Abstract

Extant empirical studies have predominantly focused on the nexus between working capital management (WCM) and corporate profitability. While there is a dearth of literature on the nexus between WCM and a firm’s risk, the present study examines Pakistani-listed firms coming from 12 diverse industrial segments to observe this association for a time span of ten years (2005–2014). To ensure robustness, we employed a System Generalized Method of Moments (SGMM) regression estimation to investigate the influence of WCM on the operational and market risk for firms. Empirical testing revealed that higher working capital levels were associated with lower volatility in firms’ stock price, which shows that shareholders prefer a conservative working capital policy. Moreover, firms with better cash positions were subject to lesser stock market volatility. In contrast, excess working capital and a larger net trade cycle were associated with increased volatility in the operating income. Besides, firms with lower working capital levels relative to their respective industry experienced fewer fluctuations in their operating profits. Our findings assert that short-term financial management has important ramifications for firms’ operating and market fundamentals. Practical implications are discussed for corporate managers and relevant stakeholders.

1. Introduction

Working Capital Management (WCM) is one of the major decisions in corporate finance. It plays a crucial role in corporate financial sustainability as it can directly impact the firm’s liquidity, solvency, and profitability (Opler et al. 1999). It is a forthright notion to ensure that a company can bridge the gap between short-term assets and short-term liabilities. It comprises four components: cash, inventories, accounts receivable, and accounts payable (Wang et al. 2020). Management of working capital accounts involves decisions concerning the short-term financial management of an enterprise (Ching et al. 2011). Cash management includes cash holdings to fulfill the requirements of day-to-day operations by keeping the costs at a minimum level. In the same stance, inventory management balancing is imperative for the firms because unbalancing the inventory can cause product expiration, huge storage costs, and insurance premiums (Petersen and Rajan 1997; Wang et al. 2020). Accounts receivable turnover refers to a managed time period from the goods being sold to the reception of the payment. Lastly, accounts payable turnover is the period from the goods being purchased and payment to suppliers (Arcuri and Pisani 2021). In line with these descriptions, each component should be appropriately managed to optimize the working capital. Thus, the managers should strive for the efficient management of working capital (Akbar et al. 2021). Efficient working capital management is a perfect blend of a firm’s policies and adjustments of the short-lived assets and liabilities in such a way that maturing liabilities are handled in a timely manner and fixed assets are adequately serviced (Akbar et al. 2020a). Working capital management practices not only impede the profitability but also smooth the working of the firms. Therefore, managers should pay attention to the proper application of working capital management practices (Elbadry 2018).

Excessive risk-taking can considerably impair corporate performance (Kassi et al. 2019). Risk always occupies the major attention of the decision-makers in the firms. (Gill et al. 2010) argued that working capital management practices of managers should deserve as much attention, as they can substantially impact the profitability and working conditions of a firm’s operations. The pressure of decreased credit terms, rising interest rates, and a rapid decrease in turnover of firm’s products and services can result in a pile up of inventory, hence larger capital tied up in stocks. Excessive liquidity can reduce the capital available to fund long-term projects, whereas a shortage of liquidity can hamper the routine functioning of operations. Financial managers are confronted with the challenge to strike a balance between liquidity and profitability to ensure the smooth and profitable working conditions of the firm.

Firms with lower liquidity and profitability tend to delay their financial reports (Lukason and Camacho-Miñano 2019). Reasonable liquidity is essential to ensure that firms can meet their short-term financial obligations as needed. At the same time, managers have to ensure that excess cash is not tied up in working capital. In a competitive world, efficient working capital management is important for all firm sizes operating in any part of the world (Michaelas et al. 1998). Given the substantial investment in working capital and the impact of working capital policy on a firm’s risk and return, working capital policy choice can have important ramifications for firm profitability and performance. Successful management of working capital will result in increased firm performance.

An overwhelming number of researchers from both developed and developing countries have examined the impact of WCM on the profitability and performance fundamentals of firms. One could easily understand the theoretical importance of working capital management and firm performance relationship from the fact that this phenomenon is discussed in almost every book on corporate finance. Measuring a firm’s liquidity is a quantitative process. The most conventional measures of liquidity are the current ratio and quick ratio. However, several researchers including Emery (1984) and Kamath (1989) have claimed that liquidity management is an ongoing process and is dependent on the operating cash flows generated by the firm’s assets. However, less attention has been paid to how WCM can influence Pakistani-listed firms’ operating and market risk (Prasad et al. 2019). Notwithstanding, studies from Pakistan overemphasized the working capital and profitability relationship and new trends have not been empirically tested. Past empirical work has predominantly focused on the operating performance effect of working capital management. However, it is equally important to observe the relationship between working capital management and firm risk. There exists a tradeoff between profitability and firm risk. An aggressive working capital management policy may increase the firm risk exposure mainly due to fluctuations in the prices of raw materials and lost sales because of probable stock outs (Gounopoulos et al. 2017).

The literature on working capital investment is divided into competing views. In a study of 204 non-financial Pakistani firms, (Nazir and Afza 2009) reported that investors give more value to firms with more aggressive management of their current liabilities. In contrast, a conservative working capital policy might lower these risks. Still, it will harm the firm’s performance because a substantial amount of funds will be wedged in inventory and receivables, hence lowering the firm profitability.

The present study empirically examined the impact of working capital management of Pakistani firms on their operating and market risk. We added to the findings of Baños-Caballero et al. (2014) and investigated the possible concave relationship between investment in working capital and the operating and stock market performance of the firm. A significant result in this scenario will suggest that optimal working capital does exist, and firms can enhance their profitability and stock performance by converging to that optimal point. We found that higher working capital levels are associated with lower volatility in firms’ stock price, which shows that shareholders prefer a conservative working capital policy in the context of Pakistan. Moreover, firms with better cash positions are subject to lesser stock market volatilities.

On the contrary, higher working capital levels and a larger net trade cycle were associated with increased volatility in operating income. Firms with lower working capital relative to their respective industries experience fewer fluctuations in their operating profits. Similarly, higher current ratios were also associated with larger variations in the profitability of firms. The implication is that short-term financial management has important ramifications for the operating and market risk perception of firms. The management should be aware of the possible effects of their working capital policy on firms’ operating and market fundamentals.

