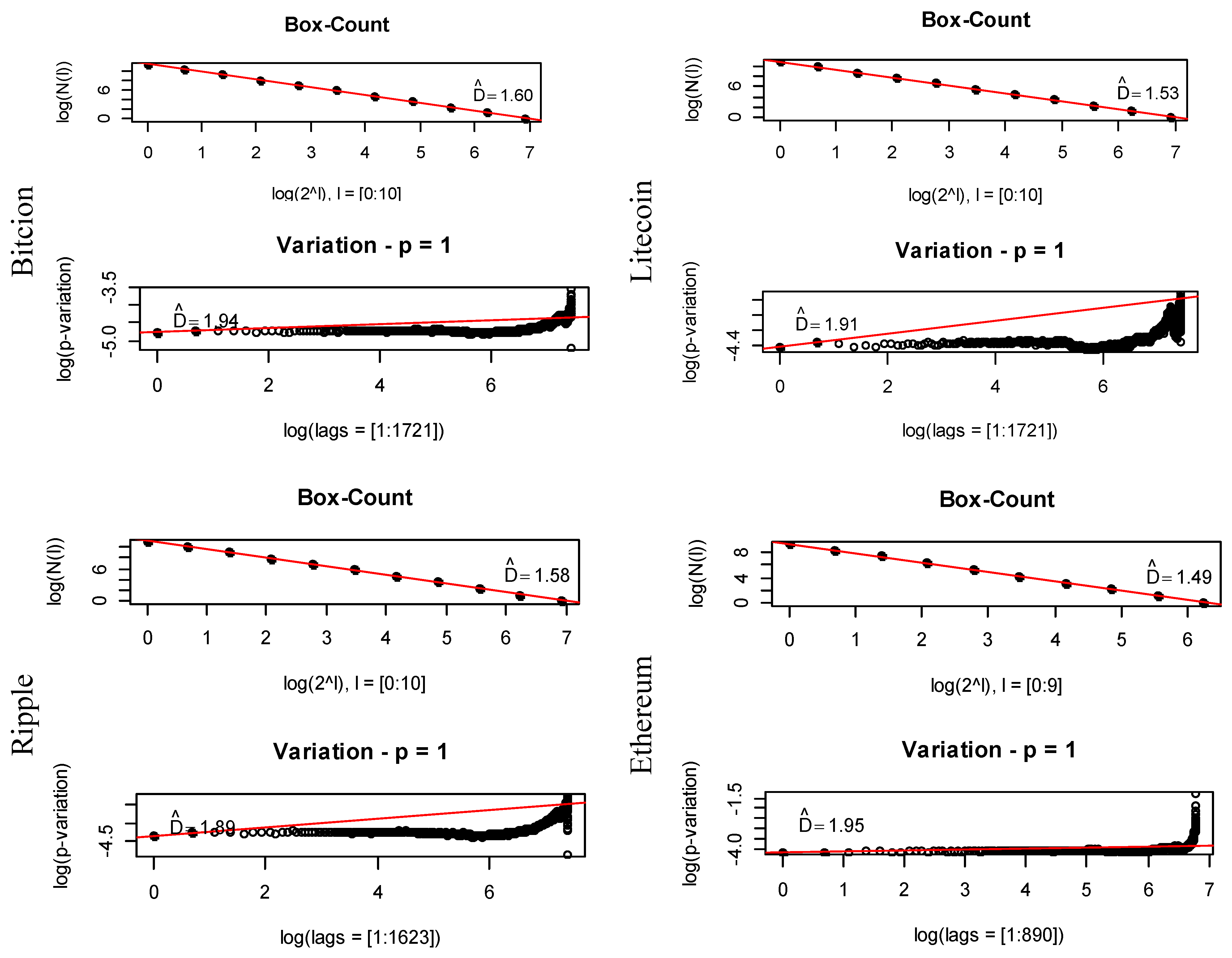

Fractality Test: Hurst Exponent and Fractal Dimension

5. Conclusions

Author Contributions

Conflicts of Interest

References

- Alligood, K.T.; Sauer, T.D.; Yorke, J.A.; Crawford, J.D. Chaos: An introduction to dynamical systems. Phys. Today 1997, 50, 67. [Google Scholar] [CrossRef]

- Strogatz, S.H. Nonlinear Dynamics and Chaos: With Applications to Physics, Biology, Chemistry, and Engineering; CRC Press: Boca Raton, FL, USA, 2018. [Google Scholar]

- Benzi, R.; Paladin, G.; Parisi, G.; Vulpiani, A. On the multifractal nature of fully developed turbulence and chaotic systems. J. Phys. A Math. Gen. 1984, 17, 3521. [Google Scholar] [CrossRef]

