1. Introduction

China lacks sufficient domestic oil and natural gas resources, but is relatively rich in coal reserves. In 2023, the country imported 564 million tonnes of crude oil [

1], and China’s foreign oil dependence has remained above 70% in recent years. This heavy reliance poses significant risks to the national oil security, economic security, and national security of the entire country in the event of import disruptions. Establishing a diversified oil supply system is therefore crucial to mitigating such risks. One key strategy is to actively develop substitutes for crude oil and vigorously promote coal-to-liquid (CTL) technology. In 2017, the National Energy Administration of China announced a target to achieve a CTL production capacity of 13 million tons/year by 2020 [

2], and planned the construction of four CTL demonstration projects over the following five years. More recently, in 2024, six government departments jointly issued the Opinions on Strengthening the Clean and Efficient Utilization of Coal, emphasizing the construction of strategic CTL and the acceleration of gas bases, and calling for enhanced production capacity and technical reserves for CTL and gas production [

3]. Despite these initiatives, one major challenge associated with CTL is its high CO

2 emissions, especially under increasing emission reduction pressure.

Carbon capture and storage (CCS) could be a vital choice for future clean energy production and climate change alleviation [

4,

5,

6]. According to the International Energy Agency (IEA) [

7], CCS could contribute up to 12% of global CO

2 reduction by 2050. CCS technologies are recognized to reduce carbon emissions under supportive policy frameworks in China [

8]. Several CCS projects have been launched in recent years, including those in China. In 2022, China’s first million-tonne-per-year integrated CCS project entered full operation. Additionally, Hua Neng initiated a 1.5 Mtpa coal-fired power CCS project, and several other companies have announced CCS projects [

9]. CCS is considered a key cost-effective technology to facilitate the economic decarbonization of China’s industry [

10,

11]. Similarly, CTL and CCS technology (CTL-CCS) could be integrated to reduce CO

2 emissions [

12,

13]. However, high investment costs remain one of the major barriers to the deployment of CTL-CCS, as is the case with its applications in power plants and other large industrial sources of CO

2, particularly in the absence of carbon pricing mechanisms [

14].

To achieve a cost-effective commitment of peaking CO

2 emissions before 2030, China has decided to resort to market-based approaches. China’s national carbon emissions trading system (ETS) was launched in 2017 and online trading was officially launched on 16 July 2021, initially covering only the power sector (coal and gas power). In the first compliance period, 2162 key emission entities were covered by China’s national ETS, covering approximately 4.5 billion tons of CO

2 emissions [

15]. As a result, China’s national ETS has become the world’s largest carbon market. Recent policy signals indicate that the national ETS will soon expand to cover other industries. However, among the more than 10 sub-industries currently under consideration, the CTL sub-industry has not yet been mentioned. In the chemical industry, only methanol, synthetic ammonia, and calcium carbide have been considered and discussed [

16]. Whether CTL will be covered by the national ETS in the future remains unclear.

Table 1 summarizes the carbon prices of the major carbon emission trading markets in domestic and foreign regions. These markets vary significantly in their design features, including cap setting, coverage, allowance allocation methods, offset mechanisms, etc. Some experts believe that China’s carbon price will rise to approximately 200 yuan per ton by 2030 [

17].

The carbon cost could be imposed either based on carbon emissions (as in downstream mechanisms like ETS) or on carbon consumption (as in upstream carbon taxes) [

21]. Compared with the downstream carbon price, the upstream carbon tax generally requires less effort in design and implementation. Some Chinese scholars argue that an upstream carbon tax should be implemented to simplify the design and implementation [

22,

23]. In addition to the ETS, the policy Opinions on the Complete, Accurate and Comprehensive Implementation of the New Development Concept to do a good job of Carbon Peak and Carbon Neutral Work was published in 2021, which mentioned that tax policies for carbon emissions reduction should be studied [

24]. Since the 1990s, both carbon taxes and ETS have been increasingly implemented across various jurisdictions with a wide range of carbon prices.

Table 2 provides a brief overview of selected carbon tax systems worldwide. Looking ahead, China is also likely to use both in parallel in the future. ETS would mainly regulate enterprises in covered sectors, while the carbon tax is used to promote carbon emissions reduction in other industries or fields. In addition, CCS projects in the US could obtain financial support from the US section 45Q Tax Credit policy. In 2018, projects could receive 50 USD/tCO

2 for geologic storage and 35 USD/tCO

2 for enhanced oil recovery [

25].

CTL, as a technology utilized in the upstream fuel production process, will inevitably be covered by either the ETS or a carbon tax. The upstream carbon tax is typically levied on specific fuels such as oil, gas, and coal, whose derivative products are based on their carbon content. It is a flat tax on all carbon entering the plant. In contrast, the downstream carbon price is usually applied according to the actual carbon emissions. Different regulatory approaches have different implications for the CTL technology. A key related issue is whether the carbon removed via CCS will be exempt from carbon taxation or not, which will create various incentives for the utilization of CCS technology [

29,

30].

