In this section we shall provide two numerical examples that represent the two varying premium cases discussed previously in this paper and the numerical results regarding the ruin probabilities are given with some concluding remarks.

6.1. An Example for Premiums Adjusted by Aggregate Claims

This example is designed for the case that premiums are adjusted according to aggregate claims. We assume that the economic state is fixed over a year from the beginning, and the economic state affects the aggregate claims distribution in the year. It implies that the yearly aggregate claims distribution changes whenever the economic state changes. The aggregate claims are assumed to be negative binomial distributed as follows:

Economic state 1 (normal): mean , variance ;

Economic state 2 (deflation): mean , variance ;

Economic state 3 (inflation): mean , variance .

The one-step transition probability matrix of the economic state is

with stationary distribution

. The expected long-term aggregate claim amount is:

.

Suppose the set of premium loading is . The rules for adjusting the premiums are given as follows.

If the recorded aggregate claims in the current period is no more than the 30th percentile of the aggregate claim distribution, then the premium level for the next period will move to the lower premium level or stay in the lowest one;

If the recorded aggregate claims in the current period is more than the 30th percentile but no more than the 70th percentile of the aggregate claim distribution, then the premium level for the next period will remain in the current premium level;

If the recorded aggregate claims in the current period is more than the 70th percentile of the aggregate claim distribution, then the premium level for the next period will move to the higher premium level or stay in the highest one.

Remark 3. The transition matrix of economic state given above is a hypothetical one. Different matrices will generate different sequences of premiums in the future. How to obtain a reliable estimate of such a transition matrix in real-life is beyond the scope of this study. Econometric studies could possibly provide answers to this question.

The above set of premium rules is again a hypothetical one and is a much simplified version of the real-life bonus-malus rules. This helps to simplify the computational process and can sufficiently showcase our key results obtained in the main text before.

The premium loadings given in c do not indicate the bonus or malus cases directly. Only when the initial premium level (or base level) is chosen, then we can tell whether a given premium level is a bonus (lower than base level) or a malus case (higher than base level).

