Determinants of Indebtedness: Influence of Behavioral and Demographic Factors

Abstract

:1. Introduction

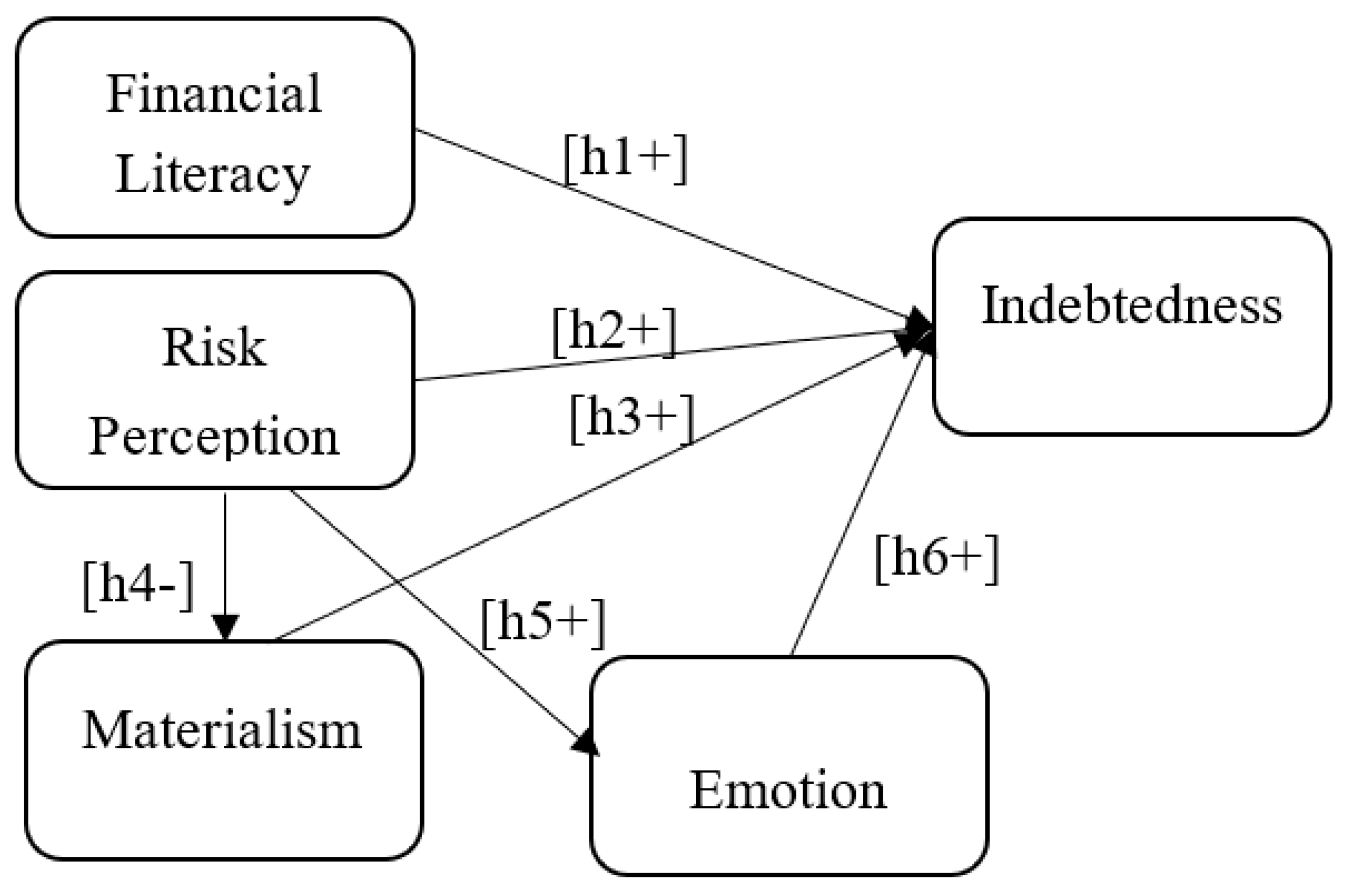

2. Theoretical Basis

3. Methodology

4. Results and Discussion

4.1. Respondents’ Demographic Characteristics

4.2. Measurement Model Assessment

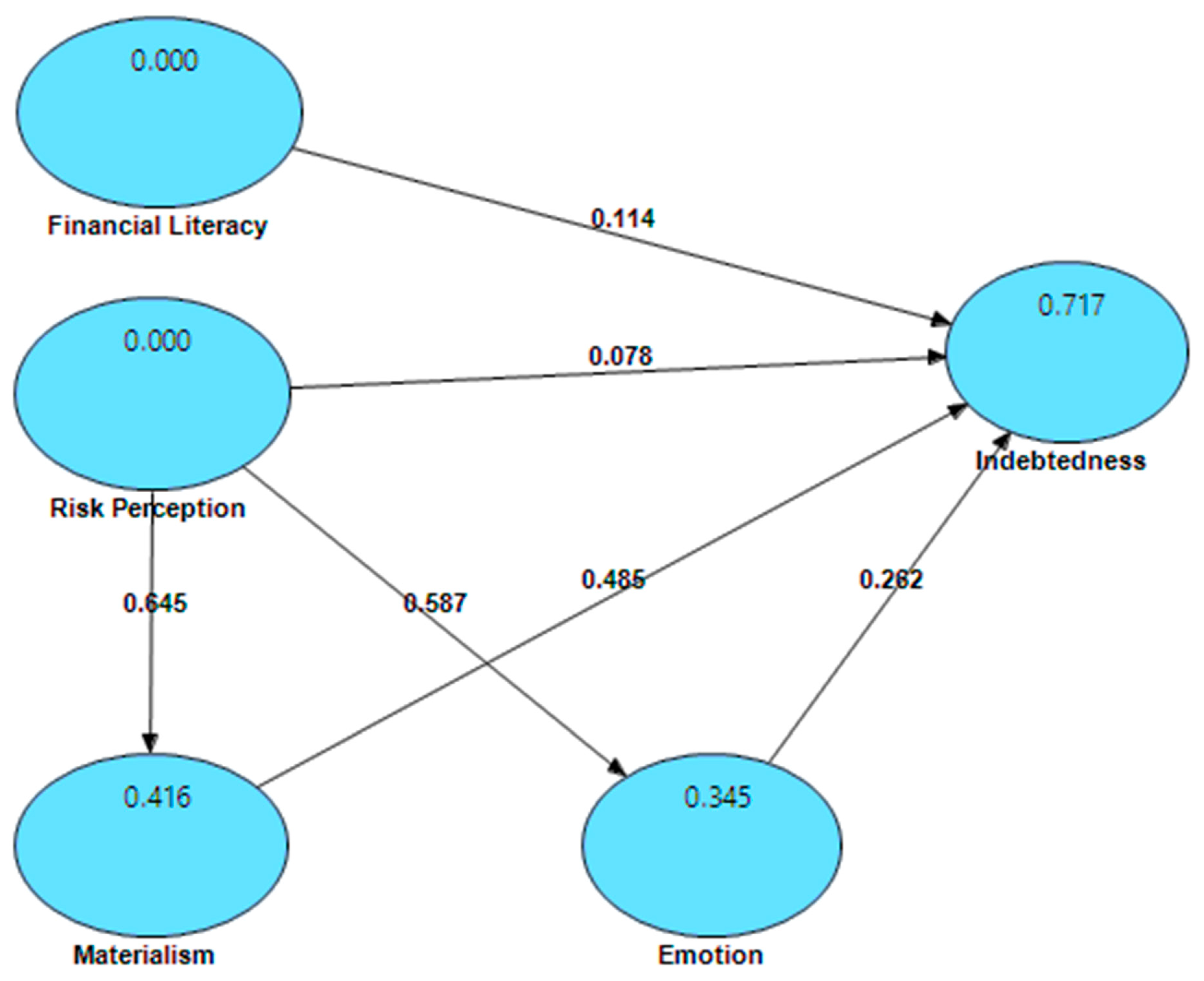

