1. Introduction

Contemporary management covers various areas that are a manifestation of organized human activity. In addition to issues related strictly to commercial activity, an important subject of modern management interest is improving the rationality of decision-making processes that shape the framework of such activity. The processes in question concentrate on the processing of large collections of varied information and are key to generating value. This sphere is also strongly related to investing in solutions to increase the security of information resources (

Deane et al. 2019) and the credibility and reliability of the processes of their processing (

Goldstein et al. 2011) because, as it turns out, such activities have a significant impact on the valuation of traded resources. Research shows that the difficult market situation (or its improvement) in the case of large corporations determines the valuation of the entire industry and the goods it uses (

Jayanti and Jayanti 2011). One of the specific areas that is important for shaping the rules of cooperation between commercial entities and finding what is the level of risk such entities are ready to accept in the event of starting possible cooperation with other organizations is bankruptcy proceedings (

Lukason and Camacho-Miñano 2019). The commonly observed fairness and professionalism of decisions that can potentially be expected when a court is considering bankruptcy is key to assessing the sense of initiating such a procedure. Nowadays, where the risk of doing business has increased significantly as a result of the pandemic, the problem is becoming even more acute. Therefore, without the effective possibility of taking advantage of sanctions in the form of bankruptcy proceedings, the company’s contracting party will be exposed to additional risk while deciding to start cooperation (and sometimes will resign from a very attractive but risky contract).

Contrary to the appearances, this case is much more complicated than it may initially appear to an outside observer (

Horváthová and Mokrišová 2018). An application for a declaration of insolvency of an enterprise is filed in court when there is a well-founded fear that the debtor’s assets are too small to pay off most of his liabilities. This often happens too late even to pay off a small part of them. Thus, by definition, we are dealing with a deficit in the value of assets. The assets must, however, be large enough for the accumulated resources to at least cover the administrative costs of the bankruptcy proceedings itself (while the surplus may be divided, in accordance with the law, between creditors). Therefore, unacceptable is the situation in which there are unexpectedly insufficient funds for actions provided for under the procedure during the ongoing bankruptcy proceedings. The decision-maker (in this case a judge of the commercial court) who decides whether or not to initiate bankruptcy proceedings bears a very large responsibility in these circumstances. The difficulty of the situation results from the limited access to the necessary information, which, in addition, to a large extent is only a forecast or accounting data, the value of which often significantly differs from the selling value of the debtor’s assets (

Mączyńska 2009;

Bauer 2014;

Bauer 2015).

Estimating the value of assets of a bankrupt organization can be carried out while using many different methods, however, the final verification of the accuracy of the assumptions that are made will take place on the free market when the moment of actual sale of the entire enterprise or its individual elements (which make up the value of the bankruptcy estate) takes place. The moment of the valuation may be significantly distant in time from the sale of the asset. According to the Doing Business report, the average duration of bankruptcy proceedings in Poland is approx. 3 years (

World Bank Group 2017, p. 232). In addition, the price that will be obtained will be the result of a combination of various current conditions (such as the temporary financial capacity of a potential buyer, a change in the value of a bankrupt enterprise as a result of changes in demand for its products or services, or events such as further development of a pandemic) and as a result this price may significantly differ from the expectations (

Budzanowska-Drzewiecka et al. 2016). It may happen that some elements will have a higher value when they are combined into a whole (synergy effect), while when some component is missing, the value of the remaining set will dramatically decrease (this is the situation in the case of technological lines built from a set of devices that can also work separately). Taking into consideration the fact that the main contribution of the paper is the description of the verified tool in a form of the applied survey which was used to construct the hierarchy of significance of different types of information relating to the risk of conducting bankruptcy proceedings, the main findings show that insolvency specialists prioritize the information (financial and also not financial) not originating from financial reporting. In general, the launch of bankruptcy proceedings can also be viewed in terms of the sustainable development of the system of cooperating entities. The weakest entities that manage assets ineffectively are eliminated and the assets themselves go to new owners who are able to use them better. However, this will only happen if the entire process is professionally carried out and based on a reliable and realistic valuation.

2. Background

Two basic issues should be clarified when considering the role of information in assessing the risk of conducting bankruptcy proceedings. The first is the answer to the question about the nature of information, i.e., its features, which are of key importance from the perspective of the possibility of using it in a reliable process of assessing the value of the assets of a bankrupt organization. It is the properties characterizing the information itself that determine whether the right decision will be made owing to its correct interpretation (

Dziekoński 2017). The second question concerns the types of information sources that are used in the analyzed assessment procedure.

2.1. Features of Information Influencing the Risk Assessment in the Process of Property Valuation

Information is an extremely difficult concept to define, which results in the fact that there are many proposals to describe it. It can be said that the situational approach is dominant, in which the perspective of the needs in which information is used determines the way of defining information. Currently, however, there is a certain consensus that allows us to state that in the case of information we are dealing with some kind of intangible resource. This resource is created as a contractual (i.e., recorded according to a certain fixed notation) reflection of some aspect of dynamic reality. Then, such a mapping is the basis for indicating the originally registered feature of reality. Therefore, we are dealing with a certain model of reality that to a greater or lesser extent corresponds to the needs and expectations of the subject performing its interpretation (

Burgin 2019). The accuracy of the decision to start or resign from bankruptcy proceedings depends on the role of the information used on this occasion. This is determined by the circumstances, the scope of which results primarily from the answers to the following questions (

Wolfengagen et al. 2019;

Birchler and Bütler 2007;

Barkova et al. 2017):

Does the decision-maker potentially have access to information on phenomena, the description of which he will actually need?

Will the information be up to date?

Will the information faithfully reflect the assessed reality?

Will the information be complete?

Will the information be interpretable?

Will the information be unambiguous?

Does the form of recording information allow for its further analysis and use in the decision-making process?

Can information be obtained with the means available to the decision maker?

Does the information represent the required level of detail?

Does the information come from a reliable source?

Can the information be attributed to a specific source?

Does the information detail the image of the analyzed reality or does it repeat what already possessed information contains?

Does the information have elements that allow it to be identified and easily found in a larger set?

Does the information help to improve the accuracy of the decisions made?

Could the information have been manipulated or distorted by the influence of additional factors, people or phenomena?

Does the information properly highlight the key aspects of the characterized reality?

As a result of providing an unsatisfactory answer to a certain subset of the above questions, which relate to one or several of the above circumstances, there appears dysfunctional situation that leads, among others, to the following consequences (

Czekaj 2012;

Mindt 2017):

Inability to find the necessary information due to its excess;

Inability to use information due to its incompleteness;

Inability to use the information due to its lack of clarity;

Inability to use information due to its internal contradiction;

The inability to use the information because of the fact that the information is out of date.

The above-mentioned consequences of the occurrence of unfavorable circumstances, which significantly affect the effects of using information in the process of assessing the risk of conducting bankruptcy proceedings, may ultimately lead to a wrong decision. The judge making such a decision must be able to assess the risk of making a mistake and effectively minimize it. In pursuing this goal, the judge analyzes various documents, which are usually burdened with various defects resulting from the occurrence of the above-mentioned circumstances and their consequences (

Stańczyk et al. 2020). Therefore, in the following part of the discussion, typical information that appears in the process of making a decision about whether to proceed to bankruptcy proceedings will be discussed and critically analyzed.

2.2. Typical Information Constituting Basis for Insolvency Proceedings Risk Assessment

The needs of enterprises going bankrupt and their stakeholders in the field of information and types of such information can be viewed from both scientific as well as legal standpoint. Both approaches are linked to the judicial practice of bankruptcy proceedings. The accepted basis for the study in this topic is the statement cited in the literature that one of the undisputed roles of a bankruptcy proceedings is the reduction of information asymmetry (see i.a.

