1. Introduction

Households are economic actors that make decisions in the area of consumption, savings, and investments, with the use of credits or loans being a common way of financing consumption. This is particularly noticeable in relation to households in the Visegrad Group of countries (V4, i.e., the Czech Republic, Poland, Slovakia, and Hungary), which in the years before the COVID-19 pandemic were increasing their debt. The phenomenon of household indebtedness itself is common and natural in the case of countries with a modern financial system, and V4 countries are included in this group.

The lifestyle a person follows is a crucial factor that determines the demand for financial resources—the more consumption-oriented it is, the greater the tendency to use credit (so-called

consumer credit). On the one hand, consumer credit allows a household to function at a higher level of consumption, on the other, it can be a vital resource for covering temporary shortages of funds (

Wiśniewska 2016). Moreover, the funds obtained allow for the improvement of household members’ living standards, and unexpected situations are often the factors that determine the use of credit (

Bywalec 2009). In contrast, less affluent households reach for credit in order to meet basic consumer needs, such as the purchase of food and clothing, or to cover healthcare services (

Wałęga and Wałęga 2016). It is worth highlighting that affluent people are more likely to borrow money than those who take out loans out of necessity related to poverty (

Kata et al. 2021).

It should be pointed out that ongoing consumption depends not only on current income, but also on past income. If a particular household gains higher earnings for a certain period, then the structure of expenditure, consumption, and investment is also high. If household income declines, people strive to maintain consumption at the current level (the so-called ratchet effect), as a result, they decide to make use of consumer credit (

Brzezicka 2017;

Khandani et al. 2013).

Consumer loans are offered by financial institutions; they provide relatively easy access to cash and are perfect in emergency situations or when there is a need to obtain liquid assets.

The theoretical economic framework for consumption, savings, and debt decisions was developed in life cycle theory (

Modigliani and Brumberg 1954) and in fixed income theory (

Friedman 1957). In these economic models, households generally choose to access a loan as a means of managing anticipated spending based on the expectation of increased future income. The rationale is that incomes are generally low early in a person’s working life and tend to increase over time. At the beginning of their working life, people expect higher future income and thus finance the purchase of assets to raise consumption above the level offered by their current income. As they approach the end of their working life, individuals increase their level of savings in preparation for retirement, when spending will be greater than earnings. On this basis, it can be indicated that the factors influencing the demand for consumer credit are socio-demographic factors (e.g., age, gender, education level, family size, and geographical area) and economic factors (e.g., net wealth, income, and work status) (

Ottaviani and Vandone 2011).

The determinants of household indebtedness can be divided into two types: household-dependent factors shaped within the entity, and factors independent of it, occurring in the environment of the entity. The household-dependent determinants include, among others, household members’ income, propensity to consume, or attitude to risk. These are elements that depend on the characteristics of a given entity: the education, age, and knowledge of household members (

Rahman et al. 2020). These are defined as behavioural determinants, and the most relevant include: financial knowledge, risk perception, materialism, and emotions, all of which influence the tendency to accumulate debt (

Azma et al. 2019;

Muñoz-Murillo et al. 2020). Financial literacy should facilitate financial decision-making, including debt decisions (

Ward and Lynch 2019), and

Flores and Vieira (

2014) found that financial literacy has a significant impact on debt. According to

Darriet et al. (

2020), the reasons why people spend more than they earn are as follows: people on low incomes are unable to cover their basic expenses, while people on high incomes show a greater willingness to spend and a lack of willingness to save. Risk perception refers to how a person perceives risk when making decisions (

Darriet et al. 2020). It has been found that consumers who have high expectations may underestimate risk (

Barros and Botelho 2012), while those with high-risk perceptions tend to have low levels of debt (

Nguyen et al. 2019). It is worth emphasizing that risk perception is an important component of financial decision-making and other risk-related behaviour (

Gärling et al. 2009). Materialism is another determinant linked to the act of consumption (

Mishra and Mishra 2016). People with high levels of materialism are described as spenders (

Azma et al. 2019), while those with low levels are savers, as non-materialistic people will invest in stocks, bonds, or mutual funds (

Rahman et al. 2020). The determinant of emotions is related to the individual’s ability to express emotions when making financial decisions. According to

Flores and Vieira (

2014), emotions influence people’s behaviour related to consumption, risk-taking, and decision-making. The authors also indicated that emotions such as pride, shame and nervousness affect the amount of household debt (

Flores and Vieira 2014). In a socio-cultural context, every decision, including decisions about debt, is subject to emotions. Given this context, emotions can be divided into three categories: background (long-lasting and influenced by the way primary emotions are expressed, e.g., apathy), primary (easily expressed by people, e.g., anger and fear) and social (influenced by society and culture, e.g., pride, embarrassment, and jealousy) (

Rahman et al. 2020). Therefore, it can be concluded that consumers’ financial decisions may reflect their psychological and social values (

Eberhardt et al. 2019).

Taking into account the relationship between demographic factors and financial behaviour, it is possible to elucidate a significant relationship between gender and financial skills. Studies show that women are more financially excluded than men, but this improves significantly with education, wealth, and encouragement from spouses to acquire and use financial knowledge (

Fletschner and Mesbah 2011). In addition, perception of risk varies across occupations, income, religion, marital status, and level of education. Younger people tend to perceive their debt as much lower, while people over 45 are more likely to have higher indebtedness (

Keese 2010). Also, level of education affects the propensity to enter into debt, that is, the lower the level of education, the higher the propensity to be in debt (

Greig et al. 2019). In contrast,

Flores and Vieira (

2014) noted that women are less likely to be in debt than men (

Flores and Vieira 2014).

