On the Market-Consistent Valuation of Participating Life Insurance Heterogeneous Contracts under Longevity Risk

Abstract

1. Introduction

2. Model Setup

| Assets | Liabilities |

2.1. Contract Structure

- Case 1:

- the minimum interest rate , , promised by the insurer;

- Case 2:

- the contract maturity date , .

2.2. Modelling Insurance and Financial Risk

3. Valuation

4. Numerical Analysis

- firstly, the fair participation rates , , under the pricing measure Q;

- secondly, the annual certainty equivalent log-returns of the life insurance contracts under the real world measure P, henceforth just certainty equivalent returns, denoted by , , based on the fair participation rates .8

- (2.1)

- Group 2, endowed with a lower interest rate guarantee, is naturally provided with a higher fair participation rate and a perceptibly larger implied certainty equivalent return . In order to examine the goodness of the contract design in (4), middle row, to achieve similar rates of return for different groups of customers, we further carry out the analysis under the assumption that the same payout structure of group 1 is applied to group 2 (but still with different guarantees ) and find that and are even higher. Therefore, if the insurance company aimed at treating both groups fairly when the payoff structures are identical, it should assign a much larger fair participation rate to the second group than to the first one, resulting in a greater difference between and . That is why our attempt at designing contracts that potentially provide the same rate of return to customers endowed with different minimum interest rate guarantees leads to more desirable results.

- (2.2)

- For any portfolio size, an increase in the longevity risk premium, i.e., lower values for , leads to smaller fair participation rates. This is because longevity improvements anticipated by the insurer increase the expected number of survivors, and consequently the value of the outstanding liabilities. To offset this effect and simultaneously ensure fairness, lower participation rates are offered. The same observation holds true for the certainty equivalent returns of the policyholders under the physical measure P. The reason for this is due to the smaller participation rates , , since a greater degree of conservativeness harms the customers’ benefits.

- (2.3)

- For the exceptional case where , the fair participation rates are considerably higher than those obtained with larger portfolio sizes due to the sizeable extinction probability of the groups and the fact that the equity holders seize all the assets pertaining to the extinct group(s). As a compensation, the policyholders need to be served with substantially larger participation rates.

- (2.4)

- It seems that, with a very small portfolio size, e.g., , , the portfolio is already well-diversified, i.e., the expected impact of the systematic part of the biometric risk is the only component still playing a role, since similar results are achieved as, e.g., when 100,000.

- (2.5)

- It is notable that all certainty equivalent returns lie between the risk free rate of return and the expected rate of return of the assets under P, i.e., , . It is true that our life insurance policies cannot beat the pure investment into the assets due to the guaranteed interest rate, although the values obtained are much closer to than to r. Nevertheless, the included guarantees of the insurance products make them much less risky and are crucial for many potential customers when comparing different investment opportunities.

- (3.1)

- We observe that policyholders in the larger group obtain relatively higher fair participation rates , , and consequently mostly also relatively higher certainty equivalent returns on their investments when comparing them with the corresponding numbers from Table 2.

- (3.2)