CCS is a vital choice for CTL to address growing CO2 emission reduction pressure, while high investment costs remain a major barrier. The carbon price—whether upstream or downstream—is expected to serve as a primary policy instrument to encourage CCS implementation. Based on the above current price levels in domestic and foreign carbon markets and carbon taxes, the carbon price is assumed to fluctuate between 0 and 200 RMB/tCO2 before 2030. However, the regulation path of CTL in China remains under discussion. The carbon cost could be imposed either based on carbon emissions or carbon consumed. Therefore, it is essential to analyze both regulation options and assess how different carbon price levels may affect the cost-effectiveness of CTL production, both with or without CCS.

2. Process Simulation

Until 2023, China had eight indirect liquefaction projects and one direct liquefaction project in operation. Four projects under construction were based on indirect liquefaction. Considering how indirect liquefaction technology is the dominant CTL technology in China, it was chosen to be simulated and analyzed.

Figure 1 and

Figure 2 present two configurations of indirect coal liquefaction using Fischer–Tropsch (FT) synthesis: one with recycling unreacted syngas (

Figure 1) and the other with once-through synthesis combined with electricity generation from unreacted syngas (

Figure 2). Each route can be integrated with or without CCS. Once-through synthesis with CCS is named FT-OT-CCS, while the one without CCS is named FT-OT. Similarly, the system that recycles unreacted syngas with CCS is named FT-RE-CCS, whereas that without CCS is named FT-RE.

Table 3 shows the eight different scenarios in the analysis. They are categorized by the technical production route, which is either once-through synthesis or recycling unreacted syngas, with or without CCS, and further differentiated based on the carbon cost mechanism, which is represented by either the upstream carbon tax or the downstream carbon price.

The technical route mentioned here has not yet been fully industrialized. Therefore, flow simulation is needed to obtain relative data and Aspen Plus 11.1 is adopted as a popular simulation software [

31,

32,

33].

Figure 3 displays the simulation flowchart of the FT-RE-CCS production route. The main stream data in

Figure 3 are listed in

Supporting Information Table S1.

The entire system could be subdivided into several key subsystems, including air separation unit (ASU), gasification, water gas shift (WGS), syngas cleaning, synthesis and distillation, flue gas cleaning, and power generation. Semi-mechanistic models, for each selected technology of the subsystems, were developed and are listed in

Table 4 [

34]. For model validation, the simulation data were compared with the literature data. The relative error for key parameters (e.g., temperature, pressure, flow, and gas composition) between the literature data and the simulation data must be less than 5%, and the overall average relative error for each unit must be below 10% [

35,

36].

Anthracite coal or gas coal with a carbon content of 80–90% is primarily used in indirect CTL technology in China. One representative gas coal sample [

42] from southwest China was selected as an example. The mass fractions of Ash, C, H, N, S, and O were 8.8%, 82.7%, 5.2%, 1.3%, 0.8%, and 5.4%, respectively. The mass fractions of water, fixed carbon, volatiles, and ash are 3.3%, 52.5%, 32.5%, and 8.8%, respectively. The main simulation results for a raw coal input of 1 kg/s are listed in

Table 5 [

34]. When producing the same annual oil product amount of 3 million tonnes, the product mass fraction distribution is 12% gasoline, 28% kerosene, and 60% diesel oil, respectively, while FT-OT-CCS and FT-OT pathways generate 670 and 652 kWh of electricity per year, and annual CO

2 emissions from FT-OT-CCS, FT-OT, FT-RE-CCS, and FT-RE are 2.3, 12.6, 3.2, and 19.3 million tonnes, respectively.

3. Economic Analysis Model

The Electric Power Research Institute Technical Assessment Guide (EPRI TAG) cost estimation model [

43] was used to calculate the total capital investment (CI). It was assumed that each technical route operates at a total capacity of 3 million tons of oil products per year, which means the output with a mix of gasoline, kerosene, and diesel was 3 million tons in total per year in each scenario. The basic calculation model, presented in

Table 6, contains two parts: the total capital investment (CI) and the total operation and maintenance costs (OM) [

44,

45].

Total plant investment and OC are included in CI. The main parameters for calculating CI are main equipment investment and equipment contingency. Main equipment investment is calculated by adding estimated main equipment investment costs using the chemical engineering plant cost index (Equation (1)) [

34]. Primary equipment investment costs for a production amount of 3 million tonnes of oil per year are calculated and shown in

Supporting Information Table S2.

where I

PE represents main equipment investment, I represents individual equipment investment costs, j represents the jth equipment, m represents the total amount of equipment, f represents the domestic factor, S represents the equipment production scale, b represents basic, and x represents the scale index. The scale index x and

used for each piece of equipment are the same in the literature [

34].

