Financial Transactions Using FINTECH during the Covid-19 Crisis in Bulgaria

Abstract

1. Introduction

2. Literature Review

3. Research Objective and Methodology

- Null hypothesis H0—the status quo is real, “nothing interesting is happening”;

- Alternate hypothesis H1—what we are trying to demonstrate.

- The probability density function has the form:where t is a constant that depends on v.

- It is characterized by v degrees of freedom. Therefore, the designation tv fully describes the distribution.

- The distribution is symmetrical about zero.

- The distribution approaches the standard normal distribution as sample volume n increases. When n tends to infinity, the two distributions become identical.

- The percentage point or critical value of t, to the right of which lies a certain percentage (100α%) of the whole face of the surface locked between the probability density function p(t) and the horizontal axis t, is written as tv(α). Since t-distribution is symmetrical about zero, then .

- It is characterized by and degrees of freedom. Therefore, the notation fully describes the distribution.

- The distribution is positively asymmetric, i.e., right downloaded.

- = .

- The percentage point or critical value of F, to the right of which lies a certain percentage (100α%) of the entire face of the surface, locked between the probability density function p(F) and the horizontal axis F, is written as . The percentage points for different values of α and v1 and v2 are tabulated.

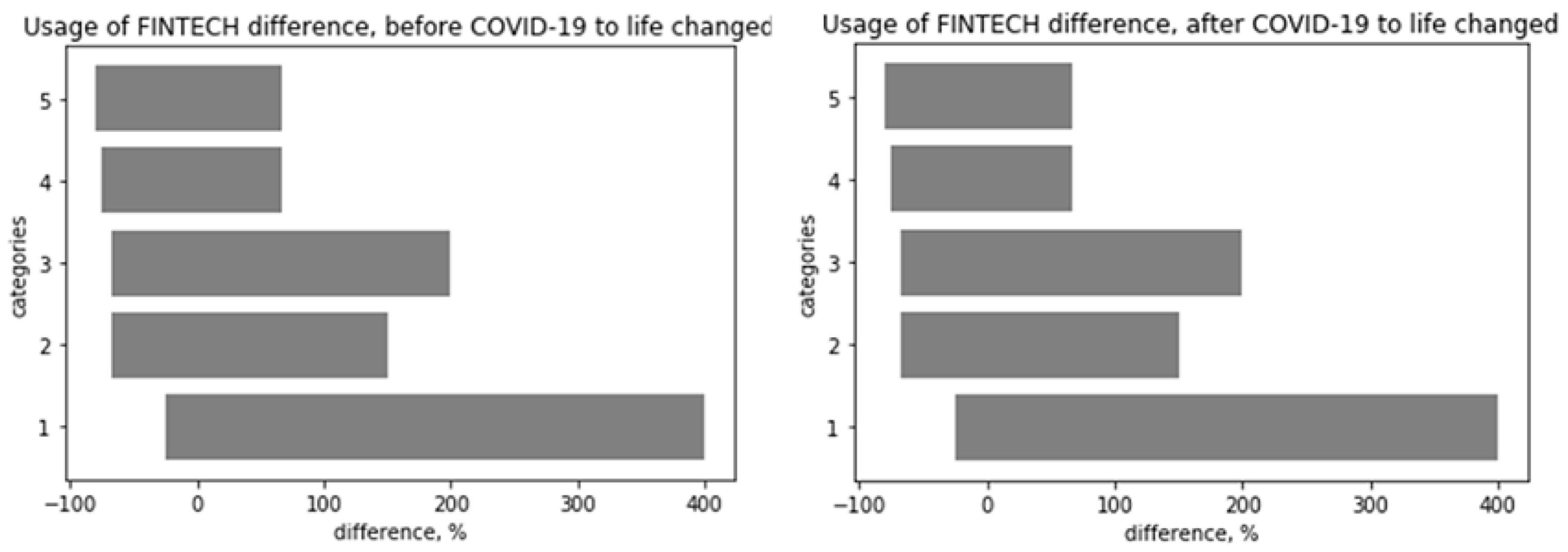

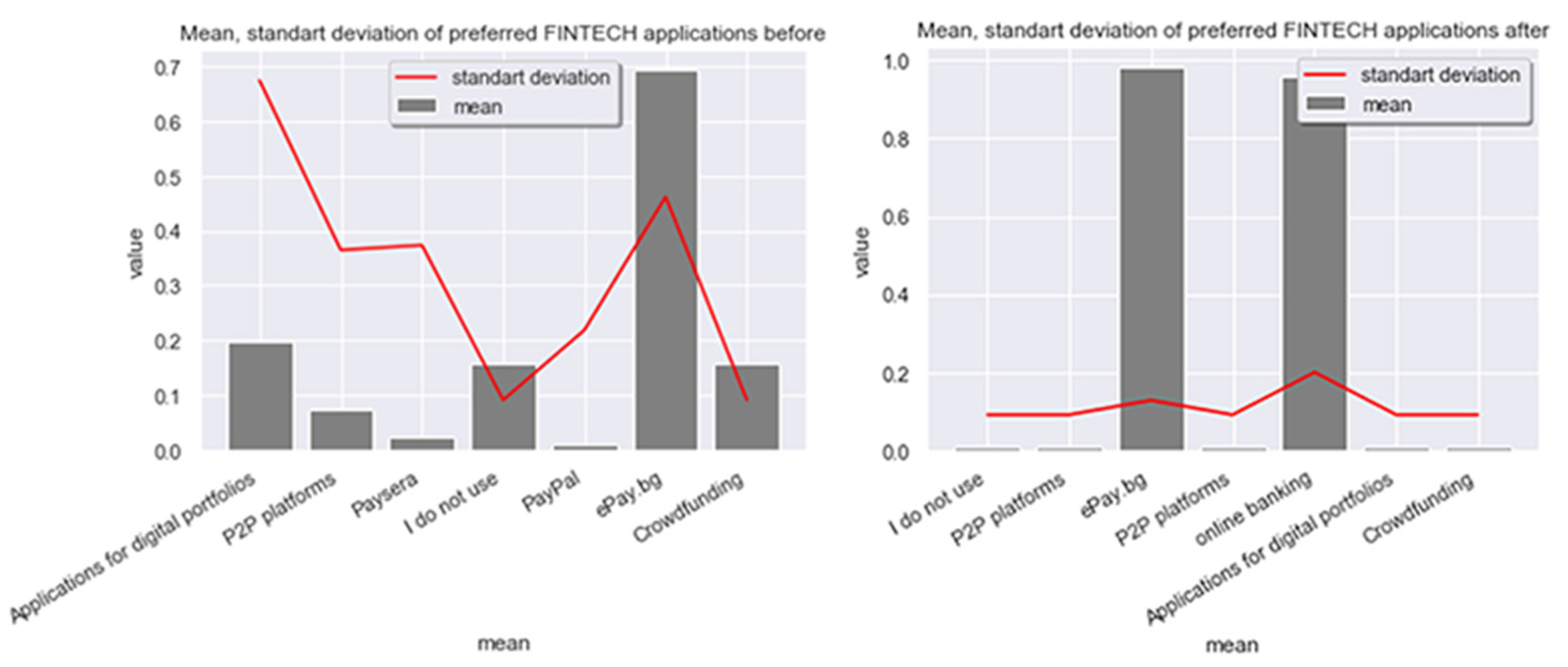

4. Results and Discussion

4.1. Hypothesis Testing

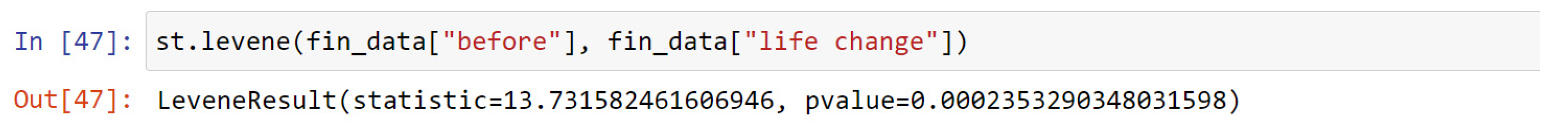

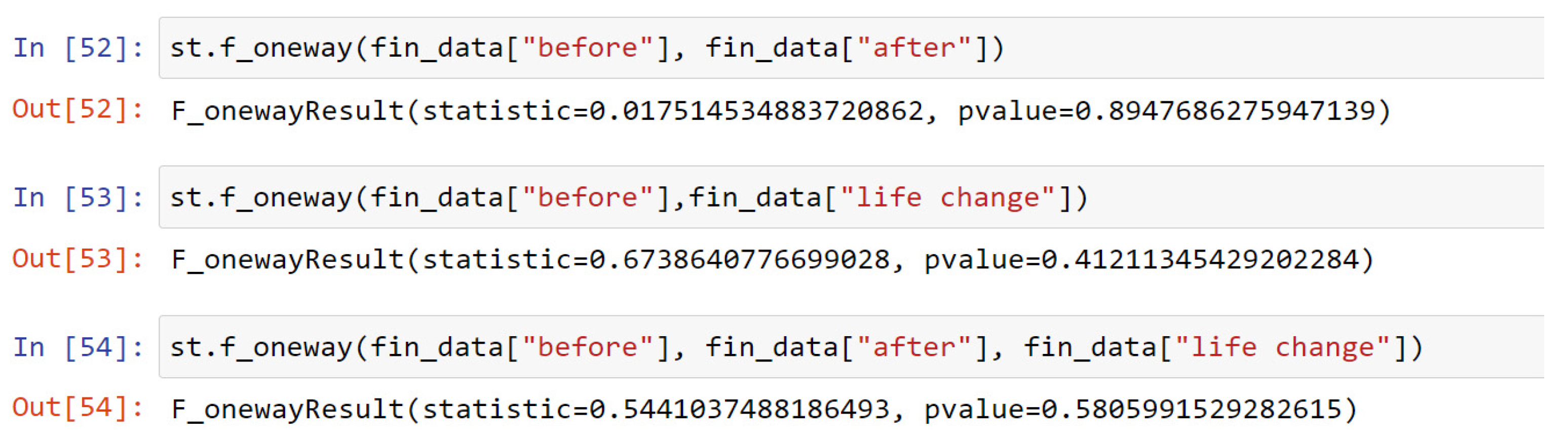

Two-Sample Paired t-Test, Levene’s Test, and ANOVA Test

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix B

Appendix C

| Which FINTECH Have You Used before Covid-19 * | Which FINTECH Have You Used after Covid-19 * | ||

|---|---|---|---|

| ePay.bg | 142 | ePay.bg | 238 |

| Paysera | 6 | Paysera | 0 |

| P2P platforms | 18 | P2P platforms | 4 |

| Applications for digital portfolios | 48 | Applications for digital portfolios | 2 |

| Crowdfunding | 2 | Crowdfunding | 2 |

| Other—I do not use; PayPal | 40; 2 | Other—I do not use; online banking | 2; 232 |