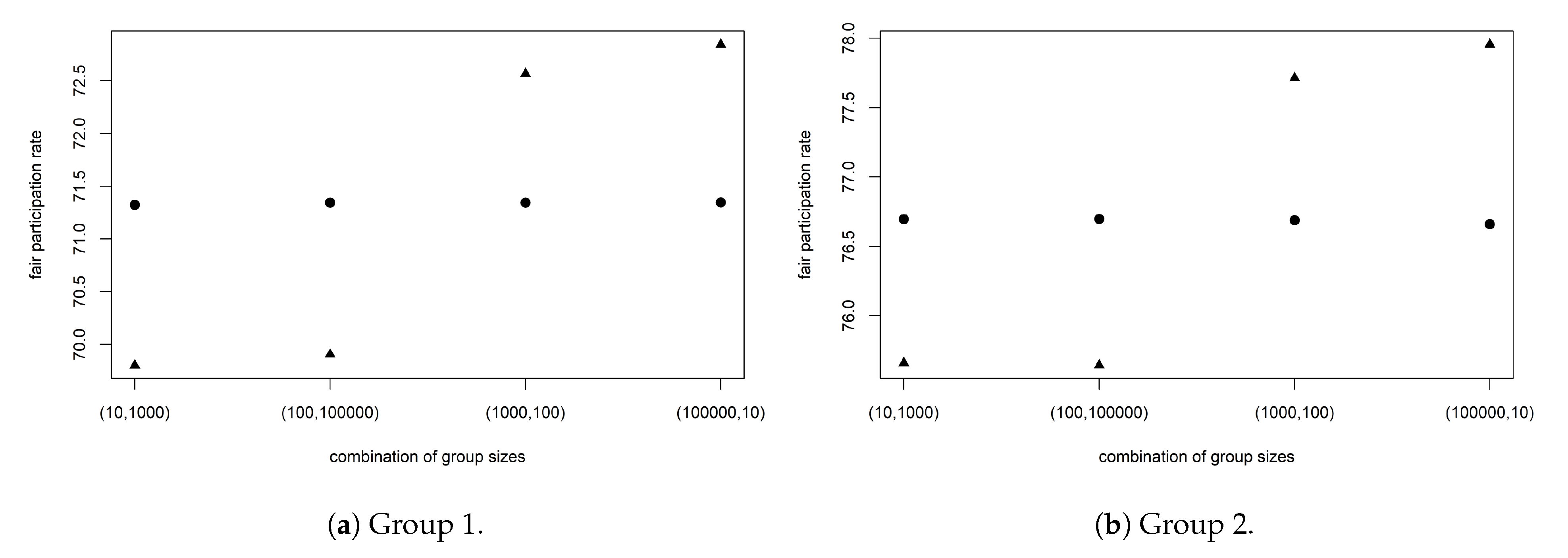

- For the first group, an increase in leads to an increase in and in general, independently of the size of the other group, while, for the second group, the opposite relations apply. We can conclude that, if there are only a few policyholders holding a lower individual guarantee than the rest, their participation in the surplus distribution must be very high to ensure fair contracts, especially if they represent a clear minority. Another related interesting fact is that a sudden spread within the values for and , , occurs as soon as the size ratio between the two groups shifts.

- (5.1)

- One of the main questions is: why are fair participation coefficients for the second group so much smaller compared to group 1, even though in Case 1 it was seen that a longer duration leads to higher fair participation rates? A possible explanation is the fact that only a portion of the assets , pertaining to the first group at , is paid out to its policyholders if the insurer is able to achieve a surplus. As a consequence, group 2 profits from the residual amount staying in the company which boosts the probability of gaining relatively high assets’ values in the future. To maintain fairness, a lower is required.

- (5.2)

- The spread between and is always significantly positive, although it decreases as increases. Clearly, the substantially higher fair participation rates for group 1 play a major role here. Nevertheless, these differences are much less relevant than those between and .

- (6.1)

- The fair participation rates , , grow with . Therefore, it is surprising that, unlike the certainty equivalent return of the first group, declines as the second group size increases (as in Table 3 where this also holds for ). Yet, this finding reinforces the fact that low values of , when is small, are necessary.

- (6.2)

- The most remarkable feature is given by the variation in the values of for a given mortality pricing assumption when changing the composition of the portfolio (in particular, when comparing cases with to cases with ).

- (7.1)

- Compared to Remark (6.2), the fair participation rate of the second group seems to smooth out over time within one longevity pricing assumption since the fluctuations between the varying pooling schemes subside. Specifically, goes down if is large (unlike Table 4 when compared to Table 3) and it goes up if is small (as in Table 4 when compared to Table 3). Looking at the values of , the same pattern is observed, i.e., a high results in lower fair participation coefficients and a low leads to (much) higher ones.

- (7.2)

- Concerning the certainty equivalent returns, those of group 1 behave quite as expected, i.e., for the first two pooling schemes (low ), smaller figures of are obtained and for the last two combinations (high ), larger values occur, compared to Table 6. By contrast, the relevant values of are always significantly higher than their counterparts in the previous table. A possible reason for that is our assumption made in the specific definition of this quantity given in (25), namely that the premature payoff to the second group conditioned by a default event at time is invested into the riskless asset until .

5. Concluding Remarks

- If the insurer decides to heavily load risk premiums for the systematic part of the insurance risk, lower fair participation rates result. This in turn also hits the customers’ returns, particularly if the presumptions on the longevity risk are very prudent.

