Analyzing the Feasibility of Lithium Extraction in Mexico: Supply Chain Modeling with Economic and Environmental Considerations

Abstract

1. Introduction

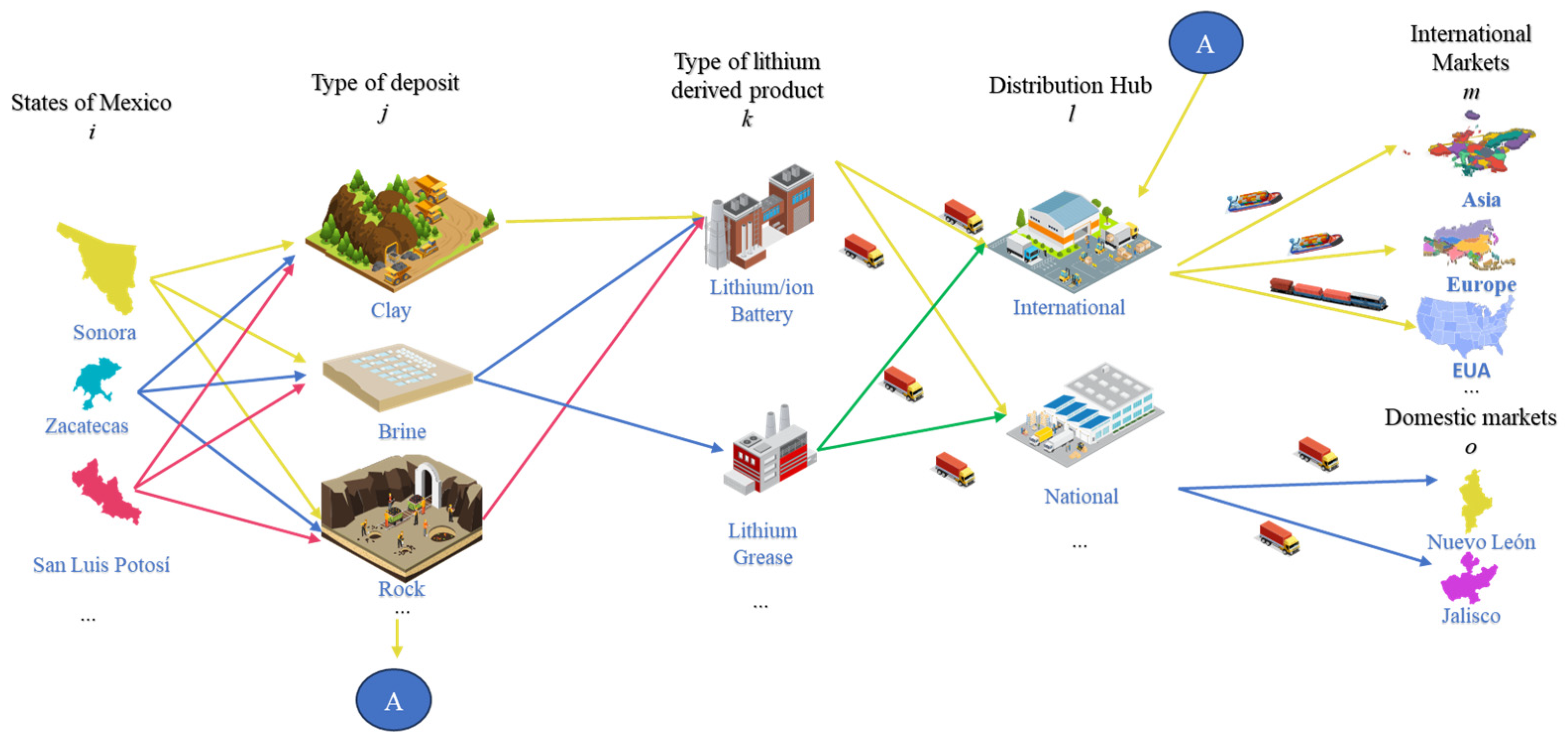

2. Problem Statement

3. Methods

3.1. Mathematical Model

3.1.1. Lithium Extraction

3.1.2. Lithium Processing

3.1.3. Costs and Sales

3.1.4. Emissions

3.1.5. Assumptions and Parameters

3.2. Case Study

4. Results and Discussion

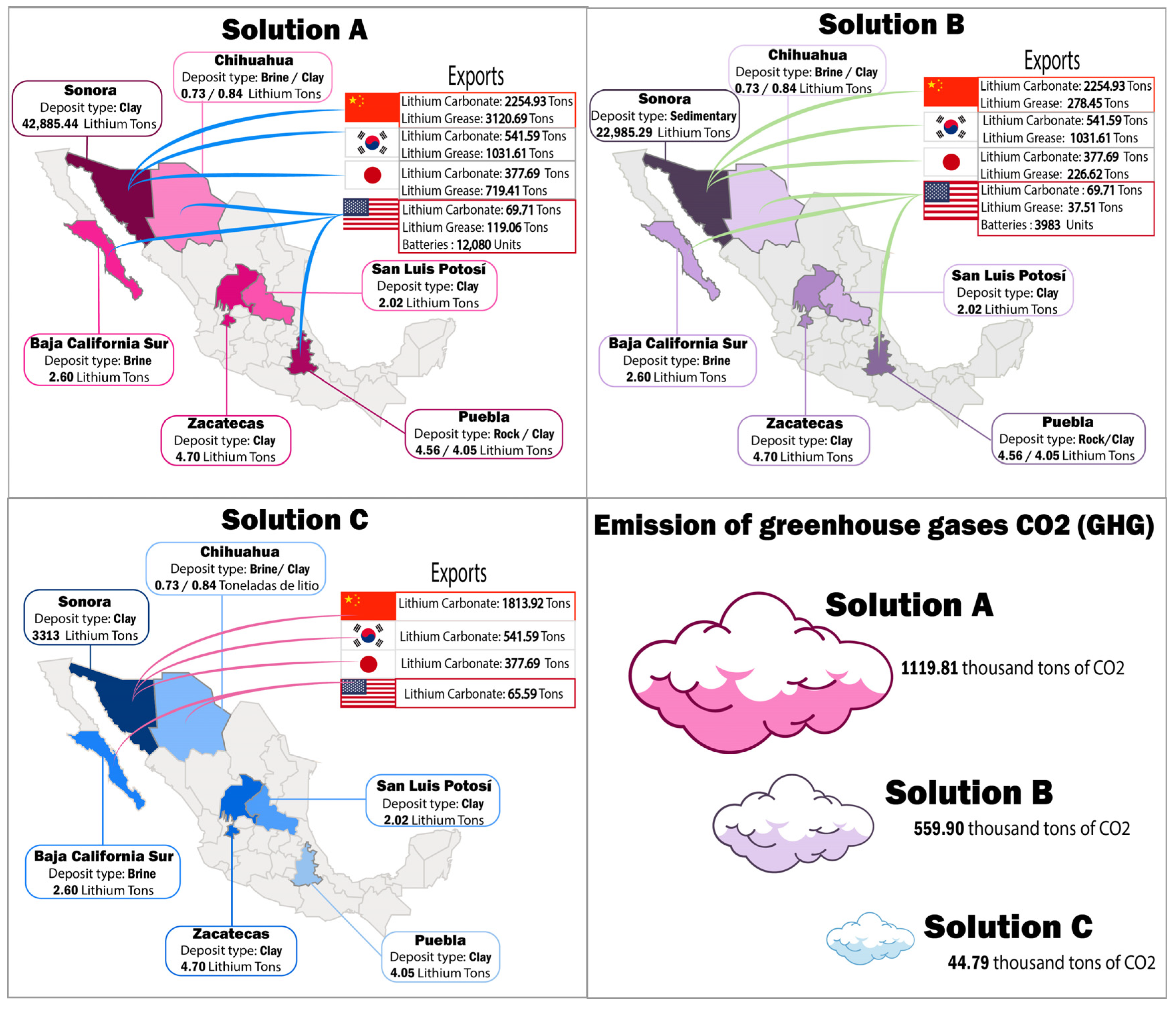

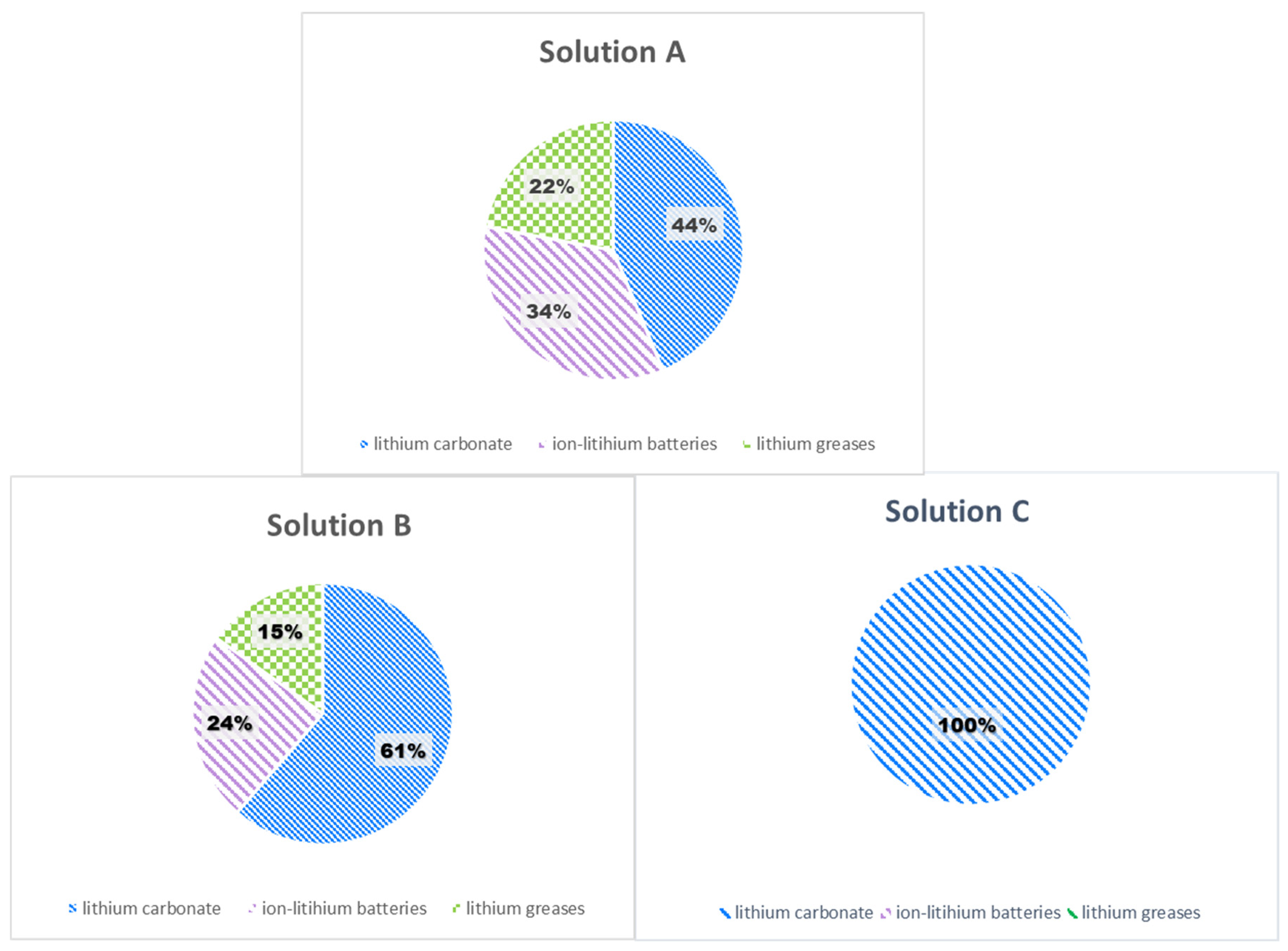

4.1. General Results

4.2. Solution A

4.3. Solution B

4.4. Solution C

5. General Discussion

6. Conclusions

6.1. Lithium Trade Diversification

6.2. Strategic Insight

6.3. Future Directions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| Indexes | |

| i,ia | States of Mexico |

| j | Type of lithium deposit |

| k | Lithium-derived product types |

| l | Distribution hub |

| m | International markets |

| o | Domestic markets |

| Binary Variables | |

| Binary decision variable to determine the state i where lithium-derived product types k will be fabricated | |

| Variables | |

| Total extraction cost | |

| Total process cost | |

| Total transport cost | |

| Rate of extracted lithium of deposit type j in state i | |

| Rate of extracted lithium of deposit type j in state i sent to state ia | |