Equipment contingency is calculated by summing each equipment’s contingency. Each equipment’s contingency is calculated by multiplying each equipment’s investment cost and its contingency expense factor (Equation (2)) [

34]. Contingency expense calculated is shown in

Supporting Information Table S3 when the production amount is 3 million tonnes of oil per year.

where I

EC is equipment contingency, FEC represents contingency expense factor for each piece of equipment.

Fixed expenses and variable expenses are included in OM.

Table 7 shows the main assumption parameters for calculating fixed expenses in China.

The calculation of variable expenses, detailed in

Table 6, is primarily based on the consumption of raw materials multiplied by their purchase prices, and the output of products multiplied by their respective selling prices in the Chinese market. Tax credits or carbon offsets were not considered in this study.

The estimated densities of diesel oil, gasoline, and kerosene oil are 0.86, 0.739, and 0.8 kg/dm

3, respectively. Various agencies forecast that Brent oil prices could be in the range of USD 65 to USD 75 per barrel in 2025, and likely to continue to fall after 2025 [

47,

48]. Diesel oil, gasoline, and kerosene prices are estimated to be 7.1, 6.8, and 4.6 RMB/dm

3 when the Brent crude oil price is about USD 65 per barrel. Then the price of oil is calculated as approximately 7500 RMB per tonne. As for carbon pricing, a range of 0–200 RMB/tCO

2 is assumed. For the upstream carbon tax, the carbon pricing cost is calculated by multiplying the carbon price and the amount of CO

2 converted from the carbon content of coal consumed. For the downstream carbon price, the carbon pricing cost is calculated by multiplying the carbon price and the amount of CO

2 emission from syngas cleaning or flue gas. Reference carbon prices in several countries and major domestic and international emissions trading markets are shown in

Table 1 and

Table 2.

Table 8 shows the main parameters needed for calculating variable expenses.

4. Results and Discussion

4.1. The Product Cost

According to the economic estimation model, the product cost can be calculated using the equations

where C represents the product cost, CRF represents the capital recovery factor, a represents the discount rate, and n represents the plant lifetime, which is the total number of operation years. CI is the capital investment, P is the total output of system products, and

is the total O&M costs per year.

The effects of two levy methods, the upstream carbon tax or the downstream carbon price, and carbon prices on the oil cost under eight scenarios are listed in

Figure 4. First, while an upstream carbon tax significantly increases product costs, it does not alter the relative cost differences between technologies. Consequently, it fails to incentivize enterprises to implement relative measures such as CCS technology to reduce emissions. In contrast, the downstream carbon price can reduce the additional product cost when adopting CCS. Especially for the FT-RE system, when the carbon price reaches 200 RMB/tCO

2, adopting CCS technology can decrease the product cost. This indicates that the downstream carbon price is more conducive for reducing the emissions in production systems. Second, FT-RE consistently reveals a lower product cost than FT-OT, with or without CCS and under either carbon cost type, underscoring its superior economic performance. In addition, for systems with CCS, the downstream carbon price often has little impact on product cost due to their lower emissions. As the carbon price increases from 0 to 200 RMB/tCO

2, the oil cost for the FT-RE-CCS and FT-OT-CCS systems increases by only about 2% and 3%, respectively, while the oil cost increases by about 11% and 16% for the FT-RE and FT-OT systems. In other words, regardless of the carbon cost implemented, the product cost will increase to some extent due to the current difficulty in rapidly deploying CCS in CTL systems. To limit the product cost increase to below 10%, the upstream carbon tax should not exceed 100 RMB/tCO

2, while the downstream carbon price should remain below 120 RMB/tCO

2. For a more stringent cap of a 5% cost increase, the upstream carbon tax should be kept under 40 RMB/tCO

2, and the downstream carbon price under 60 RMB/tCO

2.