The review of studies from Pakistan’s context showed that most of the empirical work is just replication studies discussing similar variables and methodology with a different data set. The present study is an attempt to cover this gap. This study is expected to make several theoretical contributions to the existing body of knowledge in the scenario of Pakistan. The contribution of this endeavor is three-fold. First, as the literature on working capital management predominantly focuses on the operating performance aspect of the firm, very scarce literature has paid attention to how working capital management practices affect the corporate level risk, especially in the context of Pakistan. Moreover, this study attempts to identify the excessive working capital tied up in Pakistani firms, the historical growth in cash, and other components of working capital. These statistics will provide useful information to the corporate managers about the efficiency of working capital and the areas needing improvement. Nonetheless, it will help practitioners to make a comparative analysis of the working capital management between developed and developing countries. Thus, this research is unique in its nature as it is addressing the Pakistani-listed companies in the context of WCM, operations, and market risks relationship. Secondly, we examined the impact of working capital management practices on operating risk and accessing the stock market risk. Hence, the empirical results can help to explore the possible links between working capital management and operating and market risks. Thirdly, to address the endogeneity issue, we used the Generalized Method of Moment (GMM) technique.

The rest of the paper is structured as follows. Section 2 presents theoretical underpinnings, discusses the strand of literature related to WCM, and forms the basis for the study’s hypothesis. Section 3 elaborates on the data and methodology. Section 4 encapsulates data analysis, and Section 5 concludes the study.

2. Theoretical Background and Literature Review

2.1. Theoretical Underpinnings

Efficient WCM will enable firms to adjust quickly to the changes in market fundamentals, such as interest rates, fluctuation in the prices of raw material, and moving ahead of competitors (Appuhami 2008). The initial concept of working capital was to ensure that a firm can meet its short-term obligations in the event of liquidation. Thus, the main objective of financial managers was to govern firms in such a way that current assets matched with current liabilities. The new approach of WCM is to manage the firm’s operating cycle while striving to maximize its profitability. The operating cycle comprises the whole series of cash flows generated by the firm’s main business operations. Symbolically, the idea of WCM is to keep a particular level of water in the tank, keeping in mind the future inflows and outflows of water. Thus, the water in the tank will serve as a buffer.

Similarly, firms must maintain a buffer of short-term assets to accommodate the uncertainty caused by the market inefficiencies, such as transaction costs, ordering costs, information costs, production limitations, etc. In a perfect world, the inflows and outflows of raw materials, finished goods, or cash could be predicted accurately, making it needless to maintain buffers of inventories or cash. However, in a world characterized by late payments, order changes, and plant shutdowns, it is indispensable to hold inventories, cash, and receivables. Considering these inefficiencies, firms that are reluctant to maintain sufficient liquid assets may have to delay payments to suppliers, obtain short-term financing on unfavorable terms, or even sell the assets (Emery 1984). To avoid such adverse consequences, firms maintain liquid reserves that can be liquidated instantaneously. Therefore, the main purpose of holding a positive net working capital is for unanticipated events that can significantly change the inflows and outflows of cash, raw materials, or finished goods.

Osisioma (1997) describes efficient WCM as “the policies, adjustments, and management of the level of short-lived assets and liabilities of the firm in such a way that maturing obligations are timely met, and the fixed assets are properly serviced”.

The first theoretical paper on WCM was designed by (Sagan 1955). The study stressed the importance of WCM and cautioned that it could have serious repercussions for a firm’s sustainability and realized the need for developing a theory for the management of working capital. He pointed out that financial managers’ activities were mainly limited to managing cash flows generated from main business operations and emphasized that financial managers must also know the techniques to manage inventories, receivables, and payables because all these components affect the cash position of the firm. The work of Sagan was primarily focused on cash accounts of working capital and suggested that the task of the financial manager is to arrange funds when needed and to invest provisionally idle funds as profitably as possible, keeping in mind the safety and marketability of these funds by analyzing the risk and return associated with various investment opportunities. Van Horne (1969) further extended the theoretical perspective of working capital theory and developed the framework of a probabilistic cash budget to make decisions about the level of working capital and the maturity structure of debt considering the risk–return tradeoff. He suggested making different forecasts of current assets requirements along with their subjective probabilities, considering the different possible outcomes of sales, receivables, payables, and other related short-term inflows and outflows. Hence, the firm can design a WCM schedule by including each choice of debt maturity, probability distributions of the current asset holding, opportunity cost, probability, and expected probability of running out of cash in the future. The firm can then choose the best possible alternative by balancing the risk of a liquidity crunch and the cost of the funds required to avoid such a possibility. The study provides a unique approach for managing a firm’s liquidity affairs by drawing probabilistic outcomes of the variables. However, its practical application is constrained by a lack of information about the likelihoods of liquidity holdings, opportunity cost, and running out of cash under different debt maturities.

Based on the risk appetite of the finance managers and the financial strength of a given firm, the management should adopt different approaches to manage their short-term financial affairs.

Van Horne (1980) described the aggressive WCM approach by arguing that managers make more use of the short-term debt resources than signaled by the matching approach. Aggressive WCM is thought to be a highly profitable and, at the same time, a highly risky approach to the management of a firm’s financial affairs.

The firm’s financing policy will be regarded as conservative if it depends more on long-term debt to meet its financing requirements. Financial managers with a conservative approach to WCM tend to lower the liquidity risk even at the cost of a decrease in profitability. Consequently, the firm will experience increased investment in inventories and receivables, and payables will decrease, leading to an increase in CCC (GAPENSKI 1999).