Appendix D

| Pivot Table of Respondents’ Profiles | |||||

| Count of Sex | |||||

| Sex | Age | Education | Occupation | Personal income | Total |

| Men | 30 to 39 | Higher | Employee | 1000 to 1499 | 1 |

| 561 to 999 | 2 | ||||

| over 2000 | 1 | ||||

| Employee Total | 4 | ||||

| Manager/owner | over 2000 | 1 | |||

| Manager/owner Total | 1 | ||||

| Middle-level manager | 1000 to 1499 | 1 | |||

| 1500 to 1999 | 2 | ||||

| over 2000 | 2 | ||||

| Middle-level manager Total | 5 | ||||

| Self-employed | 1000 to 1499 | 1 | |||

| Self-employed Total | 1 | ||||

| Higher Total | 11 | ||||

| PhD | Employee | 561 to 999 | 2 | ||

| over 2000 | 1 | ||||

| Employee Total | 3 | ||||

| Middle-level manager | 1000 to 1499 | 1 | |||

| Middle-level manager Total | 1 | ||||

| PhD Total | 4 | ||||

| 30 to 39 Total | 15 | ||||

| 40 to 49 | Higher | Employee | 1000 to 1499 | 2 | |

| 561 to 999 | 4 | ||||

| Employee Total | 6 | ||||

| Manager/owner | 1500 to 1999 | 1 | |||

| over 2000 | 1 | ||||

| Manager/owner Total | 2 | ||||

| Middle-level manager | 1000 to 1499 | 1 | |||

| Middle-level manager Total | 1 | ||||

| Higher Total | 9 | ||||

| PhD | Employee | 1000 to 1499 | 3 | ||

| 561 to 999 | 1 | ||||

| Employee Total | 4 | ||||

| PhD Total | 4 | ||||

| 40 to 49 Total | 13 | ||||

| 50 to 59 | College | Employee | 561 to 999 | 2 | |

| Employee Total | 2 | ||||

| College Total | 2 | ||||

| Higher | Employee | 1000 to 1499 | 1 | ||

| 1500 to 1999 | 1 | ||||

| Employee Total | 2 | ||||

| Manager/owner | over 2000 | 2 | |||

| Manager/owner Total | 2 | ||||

| Middle-level manager | 561 to 999 | 2 | |||

| Middle-level manager Total | 2 | ||||

| Self-employed | over 2000 | 1 | |||

| Self-employed Total | 1 | ||||

| Higher Total | 7 | ||||

| 50 to 59 Total | 9 | ||||

| over 60 | Higher | Employee | 561 to 999 | 2 | |

| Employee Total | 2 | ||||

| Higher Total | 2 | ||||

| PhD | Employee | 1000 to 1499 | 1 | ||

| Employee Total | 1 | ||||

| PhD Total | 1 | ||||

| over 60 Total | 3 | ||||

| up to 29 | College | Self-employed | 561 to 999 | 1 | |

| Self-employed Total | 1 | ||||

| Student | 561 to 999 | 2 | |||

| No income at the moment | 1 | ||||

| Student Total | 3 | ||||

| College Total | 4 | ||||

| High school | Employee | 561 to 999 | 1 | ||

| Employee Total | 1 | ||||

| Student | I have no income | 1 | |||

| Student Total | 1 | ||||

| High school Total | 2 | ||||

| Higher | Manager/owner | 1500 to 1999 | 1 | ||

| Manager/owner Total | 1 | ||||

| Student | 561 to 999 | 1 | |||

| up to 560 | 2 | ||||

| Student Total | 3 | ||||

| Higher Total | 4 | ||||

| up to 29 Total | 10 | ||||

| Men Total | 50 | ||||

| Woman | 30 to 39 | College | Employee | 1500 to 1999 | 2 |

| Employee Total | 2 | ||||

| Manager/owner | 1000 to 1499 | 2 | |||

| Manager/owner Total | 2 | ||||

| Student | 561 to 999 | 2 | |||

| Student Total | 2 | ||||

| College Total | 6 | ||||

| Higher | Employee | 1000 to 1499 | 9 | ||

| 1500 to 1999 | 2 | ||||

| 561 to 999 | 8 | ||||

| over 2000 | 5 | ||||

| up to 560 | 2 | ||||

| Employee Total | 26 | ||||

| Manager/owner | 1000 to 1499 | 2 | |||

| over 2000 | 1 | ||||

| Manager/owner Total | 3 | ||||

| Middle-level manager | 1000 to 1499 | 6 | |||

| 1500 to 1999 | 5 | ||||

| over 2000 | 4 | ||||

| Middle-level manager Total | 15 | ||||

| Self-employed | 1000 to 1499 | 3 | |||

| 561 to 999 | 2 | ||||

| over 2000 | 2 | ||||

| Self-employed Total | 7 | ||||

| Student | up to 560 | 2 | |||

| Student Total | 2 | ||||

| Higher Total | 53 | ||||

| PhD | Employee | 1000 to 1499 | 9 | ||

| 561 to 999 | 4 | ||||

| over 2000 | 1 | ||||

| Employee Total | 14 | ||||

| Middle-level manager | 1000 to 1499 | 1 | |||

| Middle-level manager Total | 1 | ||||

| PhD Total | 15 | ||||

| 30 to 39 Total | 74 | ||||

| 40 to 49 | Higher | Employee | 1000 to 1499 | 8 | |

| 1500 to 1999 | 2 | ||||

| 561 to 999 | 4 | ||||

| over 2000 | 6 | ||||

| Employee Total | 20 | ||||

| Manager/owner | 1500 to 1999 | 2 | |||

| over 2000 | 6 | ||||

| up to 560 | 2 | ||||

| Manager/owner Total | 10 | ||||

| Middle-level manager | 1000 to 1499 | 1 | |||

| Middle-level manager Total | 1 | ||||

| Self-employed | up to 560 | 2 | |||

| Self-employed Total | 2 | ||||

| Unemployed | 561 to 999 | 2 | |||

| No income at the moment | 2 | ||||

| Unemployed Total | 4 | ||||

| Higher Total | 37 | ||||

| PhD | Employee | 1000 to 1499 | 4 | ||

| 561 to 999 | 1 | ||||

| up to 560 | 2 | ||||

| Employee Total | 7 | ||||

| Middle-level manager | over 2000 | 2 | |||

| Middle-level manager Total | 2 | ||||

| PhD Total | 9 | ||||

| 40 to 49 Total | 46 | ||||

| 50 to 59 | College | Employee | 561 to 999 | 3 | |

| Employee Total | 3 | ||||

| College Total | 3 | ||||

| Higher | Employee | 1000 to 1499 | 3 | ||

| 1500 to 1999 | 2 | ||||

| Employee Total | 5 | ||||

| Manager/owner | over 2000 | 2 | |||

| Manager/owner Total | 2 | ||||

| Middle-level manager | 561 to 999 | 2 | |||

| Middle-level manager Total | 2 | ||||

| Self-employed | over 2000 | 1 | |||

| Self-employed Total | 1 | ||||

| Higher Total | 10 | ||||

| 50 to 59 Total | 13 | ||||

| over 60 | Higher | Employee | 1000 to 1499 | 2 | |

| 561 to 999 | 2 | ||||

| Employee Total | 4 | ||||

| Manager/owner | up to 560 | 2 | |||

| Manager/owner Total | 2 | ||||

| Retired | up to 560 | 2 | |||

| Retired Total | 2 | ||||

| Self-employed | 1000 to 1499 | 2 | |||

| Self-employed Total | 2 | ||||

| Higher Total | 10 | ||||

| PhD | Employee | 1000 to 1499 | 1 | ||

| Employee Total | 1 | ||||

| PhD Total | 1 | ||||

| over 60 Total | 11 | ||||

| up to 29 | College | Self-employed | 561 to 999 | 1 | |

| Self-employed Total | 1 | ||||

| Student | 561 to 999 | 4 | |||

| No income at the moment | 1 | ||||

| up to 560 | 4 | ||||

| Student Total | 9 | ||||

| College Total | 10 | ||||

| High school | Employee | 561 to 999 | 3 | ||

| Employee Total | 3 | ||||

| Student | 561 to 999 | 6 | |||

| I have no income | 2 | ||||

| No income at the moment | 2 | ||||

| Student Total | 10 | ||||

| High school Total | 13 | ||||

| Higher | Employee | 1000 to 1499 | 4 | ||

| 561 to 999 | 3 | ||||

| Employee Total | 7 | ||||