| Rate of imported lithium of deposit j in state i | |

| Rate of lithium-derived product type k for export to international market m | |

| Rate of extracted lithium of deposit type j in state i | |

| Rate of lithium-derived product type k for transport to domestic market o | |

| Rate of lithium carbonate processed in state i from deposit type j | |

| Rate of lithium carbonate processed in state i from deposit type j, to be transported to hub l for export to the international market m | |

| Rate of lithium production in state i for lithium-derived product type k destined to hub l | |

| Total production capacity of state i for types of lithium-derived product type k | |

| Total annual cost | |

| Sales | |

| Profit | |

| Greenhouse gases | |

| Parameters | |

| Fixed cost for lithium processing by lithium-derived product types k | |

| Variable cost for lithium processing by types of lithium-derived product type k | |

| Specific lithium extraction cost by deposit type j | |

| Transport cost of state i to state ia | |

| Transport cost for lithium/derived products of state i to hub l | |

| International transport cost to market m | |

| National transport cost to market o | |

| Transport cost for carbonate lithium of state i to hub l | |

| Amount of international demand of lithium-derived product types k for export to international market m | |

| Amount of national demand of lithium-derived product type k for national market o | |

| Amount of lithium in the deposit | |

| Amount of international demand of lithium carbonate from deposit type j | |

| Distance of state i to state ia | |

| Distance to hub l | |

| Distance to domestic market o | |

| Distance to international market m | |

| Emission factor of ground transport | |

| Emission factor of barge transport to international market m | |

| Emission factor of lithium extraction for type to deposit j | |

| Emission factor of lithium production for lithium-derived product type k | |

| Extraction efficiency for each type of deposit j | |

| Production efficiency for lithium extracted from deposit j processed for lithium-derived product types k | |

| Production capacity of state i for lithium-derived product type k | |

| International selling price of lithium-derived product type k | |

| Nacional selling price of lithium-derived product type k | |

| International selling price of lithium carbonate processed in deposit type j |

References

- Kalair, A.; Abas, N.; Saleem, M.S.; Kalair, A.R.; Khan, N. Role of energy storage systems in energy transition from fossil fuels to renewables. Energy Storage 2021, 3, e135. [Google Scholar] [CrossRef]