Smith and Strömberg 2005;

Bauer 2018a,

2018b). Analyses concerning different legal solutions should be conducted with the use of economic knowledge (

Stiglitz 2004, p. 9). Actions aiming at improved diagnosis of the problem of enterprise bankruptcy should serve inhibiting the spread of negative consequences of bankruptcy (

Mączyńska 2008), thus favoring not only the stakeholder of the bankrupt, but also the entire society, and even contribute to improved functioning of economies at an international scale, which is in general embodied by the idea of sustainable development.

Scientific research emphasizes the role of financial information in the assessment of an indebted enterprise. Special attention is assigned to the information that originates from financial statements of the obligor (

Wędzki 2015;

Zorn et al. 2017). Various types of information are discussed in literature as significant and even of priority for the conduct of a bankruptcy proceedings. Special rank is assigned to the information on the costs of bankruptcy proceedings and valuation of assets of the obligor. The reporting information, particularly referring to the going concern assumption is indicated as a significant supplement of the decision process (

Bauer and Hospodka 2020).

Literature studies have shown that the information on the costs of bankruptcy proceedings is of key significance for the initiation and conduct of a judicial process (e.g.,

Altman and Hotchkiss 2006;

Marsh 2010;

Finch 2012;

Morawska 2013;

Bauer 2013;

Prusak et al. 2019;

Staszkiewicz and Morawska 2019;

Bauer and Hospodka 2020). The significance of the bankruptcy proceedings cost estimation stems from the fact that it constitutes high value as compared to the value of the bankrupt’s assets. It has been even ironically referred to as one has to be rich for court to announce bankruptcy (

Marsh 2010). This is confirmed by the empirical studies conducted in Poland showing that the cost of a bankruptcy proceedings comprise as much as 35% of the bankruptcy estate (

Morawska 2013). Confirmation of the role of their calculation is also the standpoint of bankruptcy specialists indicating that the information on the costs of bankruptcy proceedings is of key significance for the bankruptcy process. Close to 83% respondents stated that this information is important (

Bauer and Hospodka 2020).

Another information mentioned in literature as necessary for a bankruptcy proceedings is the data on the value of the obligor’s assets and the correct measurement of the value of assets of companies, for which there is a risk for the continuation of operation or bankruptcy (see i.a.

Newton 2010;

Altman and Hotchkiss 2006;

Bauer 2014;

Bauer 2015). Despite the justified concerns regarding the capacity of an entity to continue its operation, they pursue their business activity, and the users of financial statements make business decisions (for example, entrepreneur make decisions on future business opportunities, business partners make decisions on continuing cooperation, courts issue basis for announcing bankruptcy). The role of bankruptcy institution in the reduction of informational asymmetry is strictly related to the information on the assets of the obligor. This should be favored by legal regulations (

Smith and Strömberg 2005), which aim at supporting honesty and discipline in managing the finances of a bankrupt business (

Wessels et al. 2009). From the viewpoint of the risk of bankruptcy process, the information on the valuation of obligor assets is important already at the preliminary stage of the proceedings. It is used as a comparative value for the estimated costs of bankruptcy proceedings. A problematic issue is to select the suitable valuation measure. In the case of judicial bankruptcy proceedings, two measures are used at the same time: book value and estimated commercial (liquidation) value of the assets. There are reservations as to the role of information originating from financial statements, because the book value does not fully reflect the commercial value of the assets, and it can even markedly differ (

Mączyńska 2009;

Bauer 2014;

Bauer 2015). Estimated values are also not the perfect measure, because they are not free from the impact of the intention of the person making the estimations. The obligor may manipulate the estimations in order to obtain the expected benefits, e.g. overestimate the estimated assets value in order to exhibit the capacity to cover costs of bankruptcy proceedings (

Altman and Hotchkiss 2006). During a research concerning the significance of the information on the book value of assets, Polish insolvency specialists have indicated it as important for the transparency of the bankruptcy process (

Bauer and Hospodka 2020). Therefore, it appears advisable to use more than one measure of assets value in a bankruptcy process.

Using the information concerning bookkeeping valuation requires the knowledge of the methods assumed. The information on the assumed or rejected going concern assumption is the priority information. Although the objective of bankruptcy proceedings is liquidation of the obligor’s assets and settlement of claims of creditors to the greatest possible extent, the practice of bankruptcy proceedings shows that there are cases where entities while preparing a financial statement for the purpose of commencing a bankruptcy proceedings prepare them with the going concern assumption (

Górowski 2016, p. 244;

Bauer 2016, p. 130). In practice, making the decision on assuming business continuation is not easy. In some cases, it requires the preparation of a multi-annual economic forecasts (

Górowski and Kurek 2019, pp. 186–89). However, it is one of the pieces of information expected from the stakeholders of a company undergoing a bankruptcy process (

Bauer and Hospodka 2020).

The content of the information base for bankruptcy processes is regulated by the provisions of national law. Legal regulations in this field are highly diverse. In many countries, the laws oblige the debtor to submit information on the value of assets already upon initiating the bankruptcy proceedings, such as lists of estate assets and claims, sometimes financial statements or preliminary valuation of its assets (

Smith and Strömberg 2005). The approach of the USA has been indicated as the most detailed one in the field of financial information. US GAAP represents the most detailed approach to bankruptcy bookkeeping. Also the scientific studies concerning this topic are much more comprehensive than in other countries (e.g.,

Newton 2010;

Haskin and Haskin 2012). Valuation in liquidation values is indicated in the USA as the correct approach to valuation in terms of bankruptcy. Apart from the information on assets, costs related to sale of assets, as well as the potential revenues and costs which will be booked in the period of judicial proceedings are also calculated (

Bauer and Hospodka 2020).

Legal regulations concerning the information required for submission in court at the preliminary stage of the proceedings should be considered as rather comprehensive. Apart from the identification data of the obligor and their creditors, with the application for bankruptcy, the obligor is obliged to submit the current list of assets, with estimated valuation of their components, as well as a balance sheet prepared by the obligor for the purposes of the proceedings for a day within thirty days prior to the date of submitting the application (The Bankruptcy Law, article 23). In the context of this article, a conclusion arises that from the standpoint of a court, for the aptness of the decision made, both information on the balance sheet value as well as estimated value of the assets is required. Balance sheet further contains bookkeeping data concerning the values of individual liability groups. From the standpoint of a bankruptcy proceeding, the information on the value of the obligor’s liabilities might be particularly significant.

The information provided by the obligor are supplemented upon request of the court by the temporary court supervisor with the information on the financial status of the obligor, type and value of their assets, and the expected bankruptcy proceedings costs (The Bankruptcy Law article 38 para. 3). Information on the estimated bankruptcy proceedings costs is a priority for the commencement of bankruptcy proceeding, because if their value is greater than the assets value it forms the basis for rejection of the application for bankruptcy (The Banktuptcy Law 2003, article 13, 38). Therefore, from the viewpoint of bankruptcy law, the correct estimation of bankruptcy proceedings costs and obligor assets value is of key significance for restricting the risk of unjustified commencement of judicial proceedings due to low value of bankruptcy estate.

In the context of the above scientific considerations, as well as analysis of legal regulations it has been assumed that information is the key factor favoring minimization of the risk of insolvency proceedings failure, understood as the incapability to cover at least the costs of bankruptcy proceedings. This task is covered by the reduction of the information asymmetry between the stakeholders having access to the complete documentation of the obligor and preparing information for court, and the key stakeholders making decisions in the bankruptcy process, i.e., the judges.

3. Method

The empirical data collection process was conducted based on the survey studies, which were participated by 103 specialists in the field of insolvency. Another group of respondents comprised of key decision-makers participating in the decision-making process on the commencement or resignation of bankruptcy proceedings. This group included commercial court judges, restructurization advisors, administrative receivers, and certified auditors.