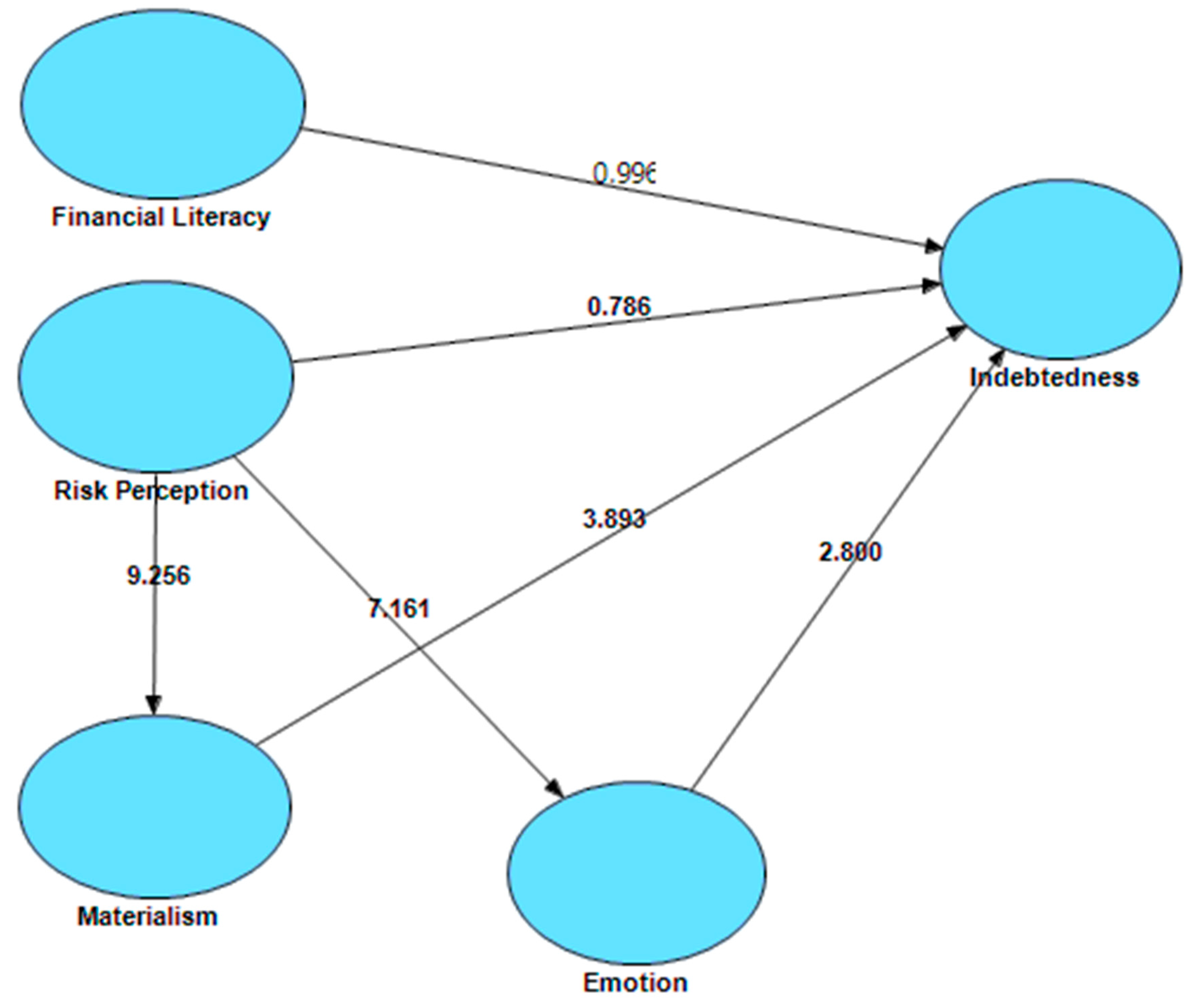

4.3. Structural Model

4.4. Assessment of Demographic Profile and Constructs

5. Conclusions, Implications, and Limitations

Author Contributions

Acknowledgments

Conflicts of Interest

References

- Ahmed, Zafar U., Ishak Ismail, M. Sadiq Sohail, Ibrahim Tabsh, and Hasbalaila Alias. 2010. Malaysian consumers’ credit card usage behavior. Asia Pacific Journal of Marketing and Logistics 22: 528–44. [Google Scholar] [CrossRef]

- Azma, Nurul, Mahfuzur Rahman, Adewale Abideen Adeyemi, and Muhammad Khalilur Rahman. 2019. Propensity toward indebtedness: Evidence from Malaysia. Review of Behavioral Finance 11: 188–200. [Google Scholar] [CrossRef]

