Abstract

The design of new consumer chemical products is a complex task at different levels. In addition to the technical challenges of the formulation, design teams should also consider the requirements of the organization where the design is performed. The objective of this article is to present a knowledge base to support decision-making for the design of formulated products, considering the organizational dimension. For this, data were collected during ten semi-structured in-depth interviews with industrial experts who are also decisional actors in the design process. From the collected data, design recommendations were identified and analyzed. These recommendations are statements which can be used by organizations to evaluate, understand, improve, or create their own design methodologies considering their context and resources. Subsequently, the extracted recommendations were analyzed according to three types of criteria: the stages of the design process, the involved actors, and the organizational context. As a result, a knowledge base containing systematically organized recommendations that have led to the development of successful products is presented. Finally, the multiple uses of the knowledge base are shown with theoretical examples and the knowledge base is applied to analyze the design process of a real organization: in a small and medium-sized enterprise (SME) in the cosmetic sector.

1. Introduction

The design of new products is essential to maintain or improve the competitive advantages of companies in the market []. However, the design of innovative chemical products is a complex task at many different levels. Product design involves the activities of creating, developing, and marketing a product that is accepted by customers and satisfies their needs. Chemical companies face different situations and special challenges according to the type of product they are designing and the target market they want to reach []. Indeed, besides the technical challenges during product formulation and the definition of process conditions, design teams must also consider the requirements of the organization in which the product design is carried out [,].

The organizational context for product design involves the interaction of multiple actors with different competencies and responsibilities [,,]. These actors can be internal to the organization, such as the project manager, design team, laboratory technician, quality manager, and purchasing manager, among others. They can also be external, such as users, customers, suppliers, regulatory entities, or external consultants. The role of the actors and their interrelationships are specific to each company and evolve during the development of the design process. Thus, the success of a product depends not only on meeting technical requirements, but also on satisfying the expectations and requirements of stakeholders, notably the final user and others such as regulators, and the company itself []. In this sense, the design process is a detailed activity that takes place in a complex and changing organizational context that necessarily affects the outcome of the design [,,]. This means that different approaches may be used depending on the company culture to respond to a specific design problem [].

Despite the importance of having an organizational approach for designing new products, there are not many design methodologies for chemical products that take this aspect into account []. Most of the published methodologies focused on technical and financial aspects [,,,,]. There are some works that consider the company structure for decision-making during product formulation [,]; however, they do not present an in-depth knowledge management strategy for designing within organizations. Thus, the lack of consideration of the organizational context in the design process is a research opportunity for the proposition of a novel design methodology [,].

Considering the above, this article analyzes the organizational dimension of the design process of several companies of formulated chemical products and uses this information for the construction of a knowledge base. For this, the chemical product design process is understood as a temporal decision-making system that appears when a company decides to initiate a product development project []. In such a system, actors exchange elements such as knowledge, information, energy, materials, value, and other resources []. In this case, knowledge is not only structured information about the product, but also information about the context []. Through this analysis, the key moments within a product design project, as well as the actors and the decisions made at different levels, were identified. Subsequently, the results are used to create a knowledge base containing recommendations to incorporate the organizational dimension in chemical design methodologies. The representation of this expert knowledge in a knowledge base allows its exploitation for its application in the improvement or construction of chemical product design methodologies.

This paper is organized as follows: Section 2 presents a description of the state of the art in knowledge management for chemical product design and explains some important concepts. Section 3 shows the methodology used to capture expert knowledge in formulated product design for the construction of the knowledge base. Section 4 explains the analysis framework for the formalization of the collected information, which has three axes: the design stages, the actors, and the organizational context. Subsequently, Section 5 relates the collected knowledge with the elements of the analysis framework, building in this way the structured knowledge base, which is the main contribution of this article. Finally, Section 6 shows some possible uses of the knowledge base and Section 7 presents its use in a real case study of a cosmetic company.

2. Background

2.1. Capitalization Organizational Knowledge for Chemical Product Design

The objective of a knowledge base is to facilitate the understanding of a topic and make knowledge accessible. Thus, it gives sense to information and enables better-informed decisions. A knowledge base in the domain of knowledge management provides the means and documents that can be exploited by decision-makers []. Its construction faces several challenges: it should be adapted to the specific topic, in this case to the chemical product design process, which is done by multidisciplinary collaborative teams; it should organize heterogeneous information coming from diverse sources, as the ones involved in the design process; and it should be managed, updated, and refined according to the advances in its field of application, maintaining coherence between new and old knowledge [].

On the one hand, in the field of chemical engineering, knowledge bases have been widely used to support the design of chemical products. Outstanding examples of highly developed tools implementing knowledge bases include the virtual process-product design laboratory (VPPD-Lab) [] and the computational tool ProCAPD [,]. Both of them contain property models, databases and knowledge bases to support the design of formulated chemical products. These tools deal mainly with technical knowledge, not including an organizational approach.

On the other hand, as knowledge is recognized as a key organizational resource [], diverse knowledge management systems have been applied to support the decision making process during design. For example, Zhong et al. proposed a knowledge management system based on information of customers and the application of kansei engineering concepts []; Berao et al. proposed an architecture for knowledge management to support collaborative activities and design within organizations []; Zahng et. al. showed the importance of knowledge management in open innovation and sustainable competitivity []. All of the above examples highlight the importance of having knowledge management systems adapted to the purposes and profiles of the organizations to ensure their effective implementation [,]. In view of this, this article explores the design process in companies producing formulated chemical products (mainly cosmetic companies), in order to establish a knowledge base of design recommendations adapted to this type of organization.

2.2. Implicit and Explicit Knowledge

In general terms, knowledge can be classified into two categories. It can be explicit and implicit. The former is based on well-established facts while the latter is based on know-how, experience, and intuition []. Explicit knowledge is available in documents, databases, and computer information systems. It is structured and easy to share. Explicit knowledge is normally clear and accessible, and it is usually well-recognized by the design team. An example of explicit knowledge in chemical product design corresponds to established physicochemical specifications, models, equations, formulas, and well-known production process fundamentals, among others.

Otherwise, implicit knowledge is difficult to acquire, transmit, and be conserved within the design teams. This knowledge is also highly related to the design context because it is the result of the trajectory of both the organization and the individuals. Implicit knowledge evolves with practices, changes in organizational structures, design habits, and development experiences, among others. It remains implicit to individuals and is eventually lost if it is not codified, transferred and shared within the organizations [].

It should also be noted that there may be other reasons why knowledge may not be easily accessible. For example, when companies want to protect their private information and maintain a competitive advantage in their industry, they may require their employees to sign confidentiality agreements that prohibit them from disclosing certain information to third parties. In addition, organizations can also use intellectual property protection mechanisms, such as patents, to prevent others from using their technology or ideas. This type of practice should be considered when developing knowledge systems for specific companies (as for example it is shown in [,]). Our research focuses on the problem of the accessibility of information due to its implicit nature. Thus, this article presents the construction of a knowledge base for chemical product design regarding the organizational context, which formalizes the implicit knowledge of several design experts from different chemical product design processes and different organizations.

3. Methodology: Building the Expert Knowledge Bases

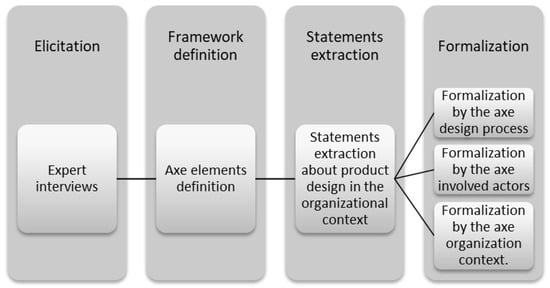

The knowledge base developed in this research comes from information gathered through interviews with experts. Key information related to the design process is extracted from the interviews and then it is analyzed according to a framework comprising three axes to structure it. Figure 1 shows the path used for the construction of the knowledge base. This approach uses four phases: elicitation, framework definition, information extraction, and formalization. The scope of each stage is described below.

