1. Introduction

Nearshoring has become a pivotal paradigm in contemporary global trade, characterized by the relocation of production facilities closer to target markets. Scholars highlight three principal benefits of this strategy: enhanced operational efficiency, diminished logistical and geopolitical risks, and greater agility in meeting evolving consumer demands [

1]. By shortening supply chains, firms can reduce lead times and buffer themselves against international disruptions, thereby strengthening their overall resilience.

For Mexico, nearshoring presents a strategic opportunity to deepen its integration into global commerce. Its proximity to the United States, the world’s largest consumer market, affords unparalleled advantages in transit speed and cost. Coupled with competitive labor costs, this geographic leverage makes Mexico a prime locale for firms seeking to optimize their value chains [

1].

Beyond location-driven benefits, Mexico’s diversified industrial base underpins its attractiveness. The nation boasts established clusters in automotive, electronics, aerospace, and food processing, which together form a dynamic ecosystem capable of supporting end-to-end manufacturing processes [

2]. A young, technically proficient workforce further enhances this profile, enabling firms to maintain high productivity levels while also ensuring cost competitiveness.

Finally, Mexico’s participation in multilateral trade agreements amplifies its nearshoring appeal. Under the United States–Mexico–Canada Agreement (USMCA), Mexican exports gain preferential access to over 46 countries, strengthening its position as a nearshoring hub and incentivizing foreign direct investment [

3].

Figure 1 illustrates the distribution of automotive manufacturing firms across the country. It was adapted from [

4].

Mexico’s surge in nearshoring-driven industrialization has placed acute pressure on its electricity grid. In northern manufacturing hubs, surging demand often outstrips generation capacity, leading to power outages that halt production lines and erode investor confidence. This vulnerability is compounded by the country’s heavy dependence on fossil fuels, which not only elevates energy prices but also amplifies the environmental footprint of new facilities. Regulatory ambiguity, particularly around granting permits for renewable projects and a shortfall in clean-energy investments, has further delayed Mexico’s shift toward a more resilient, low-carbon grid [

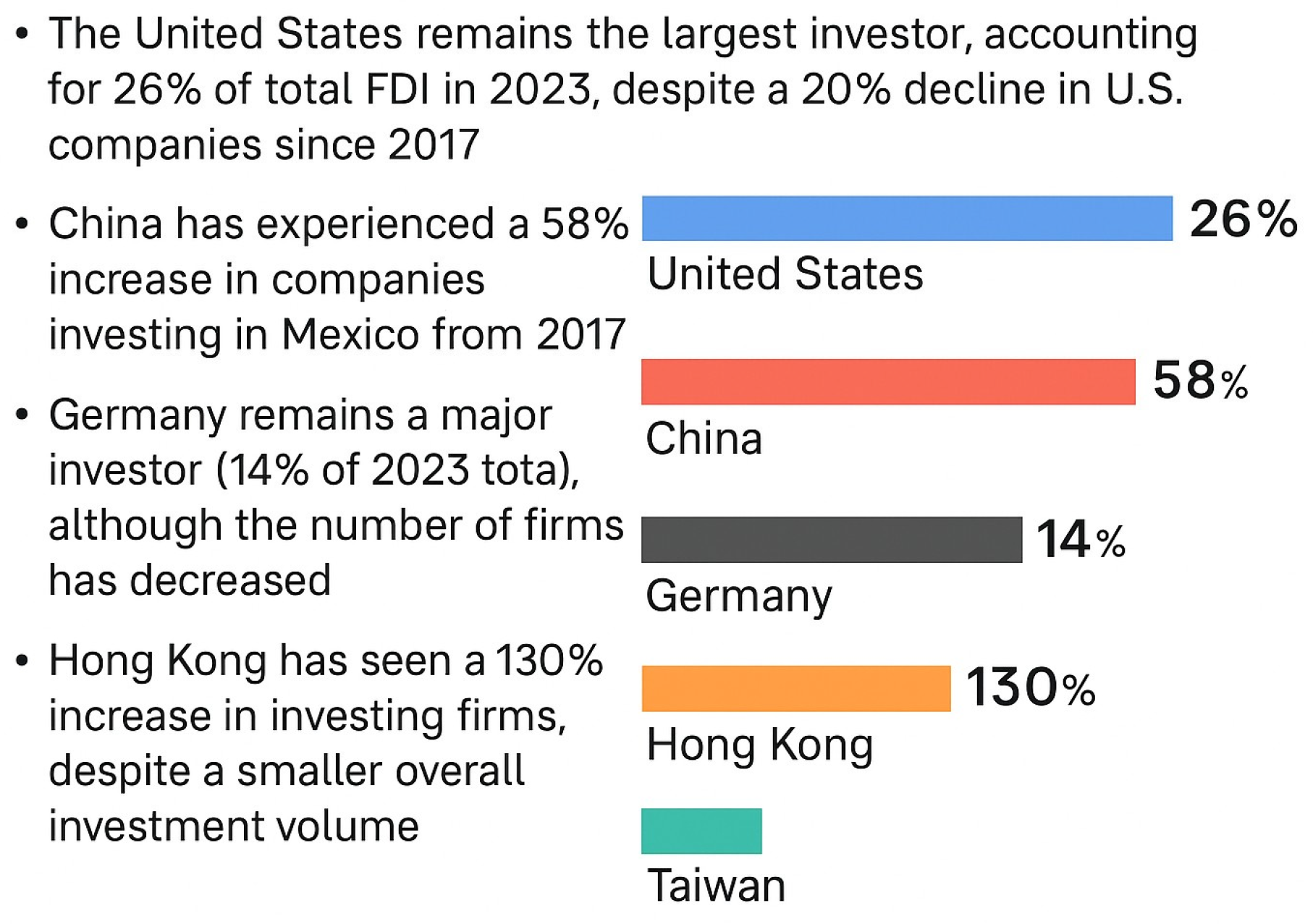

2]. Concurrently, foreign direct investment trends mirror the global reorientation toward nearshoring. Between 2017 and 2023, Taiwan’s investment volume and number of entrants in Mexico experienced a modest decline. In contrast, Hong Kong-based firms expanded their presence by approximately 130%, despite accounting for only a small share of total FDI flows. These shifts highlight both the competitive landscape for nearshoring destinations and the strategic recalibrations undertaken by source economies in response to supply chain realignments [

5].

Figure 2 shows FDI in Mexico.

The rise in total investment, from

$14.1 billion in 2022 to

$22.3 billion in 2023, underscores Mexico’s growing prominence as a global manufacturing hub, mainly driven by its proximity to the U.S. and favorable trade agreements [

5].

Additionally, Mexico’s automotive sector is expanding rapidly through nearshoring; however, energy reliability has emerged as a critical bottleneck. Industry surveys and experts report that many new projects have been stalled by uncertainty in securing sufficient power from the grid, as companies “hoped to increase their electricity consumption but had faced setbacks due to CFE” (the state utility) [

6,

7]. 67% of firms in Nuevo León (a major automotive hub) seeking to grow operations recently encountered power supply constraints [

6]. The automotive sector alone accounts for about 2.8% of Mexico’s national electricity demand [

7], so even regional grid instabilities can disrupt production lines. Researchers have quantified the stakes: manufacturing output in Mexico is susceptible to electricity costs and outages, with an average elasticity estimate of −0.28 and a maximum of −0.51 for the auto industry [

8]. This means that unreliable or expensive power has a disproportionately large impact on automotive production output, underscoring the need for adaptive strategies.

To address these challenges, manufacturers and policymakers are turning to on-site generation and smart energy management. Distributed generation (DG) solutions, such as solar photovoltaic (PV) systems combined with battery storage, are gaining traction as a direct response to grid shortfalls [

7]. By integrating PV and Battery Energy Storage (BESS) at factories, firms can buffer against grid outages and even form self-sustaining microgrids. For example, Quartux and other energy service providers report that solar-battery installations of up to 0.5 MW (the threshold for exempt distributed generation in Mexico) have already helped automotive suppliers secure reliable power in the face of utility limitations [

7]. Such solar and storage microgrids allow a plant to run critical processes during blackouts, effectively decoupling production from grid instability. A Mexican industrial project deployed a 3.72 MWh liquid-cooled BESS with a high-voltage solar array, creating a resilient power system that maintains operations throughout outages [

9].