2.2. Literature Review and Hypotheses Development

The literature on the WCM around the globe has predominantly focused on the operating performance and profitability of the firms. A number of research studies found a positive association between WCM practices and firm performance, e.g., Baños-Caballero et al. 2014; Lyngstadaas and Berg 2016; Tauringana and Adjapong Afrifa 2013; Sohail et al. 2016; Prasad et al. 2019; Akbar et al. 2020a. Moreover, the nature of the relationship of WCM practices with firm performance also depends upon the context of the country and market structure. Akbar et al. (2021) argued that during the global financial crisis, firms adopted a conservative WCM policy, and this confirmed that most firms are more ethical in short-term financial management. The deployment of the GMM technique reveals the presence of a concave relationship between WCM practices and firm performance. Another study by Wang et al. (2020) determined the impact of WCM practices on the firms’ financial performance across the corporate life cycle. The empirical findings reveal that overall WCM practices are negatively associated with the firm performance, but this association is not static across all stages of the corporate life cycle. At the introduction stage, a negative association is more pronounced, whereas WCM practices do not affect the performance of matured firms. Moreover, conservative strategy negatively affects the firms’ performance at all the life cycle stages. Sohail et al. (2016) tested the aforementioned relationship in the context of Pakistani scheduled listed banks. They argued that both the cash conversion cycle and cash-to-cash equivalent affect the firm performance differently. Working capital management is one of the crucially important practices of the managers and they should be equipped with efficient skills to prevent the occurrence of several liquidity challenges (Wanyoike et al. 2021).

Le (2019) discovered a pronounced inverse link between net working capital (NWC) and business valuation, profitability, and risk. Firm managers must make a trade-off between their profitability and risk-control objectives when managing working capital. Working Capital Management is very crucial in enterprises with limited access to finance; it is also important when firms are increasing their investments during times of economic recovery. Tzeremes (2020) confirmed the presence of a nonlinear (U-shaped) link between business market value and operational efficiency levels. By using the local linear estimator, the study demonstrated that lower market values are related to higher operational inefficiencies, whereas higher market values are associated with higher operating efficiencies. Gupta and Pathak (2018) stated that under normal market conditions, a risk–return relationship might be conventionally positive (risk-averse) or “paradoxically” negative (risk seeking). Xing and Yu (2018) argued that financial crises during the previous few decades have revealed the enormous impact of market structural breaks on firms’ lending behavior. Credit risk models for firms have traditionally assumed that a firm’s conditional rating transition (or default) probabilities (or intensities) are dependent on specific risk elements that can explain the movement and co-movement of obligors’ credit risk (or more generally, the borrowers).

In the context of China, A. Akbar (2014) found that a higher WCM adversely affects the performance of Chinese textile companies. Another study by Khan et al. (2016) found that financially constrained firms have a lower investment in the working capital. Kayani et al. (2020) proposed that New Zealand and Australia are attractive destinations for investors due to their business-friendly environments. In this environment, WCM and financial performance relationship determination can contribute significantly to business flourishment. After the deployment of econometric techniques, it was proven that WCM has a positive relationship with the firm’s financial performance. However, the cash conversion cycle and inventory conversion period exhibit a negative relationship with firm performance. This indicates that reduction in cash conversion cycle and inventory conversion period can boost the financial performance. Each component of working capital affects the gross profit and cash conversion period differently. Hussain et al. (2021) proposed that the usage of interest rates as an interaction variable generates interesting insights in determining the WCM and firm performance relationship. If the interest rate interacts with average payable days, then the firm performance decreases as the interest rates increases. The relationship of the cash conversion cycle is also reversed when using the interaction of interest rates. This indicates that each component of WCM has a significant impact on the firm’s performance.

Efficient WCM is a key in corporate finance to earn maximum shareholder wealth. It is short-term resource management, which is significantly associated with the short-term financing of firms and investment decisions. Efficient WCM positively influences financial performance, but this relationship depends upon the settings of the organizations. WCM positively affects the firm performance in institutional ownership but negatively affects managerial ownership (ur Rahman et al. 2019). Macroeconomic factors always play at the front line of economic growth. Soukhakian and Khodakarami (2019) examined the relationship of WCM and firm performance with the direct and moderating role of inflation and GDP. The empirical results of the two-stage least square method reveal that the cash conversion cycle is negatively related to the ROA and refined economic value added. That is, shorter duration in the collection of receivables will enhance firm performance.

Moreover, macroeconomic variables are positively and significantly related to the WCM and financial performance relationship. Thus, it is true that efficient WCM always contributes to the financial performance of the firms. Another study by Kaushik and Chauhan (2019) proved this association in the context of Indian firms. The deployment of econometric analysis revealed that WCM practices improve short-term financing efficiently, which eventually enhanced the financial performance of the Indian firms. Moreover, the aforementioned studies depicted that WCM-Firm Performance (FP) association is mainly dependent on the internal factors, specifically on the choice of WC policy used by the firms. Previous literature on the WCM-FP relationship is divided into three strands: determinants of working capital policy (Sohail et al. 2016; Tauringana and Adjapong Afrifa 2013; Elbadry 2018); association between WCM and firms’ operating and market performance (Baños-Caballero et al. 2014; Abuzayed 2012; Akbar and Akbar 2016); and the nature of the relationship between WCM-FP (Aktas et al. 2015; Baños-Caballero et al. 2014). Despite the breadth of literature on WCM-FP, less attention has been paid to the impact of WCM practices on the operating and market risk in the context of Pakistan. Particularly, which practices and policies of WC can reduce the firms’ operation and stock risk? Can a higher level of current assets reduce the operating risk?

Risk is the path-by-path aftermath of organizational practices and policies. It mitigates the information asymmetry between insiders and outsiders. It is an inescapable signal to the shareholders, leading to either too low valuations or political suboptimal investment (Haj-Salem and Hussainey 2021). WCM practices are associated with risk exposure. Cash and cash equivalents are one component of WC. They are considered the king of the business environment since they directly influence the firm value and determine the financing operations and payouts (Chen et al. 2020). It is a liquid asset that provides firms with the necessary liquidity to overcome a span of cash (Haj-Salem and Hussainey 2021).

Holding cash allows firms to benefit from lower transactional costs and to face unpredicted contingencies. Thus, it implies that an efficient level of cash and cash equivalents is necessary for the firms’ operation. Still, excess WC and a larger net trade cycle have been associated with increased volatility in the operating income (Haj-Salem and Hussainey 2021). An increase in the WC requires additional financing, and a firm that holds too much WC may incur high-interest expenses and potentially operating risk (Chalmers 2020).