Figure 1.

Method for the construction of the knowledge base.

3.1. Elicitation

A total of ten experts were interviewed using semi structured interviews. This was carried out because the use of expert informants is a cost-effective and time-efficient way of gathering detailed and in-depth information [], especially in relation to implicit knowledge. A relatively small sample of experts was used given the experience of the interviewees, who provide both unique and specialized knowledge and perspectives []. Additionally, using the methodology presented here and the structure of the knowledge base presented in the next section, the knowledge base can continue to be expanded with its use and with the contribution of new experts over time.

The semi structured interviews had three parts: the first part giving a presentation of the objectives of the research, the second part devoted to gaining knowledge about the expert’s profile and trajectory, and a third part asking about the design processes the experts carry out in their respective companies. The complete interview topics are presented in Table 1.

Table 1.

Interview protocol applied to chemical product design experts.

All the interviews were carried out via Microsoft Teams during the second half of 2021. Although remote interviews are less personal and potentially less effective in establishing a connection with the interviewee [], they were used given the constraints of the pandemic and the location of the experts. The good thing about online interviews is the ease of scheduling and the speed of the interviews. Each interview lasts about one hour. Information about the general characteristics of the process and the corporative strategies of the companies where the expert work was also collected. The profile of the experts is shown in Table 2.

Table 2.

Profile of the interviewed experts.

3.2. Framework Definition

To structure the information for the construction of the knowledge base, an analysis framework is defined based on three axes: design stages, actors involved, and organizational context. These axes of analysis are selected considering that the focus of the research corresponds to the design process of chemical products, which is represented through the design stages, and the organizational context, which is represented with the involved actors and the business strategy of the company [,]. In a possible future expansion of the database, it is possible to include more dimensions, i.e., innovative capacity, long-term goals of the company, among others.

Based on the analysis of the information from experts, it was found that the different design processes have similarities, but also different elements, i.e., different design stages, actors, and contextual conditions. To be as exhaustive as possible, the elements within the axis of design stages and actors are established by including all the elements mentioned by the experts from all the analyzed design processes. Additionally, the elements of the organizational axis are defined based on an adapted version of the elements in the business model canvas (BMC) []. Considering that the BMC is a tool used to establish new business plans, its choice for the analysis of the organization’s context is based on the model’s ability to capture the elements of the design system, actors (customers, suppliers, areas of the organization involved), process stages (key activities of the BMC) and resources (key resources). In addition, it allows an analysis of the operational, tactical and strategic dimensions that give context to product design (product communication strategies, consumer relations, and cost structure) [].

3.3. Extraction

To extract the implicit knowledge of the experts in terms of chemical product design, a 3-step process was followed: 1. The transcription of the interviews: to create a written record of the conversation; 2. Manually coding the data: to identify and tag significant topics or patterns; and 3. Analyze the data: to interpret the data and draw conclusions []. Following that process, recommendations or design statements expressed by the experts were extracted from the collected information. The focus was the information considered implicit (based on their experience and context) and at the same time applicable to different design processes as recommendations for decision-making, considering the organizational dimension. The specific criteria used for the extraction of statements were:

- Generic information that can be applied by any design team.

- Information considering the organizational dimension of the design.

- Clear learnings from the expert’s experience.

- Conclusions made by the expert comparing two or more design processes.

- Key decision points that are evident to the expert.

To avoid the influence of researcher biases during the analysis process, a multi-investigator approach was used. This was carried out to triangulate the data and provide a more complete understanding of the data.

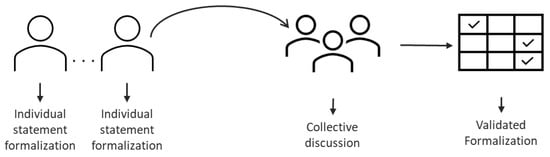

3.4. Formalization

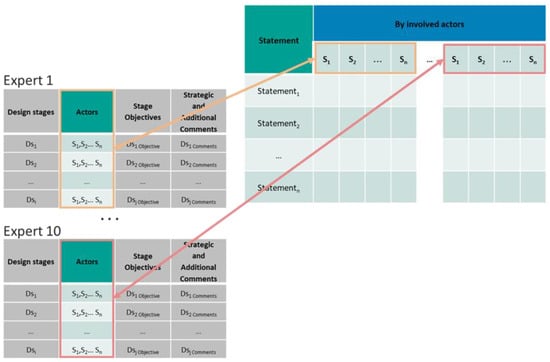

Information was formalized by classifying the individual statements extracted from experts according to the defined analysis framework. Each statement was compared to each element of the framework to establish the existence of an interrelation between them (indicating it with 1) or none (indicating it with 0). Additionally, the formalization was validated by our research team, who are also four experts in product design. Experts of our research team individually validated the interrelations between the lists of statements and the framework. Then, they performed a Delphi-based group discussion to reach a consensus about the interrelation matrix []. The procedure of this validation is represented in Figure 2.

Figure 2.

Qualitative analysis for the formalization carried out by the research team.

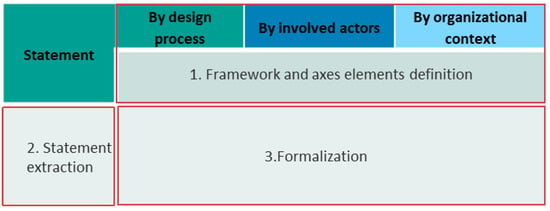

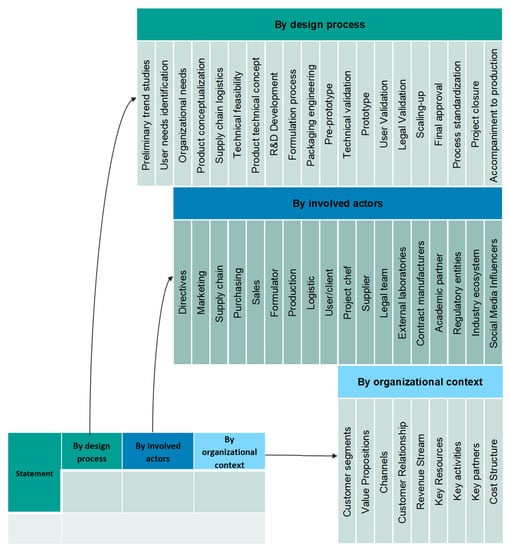

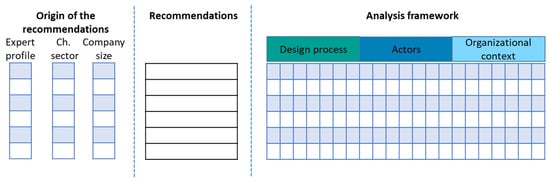

4. Architecture of the Expert Knowledge Base

For the construction of the knowledge base, three blocks are assembled: 1. The framework comprising the axis (design process, involved actors, organizational context) and their elements; 2. The list of statements extracted from the experts; and 3. The formalization of their interrelation. This corresponds to the general structure of the knowledge base, as shown in Figure 3. It is developed in the following subsections.

Figure 3.

General structure of the knowledge base.

4.1. Analysis Framework Definition

4.1.1. Elements of the Axis Design Process

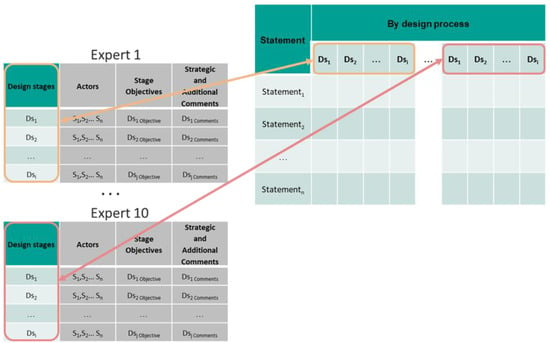

The elements of the design process correspond to the design stages mentioned by the experts. As presented by [], information from the design process described by each expert is organized in a matrix with the categories shown in Table 3.