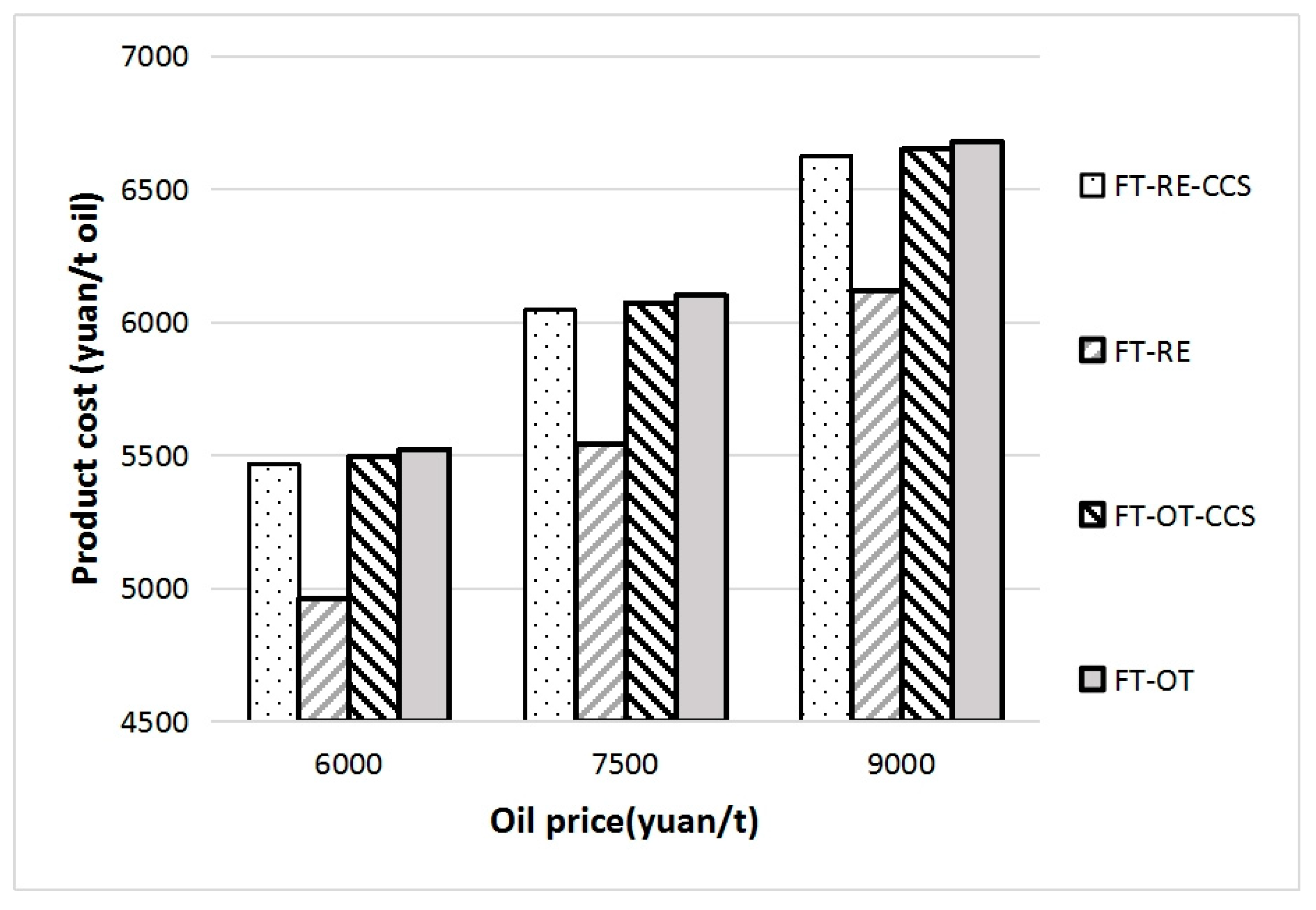

Given the volatility of global oil prices, a sensitivity analysis of product cost against varying oil prices is considered when there are no carbon prices, as shown in

Figure 5. The higher the oil price, the higher the product cost. When the carbon price is higher, the relative product cost will increase with the same growth rate.

4.2. IRR and NPV

The Internal Rate of Return (IRR) of a project means the discount rate when the total annual cash inflow accumulated during the entire economic life cycle (or within depreciation life) is equal to the total cash outflow. Therefore, during the calculation period, the discount rate of the Net Present Value (NPV) of the project is zero. The formulas are [

54]

where NPV represents net present value, i represents the ith operation year, n represents the total number of operation years, a represents the discount rate, V

i represents the cash flow of a year, V

0 represents the initial investment costs, and IRR is the internal rate of return.

IRR, which represents a project’s maximum profitability and the highest acceptable loan interest rate, should exceed the benchmark yield or bank lending rates. If the lending rate is higher than the IRR, then the project will incur a loss. Therefore, the IRR serves as a critical benchmark to determine the minimum requirements for accepting an investment program by analyzing the actual investment returns.

Figure 6 illustrates the impacts of different carbon pricing methods and price levels on the IRR across the eight scenarios. The upstream carbon tax shows a more substantial influence than the downstream carbon price, as evidenced by a significantly steeper decline in the IRR as carbon prices rise. Nevertheless, the influence of the downstream carbon price on systems with CCS remains relatively small, especially for FT-OT-CCS and FT-RE-CCS. Compared to those from FT-OT and FT-RE, the CO

2 emissions from those two are significantly reduced from 13–19 Mt CO

2 to only 2–3 Mt CO

2 by coupling CCS. The influence of the downstream carbon price significantly declined at the same time. As the price increases, the difference in IRR caused by the adoption of CCS technology decreases. When the downstream carbon price increases from 0 to 200 RMB/tCO

2, the IRR differences between FT-RE-CCS and FT-RE drops from 7% to 3%, and that between FT-OT-CCS and FT-OT drops from 5% to 1%, respectively. From the change trend in IRR, it could be found that if the downstream carbon price rises higher, to 300 RMB/tCO

2 for example, the IRR of FT-OT-CCS will achieve the highest value, at nearly 19%.

