Circularity and Digitalisation in German Textile Manufacturing: Towards a Blueprint for Strategy Development and Implementation

Abstract

1. Introduction

2. Literature Review

2.1. The German T&C Industry

2.2. The Circular Economy in T&C Manufacturing

2.3. Digital Technology Deployment in T&C Manufacturing

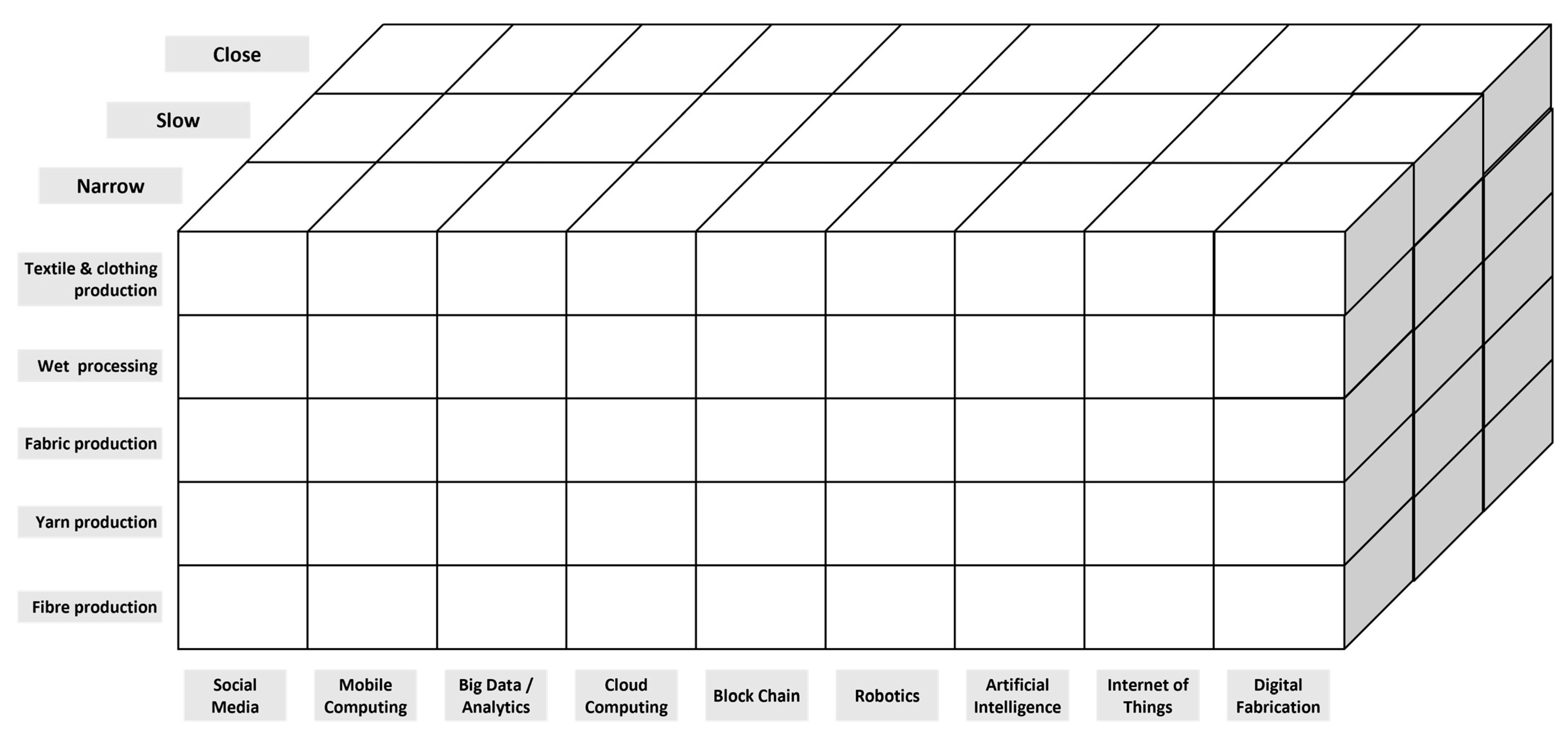

2.4. Provisional Conceptual Framework

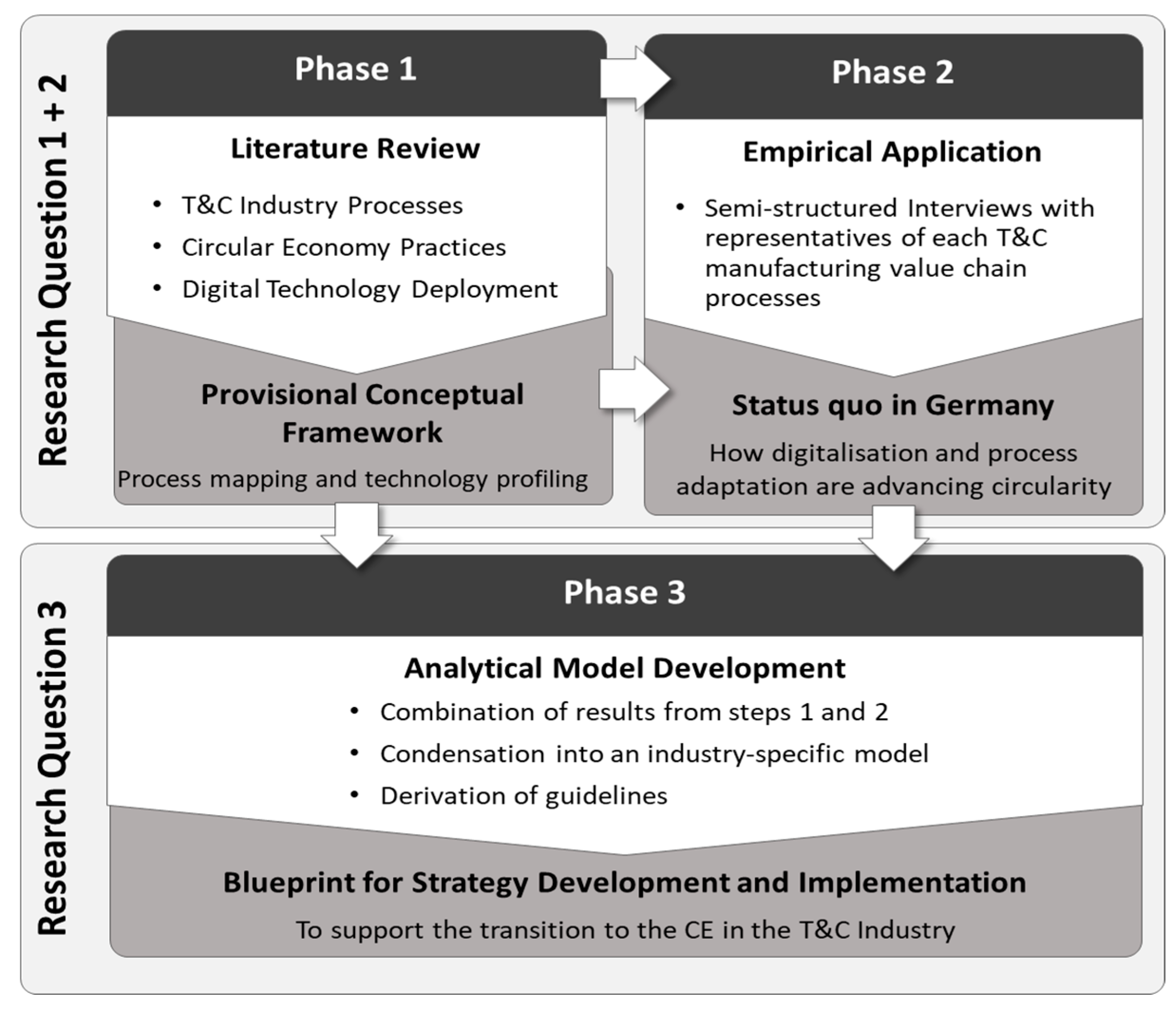

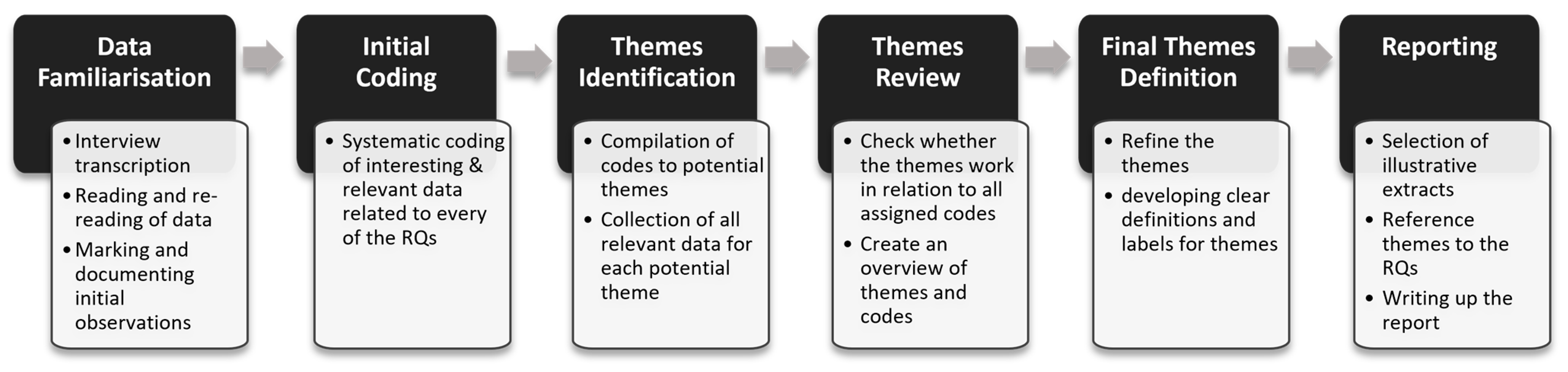

3. Research Method

4. Results

4.1. How Is the Circular Economy Currently Implemented in German T&C Manufacturing Companies? (RQ1)

4.1.1. Overview

4.1.2. Narrowing/Eco-Efficiency

Reduce Negative Environmental Impact

Reduce Waste and Scrap

Reduce Resource Consumption

4.1.3. Slowing

Waste Utilisation

Durability of Products and Materials

Extend Product Lifespan

Extend Lifespan of Machines and Equipment