Table 3.

Generic data screening matrix for information collection [].

For the framework definition, all the “design stages” of the ten product design processes were used to establish the elements of the axis design process. Each expert contributes to a certain number of stages.

When adding data from a new expert, the number of categories increased, as shown in Figure 4. In the case of repeated information, only one of the columns is retained. When analyzing the design stages of the different organizations, the names assigned by each of them may differ from each other, despite having similar objectives. Additionally, some companies grouped several stages into one. In those cases, the most general name for each element of the axis reflecting a single objective in the process is kept. In the end, a definitive list of design stages was obtained. All stages were kept, even if they had only been mentioned by one expert.

Figure 4.

Multi-expert data compilation regarding the elements of the design process axis.

4.1.2. Elements on the Axis of Actors

The elements defined in the axis of actors makes it possible to highlight the relationships between expert statements and the organizational actors who appear in those sentences. For their definition, a similar data treatment as the one presented for the axis “design stages” is carried out, adding as many rows as necessary according to the actors named by the experts. Figure 5 shows how new elements were integrated into that axis.

Figure 5.

Data collection regarding involved actors.

4.1.3. Elements on the Axis of the Organizational Context

The third axis of the framework focuses on the organizational aspects and the business context. It is done using an adapted version of the business model canvas [], which is a model strategic management template used for new business creation processes. In this case, it was used in the analysis of product design processes given that it adequately summarizes many of the key aspects of the organizational context, as well as the organizational conditions and resources that exist in the product design system. This adapted model for product design has nine elements:

- Customer segments: this corresponds to the target market. Normally, the design team and the organization have well-defined customer segments and focus on identifying and responding to their needs.

- Value propositions: this is the reflection of the organization’s strategic directives. It affects the decision-making process in the company, including all stages of product design.

- Channels: the channels of communication with customers refer to the means and resources used in product design to obtain information on the needs and requirements of the target market.

- Customer relationship: this refers to all interactions with the customer. During all the stages of product design and development, the design team can potentially interact with its users, whether for needs analysis, testing, or prototype validation.

- Revenue stream: this is the profit and revenue from each company market segment.

- Key resources: this groups all the organization’s available resources, including physical, human, and economic, and their effect on decision-making based on them or on the possibility of obtaining them.

- Key activities: these are the product design stages that are well-defined and structured, reactive to organizational changes, and clear to the actors involved.

- Key partners: the design team establishes who may be potential partners. They expect exchanges of information, services, or products.

- Cost structure: economic considerations of market segments that should be respected throughout the design process.

5. Results

5.1. Framework and Complete Axis Elements Compilation

Figure 6 shows the complete compilation of the elements of each of the three axes of the analysis framework. For the design process axis, 20 descriptive elements were identified. On the other hand, 18 internal or external actors that can play a role in the design of chemical products were identified. Additionally, it presents the nine elements of the organizational axis previously described.

Figure 6.

Compilation of the elements of the analysis framework.

5.2. Statements Extraction

In this section, the extraction of the statements that are part of the knowledge base is exemplified. The statements extracted from two of the ten experts are presented below.

5.2.1. Expert 1

The expert works in a Latin American multinational producing cosmetic products. The expert shared some experiences as an actor in different roles in a cosmetics company, highlighting a multirole experience moving from a technical to a management role. The expert has been part of teams dedicated to different types of cosmetic products, in the form of emulsions, liquids, and solids. Currently, the expert plays the role of project articulator between the different areas of the organization.

The statements extracted from the interview with this expert are:

- Involve the entire design team in the early design stages.

- Let the formulating team provide inputs throughout the entire design process.

- Be aware of constraints given by access to resources, materials, and technology.

- Be clear about the objectives of the project and the regulatory constraints.

- Involve the user as quickly as possible to validate the results at different stages of the design.

- Know the structure and functioning of the design team.

- Involve the company’s operational logisticians to establish the impact of adding a new product.

- Find key partners in suppliers and service providers.

- Consider the needs that a new product generates for the logistics, warehousing, and purchasing areas.

5.2.2. Expert 2

The expert has experience in the technical development of cosmetic products in liquid form and has played a leading role in different aspects of product development, such as the transfer and scale-up of products to the production plant. Throughout this experience, the expert highlights the evolution of internal processes in the organization, which is reflected in the way the team designs, develops, and integrates products in the production lines.

The statements extracted from the interview with this expert are:

- Share timing, objectives, and resources available for the project from the beginning.

- Allow the technical area to have a voice when final decisions are made.

- Solve problems on the spot, get representatives from the most relevant areas to discuss.

- Consult regulatory issues before making radical changes in formulations.

- Save, organize, and use experience from previous projects.

- Anticipate product life after manufacture, reflect on how the user is affected.

- Always ensure the safety of your product, and different sources of information, in addition to testing.

- Set key tasks for each area of the organization involved, turn them into experts.

The complete list of statements extracted from the ten interviews is presented in Appendix A in Table A1.

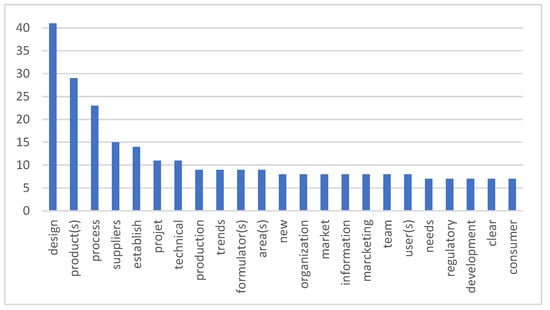

Analyzing the words in the recommendations presented in, we found the most frequently repeated words, as shown in Figure 7. It was found that the most repeated word after design, product, and process, is suppliers, which indicates that this actor is significant in the design process.

Figure 7.

The 20 most repeated words in recommendations and their frequency within the knowledge base.

Additionally, by grouping repeated words by similarity, the following clusters were found: a group related to the technical component of the design with words such as technical, production, development, and formulator; a group of words related to the market component of the design with words such as trends, new, market, and marketing; a group related to the organizational component of the design such as team, organization, areas, and actors (supplier, user, consumer); and a group related to information for design with words such as information and regulatory.

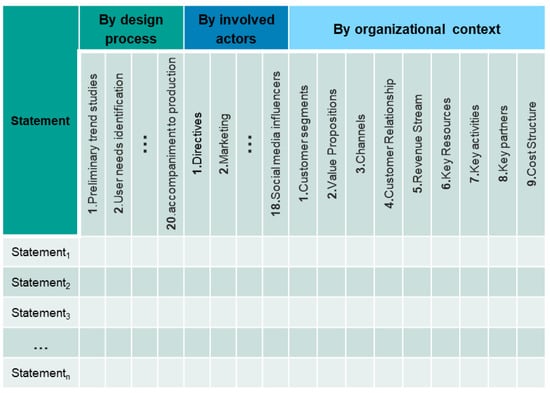

5.3. Statement Formalization

In this section, all the extracted statements are analyzed according to all the elements of the analysis framework. When an interrelation between a statement and an element of the framework is found, it is indicated with a 1 in the formalization matrix. This process is illustrated below by analyzing the first statement of expert number 1: “Involve the entire design team in the early design stages”; the analysis is the following:

It is a general statement corresponding to a recommendation to organize the design team around the design process. When analyzing the statement concerning the design process, it mentions that it should be applied to the initial stages. Thus, the statement is concerned with the initial design stages of the axis design process, from preliminary stages to product conceptualization. About the actors, it refers to all the internal teams of the organization. Thus, regarding the actors’ axis, the statement is related to all the representatives of the internal areas of the organization. Regarding the organizational context, it is considered related to a key activity in the design process. Table 4 summarizes the characterization of this statement (only the elements with a 1 are shown there).