- Capra, F. The Web of Life; Anchor Books: New York, NY, USA, 1996; pp. 153–171. [Google Scholar]

- Hastings, A.; Powell, T. Chaos in a three-species food chain. Ecology 1991, 72, 896–903. [Google Scholar] [CrossRef]

- Lahmiri, S. A study on chaos in crude oil markets before and after 2008 international financial crisis. Phys. A Stat. Mech. Appl. 2017, 466, 389–395. [Google Scholar] [CrossRef]

- Buzsaki, G. Rhythms of the Brain; Oxford University Press: Oxford, UK, 2006. [Google Scholar]

- Cheah, E.T.; Fry, J. Speculative bubbles in Bitcoin markets? An empirical investigation into the fundamental value of Bitcoin. Econ. Lett. 2015, 130, 32–36. [Google Scholar] [CrossRef]

- Glaser, F.; Zimmermann, K.; Haferkorn, M.; Weber, M.; Siering, M. Bitcoin—Asset or currency? Revealing users’ hidden intentions. In Proceedings of the 22th European Conference on Information Systems, Tel Aviv, Israel, 9–11 June 2014. [Google Scholar]

- Morgan Stanley Smith Barney LLC. Update: Bitcoin, Cryptocurrencies and Blockchain. 2018. Available online: https://fa.morganstanley.com/thempzgroup/mediahandler/media/122866/Bitcoin.pdf (accessed on 2 April 2019).

- Kortian, T. Modern Approaches to Asset Price Formation: A Survey of Recent Theoretical Literature; Economic Research Department, Reserve Bank of Australia: Sydney, Australia, 1995.

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System. 2008. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 2 April 2019).

- Böhme, R.; Christin, N.; Edelman, B.; Moore, T. Bitcoin: Economics, technology, and governance. J. Econ. Perspect. 2015, 29, 213–238. [Google Scholar] [CrossRef]

- Kaşkaloğlu, K. Near zero Bitcoin transaction fees cannot last forever. In Proceedings of the International Conference on Digital Security and Forensics (DigitalSec2014), Ostrava, Czech Republic, 24–26 June 2014; pp. 91–99. [Google Scholar]

- Poon, J.; Dryja, T. The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments. 2016. Available online: https://lightning. network/lightning-network-paper. pdf (accessed on 2 April 2019).

- Eyal, I.; Gencer, A.E.; Sirer, E.G.; Van Renesse, R. Bitcoin-NG: A Scalable Blockchain Protocol. In Proceedings of the 13th USENIX Symposium on Networked Systems Design and Implementation (NSDI’16), Santa Clara, CA, USA, 16–18 March 2016; pp. 45–59. [Google Scholar]

- Reid, F.; Harrigan, M. An analysis of anonymity in the bitcoin system. In Security and Privacy in Social Networks; Springer: New York, NY, USA, 2013; pp. 197–223. [Google Scholar]

- Ahmed, M.; Shumailov, I.; Anderson, R. Tendrils of Crime: Visualizing the Diffusion of Stolen Bitcoins. arXiv 2019, arXiv:1901.01769. [Google Scholar]

- Underwood, S. Blockchain beyond bitcoin. Commun. ACM 2016, 59, 15–17. [Google Scholar] [CrossRef]

- Zyskind, G.; Nathan, O. Decentralizing privacy: Using blockchain to protect personal data. In Proceedings of the 2015 IEEE Security and Privacy Workshops (SPW), San Jose, CA, USA, 21–22 May 2015; pp. 180–184. [Google Scholar]

- McCorry, P.; Shahandashti, S.F.; Hao, F. A smart contract for boardroom voting with maximum voter privacy. In Proceedings of the International Conference on Financial Cryptography and Data Security, Sliema, Malta, 3–7 April 2017; Springer: Cham, Switzerland, 2017; pp. 357–375. [Google Scholar]

- Reyna, A.; Martín, C.; Chen, J.; Soler, E.; Díaz, M. On blockchain and its integration with IoT. Challenges and opportunities. Future Gener. Comput. Syst. 2018, 88, 173–190. [Google Scholar] [CrossRef]

- Tian, F. An agri-food supply chain traceability system for China based on RFID & blockchain technology. In Proceedings of the 2016 13th International Conference on Service Systems and Service Management (ICSSSM), Kunming, China, 24–26 June 2016; pp. 1–6. [Google Scholar]

- Swan, M. Blockchain: Blueprint for a New Economy; O’Reilly Media, Inc.: Sebastopol, CA, USA, 2015. [Google Scholar]

- Tapscott, D.; Tapscott, A. Blockchain Revolution: How the Technology Behind Bitcoin is Changing Money, Business, and the World; Penguin: New York, NY, USA, 2016. [Google Scholar]

- Gandal, N.; Hamrick, J.T.; Moore, T.; Oberman, T. Price manipulation in the Bitcoin ecosystem. J. Monet. Econ. 2018, 95, 86–96. [Google Scholar] [CrossRef]

- Viglione, R. Does Governance Have a Role in Pricing? Cross-Country Evidence from Bitcoin Markets. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2666243 (accessed on 2 April 2019).