4.1.4. Closing

Recycling of Products and Materials

Recyclable Products and Materials

4.1.5. Summary

4.2. How Are DTs Being Used to Support and Advance CE Practices in German T&C Manufacturing Companies? (RQ2)

4.2.1. Overview

4.2.2. Social Media and Digital Collaboration

4.2.3. Mobile Computing

4.2.4. Big Data and Analytics

4.2.5. Cloud Computing

4.2.6. Blockchain Technology (BC)

4.2.7. Robotics

4.2.8. Artificial Intelligence (AI)

4.2.9. Internet of Things (IoT)

4.2.10. Digital Fabrication

4.2.11. Other Digital Systems and Platforms

4.2.12. Summary

4.3. What Are the Challenges and Critical Issues for Current and Future CE Transition and Digitalisation in the German T&C Manufacturing Sector? (RQ3)

4.3.1. Challenges

4.3.2. Success Factors

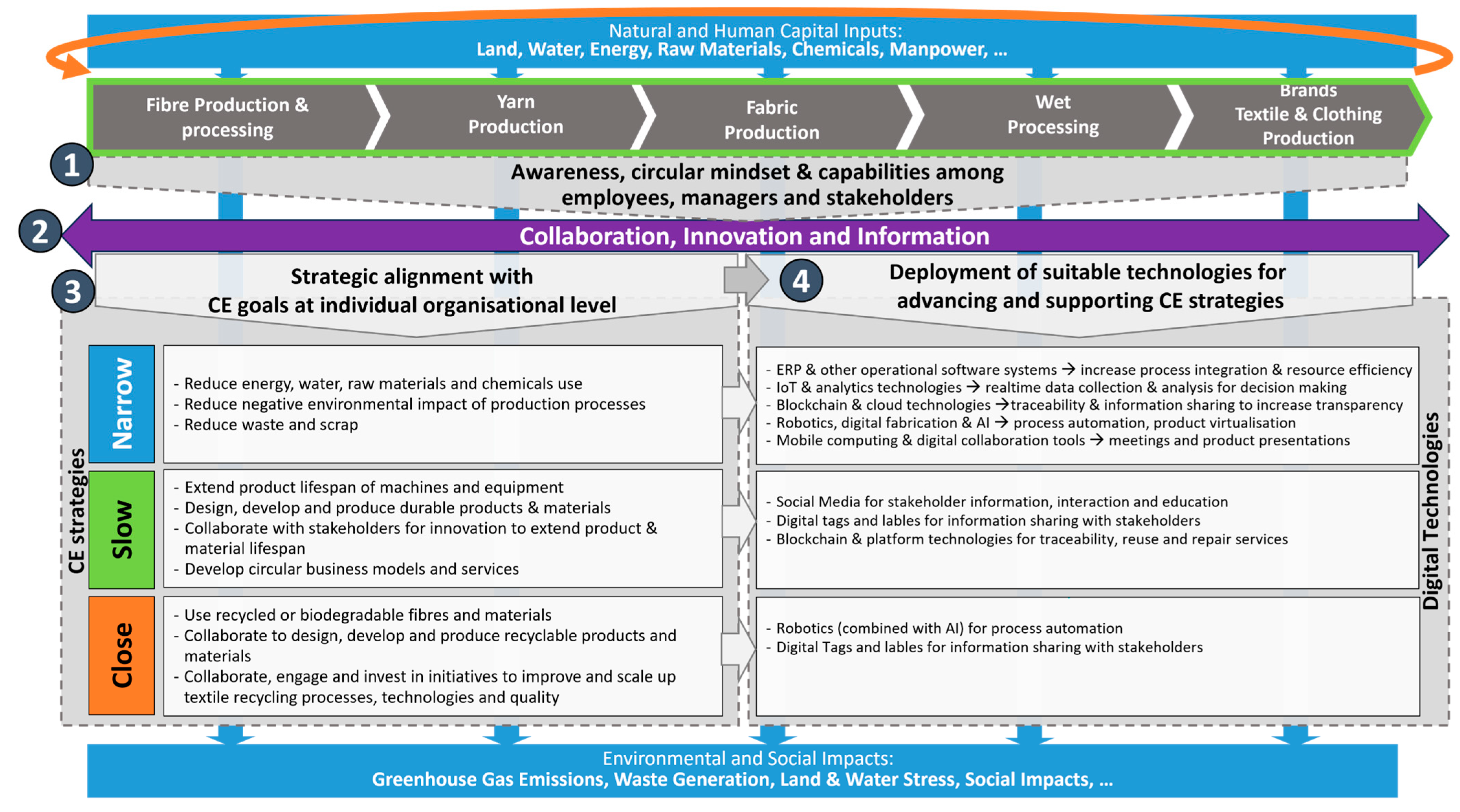

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Theme | Company Code | Statement Examples |