Table 4.

Example 1 of expert statement formalization.

The complete analysis of all statements is the knowledge base proposed in this article. Figure 8 shows a sketch of the knowledge base matrix that gathers the three analyzed axes: design process, actors, and organizational context, thus formalizing the statements in it. The complete knowledge base is presented in Appendix A in Table A2.

Figure 8.

Knowledge base matrix sketch.

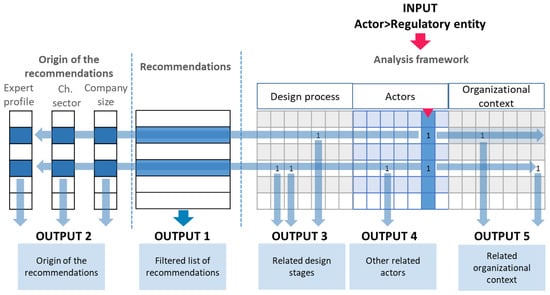

6. Possible Uses of the Knowledge Base

The knowledge base is very rich in information. On the one hand, we have the recommendations and their origin (experts’ profile and their company) and on the other hand, we have the analysis of the recommendations according to the proposed framework. This is illustrated in Figure 9.

Figure 9.

Structure of the information for using the knowledge base.

It is possible to filter the recommendations according to the information in each of the columns to the right or the left of the list of recommendations. For example, with the information source, it is possible to search for recommendations from SMEs or multinationals, or those from the cosmetic or pharmaceutical sector. It is also possible to search for recommendations according to the elements of the analysis framework. For example, recommendations related to a specific design stage, to a specific stakeholder, or a specific element of the business model.

For example, if the case is that the user of the knowledge base wants to identify all the recommendations related to the external actor “regulatory entities”, he can filter the recommendations containing 1 for that actor as shown in Figure 10.

Figure 10.

Example 1: Filtering the knowledge base to see the recommendations related to the actor “regulatory entities”.

As a result, the knowledge base shows the six recommendations with the related information, as shown in Table 5. There, it is possible to see, for example, that the internal actors that most relate to the regulatory entities are the formulators, the project manager, and the legal team (in the case there is such a team in the organization).

Table 5.

The output of example 1: recommendations, and related information, when filtering the database for “regulatory entities”.

It is also possible to filter more than one element of the knowledge base simultaneously to be more precise in the search. For example, if the user of the knowledge base is interested in recommendations from SME implying the actor “Regularity entities”, he can select two filters and the knowledge base will present only the first recommendation in Table 5.

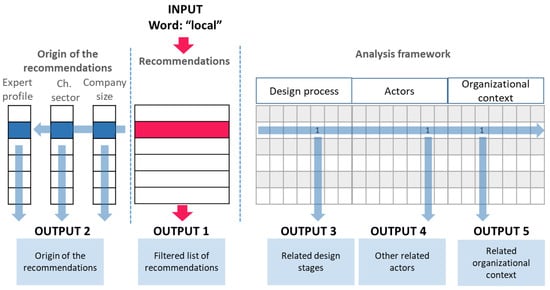

Finally, we can also filter the recommendations according to the words they contain. For example, if a user of the knowledge base wants to obtain recommendations related to the local context, he can filter the recommendations to obtain those containing the word “local”, as shown in Figure 11.

Figure 11.

Example 2: filtering the recommendations containing the word “local”.

As a result, the knowledge base displays three recommendations related to local delays, local users, and the local environment. The three recommendations explain that local variables should be considered in the product design project. The knowledge base gives details about when to apply these recommendations and which actors are involved. Additional filters concerning the framework, or the origin of the recommendation, can also be applied to be more precise in the search.

7. Application Case

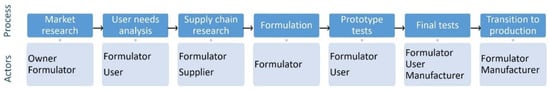

An additional expert was interviewed to compare the design process of his company with the knowledge base and to obtain adapted recommendations to manage its design process. The expert has the following profile:

Expert 11:

The expert works in a small start-up company in the cosmetics sector. His experience is as a product formulator in an entrepreneurial environment, where he must fulfil functions beyond the formulation itself (contact with suppliers, study and consultation on market trends, benchmarking). This multipurpose role gives the expert a global vision of the aspects related to the creation of newly formulated products, including the relationships established with customers, suppliers, and service providers. The design process developed in his company has the stages and actors shown in Figure 12.

Figure 12.

Design process with actors from expert 11.

According to the expert, the company has the following objectives:

- To search for broader brand awareness and winning customers’ loyalty to project towards sustained growth.

- To strengthen the relationship with suppliers and contractors, the latter in charge of the production of the products.

The company has the following characteristics:

- It has several commercialized products and a customer base that recognizes and appreciates its brand.

- It establishes initial contact with the suppliers to assess the feasibility of the product concepts.

- It prefers to work with local suppliers.

- It offers product alternatives based on the local context of the consumers.

- It works with third-party contractors to scale up production at the factory, maintaining quality controls.

- It finds allies in contractors, suppliers, and distributors.

The knowledge base can be used to obtain recommendations that help the company to approach its objectives. For this, the company objectives and characteristics can be used to define criteria in the framework and to filter adapted recommendations. Considering company characteristics, the following criteria that are part of the knowledge base framework can be used to search for recommendations:

- Key stages of the company design process are the user needs identification and supply chain logistics.

- It has as key external actors: users/clients, suppliers, supply chain, and contract manufacturers.

- Additionally, recommendations containing the words “local” will also be considered.

Comparing the objectives of the company with the elements of the business canvas model (explained in Section 4.1.3), the following elements of the knowledge base framework can be used to select recommendations:

- The definition of the customer segment of the business model, which is in line with the customer loyalty that the company wants to win.

- The revenue stream of the business model, which is in line with the assurance of financial sustainability.

The knowledge base was used to pre-select all recommendations related to one of the previously mentioned elements. In this case 79 recommendations were found. Then, only those recommendations related to one of the company objectives and with one or more company characteristics were selected. In this case 23 recommendations were kept. Finally, those recommendations that touched four or more elements related to the company characteristics were prioritized. Seven recommendations were finally kept. They are shown in Table 6.

Table 6.

Recommendations for the case of application.

Those recommendations focused on the customer, on creating a good communication with him, and in generating products according to his needs. Interestingly, the recommendations invite us to work mainly in relation to the early stages of design (as shown on the right side of the table), the moment when the customer’s needs are defined and the product concept is generated. In addition, the recommendations are highly related to a stakeholder that does not explicitly exist in the company, marketing. In this sense, by following the recommendations, the company should define tasks and responsibilities for a marketing type actor, which is mainly concerned with the customer relationship. Most of the recommendations come from SME and from the cosmetic sector. Finally, it is up to the company to decide whether it wishes to apply the recommendations.

8. Discussion and Conclusions

This article describes a knowledge base approach to represent the implicit knowledge of chemical product design experts. The method consists of four parts: gathering firsthand information; establishing a framework for analysis; extracting statements concerning the chemical product design process; and characterizing those statements concerning the previously established framework. The consolidation of these four elements allows us to present a knowledge base of available information to be used by organizations to analyze their product design process.

The knowledge characterization approach related to the chemical product design process in a business context, presented here, considers multiple elements of different dimensions of the product design system. This data processing allows us to perform an organized knowledge representation; eventually, this representation can be useful for exploiting implicit knowledge in product design. In addition, the knowledge representation can give a broad vision to both the design team and the management directives. This knowledge characterization approach permits having a closer and more realistic picture of the product design process requirements, according to experts.

The proposed knowledge base presented here is the result of the collective participation of experts and the research team. It is essential that it be disseminated to the community in general concerned with the design of chemical products; this would consolidate its acceptance as a descriptive instrument of the product design system, in addition to being tested in a real situation to establish whether it meets its objective as well as its ability to adapt and evolved in different contexts.