The second group of determinants are factors specific to the state and the market in which the household operates, i.e., its environment. These include both the situation on the labour market and the monetary policy of the central bank, as well as the range of financial services offered by banking and non-banking entities. Research has confirmed the relationship between economic growth and household indebtedness. In addition to business cycle fluctuations, the interest rate, unemployment rate, and inflation can also affect the amount of indebtedness. Commodity price shocks (e.g., oil) and global financial shocks are also mentioned among this group of factors (

Theong et al. 2018). Studies have confirmed the relationship between economic growth and debt, meaning that debt increases with economic growth. As incomes rise in good times, loan repayment becomes easier, while during a recession, bad loans increase due to the financial difficulties experienced by households (

Fernández de Lis et al. 2000). From the lenders’ perspective, interest rates represent the rate of return on the business of lending, while from the perspective of borrowers, interest rates represent the cost of a loan. An increase in interest rates usually reduces the ability of borrowers to meet their debt obligations (

Beck et al. 2015). The unemployment rate is one popular indicator of indebtedness. As a result of a slow rise in unemployment, borrowers reduce their spending due to less liquid cash flow, which weakens their ability to meet loan obligations. Job loss has a negative impact on the household and may cause payment problems. This results in a decrease in the value of loans (

Messai and Jouini 2013). There are ambiguous links between inflation and credit debt. On the one hand, inflation is often driven by low interest rates and devalues the real value of debt, stimulating higher household spending and even reducing unemployment, thus sending a negative signal. On the other hand, inflation reduces the real value of income because wages do not rise with inflation. This makes debt repayment difficult because there are fewer funds available, which ultimately deteriorates the quality of the loan portfolio (

Klein 2013). Another factor affecting household indebtedness is commodity price shocks. According to the

IMF (

2015), commodity (oil) price shocks are actually procyclical and provide a feedback loop on banks’ balance sheets (

IMF 2015). Besides, oil price increases have been found to improve the asset position of borrowers and reduce their risk of default (

Idris and Nayan 2016). Global financial shocks decrease external demand and reduce production in export-dependent countries. An adverse global financial shock worsens domestic conditions for financing, creates negative wealth effects, and consequently reduces real economic activity. Domestic credit conditions also become more restrictive as household balance sheets deteriorate (

Tng 2013). One of the global shocks that has taken place in recent times is the COVID-19 pandemic.

The research aim of this paper is to investigate and evaluate the changes in the value of consumer loans as a result of exogenous factors (COVID-19) in the Visegrad Group (V4), over a relatively short period of time. The pandemic in the V4 countries has influenced the propensity of households to take out loans, as well as the propensity for institutions to lend to them, thus affecting both borrowers’ and lenders’ behaviour.

There are both theoretical and practical reasons for undertaking such a subject of research. The current state of knowledge on the consumer credit market situation in V4 countries is incomplete. The relation between the consumer credit market and the COVID-19 pandemic is not widely described in the literature and is mainly broached in national literature. It is more common to find studies focusing on the impact of the pandemic on the banking sector (

Andersen et al. 2020;

Beck 2021;

Aiyar et al. 2021), on consumer credit regulation (

Gębski 2021;

Davola 2020) or on assessing the situation of the consumer credit market in Europe or the European Union (

Dursun-de Neef and Schandlbauer 2021;

Demertzis et al. 2020). Consequently, there are many investigations on the impact of the pandemic on consumer loans, but there are no studies showing the impacts on the consumer loan market in the Visegrad Group of countries during the pandemic in a comprehensive and integrated manner, simultaneously combining theoretical aspects and research results. The issue of the impact of the pandemic on the consumer loan market in V4 countries is important not only from the cognitive point of view, but also for economic practice. The situation and development of this market during the pandemic is important from the point of view of borrowers, lenders, and economic entities, as well as the whole economy. Meanwhile, the results of our research allow us to conclude that the COVID-19 pandemic has determined the value of household debt in V4 countries and has also had an impact on the decision-making of households on taking out consumer loans. This situation prompted an investigation into the relationship between the level of household consumer credit debt and the development of the pandemic. This was followed by research into the impact on consumer credit debt, principally of the number of COVID-19 cases, the number of COVID-19 deaths, the number of COVID-19 tests, the number of COVID-19 vaccinations, and the change in the level of the restrictiveness index.

Consequently, the main objective of this paper is to investigate the impact of the COVID-19 pandemic on the value of consumer credit incurred in V4 countries, i.e., the Czech Republic, Poland, Slovakia, and Hungary. The specific aim is to explore the situation of the consumer credit market in the Visegrad Group of countries during the COVID-19 pandemic.

The main objective is divided into theoretical–cognitive and application aims. The achievement of the theoretical–cognitive goal in terms of presenting existing knowledge required the identification of areas of the situation on the consumer credit market (especially during the pandemic), as well as determining household indebtedness. Achievement of the theoretical–cognitive objective, in turn, required the study of the volume and dynamics of the value of consumer credit in V4 countries, and the development of a model of the relationship between the determinants of household consumer credit indebtedness during the pandemic. The application (practical) objective encompassed conclusions based on the research, as well as recommendations for various groups of stakeholders interested in the issues of consumer credit during the pandemic, including borrowers, lenders, institutional entities, economics practitioners, and students of various fields of study.

Based on the subject of the research and the adopted objectives, the hypothesis was formulated that the COVID-19 pandemic has determined the amount of household consumer credit debt in the V4 group, but that the determinants of this debt and the direction and strength of their impact are varied.

The considerations undertaken in the paper fall within the framework of economic sciences in the discipline of finance, with particular emphasis on sub-disciplines such as banking, international finance, and credit markets. The problems discussed in the article relate to current problems experienced by contemporary finance, also from the aspect of dilemmas related to the development of the field of finance.

2. Literature Review

The COVID-19 outbreak triggered by the SARS-CoV-2 coronavirus in the Peoples’ Republic of China has been and is still being observed, endured, and commented on by governments, scientists, and the public. The rapid increase in positively diagnosed cases, as well as the subsequent boost in secondary outbreaks in many countries around the world, have raised international concerns. What is evident is that the ongoing pandemic and the ensuing public health interventions have seriously disrupted economic activity, affected the financial markets, and highlighted various issues, such as the significant reduction in production and in the number of contracted loans (including consumer credit).