- Bouoiyour, J.; Selmi, R. What does Bitcoin look like? Ann. Econ. Financ. 2015, 16, 449–492. [Google Scholar]

- Ciaian, P.; Rajcaniova, M.; Kancs, D.A. The economics of BitCoin price formation. Appl. Econ. 2016, 48, 1799–1815. [Google Scholar] [CrossRef]

- Dyhrberg, A.H. Bitcoin, gold and the dollar–A GARCH volatility analysis. Financ. Res. Lett. 2016, 16, 85–92. [Google Scholar] [CrossRef]

- Katsiampa, P. Volatility estimation for Bitcoin: A comparison of GARCH models. Econ. Lett. 2017, 158, 3–6. [Google Scholar] [CrossRef]

- Brauneis, A.; Mestel, R. Price discovery of cryptocurrencies: Bitcoin and beyond. Econ. Lett. 2018, 165, 58–61. [Google Scholar] [CrossRef]

- Takaishi, T. Statistical properties and multifractality of Bitcoin. Phys. A Stat. Mech. Appl. 2018, 506, 507–519. [Google Scholar] [CrossRef]

- Lahmiri, S.; Bekiros, S. Chaos, randomness and multi-fractality in Bitcoin market. Chaos Solitons Fractals 2018, 106, 28–34. [Google Scholar] [CrossRef]

- Urquhart, A. The inefficiency of Bitcoin. Econ. Lett. 2016, 148, 80–82. [Google Scholar] [CrossRef]

- Bariviera, A.F. The inefficiency of Bitcoin revisited: A dynamic approach. Econ. Lett. 2017, 161, 1–4. [Google Scholar] [CrossRef]

- Bariviera, A.F.; Basgall, M.J.; Hasperué, W.; Naiouf, M. Some stylized facts of the Bitcoin market. Phys. A Stat. Mech. Appl. 2017, 484, 82–90. [Google Scholar] [CrossRef]

- Garnier, J.; Solna, K. Chaos and Order in the Bitcoin Market. arXiv 2018, arXiv:1809.08403. [Google Scholar] [CrossRef]

- Dos Santos, R.P. On the Philosophy of Bitcoin/Blockchain Technology: Is it a Chaotic, Complex System? Metaphilosophy 2017, 48, 620–633. [Google Scholar] [CrossRef]

- Pilkington, M. Bitcoin through the lenses of complexity theory: Some non-orthodox implications for economic theorizing. In Handbook of the Geographies of Money and Finance; Pollard, J., Martin, R., Eds.; Edward Elgar: Cheltenham, UK, 2017. [Google Scholar]

- Al-Yahyaee, K.H.; Mensi, W.; Yoon, S.M. Efficiency, multifractality, and the long-memory property of the Bitcoin market: A comparative analysis with stock, currency, and gold markets. Financ. Res. Lett. 2018, 27, 228–234. [Google Scholar] [CrossRef]

- Bouri, E.; Gupta, R.; Lahiani, A.; Shahbaz, M. Testing for asymmetric nonlinear short-and long-run relationships between bitcoin, aggregate commodity and gold prices. Resour. Policy 2018, 57, 224–235. [Google Scholar] [CrossRef]

- Khuntia, S.; Pattanayak, J.K. Adaptive market hypothesis and evolving predictability of bitcoin. Econ. Lett. 2018, 167, 26–28. [Google Scholar] [CrossRef]

- Khuntia, S.; Pattanayak, J.K. Adaptive long memory in volatility of intra-day bitcoin returns and the impact of trading volume. Financ. Res. Lett. 2018. [Google Scholar] [CrossRef]

- Jiang, Y.; Nie, H.; Ruan, W. Time-varying long-term memory in Bitcoin market. Financ. Res. Lett. 2018, 25, 280–284. [Google Scholar] [CrossRef]

- Jang, H.; Lee, J. An empirical study on modeling and prediction of bitcoin prices with bayesian neural networks based on blockchain information. IEEE Access 2018, 6, 5427–5437. [Google Scholar] [CrossRef]

- Lorenz, E.N. Deterministic nonperiodic flow. J. Atmos. Sci. 1963, 20, 130–141. [Google Scholar] [CrossRef]

- Li, T.Y.; Yorke, J.A. Period three implies chaos. Am. Math. Mon. 1975, 82, 985–992. [Google Scholar] [CrossRef]