| Manager/owner | 1500 to 1999 | 2 | |||

| Manager/owner Total | 2 | ||||

| Middle-level manager | 1500 to 1999 | 2 | |||

| Middle-level manager Total | 2 | ||||

| PhD student start-up entrepreneur | 561 to 999 | 3 | |||

| PhD student start-up entrepreneur Total | 3 | ||||

| Self-employed | No income at the moment | 2 | |||

| Self-employed Total | 2 | ||||

| Student | 561 to 999 | 5 | |||

| up to 560 | 4 | ||||

| Student Total | 9 | ||||

| Higher Total | 25 | ||||

| up to 29 Total | 48 | ||||

| Woman Total | 192 | ||||

| (blank) | (blank) | (blank) | (blank) | (blank) | |

| (blank) Total | |||||

| (blank) Total | |||||

| (blank) Total | |||||

| (blank) Total | |||||

| Grand Total | 242 | ||||

References

- Abraham, Katharine G., John Haltiwanger, Kristin Sandusky, and James R. Spletzer. 2018. Measuring the Gig Economy: Current Knowledge and Open Issues. IO Theory eJournal. [Google Scholar] [CrossRef]

- Adamko, Peter, Erika Spuchlakova, and Katarina Valaskova. 2015. The history and ideas behind VaR. Procedia Economics and Finance 24: 18–24. [Google Scholar] [CrossRef]

- Ahani, Ali, and Mehrbakhsh Nilashi. 2020. Coronavirus outbreak and its impacts on global economy: The role of social network sites. Journal of Soft Computing and Decision Support Systems 7: 19–22. Available online: http://www.jscdss.com/index.php/files/article/view/222 (accessed on 15 February 2021).

- Arner, Douglas W., Janos Nathan Barberis, and Ross P. Buckley. 2015. The Evolution of Fintech: A New Post-Crisis Paradigm? SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Arulogun, Oladiran Tayo, Oluwatobi Noah Akande, Akinyinka Tosin Akindele, and Taofeeq Alabi Badmus. 2020. Survey dataset on open and distance learning students’ intention to use social media and emerging technologies for online facilitation. Data in Brief 31: 105929. [Google Scholar] [CrossRef] [PubMed]

- Ascher, David, Paul F. Dubois, Konrad Hinsen, Jim Hugunin, and Travis Oliphant. 1999. Numerical Python. The Regents of the University of California. Available online: https://www.cs.mcgill.ca/~hv/articles/Numerical/numpy.pdf (accessed on 23 January 2021).

- Autio, Erkko, Satish Nambisan, Llewellyn D. W. Thomas, and Mike Wright. 2018. Digital Affordances, Spatial Affordances, and the Genesis of Entrepreneurial Ecosystems. Strategic Entrepreneurship Journal 12: 72–95. [Google Scholar] [CrossRef]

- Baltar, Fabiola, and Ignasi Brunet. 2012. Social research 2.0: Virtual snowball sampling method using Facebook. Internet Research 22: 57–74. [Google Scholar] [CrossRef]

- Barnes, Larisa Ariadne Justine, Lesley Barclay, Kirsten McCaffery, Margaret I Rolfe, and Parisa Aslani. 2020. Using Facebook to recruit to a national online survey investigating complementary medicine product use in pregnancy and lactation: A case study of method. Research in Social and Administrative Pharmacy 16. [Google Scholar] [CrossRef]

- Barrett, Michael, Elizabeth Davidson, Jaideep Prabhu, and Stephen L. Vargo. 2015. Service Innovation in the Digital Age: Key Contributions and Future Directions. MIS Quarterly 39: 135–54. [Google Scholar] [CrossRef]

- Barua, Akrur, and David Levin. 2020. What’s Weighing on Consumer Spending: Fear of COVID-19 and Its Economic Impact. Economics Spotlight. Available online: https://www2.deloitte.com/us/en/insights/economy/spotlight/economics-insights-analysis-08-2020.html (accessed on 1 August 2020).

- Blagoev, Dimitar, and Radostin Boyadzhiev. 2020. Methodological aspects of portfolio management of investment projects for real assets in business organizations. Narodnostopanski Arhiv 73: 79–102. Available online: https://www.researchgate.net/publication/343426152_Narodnostopanski_arhiv_2020_br3_godina_LXXIII_COVID-19_tematicen_broj_na_naucnoto_spisanie_ECONOMIC_ARCHIVE_2020_vol3_Year_LXXIII_COVID-19_thematic_issue_of_the_journal_in_Bulgarian (accessed on 15 February 2021).

- Blasius, Jörg, and Maurice Brandt. 2010. Representativeness in Online Surveys through Stratified Samples. Bulletin of Sociological Methodology/Bulletin de Méthodologie Sociologique 107: 5–21. [Google Scholar] [CrossRef]

- COVID-19 Data Repository by the Center for Systems Science and Engineering (CSSE) at Johns Hopkins University. 2020. Available online: https://github.com/CSSEGISandData/COVID-19 (accessed on 4 February 2021).

- Clement, J. 2020. Internet Usage Worldwide—Statistics & Facts. Available online: https://www.statista.com/topics/1145/internet-usage-worldwide/ (accessed on 15 February 2021).

- Cojoianu, Theodor Florian, Gordon L. Clark, Andreas G. F. Hoepner, Vladimir Pažitka, and Dariusz Wójcik. 2020. Fin vs. Tech: Are Trust and Knowledge Creation Key Ingredients in Fintech Start-Up Emergence and Financing? Small Business Economics. [Google Scholar] [CrossRef]

- Coman, Emil N., Katherine Picho, John J. Mcardle, Victor Villagra, Lisa Dierker, and Eugen Iordache. 2013. The Paired t-Test as a Simple Latent Change Score Model. Frontiers in Psychology 4. [Google Scholar] [CrossRef]

- Couper, Mick P. 2001. Web Surveys: The Questionnaire Design Challenge. Paper presented at the 53rd Session of the ISI; Available online: https://2001.isiproceedings.org/pdf/263.PDF (accessed on 15 February 2021).

- Couper, Mick P., Roger Tourangeau, Frederick G. Conrad, and Scott D. Crawford. 2004. What They See Is What We Get: Response Options for Web Surveys. Social Science Computer Review 22: 111–27. [Google Scholar] [CrossRef]

- Cumming, Douglas J., and Armin Schwienbacher. 2018. Fintech venture capital. Corporate Governance: An International Review 26: 374–89. [Google Scholar] [CrossRef]

- Deloitte. 2016. Fintech in CEE. Department for International Trade, UK. Available online: https://www2.deloitte.com/content/dam/Deloitte/global/Documents/About-Deloitte/central-europe/ce-fintech-in-cee-region-2016.pdf (accessed on 15 February 2021).

- Damyanov, Atanas. 2020. Eclectic Views on the Consequences of Covid-19. Narodnostopanski Arhiv 73: 31–43. Available online: https://www.researchgate.net/publication/343426152_Narodnostopanski_arhiv_2020_br3_godina_LXXIII_COVID-19_tematicen_broj_na_naucnoto_spisanie_ECONOMIC_ARCHIVE_2020_vol3_Year_LXXIII_COVID-19_thematic_issue_of_the_journal_in_Bulgarian (accessed on 15 February 2021).

