Abstract

The construction industry has dynamic supply chains with multiple suppliers usually engaged in short-term relationships. Government legislation, novel types of payment agreements, conventional information technology solutions, and supply chain management best practices have endeavoured to solve payment-related financial issues in the construction industry, which are mainly caused by the complexities of the construction supply chain. Nevertheless, payment-related issues persist as one of the key challenges in the industry. Applications of blockchain technology–a trusted, distributed data storing mechanism–along with smart contracts are gaining focus as solutions for complex interorganisational processes. A smart contract is a self-executing script that codifies a set of rules or agreements between multiple parties and runs across the blockchain network. This paper identifies the suitability of blockchain and smart contract technologies in solving payment issues in the construction industry. An expert forum of construction industry stakeholders served as the primary data collection method through a structured questionnaire. The key finding of the paper is that blockchain and smart contract powered solutions can significantly mitigate the payment and related financial issues in the construction industry, including partial payments, nonpayments, cost of finance, long payment cycle, retention, and security of payments.

1. Introduction

The construction industry produces some of the most complex and largest objects, such as buildings, bridges, dams, and tunnels. Such complex construction requires integrating many specialists and suppliers of products, components, and sub-elements through multiple supply chains [1]. Usually, the construction industry has lengthy, network-structured, dynamic supply chains with a large number of internal and external suppliers [2]. Supply chains of project-based industries like construction have inherent uncertainties, due to the complexities involved [3]. The most adverse impacts are inefficiency, compliance issues, long payment cycles, and inefficiencies in finance and payments. Besides the long payment settlement periods as stipulated in contractual arrangements, delayed payments [4] and partial or nonpayments are quite frequent in the construction industry [5]. Due to these payment inefficiencies, the cost of finance is significantly increased to cover the risk, increasing the total cost of construction. Therefore, payment and related financial issues are categorised as one of the most crucial issues in the construction industry [6,7].

Blockchain is a distributed data storing mechanism to replicate, share, and synchronise data spread across different geographical locations, such as multiple sites, countries, or organisations [8]. In 2015, a new programming paradigm was created by introducing the DApp (Decentralised Application) concept for Ethereum as the first practical distributed processing model to run on top of a blockchain network [9]. The key properties of blockchains and smart contracts include immutability, high availability, integrity, and transparency [10]. These properties enhance the trust, accountability, auditability, and automation of applications that leverage blockchains and smart contracts. With trusted data storing and distributed processing models, researchers and industry practitioners began to explore use-cases beyond cryptocurrencies, including finance and supply chain applications [11,12]. For example, Di Ciccio et al. [13] discussed the applicability of blockchain to enhance the traceability of interorganisational processes, such as supply chains.

Therefore, this paper identifies the most significant payment and related financial issues in construction supply chains and explores the underlying reasons for these issues. It highlights the greater benefits of blockchain and smart contracts compared with conventional information systems, and then proposes blockchain and smart contracts as a solution for payment issues in construction supply chains.

The structure of the rest of this paper is as follows. Section 2 provides the background to the study related to the construction supply chain and payment issues in construction. It also presents blockchain technology, smart contracts, and notable properties of blockchain. The research methodology is described in Section 3. Section 4 presents the results and discussion, and the conclusions are presented in Section 5.

2. Background with Key Literature Findings

2.1. Construction Supply Chain

A supply chain is a network of different processes of multiple organisations, which are linked as upstream (i.e., suppliers) and downstream (i.e., customers), that delivers products or services to the ultimate consumer [14,15]. The concept of Supply Chain Management (SCM) flourished in the manufacturing industry [16], and modern SCM systems incorporate the latest Information and Communication Technologies (ICTs), such as cloud computing, Internet of Things (IoT), big data, artificial intelligence and machine learning, multichannel communication, and social media [17,18]. Many manufacturing industries optimise their supply chains to achieve a significant market advantage over their competitors [19].

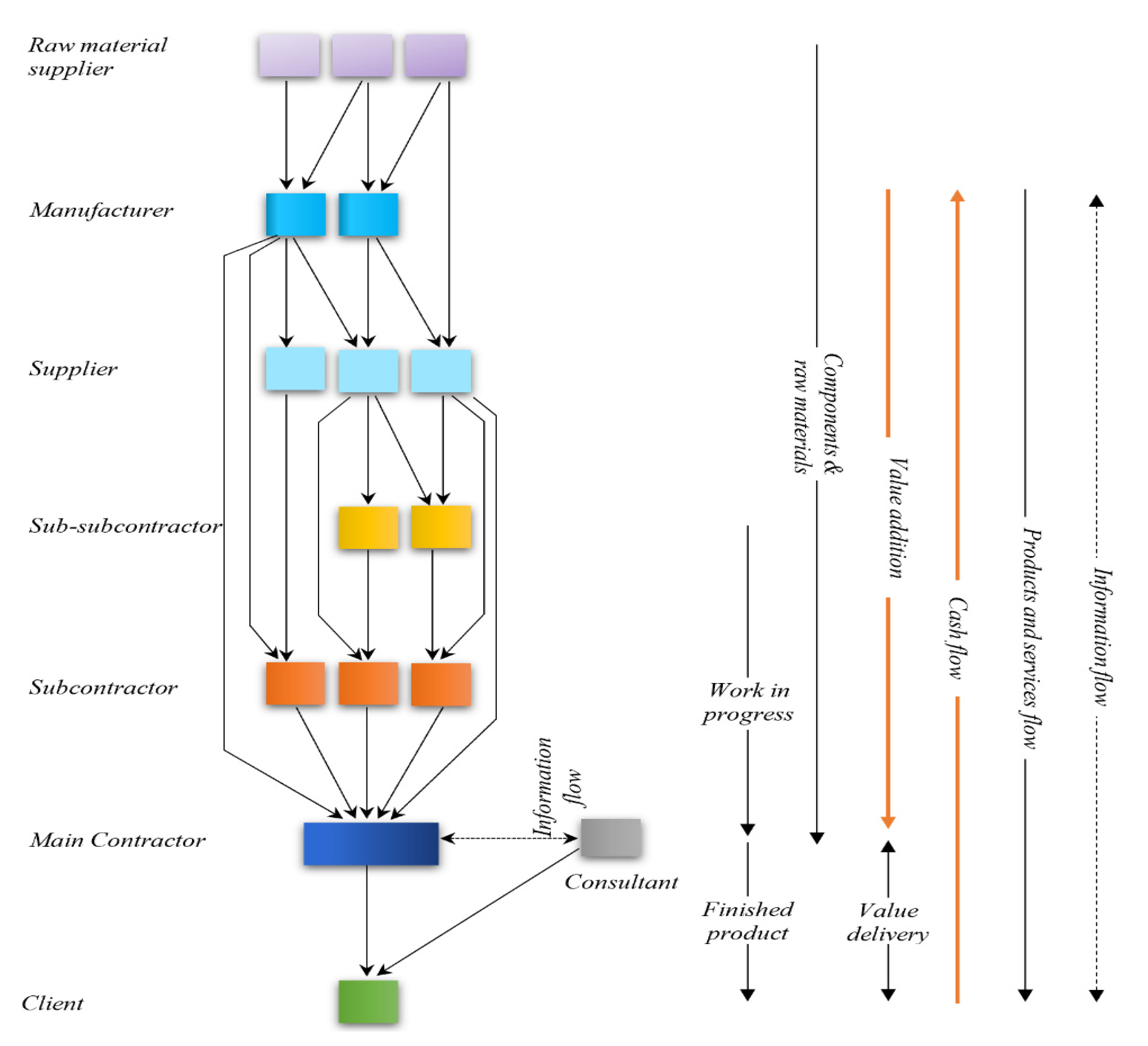

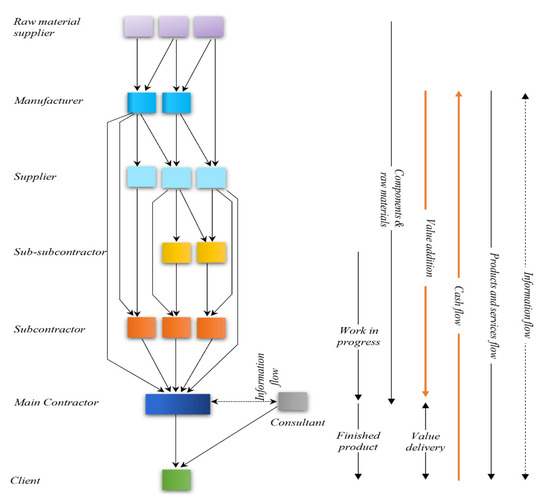

The construction industry has a project-based production process, usually scattered across different geographical locations, and produces some of the most complex and extensive objects [20]. Many specialists, labour, machinery, components, sub-elements, and material should be coordinated on a construction project [1,21]. The nature of construction production gives rise to dynamic, long supply chains. These complex supply chains cause significant uncertainties and issues in the construction industry, especially related to finance and payments [3]. Every project can be considered as a new supply chain, due to a significant number of new outcomes, manufacturers, suppliers, subcontractors, sub-subcontractors, and others, in a fresh geographical location [22]. Typically, the construction industry has lengthy, network-structured, dynamic supply chains rather than short, vertical supply chains [23]. Figure 1 illustrates a basic supply chain network in the construction industry, including the flow of information, cash, components and raw materials, and products and services. As illustrated in Figure 1, the most significant difference of a construction supply chain compared with a manufacturing supply chain is that a construction supply chain has lengthy value addition processes from top to bottom, and the funding predominantly originates from the bottom of the supply chain. Therefore, lengthy, network-structured, and dynamic construction supply chains cause many issues, including payment issues [4].