|---|---|---|

| Reduce negative environmental impact | A | “We have our own wastewater treatment plant on site”. |

| B | “We have been recording this consistently since 1997. We can systematically record key indicators, and are actually always up to date in terms of the current input and output; this systematic tracking allows us to establish benchmarks and set improvement goals”. | |

| C | “We make significant investments in photovoltaic systems wherever it is feasible”. | |

| D | “We hold various certifications, including Ökotex for our products, as well as GOTS, GRS, and RWS certifications”. | |

| E | “We have a water treatment system that effectively recovers and processes water for reuse. The system employs various process chemicals, ensuring compliance with ZDHC [Zero Discharge of Hazardous Chemicals] standards, to make the treated water suitable for repeated use”. | |

| F | “20% of our energy consumption is covered by our photovoltaic system […]. We calculate and balance our CO2 footprint annually (Scope 1, 2, and 3) and fully offset the calculated CO2 emissions through the support of climate projects”. | |

| G | "Regarding emissions, our digital printing processes and the use of certified inks have virtually eliminated exhaust emissions. This also leads to significantly fewer chemicals on the fabric”. | |

| H | “As a textile finisher, energy consumption—both electricity and heat—is a significant factor. For instance, we require 4 million kilowatt-hours of electricity annually, a quarter of which is generated through on-site solar photovoltaics (PV), a practice we began over 20 years ago and have gradually expanded. However, further expansion of renewable electricity generation currently seems unfeasible. In addition to electricity, we also require 8 million kilowatt-hours of thermal energy, which we generate sustainably using biomass”. | |

| I | “We aim to minimize air freight wherever possible and have set specific air freight targets for each department”. | |

| J | “We are collaborating with other brands and partners at our production sites. This initiative focuses on substituting coal with natural gas or biomass and implementing various energy efficiency measures to further reduce our environmental impact”. | |

| Reduce waste and scrap | A | “We reduce waste by integrating quality assurance measures to ensure optimal production outcomes”. |

| B | “When we notice during production checks or inspections that the product quality is deteriorating, adjustments are made at the cotton stage, including adapting the blend to counteract the issue”. | |

| D | “We have system that analyses and categorises waste into different types, aiming to reduce avoidable waste. This effort spans a wide range, starting from copier paper and extending to various other areas […]. We operate on a made-to-order production basis”. | |

| E | “We aim for real-time error detection to minimise waste, so that as soon as a defect is detected, we can intervene before too much low-quality material is produced”. | |

| F | “We produce almost exclusively on-demand, with everything tailored to customer requirements. We maintain only a small stock program, which we constantly adjust by monitoring which colors perform well and to what extent”. | |

| G | We carefully evaluate where we can reduce waste, particularly since we have to pay for disposal. One significant area of improvement has been the reduction in waste from printing ink, which used to be a major issue. Now, thanks to advancements, ink usage has been minimised, and almost no ink needs to be discarded anymore. | |

| H | “Production is increasingly aligned with actual sales or near-certain demand. This approach minimises overproduction and eliminates surplus stock that would otherwise need to be reprocessed or discarded later”. | |

| Reduce resource consumption | A | “We operate an on-site gas power plant, which not only generates energy but also produces steam and heat that are directly utilized in production processes, ensuring a very high level of efficiency”. |

| B | “Between 2008 and 2023, we progressively reduced water usage by 30%. For example, in 2008, 132 L of water were needed per kilogram of yarn, whereas by 2023, this figure had dropped to just 96 L”. | |

| C | “We have modernised our dyeing facility in Germany, equipping it with completely new, fully automated dyeing kettles featuring smaller, individually adjustable batch sizes. This allows for a more efficient dyeing process, significantly reducing water consumption and chemical use […]”. | |

| D | “There are various ongoing projects aimed at energy savings, as is mandatory for everyone, including us. We are certified in energy management”. | |

| E | “Our process involves an important distinction: the precursor to our final product is a fleece […]. The edges of this need to be trimmed. Since no solidification has yet occurred, these trimmed edges are collected via suction systems and fed back […]. This allows us to save material that would otherwise need to be added anew”. | |

| F | “Our electricity, gas, heating oil, and diesel consumption are continuously monitored. Through a variety of measures, we have achieved significant energy savings in recent years. For instance, since 2019, our electricity consumption per meter of produced fabric has been reduced by nearly 19%”. “Since 1998, we have been monitoring our water consumption and continuously evaluating necessary measures to conserve this resource […]. We have achieved significant reductions over the past five years, cutting our annual municipal water consumption by nearly 25% and our annual water consumption for climate control in production by almost 47%”. “We are reusing leftover yarns by incorporating them into the production process, such as into the selvedge". | |

| G | “We reuse water up to four times, capturing it with installed pumps and tanks. For instance, we reuse cooling water in the dyeing process, significantly reducing our energy and water consumption […]. We are already forced to do this for energy reasons - we have had this system for over 20 years now and nobody forced us to do it, [but] we are business people and can do the maths”. | |

| H | “We have implemented a rigorous selection process for dyes, chemicals, and auxiliaries, prioritising those with a very high efficacy spectrum. For example, when working with cellulose and reactive dyes, it is possible to purchase inexpensive reactive dyes with yields of only 60–75%, coupled with an extensive need of water. Our approach focuses on sourcing dyes with the highest possible fixation rates, ensuring that 75–95% of the applied dye remains on the material and not in the water”. | |

| J | “We are working intensively with our suppliers, to establish and evaluate new dyeing and finishing processes and implement process optimisation. Particularly in our production countries, water recovery has become a standard practice due to the limited availability of water. We actively support these initiatives and closely monitor developments, ensuring significant progress is made in this area”. |

| Theme | Company Code | Statement Examples |

|---|---|---|

| Waste utilisation | A | “Defective goods, as long as they are in acceptable condition and not heavily contaminated, are sold as B-grade products”. |

| C | “Yes, our main revenue driver when it comes to waste utilisation is selling our waste. We have different types of waste with varying lengths and qualities at multiple stages, and even our combings are of interest to those who need shorter fibers. If we simply sell our waste in bulk, we generate significantly more revenue compared to all our recycling efforts, and it doesn’t appear that this will change”. | |

| D | “Waste is collected and sold separately as far as possible”. | |

| E | “We try to separate and collect as much as possible—whether it’s household waste, production waste like nonwoven scraps, old wood, or plastic packaging”. | |

| F | “We are currently collaborating on a research project with [university], where we produce round-needled tubular structures from our own waste trimmings. These are intended for use in furniture manufacturing. Since 2018, we have also had our own home collection, offering cushions and small furniture, and we aim to incorporate such circular products into this line”. | |

| H | “Almost nothing goes into general waste; we sort and return all cardboard, films, and yarns used in production”. | |

| I | “We repurpose leftover materials for smaller projects. For example, in our own service factory, we create items like bags from these materials. All of our posters and banners, which are made of textile, are collected from our stores and points of sale, then transformed into bags. These are often used as giveaways and feature interesting designs and images. We are actively working on many projects to reuse waste in this area”. | |