The method for knowledge base creation presented in this article can be used in other domains with different contexts, and can be used by organizations to store and organize implicit knowledge acquired through experience. The use of the knowledge base can be useful for problem-solving in organizations since it allows the managers to access formalized and categorized information; the statements in this case will act as recommendations or considerations to be considered to act and intervene in design processes. The knowledge base is susceptible to being fed with fresh information from new actors and experts until it becomes a robust system.

Finally, this knowledge database could be valorized through the development of a design product management recommendation tool. To facilitate the selection of the best recommendations, it is possible to apply multi-criteria analysis methods to select the most relevant recommendations (for example with ELECTRE method []) and rank them according to the criteria of the design team (for example with analytic hierarchy process []). Considering that the knowledge base is the first version of the formalization of the know-how of project leaders, the following research step consists of proposing a tool giving recommendations to formulators. More precisely, the aim is to describe the current design process of a company and analyze if the application of some knowledge integrated into the database will help improve this process.

Author Contributions

Conceptualization, J.L.R.-G.; methodology, J.L.R.-G., J.S.-R., J.A.A.-E., P.C.N.-R., V.B. and V.F.; validation, J.L.R.-G., J.S.-R., J.A.A.-E., P.C.N.-R., V.B. and V.F.; investigation, J.L.R.-G.; resources, P.C.N.-R., V.B. and V.F.; writing—original draft preparation, J.L.R.-G. and J.S.-R.; writing—review and editing, J.L.R.-G., J.S.-R., J.A.A.-E., P.C.N.-R., V.B. and V.F.; project administration, P.C.N.-R., V.B. and V.F. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. List of Statements and Its Categorization

Table A1.

Statements that constitute the knowledge base.

Table A1.

Statements that constitute the knowledge base.

| Number | Expert | Company Type | Chemical Sector | Statements |

|---|---|---|---|---|

| 1 | 1 | SME | Cosmetic | Clearly choose your direction for the new product design, choose between a new product innovation approach or an existing product copy approach. |

| 2 | 1 | SME | Cosmetic | Align your design project goals with the geographic and demographic context of your organization. |

| 3 | 1 | SME | Cosmetic | If possible, ask about the formulation services offered by the suppliers of the raw materials they provide. |

| 4 | 1 | SME | Cosmetic | Clearly define and communicate your objectives in terms of costs and target audiences. Consider your constraints in terms of production capacity and third-party contracts. |

| 5 | 1 | SME | Cosmetic | If your design process is based on an innovative approach, focus on meeting the needs of your users. |

| 6 | 1 | SME | Cosmetic | Validate your product conceptualization and ingredient selection with prototypes. |

| 7 | 1 | SME | Cosmetic | Use market trends as a guide for your design projects. |

| 8 | 1 | SME | Cosmetic | Base your new designs on the experience of the organization’s previous projects. |

| 9 | 1 | SME | Cosmetic | Try to make maximum use of the help provided by the suppliers. |

| 10 | 2 | SME | Food | Design approach is usually dictated by the available technology. |

| 11 | 2 | SME | Food | Establish if your design process is based on adding value to scientific developments. |

| 12 | 2 | SME | Food | Have a clear understanding of the availability of resources when conducting market research. |

| 13 | 2 | SME | Food | Use techniques such as competitor benchmarking as input to customer needs analysis. |

| 14 | 2 | SME | Food | Establish stages of direct testing with users, in addition to satisfaction tests. |

| 15 | 2 | SME | Food | Evaluate projects that diversify markets. |

| 16 | 2 | SME | Food | Develop in parallel activities of market analysis, advertising, marketing, brand development, and the search for potential customers. |

| 17 | 2 | SME | Food | Establish the different business models according to the target products and by-products. |

| 18 | 2 | SME | Food | Please note that regulatory limits vary depending on the type of ingredients and the type of product. |

| 19 | 3 | Multinational | Pharmaceuticals | Be clear and inform your product design team of your process for product design and development. |

| 20 | 3 | Multinational | Pharmaceuticals | Be clear about your process for product design and development, let your product design team know the process. |

| 21 | 3 | Multinational | Pharmaceuticals | Allow the project manager to be the bridge between the different areas of the organization such as R&D, production site, suppliers, among others. |

| 22 | 3 | Multinational | Pharmaceuticals | Exploit the process of product ideation, packaging, redesign, building the link between the commercial sector of the company and R&D. |

| 23 | 3 | Multinational | Pharmaceuticals | Study the opportunities that arise from the trends evidenced in market research. |

| 24 | 3 | Multinational | Pharmaceuticals | Evaluate in the early stages of design: feasibility of concepts, commercialization, formulators and regulatory agencies involved, and technology availability. |

| 25 | 3 | Multinational | Pharmaceuticals | Encourage oversight and validation of product technical risks by formulators. |

| 26 | 3 | Multinational | Pharmaceuticals | Consider elements of purchasing, warehousing, tracking codes, quality control, local delays, to scale up to commercial. |

| 27 | 3 | Multinational | Pharmaceuticals | Consider regulatory approval times and stability testing times in each project. |

| 28 | 3 | Multinational | Pharmaceuticals | Consider the user for efficacy or clinical tests, also in some sensory tests. |

| 29 | 3 | Multinational | Pharmaceuticals | Consider the bureaucratic tradeoffs within your organization in your design project. |

| 30 | 3 | Multinational | Pharmaceuticals | Involve suppliers as early as possible in the design process. |

| 31 | 3 | Multinational | Pharmaceuticals | Always establish which processes can be done in-house and which ones need a third party. |

| 32 | 3 | Multinational | Pharmaceuticals | Do not only consider technical requirements when making decisions, include sustainability elements throughout the design (suppliers, process, formula, packaging). |

| 33 | 4 | SME | Food | Consider the mission and vision of the organization as a guide in the process of designing a new product. |

| 34 | 4 | SME | Food | Establish a differentiation strategy to your customers. |

| 35 | 4 | SME | Food | Adapt formulations to the local consumer without losing the degree of originality. |

| 36 | 4 | SME | Food | Base the formula proposal on the availability of raw materials and the possibilities of the transformation process. |

| 37 | 4 | SME | Food | Use techniques such as design of experiments to adjust recipes or formulations. |

| 38 | 4 | SME | Food | Keep in mind that the relationship with suppliers influences the new recipes/formulas. |

| 39 | 4 | SME | Food | Obtain information about synergies between ingredients from suppliers |

| 40 | 4 | SME | Food | The experience of formulators is important in predicting the behavior of ingredients. |

| 41 | 4 | SME | Food | Use user trials to adjust formulations. |

| 42 | 4 | SME | Food | Use the industry ecosystem to gather information, testing, and verification of quality. |

| 43 | 5 | LA multinational | Cosmetic | Establish which innovation model will guide the product design; for example, "agile" or "user-centric". |

| 44 | 5 | LA multinational | Cosmetic | Consider the marketing strategy and the vision of the directives as a guide in the process. |

| 45 | 5 | LA multinational | Cosmetic | Turn the technical area into a strategic partner of the marketing area. |

| 46 | 5 | LA multinational | Cosmetic | Find the balance between marketing visions and technical proposals. |

| 47 | 5 | LA multinational | Cosmetic | Define whether the formulator plays an all-inclusive role or a technical role. |

| 48 | 5 | LA multinational | Cosmetic | Anticipate complexity by coordinating the different teams within the organization. |

| 49 | 5 | LA multinational | Cosmetic | Consider the size and bureaucracy of the company, the flow of information may be affected. |

| 50 | 5 | LA multinational | Cosmetic | Manage logistical and inventory risks at the earliest stages. |

| 51 | 5 | LA multinational | Cosmetic | Involves a global vision of the whole process in design. |