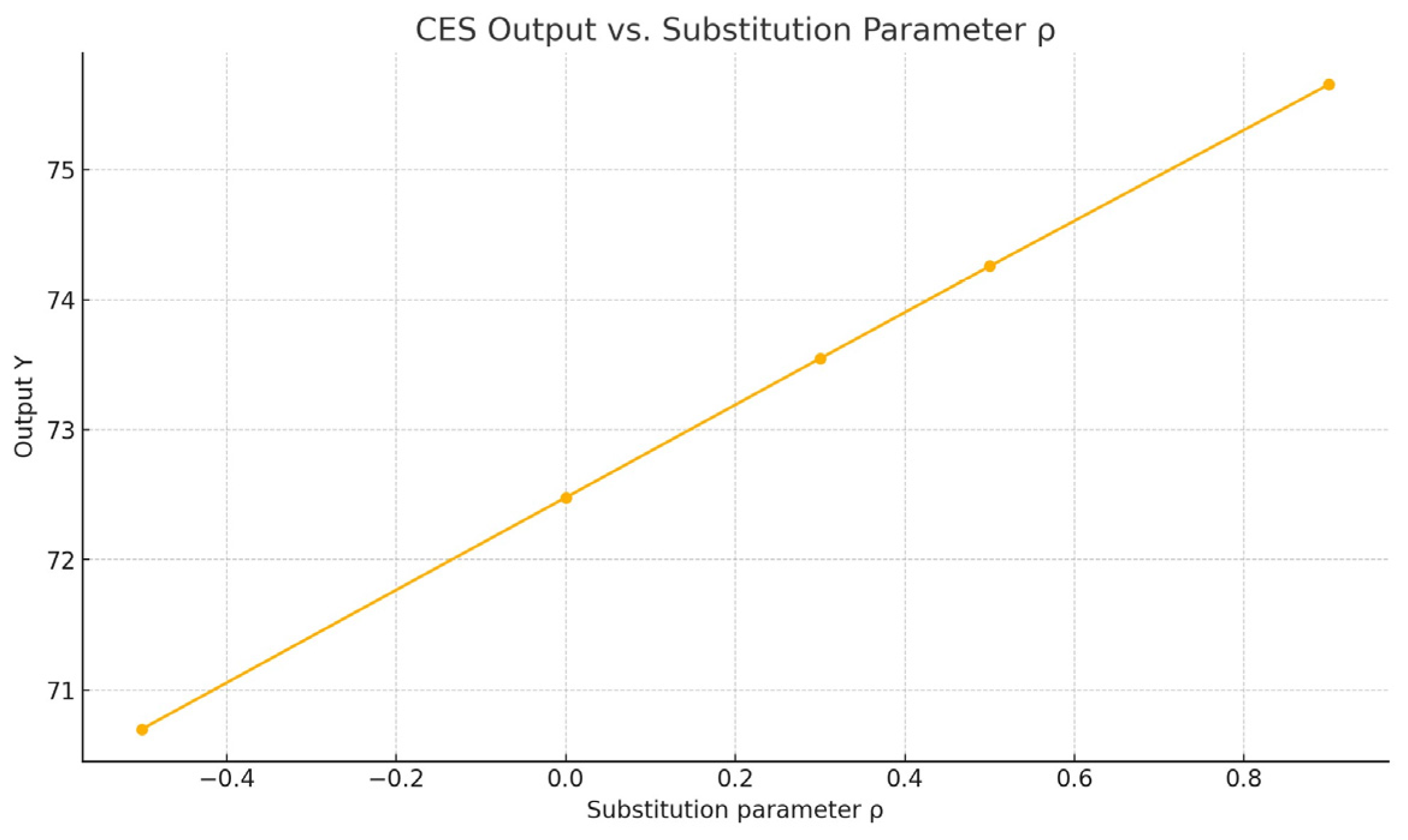

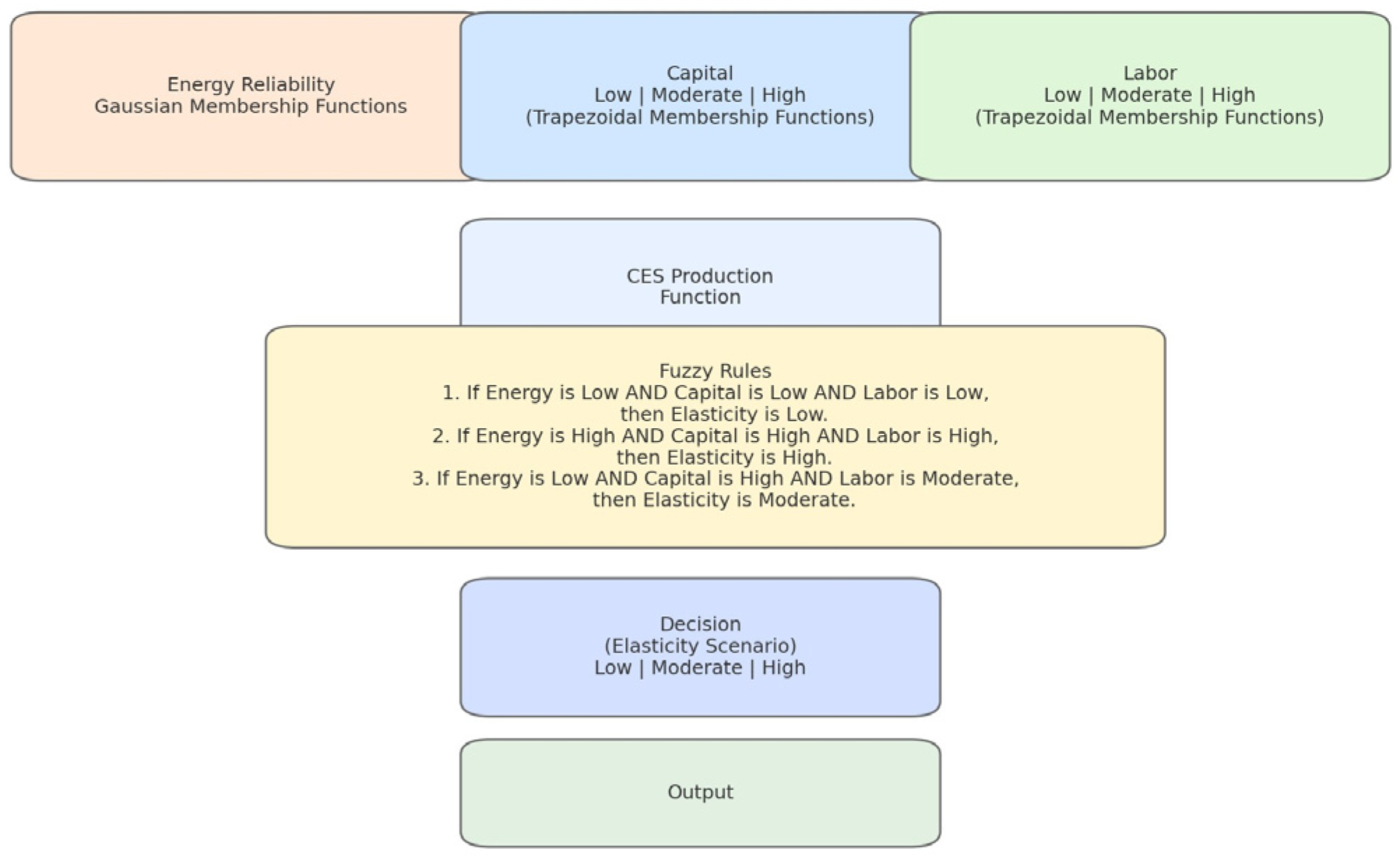

This paper proposes a fuzzy logic–based decision-making framework to overcome Mexico’s energy-related nearshoring barriers. By combining a rule-based inference engine with the Constant-Elasticity-of-Substitution (CES) production function [

10,

11,

12], the framework quantifies how capital and labor can substitute for unreliable energy inputs. In doing so, it fills a critical methodological gap: existing optimization tools (e.g., mixed-integer linear programming [

13], stochastic programming [

14]) assume perfect probabilistic knowledge of future energy availability and treat electricity as an immutable constraint, while pure fuzzy systems lack an endogenous economic model to guide resource reallocation under grid instability.