- Kim, J.; Song, J.; Kim, C.H.; Mahseredjian, J.; Kim, S. Consideration on present and future of battery energy storage system to unlock battery value. J. Mod. Power Syst. Clean Energy 2024, 13, 622–636. [Google Scholar] [CrossRef]

- Patil, G.; Pode, G.; Diouf, B.; Pode, R. Sustainable decarbonization of road transport: Policies, current status, and challenges of electric Vehicles. Sustainability 2024, 16, 8058. [Google Scholar] [CrossRef]

- Vega-Muratalla, V.O.; Ramírez-Márquez, C.; Lira-Barragán, L.F.; Ponce-Ortega, J.M. Review of lithium as a strategic resource for electric vehicle battery production: Availability, extraction, and future prospects. Resources 2024, 13, 148. [Google Scholar] [CrossRef]

- Vivoda, V.; Bazilian, M.D.; Khadim, A.; Ralph, N.; Krame, G. Lithium nexus: Energy, geopolitics, and socio-environmental impacts in Mexico’s Sonora project. Energy Res. Soc. Sci. 2024, 108, 103393. [Google Scholar] [CrossRef]

- Altiparmak, S.O. China and Lithium Geopolitics in a Changing Global Market. Chin. Polit. Sci. Rev. 2022, 8, 487–506. [Google Scholar] [CrossRef]

- Schönfisch, M.; Dasgupta, A.; Wanner, B. Projected global demand for energy storage. In Emerging Battery Technologies to Boost the Clean Energy Transition, 1st ed.; Passerini, S., Barelli, L., Baumann, M., Peters, J.F., Weil, M., Eds.; Springer: Cham, Switzerland, 2024; pp. 29–52. [Google Scholar] [CrossRef]

- Johnson, C.A.; Clavijo, A.; Lorca, M.; Andrade, M.O. Bringing the state back in the lithium triangle: An institutional analysis of resource nationalism in Chile, Argentina, and Bolivia. Extract. Ind. Soc. 2024, 20, 101534. [Google Scholar] [CrossRef]

- Yang, S.; Wang, Y.; Pan, H.; He, P.; Zhou, H. Lithium extraction from low-quality brines. Nature 2024, 636, 309–321. [Google Scholar] [CrossRef]

- Water for Food and Wellbeing in Latin America and the Caribbean. Social and Environmental Implications for a Globalized Economy. Available online: https://ris.utwente.nl/ws/files/140209304/Campuzano2014water.pdf (accessed on 18 February 2025).

- Mousavinezhad, S.; Nili, S.; Fahimi, A.; Vahidi, E. Environmental impact assessment of direct lithium extraction from brine resources: Global warming potential, land use, water consumption, and charting sustainable scenarios. Resour. Conserv. Recycl. 2024, 205, 107583. [Google Scholar] [CrossRef]

- Gebre, S.L.; Cattrysse, D.; Van Orshoven, J. Multi-criteria decision-making methods to address water allocation problems: A systematic review. Water 2021, 13, 125. [Google Scholar] [CrossRef]

- Marmolejo Cervantes. M. Á.; Garduño-Rivera, R. Mining-energy public policy of lithium in Mexico: Tension between nationalism and globalism. Resour. Policy 2022, 77, 102686. [Google Scholar] [CrossRef]

- Martinez, N.; Terrazas-Santamaria, D. Beyond nearshoring: The political economy of Mexico’s emerging electric vehicle industry. Energy Policy 2024, 195, 114385. [Google Scholar] [CrossRef]

- Vega-Muratalla, V.O.; Ramírez-Márquez, C.; Lira-Barragán, L.F.; Ponce-Ortega, J.M. Optimal evaluation of brine desalination in the lithium supply chain: Balancing multi-objective strategies with global clean energy and electric vehicle initiatives. Chem. Eng. Res. Des. 2025, 215, 547–567. [Google Scholar] [CrossRef]

- Ge, B.; Hu, L.; Yu, X.; Wang, L.; Fernandez, C.; Yang, N.; Liang, Q.; Yang, Q.H. Engineering triple-phase interfaces around the anode toward practical alkali metal–air batteries. Adv. Mater. 2024, 36, 2400937. [Google Scholar] [CrossRef]

- Lithium in Nature, Application, Methods of Extraction. Available online: https://www.researchgate.net/publication/308972413_LITHIUM_IN_NATURE_APPLICATION_METHODS_OF_EXTRACTION_REVIEW_A_review_of_the_world’s_largest_lithium_deposits_made_the_analysis_of_its_global_production_and_reserves_Deposits_of_lithium_are_known_in_Chi (accessed on 18 February 2025).