- Baker, H. Kent, Satish Kumar, Nisha Goyal, and Vidhu Gaur. 2019. How financial literacy and demographic variables relate to behavioral biases. Managerial Finance 45: 124–46. [Google Scholar] [CrossRef]

- Barros, Lucia, and Delane Botelho. 2012. Hope, perceived financial risk and propensity for indebtedness. BAR-Brazilian Administration Review 9: 454–74. [Google Scholar] [CrossRef] [Green Version]

- Caetano, Gregorio, Miguel Palacios, and Harry Anthony Patrinos. 2011. Measuring Aversion to Debt: Experiments among Student Loan Candidates. Social Science Research Network. Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1895966 (accessed on 26 November 2019).

- Chaplin, Lan Nguyen, Deborah Roedder John, Aric Rindfleisch, and Jeffrey J. Froh. 2019. The impact of gratitude on adolescent materialism and generosity. The Journal of Positive Psychology 14: 502–11. [Google Scholar] [CrossRef]

- Chatterjee, Devlina, Mahendra Kumar, and Kapil K. Dayma. 2019. Income security, social comparisons and materialism. International Journal of Bank Marketing 37: 1041–61. [Google Scholar] [CrossRef]

- Cohen, Jacob. 1988. Statistical Power Analysis for the Behavioral Sciences, 2nd ed. Hillsdale: Lawrence Erlbaum. [Google Scholar]

- Darriet, Elisa, Marianne Guille, Jean-Christophe Vergnaud, and Mariko Shimizu. 2020. Money illusion, financial literacy and numeracy: Experimental evidence. Journal of Economic Psychology 76: 102211. [Google Scholar] [CrossRef]

- Daud, Siti Nurazira Mohd, Ainulashikin Marzuki, Nursilah Ahmad, and Zurina Kefeli. 2019. Financial Vulnerability and Its Determinants: Survey Evidence from Malaysian Households. Emerging Markets Finance and Trade 55: 1991–2003. [Google Scholar] [CrossRef]

- Disney, Richard, and John Gathergood. 2011. Financial Literacy and Indebtedness: New Evidence for UK Consumers. EconPapers. Available online: http://econpapers.repec.org/paper/notnotcfc/11_2f05 (accessed on 26 November 2019).

- Eberhardt, Wiebke, Wändi Bruine de Bruin, and JoNell Strough. 2019. Age differences in financial decision making: The benefits of more experience and less negative emotions. Journal of Behavioral Decision Making 32: 79–93. [Google Scholar] [CrossRef]

- Endut, Norhana, and Toh Geok Hua. 2009. Household Debt in Malaysia. BIS Papers No 46. Basel: Bank for International Settlements Communications, pp. 107–16. [Google Scholar]

- Farrar, Sue, Jonathan Moizer, Jonathan Lean, and Mark Hyde. 2019. Gender, financial literacy, and preretirement planning in the UK. Journal of Women and Aging 31: 319–39. [Google Scholar] [CrossRef]

- Fletschner, Diana, and Dina Mesbah. 2011. Gender Disparity in Access to Information: Do Spouses Share What They Know? World Development 39: 1422–33. [Google Scholar] [CrossRef]

- Flores, Silvia Amélia Mendonça, and Kelmara Mendes Vieira. 2014. Propensity toward indebtedness: An analysis using behavioral factors. Journal of Behavioral and Experimental Finance 3: 1–10. [Google Scholar] [CrossRef]

- Gärling, Tommy, Erich Kirchler, Alan Lewis, and Fred Van Raaij. 2009. Psychology, financial decision making, and financial crises. Psychological Science in the Public Interest 10: 1–47. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Gathergood, John. 2012. Self-control, financial literacy and consumer over-indebtedness. Journal of Economic Psychology 33: 590–602. [Google Scholar] [CrossRef] [Green Version]

- Ghani, Nazreen Abdul. 2010. Household Indebtedness and its Implications for Financial Stability in Malaysia. Household Indebtedness and Its Implications for Financial Stability 67. Available online: https://core.ac.uk/download/pdf/6281321.pdf#page=81 (accessed on 29 November 2019).