Figure 1.

Basic supply chain network of the construction industry.

2.1.1. Time, Cost, and Quality Issues Related to the Construction Supply Chain

The construction industry faces a significant number of issues and challenges in every phase of construction, including design, construction, operation, maintenance, and decommissioning phases. The construction supply chain has poor trust, lack of knowledge management, limited integrations, and less collaboration and coordination, leading to many issues, including time, cost, or quality-related issues. System integration and real-time data sharing are critical features of the modern enterprise system [24,25]; however, many construction supply chain systems lack these types of advanced features. A number of research and government initiatives and projects have tried to solve these issues in the construction supply chain, and yet the industry still grapples with these significant issues [26].

Durdyev and Ismail [27] highlighted that obsolete technology and supply chain issues lead to low productivity of the construction industry compared with other industries. From the main contractor’s point of view, material delay or supply chain issues are some of the main causes of construction project delay [28]. A construction project has a multitude of diverse activities. Activity sequence and their timing are a significant factor for both internal and external preceding activities. Therefore, supply chain issues, such as delays, insufficient quantities, and other factors have a negative compounding effect on construction project performance [29].

As illustrated in Figure 1, the distance between the finance source to the topmost source of supplier or manufacturer in construction supply chains is significantly longer than other supply chains. Subcontractors, sub-subcontractors, and suppliers expend their resources first and get paid last. The construction industry usually has agreed on lengthy payment cycles. These months-long payment cycles intensify financial inefficiency. Usually, upper nodes of the construction supply chain face significantly delayed payments, partial payments, and nonpayments, due to various supply chain-related issues [4,5].

The quality and origin of the materials and components are key elements of compliance of the final product. The contractor cannot achieve compliance without the cooperation of other stakeholders, including suppliers and manufacturers [30]. Construction projects have quality and compliance issues, and a significant number of cases are directly related to materials and components or supply chain-related issues. Topchiy et al. [31] mentioned that there is a significant level of potential risks associated with random testing methods used to exemplify quality or origin. For example, the tragic fire that spread through the Grenfell Tower in the UK was sped up by the building’s exterior cladding system that used noncompliant aluminium composite materials [32]. Unfortunately, the current methods of construction supply chain management have been unable to resolve these compliance issues [11].

2.1.2. Payment Issues in Construction

The construction industry has a chained payment settlement culture, and default settlement durations are much higher than the other industries [5]. Generally, in construction projects, the payments are made progressively based on the value of work done during a certain period or at the completion of an agreed milestone. The conditions of contracts stipulate the payment settlement procedure. Generally, there are periods defined for preparing, checking and certifying the bill, and finally making the payment [5]. Danuri et al. [4] mentioned that 1.6% of income is lost, due to payment delays in the construction industry. This lengthy default payment settlement cycle typically takes a few months. Researchers have identified that this chained payment settlement culture negatively impacts the topmost nodes in the supply chain, such as subcontractors, sub-subcontractors, and suppliers. Further, partial payments and nonpayments are quite common in the construction industry—making the situation worse for upstream members [5,33].

Dainty et al. [34] highlighted that the impact of payment delays in the construction industry would lead to over-pricing against that risk of delay. Abeysekera [33] found that a payment delay of just one week creates a loss to a client that is equal to 0.05% of the contract sum when the interest rate is 5%. Poor payment guarantees and low trust with the lower nodes in the supply chain negatively impact the quality and the price of the product and service [4]. The lengthy payment settlement duration adds an extra burden to projects as the cost of finance and additional delays create adverse impacts.

These complex supply chains with low transparency weaken the level of trust and security of payments; ultimately leading to project delays, cash flow issues, disputes, abandonment of projects, low quality or compliance issues, and the high cost of the final products [4,6].

The above-mentioned issues can be summarised into 11 key issues, namely, cash flow issues, cost of finance, cost overrun, long payment cycle, nonpayments, partial payments, payment delays, payment disputes, payment hold, retention, and security of payment issues. Many reasons behind these payment and related financial issues are presented in the literature. These were categorised into 34 main reasons as follows: Cash flow difficulties arising from other projects, complications from contractual conditions, contract types/procurement methods used, cost overruns caused by poor estimating, delay in certification, disputes regarding payment claims, disputes over the quality of work, entrance with low capital, financial difficulties caused by failure to secure contracts, frequent change of sub-contractors/suppliers, higher capital requirements in certain projects, improper supervision and financial control, improper withholding of payment, ineffective utilisation of funds, lack of knowledge and experience in the field, lack of proper external processes, lack of proper internal processes, lack of trust among members, legislative procedures (construction contracts act), long project durations, nature of projects (different locations with many new suppliers), over-reliance on client/payer, payer’s poor financial management, payment culture of the industry (work first and get paid later), perception in the industry that late payment is acceptable, project delays because of supply chain issues, requirement and design changes, rework of errors during construction, slowness in the decision-making process, structure of the industry (coordination issues with many parties), the attitude of the payer (dishonest/unethical conduct), the easy exit of players (little/no liability to creditors), time overrun of projects caused by poor planning, and work done exceeding allocated budget [6,35,36,37,38,39,40,41,42,43,44]. Mitigating these underlying reasons will contribute to solving the payment issues in the construction supply chain. Government legislation such as security of payment acts, novel types of payment agreements, and ICT applications have been implemented in various countries to solve payment issues and underlying reasons [43,45,46]. However, these issues persist in the construction industry, as evidenced by large construction companies, such as Carillion, Cooper and Oxley, and Strongbuild, going into administration because of cash flow management issues [12], and small and medium players in the industry being affected by insolvency [47].

2.2. Blockchain Technology and Smart Contracts

2.2.1. Blockchain Technology

After the introduction of Ethereum as a Turing-complete DApp implementing platform [39], the potential of applying blockchain technologies for sectors, such as elections, power, supply chain, property, health, food, waste management, identity management, collectables, legal contracts, and many others, has been increasingly explored [26,48,49,50].