- Zelek-Molik, A.; Litwa, E. Trends in research on novel antidepressant treatments. Front. Pharmacol. 2025, 16, 1544795. [Google Scholar] [CrossRef] [PubMed]

- Ghorbani, Y.; Zhang, S.E.; Bourdeau, J.E.; Chipangamate, N.S.; Rose, D.H.; Valodia, I.; Nwaila, G.T. The strategic role of lithium in the green energy transition: Towards an OPEC-style framework for green energy-mineral exporting countries (GEMEC). Resour. Policy 2024, 90, 104737. [Google Scholar] [CrossRef]

- Battery 2030: Resilient, Sustainable, and Circular. Available online: https://www.globalbattery.org/media/publications/battery-2030-resilient-sustainable-and-circular.pdf (accessed on 18 February 2025).

- Tabelin, C.B.; Dallas, J.; Casanova, S.; Pelech, T.; Bournival, G.; Saydam, S.; Canbulat, I. Towards a low-carbon society: A review of lithium resource availability, challenges and innovations in mining, extraction and recycling, and future perspectives. Miner. Eng. 2021, 163, 106743. [Google Scholar] [CrossRef]

- Schadlow, N.; Herman, A.L. Battery Power: China’s pursuit of a global green-energy monopoly includes locking up the battery supply chain. The Pentagon has a strong interest in not letting that happen. Hoover Digest 2021, 4, 17–29. [Google Scholar]

- Bridge, G.; Faigen, E. Towards the lithium-ion battery production network: Thinking beyond mineral supply chains. Energy Res. Soc. Sci. 2022, 89, 102659. [Google Scholar] [CrossRef]

- Tan, J.; Keiding, J.K. Mapping the cobalt and lithium supply chains for e-mobility transition: Significance of overseas investments and vertical integration in evaluating mineral supply risks. Resour. Conserv. Recycl. 2024, 209, 107788. [Google Scholar] [CrossRef]

- Yang, Z.; Huang, H.; Lin, F. Sustainable electric vehicle batteries for a sustainable world: Perspectives on battery cathodes, environment, supply chain, manufacturing, life cycle, and policy. Adv. Energy Mater. 2022, 12, 2200383. [Google Scholar] [CrossRef]

- Popien, J.-L.; Husmann, J.; Echternach, T.; Barke, A.; Cerdas, F.; Herrmann, C.; Spengler, T.S. Design of battery supply chains under consideration of environmental and socio-economic criteria. Procedia CIRP 2024, 122, 127–132. [Google Scholar] [CrossRef]

- Jones, E.C. Lithium supply chain optimization: A global analysis of critical minerals for batteries. Energies 2024, 17, 2685. [Google Scholar] [CrossRef]

- Afroozi, M.A.; Gramifar, M.; Hazratifar, B.; Keshvari, M.M.; Razavian, S.B. Optimization of lithium-ion battery circular economy in electric vehicles in sustainable supply chain. Battery Energy 2025, 4, e20240057. [Google Scholar] [CrossRef]

- Shao, L.; Jin, S. Resilience assessment of the lithium supply chain in China under impact of new energy vehicles and supply interruption. J. Clean. Prod. 2020, 252, 119624. [Google Scholar] [CrossRef]

- Jin, P.; Wang, S.; Meng, Z.; Chen, B. China’s lithium supply chains: Network evolution and resilience assessment. Resour. Policy 2023, 87, 104339. [Google Scholar] [CrossRef]

- Towards a Resilient Battery Supply Chain Strategies and Enablers for Managing Vulnerabilities and Enhancing Resilience for a Swedish Automotive OEM. Available online: http://hdl.handle.net/20.500.12380/306530 (accessed on 18 February 2025).

- Risk Management Associated with the Supply Chain of a Manufacture of Lithium Batteries. Available online: http://hdl.handle.net/2117/422969 (accessed on 18 February 2025).

- Kchaou Boujelben, M.; Gicquel, C.; Minoux, M. A MILP model and heuristic approach for facility location under multiple operational constraints. Comput. Ind. Eng. 2016, 98, 446–461. [Google Scholar] [CrossRef]

- Ausenco Services Pty Ltd. Technical Report on the Feasibility Study for the Sonora Lithium Project. Available online: https://bacanoralithium.com/_userfiles/pages/files/documents/technicalreportontheprefeasibilitystudyforthesonoralithiumprojectmexico_compressed.pdf (accessed on 18 February 2025).

- Jaskula, B.W. Lithium. In Mineral Commodity Summaries 2022; USGS: Reston, VA, USA, 2022; pp. 100–101. [Google Scholar] [CrossRef]

- Perfil del Mercado del Litio. Available online: https://www.gob.mx/cms/uploads/attachment/file/624816/15Perfil_Litio_2020__T_.pdf (accessed on 18 February 2025).