- Brock, W.A. Distinguishing random and deterministic systems: Abridged version. J. Econ. Theory 1986, 40, 168–195. [Google Scholar] [CrossRef]

- Scheinkman, J.A.; LeBaron, B. Nonlinear dynamics and stock returns. J. Bus. 1989, 62, 311–337. [Google Scholar] [CrossRef]

- Grassberger, P.; Procaccia, I. Measuring the strangeness of strange attractors. Phys. D 1983, 9, 189–208. [Google Scholar] [CrossRef]

- Takens, F. Detecting strange attractors in turbulence. In Dynamical Systems and Turbulence, Warwick 1980; Springer: Berlin/Heidelberg, Germany, 1981; pp. 366–381. [Google Scholar]

- Adeli, H.; Ghosh-Dastidar, S.; Dadmehr, N. A wavelet-chaos methodology for analysis of EEGs and EEG subbands to detect seizure and epilepsy. IEEE Trans. Biomed. Eng. 2007, 54, 205–211. [Google Scholar] [CrossRef]

- Becks, L.; Hilker, F.M.; Malchow, H.; Jürgens, K.; Arndt, H. Experimental demonstration of chaos in a microbial food web. Nature 2005, 435, 1226. [Google Scholar] [CrossRef]

- Lee BH, K.; Price, S.J.; Wong, Y.S. Nonlinear aeroelastic analysis of airfoils: Bifurcation and chaos. Prog. Aerosp. Sci. 1999, 35, 205–334. [Google Scholar]

- Gunay, S. Chaotic structure of the BRIC countries and Turkey’s stock market. Int. J. Econ. Financ. Issues 2015, 5, 515–522. [Google Scholar]

- Barkoulas, J.; Travlos, N. Chaos in an emerging capital market? The case of the Athens Stock Exchange. Appl. Financ. Econ. 1998, 8, 231–243. [Google Scholar] [CrossRef]

- Serletis, A.; Shintani, M. No evidence of chaos but some evidence of dependence in the US stock market. Chaos Solitons Fractals 2003, 17, 449–454. [Google Scholar] [CrossRef]

- Eissa, M.; Sayed, M. A Comparison between Active and Passive Vibration Control of Non-Linear Simple Pendulum. Part I: Transversally Tuned Absorber and Negative Gφn Feedback. Math. Comput. Appl. 2006, 11, 137–149. [Google Scholar] [CrossRef]

- Cai, J.; Lin, M.; Yuan, Z. Secure communication using practical synchronization between two different chaotic systems with uncertainties. Math. Comput. Appl. 2010, 15, 166–175. [Google Scholar] [CrossRef]

- Blank, S.C. “Chaos” in futures markets? A nonlinear dynamical analysis. J. Futures Mark. 1991, 11, 711–728. [Google Scholar] [CrossRef]

- Brock, W.A.; Dechert, W.D.; Scheinkman, J.A.; LeBaron, B. A test for independence based on the correlation dimension. Econom. Rev. 1996, 15, 197–235. [Google Scholar] [CrossRef]

- Brock, W.A. Causality, chaos, explanation and prediction in economics and finance. In Beyond Belief; CRC Press: Boca Raton, FL, USA, 2018; pp. 230–279. [Google Scholar]

- McKenzie, M.D. Chaotic behavior in national stock market indices: New evidence from the close returns test. Glob. Financ. J. 2001, 12, 35–53. [Google Scholar] [CrossRef]

- Opong, K.K.; Mulholland, G.; Fox, A.F.; Farahmand, K. The behaviour of some UK equity indices: An application of Hurst and BDS tests1. J. Empir. Financ. 1999, 6, 267–282. [Google Scholar] [CrossRef]

- Serletis, A.; Gogas, P. Chaos in East European black market exchange rates. Res. Econ. 1997, 51, 359–385. [Google Scholar] [CrossRef]

- Mandelbrot, B. How long is the coast of Britain? Statistical self-similarity and fractional dimension. Science 1967, 156, 636–638. [Google Scholar] [CrossRef] [PubMed]

- Theiler, J. Estimating fractal dimension. JOSA A 1990, 7, 1055–1073. [Google Scholar] [CrossRef]

- Peters, E.E.; Peters, E.R.; Peters, D. Fractal Market Analysis: Applying Chaos Theory to Investment and Economics; John Wiley & Sons: Hoboken, NJ, USA, 1994; Volume 24. [Google Scholar]

- Diego, P.; Giampiero, P. Chaotic dynamics and fractals in magmatic interaction processes: A different approach to the interpretation of mafic microgranular enclaves. Earth Planet. Sci. Lett. 2000, 175, 93–103. [Google Scholar] [CrossRef]