The potential losses produced by events caused by inadequate or failing processes, people, equipment, and systems, as well as external occurrences, are referred to as operational risks (Ruiz-Canela López 2021). Rubino (2018) argued that risk and uncertainty have negative outcomes as well as positive opportunities; in order to implement this philosophy within the company, events must be identified and evaluated (Ruiz-Canela López 2021) One of the basic problems for management is to enhance performance through operational risk identification, evaluation, and management, with operational risks being the most common element for any business unit in an organization.

Razi et al. (2021) proposed that different aspects of policies could reduce the risk in the day to day-to-day operations of the firms. This implies that effective management of current assets would help manage the short-term financing, which eventually fuels the proper operatation of the firms. Hence, the risk associated with the operations could be reduced. Mohamad and Saad (2010) proposed this that in the context of firms’ value and profitability. In the same stance, Abuzayed (2012) conceptualized this relationship in the case of Jordan. Deployment of panel data techniques on a sample of listed firms proposed that efficient WCM can improve the investors’ awareness and information transparency, which improves the stock performance by reducing the market risk.

Wanyoike et al. (2021) found that excess working capital with large creditor management practices increases the volatility in the operational performance, which entails operational profits volatility. Hence, the firms should equip their managers with WCM skills to implement an efficient policy to control the volatility in operating profits. Kasozi (2017) used the South African manufacturing firms to test the level of WCM and the level of volatility in the operational profits. Results revealed that higher WC increased the level of current assets more than the current liabilities. This invites a larger net trade cycle, which eventually results in higher volatility in the operating profits. By putting the outcomes of these studies in perspective, we put forward the following hypotheses:

Hypothesis 1 (H1).

There is a positive association between higher working capital and a firm’s market risk.

Hypothesis 2 (H2).

There is a negative association between higher working capital and a firm’s operating risk.

3. Data and Methodology

As in (Armstrong and Vashishtha 2012) the annualized standard deviation of the monthly return of firms is used as a proxy to measure firm risk exposure. ENWC and NTC are the main explanatory variables to measure the working capital management policies of Pakistani firms. Excess net working capital for each firm is calculated by subtracting the individual firm’s excess net working capital from the industry average. The third regression model observes the impact of individual components of NTC on the operating and market risk of firms. Moreover, the fourth regression model evaluates the impact of cash management policies on the market risk perception of sample firms. Besides the key explanatory variables, our panel regression models include firm size, leverage, age, Tobin’s Q, sales growth, GDP, and interest coverage ratio, which can significantly affect the firm’s riskiness in the stock market (See Table 1 for variables calculation and description).

Table 1.

Summary statistics for NWC to sales ratio by industry.

GMM-based panel regression estimates are used to control the effect of endogeneity in all cases, because if present in the data it can it lead to misleading results.

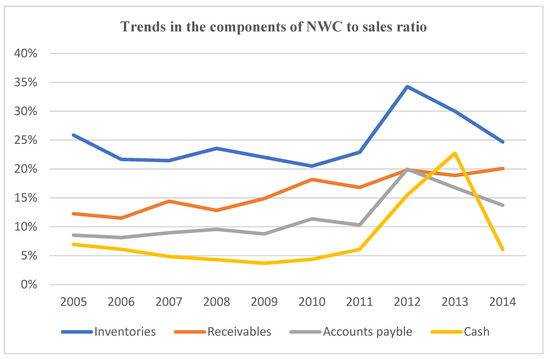

To assess which one of the three components of the NWC contributed most to the decrease in the NWC to sales ratio, Figure 1 reports the behavior of the average inventories, receivables, account payables, and cash deflated by sales through time. There is a slight decrease in the values of inventories, account payables, and cash holdings from 2008 through 2009. This is perhaps due to the uncertainty caused by the financial and liquidity crunch of 2008. The three components of the NWC to sales ratio and the cash holdings remained somewhat stable through time, yet the time period after the year 2011 is marked by a sharp upward movement in all the components of the NWC and cash holdings. This upward trend is more pronounced in 2012, which indicates a shift toward a conservative working capital policy by the management of these firms. However, the year 2014 again witnessed the decline in the components of NWC and cash values, which indicates improvement in the working capital practices.

Figure 1.

Yearly average of inventories, account receivables, and account payables. This figure shows the year-wise cross-sectional average for inventories, receivables, and payables scaled by sales for non-financial Pakistani firms from 2005 to 2014.

Table 1 reports the industry-wide summary statistics of the median NWC to sales ratio of Pakistani firms and their respective standard deviations. For the year 2005, non-metallic was the most efficient sector as it had the lowest NWC to sales ratio compared with all the other industrial sectors. However, the corresponding standard deviation was 92%, which shows significant variation in the NWC to sales ratio within the non-metallic sector. The ratio, however, increased considerably and reached 8.7% in the year 2014. This reflects a shift in the WCM practices of firms over the period of study.

On the contrary, the textile sector had the highest NWC to sales ratio of 32% for 2005. This indicates that the key sector of Pakistan’s economy was having considerable inefficiencies in the working capital management practices, which resulted in more funds being tied up in short-lived assets. However, the ratio improved reasonably and came down to 18.6% in 2014. In the same year, however, the electrical and apparatus sectors had the highest NWC to sales ratios of 74.7% and 26.5% in 2005. These figures are quite alarming and required the management of these firms to take some serious steps to rectify the inherent inefficiencies in the working capital management practices, because holding larger inventories and relaxed terms to account receivables substantially affected the performance of this sector. Similarly, for the fuel and energy sector, the ratio was 32.5% in 2014, which is more than twice of NWC to sales ratio of 2005. The reason is that Pakistan’s economy faced severe energy crises during the study period. Hence, this trend highlights the inventory management and recovery problems that the fuel and energy sector were exposed to.