| J | “For our products, we actively engage in upcycling. Items that may be faulty, particularly from our manufacturing process, are repurposed and enhanced to create new products. For example, we produce shopper bags or wallets from cutting scraps. We consistently explore ways to make better use of these materials, ensuring they are transformed into valuable items rather than wasted”. | |

| Durable products and materials | B | “We aim to explore niche markets to sustain jobs at our location. Technical textiles, for instance, are significantly more profitable than basic yarns used for producing T-shirts. Our focus is consistently on high-quality products”. |

| F | “Our fabrics are designed to be washable and easy to care for”. | |

| H | “Our focus is on ensuring our product has the highest possible durability”, which applies to both final products and intermediary materials. | |

| I | “As part of our new brand DNA, longevity has become a core focus for us. This means it is undoubtedly an important topic. We’re now introducing extended warranties, which further underscores how crucial this is for us […]”. | |

| J | “Our products have a relatively long lifespan. We’re talking about 10 years or more, potentially even up to 20 years, depending on the area of application, intensity of use, and maintenance”. | |

| C | “We have already conducted trials using reusable transport boxes for dye cones”. | |

| F | “We offer training and even provide support to end consumers. For example, if someone has a [product] with our fabric, we have a service hotline where they can ask questions like how to deal with pressure marks on velour, or how to properly clean and maintain the fabric. We also advise on removing stains from materials like marker ink or nail polish. While we don’t offer repairs, we do provide a care service to ensure the fabric lasts as long as possible, aligning with our commitment to durability”. | |

| H | “We strive to reuse everything related to packaging whenever possible. For instance, with cardboard boxes, we have agreements with our customers to return the products in the original boxes, keeping them in circulation for as long as possible. Similarly, stretch films and cores are reused whenever feasible, with efforts to employ reusable cores. For materials like plastic films, we ensure they are sorted by type and returned to the manufacturer for recycling. This approach maximizes the lifecycle of packaging materials and aligns with our sustainability goals”. | |

| I | “We try to repair first—we have a Service Factory, and we’re developing strategies to expand our repair offerings”. | |

| J | “We have offered a repair service at our company for as long as the company has existed—around 50 years”. “We also provide rental models and second-hand offerings. About a month ago, we officially launched these initiatives, which received some media attention […]. Our aim is to explore how these models can evolve into viable business opportunities […]. We are also working on designing future products in specific categories to better align them with rental systems. These products may, for example, be heavier or more modular, allowing easier replacement of components, thereby improving their suitability for rental and extending their overall lifespan”. | |

| Extend life-span of machines and equipment | B | “In the past, maintenance intervals were based on rough estimates and experience, such as assuming that a carding set would last around three months. However, with modern testing procedures and technologies, these intervals have been extended significantly”. |

| G | “Our stretching frame is older than I am, but with proper maintenance, it still makes sense to keep it running”. | |

| H | “We have implemented proactive maintenance, […], based on this knowledge, components are replaced at appropriate intervals”. |

| Theme | Company Code | Statement Examples |

|---|---|---|

| Recycling of products and materials | B | “Using recycled cotton means less water use in farming, fewer chemicals, and reduced transportation impacts. This makes it a sustainable product, and we aim to maximise its potential, particularly in the premium segment”. |

| C | “We also have our own ‘recycled product’ [made from recycled fibres], which sells steadily. However, it always includes a portion of virgin fiber to ensure the material can be processed effectively through our spinning machines”. | |

| E | “In our carbon fiber nonwoven production, the process was set up to incorporate waste from carbon fiber nonwoven production. We purchase these materials and produce our own carbon fiber nonwovens from them. This means that these products are essentially made entirely from recycled materials, qualifying as 100% secondary raw materials”. | |

| F | “We have a recycled collection for two years now. However, it’s not textile-to-textile recycling; instead, we rely on PET recycled yarns made from PET bottles. Currently, we are also exploring new options and have sourced a new fiber-to-fiber recycled yarn that we are now testing”. | |

| H | “We purchase certain packaging items, such as cartons and foils from recycled materials”. | |

| I | “We are working on a circularity collection, meaning a collection […] of mono-component products, meaning they are made of 100% recycled polyester wherever possible”. “When we use natural fibers, particularly in the wool sector, we exclusively use recycled wool, such as shredded wool or collected wool, to ensure resource efficiency. We aim to use as little conventional [virgin] wool as possible”. “The consumer can visit our website to generate and print a free DHL return label, allowing them to send products back to us at no cost. Currently, we handle this process in-house and do not collaborate with an external partner for returns”. | |

| J | “We strive for, and have already largely achieved, the predominant use of non-fossil raw materials in our products. Currently, approximately 90% of our raw materials consist of recycled, bio-based, or biomass-allocated materials. This shift has significantly reduced our carbon footprint”. “We also operate a take-back system, allowing customers to return their old products. Depending on their condition, we either repair the items under our manufacturer’s warranty or as a paid service […]. However, some products, due to their condition, cannot be economically repaired. Currently, we collaborate with ‘Fairwertung’, which oversees the redistribution of these items. This includes second-hand resale, recycling, or appropriate disposal, depending on the product’s viability. | |

| Recyclable products and materials | A | “We explore how our fibers can contribute to making textile products more circular. For instance, we assess the potential to replace synthetic fibers with functionalised viscose fibers, enabling products to be designed for biodegradability or improved recyclability”. |

| G | “We now stop printing at the seam, which means the fabric remains clean and can be more easily recycled”. | |

| H | “We’re already working with designers to use only specific dyes and chemicals, so the product can be recycled later”. | |

| I | “We have guidelines from our recycler on what materials can be used, and we integrate these from the beginning of the design process”. |

References

- Gözet, B.; Wilts, H. The Circular Economy as a New Narrative for the Textile Industry: An Analysis of the Textile Value Chain with a Focus on Germany’s Transformation to a Circular Economy; Zukunftsimpuls No. 23; Wuppertal Institut für Klima, Umwelt, Enrgie gGmbH: Wuppertal, Germany, 2022; Available online: https://epub.wupperinst.org/frontdoor/deliver/index/docId/8108/file/ZI23_Textile_Industry.pdf (accessed on 22 March 2024).

- EEA. Textiles and the Environment in a Circular Economy: Eionet Report—ETC/WMGE 2019/6. Available online: https://www.eea.europa.eu/publications/textiles-in-europes-circular-economy (accessed on 12 April 2024).

- European Commission. Circular Economy. Available online: https://joinup.ec.europa.eu/collection/rolling-plan-ict-standardisation/circular-economy-0 (accessed on 12 April 2024).

- Kirchherr, J.; Yang, N.-H.N.; Schulze-Spüntrup, F.; Heerink, M.J.; Hartley, K. Conceptualizing the Circular Economy (Revisited): An Analysis of 221 Definitions. Resour. Conserv. Recycl. 2023, 194, 107001. [Google Scholar] [CrossRef]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development. Available online: https://sustainabledevelopment.un.org/post2015/transformingourworld (accessed on 24 May 2024).

- European Commission. The European Green Deal: COM (2019) 640 Final. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:b828d165-1c22-11ea-8c1f-01aa75ed71a1.0002.02/DOC_1&format=PDF (accessed on 13 March 2024).