- Liu, J.; Xu, R.; Sun, W.; Wang, L.; Zhang, Y. Lithium extraction from lithium-bearing clay minerals by calcination-leaching method. Minerals 2024, 14, 248. [Google Scholar] [CrossRef]

- Rosales, G.D.; del Carmen Ruiz, M.; Rodriguez, M.H. Novel process for the extraction of lithium from β-spodumene by leaching with HF. Hydrometallurgy 2014, 147–148, 1–6. [Google Scholar] [CrossRef]

- Tian-ming, G.; Na, F.; Wu, C.; Tao, D. Lithium extraction from hard rock lithium ores (spodumene, lepidolite, zinnwaldite, petalite): Technology, resources, environment and cost. China Geol. 2023, 6, 137–153. [Google Scholar] [CrossRef]

- Iyer, K.R.; Kelly, J.C. Life-cycle analysis of lithium chemical production in the United States. RSC Sustain. 2024, 2, 3929–3945. [Google Scholar] [CrossRef]

- Kelly, J.C.; Wang, M.; Dai, Q.; Winjobi, O. Energy, greenhouse gas, and water life cycle analysis of lithium carbonate and lithium hydroxide monohydrate from brine and ore resources and their use in lithium ion battery cathodes and lithium ion batteries. Resour. Conserv. Recycl. 2021, 174, 105762. [Google Scholar] [CrossRef]

- Lagos, G.; Cifuentes, L.; Peters, D.; Castro, L.; Valdés, J.M. Carbon footprint and water inventory of the production of lithium in the Atacama Salt Flat, Chile. Environ. Chall. 2024, 16, 100962. [Google Scholar] [CrossRef]

- Zhao, Z.; Si, X.; Liu, X.; He, L.; Liang, X. Li extraction from high Mg/Li ratio brine with LiFePO4/FePO4 as electrode materials. Hydrometallurgy 2013, 133, 75–83. [Google Scholar] [CrossRef]

- Liu, Y.; Zhang, R.; Wang, J.; Wang, Y. Current and future lithium-ion battery manufacturing. Perspective 2021, 24, 102332. [Google Scholar] [CrossRef]

- Breakdown of Raw Materials in Tesla’s Batteries and Possible Bottlenecks. Available online: https://electrek.co/2016/11/01/breakdown-raw-materials-tesla-batteries-possible-bottleneck/ (accessed on 18 February 2025).

- Nengiwa, T.O.; Manyuchi, M. Economic analysis for refining 1TPD of lubricating oils. In Proceedings of the 8th Zimbabwe Institute of Engineers Congress, Victoria Falls, Zimbabwe, 14–19 September 2015. [Google Scholar] [CrossRef]

- Hoja de Seguridad. Trupper. Available online: https://www.truper.com/admin/descargables/hoja_seguridad/MSDS-100%20Nivel%20B%20Espa%C3%B1ol.pdf (accessed on 18 February 2025).

- Hao, H.; Mu, Z.; Jiang, S.; Liu, Z.; Zhao, F. GHG emissions from the production of lithium-ion batteries for electric vehicles in China. Sustainability 2017, 9, 504. [Google Scholar] [CrossRef]

- Climate Portal. Available online: https://climate.mit.edu/ask-mit/how-much-co2-emitted-manufacturing-batteries (accessed on 18 February 2025).

- Chein, H.; Chen, T.M.; Aggarwal, S.G.; Tsai, C.-J.; Huang, C.-C. Inorganic acid emission factors of semiconductor manufacturing processes. J. Air Waste Manag. Assoc. 2004, 54, 218–228. [Google Scholar] [CrossRef]

- Data México. Available online: https://www.economia.gob.mx/datamexico/es/profile/product/lithium-carbonate (accessed on 18 February 2025).

- New Technology and Automation in Freight Transport and Handling Systems New Technology and Automation in Freight Transport and Handling Systems. Available online: https://assets.publishing.service.gov.uk/media/5c73fc7340f0b603d87fe977/automation_in_freight.pdf (accessed on 18 February 2025).

- Google Maps. Available online: https://www.google.com.mx/maps/preview (accessed on 18 February 2025).

- Lithium Price Chart Historical Data—News. Available online: https://tradingeconomics.com/commodity/lithium (accessed on 18 February 2025).

- El Equilibrio Óptimo en el Tamaño de la Batería. Porsche Newsroom. Available online: https://newsroom.porsche.com/es_ES/tecnologia/2021/es-porsche-capacidad-bateria-autonomia-prestaciones-sostenibilidad-estudio-nurburgring-26881.html (accessed on 18 February 2025).

- Lithium-Ion Battery Pack Prices Hit Record Low of $139/kWh. Available online: https://about.bnef.com/blog/lithium-ion-battery-pack-prices-hit-record-low-of-139-kwh/ (accessed on 18 February 2025).

- Grasa de Litio Multiusos 3.5 Kg, Truper 101573. Available online: https://www.mercadolibre.com.mx/grasa-de-litio-multiusos-35-kg-truper-101573/p/MLM24666830#polycard_client=search-nordic&wid=MLM1937683029&sid=search&searchVariation=MLM24666830&position=5&search_layout=stack&type=product&tracking_id=017f3091-759e-4f62-a232-261aaa1ae96b (accessed on 18 February 2025).

- Green Freight Math: How to Calculate Emissions for a Truck Move. Available online: https://business.edf.org/insights/green-freight-math-how-to-calculate-emissions-for-a-truck-move/ (accessed on 18 February 2025).