At the same time, the information and transport sector witnessed substantial improvement in the NWC to sales ratio, which declined from 10.5% in 2005 to 2.7% in 2014. This is because the increase in firms in this sector forced management to be more efficient to sustain in a highly competitive environment. The other major sectors of the economy reported mixed trends in the working capital management efficiency measured by NWC to sales ratio, with the chemical and pharmaceutical sector reporting an increase from 16% to 22.4%, other manufacturing sectors reporting 22.8% to 24.2%, and the food sector reporting the same NWC to sales ratio in 2005 and 2014, respectively. In general, the NWC to sales ratio of these sectors was quite high and required a sizeable decrease, especially in inventory management and receivables management.

4. Empirical Strategy

The impact of working capital policy on the operating and market riskiness of a firm’s stock can be observed through descriptive statistics (Table 2 and Table 3) and the generalized method of moment estimation models. The empirical results are discussed below.

Table 2.

Variable descriptions and calculations.

Table 3.

Descriptive statistics.

Table 3 provides the descriptive statistics of the variables used in this study. The values of NTC and its components are divided by 100. MR has a mean value of 0.61, whereas the mean of VONOI is 0.34, which reflect that, on average, the market returns of the firms are twice as risky as the operating income. The mean NWC to sales ratio of 0.25 shows that the average net working capital is 25% of sales. These figures are quite large and show that financial managers of Pakistani firms have sufficient room to improve their management of working capital accounts. Sample firms take on average 90 days to convert their working capital accounts into cash. However, the value of standard deviation is quite large, suggesting that larger variations exist across industries concerning the working capital management policies.

Similarly, the mean value of DI is 73 days, which is quite large and reveals that the sample firms are facing problems in converting their inventory into sales. Moreover, on average, sample firms collect their receivables in 41 days and make payments to the creditors in 28 days. These statistics show that sample non-financial firms offer generous credit terms to their customers to expedite sales volume. As with the liquidity ratios, the mean values are lower than the standard, yet a higher standard deviation indicates that larger differences exist in the liquidity management policies across firms. As with the cash ratios, firms keep 7% of their assets in cash on average and maintain 3.4% of sales value in the form of cash. As far as the control variables are concerned, 62% of the assets of sample firms are financed by external debt, which poses a higher bankruptcy risk on the firms. Likewise, the mean age value is 32 years, indicating that larger firms dominate our sample. The average growth in sales is 13.6%, which is quite reasonable. However, a minimum value of −44% and a maximum of 80% reflects a larger difference across firms regarding sales growth. On average, firms generate 1.12 times their assets in sales. In addition, the minimum of ICR is −12.6%, which indicates the presence of financially fragile firms in the sample.

Table 4 shows the impact of working capital management on the riskiness of firm stock in the market. The first regression model reveals that the industry-adjusted excess net working capital to sales ratio has a negative and significant relationship with the market risk measured as the volatility of annualized mean stock returns of the firm. This result suggests that in the context of Pakistan, firms with higher liquidity holdings experience fewer fluctuations in stock price. The reason is that the investors perceive that the firms with lower net working capital level relative to their industry might go bankrupt because of the shortage of liquidity; thus, the higher perceived risk of liquidity shortage triggers larger volatility in the stock prices. Similarly, NTC has a negative and significant coefficient with market risk. This outcome implies that investors fail to penalize the firms with inefficient working capital management and perceive the stock of firms with smaller NTC to be riskier.

Table 4.

Results of GMM regressions. Market risk is the dependent variable.

The third regression model indicates the individual impact of working capital accounts on stock market risk. Day inventory is negatively linked with the market risk, which infers that stock investors do not properly account for the poor turnover of inventory in their buying and selling decisions. However, DAR has a positive coefficient with MR, which is quite obvious: the higher the number of days a firm takes to collect its receivables, the higher the number of doubtful debts, which leads to an increased risk of a liquidity crunch in the short term. Moreover, DAP has a negative and significant relationship with market risk variables, reflecting that firms that manage their short-term liquidity by making a late payment to the suppliers are deemed more favorable by the shareholders, as shown by the lower stock volatility of these firms.

The fourth regression model includes the ratio measures of liquidity along with the same set of control variables. Similar to the previous working capital measures, the current ratio also indicates a significant negative relation with the stock market volatility. It reveals that Pakistani firms that hold more current assets to meet current obligations faced fewer fluctuations in the stock prices during the period of the study. However, ATR is positively associated with the market risk measure, which is quite surprising and implies that firms that hold more liquid assets also face more risk.

The last regression model analyzes the effects of cash holdings on a firm’s market risk. A positive relation between cash to current assets ratio and firm risk entails that firms that maintain larger cash volume are deemed inefficient because idle cash does not earn any return. A negative coefficient between cash to sales ratio and the measure of market risk suggests that keeping sufficient cash to generate sales minimizes the market risk. As with the control variables, both size and age are positively related to market risk, showing that the stock of large and old firms is subject to higher volatility. Likewise, TQ is positively associated with MR, inferring that firms with larger market value face higher market risk. In addition, GDP growth is negatively linked to MR, which indicates that the growth in the economy significantly reduces the stock market fluctuations. However, a negative coefficient between ICR and MR demonstrates that more profitable firms experience higher market risk. In total, the above results put up a strong case for the possible effects of working capital management on the stock market fundamentals.

Table 5 incorporates all the explanatory variables in one regression model, along with the lag of the dependent variable. The cumulative model also validates the negative association between the working capital level and the market riskiness of a firm’s stock in the context of Pakistan. These results show that stock market participants favor a conservative working capital policy. In addition, the values of the second order autocorrelation and Hansen statistics are insignificant, which illustrates that the above results are robust and are not affected by the endogeneity.

Table 5.

Cumulative regression model.

Table 6 presents GMM-based regression models to reveal the impact of working capital accounts, liquidity management, and cash management policies of non-financial Pakistani firms on the operational risk of the firms that are represented by the variation in net operating income. The first regression models present the relationship between excess net working capital to sales ratio and the VONOI and several control variables. A positive and significant coefficient between ENWC and VONOI portrays that putting up extra resources in the working capital accounts can increase the operating risk for the sample firms. This is quite logical because endorsing extra resources to the short-lived assets will leave fewer funds available for the long-term value-maximizing projects, making the operating revenues more volatile.

Table 6.

GMM regression models. NOVOI is the dependent variable.