The research sample included:

29 judges conducting bankruptcy proceedings,

12 members of the Minister of Justice Council for the Amendment of Bankruptcy and Reorganisation Law,

96 people who have declared that they have practical experience in bankruptcy proceedings conducted in 2013–2015; 62 of them have declared to also have practical experience in proceedings under the Bankruptcy law that went into effect in 2016.

Fifteen respondents indicated double occupational affiliation. The sample group includes a large percentage of insolvency judges. According to the data of the Association of Restructuring and Bankruptcy Judges, there are twelve departments in Poland dealing exclusively with bankruptcy cases. There are a total of 87.8 job positions for judges in these departments. In addition, there are eighteen economic departments, which also deal with bankruptcy cases. However, there is no known number of judges who deal with bankruptcy proceedings in these departments.

The sample group includes answers of almost 43% of all the members of the Justice Council for the Amendment of the Bankruptcy and Reorganisation Law. The council consists of 28 members (

Ministry of Justice 2012).

The population size of bankrupt entities, including the number of insolvency specialists in Poland affects the restrictions concerning the possibility of conducting statistical analysis with division into subgroups of respondents representing specific professions. Furthermore, an additional issue linked to the distinction of individual respondent groups is the fact that a considerable majority of them declared more than 1 profession (e.g., a judge who is at the same time an academic employee for jurisprudence).

Although the study was conducted in one country (in Poland), it has considerably more comprehensive scale than just national. In the era of globalization, the difficulties of individual enterprises are transferred between countries, therefore legal regulations in the field of bankruptcy may have a considerably greater impact than within one country. Moreover, selection of Poland is valid because this is the country where requirements for documentation submitted at a court are relatively extensive. For example, in Czechia, which has a similar history of changes after the change from centrally planned economy to market economy, the information base for insolvency processes does not contain any elements of financial statement (more on the topic:

Bauer and Hospodka 2021). Therefore, results of the presented analysis may constitute a reference point for other countries as well.

The study included a series of issues from the field of the course of bankruptcy proceeding, however for the purpose of the titled considerations only the questions concerning the assessment of individual information types in the process of making decision on commencing bankruptcy proceedings. The empirical research carried out is part of a much broader research project regarding the informational role of accounting in restructuring and insolvency proceedings. The questionnaire contains 149 detailed questions. Three types of information (more on the topic:

Bauer and Hospodka 2020) were used for the purpose of an earlier article (which was a starting point for the exploration of the investigated problematics) concerning the role of financial information in ensuring information transparency of an insolvency proceedings.

These questions concerned:

The costs of bankruptcy proceedings,

The going concern assumption adopted in the financial statements,

The book value of assets.

In the present article, these three questions will be used in a set with five additional questions in a new context and objective, which is determination of the hierarchy of types of information indicated as significant for ensuring informational transparency of a bankruptcy proceeding, and thus minimization of the risk of failure of its conduct. The term of informational transparency of a bankruptcy proceeding, found in publications devoted to the discussed problematics has been fine-tuned as a result of literature study (e.g.,

Bushman and Smith 2003, p. 76;

Bushman et al. 2004;

Anctil et al. 2004;

Turilli and Floridi 2009, p. 105) and it means the situation when:

All stakeholders accept the decision regarding bankruptcy proceedings as a logical consequence of a confidentiality by the court,

Based on the information included in the information database of the process, stakeholders who have sufficient economic knowledge are capable of assessing the financial standing of the obligor on their own.

Questions of the survey were closed, and the used scale of the possible answers had five levels, where 1 means completely irrelevant information and 5 means crucial information. “I don’t know” or “not applicable” was a possible answer to each question. “I don’t know” means that the respondent does not know the correct answer and resigns from responding on the scale. “Not applicable” means that the respondent did not encounter such a case in his professional practice before, thus he/she is unable to provide answer on the scale.

Surveys in which respondents left fields without any value were also taken into account at the stage of data analysis. The survey contained the following questions:

Q1: Please evaluate the significance of information on the costs of bankruptcy proceedings for ensuring the informational transparency of bankruptcy proceedings.

Q2: Please evaluate the significance of information on the assumption adopted in the financial statements on the absence of entity’s ability to going concern assumption.

Q3: Please evaluate the significance of the information on the assets book value.

Q4: Please evaluate the significance of the information on the course of bankruptcy proceedings.

Q5: Please evaluate the significance of the information on the estimated net liquidation value.

Q6: Please evaluate the significance of the information on the book value.

Q7: Please evaluate the importance of information from the financial statements prepared for a day in a period of 30 days before submitting the application.

Q8: Please evaluate the importance of information on the net liquidation value of assets.

The basic thesis assumed in the considerations is the assumption that certain of the typical information used within the framework of bankruptcy proceedings risk is necessary to make the correct decision. This means that ensuring informational transparency is linked to minimizing the risk of bankruptcy proceedings, as it provides the basis for making the correct decision that is pursuant to the provisions of law. Therefore, the following research questions can be formulated:

Which of the typical bits of information used within the framework of bankruptcy proceedings risk is necessary to make the correct decision?

Of the typical information used as part of the risk assessment of bankruptcy proceedings, which are usually taken into account in such a situation, are there elements that are actually unnecessary?

Are there any combinations (perhaps an alternative to each other) of correlated types of information that jointly determine the accuracy of assessing the legitimacy for conducting bankruptcy proceeding?

Analysis of the contents discussed in the theoretical part of the considerations enables making certain hypotheses, which may aid explaining the investigated problem:

H1: Financial information that does not originate from financial statements are of key importance for the conduct of a bankruptcy proceedings.

H2: Financial information that originates from financial statements are significant for the conduct of bankruptcy proceedings.

H3: Financial information originating and not originating from financial statements bear similar significance in the opinion of respondents.

H4: Information concerning the course of a bankruptcy proceedings is of lower significance than financial information.

Financial information originating from financial statements was classified to those included in questions Q2, Q3, Q6, and Q7.

Financial information not originating from financial statements was classified to those included in questions Q1, Q5, and Q8.

Question on the information about the course of bankruptcy proceedings is included in Q4.

The study applied basic statistical analysis of answers to survey questions, and then the potential scope of correlations between them was analyzed.

As shown by the conducted international literature review, the presented study is of precursor nature. Therefore, it is impossible to compare it with results from other countries. However, the concept of bankruptcy proceedings objective (i.e., its efficient conduct, reliable settlement of creditors’ claims) remains universal. Also, the reduction of informational asymmetry and providing for the informational needs of the stakeholders, which may translate into minimized risk of bankruptcy proceedings is of universal nature. The informational needs may differ between countries due to the professional experience of respondents. Therefore, conducting the study in Poland can be viewed as valid, considering the extensiveness of informational requirements in bankruptcy proceedings, and thus the experience of insolvency practitioners utilizing different sources of information is relatively comprehensive.

4. Results

The presentation of the research results consists of three parts that are discussed one after another. The first describes the results of the basic statistical analysis of each of the three questions. The second section provides a ranking that allows to evaluate the relative importance of each of the three types of information. The third discusses the correlations between the responses given by the respondents to the three consecutive questions.

The authors are aware that the 5-point Likert scale indicates the use of an ordinal variable. Therefore, as a part of the analysis, the authors present the distribution of the results as divided into fractions that can be distinguished in the set of answers indicated by the respondents (and they use Rho to calculate the correlation). However, due to the possibility of interpretation and synthesis of the results, the authors also use the mean value (as a measure of typicality) and standard deviation (which is a synthetic approach to the differentiation of responses). This is justified due to the fact that the purpose of the analysis is not to study the factors differentiating the opinions of respondents, but the purpose is to give a general, relative value to the respective types of information (and, consequently, to propose their hierarchical arrangement). Such an approach is acceptable in the case of scientific analysis of a similar nature.