- Neri, A.; Cagno, E.; Susur, E.; Urueña, A.; Nuur, C.; Kumar, V.; Franchi, S.; Sorrentino, C. The relationship between digital technologies and the circular economy: A systematic literature review and a research agenda. R&D Manag. 2024. [Google Scholar] [CrossRef]

- Neligan, A. Digitalisation as Enabler Towards a Sustainable Circular Economy in Germany. Intereconomics 2018, 53, 101–106. [Google Scholar] [CrossRef]

- Liu, Q.; Trevisan, A.H.; Yang, M.; Mascarenhas, J. A framework of digital technologies for the circular economy: Digital functions and mechanisms. Bus. Strat. Environ. 2022, 31, 2171–2192. [Google Scholar] [CrossRef]

- Das, S.K.; Bressanelli, G.; Saccani, N. Clustering the Research at the Intersection of Industry 4.0 Technologies, Environmental Sustainability and Circular Economy: Evidence from Literature and Future Research Directions. Circ. Econ. Sust. 2024. [Google Scholar] [CrossRef]

- Govindan, K. How digitalization transforms the traditional circular economy to a smart circular economy for achieving SDGs and net zero. Transp. Res. Part E Logist. Transp. Rev. 2023, 177, 103147. [Google Scholar] [CrossRef]

- European Commission. A New Circular Economy Action Plan For a Cleaner and More Competitive Europe: COM (2020) 98 Final. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:9903b325-6388-11ea-b735-01aa75ed71a1.0017.02/DOC_1&format=PDF (accessed on 17 June 2024).

- European Commission. EU Strategy for Sustainable and Circular Textiles: COM (2022) 141 Final. Available online: https://environment.ec.europa.eu/strategy/textiles-strategy_en (accessed on 17 June 2024).

- Battesini, T.; Thomas, G.; de Medeiros, J.F.; Kolling, C.; Duarte Ribeiro, J.L.; Morea, D. Redesign in the textile industry: Proposal of a methodology for the insertion of circular thinking in product development processes. J. Clean. Prod. 2023, 397, 136588. [Google Scholar] [CrossRef]

- Jia, F.; Yin, S.; Chen, L.; Chen, X. The circular economy in the textile and apparel industry: A systematic literature review. J. Clean. Prod. 2020, 259, 120728. [Google Scholar] [CrossRef]

- Franco, M.A. Circular economy at the micro level: A dynamic view of incumbents’ struggles and challenges in the textile industry. J. Clean. Prod. 2017, 168, 833–845. [Google Scholar] [CrossRef]

- Wiegand, T.; Wynn, M. Sustainability, the Circular Economy and Digitalisation in the German Textile and Clothing Industry. Sustainability 2023, 15, 9111. [Google Scholar] [CrossRef]

- Furferi, R.; Volpe, Y.; Mantellassi, F. Circular Economy Guidelines for the Textile Industry. Sustainability 2022, 14, 11111. [Google Scholar] [CrossRef]

- Rinaldi, F.R.; Di Bernardino, C.; Cram-Martos, V.; Pisani, M.T. Traceability and transparency: Enhancing sustainability and circularity in garment and footwear. Sustain. Sci. Pract. Policy 2022, 18, 132–141. [Google Scholar] [CrossRef]

- European Parliament. Regulation (EC) No 1893/2006 of the European Parliament and of the Council of 20 December 2006 Establishing the Statistical Classification of Economic Activities NACE Revision 2 and Amending Council Regulation (EEC) No 3037/90 as well as Certain EC Regulations on Specific Statistical Domains: EC No 1893/2006. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32006R1893. (accessed on 5 September 2024).

- European Commission: Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs. In Data on the EU Textile Ecosystem and Its Competitiveness: Final Report; Publications Office of the European Union: Luxembourg, 2021.

- European Environment Agency; Mortensen, L.; Bogdanovic, J.; Reichel, A.; Asquith, M. Environmental Indicator Report 2014: Environmental Impacts of Production-Consumption Systems in Europe; Publications Office: Copenhagen, Denmark, 2014. [Google Scholar] [CrossRef]

- Schumacher, K.; Forster, A.L. Facilitating a Circular Economy for Textiles Workshop Report; NIST: Gaithersburg, MD, USA, 2022. Available online: https://nvlpubs.nist.gov/nistpubs/specialpublications/nist.sp.1500-207.pdf (accessed on 8 August 2024).

- Statista. Die zehn wichtigsten Importländer für Textilien im Jahr 2022 [In English: The Ten Most Important Import Countries for Textiles in 2022]. Available online: https://de.statista.com/statistik/daten/studie/209862/umfrage/wichtigste-importlaender-fuer-textilien/ (accessed on 17 March 2024).

- Eurostat. Where Do Our Clothes Come From? Available online: https://ec.europa.eu/eurostat/web/products-eurostat-news/-/edn-20200424-1 (accessed on 17 March 2024).

- Statista. Die zehn wichtigsten Exportländer für Textilien weltweit nach Exportwert im Jahr 2022 [In English: The Ten Most Important Export Countries for Textiles Worldweide by Ammount in 2022]. Available online: https://de.statista.com/statistik/daten/studie/209828/umfrage/wichtigste-exportlaender-fuer-textilien/ (accessed on 17 March 2024).

- Federal Statistical Office of Germany. Anzahl der Betriebe in der deutschen Textil- und Bekleidungsindustrie in den Jahren 2008 bis 2022 [In English: Number of Companies in the German Textile and Clothing Industry between 2008 and 2022]. Available online: https://de.statista.com/statistik/daten/studie/6396/umfrage/betriebe-in-der-deutschen-textil-und-bekleidungsindustrie/ (accessed on 17 March 2024).

- Reike, D.; Vermeulen, W.J.; Witjes, S. The circular economy: New or Refurbished as CE 3.0?—Exploring Controversies in the Conceptualization of the Circular Economy through a Focus on History and Resource Value Retention Options. Resour. Conserv. Recycl. 2018, 135, 246–264. [Google Scholar] [CrossRef]

- Ellen MacArthur Foundation. Towards the Circular Economy: Economic and Business Rationale for an Accelerated Transition. Available online: https://ellenmacarthurfoundation.org/towards-the-circular-economy-vol-1-an-economic-and-business-rationale-for-an (accessed on 22 March 2024).

- European Commission. Closing the Loop—An EU Action Plan for the Circular Economy. Available online: https://ec.europa.eu/transparency/documents-register/api/files/COM(2015)614_0/de00000000332178?rendition=false (accessed on 17 June 2024).

- Bocken, N.; de Pauw, I.; Bakker, C.; van der Grinten, B. Product design and business model strategies for a circular economy. J. Ind. Prod. Eng. 2016, 33, 308–320. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Savaget, P.; Bocken, N.; Hultink, E.J. The Circular Economy—A new sustainability paradigm? J. Clean. Prod. 2017, 143, 757–768. [Google Scholar] [CrossRef]

- Konietzko, J.; Bocken, N.; Hultink, E.J. A Tool to Analyze, Ideate and Develop Circular Innovation Ecosystems. Sustainability 2020, 12, 417. [Google Scholar] [CrossRef]

- Nobre, G.C.; Tavares, E. The quest for a circular economy final definition: A scientific perspective. J. Clean. Prod. 2021, 314, 127973. [Google Scholar] [CrossRef]

- World Business Council for Sustainable Development. Eco-Efficiency: Creating More Value with Less Impact; World Business Council for Sustainable Development: Geneva, Switzerland, 2000; ISBN 9782940240173. [Google Scholar]

- European Commission. Proposal for a Directive of the Euorpean Parliament and of the Council amending Directive 2008/98/EC on waste: Com (2023) 420 Final. Available online: https://environment.ec.europa.eu/document/download/ca53d82e-a4d3-40b9-a713-93585058f47f_en?filename=Proposal%20for%20a%20DIRECTIVE%20OF%20THE%20EUROPEAN%20PARLIAMENT%20AND%20OF%20THE%20COUNCIL%20amending%20Directive%20200898EC%20on%20waste%20COM_2023_420.pdf (accessed on 1 December 2023).