| 52 | 5 | LA multinational | Cosmetic | Always make direct contact with the consumer. |

| 53 | 5 | LA multinational | Cosmetic | Involve marketing, market research, purchasing, finance, suppliers, and inventories in the formulation process. |

| 54 | 5 | LA multinational | Cosmetic | Establish what the company’s strategic objective is and see how it affects the design process. |

| 55 | 5 | LA multinational | Cosmetic | Decide whether or not the suppliers can be considered as design partners. |

| 56 | 5 | LA multinational | Cosmetic | Establish clear objectives and product claims early on to assess legal feasibility with regulators. |

| 57 | 5 | LA multinational | Cosmetic | Use technical tools such as design of experiments. |

| 58 | 5 | LA multinational | Cosmetic | Consider a policy of "In the laboratory it is better to fail fast". |

| 59 | 5 | LA multinational | Cosmetic | Contrast the proposed design concept with the interests of the organization. |

| 60 | 5 | LA multinational | Cosmetic | If your business strategy is consumer-oriented, design decisions should be less bureaucratic. |

| 61 | 5 | LA multinational | Cosmetic | Avoid personal biases of the formulator by putting him/her in contact with the consumer. |

| 62 | 5 | LA multinational | Cosmetic | The information needed to make a decision must be clear: consumer needs, economic constraints, technical feasibility and product stability, production process, claims, safety. |

| 63 | 5 | LA multinational | Cosmetic | Consider time as a resource for decision making. |

| 64 | 6 | LA multinational | Cosmetic | Tailor your process to the skills of the design team. |

| 65 | 6 | LA multinational | Cosmetic | Be clear about your business and strategic model. |

| 66 | 6 | LA multinational | Cosmetic | Integrate organizational culture and business model into your design. |

| 67 | 6 | LA multinational | Cosmetic | Define which design strategy to follow, e.g., "mass consumption" or "direct sale". |

| 68 | 6 | LA multinational | Cosmetic | Base new product design on marketing trends and market studies. |

| 69 | 6 | LA multinational | Cosmetic | Let the research and development groups become the leaders of the project. |

| 70 | 6 | LA multinational | Cosmetic | Articulate your projects with the research and development team for decision making. |

| 71 | 6 | LA multinational | Cosmetic | Establish the relevance of the project between marketing and R&D. |

| 72 | 6 | LA multinational | Cosmetic | At the prefeasibility stage, all sectors of the company may be present, including the president of the company. |

| 73 | 6 | LA multinational | Cosmetic | Review the feasibility of the project based on the company’s resources and led by research and development. |

| 74 | 6 | LA multinational | Cosmetic | Establish validation points with the consumer at each stage of the design process; concept, prototype, advertising, performance. |

| 75 | 6 | LA multinational | Cosmetic | Involve the pilot plant and production plant managers in the prototype launch and production planning. |

| 76 | 6 | LA multinational | Cosmetic | Allow suppliers to become an important source of information for prototype and concept development. |

| 77 | 6 | LA multinational | Cosmetic | Observe the impact of regulatory restrictions |

| 78 | 6 | LA multinational | Cosmetic | Study market trends based on the local environment and the global context. |

| 79 | 6 | LA multinational | Cosmetic | Enable articulations and communications between teams with clear information on costs, concepts, and claims. |

| 80 | 6 | LA multinational | Cosmetic | Consider suppliers as a basis for the formulation. |

| 81 | 6 | LA multinational | Cosmetic | Allows the formulator to articulate the logistics and inventory teams. |

| 82 | 6 | LA multinational | Cosmetic | Allow the formulator to be the link between consumer and planning and production. |

| 83 | 6 | LA multinational | Cosmetic | Establish an organizational structure that allows decisions and ideas to be made by more than just one person. |

| 84 | 7 | LA multinational | Cosmetic | Please note that each company dictates its own operational approach to product design. |

| 85 | 7 | LA multinational | Cosmetic | Every product design starts with trends. |

| 86 | 7 | LA multinational | Cosmetic | Depending on the organizational strategy, trends can be followed or created. |

| 87 | 7 | LA multinational | Cosmetic | Keep in mind that design today is consumer centric. |

| 88 | 7 | LA multinational | Cosmetic | Address the challenge of understanding the consumer and transforming their needs into technical needs. |

| 89 | 7 | LA multinational | Cosmetic | Ensure that the formulator knows and is aware of the user and the marketing language. |

| 90 | 7 | LA multinational | Cosmetic | The technical know-how is acquired through experience. |

| 91 | 7 | LA multinational | Cosmetic | Understand that trends are born, grow, and die. |

| 92 | 7 | LA multinational | Cosmetic | Capturing trends and insights is possible in all types of companies. |

| 93 | 7 | LA multinational | Cosmetic | Define your design strategy, satisfy unsatisfied needs, or propose disruptive products. |

| 94 | 7 | LA multinational | Cosmetic | Understand the user’s pain. |

| 95 | 7 | LA multinational | Cosmetic | Monitor trends in the formulations generated by social media influencers. |

| 96 | 7 | LA multinational | Cosmetic | Find product insights not only in novel formulations, but also use innovation in other areas such as product communication. |

| 97 | 7 | LA multinational | Cosmetic | Design according to the realities and the context; costs, production plant… |

| 98 | 7 | LA multinational | Cosmetic | Control the appearance of hierarchies in decision making. |

| 99 | 7 | LA multinational | Cosmetic | Begin the design process with as much clarity as possible, a benefit is given to the project. |

| 100 | 7 | LA multinational | Cosmetic | Inform the whole team of the project objectives. |

| 101 | 7 | LA multinational | Cosmetic | Allow the formulator to become a negotiator in the negotiation process. |

| 102 | 7 | LA multinational | Cosmetic | Understand that suppliers are key partners for the design, they are the ones who develop the technology. |

| 103 | 7 | LA multinational | Cosmetic | Avoid delays or damage to resources due to complicated decisions. |

| 104 | 8 | LA multinational | Cosmetic | Involve the entire design team in the early design stages. |

| 105 | 8 | LA multinational | Cosmetic | Let the formulating team have input throughout the design process. |

| 106 | 8 | LA multinational | Cosmetic | Be aware of constraints given by access to resources, materials, and technology. |

| 107 | 8 | LA multinational | Cosmetic | Be clear about the objectives of the project and the regulatory constraints you will face. |

| 108 | 8 | LA multinational | Cosmetic | Involve the user as quickly as possible, validate in different stages of the design. |

| 109 | 8 | LA multinational | Cosmetic | Know the structure and process of the design team. |

| 110 | 8 | LA multinational | Cosmetic | Find key partners in suppliers and service providers. |

| 111 | 8 | LA multinational | Cosmetic | Consider the needs that a new product generates for the logistics, warehousing, and purchasing areas. |

| 112 | 9 | LA multinational | Cosmetic | Share timing, objectives, and resources available for the project from the beginning. |

| 113 | 9 | LA multinational | Cosmetic | Allow the technical area to have a voice when final decisions are made. |

| 114 | 9 | LA multinational | Cosmetic | Solve problems on the spot, get representatives from the most relevant areas to discuss. |

| 115 | 9 | LA multinational | Cosmetic | Consult regulatory issues before making radical changes in formulations. |

| 116 | 9 | LA multinational | Cosmetic | Save, organize, and use experience from previous projects. |

| 117 | 9 | LA multinational | Cosmetic | Anticipate product life after manufacture, reflect on how this affects the user. |

| 118 | 9 | LA multinational | Cosmetic | Always ensure the safety of your product, use different sources of information, in addition to testing. |

| 119 | 9 | LA multinational | Cosmetic | Set key tasks for each area of the organization involved, turn them into experts. |

| 120 | 10 | LA multinational | Cosmetic | Recognize and give importance to the technical side of the design. |

| 121 | 10 | LA multinational | Cosmetic | Manage the knowledge of experience acquired in previous developments. |

| 122 | 10 | LA multinational | Cosmetic | Establish objective tests that allow you to quickly validate prototypes. |

| 123 | 10 | LA multinational | Cosmetic | Build consensus among the areas of the organization that are affected by a new product. |

| 124 | 10 | LA multinational | Cosmetic | Develop product scale-up at the same time as formulation. |

| 125 | 10 | LA multinational | Cosmetic | Document the design process. |

| 126 | 10 | LA multinational | Cosmetic | Establish sustainability, safety, and resource use targets. |

Table A2.