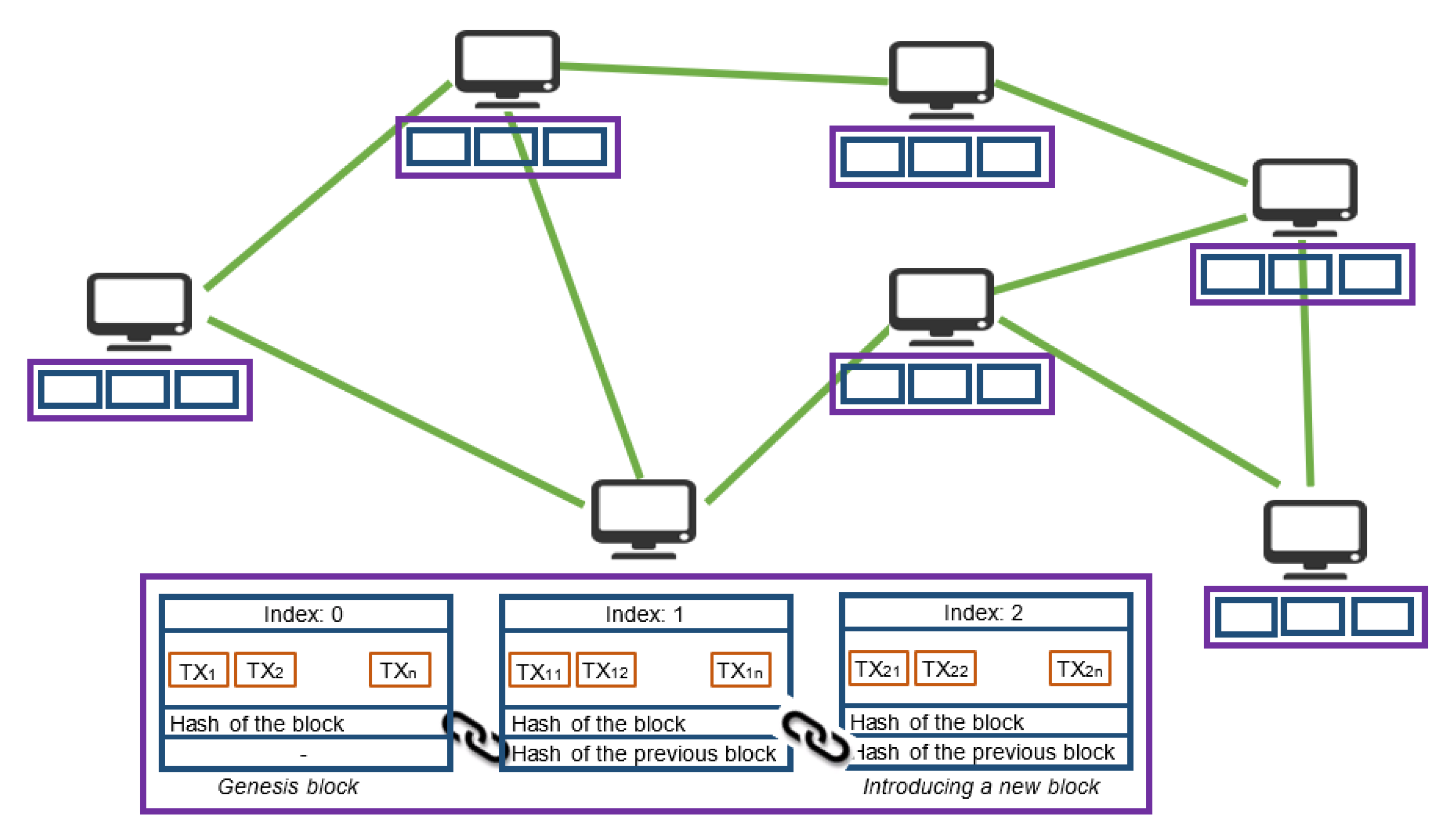

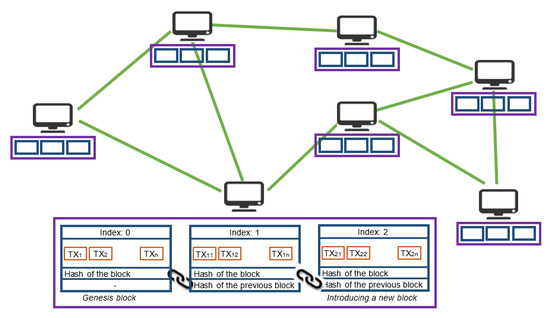

As shown in Figure 2, blockchain consists of a secure and transparent technology to transmit and store data between users through a peer-to-peer network, without a central point of control or avoiding the middleman, and ensures trust in a trustless environment [51,52,53,54]. Each member node maintains a complete dataset called a ledger. A blockchain ledger or data storage is a growing list of records, called blocks, which are linked using cryptographic hash values to the previous block [10,55].

Figure 2.

Peer-to-peer blockchain architecture. Source: Nanayakkara et al. [48].

Usually, a blockchain network can consist of up to several thousand nodes, although all nodes need not always be active. According to the network agreements or consensus algorithms and privileges of nodes to access ledger data, three types of blockchain networks can be identified as public, private, and consortium blockchain networks. The public or permissionless blockchain is open for any party to view or transact, while in compliance with the consensus algorithm of the network [56]. A permissioned private blockchain only allows authorised members of the network to access the data or execute transactions [57]. A consortium blockchain is a permissioned, partially private, multi-organisational blockchain solution for allied businesses [58]. Based on the business requirement, an application developer can use either a public, private, or consortium blockchain network.

2.2.2. Smart Contracts

The concept of smart contracts was first introduced by Szabo [59] as a computerised transaction protocol [60]. A smart contract is a self-executing contract or set of rules between two or more parties being directly written into the system and exists across the blockchain network [48,60]. A smart contract can be used to satisfy common contractual conditions, such as payment terms, compliance requirements, and conditions of contracts, without a central authority or external enforcement, while minimising malicious and accidental errors [59].

Smart contracts assist in developing, building, and running various business applications in a distributed manner [61,62,63,64]. Zhang et al. [65] (p. 2), stated that “smart contracts can store data objects and define operations on the data, enabling the development of DApps to interact with blockchains and provide seamless services to the application users”. Smart contracts are essentially computer programs with data and logic that run across all nodes in a blockchain network [60,66,67]. It can perform activities based on a predefined set of conditions with minimum or no human intervention. The most significant properties of smart contracts are self-containment, fraud resistance, integrity, nonphysicality, and disintermediation. These properties provide smart contracts with enhanced functionality, uniformity, effectiveness, accountability, auditability, and accuracy compared with traditional software solutions [48,68,69,70]. Turing-completeness is a critical factor of smart contract programming languages, as it is essential to develop complete and fully functional smart contracts [71]. Blockchain networks of the second-generation onwards support Turing-complete smart contract languages. Some of those networks are Ethereum, EOS.IO, Hyperledger Fabric, Neo, and many others [48,61,72].

2.2.3. Notable Properties of Blockchain

Blockchain technology provides a set of unique and enhanced features that increases the trust, usage, and applicability of information systems in many sectors [10,73]. Blockchain technology has the potential to enhance trust, transparency, auditability, accountability, security, robustness, resilience, performance, and equality of Internet-based information systems [74].

The level of acceptance of any software system depends on both the level of compliance with the Functional Requirements (FRs) and Non-functional Requirements (NFRs). A Turing-complete blockchain platform can equally satisfy the FRs [75] without depending on the environment similar to any general-purpose, high-level programming language [55]. Therefore, a blockchain-based software system can equally satisfy all functional requirements of any business application, just like a conventional information system. Therefore, compliance with NFRs will ultimately cause to increase the level of acceptance of any blockchain-based software system compared with conventional information systems. Decentralisation, transparency, immutability, anonymity and pseudonymity, and Turing-completeness are the most significant non-functional properties of blockchain-based systems. Researchers have identified high-level system features and the relevant system features/outcomes that impact software quality [76,77,78,79,80,81,82,83,84,85]. Table 1 shows how blockchain solutions compare with conventional information systems based on these notable software quality features.

Many researchers recognise that blockchain provides better reliability, security, and trust. However, not many papers discuss the fundamental properties that constitute these high-level features of blockchain solutions. Moreover, these broader terms are not sufficient to decide on the suitability of a blockchain-based solution versus a conventional information system. In general, it is difficult to develop and maintain blockchain-based software solutions when compared with conventional information systems. There is not much difference in usability and a relatively higher overall efficiency in blockchain-based solutions when compared with conventional information systems. Even though blockchain-based solutions generally provide better reliability, Hamida et al. [86] highlighted that a blockchain-based solution has poor recoverability or resilience.

Table 1.

Features of blockchain compared with conventional information systems.

Table 1.

Features of blockchain compared with conventional information systems.

| High-Level System Features | System Features/Outcomes | Decentralisation | Transparency | Immutability | Anonymity and Pseudonymity | Smart Contracts and Turing-Completeness |

|---|---|---|---|---|---|---|

| Developability | Complexity | [87] | [88] | [89] | ||

| Developability (time and cost) | [90] | [90] | [90] | |||

| Maturity | [87] | |||||

| Modularity | [91] | [88] | [92] | |||

| Reusability | [87] | [87] | ||||

| Testability | [92] | [86] | [86] | |||

| Maintainability | Durability | [93] | [93] | |||

| Scalability | [88] | [90] | ||||

| Modifiability | [91] | [92] | ||||

| Portability | [87] | [87] | ||||

| Uniformity | [94] | [93] | [95] | |||

| Functionality | Accuracy | [57] | [90] | [96] | ||

| Compatibility | [94] | [92] | ||||

| Interoperability | [94] | [94] | [95] | |||

| Nonphysicality | [97] | [93] | [96] | |||

| Self-containment | [97] | [97] | [89] | |||

| Suitability | [98] | [98] | [96] | |||

| Usability | Adaptability | [86] | [95] | |||

| Learnability | [91] | |||||

| Supportability | [86] | |||||

| System documentation | ||||||

| Applicability | [57] | [57] | ||||

| User interfaces | ||||||

| Reliability | Accessibility | [99] | ||||

| Availability | [100] | |||||

| Fault tolerance | [100] | |||||

| Recoverability (Resilience) | [86] | [89] | ||||

| Robustness | [94] | |||||

| Stability | [90] | |||||

| Efficiency | Effectiveness (for the total process) | [97] | [97] | [95] | ||

| Performance–Throughput (for a single action) | ||||||

| – Read | [90] | |||||

| – Write | [90] | |||||

| – Execute | [90] | |||||

| Resource behaviour-Storage, Processing, etc. | [90] | |||||

| Trust and Security | Accountability | [57] | [101] | [90] | [102] | [57] |

| Auditability | [103] | [101] | [103] | |||

| Disintermediation | [101] | [99] | [103] | |||

| Fraud resistance | [104] | [99] | [90] | [102] | [104] | |

| Privacy | [103] | [96] | [90] | [105] | ||

| Confidentiality | [105] | [90] | [105] | |||

| Integrity | ||||||

| – System | [101] | [105] | [90] | [105] | ||

| – Data | [106] | [105] | [106] | |||

Key: —Better than conventional information systems; —No significant difference compared with conventional information systems; —Worse than conventional information systems.

As Table 1 demonstrates both positive and negative outcomes of blockchain solutions compared with conventional information systems in specific scenarios, it is necessary to consider all pertinent features when deciding to implement a blockchain-based solution. In summary, blockchain technology provides better accuracy, interoperability, nonphysicality, self-containment, suitability, accessibility, availability, fault tolerance, robustness, stability, efficiency of read or execute, accountability, auditability, disintermediation, fraud resistance, and integrity, and will ultimately enable a high-level of trust and security compared with conventional information systems.