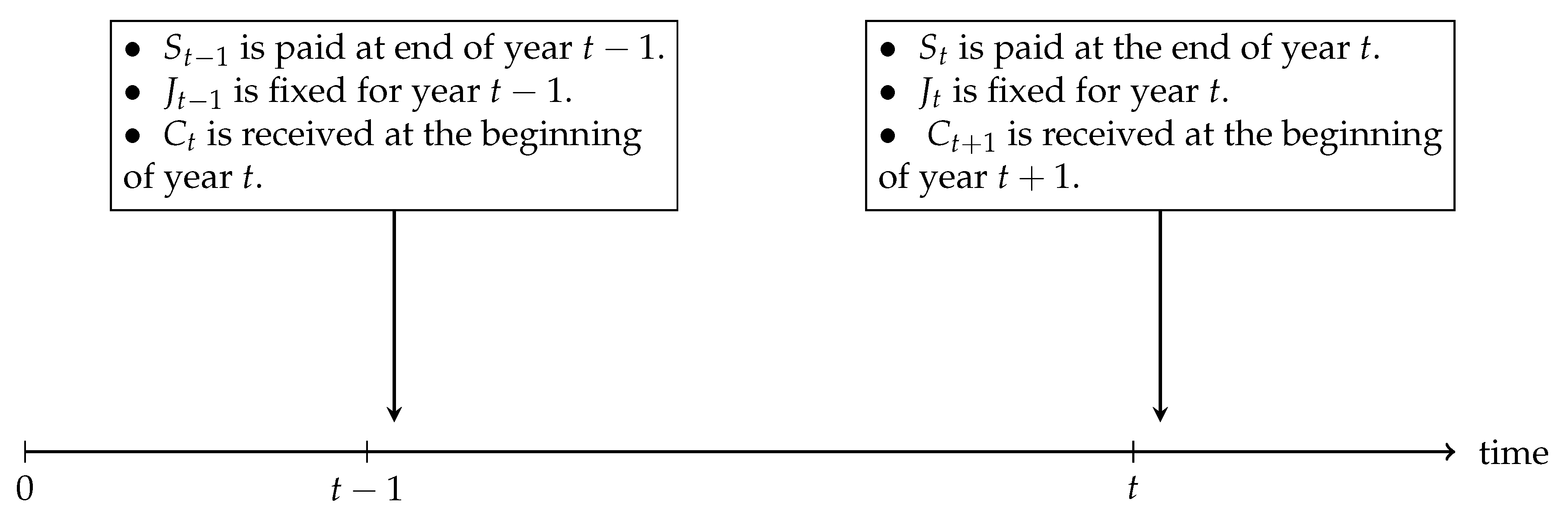

According to the above transition rule, we can calculate the transition matrix among premium levels, i.e.,

, defined in (

6) in

Appendix C. Using

, we can find the long-term stationary joint distribution of the premium levels and economics conditions:

The expected long-term premium income calculated from

is 15.89 per time unit, which is roughly 60% greater than the expected long-term aggregate claim amount per time unit. Assuming the initial economic state is 1 (normal condition), using (

8) we calculate the finite-time ruin probabilities

,

, and the associated Lundberg upper bounds for the ultimate ruin probabilities

can be found using (

12). These results are summarised in

Table 1 and

Figure 2 below.