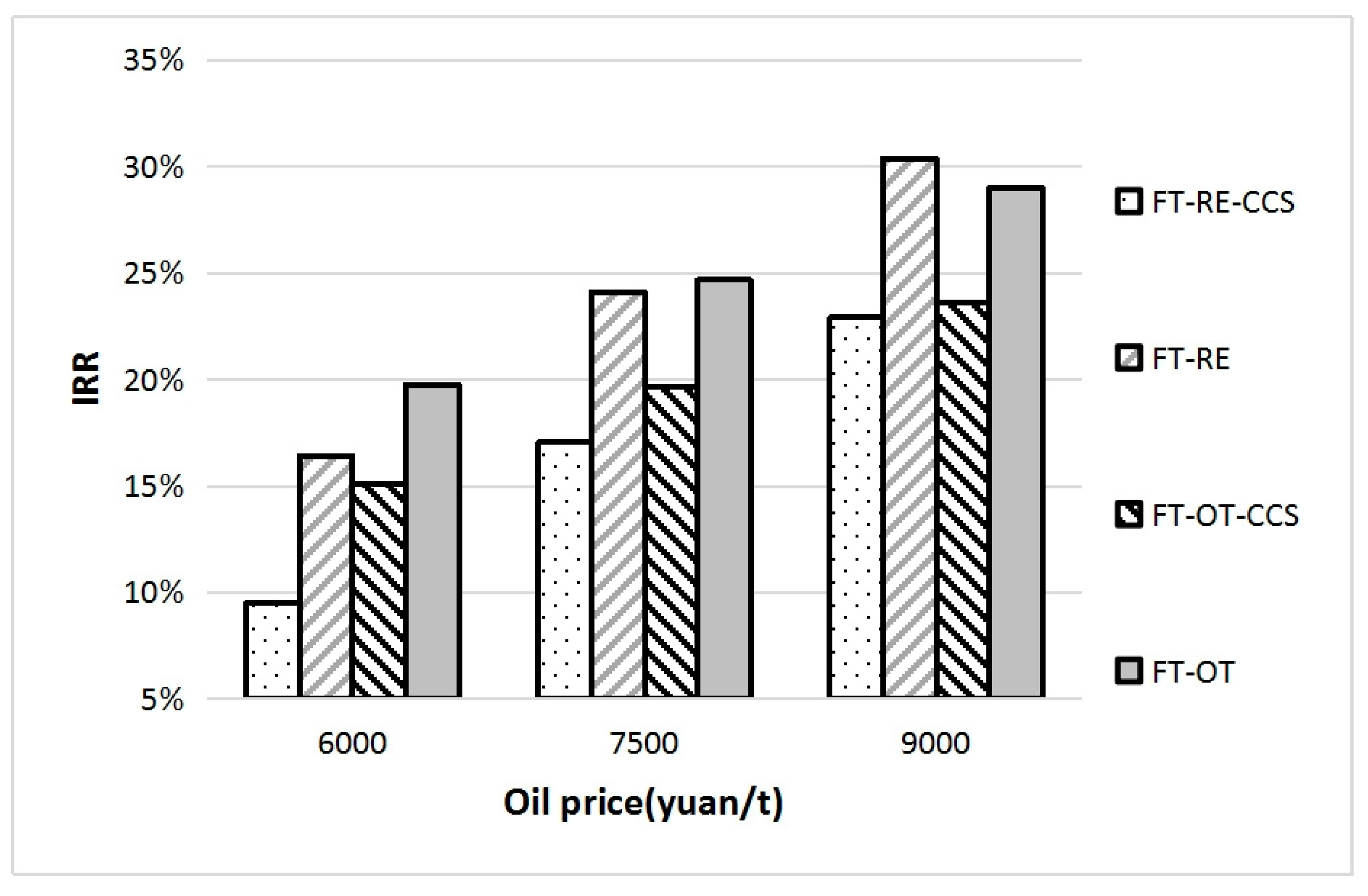

A sensitivity analysis of IRR against varying oil prices is considered when there are no carbon prices, as shown in

Figure 7. The higher the oil price, the higher the IRR. When the carbon price is higher, the relative IRR will decrease with the same growth rate.

However, relying solely on IRR is insufficient for a comprehensive economic assessment of a technology. Both IRR and NPV are called discounted cash flow (DCF) methods because they both take into account the time value of money in evaluating capital investment projects. NPV is defined as the sum of the present value of the base year at the beginning of the calculation period, discounted by the annual net cash flow according to the industry benchmark discount rate or other prescribed discount rates during the project’s economic life (or depreciation period).

If its , a single project may be considered acceptable; if , the project should be rejected. The projects with are generally cost-effective. When comparing multiple projects, the larger the NPV, the better the project. This principle is also known as the Principle of Maximum Present Value.