Central to our approach is the integration of the CES function into the fuzzy inference engine. By casting the substitution elasticity (ρ) as a linguistic variable, the Fuzzy–CES framework retains fuzzy logic’s interpretability and real-time responsiveness, yet grounds each rule in economic theory. Decision-makers can simulate scenarios—such as prolonged outages or fluctuating renewable outputs—to identify optimal strategies, including microgrid deployment, renewable infrastructure investment, or adoption of energy-efficient technologies. This capability is especially pertinent in northern industrial hubs, such as Nuevo León and Chihuahua, where recurring power shortages imperil nearshoring operations [

5].

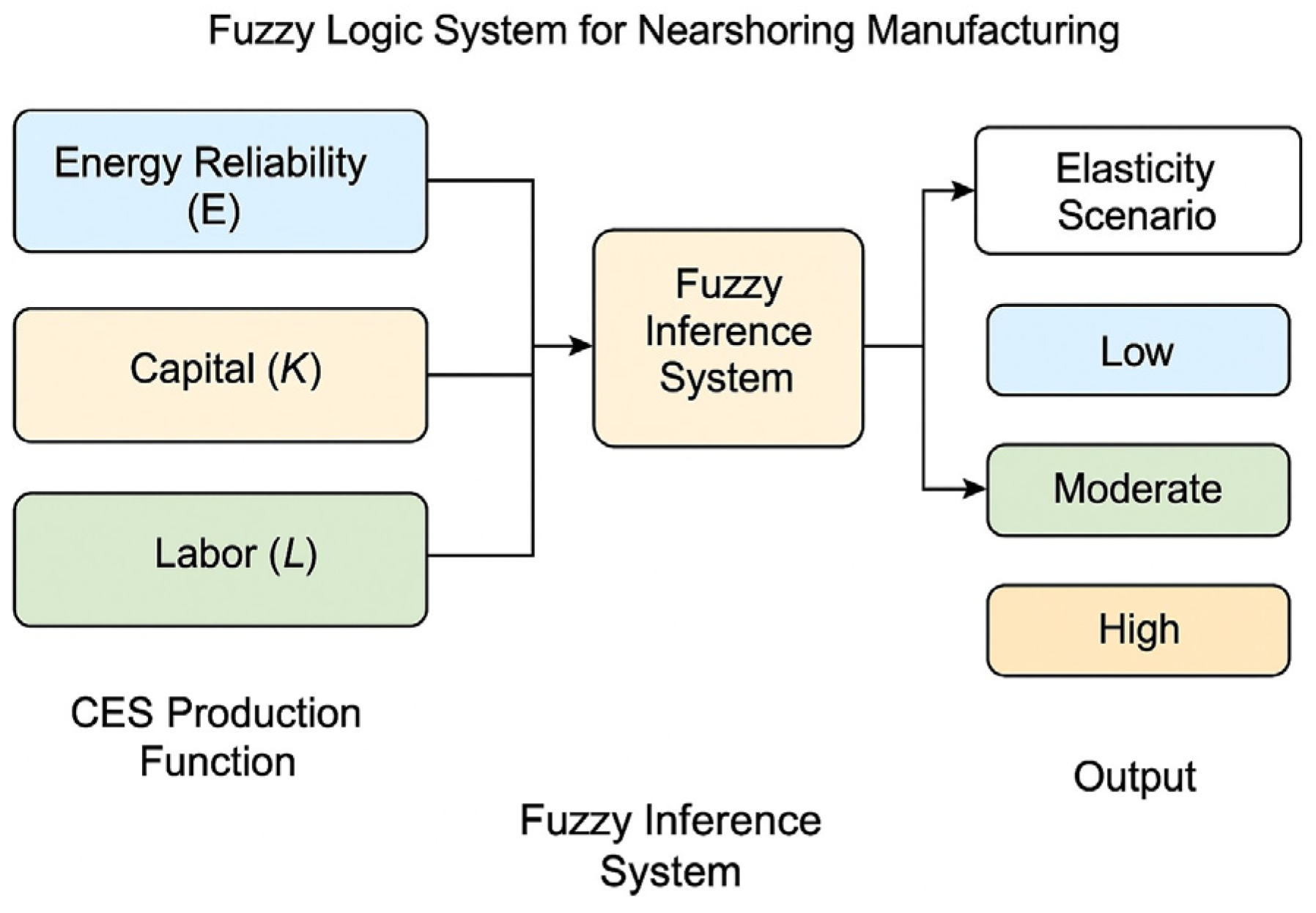

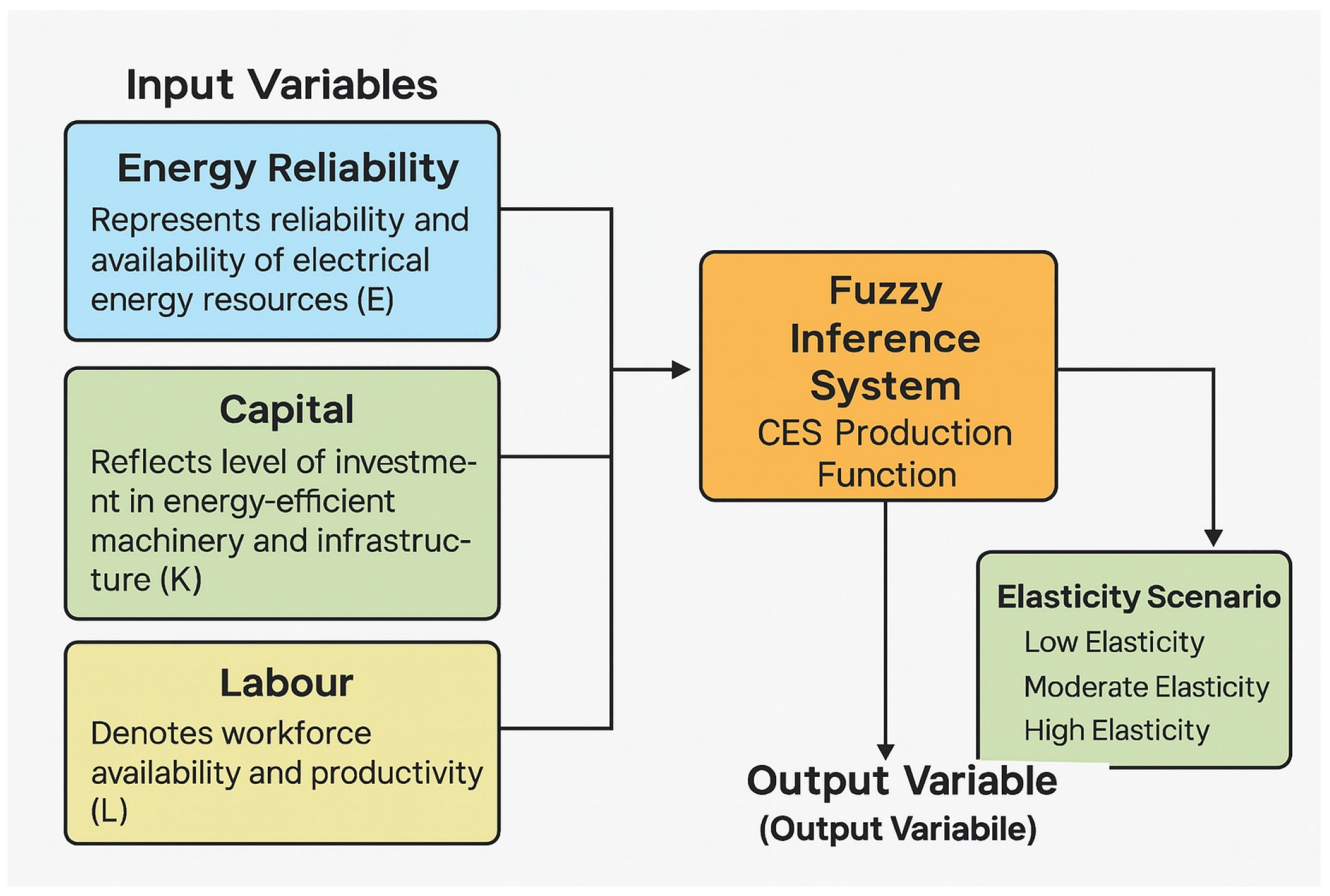

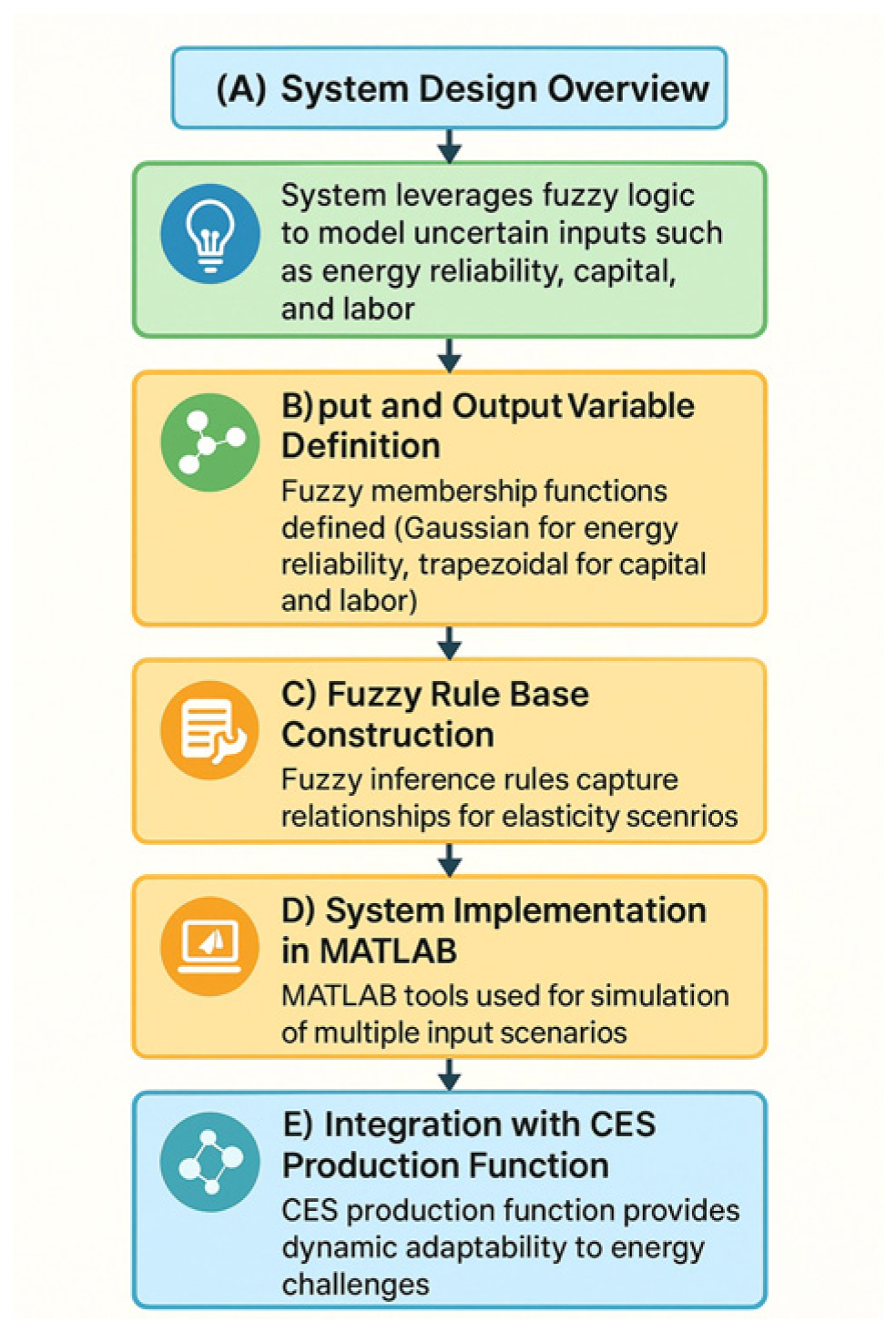

Despite its seemingly simple architecture—three inputs (Energy Reliability, Labor, Capital) and one output (Elasticity)—the proposed Fuzzy–CES engine delivers a host of critical innovations and practical advantages:

Fuzzified economic theory. In traditional production-theory applications, the CES parameter appears as a fixed scalar; here, it is reimagined as a fuzzified linguistic variable. Decision-makers express “low,” “medium,” or “high” substitutability directly within the rule base, uniting economic substitution theory with uncertainty handling in a single, interpretable inference surface.

Compact, transparent rule base. To prevent rule-based proliferation while maintaining real-time performance, the system employs only twelve carefully selected IF–THEN rules. Two membership-function types—Gaussian for Energy Reliability and Labor, and trapezoidal for Capital and the Elasticity output—were selected based on a sensitivity analysis of historical nearshoring plant data, which distilled all significant decision boundaries without redundancy.