- Kirchherr, J.; Reike, D.; Hekkert, M. Conceptualizing the circular economy: An analysis of 114 definitions. Resour. Conserv. Recycl. 2017, 127, 221–232. [Google Scholar] [CrossRef]

- Ghisellini, P.; Cialani, C.; Ulgiati, S. A review on circular economy: The expected transition to a balanced interplay of environmental and economic systems. J. Clean. Prod. 2016, 114, 11–32. [Google Scholar] [CrossRef]

- Coppola, C.; Vollero, A.; Siano, A. Developing dynamic capabilities for the circular economy in the textile and clothing industry in Italy: A natural-resource-based view. Bus. Strat. Environ. 2023, 32, 4798–4820. [Google Scholar] [CrossRef]

- Brydges, T. Closing the loop on take, make, waste: Investigating circular economy practices in the Swedish fashion industry. J. Clean. Prod. 2021, 293, 126245. [Google Scholar] [CrossRef]

- Colucci, M.; Vecchi, A. Close the loop: Evidence on the implementation of the circular economy from the Italian fashion industry. Bus. Strat. Environ. 2021, 30, 856–873. [Google Scholar] [CrossRef]

- UNEP; UNFCCC. The Sustainable Fashion Communication Playbook; United Nations Environment Programme: Nairobi, Kenya, 2023; Available online: https://wedocs.unep.org/bitstream/handle/20.500.11822/42819/sustainable_fashion_communication_playbook.pdf?sequence=3 (accessed on 25 May 2024).

- Faria, R.; Lopes, I.; Pires, I.M.; Marques, G.; Fernandes, S.; Garcia, N.M.; Lucas, J.; Jevremović, A.; Zdravevski, E.; Trajkovik, V. Circular Economy for Clothes Using Web and Mobile Technologies—A Systematic Review and a Taxonomy Proposal. Information 2020, 11, 161. [Google Scholar] [CrossRef]

- Wynn, M.; Jones, P. Digital Technology Deployment and the Circular Economy. Sustainability 2022, 14, 9077. [Google Scholar] [CrossRef]

- Kristoffersen, E.; Mikalef, P.; Blomsma, F.; Li, J. The effects of business analytics capability on circular economy implementation, resource orchestration capability, and firm performance. Int. J. Prod. Econ. 2021, 239, 108205. [Google Scholar] [CrossRef]

- Luoma, P.; Penttinen, E.; Tapio, P.; Toppinen, A. Future images of data in circular economy for textiles. Technol. Forecast. Soc. Change 2022, 182, 121859. [Google Scholar] [CrossRef]

- Bressanelli, G.; Saccani, N.; Perona, M.; Baccanelli, I. Towards Circular Economy in the Household Appliance Industry: An Overview of Cases. Resources 2020, 9, 128. [Google Scholar] [CrossRef]

- Cagno, E.; Neri, A.; Negri, M.; Bassani, C.A.; Lampertico, T. The Role of Digital Technologies in Operationalizing the Circular Economy Transition: A Systematic Literature Review. Appl. Sci. 2021, 11, 3328. [Google Scholar] [CrossRef]

- Abbate, S.; Centobelli, P.; Cerchione, R. From Fast to Slow: An Exploratory Analysis of Circular Business Models in the Italian Apparel Industry. Int. J. Prod. Econ. 2023, 260, 108824. [Google Scholar] [CrossRef]

- Alves, L.; Sá, M.; Cruz, E.F.; Alves, T.; Alves, M.; Oliveira, J.; Santos, M.; Da Rosado Cruz, A.M. A Traceability Platform for Monitoring Environmental and Social Sustainability in the Textile and Clothing Value Chain: Towards a Digital Passport for Textiles and Clothing. Sustainability 2024, 16, 82. [Google Scholar] [CrossRef]

- Bressanelli, G.; Adrodegari, F.; Pigosso, D.C.A.; Parida, V. Circular Economy in the Digital Age. Sustainability 2022, 14, 5565. [Google Scholar] [CrossRef]

- Rusch, M.; Schöggl, J.-P.; Baumgartner, R.J. Application of digital technologies for sustainable product management in a circular economy: A review. Bus. Strat. Environ. 2023, 32, 1159–1174. [Google Scholar] [CrossRef]

- Chauhan, C.; Parida, V.; Dhir, A. Linking circular economy and digitalisation technologies: A systematic literature review of past achievements and future promises. Technol. Forecast. Soc. Change 2022, 177, 121508. [Google Scholar] [CrossRef]

- Lopes de Sousa Jabbour, A.B.; Chiappetta Jabbour, C.J.; Choi, T.-M.; Latan, H. ‘Better together’: Evidence on the joint adoption of circular economy and industry 4.0 technologies. Int. J. Prod. Econ. 2022, 252, 108581. [Google Scholar] [CrossRef]

- Agrawal, R.; Wankhede, V.A.; Kumar, A.; Luthra, S.; Majumdar, A.; Kazancoglu, Y. An Exploratory State-of-the-Art Review of Artificial Intelligence Applications in Circular Economy using Structural Topic Modeling. Oper. Manag. Res. 2022, 15, 609–626. [Google Scholar] [CrossRef]

- Ellen MacArthur Foundation. Artificial Intelligence and the Circular Economy: AI as a Tool to Accelerate the Transition. Available online: https://emf.thirdlight.com/file/24/GgC25OAGBvwdiFGgtzZGVXuZsz/Artificial%20intelligence%20and%20the%20circular%20economy.pdf (accessed on 8 June 2024).

- Giri, C.; Jain, S.; Zeng, X.; Bruniaux, P. A Detailed Review of Artificial Intelligence Applied in the Fashion and Apparel Industry. IEEE Access 2019, 7, 95376–95396. [Google Scholar] [CrossRef]

- Rudisch, K.; Jüngling, S.; Carrillo Mendoza, R.; Woggon, U.K.; Budde, I.; Malzacher, M.; Pufahl, K. Paving the Road to a Circular Textile Economy with AI; German Informatics Society: Bonn, Germany, 2021. [Google Scholar]

- Russell, S.J.; Norvig, P. Artificial Intelligence: A Modern Approach, 4th ed.; Pearson: Boston, MA, USA, 2022; ISBN 9781292401171. [Google Scholar]

- Li, S.; Da Xu, L.; Zhao, S. The internet of things: A survey. Inf. Syst. Front. 2015, 17, 243–259. [Google Scholar] [CrossRef]

- Bressanelli, G.; Adrodegari, F.; Pigosso, D.C.A.; Parida, V. Towards the Smart Circular Economy Paradigm: A Definition, Conceptualization, and Research Agenda. Sustainability 2022, 14, 4960. [Google Scholar] [CrossRef]