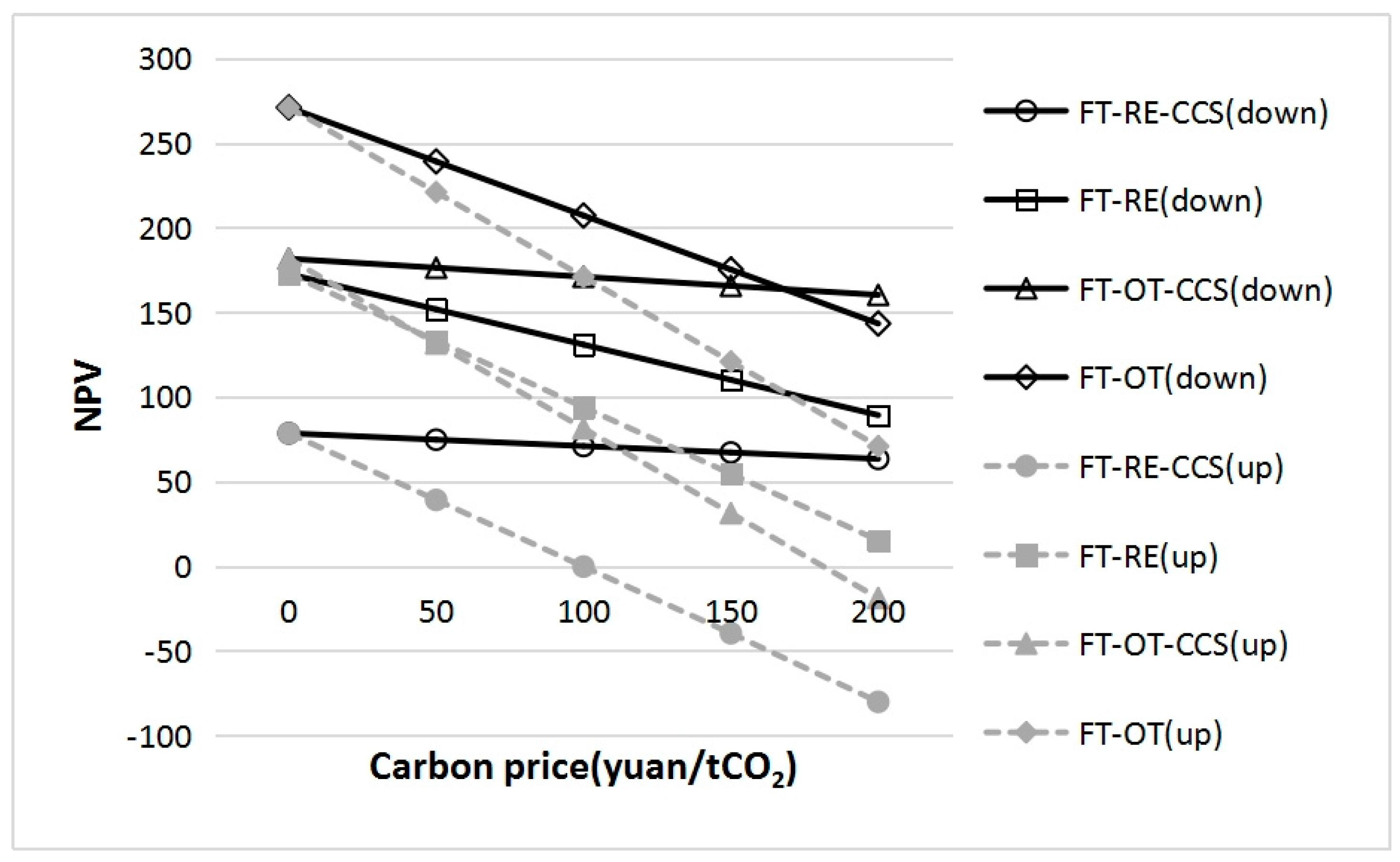

Figure 8 illustrates the impact of different carbon levy methods and price levels on the NPV. The upstream carbon tax has a greater effect than the downstream carbon price, reflected in a more rapid decline in NPV as carbon prices increase. In particular, the NPV of both FT-RE-CCS and FT-OT-CCS turns negative when the upstream carbon tax exceeds 100 and 180 RMB/tCO

2, even though their IRR remains above 8%. In other words, when the upstream carbon tax is high enough, there will be no competitive economic advantage for the two technologies. In contrast, the impact of the downstream carbon price on a system with CCS is still relatively small. The output value of CCS is based on the carbon price. The smaller the gap between the cost of CCS technology application and the carbon cost, the smaller the impact of CCS application on NPV. Especially at a high carbon price, of 200 RMB/tCO

2, adopting CCS technology has little influence on NPV for both FT-RE and FT-OT. Conversely, adopting CCS technology has more impact on NPV for both FT-RE and FT-OT at a lower carbon price. For example, when the downstream carbon price is 50 RMB/tCO

2, adopting CCS technology can decrease NPV of FT-RE and FT-OT by 51% and 26%, respectively.