- Demongeot, Jacques, Yannis Flet-Berliac, and Hervé Seligmann. 2020. Temperature decreases spread parameters of the new Covid-19 case dynamics. Biology 9: 94. [Google Scholar] [CrossRef] [PubMed]

- Deutskens, Elisabeth, Ad de Jong, Ko de Ruyter, and Martin Wetzels. 2006. Comparing the generalizability of online and mail surveys in cross-national service quality research. Marketing Letters 17: 119–36. [Google Scholar] [CrossRef]

- Dillman, Don A. 2000. Mail and Internet Surveys: The Tailored Design Method, 2nd ed. New York: John Wiley and Sons. [Google Scholar]

- Di Pietro, Roberto, Simone Raponi, Maurantonio Caprolu, and Stefano Cresci. 2021. New Dimensions of Information Warfare. In Advances in Information Security. Cham: Springer, vol. 84, pp. 1–4. [Google Scholar] [CrossRef]

- European Centre for Disease Prevention and Control. 2020. An Agency of the European Union. Available online: https://www.ecdc.europa.eu/en/covid-19-pandemic (accessed on 23 January 2021).

- European Commission. 2020. Impact of Government Measures Related to COVID-19 on Third-Country Nationals in Bulgaria. Available online: https://ec.europa.eu/migrant-integration/news/impact-of-government-measures-related-to-covid-19-on-third-country-nationals-in-bulgaria (accessed on 15 February 2021).

- Evans, Joel R., and Anil Mathur. 2005. The value of online surveys. Internet Research 15: 195–219. [Google Scholar] [CrossRef]

- Fisher, Ronald. 1934. Statistical Methods for Research Workers, 5th ed. Edinburgh: Oliver and Boyd. Available online: https://www.worldcat.org/title/statistical-methods-for-research-workers/oclc/4972023 (accessed on 14 February 2021).

- Fisher, Ronald. 1955. Statistical Methods and Scientific Induction. Journal of the Royal Statistical Society, Series B 17: 69–78. [Google Scholar] [CrossRef]

- Fisher, Ronald. 1959. Statistical Methods and Scientific Inference, 2nd ed. New York: Hafner Publishing. Available online: https://www.worldcat.org/title/statistical-methods-and-scientific-inference/oclc/1516472 (accessed on 4 March 2021).

- Fisher, Ronald. 1971. The Design of Experiments, 9th ed. New York: Hafner. Available online: https://home.iitk.ac.in/~shalab/anova/DOE-RAF.pdf (accessed on 14 February 2021).

- Frey, Bruno S., and Stephan Meier. 2004. Social Comparisons and Pro-Social Behavior: Testing “Conditional Cooperation” in a Field Experiment. The American Economic Review 94: 1717–22. [Google Scholar] [CrossRef]

- Fricker, Ronald D., and Matthias Schonlau. 2002. Advantages and Disadvantages of Internet Research Surveys: Evidence from the Literature. Field Methods 14: 347–67. [Google Scholar] [CrossRef]

- Fu, Jonathan, and Mrinal Mishra. 2020. Fintech in the Time of COVID-19: Trust and Technological Adoption During Crises. Swiss Finance Institute Research Paper, 20–38. [Google Scholar] [CrossRef]

- Gastwirth, Joseph L., Yulia R. Gel, and Weiwen Miao. 2009. The Impact of Levene’s Test of Equality of Variances on Statistical Theory and Practice. Statistical Science 24: 343–60. [Google Scholar] [CrossRef]

- Gelman, Andrew. 2013. Commentary: P values and statistical practice. Epidemiology 24: 69–72. [Google Scholar] [CrossRef] [PubMed]

- Gomber, Peter, Jascha-Alexander Koch, and Michael Siering. 2017. Digital Finance and FinTech: Current Research and Future Research Directions. Journal of Business Economics 87: 537–80. [Google Scholar] [CrossRef]

- González-Bailón, Sandra, Ning Wang, Alejandro Rivero, Javier Borge-Holthoefer, and Yamir Moreno. 2014. Assessing the bias in samples of large online networks. Social Networks 38: 16–27. [Google Scholar] [CrossRef]

- Gretzel, Ulrike, Matthias Fuchs, Rodolfo Baggio, Wolfram Hoepken, Rob Law, Julia Neidhardt, Juho Pesonen, Markus Zanker, and Zheng Xiang. 2020. e-Tourism beyond COVID-19: A Call for Transformative Research. Information Technology Tourism 22: 187–203. [Google Scholar] [CrossRef]

- Gros, Claudius, Roser Valenti, Lukas Schneider, Kilian Valenti, and Daniel Gros. 2020. Strategies for controlling the medical and socio-economic costs of the Corona pandemic. arXiv arXiv:2004.00493. Available online: https://arxiv.org/pdf/2004.00493v1.pdf (accessed on 23 January 2021).

- Haddad, Christian, and Lars Hornuf. 2018. The Emergence of the Global Fintech Market: Economic and Technological Determinants. Small Business Economics 53: 81–105. [Google Scholar] [CrossRef]

- Hendrikse, Reijer, Michiel Van Meeteren, and David Bassens. 2019. Strategic Coupling between Finance, Technology and the State: Cultivating a Fintech Ecosystem for Incumbent Finance. Environment and Planning A: Economy and Space 52: 1516–38. [Google Scholar] [CrossRef]

- Imerman, Michael B., and Frank J. Fabozzi. 2020. Cashing in on Innovation: A Taxonomy of FinTech. Journal of Asset Management 21: 167–77. [Google Scholar] [CrossRef]

- International Monetary Fund. 2018. The Bali Fintech Agenda—CHAPEAU PAPER: A Blueprint for Successfully Harnessing Fintech’s Opportunities. Washington, D.C. Available online: https://www.imf.org/en/Publications/Policy-Papers/Issues/2018/10/11/pp101118-bali-fintech-agenda (accessed on 15 February 2021).

- Ivanov, Dimitar. 2020. Macroeconomic challenges and risks posed by global coronavirus CRISIS. Narodnostopanski Arhiv 73: 3–30. Available online: https://www.researchgate.net/publication/343426152_Narodnostopanski_arhiv_2020_br3_godina_LXXIII_COVID-19_tematicen_broj_na_naucnoto_spisanie_ECONOMIC_ARCHIVE_2020_vol3_Year_LXXIII_COVID-19_thematic_issue_of_the_journal_in_Bulgarian (accessed on 15 February 2021).

- Johnson, Timothy, Karena Burke, and Susan Williams. 2014. Online snowballing: An effective method of data collection in australian young adults. Journal of Nutrition & Intermediary Metabolism 1: 42. [Google Scholar] [CrossRef][Green Version]

- Kaplowitz, Michael D., Timothy D. Hadlock, and Ralph Levine. 2004. A comparison of web and mail survey response rates. Public Opinion Quarterly 68: 94–101. [Google Scholar] [CrossRef]

- Kerényi, Ádám. 2018. The Fintech Challenge: Digital Innovations from Post-Communist EU Member Countries. Available online: http://real.mtak.hu/89231/1/Challenges_233_Kerenyi.pdf (accessed on 15 February 2021).

- Koleva, Rositsa, and Stela Kasabova. 2016. Statistical methods of business risk analysis. Ikonomika 21: 1–25. Available online: https://www2.uni-svishtov.bg/economics21/title.asp?title=582 (accessed on 23 January 2021).

- Koutras, Athanasios, Alkiviadis Panagopoulos, and Ioannis A. Nikas. 2016. Forecasting tourism demand using linear and nonlinear prediction models. Academica Turistica-Tourism and Innovation Journal 9: 85–98. Available online: http://academica.turistica.si/index.php/AT-TIJ/article/view/47/20 (accessed on 23 January 2021).

- Kwak, Nojin, and Barry Radler. 2002. A Comparison Between Mail and Web Surveys:Response Pattern, Respondent Profile, and Data Quality. Journal of Official Statistics 18: 257–73. Available online: https://www.scb.se/contentassets/ca21efb41fee47d293b-bee5bf7be7fb3/a-comparison-between-mail-and-web-surveys-response-pattern-respondent-profile-and-data-quality.pdf (accessed on 14 February 2021).

- Lambova, Largarita. 2018. Measurement—The Unregulated Problem in Empirical Studies Carried Out with the Aid Statistical Instrumentary of. Available online: https://www.nsi.bg/spisaniestatistika/page/bg/details.php?article_id=180&tab=en (accessed on 23 January 2021).

- Lee, David K. C., and Ernie G. S. Teo. 2015. Emergence of Fintech and the Lasic Principles. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Leong, Kelvin, and Anna Sung. 2018. FinTech (Financial Technology): What is it and how to use technologies to create business value in fintech way? International Journal of Innovation, Management and Technology 9: 74–78. [Google Scholar] [CrossRef]

- Levene, Howard. 1960. Contributions to Probability and Statistics: Essays in Honor of Harold Hotelling; Stanford: Stanford University Press, pp. 278–92. Available online: https://www.itl.nist.gov/div898/handbook/eda/section3/eda35a.htm (accessed on 15 February 2021).