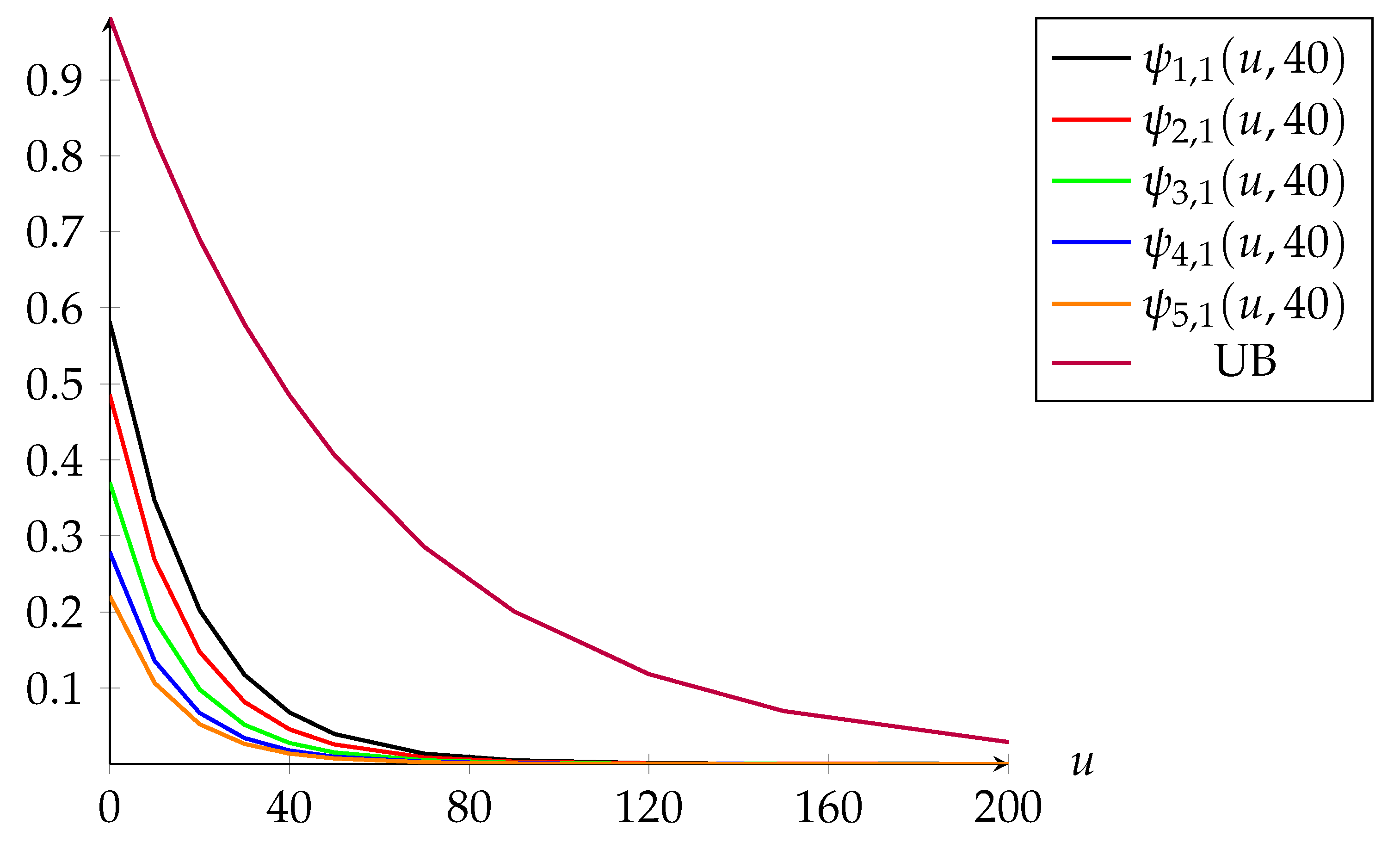

As shown in

Table 1 and

Figure 2, one can see that

,

are ordered by their initial premium levels, the lower the initial premium level is, the higher the finite-time ruin probabilities. Secondly, the initial surplus level

u has a significant impact on differentiating the five finite-time ruin probabilities: these probabilities differ more from each other when

u is small, but this impact tends to wear off when

u becomes larger. For example, for

,

, whereas

(around 0.36 in difference). On the other hand, for

,

and

(only 0.03 in difference). Its implications coincide with the practical concerns when choosing the initial premium level with different

u levels: a low initial premium level tends to be very risky when

u is small. However, when the initial surplus

u is sufficiently large, the insurer has more flexibility to lower the initial premium level that can attract more new policyholders and help with boosting the insurance business without significantly increasing the risk of insolvency.

One obvious observation in

Figure 2 regarding the upper bound is that it is very loose for all five versions of finite-time ruin probabilities. An argument for this is that the generalised adjustment coefficient

adopted in (

12) is quite conservative, since it is determined by the scenario that has the highest ruin probabilities by its definition. Also, the upper bound given in (

12) is for the ultimate time ruin probabilities, so tend to be fairly loose for finite-time ruin probabilities with

. In practice, the insurer can use these upper bounds to evaluate the worst-scenario risk of ruin in the long run.

First of all, given each initial economic state, we make similar observations in the trending in finite-time ruin probabilities when

u and

i change. Following that, comparing the three cases with different initial economic states, we have some interesting findings. Firstly, when

and three

i cases of

, the deflation economic state (state 2) leads to the highest finite-time ruin probabilities whilst the inflation economic state (state 3) has the lowest finite-time ruin probabilities. Secondly, when the initial premium level is at the lowest one (

) and

, the inflation economic state leads to the highest ruin probabilities whilst the deflation state has the lowest ones. For remaining cases, the inflation state usually ranks the highest in finite-time ruin probabilities and the normal economic state ranks the lowest. We struggle to find intuitive reasons behind these observations. One contributing factor is the initial premium amount. The ranking of ruin probabilities when

coincides with the ranking of the initial premium amounts correspond to the three initial economic states, which again confirms the significant role of the early premium income in keeping solvency when there is no capital buffer in the first place. Based on these observations, it is fair to say that both initial economic state and initial premium level play important roles in determining the finite-time ruin probabilities of the insurance business. Therefore, the insurers must keep a close eye on this matter when optimising their premium-changing strategies. Next, we shall dig further into the relationship between

u, the premium level and economic state at ruin given ruin occurs. As an example, we calculate the joint distribution of the premium level and economic state at ruin given the ruin occurs within 10 periods, i.e.,

, making use of the result (

14).