In the second regression model, we used the interaction terms to segregate excess positive and excess negative NWC. This model gives a better picture of the impact of ENWC on the operating riskiness of the firms. ENWCD has a coefficient of 0.041 with VONOI. The value is significant at 1%, revealing that firms with excess positive net working capital to sales ratio experience larger volatility in their operating income.

On the contrary, a significant negative coefficient between ENWCD1 and VONOI points out that firms that keep their working capital below the industry averages experience less volatility in their operating income. These results have very important implications for the financial managers of the non-financial sectors of Pakistan and signify that management can minimize the volatility in operating profits by curtailing the investment in working capital accounts. As with the individual components of the working capital, DI has a significant negative coefficient with the VONOI, contrary to expectation. However, a possible reason could be that firms with a higher stock of inventories are usually large-sized firms with a more stable profit base. Yet, a positive coefficient between DAR and VONOI indicate that firms that offer generous credit terms to the customers are exposed to more operating risk.

The fourth regression model explains the relationship between liquidity ratios and the operational risk of the firm. A higher CR is negatively related to VONOI, suggesting that the greater the current assets relative to current liabilities, the lower the variation in firms’ net income. In contrast, the QR has a significant positive association with VONOI. A possible interpretation is that keeping more liquid assets affects the revenue generation capacity of the firm.

The last regression model shows the impact of cash management policies of sample firms on their operating risk. CTCA has a negative and significant coefficient with VONOI, which indicates that firms with larger cash balances face less risk than firms with meagre cash holdings. However, a positive and statistically significant coefficient of 0.043 between the CTS ratio and VONOI represents that firms that need more cash relative to sales face higher variation in their operating income.

As with the control variables, size is negatively related with VONOI in all the regression models. This is quite obvious because large-size firms are usually more financially sound and undergo less fluctuation in their operating income. Similarly, age is also negatively related to VONOI in all cases, revealing that the older the firm becomes, the less variability it experiences in operating income. Moreover, both TQ and growth show a positive relationship with the VONOI. Perhaps the firms with better stock market performance and higher sales growth are usually those which are going through the expansion period and therefore undertake risky investments to boost up profit margins. Therefore, these firms also face larger volatility in their income from main business activities. Likewise, a positive relationship between GDP and VONOI is justified because growth in GDP makes a positive impact on business activities, therefore, firms experience larger fluctuations in their profits. Similarly, a positive sign between COEF and VONOI reveals that firms with a higher cost of external financing are riskier.

5. Discussion

This research was conducted against the backdrop of a dearth of research on examining the influence of a working capital policy on the operating and market risk parameters of listed firms. We used an unbalanced panel of the listed non-financial Pakistani firms over a period of 2005–14 to ascertain this association. In panel data, we frequently encountered an endogeneity problem caused by the residuals’ correlation with independent variables which led to biased inferences and theoretical explanations. Therefore, unlike many earlier studies on WCM, the current study employed a dynamic panel-based technique called SGMM to account for endogeneity. It is evident in the literature that the GMM model is not only a superior technique for solving endogeneity problem in the panel data but also controls for the unnoticed heterogeneity in order to produce unbiased coefficients (Javeed et al. 2020; Wintoki et al. 2012).

The study findings assert that firms with a higher level of working capital than their industry peers depict less volatility in their stock price. This empirical evidence illustrates that investors perceive firms with a conservative working capital policy as more financially sound than firms with an aggressive working capital policy. Similar findings were suggested by Le (2019). In contrast, higher investment in working capital was negatively linked with the VONOI, inferring that an excess of funds tied up in working capital accounts escalates the operating risk of an enterprise. This is because higher investment in WC requires high external financing (Kieschnick et al. 2013) which will increase the interest expense of the firm and resultantly deteriorate the operating performance with increased bankruptcy risk (Aktas et al. 2015). Moreover, efficient management of working capital will redeploy underutilized funds in higher value projects to minimize the operating risk of the corporation. These outcomes necessitate that corporate managers rationalize their investment in working capital to an optimal level. Too much or too little investment in WCM can exacerbate the financial stability and functioning of the sampled firms.

The policy implications of this study assert that managers should consider the influence of an inefficient WCM strategy in escalating the operating and market risk for firms. Besides, our study confirms that shareholders and creditors do consider the WCM of firms when making financial decisions. Hence, managers can send positive signals to these stakeholders by devising an efficient working capital policy that can ultimately ensure stable operating and stock market performance. Nevertheless, board of directors should regularly assess the WCM plans of top management and suggest corrective actions if necessary.

The present research only includes companies from Pakistan, so the study findings can only be generalized to firms operating in similar macroeconomic environments. Moreover, the sample was limited to the non-financial listed firms of Pakistan, therefore risk-taking behavior of financial and non-listed firms could be different from the findings of the present research.

Future research in this domain should examine the impacts of frequent leadership changes on firm’s WCM strategy (Akbar 2021). Furthermore, it would be interesting to observe the effects of WCM policy on firm competitiveness in respective industries. Future studies can also explore the role of the corporate life cycle in the nexus between working capital management and firm risk (Akbar et al. 2020b; Wang et al. 2020). Similarly, a future line of research can also explore the contribution of individual components of working capital to firm risk.

Author Contributions

Conceptualization, A.A.; methodology, A.A.; software, A.A.; validation, M.A., writing—review and editing, M.N., M.A.; Project administration, P.P.; funding acquisition, P.P. & S.R. All authors have read and agreed to the published version of the manuscript.