- Maintaining usual practised participation rates of (often prescribed by law) can give rise to severe financial problems for the insurer, as certain portfolio and parameter combinations actually imply smaller participation coefficients ensuring the fairness of the contracts.

- If the two groups differ exclusively in the promised minimum interest rate guarantee provided by the insurer (Case 1), the group endowed with the lower minimum interest rate guarantee receives a larger fair participation rate. This increase is intensified if the insurance company does not explicitly aim to provide similar returns to all policyholders. Consequently, the difference between the actual returns widens as well. Thus, the proposed definition of the payoff structure for this case turns out to be an option the insurer can exploit in order to protect the customers and advance the desirable goal of achieving similar returns for everyone.

- In Case 1, another observation leads to the insight that, if there are only a few policyholders holding a lower individual guarantee than the rest, their participation in the surplus sharing must be really high to ensure fair contracts, especially if they represent a clear minority.

- If the two groups differ exclusively in the contract maturity date (Case 2), the fair participation rate for the group with the longer contract duration is much lower, and so is the resulting actual return, although on a considerably smaller scale.

- In Case 2, the group with the longer contract duration receives a remarkably low fair participation rate if it outnumbers the members of the other group.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Bacinello, Anna Rita, Pietro Millossovich, and An Chen. 2018. The Impact of Longevity and Investment Risk on a Portfolio of Life Insurance Liabilities. European Actuarial Journal 8: 257–90. [Google Scholar] [CrossRef]

- Barrieu, Pauline, Harry Bensusan, Nicole El Karoui, Caroline Hillairet, Stéphane Loisel, Claudia Ravanelli, and Yahia Salhi. 2012. Understanding, Modeling and Managing Longevity Risk: Key Issues and Main Challenges. Scandinavian Actuarial Journal 2012: 203–31. [Google Scholar] [CrossRef]

- Bauer, Daniel, Daniela Bergmann, and Rüdiger Kiesel. 2010. On the Risk-neutral Valuation of Life Insurance Contracts with Numerical Methods in View. ASTIN Bulletin 40: 65–95. [Google Scholar] [CrossRef]

- Bernard, Carole, Olivier Le Courtois, and Francois Quittard-Pinon. 2005. Market Value of Life Insurance Contracts under Stochastic Interest Rates and Default Risk. Insurance: Mathematics and Economics 36: 499–516. [Google Scholar] [CrossRef]

- Biffis, Enrico. 2005. Affine Processes for Dynamic Mortality and Actuarial Valuations. Insurance: Mathematics and Economics 37: 443–68. [Google Scholar] [CrossRef]

- Biffis, Enrico, Michel Denuit, and Pierre Devolder. 2010. Stochastic Mortality under Measure Changes. Scandinavian Actuarial Journal 2010: 284–311. [Google Scholar] [CrossRef]

- Briys, Eric, and François de Varenne. 1994. Life Insurance in a Contingent Claim Framework: Pricing and Regulatory Implications. The Geneva Papers on Risk and Insurance Theory 19: 53–72. [Google Scholar] [CrossRef]

- Briys, Eric, and François de Varenne. 1997. On the Risk of Life Insurance Liabilities: Debunking some Common Pitfalls. Journal of Risk and Insurance 64: 673–94. [Google Scholar] [CrossRef]

- Broeders, Dirk, An Chen, and David Rijsbergen. 2013. Valuation of Liabilities in Hybrid Pension Plans. Applied Financial Economics 23: 1215–29. [Google Scholar] [CrossRef]

- Burkhart, Tobias. 2018. Surrender Risk in the Context of the Quantitative Assessment of Participating Life Insurance Contracts under Solvency II. Risks 6: 66. [Google Scholar] [CrossRef]

- Chen, An, and Michael Suchanecki. 2007. Default Risk, Bankruptcy Procedures and the Market Value of Life Insurance Liabilities. Insurance: Mathematics and Economics 40: 231–55. [Google Scholar] [CrossRef]

- Cheng, Chunli, and Jing Li. 2018. Early Default Risk and Surrender Risk: Impacts on Participating Life Insurance Policies. Insurance: Mathematics and Economics 78: 30–43. [Google Scholar] [CrossRef]

- Dorobantu, Diana, Yahia Salhi, and Pierre-Emmanuel Thérond. 2020. Modelling Net Carrying Amount of Shares for Market Consistent Valuation of Life Insurance Liabilities. Methodology and Computing in Applied Probability 22: 711–45. [Google Scholar] [CrossRef]

- Eling, Martin, and Stefan Holder. 2013. Maximum Technical Interest Rates in Life Insurance in Europe and the United States: An Overview and Comparison. The Geneva Papers on Risk and Insurance—Issues and Practice 38: 354–75. [Google Scholar] [CrossRef]

- European Parliament, Council of the European Union. 2009. Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the Taking-Up and Pursuit of the Business of Insurance and Reinsurance (Solvency II). EUR-Lex. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32009L0138&from=EN (accessed on 23 November 2020).