- How Much Does the Shipping Industry Contribute to Global CO2 Emissions? Available online: https://sinay.ai/en/how-much-does-the-shipping-industry-contribute-to-global-co2-emissions/ (accessed on 18 February 2025).

- El Litio de México: Avance y Perspectiva. Avance y Perspectiva. Available online: https://avanceyperspectiva.cinvestav.mx/el-litio-de-mexico/ (accessed on 18 February 2025).

- Litiomx. Available online: https://www.gob.mx/litiomx/que-hacemos (accessed on 18 February 2025).

- Flexer, V.; Baspineiro, C.F.; Galli, C.I. Lithium recovery from brines: A vital raw material for green energies with a potential environmental impact in its mining and processing. Sci. Total Environ. 2018, 639, 1188–1204. [Google Scholar] [CrossRef]

- Dessemond, C.; Lajoie-Leroux, F.; Soucy, G.; Laroche, N.; Magnan, J.-F. Spodumene: The lithium market, resources and processes. Minerals 2019, 9, 334. [Google Scholar] [CrossRef]

- Roy, V.; Paranthaman, M.P.; Zhao, F. Lithium from clay: Assessing the environmental impacts of extraction. Sustain. Prod. Consum. 2024, 52, 324–332. [Google Scholar] [CrossRef]

- Gaceta UNAM: Acción Migrante. Available online: https://www.gaceta.unam.mx/probable-que-trump-aplique-aranceles-del-25-solo-a-ciertos-productos/ (accessed on 18 February 2025).

| States | j = Clay | j = Brine | j = Rock | k = Lithium-Ion Battery | k = Lithium Grease | Units |