For the initial economics state 2 (deflation condition) and state 3 (inflation condition), the finite-time ruin probability results are given in

Table 2 and

Table 3, respectively.

In

Table 4,

is the highest one among all 15 cases, much larger than all the other cases. It means that, given that

and ruin occurs by time 10, the most likely premium level and economic state combination at ruin is the same as the initial combination

. The second and third most likely cases are

and

that are adjacent combinations of

. This implies that without any capital buffer at the beginning and charging the lowest level of premium, if ruin occurs early, then it will occur within the first few time units before making many transitions in either premium levels or economic states. Of course, the initial premium level and initial economic state as well as

u all play an important roles in this. We shall continue this investigation in our next scenario.

Scenario 1. Let

,

and

. Values of

are summarised in

Table 4.

Scenario 2. Keep

u and

g unchanged, but let

, the highest level of premium. The corresponding results are given in

Table 5.

In

Table 5,

is the highest one among all 15 cases, much larger than all the others. Again, given that

and ruin occurs by time 10, the most likely premium level and economic state combination at ruin is the same as the initial combination. The second and third most likely cases are

and

, the adjacent combinations of

. It looks like when

, even charging the given highest level of premium, if we know ruin occurs early, then it will still occur within the first few time units. This is a similar observation to Scenario 1. This implies that, under our model assumptions, the initial surplus plays a more important role in the insolvency risk than the initial premium level. For the purpose of comparison, we shall consider one more scenario of

to see any different observations from the

scenarios.

Scenario 3. Let

,

and

. The corresponding results are given in

Table 6.

In contrast to the previous two scenarios, in

Table 6, the top four most likely combinations of premium level and economic state at ruin are

,

,

, and

. It implies that when the initial surplus is large, given ruin occurs, then ruin would most likely occur under the worst economic state, i.e.,

, which by assumption has the highest expected aggregate claim amount per time unit. Again, the premium level at ruin seems relatively less influential than the economic state regarding insolvency. Moreover, the values of

in

Table 6 are more evenly spread out than the results in

Table 4 and

Table 5. This is because with

, there are more chances that the insurance business could stay solvent in the first few periods and ruin would occur later. The longer the surplus process runs, then the less predictable it is, thus the premium level and economic state combination at ruin.

6.2. An Example for Premiums Adjusted by Claim Frequency

In this example, we shall consider automobile insurance business and we replace the external economic environment by weather conditions. We assume that the premium levels are adjusted according to the claim frequency and the weather condition has a significant impact on the claim frequency of automobile insurance policyholders.

The claim frequency is modelled by Poisson distribution with mean 1.57, 0.785 and 2.355 for weather state 1 (normal condition), 2 (less severe condition) and 3 (severe weather condition) respectively.

The one-step transition probability matrix of weather states (environment state) with the corresponding stationary probability distribution are the same as the ones for the external economic states in the previous example. Similar to the previous example, the weather state is assumed to be fixed over a year from the beginning and the premiums depend on the current weather state.

The individual claim size distribution under each weather state is assumed to be geometric with P.M.F. for and mean . Then the expected aggregate claim amount under weather state 1, 2, and 3 is 10, 5 and 15, respectively. The expected long-term aggregate claim amount is 10, which is the same as the one in the previous example as well.

We continue to use the same set of premium loading as the one in the previous example, i.e., . The rules for adjusting premiums are given as follows:

If the number of claims in the current period is 0, then the premium level for the next period will move to the lower premium level or stay in the lowest one;

If the number of claims in the current period is greater than 0 but no more than 2, then the premium level for the next period will remain in the current premium level;

If the number of claims in the current period is more 2, then the premium level for the next period will move to the higher premium level or stay in the highest one.