- Liang, Sai, Chunxiao Li, Xiaoxia Zhang, and Hui Li. 2020. The snowball effect in online travel platforms: How does peer influence affect review posting decisions? Annals of Tourism Research 85: 102876. [Google Scholar] [CrossRef]

- Likert, Rensis. 1932. A technique for the measurement of attitudes. Archives of Psychology 22: 1–55. [Google Scholar]

- Liu, Jiajia, Xuerong Li, and Shouyang Wang. 2020. What Have We Learnt from 10 Years of Fintech Research? A Scientometric Analysis. Technological Forecasting and Social Change 155: 120022. [Google Scholar] [CrossRef]

- Ma, Yueling, Yadong Zhao, Jiangtao Liu, Xiaotao He, Bo Wang, Shihua Fu, Jun Yan, Jingping Niu, Ji Zhou, and Bin Luo. 2020. Effects of temperature variation and humidity on the death of COVID-19 in Wuhan, China. Science of the Total Environment 724: 138226. [Google Scholar] [CrossRef] [PubMed]

- Mandal, Chandi C., and Mahaveer Singh Panwar. 2020. Can the summer temperatures reduce COVID-19 cases? Public Health 185: 72–79. [Google Scholar] [CrossRef] [PubMed]

- Matthews, Amy. 2018. 10 Hottest Places to Launch a Fintech Startup in Central and Eastern Europe. July 12. Available online: https://www.equities.com/news/10-hottest-place-to-launch-afintech-startup-in-central-and-eastern-europe (accessed on 15 February 2021).

- McKinney, Wes. 2011. Pandas: A Foundational Python Library for Data Analysis and Statistics. Available online: https://www.dlr.de/sc/Portaldata/15/Resources/dokumente/pyhpc2011/submissions/pyhpc2011_submission_9.pdf (accessed on 23 January 2021).

- Michael, Bryane. 2020. The FinTech Dividend: How Much Money Is FinTech Likely to Mobilize for Sustainable Development? Available online: http://hdl.handle.net/10419/216745 (accessed on 15 February 2021).

- Milian, Eduardo Z., Mauro de M. Spinola, and Marly M. de Carvalho. 2019. Fintechs: A literature review and research agenda. Electronic Commerce Research and Applications 34: 100833. [Google Scholar] [CrossRef]

- Mitev, Petar-Emil, and Siyka Kovacheva. 2014. Young People in European Bulgaria Sociological Portrait. Sofia: Friedrich Ebert Stiftung. ISBN 978-954-2979-21-0. Available online: http://library.fes.de/pdf-files/bueros/sofia/12568.pdf (accessed on 15 February 2021).

- Mostafanezhad, Mary. 2020. Covid-19 Is an Unnatural Disaster: Hope in Revelatory Moments of Crisis. Tourism Geographies 22: 639–45. [Google Scholar] [CrossRef]

- Neyman, Jerzy, and Egon S. Pearson. 1928. On the Use and Interpretation of Certain Test Criteria for Purposes of Statistical Inference: Part I. Biometrika 20A: 175–240. [Google Scholar] [CrossRef]

- Neyman, Jerzy, and Egon Sharpe Pearson. 1933. IX. On the problem of the most efficient tests of statistical hypotheses. Philosophical Transactions of the Royal Society of London. Series A, Containing Papers of a Mathematical or Physical Character 231: 694–706. [Google Scholar] [CrossRef]

- Nikolova, Nadezhda. 2013. Statistika. Obshta Teoriya. Tempto, Sofiya. ISBN 978-619-160-140-0. [Google Scholar]

- Nordstokke, David W., and Bruno D. Zumbo. 2007. A Cautionary Tale About Levene’s Tests for Equal Variances. Journal of Educational Research & Policy Studies 7: 1–14. [Google Scholar]

- Nowlin, Christopher. 2017. Understanding and Undermining the Growth Paradigm. Dialogue: Canadian Philosophical Review = Revue Canadienne de Philosophie 56: 559–93. [Google Scholar] [CrossRef]

- Odorović, Ana, Grigory McKain, Kieran Garvey, Emmanuel Schizas, Bryan Zheng Zhang, Philip Rowan, and Tania Ziegler. 2020. FinTech Innovation in the Western Balkans: Policy and Regulatory Implications and Potential Interventions. SSRN. [Google Scholar] [CrossRef]

- Ötsch, Walter. 2020. What Type of Crisis Is This? The Coronavirus Crisis as a Crisis of the Economicised Society. Working Paper Series 57. Available online: https://www.econstor.eu/handle/10419/216728 (accessed on 23 January 2021).

- Paino, Halil, Khairul Anuar Abdul Hadi, and Wan Mardyatul Miza Wan Tahir. 2014. Financial statement error: Client’s business risk assessment and auditor’s substantive test. Procedia-Social and Behavioral Sciences 145: 316–20. [Google Scholar] [CrossRef][Green Version]

- Peng, Liangrong, Wuyue Yang, Dongyan Zhang, Changjing Zhuge, and Liu Hong. 2020. Epidemic Analysis of COVID-19 in China by Dynamical Modeling. MedRxiv. [Google Scholar] [CrossRef]

- Pennington-Gray, Lori. 2018. Reflections to Move Forward: Where Destination Crisis Management Research Needs to Go. Tourism Management Perspectives 25: 136–39. [Google Scholar] [CrossRef]

- Pernet, Cyril. 2017. Null Hypothesis Significance Testing: A Short Tutorial. F1000Research 4: 621. [Google Scholar] [CrossRef]

- Pricewaterhouse Coopers. 2017. Redrawing the Lines: FinTech’s Growing Influence on Financial Services. In Global FinTech Report 2017. Available online: https://www.pwc.com/gx/en/industries/financial-services/assets/pwc-global-fintech-report-2017.pdf (accessed on 23 January 2021).

- Qi, Hongchao, Shuang Xiao, Runye Shi, Michael P. Ward, Yue Chen, Wei Tu, Qing Su, Wenge Wang, Xinyi Wang, and Zhijie Zhang. 2020. COVID-19 transmission in Mainland China is associated with temperature and humidity: A time-series analysis. Science of the Total Environment 728: 138778. [Google Scholar] [CrossRef] [PubMed]

- Ratecka, Patrycja. 2020. FinTech—definition, taxonomy and historical approach. Zeszyty Naukowe Małopolskiej Wyższej Szkoły Ekonomicznej w Tarnowie 1: 53–67. Available online: http://cejsh.icm.edu.pl/cejsh/element/bwmeta1.element.desklight-31b2710c-e961-4d90-bc3f-730f08934191 (accessed on 15 February 2021).

- Reuschke, Darja, and Colin Mason. 2020. The engagement of home-based businesses in the digital economy. Futures, 102542. [Google Scholar] [CrossRef]

- Romānova, Inna, Simon Grima, Jonathan Spiteri, and Rebecca Dalli Gonzi. 2019. A Study of Alternative and FinTech Payment Solutions for Airlines. International Journal of Finance, Insurance and Risk Management 9: 132–46. Available online: https://www.researchgate.net/profile/Simon_Grima/publication/338007706_A_Study_of_Alternative_and_FinTech_Payment_Solutions_for_Airlines_A_Study_of_Alternative_and_FinTech_Payment_Solutions_for_Airlines_133/links/5dfa0dcb4585159aa4850b8f/A-Study-of-Alternative-and-FinTech-Payment-Solutions-for-Airlines-A-Study-of-Alternative-and-FinTech-Payment-Solutions-for-Airlines-133.pdf (accessed on 15 February 2021).

- Schueffel, Patrick. 2016. Taming the beast: A scientific definition of fintech. Journal of Innovation Management 4: 32–54. [Google Scholar] [CrossRef]

- Shi, Peng, Yinqiao Dong, Huanchang Yan, Chenkai Zhao, Xiaoyang Li, Wei Liu, Miao He, Shixing Tang, and Shuhua Xi. 2020. Impact of temperature on the dynamics of the COVID-19 outbreak in China. Science of the Total Environment 728: 138890. [Google Scholar] [CrossRef]

- Siegenfeld, Alexander F., and Yaneer Bar-Yam. 2020. Eliminating covid-19: A community-based analysis. arXiv arXiv:2003.10086. Available online: https://arxiv.org/pdf/2003.10086.pdf (accessed on 23 January 2021).

- Snijders, Tom A. B. 2002. The statistical evaluation of social network dynamics. Sociological methodology 31: 361–95. [Google Scholar] [CrossRef]

- Svabova, Lucia, and Marek Durica. 2016. A closer view of the statistical methods globally used in bankruptcy prediction of companies. Paper presented at 16th International Scientific Conference on Globalization and Its Socioeconomic Consequences, Rajecke Teplice, Slovakia, October 5–6; pp. 2174–81. [Google Scholar]

- Vučinić, Milena. 2020. Fintech and Financial Stability Potential Influence of FinTech on Financial Stability, Risks and Benefits. Journal of Central Banking Theory and Practice 9: 43–66. [Google Scholar] [CrossRef]

- Wamba Fosso, Samuel, Jean Robert Kala Kamdjoug, Ransome Epie Bawack, and John G. Keogh. 2019. Bitcoin, Blockchain and Fintech: A systematic review and case studies in the supply chain. Production Planning & Control 31: 115–42. [Google Scholar] [CrossRef]

- Wójcik, Dariusz, and Theodor F. Cojoianu. 2018. A global overview from a geographical perspective. International Finance Centres after Global Financial Crisis Brexit 207: 1–272. [Google Scholar]

- Wójcik, Dariusz, and Stefanos Ioannou. 2020. COVID-19 and Finance: Market Developments So Far and Potential Impacts on the Financial Sector and Centres. Tijdschrift voor Economische en Sociale Geografie 111: 387–400. [Google Scholar] [CrossRef]

- Woolhouse, Mark E. J., Liam Brierley, Chris Mccaffery, and Sam Lycett. 2016. Assessing the Epidemic Potential of RNA and DNA Viruses. Emerging Infectious Diseases 22: 2037–44. [Google Scholar] [CrossRef] [PubMed]

- World Bank Group. 2020. Fintech in Europe and Central Asia: Maximizing Benefits and Managing Risks. Available online: https://openknowledge.worldbank.org/bitstream/handle/10986/33591/Fintech-in-Europe-and-Central-Asia-Maximizing-Benefits-and-Managing-Risks.pdf?sequence=1&isAllowed=y (accessed on 15 February 2021).