3. Research Methodology

This paper attempts to identify the stakeholders’ perspective on the severity of payment and related financial issues in the construction industry, the main reasons that contribute to payment issues in the industry at present, and to what extent blockchain and smart contract-based solutions could help to solve payment issues compared with current ICT applications. However, the study does not focus on how cryptocurrencies can be applied in the construction industry.

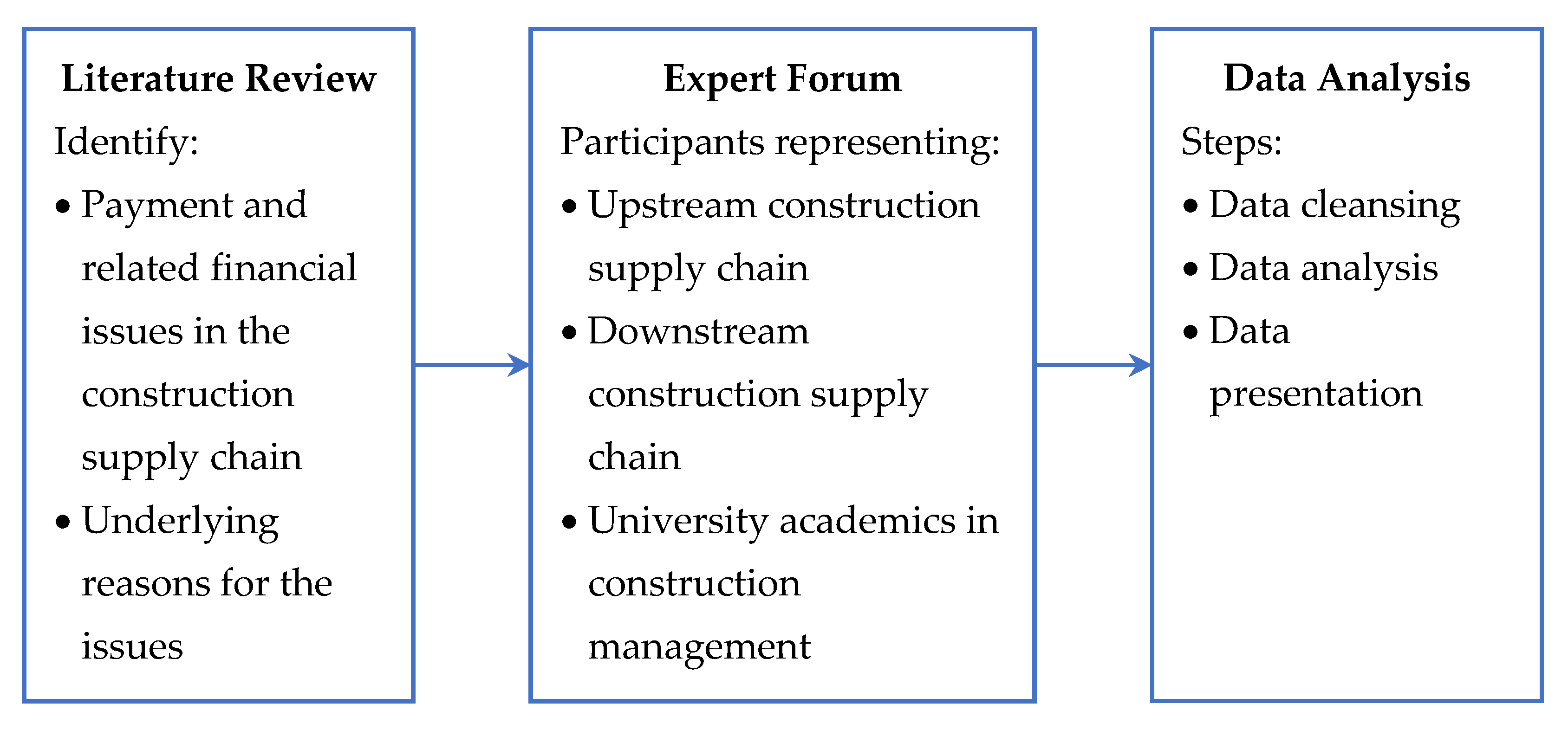

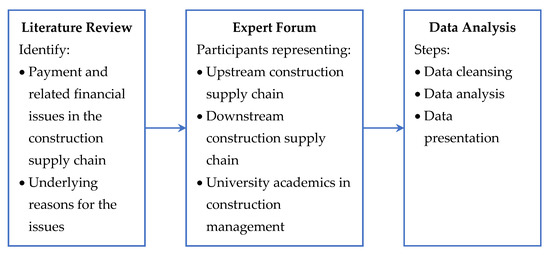

This research comprises of the three main steps illustrated in Figure 3 and presented below.

Figure 3.

Research methodology.

- Literature review

The first phase of the research was a literature review of sources, including journal papers, conference papers, textbooks, white papers, and reputed web articles to identify payment and related financial issues in the construction supply chain and construction industry. Different literature suggests various issues, and the most significant issues were compiled into eleven categories, based on their commonality. Furthermore, the literature review explored the main reasons that influence these issues in the industry, and 34 reasons were identified. The questionnaire for data collection was prepared using the outputs of the literature review.

- Expert forum

To obtain opinions and inputs, an expert forum was conducted, comprising a representative sample of 24 experts from the Australian construction industry and academics from the construction management domain, as shown in Table 2. The participants can be categorised into three primary groups represented in equal numbers. The first set of participants represented the upstream of the construction supply chain, including a supplier, subcontractors, and sub-subcontractors. The second set of participants represented the downstream of the construction supply chain, including general contractors, clients, consultants, architects, and design engineers. The final set of participants represented university academics with knowledge in construction management, digitalisation, and blockchain technologies. All 24 experts have more than ten years of domain experience.

Table 2.

Classification of expert forum participants.

Prior to the expert forum discussion, an overview of blockchain and smart contract technologies was presented to the participants to enhance their understanding of the technologies. A detailed discussion was also conducted regarding potential blockchain applications, smart contract-enabled solutions, drivers and barriers of the technology, and future directions.

The experts were assisted by researchers in blockchain and construction supply chains, who shared additional information related to blockchain and smart contract technologies during the discussion. Each group was requested to discuss the payment and related financial issues affecting the construction industry and supply chain, and the underpinning reasons for these issues. They also thoroughly discussed ICT and blockchain solutions to mitigate these issues. The expert forum participants provided their feedback by completing a printed questionnaire. The questionnaire covered four areas of concern, with a set of statements for each area. The areas were (a) severity of the payment and related financial issues in the construction industry (11 statements); (b) the main reasons contributing to these issues (34 statements); (c) capability of current ICT applications to solve payment issues (11 statements); and d) potential of blockchain and smart contracts to solve payment issues (11 statements). The participants were required to rank each statement on a five-point Likert scale, with one being the lowest value and five being the highest value.