According to the above transition rules for premium adjustments, we can also find its associated transition matrix among the premium levels in the

Appendix D, and the following long-term stationary joint distribution of the premium levels and weather states:

Using

, one can see that the expected long-term premium is around 15.9 per time unit, which is about 60% greater than the expected long-term aggregate claims per time unit. Remarkably, the expected long-term premium loading in this example is comparable to the one in the previous example. We make the expected long-term premium income and expected long-term aggregate claims of these two examples comparable on purpose such that a comparison is feasible between the two different types of premium transition rules regarding their impact on the ruin probabilities. Similarly, in the following we use the result (

9) to calculate

and use (

12) to calculate the upper bounds for the ultimate time ruin probabilities

. The results are summarised in

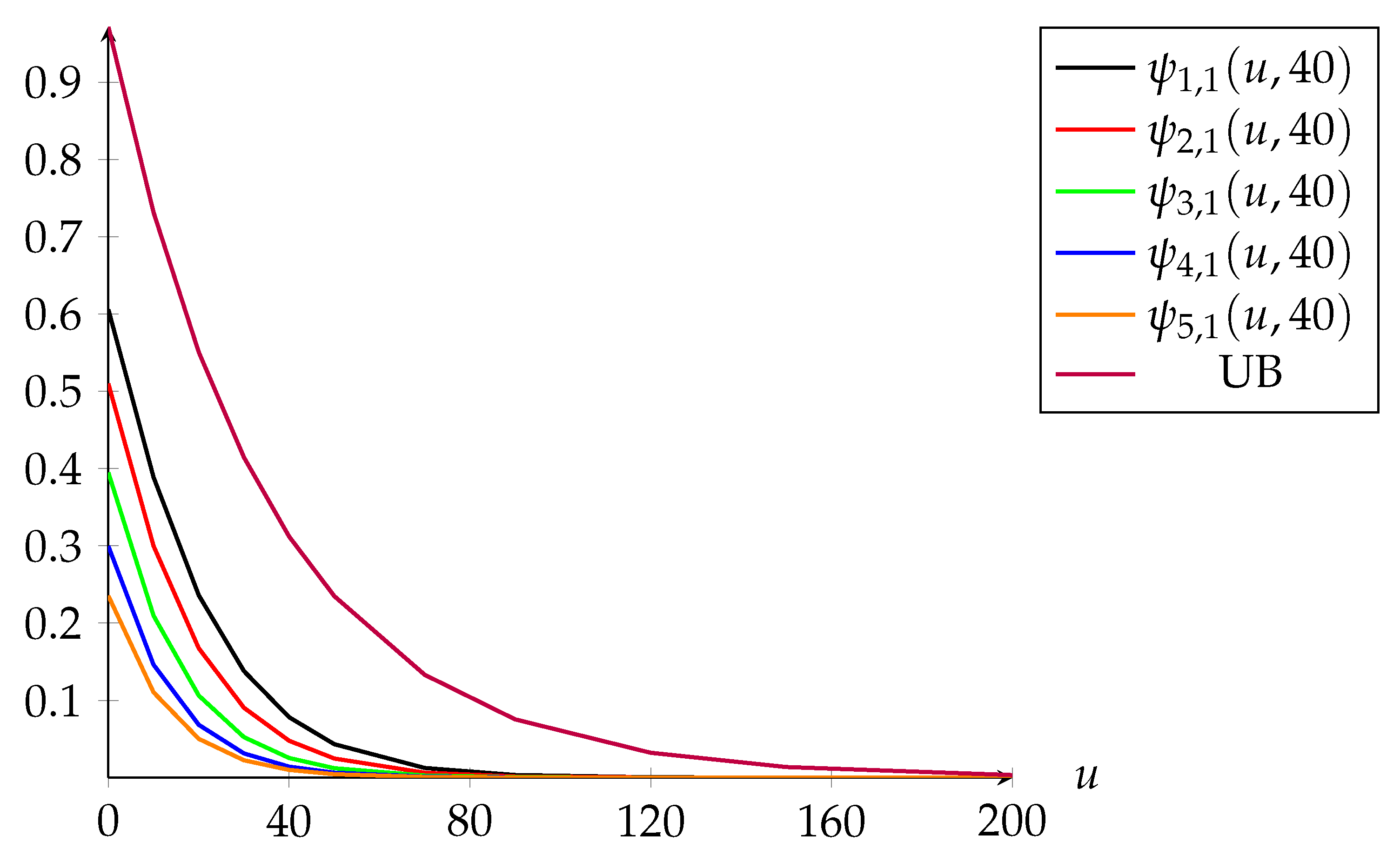

Table 7 and

Figure 3 below.