- Hassan, R.; Acerbi, F.; Rosa, P.; Terzi, S. The role of digital technologies in the circular transition of the textile sector. J. Text. Inst. 2024, 1–14. [Google Scholar] [CrossRef]

- Schöggl, J.-P.; Rusch, M.; Stumpf, L.; Baumgartner, R.J. Implementation of digital technologies for a circular economy and sustainability management in the manufacturing sector. Sustain. Prod. Consum. 2023, 35, 401–420. [Google Scholar] [CrossRef]

- Agustí-Juan, I.; Habert, G. Environmental design guidelines for digital fabrication. J. Clean. Prod. 2017, 142, 2780–2791. [Google Scholar] [CrossRef]

- Gershenfeld, N. How to make almost anything: The digital fabrication revolution. Foreign Aff. 2012, 91, 43–57. [Google Scholar]

- Huynh, P.H. Enabling circular business models in the fashion industry: The role of digital innovation. Int. J. Product. Perform. Manag. 2022, 71, 870–895. [Google Scholar] [CrossRef]

- Manaia, J.P.; Cerejo, F.; Duarte, J. Revolutionising textile manufacturing: A comprehensive review on 3D and 4D printing technologies. Fash. Text. 2023, 10, 20. [Google Scholar] [CrossRef]

- Preut, A.; Kopka, J.-P.; Clausen, U. Digital Twins for the Circular Economy. Sustainability 2021, 13, 10467. [Google Scholar] [CrossRef]

- Wynn, M.; Irizar, J. Digital Twin Applications in Manufacturing Industry: A Case Study from a German Multi-National. Future Internet 2023, 15, 282. [Google Scholar] [CrossRef]

- Porter, A.L.; Kongthon, A.; Lu, J.-C. Research profiling: Improving the literature review. Scientometrics 2002, 53, 351–370. [Google Scholar] [CrossRef]

- Miles, M.B.; Huberman, A.M.; Saldaña, J. Qualitative Data Analysis: A Methods Sourcebook, 3rd ed.; Sage: Los Angeles, CA, USA; London, UK; New Delhi, India; Singapore; Washington, DC, USA, 2014; ISBN 9781452257877. [Google Scholar]

- Cooper, D.R.; Schindler, P.S. Business Research Methods, 12th ed.; Irwin/McGraw-Hill: Boston, MA, USA, 2014; ISBN 9780073521503. [Google Scholar]

- Yin, R.K. Case Study Research: Design and Methods, 5th ed.; Sage: Thousand Oaks, CA, USA, 2014. [Google Scholar]

- Rheinhardt, A.; Kreiner, G.E.; Gioia, D.A.; Corley, K.G. Conducting and Publishing Rigorous Qualitative Research. In The SAGE Handbook of Qualitative Business and Management Research Methods; Cassell, C., Cunliffe, A.L., Grandy, G., Eds.; Sage: Los Angeles, CA, USA; London, UK; New Delhi, India; Singapore; Washington, DC, USA; Melbourne, Australia, 2018; pp. 515–531. ISBN 9781526429261. [Google Scholar]

- Braun, V.; Clarke, V. Using thematic analysis in psychology. Qual. Res. Psychol. 2006, 3, 77–101. [Google Scholar] [CrossRef]

- European Parliament. DIRECTIVE (EU) 2022/2464. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32022L2464 (accessed on 18 September 2024).

- International Organization for Standardization. Environmental Management Systems—Requirements with Guidance for Use (14001:2015). Available online: https://www.iso.org/obp/ui/#iso:std:iso:14001:ed-3:v1:en (accessed on 18 September 2024).

- Global Standard gGmbH. Global Organic Textile Standard (GOTS)—Key Features. Available online: https://global-standard.org/the-standard/gots-key-features (accessed on 18 September 2024).

- OEKO-TEX Service GmbH. Our Standards OEKO-TEX Standards Enable Everyone to Make Responsible Decisions and Protect Natural Resources. Available online: https://www.oeko-tex.com/en/our-standards (accessed on 18 September 2024).

- Dissanayake, D.; Weerasinghe, D. Towards Circular Economy in Fashion: Review of Strategies, Barriers and Enablers. Circ. Econ. Sust. 2022, 2, 25–45. [Google Scholar] [CrossRef]

- De Aguiar Hugo, A.; de Nadae, J.; Da Silva Lima, R. Can Fashion Be Circular? A Literature Review on Circular Economy Barriers, Drivers, and Practices in the Fashion Industry’s Productive Chain. Sustainability 2021, 13, 12246. [Google Scholar] [CrossRef]

- Barreiro-Gen, M.; Lozano, R. How circular is the circular economy? Analysing the implementation of circular economy in organisations. Bus. Strat. Environ. 2020, 29, 3484–3494. [Google Scholar] [CrossRef]

- Balchandani, A.; Starzynska, E.; Barrelet, D.; Berg, A.; D’Auria, G.; Rölkens, F.; Amed, I. The State of Fashion 2024. Available online: https://www.mckinsey.com/industries/retail/our-insights/state-of-fashion (accessed on 3 October 2024).

- Colucci, M.; Vecchi, A. Tackling Climate Change with End-of-Life Circular Fashion Practices—Remade in Italy with Amore. Br. J. Manag. 2024, 35, 1157–1179. [Google Scholar] [CrossRef]

- Fachbach, I.; Lechner, G.; Reimann, M. Drivers of the consumers’ intention to use repair services, repair networks and to self-repair. J. Clean. Prod. 2022, 346, 130969. [Google Scholar] [CrossRef]

- Laitala, K.; Klepp, I.; Henry, B. Does Use Matter? Comparison of Environmental Impacts of Clothing Based on Fiber Type. Sustainability 2018, 10, 2524. [Google Scholar] [CrossRef]

- Hedrich, S.; Janmark, J.; Langguth, N.; Magnus, K.-H.; Strand, M. Scaling Textile Recycling in Europe—Turning Waste into Value. Available online: https://www.mckinsey.de/industries/retail/our-insights/scaling-textile-recycling-in-europe-turning-waste-into-value#/ (accessed on 4 May 2024).

- European Commission. Ecodesign for Sustainable Products Regulation (ESPR). Available online: https://commission.europa.eu/energy-climate-change-environment/standards-tools-and-labels/products-labelling-rules-and-requirements/sustainable-products/ecodesign-sustainable-products-regulation_en (accessed on 18 September 2024).

- Neligan, A.; Baumgartner, R.J.; Geissdoerfer, M.; Schöggl, J.-P. Circular disruption: Digitalisation as a driver of circular economy business models. Bus. Strat. Environ. 2022, 32, 1175–1188. [Google Scholar] [CrossRef]

- Schöggl, J.-P.; Stumpf, L.; Baumgartner, R.J. The role of interorganizational collaboration and digital technologies in the implementation of circular economy practices—Empirical evidence from manufacturing firms. Bus. Strat. Environ. 2023, 33, 2225–2249. [Google Scholar] [CrossRef]

- Suchek, N.; Franco, M. Inter-organisational Cooperation Oriented Towards Sustainability Involving SMEs: A Systematic Literature Review. J. Knowl. Econ. 2024, 15, 1952–1972. [Google Scholar] [CrossRef]

- Budden, P.; Murray, F. Strategically Engaging With Innovation Ecosystems. MIT Sloan Manag. Rev. 2022, 64, 38–43. [Google Scholar]