Statements that constitute the knowledge base.

Table A2.

Statements that constitute the knowledge base.

| Design Process | Involved Actors | Organizational Context | |||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Statement number | 1. Preliminary Trend Studies | 2. User Needs Identification | 3. Organizational Needs | 4. Product Conceptualization | 5. Supply Chain Logistics | 6. Technical Feasibility | 7. Product Technical Concept | 8. R&D Development | 9. Formulation Process | 10. Packaging Engineering | 11. Pre-Prototype | 12. Technical Validation | 13. Prototype | 14. User Validation | 15. Legal Validation | 16. Scaling-Up | 17. Final Approval | 18. Process Standardization | 19. Project Closure | 20. Accompaniment to Production | 1. Directives | 2. Marketing | 3. Supply Chain | 4. Purchasing | 5. Sales | 6. Formulator | 7. Production | 8. Logistic | 9. User/Client | 10. Project Chef | 11. Supplier | 12. Legal Team | 13. External Laboratories | 14. Contract Manufacturers | 15. Academic Partner | 16. Regulatory Entities | 17. Industry Ecosystem | 18. Social Media Influencers | 1. Customer Segments | 2. Value Propositions | 3. Channels | 4. Customer Relationship | 5. Revenue Stream | 6. Key Resources | 7. Key Activities | 8. Key Partners | 9. Cost Structure |

| 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||

| 2 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||

| 3 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 4 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||

| 5 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||

| 6 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||

| 7 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||

| 8 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||

| 9 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||

| 10 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||

| 11 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||

| 12 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||

| 13 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||

| 14 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||

| 15 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 16 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||

| 17 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 18 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||

| 19 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| 20 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||

| 21 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||

| 22 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||

| 23 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||

| 24 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||

| 25 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||

| 26 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||

| 27 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||

| 28 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||

| 29 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 30 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||

| 31 | 1 | ||||||||||||||||||||||||||||||||||||||||||||||

| 32 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||

| 33 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 34 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||

| 35 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||

| 36 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 37 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||||

| 38 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 39 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 40 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||||

| 41 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 42 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 43 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||||

| 44 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||

| 45 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 46 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||

| 47 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||

| 48 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| 49 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||||||

| 50 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 51 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||||||

| 52 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||

| 53 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||

| 54 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| 55 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||

| 56 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||

| 57 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| 58 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| 59 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||||

| 60 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||

| 61 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||

| 62 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||

| 63 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| 64 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||||

| 65 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||||

| 66 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||||

| 67 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||||

| 68 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||

| 69 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||

| 70 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||

| 71 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||

| 72 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||

| 73 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||

| 74 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||

| 75 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||

| 76 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 77 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 78 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||

| 79 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||

| 80 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||

| 81 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||

| 82 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||

| 83 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| 84 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| 85 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||

| 86 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||

| 87 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||

| 88 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||

| 89 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||

| 90 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||||

| 91 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||

| 92 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||

| 93 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||

| 94 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||

| 95 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||

| 96 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| 97 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 98 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||||||

| 99 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| 100 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||

| 101 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| 102 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||

| 103 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||||

| 104 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||

| 105 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||

| 106 | 1 | ||||||||||||||||||||||||||||||||||||||||||||||

| 107 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||

| 108 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 109 | 1 | ||||||||||||||||||||||||||||||||||||||||||||||

| 110 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||

| 111 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||

| 112 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||

| 113 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||

| 114 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||

| 115 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||

| 116 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||

| 117 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 118 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||

| 119 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| 120 | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||||||||||||||||||||||||||||

| 121 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||

| 122 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||

| 123 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||

| 124 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||

| 125 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||

| 126 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||

References

- Morel, L.; Boly, V. New Product Development Process (NPDP): Updating the identification stage practices. Int. J. Prod. Dev. 2006, 3, 232–251. [Google Scholar] [CrossRef]

- Gani, R.; Ng, K.M. Product design—Molecules, devices, functional products, and formulated products. Comput. Chem. Eng. 2015, 81, 70–79. [Google Scholar] [CrossRef]

- Heintz, J.; Belaud, J.-P.; Gerbaud, V. Chemical enterprise model and decision-making framework for sustainable chemical product design. Comput. Ind. 2014, 65, 505–520. [Google Scholar] [CrossRef]

- Nakata, C.; Im, S. Spurring Cross-Functional Integration for Higher New Product Performance: A Group Effectiveness Perspective. J. Prod. Innov. Manag. 2010, 27, 554–571. [Google Scholar] [CrossRef]

- Goodwin, K. Designing for the Digital Age—How to Create Human-Centered Products and Services; Wiley: Hoboken, NJ, USA, 2009; p. 739. [Google Scholar]

- Driessen, P.H.; Hillebrand, B. Integrating Multiple Stakeholder Issues in New Product Development: An Exploration. J. Prod. Innov. Manag. 2012, 30, 364–379. [Google Scholar] [CrossRef]

- Majava, J.; Harkonen, J.; Haapasalo, H. The relations between stakeholders and product development drivers: Practitioners ’ perspectives. Int. J. Innov. Learn. 2015, 17, 59–78. [Google Scholar] [CrossRef]

- Serna, J.; Rincón, P.C.N.; Falk, V.; Boly, V.; Camargo, M. Methodology for Emulsion Design Based on Emulsion Science and Expert Knowledge. Part 2: An Application in the Cosmetics Sector. Ind. Eng. Chem. Res. 2021, 60, 5220–5235. [Google Scholar] [CrossRef]

- Gericke, K.; Meißner, M.; Paetzold, K. Understanding the Context of Product Development. In Proceedings of the 19th International Conference on Engineering Design (ICED), Design Organisation and Management, Seoul, Korea, 19–22 August 2013. [Google Scholar]

- Schenkel, M.; Krikke, H.; Caniëls, M.C.; van der Laan, E. Creating integral value for stakeholders in closed loop supply chains. J. Purch. Supply Manag. 2015, 21, 155–166. [Google Scholar] [CrossRef]

- Chandrasekaran, A.; Linderman, K.; Schroeder, R. The Role of Project and Organizational Context in Managing High-tech R&D Projects. Prod. Oper. Manag. 2014, 24, 560–586. [Google Scholar] [CrossRef]

- Arrieta-Escobar, J.A.; Camargo, M.; Morel, L.; Bernardo, F.P.; Orjuela, A.; Wendling, L. Design of formulated products integrating heuristic knowledge and consumer assessment. AIChE J. 2020, 67, e17117. [Google Scholar] [CrossRef]

- Gil, J.L.R.; Serna, J.; Arrieta-Escobar, J.A.; Rincón, P.C.N.; Boly, V.; Falk, V. Triggers for chemical product design: A systematic literature review. AIChE J. 2022, 68, e17563. [Google Scholar] [CrossRef]

- Fung, K.Y.; Ng, K.M.; Zhang, L.; Gani, R. A grand model for chemical product design. Comput. Chem. Eng. 2016, 91, 15–27. [Google Scholar] [CrossRef]

- Kontogeorgis, G.M.; Jhamb, S.; Liang, X.; Dam-Johansen, K. Computer-aided design of formulated products. Curr. Opin. Colloid Interface Sci. 2021, 57, 101536. [Google Scholar] [CrossRef]