- Gambaro, Anna Maria, Riccardo Casalini, Gianluca Fusai, and Alessandro Ghilarducci. 2019. A Market-consistent Framework for the Fair Evaluation of Insurance Contracts under Solvency II. Decisions in Economics and Finance 42: 157–87. [Google Scholar] [CrossRef]

- Ghalehjooghi, Ahmad Salahnejhad, and Antoon Pelsser. 2020. Time-consistent and Market-consistent Actuarial Valuation of the Participating Pension Contract. Scandinavian Actuarial Journal 14: 1–29. [Google Scholar] [CrossRef]

- Grosen, Anders, and Peter L. Jørgensen. 2002. Life Insurance Liabilities at Market Value: An Analysis of Insolvency Risk, Bonus Policy, and Regulatory Intervention Rules in a Barrier Option Framework. Journal of Risk and Insurance 69: 63–91. [Google Scholar] [CrossRef]

- Hansen, Mette, and Kristian R. Miltersen. 2002. Minimum Rate of Return Guarantees: The Danish Case. Scandinavian Actuarial Journal 2002: 280–318. [Google Scholar] [CrossRef]

- Hieber, Peter, Jan Natolski, and Ralf Werner. 2019. Fair Valuation of Cliquet-style Return Guarantees in (Homogeneous and) Heterogeneous Life Insurance Portfolios. Scandinavian Actuarial Journal 2019: 478–507. [Google Scholar] [CrossRef]

- Knispel, Thomas, Gerhard Stahl, and Stefan Weber. 2011. From the Equivalence Principle to Market Consistent Valuation. Jahresbericht der Deutschen Mathematiker-Vereinigung 113: 139–72. [Google Scholar] [CrossRef]

- Meyers, Gert, and Ine Van Hoyweghen. 2017. Enacting Actuarial Fairness in Insurance: From Fair Discrimination to Behaviour-based Fairness. Science as Culture 2017: 1–27. [Google Scholar] [CrossRef]

- Orozco-Garcia, Carolina, and Hato Schmeiser. 2019. Is Fair Pricing Possible? An Analysis of Participating Life Insurance Portfolios. Journal of Risk and Insurance 86: 521–60. [Google Scholar] [CrossRef]

- Seibel, Karsten. 2016. Die Lebensversicherung ist so ungerecht wie nie. Die Welt. Available online: https://www.welt.de/finanzen/verbraucher/article160030359/Die-Lebensversicherung-ist-so-ungerecht-wie-nie.html (accessed on 23 November 2020).

- Sheldon, Timothy J., and Andrew D. Smith. 2004. Market Consistent Valuation of Life Assurance Business. British Actuarial Journal 10: 543–605. [Google Scholar] [CrossRef]

| 1 | Actually, Hansen and Miltersen (2002) introduce the diversifiable component of mortality. |

| 2 | We assume that the insurance company issues no further debt, raises no capital and pays no dividends to the equity holders within the time frame of interest. |

| 3 | Note that we allow for different participation rates for the two groups as the insurance company’s goal is to set these rates so as to achieve fairness for both groups, see Section 3. |

| 4 | An alternative rule uses the weights , , so that the splitting rule is decided by the groups’ initial contributions. Choosing this alternative could, if only one group survives until time T, result in the equity holders receiving the remaining assets after the insurer has served the group still existent. |

| 5 | It may happen in (4) that the payoff in the third row is smaller than that in the middle one, corresponding to a lower assets’ value. However, this fairly rare event does not result in a contradiction since it is down to the insurer to decide to what extent the goal of achieving equal rates of return shall be pursued. |