In research conducted by

Horvath et al. (

2021), two potential, but not mutually exclusive, channels were indicated relating to the consequences of the pandemic on the situation in the consumer credit market. First, they ascertained that changes in the use of credit may be driven by the pandemic itself, as measured by the local number of cases (e.g., infections). In a situation where consumers are wary of being infected with the virus, they leave their homes less frequently, shop less, and stay at home (even in the absence of official orders to do so). Therefore, the term ‘pandemic’ itself can be applied not only to the immediate health effects (the number of cases), but also to voluntary changes in individual behaviour in response to the epidemic (fear of the virus). Secondly, policy responses in the form of non-productive investments, such as closing non-essential companies, also disrupt the local economy and may have a similar or potentially stronger impact on the use of credit (

Horvath et al. 2021).

In terms of supply, the COVID-19 shock may also negatively influence the availability of consumer credit. If banks expect a rise in default rates, they may possibly tighten rules for issuing credit. Indeed, our research found that the pandemic itself was the main driving force of change in the use of consumer credit. Hence, this outcome provides evidence that the fear of the virus has had strong negative effects on consumer credit demand, even in the absence of government-imposed restrictions. Further evidence lies in the fact that there has been a large drop in the number of new credit cards issued—especially for the highest risk borrowers (

Horvath et al. 2021).

According to

Gębski (

2021), almost immediately after the lockdown in Europe, the consumer finance market in the region experienced a rapid fall in the volume of credit issued. Research conducted among the members of Eurofinas (the European association of entities offering consumer loans) reveals that a reduction in new loans occurred in all major market segments. In the first half of 2020, the total number of consumer loans granted in Europe dropped by over 21%, and sharp declines were observed in all categories of consumer credit. The changes in the volume of new consumer loans were not directly related to the duration and scope of the lockdown, but rather reflected the accumulated consumer demand or the level of wealth of citizens. It was also pointed out in what way the determination and consistency of regulatory actions implemented on the financial market (e.g., credit moratoria, restrictions on the special rate in the consumer finance market, operations providing additional liquidity for the banking sector) were allowed to counteract the effects of the pandemic crisis on consumer finance. Accordingly, Europe and the U.S.A. were very effective in counteracting the effects of the COVID-19 crisis, and measures taken by financial market regulators turned out to be highly effective (there were no negative structural phenomena on the financial market). The accuracy of the selection of instruments and the speed of action limited the social and financial consequences of the pandemic, as the imposed credit repayment memorandum (limiting the costs of consumer credit and providing support to the banking sector) limited the scale of growth of households with over-indebtedness and consumer bankruptcy (

Gębski 2021).

Nevertheless, the crisis revealed many dysfunctions in the consumer finance market. At first, consumers reacted to the crisis with a purchasing panic. Their budgets were not prepared for the falling revenues caused by the COVID-19 crisis. As a consequence, their credit standing worsened and financial institutions significantly reduced their lending. After these events, trust in financial institutions around the world dropped significantly. The evaluation of market data reveals that the safeguards implemented by European financial regulators have ensured—at least until now—the stability of the financial sector. At the same time, the direct relations between consumers and banks deteriorated, with a visible deficit of mutual trust. Indeed, household indebtedness has increased largely in many markets and many consumers have been excluded from the financial sector due to their situation (

Gębski 2021).

Many studies also indicate that during the COVID-19 pandemic, demand for consumer credit has declined and consumers have started adapting their consumption to the prevailing conditions. Surveys such as that conducted by the

European Commission and ICF (

2021) have shown that, due to the outbreak of the COVID-19 pandemic, the level of indebtedness showed some signs of decline. This is because consumers postponed planned spending on items such as cars and appliances, and thereby reduced the number of credit transactions (

European Commission and ICF 2021). This thesis is confirmed by the

Canals-Cerdá and Lee (

2021) study, which investigated the impact of the COVID-19 crisis on credit channels by focusing on car loans. The study demonstrated a significant drop in auto loan originations in March–April and in November–December, and a rebound in May–June. These periods coincide closely with the waves of the pandemic, in which strong increases were observed in infections and deaths from COVID-19. Furthermore, they found the largest drop and the smallest rebound in the subprime segment in this period.

Canals-Cerdá and Lee (

2021) also show the differences in banks’ consumer lending behaviour during the current health crisis compared to past financial crises. They showed that during a financial crisis, banks provided the most car loans, while during a health crisis, banks withdrew from providing such loans in favour of other financial firms (

Canals-Cerdá and Lee 2021). Similar figures were shown in the report by the Federal Reserve Bank of New York, which examined the indebtedness and loans of households in the U.S.A. It has been shown that, mainly due to a decline in credit card balances, growth in household debt has come to a halt. The decline in credit card balances is also because of decreased consumption during the pandemic. (

Haughwout et al. 2020).

On the other hand,

Ҫolak and Öztekin (

2021) indicate that the impact of the pandemic on the situation in the bank loan market depended on a variety of banking and domestic factors. They found that a bank’s financial condition is a meaningful determinant of the behaviour of financial institutions regarding lending policies during the pandemic. In particular, lending is most detrimental to small, foreign, and government-backed banks, and to banks with lower returns on assets. The authors indicate a strong negative impact on bank lending in countries with less developed financial intermediaries, credit markets, and bond markets, which imposes more constraints on the supply of credit. Nonetheless, strong financial institutions mitigate the negative effects of the pandemic by increasing bank loans.

Ҫolak and Öztekin (

2021) also assessed the change in the relationship between regulatory/supervisory activities and the credit market situation depending on the intensity of the aggregate risk associated with the pandemic. They found no evidence that regulatory constraints (e.g., high capital requirements) hinder the accessibility of credit from lenders, and that the supply of bank loans was negatively affected by restrictive regulation and supervision. They also stated that the decline in bank lending growth was lower in countries that were better prepared to deal with the sudden health crisis. In their conclusions, they point out that any government action to minimize the economic damage caused by the pandemic should focus on stimulating demand for credit (e.g., through tax breaks or direct government loans to small businesses or consumers) (

Ҫolak and Öztekin 2021).