- Tsonis, A.A.; Elsner, J.B. Chaos, strange attractors, and weather. Bull. Am. Meteorol. Soc. 1989, 70, 14–23. [Google Scholar] [CrossRef]

- Vassilicos, J.C.; Demos, A.; Tata, F. No evidence of chaos but some evidence of multifractals in the foreign exchange and the stock markets. In Applications of Fractals and Chaos; Springer: Berlin/Heidelberg, Germany, 1993; pp. 249–265. [Google Scholar]

- Lindsay, D.H.; Campbell, A. A chaos approach to bankruptcy prediction. J. Appl. Bus. Res. 1996, 12, 1–9. [Google Scholar] [CrossRef]

- Sun, X.; Chen, H.; Yuan, Y.; Wu, Z. Predictability of multifractal analysis of Hang Seng stock index in Hong Kong. Phys. A Stat. Mech. Appl. 2001, 301, 473–482. [Google Scholar] [CrossRef]

- Hurst, H.E. Long-term storage capacity of reservoirs. Trans. Am. Soc. Civ. Eng. 1951, 116, 770–799. [Google Scholar]

- Mandelbrot, B.B.; Wallis, J.R. Robustness of the rescaled range R/S in the measurement of noncyclic long run statistical dependence. Water Resour. Res. 1969, 5, 967–988. [Google Scholar] [CrossRef]

- Mandelbrot, B. Fractals; Freeman: San Francisco, CA, USA, 1977; p. 24. [Google Scholar]

- Granger, C.W.; Joyeux, R. An introduction to long-memory time series models and fractional differencing. J. Time Ser. Anal. 1980, 1, 15–29. [Google Scholar] [CrossRef]

- Montanari, A.; Taqqu, M.S.; Teverovsky, V. Estimating long-range dependence in the presence of periodicity: An empirical study. Math. Comput. Model. 1999, 29, 217–228. [Google Scholar] [CrossRef]

- Doukhan, P.; Oppenheim, G.; Taqqu, M. (Eds.) Theory and Applications of Long-Range Dependence; Springer Science & Business Media: New York, NY, USA, 2002. [Google Scholar]

- Serletis, A.; Rosenberg, A.A. The Hurst exponent in energy futures prices. Phys. A Stat. Mech. Appl. 2007, 380, 325–332. [Google Scholar] [CrossRef]

- He, L.Y.; Chen, S.P. Multifractal detrended cross-correlation analysis of agricultural futures markets. Chaos Solitons Fractals 2011, 44, 355–361. [Google Scholar] [CrossRef]

- Qian, B.; Rasheed, K. Stock market prediction with multiple classifiers. Appl. Intell. 2007, 26, 25–33. [Google Scholar] [CrossRef]

- Zunino, L.; Tabak, B.M.; Figliola, A.; Pérez, D.G.; Garavaglia, M.; Rosso, O.A. A multifractal approach for stock market inefficiency. Phys. A Stat. Mech. Appl. 2008, 387, 6558–6566. [Google Scholar] [CrossRef]

- Stanca, L. Asymmetries and nonlinearities in Italian macroeconomic fluctuations. Appl. Econ. 1999, 31, 483–491. [Google Scholar] [CrossRef]

- Rosenstein, M.T.; Collins, J.J.; De Luca, C.J. A practical method for calculating largest Lyapunov exponents from small data sets. Phys. D: Nonlinear Phenom. 1993, 65, 117–134. [Google Scholar] [CrossRef]

- Gneiting, T.; Ševčíková, H.; Percival, D.B. Estimators of fractal dimension: Assessing the roughness of time series and spatial data. Stat. Sci. 2012, 27, 247–277. [Google Scholar] [CrossRef]

- Baillie, R.T. Long memory processes and fractional integration in econometrics. J. Econom. 1996, 73, 5–59. [Google Scholar] [CrossRef]

- Peng, C.K.; Buldyrev, S.V.; Havlin, S.; Simons, M.; Stanley, H.E.; Goldberger, A.L. Mosaic organization of DNA nucleotides. Phys. Rev. E 1994, 49, 1685. [Google Scholar] [CrossRef]

- Kantelhardt, J.W.; Koscielny-Bunde, E.; Rego, H.H.; Havlin, S.; Bunde, A. Detecting long-range correlations with detrended fluctuation analysis. Phys. A Stat. Mech. Appl. 2001, 295, 441–454. [Google Scholar] [CrossRef]

- Burlaga, L.F.; Klein, L.W. Multifractal structure of the interplanetary magnetic field. Geophys. Res. Lett. 1986, 91, 347. [Google Scholar] [CrossRef]