- Wright, Kevin B. 2005. Researching Internet-based populations: Advantages and disadvantages of online survey research, online questionnaire authoring software packages, and web survey services. Journal of Computer-Mediated Communication 10: JCMC1034. [Google Scholar] [CrossRef]

- Wu, Yu, Wenzhan Jing, Jue Liu, Qiuyue Ma, Jie Yuan, Yaping Wang, Min Du, and Min Liu. 2020. Effects of temperature and humidity on the daily new cases and new deaths of COVID-19 in 166 countries. Science of the Total Environment 729: 139051. [Google Scholar] [CrossRef] [PubMed]

- Xu, Manfei, Drew Fralick, Julia Z. Zheng, Bokai Wang, Xin M. Tu, and Changyong Feng. 2017. The differences and similarities between two-sample t-test and paired t-test. Shanghai Archives of Psychiatry 29: 184. [Google Scholar] [CrossRef] [PubMed]

- Zhu, Liting, Xiaobo Liu, Haining Huang, Ricardo David Avellán-Llaguno, Mauricio Manuel Llaguno Lazo, Aldo Gaggero, Ricardo Soto-Rifo, Leandro Patiño, Magaly Valencia-Avellan, Benoit Diringer, and et al. 2020. Meteorological impact on the COVID-19 pandemic: A study across eight severely affected regions in South America. Science of The Total Environment 744: 140881. [Google Scholar] [CrossRef] [PubMed]

- Zoroja, Jovana, Igor Klopotan, and Ana-Marija Stjepić. 2020. Quality of e-commerce practices in European enterprises: Cluster analysis approach. Interdisciplinary Description of Complex Systems 18: 312. [Google Scholar] [CrossRef]