Dursun-de Neef and Schandlbauer (

2021) also conducted research on how European banks reacted to the COVID-19 outbreak, focusing primarily on the differences between banks that were less and better recapitalized at the start of the pandemic. Applying the bank-level COVID-19 exposure measurement (calculated as a weighted average of COVID-19 cases per 1000 people), they ascertained that overall, European banks significantly reduced their lending at the start of the pandemic, but that on average, banks operating in countries with higher exposure to the COVID-19 epidemic experienced much less reduction in lending activities. When the banks were divided into those with weaker and better capitalization, essential differences were noted in the results: banks with weaker capitalizations reduced their lending to a lesser extent, while their better capitalized counterparts reduced lending much more. Moreover, the better capitalized banks increased their arrears and restructured loans more than the less capitalized ones. Evidence was also put forward that various government responses to the pandemic have helped to moderate the lending behaviour of less capitalized banks (

Dursun-de Neef and Schandlbauer 2021). The work of Dursun-de Neef and Schandlbauer indicates that governments which provided more economic support eased capital requirements and adjusted insolvency principles during the pandemic, as well as helped to bridge the gap in credit response from less and better capitalized banks. Overall, the research results draw attention to the general progress made in recovering from the unprecedented pandemic, which is largely dependent on the provision of bank liquidity. Dursun-de Neef and Schandlbauer suggest that greater economic support, loosening capital requirements, and adjusting defaults during the pandemic have removed the difference in credit responses from less and better capitalized banks (

Dursun-de Neef and Schandlbauer 2021).

Norden et al. (

2021) point out that the COVID-19 pandemic has had a significant negative impact on the local credit market (primarily in Brazil). What is more, they discovered that policy interventions have had a heterogeneous impact on the local credit market during the COVID-19 pandemic. Their work reveals that the impact on the credit market depends on the sector affected by banks and municipalities before the pandemic and is stronger with a longer duration of intervention and a higher speed of intervention (

Norden et al. 2021).

According to research carried out by

Kurowski (

2021), the financial competences of Poles should be considered as good compared to other European countries. In regard toindebtedness, the results show a low knowledge of debt management (especially in the highest age groups). In addition, Kurowski found that knowledge about finances (including the issue of taking out loans) has a fundamental impact on the debt situation of a given household. People who demonstrate greater financial literacy have relatively low levels of over-indebtedness, and the ability to manage debt plays a more important role in preparing the household budget in the event of the coronavirus pandemic. Moreover, knowledgeable consumers with higher levels of indebtedness are less likely to default as a result of the pandemic (they have more savings and are less afraid of losing their source of income). Credit experience also plays a vital role in managing the household budget. People with little experience in using consumer credit may have problems paying their liabilities and have been more exposed to credit risk than other borrowers during the COVID-19 pandemic (

Kurowski 2021).

The COVID-19 pandemic has radically changed traditional patterns of consumption in both indirect forms (i.e., influencing some of the factors that determine consumer spending, such as consumer confidence, unemployment or living costs) and in direct forms. The pandemic is also transforming consumer behaviour in relation to future expenses and, importantly, repayments of previously taken loans (

Andersen et al. 2020). Taking into consideration the expected duration of the phenomenon and its impact on the economy, and above all on employment, managing the economic exposure of consumers and outstanding loans may become a major consequence during and after the pandemic. Consumers who have used credit or loans in the past are primarily affected by the lack of protection due to the current regulatory uncertainty and need to save money to face the inevitable expenditure they must make. This reduces their purchasing power and their ability to comply with agreements with consumer credit institutions. In addition, the negative effects of the pandemic not only relate to immediate spending and the ability of consumers to pay their debts, but also to future outcomes that may result from a deterioration in their financial situation, which may worsen their ability to access credit in the future. In fact, any change will have a large impact on the consumer credit landscape of the future (

Davola 2020).

Branzoli et al. (

2021) shed light on the impact of the adoption of technology in lending during the COVID-19 pandemic. The results suggest that banks with a higher degree of pre-pandemic IT adoption granted more consumer credit as the crisis started to unfold. Greater digital capabilities may have helped banks handle a larger-than-usual number of credit applications, improve workflow through automation, and streamline approval processes. The results show that even under severe social distancing restrictions, customers still valued the possibility of having face-to-face interaction with their bank (

Branzoli et al. 2021).

3. Research Methods

Several research methods were used in this study.

In the theoretical part, a critical analysis was conducted of the scientific achievements in the field of determinants of household consumer credit indebtedness and the impact of the pandemic on the consumer credit market. The source literature analysis includes ongoing publications, mostly in English, both in the form of articles and scientific papers dealing with these issues.

In the research part, the economic statistics method was used to collect material and data and then conduct the analysis. The empirical research used mainly secondary data gathered from the databases of international institutions, i.e., the European Central Bank, the Czech Statistical Office, the Czech National Bank, the Hungarian Central Statistical Office, the Central Statistical Office of Poland (CSO), the Statistical Office of the Slovak Republic, the Ministry of Labour and Social Affairs and Family of the Slovak Republic and Our World in Data.