- Higuchi, T. Approach to an irregular time series on the basis of the fractal theory. Phys. D Nonlinear Phenom. 1988, 31, 277–283. [Google Scholar] [CrossRef]

- Taqqu, M.S.; Teverovsky, V.; Willinger, W. Estimators for long-range dependence: An empirical study. Fractals 1995, 3, 785–798. [Google Scholar] [CrossRef]

- Higgins, J.P. Nonlinear systems in medicine. Yale J. Biol. Med. 2002, 75, 247. [Google Scholar]

- Rickles, D.; Hawe, P.; Shiell, A. A simple guide to chaos and complexity. J. Epidemiol. Community Health 2007, 61, 933–937. [Google Scholar] [CrossRef]

- Williams, G. Chaos Theory Tamed; CRC Press: Boca Raton, FL, USA, 1997. [Google Scholar]

- Gunay, S. Are the scaling properties of bull and bear markets identical? evidence from oil and gold markets. Int. J. Financ. Stud. 2014, 2, 315–334. [Google Scholar] [CrossRef]

- Wuertz, D.; Setz, T.; Chalabi, Y. 00fArma-package: Modelling ARMA Time Series Processes. Available online: https://rdrr.io/cran/fArma/man/00fArma-package.html (accessed on 4 April 2019).

- Crovella, M.E.; Bestavros, A. Self-similarity in World Wide Web traffic: Evidence and possible causes. IEEE/ACM Trans. Netw. 1997, 5, 835–846. [Google Scholar] [CrossRef]

- Kantelhardt, J.W.; Zschiegner, S.A.; Koscielny-Bunde, E.; Havlin, S.; Bunde, A.; Stanley, H.E. Multifractal detrended fluctuation analysis of nonstationary time series. Phys. A Stat. Mech. Appl. 2002, 316, 87–114. [Google Scholar] [CrossRef]

- Ihlen, E.A.F.E. Introduction to multifractal detrended fluctuation analysis in Matlab. Front. Physiol. 2012, 3, 141. [Google Scholar] [CrossRef]

- Peters, E.E. Chaos and Order in the Capital Markets: A New View of Cycles, Prices, and Market Volatility; John Wiley & Sons: Hoboken, NJ, USA, 1996; Volume 1. [Google Scholar]

- Sevcikova, H.; Gneiting, T.; Percival, D. Estimation of Fractal Dimensions. Package ‘Fractaldim’. Version 0.8-1. Available online: https://cran.r-project.org/web/packages/fractaldim/ (accessed on 2 April 2019).

- Brooks, C. Testing for non-linearity in daily sterling exchange rates. Appl. Financ. Econ. 1996, 6, 307–317. [Google Scholar] [CrossRef]

- Hsieh, D.A. Chaos and nonlinear dynamics: Application to financial markets. J. Financ. 1991, 46, 1839–1877. [Google Scholar] [CrossRef]

- Barnett, W.A.; Barnett, W.A.; Kirman, A.P.; Salmon, M. (Eds.) Nonlinear Dynamics and Economics: Proceedings of the Tenth International Symposium in Economic Theory and Econometrics; Cambridge University Press: Cambridge, UK, 1996; Volume 10. [Google Scholar]

- Hsieh, D.; LeBaron, B. Finite Sample Properties of the BDS Statistic; Unpublished Manuscript; University of Chicago: Chicago, IL, USA; University of Wisconsin: Madison, WI, USA, 1988. [Google Scholar]

- Wolf, A.; Swift, J.B.; Swinney, H.L.; Vastano, J.A. Determining Lyapunov exponents from a time series. Phys. D Nonlinear Phenom. 1985, 16, 285–317. [Google Scholar] [CrossRef]

- Kanzler, L. BDS: MATLAB Module to Calculate Brock, Dechert & Scheinkman Test for Independence, Statistical Software Components T871803; Boston College Department of Economics: Boston, MA, USA, 1998. [Google Scholar]

- Mohammadi, S. Lyaprosen: Matlab Function to Calculate Lyapunov Exponent; Boston College Department of Economics: Boston, MA, USA, 2009. [Google Scholar]