Minimal calibration effort. The 3:1 design drastically reduces data requirements: plant engineers normalize only three key KPIs to a familiar 0–10 scale, define three linguistic categories per input, and thereafter need only edit a handful of rules to accommodate new conditions.

Methodological robustness and reproducibility. Implementation in MATLAB R2024a’s Fuzzy Logic Toolbox leverages built-in Karnik–Mendel type-reduction algorithms and an interactive membership-function design environment, ensuring each elasticity recommendation can be traced back to clear, domain-relevant IF–THEN logic with minimal custom coding.

Mexico’s grid still derives over 70 percent of its electricity from fossil fuels [

10], and the adoption of smart grids or distributed renewable energy remains sluggish. Regulatory uncertainty and underinvestment exacerbate this bottleneck. Our framework directly addresses these challenges by embedding infrastructure limitations and operational variability into scenario planning. Moreover, it complements broader structural improvements—such as upgrading transportation and logistics networks, streamlining bureaucracy, bolstering regional security, and expanding the advanced manufacturing workforce—thus strengthening the overall nearshoring ecosystem.

The contributions of this work are threefold:

Methodological innovation. The Fuzzy–CES paradigm unifies economic substitution theory with rule-based AI, enabling rapid, interpretable decisions that account for both energy reliability and input substitutability.

Practical relevance. By simulating diverse energy–labor–capital scenarios, the framework yields data-driven recommendations—ranging from microgrids to efficiency retrofits—that directly address grid instability in strategic states [

5].

Strategic guidance. Our analysis underscores the need for targeted investments in renewable energy, smart-grid technology, and public–private collaboration, while highlighting how fuzzy logic can extend beyond energy management to workforce planning and logistics optimization in nearshoring contexts.