- Data analysis

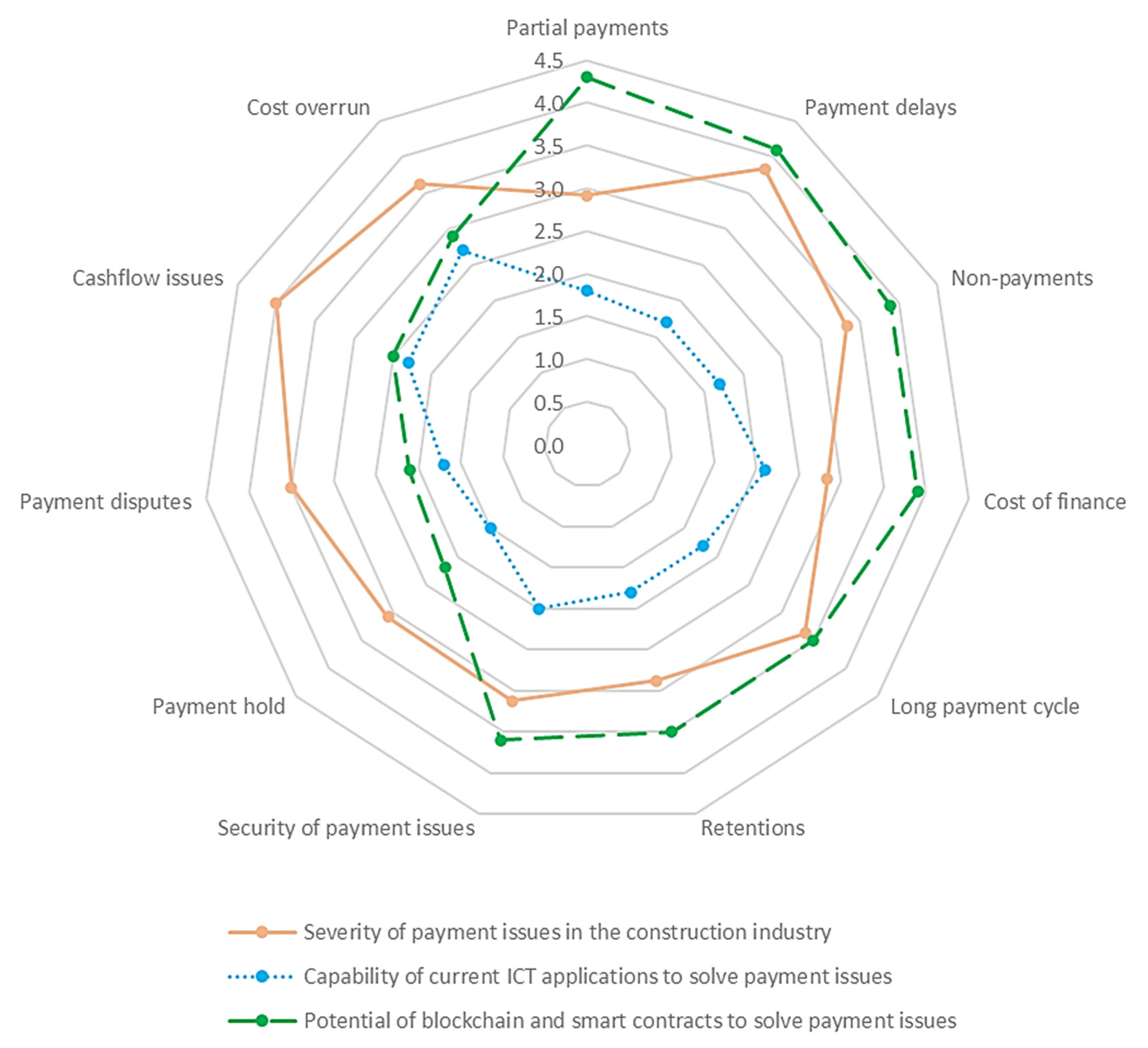

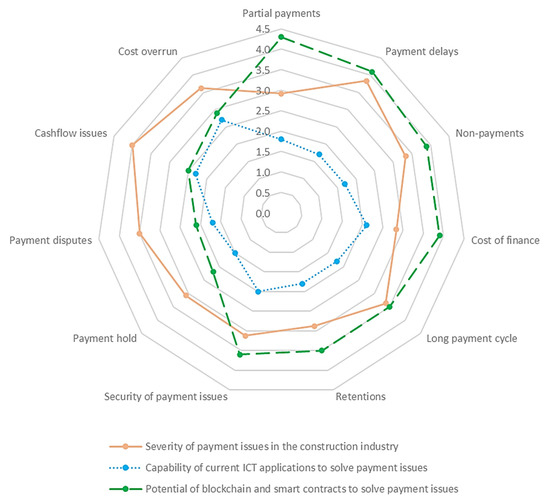

All responses obtained from the questionnaires filled by the expert forum participants were entered into a spreadsheet, and irrelevant data were cleansed. Data analysis was conducted through an overall averaging method for each statement and deriving significant values for each statement. The average of each statement in the areas, severity level of payment and related financial issues, capability of current ICT applications to solve these issues, and potential of blockchain and smart contracts to solve payment issues in the construction industry were identified and mapped on a radar chart for better result representation, as shown in Figure 4. Further, the top ten reasons contributing to payment and related financial issues were identified based on the highest average values out of the 34 statements.

Figure 4.

Mapping of the severity of payment issues, and capability of current ICT applications and potential of blockchain and smart contracts to solve payment issues.

4. Results and Discussion

Literature suggests various payment and related financial issues. These can be categorised into eleven issues: Cash flow issues, cost of finance, cost overrun, long payment cycle, payment disputes, payment hold issues, retention, security of payment issues, payment delays, partial payments, and nonpayments [5,37,40,43,107,108,109,110,111]. As explained in the previous section, the expert forum feedback was analysed and presented in a radar chart in Figure 4. The outermost points of the chart represent the most significant values, and the innermost points represent the least significant values. As shown in Figure 4 (refer to the continuous orange line), cash flow issues, payment delays, cost overrun, payment disputes, long payment cycle, nonpayments, and security of payment issues were ranked as the most significant payment and related financial issues.

Presently, ICT plays a significant role in improving efficiency, and mitigating finance and payment issues in most industries. In Figure 4, the blue dotted line represents the capability of present ICT-based solutions for mitigating payment-related issues in the construction industry. Issues that are under the internal control of the organisation, such as cash flow issues and cost overrun, can be mitigated through present ICT solutions. However, as illustrated in Figure 4, the expert opinion was that the impact of current ICT-based solutions is comparatively inadequate for most payment and related financial issues in the industry. This is due to minimum internal control and high impact to the issues by the involvement of external parties.

In Figure 4, the green dashed line represents the potential of blockchain and smart contracts to solve payment issues. The proximity of the lines representing the present ICT solutions and the potential of blockchain solutions indicates no significant impact from blockchain technology, and the lines which are further apart denote that blockchain technology provides a significant additional level of solution to the respective payment issue. As illustrated in Figure 4, blockchain and smart contract technologies could assist in overcoming payment-related issues, such as partial payments, payment delays, nonpayments, cost of finance, long payment cycle, retention, and security of payment issues, to a great extent. This denotes a significant positive impact on 64% (7/11) of the issues identified from the literature survey. According to expert opinion, payment delay is categorised as the second most significant payment and related financial issue in the industry, and the capability of current ICT applications to solve this issue is low. However, according to the experts, the potential of blockchain and smart contract technologies is significantly high to solve the issue.

Based on the expert opinions, long payment cycle, nonpayments, and security of payment issues were ranked as moderately significant issues. The capability of current ICT applications to solve these issues is also moderate, as shown in Figure 4. However, the potential of blockchain and smart contract technologies is significantly high to solve these three issues. Partial payments, retention, and cost of finance have been identified as payment-related issues in the industry with comparatively low impact compared to the other issues mentioned. According to the expert feedback, current ICT applications can solve these issues to a low or moderate level. These issues can also potentially be solved by blockchain and smart contract technologies better than current ICT applications. Therefore, the overall expert opinion shows significantly higher potential for blockchain and smart contract solutions to overcome payment-related issues in construction compared to current ICT solutions.

As presented in Section 2.1.2, thirty-four items were identified from the literature review as the main reasons behind the payment and related financial issues. If it is possible to eliminate or mitigate these underpinning reasons, it will help to mitigate payment and related financial issues in the construction industry. Most of the underpinning reasons are inherent in the construction industry and are challenging to eliminate using conventional information systems. However, the high level of transparency, trust, accountability, and automation with less human intervention inherent in blockchain and smart contract technologies can address these underpinning reasons. Based on the experts’ feedback, the most significant reasons behind payment and related financial issues out of the 34 identified reasons are ranked as follows:

- Project delays, due to supply chain issues

- Complications from contractual conditions

- Work done exceeds allocated budget

- Rework, due to errors during construction

- Disputes over-payment claims

- Perception in the industry that late payment is acceptable

- Payment culture of the industry (work first and get paid later)

- Disputes over the quality of work

- Improper supervision and financial control

- Structure of the industry (coordination issues with many parties)

A limitation of the study is the difficulty in validating the expert opinions regarding the potential of blockchain and smart contract applications. This is due to the limited availability of blockchain applications in the construction industry at present. A relatively large pool of interview participants from the industry and academia was selected to redress the subjective bias in expert feedback. Further, the low level of digitalisation of the industry is a barrier to the realisation of the potential benefits of blockchain.

5. Conclusions

Payment and related financial issues have a significant negative impact on the construction industry. It is challenging to directly eliminate the underpinning reasons of payment and related financial issues and provide solutions to these issues. Presently, ICT plays a vast role in mitigating payment and related financial issues in most industries. Novel blockchain and smart contract technologies have significant potential to resolve many payment-related issues through enhanced trust, transparency, accountability, and efficiency. There is a significant positive impact from blockchain and smart contracts to overcome payment-related issues in construction compared with conventional information systems. However, even though cash flow and cost overrun issues were ranked as highly significant payment and related financial issues, the results show that there is no direct positive impact from blockchain technology to solve these two issues. Nevertheless, partial payments, payment delays, nonpayments, cost of finance, long payment cycle, retention, and security of payment issues can be extensively mitigated using blockchain and smart contract technologies.

Many of the significant reasons behind payment and related financial issues identified through this research can be reduced or eliminated by implementing blockchain and smart contract solutions. Optimising the supply chain using blockchain and smart contract technologies will mitigate project delays caused by supply chain issues. For example, smart contracts can be created for contractual agreements and automatically execute when required conditions are met. This will reduce complications from contractual conditions and disputes regarding payment claims. Automatic execution of payment terms will also diminish the industry perception that late payment is acceptable. Although the payment culture of the industry cannot be changed through blockchain, it is likely to speed up payments, due to enhanced transparency, need for accountability, and reduced red tape. Work done exceeding the allocated budget, and improper supervision and financial control can be moderated by implementing smart contracts to monitor budgets and expenses. While rework of errors during construction cannot be mitigated using blockchain, a blockchain-based system can be created to track errors, automatically detect violations, and ensure responsible parties are held accountable. This type of system would also enable the traceability of certifications of quality and provenance of materials through the construction supply chain, and certifications of quantity and quality of work done, thereby stimulating enhanced compliance to standards. The structure of the industry makes it difficult to coordinate among numerous parties using conventional information systems, yet blockchain systems have been demonstrated to handle such complex, network-structured relationships, providing trust, security, and reliability.