Funding

The open access of this research is supported by the SPEV project 2021 at the Faculty of Informatics and Management, University of Hradec Kralove, Czech Republic.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available from the authors and can be provided on request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abuzayed, Bana. 2012. Working capital management and firms’ performance in emerging markets: The case of Jordan. International Journal of Managerial Finance 8: 155–79. [Google Scholar] [CrossRef]

- Akbar, Ahsan, Xinfeng Jiang, and Minhas Akbar. 2020a. Do working capital management practices influence investment and financing patterns of firms? Journal of Economic and Administrative Sciences 26: 1026–4116. [Google Scholar] [CrossRef]

- Akbar, Ahsan. 2014. Working capital management and corporate performance: Evidences from textile sector of China. European Academic Research 2: 11440–56. [Google Scholar]

- Akbar, Ahsan. 2021. Does frequent leadership changes influence firm performance? Insights from China. Insights from China 10: 291–98. [Google Scholar]

- Akbar, Minhas, Ahsan Akbar, and Muhammad Umar Draz. 2021. Global Financial Crisis, Working Capital Management, and Firm Performance: Evidence from an Islamic Market Index. Orignal Research 1: 21582440211015705. [Google Scholar] [CrossRef]

- Akbar, Minhas, Ahsan Akbar, Petra Maresova, Minghui Yang, and Hafiz Muhammad Arshad. 2020b. Unraveling the bankruptcy risk‒return paradox across the corporate life cycle. Sustainability 12: 3547. [Google Scholar] [CrossRef]

- Akbar, Minhas, and Ahsan Akbar. 2016. Working capital management and corporate performance in Shariah compliant firms. European Academic Research 4: 1946–65. [Google Scholar]

- Aktas, Nihat, Ettore Croci, and Dimitris Petmezas. 2015. Is working capital management value-enhancing? Evidence from firm performance and investments. Journal of Corporate Finance 30: 98–113. [Google Scholar] [CrossRef]

- Appuhami, BA Ranjith. 2008. The impact of firms’ capital expenditure on working capital management: An empirical study across industries in Thailand. International Management Review 4: 8. [Google Scholar]

- Arcuri, Maria Cristina, and Raoul Pisani. 2021. Is trade credit a sustainable resource for medium-sized italian green companies? Sustainability 13: 2872. [Google Scholar] [CrossRef]

- Armstrong, Christopher S, and Rahul Vashishtha. 2012. Executive stock options, differential risk-taking incentives, and firm value. Journal of Financial Economics 104: 70–88. [Google Scholar] [CrossRef]

- Baños-Caballero, Sonia, Pedro J. García-Teruel, and Pedro Martínez-Solano. 2014. Working capital management, corporate performance, and financial constraints. Journal of Business Research 67: 332–38. [Google Scholar] [CrossRef]

- Chalmers, David K. 2020. Working Capital Management (WCM) and Performance of SMEs: Evidence from India School of Strategy and Business UT Toronto—Canada Luca Sensini Department of Management and Innovation System University of Salerno—Italy Amit Shan BeLab, NIBS New Delhi. International Journal of Business and Social Science 11: 57–63. [Google Scholar] [CrossRef]

- Chen, Hanwen, Daoguang Yang, Joseph H. Zhang, and Haiyan Zhou. 2020. Internal controls, risk management, and cash holdings. Journal of Corporate Finance 64: 101695. [Google Scholar] [CrossRef]

- Ching, Hong Yuh, Ayrton Novazzi, and Fábio Gerab. 2011. Relationship between working capital management and profitability in Brazilian listed companies. Journal of Global Business and Economics 3: 74–86. [Google Scholar]

- Elbadry, Ahmed. 2018. The Determinants of Working Capital Management in the Egyptian SMEs. Accounting and Finance Research 7: 155. [Google Scholar] [CrossRef][Green Version]

- Emery, Gary W. 1984. A pure financial explanation for trade credit. Journal of Financial and Quantitative Analysis 19: 271–85. [Google Scholar] [CrossRef]

- GAPENSKI, LOUIS C. 1999. Debt-maturity structures should match risk preferences. Healthcare Financial Management 53: 56. [Google Scholar]

- Gill, Amarjit, Nahum Biger, and Neil Mathur. 2010. The relationship between working capital management and profitability: Evidence from the United States. Business and Economics Journal 10: 1–9. [Google Scholar]

- Gounopoulos, Dimitrios, Antonios Kallias, Konstantinos Kallias, and Panayiotis G. Tzeremes. 2017. Political money contributions of U.S. IPOs. Journal of Corporate Finance 43: 19–38. [Google Scholar] [CrossRef]

- Gupta, Ranjan Das, and Rajesh Pathak. 2018. Firm’s risk-return association facets and prospect theory findings-an emerging versus developed country context. Risks 6: 143. [Google Scholar] [CrossRef]

- Haj-Salem, Issal, and Khaled Hussainey. 2021. Risk Disclosure and Corporate Cash Holdings. Journal of Risk and Financial Management 14: 328. [Google Scholar] [CrossRef]

- Hussain, Sarfraz, Quang Minh Nguyen, Huu Tinh Nguyen, and Thu Thuy Nguyen. 2021. Macroeconomic factors, working capital management, and firm performance—A static and dynamic panel analysis. Humanities and Social Sciences Communications 8: 1–14. [Google Scholar] [CrossRef]

- Javeed, Sohail Ahmad, Rashid Latief, and Lin Lefen. 2020. An analysis of relationship between environmental regulations and firm performance with moderating effects of product market competition: Empirical evidence from Pakistan. Journal of Cleaner Production 254: 120197. [Google Scholar] [CrossRef]

- Kamath, Ravindra. 1989. How useful are common liquidity measures. Journal of Cash Management 9: 24–28. [Google Scholar]

- Kasozi, Jason. 2017. The effect of working capital management on profitability: A case of listed manufacturing firms in South Africa. Investment Management and Financial Innovations 14: 336–46. [Google Scholar] [CrossRef]

- Kassi, Diby François, Dilesha Nawadali Rathnayake, Pierre Axel Louembe, and Ning Ding. 2019. Market risk and financial performance of non-financial companies listed on the Moroccan stock exchange. Risks 7: 20. [Google Scholar] [CrossRef]

- Kaushik, Nikhil, and Swati Chauhan. 2019. The Role of Financial Constraints in the Relationship Between Working Capital Management and Firm Performance. Journal of Asset Management 25: 60. [Google Scholar]

- Kayani, Umar Nawaz, Tracy-Anne De Silva, and Christopher Gan. 2020. Working capital management and firm performance relationship: An empirical investigation of Australasian firms. Review of Pacific Basin Financial Markets and Policies 23: 1–23. [Google Scholar] [CrossRef]