- Greig, Bruce, Peter Nuthall, and Kevin Old. 2019. Farmers’ characteristics’ and the propensity to reduce debt. Agricultural Finance Review 79: 614–32. [Google Scholar] [CrossRef]

- Hair, Joseph F., Jr., G. Tomas M. Hult, Christian Ringle, and Marko Sarstedt. 2013. A primer on partial Least Squares Structural Equation Modeling (PLS-SEM). Thousand Oaks: Sage. [Google Scholar]

- Hsu, Joanne W. 2016. Aging and strategic learning: The impact of spousal incentives on financial literacy. Journal of Human Resources 51: 1036–67. [Google Scholar] [CrossRef]

- Huy, Quy, and Christoph Zott. 2019. Exploring the affective underpinnings of dynamic managerial capabilities: How managers’ emotion regulation behaviors mobilize resources for their firms. Strategic Management Journal 40: 28–54. [Google Scholar] [CrossRef] [Green Version]

- Jalil, Abdul, and Muhammad Khalilur Rahman. 2010. Financial transactions in Islamic Banking are viable alternatives to the conventional banking transactions. International Journal of Business and Social Science 1: 219–33. [Google Scholar]

- Kalwij, Adriaan, Rob Alessie, Milena Dinkova, Gea Schonewille, Anna Van der Schors, and Minou Van der Werf. 2019. The effects of financial education on financial literacy and savings behavior: Evidence from a controlled field experiment in Dutch primary schools. Journal of Consumer Affairs 53: 699–730. [Google Scholar] [CrossRef] [Green Version]

- Katona, George. 1975. Psychological Economics. New York: Elsevier. [Google Scholar]

- Keese, Matthias. 2010. Who Feels Constrained by High Debt Burdens? Subjective vs. Objective Measures of Household Indebtedness. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1592417 (accessed on 10 February 2020).

- Keese, Matthias. 2012. Who feels constrained by high debt burdens? Subjective vs. objective measures of household debt. Journal of Economic Psychology 33: 125–41. [Google Scholar] [CrossRef]

- Lin, Liqiong, Mohamad Dian Revindo, Christopher Gan, and David A. Cohen. 2019. Determinants of credit card spending and debt of Chinese consumers. International Journal of Bank Marketing 37: 545–64. [Google Scholar] [CrossRef]

- Loke, Yiing Jia. 2016. Living beyond one’s means: Evidence from Malaysia. International Journal of Social Economics 43: 2–18. [Google Scholar] [CrossRef]

- Loretts, Ekaterina, Svetlana Golovina, and Lidiya Smirnova. 2019. Functioning field of farm enterprises in Russia: Uncertainty and risks. In International Scientific and Practical Conference “Digital Agriculture-Development Strategy”. Amsterdam: Atlantis Press. [Google Scholar]

- Lusardi, Annamaria, and Olivia S. Mitchelli. 2007. Financial literacy and retirement preparedness: Evidence and implications for financial education. Business Economics 42: 35–44. [Google Scholar] [CrossRef] [Green Version]

- Lusardi, Annamaria, Pierre-Carl Michaud, and Olivia S. Mitchell. 2013. Optimal Financial Knowledge and Wealth Inequality. NBER Working Paper No. 18669. Cambridge: NBER. [Google Scholar]

- Mann, David, Chidambarathanu Narayanan, John Caparusso, and Prabhat Chandra. 2013. Asia Leverage Uncovered. London: Standard Chartered. [Google Scholar]

- Metawa, Noura, M. Kabir Hassan, Saad Metawa, and M. Faisal Safa. 2019. Impact of behavioral factors on investors’ financial decisions: Case of the Egyptian stock market. International Journal of Islamic and Middle Eastern Finance and Management 12: 30–55. [Google Scholar] [CrossRef]

- Mishra, Manit, and Sasmita Mishra. 2016. Financial risk tolerance among Indian investors: A multiple discriminant modeling of determinants. Strategic Change 25: 485–500. [Google Scholar] [CrossRef]

- Muñoz-Murillo, Melisa, Pilar B. Álvarez-Franco, and Diego A. Restrepo-Tobón. 2020. The role of cognitive abilities on financial literacy: New experimental evidence. Journal of Behavioral and Experimental Economics 84: 101–482. [Google Scholar] [CrossRef]