This paper is an early-stage outcome of a research study on developing a blockchain-based e-procurement framework for construction supply chains. The research has already modelled construction supply chains by using industry case studies. A future research outcome will be a comprehensive e-procurement framework for the construction industry based on blockchain and smart contract algorithms. A commercially scalable system is expected to be subsequently developed based on the framework. Additionally, the proposed supply chain model will be extended to integrate with related blockchain-based research on construction carbon estimating, building information modelling, construction waste management, and post-contract work and payment certification solutions.

As a concluding remark, the research outcomes demonstrate that blockchain and smart contract powered ICT solutions can significantly contribute to mitigating the payment and related financial issues and many of the significant reasons behind these issues in the construction industry.

Author Contributions

Conceptualization, S.N., S.P., and S.S.; methodology, S.N., S.P., and S.S.; formal analysis, S.N., S.P.; resources, S.P.; data curation, S.N.; writing—original draft preparation, S.N. and G.T.W.; writing—review and editing, S.P., S.S., H.M.N.D.B., and G.T.W.; visualization, S.N. and G.T.W.; supervision, S.P. and S.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Acknowledgments

The authors would like to acknowledge the support by the Centre for Smart Modern Construction, Western Sydney University, Australia for organising this expert forum which enabled the gathering of construction industry practitioners, academics and other stakeholders that gave their valuable inputs towards this research.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ashworth, A.; Perera, S. Contractual Procedures in the Construction Industry, 7th ed.; Routledge: London, UK, 2018. [Google Scholar]

- Papadopoulos, G.A.; Zamer, N.; Gayialis, S.P.; Tatsiopoulos, I.P. Supply Chain Improvement in Construction Industry. Univers. J. Manag. 2016, 4, 528–534. [Google Scholar]

- Behera, P.; Mohanty, R.; Prakash, A. Understanding construction supply chain management. Prod. Plan. Control. 2015, 26, 1332–1350. [Google Scholar] [CrossRef]

- Danuri, M.M.; Munaaim, M.C.; Rahman, H.A.; Hanid, M. Late and non-payment issues in the Malaysian Construction Industry-Contractor’s perspective. In Proceedings of the International Conference on Construction, Culture, Innovation and Management (CCIM), Dubai, United Arab Emirates, 26–29 November 2006. [Google Scholar]

- Ramachandra, T.; Rotimi, J.O. The nature of payment problems in the New Zealand construction industry. Constr. Econ. Build. 2011, 11, 22–33. [Google Scholar] [CrossRef]

- Ramachandra, T.; Rotimi, J.O.B. Mitigating payment problems in the construction industry through analysis of construction payment disputes. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2015, 7, A4514005. [Google Scholar] [CrossRef]

- Perera, S.; Nanayakkara, S.; Weerasuriya, T. Blockchain: The Next Stage of Digital Procurement in Construction. Acad. Lett. 2021. [Google Scholar] [CrossRef]

- Hewavitharana, T.; Nanayakkara, S.; Perera, S. Blockchain as a project management platform. In Proceedings of the World Construction Symposium, Colombo, Sri Lanka, 8–10 November 2019; pp. 137–146. [Google Scholar]

- Dannen, C. Introducing Ethereum and Solidity; Springer: Berlin/Heidelberg, Germany, 2017. [Google Scholar]

- Underwood, S. Blockchain beyond bitcoin. Commun. ACM 2016, 59, 15–17. [Google Scholar] [CrossRef]

- Nanayakkara, S.; Perera, S.; Bandara, H.M.N.D.; Weerasuriya, G.T.; Ayoub, J. Blockchain technology and its potential for the construction industry. In Proceedings of the AUBEA Conference, Noosa, Australia, 6–8 November 2019. [Google Scholar]

- Perera, S.; Nanayakkara, S.; Rodrigo, M.; Senaratne, S.; Weinand, R. Blockchain Technology: Is it Hype or Real in the Construction Industry? J. Ind. Inf. Integr. 2020, 17, 1–20. [Google Scholar] [CrossRef]

- Di Ciccio, C.; Cecconi, A.; Mendling, J.; Felix, D.; Haas, D.; Lilek, D.; Riel, F.; Rumpl, A.; Uhlig, P. Blockchain-based traceability of inter-organisational business processes. In Proceedings of the International Symposium on Business Modeling and Software Design, Berlin, Germany, 6–8 July 2020; pp. 56–68. [Google Scholar]

- Christopher, M. Logistics and Supply Chain Management, 1st ed.; Pitman Publishing: London, UK, 1992. [Google Scholar]

- Mentzer, J.T.; DeWitt, W.; Keebler, J.S.; Min, S.; Nix, N.W.; Smith, C.D.; Zacharia, Z.G. Defining supply chain management. J. Bus. Logist. 2001, 22, 1–25. [Google Scholar] [CrossRef]

- Shingo, S. Non-Stock Production: The Shingo System of Continuous Improvement; Productivity Press: New York, NY, USA, 1988. [Google Scholar]

- Nanayakkara, S.; Perera, P.; Perera, A. Factors Influencing Selection and Effective Implementation of ERP Systems in Medium Sized Organizations in Developing Countries. Int. J. Comput. Internet Manag. 2013, 21, 7–14. [Google Scholar]

- Nanayakkara, S.; Kusumsiri, N.; Perera, P. Adaptation of Diffusion of Innovations Theory for Successful ERP Implementation. Int. J. Comput. Sci. Technol. 2016, 7, 1–6. [Google Scholar]

- Katunzi, T.M. Obstacles to process integration along the supply chain: Manufacturing firms perspective. Int. J. Bus. Manag. 2011, 6, 105. [Google Scholar] [CrossRef][Green Version]

- Hewavitharana, T.; Nanayakkara, S.; Perera, A.; Perera, J. Impact of Enterprise Resource Planning (ERP) Systems to the Construction Industry. Int. J. Res. Electron. Comput. Eng. 2019, 7, 887–893. [Google Scholar]

- Ashworth, A.; Perera, S. Cost Studies of Buildings; Routledge: Milton Park, UK, 2015. [Google Scholar]

- Nanayakkara, S.; Perera, P.; Perera, A. Factors Incompatibility of Selection and Implementation of ERP Systems for Construction Organizations. Int. J. Comput. Sci. Technol. 2015, 6, 9–15. [Google Scholar]

- Cheng, E.W.L.; Li, H.; Love, P.E.D.; Irani, Z. An e-business model to support supply chain activities in construction. Logist. Inf. Manag. 2001, 14, 68–78. [Google Scholar]

- Nanayakkara, K.S.; Perera, P.; Shantha, F. Universal Communication Interface through Web Services for Heterogeneous Systems with Dynamic System Life Cycle. Int. J. Comput. Sci. Technol. 2014, 5, 48–55. [Google Scholar]

- Nanayakkara, N. Customizable Protocol for Information Transfer between Heterogeneous Platforms. Available online: http://dl.lib.uom.lk/handle/123/2020 (accessed on 14 April 2021).

- Hijazi, A.A.; Perera, S.; Alashwal, A.; Calheiros, R.N. Blockchain Adaption in Construction Supply Chain: A Review of Studies Across Multiple Sectors. In Proceedings of the CIB World Building Congress, Hong Kong, China, 17–21 June 2019. [Google Scholar]

- Durdyev, S.; Ismail, S. Offsite Manufacturing in the Construction Industry for Productivity Improvement. Eng. Manag. J. 2019, 31, 35–46. [Google Scholar] [CrossRef]

- Afolabi, A.; Ojelabi, R.A.; Omuh, I.; Olayeni, P.T.; Adeyemi, M. Critical success factors influencing productivity of construction artisans in the building industry. Int. J. Mech. Eng. Technol. 2018, 9, 858–867. [Google Scholar]

- Ala-Risku, T.; Kärkkäinen, M. Material delivery problems in construction projects: A possible solution. Int. J. Prod. Econ. 2006, 104, 19–29. [Google Scholar] [CrossRef]

- Janipha, N.A.I.; Ahmad, N.; Ismail, F. Clients’ involvement in purchasing process for quality construction environment. Procedia Soc. Behav. Sci. 2015, 168, 30–40. [Google Scholar] [CrossRef]

- Topchiy, D.; Scacalov, V.; Yurgaytis, A. Comprehensive verification construction compliance control as the Developer’s project risk reduction tool. Int. J. Civ. Eng. Technol. (IJCIET) 2018, 9, 985–993. [Google Scholar]

- Hackitt, J. Building a Safer Future-Independent Review of Building Regulations and Fire Safety: Final Report; Ministry of Housing, Communities & Local Government: London, UK, 2018.