| 6 | Through this way of modelling of the outstanding liabilities, it could happen that the payments to the equity holders decrease or even vanish, although the assets’ value increases at the same time. The rationale behind this circumstance is that when the assets pertaining to the policyholders as a whole create some surplus over the minimum guarantees, the insurer’s primary goal is to provide them with their regular bonuses, if possible. Some alternative modelling methods apply if the insurance company wants to calculate the possible bonus payments to the different stakeholders based on their initial contributions. In this case, the definition of , , needs to take into account that only is provided by the policyholders of the two groups at time 0 leading to a modification of (5) and (7). However, for the sake of brevity, we examine only the case described before. |

| 7 | By assuming that the markets are arbitrage-free, such a probability measure Q exists. As insurance markets are incomplete, the measure Q is chosen among infinitely many equivalent martingale measures. |

| 8 | To calculate , , we solve numerically the equations in (16) with , , given by (17) for Case 1, and (18) and (19) for Case 2. Due to the complicated structure of the outstanding liabilities, the computation of , , is based on a standard Monte Carlo simulation encompassing 100,000 draws. The calculation of , , is again based on the Monte Carlo method. |

| 9 | The parameters of are calculated via and . |

| 10 | Under the physical measure P, . |

| 11 | Under the physical measure P, . |

| Symbol | Description | Value |

|---|---|---|

| Initial contribution of a single policyholder | 35 | |

| Equity holders’ share of initial assets | 0.3 | |

| Initial age of policyholders | 40 | |

| Age independent Gompertz parameter | ||

| Age dependent Gompertz parameter | 1.098 | |

| Shape parameter of under Q | ||

| Scale parameter of under Q | ||

| r | Risk free short rate | 3% |

| Assets’ volatility | 15% | |

| Assets’ expected instantaneous rate of return | 5% | |

| Adjustment factor to force of mortality | 0.9 |

| 1 | 1 | 72.42 | 78.01 | 76.38 | 81.60 | 78.37 | 83.41 |

| 4.22 | 4.32 | 4.35 | 4.44 | 4.42 | 4.51 | ||

| 10 | 10 | 70.03 | 75.65 | 71.32 | 76.66 | 71.94 | 77.14 |

| 4.30 | 4.41 | 4.35 | 4.44 | 4.37 | 4.46 | ||

| 100 | 100 | 70.05 | 75.68 | 71.34 | 76.69 | 71.96 | 77.17 |

| 4.30 | 4.41 | 4.35 | 4.44 | 4.37 | 4.46 | ||

| 1000 | 1000 | 70.06 | 75.68 | 71.35 | 76.70 | 71.97 | 77.19 |

| 4.30 | 4.41 | 4.35 | 4.45 | 4.37 | 4.46 | ||

| 100,000 | 100,000 | 70.06 | 75.68 | 71.35 | 76.70 | 71.97 | 77.18 |

| 4.30 | 4.41 | 4.35 | 4.45 | 4.37 | 4.46 | ||

| 10 | 1000 | 68.51 | 74.59 | 69.80 | 75.66 | 70.44 | 76.18 |

| 4.26 | 4.38 | 4.31 | 4.42 | 4.33 | 4.44 | ||

| 100 | 100,000 | 68.55 | 74.57 | 69.91 | 75.64 | 70.56 | 76.15 |

| 4.26 | 4.37 | 4.31 | 4.41 | 4.33 | 4.43 | ||

| 1000 | 100 | 71.34 | 76.75 | 72.57 | 77.71 | 73.16 | 78.18 |

| 4.33 | 4.44 | 4.38 | 4.47 | 4.40 | 4.49 | ||