- Nguyen, Linh, Gerry Gallery, and Cameron Newton. 2019. The joint influence of financial risk perception and risk tolerance on individual investment decision-making. Accounting & Finance 59: 747–71. [Google Scholar]

- Okech, David, Yoko Mimura, Teresa Mauldin, and Junghyun Kim. 2013. The Influence of Financial Factors on Motivation to Save among Poor Individuals. Journal of Policy Practice 12: 107–24. [Google Scholar] [CrossRef]

- Ottaviani, Cristina, and Daniela Vandone. 2011. Impulsivity and household indebtedness: Evidence from real life. Journal of Economic Psychology 32: 754–61. [Google Scholar] [CrossRef]

- Phan, Thuy Chung, Marc Oliver Rieger, and Mei Wang. 2019. Segmentation of financial clients by attitudes and behavior. International Journal of Bank Marketing 37: 44–68. [Google Scholar] [CrossRef]

- Ponchio, Mateus Canniatti. 2006. The Influence of Materialism on Consumption Indebtedness in the Context of Low Income Consumers from the City of Sao Paulo. Ph.D. thesis, Escola de Administração de Empresas de São Paulo, Bela Vista, Brazil; p. 175. [Google Scholar]

- Quelch, John A., and Katherine E. Jocz. 2007. Greater Good: How Good Marketing Makes for a Better World. Boston: Harvard Business Press. [Google Scholar]

- Reed, Matthew, and Debbie Cochrane. 2012. Student Debt and the Class of 2011. The Project on Student Debt. Oakland: The Institute of College Access and Success. [Google Scholar]

- Richins, Marsha L., and Scott Dawson. 1992. Consumer values orientation for materialism and its measurement: Scale development and validation. The Journal of Consumer Research 19: 303–16. [Google Scholar] [CrossRef]

- Roazzi, Antonio, Maria da Graça Bompastor Borges Dias, Janaína Oliveira da Silva, Luciana Barboza dos Santos, and Maíra Monteiro Roazzi. 2011. Que é emoção? Em busca da organização estrutural do conceito de emoção em crianças. Psicologia: Reflexão e Crítica 24: 51–61. [Google Scholar] [CrossRef]

- Santos, Cristiane Pizzutti dos, and Daniel Von Der Heyde Fernandes. 2011. A socialização de consumo e a formação do materialismo entre os adolescents. RAM. Revista de Administração Mackenzie 12: 169–203. [Google Scholar] [CrossRef]

- Selvanathan, Mahiswaran, Uma Devi Krisnan, and Wong Chui Wen. 2016. Factors Effecting Towards Personal Bankruptcy among Residents: Case Study in Klang Valley, Malaysia. International Journal of Human Resource Studies 6: 98–109. [Google Scholar] [CrossRef]

- Sevim, Nurdan, Fatih Temizel, and Özlem Sayılır. 2012. The effects of financial literacy on the borrowing behavior of Turkish financial consumers. International Journal of Consumer Studies 35: 573–79. [Google Scholar] [CrossRef]

- Stock, James H., and Mark W Watson. 2003. Forecasting output and inflation: The role of asset prices. Journal of Economic Literature 41: 788–829. [Google Scholar] [CrossRef]

- Vitt, Lois A. 2004. Consumers’ financial decisions and the psychology of values. Journal of Financial Service Professionals 58: 68–77. [Google Scholar]

- Ward, Adrian F., and John G. Lynch Jr. 2019. On a need-to-know basis: How the distribution of responsibility between couples shapes financial literacy and financial outcomes. Journal of Consumer Research 45: 1013–36. [Google Scholar] [CrossRef]