- Zhang, X.; Zhou, T.; Ng, K.M. Optimization-based cosmetic formulation: Integration of mechanistic model, surrogate model, and heuristics. AIChE J. 2021, 67, e17064. [Google Scholar] [CrossRef]

- Chan, Y.C.; Fung, K.Y.; Ng, K.M. Product design: A pricing framework accounting for product quality and consumer awareness. AIChE J. 2018, 64, 2462–2471. [Google Scholar] [CrossRef]

- Cheng, Y.S.; Fung, K.Y.; Ng, K.M.; Wibowo, C. Economic analysis in product design—A case study of a TCM dietary supplement. Chin. J. Chem. Eng. 2016, 24, 202–214. [Google Scholar] [CrossRef]

- Lai, Y.Y.; Yik, K.C.H.; Hau, H.P.; Chow, C.P.; Chemmangattuvalappil, N.G.; Ng, L.Y. Enterprise Decision-making Framework for Chemical Product Design in Integrated Biorefineries. Process. Integr. Optim. Sustain. 2018, 3, 25–42. [Google Scholar] [CrossRef]

- Shenas, D.G.; Derakhshan, S. Organizational Approaches to the Implementation of Simultaneous Engineering. Int. J. Oper. Prod. Manag. 1994, 14, 30–43. [Google Scholar] [CrossRef]

- Adams, M.E.; Day, G.S.; Dougherty, D. Enhancing New Product Development Performance: An Organizational Learning Perspective. J. Prod. Innov. Manag. 1998, 15, 403–422. [Google Scholar] [CrossRef]

- Rivera, J.L.; Serna, J.; Narváez-Rincón, P.C.; Boly, V.; Falk, V. Towards a Systemic Approach for Cosmetics Formulation within Companies: Modeling the Design System. In Proceedings of the 30th Annual Conference of the International Association for Management of Technology (IAMOT 2021), Cairo, Egypt, 19–23 September 2021; pp. 529–540. [Google Scholar]

- Bosschaert, T. Symbiosis in Development Making New Futures Possible; Except Integrated Sustainability: Utrecht, The Netherlands, 2019. [Google Scholar]

- Chandrasegaran, S.K.; Ramani, K.; Sriram, R.D.; Horváth, I.; Bernard, A.; Harik, R.; Gao, W. The evolution, challenges, and future of knowledge representation in product design systems. Comput. Des. 2012, 45, 204–228. [Google Scholar] [CrossRef]

- Krishna, S. Introduction to Database and Knowledge-Base Systems; World Scientific Publishing Company: Singapore, 1992. [Google Scholar] [CrossRef]

- Jasimuddin, S.M. Disciplinary roots of knowledge management: A theoretical review. Int. J. Organ. Anal. 2006, 14, 171–180. [Google Scholar] [CrossRef]

- Kalakul, S.; Zhang, L.; Choudhury, H.; Elbashir, N.O.; Eden, M.R.; Gani, R. ProCAPD—A Computer-Aided Model-Based Tool for Chemical Product Design and Analysis. Comput. Aided Chem. Eng. 2018, 44, 469–474. [Google Scholar] [CrossRef]

- Liu, Q.; Zhang, L.; Liu, L.; Du, J.; Tula, A.K.; Eden, M.; Gani, R. OptCAMD: An optimization-based framework and tool for molecular and mixture product design. Comput. Chem. Eng. 2019, 124, 285–301. [Google Scholar] [CrossRef]

- Mohrman, S.A.; Finegold, D.; Mohrman, A.M. An empirical model of the organization knowledge system in new product development firms. J. Eng. Technol. Manag. 2003, 20, 7–38. [Google Scholar] [CrossRef]

- Zhong, D.; Fan, J.; Yang, G.; Tian, B.; Zhang, Y. Knowledge management of product design: A requirements-oriented knowledge management framework based on Kansei engineering and knowledge map. Adv. Eng. Inform. 2022, 52, 101541. [Google Scholar] [CrossRef]

- Barão, A.; de Vasconcelos, J.B.; Rocha, Á.; Pereira, R. knowledge management approach to capture organizational learning networks. Int. J. Inf. Manag. 2017, 37, 735–740. [Google Scholar] [CrossRef]

- Zhang, X.; Chu, Z.; Ren, L.; Xing, J. Open innovation and sustainable competitive advantage: The role of organizational learning. Technol. Forecast. Soc. Chang. 2023, 186, 122114. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Esposito, E. Aligning enterprise knowledge and knowledge management systems to improve efficiency and effectiveness performance: A three-dimensional Fuzzy-based decision support system. Expert Syst. Appl. 2018, 91, 107–126. [Google Scholar] [CrossRef]

- Hahn, J.; Wang, T. Knowledge management systems and organizational knowledge processing challenges: A field experiment. Decis. Support Syst. 2009, 47, 332–342. [Google Scholar] [CrossRef]

- Kimura, F.; Ariyoshi, H.; Ishikawa, H.; Naruko, Y.; Yamato, H. Capturing Expert Knowledge for Supporting Design and Manufacturing of Injection Molds. CIRP Ann. 2004, 53, 147–150. [Google Scholar] [CrossRef]

- Mohajan, H. The Roles of Knowledge Management for the Development of Organizations. J. Sci. Achiev. 2017, 2, 1–27. [Google Scholar]

- Ernst, H. Patent information for strategic technology management. World Pat. Inf. 2003, 25, 233–242. [Google Scholar] [CrossRef]

- Trappey, A.J.; Trappey, C.V. An R&D knowledge management method for patent document summarization. Ind. Manag. Data Syst. 2008, 108, 245–257. [Google Scholar] [CrossRef]

- Bogner, A.; Littig, B.; Menz, W. Introduction: Expert Interviews—An Introduction to a New Methodological Debate; Palgrave Macmillan: London, UK, 2009; pp. 1–13. [Google Scholar] [CrossRef]

- Döringer, S. ‘The problem-centred expert interview’. Combining qualitative interviewing approaches for investigating implicit expert knowledge. Int. J. Soc. Res. Methodol. 2021, 24, 265–278. [Google Scholar] [CrossRef]

- Fielding, N.G.; Lee, R.M.; Blank, G. The SAGE Handbook of Online Research Methods; Sage Publications Ltd: Newbury Park, CA, USA, 2016. [Google Scholar]

- Osterwalder, A.; Pigneur, Y. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers; John Wiley & Sons Inc.: Hoboken, NJ, USA, 2010. [Google Scholar]

- Salwin, M.; Jacyna-Gołda, I.; Kraslawski, A.; Waszkiewicz, A.E. The Use of Business Model Canvas in the Design and Classification of Product-Service Systems Design Methods. Sustainability 2022, 14, 4283. [Google Scholar] [CrossRef]

- Miles, M.B.; Huberman, A.M.; Saldaña, J. Qualitative Data Analysis: A methods Sourcebook, 4th ed.; SAGE Publications: Thousand Oaks, CA, USA, 2019. [Google Scholar]

- Grime, M.M.; Wright, G. Delphi Method. In Wiley StatsRef: Statistics Reference Online; John Wiley & Sons, Ltd.: Hoboken, NJ, USA, 2016; pp. 1–6. [Google Scholar]

- de Paula, N.O.B.; de Araujo Costa, I.P.; Drumond, P.; Moreira, M.Â.L.; Gomes, C.F.S.; Dos Santos, M.; do Nascimento Maêda, S.M. Strategic support for the distribution of vaccines against Covid-19 to Brazilian remote areas: A multicriteria approach in the light of the ELECTRE-MOr method. Procedia Comput. Sci. 2022, 199, 40–47. [Google Scholar] [CrossRef]

- Serna, J.; Díaz, E.; Narváez, P.; Camargo, M.; Gálvez, D.; Orjuela, Á. Multi-criteria Decision Analysis for the Selection of Sustainable Chemical Process Routes During Early Design Stages. Chem. Eng. Res. Des. 2016, 113, 28–49. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).