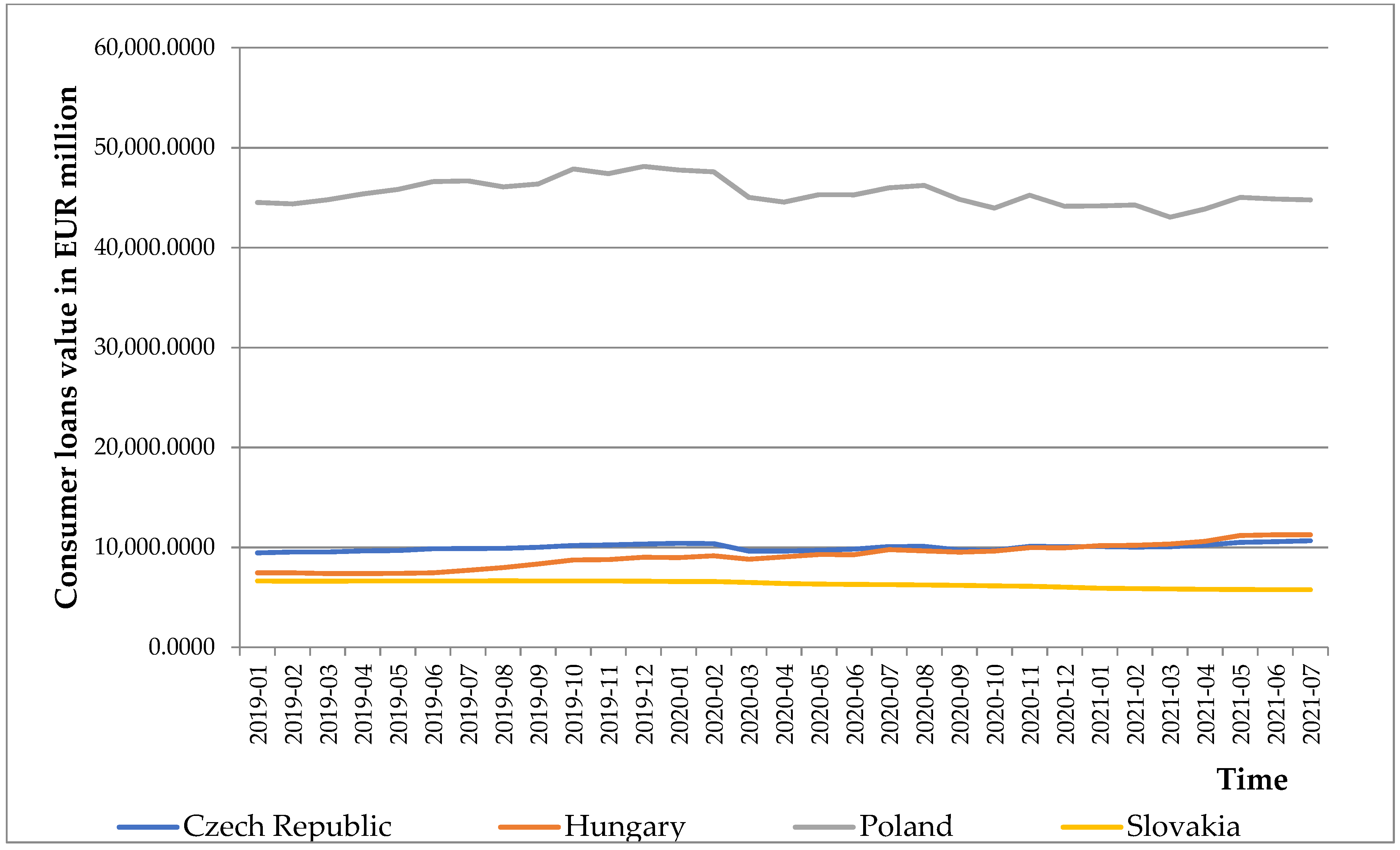

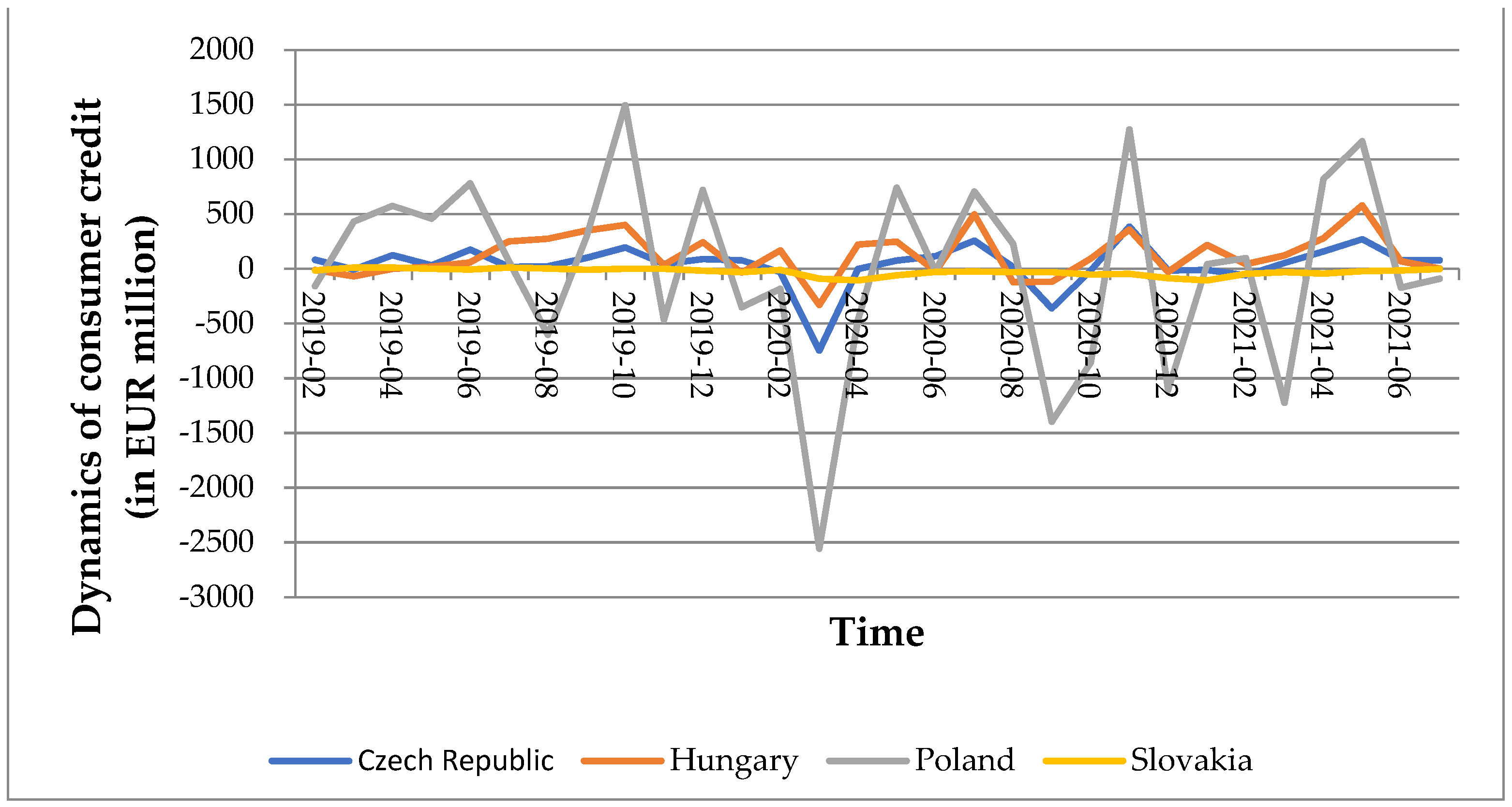

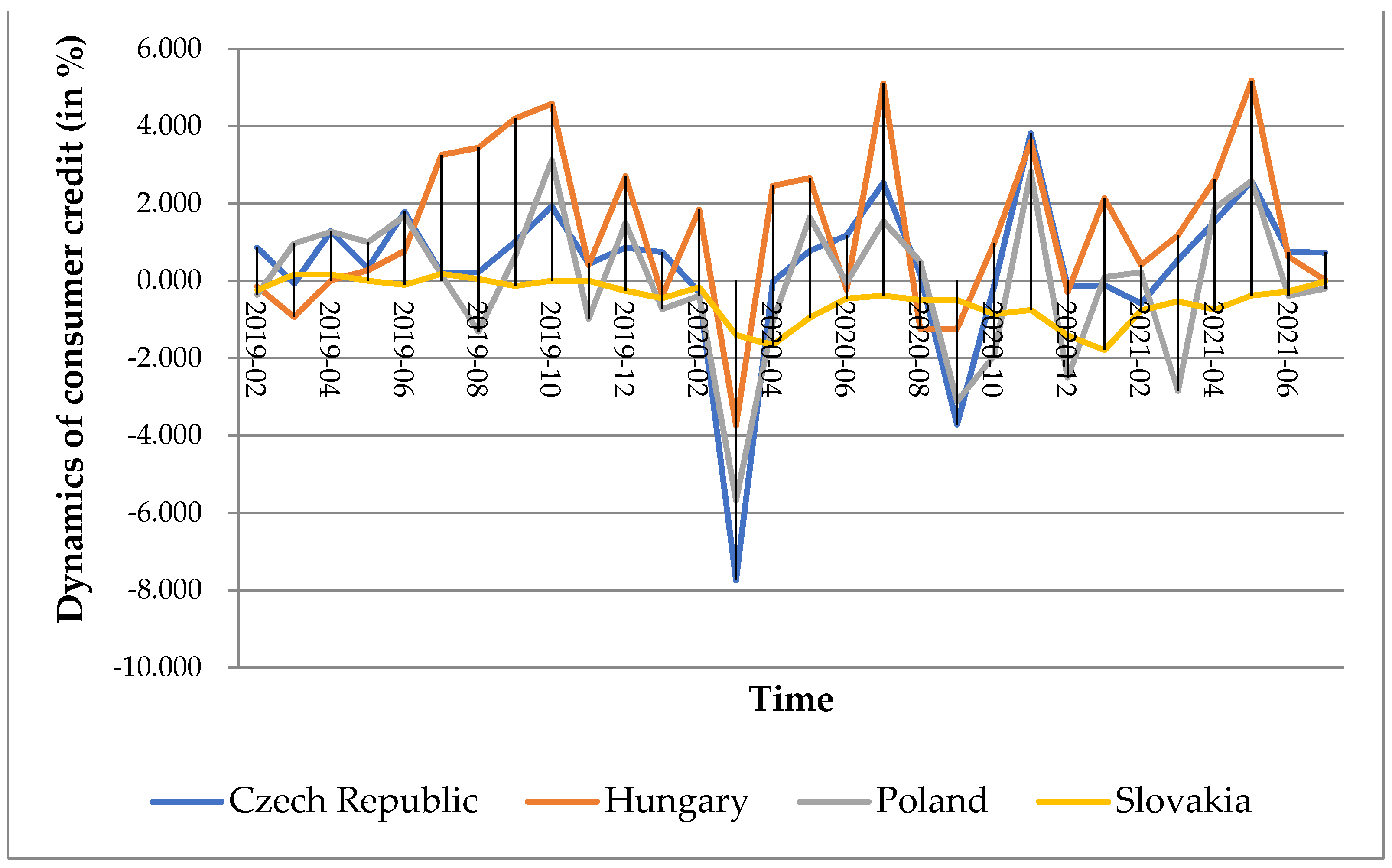

Based on the collected data, so-called desk research analysis (i.e., analysis of existing data) was carried out. Graphs were used to present and capture statistical data on the volume and dynamics of consumer credit. Appropriate statistical procedures were used in the empirical research. When examining the relationships between the value of consumer credit and the determinants of household indebtedness, correlation analysis was used. The deduction method (based on the collected data) made it possible to present trends and dependencies occurring in the consumer credit market in V4 countries. In addition, comparative analysis, time series analysis (dynamics analysis), and correlation analysis were used. Interpretation of the relationship between individual determinants and the situation on the consumer credit market (using the deduction method) made it possible to draw conclusions on the relationship between the pandemic and the consumer credit market in the Visegrad countries.