This paper advances both academic discourse and industrial practice by offering a coherent and computationally tractable tool for navigating Mexico’s energy sector constraints. By integrating CES-based modeling within a transparent fuzzy inference system, the proposed framework enhances the resilience, sustainability, and competitiveness of Mexico’s evolving nearshoring landscape. Additionally, a comprehensive case study of the automotive industry is presented to illustrate the implementation of the proposed framework. In terms of energy and manufacturing, this proposal deals with a hybrid Fuzzy–CES decision framework that translates conditions of energy reliability (E), capital (K), and labor (L) into an interpretable elasticity signal before detailed optimization, thereby complementing the growing body of energy-aware scheduling and flexibility tools. In additive manufacturing specifically, recent work has moved beyond single-machine heuristics to process–schedule co-design, learning power-demand patterns under alternative process parameters and co-optimizing them with job sequencing against time-varying tariffs and demand charges; validated on FDM with operational data, this demonstrates that peaks and total energy cost can be proactively shaped without throughput loss [

15]. At a higher level, a PRISMA-guided review integrates disparate notions of demand response, multi-energy integration, and digital enablers (ML, RL, predictive control, digital twins, blockchain) into a Climate-Resilient Industrial Flexibility Framework that links concepts, sectoral practice, and policy/market design—precisely the scaffold into which plant-level tools should plug [

16]. System adequacy and on-site reliability also hinge on which flexibility assets are financed: interval Type-2 trapezoidal fuzzy sets with PROMETHEE-II expand storage investment screening to include land intensity and resource footprints, typically elevating pumped hydro overall while favoring wind-to-hydrogen in economic/green/social priorities, evidence that portfolio choices upstream shape the reliability envelope within which factory operations unfold [

17]. On the supply side, AI has become the digital backbone of PV-rich systems, MPPT optimization, forecasting, parameter estimation, and fault diagnostics dominate a rapidly expanding literature using ANN, Type-2 fuzzy logic, CNN/LSTM, SVM, trees/forests, k-NN, and PSO; a MATLAB Type-2 selector even maps problem types to methods, improving the quality of inputs that later drive industrial scheduling and procurement [

18]. These micro-level currents are consistent with macro signals: scenario meta-analyses for 2024–2025 show demand rising faster than expected (+2200 TWh by 2035), a shrinking Net-Zero premium (19% → 15%), and a capital pivot away from gas toward grids, storage, and hydrogen, marking a shift in the system’s pressure point from generation to flexibility under the combined stresses of AI data centers, heatwaves, and transport electrification [

19]. Within this landscape, hybrid scheduling exemplars illustrate multiple routes to robustness under uncertainty and tariffs, event-triggered blends of off-line and on-line re-optimization that reduce rescheduling cost in PV–storage–turbine–grid settings [

20], remanufacturing models that jointly solve process planning and shop scheduling with speed-switching and RL-PSO to outperform on/off heuristics [

21], deep-learning-assisted multi-objective schedulers that co-optimize energy, cost, and makespan with discrete-event simulation for deployability [

22], process-aware demand-response scheduling that re-times polysilicon production to time-of-use price signals via state–task networks [

23], and AM-specific matheuristics (SLM) that jointly decide nesting, batch assignment, and orientation to minimize machine energy at realistic scales [

24]. Relative to these “optimizer-first” approaches, this proposal contributes an upstream, uncertainty-robust classification layer—embedding CES substitutability inside a Type-1/Interval Type-2 fuzzy engine, so that noisy E–K–L realities are converted into a crisp elasticity score/class; this output can gate, weight, or parameterize any of the downstream optimizers in [

15,

20,

21,

22,

23,

24], while aligning plant choices with the flexibility framework in [

16], the storage portfolio logic in [

17], the PV/AI intelligence in [

18], and the system-wide capital reallocation imperative in [

19], thereby positioning the work as a bridge from macro flexibility needs to executable, plant-level decisions in energy-constrained nearshoring.

4. Proposed Framework for Energy Reliability in the Automotive Industry for Nearshoring

The system enables manufacturers to simulate scenarios and visualize the elasticity of production under different conditions. It supports scenario planning, allowing users to test strategies such as increasing capital investment, improving energy reliability, or optimizing labor productivity. By identifying which inputs to adjust, manufacturers can enhance production adaptability and mitigate risks associated with energy disruptions.

To ensure the robustness and generalizability of the proposed Fuzzy–CES framework, input variables for capital (K), labor availability (L), and energy reliability (E) were derived from authoritative, sector-wide data sources, rather than relying solely on a single-factory case (e.g., BMW San Luis Potosí [

42,

43] or Audi [

44]). This approach enables the simulation and validation of elasticity scenarios that reflect the broader landscape of Mexican automotive manufacturing, making the framework more applicable for policymakers and industry practitioners.

Figure 8 provides a geographic overview of Mexico’s major automotive manufacturing sites, including plant locations, aggregate annual vehicle production capacity, and total sector employment, illustrating the spatial distribution and scale of the input variables used in the analysis [

45]. The network comprises three types of plants. Vehicle plants comprise a total of 20 facilities, with an annual production capacity of 5,056,148 units and a workforce of 83,967 employees. The engine plants comprise a total of 10 facilities, capable of producing 5,682,180 engines annually and employing 11,534 people. Transmission plants comprise seven facilities, with an annual output of 2,373,800 transmissions and employ 8400 staff [

45].

Energy Reliability (E) represents the stability and sufficiency of the electrical supply for automotive manufacturing. Because production in this sector is highly sensitive to power interruptions, resulting in downtime, equipment risk, and supply chain delays, a robust, quantitative reliability metric is essential for both operational and strategic analysis. The Customer Average Interruption Duration Index (CAIDI) is the industry-standard metric for reliability in electric utilities, measuring the average outage duration experienced per user annually (in minutes per year). A lower CAIDI value indicates a more reliable energy supply, and vice versa.

Energy reliability was quantified using the CAIDI reported by CRE for 2023 [

46]. CAIDI measures the average annual duration of electrical interruptions experienced per user in each grid division. For comparability, CAIDI values were normalized to a 0–10 scale using the regulatory threshold (CAIDI

DTotal = 70.93 min/year) as the maximum and the best observed regional value (31.47 min/year for Valle de México Centro) as the minimum:

For each state (or plant), the number of employees L

norm was calculated as

where

CAIDIDTotal = 70.93 is the regulatory reference.

CAIDImin = 31.47 is the best CAIDI among all regions.

CAIDIregion = CAID for each region.

According to CRE [

46],

Table 3 presents the regional energy reliability in Mexico’s electric grid, CAID and normalized energy reliability € for each distribution division and its main states.

In this research, the K input reflects the scale and technological capability of automotive manufacturing infrastructure. Because direct investment data (plant value, machinery costs) are typically confidential and not consistently reported across states or firms, annual vehicle production capacity serves as a transparent, sectorally valid proxy for deployed capital.

High production capacity = greater capital investment (larger, more automated, and modern plants).

This method is widely accepted in industrial engineering and economics for cross-sectional benchmarking.

For each state (or plant), capital intensity Knorm was calculated as follows:

Kplant = Annual vehicle production capacity for the state/plant.

Kmin, Kmax = The minimum and maximum annual production capacities among all plants/states in the national dataset.

According to AMIA [

45],

Table 4 presents the vehicle production capacity and the normalized value. K is expressed on a 0–10 scale, where 0 represents the state with the lowest production capacity (Baja California, 137,780) and 10 corresponds to the highest (Guanajuato, 888,100).

Labor Availability (L) is a key driver of operational flexibility and resilience in the automotive manufacturing industry. It reflects the total workforce available for production, which impacts not only output but also the plant’s ability to adapt to supply or labor shocks.

In a sectoral context, when confidential wage or detailed HR data are not available, the total number of plant employees is a widely accepted and transparent proxy for labor availability. Normalizing this across all plants/states allows for direct benchmarking and integration into your fuzzy inference system [

45].

For each state (or plant), the number of employees L

norm was calculated as

where

Lplant = Number of employees for each state/plant.

Lmin, Lmax = The minimum and maximum number of employees among all plants/states.

According to AMIA [

45],

Table 5 presents the number of employees required for vehicle production capacity and the corresponding normalized value. L is expressed on a 0–10 scale, where 0 represents the state with the lowest number of employees (Baja California, with 1600), and 10 corresponds to the highest (Puebla, with 16,546).

Once the input variables, E, K, and L, have been objectively quantified and normalized on a sectoral scale, the fuzzy inference system can be used to assess real-world production adaptability in Mexican automotive plants.

Therefore, each plant or region can be characterized by its unique E, K, and L profile, calculated using the presented normalization procedures and public sector data.

Table 6 presents the normalized input variables of the automotive assembly parts. For example, a plant in San Luis Potosí (Bajío region) may have E = 4.7, K = 4.1 and L = 4.1. These normalized values are then directly entered as the three inputs to the fuzzy logic system, triggering a set of inference rules. Regarding Mexico States, the E value is shown for each major electrical distribution subregion.