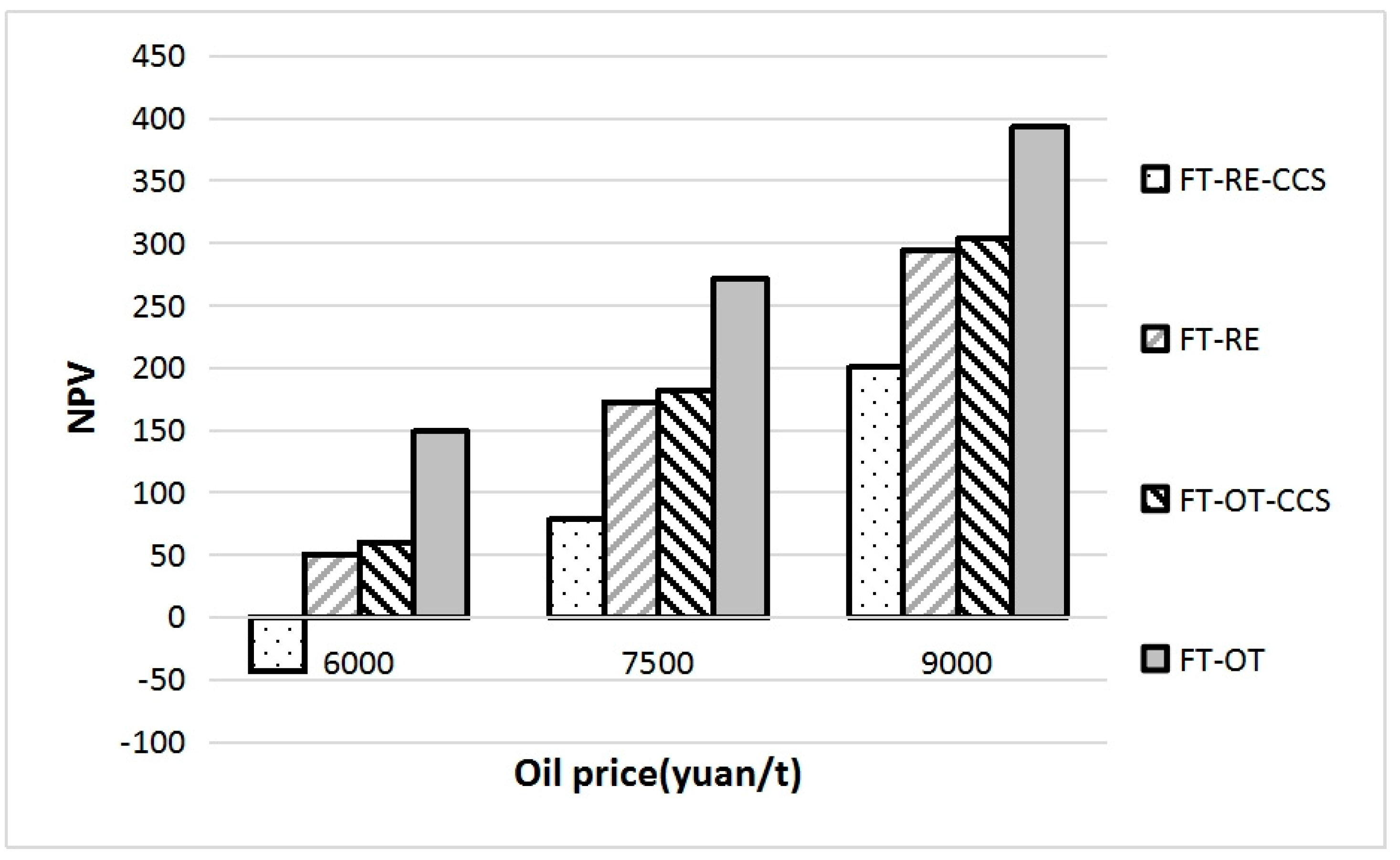

A sensitivity analysis of NPV against varying oil prices is considered when there are no carbon prices, as shown in

Figure 9. The higher the oil price, the higher the NPV. When the carbon price is higher, the relative NPV will decrease with the same growth rate.

4.3. CO2 Emissions Abatement Cost

The cost of reducing CO2 emissions is defined as the additional cost incurred for capturing CO2 when implementing CCS, compared to a reference system without CCS, given the same amount of oil products. In this study, the system boundary for economic accounting and analysis is confined to the oil project production itself. Most of time, CO2 transportation and storage typically belong to downstream industries, that is, to other companies or projects. So, the calculated abatement cost includes only the capture cost and excludes expenses associated with CO2 transportation and storage. And the CO2 emissions abatement cost of the systems should be separated according to the product.

Thus, the abatement cost is calculated as

where

RC is the CO

2 emissions abatement cost of one FT synthesis (RMB/tCO

2), CO

2 is the amount of CO

2 emissions from the production systems, P is the total output of system products, RE means recycling syngas, OT means once-through synthesis, and CCS represents CO

2 capture technology.