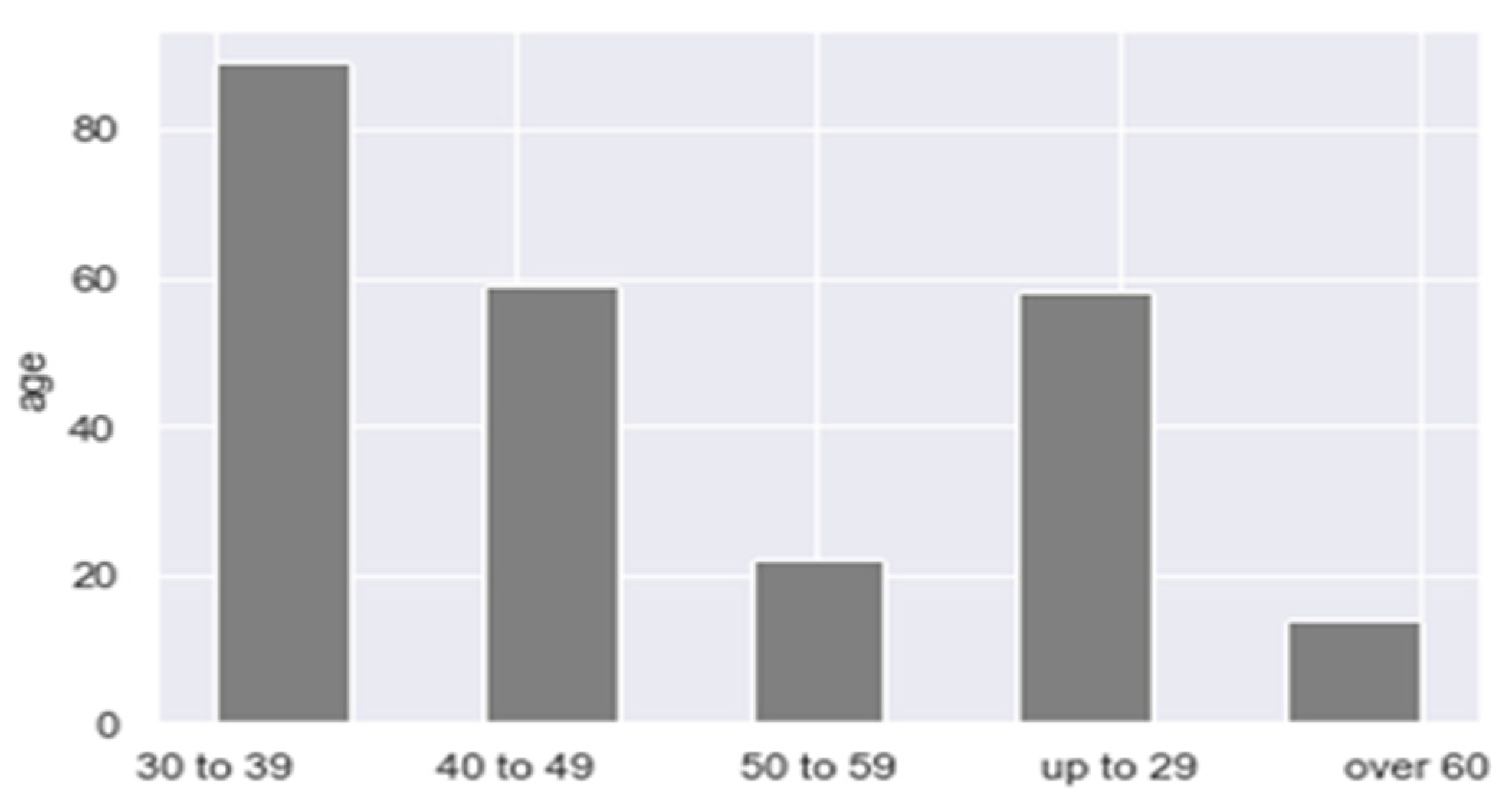

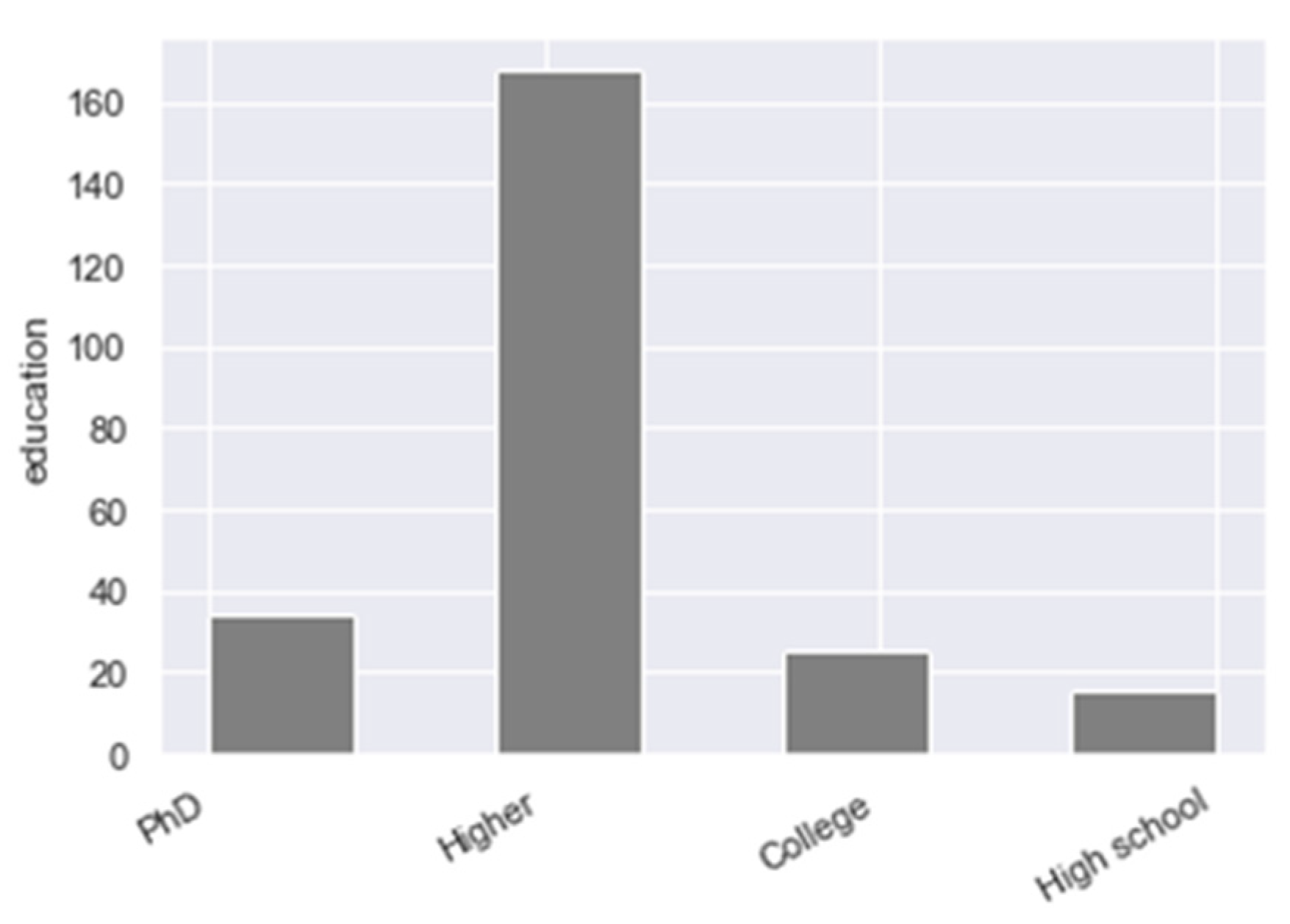

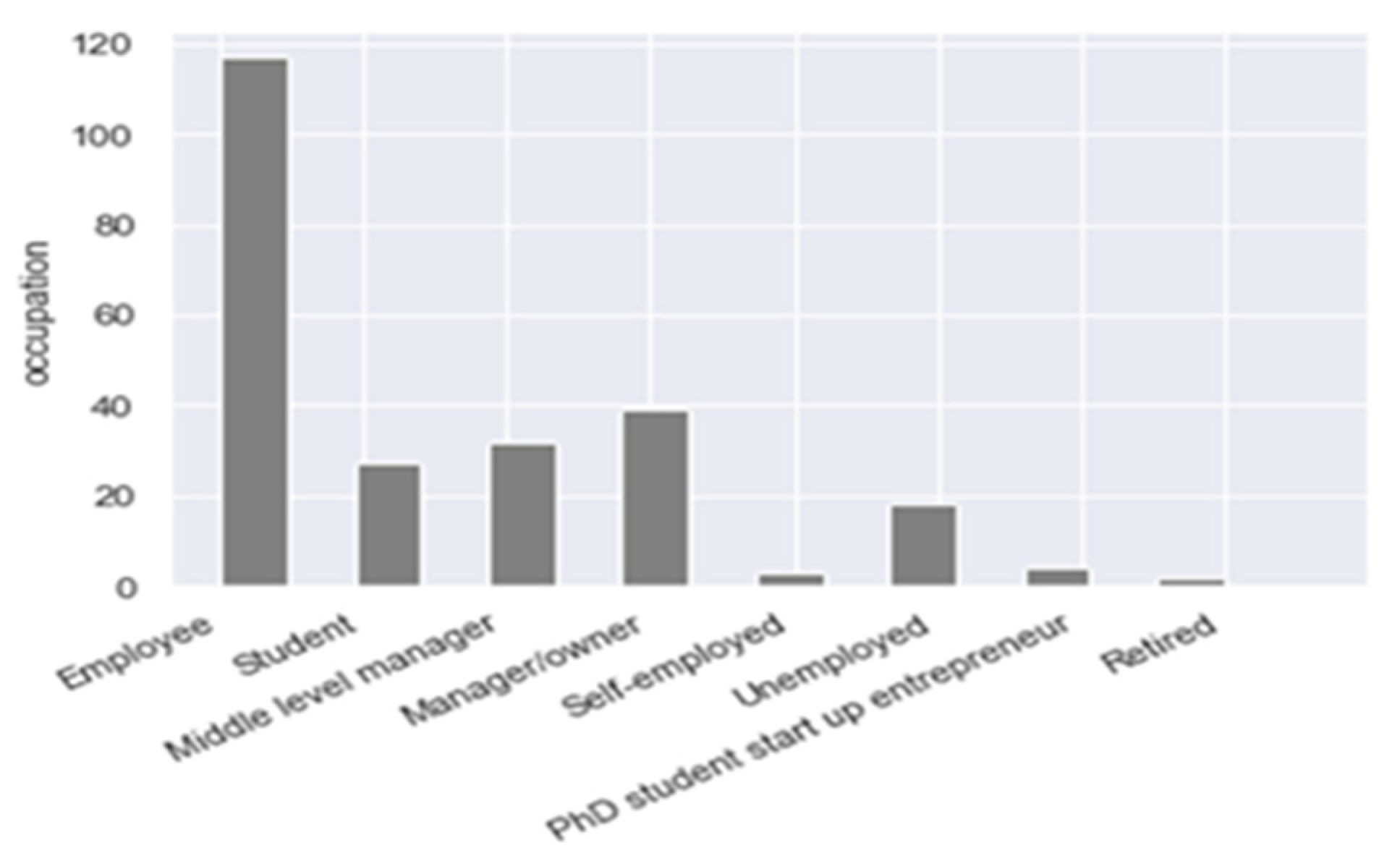

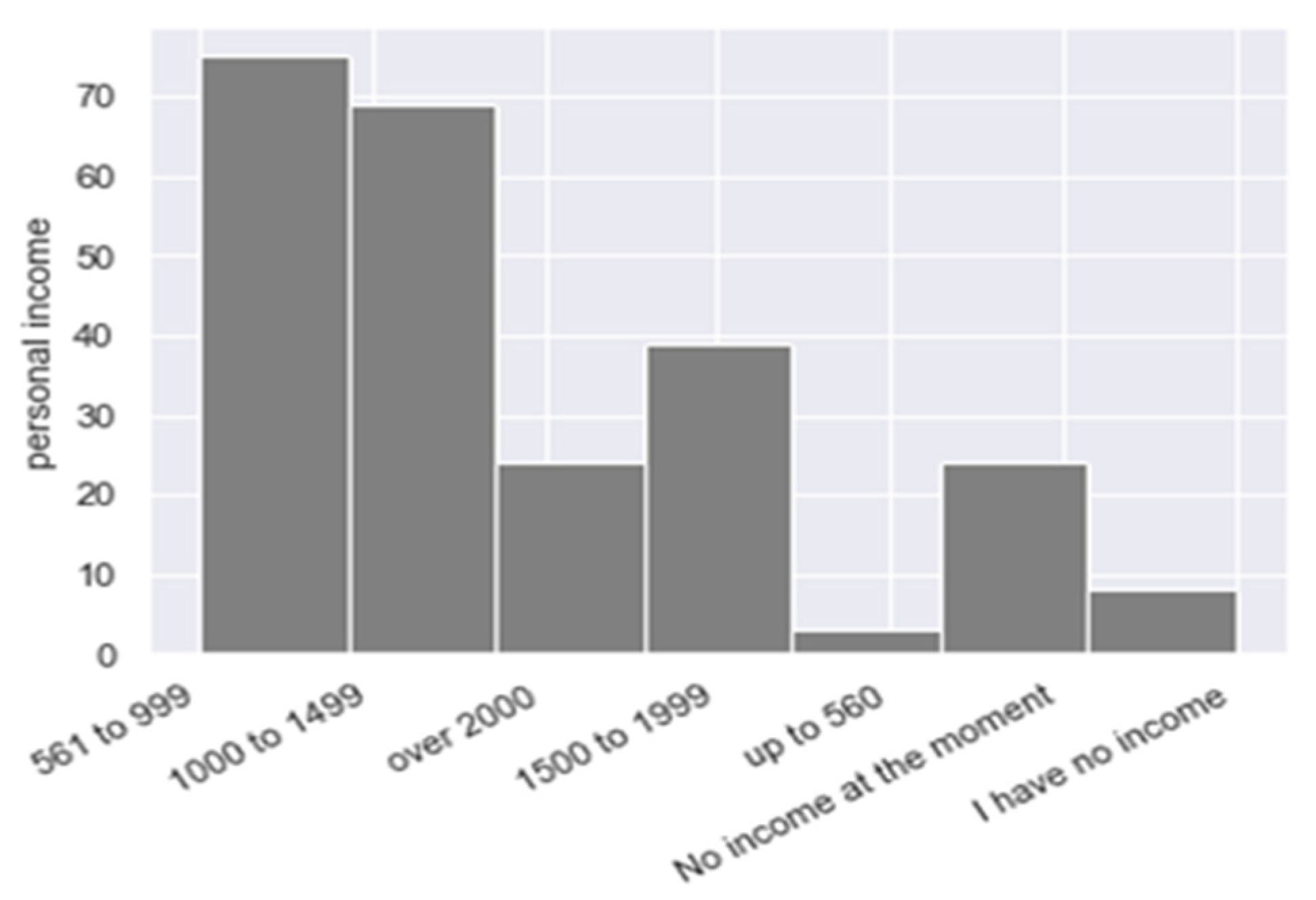

| Gender | Age | Education | ||||||||||||

| Female | Male | 30 to 39 | 40 to 49 | up to 29 | 50 to 59 | over 60 | High School | College | Higher | PhD | ||||