The following depicts in detail how varying E, K, and L, either individually or in combination, impact the decision surface and adaptability classification of the production system. By running these scenarios, the framework provides:

Quantitative assessment of production elasticity (adaptability) under current conditions.

Actionable recommendations—for instance, identifying whether improvements in grid reliability, upskilling of labor, or capital investment would most enhance resilience.

Comparative benchmarking: Plants or regions can be compared on a standardized scale, supporting both local optimization and national-level policy.

The results of this fuzzy logic system include clear insights into production flexibility, actionable guidance for resource allocation, and improved decision-making for nearshoring operations. For example, using the fuzzy rules, the normalized E, K, and L values from

Table 6 allow for a precise interpretation of production elasticity for each state.

This fuzzy logic system provides manufacturers with a comprehensive tool to evaluate and optimize production adaptability in the face of energy and operational challenges. By capturing the complexities of real-world scenarios and offering data-driven insights, the system empowers stakeholders to make informed decisions that enhance resilience, efficiency, and sustainability in their nearshoring operations.

The surface of the proposed Type-1 fuzzy system (see

Figure 9a) visually demonstrates the relationship between capital investment, energy reliability, and the resulting elasticity of production. The Decision surface attains its minimum when both capital and energy reliability are near the origin of their scales, corresponding to states such as Baja California (K, L = 0, E = 8.6), where capital is very low, even if energy reliability is high. According to the fuzzy rules (specifically Rule 9), these conditions result in only moderate elasticity, underscoring the limited adaptability in the absence of sufficient capital and labor resources—even when grid conditions are excellent.

Conversely, states like Puebla (K = 6.5, E = 8.1, L = 10) occupy the far upper corner of the surface, where both capital and energy reliability are high. Here, the system achieves its global maximum, consistent with Rule 12, which classifies this configuration as high elasticity. These conditions reflect a robust production environment, well-positioned to accommodate the fluctuations and uncertainties typical of nearshoring operations.

The surface is not strictly monotonic. Along the capital axis, when energy reliability is very low (E near 0), increasing capital from low to moderate values may initially lower the decision score before a gradual recovery, illustrating that greater investment alone does not automatically confer adaptability if the grid remains unstable. This is evident in regions where either capital or labor is high, but energy reliability remains low, highlighting the necessity of a balanced resource profile for optimal adaptability.

For states like San Luis Potosí (E = 4.7, K = 4.1, L = 4.1), all three inputs are moderate. These points lie along the surface ridge where marginal gains in adaptability become apparent as either capital or energy reliability improves. The system, as per the rule base, identifies such configurations as moderate to high elasticity, but also signals that targeted improvements in any input could push the system toward maximum adaptability.

Hence, the idea that capital expansion alone can offset poor grid conditions must be tempered; any compensation is partial and cannot match the performance achievable with reliable power. A pronounced ridge appears where Energy Reliability is moderate (around 4–6) and Capital is at least moderate (4 or higher); here, improvements in either input reinforce each other. However, beyond this ridge, the marginal gains taper off, reflecting saturation in the fuzzy rule base.

Overall, the surface confirms the study’s central argument: Capital deepening alone will not provide the elasticity needed for Mexican nearshoring factories to withstand grid volatility, unless it is accompanied by investment in local energy security, such as microgrids or on-site renewables. This finding is particularly salient in the Mexican context, where automotive vehicle assembly plants are concentrated in just 11 out of 32 states, and the distribution of energy reliability (E) is far from uniform across regions. As seen in

Table 3, states such as Baja California (E = 8.6), Puebla (E = 8.1), and Mexico State (North, Center, South; E = 8.6–10) exhibit high energy reliability. In contrast, key automotive states such as Guanajuato, San Luis Potosí, and Aguascalientes, all in the Bajío region, have only moderate energy reliability (E ≈ 4.7). The situation is even more acute in Nuevo León (E = 5.4) and Coahuila (E = 7.3), both of which are central to automotive production, yet face grid conditions that cannot be classified as optimal.

Overall, the surface confirms the study’s central argument. Unless firms invest in local energy security, such as microgrids or on-site renewables, capital deepening will not provide the elasticity needed for Mexican nearshoring factories to withstand grid volatility.

The surface of the proposed fuzzy type 2 is presented in

Figure 9b, and it is recommended for use when high uncertainty is present in the system. It depicts the Type-2 fuzzy surface for the Decision score as a joint function of Capital and Energy-Reliability. The minimum Decision values arise near the origin, where both inputs are small; under these conditions, the production system cannot compensate for supply interruptions. Raising Capital while holding Energy Reliability near its lower bound gradually lifts the surface, confirming that investment in factories or energy-saving technologies can confer limited resilience even when the grid remains unstable. Nevertheless, the effect is bounded: the Decision score reaches only moderate levels until Energy-Reliability improves.

Once Energy-Reliability enters a mid-range band, roughly the central third of its scale, the surface exhibits a pronounced upward slope, and additional capital investment yields much steeper gains in the Decision metric. Beyond this ridge, the surface begins to level off, indicating diminishing marginal returns as the rule base saturates. The global maximum lies in the far corner where Capital and Energy-Reliability approach their maxima; here, the system is highly adaptable, accommodating load fluctuations without compromising throughput. The Type-2 surface is noticeably smoother than its Type-1 counterpart, particularly along the transition between low and moderate Energy-Reliability. This smoothing reflects the Footprint of Uncertainty embedded in the Type-2 membership functions. By explicitly modeling measurement noise and linguistic vagueness, the Type-2 engine dampens abrupt changes in the decision score that small input perturbations would otherwise trigger. Consequently, the Type-2 system offers more stable guidance when grid conditions or capital estimates fluctuate within realistic error bounds, a desirable property for nearshoring factories operating under Mexico’s volatile power network.