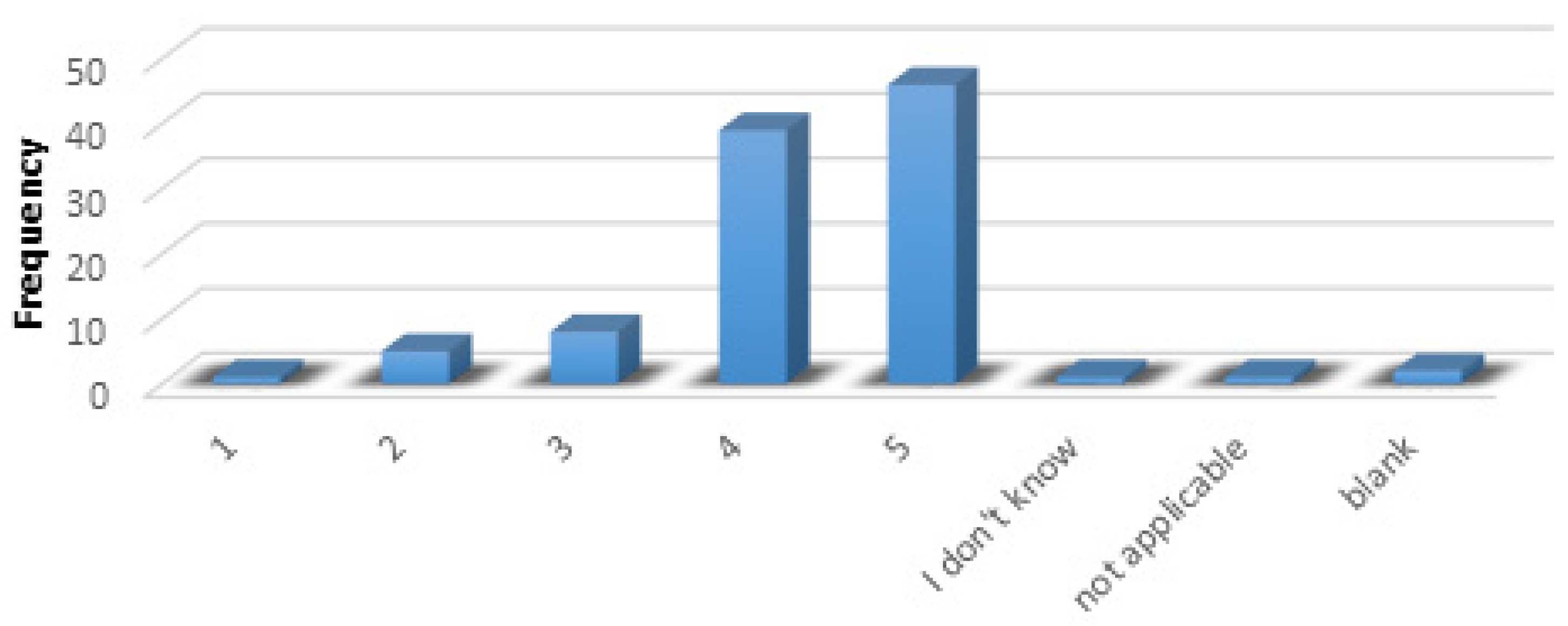

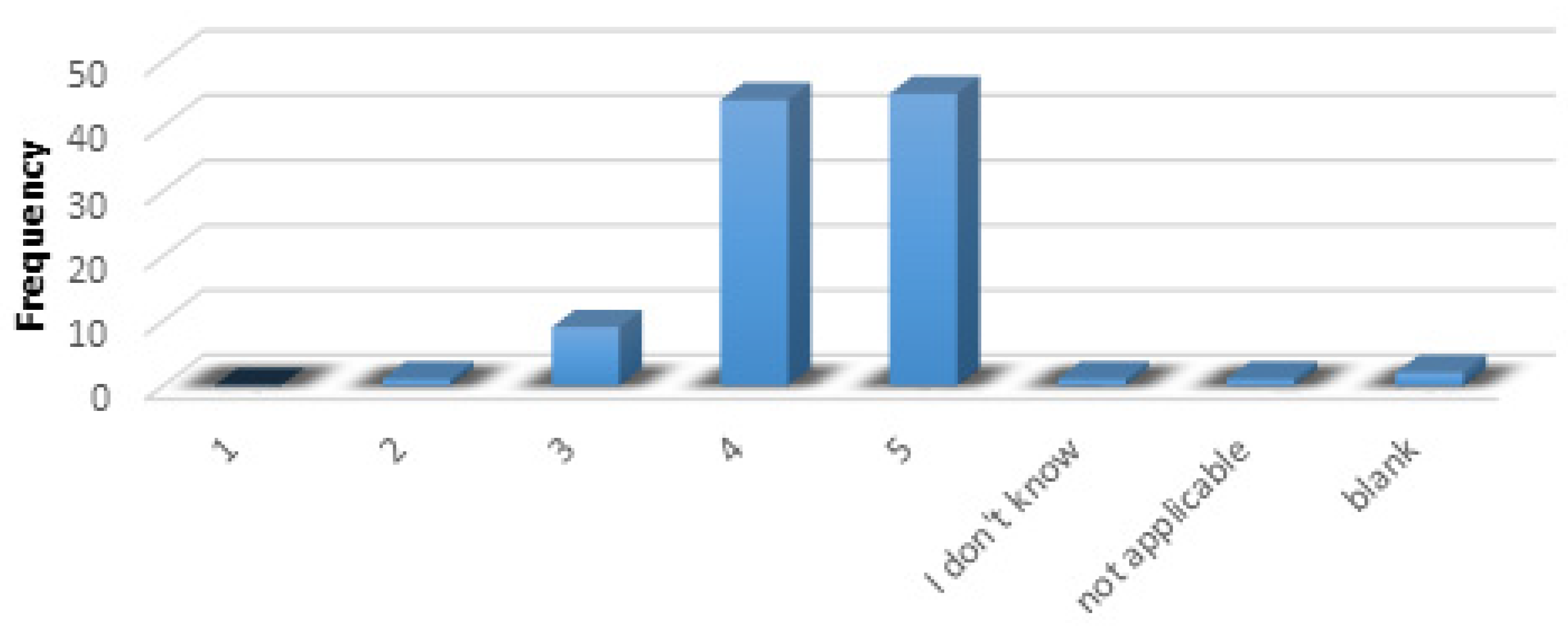

As for the data characterizing the first question regarding the significance of information on the costs of bankruptcy proceedings (

Figure 1), the most numerous group of respondents chose the answer indicating value 5—it was 46 individuals. The second most frequent option—with a result only slightly worse, because it was based on the opinion of 39 individuals out of 103 respondents—was the answer assigned to value 4. The next options were chosen much less frequently: value 3 was chosen by 8 individuals, value 2 was chosen by 5 individuals and the value 1 was chosen by only 1 person. Among other available options, the answer “I don’t know” appeared once in the survey results, also on one occasion there was chosen the option “not applicable” and the field was also left blank twice.