| 192 | 50 | 89 | 59 | 22 | 58 | 14 | 15 | 25 | 168 | 34 | ||||

| Occupation | Personal Income | |||||||||||||

| Employee | Student | Midlevel Manager | Manager/Owner | Self-Employed | Unemployed | PhD Student Start-Up Entrepreneur | Retired | 561 to 699 | 1000 1499 | up to 2000 | 1500 to 1999 | up to 560 | No Income at the Moment | No Income |

| 117 | 39 | 32 | 27 | 18 | 4 | 3 | 2 | 75 | 69 | 24 | 39 | 3 | 24 | 8 |

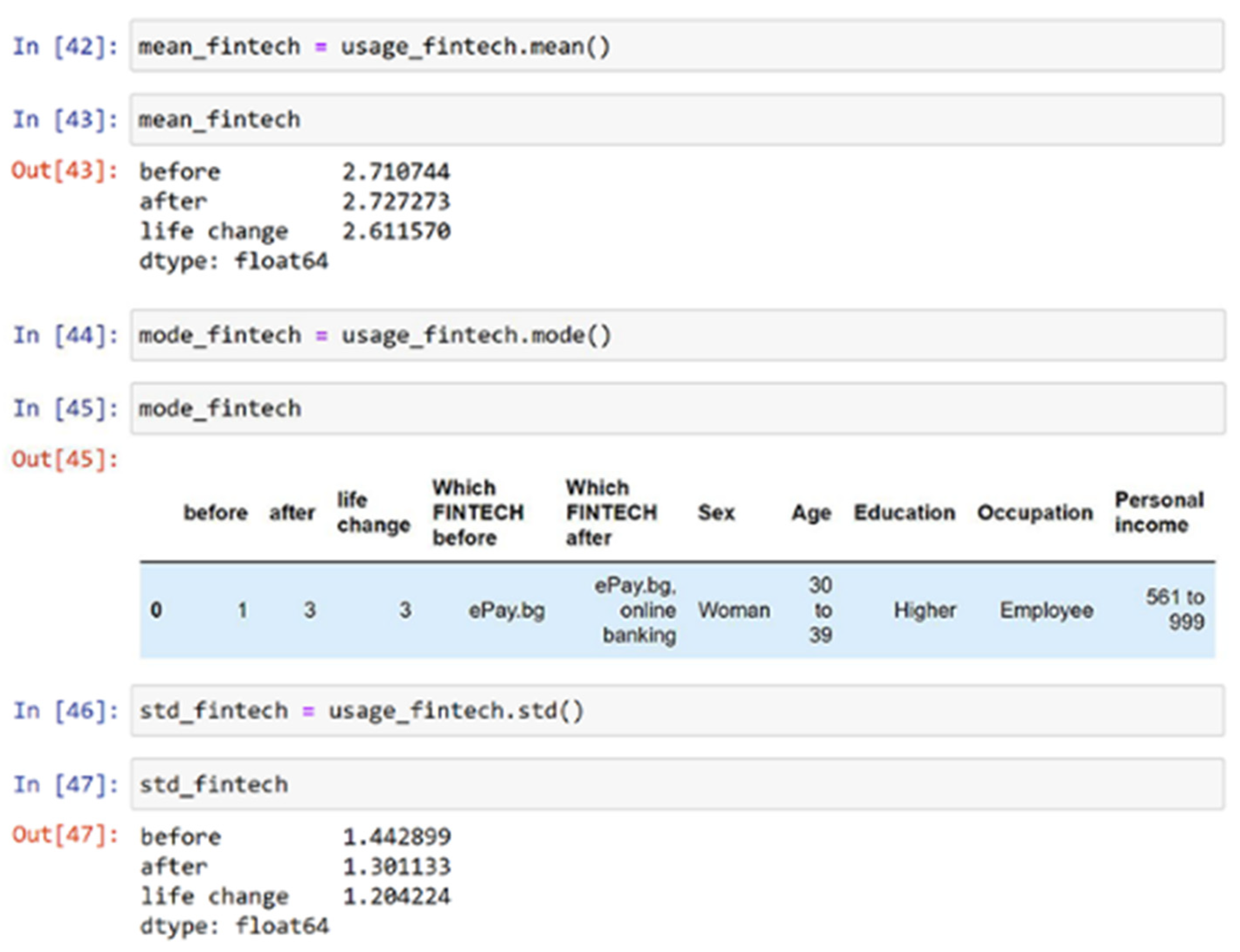

| Statistical Measures | Before | After | Life Change |

|---|---|---|---|

| mean | 2.711 | 2.727 | 2.612 |

| mode | 1 | 3 | 3 |

| standard deviation | 1.443 | 1.301 | 1.204 |

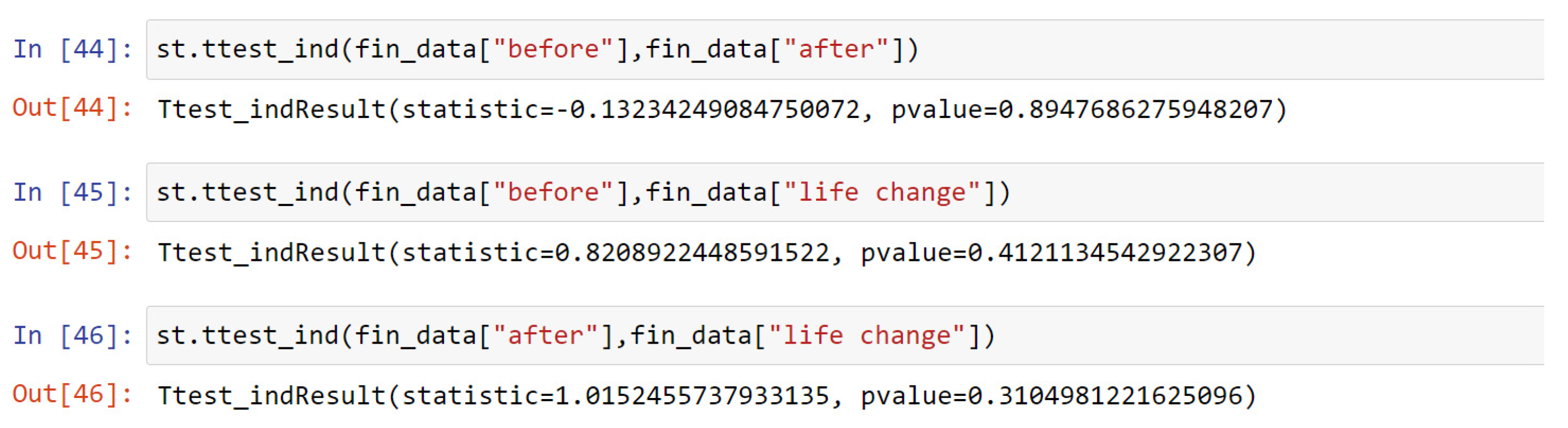

| Tests Performed for Testing H0 | Level of Significance (a Theoretical p-Value) | Probability/p-Value Comparing Usage Before and After | Probability/p-Value Comparing Usage Before and Life Change | Probability/p-Value Comparing Usage After and Life Change | Probability/p-Value Comparing Usage Before, After, and Life Change |

|---|---|---|---|---|---|

| Two-sample paired t-test | α = 5% | 0.895 | 0.412 | 0.310 | - |

| Levene’s test | α = 5% | 0.011 | 0.0002 | 0.252 | - |

| ANOVA | α = 5% | 0.895 | 0.412 | 0.310 | 0.581 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vasenska, I.; Dimitrov, P.; Koyundzhiyska-Davidkova, B.; Krastev, V.; Durana, P.; Poulaki, I. Financial Transactions Using FINTECH during the Covid-19 Crisis in Bulgaria. Risks 2021, 9, 48. https://doi.org/10.3390/risks9030048

Vasenska I, Dimitrov P, Koyundzhiyska-Davidkova B, Krastev V, Durana P, Poulaki I. Financial Transactions Using FINTECH during the Covid-19 Crisis in Bulgaria. Risks. 2021; 9(3):48. https://doi.org/10.3390/risks9030048

Chicago/Turabian StyleVasenska, Ivanka, Preslav Dimitrov, Blagovesta Koyundzhiyska-Davidkova, Vladislav Krastev, Pavol Durana, and Ioulia Poulaki. 2021. "Financial Transactions Using FINTECH during the Covid-19 Crisis in Bulgaria" Risks 9, no. 3: 48. https://doi.org/10.3390/risks9030048

APA StyleVasenska, I., Dimitrov, P., Koyundzhiyska-Davidkova, B., Krastev, V., Durana, P., & Poulaki, I. (2021). Financial Transactions Using FINTECH during the Covid-19 Crisis in Bulgaria. Risks, 9(3), 48. https://doi.org/10.3390/risks9030048