| Bitcoin | Litecoin | Ripple | Ethereum | |

|---|---|---|---|---|

| Aggregated Variances | 0.5696 *** | 0.5530 *** | 0.5041 *** | 0.5754 *** |

| −0.8609 | −0.8940 | −0.9918 | −0.8492 | |

| 0.0184 | 0.0223 | 0.0585 | 0.0265 | |

| Peng Method | 0.5391 *** | 0.5321 *** | 0.5618 *** | 0.5629 *** |

| 1.0782 | 1.0643 | 1.1236 | 1.1258 | |

| 0.0138 | 0.0150 | 0.0145 | 0.0132 | |

| Higuchi Method | 0.5983 *** | 0.6194 *** | 0.5743 *** | 0.6661 *** |

| −1.4017 | −1.3806 | −1.4257 | −1.3339 | |

| 0.0336 | 0.0470 | 0.0496 | 0.0422 | |

| R/S Method | 0.5908 *** | 0.5523 *** | 0.6197 *** | 0.5713 *** |

| 0.5908 | 0.5523 | 0.6197 | 0.5713 | |

| 0.0264 | 0.0292 | 0.0151 | 0.0176 |

| Bitcoin | 0.8396 | 0.6567 | 0.5376 |

| Litecoin | 0.9164 | 0.6984 | 0.4093 |

| Ripple | 0.9129 | 0.6768 | 0.3992 |

| Ethereum | 0.8773 | 0.6957 | 0.5219 |

| Madogram | Box-Count | |

|---|---|---|

| Bitcoin | 1.94 | 1.60 |

| Litecoin | 1.91 | 1.53 |

| Ripple | 1.89 | 1.58 |

| Ethereum | 1.95 | 1.49 |

| Bitcoin ARFIMA (4.d.2) | Litecoin ARFIMA (2.d.3) | Ripple ARFIMA (1.d.1) | Ethereum ARFIMA (1.d.1) | |

|---|---|---|---|---|

| AR-1 | 0.6023 *** (0.0538) | −1.2109 *** (0.0438) | 0.3917 ** (0.1749) | 1.7037 *** (0.1096) |

| AR-2 | −0.9488 *** (0.0349) | −0.8625 *** (0.0579) | −0.7732 *** (0.1021) | |

| AR-3 | −0.0728 ** (0.0357) | |||

| AR-4 | −0.0661 ** (0.0332) | |||

| d | 0.1098 *** (0.0354) | 0.0700 ** (0.0355) | 0.1409 ** (0.0636) | 0.2284 *** (0.0873) |

| MA-1 | −0.7121 (0.0282) | 1.1789 *** (0.0695) | −0.4843 ** (0.1943) | −1.8493 *** (0.0527) |

| MA-2 | 0.9385 *** (0.0205) | 0.7666 *** (0.1008) | 0.8909 *** (0.0550) | |

| MA-3 | −0.0928 * (0.0491) | |||

| Constant | 0.0012 *** (0.0008) | 0.0010 (0.0011) | 0.0017 (0.0020) | 0.0027 (0.0034) |

| Log-likelihood | 4369 | 3594 | 3147 | 1675 |

| AIC | −5.0640 | −4.1649 | −3.8688 | −3.7451 |

| Bitcoin FIGARCH (1.d.1) | Litecoin FIGARCH (1.d.1) | Ripple FIGARCH (1.d.1) | Ethereum FIGARCH (1.d.1) | |

|---|---|---|---|---|

| cm | 0.0008 ** (0.0003) | −0.0005 (0.0005) | −0.0017 *** (0.0006) | 0.0010 (0.0010) |

| c v | 0.0965 (0.0638) | 0.2157 *** (0.0776) | 1.8985 *** (0.7269) | 0.5213 ** (0.2466) |

| d | 0.5486 *** (0.1486) | 0.9707 *** (0.1312) | 0.6493 *** (0.1092) | 0.8071 *** (0.1740) |

| a | 0.2819 ** (0.1157) | 0.1575 (0.1501) | −0.3680 *** (0.1236) | 0.1933 (0.1488) |

| b | 0.6223 *** (0.1446) | 0.8868 *** (0.0166) | −0.2310 * (0.1193) | 0.5979 *** (0.1645) |

| Log-likelihood | 4691 | 3940 | 3702 | 1831 |

| AIC | −5.4422 | −4.5706 | −4.5532 | −4.0976 |

| e | ARFIMA par | FIGARCH par | Residuals of ARFIMA | Residuals of FIGARCH | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| m = 3 | m = 5 | m = 7 | m = 3 | m = 5 | m = 7 | |||||

| Bitcoin | 0.5 | 0.2086 | 0.4139 | w | 19.28 | 33.29 | 59.11 | 21.06 | 36.56 | 64.77 |

| c | 0.05 | 0.02 | 0.01 | 0.06 | 0.02 | 0.01 | ||||

| 1 | 0.4873 | 0.6622 | w | 16.03 | 20.86 | 26.92 | 16.44 | 21.39 | 27.60 | |

| c | 0.26 | 0.17 | 0.11 | 0.27 | 0.17 | 0.12 | ||||

| 1.5 | 0.6798 | 0.8015 | w | 13.06 | 14.94 | 17.04 | 13.42 | 15.30 | 17.56 | |

| c | 0.47 | 0.36 | 0.29 | 0.48 | 0.37 | 0.30 | ||||

| 2 | 0.8009 | 0.8796 | w | 11.65 | 12.69 | 13.72 | 12.10 | 13.16 | 14.32 | |

| c | 0.65 | 0.55 | 0.48 | 0.65 | 0.56 | 0.49 | ||||

| Litecoin | 0.5 | 0.2086 | 0.4943 | w | 25.54 | 39.41 | 65.37 | 22.53 | 34.15 | 54.61 |