Firstly, our main findings in

Table 7 and

Figure 3 are consistent with those in

Table 1 and

Figure 2 in terms of the impact of the initial premium level and initial surplus level on ruin probabilities. Secondly, given the same initial external environment state, when

u is small the premium adjustment rules based on claim frequency have a negative impact on the finite-time ruin probabilities comparing with the rules by aggregate claim amounts. Also, this effect becomes more significant when the initial premium level is lower. For instance when

this effect applies to

but it only takes effect for

when

. This is reasonable since the transition rules that adjust the premiums according to the claim frequency can not fully reflect the historical claims experience, which causes higher risk of ruin when

u is small. On the contrary, when

u is large enough, the premium rules by claim frequency seems to lower the insolvency risk of the insurer comparing with the other type of rules. This implies that, in practice, the insurers should carefully design their bonus-malus rules by taking into account factors like the capital adequacy level since the proposed rules could have significant impact on insolvency risk. Next, we shall investigate the finite-time ruin probabilities with initial weather state 2 and 3, which are shown in

Table 8 and

Table 9.

According to the results in

Table 8 and

Table 9, the trending of finite-time ruin probabilities when

u and

i change is still consistent with

Table 7. In contrast to the previous premium-changing category (by aggregate claims), when the premiums change according to claim frequency experience, there is an overall consistent ranking in the finite-time ruin probabilities among the three initial weather conditions, i.e., less severe initial weather condition (state 2) leads to the highest ruin probabilities whilst the severe initial weather condition (state 3) has the lowest ruin probabilities. This ranking can be explained by the level of right-skewness of the Compound Poisson distributions corresponding to the aggregate claims under each weather condition. Apparently, state 2 has the highest right-skewness whilst state 3 has the lowest, which relates to the risk of insolvency.

At last, we shall use the (

15) to compute the joint distribution of the premium level and weather condition at ruin given ruin occurs within 10 time periods. The results are given in

Table 10,

Table 11 and

Table 12, where the scenarios considered are the same as Scenario 1–3 in the previous example.

From

Table 10 and

Table 11, one can see that under Scenario 1 and Scenario 2 (both with

) we get similar main findings to those in the previous example. It is worth noting that in Scenario 3 where

, we get opposite findings comparing with our previous example. The top four most likely combinations of premium level and weather conditions at ruin are

,

,

and

, mostly associated with the normal weather conditions under which the claim experience should be the middle one. This is totally different from the previous example where in Scenario 3 the most likely combinations come from the worst economic state under which the claim experience is the worst. The most likely explanation lies in the way premiums are being adjusted as well as the claim experience assumptions under different weather conditions. To be more specific, we assume that individual claim amounts are not affected by weather conditions, but claim frequency does. Under the normal weather condition (

), the current premium level is likely to stay unchanged. However, under severe weather condition (

), average claim frequency is high, which leads to moving the next premium level up. To a certain extent, the worsened claim experience is off-set by the increased premium amount, which leads to a lower overall insolvency risk than the normal weather condition. We remark that this observation might not hold when the parameter assumptions are changed, which result in a different trade-off between the claim experience and premium adjustment.

Last but not least, we make a further comparison between the above two numerical examples, as the risk models constructed in those two examples are in general comparable, for example, equal average aggregate claim amounts as well as the same premium levels. We can see that the case of adjusting premiums according to claim frequency is riskier than the case of adjusting premiums according to aggregate claims under our assumptions. This finding also has some material implication for the insurance companies on how to choose an appropriate premium adjustment strategy.