Time series analysis was used to determine the dynamics and direction of changes in household debt during the COVID-19 pandemic. Based on monthly data from the European Central Bank database, linear time series models of consumer credit values in V4 countries were built, with the main trend then determined using the analytical method described by the formula:

where Ŷ is the trend; b

0 and b

1 are model parameters; and t is time.

The trend function determines the changes in the value of consumer credit in V4 countries in relation to the time variable. The parameters of the trend model (b

0 and b

1) were estimated using the least squares method (LSM):

where yt is the consumer credit values in the V4 countries in period t; t is the number of consecutive time units;

is the average consumer credit values in the V4 countries in period t; and

is the average value of time units.

The dynamics of changes in the value of consumer credit in the V4 countries was determined based on the following formula:

where Y1 is the value of consumer credit in the V4 countries in period 1; Yn is the value of consumer credit in the V4 countries in period n; and n − 1 is the number of observations reduced by 1 (which results from the construction of chain indexes).

Achievement of the main research objective was made possible using multiple linear regression analysis. The use of this research method is justified by the fact that this method is used to determine the influence of multiple independent variables on a dependent variable. In this study, it was important to investigate how the value of household consumer credit in V4 countries changed under the influence of the development of the COVID-19 pandemic. In the research, we were primarily interested in quantifying the relationship between multiple independent variables (both economic and non-economic variables characterizing the pandemic) and the value of consumer credit in the V4 countries (the dependent variable).

The main assumption of regression analysis is the lack of relationships between the independent variables. We consider that the variables directly and indirectly related to the pandemic (non-economic and economic variables) show correlations with each other, as confirmed by

Horvath et al. (

2021),

Ҫolak and Öztekin (

2021), and

Dursun-de Neef and Schandlbauer (

2021). So, to satisfy this condition, the multiple linear regression analysis was divided into two steps. In the first step, only variables directly related to the pandemic were included in the study (non-economic variables), while the second step included only variables that were indirectly related to the pandemic (economic variables), but which could affect the value of consumer loans in the V4 group.

In the first step, a separate multiple linear regression model was built for each country in the V4 group, wherein the dependent variable was the value of household consumer credit debt, while the dependent variables were the following:

- -

the number of new COVID-19 cases (b1),

- -

the total number of COVID-19 cases (b2),

- -

the total number of deaths (b3),

- -

the number of new deaths due to COVID-19 (b4),

- -

the number of new COVID-19 tests (b5),

- -

the total number of COVID-19 tests (b6),

- -

the number of people vaccinated with at least one dose against COVID-19 (b7),

- -

the number of people fully vaccinated against COVID-19 (b8),

- -

COVID-19 vaccinations in total (b9),

- -

the restrictiveness index (b10), based on nine indicators, principally restrictions, such as the lockdown of schools and workplaces, the requirement to wear a mask, as well as restrictions on movement. The range of this indicator is from 0 to 100, where zero is the mildest and 100 the strictest in terms of the level of restrictiveness.

In the second step of the analysis, only variables that are indirectly related to the pandemic—economic variables—were included, as in our opinion these can have a large impact on the value of the credit studied. Again, a separate multiple linear regression model was constructed for each country in the V4 group, in which the dependent variable was the value of household consumer credit, while the dependent variables were as follows:

- -

unemployment rate (b11),

- -

consumer Price Index CPI (b12),

- -

GDP Constant Prices (b13),

- -

wages (b14),

- -

interest rate (b15).

In the multiple linear regression analysis, the progressive stepwise regression method was applied. When building the model, all the above-mentioned variables were considered, but only those that were statistically significant were entered into the model. Statistical significance was assessed using the t-test, assuming a maximum 5% probability of inference error (p < 0.05). Thus, the variables whose value was higher than the critical value resulting from the t-Student distribution test at the level of alpha <0.05 were considered statistically significant. Subsequently, after including all statistically significant variables in the model, the linear significance for the entire constructed model was tested using the F-test statistic.

The estimated multiple linear regression model is described by the following equation:

where: b

i is the partial regression factors of the model parameters representing independent variables influencing the level of household debt due to consumer credit in V4 countries.

The application of the multiple linear regression model answered the question whether the COVID-19 pandemic, which resulted from the appearance of the SarsCov-2 virus, determined changes in the value of household consumer credit debt during the test period.

The research used the monthly values of household debt due to consumer credit in V4 countries, extracted from the database of the European Central Bank (ECB). Daily data on indicators reflecting the pandemic in V4 countries were also used. Daily data for regression analysis was averaged (arithmetic mean) and presented over 17 monthly periods. Data on the pandemic in the studied countries was obtained from the database published on

ourworldindata.org/coronavirus, which collects government data from around the world. Data on economic variables was obtained from the Czech Statistical Office, the Czech National Bank, the Hungarian Central Statistical Office, the Central Statistical Office of Poland (CSO), the Statistical Office of the Slovak Republic, and the Ministry of Labour and Social Affairs and Family of The Slovak Republic.

The research was conducted from 1 January 2019 to 31 July 2021 (time series analysis) and for the duration of the pandemic from 1 March 2020 to 31 July 2021 (regression analysis). The adopted research period was determined by the duration of the pandemic in V4 countries and the availability of statistical data. The first case of the new COVID-19 disease was recorded on 17 November 2019, in Hubei, a province of the People’s Republic of China, in the city of Wuhan. In a very short time, the disease spread around the world, and the number of COVID-19 cases increased to such proportions that less than four months later (11 March 2020), the World Health Organization (WHO) characterized the disease as a pandemic. As of the date of concluding this study, the pandemic is still ongoing, as the Sars-CoV-2 virus responsible for COVID-19 is constantly mutating. Such a situation has caused difficulties in establishing both the upper and lower limits of the study. The difficulty in determining the research period is also due to the disparity in the frequency of publication of individual statistical data. Due to this fact, two different research periods were adopted in the individual analyses. In the time series analysis, in order to compare the dynamics of change before and during the pandemic, January 2019 was taken as the start of the research. During the research period, the most complete current statistical data ended in July 2021, so the research period closed on 31 July 2021. However, in the correlation analysis, the study period was determined by the timing of the outbreak of the pandemic in each country. Although the beginning of the COVID-19 pandemic was dated November 2019, the timing of its spread to individual countries varied. Therefore, 1 March 2020 was taken as the start of the study period, as from this date all V4 countries recorded COVID-19 cases and started publishing statistical data on the spread of the pandemic. Due to the availability of up-to-date statistical data, the upper limit of the study was set—as in the dynamics analysis—on 31 July 2021.