- Bressanelli, G.; Perona, M.; Saccani, N. Challenges in supply chain redesign for the Circular Economy: A literature review and a multiple case study. Int. J. Prod. Res. 2019, 57, 7395–7422. [Google Scholar] [CrossRef]

- Dragan, G.B.; Arfi, W.B.; Tiberius, V.; Ammari, A.; Ferasso, M. Acceptance of circular entrepreneurship: Employees’ perceptions on organizations’ transition to the circular economy. J. Bus. Res. 2024, 173, 114461. [Google Scholar] [CrossRef]

| DT | Role of Advancing Circularity in T&C Manufacturing | References |

|---|---|---|

| Social media |

| [41,42] |

| Mobile computing |

| [43,44] |

| Analytics/Big data |

| [45,46] |

| Cloud and edge computing |

| [47,48] |

| Blockchain technology (BC) |

| [18,49,50,51,52] |

| Robotics |

| [48,53,54] |

| Artificial intelligence (AI) |

| [55,56,57,58,59] |

| Internet of Things (IoT) |

| [60,61,62,63] |

| Digital fabrication (DF) |

| [41,62,64,65,66,67,68,69] |

| Code | Description | Size | Interviewee |

|---|---|---|---|

| A | Manufacturer of manmade fibres for various applications | Large | Project Lead New Business Development |

| B | Processor of natural fibres and manufacturing of yarns | Medium | Certification and Sustainability Manager |

| C | Manufacturer of yarns (including dying) from natural fibres | Medium | Management Representative |

| D | Manufacturer of yarns (including dying) from natural and synthetic fibres | Large | Head of Quality Assurance |

| E | Manufacturer of nonwovens for various applications | Large | Sustainability Manager |

| F | Manufacturer of woven fabrics for home textiles | Medium | Head of Sustainability & Marketing |

| G | Manufacturer of printed fabrics for clothing textiles | Small | CEO |

| H | Manufacturer of dyed yarns for various applications | Medium | Head of Research and Development |

| I | Sports and outdoor clothing brand | Medium | Director of Quality and Corporate Responsibility |

| J | Sports and outdoor clothing brand | Large | Senior Innovation Manager Materials and Manufacturing |

| Narrowing | Slowing | Closing |

|---|---|---|

|

|

|

| CE Strategies and Practices | Narrowing/Eco-Efficiency | Slowing | Closing | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| T&C Process Clusters and Companies | Reduce Negative Environmental Impact | Reduce Waste and Scrap | Reduce Resource Consumption | Waste Utilisation | Durable Products and Materials | Extend Product Lifespan | Extend Lifespan of Machines and Equipment | Recycling of Products and Materials | Recyclable Products and Materials | |

| Fibre processing | A | x | x | x | x | x | x | |||

| B | x | x | x | x | x | x | ||||

| Yarn production | C | x | x | x | x | x | ||||

| D | x | x | x | x | ||||||

| Fabric production | E | x | x | x | x | x | ||||

| F | x | x | x | x | x | x | x | |||

| Wet processing | G | x | x | x | x | x | ||||

| H | x | x | x | x | x | x | x | x | x | |

| T&C brands/production | I | x | x | x | x | x | x | |||

| J | x | x | x | x | x | x | ||||

| Total | 10 | 7 | 9 | 8 | 5 | 6 | 3 | 7 | 4 | |

| Social Media | Mobile Computing | Big Data/ Analytics | Cloud Computing | Blockchain | Robotics | Artificial Intelligence | Internet of Things | Digital Fabrication | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| deployed | planned | deployed | planned | deployed | planned | deployed | planned | deployed | planned | deployed | planned | deployed | planned | deployed | planned | deployed | planned | ||

| Fibre production | A | x | x | x | x | x | x | ||||||||||||

| B | x | x | x | x | x | ||||||||||||||

| Yarn production | C | x | x | ||||||||||||||||

| D | x | x | x | x | x | ||||||||||||||

| Fabric production | E | x | x | x | x | x | x | x | x | x | |||||||||

| F | x | ||||||||||||||||||

| Wet processing | G | x | x | x | x | x | x | ||||||||||||

| H | x | x | x | x | x | x | |||||||||||||

| Textile and clothing production | I | x | x | x | x | x | x | x | |||||||||||

| J | x | x | x | x | x | x | x | x | |||||||||||

| Total % of companies | 100% | 0% | 70% | 0% | 60% | 10% | 70% | 10% | 30% | 10% | 30% | 10% | 20% | 30% | 40% | 20% | 30% | 10% | |

| DT | Social Media | Mobile Computing | Big Data/ Analytics | Cloud Computing | Blockchain | Robotics | Artificial Intelligence | Internet of Things | Digital Fabrication | Other | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CE Strategy | Related DT Function and CE Practice | Management System | ERP System | PDM System | E-Commerce/ Website | |||||||||

| Narrowing / Eco-efficiency | DT Function | Digital collaboration tools for meetings Virtual product presentation | Operational and strategic data analysis | Online platform for chemical management Document sharing with stakeholders | Traceability and transparency | Process automation | Image recognition for quality control Image generation/design | Traceability of materials (physical tracers) Real-time data collection | Digital printing on fabrics Digital colour management 3D design | Centralised data collection for process control and certification | Centralised data collection for operational data and process integration | Centralised product data collection for data and process integration | ||

| CE Practice | Reduce negative environmental impact Reduce material use and consumption | Reduce negative environmental impact Reduce energy consumption Reduce waste and scrap | Reduce chemical consumption Reduce material use and consumption | Reduce negative environmental impact Reduce resource consumption | Reduce waste and scrap Reduce material use and consumption | Reduce waste and scrap Reduce negative environmental impact Reduce material use and consumption | Reduce negative environmental Reduce waste and scrap | Reduce negative environmental impact Reduce waste and scrap Reduce chemical consumption Reduce water consumption Reduce material use and consumption | Reduce negative environmental impact Reduce chemical consumption | Reduce negative environmental impact Reduce waste and scrap Reduce material use and consumption | Reduce negative environmental impact | |||

| Slowing | DT Function | Consumer education about care and maintenance | Traceability and transparency | Traceability of materials (physical tracers) Digital tags for consumer information | Online marketplace for scrap and secondary raw materials | |||||||||

| CE Practice | Extend product lifespan | Durable products and materials | Durable products and materials Extend product lifespan | Waste utilisation | ||||||||||

| Closing | DT Function | Process automation | Digital tags for consumer information | |||||||||||

| CE Practice | Recyclable products and materials | Recycling of products and materials | ||||||||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wiegand, T.; Wynn, M. Circularity and Digitalisation in German Textile Manufacturing: Towards a Blueprint for Strategy Development and Implementation. Processes 2024, 12, 2697. https://doi.org/10.3390/pr12122697

Wiegand T, Wynn M. Circularity and Digitalisation in German Textile Manufacturing: Towards a Blueprint for Strategy Development and Implementation. Processes. 2024; 12(12):2697. https://doi.org/10.3390/pr12122697

Chicago/Turabian StyleWiegand, Tina, and Martin Wynn. 2024. "Circularity and Digitalisation in German Textile Manufacturing: Towards a Blueprint for Strategy Development and Implementation" Processes 12, no. 12: 2697. https://doi.org/10.3390/pr12122697

APA StyleWiegand, T., & Wynn, M. (2024). Circularity and Digitalisation in German Textile Manufacturing: Towards a Blueprint for Strategy Development and Implementation. Processes, 12(12), 2697. https://doi.org/10.3390/pr12122697