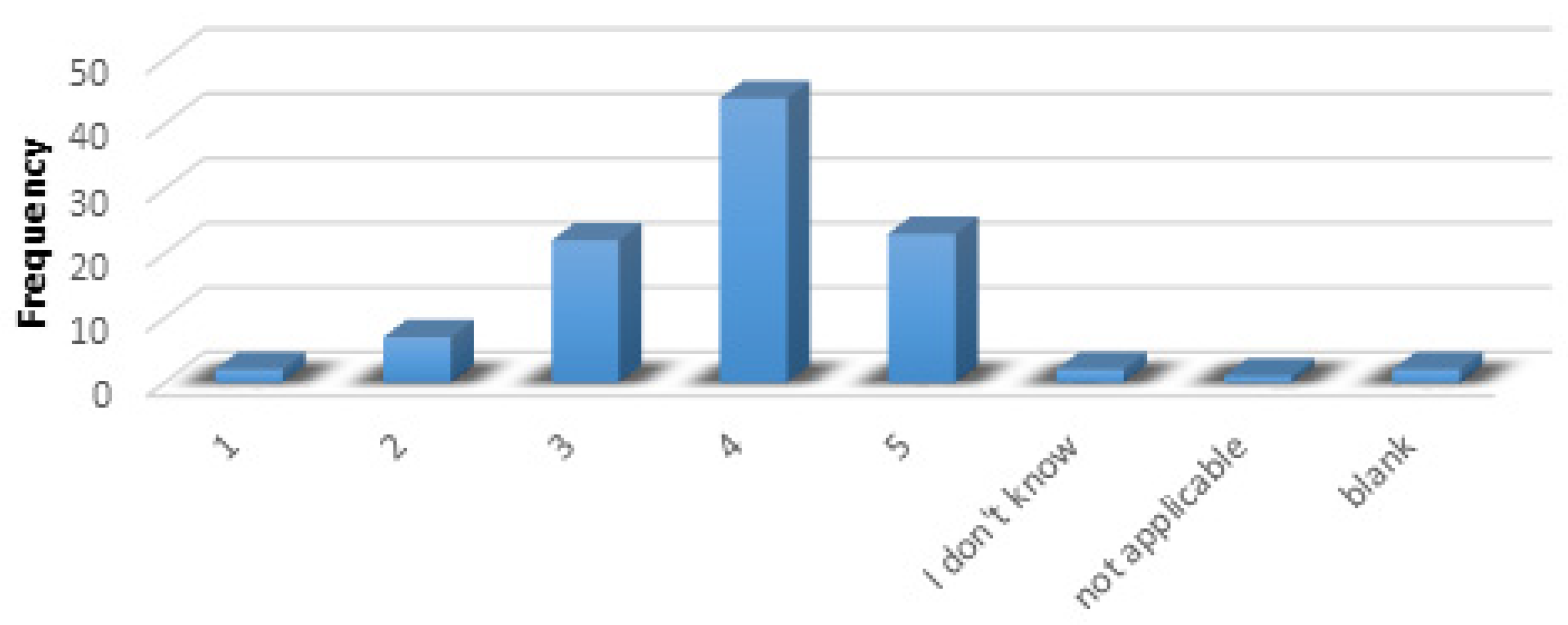

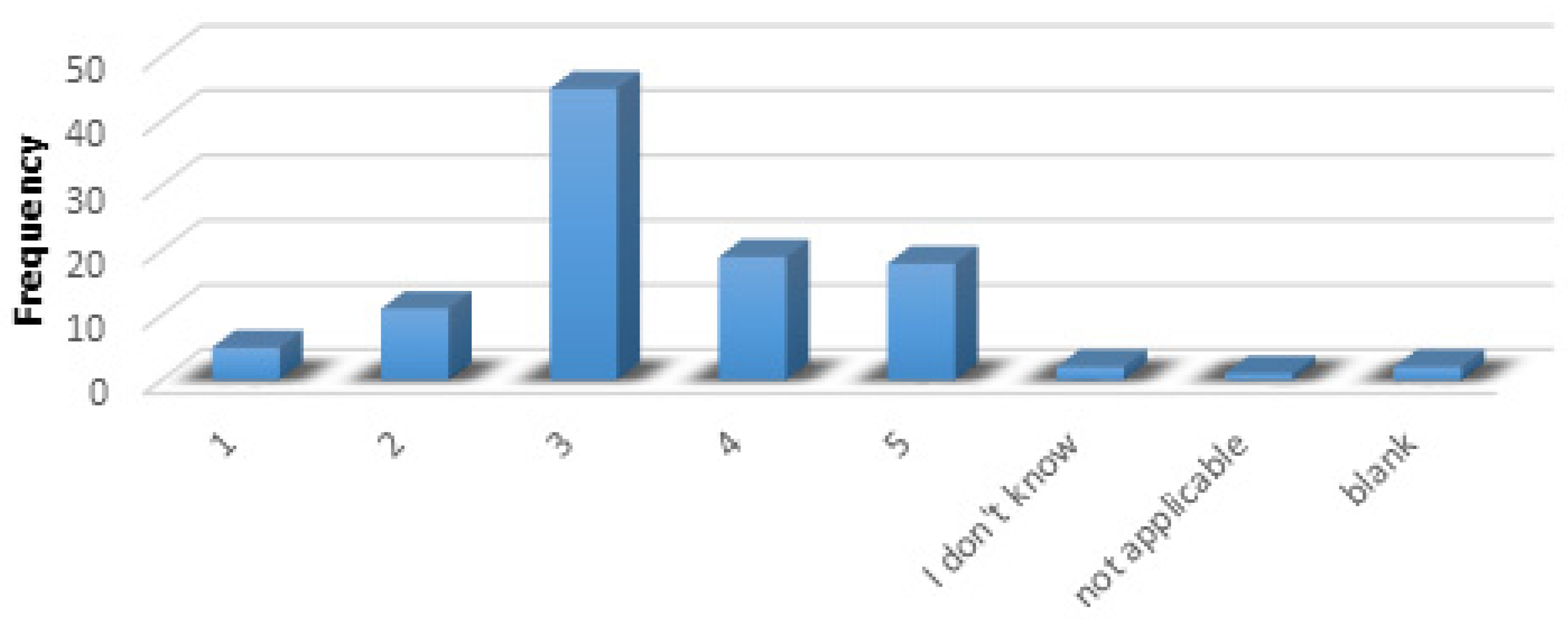

Responses to the second question regarding the significance of information on the assumption adopted in the financial statements on the absence of entity’s ability to going concern assumption (

Figure 2) were clearly dominated by the choice of the option indicating the value of 4. This judgment was expressed by 44 respondents. Values 5 and 3 were indicated by a very similar group of individuals, because 23 and 22 respondents, respectively, did so. Only 7 individuals chose the option with a value of 2 and only 2 respondents chose to indicate the value 1. Like in the case with the first question, thus so in case of the second question 2 blank fields were registered. There appeared 1 indication for the answer “does not apply” and twice there appeared “I do not know.”