- Khan, Nawab, Minhas Akbar, and Ahsan Akbar. 2016. Does an optimal working capital exist? The role of financial constraints. Research Journal of Finance and Accounting 7: 131–36. [Google Scholar]

- Kieschnick, Robert, Mark Laplante, and Rabih Moussawi. 2013. Working capital management and shareholders’ wealth. Review of Finance 17: 1827–52. [Google Scholar] [CrossRef]

- Le, Ben. 2019. Working capital management and firm’s valuation, profitability and risk: Evidence from a developing market. International Journal of Managerial Finance 15: 191–204. [Google Scholar] [CrossRef]

- Lukason, Oliver, and María-del-Mar Camacho-Miñano. 2019. Bankruptcy risk, its financial determinants and reporting delays: Do managers have anything to hide? Risks 7: 77. [Google Scholar] [CrossRef]

- Lyngstadaas, Hakim, and Terje Berg. 2016. Working capital management: Evidence from Norway. International Journal of Managerial Finance 12: 295–313. [Google Scholar] [CrossRef]

- Michaelas, Nicos, Francis Chittenden, and Panikkos Poutziouris. 1998. A model of capital structure decision making in small firms. Journal of Small Business and Enterprise Development 5: 246–60. [Google Scholar] [CrossRef]

- Mohamad, Nor Edi Azhar Binti, and Noriza Binti Mohd Saad. 2010. Working Capital Management: The Effect of Market Valuation and Profitability in Malaysia. International Journal of Business and Management 5: 140. [Google Scholar] [CrossRef]

- Opler, Tim, Lee Pinkowitz, René Stulz, and Rohan Williamson. 1999. The determinants and implications of corporate cash holdings. Journal of Financial Economics 52: 3–46. Available online: https://econpapers.repec.org/RePEc:eee:jfinec:v:52:y:1999:i:1:p:3-46 (accessed on 25 August 2021). [CrossRef]

- Nazir, Mian Sajid, and Talat Afza. 2009. Impact of Aggressive Working Capital Management Policy on Firms’ Profitability. IUP Journal of Applied Finance 15: 19–30. [Google Scholar]

- Osisioma, B. C. 1997. Sources and management of working capital. Journal of Management Sciences 2: 21–26. [Google Scholar]

- Petersen, Mitchell A., and Raghuram G. Rajan. 1997. Trade Credit: Theories and Evidence. Review of Financial Studies 10: 661–91. Available online: https://econpapers.repec.org/RePEc:oup:rfinst:v:10:y:1997:i:3:p:661-91 (accessed on 15 June 2021). [CrossRef]

- Prasad, Punam, Sivasankaran Narayanasamy, Samit Paul, Subir Chattopadhyay, and Palanisamy Saravanan. 2019. Review of Literature on Working Capital Management and Future Research Agenda. Journal of Economic Surveys 33: 827–61. [Google Scholar] [CrossRef]

- ur Rahman, Shams, Khurshed Iqbal, and Aamir Nadeem. 2019. Effect of Working Capital Management on Firm Performance: The Role of Ownership Structure. Global Social Sciences Review 4: 75–83. [Google Scholar] [CrossRef]

- Razi, Nazila, Elizabeth More, and Gensheng Shen. 2021. Risk Implications for the Role of Budgets in Implementing Post-Acquisition Systems Integration Strategies. Journal of Risk and Financial Management 14: 323. [Google Scholar] [CrossRef]

- Rubino, Michele. 2018. Comparison of the Main ERM Frameworks: How Limitations and Weaknesses can be Overcome Implementing IT Governance. International Journal of Business and Management 13: 139. [Google Scholar] [CrossRef]

- Ruiz-Canela López, José. 2021. How Can Enterprise Risk Management Help in Evaluating the Operational Risks for a Telecommunications Company? Journal of Risk and Financial Management 14: 139. [Google Scholar] [CrossRef]

- Sagan, John. 1955. Toward a theory of working capital management. The Journal of finance 10: 121–29. [Google Scholar] [CrossRef]

- Sohail, Sundas, Farhat Rasul, and Ummara Fatima. 2016. Effect of Aggressive & Conservative Working Capital Management Policy on Performance of Scheduled Commercial Banks of Pakistan. European Journal of Business and Management 8: 40–48. Available online: www.iiste.org (accessed on 17 July 2021).

- Soukhakian, Iman, and Mehdi Khodakarami. 2019. Working capital management, firm performance and macroeconomic factors: Evidence from Iran. Cogent Business & Management 6: 1–24. [Google Scholar] [CrossRef]

- Tauringana, Venancio, and Godfred Adjapong Afrifa. 2013. The relative importance of working capital management and its components to SMEs’ profitability. Journal of Small Business and Enterprise Development 20: 453–69. [Google Scholar] [CrossRef]

- Tzeremes, Panayiotis. 2020. Productivity, efficiency and firm’s market value: Microeconomic evidence from multinational corporations. Bulletin of Applied Economics 10: 95–105. [Google Scholar]

- Van Horne, James C. 1969. A risk-return analysis of a firm’s working-capital position. The Engineering Economist 14: 71–89. [Google Scholar] [CrossRef]

- Van Horne, James C. 1980. An application of the capital asset pricing model to divisional required returns. Financial Management 9: 14–19. [Google Scholar] [CrossRef]

- Wang, Zanxin, Minhas Akbar, and Ahsan Akbar. 2020. The interplay between working capital management and a firm’s financial performance across the corporate life cycle. Sustainability 12: 1661. [Google Scholar] [CrossRef]

- Wanyoike, Hellen W., Samuel O. Onyuma, and James N. Kung’u. 2021. Working capital management practices and operational performance of selected supermarkets with national network. International Journal of Research in Business and Social Science 10: 72–85. [Google Scholar] [CrossRef]

- Wintoki, M Babajide, James S Linck, and Jeffry M Netter. 2012. Endogeneity and the dynamics of internal corporate governance. Journal of Financial Economics 105: 581–606. [Google Scholar] [CrossRef]

- Xing, Haipeng, and Yang Yu. 2018. Firm’s credit risk in the presence of market structural breaks. Risks 6: 136. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).