5. Conclusions

In this study, two aims were defined: the main goal and a specific goal. The main goal was to investigate the impact of the COVID-19 pandemic on the value of consumer credit incurred in V4 countries, while the specific goal was to explore the consumer credit market in the Visegrad Group of countries during the COVID-19 pandemic. The implementation of the set goals was based on a critical analysis of source texts, as well as on a quantitative study in which two research methods were applied:

- -

research into the level and dynamics of changes in the value of consumer credit in the Czech Republic, Hungary, Poland, and Slovakia (time series analysis),

- -

research into the determinants of changes in the value of consumer credit in the Czech Republic, Hungary, Poland, and Slovakia (multiple linear regression analysis).

A hypothesis was formulated in the paper that the COVID-19 pandemic has determined the amount of household debt due to consumer credit in the V4 group, but that the determinants of this debt, as well as the direction and strength of their impact, are varied. The research results provide positive verification of the hypothesis, and the research objectives were achieved. Our work has revealed that changes in the pandemic in V4 countries translate into the propensity of households to take out consumer credit. Both the time series analysis and regression analysis confirm this outcome.

Based on the time series analysis, we demonstrated that the pandemic has influenced the tendency of households to take out loans, as well as the propensity of banks to lend them, therefore it affects the behaviour of both borrowers and lenders. We also showed that in periods of increased COVID-19 transmission, there was a low propensity for using credit, while in periods of relative suppression of COVID-19 symptoms, this tendency increased. Thus, the research results confirmed the hypothesis that the COVID-19 pandemic determined the amount of household debt arising from consumer loans.

The regression analysis results allowed for the factors influencing the value of consumer credit incurred by households to be assessed. Evidence was provided demonstrating that not all the factors that define the COVID-19 pandemic determine the value of the credit studied. Our work has revealed that the dominant factor in terms of the scope of impact on the non-economic value of household debt was the number of newly performed COVID-19 tests (variable b5). This variable was significant for the regression model for the Czech Republic, Poland, and Slovakia. Our results also confirmed that the dominant factor in terms of the strength of its impact on the value of household debt was the restrictiveness index (variable b10). Moreover, we showed that the introduction of further restrictions to prevent the spread of the COVID-19 pandemic in the Czech Republic was associated with a reduction in the value of consumer credit taken by households by over EUR 21 million. In addition, we demonstrated that the factors significant for the debt of households in the V4 group were: the number of new COVID-19 cases (variable b1), the number of new deaths from COVID-19 (variable b4), the number of people vaccinated against COVID-19 with at least one dose (variable b7), the total number of deaths (variable b3), the total number of COVID-19 tests (variable b6), and the number of people fully vaccinated against COVID-19 (variable b8). At the same time, the study results also indicated that the scope of the impact of these variables was not the same for individual countries, e.g., the number of new COVID-19 cases (variable b1) was significant for the household debt in Poland and the Czech Republic, while in Hungary and Slovakia this variable was insignificant. We confirmed that the direction and strength of the impact of the scrutinized variables varies. The research results corroborated that, for instance, the same variable (b1) has a counter-proportional effect on the value of household debt in Poland but is directly proportional to the value of household debt in the Czech Republic. At the same time, we can demonstrate that the intensity of the impact of these variables is divergent. For example, a rise in the number of new COVID-19 cases (variable b1) in Poland caused a drop in household debt by EUR 140,000, while an increase in the number of new COVID-19 cases (variable b1) in the Czech Republic entailed a surge in household debt by EUR 40,000. The analysis of the remaining variables showed similar trends.

The results of the study also proved that economic variables that are indirectly related to the pandemic in V4 countries have an impact on the value of consumer loans taken out by households. The highest correlation strength was shown between the unemployment rate variable and the Consumer Price Index (CPI) variable. This shows that both the unemployment rate and increases in the level of prices of consumer goods and services are important in decisions aimed at satisfying the consumption needs of credit-financed households.

The results of the research indicate without a doubt that the COVID-19 pandemic has determined the value of household debt in the V4 group and has had an impact on household decisions concerning taking out consumer loans.

The main conclusion of this study is that the impact of the variables analysed on the value of household consumer credit varies across countries. The results obtained differ both in terms of the strength, direction, and extent of the impact of individual variables. This makes it difficult to standardise the results and does not allow them to be applied to the entire V4 group.

The study results should, however, be taken with a certain degree of caution, as the COVID-19 pandemic is ongoing and developing and the SarsCov-2 pathogen is constantly mutating. This situation may raise new issues in the future that cannot be anticipated at present. Undeniably, this research is of a preliminary nature; nevertheless, to a certain extent it contributes to a better comprehension of the phenomenon of household indebtedness at a time of turmoil and instability resulting from health factors in V4 countries. In the future, this research will serve as the basis for further study into the phenomenon of household indebtedness in other countries.

The impact of the COVID-19 pandemic on the consumer credit market in V4 countries requires further research in the areas of confirming the importance of individual types of consumer credit against all consumer credit, as well as the share of consumer credit in the total value of loans granted to households. Conducting further exploration is important both from a theoretical and practical point of view. In future research, it would be advisable to include household indebtedness resulting from credit cards, mortgage loans, and loans for the purchase of securities, as well as household loans and indebtedness with shadow banking institutions. Longitudinal studies showing the dynamics of changes that occur during a pandemic for specific types of loans to households would be of particular value.