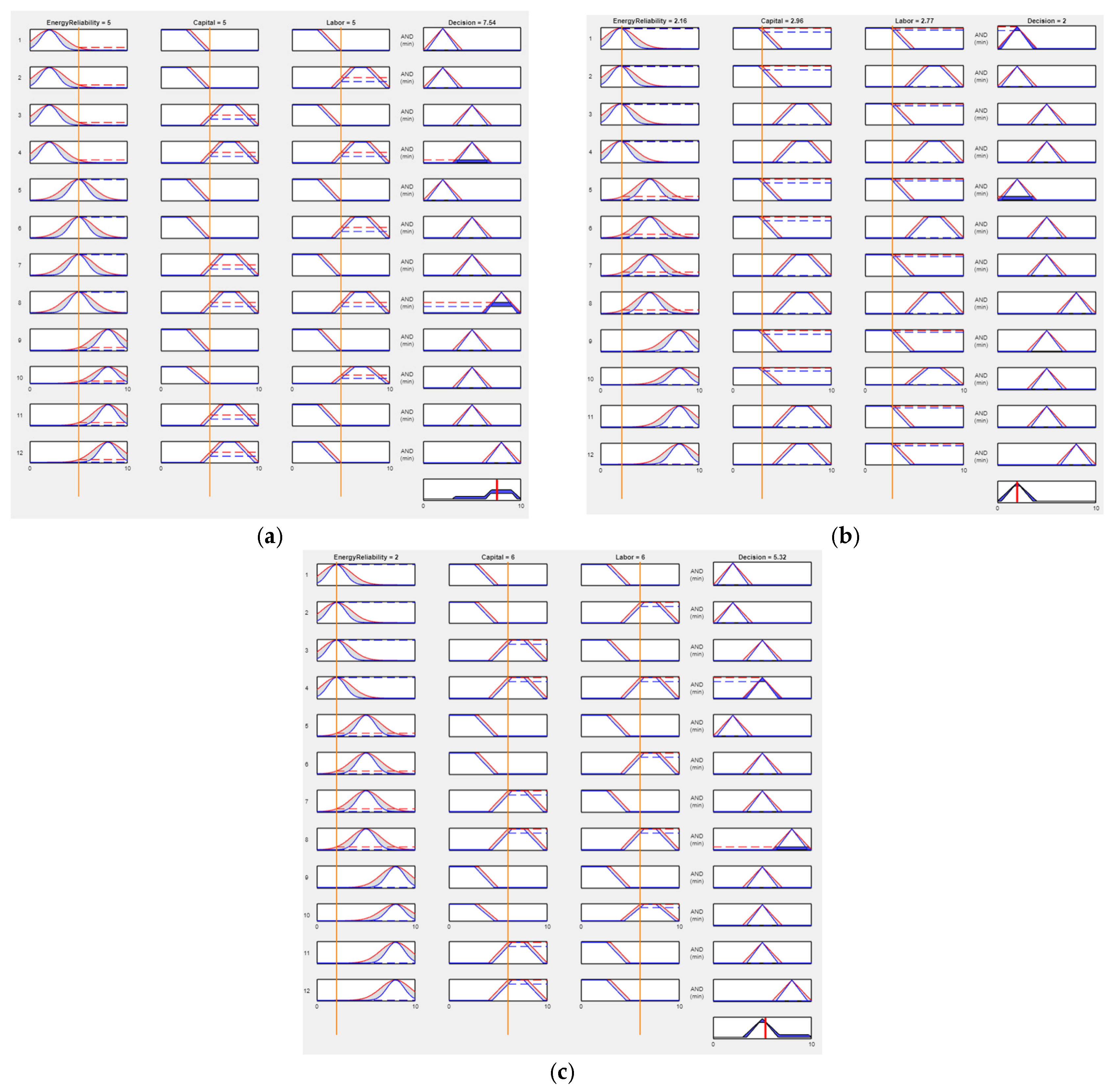

Figure 10a depicts an inference plot for the Type-1 when the factory operates at Energy-Reliability = 5, Capital = 5, and Labor = 5. At these mid-range conditions, the input for Energy-Reliability lies near the center of the “Moderate” membership function and still retains partial grade in “High”; the Capital and Labor share approximately equal membership in “Low” and “High.” As a result, several of the twelve rules fire simultaneously. Each rule’s firing strength is obtained through the standard Mamdani conjunction—minimum across the three antecedent grades, so the aggregated output, shown in the right-hand column, is the union of clipped consequents weighted by those minimum values. Defuzzification by centroid yields an overall Decision score of 7.28, a value in the upper segment of the 0–10 scale. The inference pattern, therefore, confirms that when all three resources are available at moderate-to-high levels, the fuzzy inference system classifies the system as highly adaptable; conversely, a genuinely low-adaptability outcome would require falling predominantly in the lower portions of the input ranges, which is not the case here.

Figure 10b presents a single-step inference of the interval Type-1 Mamdani fuzzy system for the input vector (E,K,L) = (2.16, 2.96, 2.77). The vertical line in the three left-hand columns represents their respective membership functions activated. Energy-Reliability falls deep within the “Low” Gaussian set and acquires only a negligible grade in “Moderate.” Capital and Labor intersect the midpoint of their trapezoidal “Low” sets while retaining a small but non-zero grade in “High,” an overlap intrinsic to the two-term partitions for these variables.

Given that the dominant membership grades correspond to “Low” on every axis, the rules whose antecedents comprise the Low–Low–Low triple fire have the highest strength. The fourth column shows their consequences after clipping; the union of these truncated output sets forms a composite fuzzy region concentrated in the first quartile of the decision universe. Centroid defuzzification of this region yields a Decision score of approximately 2.0. This numerical result places the operating point firmly within the low-elasticity regime defined earlier. Practically, a factory running at these resource levels would possess limited flexibility to reallocate inputs if external power quality were to deteriorate. The inference plot, therefore, corroborates the broader conclusion drawn from the surface analyses. Without additional capital reserves or a more reliable energy supply, the production system remains insufficiently adaptable for robust nearshoring operations.

Figure 10c illustrates the inference step for the input vector (Energy-Reliability = 2.0, Capital = 6.0, Labor = 6.0). The Energy-Reliability falls almost entirely within the “Low” membership function; its grade in “Moderate” is negligible. Capital and Labor intersect the upper half of their “High” trapezoids while retaining a small grade in “Low,” as intended by the overlapping design.

Because the dominant grades correspond to Low–High–High, the rules with that antecedent fire most strongly. Their clipped consequences aggregate into an output region centered in the middle segment of the decision universe. Centroid defuzzification produces a Decision value of 5.67. This numerical result places the operating point in the intermediate-elasticity regime: substantial capital and labor mitigate, but do not fully overcome, the limitation imposed by low energy reliability. The outcome confirms that meaningful resilience requires improvements in resource investment and grid stability.

Figure 11a shows a single inference step of the interval Type-2 Mamdani system for the balanced input vector (E,K,L) = (5, 5, 5). Each of the three input intersects its corresponding “Moderate” membership function at full grade and retains a non-negligible grade in the neighboring “High” set. The upper and lower bounds of every Type-2 membership function are displayed as paired curves, illustrating the footprint of uncertainty that distinguishes the Type-2 representation from its Type-1 counterpart.

Because substantial membership is present in both “Moderate” and “High” terms, several rules fire with comparable strength, chiefly those that contain the Moderate–Moderate–Moderate and High–High–High antecedent triples. After the usual minimum-operator conjunction, their clipped consequents aggregate into an output region centered in the upper third of the decision universe. Centroid defuzzification of this region yields a Decision value of 7.54.

This result places the operating point in the high-elasticity regime, confirming that when energy reliability, capital, and labor are all held at mid-to-upper values, the fuzzy system classifies the production system as strongly adaptable. The visibly smoother transition between the contributing rules, an effect of the interval Type-2 footprint, demonstrates the enhanced robustness of the Type-2 approach; small perturbations in the input would shift both the upper and lower membership bounds rather than altering a single crisp grade, thereby stabilizing the defuzzified output.

Figure 11b describes an inference step of the interval Type-2 Mamdani fuzzy system for the input vector (E,K,L) = (2.16, 2.96, 2.77). The vertical guideline in the three input panels marks the value relative to its two-level membership functions (upper and lower bounds shown as paired curves). Energy-Reliability is almost wholly contained in the “Low” set, while Capital and Labor lie near the center of their “Low” trapezoids and contribute only a marginal grade to “High.”

Because the dominant memberships correspond to the Low–Low–Low antecedent, the rule block associated with that combination fires with greatest strength. The clipped consequences merge into an output region confined to the lowest quarter of the decision universe. Centroid defuzzification of the aggregated set returns a Decision score of 2.0.

This value places the operating point in the low-elasticity regime: the factory could not reallocate resources if external power quality deteriorated.

Figure 11c reinforces the earlier surface analysis, demonstrating that without reliable energy and additional capital, the fuzzy inference system judges the production system insufficiently adaptable for robust nearshoring operations. Also, it presents the Type-2 Mamdani inference for the operating point (E,K,L) = (2, 6, 6). Energy-Reliability lies almost entirely within its “Low” membership set. Capital and Labor intersect the upper half of their “High” trapezoids while sharing a small grade with “Low,” reflecting the intended overlap between neighboring sets. The paired upper- and lower-boundary curves shown for every membership function visualize the footprint of uncertainty characteristic of the Type-2 formulation.

The rules combine low energy with high capital and labor, fire most strongly; their consequences dominate the aggregated output centered in the middle portion of the decision scale. Centroid defuzzification yields a Decision value of 5.32.

This result situates the factory in an intermediate-elasticity regime. Significant capital resources and labor availability provide some capacity to adapt. Still, persistently low energy reliability prevents the system from reaching the high-adaptability range documented under more favorable grid conditions.

Figure 11c reinforces the earlier conclusion that capital deepening can only partially offset the performance penalties imposed by an unstable energy supply.

Figure 12 illustrates the general representation of the proposed fuzzy logic systems, types 1 (a) and 2 (b). The memberships are also presented.