- Yusoff, Mohammed B., Fauziah Abu Hasan, and Suhaila Abdul Jalil. 2000. Globalisation, economic policy and equity: The case of Malaysia. In Poverty and Income Inequality in Developing Countries: A Policy Dialogue on the Effects of Globalisation. Paris: OECD Development Centre. [Google Scholar]

| Hypotheses/Relations | References | |

|---|---|---|

| H1: | Financial literacy positively affects propensity toward indebtedness. | Disney and Gathergood (2011) |

| H2: | Risk perception positively affects indebtedness. | Caetano et al. (2011) |

| H3: | Risk perception negatively affects materialism. | Flores and Vieira (2014) |

| H4: | Risk perception positively affects emotion. | Flores and Vieira (2014) |

| H5: | Materialism positively affects indebtedness. | Ponchio (2006) |

| H6: | Emotion positively affects indebtedness. | Quelch and Jocz (2007) |

| H7: | There is a significant difference between demographic variables with respect to the four determinants. | Keese (2010); Flores and Vieira (2014) |

| H8: | There is a difference between demographic variables with respect to individual indebtedness. | Flores and Vieira (2014) |

| Code | Characteristics | Factor Loadings | AVE | CR | Alpha (α) |

|---|---|---|---|---|---|

| Financial Literacy | 0.806 | 0.954 | 0.934 | ||

| [FL1] | Saves money every month. | 0.867 | |||

| [FL2] | Saves to buy more expensive products (e.g., car, house). | 0.822 | |||

| [FL3] | Has a financial reserve greater than or equal to three times the monthly income that can be used in unexpected cases (e.g., unemployment, sickness). | 0.846 | |||

| [FL5] | Analyzes personal finances in depth before making any major purchase. | 0.841 | |||

| [FL7] | I am satisfied with my own system to control finances. | 0.855 | |||

| [FL9] | Uses credit cards because no money is available to cover some expenses. (if applicable) | 0.881 | |||

| [FL11] | Pays credit card bill completely to avoid finance charges (interest and fines). (if applicable) | 0.895 | |||

| [FL12] | Checks credit card bills to examine errors and unauthorized charges. (if applicable) | 0.835 | |||

| Risk Perception | 0.872 | 0.971 | 0.824 | ||

| [RP2] | Accepts being a guarantor for someone. | 0.897 | |||

| [PR3] | Spends money carelessly, without thinking of the consequences. | 0.920 | |||

| [RP4] | Invests in businesses that have great chances of not working well. | 0.938 | |||

| [RP5] | Lends a great proportion of personal income to a friend or relative. | 0.925 | |||

| Materialism | 0.852 | 0.958 | 0.835 | ||

| [MT1] | I admire people who possess expensive houses, cars, and clothes. | 0.895 | |||

| [MT2] | I like to spend money on expensive things. | 0.927 | |||

| [MT3] | My life would be much better if I had things I actually do not have. | 0.954 | 0.728 | 0.888 | 0.823 |

| [MT4] | Buying gives me pleasure. | 0.916 | |||

| [MT5] | I would be happier if I could buy more things. | 0.912 | |||

| [MT6] | I like to possess things to impress other people. | 0.816 | |||

| [MT8] | It bothers me when I cannot buy everything I want. | 0.887 | |||

| [MT9] | Spending much money is among the most important things in my life. | ||||

| Emotion | 0.836 | 0.953 | 0.934 | ||

| [ET1] | I would feel ashamed if I were indebted. | 0.897 | |||

| [ET2] | I would feel nervous if I were indebted. | 0.821 | |||

| [ET4] | I would feel depressed if I were indebted. | 0.853 | |||

| [ET5] | My dietary habits would be affected if I were indebted. | 0.793 | |||

| [ET6] | My family relations would suffer if I were indebted. | 0.898 | |||

| [ET7] | My relations with friends would be harmed if I were indebted. | 0.860 | |||

| [ET9] | My work performance would be affected if I were indebted. | 0.826 | |||

| [ET10] | I would smoke more than usual if I were indebted. | 0.873 | |||

| Indebtedness | 0.703 | 0.904 | 0.862 | ||

| [ID1] | It is not correct to spend more money than I make. | 0.849 | |||

| [ID2] | It is better to gather money first and then spend it. | 0.822 | |||

| [ID3] | I know exactly how much I owe in stores, in credit cards, or to the bank. | 0.892 | |||

| [ID5] | I would rather buy in installments than to wait to gather money to buy in cash. | 0.862 | |||

| [ID6] | It is important to know how to control the expenses in my house. | 0.813 | |||

| [ID7] | I would rather pay in installments even if the total is more expensive. | 0.828 | |||

| [ID8] | People would be disappointed with me if they knew I had a debt. | 0.884 |

| Emotion | Financial Literacy | Indebtedness | Materialism | Risk Perception | |