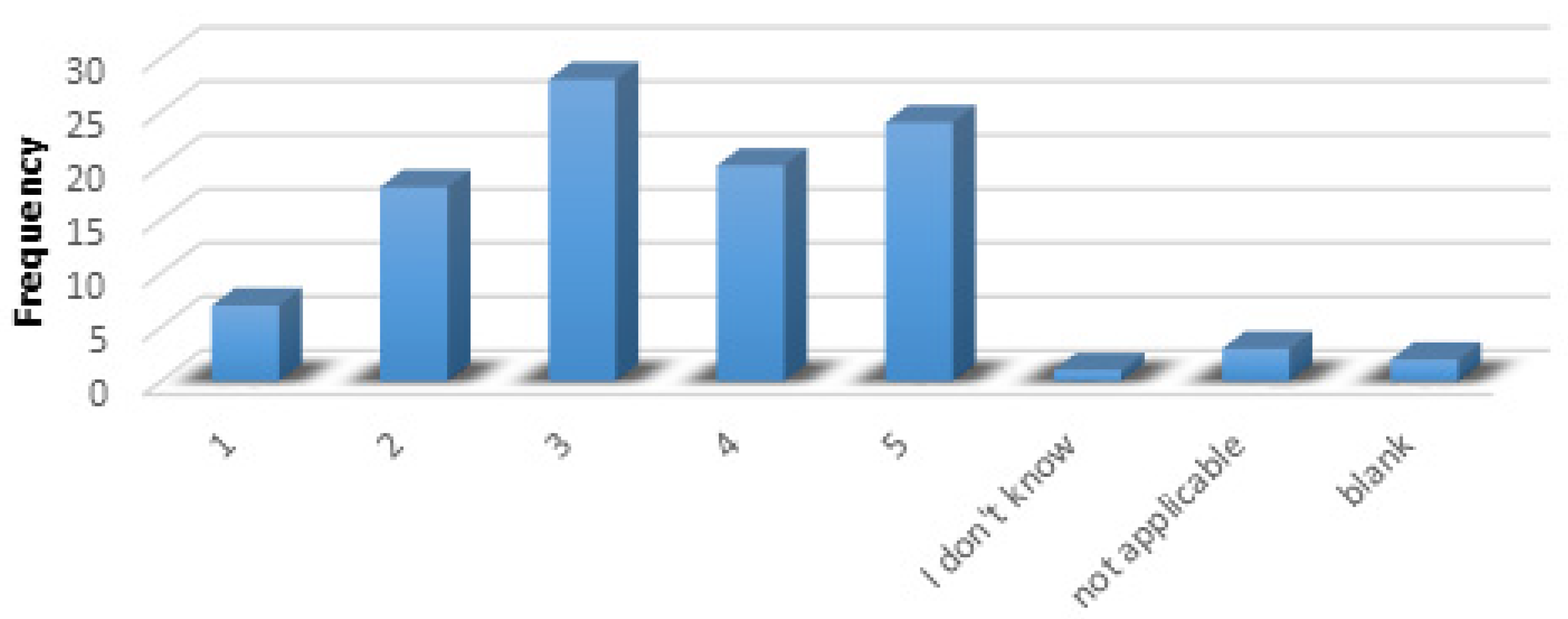

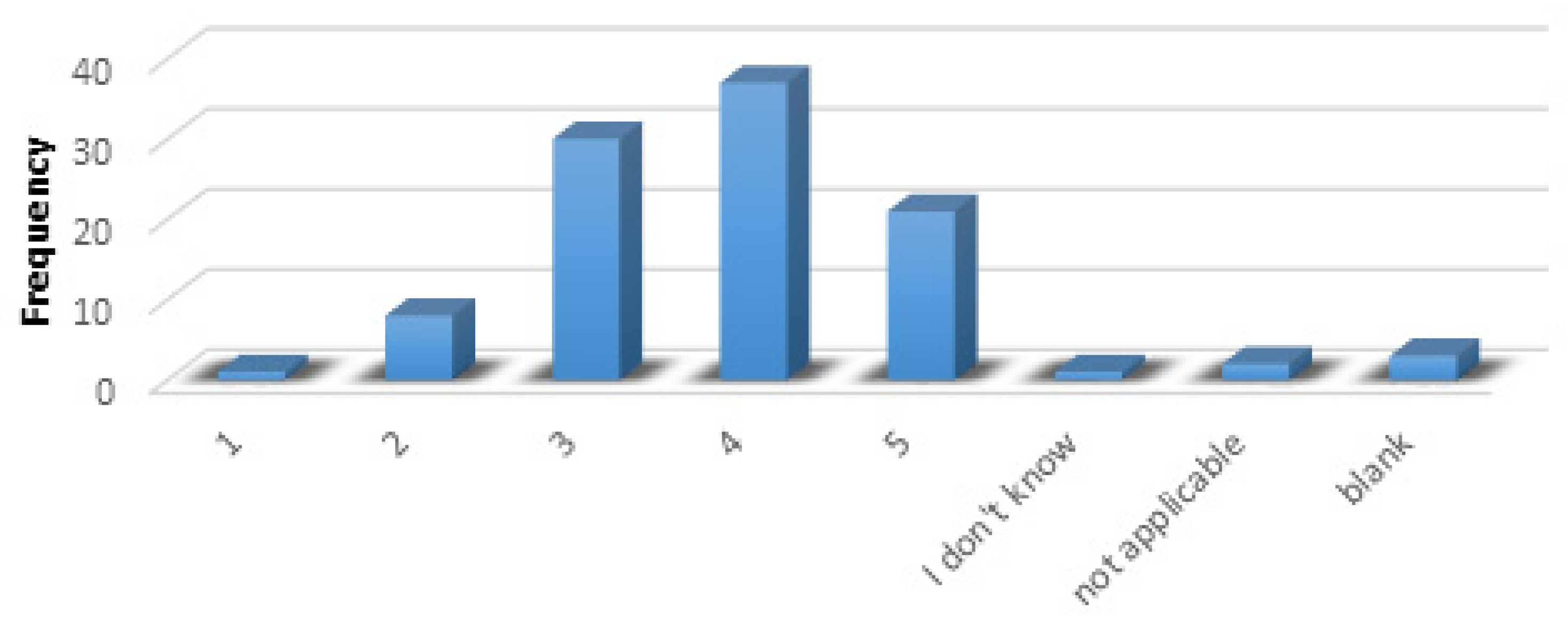

The answers to the third question regarding the significance of the information on the assets book value (

Figure 3) are the most even, although the dominant value can also be indicated here. Total of 28 individuals chose the answer to which the value 3 was assigned. The next option in terms of the frequency of occurrence in the survey results—i.e., the value 5—was indicated by 24 respondents. About 20 other individuals decided to express their opinion by choosing value 4. The answer assigned to the value 2 collected 18 responses, and the value 1 was selected by 7 respondents. Three individuals answered by choosing the option “not applicable,” 1 person decided to answer “I don’t know” and 2 other individuals left the field blank in the questionnaire.