Contribution to Nearshoring and Energy Challenges Using a Fuzzy Logic Strategy

The proposed fuzzy logic system could directly address the energy challenges faced by nearshoring operations by offering manufacturers a structured method to evaluate and adapt their production strategies [

47]. It enables companies to assess the impact of energy reliability on production processes and develop strategies to stabilize energy inputs, such as implementing renewable energy systems, investing in energy-efficient technologies, or enhancing storage capabilities. For example, the system advises long-term solutions in regions with low energy reliability, such as deploying microgrids or renewable energy infrastructure. In high elasticity scenarios, it emphasizes short-term strategies, such as increasing labor or capital investments, to sustain production.

The system provides actionable insights for investment decisions by enabling manufacturers to determine whether additional capital or labor can compensate for energy deficits. By simulating varying scenarios of energy reliability, capital, and labor availability, the system guides manufacturers in balancing resource allocation to maximize productivity. This approach is especially critical in industrial hubs with high energy demand, such as northern Mexico, as it ensures production continuity and operational efficiency.

This system’s significant contribution lies in its ability to optimize resource allocation by analyzing how inputs (energy, capital, and labor) interact under different energy conditions. It helps manufacturers prioritize renewable energy integration and energy-efficient technologies, ensuring that production processes are resilient and sustainable. The fuzzy logic system reduces reliance on trial-and-error methods, saving time and resources while enabling data-driven decisions that address specific energy challenges in nearshoring contexts.

The proposed system aligns with the goals of nearshoring by providing manufacturers with a tool to enhance their competitiveness and sustainability. It allows companies to anticipate energy-related risks, adapt their production processes accordingly, and make informed decisions that support long-term operational success. By integrating advanced computational techniques, this system enhances Mexico’s position as a leading nearshoring destination, enabling manufacturers to overcome energy challenges while maintaining high levels of productivity and adaptability.

This paper demonstrates the transformative potential of fuzzy logic systems in modern manufacturing. Combining advanced decision-making capabilities with practical applications provides a scalable and efficient solution to nearshoring and energy reliability challenges. The system’s ability to simulate real-world scenarios and generate actionable insights makes it an invaluable tool for navigating the complexities of energy challenges in global supply chain realignments.

Fuzzy Logic Type-1 employs fixed membership functions with precise parameters for inputs such as Energy Reliability, Capital, and Labor. These inputs have a single value representing their degree of membership, which works well when the inputs are stable and well-defined. However, this approach may become less adaptable in uncertain environments, as even slight changes in input values can lead to substantial changes in the output.

On the other hand, Fuzzy Logic Type 2 represents membership functions as ranges rather than fixed values. This “cloud” of possible membership values allows Type 2 fuzzy logic to handle better input uncertainty and variability, such as fluctuating energy reliability or labor availability in nearshoring operations. Accounting for uncertainty directly offers greater flexibility and robustness. The system can adapt to changes in conditions, ensuring that decision-making remains stable and accurate even when input data is imprecise or fluctuating. One key advantage of Type 2 over Type 1 is its ability to handle uncertainty more effectively. It allows the system to accommodate fluctuating inputs accurately, such as energy reliability. Type 2 also offers improved robustness because it remains stable when input data is uncertain or imprecise. Additionally, since uncertainty is inherently represented within the membership functions, Type 2 typically requires fewer rules, which enhances computational efficiency. The flexibility of Type 2 allows it to dynamically adjust to changing conditions, making it more adaptable to real-world situations. Type 2 is more suited to environments where input data fluctuates or is uncertain. It provides more robust, flexible, and adaptable decision-making tools than Type 1, making it especially valuable for addressing manufacturers’ energy challenges, particularly in nearshoring operations. Its ability to model uncertainty and variation within the membership functions gives it a significant advantage in optimizing production adaptability under varying conditions.

5. Discussion

The findings of this study underscore the pivotal role of energy reliability in determining the production elasticity and overall adaptability of nearshoring operations in Mexico’s automotive sector. As shown by recent surveys and analyses [

6,

7,

8], manufacturing output in Mexico remains highly sensitive to both energy price fluctuations and grid disruptions, with elasticity estimates for the auto sector ranging from −0.28 to −0.51, substantially larger in magnitude than those reported in other industrial contexts. Our simulation results reinforce these observations: even in states with robust capital and labor inputs, such as Guanajuato and San Luis Potosí, only moderate levels of energy reliability limit the achievable production elasticity, confirming previous research that identifies energy as a primary constraint on manufacturing resilience [

7,

8].

Unlike conventional optimization frameworks, such as mixed-integer linear programming and stochastic programming, which require detailed probabilistic knowledge of future energy states and often fail to adapt to real-time variability [

13,

14], the fuzzy logic-based approach presented here offers greater interpretability and responsiveness to practical uncertainties. The integration of the Constant Elasticity of Substitution (CES) function within the fuzzy inference system distinguishes this framework from earlier models by embedding an explicit economic rationale for factor substitution, as advocated by CES theory [

11,

12,

25,

26]. This hybrid methodology advances recent calls for decision-support systems that account for the joint effects of capital, labor, and energy in dynamic industrial settings [

30].

The case studies analyzed provide further nuance to the theoretical implications of the model. In Puebla, where all three normalized inputs, energy reliability, capital, and labor, are high, the fuzzy-CES system predicts high elasticity, in line with actual plant performance and recent investment trends [

45]. Conversely, in Baja California, despite high energy reliability, the absence of sufficient capital and labor yields only moderate elasticity, illustrating the limitations of capital deepening as a standalone strategy. This finding aligns with empirical research highlighting the diminishing returns of single-factor investments in the absence of systemic grid improvements [

7,

9].

Moreover, the introduction of Type-2 fuzzy logic provides increased robustness under conditions of input uncertainty, as suggested by earlier work on interval type-2 systems [

34,

35,

37,

38]. The system’s enhanced stability in the face of fluctuating energy and labor inputs is especially relevant in Mexico’s northern industrial hubs, where supply chain volatility and labor market dynamics frequently challenge deterministic planning. These results are based on simulation studies showing that uncertainty-aware models yield improved performance in energy-constrained environments [

30,

39].

Importantly, the framework’s practical value extends beyond operational decision-making. By providing actionable, state-level recommendations, for example, prioritizing microgrid deployment in Guanajuato or capital investment in Baja California, the system supports both firm-level strategy and regional policy development. Such recommendations echo the growing emphasis in the recent literature on targeted, data-driven interventions to enhance energy resilience and manufacturing competitiveness [

7,

9]. The methodology also aligns with Mexico’s broader policy objectives regarding grid modernization, renewable integration, and industrial decarbonization [

7,

10].

This hybridization advances earlier on energy-aware production scheduling by offering a more interpretable and adaptable model. Unlike purely statistical or black-box AI approaches, the fuzzy-CES framework retains transparency in how decisions are derived, facilitating better stakeholder trust and operational integration. The implications of this system are significant for both operational and strategic levels. On the operational side, manufacturers can use the system to evaluate investment trade-offs and prioritize resource reallocation in response to energy instability. For example, in scenarios where increasing labor is impractical due to skill shortages, the model helps identify whether capital investments, such as energy-efficient equipment, could be effective substitutes.

Strategically, the system enables long-term planning by identifying thresholds where infrastructure investment (e.g., microgrids or renewable energy deployment) becomes essential. In this way, the framework supports policy-aligned industrial strategies aimed at reducing dependency on fossil fuels while enhancing the resilience of manufacturing supply chains. Moreover, this research aligns with Mexico’s national decarbonization and energy modernization goals. The ability to evaluate production resilience in energy-constrained contexts complements broader sustainability targets and positions Mexican nearshoring hubs to attract more resilient, energy-responsible manufacturing operations.

While the system offers valuable insights, several limitations merit further investigation. First, the current fuzzy rule base is manually designed, relying on expert heuristics. Integrating machine learning techniques for rule induction could enhance scalability and precision as complexity increases. Second, the model does not currently incorporate real-time energy pricing or demand-response signals, which are increasingly important in dynamic energy markets. Future enhancements should include temporal variables and adaptive rule updating mechanisms. Additionally, although the system uses synthetic scenarios, its validation in a live industrial environment remains an important next step. Collaborations with manufacturers operating in energy-variable regions would provide real-world data for fine-tuning membership functions, improving defuzzification accuracy, and demonstrating commercial feasibility.