- Abeysekera, V. A conceptual framework for client financed construction and non-traditional approaches for financing construction work. In Proceedings of the CIOB Construction Conference, Colombo, Sri Lanka, 29 June–1 July 2018; pp. 42–49. [Google Scholar]

- Dainty, A.R.J.; Millett, S.J.; Briscoe, G.H. New perspectives on construction supply chain integration. Supply Chain. Manag. 2001, 6, 163–173. [Google Scholar] [CrossRef]

- Abdul-Rahman, H.; Takim, R.; Min, W.S. Financial-related causes contributing to project delays. J. Retail. Leis. Prop. 2009, 8, 225–238. [Google Scholar] [CrossRef]

- Prasad, K.; Vasugi, V.; Venkatesan, R.; Bhat, N.S. Critical causes of time overrun in Indian construction projects and mitigation measures. Int. J. Constr. Educ. Res. 2019, 15, 216–238. [Google Scholar] [CrossRef]

- Wong, K.; Vimonsatit, V. A study of the factors affecting construction time in Western Australia. Sci. Res. Essays 2012, 7, 3390–3398. [Google Scholar]

- Luo, H.; Das, M.; Wang, J.; Cheng, J.; Kong, H. Construction payment automation through smart contract-based blockchain framework. In Proceedings of the 36th International Symposium on Automation and Robotics in Construction (ISARC 2019), Edmonton, AB, Canada, 21–24 May 2019. [Google Scholar]

- Judi, S.S.; Mustaffa, N.; Nayan, R. A Framework for Combating Payment-Related Issues (Pri) in the Malaysian Construction Industry. J. Built Environ. Technol. Eng. 2017, 2, 112–132. [Google Scholar]

- Cheng, T.; Soo, G.; Kumaraswamy, M.; Jin, W. Security of payment for Hong Kong construction industry. Proc. Inst. Civ. Eng. Manag. Procure. Law 2010, 163, 17–28. [Google Scholar] [CrossRef]

- Paek, J.H.; Lee, Y.W.; Ock, J.H. Pricing construction risk: Fuzzy set application. J. Constr. Eng. Manag. 1993, 119, 743–756. [Google Scholar] [CrossRef]

- Ive, G.; Murray, A. Trade Credit in the UK Construction Industry; Department for Business, Innovation and Skills: London, UK, 2013.

- Peters, E.; Subar, K.; Martin, H. Late payment and nonpayment within the construction industry: Causes, effects, and solutions. J. Leg. Aff. Disput. Resolut. Eng. Constr. 2019, 11, 04519013. [Google Scholar] [CrossRef]

- Ramachandra, T.; Rotimi, J.O.B. Causes of payment problems in the New Zealand construction industry. Constr. Econ. Build. 2015, 15, 43–55. [Google Scholar] [CrossRef]

- Brand, M.C.; Uher, T. Follow-up empirical study of the performance of the New South Wales construction industry security of payment legislation. Int. J. Law Built Environ. 2010, 2, 7–25. [Google Scholar] [CrossRef]

- Chong, H.Y.; Diamantopoulos, A. Integrating advanced technologies to uphold security of payment: Data flow diagram. Autom. Constr. 2020, 114. [Google Scholar] [CrossRef]

- Das, P.; Perera, S.; Senaratne, S.; Osei-Kyei, R. Developing a construction business model transformation canvas. Eng. Constr. Arch. Manag. 2020. [Google Scholar] [CrossRef]

- Nanayakkara, S.; Perera, S.; Senaratne, S. Stakeholders’ Perspective on Blockchain and Smart Contracts Solutions for Construction Supply Chains. In Proceedings of the CIB World Building Congress, Hong Kong, China, 17–21 June 2019. [Google Scholar]

- Rodrigo, M.N.N.; Perera, S.; Senaratne, S.; Jin, X. Conceptual model on estimating embodied carbon in construction supply chains using value chain and blockchain. In Proceedings of the AUBEA Conference, Noosa, Australia, 6–8 November 2019. [Google Scholar]

- Ratnasabapathy, S.; Perera, S.; Alashwal, A. A review of smart technology usage in construction and demolition waste management. In Proceedings of the World Construction Symposium, Colombo, Sri Lanka, 8–10 November 2019. [Google Scholar]

- Lee, D.; Lee, S.H.; Masoud, N.; Krishnan, M.; Li, V.C. Integrated digital twin and blockchain framework to support accountable information sharing in construction projects. Autom. Constr. 2021, 127, 103688. [Google Scholar] [CrossRef]

- Rodrigues, B.; Bocek, T.; Stiller, B. The use of blockchains: Application-driven analysis of applicability. In Blockchain Technology: Platforms, Tools and Use Cases; Elsevier: Amsterdam, The Netherlands, 2018; pp. 163–198. [Google Scholar]

- Rodrigo, M.N.N.; Perera, S.; Senaratne, S.; Jin, X. Potential Application of Blockchain Technology for Embodied Carbon Estimating in Construction Supply Chains. Buildings 2020, 10, 140. [Google Scholar] [CrossRef]

- Hijazi, A.A.; Perera, S.; Al-Ashwal, A.M.; Neves Calheiros, R. Enabling a single source of truth through BIM and blockchain integration. In Proceedings of the 2019 International Conference on Innovation, Technology, Enterprise and Entrepreneurship (ICITEE 2019), Manama, Bahrain, 24–25 November 2019; pp. 385–393. [Google Scholar]

- Nanayakkara, S.; Rodrigo, M.; Perera, S.; Weerasuriya, G.T.; Hijazi, A.A. A Methodology for Selection of a Blockchain Platform to Develop an Enterprise System. J. Ind. Inf. Integr. 2021, 23, 100215. [Google Scholar]

- Lewis, R.; McPartland, J.; Ranjan, R. Blockchain and financial market innovation. Glob. Commod. Appl. Res. Dig. 2017, 7, 1–17. [Google Scholar]

- Martinovic, I.; Kello, L.; Sluganovic, I. Blockchains for Governmental Services: Design Principles, Applications, and Case Studies; Centre for Technology and Global Affairs: Oxford, UK, 2017. [Google Scholar]

- BlockchainHub. Blockchains & Distributed Ledger Technologies. Available online: https://blockchainhub.net/blockchains-and-distributed-ledger-technologies-in-general/ (accessed on 26 October 2018).

- Szabo, N. Smart Contracts. 1994. Available online: http://www.fon.hum.uva.nl/rob/Courses/InformationInSpeech/CDROM/Literature/LOTwinterschool2006/szabo.best.vwh.net/smart.contracts.html (accessed on 18 July 2018).

- Rudolf, T.H. Smart Contracts; Walder Wyss Ltd.: Zurich, Switzerland, 2017. [Google Scholar]

- Luu, L.; Chu, D.H.; Olickel, H.; Saxena, P.; Hobor, A. Making Smart Contracts Smarter. In Proceedings of the ACM SIGSAC Conference on Computer and Communications Security-CCS’16, Vienna, Austria, 24–28 October 2016; pp. 254–269. [Google Scholar]

- Papadakis-Vlachopapadopoulos, K.; Dimolitsas, I.; Dechouniotis, D.; Tsiropoulou, E.E.; Roussaki, I.; Papavassiliou, S. On Blockchain-Based Cross-Service Communication and Resource Orchestration on Edge Clouds. Informatics 2021, 8, 13. [Google Scholar] [CrossRef]

- El Jabari, C.; Macedo, M.; Al-jabari, M.O. Towards a New Paradigm of Federated Electronic Health Records in Palestine. Informatics 2020, 7, 41. [Google Scholar] [CrossRef]

- Daramola, O.; Thebus, D. Architecture-Centric Evaluation of Blockchain-Based Smart Contract E-Voting for National Elections. Informatics 2020, 7, 16. [Google Scholar] [CrossRef]

- Zhang, P.; Schmidt, D.C.; White, J.; Lenz, G. Blockchain technology use cases in healthcare. In Blockchain Technology: Platforms, Tools and Use Cases; Elsevier: Amsterdam, The Netherlands, 2018; pp. 1–41. [Google Scholar]

- Hamledari, H.; Fischer, M. The application of blockchain-based crypto assets for integrating the physical and financial supply chains in the construction & engineering industry. Autom. Constr. 2021, 127, 103711. [Google Scholar]

- Chowdhury, M.J.M.; Ferdous, M.S.; Biswas, K.; Chowdhury, N.; Muthukkumarasamy, V. A survey on blockchain-based platforms for IoT use-cases. Knowl. Eng. Rev. 2020, 35, e19. [Google Scholar] [CrossRef]

- Zou, W.; Lo, D.; Kochhar, P.S.; Le, X.-B.D.; Xia, X.; Feng, Y.; Chen, Z.; Xu, B. Smart contract development: Challenges and opportunities. IEEE Transact. Softw. Eng. 2019. [Google Scholar] [CrossRef]

- Erceg, A.; Damoska Sekuloska, J.; Kelić, I. Blockchain in the Tourism Industry—A Review of the Situation in Croatia and Macedonia. Informatics 2020, 7, 5. [Google Scholar] [CrossRef]

- Dos Santos, R.B.; Torrisi, N.M.; Yamada, E.R.K.; Pantoni, R.P. IGR token-raw material and ingredient certification of recipe based foods using smart contracts. Informatics 2019, 6, 11. [Google Scholar] [CrossRef]

- Liao, D.-Y.; Wang, X. Applications of blockchain technology to logistics management in integrated casinos and entertainment. Informatics 2018, 5, 44. [Google Scholar] [CrossRef]

- Suciu, G.; Nădrag, C.; Istrate, C.; Vulpe, A.; Ditu, M.-C.; Subea, O. Comparative analysis of distributed ledger technologies. In Proceedings of the 2018 Global Wireless Summit (GWS), Chiang Rai, Thailand, 25–28 November 2018; pp. 370–373. [Google Scholar]

- Iansiti, M.; Lakhani, K.R. The truth about blockchain. Harv. Bus. Rev. 2017, 95, 118–127. [Google Scholar]

- Al-Saqaf, W.; Seidler, N. Blockchain technology for social impact: Opportunities and challenges ahead. J. Cyber Policy 2017, 2, 338–354. [Google Scholar] [CrossRef]

- Buterin, V. A Next-Generation Smart Contract and Decentralized Application Platform. Available online: https://cryptorating.eu/whitepapers/Ethereum/Ethereum_white_paper.pdf (accessed on 14 April 2021).