| c | 0.11 | 0.06 | 0.03 | 0.12 | 0.06 | 0.03 | ||||

| 1 | 0.4873 | 0.7241 | w | 18.50 | 21.90 | 26.52 | 17.79 | 21.10 | 25.18 | |

| c | 0.37 | 0.26 | 0.20 | 0.38 | 0.27 | 0.21 | ||||

| 1.5 | 0.6798 | 0.8380 | w | 14.13 | 15.19 | 16.39 | 14.07 | 15.10 | 16.34 | |

| c | 0.56 | 0.46 | 0.38 | 0.57 | 0.47 | 0.39 | ||||

| 2 | 0.8009 | 0.8994 | w | 12.11 | 12.26 | 12.49 | 12.12 | 12.12 | 12.43 | |

| c | 0.71 | 0.62 | 0.55 | 0.71 | 0.62 | 0.55 | ||||

| Ripple | 0.5 | 0.2086 | 0.4938 | w | 23.77 | 33.18 | 52.17 | 23.91 | 33.64 | 52.88 |

| c | 0.12 | 0.06 | 0.03 | 0.12 | 0.06 | 0.03 | ||||

| 1 | 0.4873 | 0.7291 | w | 20.23 | 22.83 | 25.94 | 20.37 | 22.96 | 26.02 | |

| c | 0.40 | 0.29 | 0.22 | 0.41 | 0.30 | 0.23 | ||||

| 1.5 | 0.6798 | 0.8425 | w | 17.52 | 18.58 | 19.84 | 18.02 | 18.90 | 20.00 | |

| c | 0.61 | 0.51 | 0.44 | 0.61 | 0.52 | 0.45 | ||||

| 2 | 0.8009 | 0.8996 | w | 14.50 | 15.00 | 15.62 | 15.21 | 15.49 | 15.93 | |

| c | 0.73 | 0.65 | 0.59 | 0.73 | 0.65 | 0.59 | ||||

| Ethereum | 0.5 | 0.2086 | 0.4297 | w | 16.99 | 27.97 | 55.46 | 13.74 | 20.32 | 36.82 |

| c | 0.06 | 0.02 | 0.01 | 0.06 | 0.02 | 0.01 | ||||

| 1 | 0.4873 | 0.6841 | w | 12.87 | 15.79 | 19.96 | 12.59 | 14.98 | 18.81 | |

| c | 0.29 | 0.19 | 0.13 | 0.30 | 0.19 | 0.13 | ||||

| 1.5 | 0.6798 | 0.8253 | w | 10.34 | 11.39 | 11.98 | 10.40 | 11.07 | 11.65 | |

| c | 0.52 | 0.41 | 0.33 | 0.53 | 0.42 | 0.34 | ||||

| 2 | 0.8009 | 0.9054 | w | 9.46 | 9.72 | 9.50 | 8.50 | 8.63 | 8.48 | |

| c | 0.70 | 0.61 | 0.54 | 0.70 | 0.62 | 0.55 | ||||

| m = 3 | m = 5 | m = 7 | |

|---|---|---|---|

| Bitcoin | 0.2522 | 0.1513 | 0.0875 |

| Litecoin | 0.1799 | 0.1473 | 0.2070 |

| Ripple | 0.1853 | 0.1773 | 0.1992 |

| Ethereum | 0.2482 | 0.1767 | 0.0772 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gunay, S.; Kaşkaloğlu, K. Seeking a Chaotic Order in the Cryptocurrency Market. Math. Comput. Appl. 2019, 24, 36. https://doi.org/10.3390/mca24020036

Gunay S, Kaşkaloğlu K. Seeking a Chaotic Order in the Cryptocurrency Market. Mathematical and Computational Applications. 2019; 24(2):36. https://doi.org/10.3390/mca24020036

Chicago/Turabian StyleGunay, Samet, and Kerem Kaşkaloğlu. 2019. "Seeking a Chaotic Order in the Cryptocurrency Market" Mathematical and Computational Applications 24, no. 2: 36. https://doi.org/10.3390/mca24020036

APA StyleGunay, S., & Kaşkaloğlu, K. (2019). Seeking a Chaotic Order in the Cryptocurrency Market. Mathematical and Computational Applications, 24(2), 36. https://doi.org/10.3390/mca24020036