| 100,000 | 10 | 71.63 | 77.01 | 72.84 | 77.96 | 73.43 | 78.43 |

| 4.34 | 4.44 | 4.38 | 4.48 | 4.40 | 4.50 | ||

| 10 | 1000 | 82.45 | 88.11 | 84.59 | 89.59 | 85.56 | 90.24 |

| 4.61 | 4.72 | 4.67 | 4.77 | 4.69 | 4.79 | ||

| 100 | 100,000 | 82.56 | 88.09 | 84.80 | 89.57 | 85.81 | 90.22 |

| 4.61 | 4.72 | 4.67 | 4.77 | 4.70 | 4.79 | ||

| 1000 | 100 | 85.80 | 90.45 | 87.58 | 91.58 | 88.39 | 92.09 |

| 4.69 | 4.78 | 4.74 | 4.82 | 4.76 | 4.83 | ||

| 100,000 | 10 | 86.13 | 90.73 | 87.87 | 91.84 | 88.66 | 92.33 |

| 4.69 | 4.79 | 4.74 | 4.82 | 4.76 | 4.84 | ||

| 1 | 1 | 75.52 | 49.27 | 78.36 | 52.07 | 79.90 | 53.47 |

| 4.26 | 4.04 | 4.36 | 4.16 | 4.42 | 4.22 | ||

| 10 | 10 | 73.62 | 47.73 | 74.51 | 48.80 | 74.92 | 49.32 |

| 4.34 | 4.13 | 4.37 | 4.18 | 4.39 | 4.20 | ||

| 100 | 100 | 73.63 | 47.74 | 74.53 | 48.82 | 74.95 | 49.34 |

| 4.34 | 4.13 | 4.37 | 4.18 | 4.39 | 4.20 | ||

| 1000 | 1000 | 73.64 | 47.74 | 74.53 | 48.82 | 74.96 | 49.34 |

| 4.34 | 4.13 | 4.37 | 4.18 | 4.39 | 4.20 | ||

| 100,000 | 100,000 | 73.63 | 47.74 | 74.53 | 48.82 | 74.96 | 49.35 |

| 4.34 | 4.13 | 4.37 | 4.18 | 4.39 | 4.20 | ||

| 10 | 1000 | 72.82 | 53.45 | 73.65 | 54.45 | 74.04 | 54.94 |

| 4.32 | 4.11 | 4.35 | 4.16 | 4.37 | 4.19 | ||

| 100 | 100,000 | 72.84 | 53.52 | 73.71 | 54.53 | 74.14 | 55.02 |

| 4.32 | 4.11 | 4.35 | 4.16 | 4.37 | 4.19 | ||

| 1000 | 100 | 74.30 | 38.77 | 75.21 | 39.88 | 75.65 | 40.43 |

| 4.36 | 4.15 | 4.39 | 4.20 | 4.41 | 4.22 | ||

| 100,000 | 10 | 74.45 | 35.60 | 75.36 | 36.68 | 75.80 | 37.21 |

| 4.36 | 4.16 | 4.40 | 4.20 | 4.41 | 4.23 | ||

| 10 | 1000 | 70.61 | 51.90 | 71.29 | 53.75 | 71.66 | 54.62 |

| 4.25 | 4.39 | 4.27 | 4.48 | 4.29 | 4.52 | ||

| 100 | 100,000 | 70.62 | 51.99 | 71.35 | 53.83 | 71.75 | 54.71 |

| 4.25 | 4.39 | 4.28 | 4.48 | 4.29 | 4.52 | ||

| 1000 | 100 | 77.35 | 39.07 | 78.24 | 41.06 | 78.67 | 42.01 |

| 4.44 | 4.33 | 4.47 | 4.43 | 4.48 | 4.48 | ||

| 100,000 | 10 | 78.19 | 36.59 | 79.13 | 38.59 | 79.58 | 39.52 |

| 4.46 | 4.33 | 4.49 | 4.43 | 4.51 | 4.47 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bacinello, A.R.; Chen, A.; Sehner, T.; Millossovich, P. On the Market-Consistent Valuation of Participating Life Insurance Heterogeneous Contracts under Longevity Risk. Risks 2021, 9, 20. https://doi.org/10.3390/risks9010020

Bacinello AR, Chen A, Sehner T, Millossovich P. On the Market-Consistent Valuation of Participating Life Insurance Heterogeneous Contracts under Longevity Risk. Risks. 2021; 9(1):20. https://doi.org/10.3390/risks9010020

Chicago/Turabian StyleBacinello, Anna Rita, An Chen, Thorsten Sehner, and Pietro Millossovich. 2021. "On the Market-Consistent Valuation of Participating Life Insurance Heterogeneous Contracts under Longevity Risk" Risks 9, no. 1: 20. https://doi.org/10.3390/risks9010020

APA StyleBacinello, A. R., Chen, A., Sehner, T., & Millossovich, P. (2021). On the Market-Consistent Valuation of Participating Life Insurance Heterogeneous Contracts under Longevity Risk. Risks, 9(1), 20. https://doi.org/10.3390/risks9010020