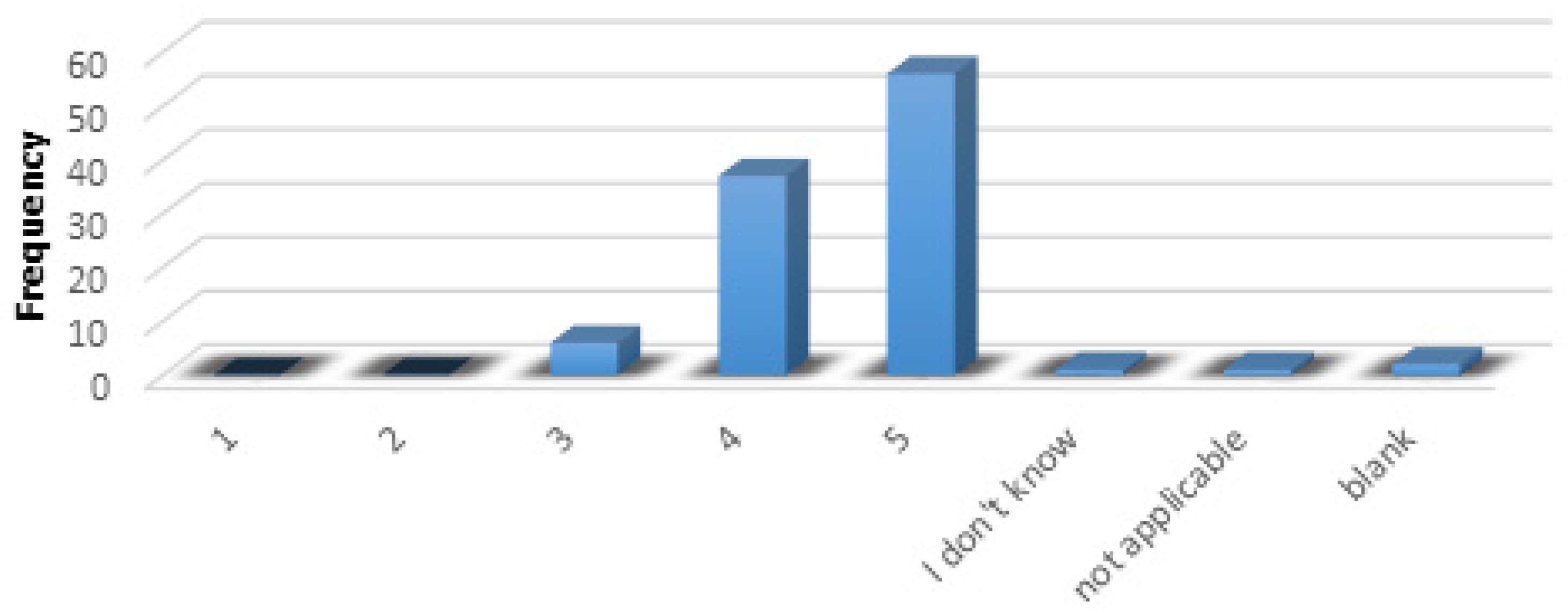

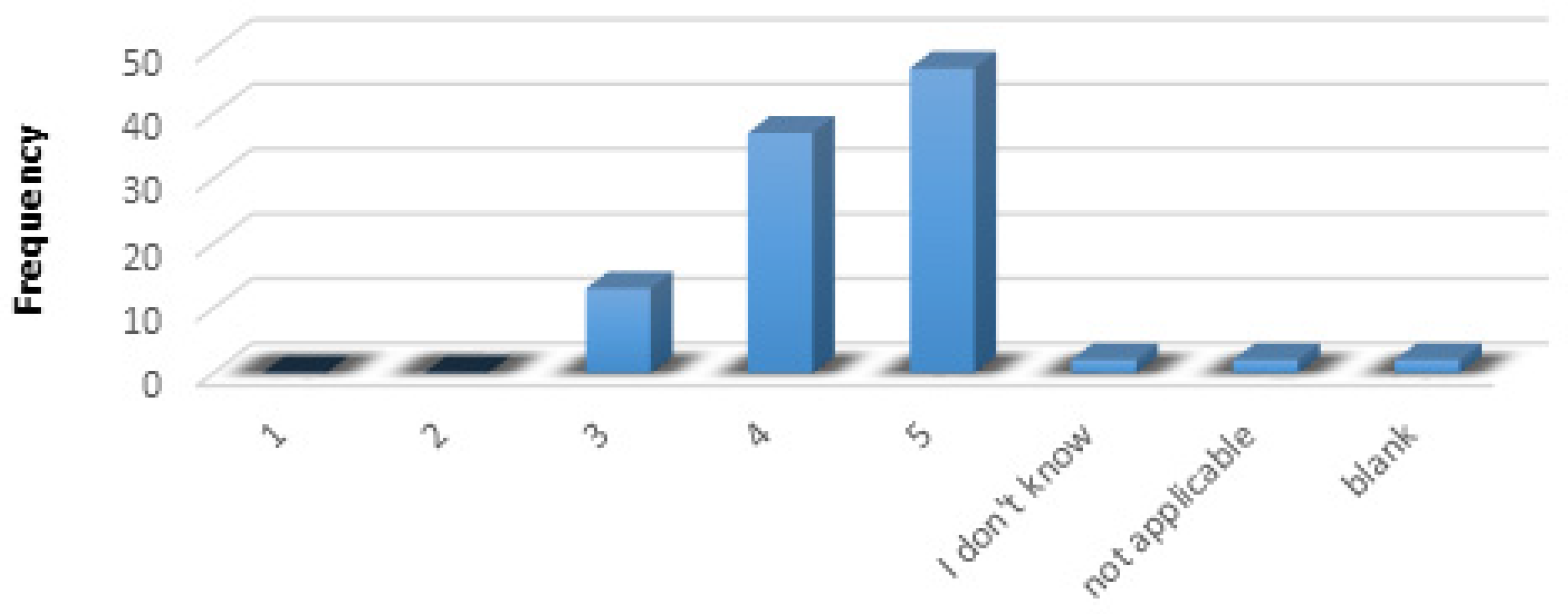

In case of the fourth question regarding the significance of the information on the course of bankruptcy proceedings (

Figure 4), the value of 5 was definitely the most frequent (56 individuals selected it). Option 4 was the next most popular one as 37 respondents chose it. 6 individuals expressed their assessment pointing to a value of 3. 2 blank fields and 1 “not applicable” and 1 “don’t know” were registered. Nobody indicated the values 1 and 2. The results were clearly focused on the choice between the values 5 (more often) and 4 (slightly less often).

The set of answers to the fifth question regarding the significance of the information on the estimated net liquidation value (

Figure 5) is very similar to the analogous set characterizing question 1. The answer that indicates 5 (45 individuals) is dominant, but the difference, when compared to the indications to value 4, is very small (44 individuals). Against this background, the remaining options are represented to a very limited extent. Value 3 was chosen by 9 respondents and one respondent indicated value 2. Nobody decided to express his assessment with value 1. Additionally, answer “I don’t know” appeared once, the answer “does not apply” also once, and 2 respondents did not give any answers to the fifth question.

The graph illustrating the responses to the sixth question (

Figure 6), regarding the significance of the information on the book value, has a clearly different shape when compared with the previous question. The value of 3 dominates in the indications of the respondents and this is the result of giving this type of answer by 45 individuals. Total of 19 respondents expressed their opinion by indicating value 4, and the next 18 respondents decided to choose the value 5 option. Value 2 appears 11 times in the set of answers while value 1 appears five times. Two individuals chose the answer “I don’t know,” 1 person indicated the option “not applicable,” twice an empty questionnaire field was registered in relation to question 6.

The seventh question, regarding the importance of information from the financial statements prepared for a day in a period of 30 days before submitting the application, has a slightly more flattened distribution of answers than the previous question (

Figure 7). The highest number of indications was recorded with option 4 (37 respondents did so). The value of 3 was the next one, chosen by 30 individuals. On the other hand the answer indicating value 5 was given by 21 respondents. Value 2 appeared eight times in the answer set and value 1 appeared only once. One person answered by choosing the option “I don’t know,” 2 individuals chose the option “not applicable,” and 3 persons left the seventh question without answering.

The last, eight question regarding the importance of information on the net liquidation value of assets (

Figure 8) is again characterized by a certain shift of the collected answers towards higher values. Option 5 was chosen by the greatest number, as many as 47 respondents. This is even more visible against the background of the next (in terms of frequency of occurrence) value, which is 4 and which was indicated by 37 individuals. About 13 times the value 3 appeared in the set of answers. However, no one decided to choose the options related to the values 1 and 2. The following options: “I don’t know,” “not applicable” or leaving the eighth question unanswered, were selected by two individuals in each of these three cases.

The detailed test results presented above have several characteristic properties. The answers to the fourth question are by far the most concentrated around the right end of the range that defines the scope of available values. The calculated mean value of the indications in this case is 4.51 (

Table 1). A similar phenomenon occurs when the analysis concerns the eighth question (average value at the level of 4.35), the fifth (average value at the level of 4.34) and the first one (average value at the level of 4.25). The dependence observed here consist in this that the higher the value of the answer, the larger group of individuals chose it (although the distance between the option denoting the values 5 and 4 in the case of the first and fifth questions is not large). In the case of the second question, it is also easy to indicate the dominant option, which was selected by indicating the value of 4. The value of 4 in the second question definitely dominates all other in terms of frequency of indications. Such a shift of the dominant option toward lower values results in a decrease in the average value, which in the case of summed answers to the second question was only 3.81. The next place in the ranking is occupied by the seventh question with an average value of 3.71 which precedes the third question (the average value here is 3.37). However, as one can read from the graphic illustration presenting the results of answers to the third question, there are two vertices of the graph, which is also the flattest one. The sixth question is an example of a further shift of the mean value of the answer toward the lower ranges of the set of available options as the mean score was 3.35. This result is close to the middle of the range, which includes all available options. This is confirmed by the highest frequency of selecting a value of 3. As a result of calculating the value of standard deviations for individual questions of the survey, it can be concluded that where the mean value is higher than 4, the respondents’ answers had to be closer one to another when compared with other cases. The analysis of the proportion indicator shows that its values only in the case of questions 1.4, 5, 8 reach a level higher than 0.80, while the estimation errors associated with this indicator reach a level lower than 0.08 (the proportion indicator combines responses indicating either high (4) or crucial (5) importance of information of a given type). This distinguishes the above group consisting of these four questions from all the other questions included in the survey, for which the proportion indicator assumes values lower than 0.66 and the estimation errors related to this indicator take values greater than 0.09.