|---|---|---|---|---|---|

| Emotion | 0.8977 | ||||

| Financial Literacy | 0.5382 | 0.9143 | |||

| Indebtedness | 0.4914 | 0.7414 | 0.8384 | ||

| Materialism | 0.4994 | 0.6262 | 0.7844 | 0.9230 | |

| Risk Perception | 0.3477 | 0.5917 | 0.5755 | 0.6068 | 0.9338 |

| Hypothesis | Hypothesized Relationship | Beta Coefficient (β) | Standard Error | t-Statistics |

|---|---|---|---|---|

| H1 | Financial Literacy → Indebtedness | 0.114 | 0.115 | 0.988 |

| H2 | Risk Perception → Indebtedness | 0.078 | 0.098 | 0.786 |

| H3 | Risk Perception → Materialism | 0.645 | 0.071 | 9.070 ** |

| H4 | Materialism → Indebtedness | 0.485 | 0.125 | 3.864 ** |

| H5 | Risk Perception → Emotion | 0.587 | 0.083 | 7.061 ** |

| H6 | Emotion → Indebtedness | 0.262 | 0.095 | 2.764 ** |

| Relations between FL, RP, ET, MT, ID, and Gender | |||||

| Characteristic | ID | ET | MT | RP | FL |

| Gender: | |||||

| Male | 3.02 | 3.28 | 3.07 | 2.25 | 3.72 |

| Female | 2.74 | 3.40 | 2.61 | 2.03 | 3.70 |

| t | 1.96 * | −0.86 | 3.43 ** | 1.98 * | 0.15 |

| Relations between FL, RP, ET, MT, ID, and Marital Status | |||||

| Single | 2.83 | 3.48 | 2.83 | 2.12 | 3.73 |

| Married | 2.81 | 3.30 | 2.68 | 2.07 | 3.69 |

| t | 1.78 | 1.47 | 1.26 | 0.40 | 0.39 |

| Relations between FL, RP, ET, MT, ID, and Credit Card | |||||

| Yes | 2.85 | 3.24 | 2.75 | 2.03 | 3.94 |

| No | 2.80 | 3.45 | 2.73 | 2.13 | 3.55 |

| t | 0.37 | −1.75 * | 0.17 | −0.80 | 3.78 *** |

| Relations between FL, RP, ET, MT, ID, and Loan | |||||

| Yes | 2.86 | 3.28 | 2.77 | 2.09 | 3.74 |

| No | 2.70 | 3.58 | 2.66 | 2.08 | 3.63 |

| t | 1.19 | −2.36 ** | 0.73 | 0.45 | 0.99 |

| Relations between FL, RP, ET, MT, ID, and Age | |||||

| 21–30 | 2.84 | 3.38 | 2.81 | 2.17 | 3.59 |

| 31–40 | 2.80 | 3.31 | 2.72 | 2.08 | 3.86 |

| 41–50 | 2.79 | 3.46 | 2.38 | 1.67 | 3.75 |

| 51 and above | 2.63 | 3.44 | 2.24 | 1.52 | 3.89 |

| F | 0.16 | 0.17 | 1.81 | 2.25 * | 2.20 * |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rahman, M.; Azma, N.; Masud, M.A.K.; Ismail, Y. Determinants of Indebtedness: Influence of Behavioral and Demographic Factors. Int. J. Financial Stud. 2020, 8, 8. https://doi.org/10.3390/ijfs8010008

Rahman M, Azma N, Masud MAK, Ismail Y. Determinants of Indebtedness: Influence of Behavioral and Demographic Factors. International Journal of Financial Studies. 2020; 8(1):8. https://doi.org/10.3390/ijfs8010008

Chicago/Turabian StyleRahman, Mahfuzur, Nurul Azma, Md. Abdul Kaium Masud, and Yusof Ismail. 2020. "Determinants of Indebtedness: Influence of Behavioral and Demographic Factors" International Journal of Financial Studies 8, no. 1: 8. https://doi.org/10.3390/ijfs8010008

APA StyleRahman, M., Azma, N., Masud, M. A. K., & Ismail, Y. (2020). Determinants of Indebtedness: Influence of Behavioral and Demographic Factors. International Journal of Financial Studies, 8(1), 8. https://doi.org/10.3390/ijfs8010008