When CO2 capture is adopted, the total CO2 emissions of FT-RE and FT-CO could be reduced from 12.6 and 19.3 million tons per year to 2.3 and 3.2 million tons per year, when producing 3 million tons of oil per year.

Table 9 shows the impact of two carbon levy methods and carbon price levels on emission abatement costs of FT-RE-CCS and FT-OT-CCS systems. The upstream carbon tax has a limited effect on the emission abatement cost. No matter how much CO

2 is captured, the total upstream carbon tax is the same, as it is calculated by the carbon consumed. In contrast, as the price of the downstream carbon price increases, the cost of emissions reduction for both systems gradually decreases, making CCS more economically attractive. For the FT-OT-CCS system, the emission abatement cost is negative when there is no carbon cost. The core products of FT-CO or FT-CO-CCS are oil products and electricity, and all the system costs are calculated for the oil products. The introduction of CCS reduces electricity output, and subsequently causes a decrease in sales and profits. Due to the income tax being as high as 25%, the total income tax has been significantly reduced, and oil product cost is slightly lower than that of FT-CO. One main factor is the electricity selling price. If the electricity selling price is 0.3 RMB/kWh, which is lower than assumed, then the emission abatement cost will become positive. Another main factor is the income tax rate. If the income tax rate is 20% which is lower than assumed, then the emission abatement cost will also become positive. A higher carbon cost significantly lowers the abatement cost, indicating that CCS technology will bring in more revenue. For the FT-RE-CCS system, the abatement cost decreases by approximately 5% for every 10 RMB/tCO

2 increase in the carbon price. When the carbon cost exceeds 196 RMB/tCO

2, the emission abatement cost will turn negative. Therefore, these results demonstrate that the downstream carbon price can make great contributions to reduce the emission abatement cost, thereby creating a stronger economic incentive for enterprises to adopt CCS and other emission reduction technologies.

5. Conclusions

Four possible technology configurations for CTL are simulated and two possible carbon pricing mechanisms are discussed. The CTL pathways include two indirect coal liquefaction options: once-through synthesis with electricity generation from unreacted syngas, and recycling unreacted syngas. Using Aspen Plus, four possible technology combinations, which are FT-RE, FT-RE-CCS, FT-OT, and FT-OT-CCS, were simulated to obtain detailed material flow data. The carbon cost could be implemented mainly in two forms according to the point of regulating emissions from the energy industries, i.e., the upstream carbon tax and the downstream carbon price. Based on a cost estimation model EPRI TAG and material flow data, the financial performance of these four systems is assessed considering carbon cost implemented in different forms.

The analysis leads to four main findings. First, adopting CCS without carbon pricing has a significant influence on economic performance of the four systems. It is clear that without the support of carbon pricing policies, enterprises lack the incentive to utilize CCS due to the economic losses even though the CCS can be scaled up. Second, the upstream carbon tax has a limited effect on the emission abatement cost, and fails to promote emissions reduction and encourage enterprises to utilize CCS. Third, the downstream carbon price could reduce the economic losses by adopting CCS, thus promoting emissions reduction in manufacturing systems under higher carbon price levels. The adoption of CCS technology will reduce the IRR by 3% and 1% and the NPV by 29% and 12%, respectively, for FT-RE and FT-OT. Forth, enterprises are willing to adopt CCS when the carbon price is sufficiently high. While the current price exceeds initial expectations, a stable and higher carbon price supported by long-term policy mechanisms needs to be stabilized in the future. Therefore, the introduction of CCS technology will gain benefits at such a high price. On the other hand, non-economic factors such as public image may be additional incentives for enterprises to introduce CCS technology under such conditions.

Although the downstream carbon price could help reduce the actual emissions reduction in CTL projects with CCS, it should be noted that the incentives provided by such policies will be very limited at low carbon price levels. Furthermore, the carbon cost will be more effective than the national carbon ETS in promoting the implementation of CCS technology in CTL systems due to the fact that free allowance allocation in ETS can mitigate the financial pressure on less efficient producers.

And it should also be noted that there are several uncertainties in the investment cost estimation. First, there will always be deviations between an actual project construction and the construction expectations. All the fixed expense assumption parameters in

Table 7 and variable expense parameters in

Table 8 will affect the results. Although such variations generally do not alter the relative comparison among various technical routes, they do influence the absolute values of the estimation results, sometimes by over 10%. As more accurate data become available, further study is needed to assess the possible impact of these uncertainties. Second, it should be noticed that only the carbon capture cost is considered in this study. The feasibility of CCS also depends on its transportation and storage costs. Pipeline transportation of CO

2 will be the primary transportation mode for large-scale demonstration projects in the future, the cost of which is estimated to be 0.7 and 0.4 RMB/ton/km in 2030 and 2060, respectively. The CO

2 storage cost will be 40–50 RMB/ton in 2030 and 20–25 RMB/ton in 2060 [

55]. Therefore, a CTL project site selected near CCS sites will be economically beneficial; otherwise, it may reduce the project competitiveness with CCS.