The last issue that needs to be analyzed is the extent of the correlation between the answers given by the respondents to the survey questions (

Table 2). In the case of the first question, the latter is most strongly correlated with the fourth (correlation at the level of 0.61) and the fifth question (correlation at the level of 0.45). It should be remembered that this is the group of questions that scored the highest average score in the opinion of the respondents (the average value for each of these questions exceeded 4, which happened also only in the eighth question). The second question correlates most strongly with the seventh question (correlation at the level of 0.51). The third question is linked to the sixth question by a correlation at the level of 0.83 and to the seventh question at the level of 0.52. The fourth question is most closely correlated with the fifth (0.51) and eighth (0.52) questions. The fifth question shows the highest correlation with the eighth question (0.70) and then (as already mentioned) with the fourth question. The sixth question (apart from the aforementioned correlation with the third question) shows a notable correlation (0.50) in relation to the seventh question. Thus, the seventh question is most strongly connected with the second (0.51), third (0.52) and sixth (0.50) questions. The eighth question shows the highest correlation with the fifth (0.70) and fourth (0.52) questions. In general, the obtained results are characterized by high statistical significance—only in the case of the correlation of the first question with the sixth and seventh questions, the probability of an error is significantly higher.

5. Discussion and Conclusions

The discussed study results constitute a continuation of studies concerning the demand expressed by specialists in the field of insolvency for different types of information, both originating from financial statements as well as other sources. A comprehensive analysis aims at explaining the hierarchy of information contained in the bankruptcy process database. This article has focused on the information used at an early stage of bankruptcy process as bearing key significance for the minimization of bankruptcy proceedings risk. It was assumed that ensuring informational transparency is linked to minimizing the risk of bankruptcy proceedings, as it provides the basis for making the correct decision that is pursuant to the provisions of law.

As a result of the conducted study it was determined that mean evaluations of insolvency specialists concerning the significance of individual types of information are within the range from 3.35 to 4.51, thus all being above the mean value of the assumed scale (3.0). Moreover, the evaluations of information not originating from financial statements were higher (from 4.25 to 4.51) than for information originating from financial statements (from 3.35 to 3.81). In connection with the above observation, it should be assumed that the hypotheses H1 and H2 were positively verified. In both cases, the responses are above average. However, as stated in the hypotheses, higher mean values were obtained for financial information that did not originate from financial statements (questions Q1, Q5, and Q8) than the mean values obtained for financial information that originated from financial statements (questions Q2, Q3, Q6, and Q7). The H3 hypothesis was verified negatively since the information that did not originate from financial statements had a clearly higher average rating than the information derived from financial statements. Results of the study have confirmed the outcomes obtained from the literature review (e.g.,

Altman and Hotchkiss 2006;

Marsh 2010;

Finch 2012;

Morawska 2013;

Bauer 2013;

Prusak et al. 2019;

Staszkiewicz and Morawska 2019;

Bauer and Hospodka 2020), stating that insolvency specialists prioritize the information not originating from financial reporting, i.e., information on the costs of bankruptcy proceedings, estimate valuations concerning assets value and commercial values. Insolvency specialists have put the greatest emphasis on the information concerning the course of bankruptcy proceedings, which are attached to judicial acts, both at the preliminary and main stage of bankruptcy proceedings. Therefore, it should be concluded that hypothesis H4 was verified negatively, which is confirmed by the answers to question Q4. In addition, the general picture presented by the alternative approach that consists in comparing the proportion indicators values which characterize the respective questions in the survey, seems to be fully convergent with the analysis already carried out. This indicator is based on the assumption that, in fact, the opinions of the respondents indicate only the above-average significance of a given type of information or the lack of such significance. Based on such a simple criterion, it can be concluded that in the set of eight types of information, there occur the differences leading to the conclusions described above.

Correlation between individual types of answers to all indications remained in the range from 0.16 to 0.83. The highest correlation level (0.83) was exhibited by the correlation between the answer concerning importance of the information on the assets book value, and the information on the book value. Such dependence confirms the consistency of the assessments made. But in fact more notable are the correlations which allow two groups of related questions to emerge. The first one embraces questions referring to the significance of information: on the costs of bankruptcy proceedings, on the course of bankruptcy proceedings, on the estimated net liquidation value, on the net liquidation value of assets. The second group embraces questions referring to the significance of information: on the going concern assumption, on the assets book value, on the book value, from the financial statements prepared for a day in a period of 30 days before submitting the application. The information database of an insolvency process contains information on book value originating from balance sheet. However, the Polish provisions of law being in effect from 2009 do not order submitting at court the additional information to the financial statements—such as the information on the going concern assumption (

Bauer and Hospodka 2021). Answers of the respondents may indicate the need of introducing changes to the provisions of law concerning the analyzed types of information.

Results of the study are not of a directly applicational character. Its objective was to discover the opinion of the respondents, who have practical or scholar experience, and who often combine theory with practice of bankruptcy proceedings in Poland. Finding out the opinion of the respondents who are stakeholders in bankruptcy proceedings by examining their satisfaction with the information provided aims at determining the usability of individual information types. As pointed out by

Mączyńska (

2008), for instance, the bankruptcy diagnosis itself may contribute to the minimization of negative outcomes of the phenomenon. As shown by the literature review, the study presented in the article is of a precursor nature. The aim of the authors is to induce the circles of scientists and practitioners focusing on the problem of bankruptcy to undertake analogous research in other European countries. In particular, the aim is to propose a standard for a research procedure suitable for duplication in other countries, which would allow a comparable diagnosis of the informational needs of stakeholders of bankrupt entities in countries other than Poland. This may positively affect the changes in informational requirements in bankruptcy processes on an international scale. By developing universal standards as a result of the analysis of many cases, it will also be possible to use such knowledge in the work of professions such as an actuary in the future. The knowledge of which information is crucial to take a relevant decision to commence bankruptcy proceedings allows to estimate the consequences of their possible absence, limited scope, ambiguity or low reliability. Therefore, the article constitutes an open discussion, which in effect may lead to the development of a standard objectivizing assessment of bankruptcy proceedings risk, which in times of globalization, seems to be invaluable.

The research results contribute to further analyses related to the role of information in the insolvency proceedings. The relatively small population of insolvency specialists in Poland is a limitation to the conducted study. Furthermore, a certain limitation is the lack of accurate data on the size of the population from which respondents representing certain functions in bankruptcy processes originate, e.g., the number of court departments conducting bankruptcy proceedings in Poland. However, no data are available on a specific number of judges conducting bankruptcy proceedings. It is also problematic for the survey to reach respondents dealing with bankruptcy cases in other countries than the Poland, where the research has been carried out. However, the authors believe that owing to the significance of the subject it will contribute to undertaking analogous research in other countries. Studies related to the information used in insolvency processes may contribute to reducing the risk of bankruptcy proceedings and favor efficiency of the actions taken. The research will be continued with regards to the methods of information transfer, constituting response to the need of stakeholders of bankrupt enterprises.