|---|---|---|---|---|---|---|

| Aguascalientes | 0.0000 | 0.0000 | 0.0000 | 52.0634 | 2.1107 | tons Li |

| Baja California | 0.0000 | 0.0000 | 0.0000 | 184.1658 | 7.4662 | tons Li |

| Baja California Sur | 0.0000 | 2.5980 | 0.0000 | 0.0124 | 0.0005 | tons Li |

| Campeche | 0.0000 | 0.0000 | 0.0000 | 0.1103 | 0.0045 | tons Li |

| Chihuahua | 0.8413 | 0.7303 | 0.0000 | 373.7020 | 15.1501 | tons Li |

| Ciudad de México | 0.0000 | 0.0000 | 0.0000 | 139.3059 | 5.6475 | tons Li |

| Coahuila | 0.0000 | 0.0000 | 0.0000 | 1.4072 | 0.0570 | tons Li |

| Colima | 0.0000 | 0.0000 | 0.0000 | 0.2376 | 0.0096 | tons Li |

| Durango | 0.0000 | 0.0000 | 0.0000 | 0.1049 | 0.0043 | tons Li |

| Guanajuato | 0.0000 | 0.0000 | 0.0000 | 0.1979 | 0.0080 | tons Li |

| Jalisco | 0.0000 | 0.0000 | 0.0000 | 101.5318 | 4.1162 | tons Li |

| México | 0.0000 | 0.0000 | 0.0000 | 9.5839 | 0.3885 | tons Li |

| Michoacán | 0.0000 | 0.0000 | 0.0000 | 0.0123 | 0.0005 | tons Li |

| Morelos | 0.0000 | 0.0000 | 0.0000 | 0.1508 | 0.0061 | tons Li |

| Nuevo León | 0.0000 | 0.0000 | 0.0000 | 12.4727 | 0.5056 | tons Li |

| Puebla | 4.5561 | 0.0000 | 4.0465 | 2.9264 | 0.1186 | tons Li |

| Querétaro | 0.0000 | 0.0000 | 0.0000 | 2.7002 | 0.1095 | tons Li |

| Quintana Roo | 0.0000 | 0.0000 | 0.0000 | 0.0946 | 0.0038 | tons Li |

| San Luis Potosí | 2.0207 | 0.0000 | 0.0000 | 2.7501 | 0.1115 | tons Li |

| Sinaloa | 0.0000 | 0.0000 | 0.0000 | 0.1702 | 0.0069 | tons Li |

| Sonora | 42,885.4400 | 0.0000 | 0.0000 | 105.7297 | 4.2863 | tons Li |

| Tabasco | 0.0000 | 0.0000 | 0.0000 | 19.1392 | 0.7759 | tons Li |

| Tamaulipas | 0.0000 | 0.0000 | 0.0000 | 20.5447 | 0.8329 | tons Li |

| Tlaxcala | 0.0000 | 0.0000 | 0.0000 | 0.0024 | 0.0001 | tons Li |

| Veracruz | 0.0000 | 0.0000 | 0.0000 | 0.8082 | 0.0328 | tons Li |

| Yucatán | 0.0000 | 0.0000 | 0.0000 | 0.1835 | 0.0074 | tons Li |

| Zacatecas | 4.6968 | 0.0000 | 0.0000 | 0.0415 | 0.0017 | tons Li |

| Parameter | Clay | Brine | Rock | Units |

|---|---|---|---|---|

| 92.37 | 90.43 | 91.35 | % | |

| k = Lithium-ion Battery | 91.40 | 92.40 | 90.40 | % |

| k = Lithium grease | 59.10 | 59.70 | 58.50 | % |

| 0.0037 | 0.0011 | 0.0030 | $M | |

| 12.7500 | 2.9000 | 15.0000 | Ton CO2/Ton Li |

| Parameter | Lithium–Ion Battery | Lithium Grease | Units |

|---|---|---|---|

| 600.000 | 300.000 | tons Li | |

| 0.085 | 0.002 | $M | |

| 0.012 | 0.141 | $M/ton Li | |

| 108.931 | 101.111 | Ton CO2/ ton Li |

| International Market m | j = Brine | j = Rock | j = Clay | k = Lithium–Ion Battery | k = Lithium Grease | ||

|---|---|---|---|---|---|---|---|

| China | 13,980.5419 | 28,863.0542 | 2254.9260 | 33,372.9060 | 1352.9560 | 0.0828 | 13,247.0000 |

| Korea | 3357.8868 | 6932.4114 | 541.5946 | 8015.6010 | 324.9570 | 0.0735 | 11,761.5600 |

| Japan | 2341.6919 | 4834.4607 | 377.6922 | 5589.8450 | 226.6150 | 0.0683 | 10,929.7000 |

| USA | 387.6011 | 800.2087 | 62.5163 | 925.2410 | 37.5100 | 0.0000 | 2362.6400 |

| Russia | 300.8942 | 621.2009 | 48.5313 | 718.2640 | 29.1190 | 0.0684 | 10,946.2500 |

| United Kingdom | 300.1917 | 619.7507 | 48.4180 | 716.5870 | 29.0510 | 0.0563 | 9000.5000 |

| Belgium | 255.5592 | 527.6061 | 41.2192 | 610.0450 | 24.7320 | 0.0601 | 9621.6200 |

| Netherlands | 213.3238 | 440.4104 | 34.4071 | 509.2250 | 20.6440 | 0.0601 | 9616.9100 |

| Germany | 169.0860 | 349.0808 | 27.2719 | 403.6250 | 16.3630 | 0.0622 | 9948.9800 |

| France | 126.7501 | 261.6777 | 20.4436 | 302.5650 | 12.2660 | 0.0605 | 9683.1100 |

| Turkey | 80.9469 | 167.1161 | 13.0559 | 193.2280 | 7.8340 | 0.0768 | 12,292.0400 |

| Spain | 49.2741 | 101.7273 | 7.9474 | 117.6220 | 4.7680 | 0.0593 | 9493.6800 |

| Parameter | Value | Units |

|---|---|---|

| National Transport Cost | 0.075 | USD ton/km |

| 0.154 | USD M | |

| 0.162 | USD M | |

| 0.154 | USD M | |

| 0.162 | USD M | |

| 0.01 | USD M | |

| 0.00010112 | ton CO2/ton Li per Km | |

| 0.00001614 | ton CO2/ton Li per Km |

| Solution A | Solution B | Solution C | Units | |

|---|---|---|---|---|

| Export of lithium precursor | 3485.22 | 3485.22 | 3040.10 | Ton of Lithium |

| Export of lithium-derived products | 3406.52 | 1126.60 | 0.00 | Ton of Lithium |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Carranza-Maldonado, J.; Ochoa-Barragán, R.; Guerrero-García-Rojas, H.; Ramírez-Márquez, C.; Ponce-Ortega, J.M. Analyzing the Feasibility of Lithium Extraction in Mexico: Supply Chain Modeling with Economic and Environmental Considerations. Processes 2025, 13, 1116. https://doi.org/10.3390/pr13041116

Carranza-Maldonado J, Ochoa-Barragán R, Guerrero-García-Rojas H, Ramírez-Márquez C, Ponce-Ortega JM. Analyzing the Feasibility of Lithium Extraction in Mexico: Supply Chain Modeling with Economic and Environmental Considerations. Processes. 2025; 13(4):1116. https://doi.org/10.3390/pr13041116

Chicago/Turabian StyleCarranza-Maldonado, Jovanna, Rogelio Ochoa-Barragán, Hilda Guerrero-García-Rojas, César Ramírez-Márquez, and José María Ponce-Ortega. 2025. "Analyzing the Feasibility of Lithium Extraction in Mexico: Supply Chain Modeling with Economic and Environmental Considerations" Processes 13, no. 4: 1116. https://doi.org/10.3390/pr13041116

APA StyleCarranza-Maldonado, J., Ochoa-Barragán, R., Guerrero-García-Rojas, H., Ramírez-Márquez, C., & Ponce-Ortega, J. M. (2025). Analyzing the Feasibility of Lithium Extraction in Mexico: Supply Chain Modeling with Economic and Environmental Considerations. Processes, 13(4), 1116. https://doi.org/10.3390/pr13041116