- Boehm, B.W.; Brown, J.R.; Lipow, M. Quantitative evaluation of software quality. In Proceedings of the 2nd International Conference on Software Engineering, Bali, Indonesia, 24–26 May 2019; pp. 592–605. [Google Scholar]

- McCall, J.A.; Richards, P.K.; Walters, G.F. Factors in Software Quality: Concepts and Definitions of Software Quality. Available online: https://apps.dtic.mil/sti/citations/ADA049014 (accessed on 14 April 2021).

- Boehm, B.W.; Brown, J.R.; Kaspar, H. Characteristics of Software Quality; North-Holland Publishing Company: Amsterdam, The Netherlands, 1978. [Google Scholar]

- Evans, M.W.; Marciniak, J.J. Software Quality Assurance and Management; Wiley: Hoboken, NJ, USA, 1987. [Google Scholar]

- Deutsch, M.S.; Willis, R.R. Software Quality Engineering: A Total Technical and Management Approach; Prentice-Hall: Hoboken, NJ, USA, 1988. [Google Scholar]

- Chidamber, S.R.; Kemerer, C.F. A metrics suite for object oriented design. IEEE Trans. Softw. Eng. 1994, 20, 476–493. [Google Scholar] [CrossRef]

- Jung, H.W.; Kim, S.G.; Chung, C.S. Measuring software product quality: A survey of ISO/IEC 9126. IEEE Softw. 2004, 21, 88–92. [Google Scholar] [CrossRef]

- Glinz, M. On non-functional requirements. In Proceedings of the 15th IEEE International Requirements Engineering Conference (RE 2007), Delhi, India, 15–19 October 2007; pp. 21–26. [Google Scholar]

- Kumar, A.; Grover, P.; Kumar, R. A Quantitative Evaluation of Aspect-Oriented Software Quality Model (AOSQUAMO). ACM SIGSOFT Softw. Eng. Notes 2009, 34, 1–9. [Google Scholar] [CrossRef]

- Barkmann, H.; Lincke, R.; Löwe, W. Quantitative evaluation of software quality metrics in open-source projects. In Proceedings of the 2009 International Conference on Advanced Information Networking and Applications Workshops, Bradford, UK, 26–29 May 2009; pp. 1067–1072. [Google Scholar]

- Hamida, E.B.; Brousmiche, K.L.; Levard, H.; Thea, E. Blockchain for Enterprise: Overview, Opportunities and Challenges. In Proceedings of the Thirteenth International Conference on Wireless and Mobile Communications (ICWMC 2017), Nice, France, 23–27 July 2017; pp. 1–7. [Google Scholar]

- Porru, S.; Pinna, A.; Marchesi, M.; Tonelli, R. Blockchain-oriented software engineering: Challenges and new directions. In Proceedings of Proceedings of the 39th International Conference on Software Engineering Companion, Buenos Aires, Argentina, 20–28 May 2017; pp. 169–171. [Google Scholar]

- Meng, W.; Tischhauser, E.W.; Wang, Q.; Wang, Y.; Han, J. When intrusion detection meets blockchain technology: A review. IEEE Access 2018, 6, 10179–10188. [Google Scholar] [CrossRef]

- Wang, S.; Yuan, Y.; Wang, X.; Li, J.; Qin, R.; Wang, F.Y. An overview of smart contract: Architecture, applications, and future trends. In Proceedings of the 2018 IEEE Intelligent Vehicles Symposium (IV), Changshu, China, 26–30 June 2018; pp. 108–113. [Google Scholar]

- Zheng, Z.; Xie, S.; Dai, H.N.; Wang, H. Blockchain challenges and opportunities: A survey. Int. J. Web Grid Serv. 2016, 14, 352–375. [Google Scholar] [CrossRef]

- Koteska, B.; Karafiloski, E.; Mishev, A. Blockchain Implementation Quality Challenges: A Literature. In Proceedings of the SQAMIA 2017: 6th Workshop of Software Quality, Analysis, Monitoring, Improvement, and Applications, Belgrade, Serbia, 11–13 September 2017. [Google Scholar]

- Coyne, R.; Onabolu, T. Blockchain for architects: Challenges from the sharing economy. Archit. Res. Q. 2018, 21, 369–374. [Google Scholar] [CrossRef]

- Arcangeli, J.-P.; Boujbel, R.; Leriche, S. Automatic deployment of distributed software systems: Definitions and state of the art. J. Syst. Softw. 2015, 103, 198–218. [Google Scholar] [CrossRef]

- Agrawal, M. IoT, Blockchain & Artificial Intelligence—New Holy Trinity (Technical white paper); Telecom Circle: Delhi, India, 2018. [Google Scholar]

- Silverberg, K.; French, C.; Ferenzy, D.; Berg, S.V.D. Getting Smart: Contracts on the Blockchain; The Institute of International Finance: Washington, DC, USA, 2016. [Google Scholar]

- Buterin, V. Privacy on the Blockchain. Available online: https://blog.ethereum.org/2016/01/15/privacy-on-the-blockchain/ (accessed on 7 September 2018).

- Korpela, K.; Hallikas, J.; Dahlberg, T. Digital supply chain transformation toward blockchain integration. In Proceedings of the 50th Annual Hawaii International Conference on System Sciences, Waikoloa, HI, USA, 4–7 January 2017. [Google Scholar]

- Lo, S.K.; Xu, X.; Chiam, Y.K.; Lu, Q. Evaluating Suitability of Applying Blockchain. In Proceedings of the 2017 22nd International Conference on Engineering of Complex Computer Systems (ICECCS), Fukuoka, Japan, 5–8 November 2017; pp. 158–161. [Google Scholar]

- Dorri, A.; Kanhere, S.S.; Jurdak, R. Blockchain in Internet of Things: Challenges and Solutions. Comput. Sci. Cryptog. Secur. 2016, arXiv:1608.05187. [Google Scholar]

- Zheng, Z.; Xie, S.; Dai, H.N.; Chen, X.; Wang, H. An Overview of Blockchain Technology: Architecture, Consensus, and Future Trends. In Proceedings of the 2017 IEEE International Congress on Big Data (BigData Congress), Honolulu, HI, USA, 25–30 June 2017; pp. 557–564. [Google Scholar]

- Karame, G.; Capkun, S. Blockchain Security and Privacy. IEEE Secur. Priv. 2018, 16, 11–12. [Google Scholar] [CrossRef]

- Rodrigo, M.N.N.; Perera, S.; Senaratne, S.; Jin, X. Blockchain for Construction Supply Chains: A Literature Synthesis. In Proceedings of the ICEC-PAQS Conference 2018, Sydney, Australia, 18–20 November 2018. [Google Scholar]

- Zyskind, G.; Nathan, O. Decentralizing privacy: Using blockchain to protect personal data. In Proceedings of the 2015 IEEE Security and Privacy Workshops, San Jose, CA, USA, 21–25 May 2015; pp. 180–184. [Google Scholar]

- Anjum, A.; Sporny, M.; Sill, A. Blockchain standards for compliance and trust. IEEE Cloud Comput. 2017, 4, 84–90. [Google Scholar] [CrossRef]

- Filippi, P.D. The interplay between decentralization and privacy: The case of blockchain technologies. J. Peer Prod. 2016, 14. [Google Scholar]

- Gaetani, E.; Aniello, L.; Baldoni, R.; Lombardi, F.; Margheri, A.; Sassone, V. Blockchain-based database to ensure data integrity in cloud computing environments. In Proceedings of the Italian Conference on Cybersecurity, Venice, Italy, 7–9 April 2021. [Google Scholar]

- Arditi, D.; Koksal, A.; Kale, S. Business failures in the construction industry. Eng. Constr. Archit. Manag. 2008, 7, 120–132. [Google Scholar] [CrossRef]

- Kaming, P.F.; Olomolaiye, P.O.; Holt, G.D.; Harris, F.C. Factors influencing construction time and cost overruns on high-rise projects in Indonesia. Constr. Manag. Econ. 1997, 15, 83–94. [Google Scholar] [CrossRef]

- Ahmadisheykhsarmast, S.; Sonmez, R. A smart contract system for security of payment of construction contracts. Autom. Constr. 2020, 120, 103401. [Google Scholar] [CrossRef]

- Raina, P. An Examination of the Retention Practice in the New Zealand Construction Industry; Auckland University of Technology: Auckland, New Zealand, 2015. [Google Scholar]

- Adams, F.K. Risk perception and Bayesian analysis of international construction contract risks: The case of payment delays in a developing economy. Int. J. Proj. Manag. 2008, 26, 138–148. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).